Easiest flavour switching Smallest 4-in-1 design

Japan’s premium vape

Top selling vape in Japan, Australia & New Zealand

Sold in 20 countries –

America, Asia and Europe

Won 10 Awards in Asia

50 Technology patents

08 Research ‘Defensive investment’ drives UK c-stores to spend a record £1bn, an ACS report finds.

09 Legislation SGF warns that an upcoming junk food ad ban will damage the retail sector.

10 Store Development Scotmid Ferry Road undergoes a major 11-week refit.

12 National Lottery A new Allwyn competition will see two community-minded retailers win £25,000 prize packages.

14 News Extra Minimum Unit Pricing Alcohol deaths raise further doubts about MUP.

22 Product News A schoolboy inspires Spar’s new sweets while Dr Pepper urges shoppers to ‘try more weird’.

24 Off-Trade News Staropramen offers a free month of Paramount+ and Smirnoff Ice celebrates turning 25.

26 Store Profile Nisa Local Wee Mill Jay Javid’s store in Rutherglen demonstrates boundless creativity in converting a traditional pub into an award-winning modern c-store.

30 Checkout Scotland Johnny Marr was the star of the show at last month’s GroceryAid event in Glasgow.

32 Hotlines The latest new products and media campaigns.

58 Under The Counter The Auld Boy hatches an ill-thoughtout moneymaking scheme.

34 Christmas There’s a Santa-sackload of exciting NPD ready to take centre stage this Christmas.

36 Big Night In The cost-of-living crisis means consumers continue to spend their nights at home and savvy retailers are set to prosper.

42 Crisps & Snacks The right balance of PMPs, spicy flavours and healthier options can increase your snacks appeal.

46 Cigars The humble cigarillo is driving cigar sales, fuelling footfall and propelling profit.

48 Retail Tech There’s a wealth of technology available to help convenience retailers take their stores to the next level.

56 Beer & Cider Get the lowdown on how cider drinkers’ tastes are changing.

Independent retailers will be able to set up loyalty schemes under their own brands using the same tech as Jisp’s Scan & Save concept after the company announced plans to provide a white label version. The firm claimed that the time was right to open the solution up to other businesses who wished to run a loyalty scheme, but did not have the technology or resources to do so themselves.

A review of alcohol labelling has revealed near universal levels of adherence to voluntary health labelling guidelines set out by drinks industry watchdog, the Portman Group. The study, which sampled 500 alcohol products from the UK’s top brands, found that over 99% of labels carry a pregnancy warning logo or message, while 96% carry alcohol unit content information, up from 94% in the Portman Group’s 2021 review.

The UK Vaping Industry Association has raised concerns that people are mistakenly blaming responsible nicotine vape retailers for the increase in ‘Spice vapes’. The group warned that there had been a rise in consumers misusing open-tank vape devices to deliver synthetic cannabinoids, such as Spice and the psychoactive chemical THC which is found in cannabis.

Nisa’s MADL raises £18m for good causes

Local causes across the UK have received a total of £18m from Nisa’s Making a Difference Locally (MADL) charity, since its inception in 2008. MADL enables independent retailers to donate money and support to their local communities. Nisa retailers and wholesale partners raise funds through the purchase of Co-op own brand products and then choose local beneficiaries for the money.

Convenience retailers invested record amounts in their stores in the last year, with much of this being spent on measures to protect their businesses from crime and rising costs, according to the Association of Convenience Stores (ACS), which published its annual Local Shop Report last month.

Investment hit £1bn for the rst time, a massive 54% hike on last year’s gure of £646m, and the highest on record since the report’s inception in 2012. But “it’s not all fun and games,” said ACS Director of Communications Chris Noice.

“A lot of that [spend] is in defensive investment – spending

money on areas like crime prevention and detection, energy e ciency and other futureproo ng and productivity measures that reduce the business’ exposure to cost increases,” he claimed.

e biggest area of investment was refrigeration, with 56% of retailers spending in this area, while 32% of retailers had invested in technology in the last year.

e report also identi ed that retailers are o ering a wider range of services, including bill payment, Post O ces, click and collect, local delivery, prescription collections and dry cleaning, to make up for shortfalls in their local area.

ACS Chief Executive James Lowman said: “ e convenience sector continues to demonstrate its importance to the UK economy at both a local and national level, as a vehicle for investment, as a job creator, and as a means of generating over £9bn in tax income for the Treasury.

Local Authorities throughout the country will be visiting shops to check for counterfeit products at the request of Food Standards Scotland, following seizures of toxic fake Glen’s vodka from stores in Coatbridge and Glasgow.

The fraudulent 35cl bottles were found to contain toxic alcohol, isopropanol, which could prove fatal if consumed in large amounts.

FSS has also been working closely with the brand owner for Glen’s vodka to try and mitigate the risk to consumers by issuing advice to help them distinguish between genuine and counterfeit products.

Every genuine bottle of Glen’s vodka has a laser-etched lot code applied to the bottle between the rear label and the base of the bottle.

They will also have specific markings on the base of the bottle which will not vary in position or detail.

Scottish Local Retailer of the Year 2023, Billy Gatt, of Premier Whitehills in Aberdeenshire came to the rescue when the village library closed its doors.

“In rural areas there are heaps of libraries closing down,” he told SLR. “We were asked [by Aberdeenshire Council] if we could be a drop-o and collection point for books. We don’t get paid anything, it’s just a service we provide so that it’s not lost to the community.”

In addition, the local Rainbows group, where Billy’s granddaughter, Bella, is a member, has set up a ‘Little library’ book exchange instore where customers of all ages can swap books. e miniature library was made by Ban & Macdu Men’s Shed charity and decorated and lled by Whitehills Rainbows. e initiatives are a true example of community spirit and a depiction of the ACS Local Shop Report ndings which show c-stores are o ering a broader range of services, to compensate for losses in the local area.

e Scottish Grocers’ Federation (SGF) has berated the UK government’s decision to introduce tough advertising restrictions on junk food, claiming it was “another blow” for multiples and suppliers, and that the increasing number of constraints on product lines would ultimately reduce footfall to local stores.

e UK government con rmed last month that a 9pm watershed on TV advertising and a total ban on paid-for online advertising of foods high in fat, salt or sugar (HFSS), would come into force on 1 October 2025.

Public Health Minister Andrew Glynne said in a statement: “We want to tackle the problem [of childhood obesity] head on and that includes implementing the restrictions on junk food

advertising on TV and online without further delay. ese restrictions will help protect children from being exposed to advertising of less healthy food and drinks, which evidence shows in uences their dietary preferences from a young age.”

He stated that the government had hit “a key milestone” by publishing its response to the 2022 consultation on the dra secondary legislation.

TECHNOLOGY Delivery app promotes healthy purchases

e number of independent stores that took part in Snappy Shopper and SGF Healthy Living Programme’s Free Banana Wednesday campaign not only helped consumers to eat more healthily, but also boosted their fruit sales.

Around 200 stores were involved in the initiative, which enabled consumers to access free fruit every Wednesday throughout August by entering the code FREEBAN on the Snappy Shopper app.

e campaign resulted in a 61% increase in bananas added to Snappy baskets. What’s more, the scheme actually encouraged consumers to buy more fruit, with Snappy recording a 16.5% increase in fruit purchases YOY on days when the promotion was running, equating to a 15% increase in value sales YOY.

While convenience retailers advertising HFSS products on their own social media pages fall outside the legislation’s scope, the rules would clearly still have an adverse impact on the sector, claimed SGF.

Chief Executive Pete Cheema said: “While we expect most of our independent retail members to be beyond the scope of the watershed restrictions, the indirect impact of the advertising ban is yet another blow for multiples, producers, and the wider supply chain. All of which are critical to UK jobs and the economy.

“ e ever-growing burden of regulations and restrictions, across a wide range of product lines, has the inevitable e ect of reducing overall footfall, making local stores less viable and putting those lifeline services at risk.”

JW Filshill has revealed strong growth in its latest financial results, with turnover rising 6% to £215m, up from £203m in the year ending 31 January 2024, and operating profit up 45% from £2.9m to £4.2m.

The business, which operates the KeyStore franchise, also saw gross profit rise 15% to reach £22.3m in the same period, while net assets rose 14% to £21.6m.

Keith Geddes, Chief Financial and Operating Officer, said improved growth and profitability was “particularly impressive” given that Filshill relocated to a new purpose-built site in Renfrew during the period.

He said the investment in the new facility and other projects demonstrated the confidence and commitment of the business.

Taranjit Singh Dhillon is Nisa’s new Head of Retail Former One Stop National Operations Manager Taranjit Singh Dhillon has been named as Nisa’s Head of Retail, a position previously held by Victoria Lockie, who is now Retail Director at Unitas Wholesale.

Dhillon, who has 20 years in retail, joins Katie Secretan’s Retail & Sales Leadership Team and will be responsible for the development and delivery of Nisa’s retail strategy, across the diverse network of customer stores.

ACS urges Chancellor to support growth

Ahead of the UK’s Autumn Budget on 30 October, ACS has made its submission to the Treasury, imploring the chancellor to create the right economic environment for retailers to invest in their businesses.

Glasgow to host Commonwealth Games

Glasgow has secured a deal to host the 2026 Commonwealth Games after Australia withdrew as hosts over costs. Commonwealth Games Australia has committed to a multi-million pound investment that would support making Glasgow 2026 a reality. The funding injection is in addition to the £100m committed by the Commonwealth Games Federation and aims to reduce any perceived financial and reputational risk highlighted by the Scottish Government.

Usdaw scuppers Tesco’s ‘fire and rehire’ plans Retail distribution trade union

Usdaw has won a Supreme Court battle against supermarket giant Tesco over proposals to ‘fire and rehire’ workers on less favourable terms. This was the final stage of a long running legal battle in England. A similar case involving workers at Tesco’s Livingston site has been stayed in the Scottish courts.

Nisa’s former Head of Retail Victoria Lockie has joined Unitas Wholesale as the buying group’s Retail Director. Lockie spent 12 years leading the Nisa Retail field team and is an ambassador for Diversity in Wholesale, Women in Wholesale and GroceryAid. Her new role will take in the continued development of the Unitas ‘Plan for Profit’ category management scheme, the group’s retail and wholesale promotional programmes, and the roll out of its Local Living own-brand range.

Sugro partners with Lumina Wholesale buying and marketing group Sugro UK has teamed up with Lumina Intelligence to equip its head office and members with critical industry insights and detailed market reports. Through this partnership, Sugro Group will gain access to exclusive reports and strategic insights, detailing latest development within the sectors, including key trends, consumer behaviours and opportunities for growth that are essential to staying competitive.

Spar Scotland wholesaler CJ Lang completed its fourth and final Kiltwalk of 2024, with all funds raised going directly to industry charity GroceryAid. Walking events took place in Glasgow, Dundee, Aberdeen and Edinburgh. The group raised over £22,000 last year for the charity and is hopeful that even more can be raised this year.

InPost Collect service set to boost c-store footfall

Retailers hosting InPost lockers can expect more shoppers through the door thanks to the firm offering a “game-changing” new Collect service. This will allow e-commerce retailers to offer delivery to any of over 8,000 InPost Lockers directly at checkout, providing customers with flexible delivery options and helping to avoid online basket abandonment.

Refrigeration and food to go are key focus areas for the new-look Scotmid Ferry Road in Edinburgh, which relaunched on August 30, following an 11-week re t.

e outlet has been expanded from 1,600sq to 2,000sq and boasts new signage and a wider entrance door and aisles to improve accessibility. In addition to expanding the sales area, the back-ofhouse infrastructure has been upgraded to support these enhancements.

e store has also taken on new recruits, with team numbers increasing 36%.

e shop’s food-to-go o er has expanded with more hot food and baguettes, as well as Rollover Hotdogs and the introduction of a Healthier Snacking line and e Kitchen selection.

ere are also new drinks-to-go o erings from Slush Puppie and a Skwishee machine, which sits alongside a Costa Express co ee machine and a freezer dedicated to Frozen Treats.

Co-Chairs of the GroceryAid Scotland Committee Jim Harper and Peter Steel are to step down from their roles a er almost six years.

In those six years the pair have transformed GroceryAid Scotland, building a strong committee of more than 25 people representing all corners of the local retailing and grocery channels in Scotland.

e pair have also overseen the launch of Checkout Scotland, the charity’s agship annual music festival which took place last month.

Committee member and SLR Publisher Antony Begley said: “When Jim and Peter took over, GroceryAid Scotland was barely surviving. What they have achieved in six years is nothing short of phenomenal and the transformation they have overseen has been spectacular.”

Four new bays ( ve metres) of refrigeration were added, increasing the store’s space across multiple chilled categories. To add a unique touch, the store has introduced new ranges in Health & Wellbeing, Mediterranean, and World Foods.

It has been a busy few weeks for the Scotmid group, which recently announced a year-long partnership with cancer support charity Maggie’s.

As part of the collaboration, Maggie’s ‘Support Squad’ will visit Scotmid stores across the country, engaging with customers to raise awareness and funds. ese ‘pop-up’ events will let customers learn more about the resources available to them and how they can contribute.

Scotmid stores have also introduced exclusive Maggie’s-branded merchandise, including limitededition pin badges and air fresheners. Additionally, Scotmid employees are encouraged to get involved in local fundraising activities.

e Scottish Grocers’ Federation (SGF) has welcomed BP’s Central Operations Director, UK retail, Andrew Kenney, as the next Vice President (VP) of the trade association’s National Executive board.

Kenney replaces current VP, Graham Watson of Watson’s Licensed Grocers, who will become SGF President for the next two years, taking the reins from outgoing SGF President, and Chief Sales & Marketing O cer at JW Filshill, Craig Brown.

SGF Chief Executive, Dr Pete Cheema OBE, said: “We are incredibly pleased to have Andy on board as the VP for the next two years, and I’m very much looking forward to working closely with him on a variety of issues impacting our sector. He brings a wealth of experience in both retail and business, with over 25 years at BP and years of service on our National Executive.

“Andy is the rst person in SGF’s 106year history to come from a forecourt background, which will add a di erent stance to the everchanging convenience market.”

SLR is working with Red Star Brands and its fast-growing RTD brand Four Loko to provide you with regular updates on the performance of an increasingly important category.

Long-term growth of the RTD category continues, growing at +4.8% in the latest 52 weeks and is now worth over £512m in value sales. We continue to see the convenience channel being the main growth driver, up +16% in value in the same period.

Premixed spirits and RTD cocktail subcategories are flourishing in the market, growing at +14% and +9%. Whereas we see the likes of alcopops and seltzers experiencing a decline.

Within the convenience channel, RTDs in the Scottish regions are outperforming the total convenience channel, growing +27% in value sales and now worth £62m in the latest 52 weeks.

Four Loko is one of the main contributors to growth within the RTD category in Scotland, adding £4.8m in sales, contributing to over 38% of the total category growth. Au Vodka and Dragon Soop are also contributing to the growth of the category.

Four loko is seeing growth of +51.5% in the total RTD category and is one of the strongerperforming brands in the market currently.

National Lottery operator Allwyn is on the hunt for community-minded National Lottery retailers for its new ‘Local Retail Champions’ campaign. Members of the public are being asked to nominate retailers who have gone above and beyond to support their community.

With total prizes worth £140,000 up for grabs, ‘Local Retail Champions’ will recognise and reward over 100 National Lottery retailers across the UK and the Isle of Man.

Winners could include those who deliver to customers unable to reach the shop or who have widened their aisles to accommodate wheelchair users, or retailers who support or sponsor local sports clubs, who focus on stocking locally

produced products or who organise local litterpicking sessions.

Two overall winners will scoop a cash prize of £5,000, plus a ‘social value store makeover’ worth £20,000. e makeover will help the shop do more for its customers, community or environment. For example, it could fund energy e cient xtures, pay for lessons for sta who want to use sign language, or refurbish space designed for community use.

In addition, 16 regional winners will be awarded £5,000 each, while 100 runners-up will receive a £100 cash prize.

Working with publisher, Reach plc, ‘Local Retail Champions’ will be promoted across a wide range of consumer-facing national and regional publications and websites, and the competition will be supported on National Lottery retailers’ in-store media screens.

Retailers can also spread the word about the competition face to face with their customers and encourage their shoppers to vote for them via their store’s social media channels by directing them to the campaign website.

National Lottery operator Allwyn’s CEO Andria Vidler said: “Retailers are the heart and soul of their communities. We can’t wait to see all the fantastic stories and urge every one of our retail partners to share details of the campaign with their customers and get involved – as there are some brilliant prizes up for grabs!”

Shops across the UK were forced to turn away customers for half a day on 12 September when they were le unable to accept card payments due to an outage at the Cardnet card payment service, which is operated by Lloyds Bank.

Retailers using PayPoint were impacted a er the rm recently extended its partnership with Lloyds, making Cardnet the main card acquiring partner across the group’s network.

Hordes of frustrated retailers complained to PayPoint about the problem, which started early in the morning and wasn’t resolved until a er 2pm.

A clearly unhappy Anne Lynne of e Corner Shop in Rhynie, Aberdeenshire, fumed: “ is is awful… I’ve had to refuse customers all morning since I opened at 6:30. Ridiculous!”

Gordon Scobie of Leswalt Village Store, Stranraer, Dumfries and Galloway, vented: “Over seven hours with no ability to take card payments is a joke in this day and age.”

Kevin Ireland of Gibby’s Convenience in Lanark said: “Card payments are normally half our takings in a day,” adding that he had been losing customers since 6am.

PayPoint apologised for the disruption and advised retailers looking to complain or claim compensation to contact Lloyds Cardnet directly at cardnet_complaints@ lloydsbanking.com or by phoning 01268 567 100 (open 8am to 9pm Monday to Saturday).

Scottish Grocers’ Federation

A little over 16 months ago, businesses across Scotland breathed a sigh of relief when the Scottish Government reversed its plans to introduce far reaching and stringent controls on alcohol marketing in Scotland, with proposed restrictions on sports sponsorship, media advertising, branding and merchandise, and in-store locations and promotions.

Well, the plans are back!

Albeit with new proposals to reduce exposure to alcohol that are narrower in scope than those previously suggested.

A 15-year high in deaths caused by drinking fuels debate over alcohol pricing.

The Scottish Government has commissioned Public Health Scotland to review the evidence before deciding on potential restrictions. We expect this to be followed by a new consultation and thorough engagement with industry, to prevent the same fallout as before. SGF plans to fully engage with members, the same as last time, and hopefully get the chance for members to address officials directly at a roundtable.

The Food and Drink sector is Scotland’s top international exporter and is globally recognised for its exceptional produce. Alcohol alone accounts for approximately 3.3% of GDP.

These restrictions could have a significant impact on our members and thousands of businesses. On top of the recent increase to MUP, any potential location restrictions will significantly hamper and disadvantage small format stores by adding to the operational burdens they already face. This is particularly concerning as it is far easier for ministers to bring forward restrictions on retail, using devolved powers, than on sports and media which could fall under reserved powers or the Internal Market Act. Watch this space!

e minimum unit price (MUP) for alcohol increased to 65p on 30 September, with the price of a 5% ABV one-litre bottle of cider increasing from £2.50 to £3.25 and a 70cl bottle of whisky at 40% ABV rising from £14 to £18.20.

However, the e ectiveness of MUP, which was originally introduced at 50p in 2018, was called into question yet again, when the government recently revealed that, devastatingly, 1,277 people in Scotland had lost their lives to alcohol in 2023 – the highest gure registered since 2008.

e Scottish Health Secretary, Neil Gray, claimed that MUP had indeed been e ective. “In e Lancet, international public health experts stated: ‘Policy makers can be con dent that there are several hundred people with low income in Scotland who would have died as a result of alcohol, who are alive today as a result of minimum unit pricing’,” he cited last month, before adding that more needed to be done to reduce harm. He then announced plans to commission Public Health Scotland to carry out a review of all the evidence available on the impact that alcohol marketing and advertising has.

Critics of MUP, including Scottish Conservative MP Tess

White, have previously accused the legislation of punishing responsible drinkers during a cost-of-living crisis.

Jas Khaira, who owns a Premier store in Alloa, shared similar concerns when he posted a list of price comparisons on his store’s Facebook page on September 10, showing the impact of the 65p MUP, and stating: “Scots who enjoy a wee tipple face some eye-watering hikes in just a couple of weeks’ time, but experts say this will only make the poor poorer.”

His post was met with numerous comments from followers venting their frustrations at the price.

Rob Brown eld said: “Highest alcohol deaths since coming to power, highest number of patients in hospital with alcohol-related illnesses, and zero proof minimum pricing has had any impact.”

Gary MacKenzie wrote: “With prices of many wines, beers and especially cider soon 30-40% higher than in England, the starting gun for the Carlisle to Dumfries booze run is ready to be red.”

While Bill Grant said: “Just another local tax and revenue generator now driving this strategy, nothing else.”

Much to Jas’ frustration, other responders accused the shop of

pro teering from the higher MUP. “I think a lot of people need to be educated on this,” he told SLR. “ ere’s not enough information out there and some people think that the retailers are making money. What they’re not realising is that the minimum unit price goes up for us too.”

Although initially receiving a frosty reception, by the time the original MUP law was implemented, it was hailed by the independent sector as a “golden opportunity” for price parity with supermarkets.

However, Jas fears that the increase in the minimum unit price may have a negative impact on convenience store sales. “We were not a ected last time because… the pricing was a lot di erent to now,” he said. “ is time it will a ect us because there’s no cash out there. With in ation, people are struggling with debt. I think people are going to buy less alcohol from us and be more attracted towards supermarkets.”

However, he felt that the latest MUP hike would do little to counter the harms caused by excessive alcohol consumption. “No matter what, I think if somebody’s going to drink, they’re going to drink,” he stated matter of factly.

It’s a haggard and tired cliché but like most haggard and tired clichés, it’s true: local retailing is a people business. At heart, the one superpower that a convenience store can wield against its competition is customer service. Nobody else comes close. Supermarkets aren’t even in the ballpark. Discounters seem to take some sort of pride in finding surly, unfriendly staff.

Only in a local convenience store can you be confident of getting a hello, a smile and a bit of banter. But, as we discovered last year when we unveiled the Above & Beyond Awards, the role that staff in your business play in your local community extends way beyond what could reasonably be expected of them.

When we launched the Above & Beyond Awards, it’s fair to say we took a bit of a flyer. Would anybody be interested in an event celebrating the stuff that nobody ever hears about? Would anybody enter? Would anybody sponsor?

As it turned out, the Awards were a success beyond our most optimistic expectations. We uncovered some truly breathtaking stories of store staff taking Above & Beyond to extreme levels. It was simply awe inspiring and, if you were lucky enough to be there, you will recall that quite a few tears were shed as the audience listened to heroic and epic tales. It was humanity at its very best.

And what stuck with me during the judging was how many of our entrants dismissed their truly heroic actions with a shrug and a ‘It was nothing special, I was just doing my job’.

Modesty is, of course, a Scottish trait – but sometimes it’s a good idea to park that modesty, just briefly, and celebrate the people who make our sector so special and so unique.

So we’ll be doing it all over again next year and we want to hear more inspiring tales of bravery, compassion, humour and care. You probably know of someone in your business who has done something special, or who routinely makes life better for colleagues and customers. Do them a favour: let us know. You can fill in the very brief entry form on our website or you can just provide us with a name and a contact number. We’ll do the rest.

ANTONY BEGLEY, PUBLISHING DIRECTOR

EDITORIAL

Publishing Director & Editor Antony Begley abegley@55north.com

Deputy Editor Sarah Britton sbritton@55north.com

Features Editor Gaelle Walker gwalker@55north.com

Web Editor Findlay Stein fstein@55north.com

ADVERTISING

Sales & Marketing Director Helen Lyons 07575 959 915 | hlyons@55north.com

Advertising Manager Garry Cole 07846 872 738 | gcole@55north.com

DESIGN

Design & Digital Manager Richard Chaudhry rchaudhry@55north.com

EVENTS & OPERATIONS

Events & Circulation Manager Cara Begley cbegley@55north.com

Scottish Local Retailer is distributed free to qualifying readers. For a registration card, call 0141 22 22 100. Other readers can obtain copies by annual subscription at £50 (UK), £62 (Europe airmail), £99 (Worldwide airmail).

55 North Ltd, Waterloo Chambers, 19 Waterloo Street, Glasgow, G2 6AY Tel: 0141 22 22 100 Fax: 0141 22 22 177 Website: www.55north.com Twitter: www.twitter.com/slrmag

DISCLAIMER

The publisher cannot accept responsibility for any unsolicited material lost or damaged in the post. All text and layout is the copyright of 55 North Ltd.

Nothing in this magazine may be reproduced in whole or part without the written permission of the publisher.

All copyrights are recognised and used specifically for the purpose of criticism and review. Although the magazine has endevoured to ensure all information is correct at time of print, prices and availability may change.

This magazine is fully independent and not affiliated in any way with the companies mentioned herein.

Scottish Local Retailer is produced monthly by 55 North Ltd.

©55NorthLtd.2024 ISSN1740-2409.

BY GAELLE WALKER

Launched last year, SLR’s inaugural Above & Beyond Awards were a poignant and powerful celebration of Scotland’s heroic convenience sector employees.

e 2024 line-up of nalists and winners included an inspiring mix of one-ofa-kind individuals, for whom ‘going above and beyond the call of duty’ was inherent.

e awards also acted as the perfect platform on which to showcase the many astonishing acts of sel essness and bravery performed by industry employees – o en in the face of challenging environments and situations.

One such lady is Alison Lennon, who claimed 2024’s Astonishing Act Award for helping to save the life of one of her shoppers. Alison, who is the manager of Day Today, Shotts, became concerned for the welfare of one of her regular elderly customers when he didn’t arrive for his daily morning paper. Astute Alison went to his house where she discovered that he had had a serious accident and had been unable to call for help. Alison quickly raised the alarm, calling the emergency services, and the gentleman was saved.

“ e Above and Beyond Awards were such a fantastic experience,” Alison says. “I’d never really considered that I was doing anything that special or ‘astonishing’ until I was nominated, so it was really lovely to be told that and to meet so many other inspiring people. Winning an award was the icing on the cake.”

Another of our fantastic winners was Claire Fleming. Claire claimed the Company Owned Store Colleague Award for the outstanding community work that she spearheaded during her time as the manager of Spar Portland Street in Troon.

Since winning her award, Spar Scotland has asked Claire to work her magic at another store within its estate – and she’s now managing Spar Saltcoats.

“Winning my award was such a proud moment for me, but win or lose, it didn’t matter,

simply being nominated was enough. It’s all about having someone notice you and say well done. Some people don’t have anyone in their life who says ‘well done’ or ‘I’m proud of you’ to them and that’s what makes the Above & Beyond awards so powerful. at recognition could be a pivotal moment in someone’s life.

“If you have someone in your team who goes out of their way to make a di erence, then please nominate them for these awards. Since winning the award I’ve taken on a new role, and I’m using my win to inspire my new team and show them what we can all achieve if we pull together and go that little bit above and beyond.”

Claire and Alison’s stories are certainly inspirational and now, with the launch of e Above & Beyond Awards 2025, we can’t wait to unearth this year’s crop of new nominees and future winners.

“It’s all about having someone notice you and say well

done.

Some people don’t have anyone

in their

life who says ‘well done’ or ‘I’m proud of you’ to

them

and that’s what makes the Above & Beyond awards so powerful. If you have someone in your team who goes out of their way to make a difference, then please nominate them!”

Open to all colleagues working in independently owned local retailing stores in Scotland that are unaffiliated or members of any symbol group, fascia or franchise.

Open to all colleagues working in CJ Lang company-owned stores in Scotland.

Open to all colleagues who have materially improved their store’s performance by suggesting or introducing a new concept, product, service, communication method or a change in operational process.

Open to all in-store teams which have pulled together to make a positive difference to their store’s performance and or to their community.

Open to all colleagues aged 25 or under working in any of the store formats detailed above who have shown themselves to be outstanding colleagues with a bright future in the sector ahead of them.

Open to all colleagues working in any of the store formats detailed above who have worked in the sector, or a single store or chain, for an extended period of time.

Open to all colleagues working in any of the store formats detailed above who truly went Above & Beyond to perform an astonishing act that had a massive positive impact on a customer, colleague or the community.

If you’ve got a superstar working in your store, then please do as Claire suggests – nominate them and give them a chance to shine.

e awards categories cover all store formats and styles, and the awards are open to all store colleagues – from sales assistants right up to store managers and from new starters to convenience veterans.

Two new categories have also been added to the awards this year.

Our Business Booster Award is designed to recognise and reward colleagues who have materially improved their store’s performance by suggesting or introducing a new concept, product, service, communication method or a change in operational process.

Our new Team Of the Year Award meanwhile, is designed to reward outstanding team e orts and highlight the positive outcomes that can be achieved with a true partnership approach. is is your chance to provide some muchdeserved recognition for those members of your team who help to set your business apart in the local community.

Whether it’s helping to raise in-store standards, turbo-charging community engagement, supporting customers in a time of need or being a superstar colleague who always has time to lend a hand or an ear – we want to hear about them.

We’ve made the awards even simpler to enter this year and all nalists will be invited free of charge to a celebratory lunch at the exclusive Corinthian Club in Glasgow on the 12 March 2025.

Working with our generous sponsors, we will ensure that everyone joining us is treated to a magical day.

So please don’t delay, get your entries in before 15 January and give those hard-working industry colleagues the recognition they so thoroughly deserve.

“Our staff are our biggest asset, clearly identified by our customers. We know convenience store staff are very much unsung heroes at times and we’re delighted to be involved in industry awards that recognise their efforts.”

Frank McCarron, Company Owned Store Director, CJ Lang/Spar Scotland

“Mondelez International is proud to play a part in celebrating some truly exceptional people across independent retail through our sponsorship of the Independent Store Colleague & Long Service categories at the SLR Above & Beyond Awards. As a provider of iconic brands including Cadbury, Oreo, Maynards Bassetts, belVita and Dairylea to name just a few, independent retailers play a crucial role in bringing our snacks to consumers across the nation. We’re delighted to support and reward those who go above and beyond for their shoppers, their staff and their communities every day. Best of luck to all the entrants!”

Susan Nash, Trade Communications Manager at Mondelez International

“Scottish convenience stores are a sevendays-a-week collective effort, with many unsung colleagues working quietly behind the scenes bringing new ideas to stores, delivering unwavering commitment to business continuity or going above and beyond for their team or local community. And that’s why we’re back for a second year, together with SLR, to recognise and celebrate the efforts and achievements of the behindthe-scenes heroes and rising stars in Scottish convenience – so we can share their stories, say thank you and inspire others to follow suit.”

Amy Burgess, Senior External Communications Manager,

“Tennent’s are excited to sponsor the Team award and celebrate the positive differences retailers are making across Scotland. Without a great team, success never comes easy!”

Nicole Halsman, National Account Manager RTM and Convenience, Tennent’s

Petits Filous has unveiled new limited-edition packaging, with new characters hidden under each lid, and an onpack competition offering £100,000-worth of prizes. The refresh and competition are supported by the brand’s biggest campaign of 2024, ‘Try Your Luck With a Lick’. This includes out-of-home advertising, video on demand, online video, social media and instore activities.

One Stop has completed its sixth range reset of 2024, with a refreshed confectionery offer. The new range has more variety, and a number of seasonal products will now be available all year round. More than 30 lines have been delisted, with 43 additions. The retailer is also introducing supplier-branded bays from Cadbury and Kinder to its company-owned stores.

Stuart Graham has joined KP Snacks as Head of Convenience and Impulse (C&I), where he will concentrate on collaborating with KP’s customer trade partners to ensure further growth for both the brand and retailers. Graham brings with him a wealth of knowledge and experience in the snacking category. His career includes senior roles at PepsiCo and Pladis, both with a strong focus on C&I.

Rose Marketing has launched its largest range of Christmas confectionery yet, with more than 30 lines. New for 2024 is a Harry Potter Stamper with Jellybeans (RSP £1.39) featuring all of the books’ favourite characters. It comes in a branded CDU of 24 x 8g units. The 2024 collection also features new Candy Castle Crew Fizzy Gingerbread Man, Fizzy Christmas Trees and Fizzy Holly Jolly Mix. These come in 90g bags with an RSP of £1.

A nine-year-old boy from Northern Ireland has seen his drawing of a sweet-eating monster inspire the packaging design of Spar’s newest confectionery launch.

Archie Barr of Ballygally in Co Antrim showed his drawing of a packet of imaginary ‘Wobbly Jelly Monster’ sweets to Chris Todd, owner of the village’s Spar store, who was so impressed that he shared the idea with Henderson Group, which owns the Spar franchise in Northern Ireland.

Henderson’s Spar UK colleagues then incorporated a graphic inspired by the drawing into the packaging for new Fizzy Fangs.

Archie said: “I didn’t believe my daddy when he rst told me my

sweetie drawing had been shared with Spar and inspired the new Fizzy Fangs monster. It’s been so exciting! e sweets taste amazing, and the packaging looks awesome.”

Del Monte has teamed-up with Disney to bring characters from the new ‘Inside Out 2’ movie to packaging across its range of products, from fresh fruits to snacks.

The partnership also gives shoppers the chance to win a trip to London inclusive of flights, accommodation and activities inspired by ‘Inside Out 2’. The competition is accessible via on-pack QR codes and requires entrants to answer trivia questions about the film.

Thierry Montange, Senior Marketing Director from Del Monte Europe, commented: “By featuring characters from ‘Inside Out 2’ on our products but also on in-store materials and brand content, we hope to make healthy eating a fun and engaging experience for children and parents alike.”

Chris, who runs Spar Ballygally with his dad Graham, added: “hen Archie rst gave me his drawing, he said it would be a top seller, and I think he’s going to be right!”

Sweet Freedom has given its range of hot chocolates, syrups, spreads, and drinks a fresh new look.

As part of the refresh, the brand’s animal characters have been ditched in favour of a single, recognisable – and female – mascot, ‘Drizzly Bear’.

The new packaging features a contemporary design with a clearer call to action and improved usage instructions. It is supported by ‘Drizzle More,’ a new campaign across Sweet Freedom’s online platforms and out-of-home marketing.

Coca-Cola Europaci c Partners

Great Britain (CCEP) has unveiled a brand-new digital promotion giving consumers the chance to earn a free Dr Pepper as part of the latest phase of its ‘Try More Weird’ marketing campaign.

Live now, Dr Pepper is giving consumers a free ‘Can-sultation’ with the Doctor when they clickthrough on links displayed across the brand’s social media ads.

ey’ll be directed to message a chatbot, where they can tick o their symptoms of boredom before being prescribed a digital voucher via Zappit to claim a free 500ml

bottle of Dr Pepper or Dr Pepper Zerooo from participating stores. e promotion is designed to get consumers to try something di erent, helping to drive trial

SNACKS Range overhaul includes increased pack sizes

PepsiCo has given its Frazzles and Chipsticks ranges an overhaul, including new pack designs across all formats. e refresh also includes increased pack sizes for price-marked packs and standard multipacks across the Frazzles range.

Rachael Smith, Head of Marketing of Extruded Snacks at PepsiCo, commented: “ e refreshed packaging includes new artwork across all our Frazzles and Chipsticks formats, including price-marked packs and more compact packaging across the six-pack formats. e elevated quality of the packaging will both appeal to current fans of the Frazzles and Chipsticks ranges and introduce these much-loved snacks to a new generation of snack lovers.”

of Dr Pepper Zerooo’s refreshed taste, and bring new shoppers into the category, while also increasing brand awareness and driving footfall in-store.

e campaign is also supported by out-of-home advertising and social media.

Rob Yeomans, Vice-President, Commercial Development at CCEP, said: “Dr Pepper continues to become more popular, growing ahead of the avoured carbonates segment in both value and volume terms, while strengthening its position as the number-two avoured carbonates brand in GB.”

The Reese’s brand has launched ‘Become a Reese’s Treat,’ a competition that gives shoppers the chance to win a sculpture of their head and shoulders made entirely from Reese’s chocolate and peanut butter.

The competition runs until 7 November and entry is via a QR code on Reese’s POS or via the brand’s social media channels.

One lucky winner will be immortalised in a chocolate sculpture made by Jen Lindsey-Clark, whose team created Chocolate King Charles Bust. They will also receive a £5,000 cash prize.

The competition coincides with the launch of a number of Halloween-themed Reese’s SKUs.

These include Reese’s Skeletons Snack Sizes (257g, RSP £4.50), Reese’s Pumpkins King Size (68g, RSP £1.25) and Reese’s Cup Snack Sizes (297g, RSP £4.50).

Win a wing walk

Dairy spread Utterly Butterly has launched an on-pack promotion giving shoppers the chance to win a £500 wing walking experience. The promo runs to mid-December and 25 lucky winners will soar through the skies with AeroSuperBatics, an aerobatic wing walking team, which the brand sponsored from 1999 to 2006. This saw the team’s biplanes wrapped in the yellow and blue Utterly Butterly colours.

World of Sweets unveils new teen brand

Confectionery distributor World of Sweets has launched Sweet Vibes, a new brand tailored towards teenagers looking for unusual flavour combinations and quirky designs. The range rolls out initially with Freakshake Cups (RSP £3.50) in three flavours: Banana, Strawberry and Choc-a-Lot. The same flavours are also available in a bag format (RSP £1.25).

Shore marks million-pack milestone with new flavour Shore The Scottish Seaweed Co. has launched its latest flavour of seaweed chips as it celebrates selling more than one million packets since last September. Salt & Balsamic is the latest flavour created by the Wickbased brand and is available in 80g share bags and 25g individual impulse bags. It joins a range of better-for-you seaweed crisps that already includes Peking Duck, Sweet Sriracha, and Lightly Salted variants.

New Signature tins nod to brand’s 1963 debut Scandinavian Tobacco Group has unveiled two new limitededition designs for its 10-pack tins of Signature Blue and Signature Original miniature cigars. The brand first launched in 1963, and the two new ‘Signature 1963 Edition’ tins tip their hat to its history, heritage and quality. As well as a new exterior design, they also include limited-edition liners inside.

White Claw unveils vodka Hard seltzer brand White Claw has launched its first-ever vodka, which rolls out in Black Cherry, Pineapple, and Mango variants (all ABV 30%), as well as an unflavoured Premium version (ABV 40%). The flavours have been designed to be mixed with any of the brand’s hard seltzer range. White Claw dominates the UK hard seltzer market, however the category as a whole is one that British consumers remain largely indifferent to.

With Halloween getting frightfully close, Gravity Drinks has unveiled new Pumpkin Potion liqueur (ABV 12%). A blend of pineapple, mango and citrus flavours with vodka, Pumpkin Potion has an RSP of £10 and comes in a circular 700ml bottle that looks like a carved pumpkin. Each bottle has an LED light on the base to give the shimmering liquid inside a spooky glow.

Arran puts boiler breakdown behind it

Arran Brewery has resumed production after a “cataclysmic” boiler failure left it unable to brew beer for almost all of this year. Engineers successfully restored the boiler to full working order last month and the brewery is back in business, albeit at a reduced capacity for the moment. It has had a successful brew of Arran Blonde, and Arran Dark has just entered the maturation stage.

Pernod Ricard has acquired a minority stake in Almave, a premium non-alcoholic blue agave spirit brand co-founded by F1 driver Lewis Hamilton and Mexican spirits group Casa Lumbre. Pernod Ricard will leverage its considerable brandbuilding and distribution clout to scale Almave globally. Almave’s two expressions, Blanco and Ambar, are currently distributed in the UK by Mangrove Global.

Molson Coors has teamed-up with Paramount+ to give away a 30-day subscription to the streaming service with multipacks of Staropramen.

e on-pack promotion, which runs until 31 January 2025, is supported by in-store and online activities, including out-of-home advertising and a paid social media programme.

All multipacks of the beer are included in the promo.

QR codes on packs take customers to a promotional microsite, where they can enter their details and the last four digits of the pack’s barcode to receive instructions

on how to claim their subscription.

RTDs

Fans can also binge the

From now until 31 October, the same microsite also gives consumers the chance to enter a prize draw to win one of 50 Everdure pizza ovens, worth more than £600 each. e partnership coincides with the return this autumn of Paramount+ hit shows Lioness and Tulsa King. Fans can also binge the brand-new season of Mayor of Kingstown and the number-one

Cîroc, Diageo’s super-premium vodka brand, has extended its RTD portfolio with the launch of a new Cîroc Red Berry Sparkling Vodka Drink (5% ABV).

This follows the launch of Cîroc Summer Citrus and Cîroc Tropical Passion earlier this year.

Cîroc Red Berry Sparkling Vodka Drink combines vodka with the flavour of ripe strawberries and succulent raspberries and is available in 250ml cans with an RSP of £2.85.

The new variant lets retailers tap into the rising popularity of RTDs, which is the fastest-growing segment within the total alcohol category.

Funkin Cocktails has given its higher-ABV Double Shot range a bold new look to tap into growing demand for more premium RTD cocktails.

A re ned colour palette, embossing, debossing and foiling are designed to suggest a premium gender-neutral o ering. New-look cans also give prominence to the bar-strength 14% ABV.

Shelf-ready packaging has also been adjusted, with a lowered front lip that ensures the product name, ABV and avour are all clearly visible in stores.

e refreshed design further distinguishes the Double Shot range from the brand’s Nitro cocktails.

e new cans come with RTD cocktail consumption at an all-time high, worth £129m and up 20.3% year on year.

Diageo has unveiled a fresh new pack design for Smirno Ice and launched a single can format to celebrate 25 years of its popular RTD brand.

e relaunch and new can format are backed by a £1m investment that includes a digital marketing campaign and sampling activities. It comes with RTDs the fastestgrowing category in the O -Trade and Smirno Ice the number-one citrus- avoured RTD in Impulse.

Jessica Lace, Head of Marketing, Smirno , Diageo GB, said: “ e

BEER Partnership goes beyond a co-branded product

Ellon-based BrewDog has teamed up with Spar to launch Sprucy Lucy, a new 4.5% West Coast Session Pale Ale.

Sprucy Lucy combines seven di erent hops to give it a resinous taste in a nod to the Spar logo’s pine tree.

Available in a 4 x 330ml can multipack, Sprucy Lucy retails at £6.49 and will be promoted in-stores and across both BrewDog and Spar’s social and digital channels.

e partnership goes beyond a simple co-branded product: Spar was founded in the Netherlands in 1932 and its name was originally De Spar, an acronym for ‘Door eendrachtig samenwerken pro teren allen regelmatig,’ which translates as ‘Everyone bene ts from joint collaboration’.

“So, the ethos of collaboration is in our DNA,” a Spar spokesperson commmented.

De Spar is also Dutch for e Spruce, the origins of the Spar logo and the inspiration for Sprucy Lucy.

modern makeover brings a vibrant energy to the product and celebrates the citrus avour notes that people know and love. We’re thrilled to share this evolution with our consumers.

“We will be investing £1m into Smirno Ice over the next 12 months to enable us to connect with our existing shoppers and reach new consumers.”

Smirno Ice (ABV 4%) is available in single 250ml cans (RSP £1.99) and in four-can multipacks price-marked at £5.49.

SHS Drinks has cut the RSP of its WKD 700ml price-marked packs by 50p, down from £3.79 to £3.29.

The new packs will phase in over the autumn across all flavours in the 700ml range. WKD PMP bottles are exclusive to independents and available only through cash and carrys and wholesalers.

The new price will apply on an ongoing basis and is not a short-term promotion. There are no associated changes to either individual bottle sizes or trade case sizes.

The move comes at the start of a key period for WKD sales, which is bookended by the new university year and the festive peak. Consequently, the brand has announced a full programme of autumnwinter activity to engage consumers and drive sales for the rest of 2024.

Barr brands buddy up for new Irn-Bru RTD Funkin Cocktails, which is owned by AG Barr, has launched a new limited-edition Irn-Bru Vodka Martini cocktail in a can. The ABV 5% RTD is available now in 200ml cans that feature Funkin’s nitrogen infused technology that aims to replicate a bar-like pour with a velvety head and smooth texture. According to Neilsen data, Funkin is the UK’s numberone canned cocktail brand.

Premium Panamanian rum reaches UK

Premium spirits distributor Highball Brands has launched the Panamanian rum brand Casa Barú in the UK. The range includes three expressions: Blanco, a white rum that offers a blend of fruit, citrus, and fresh cane notes; Double Crop, a marriage of Panamanian sugarcane with Geisha coffee fruit; and Xopa Coffee Liqueur, a combination of Panamanian rum with artisanal roasted coffee.

New vodka lemonade launches

Mark Anthony Brands has unveiled Lemada, a new canned vodka lemonade available in two flavours, Tangy Lemon and Juicy Raspberry, and made with triple-distilled vodka, real lemon juice, 100% natural flavours and no artificial sweeteners. It comes in 250ml cans and, at 4% ABV, bucks the current trend for higher-strength RTDs. Retailers should visit lemadavodka.com/ contact for stock enquiries.

Glencadam extends cask finish collection East Highland distillery Glencadam has added two new cask finishes to its non-age statement collection: Riserva Di Amarone and Reserva De Madeira. Each expression has been matured in American oak ex-bourbon casks before being married and finished in handselected barrels. Both RSP at £47, are non-chill filtered, and have been bottled at natural colour at 46% ABV.

Jay Javid’s Nisa Local Wee Mill store in Rutherglen demonstrates boundless creativity in converting a traditional pub into an award-winning modern convenience store.

BY ANTONY BEGLEY

The New Store of the Year category is always a tough one to win at the SLR Awards, attracting as it does some fantastic entries that demonstrate the very latest thinking in the local retailing space. So, it takes something special to come out top and there’s no doubt that Jay Javid’s Nisa Local Wee Mill store in Rutherglen is something very special indeed.

e store was Jay’s 11th at the time of opening and was a major undertaking for his growthhungry PGNJ business, not least because the site used to house a pub – e Wee Mill – and required some major work to turn it into the modern store that Jay and his team envisaged.

Turning pubs into stores has been a major trend in recent years thanks to Covid decimating the pub sector, but this conversion was achieved with some particular style and air, as the judges discovered.

e initial layout for the new store was dra ed by the company directors before Jay and team engaged with Nisa to draw up some CAD les. As part of the process, several members of the management team visited Ireland to get an upto-date handle on the approach and philosophy of retailers on the other side of the water.

With their ducks lined up, Vertex was called in and the nal designs were drawn up.

“It was a tricky layout to work with,” explains Jay. “We were looking to nd a layout that worked and owed with the original features of the store. Ultimately, we realised that we had to accept the structure of the building, rather than ghting against it. When we did that, we were able to dra a layout that complemented the arches and the ow, while maintaining our focus on providing that superior shopping experience that was always the focal point of what we were implementing.”

e re t cost the best part of a chunky £300k but it looks to have been money well spent. Jay’s vision for the re t was to retain a nod to the site’s previous life as a pub – the big red Tennent’s ‘T’ that now graces the beer cave was the actual big red ‘T’ that used to hang outside the pub – but he always wanted to make this his most modern store yet.

at explains all the techy upgrades like digital SELs and large digital display screens but it also explains the classy nish both inside and out.

e exterior has been clad with the trademark understated grey, white and black while the inside is clean, spacious and well lit, making it just as welcoming as the pub presumably once was. Probably even more so.

All the latest convenience trends have been re ected inside too: a dedicated food- and

drinks-to-go area, a beer cave and a big fresh and chilled section, all with the latest-spec kit.

e 32sq beer cave is another nod to the pub as it sits exactly where the pub’s o -trade section used to be. It now boasts a huge range of chilled beers, wines, ciders and RTDs, including a big array of multipacks.

e store sits in a heavily populated area and, despite having a Tesco just a hundred or so yards away, Jay was con dent his enhanced convenience o er and long opening hours – 7am to 10pm – would help him bring convenience shoppers through the door.

Sitting near both a golf course and an industrial estate, it was critical that there was a good food-to-go o er so the store has a fresh cream cake counter and a TurboChef oven and serve-over for toasties and other hot savoury snacks.

ere is also Tango Ice Blast, Fanta and CocaCola slushed drinks, and a display for the Nisa meal deal.

As with all of PGNJ’s stores, Rutherglen sources a fair amount of its stock from local suppliers, like hot savoury snacks and cakes from McGhee’s Bakery and Aulds the Bakers, and Equi’s ice cream tubs.

“We spend a lot of time with the Nisa development team and really listen to them for the basic layout of our shops and range. We share the same vision of what stores should look like, and the standards to expect.”

And while growing the portfolio is very much front of mind, Jay is very conscious of the need to keep investing in the existing stores. Nisa Rutherglen allowed Jay and his team to learn more about developing an individual store to the latest specs – and those learnings will be fed back into the other stores.

“ e retail game has changed in the past few years, so that being successful is not so much about store numbers, but investing in what you have, with innovation, a very strong online presence, and o ering home delivery which is crucial now for convenience businesses,” says Jay.

“Who’d have thought before Covid that so many shops would be delivering groceries? Now, customers have come to expect it. I’m looking at introducing food-to-go concessions, pharmacies and sub-Post O ce counters to o er more things for shoppers under one roof.”

It was clearly a challenging project for Jay and his team, but the end result was something that landed extremely well with the judges: a thoroughly modern convenience store that tastefully recognises the important heritage of the building and the needs of its customers today.

Former Smiths guitarist Johnny Marr was the star of the show at the recent Checkout Scotland event in Glasgow on what was an exhilarating night for the packed audience.

BY ANTONY BEGLEY

Now in its third year, Checkout Scotland has rmly established itself as one of the most enjoyable and unique nights in the Scottish local retailing calendar. Organised by the GroceryAid Scotland committee, the latest staging of the event saw a stellar cast of stars entertaining a packed audience of retailers, wholesalers and more.

Heading the line-up was former Smiths guitarist Johnny Marr, ably supported by the high energy antics of Dundee’s own e View while George Bowie, DJ Naeem and Jim Harper were among those keeping the dance oor mobbed on what was a truly fantastic evening.

Checkout Scotland provides a rare opportunity for the trade to gather, let their hair down and enjoy some great music and a few drinks. e event has been held in the atmospheric setting of Barras Art & Design in Glasgow since its inception.

Just as importantly, the event provides a powerful way of raising awareness of the outstanding work that GroceryAid does for industry colleagues, providing nancial, emotional and practical support – all free of charge and in complete con dence.

And, as you can see from the photos, a good time was undoubtedly had by all!

The latest addition to Soreen’s non-HFSS portfolio seeks to attract new shoppers to the bakery aisle in search of healthier desserts and treats. The new 260g loaf has an RSP of £1.50 and lands as Soreen’s biggest-ever TV campaign gets underway, which sees the brand featured on key channels. This is accompanied by digital and social media, shopper marketing, as well as in-store promotions and POS.

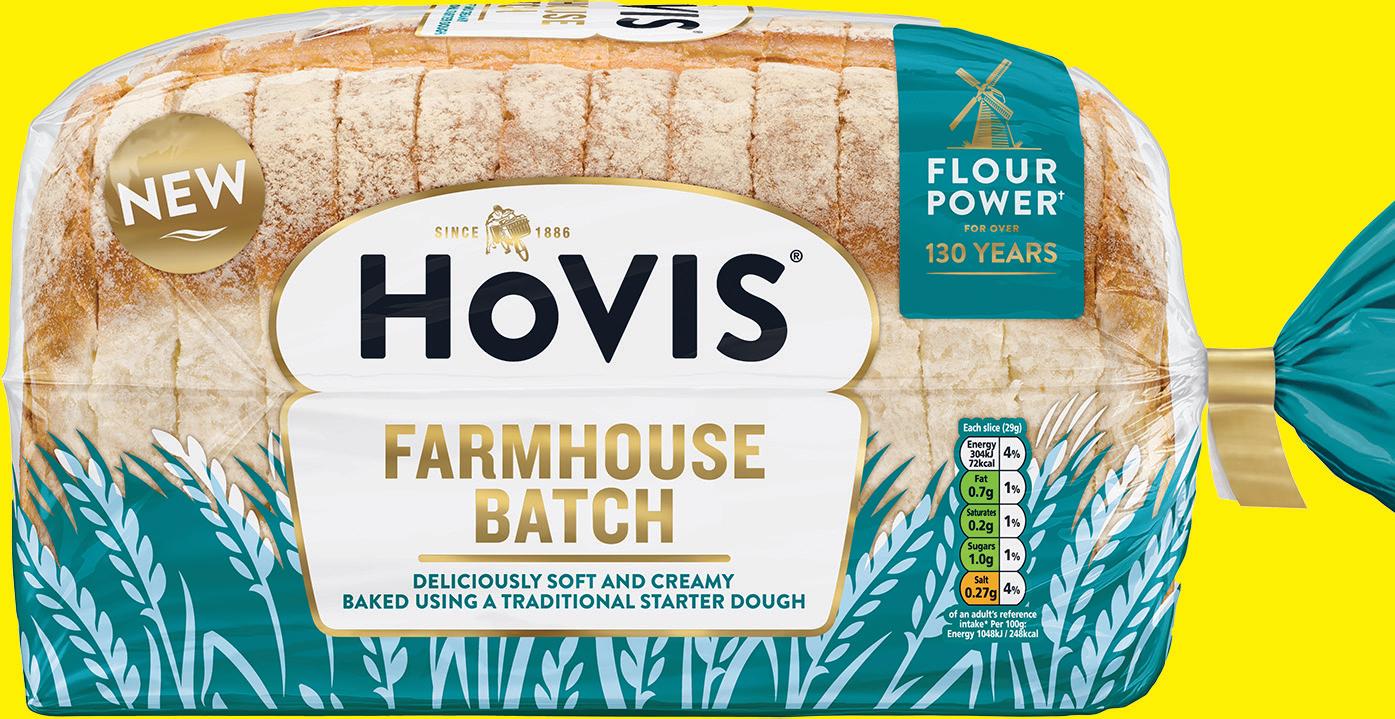

Hovis has unveiled Farmhouse Batch, a new premium but affordable alternative to standard white sliced bread.

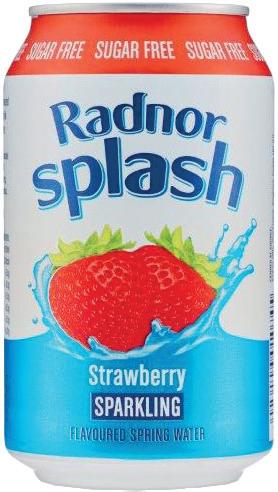

Radnor Splash’s first 330ml canned range comprises the brand’s three bestselling flavours: Lemon & Lime, Apple & Raspberry, and Strawberry. All are made with sparkling spring water and natural flavourings. The launch is supported with promotions, a social media campaign and sampling via brand ambassadors. Mixed sample cases of 24 cans are available.

The new fermented milk drink is available in a fridge-friendly 8 x 65ml bottle pack format, with an RSP of £3.70. Each bottle contains billions of gut-friendly L. casei Shirota bacteria and the peachflavoured drink is rich in vitamin C. It also contains fibre that feeds the gut bacteria. The launch is supported by video on demand, social, influencer and PR activities.

Research conducted with more than 2,000 current bread buyers, revealed that shoppers are looking for inspiration and a premium alternative from standard, everyday white loaves – but with an accessible price point. Consumers love the idea of a domed top and flour finish, and with its deliciously “creamy” taste and super soft texture, Farmhouse Batch caters to this current demand in the market.

Baked using a traditional starter dough, Hovis Farmhouse Batch is available in 400g and 800g loaves, at an RSP of £1.25 and £1.65 respectively, and initially launches into selected Tesco stores ahead of a wider roll out.

The inclusion of a starter dough, which is allowed at least 24 hours to fully develop, helps to create

a creamy taste and soft texture when the loaves are batch baked. Featuring a deeper flavour than traditional white bread, the new recipe also offers generous thick slices, a flour-dusted crust, and is free from artificial preservatives.

The launch is supported with a multi-channel campaign that includes PR, retail media, shopper marketing and influencer activities.

Alistair Gaunt, Commercial Director at Hovis, commented: “Our new Hovis Farmhouse Batch is the culmination of months of consumer insight analysis, followed by recipe and product development work with our expert bakers and cross-functional teams. We have worked diligently to ensure we’re offering shoppers a more premium yet accessible, everyday alternative when they may be looking for something different to the standard soft white loaves they know and love.”

Müller x Myprotein

Müller UK & I

The latest new flavour to join the Monster Additions range combines the usual Monster Energy blend with a light peach flavour and a hint of citrus. It is available now, exclusively in £1.49 price-marked 500ml cans. Retailers can request POS materials and download digital assets from My.CCEP.com to help bring the launch to life instore and online.

This new range is available in three fruit flavours, each with distinct properties to encourage wellbeing: Juicy Raspberry Lemonade, Zesty Orange & Passionfruit, and Zingy Lemon & Ginger. All contain fewer than 50 calories per 250ml can and are fortified with vitamins and minerals, with no artificial sweeteners, colours or added sugar. Single cans RSP at £1.89, multipacks of 4 x 250ml at £5.99.

Müller has teamed up with online sports nutrition brand Myprotein to launch a new range of high-protein yogurts and desserts that includes high-protein yogurts (500g, 45g protein, RSP £3), low-fat puddings (200g, 20g protein, RSP £1.95) and low-fat mousse (200g, 20g, protein RSP £2.50). The launch is supported by instore and digital activities.

Red Bull’s second Winter Edition comes in a cool-blue can and offers the taste of blueberry, vanilla, cotton candy and notes of eucalyptus. It is available in 250ml (RSP £1.60), 250ml £1.55 PMP, Sugarfree 355ml (RSP £1.95) and 4 x Sugarfree 250ml (RSP £5) can pack formats. In consumer testing, 72% said they would be likely to buy an Iced Vanilla Berry flavoured Energy Drink.

The latest addition to JTI’s ultravalue Mayfair Gold range is available now in cases of 5 x 30g pouches, with an RSP of £18.50. To celebrate the launch, JTI is giving retailers a chance to win prizes including a gold-wrapped Mini, £100 gift cards, iPads, and headphones. Any retailer signed up to JTI 360 can enter by scanning the barcodes of Mayfair Gold roll-your-own or cigarette outers.

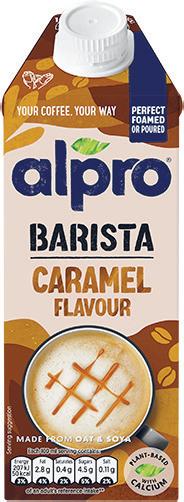

The new drink offers consumers what the brand calls “an authentic coffee shop experience from the comfort of their own homes”. It is available now in 750ml packs with an RSP of £1.75. The plant-based NPD is non-HFSS, dairy- and lactosefree and suitable for vegans. The launch comes with total barista plant-based drinks in double-digit growth (+19.2%) and caramel the preferred flavour choice of UK consumers.

Squeletons contains a mixture of three skull shapes, a different one for each of Sour Apple, Strawberry, and Orange flavours. Launching in time for Halloween, limitededition 120g packs (RSP £1.15) are available now in cases of 12. The NPD is supported by a nationwide marketing campaign for the brand’s wider Halloween range that includes cinema ads, targeted VOD, dynamic digital outdoor advertising, and in-store promotions.

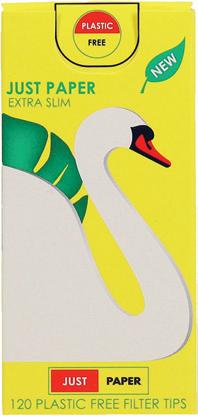

This new range of 100% plastic-free filter tips is available now with an RSP of £1.45. Just Paper features a ‘flip-a-tip’ design which dispenses loose extra-slim filters, without the use of plastic rods. Each box contains 120 filters, with 10 boxes per outer. In what Republic says is a first for the UK market, the filters give consumers an experience similar to traditional cellulose acetate filters, but with a much lower environmental impact.

The latest addition to Warburtons’ bagel range is available now with an RSP of £1.75. The bagels are boiled then baked for authentic taste and texture and are topped with sesame seeds, the second-most-popular flavour in bagels, for added texture. A source of protein, the bagels come in a pack of six, are pre-sliced and can be consumed as they are or toasted.

Old El Paso has launched ‘Turn it Up,’ a new £1.1m campaign to support its Street Vibes range. Running until November, the campaign is live across video on demand, online video, social and digital in a bid to capture the younger audience that has turned its back on broadcast TV. It also includes in-store activities, and an extensive couponing plan.

McCoy’s has been named as the NFL’s UK Savoury Snacks Partner in three-year deal. This means the brand will be lead 6pm NFL game sponsor on Sky Sports Sunday, with a new TV advert and broadcast idents, which will feature across the season-long coverage. There will also be a series of competitions and retail activations throughout the season.

Surf has launched a new £7m marketing campaign to support the relaunch of its liquid and capsule detergents that are made with essential oils designed to be mood boosting and let consumers clean with “joy infused” fragrance. The campaign focuses on a socialfirst approach to resonate and engage with consumers in “a new and joyful way”.

Chewy fruit juice drink Mogu Mogu has launched a major out-of-home nationwide advertising campaign, with ads celebrating the brand’s ‘Sip, Chew, Feel’ experience across more than 1,000 locations including bus stops, digital screens, supermarkets and shopping malls. This follows heavy investment in a global celebrity influencer campaign.

Butterkist has launched a new partnership with Channel 4 across its film programming. The deal runs until 5 January 2025 and sees Butterkist feature prominently across Channel 4’s film premiere programming and video on demand. Four different five-second blips and one 10-second ident integrate popcorn into various movie genres and scenes.

There’s a Santa-sackload of exciting NPD ready to take centre stage this Christmas.

BY GAELLE WALKER

The stage is set, the key players are primed – and with less than three months to go, it’s time to raise the curtain on Christmas 2024 – which is already promising to be a rip-roaring performance.

Low-cost impulse novelty and self-eat ranges always put on a good show at this time of year, as shoppers rush to enjoy a rst taste of festive fun – as do sharing formats, perfect for enjoying with friends and family during the build-up.

We’ve rounded up some of the best festive products waiting in the wings to make their on-shelf debuts and lend your sales some sparkle this festive season.

Hancocks saw “significant sales increases” in low-cost impulse novelty ranges last year and it’s expecting this year to be similar. As a result, many of its new product launches for 2024 are geared towards these formats.

Included in its line-up this year is a new range of festive Elfie treats thanks to a partnership with the Elves Behavin’ Badly brand.

With an RSP of £2.50, Naughty Elf Mix candy cups are filled with a mix of sugar-coated mallows, candy canes and gummy elves.

Shoppers can also get their mitts on Giant Gummy Elfies with an RSP of £1.50 and Elfie Tongue Painters Bags which have an RSP of £1.25. The blackberry, raspberry, lemon and orange-flavoured gummies paint tongues blue.

Capitalising on the “sustained growth in white chocolate” – which was up 111% year-on-year in December 2023 according to NIQ data – Fox’s Burton’s Companies is launching Merryland White Chocolate Chip Mini Cookies this festive season.

The crunchy mini cookies are packed with white chocolate chips and are available in a 150g sharing carton with an RSP of £1.75.

Cadbury Puds made their triumphant return to shelves in 2021 and the range is expanding this year with the launch of new Cadbury Mini Puds.

The bitesized offerings feature a truffle centre with hazelnut pieces and rice crisps and a Cadbury chocolate coating.

The 73g bags have an RSP of £1.98 and are sure to appeal to shoppers looking for self-treats and/or stocking filler gifts.

Oreo is also joining in on the Christmas fun this year with the launch of limited-edition Oreo Gingerbread. The embossed gingerbread-flavoured cookies are available in packs of 154g and have an RSP of £1.50 each.

A number of festive favourites are also returning to the Cadbury line-up this Christmas to help retailers get in on the gifting opportunity. These include Cadbury Buttons Selection Boxes and Cadbury Dairy Milk Winter Mint Crisp tablets.

The brand is also seeking to make the most of demand for spiced flavours this Christmas season with the launch of new Fox’s Fabulous Winter Spiced Cookies which have an RSP of £2.50.

Each milk chocolate chunk cookie is half enrobed in smooth milk chocolate with the addition of warming winter spiced flavours.

American food giant Kellanova is also hoping to make a splash on UK shores this Christmas, following the launch of its Cheez-It brand.

Described as “a one-of-a-kind snack experience baked with 100% real cheese and a unique combination of wheat, corn and potatoes,” Cheez-It Snap’d is available in two flavours: Cheese & Chilli and Double Cheese. These are available in several sizes, including 40g plain packs (RSP £1.09), 65g £1.25 price-marked packs, and 150g sharing bags (RSP £2).

The launch targets the UK’s 22.8 million cheeseflavoured crisp buyers and is supported with an £18m media spend, spanning a TV advert, radio, out of home, sampling, PR, and social.

WThe cost-of-living crisis means consumers continue to spend their nights at home and savvy retailers are set to prosper.

ith many shopping budgets squeezed in the current climate, nights in with family and friends continue to prevail as an alternative to a night out.

“As a result of the increased cost of living, 20% of shoppers are drinking less out of home with 13% saying that they are drinking more at home [Dunhumby Bespoke Shopper Survey Research BrewDog Cra Beer August 2022],” says Caitlin Brown, Category Executive, BrewDog. “ is is great news for convenience retailers and wholesalers, especially as many of these occasions are likely to be impromptu, so creating dedicated displays in-store and promotions on linked purchases can drive impulse sales.”

BrewDog has identi ed four di erent occasions which drive Big Night In missions instore for Cra Beer and Premium Lager, based on data from Kantar Insights Occasion Deep Dive September 2021.

e most popular ‘Night In’ mission (63%) was spent solo or as a couple. e rm suggests highlighting four-packs displayed alongside meal for tonight suggestions to capitalise.

e brewer states that shoppers on the Regular/Everyday Drink mission (34%), which is more habitual, rather than a special event, may be looking to moderate their drinking by supping on alcohol-free beverages.

49%

“Research has also shown that alcohol-free spirits have grown 9.2% in the o -trade [O Trade Nielsen Discovery MAT 27.01.24],” says Lauren Priestley, Head of Category Development O Trade at Diageo GB. “ is has provided people with more choice, meaning they can enjoy socialising moments at home without feeling as if they are missing out on the experience. In fact, Diageo’s ‘House of Zero’ portfolio spans across some of our most popular brands, including Gordon’s, Tanqueray, and Captain Morgan.”

see snacks as a must have for an evening in, says KP Snacks

Another contender for the Big Night In audience that is alcoholfree is Energy Drinks. Helen Kerr, Associate Director of Portfolio Development at CCEP GB, says: “ e energy drinks market is booming and innovation is key to driving this momentum.” e rm extended the portfolio of its £45m Relentless brand with the launch of a new tropical avour earlier this year. Relentless Fruit Punch comes in a bright-pink £1 price-marked 500ml can and joins the existing line-up of Origin, Cherry, and Passion Punch, alongside its Zero Sugar range of Watermelon, Peach and Raspberry. “ is latest arrival follows the

At this time of year, there will be Halloween parties galore, but even those who are staying on the sofa this spooky season, can still get in on the fun with Squashies Squeletons.

The latest launch from British sweet maker Swizzels, the multi-flavoured foam skeleton shapes come in Sour Apple, Strawberry, and Orange flavours.

The launch comes amid significant category growth, with Halloween sugar confectionery growing 18.4%, surpassing the 10.4% growth seen in chocolate confectionery [Circana, Confectionery category, Value Sales 52wks to 05/11/2023, Total Market].

The limited-edition 120g Squashies Squeletons are now available for purchase in cases of 12 (RSP £1.15).

introduction of the Relentless Zero Sugar range, which has generated nearly £9m since launching in summer 2022 and continues to deliver double digital volume and value growth,” says Kerr.

Meanwhile, BrewDog suggested Planned Social Occasions (39%), like bigger gatherings at someone’s home, and consumers in a Party Mood (36%) could be catered for with larger multi-pack formats and BrewDog’s Mixed pack.

“ e ‘Big Night In’ occasion typically sees consumers gravitate towards larger packs of beer and cider than they would normally purchase,” agrees Alexander Wilson, Category & Commercial Strategy Director at Heineken.

“Convenience retailers can capitalise by stocking small- and mid-sized packs of new beer and cider launches, such as Cruzcampo, Birra Moretti Sale di Mare and Strongbow Strawberry, to drive interest to the xture when customers are hosting, where bigger multipacks might be warranted, and people are more likely to buy something new to impress guests,” says Wilson.

Cider is also reaping the bene ts of more people staying in. Aston Manor has attributed the success of its premium-quality cider brand, Knights, to several factors, including the cost-

The snacking category has had a tougher year, as have many categories, with many producers moving away from the £1 price point – but not Golden Wonder.

“We’re performing way ahead of the market at 13% growth [Circana Aug 24]. The wider market has actually fallen by 1.6%, showing how important ‘value’ is in a market where household budgets remain under pressure.

of-living crisis, which has caused many shoppers to change their spending habits. “As part of this, more customers are purchasing cider rather than spirits [Kantar | Take-Home | Alcohol Spend Gains Loss | 12w/e 17 March 2024], which is speculatively due to less disposable income,” says the company.

“We know how important the £1 price-point is to both consumers and retailers. By sticking to the all-important £1 price-point we have continued to deliver great tasting, great value snacks with strong retailer margins. A highlight is our Transform-A-Snack brand, which is outperforming the market at 22% growth [Circana Aug 24], helped by our current on-pack promotion in partnership with the upcoming Transformers ONE movie.” are to has an ABV of 8.4% – highlights the company.

Five of the top 10 brands powering growth within the Beer & Lager and Cider categories have an ABV of 6% or more [SmartView Convenience TWC, Volume and Value Sales, 13 w/e 21.04.24], including Knights Cider – which has an ABV of 8.4% – highlights the company.

Red Star Brands has picked up on the trend for quality high-strength drinks too. “Changes in drinking habits are seen across the board