£100M INVESTMENT

Scottish stores invest almost £100m

STORM IN A TEACUP?

What will the Latte Levy mean?

RAISING THE BAR

Spar Scotland

Tradeshow review

£100M INVESTMENT

Scottish stores invest almost £100m

STORM IN A TEACUP?

What will the Latte Levy mean?

RAISING THE BAR

Spar Scotland

Tradeshow review

Top retailers share their key staff retention techniques

06 Research The 2024 Scottish Local Shop Report reveals investment in Scottish c-stores has soared to £94m.

07 Sales Greens Retail launches a new upselling initiative, leading to a 500% increase in sales of targeted products.

08 Crime Fife retailers are being urged to fight retail crime with self-reporting tech.

09 Results CJ Lang reports an increase in underlying profit for the financial year ended 28 April 2024.

10 News Extra Single-use Cup Charge Is the ‘latte levy’ really just a storm in a teacup?

18 Product News Retailers star in a new KP Snacks campaign and Highland Spring sponsors Scottish Rugby.

20 Off-Trade News Captain Morgan pairs up with Pepsi Max as Funkin unveils an indulgent dessert cocktails duo.

22 Above & Beyond Awards SLR is on the lookout for store superstars for the Above & Beyond Awards 2025.

24 Store Profile JP Pozzi David Robertson delivers an SLR Newstrade Retailer of the Year Award-winning store.

27 Healthy Living Programme For two decades, HLP has changed the lives of Scottish consumers by raising awareness – and sales – of healthier foods.

28 Spar Scotland Tradeshow CJ Lang’s third tradeshow welcomed retailers and company-owned store colleagues from across the country.

30 Store Profile Keystore More Temple Shoppers can’t get enough of Jazz Lalli’s bang-up-to-date store refit.

32 Retail Crime Independent retailers and MSPs discuss the retail crime epidemic in the Scottish Parliament and what needs to be done to tackle it.

34 Hotlines The latest new products and media campaigns.

62 Under The Counter The Auld Boy bumps into Santa, of all people, in Saltcoats, of all places.

36 Sports & Energy Drinks A steady stream of flavour innovations means there are lots of opportunities for local retailers to prosper from the Sports & Energy category.

40 Christmas Top Up Check out the latest festive NPD to ensure you make the most of the run-up to Christmas.

46 Smoking Alternatives Retailers with a strong nicotine pouch offer have lots to gain from the disposable vape ban.

50 Christmas Wines & Spirits A strong range of wines and spirits tailored to the needs of your customer base will ensure you maximise on Christmas sales.

56 EPoS The right EPoS system can be truly transformative, saving you time and revealing valuable sales insights.

58 Forecourts Operators across the UK are investing in their sites, with more fuel options, food to go, and additional services all growing footfall and increasing profits.

THE COVER

Waitrose strikes deal with Just Eat

Glasgow and Stirling Waitrose outlets were among the first to offer Just Eat deliveries after the retailer agreed a multi-year partnership with the platform that will see 229 stores offer the service. The retailer has seen average weekly on-demand grocery sales increase by 140% in the first six months of the year, while more than one million Brits now regularly get their groceries delivered by Just Eat.

InPost takes full control of Menzies Distribution

Parcel locker and courier service provider InPost has acquired the remaining 70% stake in Menzies Distribution Limited for £60.4m, giving InPost full control of the Express and Newstrade operations. InPost says Menzies’ nationwide logistics capability will allow it to scale at speed in the UK to match growing consumer demand, allowing the company to accelerate plans for new services.

Scotmid grows trading profit despite wet weather

Despite a disappointing summer which saw a drop in footfall, Scotmid Cooperative has achieved a £2.1m trading profit for the 26 weeks ended 27 July 2024, a £0.6m improvement on the interim result for 2023. Turnover rose by £2m to £214m in the same period, according to the firm’s 2024 interim report.

Working with the British Retail Consortium, Too Good To Go has united key players from the food industry, including One Stop, Co-op, Tesco, Sainsbury, Aldi and Bidfood, to call on the UK government to introduce mandatory food waste reporting for large companies. An open letter sent to DEFRA signed by 34 key representatives from across the industry pointed to the “alarming” 10.7 million tonnes of food wasted annually.

Convenience retailers in Scotland have invested £94m in their businesses in the last year, an increase of 52% on the previous year’s gures, according to the latest Scottish Local Shop Report, which highlights the crucial contribution that the convenience channel makes to the country’s economy.

e number of Scottish convenience stores was up 49, to 5,220, and the number of people employed by the sector had grown to an impressive 55,000, the report revealed. It was compiled by the Scottish Grocers’ Federation, in collaboration with the Association of Convenience Stores (ACS), and was launched at the SGF annual conference on 2 October.

Scottish stores excelled in customer relations, with 38% of consumers knowing the people working in their local shop very or quite well, compared to just 30% of consumers sharing the same opinion UK-wide, according to the ACS Community Barometer, which was cited in the report.

e report also indicated that Scottish convenience retailers

appeared to be taking more advantage of online wholesaler platforms in the last 12 months, with only 44% claiming not to use them, compared to 63% in the previous year’s report.

In addition, the stats showed that while 35% of Scottish independent retailers o er home delivery, just 13% o er the service via a third-party app – a vast contrast from the UK-wide gure of 34%.

Commenting on the report’s ndings, SGF Chief Executive Pete Cheema said: “ e information gathered in the report clearly makes the case for targeted support from government, and a more joined up approach to regulation, for our key industry.”

The Association of Convenience Stores (ACS) has raised concerns over sick pay following the publication of the UK Government’s planned Employment Rights Bill. Some of the key proposed changes in the Bill include:

Q Zero-hour contracts: Bring an end to the practice of zero-hour contracts in the UK.

Q Statutory sick pay (SSP): Entitlement of first-day SSP for ill workers (currently from fourth day) and lower earnings limit for SSP (with reduced level of entitlement).

Q Flexible working: Establish flexible working rights for workers, except in some impractical circumstances.

Q Fire and rehire: Bring an end to the practice of fire and rehire and fire and replace in the UK.

Q Unfair dismissal: The two-year qualifying period for protections from unfair dismissal will be removed (workers will be subject to a proposed nine-month probation period).

Scottish Labour Leader Anas Sarwar MSP has commended the invaluable service that convenience stores provide for their communities, while highlighting the bene ts they bring to local economies across Scotland.

Speaking ahead of the SGF’s annual conference last month, he said: “Convenience stores play a vital lifeline role in the communities that they serve.

“Across Scotland, retail workers in convenience stores go above and beyond every day to look a er people in the community. at’s why I am proud that Scottish Labour lead the way in tackling the scourge of violence against retail workers.

“It is simply wrong that Scotland’s grocery businesses face so much uncertainty due to the harsh economic climate and the complete lack of economic leadership from the Scottish Government.

“Scottish Labour will always stand shoulder to shoulder with retail workers and work with small businesses to deliver the change we need.”

As part of a wider initiative to increase basket spend, sta at Greens Retail have seen sales soar thanks to e Big Upsell Challenge, where stores in the group are pitted against one another and tasked with upselling a particular product.

e rst challenge saw 7,000 units of Swizzels Squashies sold over seven days – an increase of 500% compared to an average week. e winning store, Greens of Portlethen, sold 809 units – 13.5% more than its target.

Another challenge saw Fisher & Donaldson Fudge Doughnut sales grow 108%.

e store with the biggest sales for each upsell product was given a prize, and some shops have produced leaderboards to track their performance, with topperforming colleagues rewarded.

Ahead of the rst challenge, all stores were shown a short customer service video, while upselling techniques and phrases were communicated via a companywide video call.

A er its huge success, Green’s has made e Big Upsell Challenge a mainstay and the team is keen to boost sales further. “We review the performance weekly with all managers on a shared call, encouraging them to share their tips and tricks,” said Head of Marketing Jack Brady. “We are exploring how we can amplify these [upsells] with more engaging PoS and physical displays at the till point.”

Not only has the initiative worked a treat on sales, it has also li ed the spirits of employees and buttressed supplier ties.

A £3.5m investment will see Scotmid introduce a series of hardware and so ware enhancements to its kiosks, including new tills, printers, scanners for faster and more e cient transactions, new customer screens, and self checkouts.

Tills will be tailored to meet the unique demands of each store location, while ensuring that a strong service o ering remains for customers who prefer manual checkouts. e rm claimed that, over time, self-scan tills had become an integral part of the shopping experience due to improvements in technology and customer familiarity. It stated that today’s customers expected quicker transactions and sought more choice on how to shop at the checkout.

e introduction of new assisted checkouts is part of Scotmid’s broader strategy to respond to customer preference, providing greater convenience and exibility. e rm claimed that the checkouts would reduce wait times, increase transaction e ciency, and streamline the checkout process. Additionally, it said that the new kiosk infrastructure would help optimise store layouts, improving overall store ow and enhancing the customer experience.

e work, which will be rolled out across Scotmid’s Food and Semichem stores, is being delivered by Pan Oston/4POS.

Scotmid is proactively managing any potential risks associated with assisted checkouts. Measures include operator oversight, such as additional screens to monitor transactions, and the strategic placement of assisted checkouts near manual tills to help reduce opportunities for the .

“ e store teams had fun during the challenges, bene tting from a boost in morale, and being inspired by seeing what’s possible if they can all rally together behind a common goal,” Brady added. “Colleagues are clearly having fun coming up with clever ways to entice customers, and we’ve seen some very creative posts on social media.”

Watson’s Licenced Grocers owner Graham Watson BEM has been appointed as the President of The Scottish Grocers’ Federation’s (SGF’s) National Executive board. Graham, who was previously Vice President, took the reins from Chief Sales & Marketing Officer at JW Filshill, Craig Brown. BP’s Central Operations Director for UK retail Andrew Kenney assumes the role of Vice President. Former submariner Graham took on Moniaive’s village shop nearly two decades ago and was awarded the British Empire Medal for his services to the community.

retail sales in growth

Booker core retail sales have grown by 0.6% to £1.65bn, driven by 397 new retail partners joining Premier, Londis, Budgens and Family Shopper. The results were revealed as part of Tesco’s interim results, which showed that Booker’s overall like-for-like sales declined -1.9%. Booker’s symbol brands performed strongly, with sales up 3.1%, supported by a further improvement in availability.

BP appoints Hannah Munns as UK Convenience Trading Director

Fuel giant BP has announced that Hannah Munns is taking on the role of UK Convenience Trading Director. Munns brings over 20 years of retail experience from roles at M&S, Sainsbury’s and Asda. She will lead the growth of BP’s convenience business in the UK through the firm’s partnership with M&S, enhancing the branded grocery business and evolving the Wild Bean Café offer.

Stirling retailers adopt RAC crime reporting tool

Real-time crime information and alerts are being shared by retailers across Stirling thanks to Retailers Against Crime’s (RAC’s) SentrySIS platform. The software system, which is provided free to members of Stirling’s Business Improvement District (BID), has been successful in tracking down the culprits of a number of offences.

Moneygram services at Post Office end Moneygram is no longer available through the Post Office after a note issued by the latter on 30 September warned postmasters that its contract with MoneyGram would expire at midnight. The news came after the money transfer company’s services went offline globally following a serious cyber attack that hit the firm on 20 September.

SLR is working with Red Star Brands and its fast-growing RTD brand Four Loko to provide you with regular updates on the performance of an increasingly important category.

Flavoured RTDs continue to flourish in the alcohol market, with value growth of +3.5%, adding over £17m in value sales in the latest 52 weeks. Convenience channels would be the main drivers of growth for RTDs, up +15.4% in value and +9.7% in units year on year.

Single format RTDs would be the stronger categories within RTDs, especially within convenience stores. The ‘Drink Now RTD market (Single formats) has grown by +7.8% in value in the latest 52 weeks, equating to £31.9m in value sales added to the category.

Two brands continue to dominate the category growth within Single format RTDs, with Four Loko contributing to 17% of the total market growth, adding over £5.4m in value sales. AU Vodka also continues to be a main driver of growth in the category.

Scotland continues to outperform all other regions within RTDs, seeing growth of +14.1% in the latest 52 weeks, Four Loko is one of the strongest growth contributors, up +33% in Scotland and adding over £4.4m in sales (latest 52 weeks). Four Loko also sees success in the Scottish convenience market, being the fastest-selling brand with four out of the top five bestselling RTDs Four Loko SKUs – Dark Berry Burst, White, Pink Melon and Tropical.

Police Scotland and Retailers Against Crime have encouraged retailers to join a self-reporting retail crime pilot scheme in Fife, which Minister for Victims and Community Safety, Siobhian Brown, is hopeful may be rolled out nationally.

RAC is a retail crime partnership that operates throughout Scotland and beyond using a so ware platform called SentrySIS, whereby retailers can share intelligence with each other and the police to help tackle crime.

“ e proof of concept in Fife lets the retailer log on to the system and complete a police witness statement,” RAC National Operations Manager Stephanie Karté told SLR. “So rather than phoning 101, waiting for the police to come

out, then lling out a statement and picking up CCTV evidence, and then waiting for the police to go back to the station to generate a crime report - the whole reporting process can be completed by the retailer and sent to the police in approximately 10 to 15 minutes.

“ e retailer can ll in a statement, add images, and a link will be forwarded to them to upload the footage of the actual crime being committed that will go straight to the police system to be processed.

“ e police will then be able to generate a crime report as and when they pick it up, and the retailer will be sent an instant crime reference number.”

A Police Scotland spokesperson told SLR: “ ese businesses [compiling their own crime reports] are not only empowered to take more action against criminals, but it also frees up police time to investigate where su cient evidence exists and bring o enders to justice.” ey claimed that the scheme had already resulted in a number of individuals having been reported to the Procurator Fiscal a er being identi ed for shopli ing o ences.

Please contact info@retailersagainstcrime.org for further information.

On World Mental Health Day (10 October), a group of independent retailers announced plans to launch a Safe Space support network especially for convenience store owners. Glasgow retailer Natalie Lightfoot has teamed up with fellow Londis retailer Atul Sodha, Peterborough store owner Neil Godhania and Lancashire-based Sophie Towers, who has spent 17 years in independent retail, to create a Safe Space by Retailers for Retailers.

The team is currently setting up a website through which they can be contacted. Once a retailer has got in touch, a mentor retailer will then arrange to speak with them one-on-one.

Natalie told SLR: “We’re looking to develop a mentoring programme, where if somebody reaches out to us because they’re struggling financially or feeling overwhelmed, then we’ll try to find somebody that can lend an ear.”

She explained that running a store could be “challenging, hard and incredibly lonely” and explained “no one understands what we face more than other retailers”.

Everyone on the Retailers for Retailers team has been on mental health training courses and other retailers have also volunteered to help with mentoring.

The team is also looking to develop a podcast where retailers will share stories of traumatic experiences that they have faced and how they dealt with them.

Source: IRI flavored alcohol L52wks data to 08.09.24

Spar Scotland wholesaler CJ Lang & Son has reported another annual increase in underlying pro t for the nancial period ended 28 April 2024, though the rm has warned that a below-par summer this year has hindered trade.

Net turnover rocketed 14.2% to £253m – an increase of 10 percentage points on the previous year, while pre-tax pro ts growth was up 8% to £4m.

e group acquired three former Eddy’s Food Station stores last year, together with the Scotfresh Group of nine convenience stores. All of the stores have been converted to Spar Scotland, bar two Scotfresh sites in Cardonald and Denny, which are set to have fully transitioned by January.

Over the past 12 months, the company has also invested in

Scots come out on top

several major store re ts, as well as the roll out of the exclusive Barista Co ee o er, together with digital screens and labels.

While the group will continue to invest in the business over the coming year, the rm’s main focus will be on fully utilising its existing systems.

CJ Lang & Son CEO Colin McLean told SLR: “Having spent a lot of money on new stores and new systems – electronic shelf labels, RELEX forecast and demand

Scottish wholesaler-supplied convenience stores overperform compared to similar stores in England and Wales, revealed research compiled by wholesale and retail insight specialist TWC and commissioned by the Scottish Wholesale Association (SWA).

In terms of wholesale sales performance, TWC revealed Scotland was over-indexing on value growth.

However, Scotland was also shown to be the top-performing region in value for retail, according to TWC’s SmartView Convenience read, which analyses wholesaler-supplied symbol, fascia and independent convenience stores in GB.

TWC Managing Director, Tanya Pepin, said: “Again, Scotland showed strong results, with the largest regional share of convenience retail value sales of all GB geographies – and the best year-on-year results of all regions.”

e data further revealed that at a product category level, all impulse categories were in value growth for the latest 52 weeks and that Scotland’s growth was ahead of the rest of GB.

“In fact, across seven of the 10 core retail categories, Scotland is reporting stronger year-on-year results,” Pepin added.

planning – the big challenge is how you get the best out of what you’ve already spent. So, we’ll probably draw breath, rather than spend the kind of money that we have been spending.”

Chairman Jim Hepburn added: “We’ve continued to invest at a level probably twice that of some of our competitors. It’s important that we continue to do that and make sure that we have stores that are t in the future.”

McLean said he was “delighted” with what had been achieved, but noted “the lack of summer” had made for “a challenging start” to the year ahead, and that further challenges loomed.

He said: “We’re just trying to be sensible and recognise that we’ve had a good run, but this year is more about consolidation.”

The very best Spar Scotland retailers were honoured at a prestigious awards ceremony in Aviemore on 26 September. The glittering Spar Scotland Awards followed on from the group’s conference and tradeshow (see p28).

Booker saves symbol retailers £1m in energy costs

Since launching last year, Booker’s Energy Buying Club has saved £1m in energy prices – equating to over £5,000 per retailer per year on average. Booker teamed up with Saffron Business Solutions back in May 2023 to help its symbol retailers save money on their energy prices, with customers benefiting from better fixed terms than if they went direct.

Morrisons unveils wholesale data programme for suppliers

Morrisons has teamed up with TWC Group to enhance the data insight capabilities of its wholesale business. TWC Group’s SmartView reporting platform will go live in Morrisons later this year, providing additional insights into sales, customer behaviour and market trends. The data sources will then be expanded to include convenience retail EPoS data.

Nisa retailers to cut energy costs with analysis tools

A new partnership with technology firm Simble will allow Nisa retailers to access tools to better manage and reduce their energy consumption and costs. By integrating Simble’s cloudbased platform, SimbleSense, into their operations, Nisa retailers can now access realtime insights on energy usage and make informed decisions to improve efficiency and sustainability.

Scan & Save retailer earnings near £6m

“Finally, there is good news for Scottish wholesale-supplied symbols and fascias. Despite them having a lower share of stores numerically than England and Wales, they outperform on share of retail units sold, and Scottish symbols and fascias have more items in their baskets than their English and Welsh counterparts.”

David’s Kitchen Kirkcaldy took home Independent Store of the Year, while Company Owned Store of the Year was awarded to Spar Castletown. Meanwhile, Pinkie Farm picked up Independent Community Store of the Year, while Spar Saltcoats was honoured as Company Owned Community Store of the Year.

Celebrating the third anniversary of Scan & Save, Jisp announced that the app had earned retailers almost £6m since launching in 2021, while shoppers have saved over £2.2m. Total scans of the app’s AR vouchers also broke through the five million mark, with redemptions leading to sales topping £4m.

Regular readers will know that we are never short of topical issues to discuss, but October has been particularly busy for both SGF and the Scottish convenience sector.

On one hand we have seen the Minimum Unit Price of alcohol increase for the first time since its inception. Our biggest concern about this issue has been the lack of a Scottish Government public awareness campaign, especially around increases to price-marked packs, and the impact on the cost of living.

We are already hearing about irate customers passing the blame for price rises onto retailers. SGF went straight onto the Health Minister, who we have been working closely with on our MUP Retailers’ Guide, to raise the alarm.

Unfortunately, this followed a disappointing summer for many c-stores, with figures showing that the poor weather put a significant dampener on what was meant to be a promising sporting season.

One retailer, who followed Labour leader Anas Sarwar at the podium at the SGF Annual Conference last month, put it very succinctly: many of the profitable products earmarked by government for tighter regulations, restrictions, and bans have been used to ‘paper over the cracks’ in business viability in recent years.

What will ministers do when the stores that provide essential lifeline services for communities across Scotland start going to the wall?

On a cheerier note, SGF also celebrated 20 years of our Healthy Living Programme. We hugely value the contribution of the HLP team in surpassing all expectations. They should be very proud.

And now onto something completely different. Only four months in the making, the eagerly awaited UK budget…

As sustainability awareness grows, environmentally-savvy shoppers may be open to changing their habits.

With the Charging for SingleUse Disposable Beverage Cups Consultation due to close on 14 November, there are just days le to put forward your views on this contentious issue.

e key proposal is that a charge of at least 25p should apply to all single-use beverage cups when an individual buys a drink of any kind e.g. co ee, tea, slush, milkshake.

“In a society increasingly aware of its environmental responsibilities, charging for disposable cups, regardless of their material, represents a signi cant step toward adopting sustainable habits,” said Iain Gulland, Chief Executive of Zero Waste Scotland.

“It’s clear that consumers are ready for this change. Now, it’s time for businesses to lead by example. Retailers play a crucial role in driving change and promoting sustainable practices, both for their customers and their suppliers.

“Scotland alone used around 388 million single-use cups between

2021 and 2022. at’s 71 cups per person every year – a rate that exceeds many EU nations. ese statistics re ect a throwaway culture that’s in direct con ict with Scotland’s ambitions to become a circular economy, where materials are reused, repurposed, or recycled to minimise waste.”

Gulland claimed that moving away from disposable items isn’t just about small personal choices; it’s about protecting the planet.

He said: “As we’ve seen with other successful initiatives, like the 2014 carrier bag charge, changing consumer habits is possible. e bag charge has led to an 80% reduction in single-use bags on UK beaches, and a similar impact can be achieved with cups.”

A recent Zero Waste Scotland survey saw 74% of respondents say they would use a reusable cup more frequently if a charge was introduced, and 60% stated they would buy fewer drinks in singleuse cups. e demand for further

action is clear, with more than half of the Scottish public (56%) supporting additional measures to reduce single-use items.

“By supporting this charge, retailers can showcase their commitment to protecting the planet, encouraging customers to make more sustainable, reusable choices,” said Gulland. “We can make circular choices a natural part of our daily routines and take meaningful action to protect our planet.”

SLR’s Sustainability Retailer of the Year, Premier Dundee University Students Association (DUSA), is no stranger to disposable cup charges. Retail Services Manager Moira explained that the store introduced a 50p charge in 2018. “ e customer response was very good,” she said. “We also started selling re llable co ee cups at no pro t, and when you purchased one, you received a free co ee.

“Even now, when we say to people that there’s a 50p disposable cup charge, they don’t raise an eyebrow.”

She believes that the public is becoming more aware of the need to be more sustainable.

“We were ahead of the curve on this, but I think sustainability is becoming more prevalent now.”

Jaz Ali, who owns Premier Grangemouth in Falkirk is fairly unfazed at the prospect of a charge. “I think customers will just go with it to be honest with you,” he said. “It’s like the carrier bags – at the start when they brought in the charge, people were moaning, but eventually they’ve accepted it, and they come in and pay for them or use their own bag. It’ll be the same with the cups as well.”

Visit bit.ly/3NyCZm8 to nd out more and respond to the consultation.

If you ask any customer what the best thing about a local retailing store is, chances are it’ll be the unique relationships they have with the people in the store. As a sector we pride ourselves on it. It’s our biggest USP. We’re there for a chat when you need it, a bit of banter on good days, an arm round your shoulder on tougher days, a laugh, a giggle and very occasionally a wee tear or two. All the things you’re never going to get at a supermarket or discounter.

Our USP can be summed up in just two words: our people.

We all agree that, don’t we? How many times have we heard ‘our people are our greatest asset’? So I’m going to throw something out there that might not land too well with some retailers. If our people are our greatest asset, why are we so reluctant to invest in them? Can you think of any other industry that doesn’t make a point of investing in its biggest asset?

And yes, I’m very well aware of the practical challenges of investing in people, particularly directly in terms of wages. But here’s the thing: simply paying a minimum wage simply isn’t going to cut it much longer. Yes, we can argue –and we do argue – that retailers can’t run profitable businesses if staff costs get too high. But one thing’s dead certain: you definitely can’t run a business full stop if you don’t have any staff.

The options available to employees these days are becoming more and more attractive. Many of the discounters and supermarkets are paying more per hour than convenience stores and, arguably, for ‘easier’ jobs. Working in a local retailing outlet isn’t easy if you’re doing it right.

So why should people choose us over them? It’s a ticking time bomb and the ticking is getting louder as time goes by. So is it time that we took this challenge seriously? Really seriously. It’s not going to be easy when our entire business model is built on minimum wage staff. We’re going to have to find ways to afford improved wages and conditions by cutting costs elsewhere in the business or growing profits. It’s a daunting challenge but ignoring it isn’t going to make it go away.

Do we have to go back to the drawing board and rebuild the convenience model from the ground up to focus on higher-margin categories? Do we invest in tech to reduce wage costs? Do we embrace opportunities like home delivery? The answer is likely to be all of these things and more, and many businesses have already started on that journey.

But investing in staff doesn’t always have to mean money. Giving staff responsibility, making them feel valued, respecting them and allowing them to shine doesn’t necessarily need to cost a penny. That’s exactly what we’re discussing in this issue’s cover story and there’s a lot to learn from how other retailers are embracing this challenge.

We have reached a tipping point and what we do in the next few years will have a huge impact on the sector in the decade to come.

ANTONY BEGLEY, PUBLISHING DIRECTOR

EDITORIAL

Publishing Director & Editor

Antony Begley abegley@55north.com

Deputy Editor Sarah Britton sbritton@55north.com

Features Editor Gaelle Walker gwalker@55north.com

Web Editor Findlay Stein fstein@55north.com

ADVERTISING

Sales & Marketing Director Helen Lyons 07575 959 915 | hlyons@55north.com

Advertising Manager Garry Cole 07846 872 738 | gcole@55north.com

DESIGN

Design & Digital Manager Richard Chaudhry rchaudhry@55north.com

EVENTS & OPERATIONS

Events & Circulation Manager Cara Begley cbegley@55north.com

Scottish Local Retailer is distributed free to qualifying readers. For a registration card, call 0141 22 22 100. Other readers can obtain copies by annual subscription at £50 (UK), £62 (Europe airmail), £99 (Worldwide airmail).

55 North Ltd, Waterloo Chambers, 19 Waterloo Street, Glasgow, G2 6AY Tel: 0141 22 22 100 Fax: 0141 22 22 177 Website: www.55north.com Twitter: www.twitter.com/slrmag

DISCLAIMER

The publisher cannot accept responsibility for any unsolicited material lost or damaged in the post. All text and layout is the copyright of 55 North Ltd.

Nothing in this magazine may be reproduced in whole or part without the written permission of the publisher.

All copyrights are recognised and used specifically for the purpose of criticism and review. Although the magazine has endevoured to ensure all information is correct at time of print, prices and availability may change.

This magazine is fully independent and not affiliated in any way with the companies mentioned herein.

Scottish Local Retailer is produced monthly by 55 North Ltd.

From the smiling sales assistant who upsells a storm to the tech savvy team player who can translate EPoS data – how can retailers ensure that their top staff stay loyal?

BY SARAH BRITTON

Nobody feels welcome walking into a convenience store where sta are more interested in Snapchat than serving customers but nding employees who are truly driven to do a good job and bring that extra zing to the workplace is proving a major headache for many retailers.

Recruiting and retaining the right people is one of retail’s toughest challenges, according to Jamie Woods, Company Director at St Michael’s Services in Dumfries. “Since Covid, I’m not sure what’s happened, but it’s getting more and more di cult to nd people who are willing and wanting to work, so that is o en the challenge,” he says. “Everybody that I speak to, that’s pretty much always the rst thing that they’ll say is trying to get and keep good sta has become a real problem.”

Jay Javid of Glasgow-based PGNJ Group is also struggling to nd and retain promising employees. “Sta ng has been our biggest headache, it’s been a nightmare,” he says. “We went down the international student route. Normally they’re loyal for four years while studying, but in the last cycle a lot more have le . irty per cent of our sta have been replaced in the last 12 months by local people.”

Determined to ensure he nds and retains the best candidates, Jay has changed tack. “We’re working hard to get the right people,” he says. “Up until last year we did nothing for sta . We always gave more than minimum wage, but nothing else. Now we’ve found sta are looking for more.”

O ering people the opportunity to develop their skills is vital, says Amanda Speirs, Store Manager at Premier Girvan in Ayrshire. “We really try and keep a hold of our good team members as much as we can,” she says. “It’s di cult as an independent retailer because we can only o er so much progression. e opportunities are narrower in a small store, but not unachievable. We encourage people to develop with Team Leader and Assistant Manager roles.

“We’ve got a sta member training at the minute who came from Asda in town. He started as an Assistant and he is now training to be a Team Leader.”

Dan Brown, MD at Pinkie Farm in Musselburgh, claims that the opportunity to make more decisions at independent outlets can be a big draw for experienced supermarket sta looking for the next challenge. “If we see someone really standing out in another business, I’m never too shy to ask them if they’re interested in joining us. We had someone come over recently from Co-op. I’m not telling everyone to go and poach all the time, but I do feel a lot of chains are pushing people to their limits and taking the decision making and fun out of it.”

Amanda claims that encouraging her team to understand the bigger picture can build loyalty. “Involve them in the store – let them know how the store’s performing rst of all,” she says. “ ey’re a part of the team that makes that happen – we share our successes and ask for ideas and opinions: ‘What can we do for charity?

How can we get involved in the community?’ We have sta meetings, management meetings, group chats, and brainstorming sessions that are positive and engage the team. All that helps to have a good environment. Also having a manager visible on the shop oor makes a di erence – we all muck in and get the job done.”

Amanda is always keen to build on sta members’ natural talents. “Lynsey is absolutely our community champion. She’s a Team Leader and has good links in the community and she loves doing it.

“You play to people’s strengths and encourage that. Otherwise, people can get bored and then they’ll look for something else because they’re not being challenged or nding the job interesting anymore.”

Dan takes a similar approach with Pinkie Farm’s sta . “When I rst started, I tried to do everything myself, but now I give sta added responsibilities. In a lot of chains things are process driven, with no decisions. We try to give people projects and autonomy over how the business is run.”

He explains that sta member Tracy is his go-to for community initiatives as she really enjoys them, whereas her co-worker David likes photography and graphics, so he looks a er the store’s social media and marketing.

“ e kitchen is always a good one as well for people who like their food, so we can give them quite speci c training that they can use in the shop,” says Dan. “But also, if it’s a stepping stone for them to do bigger and better things that’s okay too. If they choose to stay, then great, but if not then that’s okay.”

Even when people leave, Dan nds that this can lead to positives for the store. “We get a lot of sta referrals from people coming from other

businesses – sta have recommended us to people because we’re supportive.”

Keith Fernie, MD at David’s Kitchen, tells SLR how one team member worked their way through the ranks whilst at college and then le the store, but was soon in contact to ask if her brother could work at the store while he was studying.

e company has developed a strong ethos of hiring members of the same family, which leads to a constant stream of the next generation looking to join the business.

“In the past, people were against employing family members and families working together, but we found that works for us,” says Keith. “We’re owned by the Sands family, and we’re run by myself and my sister-in-law, Diane, and my son Kyle runs a store. My wife, Claire, also works in the business. We’ve got sisters working together, we’ve got a father and son working together, and we’ve got a mother and son at another store as the supervisor and the cook, so that helps create a strong team.”

He claims that being respectful, appreciative and adaptable makes all the di erence. Team

members are regularly praised on the store’s social media platforms, and kindness is key.

“We keep people by treating them how we want to be treated ourselves, that’s the simplicity of it,” he says. “We genuinely try to help people. We’ve been exible and that in turn gets you the exibility and it’s generally reciprocated.”

Dan also celebrates sta achievements on social media and tries to accommodate sta requests where possible. “One of the things we’ve done more recently is to o er exible working hours,” he says. “It’s a lot easier to standardise it, but by putting in the extra e ort, we’ve found they’ve been quite grateful for it.”

Flexible hours are certainly appealing, but, of course, money is still a major factor in retaining good employees. “If I can see someone that can really bring something to the business, I would never let them walk away because of a basic wage,” says Dan. “ e people that really go above and beyond and bring more value than just sales – they bring the whole team up as well – it’s worth bringing that person in. If you see

someone who has a real talent, you should be willing to pay for that regardless.”

Jamie feels that paying above minimum wage aids loyalty. “We’ve always paid a good bit more than minimum wage,” he says. “When we get good sta , we try to look a er them and keep them, so hence we pay them a bit more than a lot of places.”

At David’s Kitchen, the food-to-go workers are paid above minimum wage. “We found food to go is a very busy, hard pace, it’s a catering environment,” he says. “We pay them a little extra because of the stress and the pressure of the position. at decision was made to keep sta on, as well as to attract new sta .”

Sta at PGNJ are paid above minimum wage, but Jay is keen to explore extra bene ts. “People want discounts, free co ee, more perks,” he says. “[Company Director] Stephen is working with a consultancy – to look at incentives to encourage loyalty. We’re looking at a loyalty package, rather than a one-o now and again. A lot of international students wanted sponsorship

which we couldn’t do in the past, because we hadn’t applied for it, but we have now so we can consider it.”

All sta at David’s Kitchen are given a discount on store-made food. “ ey get half price on anything we make, so all food to go and our own ready meals,” says Keith. “Or if you’re having a party, your bu et is half price.”

In addition, everyone gets a birthday card and a voucher for the store’s a ernoon tea and at Christmas, sta receive cards with store vouchers, which are dependent on their length of service.

Pinkie Farm sta receive plenty of perks too. “We do a he y sta discount – 10% o the whole store and 40% o all our food counter things,” says Dan. “We also have decent sta nights out and treat them well at Christmas.”

What’s more, sta are given long service awards to recognise loyalty and Dan also takes time to enter them for external awards, such as SLR’s Above and Beyond Awards (see p22), where they can receive further recognition.

At Premier Girvan, sta are treated to halfprice co ees from the Costa machine. In addition, sta are rewarded when they go above the call of duty. “It’s important to recognise and reward sta ,” says Amanda. “If someone is going above and beyond what’s asked of them – it’s nice to give them a box of chocolates. I give people a thank you on the group chat and personally for doing a good job, or a small gi .”

Amanda’s e orts appear to have paid o . “ e store’s been open for 13 years and we still have some of the original team members here, which is fantastic,” she says.

Having a solid team who can think on their feet is invaluable, adds Dan. “Before, I thought everything could be process driven, rather than having people who think outside the box,” he concedes. “It’s not easy to nd them. When you’re starting from scratch, you have to think about how you can make your business more attractive to others. Building a strong team comes over time. It’s easy once you start having good people. e more e ort I’ve put into sta , the more I’ve got out of the business.”

Keith agrees: “We all want to keep the team that we’ve got,” he says. “If you can keep sta turnover low, you’ve got a very settled team, which then becomes an experienced team.”

East Lothian-based Dan Brown of Pinkie Farm believes his staff turnover is low because he ensures the store is sufficiently staffed. “The biggest thing is having enough staff so they’re not feeling under pressure all the time,” he says. “If they always feel they’re massively behind, it brings people down and puts them off. I see more and more people leaving the bigger chains because of that. A lot of stores are expecting a Customer Service Assistant to do what a Manager should be doing. It’s about creating an environment where they aren’t feeling dumped on their own.”

Cadbury unveils retailer prize giveaway

As part of its biggest-ever onpack prize & reward giveaway – Win a Day To Remember –Cadbury is giving retailers the chance to win a Sky Glass TV complete with a 12-month Sky TV subscription. Five Sky Glass TVs and subscription packages are up for grabs, and retailers simply need to fill out the entry form on SnackDisplay.co.uk to enter the prize draw. The giveaway is open now until 30 November 2024.

Ritz rolls out festive on-pack promo

Ritz is ringing in the festive season with a brand-new on-pack promotion which will see one lucky shopper win a top prize of £10,000 in time for Christmas. Consumers are encouraged to scan promotional packs and pull a digital cracker to get involved. The brand has also rolled out a limitededition design for its 150g pack, featuring a Christmas cracker flash and starry pattern.

Unilever promotes new winter home care range

Unilever is gearing up for the cold weather by launching its annual limited-edition winter range of home care products, complete with new fragrance, Fresh Winter Breeze. Influencers Giovanna Fletcher and Lynsey Queen of Clean have been named as brand ambassadors to front the associated marketing campaign. The campaign ties into the popularity of #CleanTok, which is one of the most popular hashtags on TikTok.

Maple Pigs in Blankets are back

Snack maker Burts has announced the return of its Maple Pigs in Blankets potato chips for the festive season. Available now for a limited time, the crisps have an RSP of £1.25 per 40g bag. Based on figures from previous years, Burts is projecting a 106% year-on-year increase in sales for the 2024 festive season.

KP Snacks has unveiled a new social media campaign, starring members of its ‘SnacKPartners’ retailer forum, to raise awareness of its newly launched Heritage brands retailer incentive and to share top Bagged Snacks sales tips.

Retailers Avtar ‘Sid’ Sidhu, Sunita Aggarwal, Atul Sodha, Bobby Singh and Arjun Patel each spotlight one of KP’s ve Heritage brands: Nik Naks, Discos, Space Raiders, Roysters, and Wheat Crunchies. In a series of light-hearted, tonguein-cheek social media shorts, the

Butterkist has launched a partership with new movie, Wicked, which hits cinemas on 22 November.

To mark the film’s release, Butterkist has launched a new limitededition 180g Sweet sharing pack. Furthermore, Wicked-themed flash designs appear on sharing and price-marked packs alongside an on-pack promotion.

Running until 31 December, the promo gives consumers the chance to win a ‘Thrillifying adventure to London,’ with five prizes up for grabs. These include a stay in a luxury London hotel, a potionmaking experience, a makeover, a shopping spree worth £200 and a wizard-themed afternoon tea.

The competition runs across all of Butterkist’s Wicked-themed packs including the core Sharing range featuring Sweet (100g), Sweet & Salty (110g) and Salted (80g), as well as the new180g Sweet sharing bag. It also appears on Sweet, Salted, Toffee and Sweet & Salty £1.25 PMPs.

retailers not only bring the brands to life but also share useful tips on how to boost CSN sales.

In his video, Atul Sodha, tells retailers to ‘Space Raid’ for oxture displays to make CSN sales “extraterrestrial,” nishing his video somewhat disturbingly dressed as the Space Raiders alien. Each video includes a call to action for retailers to look out for the chance to win one of 90 £500 cash prizes by purchasing selected Heritage Brand products to range in their store.

Del Monte has launched a new campaign designed to help preserve Britain’s family baking traditions.

From now until 31 December, retailers who buy cases of all four Butterkist £1.25 PMPs featuring the Wicked on-pack promotion will be automatically entered into a prize draw with the chance to win one of 35 TV tech bundles.

Punning its iconic slogan, the canned fruit brand is looking to uncover five of Britain’s ‘Nans from Del Monte’. These grannies will not only share their favourite recipes but will also give a nod of approval to Del Monte’s own creations, just like the Man from Del Monte did in the 80s.

The campaign is fronted by former Ready Steady Cook presenter and bus pass holder, Fern Britton.

Purity expands Juice Burst Peach Ice Tea range

Highland Spring has been named as the new o cial water supplier to Scottish Rugby.

e exclusive two-year deal will see over 50,000 litres of water supplied to Scotland’s national men’s and women’s teams, U20 players, coaches, and support teams.

As part of the sponsorship agreement, Highland Spring will also supply water to Glasgow Warriors and Edinburgh Rugby.

Fans attending matches at Murray eld will also be able to

nd Highland Spring products for sale at various retail points and try the brand’s new Flavoured Still Water range in hospitality.

Purity Soft Drinks, owner of the Juice Burst and firefly brands, has added a larger 500ml format to its Juice Burst Peach Ice Tea range. Since launching in August 2023, Juice Burst Peach Ice Tea has become Purity’s second-biggest 330ml SKU and the business is now mulling over plans for a one-litre format. The new format is available now in cases of 12 x 500ml, with an RSP of £1.65.

Hula Hoops passes the £200m milestone

BATTERIES Deal sees brand logo appear on Cubs badge

also has a robust recycling plan in

Highland Spring’s focus on reducing litter and increasing recycling means the sponsorship also has a robust recycling plan in place to make it as easy as possible for fans to recycle their empties.

Battery brand Varta has partnered with e Scouts to inspire young people to adopt sustainable practices and contribute to a greener planet.

is sees the addition of the Varta logo to the badge awarded to Cub Scouts who have demonstrated an understanding of important issues a ecting the planet.

e partnership also introduces activities such as designing battery recycling boxes for the home, tree-planting initiatives, and a battery recycling competition. A highlight of the programme is the ‘Ready, Steady, Recycle’ activity, which teaches Cubs how to sort household waste, including batteries, and encourages the development of early recycling habits.

Varta will also donate £1 to e Scouts for every four batteries users of the Bower consumer recycling app –including Scout members – save from going to land ll.

One Stop is phasing out its current ownlabel products and replacing them with Tesco’s ‘Core Own Brand’ range in all of its stores, both company-owned and franchise-operated.

Tesco Core Own Brand products will be introduced in phases. The rollout started last month and will continue into next year.

One Stop hailed the move as a “gamechanger”. It said offering Tesco products will provide its franchise partners with the competitive edge to enhance customer proposition and increase footfall and basket size, while benefiting from Tesco’s extensive market research and product innovation.

KP Snacks has said its snack brand Hula Hoops has reached a retail sales value of £200m. The iconic brand is one of Britain’s bestselling snacks purchased by over 28 million UK households every year. It has £24m RSV in the past year alone, making it the second-highest value-adding brand across the Bagged Snacks category, and has outgrown the category in volume by 9% in the latest 52 weeks.

Robinsons rolls out Wicked-themed flavours and new on-pack promo Robinsons is celebrating the release of the new Wicked film by launching two new limitededition flavours within its Double Concentrate range: Amazafying Citrus Twist and Outstandiful Berry. Furthermore, an onpack promotion across Double Concentrate and Ready to Drink Raspberry & Apple gives consumers a chance to win film merch and a trip to New York.

Cadbury’s Great Retail Ideas winners named Ron and Aruna Patel, of Ron’s News in Droitwich Spa, have bagged the top prize of £5,000 in Cadbury’s Great Retail Ideas Exchange competition, held to celebrate the brand’s 200th anniversary. The competition asked retailers to share their best business ideas, and the duo won with their simple suggestion of learning customers’ names to greet them more personally.

Wrexham beers come to Scotland via UWG

The Wrexham Lager Beer Co has secured a new listing across its lager and export range with United Wholesale Grocers. This sees Wrexham Lager 440ml Export cans and Wrexham Lager 440ml cans distributed to a number of Day-Today stores, as well as supplied to independent retailers. The long-term deal marks the brand’s official entry into Scotland’s off-trade sector.

Carling has been named as the Official Beer of the Scottish Professional Football League. The partnership runs until at least the end of season 2026/27 and will see Carling – one of England’s most popular lager brands on the back of its football sponsorship – represented at league matches and every round of the Premier Sports Cup. The deal also includes opportunities for supporters from across the SPFL to get involved with.

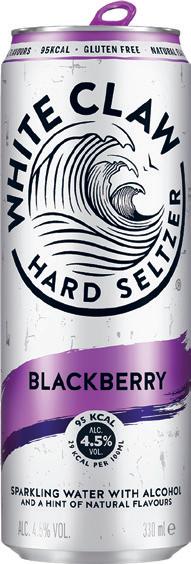

Hard seltzer brand White Claw has unveiled a new limitededition Blackberry flavour. The rich, dark and fruity variant is available now in a 330ml single can format with an RSP of £2.25. Made from natural flavours, triple-distilled spirit, and sparkling water, 4.5% ABV White Claw Blackberry has no artificial sweeteners, is gluten free and vegan friendly, and contains 95 calories per can.

The Macallan has unveiled the latest releases in its Harmony Collection, with two new single malts launched as part of the brand’s collaboration with Cirque du Soleil. Celebrating The Macallan’s 200-year anniversary, Harmony Vibrant Oak (available in domestic retail) and Harmony Guardian Oak (exclusively available in global travel retail) reflect the brand’s long association with oak.

Diageo has teamed up with Pepsico to launch a new RTD, Captain Morgan Original Spiced Gold mixed with Pepsi Max.

Captain Morgan × Pepsi Max (ABV 5%) is available in a number of formats including a 330ml can, a 250ml slimline can and a multipack of 6 x 250ml cans. e 330ml cans have an RSP of £2.59.

e launch is supported by a marketing campaign that includes out-of-home advertising, video on demand, digital video and paid social media support, as well as a sampling programme and cultural activations.

It follows news that the RTD category in GB is the fastestgrowing segment within the total beverage alcohol market, with 25% growth, and Diageo research showing that 81% of consumers agree they are more likely to purchase an RTD mixed with a branded mixer.

Commenting on the launch, Nuno Teles, Managing Director GB at Diageo, said: “With a shared emphasis on fun, our partnership with Pepsi Max brings together two iconic brands to create one epic taste that will inject excitement into the RTD category.”

Cornish family-owned brewery St Austell has made its first foray into the low/no market with the launch of Proper Job 0.5%.

Two years in development, the new beer is a low-alcohol version of the brewery’s 5.5% ABV Proper Job IPA, the off-trade’s bestselling bottled IPA.

It is brewed with a special yeast, as well as the same hops used for the full-strength version, to yield a similar citrus, grapefruit and pineapple flavour profile.

In consumer testing, St Austell said the 0.5% brew was declared “the overwhelming favourite” against competitor drinks.

A complaint against a Hello Kitty-branded wine has been upheld by the Portman Group. The complainant said they were “astonished” to see alcohol sold under a children’s toy brand. Unsurprisingly, the complaint was upheld under a rule which states that a drink, its packaging and any promotional material or activity should not in any direct or indirect way have a particular appeal to under-18s. The Italian producer – Torti Wine – disagreed that Hello Kitty was a children’s toy brand and said that it was popular with all ages particularly mothers, grans and older celebrities like Kim Kardashian. Despite this, Torti Wine did confirm that it would no longer sell the product in the UK.

With the festive season fast approaching, Funkin Cocktails is o ering drinkers a touch of indulgence with the launch of its new limited-edition Deluxe Dessert Cocktails range.

Two demand-driven vodka-based new avours are available: Deluxe Chocolate Espresso Martini, a velvety fusion of rich chocolate and bold espresso; and Deluxe Black Forest Gâteau, which blends the sweet, tart essence of ripe cherries with a hint of chocolate.

Building on the success of Funkin’s larger format Bartender Edition bottles – which currently outsell any other cocktail bottle brand by more than double – the new releases both come in 70cl bottles (RSP £12.50) with a 12% ABV, higher than the brand’s usual 10%.

Ashley Birch-Ru ell, Head of Brand at Funkin Cocktails, said consumers would enjoy replicating

the current trend in hospitality for cocktails based on classic desserts at home.

Deluxe Dessert Cocktails are in Sainsbury’s stores now, with further rollouts planned across additional retailers and wholesalers in the coming months.

Black Sheep launches latest limited edition

Black Sheep Brewery has rolled out Riggwelter: Cherry & Cacao. The new release reworks Black Sheep’s Riggwelter beer, aided by Nipo-Brazilian brewery Japas Cervejaria Artesanal, yielding a 6.0% ABV dark ale that marries Black Sheep’s Yorkshire heritage with the flavours of Japan and Brazil. Visit blacksheepbrewery. com/stocking-black-sheep for trade enquiries.

Inspired by the flavours of an ice-cream parlour, Glenmorangie has launched the fifth expression in its A Tale Of… series. The distillery used high-vanillin casks for the first time to bring out Glenmorangie’s sweetest, creamy vanilla notes in the new limited edition. Glenmorangie A Tale of Ice Cream (70cl, ABV 46%) is available now with an RSP of £76.

SLR is on the lookout for store superstars for the Above & Beyond Awards 2025 – so make sure you tell us about the unsung heroes in your business!

SLR is delighted to announce that The Scottish Sun, Scotland’s biggestselling newspaper, has joined forces with the SLR Above & Beyond Awards 2025 as official Media Partner.

Launched last year, SLR’s Above & Beyond Awards are unlike any other awards programme because they focus exclusively on the real stars of the local retailing trade, the colleagues on the shop oor that make our sector so special.

Awards ceremony in Glasgow was a genuine local hero.

This important partnership will ensure that the inspirational stories we unearth through the Awards will be shared with a much larger audience, many of them shoppers in your store.

As well as highlighting the vital role that local stores play in their communities, it is also hoped that the media partnership can play a positive role encouraging shoppers to be more respectful, understanding and compassionate when visiting their local store.

Scottish Sun Editor-in-Chief Gill Smith said: “The Scottish Sun is delighted to be this year’s Media Partner for the SLR Above & Beyond Awards. It’s amazing to be able to honour the unsung work of people in the community who make a difference as well as recognise and support the vital role of convenience stores to our readers – and to communities as a whole. Local retailers are the beating heart of communities and, for some, they are a lifeline.

“We can’t wait to hear all the inspiring stories of those celebrated at the event.”

e Awards were purposefully created to be a proud celebration of Scotland’s heroic convenience sector employees and a platform to reward and recognise the many astonishing acts that happen on a regular basis in our sector but which usually go almost entirely unnoticed.

e SLR Above & Beyond Awards 2025 will help ensure that these heroes are no longer overlooked, and we are delighted to announce

e Scottish Sun as our o cial Media Partner for the Awards. is key partnership with Scotland’s biggest-selling newspaper will play a vital role in helping share the inspiring stories we unearth with a much wider audience of consumers.

Not only will this help remind consumers about the critical role that local retailers play at the heart of every community in Scotland, our hope is that it will also have a positive impact in helping to combat the scourge of retail crime and violence that retailers are facing every day.

e winners and shortlisted entrants at the 2024 SLR Above & Beyond Awards demonstrated exactly why these awards are so necessary. From inspirational individual acts of kindness, compassion and sel essness to astonishing commitment to consistently going above and beyond the standard call of duty, every single colleague who attended the 2024

We know that virtually every store in Scotland has an unsung hero or two and we are asking for your help in bringing them to our attention. It takes literally a minute or two to complete the nomination form at slrmag.co.uk/ aboveandbeyond – and it would be a minute or two well spent.

We can only recognise and reward those going Above & Beyond if we know about them. And as well as giving them some well-deserved recognition, it may also help inspire other colleagues across the country.

Our sector is a people sector, and our people are our biggest assets. Help us celebrate them in style and provide that vital platform showing just how special the local retailing industry is.

Whether it’s helping to raise in-store standards, turbo-charging community engagement, supporting customers in a time of need or being a superstar colleague who always has time to lend a hand or an ear – we want to hear about them.

All nalists will be invited free of charge to a celebratory lunch at the exclusive Corinthian Club in Glasgow on 12 March 2025. Working with our generous sponsors, we will ensure that everyone joining us is treated to what is sure to be a magical day.

So please don’t delay, get your entries in before 15 January and give those hard-working industry colleagues the recognition they so thoroughly deserve.

ENTRY DEADLINE: 15 JANUARY 2025

CELEBRATORY LUNCH: 12 MARCH, THE CORINTHIAN CLUB, GLASGOW

INDEPENDENT STORE COLLEAGUE

(SPONSORED BY MONDELEZ INTERNATIONAL)

Open to all colleagues working in independently owned local retailing stores in Scotland that are unaffiliated or members of any symbol group, fascia or franchise.

COMPANY-OWNED STORE COLLEAGUE

(SPONSORED BY CJ LANG/SPAR SCOTLAND)

Open to all colleagues working in CJ Lang company-owned stores in Scotland.

BUSINESS BOOSTER

Open to all colleagues who have materially improved their store’s performance by suggesting or introducing a new concept, product, service, communication method or a change in operational process.

TEAM OF THE YEAR

(SPONSORED BY TENNENT’S)

Open to all in-store teams which have pulled together to make a positive difference to their store’s performance and/or to their community.

UP & COMING STAR

(SPONSORED BY CCEP)

Open to all colleagues aged 25 or under working in any of the store formats detailed above who have shown themselves to be outstanding colleagues with a bright future in the sector ahead of them.

LONG SERVICE AWARD

(SPONSORED BY CADBURY)

Open to all colleagues working in any of the store formats detailed above who have worked in the sector, or a single store or chain, for an extended period of time.

ASTONISHING ACT

Open to all colleagues working in any of the store formats detailed above who truly went Above & Beyond to perform an astonishing act that had a massive positive impact on a customer, colleague or the community.

David Robertson’s remarkable hybrid JP Pozzi business in Buckie has been built on a steadfast commitment to the newstrade category, a commitment that serves him well to this day.

BY ANTONY BEGLEY

One of the many imponderables of the local retailing trade in Scotland is the way in which the sector has, to a remarkable extent, allowed the newstrade category to wither on the vine. When retailers are looking for space for a new Costa machine, news is the rst category to get either moved to the back of the shop or removed entirely.

Granted, it’s not an easy category to manage but it’s worth asking a simple question: if the news category didn’t exist and we invented it tomorrow, how many retailers would be all over it? How many other categories deliver the sorts of seven-day footfall, sales and ancillary impulse purchases that news does? e margins aren’t great – but they’re not bad and they’re certainly better than the margins you get in many other categories.

And if you want to know what happens when you don’t take your eye o the news ball, you could do worse than take a drive up to Buckie on the north Aberdeenshire coast to see David Robertson’s JP Pozzi business.

To be clear, it’s anything but a traditional convenience store. A born entrepreneur, David makes no bones of the fact that sales and pro ts are what he’s a er and he’s prepared to go wherever that journey takes him. Which explains why JP Pozzi is essentially three businesses in one, but each element of the model has been carefully cra ed over many years to perfectly meet the needs of David’s customer base. And the entire business was built with the newstrade at its foundations.

Firstly, there’s the most traditional part of the business, the bit that looks most like a recognisable store. But unlike many traditional newsagents, it looks pukka. e design is modern and clean. It has a vaguely Prêt a Manger feel about it. News features heavily both in the centre of the shop oor and magazines dominate a wall by the counter.

e second element of the hybrid model is basically a co ee shop with tables and chairs, again tted out to a very good standard.

e third and most unlikely element of the business – Pozzi Bijou – is a sort of high-end gi shop selling an extensive range of jewellery, gi s, stationery and party items. Once again, it has been done to a very high standard and wouldn’t look out of place in a city centre department store like Frasers.

Just along the road, David also has another JP Pozzi store focusing more on gi ing and also owns two other Bijou stores in nearby Elgin and Portessie. He owns six sites, operates three himself and has tenants in the other three and employs 62 sta . An entrepreneur indeed, but a newspaper man to his core.

But what really lies at the heart of the JP Pozzi mini empire is news home delivery. A family business, David is carrying on the legacy by taking the original vision and moulding it for the future – but he has never lost sight of the importance of the home delivery services that built the business in the rst place.

To get an idea of the scale of the home delivery business, consider that from this beautiful but very small store, David delivers something in the region of 78,000 copies of the Press & Journal a year, almost 20,000 copies of e Sun, more than 22,000 copies of e Daily Mail and around 10,000 copies of e Daily Record.

Operating out of a dedicated home delivery hub room at the back of the store, the slick operation runs like clockwork a er years of honing and David delivers to Cullen, Portessie, Buckie, Portgordon, Spey Bay and beyond.

He has been quick to pick up other delivery businesses as they become available and is now widely regarded as one of Scotland’s leading experts on all things news and magazines –

- 78,000 Press & Journal a year

- 22,000 Daily Mail a year

- 20,000 Sun a year

- 10,000 Daily Record a year

and he’s not afraid to speak his mind, routinely ru ing the feathers of publishers, the NFRN and anyone else he feels could do with some friendly words of advice.

“ ere’s no question that the news category is getting harder and harder but the thing I don’t understand is why so many retailers have backed out of the category,” he says. “Back in the day, you didn’t have to work too hard at it. It more or less took care of itself. ese days you have to work at it, but the rewards are there if you’re prepared to put that work in. News is still a pro table category for retailers that do it well.

“It isn’t a one-size- ts-all category so you need to dig in and understand what your customers want. And you need to be exible and change with the times. We all know that people don’t buy newspapers as o en as they used to, but the market is still signi cant and the margins are decent. ey’re getting squeezed all the time but they’re still decent.”

To help keep his business on track, David has had to constantly evolve how he manages the category, reworking runs to drive e ciencies, carefully calculating delivery charges, managing ever-increasing cover charges and working with publishers to incentivise customers to take out subscriptions.

“We charge £2.40 in town but more for out-oftown or build deliveries because we need to use

drivers for those,” explains David. “We deliver to hospitals and such like and the boys can’t do that, so we build a robustness into the delivery charges that lets us cope with increased cover charges and so on.

“ e fact is that for too long, paper cover charges were too cheap so customers got used to paying buttons for a paper, so when they go up you get resistance but it’s still a very valuable category.”

And it’s that pragmatic, entrepreneurial can-do approach that has spilled over into the

diversi cation of the business. e co ee shop was a natural extension and a good use of the available space while the Bijou side of the business has exploded in recent years.

“Pozzi Bijou is pretty well known in the area now and we’ve worked hard to build a reputation,” he says. “It has grown and grown and it’s working really well. It complements the news side of the business perfectly.

“ e margins we get in Bijou are phenomenal and we get the volume too. I buy very carefully, and I keep a close eye on trends so that we’re

always up to date. We sell the sorts of items that people can’t get anywhere else in the area, and it works.”

at entrepreneurial drive coupled with a commitment to investment in his business and to doing everything right is what sets David apart and what saw him crowned as SLR Newstrade Retailer of the Year.

He has built a unique business by following his spirit and by being unafraid to dismiss convention and simply listening to what his customers want – and giving them it in style.

For two decades, HLP has changed the lives of Scottish consumers, helping them to adopt balanced lifestyles whilst raising awareness – and sales – of healthier foods.

The Scottish Grocers’ Federation’s (SGF’s) Healthy Living Programme (HLP) has celebrated an incredible 20 years of helping to improve eating habits across the nation and in that time it has worked with more than 2,300 convenience stores to advise on growing sales of healthier products.

HLP has engaged with over 37,000 pupils across Scotland through its ‘Welby Breakfast’ initiative, teaming up with numerous retailers and local primary schools to deliver healthy breakfast events and educate people on the importance of a healthy diet.

e programme’s Director, Kathryn Neil, said: “ is anniversary is a major milestone for HLP and the whole team and is well worth celebrating.

“Over 20 years SGF and HLP have created a programme that works for every store, and the branding is now a key xture in many new or re tted shops.

“Community engagement has been the key to success, ensuring the programme remains relevant and maintains relationships with key fascia groups, and helping to deliver the ‘responsible retailing’ message.

“HLP would like to thank everyone who has been involved in the last 20 years of their journey and here’s to the next 20!”

SGF Chief Executive Pete Cheema added: “ e programme has gone from strength to strength and is now more important than ever to both retailers and their customers. We hugely value the contribution of the HLP team and the Scottish Government in surpassing all expectations.

“England and Wales have tried in vain to replicate the success of the SGF HLP Programme, but to no avail. It is a testament to the Scottish Grocers’ Federation Healthy Living Team that this is now one of the most successful Scottish Government programmes ever. Having evolved so much over the 20 years, it is more relevant to the Scottish market than it has ever been.

“Not only does HLP help direct consumers to purchase healthier options, improving the health of communities, it also creates an avenue for new markets in healthy products, supporting the local economy. is year marks a much-deserved celebration of that achievement.”

Public Health Minister Jenni Minto commented: “I am very pleased to see the Healthy Living Programme promote a wide range of healthier food and drink and commend the Scottish Grocers’ Federation sta for the passion they have demonstrated in developing the programme –from its Big Breakfast events in schools to its engagement with island communities.”

Research commissioned by the programme shows that 40% of consumers can now identify the HLP branding in store, with plans to continue expanding the programme in the coming years.

CJ Lang certainly raised the bar with its third Spar Scotland Tradeshow, which welcomed retailers and company-owned store colleagues from across the country.

Aviemore’s MacDonald Hotel and Resort was packed to the ra ers on September 26th as more than 800 people gathered for the annual Spar Scotland Tradeshow.

ere were goody bags galore as store owners, managers and colleagues sampled the latest new products; got the lowdown on upcoming trends and legislation; and met face to face with some of the 200 suppliers attending.

SLR caught up with a selection of exhibitors to give you a avour of the event and the multitude of products and services being showcased.

Smoking alternatives wholesaler Vape Supplier had a raft of new lines on display.

“We exhibited a whole host of next generation NPD in order to help retailers grow and evolve their category in the face of challenging legislative change,” says national accounts director Gary Routledge.

“We had our commercial director hosting presentations throughout the day, and he did workshops with retailers. It was a very busy show, but every retailer we support actually came along to have a conversation about the category and about which new products they should be stocking and seeking category guidance and seeking legislative guidance. It wasn’t your typical trade show, there was real interaction going on.”

The AU vodka team were at the trade show, as well as at the Spar Scotland Awards in the evening.

“We exhibited our RTD cans including our newest flavour Pink Lemonade and Strawberry Daquiri and Blue Hawaiian cocktail cans,” says Keshav Sharma, Business Development Director at AU.

“In addition to this, we ran the bar in the evening, offering a full range of RTD and cocktail cans as well as our 70cl range.

The bar was very popular throughout the evening!

“It was a worthwhile experience for us, which allowed us to have our product tried for the first time by some people, and gain some contacts we can work with in the future.”

Facewatch took its facial recognition technology to the show to demonstrate how it can be used to reduce retail crime.

“We had huge interest at the show from retailers wanting to better understand how Facewatch worked and the benefits of the system,” says Director Liam Ardern. “Simply put, Facewatch alerts store staff immediately when a known offender on our watch list enters the store, which in turn prevents them from committing a crime or harming their staff.

“It was a great show for us, and we’ve engaged with lots of potential new customers since the show.”

Chef Praveen Kumar was on the stand to present his premium frozen Indian ready meals, which are made with ingredients from his family spice farm in India.

He says: “Our authentic Indian cuisine is listed at CJ Lang and also at independents across the nation. We got a lot of interest, especially from independent stores. We are working with a lot of them already, so it was a good opportunity for us to put a face to the name and catch up with our existing customers.

“It’s 100% a worthwhile show for retailers and exhibitors.”

Having made its debut at last year’s Spar Scotland Tradeshow, Barista Bar was back for 2024.

The Henderson Foodservice-owned concept is already the largest premium coffee-to-go brand in Northern Ireland and is quickly making a name for itself in Scotland, having been rolled out to 100 CJ Lang company-owned stores, as well as 25 independents, with more to follow.

Retailers had the opportunity to experience firsthand how Barista Bar’s quality products and proven success are driving increased footfall, customer loyalty while also offering a profitable addition to their stores.

“The Spar Scotland Tradeshow was a fantastic event for Barista Bar, marking the second year we’ve showcased our premium coffee-to-go offering in Aviemore,” said a spokesperson for the company.

“I encourage any retailer considering Barista Bar to connect with their Spar Scotland contact and embark on their own journey to experience and deliver ‘Coffee as It Should Be’.”

Having already partnered with Spar to create an exclusive beer, the Spar Scotland Trade Show provided the perfect opportunity for BrewDog to show off Sprucy Lucy. The 4.5% highly drinkable West Coast Session Pale combines seven hops to achieve unique piney notes.

Richard Garden, National Account Manager, BrewDog, comments; “The CJ Lang trade show was a great success. As well as focusing on this year’s key launch, Wingman Session IPA, it was the first time we have shared the brand-new piney ale, Sprucy Lucy, with retailers – a beer with no fewer than seven hops that was developed in partnership with SPAR and available exclusively to its members. Now retailing in 12 countries across Europe, the feedback was extremely positive, with retailers showing a keen interest and eager for more information. It was also great to hear about some of the successes they are already having in-store and we’re thrilled to see the early achievements of such an important partnership, which has enabled Sprucy Lucy to come to market.”

Retailers in need of an energy hit got the opportunity to sample Red Bull’s latest Winter edition. The Iced Vanilla Berry drink boasts refreshing eucalyptus notes, as well as energising taurine and caffeine.