Buckfast unveils two new RTDs

Buckfast unveils two new RTDs

FM’s departure comes when convenience industry needs clarity.

Eddy’s Food Station owner goes bust

DRS DELAYED… AGAIN Recycling scheme pushed back to 2027

PMPs IN FOCUS

Cost of living drives PMP spike

04 Off-Trade The Minimum Unit Price for alcohol will jump 30% to 65p in the autumn

05 Trading The Eddy’s Food Station convenience chain enters administration.

06 Illicit Trade The latest TMA Anti-Illicit Trade Survey highlights the extent of the UK’s illegal tobacco market.

08 Store Refits Spar Kilwinning reopens after a comprehensive refurbishment of the company-owned store.

10 News Extra Deposit Return Scheme The DRS launch date is pushed back to October 2027.

18 Product News Dairylea and Trainline team up, while CocaCola kicks-off an endless summer of sport and music.

20 Off-Trade News Shoppers can win cash with BrewDog and Diageo unlocks summer with new Cîroc Limonata.

22 Two Minutes Of Your Time Stephen Wilkes The J Chandler & Co National Account Manager discusses the launch of two new Buckfast RTD cans.

24 SLR Awards The on-the-road judging for the SLR Awards 2024 is now well underway with judges visiting every store on the shortlist right across the country.

26 Above & Beyond Awards The shortlisted finalists in the Up & Coming Star category tour Coca-Cola Europacific Partners’ East Kilbride site.

28 RTDs Is it time you gave more space to the RTD category in-store and focused on the fastest-selling lines?

30 Hotlines The latest new products and media campaigns.

50 Under The Counter The Auld Boy discovers that horses aren’t just a way for him to lose money.

32 Cigars The growth of cigarillos is helping drive the cigar category in Scotland, as SLR discovered when it caught up with Scandinavian Tobacco Group UK MD Gleb Pugacev.

34 Energy Drinks The lure of energy drinks shows no signs of waning as the latest market data shows that total category sales are on course to reach £2bn for the first time in GB.

40 Price-Marked Packs In today’s uncertain economic times, price-marked packs are vital in communicating value to customers and driving sales and profits for retailers.

48 Vaping Despite the prospect of the disposables ban in April next year, it’s ‘business as usual’ says Imperial Brands’ Consumer Marketing Director Yawer Rasool.

One Stop has experienced another year of growth with 27 brand-new company stores opening between March 2023 and March 2024. This is the biggest number of stores One Stop has opened in a single year over the last five years. The convenience chain is keen to continue its nationwide expansion plans and wants to hear from any retailers selling an existing business.

Spar is launching its £100,000 Community Cashback scheme for the third year in a row. Until 22 May, shoppers can apply for a grant for an organisation or charity they feel deserves funding. All applicants need to do is share the exceptional contribution that a local organisation has made to their community and what the grant would be put towards. Grants of up to £10,000 are available.

UK Total retail sales increased by 3.5% year on year in March, according to the BRC-KPMG Retail Sales Monitor for March 2024. This is the strongest result since last August and above the three-month average growth of 2.1% and the 12-month average growth of 2.9%. The primary cause of this growth was the earlier timing of Easter this year, which drew more sales from April into March compared to last year.

PayPoint ponders share buyback following figures

PayPoint has issued an unaudited post-close trading update for the financial year to 31 March 2024. It anticipates underlying core operational earnings will be more than £80m, year-end net debt below £70m and underlying profit before tax in line with expectations. The board is now considering a share buyback programme based on the strength of this performance.

e Scottish parliament has voted to increase the minimum unit price (MUP) for alcohol by 15p to 65p – a rise of 30%.

MUP has been set at 50p since Scotland became the rst country in the world to implement such a policy in May 2018. e increase is intended to counteract the e ect of price in ation.

New research has uncovered the actual cost of paying staff in the wake of the National Living Wage (NLW) rise.

e new level comes into force from 30 September. It means the minimum price for a 70cl bottle of 37.5% ABV spirits will increase from £13.13 to £17.06.

A sunset clause in the MUP legislation meant the current rules would expire at the end of April but MSPs voted by 88 to 28 in favour of extending them – with the increase thrown in.

It is estimated there are 24 alcohol-related deaths in Scotland every week, with around 700 people hospitalised over the same period.

Drugs and Alcohol Policy Minister Christina McKelvie said: “We believe the proposals strike a reasonable balance between public health bene ts and any e ects on the alcoholic drinks market and impact on consumers. Evidence suggests there has not been a signi cant impact on business and industry as a whole, but we will continue to monitor this.”

Retailers can calculate minimum prices of any alcoholic product on the SGF website.

The NLW rose to £11.44 per hour on 1 April, a 9.8% increase on 2023/24. However, a collaboration between SGF and University of Stirling put the actual cost to employers closer to £15.39 per hour. This is a jump of £1.39 on the previous year and the highest increase for at least the past eight years.

The study considers statutory costs, such as National Insurance and holiday pay, as well as additional employment expenses such as uniforms and administration costs. Meanwhile, a recent survey of SGF members found that more than 90% of respondents were less likely to hire more staff due to the wage increases. Three-quarters of owners/managers reported working over 65 hours per week to keep costs down.

As a result, additional staff costs will inevitably be passed onto customers, many of whom are also struggling to manage their household budgets.

The True Cost of Employment 2024 paper will form part of SGF’s annual submission to the Low Pay Commission, for inclusion in its report and recommendations to the Prime Minister later this year.

Assaulting a shop worker in England and Wales will be made a speci c criminal o ence, Prime Minister Rishi Sunak has announced.

A package of measures will see serial o enders required to be wear electronic tags to monitor their activities and there will be a

pilot of new community sentencing measures to tackle proli c shop the o enders. Furthermore, an investment of £55m over the next four years in facial recognition technology will help identify and catch o enders.

e move comes as retailers across the UK face a rising tide of

retail crime. ere were around 76,000 incidents of violence in local shops over the last year, along with more than 600 incidents of the an hour, according to the 2024 Association of Convenience Stores’ (ACS) Crime Report. Similar legislation has been in place in Scotland since 2021.

Discovery Retail, the parent company of the Eddy’s Food Station convenience chain founded by former Dundee United Chairman Stephen ompson, has entered administration.

Spar Scotland wholesaler and retailer CJ Lang & Son has already snapped up three Eddy’s stores in Larbert, Greenock and Leuchars, saving 35 sta from an uncertain future. e fate of a fourth store in Buckhaven remains uncertain.

Ironically, a number of Eddy’s Food Station stores had previously traded under the Spar fascia.

Eddy’s Food Station launched in May 2022 with a store in Alloa. ompson had plans to open a total of 30 within ve years, backed by London-based Nash Capital. As well as those already mentioned, the chain also acquired a store in the village of Ceres, Fife. is was subsequently sold to Greens Retail

TOBACCO Children born in 2009 will never legally buy cigarettes

Westminster MPs have voted overwhelmingly in favour of the generational smoking ban, passing the Tobacco and Vapes Bill by 383 votes to 67.

e bill still has to clear several legislative hurdles but it is possible it could pass into law as soon as the second half of this year.

It means anyone born on or a er 1 January 2009 will never legally be able to buy cigarettes or tobacco in the UK.

Health is a devolved matter, but agreement has been reached for a four-nation approach to tackling smoking. Scotland will be given the appropriate powers needed to enact the bill, but the Scottish Parliament will then need to give its consent via a vote in Holyrood.

e bill also includes measures to tackle underage vaping, with new restrictions on the display of vapes, packaging and avours.

and the Alloa site now trades as a Keystore More.

Last July, the Greenock and Buckhaven stores underwent a £600,000 refurbishment when the retailer entered into a partnership with the Iceland supermarket chain that saw the Buckhaven site converted to a dual-branded fascia with Iceland Local.

CJ Lang boss Colin McLean said: “We are happy to welcome these three convenience stores into the Spar Scotland family, following the sad news of its previous owner recently entering into administration.

“We recognise the challenges facing many convenience store operators at the moment, but we are pleased we have been able to work quickly to secure the future of these stores and the store sta involved. is will ensure local jobs are retained and the stores remain open to continue serving their communities.”

ompson is the son of, and worked alongside, Eddie ompson, co-founder of convenience store chain Morning, Noon & Night. One of the most signi cant retail deals in Scotland saw the chain of 50 stores sold for £30m in 2004.

Spar UK is offering £100,000-worth of free stock to independent retailers in England, Scotland and Wales who join the symbol group. The incentive, which is subject to terms and conditions, was launched at the National Convenience Show which took place in Birmingham from 29 April to 1 May.

Speaking ahead of the show, Ian Taylor, Spar UK Retail Director, said: “We look forward to meeting independent retailers looking to grow and develop their business with Spar. This event provides us with a platform to showcase our best-in-class offer and our commitment to the future of the convenience industry.”

HFSS opinions wanted

The Scottish Grocers’ Federation is seeking the views of its members to help shape a response to the Scottish Government’s proposed restrictions on the promotion of foods high in fat, salt and sugar (HFSS). The planned restrictions target temporary price reductions and meal deals and in-store placement of products. Visit surveymonkey.com/r/58ZHBZ9 to have your say.

GroceryAid commits to £1m funding for schoolkids

GroceryAid’s School Essentials Grant will provide £1m of support for school-aged children of grocery colleagues this year. The fund provides a £150 nonrepayable grant for every child of school age, up to a maximum of three children per eligible household, up to the fund total. Applications can be made via the GroceryAid website from 18 to 20 June.

Rustlers unveils compact food-to-go solution

Rustlers has launched a new small-footprint unit to help small- and medium-sized stores drive food-to-go sales. The units contain a digital screen for advertising alongside a preprogrammed microwave. The first 100 stores that introduce the machines before the end of the year will receive a free food-togo launch kit. Email foodtogo@ kepak.com to find out more.

Tracey Hart has been appointed to the newly created role of Director of Retail and Wholesale for News UK. The new role will see Hart – who has worked at News UK for almost 10 years – drive industry initiatives to deliver a long-term future for newspapers and the supply chain, as well as continue to manage Direct To Consumer contracts and Retail Demand Planning. She will officially assume her new role in June.

KP Snacks has named Matt Collins as its new Sales Director. Collins has been with snacking giant for 10 years, most recently as Trading Director across multiple channels. He replaces Andy Riddle who is leaving the business. Collins said he looks forward to putting KP’s trade partners “truly at the heart of our business to continue to deliver sustainable, profitable category growth”.

Dairy-free brand Vitalite UK has partnered with training provider

The Allergy Badge to offer free educational workshops that will empower retailers with the knowledge and tools to understand and better cater for people with allergies. Attendees will learn about the symptoms of an allergic reaction, the emergency use of adrenaline auto-injectors and advice on simple changes that can keep environments safe.

The Post Office has announced £30m-worth of remuneration improvements for Postmasters for 2024/25. These include a one-off pay boost, equal to 15% of Postmaster’s March 2024 trading, and increases in Mails remuneration, a 21% rise for Postmasters handling DVLA transactions and an average increase of 9.4% on outreach payments to Postmasters who operate mobile vans.

Unitas signs up to TWC’s c-store market read

Unitas has become the first wholesaler or wholesale buying group to sign up to TWC Group’s SmartView Convenience (SVC), a platform that provides a representative EPoS market read covering independent retail and wholesaler-supplied symbol stores in Great Britain. Subscribers can use the software to support marketing, trading and core range planning.

Eighty per cent of UK smokers bought tobacco products last year on which UK duty wasn’t paid. at’s the key nding from the Tobacco Manufacturers’ Association (TMA) Anti-Illicit Trade Survey 2023.

e gure is the highest recorded in the nine years the annual survey has been commissioned and represents a 6% increase on 2022.

In Scotland, the number was slightly below the UK average at 79%, a rise of 5% on the previous year.

e survey results were based on a poll of more than 12,000 smokers from across the UK. It also found that more than a third (35%) of respondents buy ‘branded’ tobacco at least once a week while one in ve (20%) smokers only ever buy ‘branded’ tobacco. is is despite the fact that all legal tobacco has been sold in standardised plain packaging since 2016.

Almost two-thirds (65%) of those surveyed claimed repeated hikes in tobacco taxes, coupled with cost-ofliving pressures, have changed where they buy tobacco from – a massive rise from the 39% recorded for 2022. If anything, it’s surprising the gures aren’t higher given the disparity between legal and illegal prices.

SYMBOL GROUPS Record numbers attend event

In January 2024, the average price for a 20-pack of legal cigarettes was £15.26 compared to between £3 and £6 for 20 on the black market. At the same time, the average price for 50g of legal Roll-Your-Own was £34.84 compared to between £5 and upwards of £8 for 50g of illicit product.

To combat the problem, the government has committed an additional £100m over ve years, spread between HMRC, Trading Standards and Border Force. However, this gure is dwarfed by the £2.8bn in lost tax revenues annually as a result of the illicit trade.

Sun City in South Africa played host to the Spar UK 2024 Conference, where 480 independent Spar retailers and families, national account customers, companyowned store colleagues, suppliers, distribution centre and central o ce bosses attended the event between 12-16 March 2024.

e conference saw a record number of attendees gather for an exchange of ideas, insights, collaborations and charity giving under the theme of ‘Winning in Convenience’.

Participants enjoyed several keynote sessions including an inspirational Q&A session with

Khumo Phalatse, Founder of It Belongs To Me, a non-pro t organisation located near Sun City that supports school girls and vulnerable young people.

e event culminated in a charity fundraising gala dinner where £65,181 was raised and shared between Spar’s national charity partner Marie Curie and It Belongs To Me.

e biennial Spar Guild Challenge also took place. A ercely competitive contest between all ve Spar UK regional Guilds saw the Scottish Guild crowned as winners, taking the Mark Gillett Award for Endeavour.

FOOD WASTE Partnership passes milestone Nisa retailers save 175,000 meals with Too Good To Go

Nisa’s independent retailers marked Stop Food Waste Day (24 April) by reaching the milestone of 175,000 meals saved since a partnership with surplus food app Too Good To Go began in 2019.

With over 300 stores signed up to the app, the latest gure equates to the equivalent of 477,187kg of CO2 avoided.

e app gives retailers a useful tool to drastically reduce the amount of food waste in store whilst o ering a helping hand to the community by sharing cutprice products in Surprise Bags at a time when the cost of living is a concern for many.

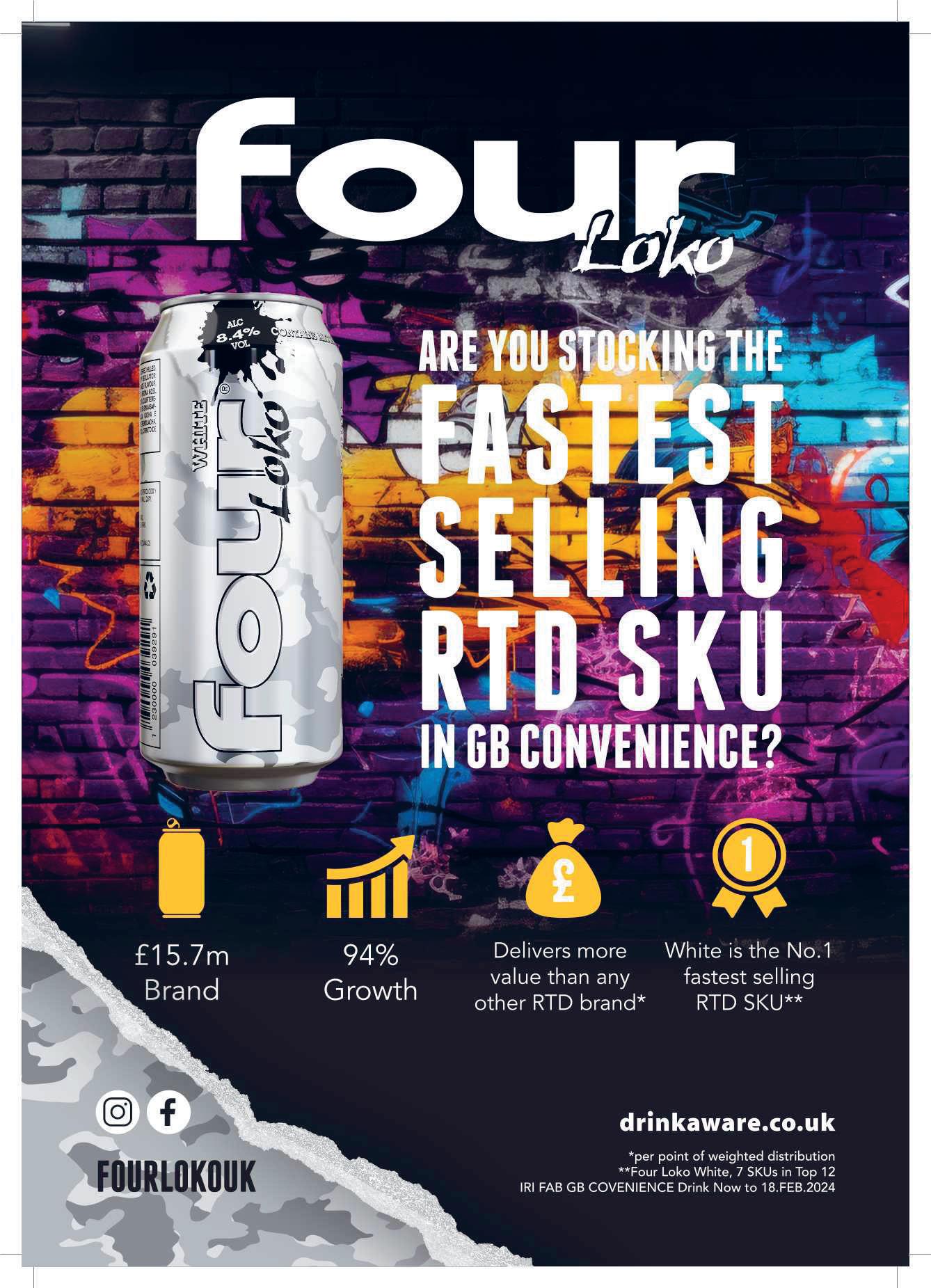

SLR is working with Red Star Brands and its fast-growing RTD brand Four Loko to provide you with regular updates on the performance of an increasingly important category.

Spar Kilwinning has completed a major refurbishment, which was celebrated with a grand reopening on 2 May.

e comprehensive overhaul, which started in September 2023, saw every aspect of the store redesigned with customer convenience in mind.

at entrance, the store now boasts a fresh, vibrant aesthetic with modern design elements. e counter area has been completely redesigned and hosts PayPoint, CollectPlus parcel service and lottery. e new CJ’s food-togo area includes hot and cold food and Rollover Hot Dogs, with an additional dedicated selfserve food-to-go counter incorporating Tango, Fanta Ice Blast and Costa Co ee.

New shelving bene ts from the introduction of electronic shelf edge labels and digital screens are used to promote special o ers and services.

As part of Spar Scotland’s commitment to sustainability, the refurbishment includes ecofriendly initiatives such as energy-e cient lighting, refrigeration and freezers, and new chilled and frozen cold rooms.

RTDs is the fastest-growing category in Beer, Wines and Spirits.

RTDs are up 24.2% by volume YOY in convenience.

RTDs are up 16.5% by value YOY in convenience

RTDs are

13.2%

in supermarkets.

e store was taken back to the brickwork and now features a modern layout, optimising the space and ow for a more seamless shopping experience, with parking for as many as 20 cars outside.

With new ooring throughout, new external and internal graphics, and a new automatic door

Frank McCarron, Spar Scotland Company Owned Store Director, said: “We are thrilled to unveil a transformed Spar Kilwinning to our local community. is refurbishment re ects our dedication to providing an exceptional shopping experience for our customers, and we look forward to welcoming everyone to our newly refurbished Spar store.”

Lottery operator Allwyn has rolled out new permanent point of sale (PPOS) to a number of trial stores ahead of a wider distribution.

e PPOS intends to deliver more modern retail environments and capture the attention of customers with eye-catching branding and calls to action. It also lets retailers display information about National Lottery-funded projects that are local to their store for the rst time.

e kit includes a lit-up Scratchcard dispenser and a new Playstation with doublesided graphics and a wing to display key information. A new external wall sign, a double-sided pavement sign and a refreshed window poster frame complete the line-up.

e height of the new Playstation tables has been

standardised at a level considerate of wheelchair users – as has the Scratchcard dispenser media screen – while the playslips are set at a height within reach of wheelchair users. Graphics and signage, as well as the surfaces they sit behind, have also been designed to meet accessibility requirements.

Lightweight designs mean the kit and its transportation are carbon e cient, while

recycled and recyclable materials have been prioritised in the manufacture and deployment of the new PPOS. e next phase of the rollout will see the new PPOS sited in around 40 stores by the end of May, with another 10,000 outlets set to receive it later in the year. e kit will then be rolled out to remaining National Lottery retailers throughout the autumn and into 2025.

Scottish Grocers’ Federation

Scottish Grocers’ Federation

Potential plans to link the Small Business Bonus Scheme to the condition of paying the ‘real’ living wage could be devastating for the convenience sector, and for tens of thousands of small businesses across Scotland.

It also misunderstands entirely the relationship between business viability, the purpose of business rates relief, and growing the number of people in employment.

Our elected representatives say “small businesses are the backbone of the economy”. So, it is astonishing that while the economy is stagnant and many businesses are struggling to stay afloat, our governments would seek to price people out of employment.

Small businesses provide benefits far beyond their individual wealth generation. C-stores provide stable and flexible local employment, access to local goods and services, and significantly boost the wider economy. They are a foundation for prosperity and growth.

Binding the ‘real’ living wage directly to rates support will mean that businesses have even less financial capacity to employ people, or increase staff hours, or provide adequate renumeration for supervisors and managers. In other words, it will have the exact opposite effect to that intended by policy makers.

We all want to ensure staff are paid well for the work they do. Ultimately, however, this will force prices up to pay for wages, contributing to inflation, and further extending the cost-of-living crisis.

As highlighted by our True Cost of Employment report, retailers are now working longer hours and hiring fewer people, just to keep wage costs down and their businesses viable.

The deposit return scheme will not now take place before October 2027, after next year’s go-live date proves to be a ‘stretching target’.

e Westminster government has con rmed that the introduction of deposit return schemes (DRS) in the UK will be pushed back two years to October 2027.

In a written ministerial statement published on 25 April, Robbie Moore MP said “launching a DRS in October 2025 was a stretching target date” and that an October 2027 implementation would be required to ensure that the rollout of schemes was e ective and e cient.

e UK government, the Department of Agriculture, Environment and Rural A airs (DAERA) in Northern Ireland, the Scottish government, and the Welsh government subsequently published a joint policy statement con rming the date and setting out a three-stage plan to ensure the target is hit.

e rst phase will see Regulation and Deposit Management Organisations (DMOs) appointed by spring 2025. e DMOs will be set up in a second phase from spring 2025 to spring 2026. e deposit return schemes should then roll out across the four nations in a third phase between spring 2026 and autumn 2027.

e schemes will be reviewed once they have been operational for su cient time to allow data about them to be collected. e review will consider the e ectiveness, costs and bene ts of the DRS, including

progress towards environmental objectives.

e joint statement also revealed that the deposit level has not been determined at this stage; DMOs will do this once they are appointed.

Furthermore, retailers who operate a home-delivery service will be pleased to learn that they will not be required to operate a takeback service for drinks containers sold online.

e Association of Convenience Stores welcomed news of the pushback. Chief Executive James Lowman said: “It’s essential that the scheme is given every opportunity to succeed, which involves as much alignment as possible between UK nations, the strategic mapping of sustainable return points, and the creation of the Deposit Management Organisation. We will continue to work with our members on how they can engage with the scheme.”

A number of producers, including Britvic, Coca-Cola and Suntory Beverage & Food GB&I, also supported the postponement. e deposit return scheme was originally planned to launch in Scotland in April 2021, and this is the h time it has been delayed. In March 2020, the start date was

pushed back to July 2022 to give businesses more time to prepare. e go-live date was then moved to August 2023 in December 2021, following an independent review that considered the impact of the pandemic on the scheme.

In April 2023, Humza Yousaf announced a further delay until 1 March 2024, citing the UK government’s delaying of a decision to exclude the scheme from the Internal Market Act.

Just two months later, at the beginning of June 2023, a disagreement between the Scottish and UK governments over the inclusion of glass saw another push back to at least October 2025. is was well timed, as the company set up to administrate the scheme north of the border, Circularity Scotland, went bust with debts of more than £86m later in the month.

Which now brings us to the October 2027 date; a total delay of six-and-a-half years. e primary school children excitedly feeding a reverse vending machine in the picture above were taking part in a 2019 DRS trial. It’s entirely possible that they will be at university when they next pop an empty drinks container into an RVM.

I speak to a lot of retailers in this job and I think it’s fairly uncontroversial to say that quite a lot of them don’t fancy the Scottish Green Party much. Greens co-leader Lorna Slater’s catastrophic handling of the DRS shambles didn’t endear her to many in the sector – so you would imagine that the demise of the Bute House power-sharing agreement would have been welcomed by more than a few retailers.

But there is a very strong argument to say that this is one of those classic cases of ‘be careful what you wish for’. The outsized influence of the Greens on government policy-making was seen by many as unfathomable distraction when the economy is crumbling down around our ears, our long-revered education system is under-performing and the NHS is in turmoil.

Yes, gender identity, home insulation and rent capping are all important issues in their own right – but given where Scotland finds itself right now, should they really be the priorities taking up so much of the time, energy and brain power of the government? That’s a question that has been put to me by many retailers, though not always in such polite terms.

The days that followed the First Minister’s apparently brutal tearing up of the Bute House agreement have led us down a path that would seemed inconceivable just a few weeks ago. John Swinney as First Minister? Or long-shot hardliner Christian Kate Forbes?

Whoever ends up calling Bute House home, one thing is for sure: they’ll be running a minority government and that will require more concessions to the Greens and others, not fewer.

Every piece of legislation that the SNP wants to pass will now require them to do deals with opposition parties and that is likely to put the Greens back in a very powerful position once again. Their influence over policy-making could conceivably increase despite the ashes of the torched Bute House agreement still being warm.

At the heart of this is that the Green Party is pursuing its own unique agenda. The mainstream parties focus largely on the same issues, those big issues referenced above. The Greens dance to a very different tune and have their own, in a sense, narrower agenda – and now they have another opportunity to leverage their influence in pursuit of their goals.

The local retailing sector badly needs unity, decisiveness and clarity to help Scotland get back in the game, but the events of the last couple of weeks are certainly not likely to deliver those any time soon.

ANTONY BEGLEY, PUBLISHING DIRECTOR

EDITORIAL

Publishing Director & Editor Antony Begley abegley@55north.com

Features Editor

Gaelle Walker gwalker@55north.com

Web Editor Findlay Stein fstein@55north.com

ADVERTISING

Sales & Marketing Director Helen Lyons 07575 959 915 | hlyons@55north.com

Advertising Manager Garry Cole 07846 872 738 | gcole@55north.com

DESIGN

Design & Digital Manager Richard Chaudhry rchaudhry@55north.com

EVENTS & OPERATIONS

Events & Circulation Manager Cara Begley cbegley@55north.com

Scottish Local Retailer is distributed free to qualifying readers. For a registration card, call 0141 22 22 100. Other readers can obtain copies by annual subscription at £50 (UK), £62 (Europe airmail), £99 (Worldwide airmail).

55 North Ltd, Waterloo Chambers, 19 Waterloo Street, Glasgow, G2 6AY Tel: 0141 22 22 100 Fax: 0141 22 22 177 Website: www.55north.com Twitter: www.twitter.com/slrmag

DISCLAIMER

The publisher cannot accept responsibility for any unsolicited material lost or damaged in the post. All text and layout is the copyright of 55 North Ltd.

Nothing in this magazine may be reproduced in whole or part without the written permission of the publisher.

All copyrights are recognised and used specifically for the purpose of criticism and review. Although the magazine has endevoured to ensure all information is correct at time of print, prices and availability may change.

This magazine is fully independent and not affiliated in any way with the companies mentioned herein.

Scottish Local Retailer is produced monthly by 55 North Ltd.

©55NorthLtd.2024 ISSN1740-2409.

The ongoing debacle following First Minister Humza Yousaf’s resignation means more chaos and uncertainty for local retailers at a time when the sector badly needs clarity.

BY ANTONY BEGLEYThey famously say that a week is a long time in politics, but it can be an even longer time in trade publishing. e problem with publishing a monthly title like SLR is that events can crop up just as you’re going to press and in the four or ve days between sending a magazine to press and it landing with retailers, the narrative can change dramatically.

at’s the position we nd ourselves in with this issue thanks to First Minister Humza Yousaf’s decision to step down just a day before we were due to go to press. What happens next is anyone’s guess but one thing is for sure: the developments will lead to yet more uncertainty and confusion for the local retailing sector at a time when what we desperately need is clarity.

As it stands right now, as we go to press, Yousaf has given his carefully worded resignation speech and the scramble to replace him is underway. e fact that Yousaf pointedly said he would remain as FM until a replacement is found was not a gesture of goodwill – it was carefully calculated. By not resigning with immediate e ect, it meant that the 28-day countdown that the SNP have to nd a new leader had not yet been triggered. In other words, he’s bought the SNP National Executive some time to get their ducks lined up.

As I write, the clear frontrunners are former party leader John Swinney and Kate Forbes, the woman who narrowly failed to defeat Yousaf in the last leadership contest, gaining 48% of the vote.

Her hardline Christian views, however, played a part in her undoing back then and may do so again. Usually described as an adherent of the ‘socially conservative Free Church of Scotland,’ Forbes has some views on subjects like same-sex marriage and abortion that many people with a more liberal outlook nd o ensive.

It’s also widely accepted that the Greens don’t seem too keen on her which may well be a factor, particularly as it looks likely that the Greens tail may well continue to wag the SNP dog, even a er a new FM is in place.

Far more likely is that Swinney, an old safe pair of hands, will prevail but that comes with the usual caveat that anything is possible in politics.

So what does all this mean for local retailers in Scotland? Well, the most obvious conclusion is that, far from a settled, concerted and strategic approach to reinvigorating Scotland’s economy, we’re more likely to see political horse-trading, confusion and compromise as key issues take a back seat to party politics once more.

It’s probably uncontroversial to say that, strictly from a local retailer’s point of view, the impact of the Greens over the last couple of years hasn’t been universally welcomed. e most obvious example is the monumental mismanagement of the DRS a air. Very few people can hand on heart say that Greens Co-Leader Lorna Slater managed that episode particularly well. It’s too easy to say with hindsight, but I’ll say it anyway: if the SNP-Greens coalition had listened to the industry – to producers, wholesalers and retailers – the DRS scheme could have been in place by now in Scotland. Not everyone may have welcomed it, but we could have got it over the line. But those in power chose to refrain from engaging with industry in any meaningful way and ignored the long, long list of enormous and very practical, real-world challenges that stood in the way of making DRS happen. Bluntly, DRS was a agship Greens policy and they were determined to get it done, regardless of reality. But reality has a nasty habit of getting in the way, as Slater found out the hard way.

ere are many in our sector who didn’t take kindly to what they saw as Slater’s cold arrogance, so there were no doubt a few retailers permitting themselves a satis ed grin when Yousaf ended the Bute House agreement between the SNP and the Greens at the end of last month.

e problem here – and it’s a big one – is that the in uence of the Greens is unlikely to be weakened by very much in the future. As e Metro told the FM on its front cover ‘You’ve only got Yousaf to blame,’ but the reality is probably a little more complex than that. e way he brutally ended the Bute House agreement had Slater and Co-Leader Patrick Harvie in apoplexy but it’s unlikely that Yousaf took that decision single-handedly.

With the Greens debating whether to move to end the agreement themselves a er the SNP backed out of its climate change targets, Yousaf got in there rst, no doubt hoping to

TheentireDRS shamblescouldhave beenavoidedifthe SNP-Greenscoalition hadlistenedtothe industry.

demonstrate bold decision-making in an attempt to prevent the next few months being dominated by politics when he had a whole lot of other realworld problems to be getting on with. at clearly back red in spectacular fashion and the tabled vote of no con dence in the leader was enough to bring the house down. Harvie said he would back the motion and the arithmetic of Holyrood meant that Yousaf needed one vote to be con dent of surviving the vote of no con dence. His only hope was, ironically, Alba’s Ash Regan, a former SNP member. Regan and party leader Alex Salmond enjoyed 48 hours in the media spotlight, touting themselves as kingmakers and issuing a no doubt lengthy list of demands to Yousaf in return for their support. Yousaf’s resignation speech, however, included an oblique reference to not betraying his principles, which e ectively put Regan back in her box.

To bring us right up to date, Labour also proposed a vote of no con dence in the Government itself, rather than just its leader. If that had gone through and been supported, it would trigger an election up here – but in reality, very few would welcome that. Scotland has a xed-term election system so, even if an election was triggered, we’d still be doing it all over again in 2026 when the next election comes around. Harvie quickly snu ed out that prospect, however, by saying that the Greens wouldn’t back the motion if it was tabled.

And here we get to the real crux: by not backing that proposal, the Labour vote of no con dence is dead in the water. Harvie made it clear that he wanted to revive the Greens’ relationship with “by far and away the biggest political party in Scotland”. It was just Yousaf that he didn’t fancy. So while Bute House is no more, it looks very much like the Greens tail may indeed continue to wag the SNP dog. If Swinney does become FM, it’s likely he will do a better job of working with those across the Chamber at Holyrood, but the fact will remain that he’ll be leading a minority government. e support of the Greens will arguably be more critical than ever.

It has been clear for some time that many in the SNP were getting a little tired of the arguably disproportionate in uence that the Greens were having on the coalition’s policy making. For many of the party faithful, issues like DRS, gender identity, housing insulation and rent capping may all be very important, but they should have been much further down the government’s priority list given the chaos that surrounds us on grand-scale issues like economics, health and education.

So is this a case of ‘be careful what you wish for’? Very possibly. While the SNP themselves, Labour and the Tories all have di erent approaches to how to treat the key issues of the day, they at least agree to a greater or lesser extent on what those issues are. e Greens’

agenda is unique in that sense and stands to one side of mainstream politics.

With a UK General Election on the horizon, it’s likely that these big issues will come to the fore once again. Sort the economy, cut waiting lists, refocus on education. ose sorts of things. And many would agree that those are indeed the sorts of things we should be focusing on. e risk in Scotland is that a minority government that has to go cap in hand to the opposition to get every piece of legislation passed will end up with another series of compromises and agreements achieved through political horse-trading.

at’s far from an ideal scenario when decisive, di cult decision-making is required to get Scotland back on its feet. In a sense the Greens have nothing to lose by leveraging their outsized in uence in this unique period in history to pursue their own agenda. ey are perfectly entitled to do so, of course, because we thankfully live under a democracy. But a democracy naturally entails cross-party dealmaking and compromise and favours and secret meetings. As Winston Churchill once famously said: “Democracy is the worst form of government, except for all others.”

So what will it mean for local retailers? Confusion and lack of clarity, for sure, but don’t count against yet more poorly considered legislation, dra ed without proper consultation with the industry.

Once again we’re helping retailers take some well-earned time off away from their stores

Last year, SBF GB&I launched Win The Weekend, a competition designed to help reward retailers with a precious commodity that can be hard to come by: time off.

The first Win The Weekend competition saw SBF GB&I help Lincolnshire retailers Tracy Raybould and Michael Saunders take two well-earned days off, presenting them with some money to help them pay for a spa weekend and enlisted expert retail support to help mind their store while they were away.

For the return of the campaign, we wanted to take Win The Weekend even further. Ten lucky winners won a £500 cash prize to help them reward themselves with days off, to spend time with their friends and family; and two of those 10 winners also got help from SBF GB&I retail experts and leading retailers to help give them peace of mind while they got the chance to unwind for two days.

One of those lucky winners was Sanjeevan Garcha, of Barnett Brothers in Corsham, Wiltshire.

SBF GB&I partnered with high-profile award-winning retailer Atul Sodha, who has more than 30 years’ experience in retailing and runs a Londis store in Harefield, Middlesex, to manage Sanjeevan’s store while she spent her prize money and took some well-earned time off to visit her grown-up children in London.

ANDY CLARK SBF GB&IWe think we are aware of a lot of the things that retailers have to do, but when you actually jump into their shoes for the day, it is very different. Things like handling parcels, taking in deliveries and people paying their weekly newspaper bill. But at the same time, we've helped remerchandise shelves, and we've done some other jobs that Sanjeevan just doesn't get time to do. It’s great because you're helping somebody deliver, you're adding value to them and helping them just feel good about their store as well as helping them make more money.

SANJEEVAN GARCHA

BARNETT BROTHERS, CORSHAM, WILTSHIRE

What are you going to do with time off you’ve won as part of Win The Weekend?

With the time off I'm going to London to see my kids because I haven’t seen them for a long time - I don’t get to see them often because I'm tied up with the store. So. I'm going to stay with them for three nights, and we are going to spend some time together and go out for dinner. I'm going to spend the money like that, which we can't normally afford to do. It’s brilliant to have this opportunity.

Do you recognise that it’s important to take time off?

My kids are always telling me that I need to take time off, because I'm always stressed. I'm always switched on thinking that I need to do this or I need to do that in the shop. Living upstairs is totally wrong – we lock up then I’d like to go and switch off but I can’t because I’m so close to the shop. It’s important to be able to relax and do nothing and not think about anything as well

ATUL SODHA SPECIAL GUEST RETAILER

ATUL SODHA SPECIAL GUEST RETAILER

OF RETAILERS VALUE THE HEALTH OF THEIR BUSINESS OVER THEIR OWN PHYSICAL OR MENTAL HEALTH 78% 1

The reason I got involved with Win the Weekend is that I wanted to lead by example and do all I can to raise awareness of the mental health issues retailers may be going through. Taking some time out for yourself is always a good idea and we don't do it enough.

We all want to give our best in this trade and sometimes that feels like you need to be physically in the store to be able to achieve that, but that's not always the case.

The weekend in Sanjeevan’s store has been eye-opening. I’ve learned things about my own store and how I do things myself, and I’ve enjoyed meeting Sanjeevan’s customers and regular shoppers. They are all absolutely delighted that she has won two days off, and that shows the value that her local community has for her and her store.

Why is Win The Weekend important for retailers?

Entering Win The Weekend is more than worth it. Not just the weekend off, but it's amazing to have a bit of money to spend on yourself as well – all without feeling guilty about it!

It’s hard to describe how delighted I was to be able to switch off for some time with my kids and not think about the store, knowing the SBF GB&I team had everything under control.

What do you think of big brands helping out retailers with campaigns like this?

SBF GB&I doing this is very good of them, and I think more companies should do this sort of thing to recognise what we retailers do. People don't realise how many hours we put into this, to provide a service to sell their brands. I know we are earning money from that, but we are putting too many hours in as well.

Hellmann’s launches Euro 2024 packs

As the official BBQ partner of Euro 2024, Hellmann’s has launched limited-edition bottles across 12 SKUs including mayonnaise, tomato ketchup and its flavoured range. New labels reflect the Euros across the top, with fan silhouettes along the bottom and celebratory confetti in the background. The bottles, launched as part of the brand’s £8m ‘Up Your BBQ Game’ campaign, are available now.

First created in 1924, Cardini’s Caesar Dressing has launched a new marketing campaign to celebrate its centenary and share the story on how the dressing was first created. Alongside the campaign, recipes have been developed to bring a fresh twist to summer dining. Currently sitting in the top 10 of the category, Cardini’s Original Caesar Dressing has enjoyed a fourth successive year of volume growth.

Tropicana freshens up Tropicana has overhauled its packaging designs to amplify what the juice brand says are “75 years of exceptional quality, craft, and heritage”. The new look creates a cohesive identity across the portfolio and reinstates the Tropicana’s orange with a straw brand asset. The redesign also more clearly communicates the consumer benefit of the different sub ranges.

Tyrrells starts recycling

KP Snacks has introduced 25% recycled content packaging for its Tyrrells sharing range. The new packaging runs across the brand’s bestselling flavours –Lightly Sea Salted, Sea Salt & Cider Vinegar, Sweet Chilli & Red Pepper and Mature Cheddar & Chive – in 150g formats. Packs feature a green flash that calls out the use of the recycled plastic. KP has removed 1,100 tonnes of plastic packaging across its portfolio since 2014.

Dairylea has launched Discovery Days, a new partnership with Trainline that o ers families discounted train tickets.

Until 31 May, shoppers can get £10 o family train tickets by scanning QR codes on promotional packs of Dairylea Triangles. e campaign is backed by PR, radio, out-of-home, social and in-store activities.

Ria Rianti, Senior Brand Manager for Dairylea at Mondelez, said: “ e partnership is set to be our biggest campaign of the year and gives retailers a valuable opportunity to drive excitement with shoppers and boost sales in the category.

“ e Dairylea range has been trusted by parents to deliver tasty and convenient cheese

snacks for over 70 years, with an incredible 91% brand awareness. is makes it an ideal range to activate a partnership like this one, giving families a little something extra in their shopping basket.”

Mondelez advised retailers to stock up on Discovery Days packs to take full advantage of the partnership and visit its SnackDisplay.co.uk website for further advice and insight into the category.

Mexican food brand Old El Paso has announced a new campaign as part of its continued partnership with Team GB ahead of the 2024 Paris Olympic Games.

The link-up kicks off this month with the brand’s biggest shopper marketing campaign to date, complete with a nationwide on-pack promotion across its entire portfolio, as well as a digital and social campaign featuring a raft of brand ambassadors from Team GB. Designed to bring households together over food as they cheer on their sporting heroes, the ‘Make Some Noise for your Home Team’ campaign is also giving fajita fans the chance to win VIP tickets to the Olympics. Consumers simply scan the QR code on participating Old El Paso packs to enter the draw throughout April to June.

Alongside the promotion, the partnership will be brought to life throughout the summer via a multimillion-pound media investment featuring double Olympic swimming champion Tom Dean, silver medalwinning weightlifter, Emily Campbell, three-time Olympic medallist and diver Jack Laugher and current BMX Olympic champion, Bethany Shriever.

Ahead of this summer’s Euros, Irn-Bru has launched special football packs that give shoppers the chance to win branded supporters’ toolkits. e new packs are backed by a £2m marketing campaign that includes TV, outdoor and digital advertising. POS toolkits are available for retailers to create some in-store footy theatre.

Jonathan Kemp, Commercial Director at Barr So Drinks, said: “IrnBru is proven to drive the category around big sporting events; it was the second-biggest national brand at the last Euros.

“Irn-Bru will be the brand of summer so drinks and we’re encouraging retailers to plan ahead, increase facings and make the most of our new packs and eye-catching POS to maximise this pro t opportunity.”

Coca-Cola has launched ‘Endless Summer,’ a new on-pack promotion giving shoppers the chance to win one of 295 pairs of tickets to Euro 24, top music festivals across Europe, and the Olympics – with spending money provided for any event outside of Great Britain. Retailers and wholesalers also have the chance to win Euro 24 tickets and spending money via the My.CCEP.com trade website.

e promotion is supported by paid social media and in uencer activities alongside online TV, digital and out-of-home advertising. Convenience retailers can request campaign POS and

digital assets from My.CCEP.com to support the promotion in-store.

Featuring an eye-catching wrist band design, promotional packs include plain and price-marked 330ml cans, 500ml PET bottles, and multipack cans of CocaCola Original Taste and CocaCola Zero Sugar. QR codes on non-promotional packs will also facilitate entry to the competition. e promo is live now and runs until 19 May. Shoppers need to scan QR codes on promotional packs to enter via the Coke App.

YOGURT ‘This Morning’ presenter is face of new campaign

Childrens’ yogurt maker Yoplait has unveiled a new marketing campaign featuring TV presenter Josie Gibson. e campaign highlights a dairy de cit in kid’s diets and seeks to educate parents and carers on the bene ts of the calcium- and vitamin D-rich children’s yogurt category. It includes out-of-home advertising, social, digital, in uencer and sampling activities, and follows the publication of a new report ‘Kids’ yogurt and consumers: a relationship turned sour,’ commissioned by Yoplait.

Prizes include festival tickets for All Points East, Boardmasters, Brighton Pride, Sziget, Lollapalooza Berlin and more, plus tickets and spending money to the Euro 24 group stages and quarter nals. Paris Olympics packages are also up for grabs.

Rob Yeomans, Vice-President for Commercial Development at CCEP GB, said: “We wanted to give our brand fans the chance to turn their dreams of experiencing live music and sporting celebrations this summer into a reality.”

Ribena has unveiled a brand new on-pack promotion across its full range of formats which will give shoppers the chance to win family experiences every day.

Prizes up for grabs include UK holiday packages and experience vouchers, as well as an additional 1,000 cash prizes to reward shoppers with some summer spending money.

Shoppers can enter the promotion via a QR code on pack.

Alongside the promo, the Ribena berries are back on TV screens again this summer.

Aurelie Patterson, Head of Ribena at SBF GB&I, said the promotion provided a great sales opportunity for retailers during the key selling season for soft drinks.

She added: “Retailers should make sure they’re stocked up and ready for the extra demand!”

Retailers can win cash in McVitie’s giveaway

McVitie’s new £1m giveaway, The Great Biscuit Break Bonanza, offers prizes for both consumers and convenience retailers until the end of May. The campaign runs across 26 bestselling McVitie’s products. Independent retailers have the chance to get their hands on thousands of cash prizes every time they purchase three cases of participating McVitie’s products.

Functional drinks brand Boost Drinks has announced a packaging refresh that sees the brand’s lozenge logo updated with a new streamlined design that gives each product a slicker and more refined look. Packs continue to champion the brand’s value proposition. The updated branding is backed by a roll out of NPD across the brand’s Energy and Sport categories, supported by a new integrated marketing campaign, ‘There’s a Boost For That’.

Lactalis has launched a new campaign to promote its Président range of French cheeses, butters and cream ahead of this summer’s Paris Olympics. New packs promote ‘Enjoy Paris,’ a competition to win a weekend for two in the City of Love, as well as hundreds of instant prizes. The competition is being publicised by instore point-of-sale and online activities which run from this month through to July.

One Stop has added another 39 products to its fresh food range. These include Fresh & Naked Wild Rocket 60g, One Stop Crispy Sweet Potato Fries 300g, One Stop Buttermilk Chicken Tenders 305g, One Stop Greek Style Yogurt 500g, One Stop Spinach & Ricotta Tortelloni 300g, Pork Farms Ploughmans Pork Pies four-pack, Wall’s Bombay Potato & Spinach Flatbread 120g, and more.

BrewDog is giving consumers the chance to win up to £10,000 with its latest crosschannel promotion, Drink Beer – Win Cash, which is running across grocery and convenience retail, BrewDog venues and participating pubs and bars.

Promotional packs are available up to June, with the competition promoted on four-packs of Punk IPA and Hazy Jane and Mixed eight- and 12-packs, as well as Mixed Alcohol-Free eight-packs.

e promotion is being supported by in-store, in-outlet, digital and out-ofhome activities.

ere are 22 cash prizes on o er, including £500, £1,000, £2,000, £5,000,

Heineken has launched limited-edition sport packaging and glassware across its Original and 0.0 variants.

and the top reward of £10,000. Shoppers will nd out immediately if they are successful, with the prize value stickered on winning cans. Prizes in the on-trade also include free pints, win your bar tab and stays in a UK DogHouse hotel.

UEFA-themed packaging and glassware are available across all Heineken Original packs, while Heineken 0.0 x F1 packs cater for petrolheads. Rugby fans aren’t left out, with Investec Champions Cup glasses also available.

To support the launch, Heineken has invested in sports-led in-store POS materials, alongside May/June out-of-home and digital campaigns in the build up to Euro 2024.

Aston Manor Cider has launched a retailer competition that will see one lucky store win a Crumpton Oaks-branded chiller worth over £2,000, along with some stock to put in it.

To be in with a chance of winning, retailers and wholesalers need to purchase a qualifying case of Crumpton Oaks cider, including PMP, plain and PET bottles, and upload a valid invoice to win. crumptonoaks.com before 30 June. There are no limits on entries, with one invoice per entry permitted.

The competition coincides with the return of Aston Manor’s Straight Outta Crumpton advertising campaign. Back for the third year in a row, from May until July, this sees the brand bring the world of cider to life through the lens of hip-hop.

Diageo’s super-premium vodka brand Cîroc has launched a new limited-edition avour, Cîroc Limonata (ABV 37.5%), in time for summer.

e latest innovation is available in a 70cl bold white and yellow bottle designed to stand out on shelves, with an RSP of £40.99.

Inspired by Mediterranean luxury, Cîroc Limonata blends the smooth taste of vodka distilled from French grapes and infused with the sweet citrus avour of fresh lemons.

e new variant taps into the growing demand for avoured vodka amongst consumers, with the category experiencing 14.1% growth in the pub sector over the last year, whilst avoured vodka

CIDER New format comes with the low/no category booming

is worth nearly £33m each year in impulse convenience.

e launch follows the success of Cîroc Summer Citrus and Cîroc Tropical Passion, which have been the brand’s most-popular and highest-performing innovations from the past few years.

Beth Weston, Marketing Manager for Luxury Spirits at Diageo, commented: “We are thrilled to be unveiling a brandnew, limited-edition avour.

“Having taken inspiration from the Mediterranean summer, this avourful citrus spirit is the perfect accompaniment to serves both at home and in venues. Cîroc Limonata is the ideal option for consumers who are looking to enjoy get-togethers.”

atchers Cider has released its top-selling alcohol-free cider, atchers Zero, in a can format for the rst time.

atchers Zero is the fastest-selling single bottle of all low/no ciders on the market and is now available in 4 x 440ml can packs.

Packaging is 100% recyclable and made using FSE-certi ed card.

e launch comes with alcohol-free drinks accounting for around £304m of the take-home market and up 13.5% in value in the past year.

RTDs

Global Brands has relaunched its popular 90s RTD, Reef, following 22% year-on-year growth in the off-trade RTD category.

The alcoholic orange and passionfruit juice drink is available in packs of 10 x 275ml bottles with an RSP of £8, with a lower, more sessionable, 3.4% ABV.

Retailers should visit globalbrands.co.uk/contact to make an enquiry about stocking.

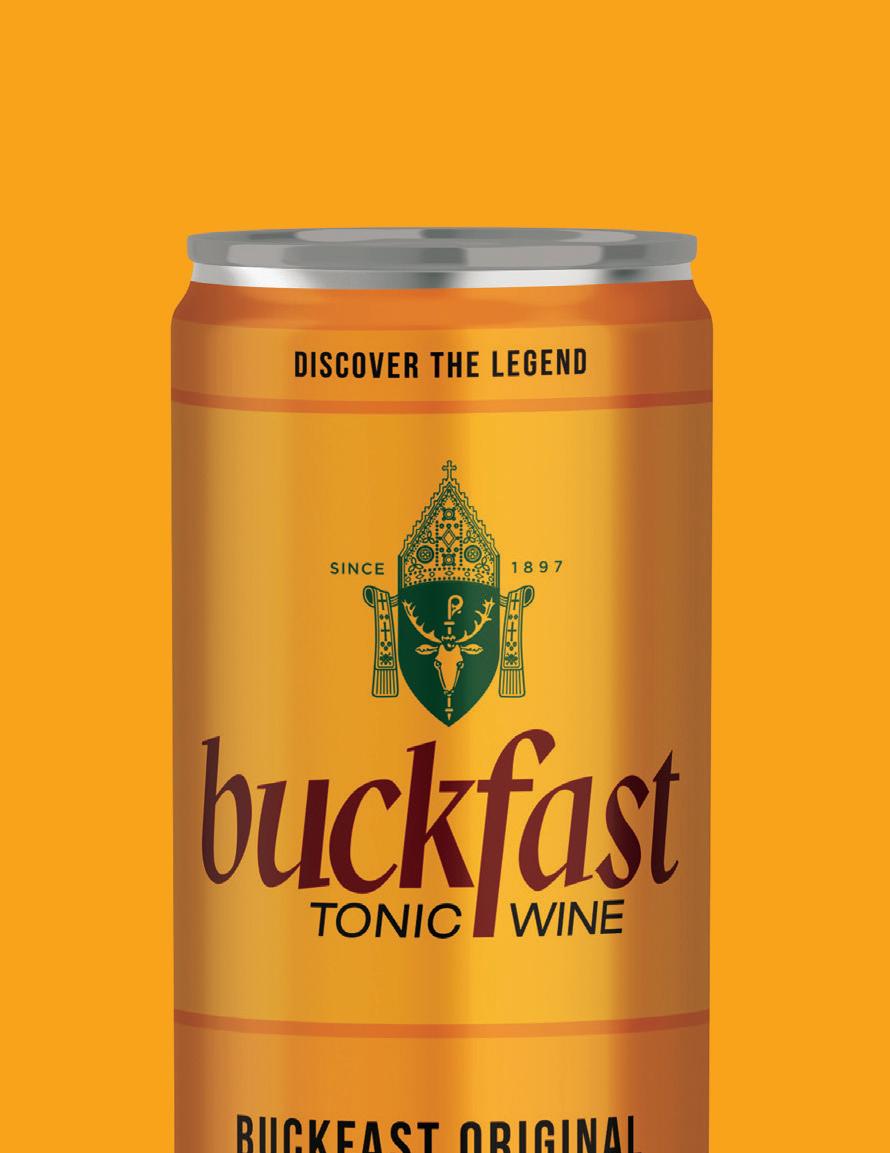

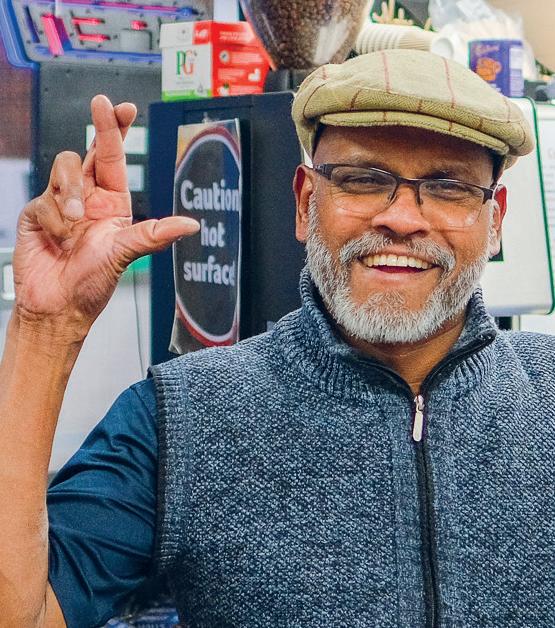

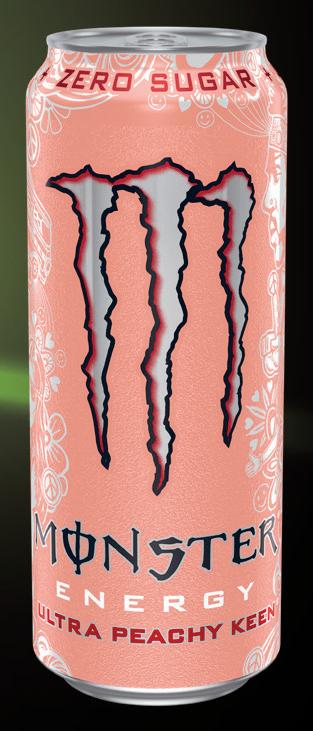

One of the most important lines in local retailing in Scotland, Buckfast is set to target a wider audience with the launch of two new RTD lines. We caught up with National Account Manager Stephen Wilkes to find out more.

Stephen will be known to many in the trade and joined J Chandler & Co in June 2022 after 11 years with Warburtons. As National Account Manager he looks after all Buckfast customers in the UK. His key tasks are to maintain and grow sales of Buckfast in Scotland and increase sales down south. Stephen is also an active member of the Scottish GroceryAid Committee.

SO

Yes, that’s right. We are bringing out two new ready-to-drink cans: e Buckfast Original 15% 250ml and Buckfast & Lemonade 5% 250ml.

ey launched across the Scottish local retailing market on Friday 3 May and are available in all major wholesalers in Scotland and their respective buying groups. ey’re also available in CJ Lang, G101 and Scotmid.

e Buckfast Original 15% is £4.59 RSP and the Buckfast & Lemonade 5% is £2.29 RSP.

For the Buckfast & Lemonade we have seen the growth in the alcoholic RTD market and we thought that a pre-mixed Buckfast could be successful. We sampled it extensively at trade and consumer events last year and the feedback was exceptional, which gave us the con dence that it could be successful for us. We have actually launched Buckfast Original 15% in a can before but the RTD market was quite immature back then and it has developed a lot since. We wanted to o er an alternative size for our existing consumers and also try to attract new consumers into the brand.

SO YOU EXPECT THE LINES TO APPEAL TO BOTH EXISTING BUCKFAST DRINKERS AND BRING NEW DRINKERS INTO THE BRAND?

Yes, we believe that the new Buckfast & Lemonade will appeal to both existing consumer and new consumers alike. For the Buckfast Original we think that one will appeal to our existing

consumers more, but of course we hope that it also appeals to new consumers too!

HOW SHOULD RETAILERS MAKE THE MOST OF THE LAUNCH?

We would encourage retailers to make sure they have plenty of cans in their chillers! Retailers could tap into the demand for these products by creating a bit of theatre in their stores and making sure that everyone knows they have the products in stock. Take advantage of their social media pages if they have them as that’s a great way to engage with their audience and drive footfall and sales.

DO YOU SEE MAJOR OPPORTUNITIES IN THE READY TO SERVE CATEGORY?

100%! It’s the fastest-growing category in BWS and the amount of product innovation in the category is fantastic. It’s a very exciting category for us to be involved in and we can’t wait to see what impact our two new products have.

HOW IS BUCKFAST PERFORMING GENERALLY IN SCOTLAND?

Buckfast continues to perform well in Scotland, in particular our 35cl ask. e cost-of-living crisis means that people are buying into the 35cl more and more. at being said, the 75cl is still comfortably our best seller. e duty increases imposed on the category by the government in August had a signi cant impact on price but we have continued to trade well since then.

HOW DO YOU THINK THE NEW MUP WILL AFFECT THE BRAND AT THE END OF SEPTEMBER?

Honestly, I don’t think that the increase in the mininum unit price will have a negative e ect on the brand because most retailers already sell well above what will be the MUP of Buckfast.

THATCHERS IS #1 FOR GROWING CIDER IN SCOTLAND

The on-the-road judging for the SLR Awards 2024 is now well underway with judges visiting every store on the shortlist right across the country.

As the SLR Awards prepare to return to their natural and long-standing home in June following the chaos of the Covid years, the judges have begun hitting the road to visit every store on the shortlist before deliberating, cogitating and remonstrating their way to choosing the winners of this year’s awards.

With stores from Scourie in the north-west of Scotland to Dumfries in the south, the judges will cover over 3,000 miles on their travels capturing video footage and photos as they go.

SLR Publisher Antony Begley, who will personally visit every store on the shortlist to ensure consistency of judging, commented: “ e way we judge the SLR Awards is unique in this industry. e fact that I will visit every single one of the stores on our shortlist means we can deliver a consistency of judging standards across categories and across geographic areas that is unrivalled.

“Yes, it makes for a busy four or ve weeks of judging and a lot of miles, but we feel that it’s important that we give all entrants a fair and consistent hearing.

“I’m delighted to say that, even just a week or so into the on-the-road judging, we’re already nding some remarkably high standards. e general level is impressively high and we’re seeing local retailing in Scotland continue on that positive trajectory that has been evident since the end of the pandemic. e levels of investment we’re seeing are remarkable and the general standard of the stores is really, really impressive.”

THE ABOVE AND BEYOND AWARDS 2024

The shortlisted finalists for the Up & Coming Star category at the recent SLR Above & Beyond Awards 2024 visited Coca-Cola Europacific Partners’ East Kilbride site last month for a fascinating VIP insider’s tour of the hugely impressive facility.

BY ANTONY BEGLEYQ Chelsea Dunlop Supervisor, Spar Boswell Park

Q Charlie MacRae

Sales Assistant, Spar, Scourie

Q Waseem Sadiq

Accounts Manager, Spar Renfrew

Q Sophie Williams Assistant Manager, Broadway Convenience Store, Edinburgh

Held for the rst time in March this year, the inaugural SLR Above and Beyond Awards were created with one simple goal in mind: to recognise and reward the people behind this remarkable convenience retailing industry. ere are many awards programmes that recognise the stores and the businesses that drive this sector, but these new awards were designed to speci cally shine a light on the people that make our sector so special.

We all know that convenience stores are the beating heart of communities right across Scotland, helping to forge, support and promote valuable connections that have a meaningful impact on local lives. But central to this power are the people behind the counter, on the shop oor and in the back o ce and stockroom, who strive day in and day out, to make a positive di erence to their colleagues, their stores and their communities.

As well as recognising their unbelievable achievements, we also aim to reward them and, working with one of our progressive partners for the awards, Coca-Cola Europaci c Partners (CCEP), we were delighted to host all of the shortlisted nalists for the Up & Coming Star category at CCEP’s impressive facility in East Kilbride last month. Or, at least, that was the plan. As luck would have it, one of our nalists – Charlie MacRae of Spar Scourie – was unfortunately unable to join us

on the day because the extreme weather of the last few weeks intervened, ferry services were cancelled and Charlie couldn’t make it.

We were, however, joined by Chelsea Dunlop of Spar Boswell Park, Sophie Williams of Broadway Convenience Store in Edinburgh and Waseem Sadiq of Spar Renfrew – and a more passionate and inspiring group of young retailers you’re never likely to meet.

Our group of Up & Coming Stars was warmly welcomed by CCEP’s Site Director Allan French, Senior External Communications Manager Amy Burgess and Wholesale Sales Manager Rab Kelly.

As luck would have it, our visit to East Kilbride fell in the same month French and his team were celebrating the 60th anniversary of the site, another remarkable achievement, particularly given the general collapse of the wider manufacturing industry in the west of Scotland over that period. e visit opened with a presentation given by French to introduce the group to the CCEP East Kilbride facility. We learned that the site was acquired in 1964 and was originally a Schweppes factory. ese days, it produces a phenomenal 36 million cases of product a year and employs around 230 people, making it one of the largest single employers in the area.

East Kilbride is one of ve CCEP bottling sites in GB and French said the company is “proud to say that 97% of everything that CCEP sells in the UK is manufactured in the UK”. Another of East Kilbride’s many claims to

fame is that it was the rst site in the UK to produce attached cap bottles that help improve recycling e ciency.

Following the welcome presentation, the group donned their hair nets, coveralls, safety glasses and protective boots to be given a guided tour of the immense and high-tech facility, covering every aspect of how it operates.

It was a rare opportunity for the group of Up & Coming Stars to gain a glimpse into a world that not many people get to see.

“It was really, really fascinating,” says Chelsea Dunlop. “I’ve never been in a factory before, certainly not one like this. I drink CCEP products every day so it was amazing to see how it all happens and how the products I and my customers drink actually get made. It’s kind of mind-blowing, the scale and speed of everything.”

Waseem Sadiq was equally impressed: “I knew that facilities like this are high tech and slick these days but I never appreciated just how impressive it all is. e scale and the capacity of the East Kilbride site is just insane. It was genuinely amazing.”

e site made a strong impact on Sophie Williams too, but it was the human side of the business at the facility that landed most strongly with her. “ e presentation that Allan French gave us was so interesting,” she

comments. “It’s clearly an unbelievably e cient and modern bottling plant but it’s the way that CCEP works with their colleagues that really blew me away. ey have so many diversity and inclusion policies in place and seem to work so hard at looking a er their team. It just looks like a great place to work and it’s really encouraging to learn how hard they are working at recruiting a really diverse team and treating them well. It was a fantastic day and I really enjoyed it.”

e day ended with a lunch back in the board room and a chance to share learnings and experiences. e Above & Beyond experience doesn’t end there, however. CCEP is intending to send some colleagues into at least one of the shortlisted stores to spend a day on a real shop oor and have the chance to experience a day at the sharp end in retail for themselves. at should be equally interesting for the lucky participants who, having spent so much time producing some of Scotland’s favourite so drinks, will get the chance to see how customers interact with the products and the brands where it matters most.

Our thanks go to Amy Burgess and the team at CCEP for organising the visit and giving our Up & Coming Stars a unique insight into what goes on behind the scenes – and we hope the visit helps our Stars continue on their stellar trajectory in retail.

It’s the fastest-growing category in BWS and volume grew by more than 24% in convenience in the last year – so why is no one talking about RTDs?

BY ANTONY BEGLEYReady-To-Drink (RTD) products have a very long and mostly venerable tradition in the local retailing channel.

e history of the category has been marked by peaks and troughs as it shi s in and out of popularity among consumers. Mostly the peaks are accompanied by much fanfare in the trade press and a ra of NPD as producers attempt to grab their share. So, with RTDs up over 24% by volume and 16.5% by value in convenience in the 12 months to the end of February [IRI data), why is no one talking about RTDs right now?

RTDs

RTDS IN SUPERMARKETS

e category is performing astonishingly well and at 24.2% growth by volume, it’s comfortably the fastest-growing sector of the wider BWS category. If you talk to wholesalers, there’s a general acceptance that RTDs are on a roll at the moment but there seems remarkably little interest or excitement elsewhere – even among some retailers.

[Source:IRI]

Which is odd, particularly when you consider that the supermarkets aren’t keeping pace. Volumes have actually been falling and were down 13.2% to the end of February, according to that same IRI data. It seems like an opportunity tailor-made for the local retailing channel.

“It’s a strange situation, that’s for sure,” says Andy Ferguson, the man driving the Four Loko brand in Scotland. “Normally with stats that mindblowing, you’d be expecting to see the trade press running endless articles and retailers beating down a path to your door. To be fair, we are seeing more and more demand for our brand, Four Loko, and we are seeing some amazing growth, but it’s odd that the sector seems to be slow to wake up to the RTD opportunity 2.0.”

e implications for retailers are fairly clear: consider devoting more space to the RTD category in your chiller and take a fresh look at your range to ensure that you are stocking the most popular lines. e RTD market has changed enormously in the last few years so a little time and e ort may be required to ensure you’ve got the right range for your shoppers.

Dragon Soop is the clear leader with sales close to £21m in Scotland and growing at 11%. WKD is also growing at 11% but sits at number three with £10.8m sales. e two growing stars, however, are Four Loko, up 88%, and AU Vodka, up 410%, albeit from a smaller base.

Four Loko’s performance makes it the number-two brand in Scotland with sales of almost £14m a year and a lot of momentum behind it. Additionally, when the Top 10 brands are broken down into individual SKUs, Four Loko White Can 440ml is the fastest-selling SKU in the category in Scotland in the last 12 months, despite having only been on sale for 10 of those months. Four Loko White Can 440ml is also the fastestselling SKU across the rest of GB too.

AU Vodka is the other rising star of the RTD, particularly on a GB basis. It has contributed almost £21m of the £33.2m total RTD category growth in the year to the end of February, although much of that came from down south. Four Loko is the second-biggest contributor to category growth across GB, adding around £7.4m, with most of that coming from Scotland where the brand was rst launched in GB.

“We’re very pleased with the performance of Four Loko in the relatively short time it’s been on the market,” says Ferguson. “ e brand is worth

£15.7m and that represents year-on-year growth of 94%. We have the fastest-selling SKU in Scotland and across GB and we’re already the number ve brand in convenience in GB over the last 52 weeks. Forecourts are a focus for us too where range is all-important and the sector can sometimes be quite slow to react to category developments. And we have big plans, including some great NPD and sponsorship of several large scale music festivals for the third year running.”

As mentioned above, most episodes of spectacular category growth are accompanied by fanfare and a wave of NPD. e rise of RTDs hasn’t quite caught the attention of the trade press, but it has caught the eye of producers keen to grab a slice of the action.

“We’ve calculated that there have been 215 new products launched into the RTD category since January 2023,” says Ferguson. “ at’s astonishing and it includes 47 own-label launches, although it also includes existing products being moved into PMP packs. at has helped add excitement to a hugely exciting category and these new products have added around £58m of new sales to the category across GB, according to IRI data.”

Many of those products have come from big brands like Absolut, Gordon’s, Captain Morgan and Bombay Sapphire. Jack Daniel’s Whisky & Zero Sugar Coca-Cola 330ml has added over £51m since January 2023, while Gordons & Schweppes Pink Gin & Tonic has added almost £3.8m.

But the RTD specialists have also more than played a part, with AU Vodka Pineapple Crush 330ml adding more than £3.5m and Four Loko White Can 440ml adding more than £3m.

“It’s a hugely interesting time for the category,” says Ferguson. “It means that retailers would be well advised to take the time to satisfy themselves that they have dedicated enough chilled space to the category in-store and that they have the fastest-selling lines in their chillers. Brands like Four

Loko, Dragon Soop and AU Vodka are driving the real growth and that’s where retailers whould focus their attention and their shelf space. We’re all aware that chilled space is more expensive than ever so making sure you’re getting maximum sales and pro t out of every facing is key.”

Ferguson says this is a “massive opportunity” for c-stores, because the real growth is coming from the channel. He predicts that more NPD will keep piling on the excitement and help retailers drive sales and pro ts.

Launched just last month, Four Loko Dark Berry Burst 440ml is the brand’s latest new avour and is, according to Ferguson, “already ying”. With an RSP of £3.49, the 8.4% ABV product will help generate fresh excitement and keep building category momentum, believes Ferguson. “ e customer base for RTDs has changed and we know that avours and NPD are key,” he explains. “ e Four Loko range started out with just four lines but the range continues to expand and this helps drive trial and brings new customers into the category for retailers.

“We are very aware that retailers don’t have elastic shelves so we will manage our range as we go to ensure that it delivers maximum impact for retailers.”

Clark McIlroy, Managing Director of Four Loko distributor Red Star Brands, adds: “RTDs are enjoying a major period of reinvigoration and the forecast for RTDs is extremely exciting with particular emphasis on at-home occasions and the linked opportunity to drive sales.

“Four Loko enjoys a well-earned reputation for being the go-to drink for those seeking unconventional fun and full-on avour. Taste is perhaps the top consideration when it comes to RTD preferences so staying ahead of the curve is critical. We’re con dent that Dark Berry Burst, with its fresh

and big

will be the perfect summer

for

Jack Link’s

Meat snacking brand Peperami has launched a new Spanish-inspired range called Peperami Tapas. The new range includes two variants, Chorizo and Salami. Both are available now in packs of six sticks with an RSP of £2 per pack. Peperami said the new range “brings the essence of Spanish charcuterie into the comfort of the home. Every bite is high in protein and bursting with flavour.”

Cadbury has expanded its Duos range by bringing another of its leading countlines – StarBar – into the growing format. Cadbury StarBar Duo offers 2 x 37g bars containing salty peanuts, chewy caramel and Cadbury milk chocolate. It is available now in cases of 32 with an RSP of 95p per pack. The launch is supported by in-store activities and POS. The duos format is currently growing by 36% in the category, with Cadbury Duos outpacing this growth even further at almost 54%.

The new range consists of three sugar-free flavours: Strawberry, Apple & Blackcurrant, and Lemon & Lime. All are available from Booker in 500ml PET recyclable (cap on) bottles. The launch is supported by an ‘always-on’ social and digital media campaign. The flavoured still water category has seen retail sales value grow by 10.7% in the last six months.

Tango Ice Blast has hit stores in a new limitededition, ready-to-drink format.

Exclusive to the convenience channel, Tango Blast is available now in Raspberry and Cherry flavours. It comes in outers of 12 in a 500ml format only, with an RSP of £1.99.

The launch will be supported by social media and PR activities, as well as in-store point of sale.

Free from artificial flavours or colours, Tango Blast is approved as vegan by The Vegetarian Society.

Tango already has a strong record of new product development, particularly with its rotational flavour series, Tango Editions, with both Berry Peachy and Paradise Punch achieving the number one fruit flavoured carbonate NPD in their year of launch. The Britvic brand is confident its latest edition, Tango Mango, will follow in the same footsteps.

Ben Parker, Retail Commercial Director at Britvic, said: “We know this has been an anticipated launch, and we’re pleased to finally announce the exclusive launch to the convenience channel. As well as the delicious flavours, the eye-catching packaging and vibrant liquids will make Tango Blast unmissable on shelves and in chillers. So, we expect the launch to appeal to fans of the brand who have come to expect something bold and different from Tango, while attracting new shoppers too.”

Burts’ new limited-edition handcooked Spicy Barbecue potato chips combine warm, spicy barbecue flavours with honey and are available in 40g and 150g formats. The product is HFSS compliant, gluten free, vegetarian friendly, and free from artificial flavours. The launch follows industry research that found Spicy Barbeque is a popular choice among consumers.

New Gluten Free Soft Pittas have a soft, fluffy texture and can be warmed in a toaster or consumed cold. The product is ideal for filling, dipping or as a snack. As well as being gluten, wheat and milk free, the pittas are high in calcium, a source of fibre and are Coeliac UK certified. They are available in a fourpack with an RSP of £3.

Scandinavian Tobacco Group

This new range is available with a £5.50 RSP in four flavours – Tropical, Blueberry Mint, Cool Ice and Arctic Freeze – and a variety of strengths. The Tropical and Blueberry Mint variants give users a fruity burst of flavour, while Cool Ice and Arctic Freeze offer a minty taste and an icy, cooling sensation. All four variants come in fully recyclable packaging and contain smaller-sized pouches. A range of point of sale material is available.