SPRING BUDGET

‘Inadequate’ budget fails retailers

VAPING BAN

Glasgow City Council wants to outlaw disposables

CRIMINAL BEHAVIOUR

SGF Crime Seminar flags rocketing crime

SPRING BUDGET

‘Inadequate’ budget fails retailers

VAPING BAN

Glasgow City Council wants to outlaw disposables

CRIMINAL BEHAVIOUR

SGF Crime Seminar flags rocketing crime

Which consumer Covid habits have held, and which have been dumped?

NEWS

04 Local Sourcing The fourth phase of SGF’s Go Local Programme gets government approval.

05 Crime Shoplifting from convenience stores hits an all-time high, new ACS figures suggest.

06 Minimum Unit Pricing MUP has averted around 150 deaths every year since implementation.

08 Vaping Glasgow City Council calls for a ban on the sale of disposable vapes.

09 Legislation Proposed alcohol advertising restrictions would cost around £18,000 per store to refit, warns ACS.

10 Newstrade Newsquest hikes six Scottish cover prices while simultaneously cutting retailer terms.

12 Sales Grocery sales continue to grow despite a lack of availability in a few fresh produce categories.

14 News Extra Spring Budget Retail trade associations are disappointed by the Chancellor’s Spring Budget.

22 Product News Sprite gets a major makeover and shoppers can win what they love with Diet Coke.

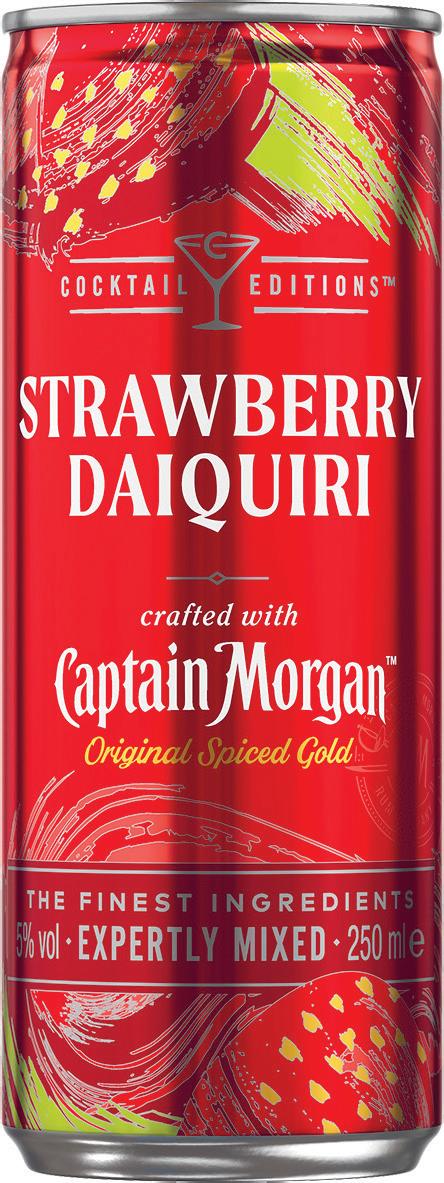

24 Off-Trade News Snoop Dogg adds a Rosé to his Cali Wine portfolio and there’s a new RTD from Captain Morgan.

26 SLR Awards With the 2 June deadline fast approaching, there are only two months left to submit your entries.

28 Checkout Scotland GroceryAid Scotland’s fantastic music festival is back, and it’s time to book your tickets!

29 Advertising Feature Invest NI Scotland is a key target market for Northern Irish food and drink suppliers seeking to expand outside their home market.

30 SGF Retail Crime Seminar Retail crime has long been endemic and has increased in recent years, as attendees at the recent SGF & RAC Crime Seminar discovered.

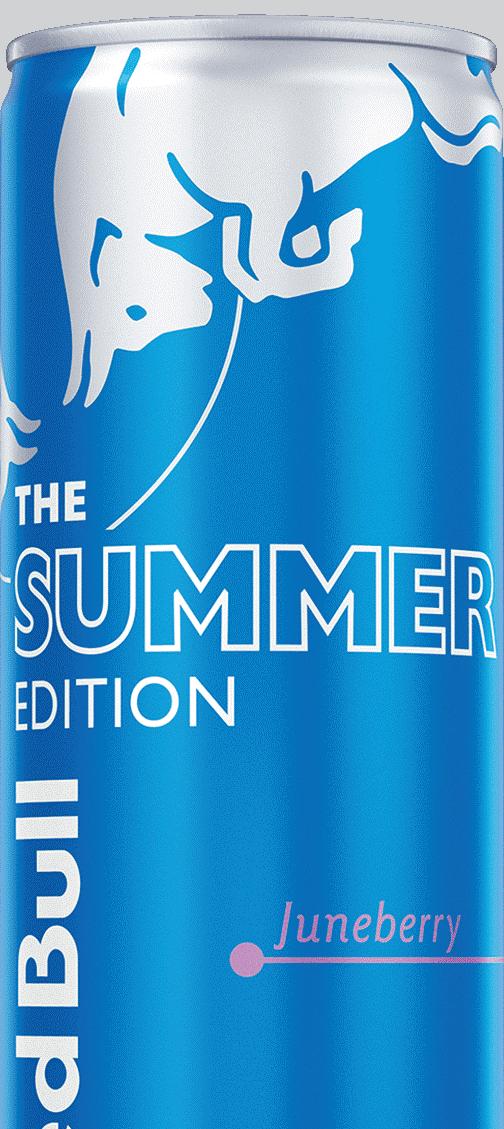

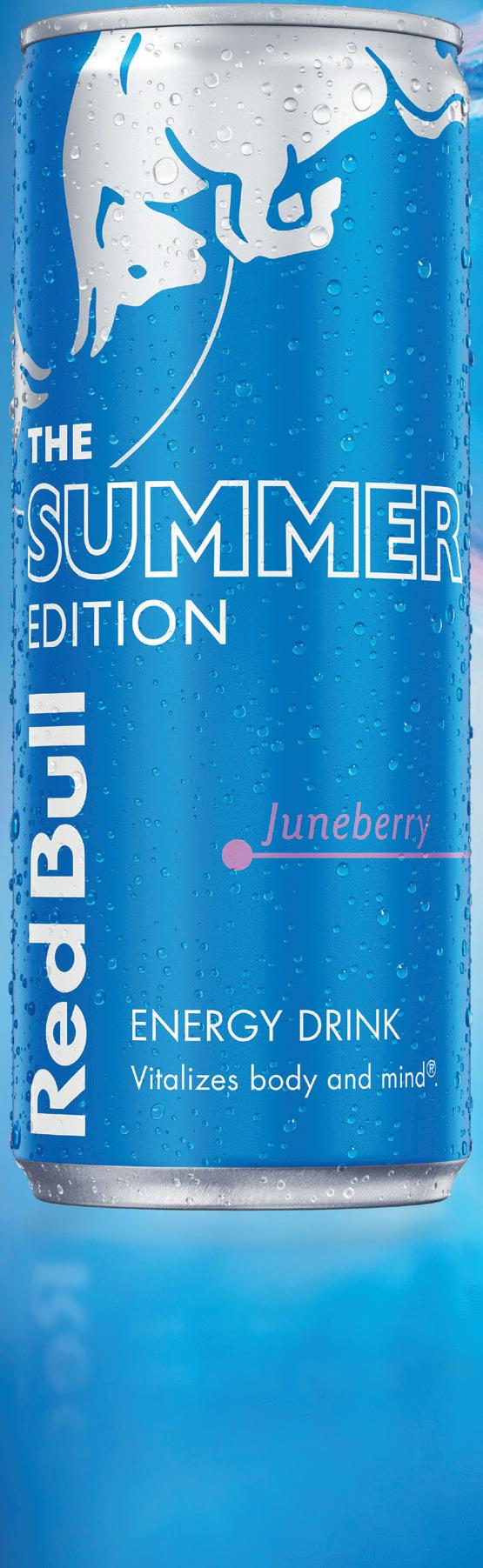

32 Retailer Competition Your chance to win £50-worth of Red Bull’s new Juneberry Summer Edition.

35 Advertising Feature TOMRA It’s Deposit Return Scheme decision time for Scotland’s local retailers.

36 Hotlines The latest new products and media campaigns.

58 Under The Counter The Auld Boy is suitably unimpressed when cans of beer are recalled for having too much alcohol.

38 Ice Cream Ice cream’s lead at the front of the frozen category shows no sign of melting away.

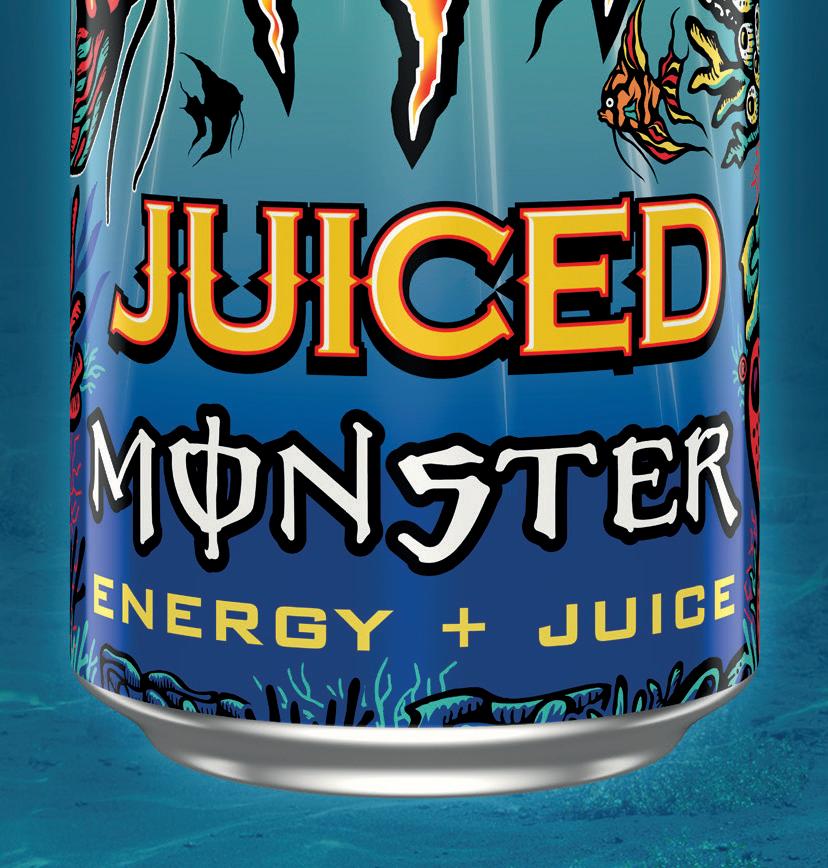

42 Soft Drinks Despite challenges, Soft Drinks remains resilient and is growing faster than other key categories.

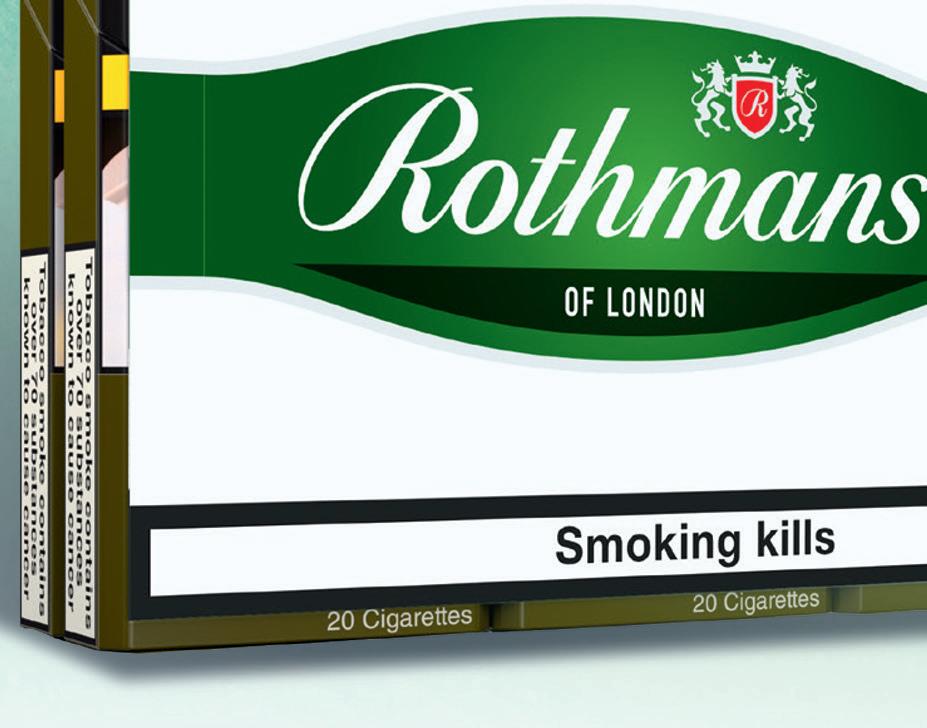

44 Tobacco Demand for low prices and value for money remains sky high in the tobacco category.

54 Forecourts Continuous investment is helping forecourts continue to drive margins in spite of the cost-of-living crisis.

ON THE COVER 18

Circularity Scotland’s official DRS logistics service partner

Biffa is to transform a former parcel depot on the Eurocentral industrial park, near Holytown, into a state-of-the-art recycling centre. The site will form part of a network of facilities across Scotland that will count, sort and bale the billions of plastic, glass and aluminium drinks containers collected through the deposit return scheme each year.

Vaping retailer VPZ plans to expand to 20 more locations across Scotland and England by the end of the year. Falkirk and seven major shopping centre sites are currently under the acquisition process and further growth is planned in the northeast of England and Yorkshire before the end of 2023. New stores have already opened in Hexham, Sheffield, Nottingham, Derby and Newquay since the start of the year.

The SGF’s Mini Summit will take place on 18 May at Macdonald Inchyra Hotel, Falkirk. Circular Economy Minister Lorna Slater will be a keynote speaker on the deposit return scheme. The event will also feature panel discussions on HFSS restrictions, alcohol advertising restrictions, vaping restrictions, and the deposit return scheme. In addition, there will be a trade exhibition and opportunities to network.

Townhead Convenience Store, which appeared as Harrid’s Convenience Store in BBC sitcom Still Game, has been awarded an alcohol licence. The Glasgow-based store is owned by an Iranian husband-and-wife duo who have a background in retail. Previously known as Alfy’s Paper Shope, the store has been trading under its current owners since late last year.

geographically and demographically diverse stores to secure increased display space for Scottish products. Available Scottish supplier databases will also be used to grow the number of suppliers and improve customer choice.

Rural A airs Secretary Mairi Gougeon said: “ e widespread participation from local producers and store owners is a testament to the success of this programme.

“It is encouraging to see an increase in shelf space for Scottish produce and a growth of nearly 40% in the sale of eligible products.

e Scottish Grocers’ Federation’s Go Local Programme has secured approval for the roll-out of the next phase of the project.

e fourth phase of the programme will build upon the aim to support convenience stores the length and breadth of Scotland to provide dedicated, long-term display space for locally-sourced Scottish products.

e target is to increase the turnover of locally and nationally produced Scottish products within the convenience store sector, mitigate lost volumes in other sectors, and aid economic recovery for Scottish manufacturers and producers.

Phase 4 will see a further allocation of £190,000 for the programme and the selection of at least 40

SUPPLIERS

“We remain committed to supporting local convenience stores, as well as helping consumers access more of the fresh, quality produce they demand from our fantastic food and drink producers.”

SGF Chief Executive Pete Cheema added: “By supporting retailers and helping them o er their customers high quality, locally sourced, fresh, and healthier food, convenience stores are a key driver in growing their local economy. Bene ting everyone, from customers to producers.”

Stores participating in Go Local see an average increase in the Local Multiplier of £159,000 per annum on the healthier products. Producers also bene t from a “meet the buyer” opportunity, which will take place at the SGF Annual Conference in October.

Phase 4 of the programme will be open to applications until 31 May 2023.

Mortons Rolls has restarted production after the business was bought out of administration.

The Glasgow-based bakery has been acquired by investors PVL after talks with HMRC, administrators, and the Scottish Government.

PVL representative John McIlvogue told the BBC: “None of us wanted the past couple of weeks to unfold in the way that they have, but it has been entirely outwith our control.

“The important thing now is that Mortons is back in action, we’ve got the workforce back on the production line, and we’re ready to start producing our famous rolls that the good people of Glasgow have been crying out for.”

Fife-based Greens Retail is set to expand nationally and has signed a ve-year deal with Nisa worth up to £200m during the term.

Currently operating 16 stores in Scotland, which have now surpassed £25m of annualised sales, retailer Harris Aslam has committed to open more than 20 new stores across Scotland and expand into England. Stores will operate under the Greens Fascia in partnership with Nisa.

Greens Retail runs stores varying in size from around 2,000sq to 6,000sq and collaborates with partners in a bid to o er the very best in-store customer experience, including in-store butchery and bakery counters, Costa Express, and Skwishee concessions.

e retailer already employs 300 members of sta and its ambitious plans for expansion will take the total headcount to more than 650 employees.

Harris Aslam, Managing Director of Greens Retail,said:

“We’ve been working tirelessly to expand our portfolio and as we continue to grow at a tremendous pace, our overall aim is to innovate and rede ne convenience retailing.

“We really want to continue to push the boundaries of retail innovation to ensure each and every one of our stores is unique to the missions and needs of its shoppers.”

Record levels of shopli ing have been committed against convenience retailers over the past year, according to new gures from the ACS.

e ACS’ Voice of Local Shops Survey of more than 1,200 independent retailers reveals that the ‘the index’ has reached a record level of +26, compared to a previous high of +25 in May 2012.

e data shows 63% of independent retailers reported that the in their businesses had either increased (35%) or stayed the same (28%) over the past year, with just 9% reporting a decrease in levels of shop the .

e survey has been tracking levels of shop the since the start of 2012; the the index had been reasonably steady from 2016 through to early 2021, but has since gradually risen to new record highs.

ACS Chief Executive James Lowman said: “ e is not a victimless crime; it takes an enormous nancial and personal toll on the retailers that are trying to run a business in their communities. e is also the biggest single trigger for abuse of colleagues and violent incidents in stores.

“We need targeted action to stop the repeat o enders that are stealing on a regular basis without any concern about being apprehended by the police.”

Across the UK, London retailers are the worst a ected, with 48% of retailers surveyed saying that the has increased over the past year. is compares to 28% of retailers in the North East who reported an increase in the , the lowest of any UK region.

In response, Paddy Lillis, Usdaw General Secretary, said: “It is disturbing to see evidence from the ACS report and police recorded crime stats showing that shopli ing is on the increase.”

Figures from the ACS 2022 Crime Report show that convenience stores spent more than £246m in the previous year on crime prevention measures like CCTV, security sta , and alarm systems.

The Scottish Government is investing £250,000 to enable Scotland Loves Local gift cards to operate digitally. By going digital, the cards can be used by businesses to reward loyal customers and encourage repeat custom. The system may also be made compatible with transport providers’ ticketing systems, en-abling relatives or businesses to gift train and bus fares into town centres.

The Snappy Group has unveiled Greg Deacon as VP of Groups and Business Development. The role will focus on the expansion of existing retail chain relationships and enhancing the Snappy Shopper marketplace proposition as the only convenience store-specific Q-Commerce platform, as well as developing new channels to increase revenue for the group.

CJ Lang & Son has welcomed Barry’s Stores to Spar Scotland.

Barry’s Stores, which is run by father and son Barry and Steven Oujla, is a group of four stores in the south of Glasgow and Paisley. e independent retailer has been operating since 1981 and employs 30 people.

Colin McLean, Chief Executive for CJ Lang & Son, said: “We are delighted to welcome Barry’s Stores to Spar. ey are rmly part of their local community with over 40 years’ experience in the convenience sector. It’s fantastic to see Steven working alongside his father as the next generation of independent retailing. e longevity of a family business is important.

“We have exciting plans for the stores. Spar Clarkston has already been re tted and their other three stores will be fully re tted in the coming months. Spar Gi nock will be extended into the unit next door to create more space for Fresh and a beer cave. Spar Cathcart will receive a modernised shop front, whilst Spar Paisley will be given a new exterior and re t inside.

“We look forward to supporting the family as they grow and develop their business over the years.”

Spar Scotland’s Abronhill and Stonehouse stores have started a trial with food waste app Gander.

The trial will run for at least 12 weeks in both stores, with the view to cutting food waste and offering customers the opportunity to buy a selection of fresh food at reduced prices.

Sonya Harper, Central Operations Director at Spar Scotland, said: “We are looking forward to seeing how the trial develops, especially as it is the first in Scotland. We hope the introduction of Gander to Scotland and to Spar Scotland stores will help enable us to reduce food waste and change shoppers’ buying habits.”

The Scottish Grocers’ Federation has launched an online resource to help convenience retailers calculate their business rates relief and transitional relief for 2023/24. The online calculators provide an estimate for a business’s Small Business Bonus Scheme and Transitional Relief, using formulae provided by the Scottish Government and based on the figures input by the user.

PayPoint has confirmed that from 1 April it is to put up its service fee charge, but the rise will be capped at 7%. The service provider reviews its service fee charge each year in line with the retail price index (RPI). Initially, the company was planning to increase the charge by 13.4% this year, the RPI at the time of its review.

Bestway has promoted

Jamie Davison to the role of Retail Director. Davison will lead Bestway’s central retail operations team, symbol team, franchise team, as well as have overall accountability for the new business and store development teams. Davison will replace Mike Hollis, who is relocating to Australia, and will formally join Bestway’s executive team on 1 July 2023.

Harbour Stores, an established convenience store in Arbroath has been put on the market. Situated on the High Street, next to the harbour, the store is surrounded by a large mix of residential and commercial properties. The store has been run by Mr Ashraf for the past 38 years; he is selling the store to retire. Harbour Stores has been put on the market on a leasehold basis at £130,000.

Scotmid is inviting charities across Scotland to become its charity partner of the year for 2023-24. The retailer is looking for an organisation that shares its values and passion for supporting local communities. The partners will encourage participation and fundraising from employees, members, and customers. Applications close at 5pm on 14 April 2023.

A former pub in Airdrie could soon be converted into a convenience store if councillors approve the building’s change of use. Applicant Anjum Faqir is seeking permission from North Lanarkshire Council to convert the Drumgelloch Bar in Forrest Street. The proposals include making a number of alterations to the building, allowing for the creation of aisles, and the installation of an ATM.

Minimum Unit Pricing has resulted in a reduction in alcohol-related deaths (-13.4%) and hospital admissions (-4.1%), new research reveals.

e research by Public Health Scotland and the University of Glasgow, which evaluated the impact of MUP on alcohol health harms over the rst twoand-half years of the policy, estimates that around 150 deaths and 400 hospital admissions were averted each year due to MUP.

Dr Grant Wyper, Public Health Intelligence Adviser at PHS, said: “ e greatest reductions were seen for chronic alcohol health harms, in particular alcoholic liver disease, which were slightly o set with less certain evidence of increases in acute alcohol health harms.

e ndings highlight that the largest reductions were found for males and for those living in the 40% most deprived areas – groups which are known to experience disproportionally high levels of alcohol health harms in Scotland.

“We know that those living in the most socioeconomically deprived areas in Scotland

experience alcohol-speci c death rates more than ve times higher compared to those living in the least deprived areas. e results published today are therefore very encouraging in addressing this inequality, and the overall scale of preventable harm which a ects far too many people.”

A report bringing together all MUP evaluation ndings will be published in June 2023.

to lay cables as part of its work to install a full- bre network across the city when its workmen dug a little too deep and dislodged stonework on the underside of the bridge.

In addition, food store Margiotta said business was down from lack of passing trade, and several shops said bus diversions had also led to fewer customers.

Edinburgh retailers are being a ected by the closure of Shandon Bridge, which has been closed since January.

Telecoms company CityFibre was reportedly digging a trench on Shandon Bridge at Ashley Terrace

BAKERY

e company is currently in talks about repairs with Network Rail, who own the bridge, but it is unclear when the necessary work will be carried out.

Keystore convenience store told Edinburgh Evening News it had seen a 60% drop in trade and had some deliveries cancelled because of diversions.

Paul Wake eld, CityFibre’s area manager for Edinburgh, said the company is “working closely with the council and Network Rail to nd a solution to reopen the bridge as soon as possible”.

A Network Rail spokesperson said the bridge can “only be reopened to tra c a er a safe and appropriate repair has been proposed and completed”.

Edinburgh-based convenience store chain Margiotta Food and Wine has formed a partnership with Mimi’s Bakehouse.

The partnership means Mimi’s Bakehouse’s cakes, brownies, tray-bakes and biscuitswill now be available to buy at the newly refurbished Margiotta Forrest Road store.

Franco Margiotta, Founder of Margiotta Food and Wine, told Edinburgh News: “Mimi’s Bakehouse is one of Edinburgh’s most beloved bakeries and we are proud to offer their products to our customers.”

Margiotta, which celebrates its 60th anniversary this year, was established after the family moved to Edinburgh from Italy in 1957. It has a growing portfolio of stores, which include Comiston Road, Dundas Street, and the newly refurbished Forrest Road.

MADL clothing banks raise over £35,000

Nisa retailers have raised more than £35,000 for local causes through Making a Difference

Locally clothing banks. More than 50 clothing banks are located outside stores across the UK, enabling Nisa customers to accumulate additional money into their MADL fund, providing further support to local communities and helping to reduce the environmental impact of unwanted clothing.

St. Michael Street News & Post Office in Dumfries has been put on the market. The store reported an annual turnover of £257,649 and pre-tax earnings of £62,000 for the year ending 31 December 2021. It is currently open Monday to Friday 5am–3pm, Saturday 5am–12.30pm and Sunday 5am–11am. A threebedroom flat is also available. The freehold store has an asking price of £190,000 or £320,000 to include the residential flat.

Scottish Wholesale Association has launched its new Wholesale Local Food Champion training pro-gramme. The programme encourages Scotland’s wholesalers to appoint an individual to take responsibility for shaping the local sourcing strategy within their business. The training programme is fully funded and supported by the Scottish Government.

Booker Group has launched its first Colleague Network to champion gender equality and to help women be at their best. The initial aims of Women in Booker are to raise awareness of gender imbalance, to create network opportunities and to support, inspire and motivate female careers across the business. The network is sponsored by members of the Booker Executive.

Glasgow City Council is calling for a ban on the sale of single-use vapes amid growing health and environmental concerns.

e council’s Environment and Liveable Neighbourhoods Committee is writing to the Scottish government to back calls for the introduction of new legislation banning their sale due to concerns about the future health of the city’s young people and the rising environmental impact of littering.

Committee members voiced fears that the brightly coloured and sweetly avoured single-use vapes

are designed to appeal to underage users who may be damaging their future health through regular and prolonged use.

In addition, in just three months, trading standards o cers seized more than 13,000 illicit vapes in spot checks on businesses selling directly to the public and other retailers.

e committee agreed that Chair, Councillor Elaine McSporran, would raise this with the Scottish government. She said: “We are seeing more and more disposable vapes littering our streets and green spaces, because people are

Spar Scotland is working with Police Scotland and Lochside Academy, the largest secondary school in Aberdeen, to discuss positive community engagement, CSR, and career opportunities.

e rst roundtable sessions took place at Lochside Academy on 20 March when Spar Scotland Area Manager Garry Brailsford and Spar Scotland Marketing Manager Paula Middleton spoke to about 100 students aged 13- and 14-yearsold about community engagement, anti-social behaviour, and career opportunities with Spar and CJ Lang & Son.

e retailer has been invited back in April to do another roundtable session with older students about career opportunities with Spar and what an employer expects of an employee in the workplace.

Paula Middleton said: “We were keen to engage with the students at the school and have a proactive roundtable discussion about career opportunities and how Spar can help them in the future in terms of community support and involvement.

“We are excited to be invited to come back again next month and discuss our partnership with the GTG Apprentice Scheme and other careers we will have available in customer service, retail, warehouse and logistics.”

just dropping them when they are empty. ey are made of plastic which, as we know, takes decades to degrade and can end up in our rivers and oceans where it is a threat to wildlife and can get into the food chain. ey are also powered by lithium batteries which contain corrosive and ammable chemicals.”

McSporran added: “ eir apparent marketing towards younger people with sweet avours and brightly coloured packaging is another concern as more and more young people seem to be using them.

“I wholeheartedly support the introduction of a ban on their sale and urge the Scottish Government to act now to avert a dual disaster in the future.”

e Scottish Government is currently conducting a review of single-use vapes, which includes consideration of a ban. e review will be led by Zero Waste Scotland. Dundee City Council has also voiced support for banning the sale of single-use vapes.

A USave store is set to open in the former ex-servicemen’s club building in Rosyth under plans submitted to Fife Council.

Planning permission was granted in March 2021 to change the use of the building at 153A Admiralty Road into flats, a shop, and an office. One of the conditions was that the hours of operation of the retail unit will be restricted to between 7am and 10pm.

Now a new planning application has been lodged by Mohammad Saleem asking for permission for three illuminated signs and three poster boxes to be put up at the site at the roundabout between Admiralty Road and Queensferry Road.

ACS has highlighted the signi cant impact that proposed measures to restrict the advertising and promotion of alcohol in Scotland would have on local shops.

e Scottish government launched a consultation on the introduction of a wide range of restrictions that seek to restrict alcohol advertising and marketing as part of its wider strategy to reduce alcohol-related harm. e key measures which would have a direct impact on local shops include:

Q Prohibiting window displays from being included within the permitted alcohol display area.

Q Limiting alcohol from being displayed in aisle-end displays.

Q Restricting the use of mixed alcohol and non-alcohol aisles.

Q Limiting the display of alcohol similar to the restrictions applied to retailers for the display of tobacco products.

Q Positioning alcohol in a separate area of the

shop behind barriers or in enclosed adjacent storage units.

e ACS submission highlights a number of concerns about the operational burden and nancial impact that the proposed restrictions would have on local shops. ACS has estimated that it would cost around £18,000 per site to re t stores to meet the proposed restrictions and would amount to a total cost of £90m for the Scottish convenience sector.

ACS Chief Executive James Lowman said: “ e Scottish government’s approach to this consultation is tin-eared to mounting pressures facing retailers. We are strongly urging the Scottish government not to proceed with these proposals.”

ACS has also signed an open letter to the Scottish government, alongside a number of other trade bodies, outlining the negative impact the proposals would have on businesses and calling for greater support for the retail industry.

The Scottish government must “ditch” plans to restrict alcohol marketing and instead bring forward a national strategy to support the sector, the GMB union warns.

The call from the GMB union, which represents thousands of workers in brewing, whisky and spirits across Scotland, comes as the government’s Alcohol Advertising and Promotion consultation closes.

GMB Scotland Organiser, David Hume, said: “While the consultation is wellintentioned, an alcohol advertising ban will inevitably be detrimental to jobs across the sector and its supply chains.

“Let’s be clear, the sector is a fundamental pillar of our economy and the jewel in the crown of our highly valuable food and drink sector – we cannot do without it.

“That’s why GMB is urging ministers to scrap their proposals and work with employers and unions to bring forward a national strategy to support the sector rather than restrict it.”

A convenience store in Muirkirk, East Ayrshire, has been put up for sale. The 750sq ft store, which is being marketed by Prime Property Auctions (Scotland), has a rateable value of £2,450 that qualifies for 100% business rates relief. The Pagan Walk unit features a kitted-out store room downstairs and a toilet to the rear. Local amenities include a primary school, football club, golf course and bowling green.

CJ Lang & Son driver Willie Brown has scooped a prize at the inaugural Spar International Driver of the Year competition, held to highlight the role lorry drivers play in Spar’s operation and promote driving as a career. The competition was hosted by Scania at its facility in Södertälje near Stockholm, Sweden, over two days. Drivers competed in three disciplines that tested their driving style, manoeuvrability, and safety awareness.

Nisa retailers have helped raised more than £1m for The One Foundation since becoming part of the Co-op Group in 2018 and stocking Co-op own-brand water. As part of this initiative, 3p of every litre of Co-op own brand water sold goes to The One Foundation – a UK charity funding grants into systemschange implementation into humanitarian water, sanitation, and hygiene programmes.

Scottish Grocers’ Federation held its annual Crime & Wellbeing Seminar at Hampden Park in partnership with Retailers Against Crime. The seminar focused on issues such as the wider economic effects of retail crime and the lived experience of retailers. Speakers including Russell Findlay MSP and Police Scotland’s Superintendent Hilary Sloan.

Regional publisher Newsquest has increased the cover prices of six of its Scottish newspapers, while also cutting terms for retailers, in a bid to save the titles from the “real possibility” of closure.

e changes, which will take e ect this week, will lead to a 20p increase at the Ayr Advertiser, which will go from £1.15 to £1.35, while the price will change from £1.10 to £1.30 at both the Dumbarton Reporter and Irvine Times.

Both the Border Telegraph and Clydebank Post will see 10p increases from £1 to £1.10, with the cost of the Barrhead News changing from £1.10 to £1.20.

e move has been made as part of a ra of cover price increases at Newsquest’s other Scottish titles, although margins will remain the same for newsagents selling them.

In Glasgow, the Monday to

Friday editions of e Herald have gone up from £2 to £2.20, with its Saturday edition’s price moving from £2.40 to £2.60.

e Glasgow Times has had a 5p increase to 90p, while pro-Scottish independence daily e National is up 10p to £1.30.

e cover price of both e Herald on Sunday and e Sunday National will increase from £2.40 to £2.50 at the end of this week.

e price of the Greenock Telegraph, Newsquest’s other Scottish daily, has gone up from 75p to 80p.

e following increases will also take e ect from this week at Newsquest’s other Scottish weeklies, where retailer terms will remain the same: Largs & Millport News from £1.10 to

EMPLOYMENT Levels of abuse are higher than before pandemic

Almost one-third (30%) of shopworkers are considering changing their job and 41% feel anxious about work because of high levels of verbal abuse, threats and assaults, new research reveals.

Retail trade union Usdaw’s annual survey shows the number of incidents has come down since the exceptionally high levels during the pandemic but remains higher than pre-Covid levels in 2019. e gures show 69.2% have experienced verbal abuse, 41.6% were threatened by a customer, and 5% were assaulted.

Paddy Lillis, Usdaw General Secretary, said: “ e potential cost for retail employers to recruit, train and induct new sta adds to the astronomical price they already pay for the from shops and security measures. at will have an inevitable impact on prices in the middle of a cost-of-living crisis and should be a concern to us all.

“Violence and abuse is not an acceptable part of the job and too many shopworkers su er all too o en. We still need better co-ordination to ensure that retail employers, police and the courts work together to make stores safer and give sta the support and con dence they need. Most of all, we ask the public to support our campaign by respecting shopworkers.”

£1.15, Alloa Advertiser from £1.10 to £1.20, Ardrossan Herald from £1.10 to £1.20, Central Fife Times from £1 to £1.10, Cumnock Chronicle from £1.10 to £1.20, Dunfermline Press from £1.25 to £1.35, East Lothian Courier from £1.20 to £1.30, Helensburgh Advertiser from £1.15 to £1.25, Musselburgh Courier from £1.20 to £1.30, and Peeblesshire News from £1 to £1.10.

Spar Scotland has donated £1,000 between four foodbanks a er a competition held on social media in January.

e symbol group’s followers on Facebook and Instagram were asked to nominate a local foodbank to receive £250 in Spar Scotland vouchers.

Paula Middleton, Spar Scotland Marketing Manager, said: “ e campaign was aimed at communities and as we are always looking at ways to give back, we thought giving away £1,000 in Spar Scotland vouchers to local foodbanks would help.”

Four winners were picked at random to be given £250 each: ornton Community Food Support, EBI Unites, Wee Mobile Foodbank Lanarkshire, and Dalbeattie Foodbank.

Nearly one-third of shopworkers thinking of quitting because of violence

Landowner Ian Maclellan and TG Convenience Stores are appealing the rejection of their plans for a McDonald’s and petrol station in Kelty. The companies want to develop a site at junction 4 of the M90 and said the roadside services would create 72 full-time equivalent jobs and inject £1.5m into the local economy. The plans were branded as “unacceptable” by Fife councillors.

Public support for Scotland’s deposit return scheme, which is due to start on 16 August, has been revealed by new research. The poll, conducted by The Diffley Partnership on behalf of TOMRA, reveals that 70% of respondents support scheme and more than 80% say they will use it. The poll reveals that the biggest driver encouraging people to use the scheme is to prevent damage to the natural environment and animals (53%).

Nisa’s Making a Difference

Locally charity has launched a fifth round of the Heart of the Community Awards to help communities celebrate the coronation on 6 May. There will be two funding opportunities to apply for as part of the awards, with 100 donations of up to £500 available for each. Nisa retailers can nominate a local group, charity or good cause to receive up to £500 in funding.

Clydebank-based Singh’s Stores is for sale as the owner looks to retire. The store, at 12-14 Auckland Place, is well located in a housing scheme and turns over £3,500 a week. The outlet, which has an alcohol licence, is open Monday to Saturday 8am–1pm and 2.30pm–6.30pm, and is closed on Sunday. It is offered as a leasehold sale at £30,000 with rental being offered at £15,000 per annum.

Convenience store value sales grew by 8% in the past four weeks ending 25 February, with volume sales up1.4%, suggesting that some shoppers prefer to visit convenience stores to limit their overall grocery spend.

e data, released by consumer intelligence company NIQ –previously known as NielsenIQ – shows grocery sales soared by 11.1%, as a result of accelerating food in ation.

e gures show till sales growth comes despite a lack of availability in a few fresh produce categories which impacted sales in the past two weeks.

e consumer intelligence company states that volumes at the multiples fell by 4.1% in the past four weeks, indicating that although in ation is still rising, shoppers’ varying coping strategies

and the additional private-label price cuts by retailers are helping to alleviate the impact of in ation on shopping baskets. While volumes are down compared to the same period in 2022, they are broadly unchanged over the past 12 weeks (-4.0%); higher in ation is boosting value sales but declining volumes are no worse.

However, there was incremental spend for Valentine’s Day and over the February half-term which helped li value growths at the multiples to 8.2%. Compared to last year, there was an increase in sales for boxes of chocolates (+23%), fresh roses (+20%), mixed oral bunches (+14%), and sparkling wine (+4%).

e NIQ data reveals in-store visits continue to rise (8.7%) and sales at stores are up 13.1%, while online sales fell by 2.5%.

Misconceptions about tins could be driving millions of shoppers to buy shorter shelf-life foods they end up wasting, according to research by Zero Waste Scotland.

e data shows 21% of the population consider tinned food “a last resort” and 33% still associate tins as the preserve of elderly people and students.

Iain Gulland, Chief Executive of Zero Waste Scotland, said: “It’s easy to overlook their ability to help us tackle the amount of food we waste. ey’re convenient and can be easily recycled at home. at makes them a win-win for both cutting food waste and avoiding sending unnecessary packaging to land ll.”

Independent convenience stores are aligned to the multiples on base pricing, but deep discount loyalty card promotions are making it increasingly difficult for the indies to compete on price, new research reveals.

The data from TWC, in collaboration with The Federation of Wholesale Distributors, shows prices have increased by +11% in independents, +13% in Tesco Express, and +17% in Tesco supermarkets in January 2023 compared to November 2021. The price differential between the independents and Tesco Express has fallen because prices have risen more at the multiples, and at the time of the audit in January 2023, there was price parity between the two.

Tesco is using its ‘Clubcard Prices’ within its convenience format to offer discounts of up to 35%, making it hard for independent convenience stores to compete with the multiples on price.

However, the research shows independent retailers are fighting for their share of local trade and pulling a number of levers to do this, with 93% of retailers trying to offer superior customer service and 89% were supporting local charities and initiatives. Many are also trying to compete on price, whether that’s by offering a wider range of cheaper products (78%), more own label (65%) or price matching (39%).

With 11% of shop owners working more than 70 hours per week and more than a quarter not taking any holiday time at all, it is no surprise that finding time to plan for the future and to invest in stores can be very difficult.

That is why SGF is very proud to announce the launch of Phase 4 of our Go Local Programme, which is delivered in partnership with the Scottish Government.

There is no question that our sector is facing an extremely challenging period and, in some cases, shops owners are doing their very best just to keep the doors open and lights on. But over the past few years we have proven that convenience stores are essential local assets, and key drivers of both economic growth and wellbeing for many communities.

Go Local grant funding is designed to help support retailers offer their customers high quality, locally sourced, fresh, and healthier food. This increases footfall and customer spend, while at the same time benefiting everyone in the community, from customers through to local suppliers and producers.

Until the end of May, convenience stores will have the opportunity to apply to the latest phase of programme, by completing the form on the SGF website (sgfscot.co.uk/ go-local). Go Local has been a tremendous and welcome success story over the past three years and highlights just how innovative and ambitious our sector can be with the right support.

The retail trade bodies are disappointed that their calls for assistance with soaring energy bills have not been answered by Chancellor Jeremy Hunt in the Spring Budget.

them to provide the necessary help for struggling small businesses.

“It is, therefore, extremely disappointing that our calls for assistance have not been answered.”

Other announcements included in the Budget include:

Q Fuel duty will be frozen for 12 months.

Q Alcohol and tobacco duties will rise by the rate of RPI as planned, with the exception of draught relief in pubs.

Chancellor Jeremy Hunt has failed to put in place meaningful support for the almost 7,000 local shops facing closure this year as a result of sky-high energy costs, according to the sector’s trade associations.

From April, the government will press on with “untargeted, inadequate” support for 12 months through the Energy Bills Discount Scheme, with a discount of 1.9p per kWh for electricity. is will reduce an average eligible convenience store’s energy bill by around £1,520 for the year. Convenience stores that signed xed contracts during the height of wholesale prices (Q3/Q4 2022) are those most likely to be at risk of closure, due to the tripling or in some cases quadrupling of their energy bills for the duration of the xed term contract. ere are up to 6,900 stores facing rates of 80-90p per kWh and above this year.

ACS Chief Executive James Lowman said: “A Budget focused on growth and investment will come as no comfort to those who will have their entire pro t margins wiped out this year by excessive xed energy contracts. Convenience stores have been le out in the cold by the Chancellor, being le to face crippling energy bills by themselves and putting thousands at risk.

“Di cult decisions will have to be made in the coming months by independent retailers about the future of their businesses, which will have a negative impact on investment and reduce the number of available jobs in communities, all while bolstering the pro ts of energy companies.”

e NFRN’s National President Jason Birks added: “I and other trade associations wrote to the Chancellor and the Business Secretary just last month imploring

Q Full capital expensing will be introduced for the next three years, with every pound a company invests in IT equipment, plant and machinery being eligible to be deducted from taxable pro ts.

Q e government will o er ‘Returnerships’ targeted at the over 50s who want to return to work.

Q Childcare reforms to make it easier for parents to return to the workplace.

Birks said the tax rises on alcohol and tobacco will also lead to an increase in illicit trading, which again hurts honest shopkeepers and fuels organised crime.

He added: “ e chancellor has shown a complete disregard for shops that are the lifeblood of their local communities. I make no bones about it – we will see many forced to close their doors for good as businesses become unviable in the current economic climate.”

Gordon Balmer, Executive Director of the Petrol Retailers Association, said: “Petrol and diesel prices are still extremely volatile due to the ongoing war in Ukraine. Many motorists will breathe a sigh of relief at the Chancellor’s decision to extend the fuel duty freeze and maintain the 5ppl cut.”

Helen Dickinson, Chief Executive of the British Retail Consortium, added: “In the face of volatile demand caused by high in ation and low consumer con dence, measures to support households with the cost of living, such as the ongoing energy bill support and changes to childcare costs, are welcomed.

“However, many businesses are weighed down by a myriad of higher costs right through the supply chain. Government must do more to limit one of the biggest drags to retail investment, which is oncoming regulatory burdens heading down the track, or risk a crash in business investment and further in ationary pressures.”

BUDGET ACS says Budget focused on growth and investment will come as no comfort to retailers on fixed energy contracts.

With marvellous benefit of hindsight, it was always likely to be a little naïve and optimistic to expect shoppers to retain the newfound passion for shopping local that they discovered in the Covid years. The cold, hard realities of modern life were always likely to kick back in at some point and, if a new Barclaycard report is to be believed, that point has arrived.

Shoppers appear to have forgiven the supermarkets and major suppliers for their failings and dirty tricks during Covid and are returning to their pre-Covid ways, largely abandoning the local stores that went the extra mile to keep them fed and watered during the toughest of times.

The Barclaycard report highlights how, within the first few months of the first lockdown being implemented, sales in local independent businesses shot up 28.6%. The supermarkets were facing massive availability issues, certain suppliers who shall remain nameless abandoned independent stores to funnel their output to the major multiples and the world was in meltdown – yet local retailers found a way, as they always do. And to my mind, local retailers shone almost as brightly as those stars in the NHS.

Fast forward to today however and 68% of shoppers are prioritising lower prices over shopping locally, says the report. Almost a third have shifted back to supermarkets because ‘prices tend to be lower’ and 23% have shifted to the big box retailers because they ‘tend to have more options’.

You don’t have to be particularly thin skinned to take mild offence at these shifts. Who was there for you when you needed them? Who found you your daily staples when Asda couldn’t? But this short memory syndrome is easy enough to understand all the same, particularly as it’s being fuelled by a costof-living squeeze that is accelerating this shift and taking us squarely back to a place where price trumps all else.

It’s not all bad news, however. A fairly chunky 23% of shoppers still try to shop locally rather than in supermarkets or online, according to the Barclaycard insights.

As for the future? Even the late Mystic Meg would have had a tough job figuring out what the next few weeks holds in store, never mind the next six or 12 months. I have a hunch, however, that local retailers will find a way. They have a knack for it, you see.

EDITORIAL

Publishing Director & Editor

Antony Begley abegley@55north.com

Deputy Editor Liz Wells lwells@55north.com

Features Editor Gaelle Walker gwalker@55north.com

Features Writer Elena Dimama edimama@55north.com

Web Editor Findlay Stein fstein@55north.com

ADVERTISING

Sales & Marketing Director Helen Lyons 07575 959 915 | hlyons@55north.com

Advertising Manager Garry Cole 07846 872 738 | gcole@55north.com

DESIGN

Design & Digital Manager Richard Chaudhry rchaudhry@55north.com

EVENTS & OPERATIONS

Events & Circulation Manager Cara Begley cbegley@55north.com

Scottish Local Retailer is distributed free to qualifying readers. For a registration card, call 0141 222 5381. Other readers can obtain copies by annual subscription at £50 (UK), £62 (Europe airmail), £99 (Worldwide airmail).

55 North Ltd, Waterloo Chambers, 19 Waterloo Street, Glasgow, G2 6AY Tel: 0141 22 22 100 Fax: 0141 22 22 177

Website: www.55north.com Twitter: www.twitter.com/slrmag

DISCLAIMER

The publisher cannot accept responsibility for any unsolicited material lost or damaged in the post. All text and layout is the copyright of 55 North Ltd.

Nothing in this magazine may be reproduced in whole or part without the written permission of the publisher. All copyrights are recognised and used specifically for the purpose of criticism and review. Although the magazine has endevoured to ensure all information is correct at time of print, prices and availability may change.

This magazine is fully independent and not affiliated in any way with the companies mentioned herein.

Scottish Local Retailer is produced monthly by 55 North Ltd.

There is absolutely no doubt that the Covid-19 pandemic and its accompanying lockdowns had a dramatic e ect on the way that Scottish consumers live and shop. e world was turned upside down and everything that we would once have described as normal went straight out the window.

e expectation that a ‘new normal’ would somehow come along and establish itself was, with hindsight, a little optimistic and it will probably be years before Covid truly retreats into nothing more than memory.

For the time being, the hangover of the pandemic remains a very real and very important factor in the lives of Scotland’s local retailers. So what exactly has the pandemic done to the world and how can retailers best respond?

at’s a question tackled in a fascinating new consumer trend study by Barclaycard and –spoiler alert – it doesn’t make for comfortable reading.

e analysis from Barclays combines hundreds of millions of customer transactions with consumer research to provide an in-depth view of UK spending.

e insight covers a range of lockdown-related topics like online grocery ordering, food-to-go, shopping locally, pricing and home delivery. It aims to establish which lockdown legacies look likely to endure, and which are already being dumped.

e report identi ed three key Lockdown Legacies and three key Lockdown Leave Behinds – and it’s the Leave Behinds that make for the most interesting, if unwelcome, reading for local retailers.

Lockdown, as we all recall, saw a shi to supporting local businesses and a growing desire to back local and regional economies with

It’s clear the pandemic radically changed the way consumers live and shop, and a new Barclaycard study has taken a closer look at which lockdown habits have turned into long-term legacies, and which have already been abandoned.

independent businesses like c-stores, butchers and bakers seeing a huge 28.6% increase in spend in 2020 compared to the year before.

e new report, however, suggests that shoppers are rapidly returning to their old ways, no doubt accelerated by the cost-of-living crisis. ese days, almost seven in 10 (68%) shoppers say they are looking for ways to reduce the cost of their weekly shop and are increasingly prioritising lower prices over their desire to shop locally.

ree in 10 (30%) of these shoppers are buying from larger supermarkets because ‘prices tend to be lower’ than in smaller, independent shops, and nearly a quarter (23%) have shi ed their spending because larger stores ‘tend to have more options’ when it comes to budget and value ranges.

It’s not all bad news though: millions of British consumers have remained loyal to local businesses. A quarter (25%) say lockdowns made them realise how much they value their local high street, so still try to support it where possible and 23% now try to spend locally rather than shopping online.

When it comes to takeaways and food-to-go, over half (52%) of consumers who ordered takeaways during the lockdowns say they now spend less on takeout food than they did during that period, with 25% reporting they now spend signi cantly less.

Meanwhile, the proportion of grocery spending online compared to in-store has risen compared to pre-lockdown levels. Before the UK’s rst lockdown in March 2020, only 10% of grocery shopping was done online – this rose to 16% during the lockdowns and has now settled at 13.4% [February 2023].

is indicates that, of the millions of shoppers who switched to buying groceries online during the lockdowns, many more have made the change permanently.

One of the biggest growth industries under lockdown was home delivery and one of the biggest concerns at the time was whether or not this trend would be sustained post-lockdown. If the report is correct, the answer is a clear ‘no’.

e number of home deliveries has fallen by an estimated 22% compared to during the pandemic. Shoppers report that they received an average of 5.0 deliveries per month during this period, compared to only 3.9 per month now.

In addition, 22% of shoppers say they currently receive no online deliveries at all, compared to only 16% during the pandemic.

Another ecommerce trend that has fallen in popularity since lockdown restrictions li ed is

The majority who started a new venture (86%) are still running their business, with over a third (34%) saying it has become their main source of finance.

Almost half (46%) of those who signed-up to pre-prepared meal-kits and 35% who started using make-your-own meal-kit subscriptions now spend more on these services each month.

Gardening, exercising and baking are reported as the most popular pursuits Brits have continued to enjoy since life returned to normal.

Scotland’s best kept retail secret, working with independent retailers for over 40 years providing access to one of the leading convenience retail groups while allowing you to run your store, your way with great ranges and great support delivered direct to your store.

Delivered direct to store, with manageable order quantities.

14,000 SKU count across all categories including Food to Go

Access to the excellent and extensive Co-op Own Label Ranges

Three weekly promotion cycle available

Year round seasonal sales opportunities

Fascia and branding opportunities through the well established brand

Rebate scheme for qualifying members, spend level applies

Extensive supplementary direct to store ranges and services

Simple Invoicing*, one consolidated weekly statement and one direct debit

*Small weekly Admin Fee applies

If you want to remain independent and have the support of PGMA behind you, drop us an email at pgma@pgma.co.uk or call Martin Devlin, Commercial Manager on 0131 343 7607.

Click & Collect. Of the 53% of consumers who have used Click & Collect, one in three (31%) now use it less regularly than they did during the lockdowns, compared to just one in ve (19%) who have increased the number of orders they choose to pick up in-store.

So much for the Lockdown Leave Behinds. But what about the trends that have stuck? Disappointingly, the three key Lockdown Legacies identi ed by Barclaycard don’t appear to highlight obvious, direct opportunities for local retailers.

e rst is badged as ‘Covid careers’ and centres around a big shi towards new business start-ups and side hustles, especially among furloughed employees who found themselves with extra time on their hands.

Barclays’ data shows that almost one-inthree consumers (28%) has started a new small business or found a way to supplement their income since the rst national lockdown three years ago.

e majority who started a new venture (86%) are still running their small businesses or sidehustle, with over a third (34%) saying it has become their main source of income.

e second major trend is a shi to ‘In-trend insperiences’ or, to put it plainly, shoppers making more of their time at home: meal-box subscriptions and digital entertainment being the two most obvious examples.

ere may be an opportunity here for local retailers to re-imagine the traditional big night in occasion, more in in line with the latest trends as highlighted by the survey. Why not try creating the next generation of Meal Deals with new versions of the meal-box theme? A bag (or box) of ingredients, complete with a bottle of wine, a 4-pack of beer, some so drinks, confectionery and snacks for a set price?

Digital entertainment subscriptions rocketed under lockdown, up 40.5% in just the rst few months of restrictions and even a er the easing of restrictions in March 2021, digital content and subscription growth has averaged 41% throughout the post-lockdown period versus February 2020. In other words, the big night in is a bigger opportunity than ever. Are you making the most of that opportunity and tailoring your o er for the masses sitting at home watching Net ix or Sky Sports with friends and family?

e nal Lockdown Legacy contained in the report is ‘Pandemic pastimes’, with more than six in 10 (62%) shoppers seizing the opportunity to learn a new hobby or skill – and millions kept up their pandemic pastimes a er lockdown had gone. Gardening (20%), exercising (19%) and baking (16%) are reported as the most popular pursuits shoppers have continued to enjoy since

Now that almost seven in 10 (68%) shoppers say they are looking for ways to reduce the cost of their weekly shop, Brits are increasingly prioritising lower prices over their desire to shop locally. Three in 10 (30%) of these shoppers say they are buying from larger supermarkets because prices tend to be lower than in smaller, independent shops.

Over half (52%) of consumersa who ordered takeaways during the lockdowns now spend less on takeout food than they did during that period.

The number of home deliveries has fallen by an estimated 22% compared to during the lockdowns.

life returned to normal – and all three o er opportunities to switched-on retailers.

Marc Pettican, Head of Barclaycard Payments, commented: “From ‘insperiences’ to online tness, the pandemic shaped and accelerated several notable shi s in consumer behaviour.

“However, the cost-of-living crunch is slowly unpicking some of these trends as consumers have had to become more selective about how and where they shop. For example, the boom in takeaways has tapered o , as has spending at local independent stores, as consumers continue to look for ways to cut costs to help make ends meet.”

ere was always going to be an extended period of ux in the wake of Covid and the local retailing sector knew that some of the habits formed under lockdown would persist and some would fade away. ings are becoming a little clearer and, as usual, the picture is a complex mix of challenge and opportunity.

e clear trends identi ed in the Barclaycard report, however, o er a decent indication as to which way the consumer wind is blowing and there are some obvious opportunities buried among the rubble. e end of Covid is a long way o yet, but keeping in touch with what your customers want is one way of staying on the right track to the end of this long and winding tunnel.

A Philip Morris Limited survey has uncovered a growing concern among convenience retailers that the current costof-living crisis will fuel a rise in illicit tobacco use. In response to rising prices, 46% of retailers plan on expanding their smokefree product range to offer adult smokers more affordable alternatives, such as e-cigarettes, heat-not-burn products, and nicotine pouches.

Data from PayPoint’s has revealed that sales of chocolates saw a massive spike ahead of Mother’s Day, including Ferrero Rocher – which saw sales increase by 42%. The data, which captured sales from the eight days prior to Mother’s Day against the same date range last year, also shows a soar in sales of Maltesers (41%), Galaxy Caramel (39%) and Aero Milk Chocolate (38%).

Almost two-thirds (64%) of UK consumers favour brands that make a conscious effort to tackle climate change, according to new research from Kana Earth. The study also found that 69% of consumers would try to avoid buying products from brands that have a large carbon footprint and negative impact on the environment if more climatepositive alternative products and services were available.

With IRI research finding the freezables category growing by 70%, World of Sweets is advising retailers to stock up on branded freezables ahead of spring and summer. The confectionery wholesaler’s top pick is Barratt Ice Duos, which was commended at last year’s Quality Food Awards. It is available in packs of 14 x 640ml, RSP £1.75 per product.

Coca-Cola Europaci c Partners (CCEP) has introduced a new taste, new visual identity and a global marketing campaign for Sprite aimed at driving trial amongst young adults.

e new formulations deliver an enhanced crisp lemon-lime avour across Sprite and Sprite Zero Sugar. A new lighter taste seeks to further di erentiate Sprite Zero Sugar from Sprite regular, in a bid to boost sales of the zero-sugar variant.

e new recipes are accompanied by the roll-out of a clean and stylish

new packaging design across all formats including 500ml and 2-ltr PET bottles, 330ml cans and multipack cans, as well as 330ml glass bottles for the on-trade.

e refreshed look and taste are supported by the return of 2022’s ‘Heat Happens’ global campaign, which will initially focus on “the irresistible taste and ice-cold refreshment of Sprite,” using audio cues including ice clinking, the sound of a can opening, and bubbles zzing to bring the message to life. Later in the year it will focus

To celebrate Ramadan, Coca-Cola Europacific Partners is giving independent convenience and food-to-go customers the chance to win a meal at home to mark Iftar, the meal eaten after sunset during Ramadan to break the fast.

There are £4,000-worth of meal delivery vouchers to be won, with 10 randomly selected winners collecting a £100 voucher across each of four prize draws.

‘Win Iftar on Us’ is live on CCEP’s trade website, My.CCEP.com, from today (Thursday 23 March). Independent retailers and food-onthe-go operators need to be registered on My.CCEP.com to enter.

The winners of the first prize draw will be drawn on Friday 31 March and every Friday thereafter until 21 April, and notified the following Monday.

on how Sprite o ers consumers a cool down in moments of mental and physical heat, positioning the brand as the antidote to heat.

e new campaign kicks-o in April and takes in digital out-ofhome, online video, social media and product sampling activities.

VP of Commercial Development at CCEP GB Martin Attock said: “We’re con dent that the great new taste and bold new look will be a hit with existing Sprite lovers and new consumers alike, helping to drive sales for our customers.”

Sensodyne has relaunched its Sensitivity & Gum range with a new formula and updated packaging.

Available in two variants – Mint and Whitening – the range features a new Micro Foam formula which targets and removes plaque bacteria. With twice daily brushing, the formulation reaches the areas in between the teeth and along the gumline. It also builds a protective layer over sensitive areas of the teeth for daily repair, and the mint flavour gives a soothing sensation.

For consumers looking for whitening benefits, the Sensitivity & Gum Whitening formulation not only helps protect sensitive teeth but helps to remove stains for whiter looking teeth resulting in a healthy and confident smile.

The relaunch is by supported with a £2m+ media campaign on TV, video-ondemand, social, online video, audio and cinema, from 1 April.

Coca-Cola Europaci c Partners (CCEP) has launched ‘Win what you love,’ a new promotion for Diet Coke in collaboration with the brand’s Creative Director Kate Moss.

Until 2 May, consumers can scan QR codes on promotional packs of Diet Coke that feature the model’s portrait to access weekly prize draws and the chance to bag an instant-win prize. e promotion runs across the core Diet Coke range and, for the rst time, Diet Coke No Ca eine variants, including take-home bottles and multipack can formats and on-the-go bottles (Diet Coke only).

It is supported by a multi-million-pound marketing campaign, which is an evolution of the ‘love what your love’ campaign launched last year and includes TV, out-of-home and digital advertising, social media and in uencer activity and in-store activation. Convenience retailers can request POS materials via My.CCEP.com.

Costa Co ee has teamed up with KitKat to bring two new drinks to Costa Express machines nationwide.

e biscuit brand has previously collaborated with Costa, but this is the rst time that KitKat drinks will be available outside of its co ee shops.

e two new drinks are a Mocha that has been cra ed using a bespoke KitKat-inspired milk chocolate

SOFT DRINKS

syrup and a Hot Chocolate made using hot chocolate powder againg blended with a KitKat-inspired milk chocolate syrup.

Both are available until Wednesday 19 April 2023. A Costa Co ee spokesperson said: “It’s an exciting rst for us to be o ering the range inspired by KitKat across our Costa Express machines nationwide.”

Soft drinks brand 7UP has unveiled a new brand identity – its first major overhaul in more than seven years.

A new design maintains the brand’s signature green colouring with the addition of citrus tones and high-contrast lines that apparently portray a feeling of upward energy.

It has already started to appear on 7UP and 7UP Zero Sugar bottles and cans around the globe.

The UK Vaping Industry Association (UKVIA) has called for a tightening-up of the UK’s vaping regulatory framework after the recall of overfilled products. UKVIA Director General John Dunne called for an active programme of testing incorporated into the MHRA approvals process, backed up by random spot checks to ensure products remaing fully compliant as long as they are in the market.

Pick and mix brand Kingsway is encouraging retailers to stock up on regal sweets ahead of the coronation on 6 May. The appropriately named brand offers a wide range of regalthemed sweets including Ravazzi Gummy Crowns, Kingsway Gold Milk Chocolate Coins and Royale Sherbert Lemons. Kingsway is also encouraging stores to merchandise a patriotic range of red, white and blue pick and mix for the occasion.

American Fizz has secured a deal to distribute US soft drinks producer Jones Soda’s range of craft sodas in the UK. Made from pure cane sugar, Jones Soda is known in the US for its bold flavours, colours and eye-catching packaging. Each bottle displays ever-changing photos submitted by brand’s consumers. Retailers can visit americanfizzwholesale.co.uk to find out more.

Babybel has supported Comic Relief’s Red Nose Day campaign again for 2023. The cheese snack brand has donated £1,500,000 to the charity over 23 years and this year Babybel donated 5p to Comic Relief for every limited-edition promotional pack sold. Money raised by Red Nose Day will help tackle homelessness, mental health problems and food poverty in the UK and around the world.

Treasury Wine Estates has re-introduced its 19 Crimes consumer campaign, which challenges the nation to find one of 400 limited-edition ‘19th Corks’ – worth £250 each – that are concealed within winning bottles. Running until 31 August, the 400 winning corks are hidden across the brand’s Red Wine, Uprising, Chard, Sauv Block and Revolutionary Rosé 750ml bottles.

Brothers marks festival tiein with Glasto promo

Brothers Festival Apple Cider has been named as official cider of Glastonbury Festival and has launched its biggest-ever onpack promo to mark the tie-in. More than a million prizes are up for grabs, including 10 pairs of tickets to the sold-out event. Other prizes include hoodies, T-shirts, bucket hats, sunglasses and can coolers, as well as a million coupons for 50p off Brothers drinks.

Speciality Brands has been named as exclusive UK distributor of the French luxury Cognac house, Camus. Speciality will focus on the classic and Borderies ranges, and the limited-edition Ile de Ré. The Camus range will be available from this month. To find out more about it, and for any trade queries, please email sales@specialitysbrands.com.

Heineken has extended its new Strongbow Ultra cider brand with the launch of Strongbow Ultra Apple. A crisp twist on Strongbow Original, the new 4% ABV addition contains 80 calories per 330ml can –36% fewer than the Original variant. Available now in single slimline 330ml cans and 4 x 330ml multipacks, Strongbow Ultra Apple is also gluten-free and vegan-friendly.

Diageo has added a new Strawberry Daiquiri pre-mix can (5% ABV) to its Captain Morgan ready-to-drink portfolio.

e 250ml cans are available in both plain packs (RSP £2.59) and £2.39 PMPs.

e new pre-mix is made using crushed strawberry juice with a squeeze of lime mixed with Captain Morgan rum for “a fun and fruity taste”.

e launch follows the recent introduction of a new pack design across the entire Captain Morgan portfolio.

Diageo’s Captain Morgan Marketing Manager Lizzy True commented: “ is latest innovation leans into shoppers’ desire for convenience, as well as the booming popularity of cocktails, with two in ve consumers in the on-trade now choosing to drink cocktails at least once a week.

“Captain Morgan provides consumers with high-quality, exciting drinks options to suit a variety of occasions, especially as we head into the summer months.”

Arran Brewery has gained a listing for its Arran Guid Ale in the Houses of Parliament, of all places.

Patricia Gibson, MP for North Ayrshire and Arran, recommended the ale to the House of Commons Guest Ale programme and it now finds itself served in the Strangers’ Bar as a guest beer.

Following her sponsorship of Guid Ale, Gibson welcomed Arran Brewery owner Gerald Michaluk to Westminster to raise a glass of the award-winning beer.

Arran Guid Ale is a celebration of a song written by Robert Burns in 1795, “Guid Ale Keeps The Heart Aboon” and is one of Arran’s core range.

Molson Coors has announced a new partnership with West Dorset-based vodka brand Black Cow and will exclusively distribute Black Cow Vodka and Black Cow Vodka & English Strawberries in the UK o -trade from 3 April.

Black Cow was co-founded by dairy farmer Jason Barber and his friend, Paul Archard. e vodka is distilled using milk from Barber’s herd of 250 grass-grazed cows, giving it a smooth texture and creamy quality.

Campo Viejo is welcoming consumers into the modern Spanish way of life, by inviting them to ‘Add Some Pasión’ with its new brand positioning.

The campaign runs across out-of-home, videoon-demand, social media, in-store activity and electronic customer relationship marketing. And no, we’d never heard of that one before either.

The campaign uses silhouettes and shapes to create an artwork that refers to key elements that define Campo Viejo. These include the Sierra de la Demanda, the mountain range landscape where the grapes are cultivated; Bodegas Viejo, the home of Campo Viejo; the water used in the winemaking process; and a barrel-load more.

It highlights the breadth of the Campo Viejo portfolio including its Tempranillo, Reserva, and Gran Reserva SKUs.

WINE Campo Viejo campaign ‘adds some pasión’ to life

Treasury Wine Estates, in collaboration with US rapper Snoop Dogg, has unveiled a new addition to its Cali by Snoop portfolio.

Cali by Snoop Cali Rosé launches in the UK from March with an RSP of £11.

e new wine is described as “a bright Rosé with ripe fresh strawberries, complemented with delicate orals and rose petal aromas. e Rosé is fruit forward with raspberry, strawberry, and cherry notes.”

e launch will be supported by a UK-wide marketing campaign that includes in-store promotion and out-of-home advertising, coupled with PR, digital, social and in uencer activities.

CIDER

Ben Blake, Head of Marketing EMEA at TWE, commented: “Following the successful launch of Cali Red, we are delighted to be continuing our partnership with music icon, Snoop Dogg, and launching Snoop Cali Rosé to the UK this spring.

“Cali by Snoop is a brand that honours Snoop’s story, one which tells of overcoming adversity,

A new £5.49 price-marked pack has been launched by Thatchers Cider for its 4 x 500ml can pack of Thatchers Gold.

The new PMP is available exclusively to convenience retailers.

Jonathan Nixon, Commercial Director at Thatchers Cider, commented: “The Gold 4x440ml can pack is the top selling branded apple cider 4-pack in the major multiples so this new price-marked pack of 500ml cans provides a strong opportunity for convenience and independent stores to offer a point of difference.

“It will drive sales and demonstrate to shoppers they are seeing value for money.”

beating the odds and taking his place as a leader in contemporary pop culture. Snoop embodies the timeless value of perseverance, and this Rosé promises to not shy away from being bold, full of character and emulate the chilled Cali lifestyle. Cali Rosé will be his second wine to launch in the portfolio, and we’re excited to see how this brand grows over the coming years.”

Snoop Dogg, who is well-known for his marijuana consumption, added: “ is year, we’re back and dropping the all-new Snoop Cali Rosé, to bring you those fresh feels from spring into summer and beyond.

“ is is how we Rosé the Snoop Dogg way!”

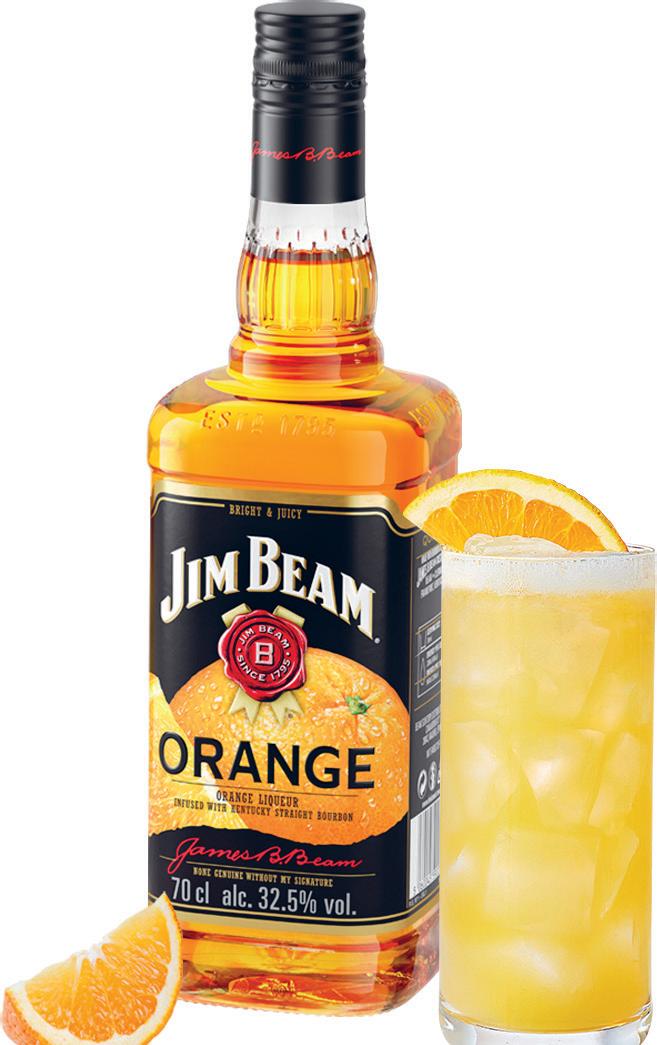

Jim Beam has launched its newest avoured bourbon whiskey in the UK, Jim Beam Orange.

Jim Beam Orange (ABV 32.5%, 70cl, RSP £18) combines orange avours with Kentucky Straight Bourbon Whiskey and o ers zesty notes notes of sweet orange, vanilla and char. It joins the brand’s range of other avoured whiskies: Jim Beam Peach, Apple, and Honey.

Sarah Isaac, Head of UK Brand Marketing at Beam Suntory, commented: “A er the successful launch of Jim Beam Peach in 2021, we are looking forward to the launch of Jim Beam Orange, to encourage new occasions and recruit new consumers to taste the spirit.”

Jim Beam Orange is available exclusively at Asda before a wider roll-out in May.

Molson Coors has launched Staropramen 0.0, a new 0.0% ABV lager that taps into growing demand for both low/no-alcohol options and world beers. It is available now in 330ml bottles and four-packs, and comes at a time when 41% of UK adults have consumed low or no-alcohol drinks in the past three months. The launch is supported by digital advertising, paid social media activity and POS.

Birra Moretti is encouraging shoppers to ‘Live Italian’ with the launch of limited-edition collectable glassware. Four designs are available as a gift with the purchase of a Birra Moretti pack. Each glassware box and selected POS will feature a QR code to an online portal that lets users play games, discover Italian food recipes and possibly win prizes.

Whitley Neill has launched two fruity new flavoured gins – Apple & Red Berries and Banana & Guava – both available now. Apple & Red Berries Gin boasts notes of crisp green apples with sweet raspberry and black cherry, whilst Banana & Guava taps into the trend for tropical flavours with sweet, ripe bananas and tropical guavas. The new products showcase Whitley Neill’s new-look bottles with embossed, patterned detailing.

Guinness has launched its Nitrosurge device in the UK, a new gadget that lets drinkers replicate the brand’s two-part pour at home. The pocket-sized device (RSP £25) is activated by clipping it on top of special cans, before pushing the button and pouring. These cans are available in multipacks of 4 x 558ml (RSP £7), initially from Tesco. There will be a wider rollout later this year.

With the 2 June deadline fast approaching, there are only two months left to submit your SLR Awards entries.

This year marks the 21st edition of the SLR Awards and we want as many of you as possible to be with us on 6 September as we celebrate not only our award winners but Scotland’s entire local retailing community.

Set to be held once more at the Radisson blu hotel in Glasgow, the event will again see the cream of Scotland’s local retailing community gather to honour some of the best retailers, stores and initiatives in our sector.

With the cost-of-living crisis, soaring energy bills, supply issues and a shambolic countdown to the launch of the Deposit Return Scheme, it’s been yet another challenging year for our convenience store community. e sector has – as it always does – risen to those challenges and we are

determined – as we always are – to recognise and pay tribute to the very best of Scotland’s local retailers.

e easy-to-use entry portal has been live for a month now, and the entries are coming thick and fast. However, the clock is ticking, and the 2 June entry deadline will be here before you know it. If haven’t entered yet, now is the time to do it to ensure you don’t miss out on your chance to be up on stage come September smiling for the camera and holding one of convenience retail’s most prestigious awards.

We know how di cult running a convenience store can be and you may well think setting aside a chunk of your valuable time to make an entry is the last thing you need, but being shortlisted or winning an award can have a massively bene cial e ect on your store, your team and your customers.

BREAD & BAKERY RETAILER OF THE YEAR

CONFECTIONERY RETAILER OF THE YEAR

FOOD-TO-GO RETAILER OF THE YEAR

FORECOURT RETAILER OF THE YEAR

FRESH & CHILLED RETAILER OF THE YEAR

NEWSTRADE RETAILER OF THE YEAR

OFF-TRADE RETAILER OF THE YEAR

SCOTTISH BRANDS RETAILER OF THE YEAR

SOFT DRINKS RETAILER OF THE YEAR

TOBACCO RETAILER OF THE YEAR

What’s more, just entering the Awards in the rst place will bene t you: it forces you to take a step back and see your store through the eyes of your shoppers. It’s easy to get caught up in the daily challenges of running the store and lose sight of what’s right in front of your eyes. Taking a deep breath and casting an objective eye over every aspect of your business will help you gure out what you’re getting right as well as spotting where there is room for improvement.

For advice on how to optimise your submission and to make your entries as strong as possible for the judges, please don’t hesitate to email events@55north.com.

So, what are you waiting for? Visit slrawards.com and enter as few or as many categories as you choose. We wish you the very best of luck.

COMMUNITY RETAILER OF THE YEAR

HOME DELIVERY RETAILER OF THE YEAR

NEW STORE OF THE YEAR

REFIT OF THE YEAR

SUSTAINABILITY RETAILER OF THE YEAR

#THINKSMART INNOVATION AWARD

TEAM OF THE YEAR

SYMBOL / FASCIA/ FRANCHISE COMMUNITY INITIATIVE OF THE YEAR

SYMBOL / FASCIA/ FRANCHISE GROUP OF THE YEAR

SPECIAL RECOGNITION

YOUNG SCOTTISH LOCAL RETAILER OF THE YEAR

SCOTTISH LOCAL RETAILER OF THE YEAR

SPECIAL AWARDS ARE JUDGES’ CHOICE ONLY, THERE IS NO ENTRY FORM

GroceryAid Scotland’s fantastic Checkout music festival is back later this year, so it’s time to make sure you’ve booked your tickets in plenty of time.

Checkout Scotland, the outstanding charity music festival organised by the Scottish Committee of industry charity GroceryAid, is set to be a highlight of the industry calendar this year – so it’s time to make sure you get your tickets sorted.

In the wake of last year’s massively successful launch, the event is back in August and it’s set to be even bigger and even better.

Checkout Scotland will take place on 31 August 2023 and o ers the perfect opportunity to gather with industry colleagues, enjoying a brilliant day out and, critically, help support the many people in this industry who have fallen on hard times or face di cult challenges.

e e ects of Covid have made the free, con dential support services that GroceryAid provides more vital than ever. Unfortunately, demand for practical, nancial and emotional support has never been higher in the charity’s 166-year history. In the last year alone GroceryAid has given out £434,000 in grants in Scotland.

Peter Steel, Joint Chairman of the GroceryAid Scotland Committee, told SLR: “We know that there are many industry colleagues in Scotland who need a little help and GroceryAid is there for them 24/7. e charity can o er emotional, practical or nancial help and all completely free

and entirely con dential. Checkout Scotland is a brilliant vehicle to help us spread the word about how GroceryAid can help and make sure that everyone in our industry knows that they have somewhere to turn in times of need.

“We would urge local retailers in Scotland to grab some tickets, come along with some guests, show their support and, of course, have a cracking day out.”

Tickets are a steal at just £75 and are available now.

ere is also a range of sponsorship packages available. All funds raised from the event will go towards helping colleagues in need with emotional, practical and nancial support from GroceryAid.

Invest NI worked with 8 client companies to showcase their products at Scothot 2023, an additional 3 businesses had independent stands and Lynas Wholesale further boosted representation at the event. NI suppliers are currently working with the Scottish Wholesale Association to skill-up to meet Scottish buyer requirements.

Andrew Ingredients is a food and bakery ingredient supplier to many sections of the food industry in the UK and Ireland, including retail, wholesale and instore bakeries, as well as hotels, restaurants, coffee shops, and other foodservice customers.