*Available in 10, 12 & 15 pack formats TENNENTS.CO.UK @TennentsLager Scottish Local Retailer of the Year – Racetrack Pitstop Bearsden profile p29 NOVEMBER 2022 | ISSUE 235 WWW.SLRMAG.CO.UK

TENNENTS.CO.UK @TennentsLager

NOVEMBER 2022 | ISSUE 235 WWW.SLRMAG.CO.UK Scottish Local Retailer of the Year – Racetrack Pitstop Bearsden profile p29 + THE FUTURE IS NOW Full SGF Conference review 4,000 STORES Premier hits milestone TOP NPD SLR Products of the Year launch COLIN MCLEAN Spar Scotland posts strong results TIME TO ‘OWN’ SUSTAINABILITY? SLR roundtable talks DRS and how local retailers can lead on sustainability.

Hovis Soft White is the fastest growing major white bread brand Soft Hovis® is Britain’s favourite branded wholemeal loaf** Hovis® Best of Both® is the No.1 Half & Half product within Impulse **** Hovis® Seed Sensations® is the fastest selling major branded seeded loaf *** *Source data: Nielsen Scantrack Epos, Total Coverage/GB, Unit % Chg YOY, 52 wks to 16th July 2022, Major Bread Brand de ned as greater than 3% of Pre Packed Bread Category Unit % share for same time period as analysis. Analysis across all white breads available in Pre Packed Bread category. Excluding Private Label. ** Source data: Nielsen Scantrack Epos, Total Coverage/GB, Unit Sales, 52 wks to 16th July 2022 analysis across all brown/wholemeal breads available in Pre Packed Bread category. Excluding Private Label. ***Source data: Nielsen Scantrack Epos, Total Coverage/GB, Unit Rate Of Sale. 52 wks to 16th July 2022, analysis across all branded Bread with Bits products available in Pre Packed Bread category. Major Brand de ned as greater than 3% of pre-packaged bread Unit % share for the same time period as analysis. Excluding Private Label. ****Source data: Nielsen Scantrack Epos, Total Impulse, Unit Sales, 52 wks to 16th July 2022 analysis across all half & half breads available in Pre Packed Bread category. Excluding Private Label.

NEWS

p6 Financial Results CJ Lang’s strategy delivers positive results, with a 10% rise in pre-tax profits.

p7 Grocery Sales British shoppers focus on four main coping strategies to manage rising inflation.

p8 Legislation Usdaw supports shopworkers enforcing the Fireworks and Pyrotechnic Articles Act.

p10 Cost-of-Living Crisis Scottish c-stores play key role in giving customers access to key government benefits.

p12 Forecourts Forecourt retailers investing in efficiency and services, says ACS Forecourt Report.

p14 News Extra Vaping The Scottish government’s proposals to ban the promotion of vaping products in stores have failed to secure majority support.

p24 Product News Skittles seeks to document LGBTQ+ history and Coca-Cola expands its football partnerships.

p26 Off-Trade News Pernod Ricard gears up for Christmas and Bombay Sapphire unveils a new global campaign.

INSIDE BUSINESS

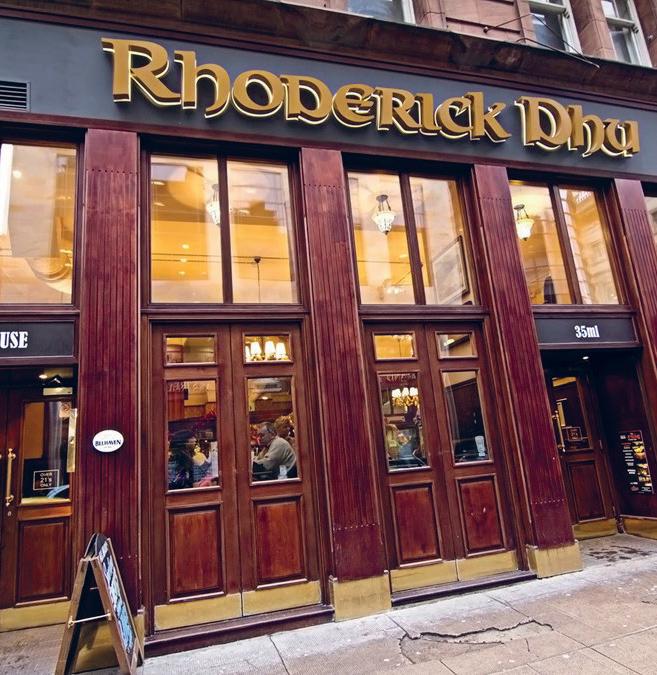

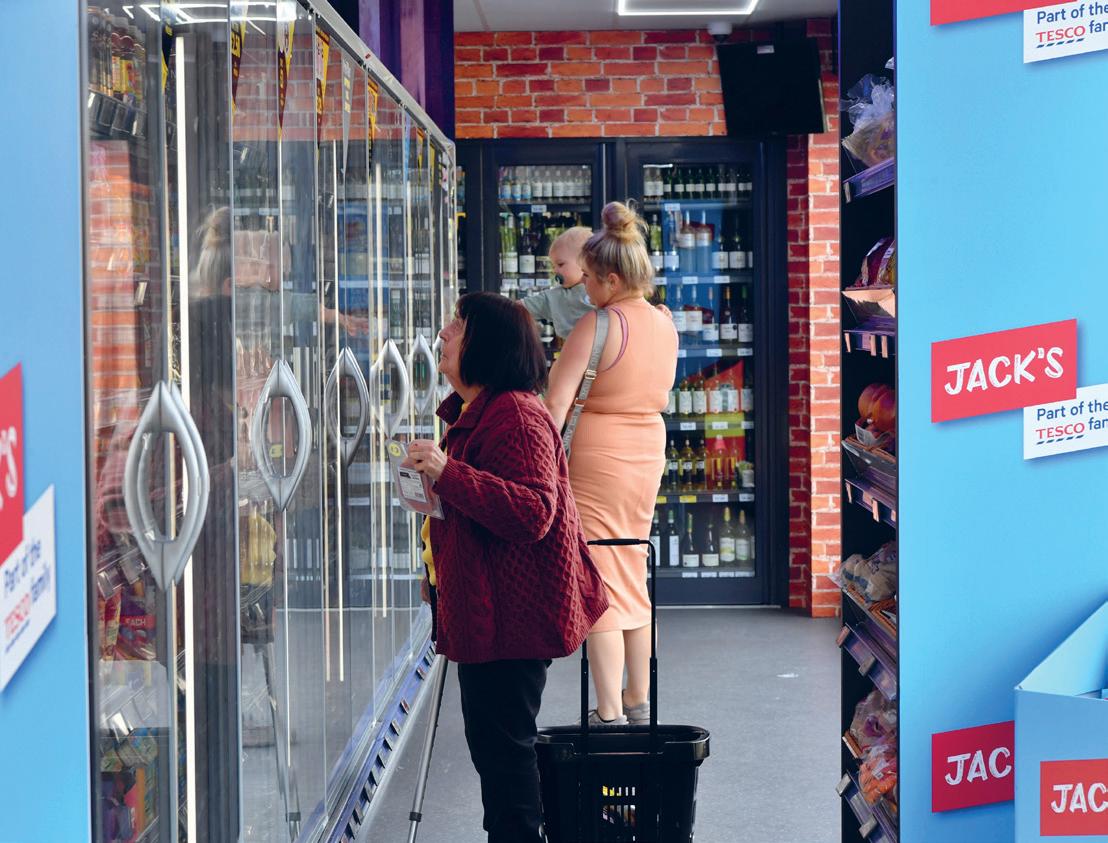

p29 Store Profile Premier Racetrack Bearsden SLR visits the stunning store that played a pivotal role in deciding who was crowned Retailer of the Year at the SLR Awards.

p34 SGF Conference 2022 Last month’s event saw the trade gather in Glasgow to reflect on the last few years and plan for a future that’s approaching faster than ever.

p36 Store Profile Premier Talbot Stores, Poole SLR visits the seaside to view Premier’s 4000th store, which offers the latest insight into the direction the symbol group is taking.

p39 SLR Products of the Year Awards It’s time to cast your votes for the products launched this year that have made a big impact on your store’s sales.

p40 Hotlines The latest new products and media campaigns.

p58 Under The Counter Has the Auld Boy found his dream job with Heineken? Probably not.

FEATURES

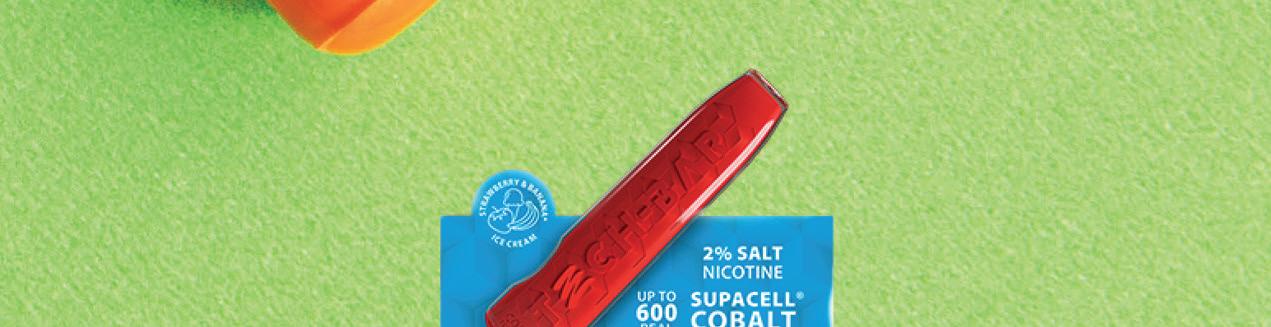

p42 Vaping Sales in the vaping category continue to grow, fuelled by the Stoptober campaign and budget concerns.

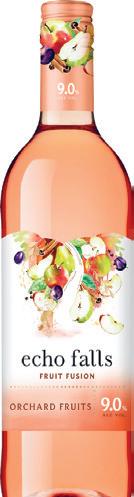

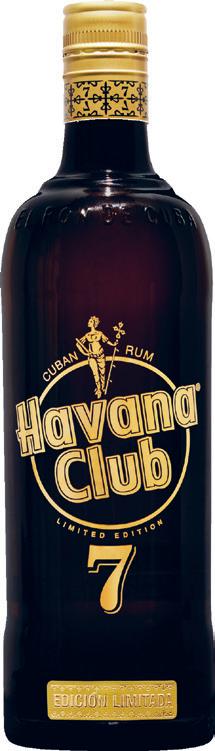

p44 Christmas Drinks This promises to be a big Christmas for retailers, with many consumers planning large get-togethers.

p46 Forecourts The Forecourt Report 2022 highlights the valuable role that forecourt stores play in their communities.

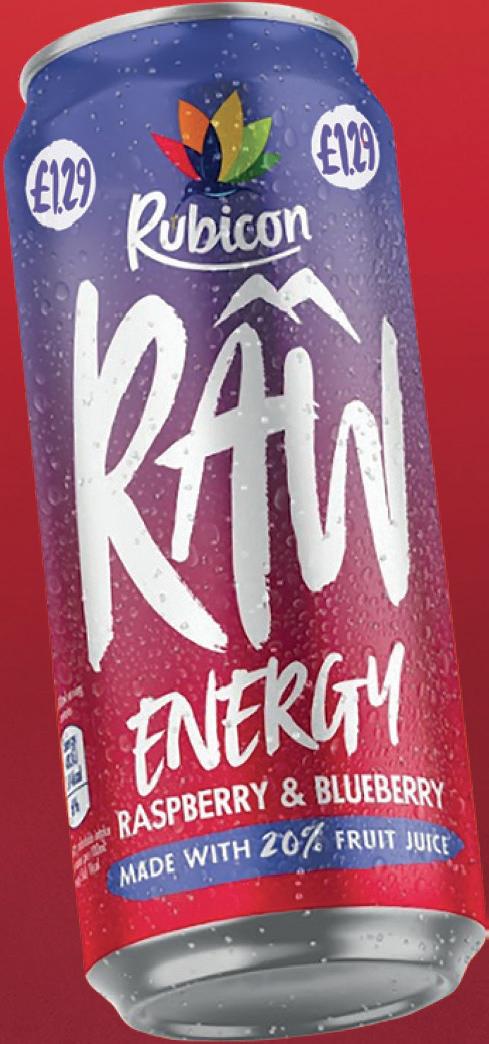

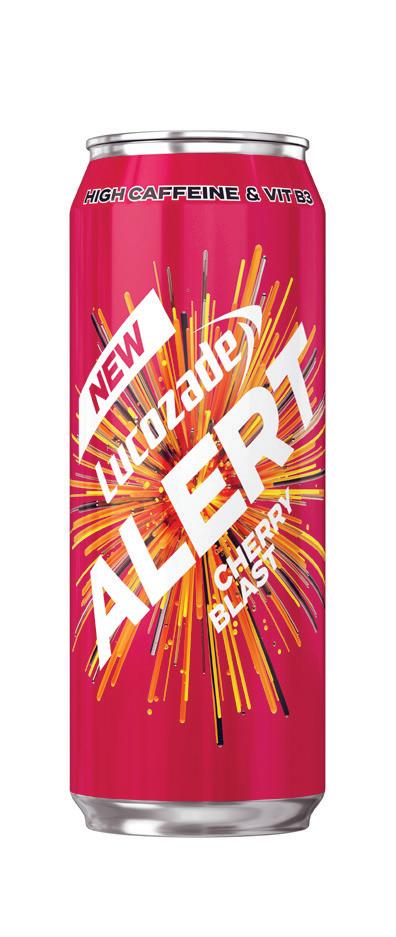

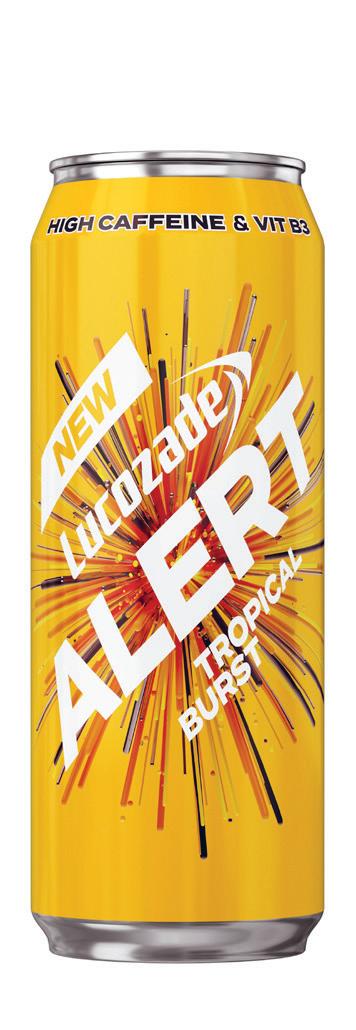

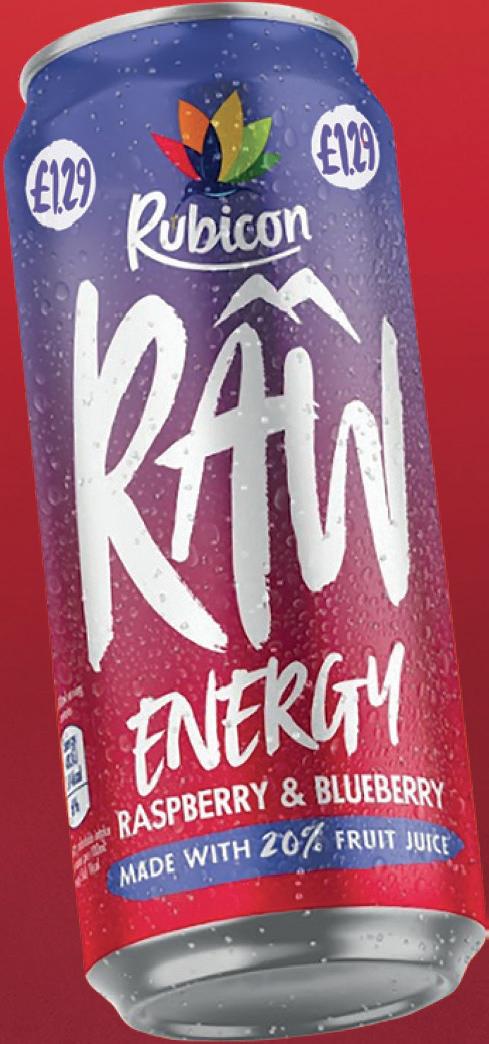

p48 Sports & Energy Growth, innovation and opportunity are driving the sports & energy category.

p54 Christmas Top Up SLR reveals the key categories and new products set to help fire up the festive season.

www.slrmag.co.uk NOVEMBER2022| SLR 5 ISSUE 235 ContentsNovember 2022 Contents

ON THE COVER p18 With DRS fast approaching, SLR convened a meeting of industry leading lights to discuss how the challenges of the new scheme could open a door for local retailers. 8 25 26 30 35 41

UK grocery price inflation rises

Grocery inflation has hit a new peak and now stands at 13.9%, according to new Kantar figures. The data reveals grocery sales rose by 4.8% in the 12 weeks to 2 October 2022. The average household is facing a £643 jump in its annual grocery bill to £5,265 if it keeps buying the same items, Kantar says. Sales of supermarket own-label lines increased by 8.1% in September, while branded items fell by 0.7%.

ACS signs up to UK Plastics Pact

ACS is signing up as a supporter of the Waste and Resources Action Programme’s (WRAP’s) UK Plastics Pact, joining other business groups in committing to making the convenience sector more sustainable. The Plastics Pact’s main objective is eliminating problematic or unnecessary single-use packaging through redesign, innovation or alternative (reuse) delivery models.

Morrisons to sell McColl’s Perth store

Morrisons will have to sell the McColl’s store in Perth and 27 stores in England and Wales after the Competition and Markets Authority (CMA) said it is “minded to accept” the supermarket’s proposals to resolve competition concerns raised by its takeover of the convenience retailer. Morrisons has offered to divest the stores to a purchaser or purchasers to be approved by CMA.

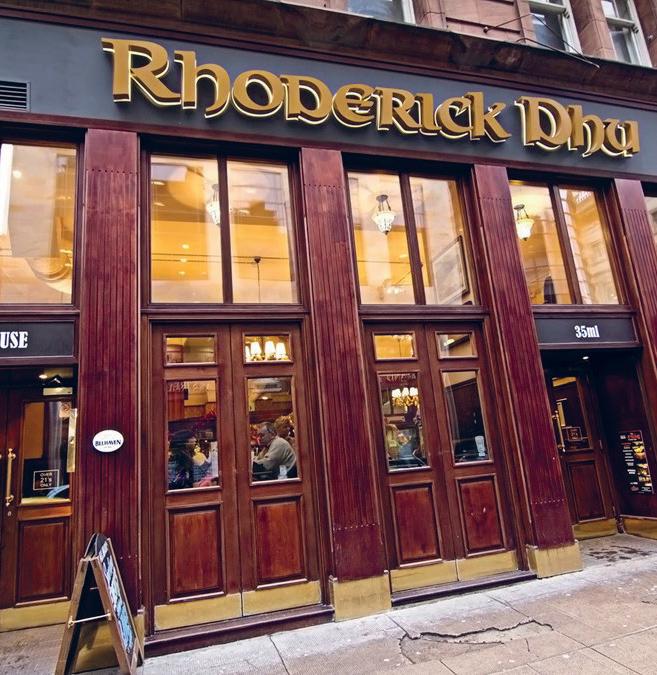

Millions skipping meals due to cost-of-living crisis

Millions of households are skipping meals or finding it hard to put healthy meals on the table as they struggle with the cost-of-living crisis, according to data from consumer champion Which?. The organisation is calling on retailers to ensure that budget lines are widely available across their stores, particularly in those areas where they are needed most.

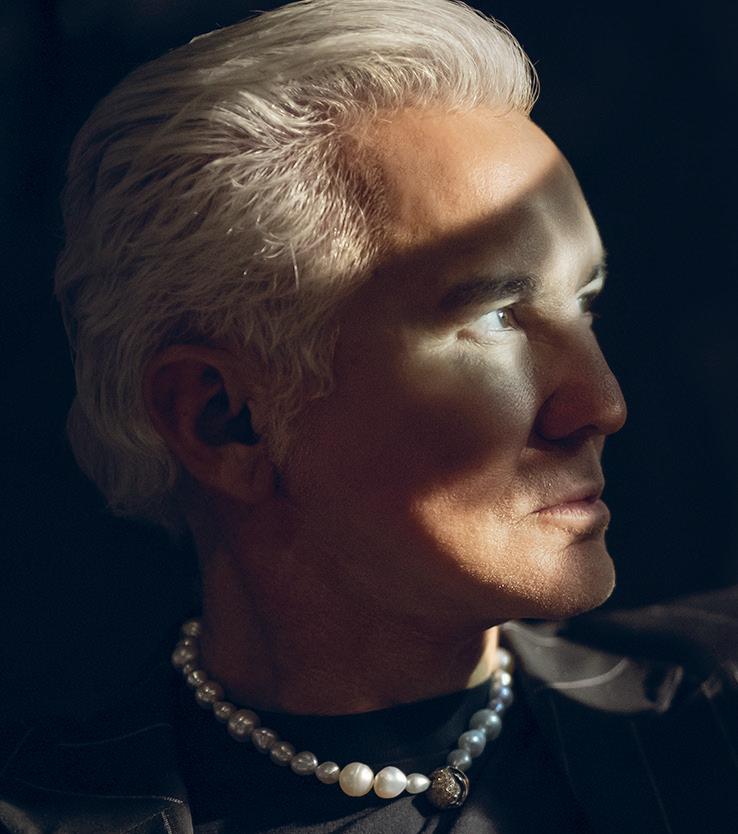

CJ Lang’s strategy delivers positive results

CJ Lang & Son has reported a 10.7% increase in pre-tax pro ts to £3.4m for the year ending 30 April 2022, with margin up 0.3% to 23.3%.

However, the Spar Scotland wholesaler and retailer’s turnover for the year was down 0.1% to £212.3m.

e company said it continues to implement its strategy for pro table growth. In 2022 there has been a continued focus on enhancing its food-to-go o er CJ’s, as well as improving and implementing consistent store standards while investing in the store estate.

In addition, investments have been made in key resources, both within the board and executive management team to onboard further skills and experience, and within company-owned stores, with signi cant investment in Crosshouse, Gatehouse of Fleet, Spean Bridge and Balmacara in the past 12 months.

CJ Lang & Son CEO, Colin McLean, said: “ e previous 12 months saw changes continue in the retail landscape as we nally emerged from Covid-19 to move into the cost-of-living crisis and a very uncertain future globally. We know that there are tough times ahead for all and our primary focus is to o er a value proposition to help support our customers and sta through the ongoing uncertainty.

Government publishes paper on independent Scotland

First Minister Nicola Sturgeon has unveiled a paper that outlines the Scottish Government’s case for Scotland leaving the UK.

e paper – called ‘Building a New Scotland’ – sets out the Scottish Government’s proposals for the economy of an independent Scotland.

e government says independence would “enable the creation of an economy that works for Scotland”. It says the proposals are designed to help businesses to:

Q have lower energy prices and secure energy supplies, by increased, better, and greener use of Scotland’s abundant natural energy resources;

Q get the workers they need, by reversing Scotland’s long-term population trends, and regaining access to talented and committed people from across Europe and the world;

Q bene t from investments made by the Building a New Scotland Fund, including in more energy-e cient business premises, investment in net zero technologies, and better digital and mobile connectivity;

Q increase dynamism and productivity by taking a new approach to fair work, one that is better for employers and employees;

Q bene t from reformed models of corporate governance that evidence shows improve pro tability;

Q in uence government policy directly through new bodies, like the Scottish Fair Pay Commission, which will assume responsibility for setting the national minimum wage.

KEEP

“Being solely Scottish-focused has enabled us to adapt quickly and react exibly to the changing retail landscape and to continue to provide a rst-class service to our independent retail customers, consumers and communities at a time when they have needed us most.”

In September 2022 the company held its biggest tradeshow, with more than 800 delegates, in Aviemore.

SGF reveals impact of energy crisis

Nearly 80% of Scottish retailers are worried that the current energy crisis could put their business at risk, according to a new survey by the SGF.

Its research reveals that retailers are experiencing a wide spectrum of energy cost increases, ranging from 50% to as high as 800%.

Retailers also said it may affect the produce they stock, meaning fewer chilled and frozen items available in store, and their capacity to employ an adequate number of staff.

The SGF warned that rising energy bills over the coming months may mean producers and retailers will have to pass the additional costs on to customers.

News

ENERGY CRISIS

UP WITH THE LATEST NEWS AS IT HAPPENS – FOLLOW US ON TWITTER @SLRMAG SLR |NOVEMBER2022 www.slrmag.co.uk6

INDEPENDENCE The Scottish Government sets out its proposals for the economy of an independent country

FINANCIAL RESULTS Spar Scotland’s primary focus is to offer a value proposition

CJ Lang boss Colin McLean

Autumn sees change in shopping behaviour

Total till sales increased by 4.7% in the past four weeks, although volume sales fell by 6%, according to new data from NielsenIQ. In the past four weeks, most categories saw value growth increase due to in ation, but volume growth slowed. In terms of value growth, this was the highest in the pet (+12.9%), dairy (+11.8%), crisps and snacks (+11.3%), and bakery (+11.2%) categories. Sales for fresh produce fell -3.2% and beer, wines and spirits were down 4.4%.

Volume growths were weakest in household (-9.4%), fresh produce (-8.3%), and meat, sh and poultry (-8%), as well as general merchandise (-7.1%).

HELPFUL launches solution to simplify DRS manual takeback

Payment management platform

HELPFUL has launched a digital payments solution to simplify the administration and financial management of DRS manual takeback.

The deposit return scheme goes live next August, and every retailer selling recyclable containers will be required to accept returned containers, while refunding 20p deposits to consumers, although exemptions will apply.

Reverse Checkout handles the full cashflow, meaning the handling fee for every eligible bottle that retailers accept goes straight into their bank account, and it refunds deposits straight to a customers’ debit cards.

Visit helpful.world/reversecheckout-for-retailers to register for more information.

NielsenIQ’s survey of shoppers in August shows British consumers are focusing on four main coping strategies to manage rising in ation. is includes monitoring the cost of their overall shopping basket (26%), opting for private label products (27%), shopping more at discounters (23%), and opting to stop buying certain products (23%).

In addition, the trend of consumers returning to shop instore continues, with store visits up +6.5% compared with a year ago, and online visits down -9.3%, with one in four households now shopping online, down slightly from last year. erefore, the online share of FMCG sales has now fallen

to 10.9%, down from 11.1% last month.

Mike Watkins, NielsenIQ’s UK Head of Retailer and Business Insight, said: “It’s still very uncertain how big the allimportant Christmas weeks will be based on current trends and the added pressure on shoppers who may look to opt for cheaper alternatives. But what we do know is that shoppers will be monitoring their weekly grocery spend even more closely. Some households may wish to bring forward some seasonal spending to help with budgeting, such as seasonal biscuits, chocolates and a ordable gi s to spread the cost of Christmas.”

Out-of-home eating occasions increasing

The number of out-of-home eating occasions increased by 2% year-on-year in the 12 weeks ending 5 September 2022, according to data from TWC and MealTrak. The data shows there were 793 million eating out-of-home occasions in the 12-week period, while value sales rose by 14% year-on-year.

Convenience stores (+10%) and forecourts (+13%) are also all outperforming the total market.

Jisp reveals strong September performance

Jisp achieved a 32% month-onmonth increase in the number of scans in September, new data reveals. There was a 33% monthon-month increase in the number of vouchers issued and a 35% rise in redemptions. Transactions increased by 24% and Jisp is helping brands achieve industry-leading conversion rates between vouchers issued to redemption of 89%.

Scottish Grocers’ Federation has clari ed an “inaccurate” news report last week that claimed that thousands of retailers would be set for a deposit return scheme exemption.

SGF Chief Executive Pete Cheema said: “Convenience store operators have never said that they want to have all their stores exempt, but rather want to be part of the scheme.

“It is essential however that DRS remains cost neutral to Return Point Operators and does not leave them with an additional cost burden or put them out of business. As far as we understand, the First Minister and her government want the same.”

SGF has consulted the Scottish Government and it further reiterated that: “Scotland’s deposit return scheme follows a return-to-retail model that ensures the accessibility of the scheme to all. e regulations speci cally allow for retailers to be able to apply for an exemption for operating a return point if they meet certain criteria.

“While this will be a decision for individual businesses to make themselves, we anticipate that some smaller retailers may choose to do so.

“We are keen to ensure this process is as straightforward as possible and are working with Zero Waste Scotland to deliver additional guidance to support retailers through the exemptions process.”

CJ Lang nails new maintenance partnership

CJ Lang & Son has formed a maintenance services partnership with City Building and Engineering Services (CBES) for more than 100 of its company-owned Spar stores. CBES will provide an assetbuilding maintenance service that includes building fabric and electrical works. The company employs more than 700 people throughout the UK.

Shoppers would ‘still buy PMPs’ if prices rise

More than 60% of independent retailers believe that their shoppers would still buy pricemarked packs if suppliers increased the price of them a little, according to a TWC survey. In addition, 80% of the retailers questioned agree that their shoppers like price-marked packs, while 78% agreed that PMPs demonstrate good value for money to shoppers.

News

www.slrmag.co.uk NOVEMBER2022| SLR 7 DRS

GROCERY SALES British shoppers focus on four main coping strategies to manage rising inflation.

DRS Exemption reports clarified SGF clarifies ‘inaccurate’ DRS exemption report

PGNJ picks up prize at Nisa Expo awards

Retailer Jay Javid’s Cambuslang outlet was awarded Convenience Store of the Year at the Nisa Expo awards, which took place at NAEC Stoneleigh in Warwickshire. The store, developed by Jay’s company PGNJ – a Nisa key account that joined the symbol group in 2019, picked up the award at a black-tie gala dinner and awards ceremony that concluded the first day of the two-day Expo.

Booker gives staff an additional pay increase

Booker has agreed to provide additional support for its employees amid the cost-ofliving crisis, with an additional pay increase outside of the annual pay review. The company’s hourly paid retail staff will receive an additional 25p per hour from 13 November, taking the base rate from £9.75 to £10 per hour. This is on top of May’s 6.67% rise, taking the overall increase this year to 9.4%.

Lhanbryde welcomes new Spar store

A new Spar store has opened in St Andrews Road in Lhanbryde, Moray. The 1,000sq ft store, previously a Keystore, opened following a small refurbishment. It offers customers a range of licensed products, lotto, Tango Ice Blast, Tchibo coffee, and a food-to-go area. On opening day customers were able to try free samples of Spar own-label products and pick up free goody bags.

Consumer confidence continues to ‘bump along’ Consumer confidence increased by two points in October to -47, new data reveals. GfK’s longrunning Consumer Confidence Index shows that three measures of confidence were up, one was flat, and one decreased in comparison to last month’s (23 September) announcement. This month’s survey was conducted among a sample of 2,001 people aged 16 years old and over.

Union urges support for store workers enforcing new fireworks law

Retail trade union Usdaw is urging support for the shopworkers who will have to enforce the Fireworks and Pyrotechnic Articles (Scotland) Act 2022, which came into force on 10 October.

e new law makes it a criminal o ence for anyone to supply reworks or other pyrotechnics to anyone under 18. However, statistics show that age-restricted sales account for nearly one- h of incidents of violence, threats and abuse against shopworkers.

Tracy Gilbert, Usdaw regional o cer for Scotland, said: “Agerestricted sales are a real mine eld for our members. If they make

a mistake they are likely to be prosecuted and ned. If they fail to ask for age identi cation from somebody who looks under-25, they run the risk of being disciplined for not following company policy and for the sale of alcohol that is a legal requirement here in Scotland.

“Asking for age identi cation can lead to abuse from frustrated and angry customers and a refusal of a sale can be a real ashpoint. Many of our members feel they are damned if they ask for ID and damned if they don’t. Scottish shopworkers deserve far more respect than they receive.”

Spar Scotland raises £24k for GroceryAid

She added: “We still need employers to make it easier for sta to report attacks and abuse, highlight the legislation to improve con dence, backed up with training, and promote the importance of reporting all incidents. At the same time, we need signi cant investment in the justice system to ensure victims get the justice they deserve.

Gilbert called for retail employers, police and the courts to work together to make stores safer and give sta the support and con dence they need, “particularly when they are on the frontline of enforcing the law”.

Snappy Group unveils new Chief Growth Officer

The Snappy Group has named Daniel Calvert as its new Chief Growth Officer.

The new role will focus on maximising revenue and growth through both organic and strategic development for The Snappy Group.

Employees from CJ Lang & Son have raised more than £24,000 for GroceryAid by taking part in all four Kiltwalks over the summer. e charity has provided grocery colleagues practical, emotional and nancial support since 1857, with a 24/7 helpline and website to help employees when they need it.

CJ Lang sta from across Scotland competed in the events in Glasgow, Aberdeen, Dundee, and Edinburgh.

A total of 186 employees from across the business got involved, completing various lengths, from the Wee Wander, to the Big Stroll or Mighty Stride. is included sta from stores across Scotland, the Dundeebased depot and head o ce on Longtown Road, as well as members of the eld teams who work across the country. Shareholders, the Chairman and the Chief Executive also took part. ree of the senior team completed all four Mighty Stride walks – over 100 miles.

In total, including a top up by Sir Tom Hunter, funds raised for GroceryAid were £24,038.

Sonya Harper, Central Operations Director for CJ Lang, said: “It was great fun getting our teams out walking the fantastic Kiltwalk routes, raising vital funds for GroceryAid while having some fun along the way. Many of our team are already talking about Kiltwalk 2023.”

Calvert has previously held strategic leadership roles with leading tech businesses, including N26, Uber Eats, and Google. He also specialises in scaling start-ups and has a strong background in e-commerce, marketplaces, and DTC models.

Calvert said: “We have ambitions to develop significantly, expanding a number of exciting business areas within the group and increasing our commitment to support local business through effective, efficient tech.”

News

HOME DELIVERY

KEEP UP WITH THE LATEST NEWS AS IT HAPPENS – FOLLOW US ON TWITTER @SLRMAG SLR |NOVEMBER2022 www.slrmag.co.uk8 CHARITY CJ Lang staff take part in Kiltwalks over the summer

LEGISLATION Usdaw supports shopworkers enforcing the Fireworks and Pyrotechnic Articles Act

Make Christmas mealtime magic TOWARDS THEIR FESTIVE FEAST Plus 1000s* of great Coca-Cola prizes WIN £200 SCAN. PLAY. WIN.** GIVE YOUR CUSTOMERS A CHANCE TO STOCK UP ON OUR FESTIVE PACKS To find out more email connect@ccep.com, call 0808 1 000 000 or to request a POS kit, visit my.ccep.com **GB, 16+ (<18 need consent). Scan the QR Code on pack to enter via the downloaded Coke App. (Open 09:00 21.11.22- 09:00 03.01.23). Playgame and earn gems to enter for a chance to win prizes. Instant App win prizes available via winning moments where 1st to enter at/after winning moment wins (end date in App), total of 2400* prizes, incl: 960 x £10 food aggregator vouchers (of the winner’s choice of 2 leading brands). 1440 x £20 food aggregator vouchers (of the winner’s choice from 3 leading brands). Winning moments roll over if not claimed. Not all prizes may be won. Plus, auto entry into weekly prize draws (end dates in App). Total 6 weekly draws include: 797 x £200 food related vouchers. Max 2 entries/person/day. 1 win/person/prize type. Mop Up draw for 1 x £200 food related voucher between 03.01.23 – 30.01.23. Excl. apply. Full T&Cs: coca-cola.co.uk/app/christmasmagic. Promoter: Coca-Cola GB. © 2021 The Coca-Cola Company. All rights reserved. COCA-COLA and COCA-COLA ZERO are registered trademarks of The Coca-Cola Company. SCAN TO VISIT MY.CCEP.COM

Post Office sees dip in cash transactions

Post Office figures for September have revealed that cash transactions fell 94% year-onyear due to the additional bank holiday for the Queen’s funeral. The figures show that £3.35bn in cash deposits and withdrawals were handled at Post Offices. Cash withdrawals totalled £785m, a dip of 2.5% month-onmonth. Personal cash deposits were still up 0.6% on August with £1.43bn deposited by personal customers. Business cash deposits totalled £1.11bn, down 7.3% month-on-month.

Nisa opens in Kilbirnie

Retailer TJ Atwal has opened a new Nisa in Kilbirnie, North Ayrshire. TJ – the owner of Dunnings Premier, also in Kilbirnie – bought the former Co-op store at 61-63 Holmhead and closed it for 18 days for refurbishment. Most of the Co-op staff have transferred to the new store. They worked at Dunnings Premier while the refurbishment took place. The store opened to customers on 5 October.

Spar Scotland tradeshow raises £4k for charities

Spar Scotland’s recent tradeshow in Aviemore, the largest event hosted by the retailer, helped raise £4,000 for charity. The company’s national charity partners Marie Curie and GroceryAid both received a donation of £2,000. The charities took part in the tradeshow exhibition on the day.

Lomond introduces Scottish product guide Lomond: The Wholesale Food Co has launched a new product brochure – Taste of Scotland Food Guide – that champions its extensive range of Scottish produce to support foodservice operatives with locally sourced ingredients. The guide features 69 Scottish producers and contains all the information usually found in product guides, but also illustrates the food miles of products.

Scottish c-stores delivering costof-living support with PayPoint

Scottish convenience stores are playing a key role in enabling customers and communities to access key government bene ts and payments through payment solutions o ered by PayPoint, new data reveals.

Housing and local authority payments gures collected by PayPoint highlight that more than £431m has been processed over the past three years, across more than 3,000 stores in Scotland.

Trends also indicate that 26.2% of those transactions happen before 9am and a er 5pm, the earliest transaction is between midnight and 1am, and the latest transaction is between 11pm and midnight. Meanwhile, 19.33% of total transactions happen on a Saturday or Sunday.

e gures show that over £23m

has been distributed for the DWP Payment Exception Service since launching last August in more than 2,200 stores in Scotland. Trends show that 10.2% of those transactions happen before 9am and a er 5pm and 5% of total transactions happen on a Saturday or Sunday. e earliest transaction happened between 6am and 7am, the latest transaction between 9pm and 10pm.

SGF Chief Executive Dr Pete Cheema said: “Scottish convenience stores are at the heart of their communities providing

Fife Creamery introduces new fleet of trucks

key services to their customers, seven days a week, and this is clearly borne out by the latest data collected by PayPoint. Local shops, as the data shows, are able to help facilitate the mass distribution of government bene ts in a quick and easily accessible way to those who need it most.

“Independent convenience stores are core community assets and are the “glue” in social and economic community building.”

PayPoint Corporate A airs & Marketing Director, Steve O’Neill, added: “Our retailer partners have always done a fantastic job delivering vital community services for people across Scotland.

is is even more important now as they help deliver important cost of living support services, including the Energy Bills Support Scheme.”

ENERGY CRISIS

Retailers urged to read latest guidance on energy security

Fife Creamery, the Kirkcaldy-based chilled and frozen food wholesaler, has launched a brand campaign ‘Scotland’s Food Wholesale Heroes’ via a new eet of trucks.

e investment has seen the addition of more than 30 new MercedesBenz 7.5-tonne vehicles.

With the introduction of newly branded vehicles, Fife Creamery saw an opportunity to shake up its public face and acknowledge the role played by its sta in the company’s recent successes.

e campaign launches with the sta members featured on the side of the trucks with some of their favourite products. It will continue throughout the year with the ‘Heroes’ making further appearances in print and online.

Logistics Manager Richard Wishart, who is responsible for Fife Creamery’s eet, said: “As we develop successfully into new market sectors, we’ve been commissioning more vehicles to deliver the increased volumes.”

Graeme Simpson, MD at Fife Creamery, added: “While there remains challenges with rising costs and bumpy supply chains, our team of ‘Food Wholesale Heroes’ continues to shine through.

“ eir work and dedication, from our warehouse operators, our administrative sta , sales representative, and all our loyal sta members, continues to be key in maintaining strong customer relationships and delivering our constantly growing range of services.”

KEEP

The Food Sector Resilience Group is urging retailers to read the latest guidance on energy security and apply for ‘protected site’ status, if they meet the eligibility criteria.

The Electricity Supply Emergency Code outlines the process for ensuring fair distribution of electricity rationing during a prolonged electricity shortage.

Details about the code and advice on how to apply as a protected site can be viewed at bit.ly/3N95AgL.

The National Grid’s gas and electricity operators, alongside the UK Government, have analysed Scotland’s anticipated energy needs over the winter months. They are “confident” these requirements will be met in full.

News

UP WITH THE LATEST NEWS AS IT HAPPENS – FOLLOW US ON TWITTER @SLRMAG SLR |NOVEMBER2022 www.slrmag.co.uk10

LOGISTICS Kirkcaldy-based wholesaler takes on 30 new 7.5-tonne vehicles

COST-OF-LIVING CRISIS C-stores supporting communities

N O W Y OU ’ RE TA LK I N GB E S T E N J O Y E D R E S P O N S I B LY @ B E L H A V E N B R E W S B e l h a v e n c o u k D I S CO V E R TH E A W A RD W I N N I N G R A N G E O F B E E RS F ROM S COTL A N D ’ S FI N E S T - S TO C K U P N O WSCOTLAND’S NO.1 ALE SCAN ME!

Geek Bar helps retailers stay on right side of law VapeWatch, the brainchild of disposable vape manufacturer Geek Bar, is a new online platform to help retailers keep on the right side of the law when it comes to supplying and selling disposable vapes. The platform provides advice on distributors, packaging, implementing a vetting process, reporting illicit products, and provides access to useful resources.

Spar opens store in Troon

A new Spar store has opened on Deveron Road, Troon. The store was previously Keystorebranded. The store offers CJ’s food-to-go, Snappy Shopper delivery, off-licence, ATM, lottery, in-store bakery, and PayPoint. The store is open 7am to 10pm, seven days a week. There are already two Spar stores in the town – Spar Logan Drive and Spar Portland Street.

Food sales continue downward trend

Food sales fell by 1.8% in September, continuing a downward trend since summer last year, according to the latest retail sales figures from the Office For National Statistics. Total retail sales volumes fell 1.4% month-on-month, far worse than the 0.5% decline that economists had forecast. Retail sales declined by 6.9% yearon-year in September, the data shows. The ONS said the data was affected by the bank holiday for the state funeral of Queen Elizabeth II.

Iceland partners with Uber Eats

Iceland is trialling rapid delivery in partnership with Uber Eats. The London-based trial will use Uber’s technology and Iceland’s in-store infrastructure to deliver goods in as little as 20 minutes. More than 1,000 branded and non-branded items from Iceland will be available on the Uber Eats app for delivery to consumers near South Bank, Poplar, and Walworth Road.

Forecourt retailers investing in efficiency and services

with 39% using LED lighting and 8% using solar panels to reduce electricity costs.

Independent forecourt retailers are making signi cant investments in their businesses, spending around £18,000 on average last year, according to the Association of Convenience Stores’ 2022 Forecourt Report.

e report shows that across the sector, the most common form of investment is refrigeration, with stores either looking to expand their range of fresh and chilled goods or upgrade their refrigeration to make it more energy e cient.

Half of the forecourt stores in the sector have doors on their chillers,

ACS Chief Executive James Lowman said: “It’s essential that the government recognises the crucial role that forecourts play in their communities. ese businesses are community hubs in their own right, providing essential services and an ever-increasing range of products for customers along with fuel and alternative power solutions.”

Other key ndings from this year’s Forecourt Report include:

Q e UK forecourt sector creates more than 84,000 jobs, with 23% of sta being in the business for more than 10 years;

Q 69% of forecourt retailers are active in their communities, raising money for local charities, getting involved with local

TECHNOLOGY New tech ‘instantly boosted morale’ Scotmid completes electronic shelf edge technology installation

Scotmid has completed a £4m in-store digital installation programme – hitting its 12-month rollout target.

Following successful trials, Scotmid has now deployed more than 550,000 electronic shelf edge labels (ESELs) across its food stores in Scotland and the north of England, in a move aimed at providing more user-friendly and easy-toread product information for customers.

e retailer says the technology also improves productivity across its stores, enabling retail information on shelves – such as pricing and promotion details – to be updated centrally.

In addition, the system has been shown to increase wider store e ciency, improve pricing and product information compliance, reduce paper wastage, and enhance store team morale.

e technology is manufactured by SoluM, a Samsunginvested company, and is run in partnership with Cambridgebased technology integrator Herbert Retail.

projects, and donating to food banks;

Q One in ve customers of forecourt stores visit every day (21%), with 80% visiting at least once a week;

Q ere are currently 768 electric charging devices located on 446 forecourt sites across the UK;

Q Average fuel prices peaked in July this year, at 188.6p for petrol and 197.3p for diesel.

Lowman added: “ is has been a turbulent year for fuel supply and pricing, with international events determining the price that consumers pay at the pump. It is encouraging to see that fuel prices are trending downward a er peaking in the summer, especially as everyone is looking to cut costs where possible.”

OFF-TRADE Co-op granted alcohol licences for Shetland stores

Provisional alcohol licences have been granted for two new Co-op stores on Scalloway and Sandwick, Shetland, despite concerns about “potential overprovision”.

Reports suggest NHS Shetland had responded to the licence applications by saying they would represent a “huge increase” in the availability of off-sales alcohol in the areas.

The health board also raised concerns about the alcohol aisle and associated promotions close to the checkouts.

A representative for Co-op, Eilidh McGuire, said having alcohol at the back of stores does not provide the “benefits” that were hoped and having alcohol closer to tills can increase monitoring.

Councillors said they had sympathy for NHS Shetland’s views, but granted the seven day a week, 10am to 10pm provisional licenses.

News

KEEP UP WITH THE LATEST NEWS AS IT HAPPENS – FOLLOW US ON TWITTER @SLRMAG SLR |NOVEMBER2022 www.slrmag.co.uk12

FORECOURTS Retailers spending around £18k on their businesses

Take a fresh look at SPAR Scotland CJ Lang & Son Ltd, Longtown Distribution Centre, 78 Longtown Road, Dundee, DD4 8JU www.cjlang.co.uk www.sparscotland.co.uk @SparScotlandSparScotlandOfficial @SparScotland CJ Lang & Son Limited To find out more and join our award winning team email Recruitment Manager, Craig Lynn: craig.lynn@cjlang.co.uk • Up to 6% rebate • Delivery to your store – anywhere in Scotland • A smooth onboarding process including market leading aftercare support • Dedicated Business Development Manager contact to support your ongoing business needs Symbol Grou p of the Ye ar W INNE R

Proposed vaping regs come under fire

Convenience Matters with the SGF

Let’s be clear. Our sector is deeply connected to every branch of the Scottish economy and to the wellbeing of our communities. That means every decision taken by our governments in Edinburgh and Westminster can have an impact on people working in convenience retail.

The priorities of the governments of the day affect how people shop, how much money they have to spend and what items they can afford. No industry is better equipped to gauge what policy is working, what people want and how robust a local economy is.

Store owners and staff have families and homes to heat too, so political uncertainty can have a double impact on colleagues. With over 49,000 people in Scotland working in convenience retail, that is a lot of families and a lot of homes.

There is no doubt that global economic headwinds and geopolitical issues have consequences in Scotland. At times like these, we need government ministers focused on rebuilding confidence and stability in the markets.

To some extent, that means setting aside party differences, holding back on impactful and potentially expensive changes, and providing funding where it is needed. There is a time and a place for transformative policy and debate. Now, however, both our sector and the Scottish economy need a clear message, meaningful support and a solid plan for the coming months and years.

It is almost impossible to say just where our industry will be a in a year, but there are many opportunities. We could be at the forefront of advances in technology and the drive toward greener and healthier communities, but only if businesses have the breathing room and confidence to invest and plan for the long term.

BY LIZ WELLS

e Scottish Government’s proposed vaping regulation have again came under re in recent weeks.

e government is proposing a range of regulations, including a ban on e-cigarette advertising on billboards, buses, lea ets and yers, as well as in-store promotional displays, free distribution, brand sharing, and sponsorship agreements.

e SGF has repeated its calls for the move to be scrapped, saying responses con rm its fears that it would hamper the drive for people to stop smoking by making less harmful alternatives less obvious.

e call comes as the proposals to ban the promotion of vaping products in Scotland’s shops have failed to secure majority support in a Scottish Government consultation.

e consultation ran from 3 February to 29 April 2022 on the Scottish Government Citizen Space website. e consultation sought views on proposed regulations that aim to “strike a balance” between protecting non-smokers and making information available to smokers. A total of 757 validated responses were received, the vast majority were from individuals, and there were 43 organisational responses.

More than half (53.8%) of those who responded said that in-store promotional displays should be allowed to remain.

Opponents argued that further regulation would be disproportionate, calling instead for an increased focus on reducing the appeal of e-cigarette products to unintended audiences and on ensuring existing regulations

controlling the sale of them are su ciently enforced.

In addition, 48.6% of those that responded to the consultation said they feared that greater curbs on the advertisement of vaping products would have a negative impact on those living at a socio-economic disadvantage. at compares to 25.5% who believed they would have a positive impact.

Concerns of deepening inequalities echoed those raised by SGF in its response to the consultation. It also highlighted Cancer Research UK projections that suggest the richest h of the country’s population could be smoke-free by 2034, but that the poorest h will not cross the 10% mark by 2050.

SGF Chief Executive Pete Cheema said: “ e opposition here is clear – and the concerns completely legitimate. While well-intentioned to improve the nation’s health, these proposals risk the unintended consequences of actually hampering e orts to make Scotland a smoke-free nation.

“Vaping products are a less harmful alternative to cigarettes and a proven route towards people quitting. If displays of them are banned in shops, fewer people will

realise they are available and fewer people will quit.

“We are not opposing these proposals for the sake of it. We genuinely believe they will make the situation worse rather than better, particularly in Scotland’s most disadvantaged communities. Consultation responses con rm our fears.”

Cheema added: “We should be using every tool available –including vapes – to help people stop smoking, rather than hiding them from view in our shops.

“We know there are concerns around children trying to buy these products, but Scotland’s convenience store sector is committed to the responsible sale of all age-restricted products. We work with our members to share and encourage best practice.”

e UK Vaping Industry Association (UKVIA) has also called on the Scottish government to go back to the drawing board with its proposal to tighten advertising restrictions on vaping.

e organisation says the feedback from the consultation clearly shows that there is no majority of support for the recommendations put forward by the government, instead it divides opinions and leaves more questions than answers on the future of vaping regulations.

John Dunne, Director General of the UKVIA, said: “Only by working with others, following the evidence and listening to people’s testimonies can we succeed in the goal of tobacco harm reduction.”

e Scottish Government said the responses and consultation analysis will “help to nalise the scope of these regulations”.

News Extra Vaping NewsExtra

Scottish Grocers’ Federation

LEGISLATION The Scottish government’s proposals to ban the promotion of vaping products in stores have failed to secure majority support

SLR |NOVEMBER2022 www.slrmag.co.uk14 RAISE A GLASS TO BOOMING DRINKS SALES THIS CHRISTMAS – P44

The SGF and the UK Vaping Industry Association have voiced their concerns about the government’s vaping proposals.

GROCERYAID: THERE FOR YOU WHEN YOU NEED US

The retail industry continues to face challenges, but support is available. GroceryAid’s Welfare Director, Mandi Leonard, advises SLR readers on who GroceryAid are and how they can help.

WHO ARE GROCERYAID?

GroceryAid is a charity that supports the people within the grocery industry, including multiples, wholesalers, convenience stores, independents, manufacturers, and service providers. From store managers to the partners of shop owners, we’ve been helping retailers and their teams for more than 160 years now. We provide a range of support, such as emotional advice and financial assistance, through our free website and confidential helpline.

HOW DOES GROCERYAID SUPPORT RETAILERS AND THEIR STORE STAFF?

Anyone working within the grocery industry can call our free and confidential GroceryAid Helpline, which is available 24 hours a day, 365 days a year and translation support in over 200 different languages. People can also visit our website, which has a wealth of information, as well as the eligibility criteria for each service we offer. Our website also has a live chat function for instant conversation. Support is available from the first day of joining the grocery trade.

HOW IS GROCERYAID WORKING WITH MANUFACTURERS, LIKE JTI UK?

We know that manufacturers have a close working relationship with the retailers that stock their products. It’s important that we collaborate with organisations, like JTI UK, to ensure we’re constantly providing educational information about the free and confidential welfare support that’s available, so they can share this with retailers too. Every month, we send a communication toolkit to our manufacturer supporters, containing a range of assets such as posters, social media assets, case studies and editorial content. All these assets can be used by manufacturers to raise awareness of GroceryAid and all the services that are open to retail colleagues.

ARE THERE ANY PROGRAMMES THAT RETAILERS CAN GET INVOLVED WITH?

There are many! The best way for retailers to get involved is to visit our website, familiarise themselves with all the support available and then spread the word to their teams. Everyone working within an independent retailer can use the free and confidential support that we offer. We encourage retailers to get involved with our continued drive to raise awareness of GroceryAid throughout the industry. More information plus free communication toolkits, can be found on the independent retailer page on our website. JTI’s team of Business Advisers are on hand to signpost grocery colleagues to the support GroceryAid can provide.

IS THERE ANYTHING NEW FOR 2023 THAT RETAILERS SHOULD BE AWARE OF?

We’ve recently partnered with Business Debtline, to provide free advice to self-employed people and small businesses with information and advice. More information can be found on our website. All our support is available to grocery colleagues and in 2023 we’ll continue to work with the sector to provide advice and support. We’ll also continue to offer independent retailers support that’s completely free – no charges and no membership fees.

For free and confidential support that’s available 24/7, 365 days a year, for grocery colleagues, their partners/spouses and dependents, call 08088 021 122 or visit www.groceryaid.org.uk

GroceryAid has been there for industry colleagues for more than 160 years, and the level of support it offers, with the help of manufacters like JTI, keeps on growing.

www.slrmag.co.uk NOVEMBER2022| SLR 15 AdvertorialJTI

DRS CHALLENGE

Many of you will be aware that retailer Abdul Majid is currently in the middle of legal proceedings challenging the legality of the Deposit Return Scheme (DRS) Retailer Handling Fee proposed by Circularity Scotland Limited (CSL).

That challenge has upset a few people and has also led to a slew of often inaccurate press reports. With that in mind, I met up with Abdul and SGF CEO Pete Cheema to find out what’s really behind this legal action.

First off, both Abdul and Pete were at pains to make it clear that they remain committed to a world-class DRS in Scotland and are fully behind local retailers playing an instrumental role in an initiative that will mark a step-change in how Scotland approaches recycling specifically and sustainability in general.

But the caveat is that they want one that is ‘fit for purpose’. In Abdul’s case, fit for purpose for his store in Bellshill and in Pete’s case, fit for purpose for the thousands of local retailers his organisation is charged with representing.

And by ‘fit for purpose’, they mean one that is indeed ‘cost-neutral’ as set out in the original Bill and as reiterated in public on several occasions since by Lorna Slater, Minister for Green Skills, Circular Economy and Biodiversity.

Abdul’s contention is that the Retailer Handling Fee is insufficient to allow cost neutrality and the lack of transparency around how the Fee has been calculated is at the heart of the problem. As Abdul puts it: “If CSL gets the Fee badly wrong, there’s potential for retailers to be wiped out” and for communities across Scotland to be left with no access to a local store.

There are a host of other problems that Abdul and SGF have with DRS, which we will explore in more length in next month’s issue – but the legality of the Handling Fee is what Abdul is challenging – and he thinks he is likely to win his case.

It’s easy to understand why CSL publishing how the Fee was worked out would have been an open invite to all and sundry to tear it to shreds. But the consequence of not publishing how it was worked out, from Abdul’s point of view, is that our sector is left in the dark footing at least part of the bill for imple menting a Scheme that it had no choice in adopting and which will fail in one of its core objectives on day one: being cost-neutral to retailers.

ANTONY BEGLEY, PUBLISHING DIRECTOR

EDITORIAL

Publishing Director & Editor

Antony Begley abegley@55north.com

Deputy Editor

Liz Wells lwells@55north.com

Features Editor

Gaelle Walker gwalker@55north.com

Features Writer

Elena Dimama edimama@55north.com

Web Editor

Findlay Stein fstein@55north.com

ADVERTISING

Sales & Marketing Director

Helen Lyons 07575 959 915 | hlyons@55north.com

Advertising Manager

Garry Cole 07846 872 738 | gcole@55north.com

DESIGN

Design & Digital Manager Richard Chaudhry rchaudhry@55north.com

EVENTS & OPERATIONS

Events & Circulation Manager

Cara Begley cbegley@55north.com

Scottish Local Retailer is distributed free to qualifying readers. For a registration card, call 0141 222 5381. Other readers can obtain copies by annual subscription at £50 (UK), £62 (Europe airmail), £99 (Worldwide airmail).

55 North Ltd, Waterloo Chambers, 19 Waterloo Street, Glasgow, G2 6AY Tel: 0141 22 22 100 Fax: 0141 22 22 177 Website: www.55north.com Twitter: www.twitter.com/slrmag

DISCLAIMER

The publisher cannot accept responsibility for any unsolicited material lost or damaged in the post. All text and layout is the copyright of 55 North Ltd.

Nothing in this magazine may be reproduced in whole or part without the written permission of the publisher.

All copyrights are recognised and used specifically for the purpose of criticism and review. Although the magazine has endevoured to ensure all information is correct at time of print, prices and availability may change.

This magazine is fully independent and not affiliated in any way with the companies mentioned herein.

Scottish Local Retailer is produced monthly by 55 North Ltd.

©55NorthLtd.2022 ISSN1740-2409.

Comment ABDUL’S

SLR |NOVEMBER2022 www.slrmag.co.uk16

Northern Ireland. Bringing our world-class food and drink to your table.

Invest Northern Ireland would like to thank Scottish convenience retailers for their interest at recent trade events.

A growing array of Pure, Natural, Quality products from Northern Ireland is now hitting Scottish retail shelves. Contact us for more information on all that Northern Ireland suppliers have to offer.

Nort hern Ireland. Altogether more.

TIME FOR LOCAL RETAILERS

SUSTAINABILITY?

BY ANTONY BEGLEY

gather some of the

thought it was time

to discuss not only

the

Scheme but also the

help us create a

issue

in

enlisted the help of

month,

So

specialists Tomra to help provide their unique insight and to answer the trickier questions that were bound to come from the panel

and

that joined the session.

Cover Story SLR Sustainability Roundtable

TO ‘OWN’

DRS: so many questions, so little time. With the biggest change to occur in local retailing in Scotland for a generation on the horizon, SLR

to

sharpest brains in

sector

the forthcoming Deposit Return

wider

of sustainability

general. To

very special roundtable at Cameron House last

we

Scottish so drinks giant Barr

Drinks

DRS

of top retailers

ATTENDEES Q Jonathan Kemp, Commercial Director, AG Barr Soft Drinks Q Ewan Dryburgh, Area Sales Manager, Scotland, Tomra Q John Lee, Vice President for Public Affairs UK and Ireland, Tomra Q Jim Carroll, Business Development Manager (Scotland), One Stop Q Javid Ghafur, Londis Breadiland Q Alex Grieve, Tomra Q Stephen Jackson, Area Business Manager, One O One Convenience Retail Q Kevin Lowe, Head of in Store Implementation, Scotmid Q Abdul Majid, Costcutter Bellshill Q Karina Matuszek, Space & Range Planning Manager, CJ Lang Q Ian Mitchell, Premier Girvan Q Julie Ross, Sustainability Manager, Scotmid Q Saleem Sadiq, Spar Renfrew Q Waseem Sadiq, Spar Renfrew Q Shamly Sud, RaceTrack Pitstop SLR |NOVEMBER2022 www.slrmag.co.uk18 With DRS fast approaching, SLR convened a meeting of some of the leading lights in the industry to discuss how the challenges of the new scheme could open a door for local retailers to take ownership of sustainability in Scotland.

SUSTAINABILITY IS INVISIBLE

SLR’s provocative contention and the starting point for the days discussions was the fact that, from a customer’s point of view, local retailers just aren’t engaging with sustainability. Since local retailers must recycle food waste, plastic packaging and cardboard by law – and are therefore already making huge sustainability gains – why is it that you never see any in-store POS highlighting these facts? Why, when you visit the social media pages of local retailers do you almost never see sustainability related posts?

is is in stark contrast to the other members of the supply chain. Producers are falling over themselves to make sustainability improvements to their product and packaging – and never miss an opportunity to shout about it. Very few supplier press releases we receive at SLR Towers these days will fail to mention sustainability. Similarly, the wholesale channel is making great strides forward and is keen to talk about it. Yet retailers, the nal and arguably most important link in that chain, almost entirely fail to communicate to shoppers, despite the fact that they are the only members in the entire supply chain actually able to talk directly to shoppers on a daily basis.

It’s a provocative point to make, but it’s also demonstrably true – as a straw poll at the roundtable demonstrated. All the retailers around the table admitted that they don’t communicate sustainability credentials to their shoppers.

e contention then, is that local retailers should use DRS as a catalyst to take a fresh approach to sustainability and commit the sector to ‘owning’ sustainability in communities across Scotland before the supermarkets do. And to be clear: this is entirely a communications issue. Retailers are already doing more than their bit for the environment. Recycling? Tick. LED lights? Tick. Low energy chillers? Tick.

All that’s missing is telling shoppers that we’re already doing all these things. As open goals go, this one is unmissable. And if local retailers can move towards ‘owning’ sustainability, they can gain a competitive advantage, particularly over supermarkets which face enormous challenges in convincing shoppers that they put the planet and communities before pro ts.

GRASP THE THISTLE

Barr So Drink Commercial Director Jonathan Kemp was quick to urge the retailers in the room to “grasp the DRS thistle.”

He said: “ ere’s no doubt DRS is a bit of a thistle, but it’s one worth grasping because it’s an opportunity for everyone to gain a competitive advantage.”

Kemp explained how usage and attitude studies have revealed consistently that the

environment and sustainability are big factors with consumers, particularly Gen Z consumers in their early 20s.

“Some of them will only buy brands if they believe those brands are they’re doing the right thing,” he commented. And while he wholeheartedly endorsed the idea of retailers getting more proactive in communicating with consumers on sustainability issues, he emphatically warned against ‘greenwashing’.

“It’s so easy for brands and retailers to be accused of greenwashing,” he said. “So you have to be very careful that any claims you are making are absolutely true and honest.”

Ultimately, he concluded, helping educate shoppers is the right thing to do – and talking about sustainability needn’t be dry and dull. If you’ve seen any of Irn-Bru’s recent virgin plastic ads featuring straplines like “I lost my virginity in a factory in Cumbernauld”, you’ll get the dri .

Kemp also suggested that DRS could end up going “the same way as the sugar levy”.

“Sugar was a huge issue at the time with enormous consumer pressure,” he said. “Since the levy came in, however, when was the last time you heard a complaint about sugar in so drinks? ey all disappeared in 2018 when the issue was very much dealt with.”

Tomra’s Ewan Dryburgh then took the chance to clarify the current state of play around DRS and dispel a few myths, highlighting how Scotland’s DRS will be “retailer-led”, which is not true of many other countries around the world which have DRS systems in place. In other words, the responsibility lies with retailers.

e target capture rate for the scheme is 90%, a huge increase in the “30% or so” that Dryburgh says Scotland currently achieves with kerbside recycling. Retailers will be obliged to return the 20p deposit in cash, if requested, so they cannot o er vouchers redeemable only in their store.

LEGAL CHALLENGE

Having clari ed the position on DRS, Bellshill retailer Abdul Majid MBE took the opportunity to explain the thinking behind his recent legal challenge which saw him raise judicial review proceedings in the Court of Session against Circularity Scotland Limited (CSL), the Scheme administrator. He is challenging “the legality of the retailer handling fees that CSL is seeking to impose on retailers”.

Abdul has hit the headlines of late and has come in for some ak from some corners, so this was a welcome opportunity to discuss his thinking.

“First and foremost, I am absolutely committed to helping deliver a world-class DRS for Scotland,” he said. “ at has never been in question – but that DRS has to be t for purpose. Retailers have been instructed that they are to deliver the DRS but my huge concern is that the proposed retailer handling fees will not cover my costs, or those of other retailers in Scotland. is could be seriously detrimental to my business and to many other businesses both in the short and long term. is could threaten the viability of my stores which provides key services and groceries to our community in Bellshill.”

e heart of the matter here is essentially that CSL has not revealed how it arrived at the proposed handling fees. e logic behind taking that route is obvious: if they did reveal how they did their sums, it would have been an open invitation to all and sundry to publicly tear the calculations apart. e only other option – the one that was taken – was to commission an independent body to calculate the handling fees, thereby distancing themselves slightly from the issue.

“My argument is that the Bill says the Scheme must be cost neutral to retailers,” said Abdul. “And CSL doesn’t appear to have considered a number of factors like the cost of doing whatever

Cover StorySLR Sustainability Roundtable www.slrmag.co.uk NOVEMBER2022| SLR 19

retailers need to do to be able to incorporate a reverse vending machine (RVM) into their store. And these costs will vary store by store.”

Abdul also highlighted how opting out of the Scheme is not a valid option either: “We’ve been told that if you don’t like it you can opt out, but retailers are risking the viability of their business if they opt out. I have absolutely nothing against DRS but livelihoods are on the line here and if CSL gets the handling fee gure badly wrong there’s potential for retailers to be wiped out.”

WHAT IF?

Stephen Jackson of One O One Convenience Retail then pondered what would happen if Abdul wins his case. “What if the judge asks what the solution is?” he asked Abdul.

Abdul’s hope is that some form of grant or interest-free loan is made available to retailers to buy the RVMs and help mitigate the capital outlay.

Stephen also said his business had many concerns over DRS and said that the legal challenge is right if the Scheme isn’t going to be cost neutral as repeatedly promised.

“We too are worried that CSL hasn’t factored in all the costs that we know we will incur in implanting DRS,” he said. “ e removal of selling space for an RVM represents a cost, pest control will be a cost, cleaning the storage bins will be cost and there will be the obvious cost of paying all the deposits upfront when retailers buy from their wholesaler or supplier.

“And even if retailers do choose to do manual handling, they can’t even prepare for that because we don’t know the cost of the bags yet!”

Many of the group also agreed that drinks containers will become a risk because they will have moved from being rubbish to being assets with a substantial value – 20p for every one. Well worth stealing, in other words.

“You can see storage space becoming more valuable than selling space,” said Stephen.

Karina Matuszek of CJ Lang shared that Spar’s modelling predicts that DRS won’t be costneutral to the business because the majority of its stores are under 2,000sq .

Scotmid’s Kevin Lowe added that, from his experiences sitting on the Scottish Retail Consortium DRS forum, the numbers don’t even work for the big retailers either.

MULTIPACK PROBLEMS

Once DRS is in place, however, retailers are likely to see a shi in buying patterns, according to AG Barr’s Kemp. “Our learnings from Australia showed an initial signi cant move into larger containers, and we predict a move away from large 24-packs, for instance, into larger bottles – which is a real opportunity for local retailers.”

With a at 20p deposit regardless of container size or price point, that prediction makes intuitive sense. A 24 pack of anything is going to increase in price overnight to the customer by £4.80. is is another opportunity for local retailers who can o er chilled 4 or 6-packs. DRS may also accelerate the ‘little and o en’ shopping model that is already in evidence.

Interestingly, Kemp also predicted a shi from cans into PET bottles. “If you take the example of schoolkids or o ce workers. ey won’t want to carry an empty, sticky can around in their schoolbag or briefcase all day, so they may shi into re-closeable plastic bottles, which is odd as it would be driving shoppers into plastic rather than out of it as DRS is meant to be doing.”

LET’S OWN IT

Scottish Local Retailer of the Year Shamly

Sud returned to the discussion point around consumer communications, admitting that while her business had made massive strides in improving its environmental credentials, they hadn’t communicated that fact to shoppers.

“We’ve got heat exchangers and smart fridges and solar panels and rainwater capture technology and so on – but we haven’t told our customers about any of that, and we really should have,” she said.

Scotmid’s Kevin Lowe questioned whether customers really wanted to know that Scotmid has digital SELs in every store. It’s a fair question but what could be the harm in telling them? It will surely be viewed positively by at least some shoppers.

Renfrew Spar retailer Saleem Sadiq stated that he believes customers “are only interested in price” and that at the end of the day “will all come down to the price at the tillpoint”.

LAYING GROUNDWORK

One of the most obvious challenges and a clear and present danger is that, come 16 August next year, customers remain oblivious to DRS. Consumer knowledge of DRS at this point is “shockingly low”, according to AG Barr’s Kemp.

“ ere are some radio ads running at the moment,” he said, and believes that producers and brand owners will ultimately do a good job of amplifying the message the closer we get to D-day – “because it’s in our own interests”.

But the fact remains that CSL has a job of work to do in the time that remains if they are to avoid the all too common situation where it’s le to local retailers and their teams to explain DRS to disgruntled shoppers wanting know why the price of their case of beer has shot up by £4.80 overnight.

e lesson, then, is to do what you can to start talking to your shoppers in good time about DRS and what it will mean for them.

Javid Ghafur of Londis Breadiland explained that is already planning to have an RVM installed in his store in February to get ahead of the game and nd out how it works before the system actually goes live.

“We plan to fund four gardening projects in our local area with a 5p deposit from the machine, which we will fund ourselves until August,” he said.

Cover Story SLR Sustainability Roundtable SLR |NOVEMBER2022 www.slrmag.co.uk20

Put recycling to work for you

Scotland’s deposit return scheme (DRS) is just around the corner. TOMRA are global providers of reverse vending machines, digital tools and specialist services that make collecting bottles and cans in Scotland’s DRS simpler and more rewarding for both you and your customers. Learn more at tomra.com Get in touch: tcs.uk@tomra.com

A bold and potentially expensive move but there is a strong logic there. Not only will Javid truly begin to ‘own’ sustainability in his community, he will also have created shopping patterns and loyalty. If his shoppers get used to bringing their containers back to his store, they’re less likely to go elsewhere in August when the Scheme actually goes live.

Leaving it until the very last minute to comply with DRS means standing on the start line with every other retailer in your area waiting for the gun to go o . Why not start a month or two early and give yourself the chance to create a little loyalty and establish some buying patterns that might then serve you well a er 16 August.

RVMs

e conversation then turned to RVMs with Saleem Sadiq stating that “RVM manufacturers aren’t transparent enough on pricing because I need to know how long it will take me to pay the machine o ”, a query rebutted by Tomra’s Dryburgh as what looks like a simple question actually turns out to be quite complex. What size and type of machine do you want, what type of service package do you need? e list goes on.

But Saleem’s question is one that many retailers will be asking themselves over coming months.

And choosing an RVM is massively complicated by the fact that Bi a, the company responsible for all upli s from all 37,000 return points in Scotland, can’t at this stage con rm

the upli schedule for each individual point, for fairly obvious reasons. Will it be every two days? Every week? Every two weeks?

e answer to that question will have a critical bearing on the type of machine each store will need. And what happens if retailers choose one machine and subsequently nd they need a bigger (or smaller one)? Will the RVM suppliers happily provide a new one and take the old one away a month or two into the contract?

SCHEME ARTICLES

Part of the discussion centred around so-called ‘scheme articles’, the containers in scope of the regulations.

Kemp con rmed that AG Barr produce Scottish-speci c SKUs featuring the deposit information on-pack. “We will absolutely help consumers understand what bottles do and don’t have deposits on it,” he said.

He also explained that manufacturers e ectively have three choices: register existing SKU as scheme articles (opening up the risk of fraud); create Scotland-only SKUs (creating potential confusion between deposit and nondeposit SKUs at transition time); or simply delisting some products in Scotland.

Price Marked Packs will also become a challenge. AG Barr plans to move to new PMPs with the deposit clearly highlighted, but there is some obvious scope for customer confusion depending upon how each producer chooses to implement PMPs under DRS.

CONCLUSION

As the three-hour conversation began to wind up, it became clear that while every retailer around the room would opt for an RVM solution over manual handling, most if not all will also run a manual handling system in parallel, just in case the machine breaks down or an unforeseen problem occurs.

Kevin Lowe said that was certainly Scotmid’s plan and also threw in the quirky and related fact that Mateus Rosé bottles don’t actually t into an RVM.

e hope, however, a er all of this long debate is that DRS ultimately becomes something of a dull non-event. e initial urry of interest will quickly die away and both retailers and consumers will just get used to it and get on with it.

“In the Scandinavian countries, they see recycling as money and they get into the routine of using the same return point,” concluded Abdul Majid. “In Scotland, we’re all small stores in the heart of our communities that people pass by on their way to wherever they’re going. It makes sense for them to come into our stores, getting rid of the bottles and then continue. e potential is huge.”

Cover Story SLR Sustainability Roundtable SLR |NOVEMBER2022 www.slrmag.co.uk22

If you produce or import drinks for sale in Scotland, then you will have new obligations under the Deposit Return Scheme. Registration with Circularity Scotland opens on 1st December 2022. Sign up now to find out how to get your business ready at circularityscotland.com/getready ready Get your business

Recycled packaging first for Cadbury

Mondelez has announced that Cadbury Dairy Milk and Cadbury Mini Snowballs 110g sharing bars are now wrapped in flexible packaging made with 30% recycled plastic. The new packaging, which has started rolling out on more than 28 million sharing bars, will be independently certified by environmental organisation International Sustainability and Carbon Certification.

Frubes enters metaverse with on-pack minigame

Frubes has launched what it says is the yogurt-in-a-tube category’s first-ever augmented reality on-pack minigame. Available now, new packs welcome six new characters to the Frubes family and feature a QR code that allows children to explore the brand’s bespoke augmented reality world. The launch is supported with TV, video-ondemand, gaming platform, and shopper marketing activities.

Yakult campaign helps shoppers feel good As part of its ongoing ‘Feel Good’ campaign, Yakult is giving shoppers the chance to win seven luxury breaks as well as thousands of feel-good prizes. Three million packs of Yakult and Yakult Light (7 x 65ml) feature the on-pack giveaway, available until 30 November. The competition is bolstered by a health and wellbeing influencer campaign, alongside digital and PR activities.

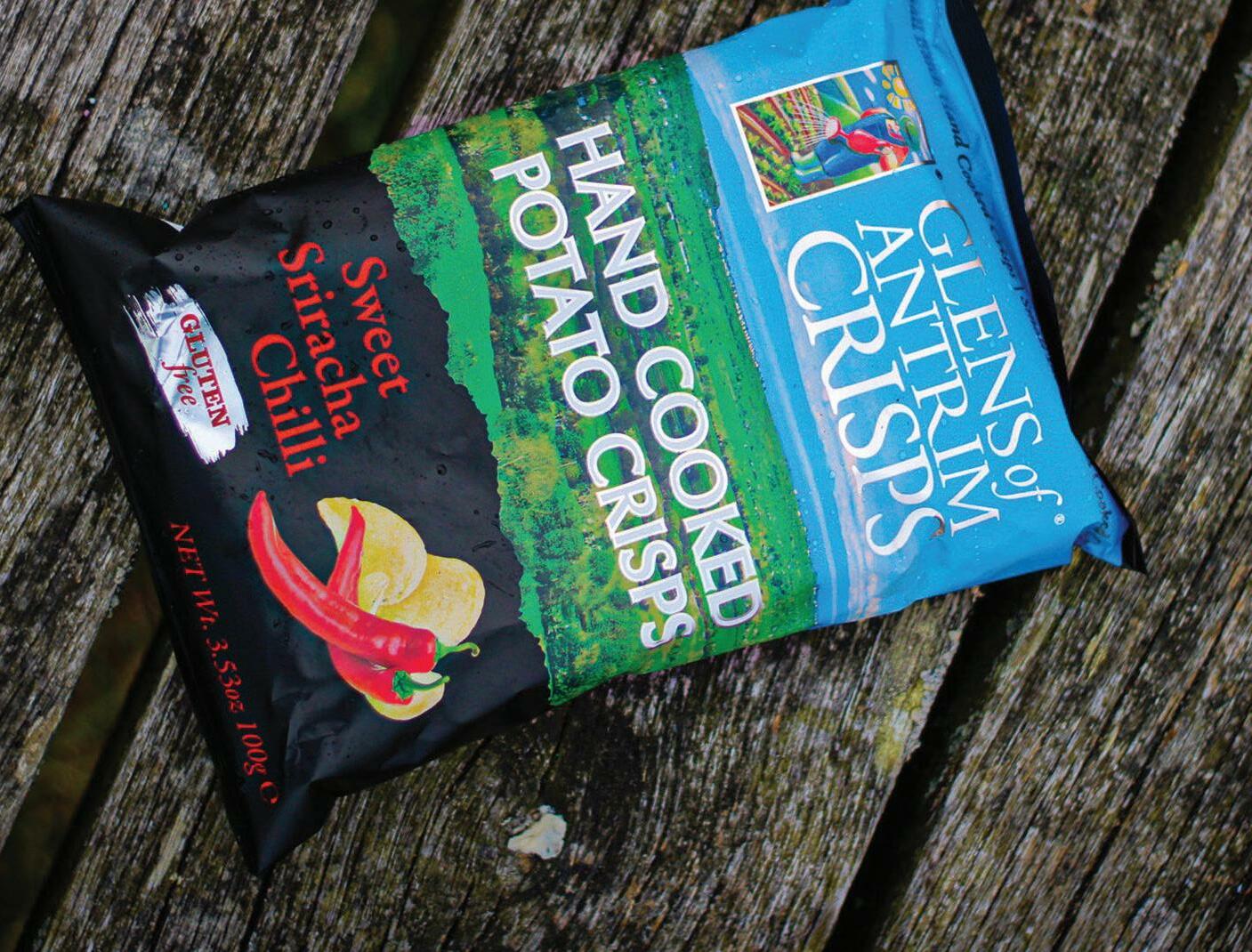

Tyrrells gets festive makeover KP Snacks has unveiled new, Christmas packaging for its Tyrrells brand, running across sharing bags of Lightly Sea Salted, Mature Cheddar & Chive, Sea Salt & Cider Vinegar, Sweet Chilli & Red Pepper, and Veg Crisps with Sea Salt. Packs feature the usual Tyrrells characters wearing paper crowns, Santa and elf hats, or carrying gifts with big bows.

Product

Skittles seeks to document LGBTQ+ history

As the UK celebrates 50 years of Pride, Skittles has partnered with Gay Times, Queer Britain and Getty Images to ll the gaps within the LGBTQ+ historical archives.

e work is part of the brand’s #Recolour eRainbow campaign, and calls on the queer community and allies to submit their own photos from Pride’s history.

e partners are collaborating to help develop and create the LGBTQ+ archives of tomorrow, shaping them into dynamic and representative collections. Together, the group will document and represent the historical and current experiences of the queer community.

SOFT DRINKS

LGBTQ+ representation in archives, museums and galleries is severely lacking. While queer people have always existed, documentation of the community and experiences has o en been obscured or erased due to legal persecution.

Suntory’s new website helps drive soft drink sales

Suntory Beverage & Food GB&I (SBF GB&I) has launched SimplySoftDrinks, a brand-new website just for retailers.

Live now, SimplySoftDrinks offers information, advice and tools, including channel-specific planograms, to support retailers in driving their sales in the category. Its free category advice is geared towards independent retailers, including convenience stores, forecourts, foodservice and health & fitness operators.

Crucially, no login details are required – all the information is free to view at any time from any device. Furthermore, the advice appears to be impartial, and there’s at least one Scotland-specific planogram.

The bespoke website features a wealth of SBF GB&I’s latest insights, to give retailers the best snapshot of the soft drinks category. It will be updated regularly with the latest insight as it evolves.

SimplySoftDrinks includes a category insight guide, including a look at the macro trends currently helping to grow the category, including health and wellbeing and sales spikes around events. There are ranging top tips, with actionable, channel-specific insights to maximise the growth opportunities, including online. Retailers can also find advice on how to offer shoppers the right range of products and achieve visibility.

Retailers can view the new website at simplysoftdrinks.com.

e group is hunting for images that have never been published before. ose who submit their images to recolourtherainbow. co.uk are also in with the chance to have their pictures published in Gay Times and donated to Queer Britain’s collection.

APPOINTMENTS

New Imperial boss named

Oliver Kutz has been named as Imperial Tobacco’s General Manager UK & Ireland.

With over 20 years’ experience in the tobacco industry, Kutz brings a wealth of knowledge and expertise to the role, having previously been General Manager

Central & Eastern Europe at Imperial Brands in 2021. Prior to this, he held the position of President and CEO of ITG Brands, a subsidiary of Imperial Brands.

With a PhD in Marketing from the University of Hamburg, Kutz frequently lectures as part of the International MBA Programme at the same institution. He is the author of several books and articles on business strategy and brand management.

News SLR |NOVEMBER2022 www.slrmag.co.uk24 Products

News

CONFECTIONERY New partnership continues #RecolourTheRainbow campaign

KEEP UP WITH THE LATEST NEWS AS IT HAPPENS – FOLLOW US ON TWITTER @SLRMAG WHAT’S FRESH ON THE FORECOURT? – P46

Coca-Cola expands football partnerships

Coca-Cola has announced new and extended partnerships with a number of leading football clubs across Europe, in a bid to unite fans over their love of the beautiful game.

Collaboration with women’s and men’s teams from clubs such as Bayern Munich, Juventus, Liverpool, PSG and Spurs will give fans access to matchday experiences, hospitality tickets, money-can’tbuy moments with players, and limited-edition merchandise prizes.

e collaborations focus on Coca-Cola and CocaCola Zero Sugar, to build on the brand’s long-standing association with football, while continuing to drive awareness of its sugar-free alternative.

In 2023, the so drinks giant will also use the partnerships to kick o a brand-new campaign, created to bring football fans across Europe together to enjoy their favourite matchday meals with an ice-cold Coke.

Michael Willeke, Integrated Marketing Experience Director, Europe, Coca-Cola, said: “Having been an integral part of the football matchday for decades, we are excited to o er fans the chance to enjoy incredible experiences and unique moments, at home, at bars and restaurants and in the stadiums, as part of our new campaign.”

FROZEN Roasties get more inclusive Aunt Bessie’s supports partially sighted with packaging first

In what it says is a rst within the Frozen category globally, Aunt Bessie’s has introduced NaviLens technology to the packaging of two of its biggest-selling SKUs, as it partners with the Royal National Institute of Blind People (RNIB) to support visually impaired shoppers.

Initially appearing on Aunt Bessie’s 10 Glorious Golden Yorkshires (190g, RSP £2) and Crispy & Flu y Roasties (1.3kg, RSP £3.35), NaviLens technology uses tags, accessed through an app which provides audible product information and navigation, to assist the visually impaired and making packaging more inclusive.

Navilens tags can be read by devices like smart phones up to 12 times further away than QR codes and with no focus required. is eliminates the need for a shopper to know the exact location of the code and helps them locate items more easily both in-store and at home.

CONFECTIONERY

Jacob’s joins forces with FareShare

Jacob’s has unveiled a year-long partnership with FareShare that will see the pladis brand donate 40,000 meals to support the food waste charity’s network of nearly 9,500 organisations. Fronting the campaign are Olympic goldmedallist Greg Rutherford and his wife, social media influencer Susie Verrill. The couple will create social media content showcasing easy ways shoppers can reduce food waste at home.

KP reformulates popchips to be non-HFSS

KP Snacks has launched its newly reformulated non-HFSS popchips portfolio. The range, which includes Sea Salt, Sea Salt & Vinegar, Barbeque, and Sour Cream & Onion variants, was reformulated to comply with legislation introduced in England last month. The new rules don’t apply north of the border, although the Scottish Government plans to introduce similar measures.

Mackies maker expands with popcorn purchase

Mars Wrigley has said that, from next year, all the cocoa used in its European production will be 100% responsibly sourced.

Benjamin Guilbert, Vice President Procurement at Mars Wrigley Europe, CIS & Turkey, said: “As one of the world’s largest buyers of cocoa, we have a responsibility to help drive positive, long-lasting, systemic impact to support the farmers and communities in our supply chain.”

Taylors Snacks has bought popcorn manufacturer South Yorkshire Foods. The move brings production of the Perthshire-based snack manufacturer’s popcorn range in-house and secures 60 jobs in Sheffield. The acquisition will also see Taylors – formerly known as Mackies at Taypack – take over the production and distribution of South Yorkshire Foods’ ‘Big Night In’ range.

Batchelors unveils pricemarked pots

Batchelors has introduced new 89p price-marked packs across its Super Noodle and Pasta pots ranges. The new packs “support retailers who are looking to display great value credentials in the current climate”. Premier Foods said offering value and delivering a strong, engaging message that provides shoppers with ‘value-confidence’ is “more important than ever”.

NewsProducts www.slrmag.co.uk NOVEMBER2022| SLR 25 SOFT DRINKS Coke teams-up with big-name clubs

Mars Wrigley Europe commits to 100% responsibly sourced cocoa

Jägermeister promo offers cool prizes

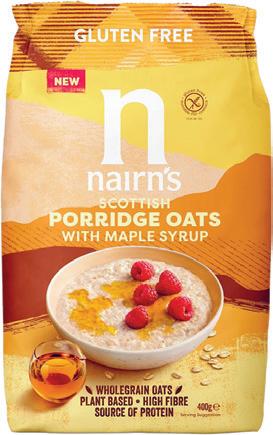

Mast-Jägermeister has launched a new on-pack promotion to encourage consumers to store Jägermeister in their freezers. When chilled to -18 degrees Celsius, a secret code appears on the back label of promotional packs, giving consumers the chance to win more than 1,500 prizes including a once-in-alifetime European Jägermeister festival experience for four.