ready

Renewable energy solutions, like Entergy Mississippi’s 100-megawatt Sunflower Solar Station in the heart of the Delta, are becoming increasingly available across the state so industries can work smarter to achieve their goals while reducing greenhouse gas emissions. Maximize your savings with the power of renewable energy in Mississippi – where we are proud to be a leader in working toward clean and efficient energy usage.

SEE WHERE MIGHTY MISSISSIPPI CAN TAKE YOU. Visit MISSISSIPPI.ORG/energy to learn more.

Top Talent. Top Companies. Arizona tops the list.

In Arizona, you’ll find the perfect balance of business opportunity and high-quality lifestyle that makes it a top state to live and work. Businesses benefit from pro-innovation policies and business stability. Residents enjoy a reasonable cost of living and beautiful scenery, all while taxes remain low for everyone. With a highly skilled talent pool and a commitment to future-forward industries like semiconductors, electric and automated vehicles and battery manufacturing, we’re maximizing our potential for generations to come.

•

•

•

•

features

16 Inflation Reduction Act Promotes the Nation’s “Energy Security”

The clock is ticking for manufacturers to get maximum tax benefits on new projects under the Inflation Reduction Act.

20 ESG: The New Metrics in Construction and Real Estate

Key environmental, social, and governance (ESG) considerations include protecting the environment/ reducing energy use, making positive contributions to the community, adopting inclusive workplace policies, and maintaining high standards of governance.

23 Fixing the Supply Chain with AI and Robotics

Automation, industrial robots, and other technology solutions have allowed manufacturers to shorten their supply chains, while also making them more efficient and reducing labor costs.

26 To Cluster or Not to Cluster…That Is the Question!

Although clusters are here to stay in some sectors — think life sciences — other industries — among them EVs and semiconductors — are geographically branching out.

FOOD PROCESSING

66 Three Big Challenges Facing the Food & Beverage Industry

While every industry — and everyone — has faced disruptions over the last couple of years, the food and beverage industry has been disrupted on an almost unimaginable scale.

69 Food Processors’ Optimal Location Decision

Whether evaluating existing buildings or finding a location for a new facility, food processors must make sure all the variables involved align to support the final decision.

lOve we

what’s next-ers momentum builders game changers companies with vision world-first innovation industry revolutionizers competitive edge seekers

Wisconsin loves to help all sorts of companies find their version of success. That includes yours. From site selection through construction, opening and expansion, we provide support to ensure your vision becomes reality. After all, your success may inspire other companies to relocate or expand here, too. That’s how we look forward.

73 Bright

Spots of the Office Sector

The post-pandemic remote working trend has resulted in “emerging” or “other” metros performing better than the more established tech markets.

76 Factoring Mexico Into a Solution to the Global Supply Chain Crisis

While its proximity to the U.S. and lower labor costs make Mexico a good location for a manufacturing operation, other costs may be higher, and its supplier base still lacks maturity.

INNOVATION CORRIDORS

From robotics to EVs, from semiconductors

hubs of innovation are advancing economic development across the nation.

• Front Line: Taking a Deep Dive into Suppliers’ Labor Force

• Economic Impact and Importance of Social and Policy Issues

• Amid Rebound, U.S. Regains Position as World Leader in FDI

• Decision-Making Dynamics in an Uncertain World

• Only the Best Is Good Enough: The LEGO Group Chooses Virginia for U.S. Manufacturing Facility

• New Report Shows NYC Economy Going Strong

• Eight Public Private Partnerships Strengthening Michigan’s Talent Pool

No Signs of the War for Talent Cooling Off

Much has been written about the Great Resignation that occurred in 2021 as a result of the COVID-19 pandemic as U.S. workers looked for a better work/life balance, increased compensation, safer working conditions, or a company culture more aligned with their values. Now, nearly three years after the global pandemic began, the number of people who are either working or looking for work has not fully recovered to pre-pandemic levels, let alone grown as it should have over the course of that time.

In the Workforce supplement to this issue (beginning on page 29), several consultants, who help companies satisfy their workforce needs when choosing a location, address the challenges businesses are facing and how they are navigating the post-2020 talent landscape.

The search can begin with an analysis of a location’s workforce data, i.e., demographics, wages, unemployment rates, etc. But qualitative information — such as information about competitors and community dynamics — also comes into play. In light of this, businesses are now looking at smaller less established markets to satisfy their labor force requirements. These markets often have lower living costs, thereby exerting less pressure on wages, and less competition for the available talent.

Companies need to have a better understanding of the reasons why individuals migrated to certain areas of the country during the pandemic in order to attract workers who are open to changing locations. They must also reprioritize their diversity, equity, and inclusion (DEI) efforts to acquire and retain the best talent. Increased diversity and inclusion in the workforce will enhance employee performance and increase company innovation.

The workforce trends highlighted above are also reflected in many of the articles comprising the rest of this year-end issue. For example, Moody’s data reveals that remote working trends have resulted in “emerging” or “other” metros performing better than more established tech markets. Graycor explains how a company’s adherence to ESG principals — which includes how the company treats its employees — is vital to the construction industry and its subcontractors. And food processors and makers of food processing equipment are among the manufacturers dealing with acute labor shortages.

It’s projected that the war for talent will continue in 2023 with many companies increasing their use of AI and automation to fill the gap and reduce labor costs. Savvy companies will also invest in upskilling current employees. Those that do will be one step ahead.

www.areadevelopment.com

2022 Editorial Advisory Board

Josh Bays, Principal site selection group

Marc Beauchamp President & CEO cai global group

H. Robert Boehringer III, Managing Director Global Location and Expansion Services kpmg

Brian Corde Managing Partner atlas insight

Kate Crowley Principal baker tilly capital

Dennis Cuneo Owner dc strategic advisors

Courtney Dunbar Site Selection & Economic Development Leader burns & mcdonnell

Amy Gerber Executive Managing Director Business Incentives Practice cushman & wakefield

Stephen Gray CEO gray

David Hickey Managing Director hickey & associates

Anthony Johnson President Industrial Business Unit clayco

Scott Kupperman Founder kupperman location solutions

Bradley Migdal Executive Managing Director Business Incentives Practice cushman & wakefield

Daniel Oney Managing Director newmark

Matthew R. Powers Managing Director Industrial Real Estate & EVP Retail/E-Commerce jll

Carolyn Salzer Director Americas Head of Logistics & Industrial Research cushman & wakefield

Chris Schwinden Senior Vice President site selection group

Eric Stavriotis Senior Vice President Advisory & Transaction Services cbre

Steven Tozier US-East Region Credit & Incentives Leader ey

AREA DEVELOPMENT

Publisher Dennis J. Shea dshea@areadevelopment.com

Sydney Russell, Publisher 1965-1986

Business/Finance Assistant Barbara Olsen (ext. 225) olsen@areadevelopment.com finance@areadevelopment.com

Advertising/National Accounts advertising@areadevelopment.com

Art

Circulation/Subscriptions circ@areadevelopment.com

Production Manager Jessica Whitebook jessica@areadevelopment.com

Business Development Manager Matthew Shea (ext. 231) mshea@areadevelopment.com

Digital Media Manager Justin Shea (ext. 220) jshea@areadevelopment.com

Web Designer Carmela Emerson

Halcyon Business Publications, Inc. President Dennis J. Shea

Correspondence to: Area Development Magazine 30 Jericho Executive Plaza Suite 400 W Jericho, NY 11753

Phone: 516.338.0900 Toll Free: 800.735.2732 Fax: 516.338.0100

Chris Volney Senior Director Americas Consulting/Labor Analytics cbre

Dan White Director Government Consulting & Fiscal Policy Research moody’s analytics

Joshua Wright Vice President Economic & Workforce Development emsi

Scott J. Ziance Partner vorys

‘Tis the Season for

Even Saint Nick knows Kentucky is the best location to ship products anywhere in the world in a single night

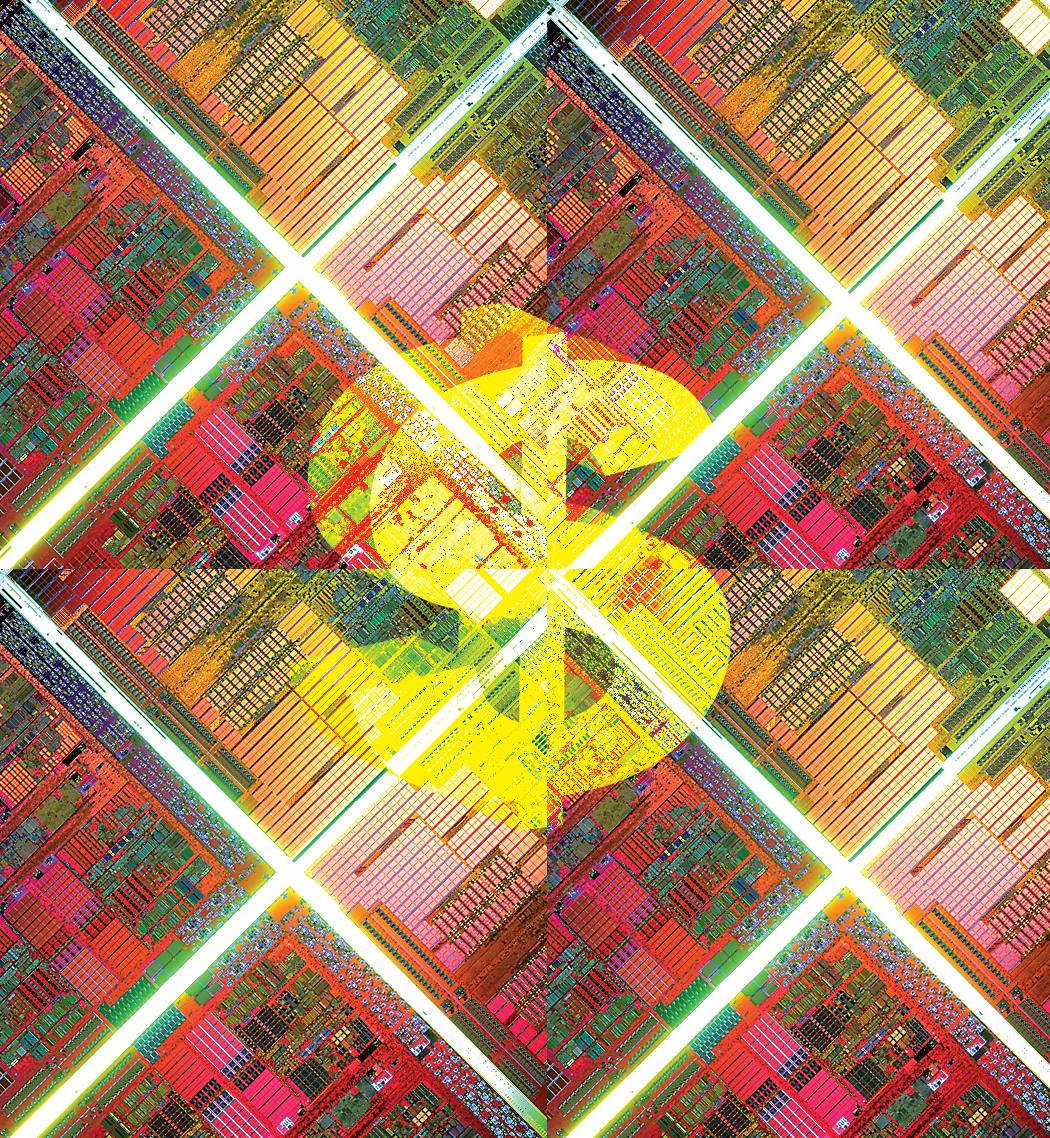

The CHIPS Act: A Historic Investment in Our Future

By helping to provide a critical domestic supply chain, the CHIPS Act represents a new era of American industrial competitiveness.

BY QUENTIN L. MESSER JR., CEO, MICHIGAN ECONOMIC DEVELOPMENT CORP.

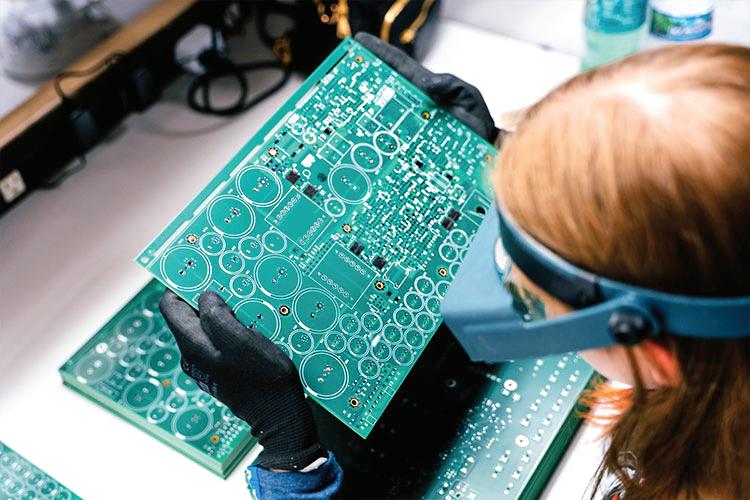

Since this summer’s passage of federal legislation aimed at boosting domestic semiconductor manufacturing, several chipmakers have announced plans to build new fabrication facilities in the United States. Fortunately for the country, the CHIPS and Science Act won’t just be a gamechanger for the semiconductor industry.

Encouraging the manufacturing of microchips at home means providing critical domestic supply chain support for businesses dependent on these critical electronic compo-

conductor chip availability. Chips are a key component of emerging technologies, including 5G wireless devices, artificial intelligence software, electric and autonomous vehicles, and cryptocurrencies — in short reaching every single business sector.

The global chip shortage has hurt the production of cars and other essential American products. Increasing the access and availability of semiconductors is crucial for our national and economic security

American semiconductor industry will also foster a vibrant innovation ecosystem that creates new opportunities. It’s easy to forget that Americans invented the transistor, a tiny semiconductor device that allowed for the precise control of the amount and flow of current through circuit boards. The birth of the semiconductor industry was the force behind the computer revolution. The next great digital invention is being built in an American garage as we speak. In Michigan, we celebrate the CHIPS Act! Michigan helped lead the bipartisan charge for the bill’s passage because we know the stable supply of chips is vital to building a championship economy in our state and nationwide. The average passenger vehicle may have 1,200

CREATING A MORE ROBUST AMERICAN SEMICONDUCTOR INDUSTRY WILL ALSO FOSTER A VIBRANT INNOVATION ECOSYSTEM.

as we compete for technological leadership on a global playing field, ensuring that Michigan-based companies like Whirlpool, GM, and Ford are able to

different chips that serve as the brains of a variety of automotive systems, from cruise control and entertainment to lane-departure warnings and other modern safety features. The transition to EVs and other propulsion systems will only increase the demand for chips, thus underscoring the necessity of a domestic chip supply chain.

Federal economic policies like the CHIPS Act validate all the work we’re doing in Michigan to support industrial sectors critical to our economic growth and future.

Michigan is home to several companies driving

a growing semiconductor supply chain ecosystem domestically and advanced research in semiconductor device and circuit fabrication at the University of Michigan among other Michigan universities. In 2018, KLA, a high-tech, Fortune 500 company specializing in systems and software integral to chip and electronics manufacturing, chose Michigan for the location of second headquarters facility, creating 600 jobs in Ann Arbor.

SK Siltron CSS has invested $300 million in a new semiconductor wafer manufacturing and R&D facility near Bay City. SK Siltron CSS will expand the production of much-needed silicon carbide wafers, considered the future of the industry because of their ability to efficiently transfer energy. Hemlock Semiconductor Operations, the largest producer of polysilicon in the United States, recently announced plans to invest $375 million to modernize and expand operations in the state. And in the Upper Peninsula, Calumet Electronics on Michigan’s scenic Keweenaw Peninsula is positioned to be one of the few domestic IC (integrated circuit) substrate suppliers in the U.S.

The CHIPS Act represents a new era of American industrial competitiveness. Building upon Michigan’s innovative tradition and unsurpassed advanced manufacturing heritage and cognizant of the hard work ahead, we are moving with confidence to create a better future to ensure we take full advantage of economic opportunity afforded by the CHIPS Act.

for free site information, visit us online at www.areadevelopment.com

“ IN MICHIGAN, WE DREAM BIGGER.”

Dreaming. Innovating. Growing. It's how Michigan talent is making an impact on the world in key industries. From tech to mobility to advanced manufacturing, there's a different kind of hustle here. Expand your business in Michigan and get access to support, camaraderie and new opportunities.

Make the move at michiganbusiness.org/pure-opportunity

Co-Founder, Duo Security

Co-Founder, Duo Security

Taking an Expanded View of Climate Change

Climate change, corporate sustainability/ESG ratings, and the use of renewables are becoming increasingly important to companies as the planet heats up.

These concerns have begun to affect facility design, according to Wassmansdorf. He has worked with a client who wants to have a manufacturing facility using “new to the world” renewable power. Also, in the event of power loss from the grid, how can solar or a company’s own resources combined with batteries or backup generators provide better continuity?

BY DAN EMERSONSummer 2022 — a season marked by historic heat waves, widespread drought, and torrential rains — ranks among the hottest on record, according to data from NASA and the National Oceanic and Atmospheric Administration (NOAA).1

During a triple-digit wave in California, Governor Gavin Newsom issued a state of emergency, ordering some manufacturers to cease operations, encouraging electric vehicle drivers to charge at night, and allowing ships in harbor to keep their engines on instead of using shore power from the grid.

With climate data showing that summer 2022 was part of a long-term trend, and not a fluke occurrence, it’s no wonder that climate change has become a more urgent factor for companies in many industries, particularly manufacturing. In fact, the Urban

Land Institute and LaSalle Investment Management recently released a new report on how climate risk assessment can help protect people and property.2

Part of the Site Selection Equation

The risk of natural hazards has always been part of the site selection equation, says Gregg Wassmansdorf, senior managing director of Global Consulting for New-

Will climate concerns cause manufacturing companies to start favoring locations in more northern latitude locations, or farther inland? It’s too soon to say, Wassmansdorf says, “but I think that will be a natural outcome and a specific function of what a specific business needs for that operation.” For example, “if your process relies heavily on water for cooling or being consumed in process, as in food and beverage manufacturing, the likelihood you would go to drought-prone locations is going to be reduced.”

Reliability of the Electric Grid

One of Wendt’s manufacturing clients doesn’t want to source energy from coal, so it factored in the percentage of renewable kilowatts a local utility could deliver. Doing so would reduce its environmental impact and also lower the carbon intensity score, which is part of the company’s ESG (environmental, social, and governance) rating, he says. The client company hopes to take advantage of wind production offsets offered by a particular locale.

ESG is a proposed corporate sustainability disclosure by the U.S. Securities and Exchange Commission, which other non-SEC companies are adopting as a common standard to benchmark how their corporate commitments, performance, and business model compare with their peers.

THE RISK OF NATURAL HAZARDS HAS ALWAYS BEEN PART OF THE SITE SELECTION EQUATION.

mark. Risks like hurricanes, earthquakes, and floods have always been assessed either as a “fatal flaw” to eliminate a particular location, or as part of the short list considerations to pick one location over another, he says. But in recent years, “more and more climate change-related factors are expanding the field of view around natural hazard risk,” Wassmansdorf says.

Cory Wendt, a principal with Baker Tilly who focuses on manufacturing and distribution advisory, says the reliability of the local electrical grid has grown in importance as a site selection concern. One example: for manufacturers whose processes discharge a large amount of water, a municipality’s capacity to handle high-strength wastewater — or its ability to expand its capacity — might be major factors in choosing a locale.

Companies are also re-evaluating their supply chains with the goal of reducing “upstream” shipping-related impact on the environment, Wendt says. He notes that the 2022 Inflation Reduction Act includes multiple incentives for manufacturers to invest in infrastructure that helps reduce their energy footprint — changes that can also help make many otherwise non-economical sites now possible.

One incentive example is investing in a digester that can be used to turn high-strength wastewater into energy. Doing so can earn an Investment Tax Credit to cover 30 to 50 percent of capital costs, Wendt explains.

1 https://www.noaa.gov/news/us-sweltered-through-third-hottest-summer-onrecord

2 https://www.lasalle.com/company/ news/uli-lasalle-provide-framework-forreal-estateindustry-to-assess-climate-risk

for free site information, visit us online at www.areadevelopment.com

What were your company’s major challenges caused directly by the pandemic, and how did you handle them?

Norheim: Our major challenges matched those of many other companies, including supply chain hurdles, remote workforce management, and obstacles caused by operating during the pandemic since we were classified as an essential business. But our workforce rallied. We persevered and overcame many obstacles in our path, even though it was difficult.

Do these problems continue to be “pain points” for American Crane and other manufacturers as well? Will the industry get back to “normal”?

Norheim: The pandemic was a painful experience to endure, but it also presented us an opportunity to grow and innovate our skills to meet the challenges before us. For example, we implemented digital transformations that were at least three times faster when compared to what we would normally accomplish in a year, giving us more tools to better meet our customers’ needs.

Leveraging several technology partners as well as internal innovation teams has helped us remain

focused on the future, while appreciating the “now.” That, coupled with our amazing people and culture, remains integral to our success. I want to build upon what we have learned and the advancements we have made. Our growth as a company has prepared us to not just survive the future but also to thrive among whatever challenges come our way.

What problem has been most difficult for manufacturers to overcome in a timely manner due to the pandemic, and why?

Norheim: As businesses and individuals, we are collectively brought out of our comfort zone, but to remain at the top of our game, we must expand our comfort zone. This leads to an incredible speed of innovation and creation of organizational and digital transformation.

A new business landscape was unfolding before COVID-19, with a 10X speed increase on digital advancements affecting industry. We’re in a period of time where you either disrupt or you get disrupted. This, coupled with workforce issues, means companies need to double down on developing culture and planning their digital transformation road map. Our company’s culture — our secret weapon — gave us the strength to endure, adapt, manage, and leverage disruptive change.

What is the most surprising lesson you’ve learned as the leader of a U.S. manufacturing company to help your company stay competitive?

Norheim: The most surprising lesson I learned is that many of us do not have a good worklife balance — or, as I like to say, a work-life integration. The pandemic shined a light on this and provided an opportunity for us to become more aware of needing self-care and boundaries, myself included.

You’re no good to your people or your company if you’re burnt out. We must encourage our people to take care of themselves and practice disconnecting. That means taking time away from work and devices to recharge, refresh, refocus, and rejuvenate. This often provides new perspectives, cre-

ative boosts, and enhanced clarity that improves productivity and other key measurable results.

The future of manufacturing includes AI and other new and evolving technologies. What tech innovations are you most excited about and why?

Norheim: As manufacturing companies, our need for embracing and leveraging technology is evident. I think the very best companies, the ones most successful at implementing and leveraging technologies of the future, will do so because they value technology and humanity. It’s not “either/or” but the merging of the two that will grant us a prosperous future.

I’m most excited about how we’re embracing technology versus which one we’re focused on. At American Crane we created an Innovation Lab in 2019 to give us the framework to stay on top of not just the emerging technologies of today, but also those of tomorrow. I believe it’s very important to experiment with new technologies, remain ahead of the curve, and allow space for your team to learn and find ROI.

Fewer than one in three manufacturing professionals today are women, despite representing nearly half of the overall U.S. workforce. Why is that, and what can be done to get more women professionals into the industry?

Norheim: Our biggest hurdle is that many women are just not aware of the opportunities available in manufacturing. There is significant overlap between what women want in careers and the attributes of careers in manufacturing. That’s why we need to educate others about the opportunities and benefits of a manufacturing career.

That’s why I invite women already in manufacturing to be role models to inspire the next generation of women (and men) to enter our industry. I encourage them to promote their pride and passion for manufacturing by sharing why they love their jobs, their companies, and this industry.

In what ways can women proactively help solve critical problems that could negatively

impact the future of U.S. manufacturing?

Norheim: Creating an inclusive and diverse workforce brings different perspectives together. This builds an environment fostering the appreciation of all members’ creative diversity through trust, respect, and openness.

Leveraging our company’s creative diversity also can be a competitive advantage by its ability to improve management, communication, and teamwork throughout our organization and to increase our company’s efficiency. All of these things help create cognitive diversity to solve problems more effectively. The greater perspective gained on an issue, the better the solutions will be. In the end, employees will be more engaged and eager to come to work as a result of the welcoming environment, and productivity and overall profitability will go up.

How can American Crane and other manufacturing companies best prepare for the next national or global crisis?

Norheim: In the recent sea of chaos, we all have been touched by tsunami-like waves in our personal and professional lives. And while often overwhelming, among the waves of change we find our direction. We cannot direct the wind, but we can raise our sails and adjust as needed.

It has never been more important to communicate with your people in order to adjust your [operational strategies] and keep your team engaged and productive. Leveraging the growth and skills you have obtained from this crisis helps maintain agility and responsiveness to manage the coming crests and troughs. Rough seas make stronger sailors. Tough times build greater people. And storms don’t last forever.

THE ASSIGNMENT

Area Development’s staff editor, Lisa Bastian, recently posed some question to American Crane’s CEO & President, Karen Norheim, about how overcoming pandemic challenges has strengthened the company for what lies ahead, as well as opportunities for women in manufacturing.

New Report Shows NYC ECONOMY GOING STRONG

A new report on New York City’s economy shows that the city still lives up to its long-standing reputation as the global business capital.

The New York City Economic Snapshot, a report released for the first time in October by New York City Economic Development Corporation (NYCEDC), aggregates and highlights data to measure the strength of the city’s economy.

NYC is the largest city in the country, and with a gross metropolitan product (GMP) of $1.66 trillion, it produces more value than the entire state of Texas. The city ranks as the #1 U.S. destination for foreign direct investment (FDI) and #4 globally for total FDI inflows since 2014. It’s also the #2 global startup ecosystem, now valued at $371 billion. And, with the nation’s biggest consumer base at over 20 million, companies in NYC can test their ideas and products at scale — with a diverse audience that represents the world.

At 20M+, the NYC consumer base represents the world.

“The Snapshot helps inform NYCEDC’s work not just in leading the city’s recovery from COVID, but in building a more vibrant and inclusive economy for the future,” said Andrew Kimball, NYCEDC President & CEO, in a note introducing the October report.

According to the report, one in 10 businesses in the city have opened in the last year alone, with the NYC metro area adding 450,000 jobs in that time — almost 200,000 more than runners-up Los Angeles and Dallas.

The report goes on to present metrics for tourism, transit, office and retail occupancy, and more — all data points that businesses can use to get a clear picture of the city’s economy.

REAFFIRMING A GLOBAL BUSINESS CAPITAL

While the Snapshot gives a monthly picture of recent trends, these trends only reaffirm New York City’s long-standing status as a premier business destination.

Visit edc.nyc/Business to contact the team at NYCEDC and get started today.

To read, and subscribe to, the NYC Economic Snapshot, Visit edc.nyc/Insights

When it comes to talent, the city has the nation’s largest and most skilled labor force at over four million, with 2.3 million holding a bachelor’s degree or above — more than Los Angeles; San Francisco; Washington, D.C.; Philadelphia; and Boston combined.

Companies are already taking notice. In 2022, Suntory, a global beverage industry leader, celebrated the opening of its New York City office, while monday.com, a work-operating system, opened its new North American headquarters in the city — with Mayor Eric Adams cutting the ribbon. Funders are seizing the opportunity too — within the past year, leading international tech VCs including Index Ventures, Sequoia Capital, and Andreessen Horowitz have all opened offices in NYC.

A ONE-STOP SHOP FOR BUSINESSES

T he Business Development team at NYCEDC has the connections and experience to help companies succeed in the diverse NYC business ecosystem.

The team can guide companies through every step of the expansion or relocation process, offering solutions and guidance on site selection support, access to talent and workforce development programs, financial incentives analysis, city and state agency navigation, connections to industry associations and local chambers of commerce, and more.

The center of industry. The center of everything. NYC: A global innovation hub

With unmatched talent, diverse funding sources, and a robust workforce and opportunity pipeline, NYC is a thriving business ecosystem and a powerhouse of equitable innovation—in industries from offshore wind to tech to life sciences and beyond.

Bring your business to NYC, with NYCEDC by your side—helping you make connections, forge strategic partnerships, and hit the ground running.

Visit edc.nyc/business.

Inflation Reduction Act Promotes the Nation’s “Energy Security”

The clock is ticking for manufacturers to get maximum tax benefits on new projects under the Inflation Reduction Act.

By Cory Wendt, Principal, Baker TillyThe Inflation Reduction Act of 2022 (IRA) includes the largest legislative energy incentive in U.S. history, promoting the transition to efficient use of renewable energy. It includes over 70 separate investment, production, or excise tax credits, most of which are effective through 2032. However, manufacturers and other entities that are eligible for the tax incentives can preserve maximum benefits now if they can begin construction on qualified projects leading up to the end of 2022.

Background

The IRA’s “energy security” subtitle includes provisions providing tax credits for the production and/or consumption of clean energy, carbon emissions reduction, and electric vehicle purchases as part of the effort to promote domestic energy security and manufacturing. Manufacturers could get the tax benefit related to an in-progress or planned project at an existing facility or if they produce renewable energy equipment compo

nents. Almost any entity with environmental, social, and governance (ESG) initiatives will likely benefit from use of IRA tax incentives.

The IRA provides for a direct offset to federal tax liability in the form of a tax credit. Eligible entities (including manufacturers) can use the tax credit against their own tax liability. If a company doesn’t have tax liability or taxable income, they can transfer/sell the credit to another taxpayer. Tax–exempt entities (like state and local governments, the Tennessee Valley Authority, tribal governments, and colleges and universities) can receive a direct payment from the IRS. This credit will be tied to costs related to eligible projects placed into service after December 31, 2022.

Types of Tax Credits

There are three types of tax credits that will help manufacturers and other entities decrease their capital cost for projects that promote energy conservation, whether that relates to storage of energy, a reduction of net new energy/emissions, or the creation of renewable energy at their facility:

• • The investment tax credit (ITC) is a percentage of eligible energy capital cost for new construction related to new property that captures or generates different types of renewable energy. The credit will vary in amount based on energy property type, project location, and American content. It likely will be the most accessed credit, as the credit is earned when the project is placed in service.

• • The production tax credit (PTC), which can be for a variety of alternative fuels (solar, wind, biomass, geothermal, hydropower, to name some), is paid based on unit production over 10 years.

• • The excise tax credit (ETC) offers benefit per gal-

GREATER PHOENIX

A game changer for business growth and development

Companies that relocate here are scoring big wins with reliable power, diverse water resources and a robust dark fiber network. Add SRP to your lineup and reap the rewards of a true team player.

Learn more at PowerToGrowPhx.com

lon for any biodiesel mixture, alternative fuel, alternative fuel mixture, sustainable aviation fuel sold or used by a company.

Both the ITC and PTC have a base credit and a 5X bonus criteria value for projects meeting prevailing wage and apprenticeship criteria. The IRA will give additional bonus credits to those who can produce or use domestic content in the energy projects.

Additional bonus credits will be given to projects locating in a named “Energy Community.” These Energy Communities are specific census tracts that are defined and targeted areas where prior economies were tied to coal, oil, and/or natural gas heavy industry sites. These targeted areas are meant to drive investment in new energy production infrastructure.

For certain wind and solar projects, an additional credit yet is additive to above credits for projects located in Environmental Justice areas.

The significance of the legislation has been slow to resonate among the primary beneficiaries of the law, perhaps because the energy credits are a new entitlement buried as a subtitle in a much larger law. A manufacturer may be surprised to hear that a 30 percent — even now up to 50 percent — benefit of a $20 million project may be eligible for an ITC.

In addition to tax credits for energy projects, there are also more than 20 ITC and PTC tax credit types for manufacturers who invest in their U.S. facility production lines to make energy equipment (or will make certain components going into that energy equipment) that will go into energy projects.

The spirit of the IRA tax incentives is to help American companies maximize existing energy resources using a range of new, advanced, efficient technologies. The incentives encourage companies undertaking a major building project to ask, “Will it really cost any more to build a property that will be more efficient in the long-term?”

Wastewater Projects

If a company is attempting to use less energy or reduce its carbon footprint, an IRA tax credit can help. A company may not even have “renewable energy projects” as a priority, but if they need to install a wastewater treatment plant, that could qualify for the credit.

The food and beverage industry, for example, may not use a lot of energy compared to others in the manufacturing sector. But food and beverage companies do create a byproduct water that needs to be treated. Because that wastewater is rich in nutrients, it can also generate energy.

That wastewater is often the biggest point of interaction with the municipality because it’s discharging to the municipality. Companies are always considering whether they pretreat wastewater or whether they discharge and let the municipality treat it. Municipalities generally charge a rate per gallon per unit of strength that is applied to that discharge. If they needed to expand their wastewater treatment facility, the cost of that expansion

would generally be passed on to industry in the form of higher rates.

Because of the IRA, municipalities now have a tax incentive to expand their wastewater treatment facilities without increasing their wastewater treatment rates as much. They can use this expansion as an incentive to retain an expanding local company or to draw new industries to the area.

The IRA tax credits also may influence the site selection of non-American companies looking to relocate to expand their market share.

The Clock Is Ticking

The most important thing for manufacturers, and other qualified entities, is taking action soon to preserve the tax credit.

In order to preserve the tax credit, without needing to meet any prevailing wage and apprenticeship requirements (and as a result securing the 5X bonus criteria), a project must begin construction before 60 days after the IRS issues guidance on those requirements. That guidance has not been issued but is likely to be issued soon.

Prior IRS guidance has established two ways to meet “begin construction” — physical work of a significant nature or meeting the 5 percent safe harbor provision. Either test can allow you flexibility if you are not yet permitted to get dirt moving on your site.

How Do I Take Advantage of the IRA’s New or Expanded Credits?

• Are you considering a plant expansion where you are changing the use, consumption, or storage of energy at your facility?

• Do you manufacture components qualifying as renewable or which have high domestic content?

• Does your company have an ESG strategy driving future capital investments?

• Are you planning or currently executing a project to enhance heat or carbon capture, utilize wind, solar or hydropower, or harness biogas to make heat, electricity, or a transportation fuel?

If you can answer “yes” to any of the above, here is what your business needs to know now:

• Approximately 70 different energy property types are eligible for their own federal tax credit.

• The federal tax credits can be used by an owner of the project or be sold to another taxpayer.

• To preserve and maximize the tax credit value percentage, you can take early steps to meet safe harbor.

• Most credits are good through 2032 — the longest ever U.S. “energy policy” timeframe.

• Significant enhancements have been made to the USDA and DOE loan programs (some for direct, low-interest loan funding).

• If structured optimally and timed correctly, a credit could be worth 50+ percent of total qualifying costs. n

ESG: The New Metrics in Construction and Real Estate

Key environmental, social, and governance (ESG) considerations include protecting the environment/reducing energy use, making positive contributions to the community, adopting inclusive workplace policies, and maintaining high standards of governance.

By Michelle Palys, Vice President of Performance Excellence and ESG; and Brian Gallagher, Vice President Corporate Development; GraycorWith engineering and construction making up more than 11 percent of global domestic product, there is a growing focus on how the building industry conducts business. What started as a movement among institutional investors and their financial partners has expanded across almost all sectors, and environmental, social, and governance (ESG) considerations now impact many real estate decisions and capital project planning. Consumer behavior is partly responsible for the change. So is the fact that investors and lenders increasingly view a company’s ESG policies as indicative of how that company is positioning itself for success in the marketplace.

Regulatory decisions further heighten the importance of ESG. A change that will soon make itself felt is the Securities and Exchange Commission (SEC) release of ESG disclosure rules for Scope 3 emissions. (The Environmental Protection Agency defines Scope 3 emissions1 as “the result of activities from assets not owned or controlled by the reporting organization, but that the organization indirectly impacts in its value chain.”) Combined, these factors mean one thing for developers and corporations undertaking capital

Governance

Social

projects: not only will they have to institute, track, and report their own ESG efforts, but they will have to include those of their contractors and other project partners.

What are the New Metrics?

Requiring all business partners to demonstrate responsible practices for environmental, social, and governance concerns is a broad request. To achieve success, the entire project team will have to break their processes down into

manageable pieces, identifying metrics and outlining specific rules for meeting, measuring, and reporting those metrics. Fortunately, some contractors and other stakeholders are poised to meet them more than halfway.

• • Environmental/Sustainability — Sustainable building has been an important topic in the construction industry for years. Great strides have been made in identifying life-

for free site information, visit us online at

cycle costs/benefits and balancing competing considerations across the lifetime of a structure. Many contractors are now well-versed in the kind of early planning that makes these assessments and decisions possible. Thorough pre-construction planning and sourcing phases are the key, and these phases should prioritize:

• Sustainable site planning

• Safeguarding water and water efficiency

• Energy efficiency and renewable energy, with a focus on:

• Conducting a comprehensive energy analysis

• Enhancing a building’s environmental management system (EMS)

• Installing sensor systems to monitor and adjust environmental conditions

• Installing demand-based fresh air distribution

• Installing ventilation heat recovery systems

• Retrofitting indoor and outdoor lighting systems using LED or other technology

• Implementing solar solutions

• Pursuing LEED certification

• Conservation of materials and resources

• Indoor environmental quality

contractors who have funding programs), supporting charitable 501(c)(3) nonprofit organizations that align with the team’s values. Often this means providing basic needs to area residents, such as food, shelter, education, and healthcare, as well as civic, environmental, and cultural programs. Along with financial assistance, volunteer involvement on the part of project stakeholders is also desirable.

Diversity, equity, and inclusion (DEI) is another pillar of social responsibility. Advancing DEI should begin with team culture and employee development, then extend to trade partners and communities. Because there are many factors for achieving success with DEI efforts, contractors and other partners should demonstrate that they have set up a company-wide council, with council members from across different departments. The goal should be to not only increase the participation of women and minorities, but also to make changes in operations and communications to sustain diversity. This means identifying and removing biases in recruiting, hiring, and promotion as well as educating people already within the organization to make them inclusive leaders and individual contributors.

Supplier diversity is another aspect of strengthening the social fabric. Working with and supporting minorityowned, women-owned, and small businesses contributes to the economic growth and expansion of communities. It is a good idea for owners and contractors to have established supplier diversity programs in place to support this goal.

•

• Social — Responsible social behavior begins with how a company, organization, or team treats its own employees. For the construction industry, safety and health are fundamental considerations. In addition to workplace safety programs, the individual as well as collective health and safety of employees should be an area of focus. Wellness programs that incentivize physical activity with reduction in insurance premiums should be instituted to proactively support employees’ health.

Promotion of healthful foods at events and provision for standing desks and ergonomic furniture in offices are other options. Benefit packages should include healthcare and retirement plans, family and medical leave, and a budget for training and education. The good news, when it comes to starting or maintaining such programs, is that they enable better productivity, ensure quality, and control insurance costs, improving employee retention and advancing employers’ competitive position within the industry.

To comply with the principles of ESG, teams are also expected to enhance the quality of life of the people in surrounding communities. A direct way to accomplish this is to establish a funding program (or partner with

The International Living Future Institute (ILFI), through their Just Program, encourages organizations to disclose employee-related indicators to measure social performance. The good news is that most organizations have progress on one or more of the institute’s indicators. Disclosing program results can demonstrate a firm’s formal commitment to social well-being.

Indicators include:

Employee benefits

Healthcare

Retirement provision

Family/medical leave

Training and education

Stewardship

Local communities

Charitable giving

Diversity, equity, and inclusion

Gender/ethnic diversity

Engagement

for Successful Site Selection, set

Sights on Georgia Ports

• Full-time employment • Pay-scale equity

• Purchasing and supply chain • Equitable purchasing

• • Governance — With societal and environmental concerns making daily headlines, the “governance” aspect of ESG can get overshadowed. However, to understand why the “G” in “ESG” is given equal weight, one has only to think of headlines that have been generated as a result of poor governance — i.e., rules, procedures, and decisionmaking hierarchies that have allowed company representatives to make missteps that ended up reflecting poorly on their organizations. It becomes apparent that the governing bodies of all companies involved in a given project should meet benchmarks for good governance, demonstrate strong management capabilities, and effectively manage risk.

Furthermore, all business development strategies and business practices should support the team’s core values, which, in turn, should emphasize honesty and integrity, commitment and follow-through, and full transparency (a “nosurprises” management style). Team interactions should be based on a thorough understanding of customer and project needs and on long-term continuity in client and subcontractor relationships. A commitment to innovation and investment in new technology, along with a system of subcontractor prequalification, further contributes to solid project outcomes.

If you want to position your business in the most desirable area of the country right now, the Savannah corridor, take the easy route: use the Georgia Ports’ Site Selection Tool. This robust online resource allows you to easily compare land and building availability, work force readiness, plus, important utility and transportation options.

Real-time data. Really fast.

Go to GAPorts.com/SiteSelection and set your sights on success.

To assure that all participants in a construction project are meeting the demands of ESG, the team should pursue mastery of logistics and coordination. Implementing ESG should involve inventorying current efforts, performing a GAP analysis, developing a system of metrics and tracking, and informing and educating internal stakeholders.

Taking all of its components together, ESG’s requirements for owners and their partners to not only protect the environment and reduce energy use, but make positive contributions to their communities, adopt inclusive policies, and maintain high standards of governance require a new level of planning from the top down. Once plans are in place, tracking and reporting — underpinned by transparent and comprehensive team-wide communications — is the recipe for success. n 1 https://www.epa.gov/climateleadership/scope-3-inventory-guidance

Fixing the Supply Chain with AI and Robotics

Automation, industrial robots, and other technology solutions have allowed manufacturers to shorten their supply chains, while also making them more efficient and reducing labor costs.

By Steve Kaelble

By Steve Kaelble

One of the many lessons learned from the COVID-19 pandemic was just how fragile the global supply chain is. For decades, much energy has been spent streamlining the supply chain, building efficiencies, and finding low-cost options — but the result has been an increased vulnerability to shutdowns, labor shortages, and other disruptions tied not just to the pandemic but also to the global economy and the war in Ukraine.

“With COVID, the level of volatility in supply chains rose to a level that was unprecedented and caught a lot of people by surprise — and not in a very good position,” says Claudio Knizek, global leader of Advanced Manufacturing and Mobility at EY-Parthenon. “There’s always been interest and appetite to understand and predict the supply chain, but now more than ever many companies are looking for technologies and software to predict supply chain issues before they happen.”

Technology solutions range from an ever-increasing use of industrial robots to tapping into more powerful uses of data, artificial intelligence, and machine learning to gain effective insights. Organizations are looking for new ways to run their manufacturing and distribution operations with fewer people, while making more prescient decisions that can help avert shortages.

Adding Automation to the Supply Chain

The digital technology conglomerate ABB surveyed hundreds of American

and European business executives on topics including supply chain plans. Just under half said they plan to use robotics and automation to build supply chain resiliency.1

A key aim, of course, is increased efficiency, and one result of relying a bit less on human efforts is added flexibility when making location decisions. A big factor in the recent supply chain turmoil has been the increasingly global reach of operations. If finding cheaper labor was a big driver behind overseas operations, automation can make it more feasible to locate operations closer to home.

Indeed, the ABB survey found that more than a third of executives were making plans to bring production back to the U.S., and a third said they’d look at nearshore loca-

tions for new operations. In all, the survey found that 70 percent of companies are considering reshoring or nearshoring projects.

“There is an increased appetite to bring manufacturing and supply chains closer to end markets, closer to the U.S.,” Knizek says. “There are benefits to having sourcing closer to the U.S., Mexico, or South America.”

To be sure, costs remain lower in China and Southeast Asia, he says, and China has noteworthy supplier infrastructure advantages. “But increasingly, firms are looking to find ways to move production back to U.S. but need to lower costs and make the return on investment work.”

“Around 2015 to 2016, technology kind of finally caught up to a certain extent with promises it was making,” says Jason Bergstrom, Deloitte’s Smart Factory GoTo-Market leader and a partner in the firm’s manufacturing practice. Manufacturing, he says, has really started to shift from a human-centered operation to a process that’s increasingly automated. “We’ve seen technology really catch up and advance at an exponential rate and have made that shift to what we now think of as a hybrid — humans and machines operating together.”

The Future of Automation

Automation is getting better and cheaper all the time, on the production line and in the warehouse, according to Bergstrom. “The level of the bar between what should be done by a human and what can be done by a machine continues to fall on a cost basis and rise on a capability basis,” he says. “What made sense to automate in 2015 looks very different today because of the continually falling costs to automate combined with the fact that you can now do so much more as you transition from weak automation to strong automation.”

Less than a decade ago, he says, “you’d see just the automating of transactional, discrete tasks that required really no logic,” he explains. “A series of steps…a human used to do them, now a machine does them — easy to codify, with almost no logic.”

To use an automotive manufacturing example, imagine having a piece of plastic move into a fender press, and rather than have a human run that press, a machine conveys the plastic through and sends a fender out the other side. That was typical automation circa 2015, he says.

“Fast forward to today for that same operation,” Bergstrom continues. “It’s still automated, but with more advanced learning capabilities and vision capabilities. You take that same piece of plastic, use vision systems to do quality scans in an automated way, and kick out components and raw materials that don’t meet specs to eliminate quality issues downstream.”

Plainsight Corp., based in San Francisco, is one of many companies offering this kind of AI-powered computer vision capabilities in manufacturing. It promises such benefits as process automation and risk reduction, safety and productivity monitoring, precision counting along the assembly line, automated product and packaging inspections, quality monitoring, and defect detection.

“Currently, clever machines are used to improve and automate production processes, influencing quicker decision-making, better safety precautions, and highquality improvements,” according to a white paper produced by Heriot-Watt University in Scotland.2 “With every manufacturer’s goal being to reduce risks and improve production efficiency, the role of artificial intelligence in this sector will continue to intensify.”

It’s no longer simple automation with robots assembling widgets, Knizek says. “You have intelligent robots, ‘cobots’ (collaborative robots) able to work side-by-side more effectively. You’re improving processes through more use of Big Data, predictive maintenance to reduce downtimes, or finding ways to anticipate process disruptions,” he says. “Firms able to leverage all of these technologies concurrently will be best positioned.”

“In the supply chain, AI can be used as a virtual assistant for robotic process automation and predictive analytics,” according to Ryan Prindiville, partner at the technology and consulting firm Armanino. “In today’s digitally connected world, AI is not just a nice-to-have; it’s an imperative to stay competitive. According to Gartner, supply chain organizations expect the level of machine automation in their supply chain processes to double in the next five years.”3

Better Insights into the Supply Chain

Aside from employing more physical automation on the factory floor and at distribution centers, technology can enable a healthier supply chain by providing more visibility into operations and potential problems. A couple of key concepts, says Knizek, are supply chain control tower and digital twin solutions.

“Essentially you are trying to monitor the full end-toend supply chain in an integrated and holistic manner, and trying to anticipate shortages before they occur,” he says. “This field has advanced significantly. You have firms that are still susceptible to issues in transportation and shortages of labor, but they are better able to get a handle on it.”

A supply chain control tower is essentially a dashboard of data and metrics. But to really provide the kind of visibility and insights that organizations need, it can’t just be a display of numbers. It must tap into advanced technologies such as AI with machine learning.

Extending control tower functionality with AI and machine learning can cut down on manual processes and offer the most actionable information. “Companies further along in this journey really use these tools on a dayto-day basis, and can anticipate problems weeks before they happen,” Knizek says.

Similarly, a supply chain digital twin is basically a simulation model of the actual supply chain. It brings in real-time data to help predict how the supply chain will behave and what unusual situations lie around the corner. It’s good for spotting bottlenecks before they become a problem, optimizing inventory, planning transportation, and testing any changes that might be

planned for the supply chain.

The Impact on Location

The supply chain challenges of recent years have put the spotlight on the downsides of sourcing goods and materials from all over the planet. Onshoring and nearshoring are great remedies to some of those problems, but then you’re faced with costlier labor and the worker shortages happening closer to home. Automation can come to the rescue, Knizek says.

“It’s very hard for U.S. firms that have production overseas to bring production to the U.S. without putting in any kind of automation technology or artificial intelligence and machine learning that improves your efficiency,” he says. “There are still significant labor costs, and with inflation the way it is in the U.S., labor rates will go up. People will pay attention to tools they can use to lower the costs, to make them more in line with costs overseas.”

That doesn’t mean you have to match costs exactly when moving back closer to home, he adds. “The U.S. will never be able to compare with places like Vietnam and Indonesia,” he says. But if through automation you can get the total costs close enough, some of the benefits of producing goods closer to home start to win the day.

Beyond mitigating potential supply chain disruptions, those benefits include the elimination of international shipping costs, according to Saman Farid, CEO of Formic Technologies, speaking on a Thomas Industry Podcast.4 “We think that we can match, if not exceed, the kind of productivity of a Chinese factory here in the U.S. through technological innovation, and that innovation is in the form of drastically better automation, used at a much greater scale.”

Increasing automation may mean fewer humans, but it doesn’t mean no humans, Bergstrom points out. Deloitte has clients visit its “Smart Factory” in Wichita, Kansas, which is a showcase of production capabilities maximizing such technologies as AI, machine learning,

Big Data, robotics, and vision solutions. “We intentionally talk to them about the machine-human interface that will never go away. The lion’s share of everything manufactured will always have a human component.”

That said, it requires a different labor mix to run such facilities. “Instead of a low-cost hourly person, you now have a different mix of people — developer, coder, maintenance. Although you are replacing an operation with an automation step, you have support roles that come into play,” he says.

“Right now, there’s a real need to hire people with more advanced skills such as mechatronics — you can’t hire enough of these folks,” Knizek says. “There’s a tremendous need for data scientists, and those are even harder to come by. There’s a real challenge right now in the manufacturing space to really get enough people with these skills.”

Bergstrom notes that in the past, manufacturing that wasn’t offshored was often set up in rural parts of North America, to achieve lower operating costs. That isn’t as easy to do with a more automated facility. “You’re actually seeing manufacturers get closer to urban centers than in the past, for that very reason,” he says. “Through automation and what we’re doing, it requires capabilities you’re not going to find in rural environments.”

“That drives all kinds of second-order questions,” Knizek says. “Where do you recruit? Do you set up your own training program? Do you need to raise wages to attract these people?”

Workforce development is always a vital topic in location decisions, but this reality is adding new twists, he says. “Any government looking to really position itself as a manufacturing hub with advanced manufacturing needs to be investing in all these topics.” n

1 https://www.globenewswire.com/en/news-release/2022/06/28/2470499/0/en/ABB-surveyfinds-70-of-US-businesses-looking-to-bring-production-closer-to-home-robotic-automationand-workforce-upskilling-essential-to-return-of-operations.html

2 hhttps://www.hw.ac.uk/uk/study/undergraduate/subject/computer-science.htm 3 https://www.gartner.com/smarterwithgartner/gartner-predicts-the-future-of-supplychain-technology

4 https://www.thomasnet.com/insights/how-automation-can-propel-manufacturinginnovation-in-the-u-s

To Cluster or Not to Cluster… That Is the Question!

Although clusters are here to stay in some sectors — think life sciences — other industries — among them EVs and semiconductors — are geographically branching out.

By Rich Thompson, International Director, Supply Chain & Logistics Solutions, JLLOne of the unanticipated outcomes of the COVID-19 pandemic is the reconfiguration of global manufacturing and supply chains. While you might expect manufacturers to be attracted to traditional “industry clusters” where talent and suppliers will come together in a certain market or geography — think of the close ties between automakers and Detroit — that isn’t necessarily the case today. In some sectors, traditional industry or logistics clusters are less important than they have been at any point in the past.

Disruption has created opportunity for U.S. manufacturing. Following various supply chain disruptions and lengthy logistics logjams beginning in 2020, many manufacturers have been near-shoring or on-shoring their manufacturing operations and reconfiguring their supply chain networks.

Shifting Manufacturing and Supply Chain Footprints

No wonder JLL Research finds that demand for U.S. manufacturing-related facilities soared 93 percent year-

over-year from the first quarter of 2021 to the first quarter of 2022.1 More than 1,800 companies reshored manufacturing in 2021, and reshoring is expected to create 350,000 new U.S. jobs by the end of 2022, up from 260,000 in 2021, according to The Reshoring Initiative®’s IH 2022 Data Report.2

To be clear, the shifts are not limited to the United States. Manufacturers with customers around the world are looking to keep operations close to customers to reduce the risk of future supply chain delays and facilitate product delivery. Moving manufacturing closer to consumers — whether in the Americas, APAC, or EMEA — also helps mitigate risk and the impact of high shipping costs.

Many companies also have diversified their supplier networks to avoid over-dependence on any single company or country. The life sciences, pharmaceuticals, heavy equipment, electronics, and semiconductor industries, in particular, suffered serious impacts when supplies became unavailable as the pandemic disrupted manufacturing and business activity in APAC.

Meanwhile, the conflict between Russia and Ukraine has disrupted global energy markets and added pressure to skyrocketing energy costs, with particular impact on chemicals, resins, plastics, fertilizers, paper, and pulps industries reliant upon natural gas. The United States and Canada have emerged as countries of choice and highly attractive locations for high energy, gas-reliant manufacturers.

Within the United States, however, the industries most affected by current trends are not necessarily locating in or near industry clusters. Multiple factors are pushing manufacturers beyond the traditional cluster markets. The tight market for labor — in particular for skilled manufacturing jobs — has made access to labor more of a challenge than in that past, driving manufacturers to areas with available labor pools. Tax incentives are always a factor, as is access to rail, highways, and other shipping infrastructure. Large developable land sites are also harder to come by, as manufacturers are

Bahama Buck's® is the Greatest Sno on Earth®

In 1990, Blake and Kippi Buchanan started a snow cone shack in the heart of Lubbock, Texas with a passion for people and tasty treats. Today, this international brand services 107 stores throughout the U.S. and Puerto Rico.

Scan the QR code below to learn why the Buchanans find there is no better place to inspire a people-first culture than in the "Hub City."

often competing with logistics companies for major parcels.

The

Dispersed

Footprint of EV Manufacturing

EV manufacturing, in particular, is not developing around the historic automotive centers of Detroit. While some EV manufacturing has settled in Michigan, the largest U.S. manufacturing developments are under way in 17 different states, including Arizona, Texas, Georgia, Ohio, Tennessee, and Indiana.

The United States is becoming a location of choice for companies producing electric vehicles (EV) and EV batteries as major domestic automakers shift production to EVs in response to soaring global demand. Recent federal legislation — including the 2021 Infrastructure Investment and Jobs Act (IIJA) and the 2022 Inflation Reduction Act (IRA) — has provided funding and expanded tax credits to accelerate the transition to clean energy infrastructure and EV vehicles for public transit and the commercial and consumer markets.

AS SOME INDUSTRIES DEVELOP IN DIVERSE LOCATIONS, OTHERS [E.G., LIFE SCIENCES] CONTINUE TO BENEFIT FROM LOGISTICS CLUSTERS.

Instruments began construction on a new facility in May 2022. GlobalFoundries also is expanding its U.S. manufacturing, investing in additional capacity at its Malta, New York, headquarters.

Most recently, Idaho-based Micron announced that it will invest up to $100 billion to build semiconductors in New York State — reportedly the largest semiconductor fabrication facility in the history of the United States and possibly the largest in the world. The state is providing $5.5 billion in state tax incentives for the project, which is also likely to tap CHIP tax credits.

Clusters Here to Stay in Some Industries

It is hard to “cluster” big manufacturing operations, such as EV and EVrelated manufacturing, when each plant requires large ready-to-develop land sites, supply chain infrastructure, access to labor, as well as tax and economic incentives. EV manufacturers also are attracted to areas with comparatively low energy costs to reduce production costs.

Semiconductors Nationwide

With factories coast-to-coast in 18 states, the U.S. semiconductor industry is another that is not clustered around a particular location, according to the Semiconductor Association’s 2021 State of the U.S. Semiconductor Industry report.3 Semiconductor manufacturing is resurging in the United States, with new manufacturing facilities planned in locations far beyond the industry’s roots in Texas and Silicon Valley. Intel, for example, is expanding its U.S. footprint by investing billions of dollars into two chip production plants in Arizona and two in Ohio, and an advanced packaging facility in New Mexico.

In 2020, TSMC also announced plans to build a factory near Phoenix, Arizona, to be near the talent and suppliers already supporting Intel. Meanwhile, Samsung Foundry announced in late 2021 that it is building a plant near Taylor, Texas. Near Sherman, Texas, Texas

As some industries develop in diverse locations, others continue to benefit from logistics clusters. Life sciences organizations, for example, continue to cluster in such markets as the San Francisco Bay area, New Jersey, San Diego, Boston, and Raleigh-Durham. Manufacturers of petrochemical products, resins, and plastics tend to cluster around ports to streamline exports.

One reason is that clustering reduces the cost and time of delivering product to end-users. With proximity to multiple downstream manufacturers, suppliers can exploit economies of scale while offering customers faster, lower-cost deliveries. Clustering also can produce a labor pool with specialized industry knowledge — which is a major reason why life sciences companies tend to cluster around major life sciences research organizations. In addition, geographic proximity can spur innovation as small entrepreneurs and established manufacturers come together in economic activity as well as research and development.

Whatever the industry, a myriad of factors enter into site selection decisions for manufacturing operations. With access to strong labor pools, logistics infrastructure, energy, and large shovel-ready sites among the primary concerns, companies are willing to look outside traditional industry clusters with regard to their strategic U.S. manufacturing location decisions. n

1 https://www.us.jll.com/en/views/resurgence-for-made-in-america 2 https://reshorenow.org/content/pdf/2022_1H_data_report-final5.5.pdf 3 https://www.semiconductors.org/state-of-the-u-s-semiconductor-industry/

The great thing about Virginia is the prevalence of technical talent that we have here. That’s due to many other technical companies being located here as well as the excellent graduates that we get from all of our state universities.

TIM HURLEBAUS President

TIM HURLEBAUS President

See the advantages Virginia can offer your business at vedp.org

THE GREAT MIGRATION OF WORKERS

“Now Hiring” — the sign that we see across the country, from main street to downtown to the county road. This sign now seems to be a permanent fixture in windows of small and large businesses alike. Competing billboards along the highway shout to us from the roadside why you should consider working for “company A” as we read the same reasons that the last three billboards gave for their respective companies. Online advertisements and virtual recruiters constantly let us know of the opportunities just on the other side of the cyber fence. The workforce issue has always been around; however, the pandemic and further economic impacts since

then have accelerated this shift in the last few years. What can we discern in the now years since the pandemic? Prior to 2020, wages were in a price war to try to keep employees from moving from one location to another down the street. In 2022, employers continue to struggle with keeping employees interested in coming to work, especially in the office. What are the drivers for migrating away from a current employer? Where are people going? What are prospective employees seeking? Let’s dive into the various forces that are influencing the workforce today and subsequently the employers and communities so desperate to find (and retain) them.

Movement

Despite the disruptions of the pandemic, 2020 was a pivotal year — knowing it was also a census year. As a result, we can dig into data provided on a decade basis as a starting point for further analysis. In March of 2022, the U.S. Census bureau1 produced a report noting the migration patterns of people within the United States. This data is produced at the county level, so you see a significant amount of “hot spot” data for inference purposes.

When comparing the data migration patterns from 2019–2020 and 2020–2021, there are several notable differences. The 2019–2020 migration data (i.e., preand early pandemic months) indicates movements from “rural” areas to more suburban areas. Metro areas noted the largest increases in population, though not all these increases occurred in a “downtown

ByCompanies must understand how a shift in workforce development and remote work will impact their location decisions.

A Division of the Missouri Department of Economic Development

A Division of the Missouri Department of Economic Development

core” (centralized, urban county). Surrounding urban areas appealed to many people due to amenities, job opportunities, and available supply of housing options. This data appears to indicate a move toward places that offered more due to the convenience and proximity of the urban core, though life in the urban core was not as sought after.

The data changes substantially in 2020–2021 (midpandemic to waning pandemic months). Core urban areas, especially in the North and East/West coasts, and in the Midwest and South, saw some of the largest decreases due to net migration patterns. The largest increases in net migration patterns appeared to be the suburban areas around urban “cores,” and these increases were weighted toward areas in the South and Midwest. According to the data, the state of Florida saw some of the highest increases in net migration, taking four spots out of the top 10 largest migration net increases. The largest decrease areas were New York-Newark, San Francisco-Oakland, Los Angeles, Seattle, and Washington, D.C.-Baltimore.

However, this data does not tell us “who” was making these transitions. Further analysis needs to be done to sort out the timing of this information too: were these migration patterns unique to this time? For example, does the data reflect retirees seeking to capitalize on the white-hot housing market, trying to get the best bang-for-their-buck and move to their retirement home? Or were these patterns indicative of the closures of higher education institutes and travel opportunities and the movement of young people back “home”?

For further insights into the “who” we can look at other data produced by a unique source: moving and storage companies. Extra Storage Space2 notes that

all age demographics participated in the movements during and after the pandemic, from young professionals to retirees. A Pew Research study3 noted that nearly one in four people in 2020 moved or knew someone who moved due to the pandemic environment. However, of that population, over a third of the moves were made by young people aged 18–29. While the pandemic possibly had a stronger migration influence on young people, the data still notes participation from all age levels. Therefore, with the population shifting during this time, what were the main drivers for these decisions to move?

Forces

Several studies of this time note the prevailing factor for moving was the cost of living. Communities and campuses that closed due to the pandemic could not provide the long-term financial security that people rely on. As the economy struggled through the mid- and late-pandemic months, many people could not afford to stay in the places they were, so they started to look for areas where their dollar would go farther.

This was especially impactful on young families due to the costs of childcare or the absence of options for childcare and the requirement for a caregiver to stay home. Move.org notes the average cost of childcare for a household in America is $175/week for a four-year-old or 13.9 percent of the median household income (across the United States). Some states have much higher costs associated with childcare and a greater impact on a family’s budget.4 With increases in costs like this for the working-class family and an uncertain future, many families looked to move “home” to be nearer other family members

THE LARGEST INCREASES IN NET MIGRATION patterns appeared to be the suburban areas around urban “cores.”

To learn more about how inspiring businesses are leading the way to a strong economy, visit ArkansasEDC.com/ whyarkansas

“

Arkansas is the perfect fit for Dassault Falcon Jet environment that encourages business and attracts the best people. And the people are the key to our success.”Sebastien Deltheil - General Manager, Dassault Falcon Jet, Little Rock

who could support them.

Simultaneously, the great migration saw a necessary and, in many cases, mandated requirement for remote work. Many businesses had to quickly adapt working models to accommodate this new factor. As the pandemic began to subside, many workplaces maintained the remote policies created in one fashion or another. However, with the rise of remote work options, working professionals could also benefit from flexibility in location. If employees can work from anywhere, why not be in a place that benefits your wallet the most!

Not all moves were just for families — many areas that saw migration growth were outside of historically large urban areas to smaller suburban communities, even rural areas. Individuals and families, according to real estate, finance, and moving companies like Zillow, 5 BankRate,6 and Neighbor.com,7 were looking for more space and the ability to stretch their dollar.

Communities that saw the largest net migrations bring some common amenities and features. Outdoor activities were on the rise during and following the pandemic as indoor spaces were shut down or severely restricted in capacity. Areas for year-round outdoor activities naturally occur more in the Sunbelt states. Other states that saw increases include Tennessee, the Carolinas, Utah, Idaho, Montana, and Arizona — all states known for adventurous recreation and support of the scenic outdoors. Areas that provided options and a better cost of living saw the benefits of an increase in population.8

Another force that drove the migration from larger urban areas included crime. Urban areas will inherently see a larger percentage of crime due to population densities. Statistics highlight the increases in crime across the country, especially in urban areas over the last two to three years.9 Families and individuals want to feel safe within their community, and if the community cannot offer that, they will find a better opportunity.

Assessments

With a better understanding of the forces that migrated people to different areas during and postpandemic, what can be done by employers and communities to attract the attention of workers who are

open to the idea of changing location?

Employers have felt and will continue to feel the incredible balancing act of offering flexibility while still maintaining a strong workplace culture. How do you bridge the two? For some employers, a flexible “in-office” schedule or an entirely remote option is advisable. As long as the work is getting done and productivity is maintained, many employers have embraced a lighter in-person workplace. This is beneficial for workers within professional or service industries.

Employers in areas that have seen a decrease in employees may have to look for workers who are not within traditional “reach.” Employers will need to assess whether they can accommodate a worker in another area of the state or even the country to fill talent shortages. While technology can expand the reach of some tasks to remote settings, many still seek to be a part of their workplace culture and community. Employers must be willing to offer flexibility (to the degree they can) and at the same time offer a workplace that people want to be a part of. Otherwise, employers will struggle to fill roles and retain top talent.