simaimpianti.net ai-lati.com

simaimpianti.net ai-lati.com

GROUP PACK, produces complete automatic or semi-automatic “custom” machines and systems for weighing, bagging, packaging, handling, palletising and wrapping any type of product (milling, food, agricultural, zootechnical, chemical-pharmaceutical, construction and mining), and any type of format, in open-mouth bags with different closures, and internal valve or external valve bags with linear ultrasonic sealing. Trust our experience, let’s study together the right solution for you.

Automatic machines for valve bags PROSOL / Italy

Concept by Paolino Barosi

Automatic machines for valve bags PROSOL / Italy

Concept by Paolino Barosi

When standard approaches don't match your criteria, we're here to turn your idea into reality.

Tailor-made to fit your needs, every custom product is engineered to increase your production e ciency.

FOOD INDUSTRY PLANTS

DESIGN | PRODUCTION ASSEMBLY | ASSISTANCE

MACHINERY | STEEL STRUCTURES

SILOS | ACCESSORIES | PIPING

PROPRIETOR

EDITORIAL DIRECTOR

Andrea Valente

President Italmopa

EDITOR-IN-CHIEF

Claudio Vercellone

TECHNICAL DIRECTOR

Lorenzo Cavalli President ANTIM

SCIENTIFIC BOARD

Carlo Brera Food safety

Marina Carcea

Research Centre for Food and Nutrition (CREA - Rome)

Giuseppe Maria Durazzo Food law

Luigi Pelliccia

Head of Federalimentare Market and Research Department

Giovanni Battista Quaglia Food technology

EDITORIAL BOARD

Piero Luigi Pianu

Laura Pierandrei

INTERNATIONAL RELATIONS

Alfredo Tesio

EDITORIAL STAFF

Lorenzo Bellei Mussini ufficiostampa@avenue-media.eu

ADVERTISING MANAGER

Massimo Carpanelli carpa@avenue-media.eu

PUBLISHER

Edizioni Avenue media®

Viale Aldini Antonio, 222/4 - 40136 Bologna

PRINTED BY: MIG - Moderna Industrie Grafiche

Registration n. 6129 of

data processing in accordance with Regulation (EU) 2016/679. Privacy policy is available on Avenue media website www.avenuemedia.eu on “Privacy Policy - Publishing” page: www.avenuemedia.eu/en/privacypolicy-specialist-publisghing/

by Andrea Valente President Italmopa

by Andrea Valente President Italmopa

Once again in 2023, the volume of exports of flours and semolina produced by Italian mills showed a growing trend. In fact, based on the foreign trade data released by the Italian Institute of Statistics, last year the export volume of domestic soft and durum wheat flour recorded an increase

of 4.7% for soft wheat flour and 13.6% for durum wheat semolina compared to 2022.

The main destinations for soft wheat flour produced by the Italian milling industry were France, the United States, Germany, the United Kingdom and Spain. However, very significant

increases were also recorded in the volumes exported to all the main EU countries, those of the Persian Gulf and Japan.

As far as durum wheat semolina is concerned, France, Germany and

Belgium are the main outlet markets; they absorb almost half of the overall Italian export volumes.

Therefore, the overall export figures for both soft and durum wheat flour show once again a positive trend consolidated

over time in terms of value and volume, thus confirming the unquestionable quality and great versatility of flours and semolina produced by the Italian milling industry.

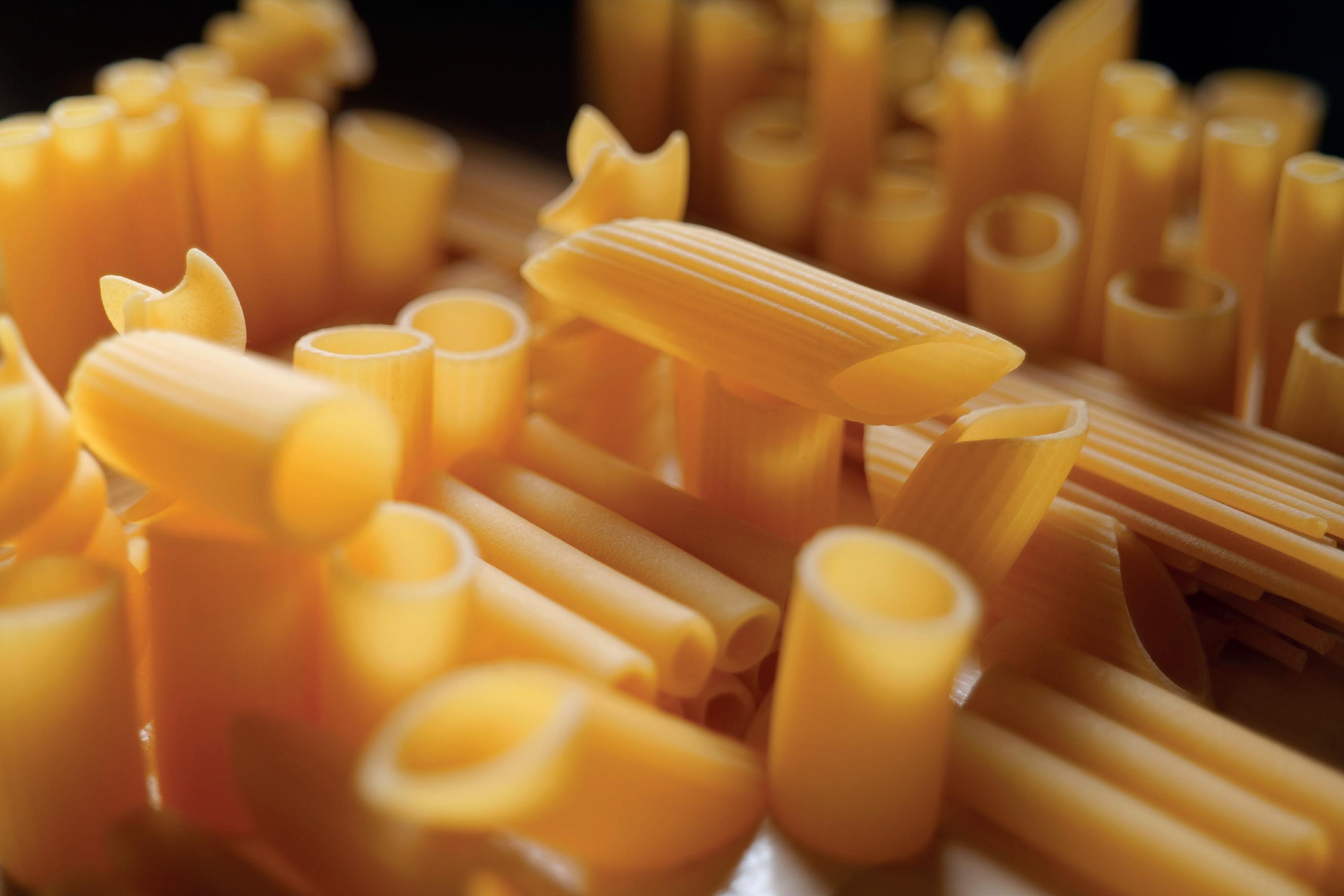

This important result, which makes us particularly proud, highlights the extraordinary and acknowledged ability of Italian millers to select and blend the best grains, regardless of their country of origin, to obtain flours and semolina that fully meet the many requirements of the domestic and international market, as well as the increasingly demanding requirements of consumers. Flours and semolina that - it is worth recalling - are the basic ingredients of Made-in-Italy flagship food products such as pasta, pizza, bread and confectionery products, known and appreciated all over the world.

Andrea Valente

by Luigi Pelliccia Head of Federalimentare Market and Research Department

by Luigi Pelliccia Head of Federalimentare Market and Research Department

The abnormal and unprecedented drop in food sales on the domestic market, with volumes falling to -4.2% in 2022 and in the first ten months of 2023, has made the space offered by foreign markets thrive, now more than ever. But let us look back for a moment. For the Italian food industry, exports reached 48.5 billion and a growth of +18.9% in

2022, clearly accelerating compared to +12.4% recorded in 2021. Growth had been largely related to the price effect, so it was somewhat “inflated” and had not brought significant benefits in terms of profitability. The only objective, and positive, macro-factor for the food industry exports in 2022 had been the acceleration in volumes, from +1.8% in 2021 to +4.3%, a 2.5 point gain. This was no small thing in an international scenario that promised to become increasingly complex. Once again, the Italian food industry had received valuable support from the US, which had confirmed itself as a market with great potential, closing the year with +17.6% in currency and -1.7% in quantity. However, this decline had brought an early sign of reflexivity and uncertainty, which would then explode in 2023. Finally, the milling industry had closed 2022 with a rewarding export pace. The share of exports by value had reached 567.4 million, with a significant +29.5%, linked to a strong cost-pricing effect that had affected the sector, along with a share in volumes exceeding 603 thousand tonnes, up +4.0%. In a nutshell, this was the situation before 2023 which, let us address this right away, turned out to be - to a large extent - disappointing for food exports and for Italy’s exports as a whole. The figures are related only to the first nine months of the year, but they are enough to outline reliable preliminary results. In the meantime, the general picture for the year immediately turned out to be not so stimulating, with international trade poorly boosted and an estimated growth rate below +2% at the end of the year. In fact, too many were the

We develop solutions that allow you to optimize production processes by integrating every component of the plant into an efficient and high-performing automation system

We apply Industry 5.0 principles at all levels of the company to make your plant more sustainable and innovative over time.

uncertainties triggered by the context, even though the tensions related to energy have largely subsided. Therefore, Italy’s total exports reached +1.2% in value over nine months, matched by -3.8% in volumes. Internally, the food industry reached +7.1% in currency, corresponding to -3.2% in volumes, which showed a marked setback compared to 2022.

Among the major markets, the noticeably above-average growth of important outlets such as France (+13.0%) and Poland (+16.6%) should be noted over the period. Right behind, Germany (+11.7%), Spain (+10.5%) and the United Kingdom (+9.6%) stood out. The real novelty was represented by the US market, which emerged as the most critical one and caused the greatest concern. In fact, it showed a trend decline in value of -1.8% over the nine months, after +17.6% reached in the 2022 final figures. The price effect was not enough to “dope” the currency figure. In fact, the fall was also triggered by the euro’s appreciation against the dollar that emerged during the year, which often came close to 10 percentage points, and which added to the pressure on cost-price at source. Not surprisingly, the export slowdown in the US also affected the other EU partners. Therefore, it is not surprising that the EU food industry market, although slowing down, appeared better in tune than the global food industry market, reaching a trend of +10.6% in currency over the nine months, along with a marginal drop of -0.4% in volumes, which meant substantial stability.

In short, the EU 2023 performance emerged as the “hard core” of the

THE

FOOD INDUSTRY IS RECEIVING VALUABLE SUPPORT FROM THE US

sector’s exports, unlike those recorded over time, which were typically lower than the overall performance. As a result, the non-EU area emerged as the most affected, also because of the negative weight exerted within it by a leading area such as the North American market, with a downturn not only for the United States, but also for Canada, which showed an even more marked setback. In this scenario, milling exports reached 460.7 million euros in the first nine months of 2023, up 7.6% on January-September 2022, accompanied by a quantity share of about 462 thousand tons, corresponding to +1.2%. If the pace of the sector’s exports in currency was virtually identical to the

pace of the country’s overall “food and beverage”, the actual pace in volumes was definitely better, with a moderate growth of +1.2%, which nonetheless opens up a significant gap with the -3.2% in volumes reached by general food and beverage exports. The top three foreign markets in the milling sector were rewarding in terms of both currency (less significant in a year of inflation) and quantity. Germany, as the first market, with 75 million euros of flour exported over the nine months, recorded +11.3% progress in value and +6.3% in volumes. The second market, France, with 71 million euros, reached +10.4% in value and +8.0% in volumes. Spain, the third market, with 41.4 million euros over nine months, did even better in terms of increases, +20.9% in currency and +9.0% in volumes. The fourth market, the US, was disappointing, with the fall it was involved in at an overall level, as described above. In fact, in this country, the milling industry, with a 35.5 million share, showed declines of -5.5% in currency and -15.2% in

www.horizonevo.com

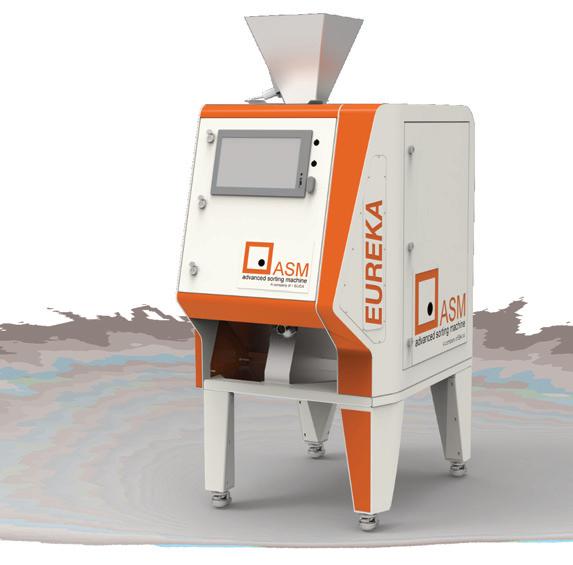

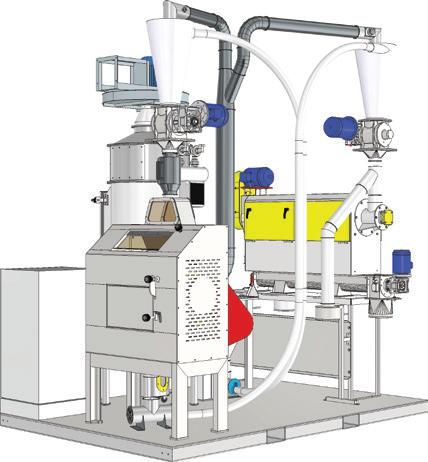

Horizon was born from the meeting of thirty years of experience in the industrial and milling sector with the desire to design and develop innovative and efficient machines, created to meet in a personalized way all the management needs of product flow, thus facilitating the management of the production chain.

In order to achieve this objective, it has equipped itself with numerous development, certification and diagnosis tools, with constant investments in human resources, software and hardware, essential for efficient management.

The core business is the development of machines for weighing, controlling and regulating cereal humidity, controlling and regulating product flow, but thanks to the company’s profound know-how it is possible to supply batch and continuous mixing systems as well as transport and the study of complete systems.

volumes. The UK, in fifth place, also lost momentum, with changes of 0.7% in currency and -5.5% in volumes. It must be said, however, that out of the top ten international milling outlets, only three experienced drops in volumes. The Netherlands should be added to the first two just mentioned, with a slight drop in quantity of -1.0%, and +13.2% in value.

In short, the milling industry stood tall in a difficult year, much better than

food and beverage as a whole, showing remarkable resilience. The operators in the industry did well. It is safe to say so, because the expertise is proven above all in difficult times, and not when drive to expansion is generalised and everyone roughly floats. Looking ahead, however, not everything is positive. We are referring to the fact that in the first nine months of 2023, the top five international outlets in the industry, despite the setback in the US, accounted for 54.1%, a very high percentage of the industry’s total

exports. Five years earlier, in 2018, the first five outlets (represented by the same countries, although in a different order) covered 47.5% of total

Source: Federalimentare processing based on ISTAT data

industry exports. In short, the sector has strengthened its “strong legs” over time, but has gone backwards in its market diversification strategy. It should also be noted that, from a wider perspective, Italy’s agri-food balance in the first nine months of 2023 showed a deficit of 1,603.2 million euros, up +37.1% on the same period in 2022. More specifically, the balance of the primary segment went

into red for 15,283.5 million euros, up +10.5% on the level reached in the first nine months of 2022. These figures underline the dependence of the Italian food supply chain, mainly the milling industry, on international supplies, and their high exposure to the repercussions of international commodity prices. In concrete terms, the 2024 outlook remains rather complex. Domestic consumption should stop

WHY NOT RENOVATE YOUR PLANSIFTER WITH A SET OF OUR BESPOKE SIEVE STACKS?

WE DESIGN AND BUILD TAILOR-MADE SIEVE FRAMES TO MAKE YOUR PLANSIFTER AS GOOD AS NEW!

RENOVATING YOUR PLANSIFTER ADVANTAGES INCLUDE:

• LARGER SURFACE AREA

• REDUCTION OF BACTERIAL COUNT IN FRAMES

• LOWER MAINTENANCE

• EASY TO INSTALL

• ENERGY SAVING

POLYPROPYLENE OR ALUMINIUM FRAMES FOR ANY MODEL OF PLANSIFTER

the drop in volumes experienced over the last two years, with inflation finally and probably settling at around +2%. However, domestic consumption will not benefit from significant rebounds. While international trade could mark a +3.0% combined progress in real terms, after the rate below -2% recorded last year. This is not much, but it is nevertheless close to the standard pace of the prepandemic years, and the strategic role of foreign markets is underlined, as an offset to the constantly sluggish condition of the domestic economy. In short, in the year that has just begun, the milling industry will not be helped by a strongly recovering economic environment, and will basically have to roll up its sleeves on its own. However, it has shown that it can do so.

Luigi Pelliccia

The last Annual General Assembly of Italmopa Youth Group was held in Rome, at the Hotel delle Nazioni. On that occasion, the handover took place between Giorgio Belotti, outgoing president of the Youth Group, and the newly elected Clelia Loiudice for the two-year period 2024/2025.At the same time, the members of the Youth Group Board were appointed, which includes, for the aforementioned twoyear period: Caterina Borgioli (Molino Borgioli), Stefania Dallagiovanna (Molino Dallagiovanna G.R.V.), Elena Felis (Molino Pasini), Paolo Gallo (Molino San Paolo), Federica Grassi (Molino Grassi). President Loiudice was asked to outline the ideas and projects for the promotion of the Youth Group and its activites.

The Editorial Staff

President Loiudice, how do you intend to organize your presidency in terms of the Italmopa Youth Group’s activities?

At the Annual General Meeting in December, I was able to see for myself the enthusiasm and high level of competence of the Italmopa Youth Group. Hence, I feel the responsibility not to disappoint the expectations towards our Association and to provide the Group with inspiring and targeted meeting opportunities. We will start with a short questionnaire to intercept the main interests of the membership base as well as its availability in terms of time to devote to the Group and experiences to share. Certainly, some

activities, such as the Board meetings, can continue to be hold online, as it has been widely tested in recent years. However, the hope is that live meetings will see an ever-increasing participation, since they express the maximum uniting force for the Youth Group, thanks to the opportunity to exchange opinions and ideas firsthand, in a friendly and fair atmosphere among colleagues. Our activities will always be focused on the role played by the mill, considered not as an industry of its own, but rather as a crucial segment within the main supply chains of good Italian and international food, both for soft and durum wheat. At the same time, we will not forget to cultivate relations with our colleagues in other associations of young industrialists working in the agro-food industry, with whom we have been maintaining successful dialogues for some time, sharing areas of in-depth analysis and common growth.

What topics will be the focus of the Group’s next initiatives?

During the first Youth Group Board meeting, several ideas and needs for further investigation emerged. One topic that will certainly bring revolutionary innovations in all sectors is the Artificial Intelligence: we will try to understand what the opportunities may be for our companies and what

LIVE MEETINGS SUCCESSFULLY UNITE THE GROUP

the risks are, what the current state of the art is, and what the prospects are for mills. In addition, we will continue the training process on sustainability, which started several months ago, through webinars dedicated to the upcoming European regulatory changes related to the drawing up the sustainability report. Another topic that has stirred up great interest, and which is closely related to sustainability, is the issue of climate change and its impact on our industries and their procurement policies.

Are there international realities similar to yours with which you believe it is possible to network?

In Italy, there is a fairly high number of mills, of varied sizes, unlike other European countries where there is a greater concentration of milling capacity in the hands of a few large enterprises: for this reason, it is difficult to find Youth Groups similar to ours elsewhere. However, I think it is important to emphasise the international scope of

Plants for handling and storing fragile granular products for food and non-food industries.

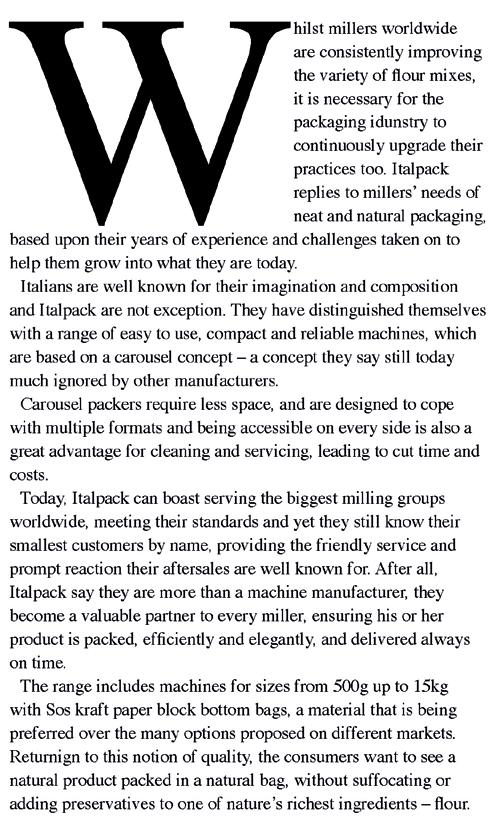

• PASTA AND PET-FOOD STORAGE SYSTEMS

• STORAGE OF PASTA NESTS

• BUCKET ELEVATORS

• BELT CONVEYORS

• VIBRATING SIEVES FOR PASTA AND PET-FOOD

• CHAIN CONVEYORS

• SPIRAL DESCENDERS

• VIBRATING EXTRACTORS

OUR SYSTEMS ARE WORKING IN OVER 85 COUNTRIES, WITH MORE THAN 22 000 MACHINES AND 2 500 SILO BINS. EVERY YEAR WE STORE AND MOVE 30% OF THE WORLD’S SHORT-CUT PASTA PRODUCTION.

our Group, starting from the personal background of its members, who, in many cases, have had the opportunity to study and work in other EU countries: these aspects will certainly make our membership as Italmopa to the European Flour Millers or Semouliers more fruitful and collaborative.

Today’s way of communicating is different: what contribution could the Youth Group give in developing communication activities with particular reference to the most interesting and topical issues for the milling sector?

It is something we are discussing about, at a time when even social

INTELLIGENCE WILL BRING REVOLUTIONARY INNOVATIONS IN THE INDUSTRY

networks start showing some signs of weakness in terms of communication effectiveness. Certainly, we will still communicate through the official press channels: for example, we have started to tell about our activities again and communicate our programmes on Molini d’Italia’s “Spazio Giovani” column. Moreover, we will try to reawaken the somewhat “dormant” pages on social networks, reporting all the activities of interest to the Group, the impressions of the young participants, and the main events in which we are involved as a group or as individual member companies, since the exchange of information and ideas is certainly an irreplaceable source of wealth for our Association and not only.

The Editorial Staff

ANTIM’S PRESIDENT, LORENZO CAVALLI, ILLUSTRATES PAST AND FUTURE ACTIVITIES OF THE ASSOCIATION

by Editorial Staff

by Editorial Staff

Molini d’Italia International is the ideal showcase to introduce the activities of Antim (Italian Association of Milling Industry Technicians). Founded 30 years ago, the Association organises several technical meetings, which allow members to get to know

each other and maintain friendly relations, as well as to learn about the different production methods of many important milling companies, addressing topics of major importance and topicality. An irreplaceable wealth of knowledge, made possible by the great willingness and enthusiasm

of the milling and machinery construction companies, which opened their doors to members’ visits. Lorenzo Cavalli, the Antim’s President, replies to Molini d’Italia International’s Editorial Staff as follows.

The Editorial Staff

Key components for any milling and industrial conveyor and aspiration system designed to provide outstanding performance.

SEMOLINA AND FLOUR CONVEYOR COMPONENTS

MILLING AND INDUSTRIAL ASPIRATION COMPONENTS

They are manufactured in: Mirror-finish aisi stainless steel 304 BA with a thickness of 10-12-15/10, TIG welded and polished.

Carbon steel with a thickness of 12-15/10, coated with certified food-grade powder paint. Available in various diameters: 105-120-150-200-250-300 mm.

Manufactured in galvanized steel Z200 or aisi stainless steel 304-316 2B, with a thickness of 6-8-10-12/10, in various diameters and sizes for both standard Seven products and custom ones.

CARBON STEEL COMPONENTS

We produce: pneumatic manifolds, small cyclones, line manifolds, hoppers, bends, joints, and plenums, with a thickness of 15-20-30/10 coated with certified food-grade powder paint.

Mr. Cavalli, what were the activities carried out last year by the Association?

Antim carried out several activities in 2023. On 4 May, we took part in the Barilla Academy (The Italian Food Academy) in Parma; on 5 and 6 May, we held an important Technical Day entitled “Legume Flours: Opportunities and Knowledge” in Uzwil, Switzerland, which included a special tour at the headquarters of Bühler. On 11 May 2023, the Ministry of Enterprises and Made in Italy invited Antim to the first meeting chaired by Benedetto

Mineo, the Italian price watchdog, to understand why the price of pasta is rising and the remedies Minister Alfonso Urso should put in place. The meeting took place in the charming Parliament in the Piacentini Palace, the historic headquarters of the Ministry of Economic Development. There, too, Antim, represented by its treasurer Gerardo Calvello, gave its contribution in terms of competence and depth that was much appreciated by President Mineo and the whole group of participants. On 8 June 2023, in Corato at a well-attended conference

at the Molino Casillo, a “Memorandum of Understanding” was signed with the Italian Maintenance Association (A.I.MAN) “to jointly promote safety and sustainability in maintenance processes”. Finally, from 6 to 8 October, a Technical Day was organised in Oristano with the title “Ecosustainability requirements and benefits in Milling Plants’, which included a visit to Molino Simec. On that occasion, the 30th anniversary of the official founding of Antim was celebrated, although it was a late celebration because of Covid.

What are the plans for the 2024?

The board and I work daily, and we shall not forget that it is a non-profit association. On 21 January, Antim took an active part in Sigep 2024, with a view to continuous information and training in the milling sector. On 28 February 2024, Antim took part in the PestMed Expo conferences at BolognaFiere, with a masterful presentation given by me.

We are working on a memorandum of understanding with an important international company that has a prestigious headquarters in Italy, for the development of artificial intelligence in our sector and in particular at certain process stages. Moreover, we are working on this topic for a forthcoming conference, which will make all members aware of the project and welcome ideas to be developed, personal and corporate availability. The treasurer and president always fulfil all the legal and tax obligations, with the closing of the Association’s budget and the approval of the provisional and final budgets.

After Sipeg, what are the new trends you are addressing with the creation of new types of flours?

The Sigep has always inspired and provided us with a real understanding of future market and consumer trends. As Antim, we have long been committed to the production of wholemeal flours and semolina with a focus on healthiness and hygiene. We know that our profession is very important because we produce “food” (semolina and flour) that is eaten by humans as well as byproducts that feed our meat animals and pets (bran and middlings).

Food safety and hygiene. What are the necessary conditions for producing safe flours?

In order to produce safe flours, there is a great deal of planning and daily efforts involved. Planning right down to the design and/or replacement of certain plants, not only for perfect operation, but first and foremost to always have hygienically safe plants that can produce safe flours. This is why we have long had technical collaborations with trade magazines and with manufacturing companies so that millers (milling technicians) are always up-to-date, being able to make use of the latest evolutions in the sector developed by specialised engineers.

How is your experience in the ecological transition of mills?

For mills, environmental protection is a fundamental principle. Although mills are energy-consuming companies,

WE HAVE LONG-STANDING PARTNERSHIPS WITH MANUFACTURING COMPANIES

they are still industries linked to the world of agriculture, which is why the objectives of the process of change and transformation of societies and the economy are all sustainability-oriented. Our work starts from nature, which is why we are committed to safeguarding it and respecting the people in the different territories where we operate. The short supply chain, energy saving in the factory and attention to waste are some of the tools we use to give substance to our commitment. For us, being sustainable means first and foremost preventing and minimising the impacts of our processes and products on the environment: this is why we have created programmes and initiatives aimed at progressively reducing environmental impacts and improving the efficiency of our use of resources. We are convinced that recognising the close relationship between the economy and the environment is crucial

for genuine sustainable development. The historical moment we are living requires a constant and concrete commitment from everyone to create a more sustainable future also in view of achieving the UN Agenda 2030 goals. The challenge we have taken on is to combine efficiency and respect for the environment, innovation and quality of life, energy saving and development, focusing on quality rather than quantity. The areas in which we have worked to increase sustainability are the following:

1) maximum attention to the individual mill motor and in particular to the power factor correction units;

2) storage warehouses, with LED neon replacement; 3) backhauling, the use of return trips of our vehicles, to prevent them from returning empty, with a reduction in fuel costs; 4) to avoid waste and consequent waste production, we have focused our attention on the management of recyclable pallets and packaging for product transportation. We believe that sustainability, which initially entails an additional cost for the company, can lead to an economic return by reducing waste and energy consumption, which improves the company’s reputation and image.

The Editorial Staff

Italian trade is increasingly dependent on maritime transport. In fact, 37% of our import/export travels by sea and its value reached 254 billion euros in the first nine months of 2023. Over the 20-year period 2003-2023, sea transport increased by 8%, with a parallel decrease in road transport. Along the routes of international freight traffic, Italy can play a major role thanks to a renewed strategic central position in the Mediterranean, which is today the hub towards the markets of Northern Europe as well as the Middle East and North Africa (MENA) area, the largest GDP and trade area in the world, the main gateway to Africa and a hub for the Atlantic shore of the United States. Moreover, the import/export of the world’s key players (US and China) and Europe’s

(Germany, France and Italy) towards the countries on the southern shore of the Mediterranean and the Gulf (MENA area) has been steadily growing over the past 15 years.

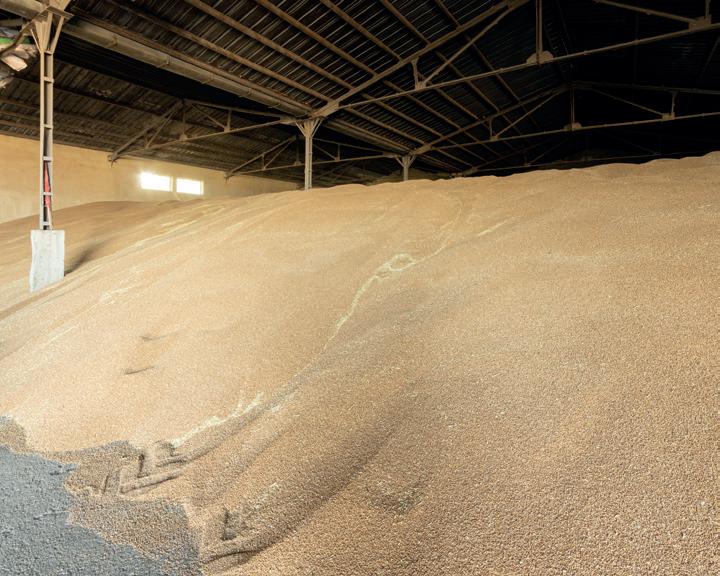

The transport of cereals

As far as the grain trade - specifically wheat - is concerned, Italian ports play a major role, as wheat (durum and soft) is a key raw material for Italian food industry. Their strategic location, modern infrastructure and cargo handling capacities help to ensure a reliable supply chain capable of supporting the production of wheat-based products that are an integral part of Italy’s culinary tradition. Managing efficiently these ports is a way to ensure Italy a constant and stable wheat supply,

which is essential to maintain its world leadership in the production of pasta and other excellences of Italian food industry. The maritime traffic market for dry bulk - and therefore also for wheat -

is strongly linked to port structures and their operational dynamics, as the handling of this type of goods requires terminals with specific features. In fact, dry bulk carriers play a major

role in the transport chain because they are able to connect producers with end users; their efficiency is influenced by a number of internal and external factors, as well as by the design layout underlying the terminal construction. Dry bulk carriers play a key function because they are mainly responsible for the efficiency of the whole logistics chain, an aspect that determines its cost more than any other. Dry bulk terminals serve ships with large holds, usually divided into compartments that can be used selectively according to the product category. The ideal location for this type of terminal is determined by shipping factors, such as the exposure to weather conditions and the depth of the seabed, combined with easy land transport (road/rail) and the availability of large storage capacity areas. A strong economy of scale for the management of space and equipment, and for the specialisation of personnel is based on the concentration of handling operations for one or a few types of products in large quantities. The generally downward trend recorded for this traffic segment in the ports of the Mediterranean region over the last decade is associated with a decline in the Ionian ports share, only partially

counterbalanced by the growth of Adriatic sea’s ports over the last threeyear period.

An important reference case for the Adriatic-Ionian area is the port terminal of Ravenna, the largest platform for dry bulk cargo in the Mediterranean, which operates with equipment and facilities (grinding, mixing, bagging, etc.) distributed over quays 2 km long and an area of 800,000 square meters, and which can count on its own rail yard; this terminal is able to handle up to 7 million tonnes per year between loading and unloading. The port of Ravenna is a leader in the import of cereals, oilseeds and raw materials for the production of ceramics. According to the data of Port Infographic 2023, a research work published online within the SRM’s permanent observatory on the economy of sea transport and logistics carried out thanks to the partnership between SRM and Assoporti, the only dry bulk cargos handled in the period JanuarySeptember 2023 at the port of Ravenna amounted to 7,906,002 tonnes, 9% less than in the same period of 2022.

The Port of Ravenna’s website shows that the various factors that caused the sharp downturn in the world economy (energy crisis, inflation, increase in bank rates, interruption of supplies, which limited the circulation of foodstuffs and caused a general increase in prices) inevitably affected the traffic of goods handled in Italian ports. In addition, Ravenna also had to deal with the damage caused by the flooding that hit the Romagna region in May 2023 and the repercussions caused by the crisis in the Red Sea. Subsequently, with its 5,206,157 tonnes of goods handled, in 2023 the food sector recorded a drop of 8.8% compared to 2022. If we analyse the individual commodities trend, a negative sign was reported for agricultural products and, in particular, for cereals handling (unloading only), which closed 2023 at -6.7% compared to 2022.

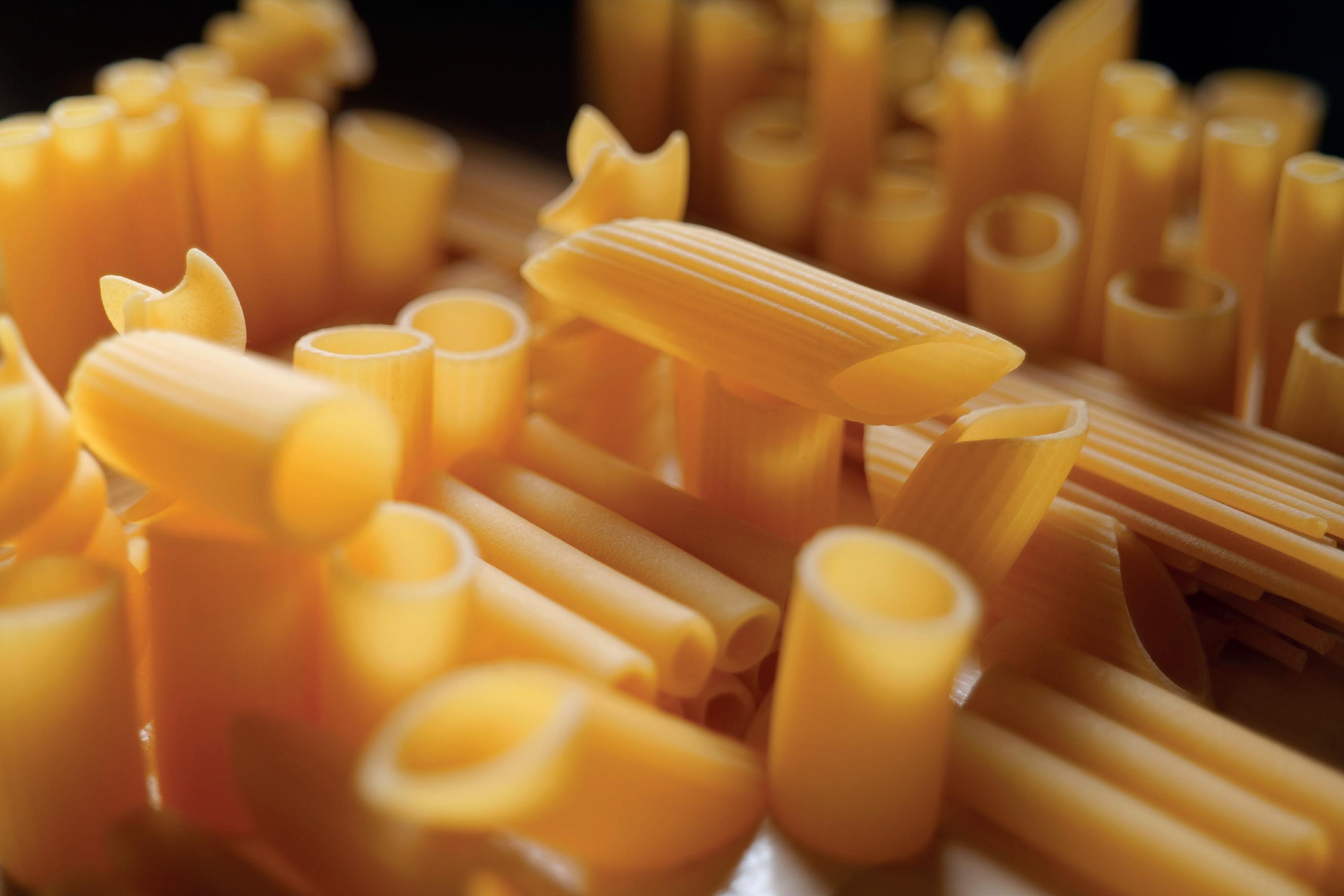

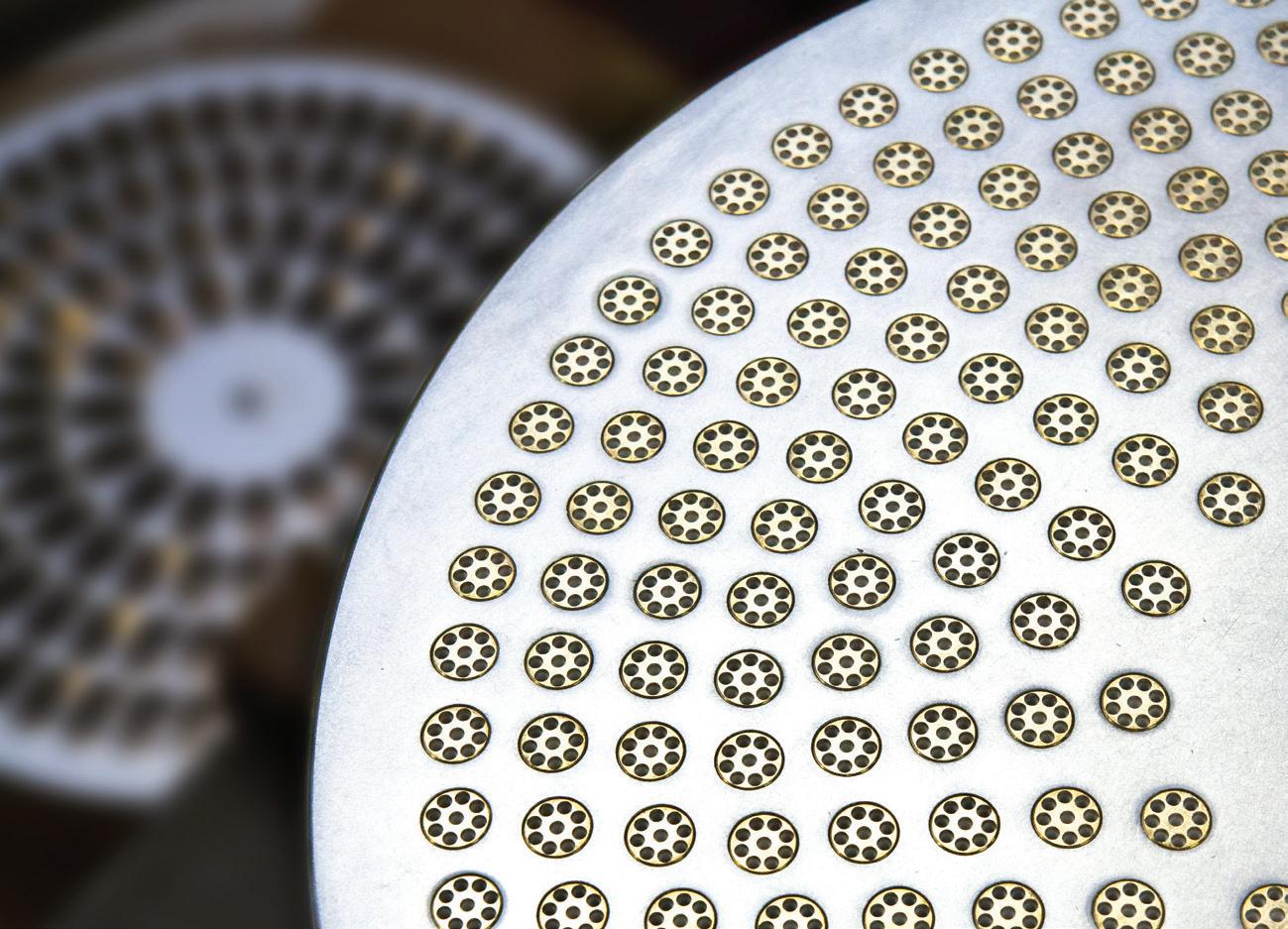

All results confirm it: our most advanced research leads to exceptional pasta quality levels, guaranteeing extraordinary solutions for the field. The new range of long and short-cut pasta lines, GPL 180 and TCM 100, are proof of the important technical and technological developments which, together with our innovative R&D laboratory and our ever-evolving value-added services, demonstrate the exclusive advantages of our know-how.

www.fava.it - www.storci.com

Another important Italian terminal for the grain market is the port of Venice. Located within the lagoon, it covers two areas: the Marittima, in the historic centre, which welcomes passengers, and Porto Marghera, where freight traffic (containers, dry and liquid bulk cargos) and ferries are concentrated. Thanks to a significant demand in the port and hinterland, rail and waterways intermodality, good nautical accessibility and unified control procedures, the port of Venice is a reference port for agri-food bulk traffic. The agri-food sector, which accounts for 7.7% of the total volume, in terms of tonnes handled in the port of Venice, is characterised by two types of industries: the milling industry (flour mills for human nutrition) and the animal feed industry (poultry, pig and cattle farms). In addition, the oilseed pressing industry for the production of oils and flours, the latter meant for the livestock sector through the feed industry. It should

be considered that, especially for cereals, the volumes handled by the ports also depend on the domestic harvest and that of central European countries, which supply the industries of the sector by road and rail; in particular, the activity of the port of Venice is mainly affected by the trend of harvests in eastern Europe. For that matter, in 2022, the port of Venice was among the first ports to welcome ships from Ukraine and distinguished itself during the Ukraine Solidarity Lanes initiative promoted by the European Commission. According to Port Infographic 2023 data, dry bulk cargos alone handled in the period January-September 2023 at the port of Venice amounted to 5,387,795

tonnes, +2.6% compared to 2022. It is important to point out that, since 2018, an expansion plan has been in place at the Venice terminal by significant production companies in the agrifood sector. For instance, Cereal Docks has invested 60 million euros in the modernisation of the production plant in Via Banchina dei Molini; it was purchased in 2011 by the multinational Bunge, had been undergoing a complete renovation since 2012 onwards and reached full capacity in 2016, a year ahead of schedule. The plant is currently equipped with silos with a total storage capacity of 90,000 tonnes, which feed an oil, flour and lecithin extraction plant. Such a capacity is supported by the new unloading quay on Marghera’s western industrial canal, which can count on a water space that allows the mooring of Panamax ships up to 240 metres long, with consequent benefits in terms of efficiency. Now, it will be necessary to implement the already good logistics network towards the mainland in order to fully capitalize on these investments.

Located on the northern coast of the Gulf with the same name, the port of Taranto consists of a wide roadstead called Mar Grande and an inland inlet called Mar Piccolo. Port’s infrastructure is distributed along the north-western sector of the Mar Grande (Commercial Port and Industrial Port) and immediately to the west (Multifunctional Pier and Pier 5). The port of Taranto can benefit from a strategic geographical position: it is located along the Suez-Gibraltar route and is part of the TEN-T network as the final node of the rail-road terminal of the Scandinavian-Mediterranean corridor, a maritime node linking the corridor to Valletta. In 2022, the port of Taranto handled up to 14,572,761 tonnes of goods, made up of dry bulk (7,944,214 tonnes), liquid bulk (3,550,559 tonnes) and miscellaneous goods (2,794,141 tonnes), while the container sector handled a total flow of 26,269 TEU. Also according to Port Infographic 2023 data, dry bulk alone handled in the period JanuarySeptember 2023 at the port of Taranto amounted to 5,798,940 tonnes, a 5.7% decrease compared to 2022. It should be noted that, in 2020, in an attempt to create new opportunities at the Port, Confindustria Taranto had put

forward a project for the reconversion of jetty II in the Port of Taranto to create an agri-food hub. An initiative that, unfortunately, was not followed through.

There is growing evidence that the great potential of the Italian agrifood chain is becoming more and more strategic for the Italian territory, since it can provide new economic and employment boost to the areas where it is developed. Therefore, even

those ports that are less suited to the import of solid bulk have taken into consideration the creation of dedicated hubs. This is the case of the port of Trieste, Italy’s main oil port and, following the Russian invasion of Ukraine, a transit port for Kiev wheat; anyway, there is already a cereal terminal (mainly for durum wheat) at Pier VI, consisting of three buildings (a port silo, hangar “65” and the milling plant building) owned by Grandi Molini Italiani. At the same time, the tradition of the area also plays a role in the vocation of a port

Flameless Venting VIGILEX VQ

Curved Flameless Venting VIGILEX VQ

Flameless Venting VIGILEX VQ

Curved Flameless Venting VIGILEX VQ

hub. On the other side of the Italian boot, in the western part of the peninsula, starting from the north, there is the port of Genoa (including the Savona-Vado port of call), one of the Mediterranean’s main maritime hubs. While the dry bulk alone handled in the period January-September 2023 amounted to 2,643,471 tonnes (-13% compared to 2022, according to Port Infographic 2023), the Western Ligurian Sea Port System Authority’s annual report for 2022 shows that imported wheat amounted to 74,480 tonnes in the Savona-Vado port of call alone. A certainly significant quantity, although not at the same level of Ravenna and Venice. Even the port of Livorno, a multi-purpose port equipped with infrastructures and means that allow it to receive any type of ship and handle any type of goods, does not show significant numbers in terms of solid bulk cargos. Like many other Italian ports, the port of Livorno has also been affected by the negative economic situation characterised by the slowdown in the European economy as well as the uncertainties

related to the higher interest rates. In particular, the data published by the Port System Authority of the Northern Tyrrhenian Sea, referring to the period January-June 2023, show that volumes of imported dry bulk only reached 264,522 tons (-16.5% compared to the same period of 2022), and cereals only 27,457 tons. The port of Naples, whose geographical position makes it a crucial hub for the transport of goods to the southern regions of Italy, also finds a place in this quick overview. The port showed a sharp drop (-9.6%) in imports of dry bulk goods in the period January-September 2023, which stood at 993,813 tonnes, while in 2022 they had amounted to 1,161,363 tonnes, with 273,791 tonnes of cereals.

Italy ranks 14th in the Liner Shipping Connectivity Index, which measures the competitiveness of the global port and logistics system. Therefore, the Italian port system should make better use of its strategic geographical position and Italian ports should

aspire to become alternative transit points to those of North Africa and Piraeus, specifically with regard to direct trade with China. However, the next and major challenge concerning ports is their sustainability, with their crucial energy and environmental reconversion. In order to achieve the European goal of climate neutrality for human activities, this sector too will have to contribute to decarbonisation. This is one of the areas on which, due to the global nature of the sector and its specific characteristics, it is perhaps more difficult to take action. For instance, replacing diesel that moves ships requires not only action on fleets but also on ports. So, what kind of technologies need to be put in place to find the most appropriate solutions? What investments will such transformations require? How will ports have to adapt to accommodate and supply ships with zero impact on the environment, as well as to manage more environmentally friendly storage centres?

During the last edition of Sigep, the International Trade Show of Artisan Gelato, Pastry and Bakery, a research study commissioned by the Italian Bakery Ingredients Association (AIBI) to Format Research was presented. The study traced an outline of the Italian bakery sector, focusing on consumption and perspectives for artisan bakery. It showed that in Italy there are some 47,000 companies working for the production and trade of bakery products (76%) and pizza and pastry (24%). The study indicated that the revenues of the entire sector exceed 13 billion euros, two thirds of which are produced by companies with more than 10 employees, despite the fact that they only account for 8.2% of the total, while companies with less than 10 employees make up the overwhelming majority of this sector (91.8% of the total). And it is precisely on this fabric composed mainly of small businesses that the impact of energy costs and the increase in raw materials had the greatest effect during 2023. However, for 69.8% of artisan bakers, in 2024 the consumption trend will remain stable or increase slightly, while for 79.4%, the sector will experience no major shocks or even growth in the coming years (14.8%).

The increase in energy and raw material costs and the attention to health have not stopped Italians’ passion for bread. After all, bread represents much more than just food: despite price rises and changing lifestyles, its relation with the Italian food culture and everyday life is still very strong. Certainly, the rising cost of raw materials for bread production is having a significant impact on the bakery and confectionery sectors but, at the same time, the bakery world seems to be still crucial. As it has already been mentioned, the smallest companies are most affected by rising operating costs and they will necessarily have to review their investment plan. On the other hand, the medium-large companies resist quite well and should have no difficulty in

carrying out their planned investments. In general, the strategies and solutions put in place by companies to limit the impact on margins caused by rising energy and raw material costs have led to an inevitable increase in prices (for 60% of companies). In fact, there is practically no company that will act on product quality to protect its profit margins.

Italians’ consumption trends, aimed at pursuing a healthy lifestyle, are

paving the way for change. Eating has become an increasingly personalised act, closely linked to one’s perception of the world. This is one of the reasons why the Bakery Art market is constantly evolving, where bread is in all respects an experience to be enjoyed. According to the survey, for 66.4% of consumers, the choice of ingredients is paramount, confirming that Italians are a very demanding people. 54.4% ask for a digestible product, while 31.2% prefer a healthy product, in response to specific dietary needs or intolerances. The search for well-being

is even more evident when it comes to confectionery, where Italians prefer “healthy” products (58.4%), i.e. with less sugar and fat. 48% of operators consider the choice of consumption in favour of “free from” products, e.g. without milk and eggs, to be relevant, and the proposal of reduced weights is also important. It must also be said that people appreciate more and more the reinterpretation of classic product, a trend that has especially promoted large leavened products such as panettone In our social media age, attention to aesthetics could not be overlooked; in fact it determines the choice of confectionery products for 21.8% of those interviewed. As to ingredients, traditional flours are bound to prevail in the artisans’ choice (66.6% of those interviewed); however, the use of other options such as rice, soy and manitoba flour is also growing, which could cover more than 20% of the market in 2024. Good news also for extra virgin olive oil, which should see an increase in its use

in the bakery world, replacing butter in some processes. Seed oil, in particular sunflower oil, covers 27.3% of the market, due to its versatility. Among fats, butter prevails, but the new margarine, vegetable-based and redesigned for those with dietary problems or intolerances, is appreciated by 26% of the artisans, who value its multiple uses and fewer critical issues with allergens.

Over the past ten years, bakery companies have experienced a slight but steady decrease in consumption, which has been around 1% in the last period. According to 69.8% of the companies, this trend is stable. For the coming years, current volumes are expected to be maintained (78.4% of the companies claim that the consumption level will remain stable). The companies in the bakery, pizza and pastry trade as a whole, expect an average growth in consumption of 1.6%. Consumers’ attention to ingredients (the type of oil, flour, etc.), the digestibility of products and special processing for intolerances, diets, etc. is increasing and will continue to increase

in the coming years. Consumers will also focus more and more on healthy products, the so-called “free from” cakes (no milk, no eggs, etc.) and single-

THE ATTENTION TO “FREE FROM” PRODUCTS IS CONSTANTLY INCREASING

serve cakes. Among the types of yeast and other leavening agents, sourdough and classic baker’s yeast are the most widely used today. In the coming years, the use of sourdough will increase compared to other leavening agents. As to flours, flour grinds 0, 00, 1 and 2 are the most widely used today. The use of alternative flours (rice, soy, manitoba, etc.) is expected to grow significantly in the coming years. Finally, a significant reduction in the use of seed oil is expected. Moreover, an increase

in the use of “hydrated” creams and a reduction in the use of any other type is also expected. An increase in the use of butter, which is more versatile than other ingredients, is predicted, together with a reduction in margarines and mélange.

It should be noted that the Italians’ attention is also focused on “sustainable” bread, and specifically

on the use of recycled paper bags and state-of-the-art production machinery. After all, sustainability is one of the highest concern to the entire community. Artisanal bakery, by definition, has good prerequisites in this regard, because bread is produced locally every day. As to consumption, new anti-waste opportunities are emerging, such as bread on request or the possibility of buying fresh products at half price from late afternoon onwards. Surplus is perhaps

the most complex aspect to manage, but this is precisely how no waste is truly achieved. Suffice to say that last-minute markets already have around 1.5 million users per year. Not throwing away but reusing and redistributing means creating more value and more work. In this context, businesses and bakers must network. Indeed, sustainability means rolling up our sleeves and working together, from social to surplus management. For example, in Northern Europe glass and plastic recycling takes place in the shop: one could take a cue from this. Other initiatives, e.g. “pending bread”, directly involve bakers, let alone the ecological packaging, a sustainable tool par excellence. The Editorial

During the last Annual General Meeting, Andrea Valente, owner of Molini Valente in Felizzano (Alessandria, Italy), was confirmed for the next two years as President of Italmopa, the Association of Italian Millers, which exclusively represents the Italian soft and durum wheat milling industry. Andrea Valente will continue to be assisted in his duties by the current vice-presidents: Alexander Rieper (A. Rieper) and Emanuela Munari (Munari F.lli) for the Soft Wheat Mills

Section, Vincenzo Martinelli (Candeal Commercio) and Umberto Sacco (Moderne Semolerie Italiane) for the Durum Wheat Mills Section.

In addition to Valente’s confirmation at the helm of the Association, during the Annual General Meeting, the figures of the Italian milling industry for 2022 were released, showing that the year was characterised by a generally by Italmopa

EWSPEST CONTROL

EWSBIO TREATMENT

EWSFAUNA MANAGEMENT

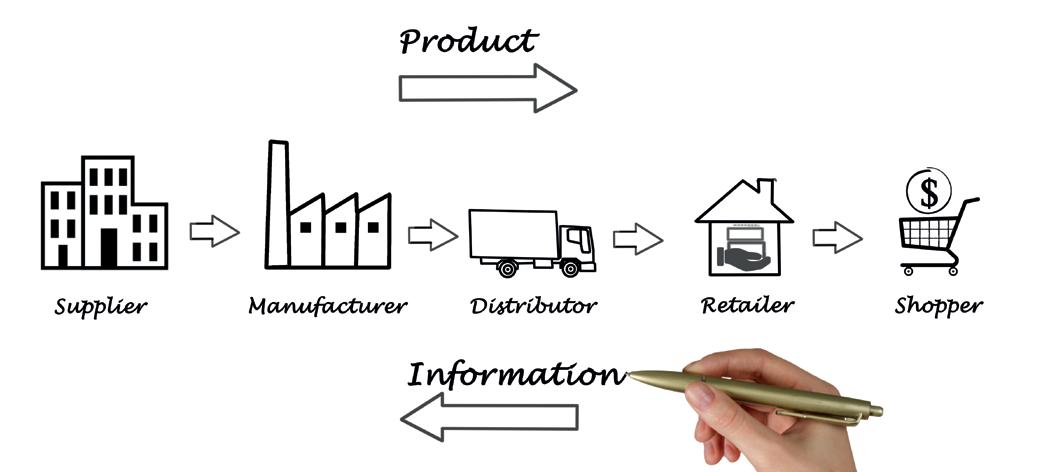

The agri-food sector is among the most sensitive when it comes to pest control. Those working in this sector know well that infestations can arise at any step of the supply chain: from raw material harvesting to the final consumer.

Scan the QR code to learn more!

EWS

Via

EWS Group offers comprehensive services to protect both buildings and goods from infestations, applying IPM (Integrated Pest Management) standards.

+39 010 4714117

info@ews-group.it

www.ews-group.it

EWS Group

positive production trend in both the soft and durum wheat milling sectors. Moreover, both sectors recorded an increase in turnover as a result of the sharp rise in agricultural raw material and energy costs, which inevitably affected flour prices. In 2022, the volume of flour products produced by the Italian milling industry reached 8.128 million tonnes, an increase of about 4.1% compared to 7.810 million tonnes in 2021, while the total volume of products of the Italian milling industry - including milling by-products - reached 11.583 million tonnes. A trend with a plus sign that seems to be confirmed also for 2023, despite the reduction in food consumption caused by the economic uncertainties linked to the continuing war in Ukraine and the crisis in the Middle East. Based on the production and price indicators for the different types of flour and milling by-products, in 2022 the turnover of the milling industry exceeded 6 billion euros. As far as the soft wheat milling industry is concerned, it is worth mentioning an overall increase in flour production volumes of 3.4% compared to 2021 (from 3.930 to 4.062 million tonnes).

The positive trend also concerned the main commercial channel for soft wheat flour, i.e. the bakery sector, which in the past, and not only in the recent past, had always recorded a constant and worrying downtrend: in fact, the

production of flour meant for the bakery channel and bread substitutes showed an encouraging overall growth of 3.9%, driven by the robust demand coming from large-scale distribution, while demand from the artisan bakery channel was lower, but still on the rise. The flour production for the confectionery sector was substantially stable (+0.4%) despite the drop in demand for festive sweets production. Some particularly positive signs in demand still come

from the pizza channel (+7.2%), driven by the frozen food sector (+13.2%), and exports (+19.8%), as a result of an increasingly widespread international appreciation of the quality and versatility of Italian flours. On the other hand, the volume of flours sold on the shelves decreased: a 8.6% drop recorded by this channel represents a further reduction of excessive hoarding by retail customers, which had characterised the first stage of the Covid emergency.

In 2022, the durum wheat milling sector recorded an overall increase, compared to 2021, of about 4.8% in semolina

production, due to the positive trend in demand from the pasta industry, driven by export success. It should be noted that demand for semolina, which was very high in the first half of 2022, gradually lost intensity in the following months.

Italmopa’s activities are also characterised by careful communication and promotion of

the sector. With this objective in mind, the “Mills Open Day” was created; it is an initiative desired and conceived by the Association, a notto-be-missed opportunity for those, particularly consumers, interested in

experiencing the fascinating process of soft and durum wheat milling, and its transformation into various types of flours and semolina meant for Made-in-Italy flagship food products such as bread, pizza, bakery products and pasta. This is a unique opportunity because it allows mills to communicate directly, without filters, and consumers to experience first-hand how much work and knowledge is required to produce quality flours: from wheat reception to wheat selection, from milling to analysis, and on to packaging. This is also culture, this is also history. And above all, it is the best way to respond to the many biases against a sector that is crucial for the country. The 2023 “Mills Open Day” was a success: thousands of consumers visited the milling plants that joined this initiative, and received extensive, verifiable and transparent information, thus freeing themselves from the role of passive viewers of a communication marketing trend that too often and irresponsibly relies on alarmism, especially when it comes to food. After all, the Italian milling industry is an absolute excellence, a leader in the European Union in terms of volume, quality and versatility of flour products.

by Italmopa

The congress for the 30th anniversary of Antim (Italian Association of Milling Industry Technicians) was an important opportunity to discuss some legal and practical aspects related to ecosustainability. From the point of view of food law, sustainability is reflected on various aspects of business activity, mainly on the fight against waste, the sustainability report, consumer communication and fair competition.

For the time being, there is no single approach, not to mention a single way, from a legal point of view, to achieve the environmental and social sustainability goal. In this scenario, the significant topic related to the fight against waste is regulated by the socalled “Gadda” law (19 August 2016, no. 166); its aims are: a) to encourage the recovery and donation of surplus food for social solidarity purposes,

prioritising it for human use; b) to encourage the recovery and donation of pharmaceuticals and other products for social solidarity purposes; c) to contribute to limit any negative impact on the environment and natural resources through actions aimed at reducing waste production and promoting reuse and recycling in order to extend the life cycle of products.

The “Gadda” Law stipulates that donors must give, free of charge, the surplus food received, suitable for human consumption, as a priority to people in need. Surplus food that is not suitable for human consumption can be given for the life support of animals(1) and for selfcomposting or community composting using an aerobic method. Food with label irregularities, which are not related to expiry date information or substances or products causing allergies and intolerances, can be given to donors.

by Giuseppe Maria Durazzo Lawyer and expert in food law

by Giuseppe Maria Durazzo Lawyer and expert in food law

The health and hygiene management of donated food involves, as consolidated experience confirms, several obligations that must be carefully complied with during transport, storage and distribution.

At EU level, the topic of waste reduction finds its cornerstone in the draft amendment of Directive 98/2008, in particular in the future

• INDUSTRIAL CONSTRUCTION

• CIVIL CONSTRUCTION

• CONCRETE SILOS

• ORDINARY AND EXTRAORDINARY MAINTENANCE OF CIVIL AND INDUSTRIAL BUILDING

• AIRLESS PAINTINGS

• CERTIFIED ECOLOGICAL SANDBLASTING

Via San Tommaso, 61 - Altamura - Bari - Italy +39.080.914 06 13 - info@cegliacostruzioni.it

Giangrazio Ceglia +39.340.9846919

www.cegliacostruzioni.it

Art. 9a. Another relevant topic is the sustainability, environmental, social and governance (Esg) report, envisaged by the Commission’s Green Paper (2001) in its first lines and compulsory for certain companies since 2024. The report is a corporate document that contains information on social and ecological issues. It is part of the “nonfinancial statement” that is drawn up in Italy pursuant to Legislative Decree no. 254/2016. The set of practices to improve environmental performance helps create the “green reputation” that is not only rewarded at a public, banking, insurance, and commercial supply chain level, but it can also be relevant in case of incidents that result in the violation of criminal precepts on public health, personal injury and food non-compliance.

A related topic of interest, especially for certain agri-food chains is deforestation, which is regulated by Regulation (EU) 2023/1115 of 31 May 2023 on the making available on the Union market and the export from the Union of certain commodities and products associated with deforestation and forest degradation. It applies to soybean, rubber, paper, beef, coffee, cocoa, palm oil and wood sectors. In a nutshell, the commodities and by-products concerned are not placed on the market or exported unless they meet the following conditions at the same time: (a) they are deforestation-free; (b) they have been produced in accordance with the relevant legislation of the country of production; (c) they are accompanied by a due diligence(2) statement.

Sustainability communication to the public (no matter what the future extent of compulsory EGS reports will be) is already key from the food company’s perspective and therefore also of great concern from a legal point of view. The fight against “greenwashing” , i.e. the communication or marketing strategy pursued by companies, institutions, and bodies that present their activities as environmentally sustainable, attempting to conceal their negative environmental impact, is one of the principles of public

SUSTAINABILITY IS REFLECTED ON VARIOUS ASPECTS OF BUSINESS ACTIVITY

information and legal management that also allow certain activities to be based on this fight to counter “greenwashing”(3) making use of clever devices. Greenwashing will be explicitly part of EU law with the new directive on misleading advertising that is expected to be approved in November (for the time being, it has not yet) and implemented within 24 months; it will enable rules to be strengthened to ban a certain kind of behaviour that will be qualified as misleading advertising. Generic environmental claims and other misleading marketing “tricks” will be banned and only sustainability labels based on certification schemes approved or established by public authorities will be allowed. Generic environmental claims, e.g. “”environmentally friendly”, “natural”, “biodegradable”, “climate neutral” or “eco”, and in general those lacking proof of recognised environmental performance relevant to the claim, as well as claims based on emission offsetting schemes that a product has a neutral, reduced or positive impact on the environment of a certain %(4)

will fall under the future bans. As Conai recalls in its guides to which, within the limits of a technical publication I take the liberty of referring for consultation, today there is information that may contain aspects of non-compliance. Among the claims examined: “100% recyclable”, “sustainable/ecological/ low environmental impact/zeroimpact packaging” (far too general), “eco-friendly/environmental friendly/ green/natural packaging” (allowed only if proven). I have noticed that the whole issue of private trademarks inspiring positive environmental sentiments that do not seem to draw any particular attention from the legislator remains open. Currently, the main legal instruments for fighting against misleading advertising in Italy are Legislative Decree No. 206 of 6 September 2005 (Consumer Code) and Legislative Decree 2023/26 implementing (EU) Directive 2019/2161 on unfair commercial practices (unfair competition). Article 6 of the Consumer Code indicates the basic contents of information and even those concerning the possible presence of materials or substances that may cause harm to man, property or the environment. The Code of Self-Discipline for Commercial Communication has added a new Article No.12 on this matter, entitled “Natural Environment Protection” , which is related, as it is well known, to operators who advertise to the general public. In France, the Law No. 2021-1104 “portant lutte contre le dérèglement

DEFORESTATION IS AN IMPORTANT ISSUE FOR SOME AGRI-FOOD CHAINS

climatique et renforcement de la resilience” (fighting climate change and strengthening resilience), makes it compulsory to provide information on the “climate impact” in advertisements from 2030 onwards; at least 20% of the sales space in large-scale retail distribution will have to be allocated to the sale of bulk products in order to achieve the desired reduction in primary food packaging. Along with the relevant legal instruments in the field of environmental sustainability, there are those practices, such as the depreciation of products close to their expiry date or preferable consumption date, which, although meant for commercial and business purposes, as well as for waste reduction, fall nevertheless under the applicability of hygiene and health regulations, rather than those on labelling, sale price, weight, and the proper use of materials in contact with food. Even the free gift of food or food residues to the consumer, e.g. pet food, managed as a customer loyalty approach rather than as a waste and garbage reduction solution, falls, at least in principle, among the activities that remain subject to the industry regulations from the food operator’s

perspective. Therefore, the consumer who picks up some offcuts for his dog in the food shop, for instance, may not be aware that, under the law, he could not move inside the shop with that food, unless he takes extra care. As with all matters in legal evolution, when it comes to environmental communication and the creation of good practices that allow for sustainability benefits, including social ones, it will take time for case law to consolidate, but also for the detailed regulatory framework to be completed.

Fragmentation within the EU, between member countries, seems a real risk, even if one considers only the different approaches to the value of recycling, rather than reuse, or to very specific issues such as the choice of plant varieties, with respect to the objectives of local biodiversity protection; or even if one considers the issues of the real environmental impact of the technological choices made by a single food company, the replacement of food processing methods or the impact of supply chain integration into sometimes very articulated supply chains, as well as the use of third-party processing that is carried out in another country where rules and environmental conditions are different. These are real examples that can be applied to many food production and processing realities. The application,

which may vary from country to country, of the same criteria for evaluating or comparing different development models, may represent - starting from a technical problem - a legal distortion in the legal treatment of companies, as well as an economic distortion within the EU market. Through an indepth study on this macro topic, Antim has confirmed its ability to anticipate the upcoming challenges in which its members are involved as active players and advisors for decision-makers.

Giuseppe Maria Durazzo

1. See what I wrote in: Organic pet food production, “Molini d’Italia” 11/2023 page 35

2. See what I wrote in: Deforestation and food production, “Molini d’Italia” 8/23, page 31 (https:// www.treccani.it/vocabolario/ greenwashing_%28Neologismi%29/)

3. https://www.europarl. europa.eu/news/it/pressroom/20230918IPR05412/ eu-to-ban-greenwashing-andimprove-consumer-information-onproduct-durability

4. Art. 12 - Natural environment protection. Marketing communication claiming or evoking environmental or ecological benefits shall be based on truthful, relevant and scientifically verifiable data. Such communication must make it clear to which aspect of the advertised product or activity the claimed benefits relate.

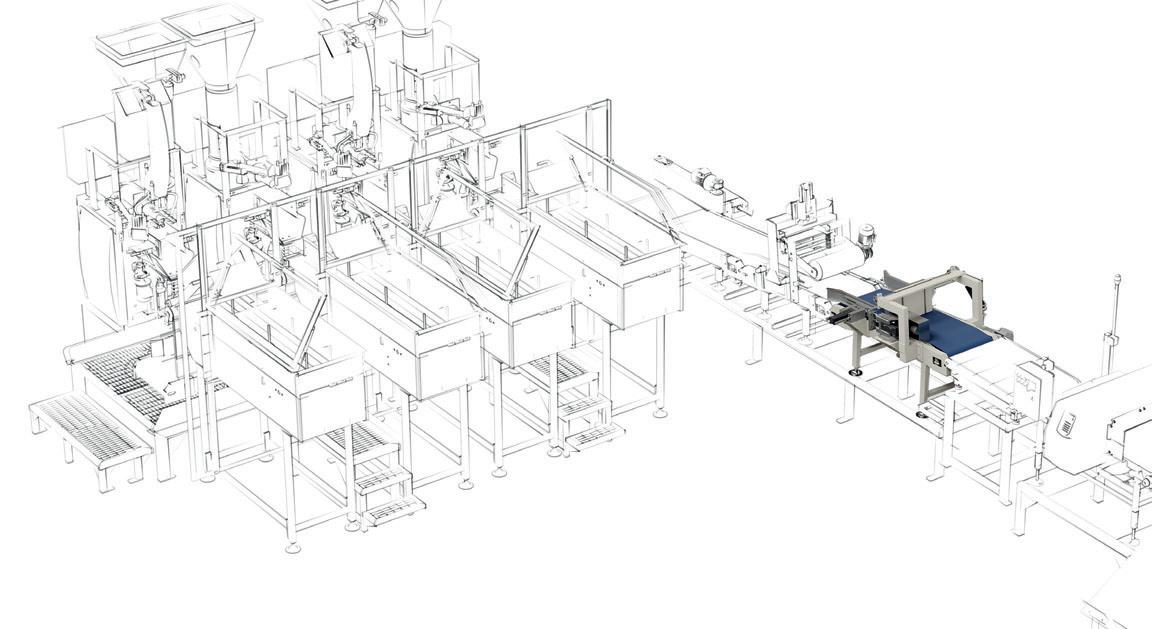

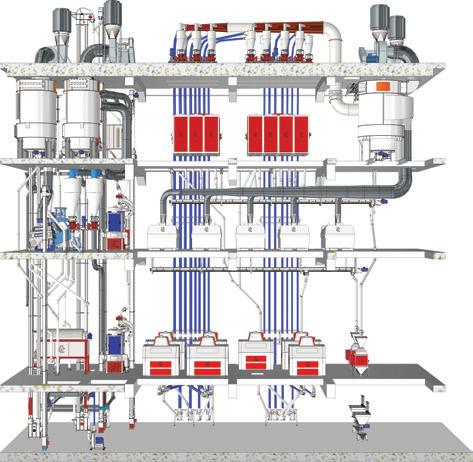

Ocrim, a Cremona-based company, top player in the milling sector with a history of excellence and innovation, proudly announced the acquisition of Sima (Treviso, Italy), another key player in the panorama of storage facilities. This operation marks a significant step in Ocrim’s growth strategy, consolidating its position as a key player in the construction of milling plants, through the direct and specialized offer of complete solutions for storage plants.

Over the years, Ocrim has earned a global reputation for providing advanced technologies and cuttingedge services in the milling industry.

The company has been a pioneer in integrating technological innovation with the practical needs of milling companies, offering tailor-made solutions that improve efficiency, quality and sustainability in the processing of wheat, corn and cereals in general.

The acquisition of Sima - specialized in the design and construction of storage

systems that guarantee the optimal conservation of raw materials and finished products - was a strategic move aimed at expanding Ocrim’s offer and responding to the growing needs and requirements of the market. The integration of the skills of Sima - present in the sector for over forty yearswill allow Ocrim to offer complete solutions, covering the entire production chain, thus integrating the storage of cereal and finished products in the mill. The two companies share values such as honesty and reliability, a sense of collaboration and availability and above all attention towards their human capital. Ocrim has always been an attentive and 360-degree prepared supplier and certainly the construction of storage systems has always been part of its skillset. But this agreement concretely allows it to add a new piece to its industrial supply chain, as well as to the agri-food supply chain “The Italian Argi-Food Chain Choice”, of which Ocrim has been spokesperson for eight years.

growing needs of our customers and to respond to the increasingly complex requests of the market which is looking for loyal, strong and complete partners”.

Ocrim Ceo, Alberto Antolini, said: “This acquisition represents an important step in our growth strategy. With Sima’s experience and expertise, we are ready to reach new levels of excellence and meet the

It is clear that Ocrim aims to capitalize on the synergies between the two companies, combining its experience in the milling sector with Sima’s specialization in storage facilities. This integration will allow the Cremonabased company to offer more complete and competitive solutions on the market, positioning itself as an undisputed interlocutor in providing end-to-end solutions for the milling industry.

In conclusion, the acquisition of Sima represents an exciting chapter in Ocrim’s success story. With a futureoriented vision and an ongoing commitment to innovation, Ocrim is preparing to reach new heights of excellence in the global milling market.

23

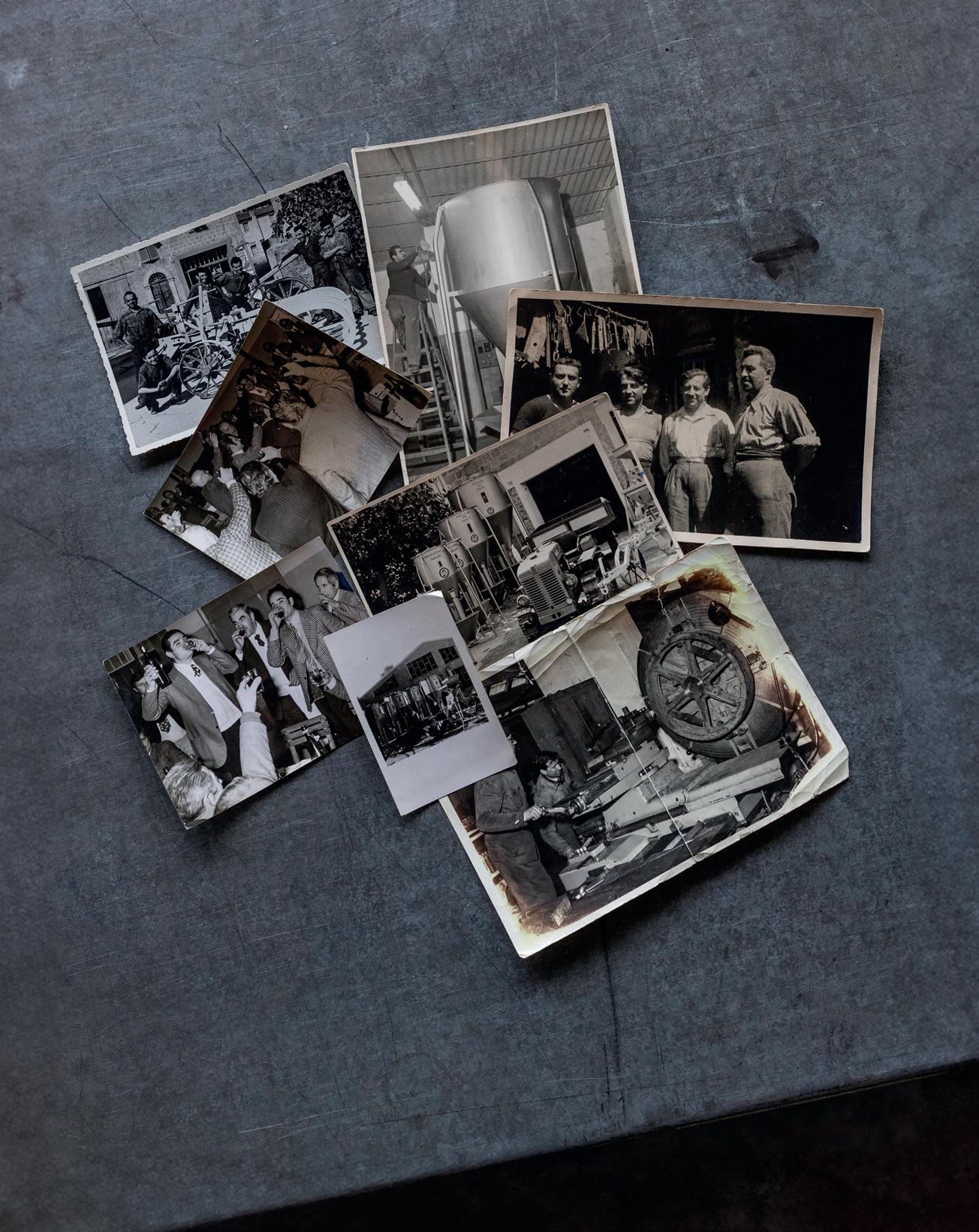

rd of February: a special day for Cusinato Giovanni Srl and its founder Giovanni.

In a splendid 18th century Venetian villa in Bassano del Grappa, Vicenza (Italy), the 60th company anniversary of an amazing journey that began back in 1964 was celebrated together with all the employees of the Cusinato Group, with the participation of customers, agents, suppliers and friends.

A journey of sixty years through which Cusinato, with over 23,000 machines and 2,600 silos installed, has become a leader in the production of high quality plants dedicated to the handling and storage of food and non-food products, such as pasta, pet food, snacks, dried fruit, candies, pulses, seeds, flours, wood pellet, plastic granules and many more. Present in 85 countries around the world, with its plants Cusinato handles more than 30% of the world’s short cut pasta production every year.

Constant growth supported by many strategic choices in synergy with each other, such as the pursuit of the highest quality in plants, diversification of

application sectors, an international outlook on target markets and continuous investment in research and development.

Cusinato plants can connect to customers’ computer systems to achieve total integration with the production planning, with the possibility of calculating the main performance indexes, guaranteeing complete traceability of products and performing remote assistance.

The event on 23rd February was also an opportunity to celebrate the 85th birthday of the founder Giovanni Cusinato, an entrepreneur who made himself out of nothing, but who always believed in his own abilities and ideas, looking to the future with tenacity and foresight.

Over the years, he has been able to pass on the company’s values and mission to his children and a new, high-profile management team, who together now lead the company into the future.

Fieragricola in Verona (Italy) was the occasion for Cimas Group to confirm its growth and stimulate great interest in its activities. A targeted and wide audience visited the stand and was entertained to learn about all the news, showing particular interest in the latest plants built, in Italy and in the world, demonstrating that the company has fully met the expectations of customers and prospects. Cimas Group, now specialized in the construction of feed mills and turnkey storage facilities, focuses on three elements: challenge, dynamism, optimism and investments in digital transition. In order for innovation to be the main objective in this constant change in the industrial world with particular attention to the agricultural and livestock sector, Cimas Group has set itself the goal of continuous improvement in its production processes.

All the new 4.0 machines for raw material processing and sheet metal cutting with laser and plasma technology are a tangible demonstration of this, together with the simplification aimed at designing and implementing new simplified control systems. Redesign and redesign are aimed at maximizing performance efficiency and reducing energy consumption and waste dispersion. Cimas Group is present in Italy in Ponte Felcino, Perugia, the village where it was founded more than 150 years ago. Today, the Group is one of the most important European companies that meet the needs of those who require the most advanced storage systems and the best plants dedicated to the improvement of production processes in feed mills.

In 2003 the company created Cimas Industrie S.a.r.l. in the industrial development district of Bizerte, Tunisia, with the aim of having an operational tool capable of guaranteeing skills and services to those market areas characterized by a high growth rate in the agriculture and livestock sector.

Mattia Nataloni, Cimas Export Sales Director, said: “Our presence at Fieragricola confirms our propensity to invest and, at this time, also to take entrepreneurial risks. The discussion with high-profile managers and the exchange of opinions and reflections with important Italian entrepreneurs present was a stimulus and a confirmation: Cimas wants to be a protagonist in its reference sector. One of the fundamental aspects to better manage a company in the period we are experiencing, with truly unpredictable economic and social imbalances that create great logistical and relational supply difficulties, is to keep innovation and dynamism alive. What we have been trying to do in the company for six generations is precisely this: to keep up with the technologies that our sector requires, to create new technologies and to always be highly competitive in terms of price and service offered”.

Rivestimenti di celle e silos con resine epossidiche certificate per il contatto con alimenti

Rivestimenti di pavimenti con resine multistrato e autolivellanti

Tinteggiatura superfici interne ed esterne di opifici industriali

Andria (BT)

0883.251661

info@pi-sa.it

www.pi-sa.it

Impermeabilizzazione con poliurea