State Supreme Court hears Puce v. Burnsville park fee case

The Minnesota Supreme Court heard oral arguments in Puce v. Burnsville on Oct. 4 in the Minnesota State Capitol.

Puce v. Burnsville is a challenge to the city’s park fee ordinance. Under Minnesota law, any development fees or dedications must have a direct connection to the project and the impact must be specific to that project.

The case involves a commercial property at 2208 Old County Road 34 Place, where land owner Almir Puce sought to open an automobile shop and bakery. The city of Burnsville ordered Puce to pay a $37,804 parkland dedication fee before later knocking the fee down to $11,700.

The city of Burnsville won in the initial chal lenge in Dakota County Court, and the Min nesota Court of Appeals overturned the district court ruling in favor of Puce.

The appeals court found Burnsville illegally imposed a parkland dedication fee on a commer cial developer without reasonably determining the city needed to acquire, develop or improve parkland as a result of the development.

Puce v. Burnsville could have significant im pact on the development process. The Burnsville City Council voted to seek further legal review after the Minnesota Court of Appeals ruled against the city, sending the case to be reviewed by the Minnesota Supreme Court.

The League of Minnesota Cities submitted an amicus brief in favor of Burnsville and Housing First Minnesota submitted an amicus brief in fa vor of Almir Puce.

Editor’s Note: Housing First Minnesota is the publisher of Housing Industry News.

Energy

Housing inventory remains low even as housing market shifts

Across the country rising mortgage rates and inflation have had a stifling impact on the housing market. It is no surprise when considering that from the start of the year, mortgage rates have more than doubled, increasing from 3% in January to rates now over 6% this fall.

Permits for new single-family homes have fallen 16% year-to-date in the Twin Cities, according to the Keystone Report for Housing First Minnesota. While that is a notable drop, single-family permit ac tivity remains on pace with pre-pandemic construction levels, with a 1% increase in the number of single-family permits pulled year-to-date compared to 2019.

“Rising inflation and climbing interest rates are having a clear impact on the hous ing market as more buyers are priced out of homeownership,” said James Vagle, CEO of Housing First Minnesota.

18 million U.S. households have been

priced out from purchasing a $400,000 home since interest rates rose from 3% to 6%, according to John Burns Real Estate Consulting. During its latest National Housing Market Update, Zonda noted that monthly payments have risen 40% to 60% depending on the market.

South Dakota, Ohio and California — all three are renting and they all absolutely want to own a home. They were all trying to buy a home and have all been moved to the sidelines,” said Ali Wolf, chief econo mist for Zonda. “That is an opportunity for how we reach these buyers and get them to a point to convert to homeownership.”

With so many buyers being priced out, overall housing inventory has started to tick up from its historic lows. Inventory of homes for sale in Minnesota climbed 2% in August, up to 13,271 homes for sale, but is still down 41% from the number of listings available in August 2019.

James Vagle, CEO OF HOUSING

“A lot of buyers have been pushed to the sideline and are going through some of the shock. I was talking to millennials from

Many builders are offering rate buy downs as incentives to help homebuyers with the affordability issues from rising rates, but Wolf noted that even when builders offer these incentives there seems to be a disconnect for the buyers.

Fed raises rates by 75 basis points

In its continued effort to fight inflation, the Federal Reserve raised the federal funds target rate another 75 basis points mid-September. This is the third consecutive increase of 75 basis points.

The large hikes are sending shockwaves through the financial markets and the overall economy. Federal Reserve officials have now hinted at plans to continue tightening monetary policy and keeping it tight for years to come.

HOUSING INDUSTRY NEWS | 1

VOL. 6 ISSUE 5, OCT. 2022THE MINNESOTA HOUSING INDUSTRY NEWS SOURCE BY HOUSING FIRST MINNESOTA • HOUSINGINDUSTRYNEWS.ORG

Code review PAGE 4 45L tax credit returns PAGE 7 Building material prices climb as lumber prices fall PAGE 9 INSIDE THIS ISSUE 2960CentrePointeDrive Roseville,MN55113 HousingFirstMN.org PRSRTSTD U.S.POSTAGE PAID PERMIT#93652 TWINCITIES,MN

Permits for new single-family homes have fallen 16% year-to-date in the Twin Cities.

Housing Industry News will continue to follow this story and provide updates in future issues of both its online and print editions. CONTINUED >> PAGE 8

CONTINUED >> PAGE 7

“Rising inflation and climbing interest rates are having a clear impact on the housing market as more buyers are priced out of homeownership.”

FIRST

MINNESOTA

An industry of problem solvers

2022 has been a year of change for the housing industry. After a strong start in the first quarter, we’ve encountered some headwinds and today find ourselves facing macroeconomic issues driven by the markets and responses to Federal Reserve policies.

These factors impact our short-term industry outlook in one way or another. We’re seeing it in the national measures of homebuilder confidence, and in our own networks, we know that our challenges will be different than they’ve been — at least for a while into the short term.

And that’s where we come in. We are an industry of problem solvers. We see challenges and we get to work, finding ways to make homeownership dreams come true.

For some segments of our market, unique opportunities are going to emerge that didn’t exist a year ago when we were dealing with historically low interest rates. For other segments, new approaches are going to be necessary to meet the demands of an undersupplied market.

Builders and their suppliers have met the moment throughout the ups and downs of economic cycles for decades. This period of economic challenge will be unique in its own way, but our response will be rocksolid and focused on finding ways to bring homeownership opportunities to Minnesotans.

I don’t have a crystal ball that I can rely on for predictions on how and when our macroeconomic landscape will even out, but I do have certainty on a few things.

The first, is that homeownership will remain atop the priorities of virtually all Minnesotans and that our undersupplied market will require a surge in homebuilding over the next decade. I’m also confident that ours is an industry of problem solvers who will find a way through this short-term era of challenge and lead us into the coming decade by extending the opportunity of homeownership for everyone, everywhere.

Onward, James Julkowski

Subscribe

Stay up to date on the latest housing news. Subscribe to our blog at HousingIndustryNews.org

Advertising

For advertising information, rates, editorial calendar and production specifications, contact: Brad Meewes at 651-269-2399 (Brad@HousingFirstMN.org) or Kori Meewes at 612-801-9874 (Kori@HousingFirstMN.org)

News Tips

Have an idea for a story for our next issue? Contact Editor Katie Elfstrom at Katie@HousingFirstMN.org or send your story to Info@HousingIndustryNews.com

Follow Us

Go to HousingIndustryNews.org for subscriber exclusives, breaking housing news and features.

Be a part of the growing housing movement in Minnesota. Twitter: Follow us @HousingFirstMN Facebook: facebook.com/HousingFirstMinnesota

HOUSING

PUBLISHER James Vagle

James@HousingFirstMN.org

EDITOR

Katie Elfstrom

Katie@HousingFirstMN.org

GRAPHIC DESIGN Emily Doheny

ACCOUNTING

Janice Meyer

ADVERTISING SALES

Brad Meewes Kori Meewes

CONTRIBUTING WRITERS

Katie Elfstrom

Katie@HousingFirstMN.org

Nick Erickson

Nick@HousingFirstMN.org

Mark Foster Mark@HousingFirstMN.org

Kristen Ober Kristen@HousingFirstMN.org

Kate Wigley

Kate@HousingFirstMN.org

James Vagle James@HousingFirstMN.org

Housing First Minnesota James Vagle, Chief Executive Officer

James Julkowski, Board Chair

Housing Industry News is a publication of Housing First Minnesota. Housing Industry News is published and distributed six times per year to housing industry professionals and others associated with the homebuilding industry. Neither the advertisers, nor Housing First Minnesota, will be responsible or liable for misinformation, misprints, typographical errors, etc., herein contained. For address change information, contact Housing First Minnesota. Suggestions, ideas and letters are welcome.

HOUSING INDUSTRY NEWS

2960 Centre Pointe Drive Roseville, MN 55113 info@HousingFirstMN.org www.HousingFirstMN.org

Housing Industry News is published by Housing First Minnesota

Entire contents copyright 2022 All rights reserved

The Parade of Homes has a proud legacy of providing homeownership opportunities in our state. In our continued commitment to expanding the opportunity for homeownership for everyone, everywhere in our state, we’re pleased to have launched the Parade of Homes First-Time Homebuyer $10K Giveaway!

Thank

to our generous donors for making this possible

Housing First Minnesota is the voice for homebuilders, remodelers and all who are dedicated to building safe, durable homes at a price Minnesotans can afford.

Housing First Minnesota is dedicated to advancing the American dream of homeownership for Minnesotans and is the leading resource for housing-related issues in Minnesota. This advocacy work has never been more important. The housing industry remains under intense regulatory and political pressures that impact Minnesota homeowners’ ability to buy, build and remodel their dream home.

Housing First Minnesota supports reasonable policies, regulations and protections, but our call for affordability for families is a voice that must be heard.

Learn more at HousingFirstMN.org.

2 | HOUSING INDUSTRY NEWS SIGN UP TO BE A PART OF THE HOUSING MOVEMENT • HOUSINGINDUSTRYNEWS.ORG PRESIDENT’S NOTE

BOARD CHAIR NOTE

HousingIndustryNews.org

James Julkowski 2022 Board Chair, Housing First Minnesota

October 2022, Volume 6, Issue 5

INDUSTRY NEWS

Giveaway $10K FIR S T-TIME HOMEBUYER

you

Across the country, there is much talk about housing

HERE ARE SOME OF THE LATEST QUOTES ON THE STATE OF THE INDUSTRY:

Rent control has long been considered poor policy. It distorts the market, as price controls tend to do.”

TRIBUNE EDITORIAL BOARD

TRIBUNE EDITORIAL BOARD

Mortgage rates continued to rise alongside hotter-than-expected inflation numbers this week, exceeding 6% for the first time since late 2008. Although the increase in rates will continue to dampen demand and put downward pressure on home prices, inventory remains inadequate. This indicates that while home price declines will likely continue, they should not be large.”

SAM KHATER FREDDIE MAC

Rising rents significantly impact consumer price inflation. In a sense, at least for the short term, raising interest rates will further push up inflation.”

LAWRENCE YUN NATIONAL ASSOCIATION OF REALTORS ®

Interest rates have really cut into demand. The median monthly mortgage payment on a home is almost 40% higher than what it was a year ago, so that just really cuts into buyer’s budgets, it’s why we’ve seen a slowdown in prices, demand and sales.”

DARYL FAIRWEATHER REDFIN

You don’t need to study economics to know that surging demand amid stagnant supply causes prices to rise. According to the Case-Shiller Index, nationwide home prices jumped by nearly 20% last year alone. That’s the highest rate since 1979, another year of crippling inflation and economic uncertainty.”

M. NOLAN GRAY CALIFORNIA YIMBY

M. NOLAN GRAY CALIFORNIA YIMBY

Given the large role affordability challenges appear to be playing in shifting housing market dynamics, the recent pullback in home prices is likely to continue.”

ANDY WALDEN BLACK KNIGHT, INC.

ANDY WALDEN BLACK KNIGHT, INC.

Lumber Yards

MN

WI

SIGN UP TO BE A PART OF THE HOUSING MOVEMENT • HOUSINGINDUSTRYNEWS.ORG HOUSING INDUSTRY NEWS | 3

THE HOUSING BEAT

STAR

Providing our customers with construction solutions, quality building materials and superior service Get a quote today, visit www.abc-clc.com 14

Across

&

Andersen® is the #1 trusted and recommended window and door brand* *2022 Andersen brand surveys of U.S. contractors, builders & architects “Andersen” and all other marks where denoted are trademarks of Andersen Corporation. ©2022 Andersen Corporation. All rights reserved. DRAFTING & DESIGNWINDOW SERVICESCABINET DESIGN WALL PANELSCOMMERCIAL SERVICES

Energy Code review, 2023 National Electrical Code, water quality fees

On Aug. 23, Administrative Law Judge Eric Lipman held a virtual hearing on the U.S. Department of Energy’s (DOE) review of the 2021 International Energy Conservation Code (IECC). At this hearing and over the next several weeks, stakeholders weighed in on this review and whether to open Minnesota’s residential energy code for rulemaking.

Back in the fall of 2020, Lipman recommended that the Department of Labor and Industry (DLI) not open rulemaking until the next code cycle. In a move celebrated by the housing industry, then-DLI Commissioner Roslyn Robertson concurred with that decision in 2020, leaving the state’s energy code in place.

Since 2018, Minnesota has operated on a six-year code cycle. The next code cycle would review the 2024 series of I-Codes for adoption in 2026.

Commenting in support of opening rulemaking for the 2021 IECC were the American Chemistry Council, Responsible Energy Code Alliance, Midwest Energy Efficiency Alliance, the city of Minneapolis, New Building Institute, Center for Energy and Environment, the Minnesota Propane Association, AIA Minnesota, Fresh Energy, Green New Deal Homes SBC and Twin Cities Habitat for Humanity.

Housing First Minnesota, Central Minnesota Builders Association (CMBA) and Builders Association of Minnesota opposed opening rulemaking.

"Opening Minnesota Rules Chapter 1322 to an off-cycle adoption under the 2021 IECC is not only unwarranted and unnecessary, but also poses a significant roadblock to Minnesota’s already stressed housing market,” said Housing First Minnesota in its comments.

During the Aug. 23 hearing, Steve Gottwalt, CMBA’s government affairs consultant, testified against opening Minnesota's Energy Code.

"We do not have a crisis of energy efficiency in new homes; we have a crisis of housing affordability and availability,” stated Gottwalt.

Both CMBA and Housing First Minnesota cited Minnesota’s housing crisis, the lengthy payback for homebuyers and the voting irregularities at the International Code Council level as reasons not to open rulemaking.

A recommendation from Lipman is expected later this fall.

2023 National Electrical Code

At its July meeting, the Board of Electricity appointed a technical review committee as the state prepares to adopt the 2023 National Electric Code (NEC), which was published on Sept. 1. The first hearing of the 2023 NEC technical review committee was held on Sept. 22.

One of the biggest changes in the 2023 NEC is the delay of certain requirements that impact nuisance tripping of HVAC systems. According to the National Association of Home Builders (NAHB), the NEC included provisions that were beyond the specifications HVAC system manufactures, causing GFCIs to trip.

“Nuisance tripping poses health, safety and durability issues,” said Nick Erickson, senior director of housing policy at Housing First Minnesota. “We raised issues of nuisance tripping in the 2020 NEC adoption process and were told that the code was working as planned. The reversal of the NFPA underscores the need for a more rigorous review, both at the NFPA level and here in Minnesota.”

In advance of the technical review of the 2023 NEC, Housing First Minnesota sent the Board of Electricity the results of a statewide survey it conducted earlier this year.

• 71% of respondents said the Board of Electricity review serves to rubber stamp and no respondents thought the Board undertakes a rigorous review of the mod el code.

• 100% of respondents said they do not feel the Board of Electricity balances safety and affordability.

• 88% of respondents don’t believe the

Board of Electricity will provide a fair hearing on NEC amendments.

• 88% of respondents said the Minnesota’s Electrical Code adoption is too frequent. The survey respondents included builders of 15% of the state’s homes in 2021 and electrical contractors who worked on 21% of the new homes built in Minnesota in 2021.

Water quality fees

Several sectors, including housing, responded to the Minnesota Pollution Control Agency’s (MPCA) call for comments on proposed water permit fee increases. The proposals included significant increase in construction stormwater permit fees and the creation of a new subdivision fee.

In their published comments on the fee hikes, Housing First Minnesota and CMBA said this lack of transparency prohibits the public from making fully informed comments.

Both groups also called any changes in fees, which they opposed, to be phased in at the same schedule as the MS4 permit increases which are phased in over a three-year period.

“Proper policy making requires transparency,” said Erickson. “We asked the MPCA to ‘show us the math’ on both the significant permit fee increases and the creation of a new subdivision registration fee. They did not, which is unfortunate.”

The Builders Association of Minnesota concurred that any stormwater fee increases should be phased in with local government MS4 fees and opposed the proposed fee increases, but it expressed support for fee increases on a smaller scale.

In addition to the response from the housing industry, the fee hikes were opposed by local government and agriculture organizations.

4 | HOUSING INDUSTRY NEWS SIGN UP TO BE A PART OF THE HOUSING MOVEMENT • HOUSINGINDUSTRYNEWS.ORG

REGULATORY AFFAIRS

The

first hearing of the 2023 NEC technical review

committee

was

held

in September. Jeff Belzers_OctHIN22_placed.indd 1 9/15/22 5:08 PM

St. Paul revisits rent control after federal lawsuit and decline in production

After a citywide slowdown in housing construction and a federal lawsuit, the city of St. Paul has taken steps to amend the city’s voter-approved rent-control ordinance that took effect in May.

In November 2021, St. Paul residents approved the nation’s strictest rent control measure. St. Paul’s rent control policy capped rent increases to 3%, and unlike many such ordinances enacted across the country, St. Paul’s policy included any new for-rent projects in the city. Since its approval by voters, the policy has had an adverse impact on the construction of new housing in the city, with some housing projects that were in the works in the city halting construction.

The city of St. Paul has also found itself in Federal Court over the policy. Two building managers sued, alleging the St. Paul policy violates the U.S. Constitution. The lawsuit, the inability to recoup costs due to inflation and the devastating impact on new construction caused the city to reexamine the policy.

In several hearings, the city of St. Paul has proposed amendments to the city’s rent

control policy, including new construction having a 20-year exemption to the policy, changes to how much rates could increase after a “just cause” vacancy and the ability to index rent increases with inflation.

“We appreciate the effort and intention of each of the [amendment] authors but depending upon what passes, this only makes rent control slightly less terrible in St. Paul,” said Cecil Smith, president and CEO of Minnesota Multi-Housing Association, in testimony to the city of St. Paul. “Rent control never works. If it did, we would be modeling this policy on a successful formula. But none exists.”

A vote on the new policy was scheduled for late September. The results were not available at the time of printing.

City of Plymouth proposes new inclusionary zoning policy

The city of Plymouth unveiled the final draft of its moderate-income housing policy, which aims to increase the production of housing units in the city available to residents making less than the area median income.

Under the proposal, all types of new housing receiving financial assistance from the city would need to reserve 10% to 20% of units to be affordable, moderate-income dwellings, depending on the affordability standard. All units would need to retain the same construction requirements and interior finishes of market-rate construction.

These requirements would be in place on these units for 25 years after construction.

In its comments, Housing First Minnesota said that structurally, the policy appears to result in a regulatory taking that opens the city to potential legal challenges from property owners and project applicants. The association explained the only way to meet this is to have the other housing units absorb the costs of

these units, raising housing costs on all other new residents.

“There seems to be a belief that government can mandate affordability while still mandating high construction and development costs,” said Nick Erickson, senior director of housing policy for Housing First Minnesota. “Government cannot mandate affordability without also offering regulatory relief to help get projects to the desired price point.”

Housing First Minnesota said that more effective approaches would be to work with developers and builders on ways they can reduce construction costs to enable these units to be more affordable. Specific proposals included waiving park fees for projects, reducing parking requirements or reducing other land dedications, fees or other exactions common in the development process.

The city of Plymouth met Sept. 22 to take additional public comments on the policy.

SIGN UP TO BE A PART OF THE HOUSING MOVEMENT • HOUSINGINDUSTRYNEWS.ORG HOUSING INDUSTRY NEWS | 5

The city of Plymouth proposed requiring a portion of new housing units to be reserved as moderate-income dwellings. | Photo: City of Plymouth

The city of St. Paul has taken steps to amend the city’s voter-approved rent-control ordinance that took effect in May.

Untitled-1 1 9/8/22 11:30 AM

What to look for in the upcoming 2022 elections

Q&A with Todd Rapp, Minnesota Political Expert

Housing Industry News recently sat with one of the state’s premier political forecast ers, Todd Rapp, to get his perspective on what Minnesota voters are thinking about as they engage with their ballots this fall and how the political landscape could impact our elections.

Q: Just weeks remain until the No vember elections, what do you see as the top issues for voters as they go to the ballot box?

TR: Three critical issues for 2022 voters have already emerged, and the polarized opinions on these issues have shaped the closeness of this election. Opinions on President Biden’s perfor mance, Donald Trump’s continued influence and the Dobbs decision have solidified the par tisan divisions in this country.

For likely voters who are still uncertain about who to vote for, personal security issues — ranging from the economy, the stock mar ket, crime, COVID, access to health care and Ukraine — will be front and center in their decision-making. As the Jan. 6 committee continues to meet, we may see revelations that impact the election, although its work may al ready be baked into the results.

TR: Politically, Minnesota has five geographic regions that are ideologically distinct. The most conservative areas of the state are the exurban counties, some of the fastest growing areas of the state and the core of libertarian politics.

Counties dominated by rural townships and small cities are the second most conservative, but they are shrinking in population and have a higher percentage of 65+ voters than any sec tion of the state.

The second- and third-tier suburbs, with about 20% of the voters, are the true swing areas of the state. As second-tier suburbs pass through their redevelopment stages, they are becoming more DFL in their voting patterns.

Rural cities with colleges have emerged as part of the DFL party’s emerging liberal base. Although less than 10% of the state’s popu lation, they are an important target for DFL turnout in statewide elections.

The urban areas within the I-694 and I-494 beltway are the most dependable liberal voters and the most strongly aligned with significant

progressive change, with a number of DFL statewide and legislative candidates winning these areas with 70% or more of the vote.

TR: In 15 of the last 16 statewide elections, Minnesota has ended up with purple govern ment, a nation-leading outcome for a state tra ditionally perceive to be blue. Ticket-splitting is a Minnesota tradition, although it is becoming less prominent than a decade ago. Today, the concentration of DFL voters (especially in Con gressional Districts 4 and 5) helps DFL state wide candidates but results in a lot of “wasted votes” for DFL legislative candidates. For exam ple, the DFL has 30 super-majority seats in the Minnesota House (likely margins of 65%-35% or more), while Republicans only have 17 sim ilar seats.

That represents a lot of extra DFL votes in safe seats, which explains why DFL statewide candidates can win by as much as 7% to 10% yet the battle for legislative control can be very close. Sometimes, just based on how the lines are drawn, this will result in the parties sharing control, each with small majorities in their branch of the Leg islature. So, I expect that we will continue to see shared government much of the time for the re mainder of this decade, caused by the concentra tion of voters as much as actual ticket-splitting.

Q: How do you assess the national landscape?

TR: The national landscape is dominated by voters’ distrust for the opposition party, or in the case of Independents, distrust of both par ties. This “anti-ideological” trend is beginning to cause splits with the two parties, as pro-Trump Republicans clamor for the defeat of RINOs, and super-progressive Democrats from the far West and Northeast complain about the voting patterns of moderate Democrats from the Mid west and South.

It is unlikely that the current leadership in Washington will be able to create a course cor rection, so it may be 5-10 years before we see more stable outcomes in the national elections. I am expecting more than just a few surprise results in congressional races on election night.

6 | HOUSING INDUSTRY NEWS SIGN UP TO BE A PART OF THE HOUSING MOVEMENT • HOUSINGINDUSTRYNEWS.ORG HOUSING ON THE HILL

Q: Starting a new 10-year journey following the census and redistrict ing, what do we make of the politi cal composition of our state — how many ‘Minnesotas’ are there today?

Q: In 2020, Minnesota voters chose to elect a split state legislature with a DFL-controlled House of Represen tatives and a GOP-controlled Senate. Does Minnesota continue its tradition of ticket-splitting down ballots?

Todd Rapp, Minnesota Political Expert

Peter Coyle | pcoyle@larkinhoffman.com | 952-896-3214 Larkin Hoffman has been a go-to real estate law firm for more than six decades. We advise clients on all aspects of real estate and real estate development – including acquisition, approvals, assembly, construction, leasing, financing, development, land use, environmental regulation, property conversions and redevelopment, eminent domain and inverse condemnation, property tax appeals, and litigation. This full-service approach ensures we are able to address and manage every element of our clients’ real estate matters. WE BUILD TRUST Builders & Remodelers Trade Show Is Back! Join builders, remodelers, business leaders, innovators, and purchasing influencers from across Minnesota in search of new products, creative solutions, and reliable services provided by industry partners. Mark Your Calendars February 16, 2023 • 1-6PM • BRSMN.org Canterbury Park Expo Center, Shakopee, Minnesota A Division of SPONSORED BY: > Exhibitors Book a Booth Questions? Contact Nicole Coon at Nicole@housingfirstmn.org

Housing inventory remains low even as housing market shifts

“One of the things that has become ap parent to me is that consumers don’t know the same jargon as we do. The idea of a mortgage rate buydown is not as impactful for consumers who don’t track mortgage rates or don’t understand the impact of that on your monthly payment and on the life time of that loan,” said Wolf.

According to Vagle, now more than ever lawmakers and leaders need to look at methods to bring down the cost of new homes in Minnesota.

“The demographics remain the same: we have a large population in their peak homebuying age and a shortage of homes in our region. It’s more important than ever that lawmakers and leaders look at inno vative ways to bring starter homes back in Minnesota,” said Vagle.

Save

45L tax credit returns for energy-efficient new home construction

When Congress approved the climate change bill known as the Inflation Reduction Act in August, it brought back the 45L tax credit for energy-efficient buildings. The tax credit criteria is set by the U.S. Department of Energy.

The 45L tax credit, which provided builders a tax credit for energyefficient new homes, expired in 2021. The $2,000 tax credit provision has been retroactively extended for all of 2022 and will continue through 2032. Beginning in 2023, the tax credit will be $2,500 per home if the home meets the eligibility standards of the EPA’s ENERGY STAR certification for single-family new homes and will

increase to $5,000 per unit for homes that are certified to meet the Department of Energy’s Zero Energy Ready Home program.

“There appears to be an issue remaining to be resolved for Minnesota related to non-gaskets attic hatches and the Energy Star requirements,” said Nick Erickson, senior director of housing policy for Housing First Minnesota. “Housing First Minnesota is reaching out to the Department of Energy to see if an exception to the requirements can be made.”

Builders with questions about the 45L tax credit should contact their energy rater or tax professional.

AM

Welcome & Update on Minnesota’s Green Path

AM

Update on Xcel Energy & CenterPoint Energy Utility Rebates

Dominique Boczek Caldwell, Program Manager, ICF/ High Efficiency New Homes Program

Get Ready for Changes to the 45L Tax Credit* Rick Cobbs, Director of Production Services, The Energy Network WW

The Awesome Wall: A Better Way to Build

Anschel, Owner, OA Design + Build

The Road to Net-Zero Energy Homes

Patrick Huelman, Associate Extension Professor, University of Minnesota

in the

session

currently pending

SIGN UP TO BE A PART OF THE HOUSING MOVEMENT • HOUSINGINDUSTRYNEWS.ORG HOUSING INDUSTRY NEWS | 7 CONTINUED FROM PAGE 1

Under the provisions of the 45L tax credit, eligible contractors may request up to $2,500 to $5,000 credit for new energy-efficient systems.

® 9TH ANNUAL DISCOVER THE LATEST IN GREEN BUILDING! WHEN: Thursday, November 10, 2022 | 8:30 AM-Noon WHERE: Virtual (participate from your home, business, or anywhere else) REGISTER: MNGreenPath.org/GP-Conference COST: $49 Housing First Minnesota Member | $59 Non-Member CREDITS: Earn three credit hours of continuing education credits for Minnesota residential contractors and remodelers, including energy training. Plus, earn three credit hours for Minnesota Realtors® SPONSORED BY: Builders

Designated Green Path Builder program receive one complimentary registration *This

is

MN Dept. of Labor and Industry approval. All other sessions have been approved. 8:30

8:45

9:00 AM

10:00 AM

Michael

11:00 AM

SCHEDULE:

Money On Health Insurance Learn more at HousingFirstMN.org

Not all housing markets are the same

As mortgage rates hurdled over 6% in Sep tember, the highest level on record since the Great Recession, buyers are starting to be come more hesitant during their home search. Many buyers are even being completely priced out of the market.

Concerns over rising interest rates, delays in project timelines, rising construction costs, labor shortages and other factors have led to a decel eration in the new construction home market.

The slowdown is happening nationwide. According to the National Association of Home Builders, new home sales were down 14% year-to-date in August.

All four U.S. regions recorded declines in new home construction with the Northeast down 5.6%, the South down 10.8%, the West down 16.7%, and the sharpest drop in the Midwest with new homes sales down 24.5%. While the slowdown is happening across all four regions, not all metros are seeing the same impacts.

Across major metros, Zonda reports that 96% of select markets increased quick movein (QMI) count year over year. QMIs are homes that can be occupied within 90 days.

The markets posting the biggest gains were Riverside/San Bernardino, Raleigh and

Tampa. Context is key though. QMIs are 32% higher than 2019 in Riverside but remain be low pre-pandemic levels in Raleigh and Tampa.

According to Zonda, Salt Lake City, Jack sonville and Las Vegas have seen the steep est growth in QMIs compared with the same time in 2019.

In many metros, sales are still growing when compared to the more baseline housing market of 2019, according to Zonda. In fact, markets like Indianapolis, Jacksonville and Miami have seen significant growth in their average sales rate in 2022, when compared to 2019.

Fed raises rates by 75 basis points

“We anticipate that ongoing increases will be appropriate. We are moving our policy stance pur posefully to a level that will be sufficiently restrictive to return inflation to 2%,” said Federal Re serve Chair Jerome Powell.

The Fed gave indicators that the target for the federal funds rate could potentially increase by 75 more basis points in Novem ber, 50 points in December and concluding with 25 points at the start of 2023.

“Reducing inflation is likely to require a sustained period of be low-trend growth, and there will very likely be some softening of labor market conditions,” said Powell. “Restoring price stabili ty is essential to set the stage for achieving maximum employment and stable prices over the longer run.”

The 30-year fixed mortgage rate climbed over 7% in Sep tember. The expected additional tightening from the Fed is expect ed to take this rate higher before the end of the year.

We have a spot for

and

business.

Along with that, the Fed pre dicts GDP growth slowing to 0.2% for 2022, rising slightly in the following years to a lon ger-term rate of just 1.8%. The revised forecast is a sharp cut from the 1.7% estimate in June and comes following two consec utive quarters of negative growth, a commonly accepted definition of recession.

“Despite the slowdown in growth, the labor market has re mained extremely tight, with the unemployment rate near a 50-year low, job vacancies near historical highs and wage growth elevated,” said Powell.

The Fed expects the unemploy ment rate to rise to 4.4% by next year from its current 3.7%.

“The labor market continues to be out of balance, with demand for workers substantially exceed ing the supply of available work ers. The labor force participation rate showed a welcome uptick in August but is little changed since the beginning of the year,” said Powell. “[Federal Open Market Committee] participants expect supply and demand conditions in the labor market to come into better balance over time, easing the upward pressure on wages and prices.”

8 | HOUSING INDUSTRY NEWS SIGN UP TO BE A PART OF THE HOUSING MOVEMENT • HOUSINGINDUSTRYNEWS.ORG MARKET REPORT

CONTINUED FROM PAGE 1

THE LARGEST VARIETY OF ONLINE COURSES FOR MN CONTRACTORS AVAILABLE FROM ANY PROVIDER CONTRACTORU.COM Online Continuing Education Courses 40 on-demand courses available 24/7. Courses taught by 20 top industry experts! Live Webinar Courses January through March 2023 Contractor Pre-License Exam Prep Course Know someone wanting to become a licensed MN Contractor? We can help prepare them for the exam. SPONSORED BY

you

your

Housing First Minnesota is an amazing community of smart, dedicated, and successful business people working together to make this industry stronger and healthier. We help our members build their businesses through marketing, advocacy, and industry connections, all while creating the opportunity for homeownership for everyone, everywhere in our state. JoinHousingFirstMN.org AVERAGE SALES RATE CM2019 CURRENT SOURCE: ZONDA Have a story idea for this publication? Let us know! Send your story to info@housingfirstmn.org

Building material prices climb even as lumber prices fall

Softwood lumber prices continue to fall in 2022, but the drop has yet to offset the price increases from the previous price surges caused by the pandemic supply is sues. On top of that, additional building material price increases pushed overall ma terial prices to climb again in August, up nearly 1%.

According to the National Associa tion of Home Builders (NAHB), gypsum building materials increased 3.3% in Au gust, the price for distribution transformers increased by 40% over the past 12 months and ready-to-mix concrete climbed 1.6% for the month of August.

While lumber prices have fallen 32.7% year-to-date, prices remain 46.4% above pre-pandemic levels, according to NAHB.

NAHB notes that building materials prices have climbed 4.9% through the first eight months of 2022 and 14.3% over the past year. The Producer Price Index for goods inputs to residential construction, including energy, decreased 0.9% in Au gust following a 1.5% decline in July.

Housing Industry Data?

got you

SIGN UP TO BE A PART OF THE HOUSING MOVEMENT • HOUSINGINDUSTRYNEWS.ORG HOUSING INDUSTRY NEWS | 9

Overall building material prices increased 1% in August. | Source: NAHB Need

We've

covered at HousingIndustryNews.org HousingFirstMN.org

10 | HOUSING INDUSTRY NEWS SIGN UP TO BE A PART OF THE HOUSING MOVEMENT • HOUSINGINDUSTRYNEWS.ORG West - 77 South - 76 Midwest - 82 Northeast - 76 Regional Remodeling Market Indices, 2022 Q2 SOURCE: NAHB The Overall Remodeling Market Index is calculated by averaging the Current Marketing Index and the Future Market Indicators Index. Any number over 50 indicates that more remodelers view remodeling market conditions as higher than the previous quarter. Results are seasonally adjusted. United States 77 Housing market report 10,140 Year-to-Date Single-Family Construction Select Cities Mankato 152 SOURCE: U.S. CENSUS SOURCE: U.S. CENSUS Duluth 400 SOURCE: U.S. CENSUS Twin Cities 7,004 SOURCE: U.S. CENSUS Rochester 393 SOURCE: U.S. CENSUS St. Cloud 71 SOURCE: CITY OF MOORHEAD Moorhead 46 SOURCE: U.S. CENSUS. HOUSING FIRST MINNESOTA COLLECTED THE ABOVE PERMIT INFORMATION FROM AVAILABLE PUBLIC RESOURCES. State of Minnesota Through August 2022 Homebuilding continues to cool going into fall MARKET REPORT Twin Cities Median Sales Price SOURCE: MINNEAPOLIS REALTORS® Minnesota Median Sales Price SOURCE: MINNESOTA REALTORS® +4.4% Y-Y Change +5.6% Y-Y Change $350,000 $316,000 2021 2021 $330,000 AUG. 2022 $316,000 AUG. 2021 $369,750 AUG. 2022 $350,000 AUG. 2021 Minnesota Construction Employment Past 5 Months SOURCE: DEED Twin Cities Construction Employment Past 5 Months SOURCE: DEED Employment Update Minnesota’s seasonally adjusted unemployment rate ticked up slightly to 1.9% in August, according to the Minnesota Department of Employment and Economic Development. This is compared to the July rate of 1.8%. The national unemployment rate also increased slightly from 3.5% in July to 3.7% in August. Construction employment in Minnesota declined 1.1% year-over-year in August. This is only one of two industries in the state that saw employment declines for the month. New single-family construction in the Twin Cities con tinued to cool down as the summer season came to a close. In August, homebuilders in the Twin Cities metro pulled 344 permits for new homes, a 28% decline from the previ ous year. Rising interest rates and increasing home prices are leading to more hesitation from buyers. SOURCE: CITY OF ST. CLOUD

Millennials want to own homes, but affordability stands in the way

Rising interest rates, coupled with an al ready tight and competitive market, are im pacting purchasing power of would-be home buyers. Consequently, the housing market is starting to see a shift in who is buying homes — especially in the millennial age group.

Millennials are now the largest generation of potential homebuyers, but this age group is becoming more pessimistic that they will ever own a home. According to a recent sur vey from Apartment List, about one in four millennials who currently rent have given up trying to become homeowners. In 2018, only 13% of millennials expressed this sentiment.

Three-quarters of this group note that their decision to rent indefinitely is largely a finan cial one and report that high home prices and securing money for a down payment are the biggest hurdles to becoming homeowners.

However, overall, millennials want to own a home. According to a report from Bankrate, nearly 74% of millennials surveyed consider owning a home to be a high life achievement, but in the current market, owning a home is not plausible for many would-be buyers.

Consequently, the market is starting to notice this shift. According to the Nation al Association of REALTORS®, first-time homebuyers accounted for 29% of home

Increasingly, Millennial Renters Are Giving Up On Homeownership

The annual share who plan to "always rent" instead of buy

sales nationwide in July 2022. This is down slightly from the same time last year.

Millennials choosing to enter the housing market are also confronted with increased competition for homes at certain price levels. Rising cost of living and increasing interest rates are severely impacting how

much buyers of all segments can afford, which is consequently putting additional pressure on the market for homes at lower price points.

According to Zillow, monthly mortgage payments are now 75% higher than they were in June 2019.

"Buyers are stretched thin when it comes to affordability, and they are flocking to the lowest-priced homes on the market to get their foot in the door," said Nicole Bachaud, senior economist with Zillow.

Construction Loan for Builders & Buyers

With a One-Step Construction Loan from Old National, your clients can manage the entire home financing process with one application. That means less hassle and more peace of mind for everyone involved.

• Convenient one-time closing

• Rate locked at application to avoid rising rates during construction

• Interest-only payments during construction period, up to 12 months

• Variety of rates and terms available

• Conforming and jumbo loan amounts available

To learn more, our mortgage experts are ready to help.

Steve Dobin

Mark Gregg

Mortgage Sales Manager, SVP NMLS #488964 612-656-3443

Steve.Dobin@oldnational.com

Mortgage SVP NMLS #501974 763-204-7251 Mark.Gregg@oldnational.com

Apply online: oldnational.com/dobin

Dillon Borowicz

Mortgage Sales Assistant NMLS #2305484 612-656-3778

Dillon.Borowicz@oldnational.com

oldnational.com/mortgage

SIGN UP TO BE A PART OF THE HOUSING MOVEMENT • HOUSINGINDUSTRYNEWS.ORG HOUSING INDUSTRY NEWS | 11

Nearly one in four millennials who currently rent have given up on homeownership, according to a recent survey by Apartment List. | Source: Apartment List Subject to credit approval. Property insurance required.

SCAN TO LEARN MORE FLEXIBLE AND SIMPLE A

*2022 results are preliminary and include survey responses from the first quarter of the year. Source: Apartment List Survey Data. Sample limited to millennials who do not already own a home.

Industry swings for a cause at charitable golf event

More than 135 golfers enjoyed a picture-perfect day at the Housing First Minnesota Foun dation’s sold-out Building Futures Golf Classic at The Wilds Golf Club in Prior Lake on Sept. 13. As golfers made their way through the course, they had the opportunity to stop and chat with some of the 18 sponsors, network with other golfers and enjoy specialized games. Proceeds from the annual golf tournament benefit the Foundation’s community build projects for veterans experiencing homelessness and women undergoing chemical dependency recovery.

Region’s largest building industry trade show is back

The Builders and Remodelers Show (BRS) is set to return in 2023 redesigned and re imagined. The show will premiere at a new location of Canterbury Park Expo Center in Shakopee on Feb. 16, 2023.

BRS, which is put on by Housing First Minnesota, has a 50-year legacy of connect ing building industry professionals. The trade show brings together builders, remodelers, business leaders and purchasing influenc ers from across Minnesota in search of new products and creative solutions.

“We’re excited to take the best parts of our traditional and renowned trade show

and reimagine it to maximize connections in this new format,” said James Vagle, CEO of Housing First Minnesota. “Now more than ever our industry needs to come together to find new solutions and connections.”

The new location is not the only refreshed aspect of the show. The industry trade event will also feature new exclusive show offers, new training sessions and opportunities, and new products and services.

More information about the event can be found at BRSmn.org.

12 | HOUSING INDUSTRY NEWS SIGN UP TO BE A PART OF THE HOUSING MOVEMENT • HOUSINGINDUSTRYNEWS.ORG

The Building Futures Golf Classic is one of the Housing First Minnesota Foundation's annual fundraisers to support its work building and remodeling homes for those in need in the community.

INDUSTRY IN ACTION

STORY EXTRA Learn more about the show at BRSmn.org.

SIGN UP TO BE A PART OF THE HOUSING MOVEMENT • HOUSINGINDUSTRYNEWS.ORG HOUSING INDUSTRY NEWS | 13Untitled-2 1 9/29/22 8:13 AM

Industry partners build shed to help victims of domestic violence

This summer, Lennar staff and Carpentry Contractors Company (CCC) teamed up to build a shed for Home Free, a community

James Hardie

James

needed for the shed, Lyman Roofing and Sid ing donated roofing and soffit material, and CCC donated labor and trucking to build and

House that Hope Built benefits HopeKids Minnesota

In September, RT Urban Homes, Inc. host ed a celebration for the completion of the 2022 House that Hope Built with trade partners, subcontractors, Tradition Companies and Ho peKids. The festivities featured face painting, a petting zoo, a bounce house, rock painting, food trucks, treats and a surprise visit from Minne sota Wild mascot, Nordy. The 2,800-squarefoot House that Hope Built, located in Victo ria, has five bedrooms and four bathrooms and

National Truck Driver Appreciation Week celebrated by industry

Dakota County Lumber Company cele brated National Truck Driver Appreciation Week in September by making boxes of treats for their delivery team. The staff also created a snack station for the many vendor drivers that keep their inventory stocked.

“Our drivers are our logistics experts, problem solvers, first line of customer ser vice and often the only touch point our cus tomers' customers have with our company. They do the right thing when nobody is watching and rise to any challenge present

was on the 2022 Fall Parade of Homes. The rocks painted by the children at the celebration were featured in the yard for tour-goers to see. The home is for sale and all net proceeds will benefit HopeKids Minnesota.

Tradition Companies has been supporting HopeKids Minnesota, a local nonprofit that provides unique support for children with life-threatening illnesses and their families, for more than a decade.

Stands up to storms and

weather

Water resistant to protect against swelling, warping and cracking; also resists mold damage

Won’t be eaten by

Fire

performance,

specifically

help keep your homes looking

A James Hardie

James Hardie

no matter what nature

matter what

keep

homes looking beautiful longer

designed to resist shrinking, swelling and cracking even after years of wet or freezing conditions. A James Hardie exterior can help keep your homes looking beautiful longer – no matter what nature brings.

Contact a sales representative: Kevin Morel | (612) 323-6358 kevin.morel@jameshardie.com

Contact a sales representative: Kevin Morel | (612) 323-6358 kevin.morel@jameshardie.com

or freezing conditions.

Contact a sales representative: Kevin Morel

Contact a sales representative: Kevin Morel | (612) 323-6358 kevin.morel@jameshardie.com

kevin.morel@jameshardie.com

Morel

Contact a sales representative: Kevin Morel | (612) 323-6358 kevin.morel@jameshardie.com

14 | HOUSING INDUSTRY NEWS HOUSINGINDUSTRYNEWS.ORG INDUSTRY GIVES BACK

A James Hardie exterior can help keep your homes looking beautiful longer – no matter what nature brings.

© 2019 James Hardie Building Products Inc. All Rights Reserved. AD1511-MDW-03/19 James Hardie fiber cement products are Engineered for Climate . For® ® uncompromising performance, our HZ5 siding and trim are specifically® designed to resist shrinking, swelling and cracking even after years of wet or freezing conditions. A James Hardie exterior can help keep your homes looking beautiful longer – no matter what nature brings. Contact a sales representative: Kevin Morel | (612) 323-6358 kevin.morel@jameshardie.com © 2019 James Hardie Building Products Inc. All Rights Reserved. or freezing conditions. A James Hardie exterior can help keep your homes looking beautiful longer – no matter what nature brings. Contact a sales representative: Kevin Morel | (612) 323-6358 kevin.morel@jameshardie.com © 2019 James Hardie Building Products Inc. All Rights Reserved. AD1511-MDW-03/19 designed to resist shrinking, swelling and cracking even after years of wet or freezing conditions. A James Hardie exterior can help keep your homes looking beautiful longer – no matter what nature brings. Contact a sales representative: Kevin Morel | (612) 323-6358 kevin.morel@jameshardie.com Achieve instant curb appeal and lasting character.

TOUGHER

THAN THE ELEMENTS © 2019 James Hardie Building Products Inc. All Rights Reserved. AD1511-MDW-03/19 James Hardie fiber cement products are Engineered for Climate . For® ® uncompromising performance, our HZ5 siding and trim are specifically® designed to resist shrinking, swelling and cracking even after years of wet or freezing conditions. A James Hardie exterior can help keep your homes looking beautiful longer – no matter what nature brings. Contact a sales representative: Kevin

| (612) 323-6358 kevin.morel@jameshardie.com © 2019 James Hardie Building Products Inc. All Rights Reserved. AD1511-MDW-03/19

Hardie fiber cement products are Engineered for Climate . For® ® uncompromising performance, our HZ5 siding and trim are specifically® designed to resist shrinking, swelling and cracking even after years of wet or freezing conditions. A James Hardie exterior can help keep your homes looking beautiful longer – no matter what nature brings.

| (612) 323-6358

© 2019 James Hardie Building Products Inc. All Rights Reserved. AD1511-MDW-03/19

fiber cement products are Engineered for Climate . For® ® uncompromising

our HZ5 siding and trim are

®

© 2019 James Hardie Building Products Inc. All Rights Reserved. AD1511-MDW-03/19

James

Hardie fiber cement products are Engineered for Climate . For® ® uncompromising performance, our HZ5 siding and trim are specifically® designed to resist shrinking, swelling and cracking even after years of wet or freezing conditions. A

exterior can help

your

– no

nature brings.

© 2019 James Hardie Building Products Inc. All Rights Reserved. AD1511-MDW-03/19

James Hardie fiber cement products are Engineered for Climate

. For® ®

uncompromising performance,

our HZ5 siding and trim are specifically® designed to resist shrinking, swelling and cracking even after years of wet or freezing conditions.

exterior can

beautiful longer –

brings.

harsh

animals or insects

resistant

Helps

reduce time and money spent on maintenance

The new shed will help the organization store children's bikes and outdoor toys.

Photo: Lyman Lumber Company

Snack station for vendor drivers. | Photo: Dakota County Lumber Company

Inside the kitchen of the 2022 House that Hope Built. | Photo: RT Urban Homes

Xcel Energy approved to build one of the nation’s largest solar plants

On Sept. 15, Xcel Energy received unanimous approval from Minnesota Public Utilities Commission (PUC) to move forward with building a massive solar power plant in Becker, Minnesota. Sherco Solar will be the largest so lar development in the Upper Midwest covering 3,497 acres in the Becker area. The facility will help replace the three coal-fired Sherco power plants that Xcel will begin closing in 2023 in an effort toward the company’s goal to triple the amount of solar in the Upper Midwest by 2028 and to deliver 100% carbon-free electricity by 2050. The project will be completed in two phases, the first in 2024 and the second in 2025. The project is supported by clean energy groups, local governments and labor unions, but the cost of project has drawn some controversy. Prior to the Inflation Reduction Act passing, Xcel estimated the average residential customer would be charged roughly $5.60 to $7.90 annually between 2026 and 2031. Xcel has declared the project’s revised cost following the passing of the law is a “trade secret,” which the Star Tribune for mally challenged and was denied by the PUC. The PUC informed the Star Tribune the total cost of the project will be disclosed mid-October. The price tag has been disclosed as at least $575 million.

Despite Minnesota construction wages being up 8.9% from last year, the Minnesota Department of Employment and Economic Development (DEED) reported in Septem ber that the state is down 1,568 construction jobs from a year ago. Although construction employment in the U.S. is up 4% overall, Minnesota doesn’t seem to be following the same trend line. Brian Johnson, staff writer with Finance & Commerce, reported that manufacturing lost the most jobs (3,200); followed by trade, transportation and utilities (2,300); construction (1,900); information (500) and leisure and hos pitality (100), while government had the biggest gains with 2,800 jobs added. On the upside, construction is one of the few sectors where wage increases are outpacing inflation.

STAY INFORMED WITH THE

Since the inception of the Southwest Light Rail Tran sit (LRT) in 2011, the cost of the project has more than doubled and the line’s opening date has been delayed nine years, the Office of the Legislative Auditor reported at the beginning of September. The light rail line, which is meant to connect Minneapolis to the western suburbs, is now estimated at a whopping $2.74 billion cost, with the federal government covering $969 million, Henne pin County covering $772 million, Hennepin County Regional Railroad Authority covering $200 million and the rest of the funding is being supplied by cities and the state of Minnesota. That leaves an estimated half a bil lion dollars of the project unfunded. The Southwest LRT was originally supposed to be completed and open to the public in 2018; the Metropolitan Council now estimates the project will be ready in 2027. Following the release of the auditor’s report, the Metropolitan Council and the project itself have drawn criticism from across the polit ical spectrum.

SIGN UP TO BE A PART OF THE HOUSING MOVEMENT • HOUSINGINDUSTRYNEWS.ORG HOUSING INDUSTRY NEWS | 15

SOURCE: OFFICE OF THE LEGISLATIVE AUDITOR. PHOTO SOURCE: KSTP

Construction labor shortage continues even as wages increase

SOURCE: ISTOCK.COM SOURCES: STAR TRIBUNE AND BRING ME THE NEWS PHOTO SOURCE: STAR TRIBUNE

Minnesota Office of the Legislative Auditor releases report on the Southwest Light Rail Transit delays and costs

HousingFirstMinnesota @HousingFirstMN

LATEST HOUSING NEWS IN THE DIRT PUT NATURAL GAS IN, GET A LOT OUT. © 2021 Xcel Energy Inc. Xcel Energy’s FastApp tool helps speed up your natural gas hookup. It gives you access to dedicated professionals, costeffective designs and in-project timelines. Plus you’ll alwayshave a single-point contact with our construction team. For more info, visit xcelenergy.com/Builders 9.75x6.675_MN-HINdirec_Apr2021_P01.indd 1 4/2/21 10:42 AM

POWERING UP

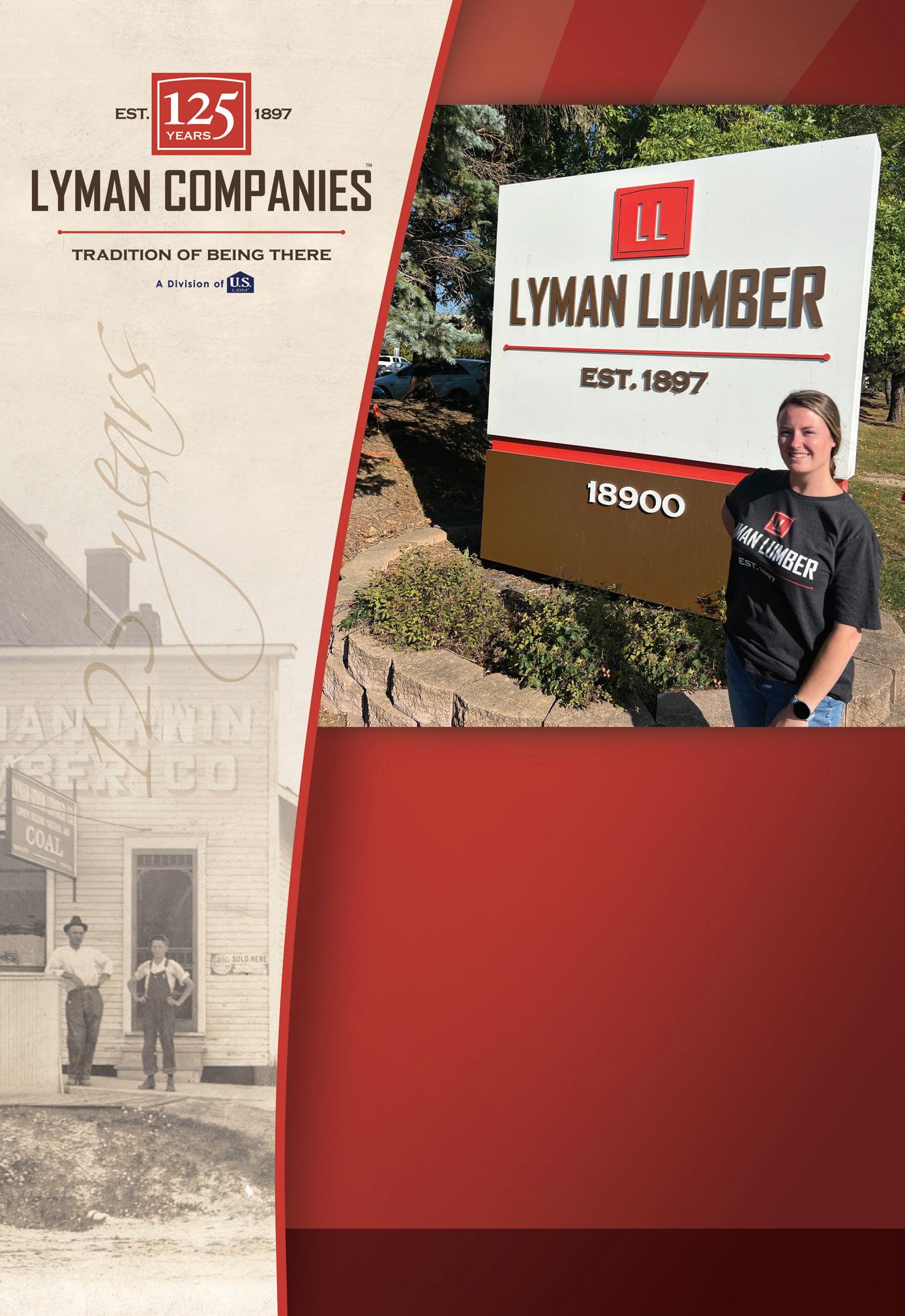

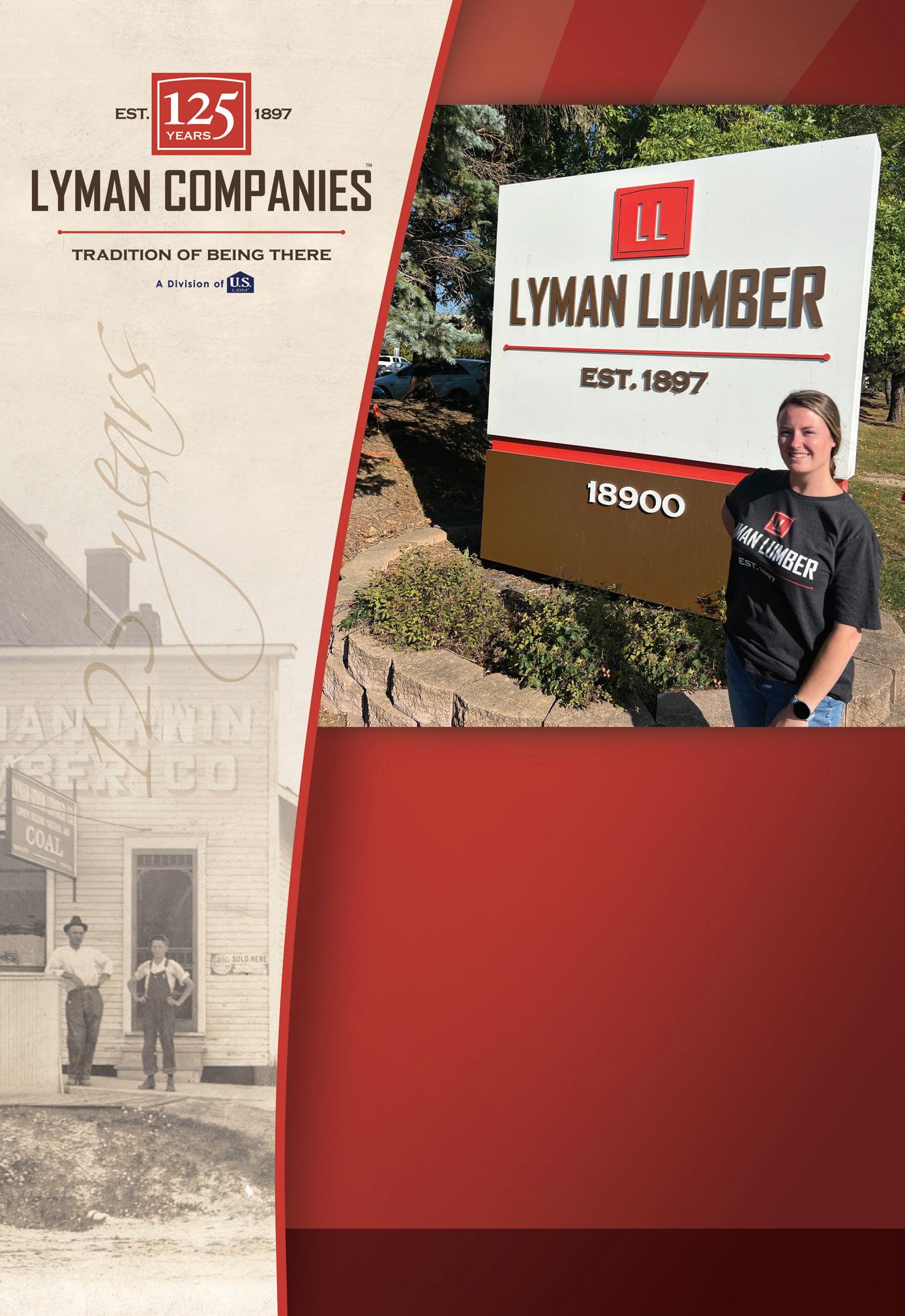

Celebrating our 125th anniversary means recognizing everyone who has contributed to our success. Lyman learned decades ago that the women on our team are golden!

One of our golden girls is account coordinator, Bri McDonald. Bri is a mover and a shaker. She never hesitated to step headfirst into a male dominated industry. Bri meticulously manages projects for our customers and is a huge asset.

Her advice for women joining the trade is “Believe in yourself, ask lots of questions and don’t shy away from a challenge. Most importantly, find a company like Lyman, who appreciates what you bring to the table and offers growth opportunities!”.

WANT TO JOIN THE TEAM?

16 | HOUSING INDUSTRY NEWS SIGN UP TO BE A PART OF THE HOUSING MOVEMENT • HOUSINGINDUSTRYNEWS.ORG VisitLymanCareers.com&changeyourfuturetoday!

Lyman_Oct22HIN_placed.indd 1 9/27/22 8:07 AM

TRIBUNE EDITORIAL BOARD

TRIBUNE EDITORIAL BOARD

M. NOLAN GRAY CALIFORNIA YIMBY

M. NOLAN GRAY CALIFORNIA YIMBY

ANDY WALDEN BLACK KNIGHT, INC.

ANDY WALDEN BLACK KNIGHT, INC.