1 minute read

Pause =/= Cut

from Q2 2023 Commentary

by bayntree

Market sentiment suggests that at some point, the Federal Reserve will conclude its rate-hiking cycle and subsequently cut rates. Such a move is usually performed to loosen financial conditions and provide an economic boost, especially if the economy is in a recession. However, the likelihood and time frame for this scenario remain uncertain.

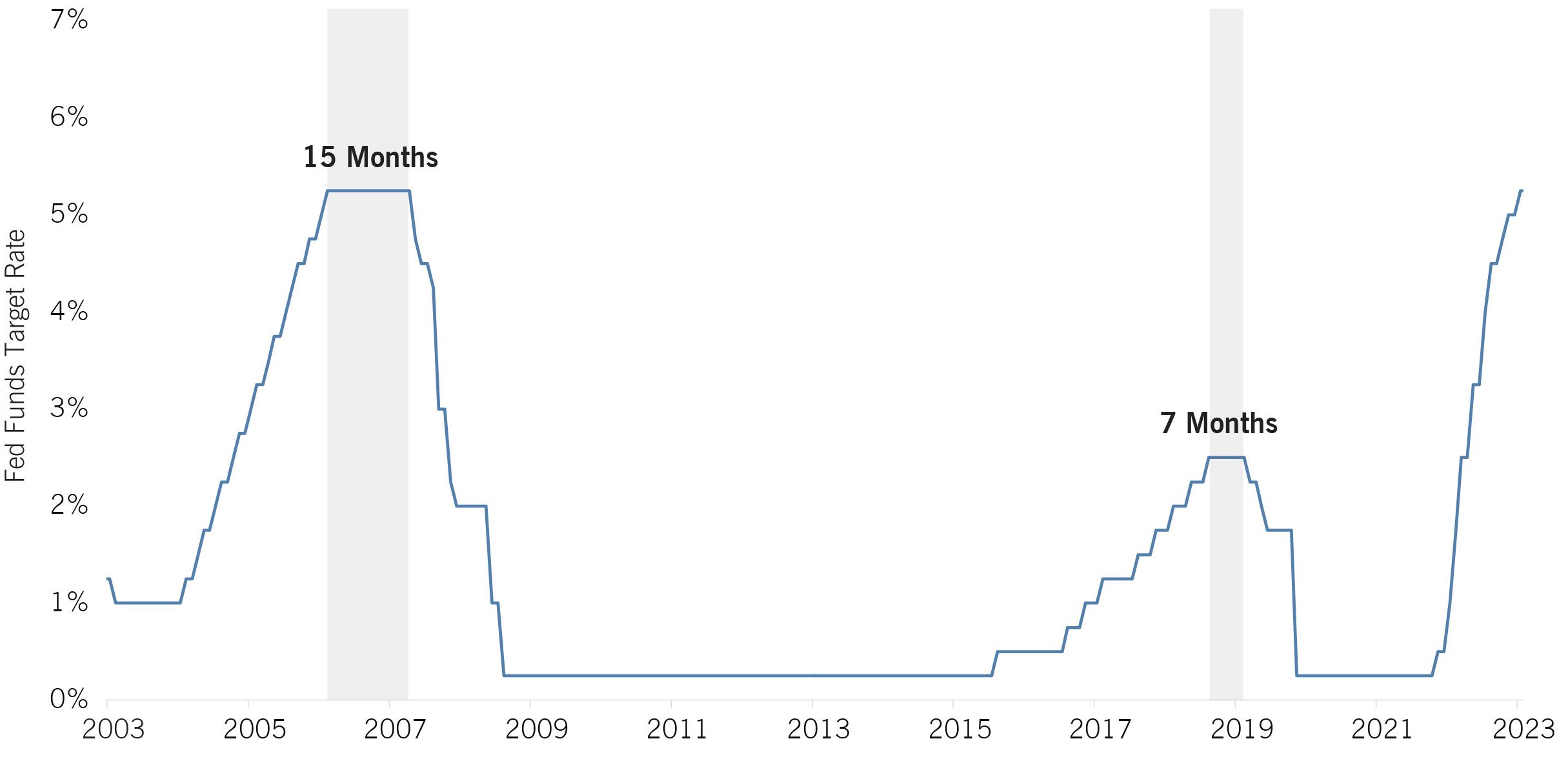

One of the primary concerns is the possibility of the Fed cutting rates too soon, leading to a resurgence of inflation, like what occurred during the Volcker era when premature rate cuts resulted in inflationary spikes. As a result, in the last two hiking cycles, the Federal Reserve adopted a different approach, keeping rates unchanged for extended periods (15 months in 2008 and 7 months in 2019).

Despite the market’s optimism regarding the Federal Reserve’s ability to engineer a soft landing, the board members are maintaining a cautious stance and refraining from prematurely declaring victory. After all, the longer the Fed maintains elevated rates and financial conditions are tight, the greater the risk of being pushed into a recession. Market participants are closely monitoring the Fed’s actions and communications to gauge the future direction of monetary policy.