1 minute read

Dynamic Shifts in DRB

from Q2 2023 Commentary

by bayntree

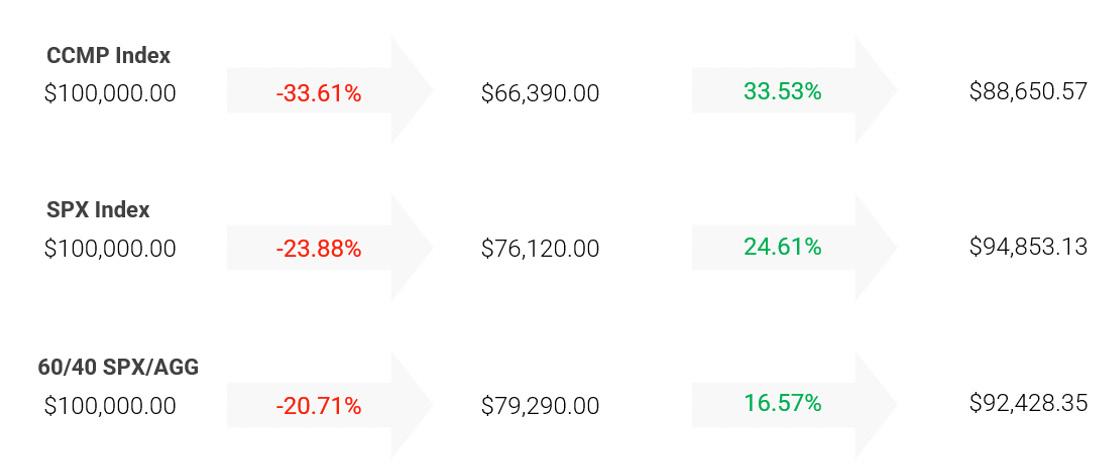

Investing can seem complicated. But the goal is rather simple: getting the most capital appreciation per risk. Our focus on minimizing drawdown risk is for this purpose and the math is straightforward. The greater the loss, the greater the returns are needed to break even and appreciate. For example, as the table, “Math of Loss” shows, the tech heavy NASDAQ Composite Index with a 33.53% short-term performance. Although impressive, it still lags other investments that have taken a much smaller drawdown.

Math of Loss

Source: Bloomberg, Redwood.

*Hypothetical simulation of growth based on index. For illustration purposes only. No actual account was traded. An investor cannot invest directly in any of the above indices. Past index performance is not a guarantee of future results.”