1 minute read

Portfolio Recap

from Q2 2023 Commentary

by bayntree

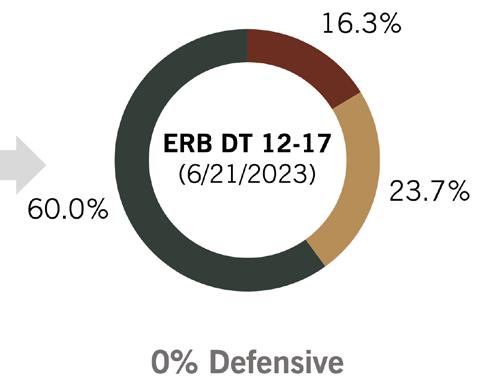

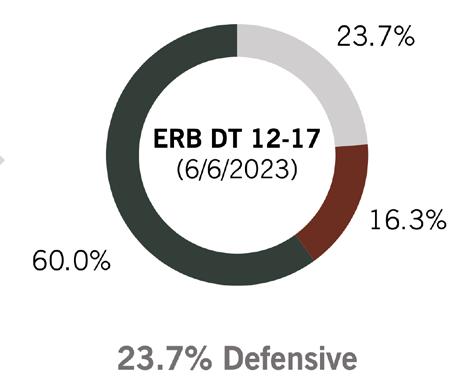

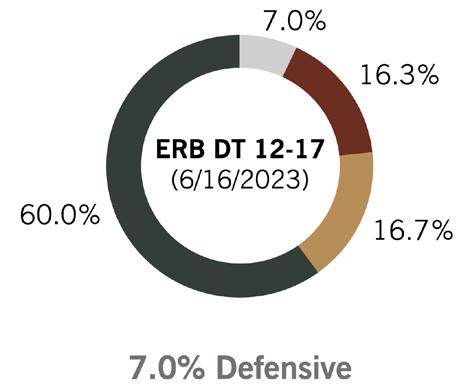

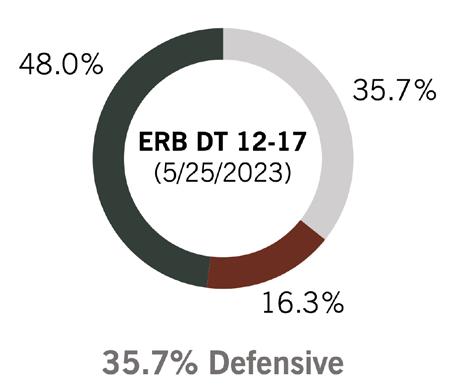

In the second quarter of 2023, we saw continued elevated portfolio activity in response to market movements. Our investment portfolios combine strategic long-only beta with active risk-managed strategies. These active risk-managed strategies can allocate predominately to cash or cash alternatives in a “defensive” position. They utilize a quantitative research process designed to respond to markets with potentially heightened risk.

The ensemble of multiple diversified strategies helps moderate risk in the overall portfolio toward their drawdown objectives while still attempting to participate in most market appreciation.

While we entered the quarter with a higher defensive position, market stability in response to lower inflation and unsurprising Federal Reserve rate hikes led us to end the quarter fully invested.

We believe a higher interest rate environment can provide some extra benefits to actively risk-managed strategies. While in defensive positions, allocating to cash & cash alternatives such as short-term treasuries pay a higher yield. For example, U.S. 3-Month Treasury Bills have a rate close to 5.25% as of 7/26/23.