1 minute read

Liquid Public Bonds vs. Less Liquid Private Debt

from Q2 2023 Commentary

by bayntree

With our RiskFirst ® approach, we prioritize drawdown risk and management. This means we view all investment options through the lens of potential capital loss.

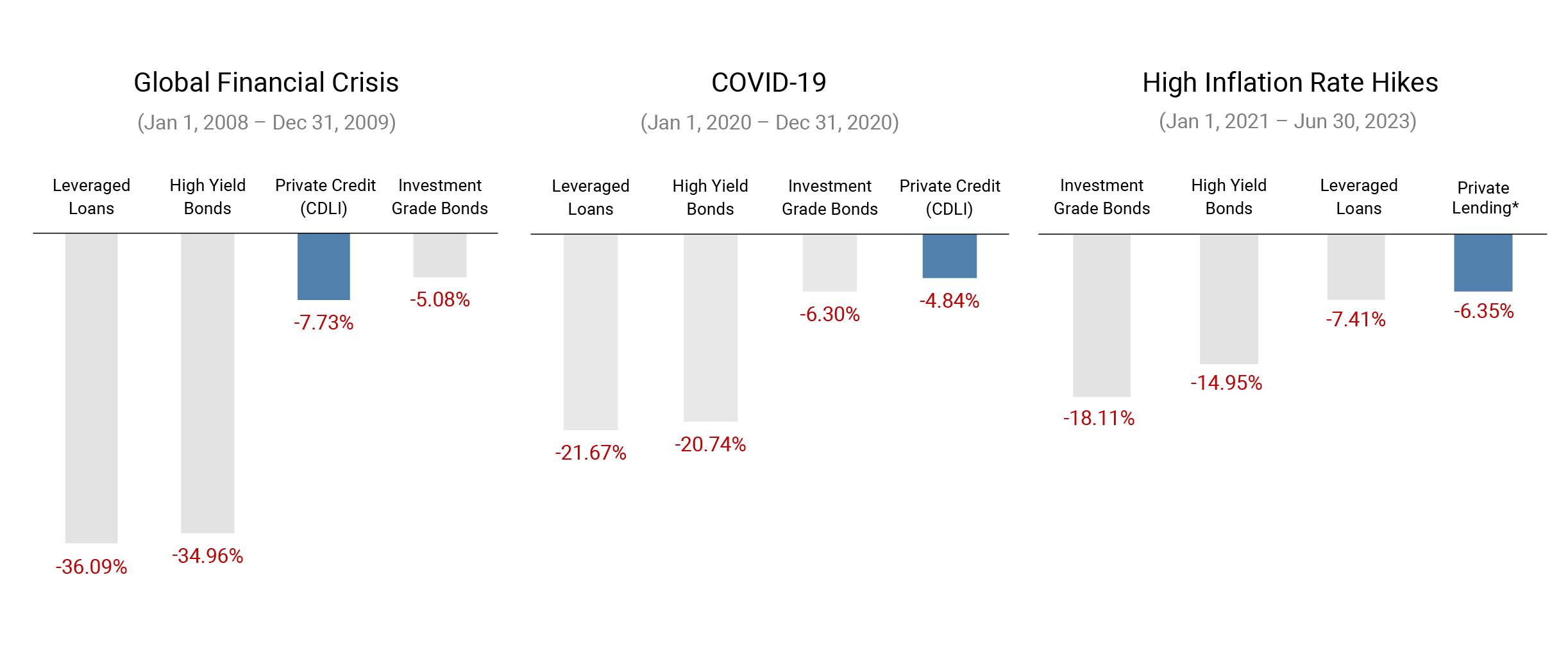

In the market downturns of 2008 and 2020, investment-grade bonds displayed resilience by absorbing much of the selling pressure in broader markets. Their limited drawdown and widespread accessibility made them a favored choice in riskmanaged asset allocations. However, in 2022, they faltered as a volatility damper due to heightened duration risk and increased correlation with stocks, resulting in simultaneous declines. This change in behavior caused portfolios like the 60/40 to experience a significant 23% decline, with the AGG dropping 16% during this period. Instead of mitigating volatility as expected, investors were hurt by bonds exacerbating the damage.

Despite their solid creditworthiness and absence of defaults, the aggressive sell-off of publicly traded investment-grade bonds highlights the inherent risk of liquidity as a doubleedged sword. While liquidity enables easy conversion into cash, it also means everyone has the same ability to sell rapidly during market downturns, leading to significant downward pressure on otherwise fundamentally sound assets. In contrast, private debt, as a non-traded security, offers stability during bear markets due to limited liquidity and reduced vulnerability to mass selling pressures. Including private debt in a well-structured portfolio can provide resilience and more effective risk management, navigating market fluctuations with greater stability and long-term potential.