1 minute read

Conclusion

from Q2 2023 Commentary

by bayntree

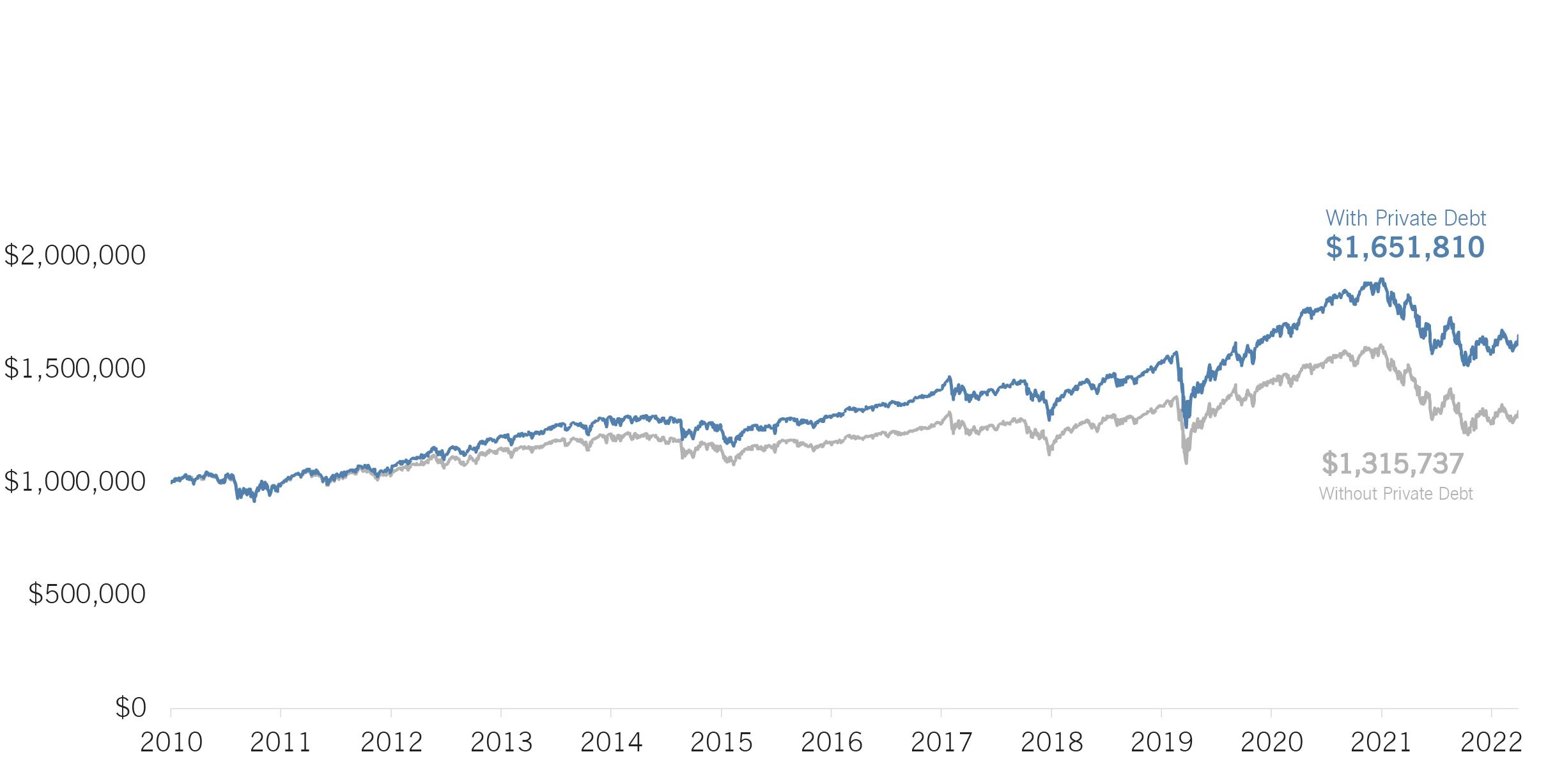

Our focus will always be on creating solutions centered around drawdown and mitigating downside risk. Introducing private debt into our engineered asset allocation portfolios can potentially enhance return, and, more importantly, limit drawdown risk.

With its benefits, why haven’t more investors adopted private debt into their investment portfolios? A major reason is that historically, private debt was very difficult to access – investors needed to be accredited, and most private debt funds were partnerships that required paper subscriptions. This made it more difficult to add private debt into portfolios in the same way as a mutual fund or ETF.

With innovations, private debt can now be accessed by all investors as a single ticker like a mutual fund. The tradeoff, however, is partial liquidity. Private debt closed-end interval funds, for example, have quarterly liquidity. Yet the benefits may outweigh the cons. A small inclusion in a 60/40 can help drive additional return while dampening volatility, even with the sacrifice of some limited liquidity in the portfolio.

Adapting to new markets is a never-ending process of constant growth and improvement. It requires the rejection of complacency, a willingness to embrace the unknown, the desire to challenge assumptions, and the ability to let go of the familiar.