2030 MASTER PLAN

At Blue Federal Credit Union we are a lifestyle brand that happens to be a credit union with a unique relationship with our members and communities. While becoming a sought-after lifelong champion delivering a Blue experience, we will make Blue an irreplaceable co-pilot encouraging and propelling optimistic builders forward. Ultimately, we will create community-building connections to transform the financial services experience, bringing our drive to help our members and communities discover pathways to realize their possibilities.

Members deserve a community built around authentic connections OUR

To discover pathways to realize your possibilities.

We bring positivity, humor, and energy. We know there is always more. Our passion and personality energize an uncommon commitment to each other and our communities.

Blue will be the lifelong champion our customers seek.

Our competence, consistency, and follow through build a foundation of trust. We go further to make a difference, win for members, and grow Blue.

Warren Federal Credit Union was chartered in 1951 by a group of civilian personnel at F.E. Warren Air Force Base in Cheyenne, WY. Over the course of 65 years, Warren established roots and built trust with military and community members and their families in Wyoming, Colorado, and throughout the world. Beginning a similar journey more than 50 years ago, Community Financial Credit Union was chartered to serve the financial needs of employees at the Rocky Flats Environmental Technology site and later merged with Boulder Municipal Employees Credit Union and expanded their service to Broomfield and the surrounding communities.

Understanding the highly competitive Front Range financial marketplace, an environment of increasingly complex financial regulation, and the necessity of timely and well-considered growth, the Board of Directors of Warren and Community Financial approved a plan to merge in October 2015. The merger of these two established credit unions to become Blue Federal Credit Union created the possibility for a new beginning and promised new opportunities.

At the start of 2020, the acquisition of two Liberty Savings Bank branch locations was announced. Liberty, long thought of as a financial institution committed to lifelong relationships with members, was a perfect fit to help Blue expand into new communities.

Blue acquired nearly $100 million in deposits, over 2,000 new members and two physical branch locations in Denver and Granby, Colorado.

We have always, and will continue to, look ahead at what is possible; all the while honoring and reflecting on where we have been. As we celebrate 70 years of being in business in 2021, this continues to ring true. We have over 100,000 members worldwide, 18 physical branch locations, and over $1.5 billion in assets. In 2021 we also officially moved into our brand new World Headquarters in the heart of Cheyenne, a building that represents a culmination of 70 years of growth.

Blue is a one-of-a-kind credit union that puts our members, employees, and communities at the center of service delivery and innovative products. We look forward to continued growth for decades to come as we discover pathways to realize our members’ possibilities.

Our teams are passionate creators building a better tomorrow in Colorado, Wyoming and beyond for themselves, their loved ones, and their communities. As a financial services company, we are compassionate and caring, offering opportunities for personal and professional growth and developing strong loyalty with our communities and members. We are driven by the strong belief that creating connections to support the path to realizing possibilities is not only a social responsibility but a way to achieve long-term growth and economic success. Attracting and retaining talent is essential as we seek to differentiate Blue and pursue a purpose-driven strategy. Every day, our ‘Do Good’ team brings their hearts to work. They share a smile, an assuring voice, and a helping hand. They are your branch managers, relationship bankers, tellers and so many more.

In 2019 the Board of Directors and Blue Leadership embarked on a path to develop a long-range and comprehensive plan to guide our future. The landscape is changing dramatically, and it has become evident overall financial and economic systems are undergoing a time of accelerated innovation and transformation with an intense increase in competition from not only traditional financial services but industry disrupters and FinTech companies. In addition, the consumer now has enormous power to evaluate, explore options and find what they believe is of greatest value to them and we want to be part of that conversation. Their expectations for convenient and personalized financial services coupled with exploding use of technology and data analytics are all driving critical change.

When we started this planning process in the fall of 2019, we knew it would require us to think holistically about the impact we make in our members’ lives. In the spring of 2020, the COVID-19 pandemic solidified the need for Blue to further advance financial services delivery and utilization to better meet the needs of our members and our communities.

During the process, we embraced a customer mindset to imagine ourselves as potential members of Blue Federal Credit Union, which helped to ensure we were as hyperfocused on meeting our members’ needs as our community deserves. We learned about the significant role true and authentic relationships with a financial institution can play in shaping a person’s life. We realized there are opportunities to matter more.

When we completed the planning process in the winter of 2020, we stepped into a deeper purpose and created a new mission statement that places our members at the center.

BY DECEMBER 31, 2030, BLUE WILL DELIVER A SOUGHT AFTER EXPERIENCE FOR ‘IDEAL MEMBERS’ SEEKING A LIFELONG CHAMPION, ACHIEVING A NOTABLE IMPACT FOR MEMBERS AND THEIR COMMUNITIES AND REACHING OVER $6 BILLION IN TOTAL ASSETS.

WHAT SETS YOU APART; WHAT MAKES YOU EXCEPTIONAL, UNRIVALED, IRREPLACEABLE, ONE-OF-A-KIND.

Now is the time to position ourselves to standout and this plan will guide us. We have discovered what differentiates Blue and declared a 10-year differentiation strategy to deepen relationships, create connections, and expand market share in a unique and powerful way. We envisioned an innovation business model to deliver on our strategic intention. Our objective was to look forward 20 years and plan for 10 years, ultimately creating the Blue Master Plan.

Blue 2030 captures the undeniable ethic, unshakable spirit, and unwavering commitment that defines us. We invite you to join us on this journey.

Early on, we recognized we must embrace a challenger mindset that transcends financial service. We want to give people a reason to care, to elevate beyond category restraint and to move from a local credit union to a sought after partner unleashing individual and collective potential.

As with any research project, we sought to reach new conclusions through a systemic process and to find answers to a set of fundamental questions:

Why do we matter?

Why should you matter to me?

What do we do?

What difference do we make in the lives of those we serve?

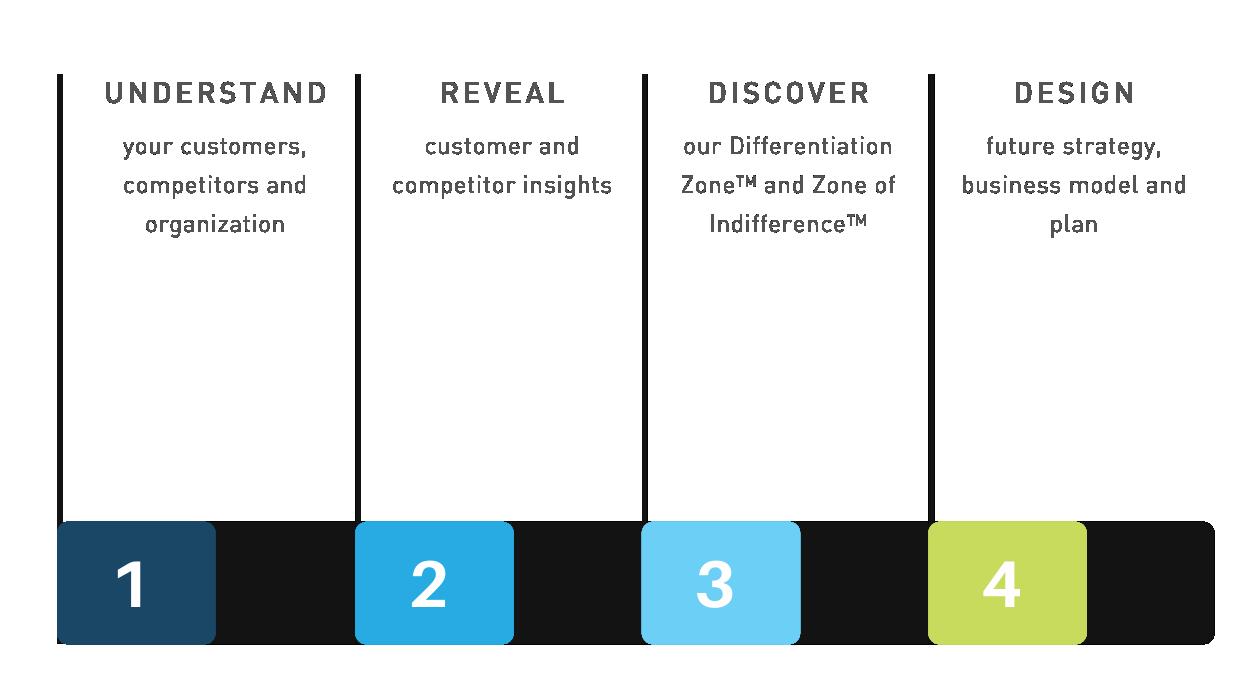

Recognizing our skill limitations and our desire to seek experts in the field of research and strategy, we engaged the services of Corona Insights to become our partner in this extraordinary journey. The Master Planning process progressed through four phases.

To kick off our process, we engaged in conversation with staff and the board of directors during October 2019 to hear what we should be attentive to during the inquiry of our efforts. Several overarching topics emerged.

• The rising expectations among customers for instant communications, security, and convenience often made possible through advancements in financial technology.

• The new and novel ways in which our customers’ needs are being met by disrupters outside our industry like Amazon, Uber, DoorDash, and Airbnb.

• The macro-level changes in how people approach the financial health of their lives, including the growth of the sharing economy as well as the increasing role that cryptocurrencies play in our lives and the global economy.

A few overarching findings of this exercise include:

• Customers will expect to be able to learn and grow through virtual experiences.

• The short-term future is likely to be heavily driven by changes that occur as a result of COVID-19. We believe the pandemic will likely drive change in two key areas: customer interactions (through technology) and a poor economy. The former will place an increased level of importance in interactions and connections with customers outside of branches, and the latter will drive an increased need for organizations to help their customers weather the storm.

• The mid-term future is likely to be driven by new competitive entrants finding innovative ways to serve customers. As the idea of a financial institution continues to be blended with FinTech solutions, we will need to find ways to either partner with new entrants to expand our service delivery model or develop solutions of our own.

• The long-term future could be driven by shifting perceptions between generational cohorts. Younger generations have grown up with technology solutions and have an expectation that their service providers will supply solutions that can be accessed anywhere, any time. While this will certainly manifest itself in financial services directly, it will also impact adult education and financial literacy as well.

After our staff and board of directors helped us shape the foundation of our process, we realized we would have to look outside of ourselves if we wanted to truly push us into a purpose-driven future that is relevant, vital, and uniquely Blue. We called our 20192020 master planning process “Leading the Legacy” to link our future to our roots. We knew the outcome of this process would need to stay true to who we are while inspiring us to stretch for more. To hold fast to who we have always been, we held the following statement as the guideposts of our process:

To ensure we maintained an expansive view of our strategic possibilities, we oriented our process around illuminating Blue’s differentiation—what makes us both different and special—as an organization in relation to our:

• Context – the trends with the power to influence member decisions and drive competitor actions

• Competitors – those contending for the heart, mind, and wallet share of our members

• Customers (Members)– the people whose lives we promise to impact through mission delivery

The lessons we learned from the unexpected challenges of 2020, as well as the insights gleaned from our process, emboldened us to foresee a future as the soughtafter lifelong champion our customers value most. As a leader in 2021, we were called to push beyond our comfort zones and envision a Blue that is data-driven, empathybased, customer-centered, and purpose-filled. We gleaned powerful insights and fresh ideas about Blue’s customers, competitors, and context from these 13 studies:

ContextCustomers and competitors respond to increasing trends and changing conditions. We focused on those most likely to influence behaviors and drive decisions, with an eye towards the future. The external context of the world changed drastically and quickly with the onset of COVID-19 in the spring of 2020. To stay attuned to customer needs, we hyper-focused our research on the trends and conditions that most influence customer behavior, such as:

• A paradigm shift related to what “membership” is and what about it matters most to members

• An increasingly digital future reveals what technology makes possible: a customercentered experience characterized by convenience, value, and personalization

• A shift in perception due to COVID-19 that is challenging our assumptions about the outlook of the economy as well as the ways in which we can meet the needs of customers in times of greatest need

• An increasing expectation that companies deliver on a deeper purpose; one devoted to improving the lives of people and communities

Blue’s competitive landscape is dynamic. Competitors focus on opportunities to create unique solutions which fulfill customer expectations that rivals cannot match. We scanned our competitive landscape and learned how competitors are positioning themselves to customers and meeting their needs. We considered four types of competitor from a customer’s point of view:

• Replacements -Your customer views your product or service as easily replaceable by something similar. They may not be able to tell the difference between your offerings and others, leaving them feeling a bit confused or complacent. Your customer may decide to stick with what they know rather than try something unknown, until they are drawn to something new or different.

• Alternatives - Your customer is evaluating their choices 24/7 and 365 days a year as they explore options that address the thing that matters most to them. They are drawn to alternatives. Direct-to-Consumer marketing is the domain of the alternative.

• Catapults - What matters most to your customer just landed in their lap, courtesy of a smartphone. Catapults meet customer needs in new and unprecedented ways through previously unavailable or unbelievable options. Catapults are a whole new possibility. Yesterday’s novelty is today’s alternative and is on the path to replacement.

• Community Builders - Your customer craves connections and positive human interactions, especially in times of anxiety and discord. As your customer seeks to address what matters most to them, they may consider joining a community. What matters most includes a heart connection in addition to a head-based logical solution. A sense of belonging expands the customer experience. Many competitors approach differentiation from a branding perspective and position themselves around being “community-oriented”, though few genuinely play a community-building role.

WITH A TRACK-RECORD OF GIVING BACK AND STRENGTHENING OUR COMMUNITIES, WE WILL REMAIN A COMMUNITY BUILDER WELL INTO THE FUTURE.

We’ve reached a tipping point in the last three to five years in terms of customer expectations around digital delivery of products/services, and competitors are responding. Competitors are anticipating customer needs, then crafting deliberate strategies to imagine new and novel ways to meet those needs. Innovation, market leadership, and data are cornerstones of their market growth strategies.

Customers expect comparable experiences, choices, and offerings from the companies with which they choose to engage. Value-drivers abound from trailblazers in technology and consumer goods. Companies that don’t keep up can expect diminished brand loyalty and market share. We learned about the customers of today: who they are as people, what their aspirations are, what they do and do not care about, and how they prefer to define their relationships with financial institutions.

• There’s a strong desire among customers for financial education that goes beyond online articles and webinars.

• They want accessible and relevant resources to help understand the very real financial challenges they face.

• In their relationships with a financial institution, customers are seeking authentic human connections that demonstrate empathy and understanding, as well as tangible coaching for making financial decisions. Customers are highly attuned to whether an institution is genuinely connected to the local community; they care deeply about the role organizations like Blue can and should play in building and supporting local communities.

• While customers DO care about convenience, accessibility, and having a onestop-shop for all their financial needs, they DO NOT care as much about the type of organization that meets their needs (e.g. bank v. credit union v. FinTech application), tax status (e.g. nonprofit v. for-profit), nor the historical roots of an organization.

Changes to adult education and financial literacy are very likely to happen and are expected to have a high impact on us. While somewhat less significant, changes to corporate social responsibility and philanthropy are also important to consider.

Overall, changing consumer expectations in other industries are likely to shape our future. The blurring of lines between industries is real and there is much to be learned from trends in other industries. As consumer expectations shift across these industries, our strategies will need to shift to serve members effectively. In summary, our core industry is not expected to drive customer preferences to the same extent as moves in other industries. Opportunities to reimagine, reinvent, and rediscover can be found outside the financial services industry.

WE ARE UNWAVERING IN OUR COMMITMENT AND EXTREMELY LOYAL.

The expression ‘True Blue’ originated in 17th century England. In a town called Coventry, locals developed a reputation for the stalwart, unfading nature of the blue dye they used on their clothing. While other dyes at the time often faded when washed, the ‘True Blue’ dye of Coventry’s dyers held fast and stayed true. Just like the “True Blue” dye that never fades, we hold fast to the commitments to our members that got us to where we are today.

What sets us apart, makes us exceptional, unrivaled, irreplaceable, one-of-a-kind

We consistently deliver exceptional, unique, and unexpected products, services and experiences that result in positive member outcomes and our members feel valued

Building on the data discoveries, lessons learned, and insights gleaned during the master planning process, the path to greater relevance and impact on our customers’ lives became clearer. When it comes to their financial needs, we know that what matters most to members is the human element; that they have a person and organization with whom they can personally connect on their journey to financial health and vitality. We discovered a compelling strategic opportunity. Blue will enjoy a one-of-a-kind relationship with our members and communities.

BLUE WILL BE THE OUR CUSTOMERS SEEK LIFELONG CHAMPION

We know that the path to realizing possibilities is a personal journey, one that requires individualized options to meet the unique needs of our members. No two people have the same path to realizing their possibilities and that is why we are pioneering a bold new approach to financial services. Creating innovations through the power of data and opening our hearts to the needs of each person will create unmatched human connections to transform experiences. Through our new innovation business model, we will identify and build products to allow us to surround those we serve with personal support that matches their unique circumstances.

This is finances with heart: our promise that no matter where someone is on their path to realizing their possibilities, we’ll be with them all the way.

Most importantly we will strive to offer member experiences that are refreshing and intentionally unexpected. As our path to greater relevance and impact on our members lives becomes clearer, we will be unwavering in our commitment to:

• Be extremely loyal

• Be unique, unexpected, and true to who we are

• Not offer the same old stuff as everyone else

• Anticipate and respond

As we learned during our analysis, innovation requires a tolerance for risk and a willingness to experiment, in addition to a laser-focus on identifying and anticipating the needs of customers. In developing our strategies, we recognized our new business model will not appeal to everyone. We will appeal to those who care about their own prosperity and that of the region they call home, wherever they are. They’re united by an outlook on life, not an income bracket. Ultimately, we identified unique characteristics we will seek in our ideal member. Innovation is going to require a shift in our mindset from “We’ve never tried that” to “Let’s try that!”

Our Innovation Business Model will require a purposeful focus on building a culture of experimentation, trendsetting, risk-taking, and innovation. To offer our members an experience that feels refreshing and intentionally unexpected, we created an innovation business model that places the Blue customer experience at the forefront, with opportunities to explore new and novel ways in which we meet the needs of our members. Specifically, we’ll orient innovation in our tailored products and services around:

DESIGN ‘CHAMPION’ EDUCATION, ADVISING, AND COACHING PROGRAMS FOR OUR ‘IDEAL MEMBER’ FINANCIAL EDUCATION.

What is a member? Our ideal member is someone that belongs to Blue; feels a part of Blue; values their engagement with Blue. Throughout this process we found our members value what we are offering. However, we must ensure our members feel we care about their financial lives. They want to improve their financial lives through a trusting human connection. Seeking personalized service and a one-stop shop are critical attributes our members and potential members are seeking. There is a tipping point of member expectations around digital delivery of products/services and our competitors are responding. As we pursue our new strategy and innovation business model, we will strive to identify the next best action for our members and give the right counsel at the right time.

DESIGN

‘IDEAL MEMBER’.

We are competing locally and globally and seeking to adapt to changing expectations at an accelerating pace. We know our members often use a variety of different services to fulfill their financial needs and our research told us they are seeking clear value and personalized service. They want control and customization with convenience, a one stop shop with unique offerings

Cost, convenience, and the sense that a product/ service is designed for our members and tailored to their needs are areas of emphasis for the competitors we studied. In response to our findings, we will create holistic value with our products and services. This will involve:

• Rethink rewards program

• Design, test, launch and grow a revitalized membership program

• Reimagine and redesign products and services

DESIGN A NEW MODEL TO ENGAGE ‘IDEAL MEMBERS’ WITH BLUE TO ACHIEVE A NOTABLE AND MEASURABLE IMPACT FOR MEMBER COMMUNITIES.

Positioning Blue as a community-building competitor is an attempt to differentiate around authentic community connection. Community involvement of financial institutions is appealing to members on multiple levels, and they are seeking something they can contribute to and believe in. They don’t want just marketing, they want the connection to have a tangible impact, be authentic and local.

The path to realizing possibilities is not always a straight line and we recognize there are many challenges facing communities today. We strive to make the biggest impact possible, and we are committed to supporting community strength and vitality through impactful and meaningful engagement. This includes financial support through our Blue Foundation, employee giving, fundraising and other community investments.

In our efforts to transform and innovate, we are committed to tackling challenges in support of those we serve. Community impact should ideally benefit members and our strategies will strive to help build healthy communities. As a community builder, we crave connections and positive interactions. We will be a lifelong champion with heart. With a true cooperative spirit connected to and inspired by the communities we serve, we are building lifelong relationships guided in the belief that their success is ours. Giving back to our communities is at the heart of our purpose to create connections and this will be achieved through the My Community efforts to include:

• Work at the local level.

• Engagement, impact, and Blue Foundation

• Improve outcomes for our members and communities through improved members’ experiences and innovative products and services,.

• Partner with organizations who share our purpose and mission.

In doing so, we will strive to understand social detriments to overall community and member health. From research, we know customers are seeking connection to institutions who value them as a customer and demonstrate a commitment to serving what is important to them.

THE NEXT 10 YEARS WILL REQUIRE FOCUSED, INTENTIONAL, AND VISIONARY COMMITMENT EXECUTED BY 3-YEAR OPERATIONAL PLANS.

Drive growth through geographic expansion and market penetration

Design and deliver a differentiated experience that shifts member base to ideal customers

Become a purposedriven organization dedicated to a notable impact

Expand our proven model and approach to deliver more impact, further differentiate, and drive financial success Blue will be a recognized leader in purpose-driven differentiation

Achieve differentiated expansion and outsized success through notable impacts and continuous innovation

Blue will be a recognized leader in purpose-driven differentiation

Design, launch, scale and deliver a soughtafter experience

Attract and retain more of our ideal customers

Continue to innovate to stay ahead of the competition

Attract and retain Y% more of our ideal customers

Expand our proven model and approach to deliver more impact

Continue to innovate to stay ahead of the competition

The majority of members will be ideal customers

BY DECEMBER 31, 2030, BLUE WILL DELIVER A SOUGHT AFTER EXPERIENCE FOR ‘IDEAL MEMBER’ SEEKING A LIFELONG CHAMPION, ACHIEVING A NOTABLE IMPACT FOR MEMBERS AND THEIR COMMUNITIES AND REACHING OVER $6 BILLION IN TOTAL ASSETS.

2021-2023 2024-2027 2028-2030

Design Blue’s impact index and data tracking Implement impact measurement

Achieve $2 billion in total assets through planned expansion, relationship deepening, technological investments, and more

Evaluate and report results

Tailor member experience and community engagement to achieve more impact Celebrate impact

Measure impact

Evaluate and report results

Tailor member experience and community engagement to achieve more impact Celebrate impact

Achieve $4 billion in total assets Achieve $6 billion in total assets

• Convert most promising ideas into a variety of concepts for piloting in 2022

• Use a standard template with categories such as strategy alignment, ability to attract more ideal customers, opportunities to build brand trust, etc.

• Think of this as a mini business plan considering retail, digital, technology, data, people, and facilities

• Test concepts through the second phase of prototyping and experimenting using data to assess proof of concept

• Evaluate synergies across My Life, My Money, and My Community

• Apply a data-driven process and criteria for executives to select the most promising concepts to advance to the pilot stage

• Build out the implementation plan and financial model for 2022

• Prepare staff for 2022 work

• Pilot new business model: My Life, My Money, and My Community

• Evaluate synergies across My Life, My Money, and My Community based on concept decisions made in 2021

• Test and evaluate for effectiveness; improve as necessary

• Create a phased launch plan for the 2nd half of the year

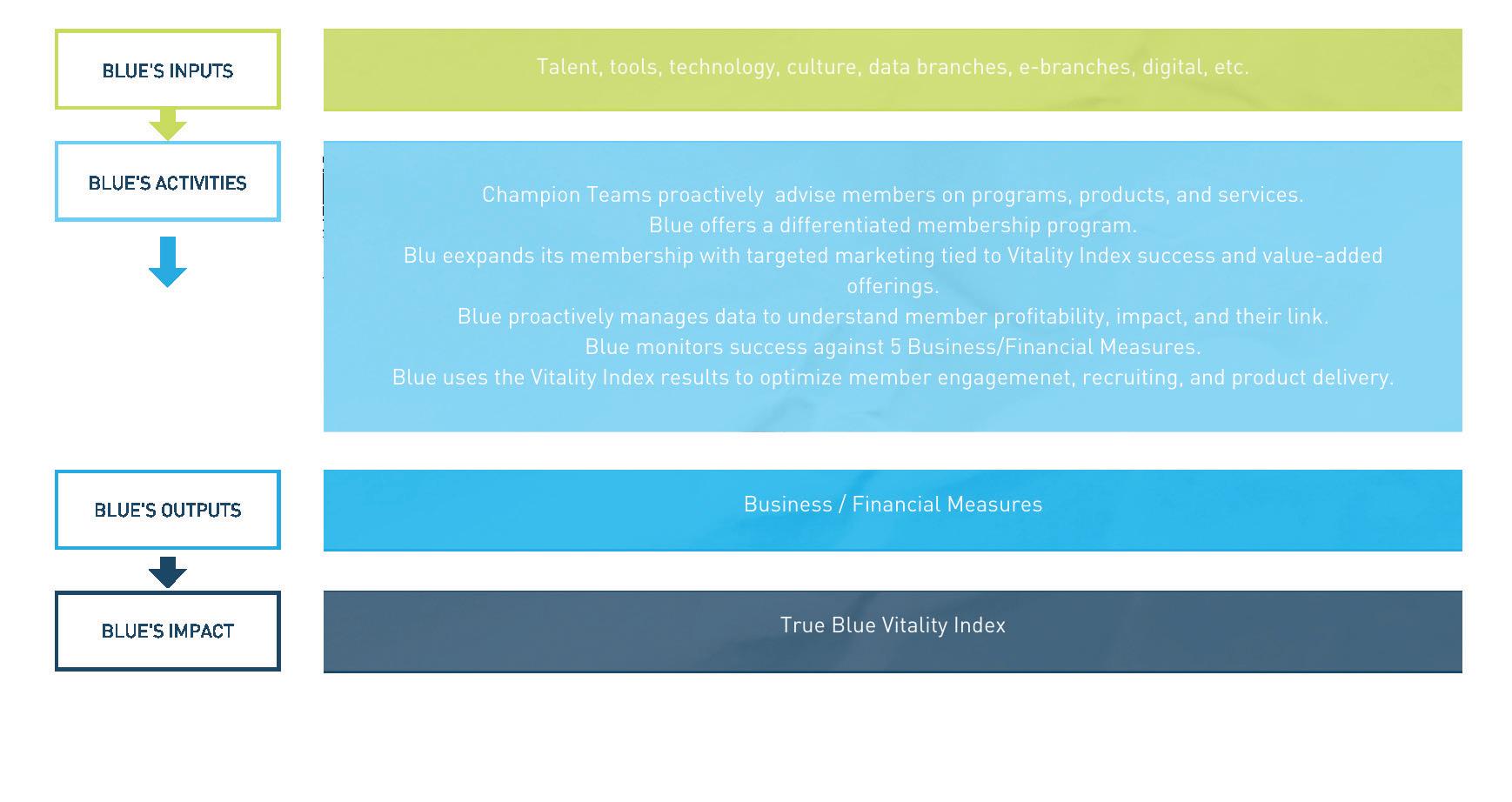

We achieve a notable impact on our members’ lives, money, and communities as measured by our Vitality Index.

The Blue Vitality Index captures our steadfast commitment to our mission to discover pathways to realize your possibilities. Our values serve as guideposts for our daily actions and for the mindset we bring to our organizational culture.

“Vitality” expresses the holistic difference we make in the lives of our members, our employees, and in the specific communities we touch through our mission and values. Our innovation business model helps us determine the specific inputs, activities, and outputs necessary to achieve the outcome of “Vitality.”

By measuring and evaluating the impact we’re making on the lives of our members, our employees, and our communities, we keep our promise to be your lifelong champion who helps you achieve your dreams and realize your possibilities. The Blue Vitality Index guides decision-making in terms of how we…

Deploy and allocate our resources

Recruit, develop, and retain our employees

Engage our customers and employees

Accelerate the success of our communities

Maximize the possibilities for our members

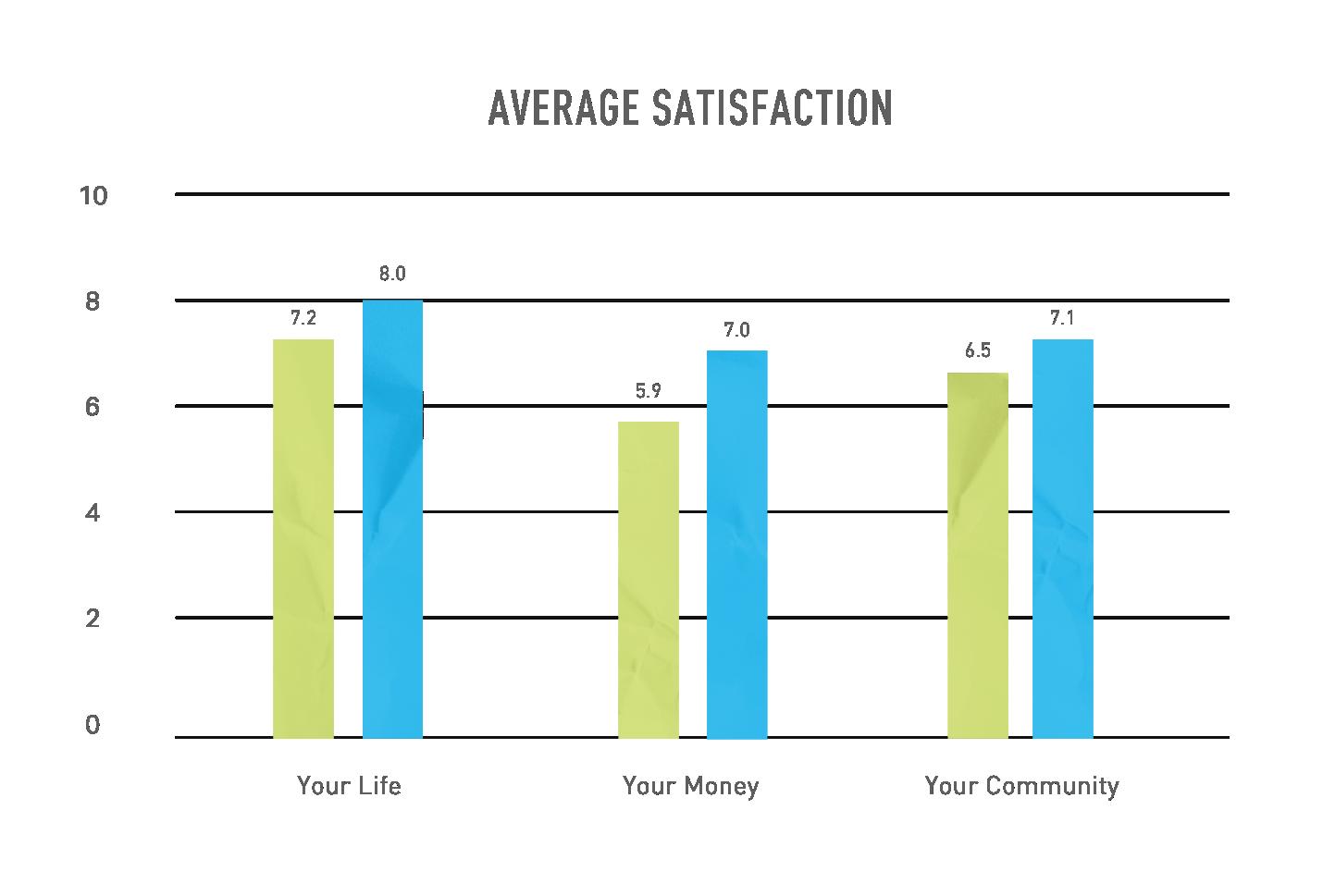

As illustrated by a member survey conducted in the summer of 2021, we are poised to measure our mission impact. We know that members are more satisfied with their life, money, and community than non-members. We also know that members and non-members desire assistance in achieving their important goals, all of which have a financial component.

Sharing those real stories in connection with our strong brand will attract and retain more members who seek our unique value-added offerings. It will also aid us in optimizing our products, services, and programs to achieve a dual bottom-line of financial success and mission impact.

DATA ANALYSIS WILL REVEAL WHICH PRODUCTS, SERVICES, AND PROGRAMS CREATE THE FOLLOWING RESULTS (WORKING CLOCKWISE FROM THE UPPER LEFT).

• High/Low – These offerings are subsidized with profit from others. They are central to mission delivery.

• High/High – These offerings might be used as selling points to attract and retain more members.

• Low/Low – These offerings might be dropped completely or redesigned for increased financial or mission performance.

• Low/High – These are the “cash cows” that subsize other offerings.

WE MEASURE STRATEGIC SUCCESS IN TWO WAYS: 2023: FINANCIAL/BUSINESS SUCCESS

• Financial/Business Success – A set of five measures encapsulate our commitment to operating a financially healthy, profitable, and growing credit union. Employees were notified of the 2023 targets on December 9, 2020, when Blue 2030 was announced. They are monitored routinely by Blue.

MEASURES

LOAN SHARE 2023: $2,000,000,000 JULY 2021: $1,554,383,252 2023: 140,000 JULY 2021: 105,243 2023: 50% JULY 2021: 39%

2023: 97.50% JULY 2021: 85.31%

RETAIL/TOTAL LOANS LOAN SHARE OF WALLET

2023: 35% MARCH 2021: 25.5%

Efficacy: An individual’s belief in his or her capacity to execute behaviors necessary to produce specific outcomes.

Efficacy is employed in the component measures of the Vitality Index because:

• It is an established and measurable outcome in evaluation

• It changes over time and can be influenced by interventions

• It captures unique goals/motivations across audiences

• It is essential to the concept of Vitality

The index measures enduring vitality as the product of how well customers, employees, and the communities we serve fare in terms of each aspect of the innovation business model.

Each component of the Innovation Business Model will receive a score. Once the first wave of data collection is complete, factor analysis will help determine which questions carry the most significant weight in determining each component score. These scores together will result in a single, total score for the Vitality Index.

The same weighting process will be employed in future waves of data collection/ analysis.

These scores can then be compared across our members and nonmembers in our service area. Additionally, scores can be compared across demographics to identify populations of interest for Blue to target with programs and services. Finally, trends in scores over time will provide measures of success for our ability to deliver on our mission and identify areas for improvement.