32 minute read

Turkey in focus

ANALYSIS: Turkey

Turning a corner?

Turkish delight at improving markets

Yogender Malik looks at how Asia’s bridge to Europe and the wider Mahgreb region, Turkey, is positioning itself for changing economic conditions moving forward and looking to capitalise on an improving domestic scene…

Huge investments and steady expansions by existing producers, two new entrants ( one each in float and container glass segments) has made Turkey one of the most dominant glass producers in both- flat and container glass segments in the European and Asian region.

All of the glass producers in the three major sub-segments enjoys significant scale of operations, which enable these producers to achieve economies of scale and lower production costs. Most of the producers are also highly backwardly integrated, which further help them in optimising the total cost of production.

Economic slowdown has had an adverse impact on glass consumption in Turkey in last one and a half years. After extending the high economic growth of 2017 into the first quarter of 2018, Turkey was confronted with problems such as rising inflation and shrinking domestic demand. This situation was caused by volatility in foreign exchange rates and geopolitical tensions, especially starting from the second half of the year 2018. To address these challenges, the government announced the New Economy Program (NEP). The NEP was designed to promote savings and export-driven growth in order to stimulate the economy. Subsequently, the Turkish Central Bank (CBRT) implemented contractionary monetary measures to support the NEP targets.

Economic slowdown in the country has adversely impacted the construction, automotive and consumer demand to a large extent in last two years, which has an adverse impact on flat and container glass demand in the domestic market. But, Turkey’s strategic location provides the country’s glass producer to reach to a number of export markets without incurring too much on the transportation.

Sisecam, the glass giant from the country dominates the glass production in all the three major segments of the industry. Sisecam’s domination in Turkish and regional glass market can be understood from the sales and production figures. In 2018, the company registered sales revenues of USD 3.2 billion. The company produced 4.9 million tons of glass, 2.4 million tons of soda ash and 4.1 million tons of industrial raw materials. The company invested a total of USD 650 million in new plants and capacity up gradation of existing plants.

Glass trade According to the information from Turkey Statistical Institute (TSI), Turkey exported nearly USD 535 million worth of glass products in the first six months of the year 2019. Exports during the first six months increased by USD 40 million as compared to the export figures for the first six months of 2018.

Turkish glass producers exported float glass, container glass and tableware glass to 164 countries across the globe. Italy was the top destination for glass exports from the country. With total exports of USD 45.492 million, Italy accounted for 8 percent of total glass exports from Turkey. Germany with exports worth of USD 43.649 million was second largest export destination. Israel with USD 26.827 million, Spain with USD 26.196 million and USA with USD 25.363 million were the tird, fourth and fifth largest destination of glass exports from the country.

During the same period, Turkey’s imported a total of USD 328.407 million worth of glass products. Imports of glass products, which was USD 453. 873 thousand during the first six months of 2018 , decreased by USD 125.465 thousand dollars. China was the largest source of imports of glass products with imports worth USD 65 million. Germany with USD 38 million, Italy and France with USD 25 million and Bulgaria with USD 20 million were the second, third, fourth and fifth largest import destination for glass imports in the country.

Another interesting development that is taking place in the wider Central Asian region as investments continue to pour into companies in those countries. As these factories become more and more sophisticated, there is a danger that what were previously extremely lucrative export markets may become less accessible. Take, for example, Azerbaijan where Azerbaijani Ask Glass (a subsidiary of the Azerbaijan Industrial Corporation) has begun exporting glass containers to Georgia, and in 2020 will significantly increase deliveries.

Ask Steklo signed a contract with Coca-Cola Bottlers Georgia to supply 2.6 million glass containers to Georgia to dispense Coca-Cola and Fanta drinks in them by the end of 2019.

In 2020 export volumes will increase the initial forecast provides for the supply of 10-20 million units of glass containers, according to the Azerbaijan Industrial Corporation.

ANALYSIS: Turkey Turning a corner?

Ask Glass has been asked to carry out a set of measures to improve the quality of its products.

Ask Glass was established in February 2018 and is located in Baku. The company is located on an area of 22 hectares and is equipped with the most modern Italian equipment, along with the use of local raw materials,

Ask Glass also purchases glass in Russia, Ukraine and Turkey while the production capacity of the plant is 80-85 million units of glass containers. As this capacity grows, and reliability and quality improve, will there be a decrease in demand from Turkey?

Raw material availability Availability of most of the raw materials for glass production in Turkey has provided Turkish glass producers with a huge competitive strength in glass production. The fact that Turkey has emerged as one of the largest soda ash producing country has helped Turkish glass producers to source the demand of this critical raw material at very competitive prices. Country’s Ciner Group expanded production at its site in Beypazari, Turkey by 500,000 metric tons in March 2017. This was followed by the start-up of a new soda ash production facility at Kazan, with an annual soda ash capacity of 2.5 million metric tons. Both plants are low-cost Trona based facilities. The favourable production costs at both plants meant they can supply domestic glass producers competitively.

Container glass Catered by three large and one mid-sized container glass producing companiesSisecam, Park Cam and Gurallar Group and new entrant Basturk Cam, Turkish container glass industry has enjoyed very steady growth rates in recent years. However, significant capacity additions by existing producers and a new entrant in last few years has created a situation of overcapacity in domestic market.

Significant demand from Turkish food and beverage sector is the largest contributor for the country’s container glass industry. There were 47,617 food processing and 595 beverage producing enterprises in Turkey as of 2018, according to the latest statistics published by TurkStat. Turkey has a modern and developed

EXPORTS REACHED NEARLY US$535M. OF GLASS PRODUCTS IN THE FIRST HALF OF 2019

food processing industry supplying the domestic population and exporting, which represents 16 percent of all manufacturing activities. As of the end of 2018, there were 611 foreign direct investments in food and beverage production: 101 of these were German, 44 Dutch, 33 French, 31 from the United States, 30 from Italy, 26 from Russia, 26 from Iran and 25 Swiss.

For container glass segment, 2019 has been a tough year due to softer demand for glass packaging products in the domestic market as a result of contraction in non-alcoholic beverage consumption due to inflationary pressures seen on product prices. Most of the container glass consuming sub-segments kept their inventory levels relatively low considering their lower sales, which had an adverse impact on container glass consumption in the country.

Sisecam- Container division Sisecam’s glass packaging division is the largest container glass producer with an installed capacity of 1.2 million tons per annum. The company conducts its production activities in Turkey at three facilities located in Mersin, Bursa, and Eskisehir.

In 2019, the company has increased the installed capacity at Yenisehir and Mersin plants. In April 2019, the company added 20,000 tons per annum capacity at Yenisehir plant. Later in June 2019, the company increased the installed capacity at Mersin plant by 30,000 tons per annum. Following the commissioning of its fourth furnace at Mersin plant in June 2019, Sisecam’s container glass division increased the installed capacity of container glass production in Turkey to 1.335 million tons per annum with a total of 12 furnaces. The new furnace in Mersin has an installed capacity of 80,000 tons per annum. Sisecam invested USD 18 million to set up this furnace.

In 2018, Sisecam’s container glass division had installed a new furnace at Eskisehir plant. The company made an investment of USD 66 million for this furnace, which has added 150,000 tons per annum of container glass capacity. This furnace become operational in July 2018. The company also undertook cold repair of one of its furnaces at Yenisehir plant, which added an additional capacity of 30,000 tons per annum in May 2018.

In addition to Turkey, Sisecam’s container glass operations are spread to three other countries- Russia, Ukraine, and Georgia. The company has an overall installed capacity of 2.645 million tons of glass containers in these four countries.

According to Prof. Ahmet Kırman, Deputy Chairman and CEO of Sisecam Group, “ We are the third largest manufacturer of glassware and the fifth largest manufacturer of glass packaging and flat glass today. In addition to ranking among the top 10 soda producers of the world, we are also the world leader in chromium chemicals. Continuing its production activities in 13 countries, our Group strengthens its capacity and technological power with its innovation, creativity, expertise and qualified human force, and looks toward the future with trust thanks to its product and service quality meeting the changing market needs”.

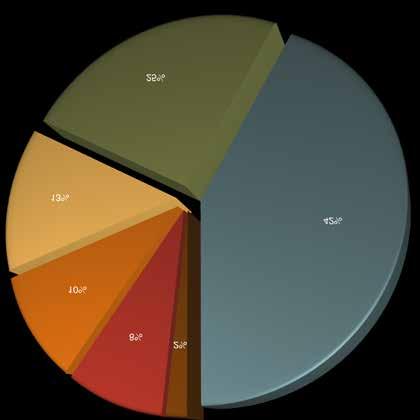

Packaging materials in Turkey by market share (%)

Paper Cupboard Glass Carton

Wood Metal Paper

Park Cam Glass With an installed capacity of 1000 tonnes per day, Park Cam is the second largest container glass producer in Turkey. A subsidiary of Ciner Group, which is one of the largest business conglomerates in the country, Park Cam opened its first production line in Bozuyuk with an installed capacity of 500 tonnes per day in 2013. The company commenced production with the second furnace with an installed capacity of 500 tonnes per day in 2015. Both the plants are biggest rear-fired container glass plants with a daily capacity of 500 tons, and is among the most modern plants in the world in terms of technology. Currently, the company produces 6.5 million glass bottles in flint and green colours.

Park Cam has plans to set up two more glass furnaces with a total capacity of 1000 tonnes per day ( 500 TPD each) in coming years. Initially, the company planned to start the construction of third furnace in 2017, but it has been delayed. Upon completion of these two furnaces, the company will become one of the largest container glass producers in the country and region.

Park Glass’s parent company, Ciner Group is one of the largest groups of Turkey that carries out activity in mining, energy, glass, chemicals, media, maritime, tourism and other business sectors. Ciner Group is also one of the largest soda ash producer in the country.

Gurallar Cam Ambalaj More popular because of company’s tableware glass products, Gurallar Group ventured into container glass production in 2014. The new venture, Gurallar Cam Ambalaj commenced commercial production of container glass in February 2015. With an installed capacity of 300 tonnes per day, the company focuses on producing food jars and soft drinks bottles.

In November 2019, the company received the Red Dot 2019 Award in Berlin, Germany, one of the most prestigious awards in the design world, for its “Mai Dubai” bottle. Red Dot is a design concept competition that awards outstanding international product designs in a wide range from fashion and jewelry design to electronic devices, kitchenware and furniture. The competition, organized each year to identify and evaluate new designs, have great importance in the manufacturing industry.

Basturk Cam Part of the Basturkler Sirketler Group of Companies, Basturk Cam, a relatively newcomer to the container glass industry, is located at the heart of the Malatya agricultural region of Eastern Anatolia. The first phase of the company’s 300 tonnes/day glass melting furnace was commissioned in the mid-2018.

According to the company, in its first year of operation, it has produced more than 300 million pieces of glass bottles and nearly 250 million pieces of glass jars. Nearly half of the output went to domestic market, while the other half of the output was exported to food and beverage companies in Europe and other neighbouring countries. 1

Flat Glass Turkish flat glass industry is dominated by two producers. Sisecam’s flat glass division and Duzce Cam, which entered into flat glass production in the last decade.

As mentioned elsewhere in the article, Turkish flat glass industry had to bear the consequences of slowdown of country’s construction and automotive industries.

Construction sector in particular has resulted in decline of flat glass demand in the country during last eighteen months. The collapse in Turkey’s currency and surging interest rates have plunged the country’s construction industry into recession during this period. The construction sector was the driving force of the country’s booming economy, which had a track record of more than 5 percent growth. Barometer of country’s construction sector, Istanbul’s Fikirtepe district is the center of a massive urban redevelopment project, but construction activities have almost come to a standstill in last eighteen months.

TIN BATH EXCELLENCE MADE IN GERMANY.

JOHANNES ERTL (HEAD OF TIN BATH DEPARTMENT)

Over the last seven years HORN Glass Industries has planned and built seven Tin Baths with capacities from 250 tpd up to 1000 tpd. Our expertise gained from decades of experience in the glass melting business, helps us to fi nd the perfect Tin Bath solution for every project.

All key components are produced in our own manufacturing department in Plößberg/Germany.

Sisecam- Flat glass division Flat glass division of Sisecam Group is the dominant float glass producer and supplier in domestic market. With seven float glass lines and an automotive glass production line in Turkey, Sisecam has an installed capacity of 1.795 million tons in Turkey. In addition to Turkey, Sisecam also operate float glass operations in nine other countries with an overall installed capacity of 3.2 million tons per annum.

The company has participated in a number of prestigious projects in the country. Recently, Sisecam supplied value added glass for Istanbul’s new airport. Sisecam supplied a total of 200,000 square meters of glass (or over 16,000 tons of glass). 44% of the facade of the airport facades is made of glass supplied by Sisecam. High value added glass covers the vertical facades of the central passenger terminal, the terminal blocks, the domes providing light in the building, the sleeves for taking passengers from and to the aircraft, etc.

Flat glass accounted for 38 % of the company’s revenue during the first six months of 2019. Container glass business contributed 22 %, chemicals and tableware glass accounted for 21 % and 17 % respectively, while 2 % of the revenues came from other streams. Sales from domestic operations (including domestic market and exports) accounted for 58 % of the company’s revenues, while European operations contributed 24 % of revenues. Russia, Ukraine and Georgia contributed for a further 15 % of the total revenues, while rest 3 % was contributed by operations in other geographies.

Many of the company’s investments since 2012 are brown-field projects in markets where Sisecam has prior operational experience, many of the company’s operations are located in emerging markets where geopolitical risks are compounded by low predictability of regulations and policies. For example, the company’s container glass business is particularly exposed to Post-Soviet states with five plants in Russia, one in Ukraine and one in Georgia.

Sisecam spent a total of TRY5.1 billion between the years 2013 and 2016 to increase its capacity and diversify its geographical footprint. This included investments in Turkey, Russia, Bulgaria, Romania, Georgia and Italy as well as acquisitions in India, Germany, Slovakia and Hungary.

Sisecam made its first expansion into flat glass production outside of Turkey in 2006, opening a flat glass manufacturing facility in Bulgaria, which was followed by the commissioning of a mirror plant and processed glass plant in late 2006 and an automotive glass plant in July 2010. I

In 2013, Trakya Cam further expanded in Bulgaria by opening a laminated and coated glass facility. Also in 2013, Trakya Cam continued its expansion in Europe by acquiring Richard Fritz Holding GmbH (“Richard Fritz”), a German company that is one of the leading suppliers of encapsulated automotive glass and currently operates production facilities in Germany, Hungary and Slovakia.

In 2015, Trakya Cam invested in new automotive glass factories in Russia and Romania. Trakya Cam acquired all of the assets of Italy-based flat glass producer Sangalli Vetro Porto Nogaro S.p.A. (“Sangalli Vetro Porto”) and Sangalli Vetro Manfredonia S.p.A. (“Sangalli Vetro Manfredonia”) in 2016 and 2018, respectively, and, as a result, became (when including its capacity in Turkey) the largest flat glass producer in Europe in terms of production capacity according to management estimates. The Sangalli Vetro Manfredonia (now known as “Sisecam Flat Glass South Italy”) flat glass production facility, which is located in southern Italy, which recently completed cold repair work, has a production capacity of 190 thousand tonnes per year, a laminating line with four million square metres per year capacity, a coating line with four million square metres per year capacity and a satin coating line with 1.5 million square metres per year capacity.

In 2013, Sisecam entered into a 50 : 50 joint venture with leading Indian glass producer Hindusthan National Glass and Industries Limited for a float glass line company in India named HNG Float Glass Limited. In 2018, Trakya Cam purchased HNGIL’s interest in HNG for US$85.7 million and renamed the company Sisecam Flat Glass India Limited.

In late 2019, Sisecam also inaugurated its second flat glass investment facility in Sant’Angelo in Puglia, Italy with Italian Prime Minister Giuseppe Conte in attendance. Table 1

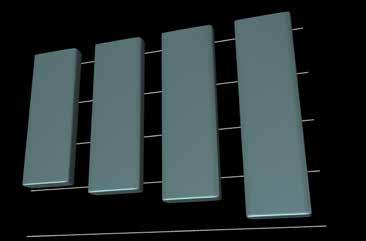

2015 2016 2017 2018 Total float glass exports (sq metres)

61,014,540 141,132,260 144,690,229 201,325,769

Total container glass exports (Kg)

1

1

We are changing the world of glass melting for good, with a new super-efficient furnace offering lower emissions, lower heat losses and lower energy consumption.

The opening ceremony of the Manfredonia facilities took place two months earlier than planned on 30th November and was hosted by Şişecam Group Vice Chairman and General Manager Ahmet Kırman.

Along with Mr Conte, Turkey’s Ambassador to Rome Murat Salim Esenli, Puglia Regional President Michele Emiliano and Monte Sant’Angelo Mayor Pierpaolo D’Arienzo also attended the ceremony.

Speaking at the opening ceremony of the facility, Mr Conte said that he attended the ceremony to show the special importance his government considers the development in the southern part of the country.

Extending thanks to Mr Kırman for the investment, Conte stated: “Şişecam has come with a sustainable project both economically and environmentally and taken an important step by putting this facility into operation.”

Mr Esenli emphasised that the presence of Turkish company Şişecam in Italy is an indication of the economic power and the visionary perspective of Turkey.

He added: “I would like to consider the attendance by Prime Minister Giuseppe Conte in such an important opening as an indication of the importance he and the government he represents to relations and cooperation with Turkey.” He underlined that Şişecam continues to grow in line with its performance-based investment policy with a view to becoming one of the world’s largest three producers in the main areas of activity.

He said: “Including our recent soda investment in the U.S., we are operating in 14 countries on four continents, bringing our innovative products to our customers in more than 150 countries and providing jobs to 22,000 people.

Mr Kırman added: “Along with additional investments, we have invested more than 55 million euros in the facility, including purchase price and business capital.”

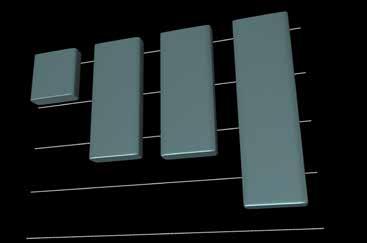

Italy Israel Iraq USA Lebanon France Romania Azerbaijan

Table 1

70,676,238 23,710,175 26,322,399 15,452,521 14,223,923 11,219,178 12,438,125 4,294,782

Leading container glass export destinations (Kg)

1

Duzce Cam Established in 2007, Duzce Cam is the only other float glass producer in Turkey. Located in Duzce 2nd Organized Industrial Zone Duzce Cam, commenced commercial production of float glass in 2012 with a capacity of 600 tonnes per day.

In 2016, the company added second float glass line with an installed capacity of 800 tonnes per day, taking the overall installed capacity to 1400 tonnes per day

Glass tableware Two of the most popular global tableware glass producers in the country has made Turkey a regional powerhouse in tableware glass production. Sisecam Group’s company Pasabahce and Gurallar Group have contributed immensely towards the development of country’s tableware glass industry.

Pasabahce Tracing its history to 1935, Pasabahce is the oldest glass producer in Turkey. The company is among the most reputed global producers of tableware glass. With 12 glass furnaces, over 80 production lines, the company produces value-added, printed and decorated tableware glass products at its highly automated production plants located in Turkey, Bulgaria, Russia and Egypt.

Pasabahce Cam has secured competitive advantage in the domestic and export

CONTINUALLY DESIGNING, BUILDING AND MODERNISING

www.teco.com TOTAL FURNACE CAPABILITY

glassware markets and cemented its leading position with its investments at its Turkey based production plants in Eskisehir, Kırklareli and Denizli. The company exports its glassware products to more than 140 countries, boasts a product line of more than 20,000 items and operates 44 stores across the country. During the first nine months of 2019, Pasabahce achieved a total sales of 2,210 million TRY, registering a growth of more than 25 % over the sales figures of 1,763 million TRY. According to management estimates, the tableware glass group had a 67.2% market share in the Turkish market and 8.0% market share globally. It was ranked third globally and (when including its sales throughout Turkey) second in Europe, in terms of revenue.

Gurallar Group Gurallar is the sixth largest glassware manufacturer in the world and is most famous for the production of its tableware brand, LAV. The company was set up in 1996 by the Gural family, with the aim of creating tableware products under the brand name ‘Gurallar Artcraft’ (later changed to LAV). Company’s tableware production facilities are located in Kutahya, supplying 2 million items every day. Its two production facilities occupy a total area of 300,000 square meters and employ 2,000 people. In total, 3,500 different products are made and exported to 130 countries, including Brazil, China, Philippines, France, Spain and Iran. The company claims to sell its LAV products in 35,000 shops throughout Turkey and a further 100,000 stores around the world.

Egypt looks at auto market Egypt has long looked at Turkey as a destination for automotive parts, with glass being one of them. However, at present, this remains a distant dream despite the industry’s best efforts. If it did succeed though, then perhaps there would be a surge in imports into the country. Certainly, the Egyptian market itself is proving harder for Turkish companies to enter as a preference for Chinese goods continues to rise.

The Egyptian car market witnessed a clear change in the pricing of Turkish cars, after activating the last stage of the Free Trade agreement with Turkey, under which all products exchanged between the two countries shall be free of customs. So, all imported cars from Turkey became completely exempted from customs which revived the sales movement in the local market. But this was not the case for the local feeder industries, as Turkey does not import any of its car components from Egypt.

Hence, the Free Trade deal was no use for the feeder industries, the main driver of the localization of automotive industry.

Deputy Chairperson of the Chamber of Engineering Industries at the Federation of Egyptian Industries (FEI), Abdel Moneim El-Qady, said there is no positive effect from the agreement on feeder industries, since Turkish cars do not rely on Egyptian raw materials.

Moreover, he believes that Egyptian automotive assembly companies prefer Chinese products over Turkish, due to their higher quality and lower prices. Therefore, the agreement will not benefit this sector as well.

The deal reduced the price difference between imported cars and locally assembled ones which are subject to 40% customs. It increases the difficulty of market competition, adding to the burden of local assembly companies which will be forced to lower their prices.

El-Qady explained that feeder industries supply their production to local assembly companies, while spare parts come second in terms of priority. As for exporting, it is still difficult without incentives that help that local industry to compete globally, similar to the Tunisian experience.

In Tunisia, the government obligated car importers to rely on local spare parts, which boosted the feeder industries significantly.

In a related context, Ali Tawfik, head of the Federation of Feeder Industries, said China is the main supplier of cars, auto components, and spare parts, however importing from Turkey has several advantages, the most important of which is its geographical proximity. Therefore, shipping

Company: Sisecam: Flat Glass division Manufacturing plants: Kırklareli, Mersin, Bursa and Ankara Markets: Domestic and Export Markets Other: Sisecam’s flat glass division is the largest flat glass producer in Turkey. The company operates a total of seven float glass lines and an automotive glass production line in Turkey. Company’s overall installed capacity is 1.795 million tons in Turkey. In addition to Turkey, Sisecam also operate float glass operations in nine other countries with an overall installed capacity of 3.2 million tons per annum.

Company: Duzce Cam Location: Duzce Industrial City Markets: Domestic and Export markets Other: A relative newcomer in Turkish flat glass industry, Duzce Cam operate two float glass production plant at Duzce Industrial City with an installed capacity of 1400 tons per day.

Company: Sisecam container glass division Location: Mersin, Bursa, and Eskisehir. Markets: Domestic and export markets. Other: Sisecam’s glass packaging division is the largest container glass producer in Turkey with an installed capacity of 1.2 million tons per annum. The company conducts its production activities in Turkey at three facilities located in Mersin, Bursa, and Eskisehir. In addition to Turkey, Sisecam’s container glass divison also operate container glass plants in Russia, Ukraine, and Georgia. The company has an overall installed capacity of 2.645 million tons of glass containers in these four countries.

Company: Park Cam Location: Bozuyuk Markets: Domestic and Export Markets Other: A subsidiary of Ciner Group, which is one of the largest business conglomerates in the country, Park Cam operate two container glass furnaces with an overall installed capacity of 1,000 tons of glass containers per day. The company opened its first production line with an installed capacity of 500 tonnes per day in 2013, followed by a furnace with similar capacity in 2015. Both the plants are biggest rear:- fired container glass plants with a daily capacity of 500 tons, and is among the most modern plants in the world in terms of technology.

Company: Gurralar Cam Ambaraj Location: Kutahya Markets: Domestic and Export Markets Other: Gurallar Cam Ambalaj, a group company of leading tableware glass producer, Gurallar Group commenced commercial production of container glass in February 2015 with an installed capacity of 300 tonnes per day.

Company: Basturk Cam Location: Eastern Anatolia Markets: Domestic and Export Markets Other: Basturk Cam, a relatively newcomer to the container glass industry, is located at the heart of the Malatya agricultural region of Eastern Anatolia. The first phase of the company’s 300 tonnes/ day glass melting furnace was commissioned in the mid:2018.

Heye Ranger 2 – Camera Check Detection at its best

Check detection is one of the most important quality inspections in container glass production. The HiSHIELD Ranger 2 has been developed to fulfill the customer‘s quality expectations and it is fully available in every country.

FULLY MODULAR AND SCALABLE SYSTEM A Ranger 2 system consists of one camera, collecting five images simultaneously via five lenses and fiber optic image guides, the illumination unit and the control unit with the software for image processing, including the decision “container okay or not okay”. Based on the budget and needs of the glass plant, you can start with one system and add any number of parallel systems whenever you want. A typical and recommended configuration would be four parallel systems, each dedicated to and optimized for one of the following types of checks:

horizontal shoulder vertical bottom.

Each system runs independently and does not need to be synchronised with the others. So there is no influence or need to compromise between the systems. This allows an individual optimisation of all settings (illumination etc.) for the respective type of check. If one system is not available or not adjusted optimally, the others are still fully operational.

INTELLIGENT CLOUD MASKING – SELF LEARNING SYSTEMS Every container produced must be regarded as a unique object and any check detection concept has to respect this. For this reason each Ranger 2 system is using Heye’s Intelligent Cloud Masking (ICM). Bearing in mind that each article is distinctive, the Ranger 2 system is designed to investigate each one independently. Accordingly, it is not necessary to teach the detection system, but each container serves as a time saving reference for itself. Moreover, the inspection zones are dynamic in nature. The Ranger 2 system is therefore able to detect different

www.asianglass.com variations of checks, as well as to recognize new variations of them during production.

Apart from advanced camera and non-contact solutions, smart data is the key. The Heye PlantPilot collects and aggregates production data in the plant. The borders between Hot End and Cold End will disappear, information is shared on the spot. Tracking and tracing as well as the possibility of creating user-specific analysis are additional components, allowing continuous improvement processes to increase productivity. Self-learning systems are one of the cornerstones of Industry 4.0. The Ranger 2 camera check detection proves to be the best solution in the market. Heye’s clear and innovative product strategy, integrating latest camera solutions, remains unchanged.

ABOUT HEYE INTERNATIONAL: Based at Obernkirchen, Germany, Heye International GmbH is one of the international glass container industry’s foremost suppliers of production technology, high performance equipment and production knowhow. Its mechanical engineering has set industry standards for more than five decades. Extensive industry expertise, combined with the positive attitude and enthusiasm of Heye International employees is mirrored by the company motto ‘We are Glass People’. Its three sub-brands HiPERFORM, HiSHIELD and HiTRUST form the Heye Smart Plant portfolio, addressing the glass industry’s hot end, cold end and service requirements respectively.

FURTHER INFORMATION: Mr. Peter Witthus, Marketing at Heye International GmbH, Lohplatz 1, 31683 Obernkirchen, Germany. Telephone: +49 (0)5724 26-0. Fax: +49 (0)5724 26-539. Email: marketing@heye-international.com Web: www.heye-international.com

Turkish products to Egypt takes only four days, unlike Chinese shipments that take more than 30 days to reach the Egyptian ports.

Tawfik noted that if Turkish car makers used Egypt-made auto, this would contribute positively to the recovery of local feeder industries, especially following the Free Trade deal.

However, it is difficult to export local auto components to Turkey as they have more advanced feeder industries. Turkey exports approximately 1m cars annually, and production costs there are lower than in Egypt because of the huge production volume.

Tawfik proposed signing cooperation contracts between Turkish and Egyptian auto companies to benefit from the deal, as some industries to be assigned to Egyptian companies and others to Turkish ones based on product quality and operating cost.

Such steps can create an integrated system between the two countries which will reflect on the quality of the final products and their prices.

Egypt cannot compete with Turkey in terms of final products, as the Egyptian industry suffer more difficult challenges than Turkey, such as high interest rates and transportation costs.

Tawfik pointed out that the feeder industries companies formed a committee to set unified specifications for auto components and spare parts, such as brakes and glass. Those specifications are ready, but they have not been issued yet.

He called lawmakers and market leaders to set clear specifications of imported cars, so that importers could refrain from bringing low-quality products that lack international safety standards, which may cause traffic accidents or increase pollution.

There should be laboratories to examine imported auto products to ensure their suitability for local use.

Investments: will the hand-brake be applied?

One of the world’s biggest financial institutions is to squeeze its lending to Turkey this year following tensions between the EU and Ankara over its controversial oil and gas drilling operations in waters off Cyprus.

The European Investment Bank (EIB), the lending arm of the EU, has announced it will restrict loans to Turkey which over the last decade have amounted to around €19 billion ($20.94 billion).

Brussels is against any exploration for oil and gas in territory that falls under EU member state Cyprus’ exclusive economic zone. However, Ankara claims Turkish drilling ships are operating within Turkey’s continental shelf.

The EIB is one of the biggest sources of finance for Turkish infrastructure projects, but it has now said it will stop lending to public agencies in the country, while adopting a selective approach to the private sector in Turkey. However, the bank added that funding taps would remain closed to companies with links to the Turkish government.

The EU has felt obliged to take countermeasures against Turkey after it ignored demands not to send a new drilling ship to the Eastern Mediterranean, and its foreign affairs commissioner, Josep Borrell, recently said Brussels was preparing to impose sanctions.

Since last year, the EIB has only made one loan to a private company in Turkey, and that was after two years of negotiation for the construction of a greenfield glass-fiber manufacturing plant.

Kader Sevinc, a Brussels-based senior EU expert, said that although EU sanctions may have little impact on Turkey’s economic relations with the bloc and its members, they still sent a strong political message.

Company: Pasabahce Location: Eskisehir, Kırklareli and Denizli. Market: Domestic and export markets Other: Oldest glass producer in Turkey, Pasabahce is one of the most renowned names in global glass tableware industry. The company ranks the second in Europe, and the third globally in glass tableware production. Also owning the ‘Pasabahce Stores', leader of specialized retailing in Turkey with its unique structure, Pasabahce is one of the oldest enterprises in Turkey with a history of more than 80 years. With a comprehensive product range that includes more than 20,000 handmade and batch:produced products, Pasabahce addresses a large consumer base and exports its products to 140 countries.

Company: Gurallar Group Location: Kutahya Market: Domestic and export markets. Other: Founded in 1994 as a part of the Gurallar Group, the company has played an important role in the development of the tableware glass industry, breaking the monopolistic nature of the Turkish glassware industry. In 2014, the company underwent a corporate rebranding to transform itself into a global player, deciding to continue its journey with the LAV brand. Developed with the innovative perspective of the Gurallar Group, whose origins dates back to 1948, LAV has brought to the table glassware industry the capability of its parent company together with the experience of the ArtCraft brand.

“Turkey’s growing financial and energy dependence on certain non-Western actors is worrisome and may lead to grave dangers in the years to come,” she told Arab News.

“Progressive local authorities, the winners of 2019 local elections in all major cities, have been subjected to a strong political and administrative pressure from the government, suffering from unfair treatment in terms of allocation of resources,” added Sevinc.

In that regard, the EIB’s lending restrictions are likely to affect important infrastructure projects planned in Turkish cities such as Istanbul, Ankara, Izmir and Antalya, which are now governed by opposition mayors. Work in the popular tourist destinations cannot be carried out using municipal resources alone.

According to Sevinc, the EU and the West should develop a constructive agenda and create new mechanisms focused on the promotion of democracy and infrastructure development in support of local authorities.

“Despite the current government’s policies, Turkey still has a pluralistic society and the EU has a role to play. Let’s not forget, only a constructive Europe can play this historical role,” she said.

Turkey has been holding discussions with Brussels about joining the EU since 2005, but prospects faded after talks were de facto suspended following the failed coup attempt in Turkey in 2016.

Amanda Paul, senior policy analyst at the European Policy Centre (EPC), said: “Unless there is a change of policy from the EU, the EIB seems set to maintain this approach. A change in stance from the EU would require a change of approach from Turkey vis-a-vis its drilling activities in the Eastern Mediterranean. There is no sign of that happening for the time being.”

COST-EFFECTIVE GAS SUPPLY

„Bohle stands for highest quality and passion for glass technology, just like us. That’s why we trust their cutting technology.”

HYDROGEN NITROGEN OXYGEN H2 O2 N2

ON-SITE GAS GENERATION SYSTEM FOR A MORE COST-EFFECTIVE AND RELIABLE SUPPLY

At HyGear, we differentiate ourselves with our cutting-edge technology of on-site gas generation and recovery of industrial gases. In order to guarantee the reliability of supply, we offer back-up with our own fleet of trailers and through our global partners.

Our approach is unique because of our strong technology backbone and the way we partner with you as our customer.

OUR PROMISE

COST SAVINGS RELIABLE SUPPLY

CO 2 REDUCTION NO SURPRISES

Contact us today to find out how. Europe: +31 88 9494 308 | sales@hygear.com Asia: +65 6909 3064 | asia@hygear.com www.hygear.com

INCREASED SAFETY

GLOBAL SUPPORT

Silberschnitt ® cutting wheels are available in a wide variety of different dimensions, cutting angles and grinds. The cutting wheels are available in tungsten carbide and also in PCD. The Silberschnitt ® cutting wheels from Bohle are accurately manufactured with high precision machinery and deliver excellent cutting results and long service life.

www.bohle.com