10 minute read

Global View

Pioneer Float Glass Manufacturing, Inc., formerly Asahi Flat Glass Philippines, is experiencing steep declines in sales of as much as 50 percent on unabated influx of imported cheap, undervalued and substandard glass products.

Paul Go, president of the lone integrated glass manufacturing in the Philippines told reporters that its sales continued to drop by 40- 50 percent year to date.

Go noted that illegally shipped glass products have worsened following the issuance of two injunctions from Makati and Pasay regional trial courts on Department Administrative Order 1905 of the Department of Trade and Industry (DTI), which imposes mandatory inspection and strict monitoring of all glass products.

With the indefinite court injunctions, the DTI submitted an opposition to the courts but which was denied.

These debacles have tied the hands of the DTI to stop the entry of substandard glass and even monitor the sale of this construction material.

The only protection left for the local glass manufacturer is the provisional safeguard measure that DTI imposed in May this year to stem the surge of imported glass as it has caused serious damage to the domestic glass manufacturing industry. The DTI slapped a provisional safeguard duty of ₱2,500 per ton on imported clear glass and ₱2,800 per ton on tinted imported glass.

But Go explained that the provisional safeguard measure is for a limited time only of 200 days only. Even if the Tariff Commission will concur with the DTI decision and decides to implement a permanent safeguard duty, it still has a time limit.

But what really hurts the industry more is the absence of regulations on standards as the DAO 1905 had been struck with court injunctions.

Without the standards regulation, Go said imported glass have been flowing in and undervalued by as much as 30 percent.

The objective of DAO 1905 is to level the playing field by requiring all glass players to comply with the technical safety and quality standards because glass can be life-threatening if it does not meet the correct standards.

In addition, Go stressed the need to level the playing field because Pioneer is also exporting to other countries, which also imposed their own standards.

“We comply with their standards and yet imported substandard glass can easily enter the country,” he said noting that the oversupply in glass production China enters the local market without any regard of the domestic standards.

Pioneer exports 30 percent out of its 550 metric tons daily production mostly to Asean countries.

Global View Cube unboxes an expanded future

UNITED KINGDOM

Glass and aluminium specialist Cube Glass is set to near double the size of its footprint with the acquisition of its existing Cumbernauld premises and a planning application for a substantial extension.

Cube Glass, which will purchase its 4,200 sq ft factory unit at Tannoch Place from landlord Ashtenne, has submitted plans to build a 3,800 sq ft factory extension.

The acquisition also includes enough land to build another 1,700 sq ft unit for further expansion if and when required.

Gary Thorn, Cube Glass founder and managing director, said the expansion will enable the firm to cope with bigger jobs.

He said: “A positive response from North Lanarkshire Council to our planning application will result in our building a much-needed extension which will permit us to get closer to fulfilling our company’s potential.

“The additional space should deliver a 20% rise in turnover since we will be able to bid for larger aluminium curtain walling jobs with higher contract values. We will also be buying a couple of large CNC machines to carry-out this anticipated additional work.

“In addition, with this increased capacity we will be able to meet customer demand for these bigger jobs which, in turn, secures the jobs of our existing workforce. A further spinoff will be the creation of up to four new jobs, including a

Brexit: an opportunity for Pfaudler?

UNITED KINGDOM

Brexit has brought an unexpected bonus to the owners of the Fife arm of Pfaudler.

The firm supplies a range of products and services to the chemical and pharmaceutical industries.

The Leven facility, which has a staff of 86, provides a range of services including glass lined vessels and the refurbishment of glass lined vessels for the UK market.

Turnover at the firm fell by 1% from £16.5 million in 2018, to £16.4m for the year ending August 31 2019. However, pre-tax profits fell by 44% from £845,221, to £476,564.

The firm employs 133 staff across its UK facilities in Leven and Bolton.

In the annual report, financial controller Kathryn McCann attributed the revenues fall in turnover to Brexit uncertainty.

She said: “Several customers have been holding off making capital investment decisions.

“They have instead been spending on securing their supplies of materials in case of a no deal scenario.”

However, Ms McCann added that because of the extended duration of Brexit, customers are now having to make investment decisions, with several large orders already secured or set be secured in 2020.

A Brexit upside for the firm is that customers are insisting on UK manufacture of new vessels because of concern about changes to tariff rules and quality stamps.

With a projected increase in volume for the UK market, the firm is looking to increase staff numbers and has already taken on more staff and apprentices.

The accounts signal a positive couple of apprentices. We hope, again subject to planning consent, to be in a position to move into the new extension by the end of 2020.”

Cube Glass has already established a presence in sectors such as education health, industrial, social care, commercial property and residential homes. Recent six-figure contracts have placed the manufacturer and installer on track for another record year of sales and profits.

reversal of fortunes for the firm, which went through a round of redundancies in 2016 amid concerns that large sections of its work could be transferred to Germany.

The firm’s focus is on growing higher margin markets including reglassing.

The UK proved to be the firm’s biggest market, accounting for £10.1m of turnover, while Asia brought £1m.

Europe, the Middle East and Africa attracted £3.4m of turnover and north and south America delivered £1.7m.

WHEN QUALITY MATTERS

Global View AGC and Citrine to combine on AI glass

EUROPE

AGC Glass Europe, a European leader in flat glass, and Citrine Informatics are collaborating to use artificial intelligence (AI) to accelerate the development of next-generation glass. Citrine Informatics is a technology platform that harnesses the power of AI to bring new materials to market faster, and capture materials-enabled product value. There is currently high global demand for optimizing optical and mechanical properties for strong scratch and abrasionresistant glass in the automotive and communication industries. The purpose of the collaboration is to look for innovative solutions to meet this ever-higher glass performance demand faster than ever before.

AGC is providing experimental data to build proprietary AI models using the Citrine platform and is iteratively testing the newly suggested materials. The models are improved by Citrine through this sequential learning process, which targets the identification of the best process conditions to reach high-performance glass materials.

"The future of materials development depends on speed. Developing these high performance materials faster will require managing and using data more effectively, which includes consolidating data into a single consistent searchable format, as well as structuring, storing, and using materials data to harness the power of AI," said Marc Van Den Neste, CTO of the Building & Industrial Glass Company from AGC. "Artificial Intelligence is expected to dramatically change how the scientists design experiments or value data, leading to breakthrough results." "AI-driven materials development is the future of the materials industry and we are honored to be working with AGC," said Greg Mulholland, CEO of Citrine Informatics. "The companies who are first to invest in this technology such as AGC, will reap tremendous market rewards."

Based in Louvain-la-Neuve (Belgium), AGC Glass Europe produces, processes and markets flat glass for the construction industry (external glazing and interior decoration), car manufacture and solar power applications. It is the European branch of AGC, the world’s leading producer of flat glass. It has over 100 sites throughout Europe, from Spain to Russia, and employs around 16,500 employees. Citrine Informatics technology accelerates the materials development cycle by combining materials data domain-specific AI. The Citrine Platform is designed to be the operating system of the materials and chemicals industry. Citrine is headquartered in Redwood City, CA.

New owners at Allied to drive a new era

UNITED KINGDOM

A Yorkshire manufacturing firm which can trace its roots back to the heyday of the industrial revolution has received backing from a global private investment advisory firm.

An affiliate of Sun European Partners has completed the acquisition of Allied Glass for an undisclosed sum.

Headquartered in Leeds, Allied is one of the largest UKbased manufacturers of glass packaging containers for the premium spirits and food and drinks markets.

In a statement Sun European Partners said: “With two manufacturing facilities and a dedicated decoration centre in Yorkshire, Allied is focussed on the short and medium production run segment of the market which values flexibility, a collaborative approach to innovation and extremely high technical standards.

“The company continues to benefit from market trends towards premiumisation and sustainability.

“Over the last three years, the business has doubled its customer base which includes craft manufacturers and the largest blue-chip organisations in the industry and delivered sales growth of 13 per cent pa (per annum).”

Chris Carney, Principal at Sun European Partners, said: Allied to the next level.

“Our business is well positioned within a growing market and Sun’s deep manufacturing expertise will be invaluable

“Allied Glass is a market leader in its field with impressive technical capability and a flexible customer-focused approach that sets it apart in serving the highgrowth premium segment of the spirits and drink market.

“The impressive management team have been instrumental to the success of the business to date, and we look forward to working together with Alan and his team, whilst further investing in the business to support their continued development.”

Alan Henderson, CEO of Allied Glass, added: “We are excited to be working with Sun European Partners as we look to take as we look to deliver on our potential.”

The statement added: “ Sun European Partners has extensive experience in the manufacturing and packaging sector.

“In addition to having affiliates that owned Albéa and Coveris, two global leaders in the packaging industry, affiliates of Sun European Partners have completed more than 50 acquisitions in this sector.

DLA Piper acted as legal advisers and advice was also supplied by EY, Roland Berge and ERM.

Sun European Partners is a private investment advisory firm, which focuses on identifying companies’ untapped potential. Since 1995, affiliates of Sun European Partners have invested in more than 375 companies worldwide across a range of industries and transaction structures with turnover of around €40 billion. Sun European Partners has offices in London and affiliates with offices in Boca Raton, Los Angeles and New York.

Allied Glass can trace its roots back to the latter half of the 1 9th century.

Its operations today are an amalgamation of Lax and Shaw, founded by Thomas Lax and John Shaw in Hunslet, Leeds, in 1891, and the Hope Glass Works of Knottingley, originally home to Gregg and Company, which dates back to 1874.

Growing numbers of Yorkshire firms are attracting interest from global investors who are looking to strengthen their portfolio.

ASIA... is one click away

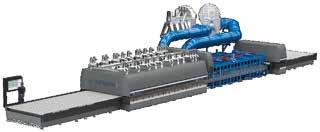

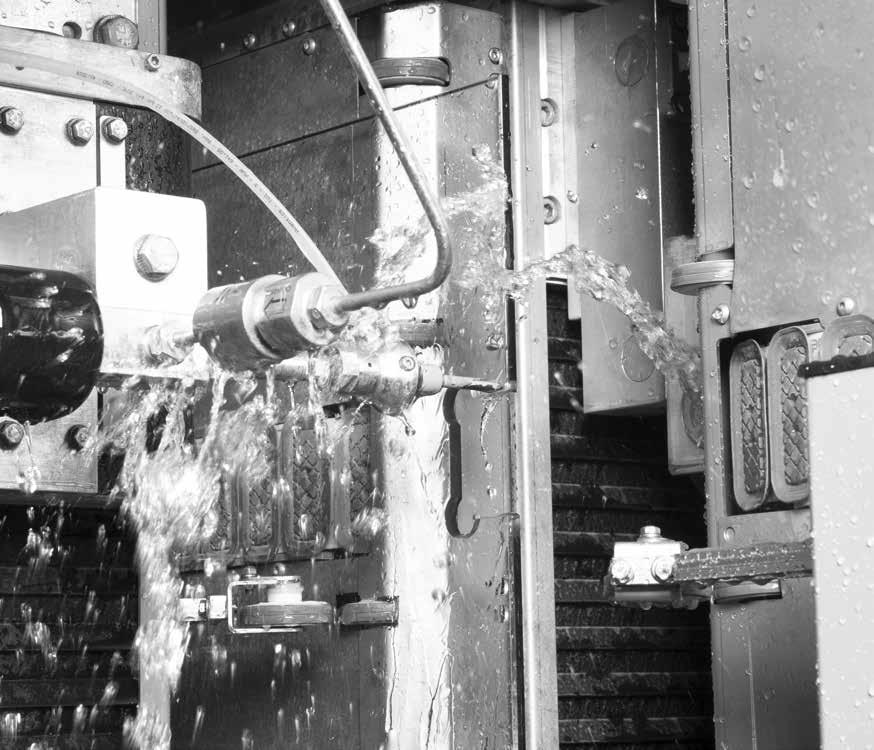

SplitFin Unique solution for processing with water jet technology

The SplitFin is an integrated and continuous solution for fast, eff ective and uncomplicated processing of glass sheets. The line is aimed especially at the complete processing of sheets. A signifi cantly higher output is achieved in comparison with individual machines as a result of the distribution of the processing steps (edge polishing and grinding / drilling and milling with water jet / washing & drying) and the associated permanent use of the individual devices. The SplitFin sets new standards, not only through extremely fast cycle times, unparalleled in the industry, but also with regard to ease of maintenance as all of the most important mechanical assemblies are easily accessible and in the dry area as far as possible. Confi gure online now www.lisec.com/confi gurator

Use our confi gurator for possible machine and line confi gurations: www.lisec.com /confi gurator