Pioneer sees flat glass sales slump Philippines Pioneer Float Glass Manufacturing, Inc., formerly Asahi Flat Glass Philippines, is experiencing steep declines in sales of as much as 50 percent on unabated influx of imported cheap, undervalued and substandard glass products. Paul Go, president of the lone integrated glass manufacturing in the Philippines told reporters that its sales continued to drop by 4050 percent year to date. Go noted that illegally shipped glass products have worsened following the issuance of two injunctions from Makati and Pasay regional trial courts on Department Administrative Order 1905 of the Department of Trade and Industry (DTI), which imposes mandatory

inspection and strict monitoring of all glass products. With the indefinite court injunctions, the DTI submitted an opposition to the courts but which was denied. These debacles have tied the hands of the DTI to stop the entry of substandard glass and even monitor the sale of this construction material. The only protection left for the local glass manufacturer is the provisional safeguard measure that DTI imposed in May this year to stem the surge of imported glass as it has caused serious damage to the domestic glass manufacturing industry. The DTI slapped a provisional safeguard duty of ₱2,500 per ton on

imported clear glass and ₱2,800 per ton on tinted imported glass. But Go explained that the provisional safeguard measure is for a limited time only of 200 days only. Even if the Tariff Commission will concur with the DTI decision and decides to implement a permanent safeguard duty, it still has a time limit. But what really hurts the industry more is the absence of regulations on standards as the DAO 1905 had been struck with court injunctions. Without the standards regulation, Go said imported glass have been flowing in and undervalued by as much as 30 percent. The objective of DAO 1905 is to level the playing field by requiring

all glass players to comply with the technical safety and quality standards because glass can be life-threatening if it does not meet the correct standards. In addition, Go stressed the need to level the playing field because Pioneer is also exporting to other countries, which also imposed their own standards. “We comply with their standards and yet imported substandard glass can easily enter the country,” he said noting that the oversupply in glass production China enters the local market without any regard of the domestic standards. Pioneer exports 30 percent out of its 550 metric tons daily production mostly to Asean countries.

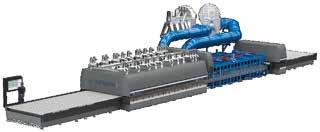

Global View Cube unboxes an expanded future UNITED KINGDOM Glass and aluminium specialist Cube Glass is set to near double the size of its footprint with the acquisition of its existing Cumbernauld premises and a planning application for a substantial extension. Cube Glass, which will purchase its 4,200 sq ft factory unit at Tannoch Place from landlord Ashtenne, has submitted plans to build a 3,800 sq ft factory extension. The acquisition also includes enough land to build another 1,700

sq ft unit for further expansion if and when required. Gary Thorn, Cube Glass founder and managing director, said the expansion will enable the firm to cope with bigger jobs. He said: “A positive response from North Lanarkshire Council to our planning application will result in our building a much-needed extension which will permit us to get closer to fulfilling our company’s potential. “The additional space should

deliver a 20% rise in turnover since we will be able to bid for larger aluminium curtain walling jobs with higher contract values. We will also be buying a couple of large CNC machines to carry-out this anticipated additional work. “In addition, with this increased capacity we will be able to meet customer demand for these bigger jobs which, in turn, secures the jobs of our existing workforce. A further spinoff will be the creation of up to four new jobs, including a

couple of apprentices. We hope, again subject to planning consent, to be in a position to move into the new extension by the end of 2020.” Cube Glass has already established a presence in sectors such as education health, industrial, social care, commercial property and residential homes. Recent six-figure contracts have placed the manufacturer and installer on track for another record year of sales and profits.

Brexit: an opportunity for Pfaudler? UNITED KINGDOM Brexit has brought an unexpected bonus to the owners of the Fife arm of Pfaudler. The firm supplies a range of products and services to the chemical and pharmaceutical industries. The Leven facility, which has a staff of 86, provides a range of services including glass lined vessels and the refurbishment of glass lined vessels for the UK market. Turnover at the firm fell by 1% from £16.5 million in 2018, to £16.4m for the year ending August 31 2019.

16

asianglass AG 20-1

However, pre-tax profits fell by 44% from £845,221, to £476,564. The firm employs 133 staff across its UK facilities in Leven and Bolton. In the annual report, financial controller Kathryn McCann attributed the revenues fall in turnover to Brexit uncertainty. She said: “Several customers have been holding off making capital investment decisions. “They have instead been spending on securing their supplies of materials in case of a no deal scenario.” However, Ms McCann added

that because of the extended duration of Brexit, customers are now having to make investment decisions, with several large orders already secured or set be secured in 2020. A Brexit upside for the firm is that customers are insisting on UK manufacture of new vessels because of concern about changes to tariff rules and quality stamps. With a projected increase in volume for the UK market, the firm is looking to increase staff numbers and has already taken on more staff and apprentices. The accounts signal a positive

reversal of fortunes for the firm, which went through a round of redundancies in 2016 amid concerns that large sections of its work could be transferred to Germany. The firm’s focus is on growing higher margin markets including reglassing. The UK proved to be the firm’s biggest market, accounting for £10.1m of turnover, while Asia brought £1m. Europe, the Middle East and Africa attracted £3.4m of turnover and north and south America delivered £1.7m.

www.asianglass.com