Banco Insdustrial’s complete diagram of digital solutions, which go beyond digital banking, allow the access to services and products while contributing to the clients’ development all throughout the region

Prouced by Jassen Pintado

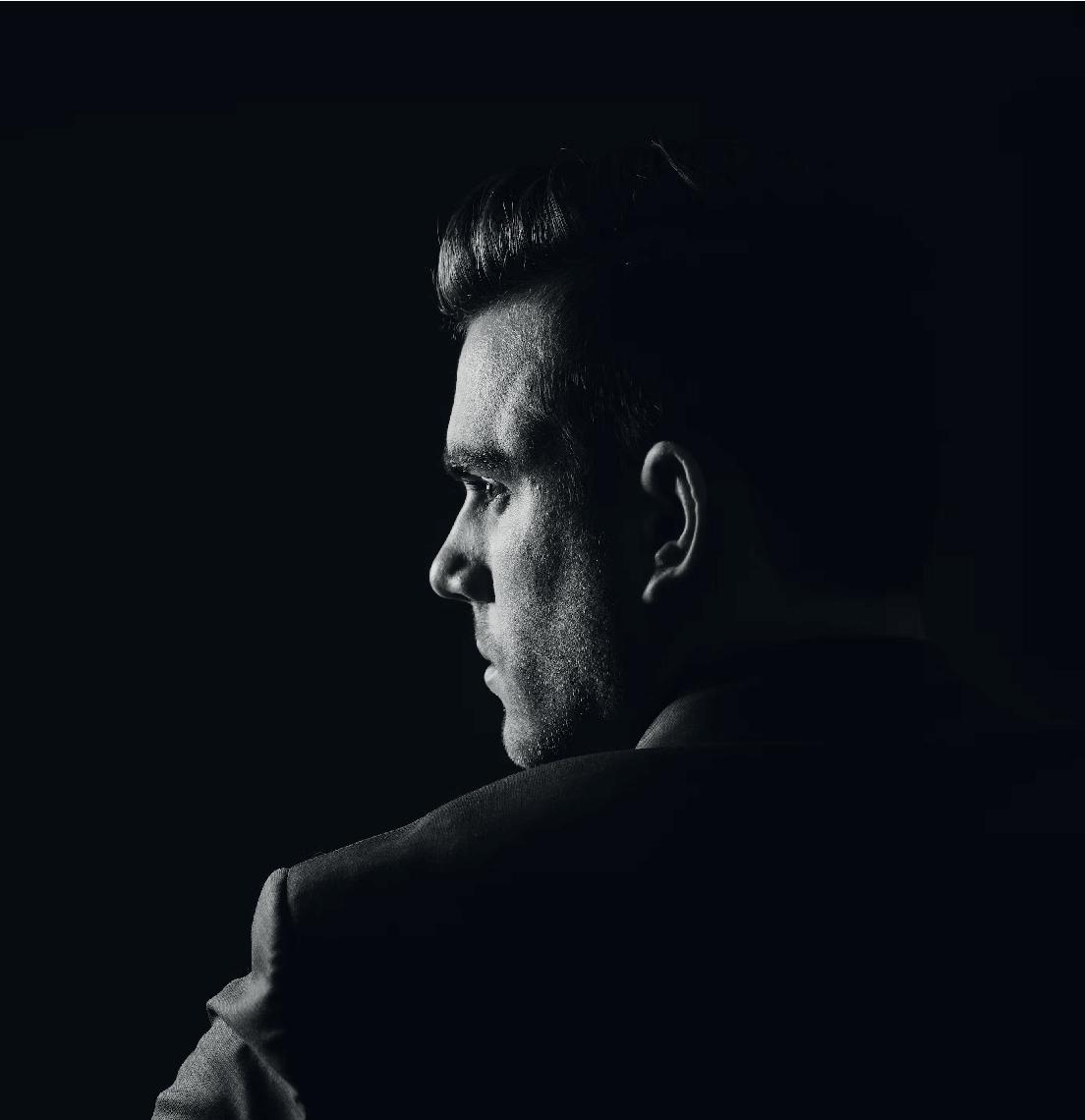

Interviewee

Javier Ramírez Penagos, Head of Digital Transformation at Banco Industrial

For more than 50 years Banco Industrial has helped to support, drive and promote Central America’s economical development. This banking institution was conceived in 1968 within the Guatemalan Chamber of Industry, offering universal banking services to business and corporate sectors, MSMEs and individuals since then.

Banco Industrial belongs to the BI Capital Corporation holding, which contributes to the region’s growth by being present in Honduras with

Banco del País and Seguros del País (insurance company), in El Salvador with Banco Industrial, and in Panama with BI Bank.

In Guatemala, banco Industrial has been named “Best Bank in Guatemala” for more than ten consecutive years

by the most internationally prestigious financial magazines, recognizing its strength, leadership, positive impact on the region, innovative culture and its outstanding service.

“Our financial services are complemented with integrated

ecosystems which allow the generation of solutions to drive the growth and development of customers as well as of the communities where the brand offers its services”, commented Javier Ramírez Penagos, Head of Digital Transformation at Banco Industrial.

Ramírez Penagos earned a bachelor’s

degree in Systems Engineering from the Universidad Rafael Landívar and an MBA from INCAE (Central American Business Administration Institute), besides other certificates.

His career at Corporación BI started 12 years ago, during which he has performed at different positions in different areas. During his tenure, he has overseen the corporation’s strategy of transformation and digitalization since 2017. While

- JJavier Ramírez Penagos, Head of Digital Transformation at Banco Industrial

Our financial services are complemented with integrated ecosystems which allow the generation of solutions to drive the growth and development of customers as well as of the communities

leading the implementation of digital strategies, Ramírez Penagos and his team have obtained different accolades thanks to the functionalities that have led Banco Industrial’s electronic banking.

“I lead the Open Banking and Innovation strategy, forming new partnerships as well as discovering and deploying disruptive technologies adapted to the banking industry”, the executive added.

Banco Industrial’s reach provides its customers with first level and world class attention through three main divisions:

• Strong, integral and international Corporate Banking.

• Business Banking, with the capacity of driving and contributing to the development of the country’s economy for companies at different stages of their evolution.

• Individual Banking, providing services to a wide customers and users portfolio with financial and tech solutions, and which has been recognized due to its customer service’s high standards.

Banco Industrial offers financial products and services through a network with more than 3,180 locations throughout Guatemala, and access to the most complete electronic banking both via the bank’s website and mobile devices from all over the world. From these, customers can make payments to more than 2,400 service providers, bank transfers to their own accounts or accounts from other banks, as well as international transfers and a regional connection.

The goal of Banco Industrial’s Digital Transformation division is to make

Electronic Banking available to all its customers -individual business and corporative banking clientsboth through its website as well as via its app, so they can make all the money transactions and other bank movements without attending the bank’s locations.

Banco Industrial offers totally digital products (for savings and monetary accounts) to all its customers, and with these digital products it simplifies the acquisition of a new product or service, thus allowing its clientele to carry out these transactions when and where it’s more convenient for them.

“We want to become that hub where our app is the most used in the country, by providing our clients with value-added services and giving them the possibility of managing issues beyond financial services online through BI en Línea”, pointed out Carlos Vides, Modern Banking

Assistant Manager at Banco Industrial.

The institution considers Digital Transformation as a continuous and permanent process, whose achievements are constantly measured and goals evaluated after factors such as the growing number of users, functionalities and other parameters that ease the decision-making process at which efforts can be aimed.

For that reason, new technologies and functions able to generate value and optimize the user’s experience are constantly introduced to digital banking.

On the other hand, Innovation teams have been created, finding themselves steps ahead regarding new technologies and trends in the banking and financial sectors.

“We are working on updating our current resources, but always looking ahead. This allows us not only to update our infrastructure, but also

- JJavier Ramírez Penagos, Head of Digital Transformation at Banco Industrial

We believe in solutions built from diversity and union, so we go ‘Together, always forward’

to be up to date with our clients’ needs and demands”, Ramírez Penagos explained.

If the bank’s Digital Transformation process is understood as a continuous process, this area is subject to investments on technology and innovation to support Digital Banking, which allows the bank to continue offering services focused on fulfilling its clients’ needs and expectations.

As part of its strategy, the bank is considering these products and services to go beyond the bank’s digital channels to be used by third parties such as fintechs and entrepreneurs, among others, so BI’s services would be offered through different platforms, and the same experience offered to new customers.

To successfully develop its Digital Strategy and offer customers a wide array of products and services,

Banco Industrial has its key partners’ support regarding technologies and other areas.

The institution holds a productive relationship with GBM to support almost all the digital strategy stages: from Infrastructure and User’s Experience to new technologies and multiple innovations, thus achieving the implementation of strategical projects such as an Artificial Intelligence chatbot know as ABI, an Open Banking strategy and the implementation of resources on the cloud, among others, besides offering consultancy services on strategical matters.

NIU Solutions, on its behalf, enabled Banco Industrial to be pioneers in inbound marketing, by using tools such as HubSpot, besides contributing to take part in digital sales and implementing new portals to manage products digitally, such as CrediAuto, CrediMoto,

CrediVivienda, among others. Facephi, a company focused on face biometrics -and other servicesis also one of the institution’s most important allies, with contributions to the improvement of the user’s experience on the BI en Línea app, and also with its security by

integrating its technology with GBM’s, thus making Banco Industrial to become, in 2016, the fourth bank in Latin America and the first one in the region to own this technology.

There is also a more than ten-year productive relationship with Tribal WW regarding consultancy and

strategy matters, development and innovation in digital channels from their creation to the marketing stage of this services.

“The work of many people from both Banco Industrial and its suppliers has helped us achieve this great improvement”, Ramírez

Penagos commented.

Banco Industrial has more than 15,000 collaborators who are key when dealing with the constant efforts made to satisfy customers and users

Technology has changed the way in which users relate to brands: from more punctual and occasional moments of relationship, we have moved on to intense, personalized and more participatory contacts.

with efficiency and trustworthiness.

The institution’s personnel is bound to constant learning to increase and update their talent and skills, so they can innovate in every aspect.

“We believe in solutions built from diversity and union, so we go ‘Together, always forward’, as a brand’s promise”, the executive added.

The boost BI provides to all of its customers is the same that leads the institution to drive the development of the community it serves with excellency.

“Guatemala presents multiple challenges and needs, so Banco Industrial invests, in an active and participative way, in initiatives oriented to generate integral and sustainable welfare in our society”, commented María José Paiz, from the Institutional Relationships Department at the Corporation.

The following are included

among the programs in which the bank is involved:

• Education as a driving force for progress. BI constantly invests in educational programs and platforms for children, younglings, and women. Additionally, it has designed a specific financial welfare Platform, which, through different formats, provides individuals and MSMEs with knowledge and training resources.

The Platform was created with the goal of enabling the financial inclusion of people who make decisions after being informed of its benefits.

• Education and sports. Support to different literacy programs, academical, technical, and university scholarships and the implementation of computing and technical labs. It includes daily sports practice for 1,550 children and youngsters as a measure for preventing violence and crime.

• Innovation, entrepreneurship, acceleration and escalation for MSMEs. The bank provides resources at no cost for financial

- María José Paiz, from the Institutional Relationships department at the Corporation

Guatemala presents multiple challenges and needs,

so Banco Industrial invests in initiatives which are oriented to generate integral and sustainable welfare

welfare, acceleration and escalating programs, partnerships with academic institutions for business strengthening, development of skills for the exportation of products and services, seed capital and grants for companies led by women, among others.

Additionally, the bank contributes with health and communal development programs which boost the community’s welfare.