IFrnrunr Sronv

I Nsurnrro ENGrNerneo Wooo

Pnooucrs Mnrr THsR ENrnnNcr

10

MnncrN Burlorns

Use UNoEnTnYMENT To M,qnxrr ENcrNrenro FroonrNc

12

Frnrunr Sronv

Mosr De,qrrns Srcr ro Sprcr,qr Onorns ro SErr New Tvpgs or Tnrnrro Wooo

Pnooucr SporllcHt

Lnrrsr Lrrr Cvcre AssrssurNr FRvons

Tnrnrro Wooo ovrn Co,raposrrrs

Ir.rousrnv Tnrros

Socrnr Mrorn Pnovorus Tnrnrro Wooo

Frnsr PrnsoN

AWPA ExEc RrspoNos ro Frooo or NoN-SrnNonRDrzED Wooo oN Mnnrrr

lNousrnv Tnrnos

Crrrvuens or Hope rN HousrNc Dnrn

6 Tornrlv RlNoor.,r

22 Compn nvr t NrrrLrcENcE

24 osrr oN Snrrs

26 GnrrN Rrmrulrc

Snlrs

53 onrr Boox

54 lorr Frr-r

54 Aovrmsrns lNorx

BnrlruNc lruousrnY Nrws & lruousrnv PHoro Downronos

B urrorNc-PnoDUCTS.coM

(Forrow LrNr ron Pnoros)

Tam-Rail's strength comes from three layers, not metal inserts.

Everywhere you look, there's something to like about the patented triple-layer Tam-Rail' Railing System. No metal inserts in the 6- and 8-foot sections for easier workability. A new formulation for even greater strength. And convenient kit packaging for easier installation. Three strong layers. C O

One beautiful choice. For more information. call or visit us on the web.

f ncno RECENTLv oF A MUSICIAN tumed a simple idea into a $20-million business with a llot of profit. Certainly, he was an unlikely entrepreneur, but in solving a problem he personally had, he redrized there were many other musicians facing the same problem. About the tenth year of running his own business, he woke up one morning and realized it was no longer want he wanted to do. He tried ignoring this feeling as long as he could-after all, he was making millions annually. He was fortunate to sell the company just a few weeks later for a tidy sum (albeit less than he could have) and about eight months later completely walked away. Since then, he has no regrets and simply does not care what the new owners are doing with his "baby."

His story caught my attention because it is something I have seen others wrestle with, as I have a few times in my career. Many reading this column will not have a tremendous amount of sympathy with the above example, but it is an issue that plagues all of us in some way. When is the right time to sell, move to a new job or career, or retire?

Several times in my corporate life,I woke up and said to myself, "Enough!" Coming to those conclusions was always hard. In one case, we had grown our company from bankrupt to extremely profitable. But around year seven I knew it was time to get out. I stayed on until I absolutely could not stand it any more-about three years too late. In another situation, I knew that I would never be happy working for the owner and, despite earning the most I ever had, knew I had to walk away before it consumed me. The upheaval caused by both of those moves was quite dramatic for me and my family, but over time turned out to be among the best decisions I have ever made. In one case, it led me in a circuitous route to this magazine.

Whatever role we are in, the dynamics can change. And sometimes while it is regrettable, when the job or business seems like an albatross around your neck, when you grow bored, when going to work is the last thing you want to do, when you realize you've reached your limitations, or when the whole company or industry changes around you and you have taken it as far as you can go, it is time to walk away with no regrets.

In the first of my situations above, it was one of my top two favorite jobs and one of my greatest business accomplishments. It initially gave me the greatest joy, but time and circumstances changed. Typically, as a company grows, the demands and challenges increase. New pressures arise. You find yourself having to deal with politics or to get rid of employees who in the beginning were friends burning the midnight oil at your side, but who had been outgrown by the new demands. The business culture changes and you must make decisions you would have never imagined five years earlier. You even find yourself separating from the people who helped you in the beginning, as layers of management increase and you begin to focus on the strategic instead of the-day-to-day.

We often accept a job or launch a company to fulfill a personal passion or vision or simply to serve a gap in the market. Often, you achieve all your goals despite yourself, by being in the right place at the right time. And when you get there, you may ask yourself, "What's next?" Many will set a new round of goals or move to a new dream. Others will take stock of themselves, build some space, and fade into the sunset, temporarily or permanently. I know owners who had great vision and yet could not manage, so they and the management team became bogged down with a morass of daily problems. They would not delegate until they finally knew it was time to sell out. I have seen managers who had to suffer a heavy personal toll, including heart attacks, before they finally realized they belonged elsewhere.

Leadership skills and management skills are very different, and most owners and managers generally are not good at both. In whatever role you play, when the passion is gone, the best decision you can make for your company, your customers, and yourself, may be to move on to new pastures. And yet, so many do notl It is hard to walk away from something that earlier was so great.

Whatever the reason, when the light burns out, it is time to move on, hopefully to something even better.

www. bu ld in g-prod ucts. com

A publication of Cutler Publishing 4500 Campus Dr., Ste.480, Newport Beach, CA 92660

Publisher Alan 0akes ajoakes@aol.com

Publisher Emeritus David Cutler

Director of Editorial & Production David Koenig dkoenig@building-products.com

Editor Karen Debats kdebats@building-products.com

Gontributing Editors

Carla Waldemar, James Olsen, Jay Tompt

Advertising Sales Manager Chuck Casey ccasey@building-products.com

Administration Director/Secretary Marie Oakes mfpoakes@aol.com

Circulation Manager Heather Kelly hkelly@building-products.com

How to Advertise

Chuck Casey

Phone (949) 852-1990 Fax 949-852-0231 ccasey@building-products.com

Alan Oakes www.building-products.com

Phone (949) 852-1990 Fax 949-852-0231 ajoakes@aol.com.

CLASSIFIED MARKETPLACE

David Koenig

Phone (949) 852-1990 Fax 949-852-0231 dkoenig@building-products.com

How to Subscribe

SUBSCRIPTI0NS Heather Kelly

Phone (949) 852-1 990 Fax 949-852-0231 hkelly@building-products.com

orsend a check to 4500 Campus Dr., Ste. 480, Newport Beach, CA 92660

U.S.A.: One yeat (12 issues), $24 Two years, $39 Three years, $54

FOREIGN (Per year, paid in advance in US funds): Surface-Canada or Mexico, $49 Other countries, $65 Air rates also availabb.

SINGLE COPIES $4 + s6;Op'nn BACK TSSUES $5 + shipping

BUILDING PRODUCTS DIGEST is published monthly at 4500 Campus Dr., Ste. 480, Newport Beach, Ca. 92660-1872, (949) 852-1990, Fax 949-852-023'1, www.buildingproducts.com, by Cutler Publishing, Inc. (a California Corporation). lt is an independently owned publication for building products retailers and wholesale diskibutors in 37 states East of the Rockies. Copyright@201 1 by Cutler Publishing, Inc. Cover and entire contents are fully protected and must not be reproduced in any manner without written permission. All Rights Reserved. BPD reserves the right to accept or reject any editorial or advertising matter, and assumes no liabilitv for materials fumished to it.

Dispersed (aka micronized) copper azole preservatives are the most common wood preservatives in No*h America; the combination of azoles in the Type C formulation is the most advanced form, requiring the least amount of chemical.

Wolmanized'Outdoofl wood is the preserued wood backed by the respected Good Housekeeping Seal and its two-year consumer promise.

The treated wood process using dispersed copper azole is certified under Scientific Certification System's Environmentally Preferable Product program based on Life Cycle Assessment.

Wolmanized" Outdoof wood has been listed as a Green Approved product by the NAHB Research Center and can contribute points toward a home's National Green Building Certification.

The widely known Wolmanized name has signified effectively preserved wood for many decades. The brand has led the industry on both technological and mad<eting fronts.

For more information, consult your provider of Wolmanized' Outdoot* wood, or visit www.wolmanizedwood.com/bpd Download the white paper, "heated Wood Mo*et Moves to CopperAzole!'

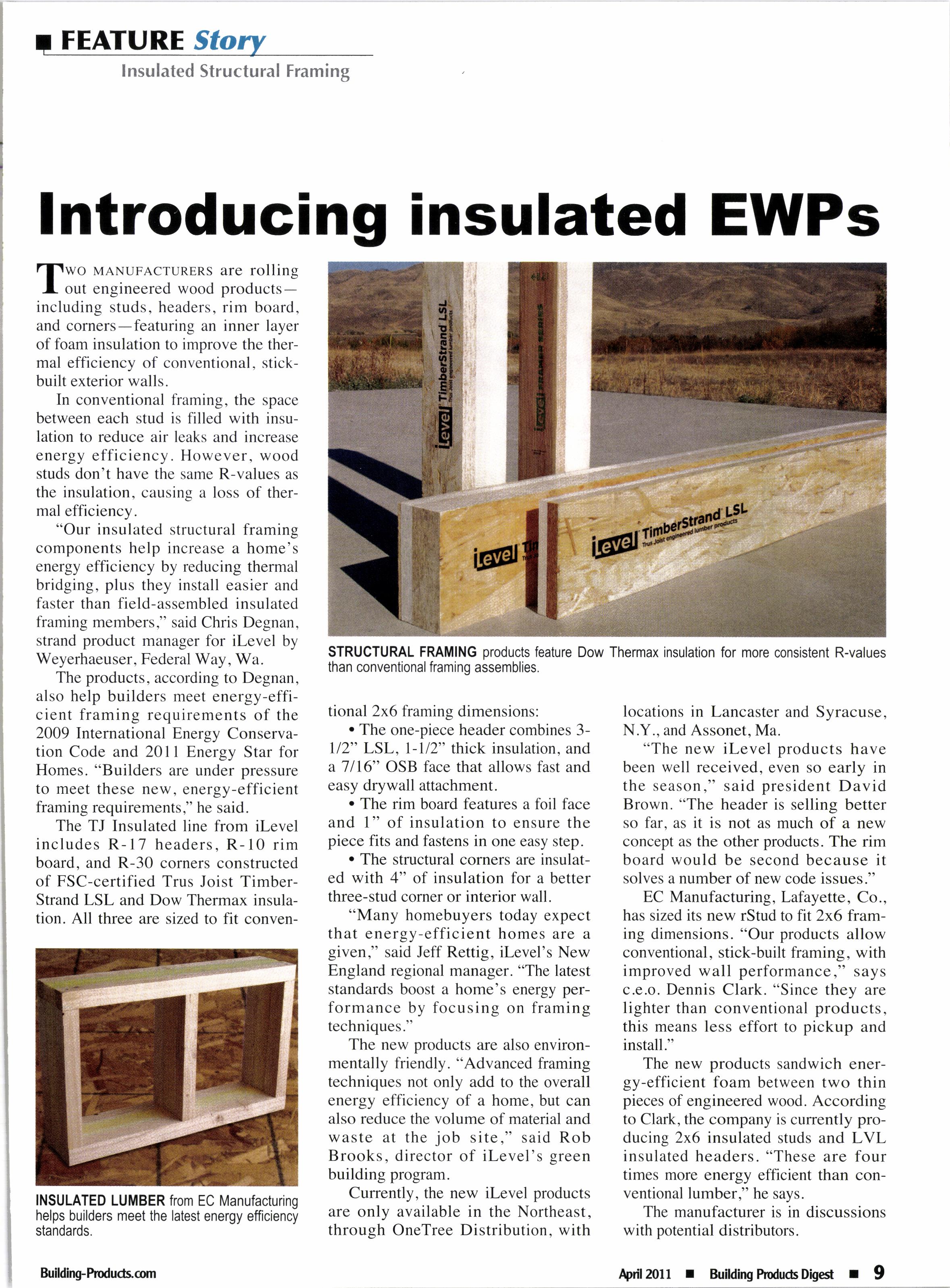

tTt*o MANUFACTURERS are rolling I. out engineered wood productsincluding studs, headers, rim board, and corners-featuring an inner layer of foam insulation to improve the thermal efficiency of conventional, stickbuilt exterior walls.

In conventional framing, the space between each stud is filled with insulation to reduce air leaks and increase energy efficiency. However, wood studs don't have the same R-values as the insulation, causing a loss of thermal efficiency.

"Our insulated structural framing components help increase a home's energy efficiency by reducing thermal bridging, plus they install easier and faster than field-assembled insulated framing members," said Chris Degnan, strand product manager for ilevel by Weyerhaeuser, Federal Way, Wa.

The products, according to Degnan, also help builders meet energy-efficient framing requirements of the 2009 International Energy Conservation Code and 201I Energy Star for Homes. "Builders are under pressure to meet these new, energy-efficient framing requirements," he said.

The TJ Insulated line from ilevel includes R-17 headers, R-10 rim board, and R-30 corners constructed of FSC-certified Trus Joist TimberStrand LSL and Dow Thermax insulation. All three are sized to fit conven-

tional 2x6 framing dimensions:

. The one-piece header combines 3ll2" LSL, l-112" thick insulation, and a7116" OSB face that allows fast and easy drywall attachment.

The rim board features a foil face and 1" of insulation to ensure the piece fits and fastens in one easy step.

. The structural corners are insulated with 4" of insulation for a better three-stud corner or interior wall.

"Many homebuyers today expect that energy-efficient homes are a given," said Jeff Rettig, ilevel's New England regional manager. "The latest standards boost a home's energy performance by focusing on framing techniques."

The new products are also environmentally friendly. "Advanced framing techniques not only add to the overall energy efficiency of a home, but can also reduce the volume of material and waste at the job site," said Rob Brooks, director of ilevel's green building program.

Currently, the new ilevel products are only available in the Northeast, through OneTree Distribution, with

locations in Lancaster and Syracuse, N.Y.. and Assonet. Ma.

"The new ilevel oroducts have been well received, even so early in the season," said president David Brown. "The header is selling better so far, as it is not as much of a new concept as the other products. The rim board would be second because it solves a number of new code issues."

EC Manufacturing, Lafayette, Co., has sized its new rStud to fit 2x6 framing dimensions. "Our products allow conventional, stick-built framing, with improved wall performance," says c.e.o. Dennis Clark. "Since they are lighter than conventional products, this means less effort to pickup and install."

The new products sandwich energy-efficient foam between two thin pieces of engineered wood. According to Clark, the company is currently producing 2x6 insulated studs and LVL insulated headers. "These are four times more energy efficient than conventional lumber," he says.

The manufacturer is in discussions with potential distributors.

fn rooev's coMPETrrrvE environlment. the more vour sales associates know about the products they sell and what differentiates one within a category from another, the better their ability to close value-added sales. This can be especially true when selling products with attributes that are invisible but nevertheless very important.

For example, when selling underlayment for engineered wood and laminate flooring, it is very helpful to point out distinguishing characteristics of the various products you offer. What lies beneath a finished floor can, indeed, make a big difference in the overall performance of the floor.

There's a lot that can be talked about. The specifications and characteristics of an underlayment can affect walking comfort, sound transmission between floors, the perceived warmth or coldness of the floor underfoot, the ability of the underlayment to handle moisture emanating from the subfloor, and the smoothness of the finished surface. In newly sold or rental housing, imperfections in any of these qualities can lead to issues that can result in callback of the contractor or complaints to the owner and, perhaps, even reverberate to the supplier.

A salesperson selling engineered wood and laminate flooring should know about the standards that apply to underlayment and what the product labeling on underlayment packaging stands for. For example, to meet building codes, acoustical underlayment, which is designed to minimize noise transmission, has to be tested in a flooring assembly to make sure the assembly conforms to impact insulation and sound transmission levels.

Acoustical underlayment can quiet impact sound, dampen ambient sound, and inhibit noise from traveling into the room below.

Distributors and retailers selling engineered wood and laminate flooring to owners and contractors of new and renovated rental units and condos should recommend acoustical floor underlayment that meets or exceeds local building department acoustical

standards.

The best way to make sure an underlayment for engineered wood and laminate floors meets applicable standards is to look for documentation that the product has been laboratory tested as part of an assembly, because that is what the code looks for. When evaluating floor underlayment, building departments often rely on tests to define the performance of a

floor/ceiling assembly-how well they insulate against noise created by impact and airborne vibration. Manufacturers that have their products tested usually label the products to indicate the standards to which they conform.

There are two tests performed in a controlled laboratory environment that are recognized by the International Building Code for sound that travels from one living area down to another, including in a multi-family residential complex. One is the test for Impact Insulation Class (IIC) and the other is the test for the Sound Transmission Class (STC).

IIC evaluates the ability to block impact sound by measuring the resistance to transmission of impact noise or structure-borne noise. STC tests the ability of a specific construction assembly (e.g., floor, door or window) to reduce airborne sounds, such as voices, stereo systems, and TV. The higher the number, the higher the resistance.

In addition to minimizing sound transmission, acoustical underlayment with an appropriate compression resistance can help smooth out minor imperfections in the subfloor while properly supporting the floor, enabling the top finish surface to lay flat. It also adds thermal insulation that helps keep the floors warm in cold weather and cool in warm weather. Also, the cushioning effect of quality underlayment lessens the strain of each footfall on knee and hip joints, resulting in more comfortable walking. Some underlayment options that are engineered to wick away sub-floor or incidental perimcter moisture can help protect engineered wood and laminate flooring from subfloor moisture that could otherwise mar the finished floor.

And for customers aiming for environmentally friendly floors (a market that is growing every year), there are acoustical underlayments clearly manufactured to fulfill environmental interests, which are third-party certified for sustainable attributes and are made primarily from post industriallpre-consumer recycled fibers that may otherwise have ended up as land fill.

- Bob Pratt is technical direc'tor oJ MP GlobaL Products, Norfttlk, Ne., manujhcturer of sustainabLe underlayments, including QuietWalk, a sound-attenuating underlayment for laminate and floating-wood flooring. Reach him at (888) 379-9695 or via www.quietwalk.com.

Two Coat Exterior Prime

0ur two-coat process starts with an atkyd sea[er to btock tannin migration, fottowed by a high-performance acrytic primer The resu[t: RESERVE quatity, inside and out.

Made of quaLity, ctear, finger-jointed Western Red Cedar or Redwood, these products are naturalty designed for exterior use-both species are ideal for enduring extreme weather.

RESERVE oroducts come in a wide range of sizes, lengths and finishes. Whether the project ca[[s for SlS2E or S4S, we offer lengths ranging from 16'to 20'. Pattern stock is also availabte

1x4 - txL2

s/ax45/ax12

2x4 - 2x12

Our Siskiyou Forest Products RESERVE line is specially manufactured and treated to create the highest quality product available. Using state-of-the-art application and curing equipment, our premium Western Red Cedar and Redwood stock is made to last for many generations. We are proud to offer a beautiful, durable product that is ready for installation and final painting the moment it reaches the craftsmen.

hesplrB THE MULTrruns of treated .l-fwood products now on the market, the typical lumberyard stocks a single brand of copper-based treated, occasionally with a small backup of borates. Where are all the other options -the carbon-based, chemicalfree, thermally modified, mold-protected, fire retardant, and salt-water compatible?

Obstacle One: The primary reason why dealers aren't stocking more types of treoted wood is that, with justin-time delivery from their neighborhood wholesalers and treaters, they don't have to.

Whatever dealers need is usually a phone call away. And a short delay typically isn't a problem, since so many specialty treatments, like fire retardants or ACZA, are for commercial or industrial applications for larger projects that are planned well in advance.

Jaeger Lumber, Union, N.J., stocks only micronized copper azole. "Stocking lumber takes a lot of space and a duplicate inventory would be cost prohibitive for most lumberyards," said Bryan Jaeger. Other products aren't special ordered, unless specified by the customer or required by building codes, "due to the special order restrictions of returns. We can and would for a sizable enough job, but for a remodeler or a consumer it is simply not practical."

Obstacle Two: Insfficient demand for alternatives, because current copper-based treatments are seen as " good enough."

"We have not witnessed the customer specifying any particular kind

of treatment," said Harold Baalmann, president of B&B Lumber Co., Wichita, Ks. "They are most concerned about knot structure and wane, or how it looks. For that reason we carry a lot of #l SKUs, especially in lengths that will be visible."

John Daingerfield, buyer at Jaeger Lumber, added, "We do occasionally get inquiries for some of the other alternatives, but when you find out what the client is trying to accomplish, typically they can accomplish their goals with what we stock (MCA).

"There are many, and in my opinion too many, other options for treated wood for exterior uses. Small incremental differences in features and benefits for increased cost are not a benefit. In our area, treated wood is used

for sill plate and exterior uses. Boratetreated lumber can't get wet or the chemical will leach out of the wood, so it is not on option here. Formosan termites haven't made it this far north, so that isn't an issue here. No one in our market frames with treated wood. Fire retardant treated wood is an entirely different category for different uses. We source that locally through distribution."

Obstucle Three : Alternatives, often sold in smaller quantities, usually carry higher price tags.

Lapointe Lumber's two yards in central Maine stock only MCA. "We will on occasion order in some lumber treated to heavier rates than normal for jobs that call for that, such as docks,

piers or pilings," said v.p. Dick Tarr. "We have also ordered in fire treated lumber and plywood when asked for in commercial projects."

A few years ago, Lapointe also considered other treated alternatives, including TimberSil, but the products "never got off the ground in this area."

Lapointe has samples of thermally modified wood on its sales counters, hoping to kickstart sales. The samples, Tarr said, "have piqued the interest of a few customers, however pricing could be too high for some projects that they were considering."

Indeed, low cost is one of the reasons many customers choose wood in the first place. "I wouldn't say we 'upsell' any treated," said Chad Korte, president of Home Lumber, New Haven, Ct. "We sell customers on the value of treated lumber due to its lower cost compared to much more expensive alternatives that don't necessarily perform that much better."

Home Lumber inventories mainly MCA for exterior applications and borates for plate material. "We have special ordered thermally treated lumber for one customer, and fire treated material in several other cases," Korte said.

If someone's looking for a better product at Fullerton-The Builder's Choice, Watertown, Mn., instead of substituting treatments, "we upsell them on just the grade of lumber," said manager Paul Silver. "For example, we stock all #l southern yellow pine versus #2 ponderosa pine."

Nonetheless, there are dealers out

there who believe in having multiple treatments on hand and in taking a chance on new products.

Brands Inc., Columbus, In., stocks mostly MCA, but also some MCQ (514x6, KDAT radius edge decking), borates (2x4 and 2x6 for interior plate stock), fire retardant treated (dimension and plywood), and CCX (treated plywood)-enough for president Jesse Brand to admit, "We probably overdo it here at Brands."

Wider inventories are also more common in environmetnally sensitive areas, such as California. Golden State Lumber, Napa, Ca., has wholesaler United Pacific Forest Products, Tigard, Or., oversee the treated program for its four yards. They stock ACQ, tinted ACQ, borates, and interior fire retardant treated.

According to UPFP's David Billingsley, "This inventory ranges from 2x4 8' through 8x8 24' , as well as plywood from 3/8" to 3/4", including some 9' and l0' panels. Although every (Golden State) yard does not stock every item, we have the ability to transfer material between locations."

Other treatments readily available to Golden State, though not in their yards' current on-the-ground inventory include anti-mold (Quantum and BluWood), ACZA, ACZA with Polyurea coatings, and exterior fire retardant. They will also offer MicroPro micronized copper azole as soon as it is available, which Billingsley expects by the end of the month.

f, nacaNr LIFE-cycLE ASSESSMENT of ACQ-treated wood la.completed by third-party engineering firm AquAeTer revealed results not surprising to the wood industry: across the board, pressure treated wood is friendlier to the environment that wood-plastic composite decking. A complete peer review article was published in the January 3,2011, online edition of the Journal of Cleaner Production.

The goal of the LCA was to investigate the cradle-tograve environmental impacts related to ACQ-treated lumber decking and, using the LCA model, quantify these impacts. Relying on an inventory of environmental inputs and outputs attributable to treated lumber decking, AquAeTer completed a comparable inventory of woodplastic composite (WPC) decking. Results were then calculated for both, and comparisons drawn based on impact indicators for each product.

Information sources for both products include published data and surveys, with some information estimated/assumed based on known information.

Four phases defined the LCA: goal and scope definition, inventory analysis, impact assessment, and interpretation. Parameters for pressure treated wood included inventory inputs, outputs and impact indicators based on 1,000 bd. ft. per representative deck (320 sq. ft.). For WPC, the manufacture, use and disposal of the product was evaluated for 1,000 bd. ft. per representative deck (320 sq. ft.).

Products used in the LCA: ACQ-treated southern pine 5/4x6 radius-edge decking, treated for above-ground/ exterior exposure according to AWPA standards and "typi-

Treated wood = Equivalent of driving a car 38 miles per year

GomPosite = Equivalent of driving a car 540 miles per year

According to the EPA, life cycle assessment is a technique used to assess the environmental aspects and potential impacts associated with a product, process or service.

cal" WPC product with nominal dimension of 5/4x6 inch 82 x 152 mm) and actual dimensions of 1.175x5.4 inches (29.84 x 137 mm). (For the purpose of this LCA, the WPC product was modeled as if manufactured from 5O7o recycled wood flour,25Vo post-consumer recycled HDPE, and 25Vo virgin HDPE. As product formulas vary by brand, this mixture was assumed as the U.S. national average.)

For treated wood, four main life-cycle stages were recognized: lumber production (includes replanting a harvested area of forest, growing/maintaining the forest plantation until harvest, harvesting of the trees, drying, milling and associated transportation), lumber treating, treated wood as decking, and treated wood disposal. Life-cycle stages for WPC included production, use and disposal.

Impact indicators tracked and evaluated included:

. Greenhouse gas emissions: the quantification of human-caused emissions with the potential to affect global climate.

. Fossil fuel use: finite resource depletion related to global climate change, national security (dependency on imports), and finances (diminishing resources = increased costs/limited availability).

Water use: total amount of water used throughout each process of the product life.

Acidification: the potential for emissions that result in acid rain deposition on the earth's surface.

. Smog-forming potential: assesses the potential of air emissions to result in smog.

Ecological toxicity: includes ecologically toxic impact indicators that are normalized to a common herbicide of accepted ecological toxicity.

Eutrophication: characterized the potential impairment of water bodies resulting from emissions into the air.

In addition, the total amount of energy input over the

life cycle of both products, while not considered an impact indicator, was still tracked as part of the LCA.

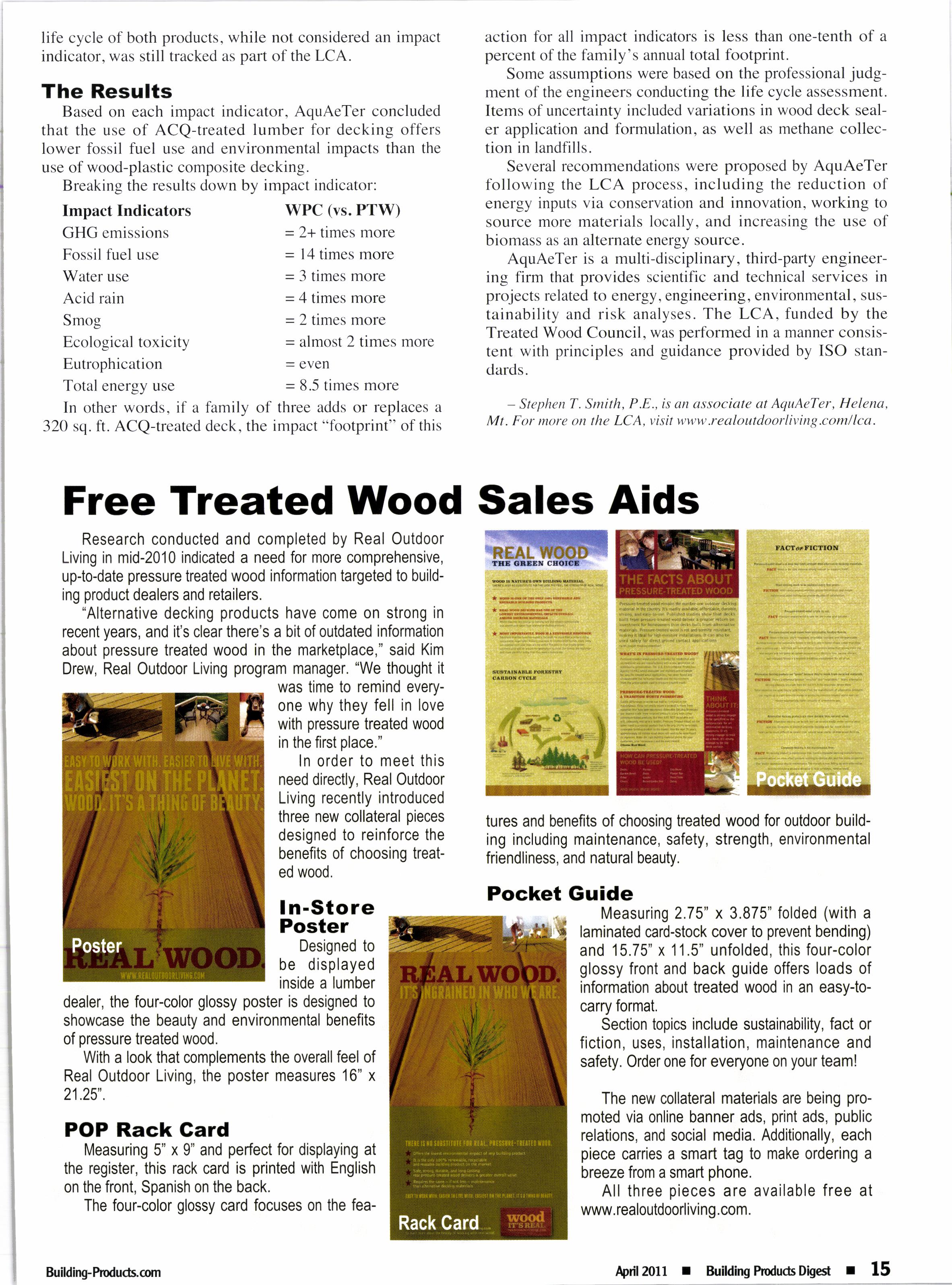

Based on each impact indicator, AquAeTer concluded that the use of ACQ-treated lumber for decking offers lower fossil fuel use and environmental impacts than the use of wood-plastic composite decking. Breaking the results down by impact indicator:

GHG emissions

Fossil fuel use

Water use

Acid rain

Smog

Ecological toxicity

Eutrophication

Total energy use

WPC (vs. PTW)

= 2+ times more

= 14 times more

= 3 times more

= 4 times more

= 2 times more

= almost 2 times more

= 8.5 times more

In other words, if a family of three adds or replaces a 320 sq. ft. ACQ-treated deck, the impact "fbotprint" of this

action fbr all impact indicators is less than one-tenth of a percent of the family's annual total footprint.

Some assumptions were based on the professional judgment of the engineers conducting the life cycle assessment. Items of uncertainty included variations in wood deck sealer application and formulation, as well as methane collection in landfills.

Several recommendations were proposed by AquAeTer following the LCA process, including the reduction of energy inputs via conservation and innovation, working to source more materials locally, and increasing the use of biomass as an alternate energy source.

AquAeTer is a multi-disciplinary, third-party engineering firm that provides scientific and technical services in projects related to energy. engineering. environmental, sustainability and risk analyses. The LCA, funded by the Treated Wood Council, was performed in a manner consistent with principles and guidance provided by ISO standards.

Research conducted and completed by Real Outdoor Living in mid-2010 indicated a need for more comprehensive, up{o-date pressure treated wood information targeted to building product dealers and retailers.

"Alternative decking products have come on strong in recent years, and it's clear there's a bit of outdated information about oressure treated wood in the marketplace," said Kim Drew, Real Outdoor Living program manager. "We thought it was time to remind everyone why they fell in love with pressure heated wood in the first olace."

ln order to meet ihis need directly, Real Outdoor Living recently introduced three new collateral pieces designed to reinforce the benefits of choosing treated wood.

Designed to be displayed inside a lumber dealer, the four-color glossy poster is designed to showcase the beauty and environmental benefits of pressure treated wood.

With a look that complements the overall feel of Real Outdoor Living, the poster measures 16" x zt.zc.

Measuring 5" x 9" and perfect for displaying at the register, this rack card is printed with English on the front, Spanish on the back.

The four-color glossy card focuses on the fea-

tures and benefits of choosing treated wood for outdoor building including maintenance, safety, strength, environmental friendliness, and natural beauty.

Measuring 2.75" x 3.875" folded (with a laminated card-stock cover to prevent bending) and 15.75" x 11.5" unfolded, this four-color glossy front and back guide offers loads of information about treated wood in an easy-tocarry format.

Section topics include sustainability, fact or fiction, uses, installation, maintenance and safety. Order one for everyone on your team!

The new collateral materials are being promoted via online banner ads, print ads, public relations, and social media. Additionally, each piece carries a smart tag to make ordering a breeze from a smart phone.

All three pieces are available free at www. realoutdoorliving.com.

- Stephen T. Srnith, P.E., is an associate eil AquAeTer, Helena, Mt. For more on the LCA,visit vt'tt,v,.realoutdoorlivinR.com/lca.

fN aN AGE wHERE company impact measurement goes lbeyond sales numbers to include Facebook fan page "likes," more and more building product manufacturers and service providers are tuming to social media as an integrated part of their marketing communications plan. While still a novelty to some, the building products community within blogs, Facebook, Twitter, YouTube, and the like is growing by leaps and bounds.

"Social media growth in the building industry makes perfect sense," said Bryan Wright, owner and senior strategist of BeWright & Associates. "This is an audience that rarely sits down at a desk: they're using laptops and smart phones as their primary methods of communication with customers, dealers, co-workers and peers. Social media

gives them a clear path to keeping up with the companies they like in real time."

Wright is also the architect of an increasingly successful social media campaign for the Real Outdoor Living pressure treated wood promotion program managed by the Southeastern Lumber Manufacturers Association. He has more than a decade of communications experience in construction and building products, has become a social media expert, and is a regular blogger on ToolBoxB\zz.com.

"Our goal was to reinvigorate the social media outlets already in place, then build out from there," said Kim Drew, Real Outdoor Living program manager. "Working with Bryan, we've created a dynamic dialog of information across our targeted audience base of consumers, lumber dealers, retailers and deck builders."

Social media successes have been quick to come to the Real Outdoor Living program. The "Wood" Facebook page has seen fans increase exponentially since January 2Oll.ln February alone, the page enjoyed a32l7o increase in regular users over January numbers. Over on Twitter, a short series of tweets reached upwards of 19O00 followers within a minimal late-January time frame. Wright attributes these numbers to two things: regular activity and quality content.

"For a non-branded commodity product, we're thrilled with these numbers," added Drew. "They indicate that we're pulling wood fans back to the nest, reinvigorating them with new information and updated ideas for working with our product."

Wright points out that social media can be a solid directional device for leading customers where you want them to go. "Everything we do with Real Outdoor Living leads back to the website; that's the consummate source for pressure treated wood information. And our recent site visit numbers indicate we're doing just that," he continued.

Blogs, a more advanced online way to share copy, video and/or photos with a particular demographic, are an intrinsic part of the social media platform.

"We've had some outstanding successes with bloggers within the industry," continued Drew. "From ToolBoxBuzz.com to ToolSkool.com to HomeConstructionlmprovement.com and MyFixltUplife.com, these

folks are some of the most plugged-in information sources in the industry."

Beth Knott, author of the ToolSkool.com blog, uses social media as a way to get timely information to "friends" and "followers" about new tools and hot industry topics. "Our audience might not monitor our Web site every day, but they are on social media every day," said Knott. "When they see a Facebook status update or a tweet from us, they know to check out the site for the latest information."

If you have a smart phone, you're probably familiar with smart tags: those tiny little boxes seen in ads or on signage that are scanned with a phone app in order to direct you to a specific website. Relative newcomers to the fast-paced online world, these tags are bridging the gap between customer and product by providing instant-access information needed to complete a potential sale.

The tags can also be used as a portable source of information. "Our jusrpublished membership directory includes a smart tag on the back cover for easy smart phone access to the SLMA website," said Erica Strickland, communications and membership manager for SLMA in Atlanta, Ga. "Our members were asking for a portable way to manage the massive amounts of information contained in our annual directory. Now they can scan the tag with their smart phone and be taken to the most updated version of the directory, right on their handheld screen. It's going to increase the speed and efficiency with which our members do business."

Thinking of sticking your toe into the social media pool? Wright offers a few tips:

. Evaluate. Research everything: where your target audience lives online, what the competition is doing well (and where there's room for improvement), and what information on your product or service is already online.

. Plan. Decide what your properties will look and feel like. Echo your existing communications efforts by giving your Facebook page or twitter account the same voice as your print ads or community relations efforts.

Design. The average online attention span is about seven seconds. How will you grab and keep interest? Videos and photographs equate to longer online visits than text only.

. Reach out. Before ever going live, have a solid plan in place for reaching out proactively to your desired audience. Just because you build it doesn't mean they will come; they'll need to be asked.

. Keep it fresh. A good rule of thumb: update your properties three to four times a week-and never let a user question go unanswered for more than 24 hours. Realize that the entire concept is fluid, and sites may need revisions once a month to stay on top of trends and information.

"Most importantly: your social media program is not a job for the intern," concluded Wright. "Social media is a complex form of word-of-mouth marketing and should be treated with all the respect it deserves."

- To visit Real Outdoor Living in the world of social media, visit:

www.facebook.com: "Wood" fan page

www.tw itter.c om/ w oodaho lic s www.y o utub e.c oml wo odit sr eal

fooev. ovER HALF of the treated |- lumber sold in retail stores does not meet the standards of the American Wood Protection Association. It's critical that buyers and sellers are able to see through misleading labeling and clearly distinguish treated wood that meets the standards from wood that doesn't.

The problem traces back to about l0 years ago, when several wood preservative manufacturers entered into a voluntary agreement with the EPA to restrict the types of wood products that could be treated with CCA, starting January l, 2004. Dimensional lumber treated with CCA could no longer be sold into most commercial and consumer markets, so a number of new preservatives entered the marketplace to fill the void.

Initially, most of the next-generation treated wood products were AWPA standardized-but this quickly changed as competition between chemical manufacturers, wood treaters, and retailers heated up in this challenging economic environment. To increase market share, some manufacturers began offering wood treated to lower Dreservative retention

amounts than those listed in AWPA standards or they used preservatives not standardized by AWPA.

AWPA standards are important to the building products market for many reasons:

. Most, if not all, of North America's experts in wood protection serve on AWPA's technical committees and provide the critical peerreview process needed to distinguish effective preservatives from those that may not perform well.

. AWPA is accredited by the American National Standards Institute as a standards development organization, which means that AWPA's standardization process is open, consensus-based, requires consideration of all viewpoints, and provides due process for all participants.

AWPA standards are the only standards prescribed directly in the major model building codes for uses where treated wood is required.

AWPA also requires that the manufacturing plant is audited by a thirdparty inspection agency in accordance with the Treated Wood Program of the American Lumber Standard Committee, which operates under procedures

established by the U.S. Department of Commerce.

. Furthermore, AWPA has been developing standards for wood preservatives and treated wood since 1904. There are no mandatory fees for obtaining AWPA standardization, just the submission of sound, scientific data supporting the performance of the product under consideration. AWPA and its standards development process may not be perfect, but it does provide the most rigorous review of wood preservative performance data by people whose expertise is in wood deterioration and protection.

Unfortunately, AWPA standardization is so important that a significant amount of effort is employed to make people think non-standardized products are equal to the treated wood products listed in AWPA standards. At a recent treated wood industry conference, a proposal was made to include non-AWPA standardized treated wood in the "CheckMark" program, a voluntary program administered by the Western Wood Preservers Institute that helps individuals readily identify wood treated in accordance with AWPA standards. The presentation featured a graphic of a product evaluation report with an ANSI logo to show that the organization producing the evaluation report was also ANSI accredited. The logo was quite blurry, so it was not possible for the audience to see that the logo was for ANSI product certification-a program that has nothing to do with product performance or standardization.

The presenter discussed AWPA standards, then displayed a slide showing that over 8O7o of building code officials preferred evaluation reports. The study referenced, however, had nothing to do with treated wood, nor was it a comparison of

AWPA standards to evaluation reports. The presentation also indicated that because product evaluation reports are based on the same data as indicated by an AWPA document referred to as "Appendix A," the products have the same criteria as those standardized by AWPA. The presenter neglected to mention, however, that Appendix A expressly limits its use to the AWPA standardization process, and that the critical element of expert peer review is missing outside of AWPA standardization.

Another problem in the marketplace is product labeling. Many manufacturers of products that do not meet AWPA standards tend to use AWPA's Use Category designations on the treated wood end tags. This problem became so prevalent that AWPA approached an organization that develops product evaluation reports to request their assistance in preventing deceptive labeling practices. One of their committees ultimately agreed that if an AWPA Use Category designation was used on the end tag of materials not meeting AWPA Standard U1, the tag must also read "Not listed in AWPA Ul." Over time. however, the AWPA Use Category remained a prominent part of the front side of the label, and some treated wood manufacturers relegated the required language to the back of the label, buried among several lines of fine print. AWPA frequently receives inquiries from people who have been led to believe that this means the product meets AWPA standards, expecting AWPA to provide support for such non-standardized products.

So, how does one determine if treated wood meets AWPA standards?

The easiest way is to look for "AWPA U1" on the end tag. If you don't see it, then the treated wood probably doesn't meet AWPA Standards.

Another helpful tool is the presence of a "CheckMark" next to the logo of an ALSC accredited agency. Wood treated to AWPA Standards must also

identify the producer, preservative, retention (amount of preservative), and the AWPA Use Category.

For more information, visit the References and Technical Information pages of www.awpa.com.

- Colin McCown is executive vice president of the American Wood Protection Association, Birming,ham, Al. Reach him at ( 205 ) 7 3 3 -4077 o r mccown@ a w'pa.com

I. inventorv. vacancies and units in use indicate ihut ttr" inventory correction in the shelter market is gaining momentum and finished the year a bit stronger than had been anticipated.

The following is a summary of the updated demand/supply balance in the U.S. shelter market.

The excess inventory of vacant units for sale or rent has fallen 600.000 units. from 1.8 million units at the end of 2009 to 1.2 million at the end of 2010. Here's how I arrive at this estimate:

. Vacant units for sale or rent fell from 5.0Vo of the housing stock at the end of 2OO9 to 4.67o at the end of 2010.

. Over the late 1990s and early 2000s, vacant units for sale or rent hovered around 3.67o. I assume that this is the "normal" or equilibrium vacancy rate for a market in balance.

The difference between the actual vacancy rate for housing for sale or rent less the average is0.9Vo, which is equal to 1.2 million units given that current housing stock was 130.8 million units.

Once this excess of vacant units for sale or rent is absorbed and the vacancy rate returns to equilibrium, then demand for shelter will have to be met through new shelter production and not existing homes.

Household formations gained momentum in 2010 as reflected by the

gains in the number of housing units in use. At the end of 2010, the number of houses in use (which is equal to households by the Census' definition) was up 1.08 million units from the end of 2009, after increasing at an average annual rate of 370,000 households per year in 2007-2009.

With household formations falling well below the pace that underlying demographics support, we have built up a pool of pent-up demand that I estimate at around 1.24 million families. The rate at which this pool of potential households moves into the shelter market heavily depends on employment. Note, I am not saying anything about whether they are buying or renting or moving into a singlefamily, multifamily, or mobile home. All I am saying is that they move into a "shelter" unit.

Over the next year, demographics will support the formation of another 1.0 million households, which would push the pent-up demand to 2.3 million units if none of this demand has already moved into a shelter. On the supply side, our forecast for housing starts and mobile home production net of normal demolition levels will net an additional 400,000 units to the housing stock through 201I, which, when added to the excess inventory at the end of 2010, puts the number of units that needs to be absorbed in 201 I to clear the overhang at 1.6 million units.

In our forecast, growth in the economy gains momentum in 20 ll and employment improves (the number of people employed, not necessarily the unemployment rate), which will unleash the pent-up demand for shelter and excess inventory will be absorbed by mid-2012 or earlier.

The Census reports that the housing stock increased 700O00 units to 130.8 million units at the end of 2010. Additions to housing stock are equal to new homes completed plus mobile homes delivered. Conventional housing completions in 2010 fell 18% from 2009 to 650,000 units in 2010. And, assuming mobile home production is close to the units put in place, just 510,000 mobile homes were added to the housing stock.

Given the increase in housing inventory, completions, and mobile home production in 2010, the implied loss of shelter units (demolition) in 2010 was just 50,000 units (0.047o of housing stock). From 1999 to 2009, demolitions averaged 0.187o of housing stock. Applying this rate to housing stock at the end of 2009, demolitions would be closer to 200,000 units and housing stock would be lower. This is key because these uncounted demolitions add to the inventory of vacant homes. Keep an eye on this estimate because it increases the share of shelter units in use to levels closer to something near equilibrium.

So the inventory correction in the housing market continues to unfold and it looks like the excess inventory will be absorbed by the end of 2011 or the first half of 2012, depending on how fast the pent-up demand moves into the shelter market. We should start to see spot (sub-regional) tighr ness in the housing market by the end of 201 I ifthese data are correct.

- Bob Berg is principal economist for wood products at RISI. Reach him at

Attach and bolt

Eclipse" Energy Guard applied to WindBrace^ wall panels reduces construction time and material.

WindBrace" wall nanels are a full I t/a in. taller than standard O5B parrels, allowing builders to tie the top plate to the bottom plate in a single sill-to'plate structural panel, eliminating the need to install metal connectors, threaded bolts, blocking and filler strips.

Install and nail panels according to instructions. Seal corners and edges with Eclipse" Energy Cuard tape to replace housewrap. Use adhesive flashing around window and door openings.

866-835-4O45 | royomartin.com

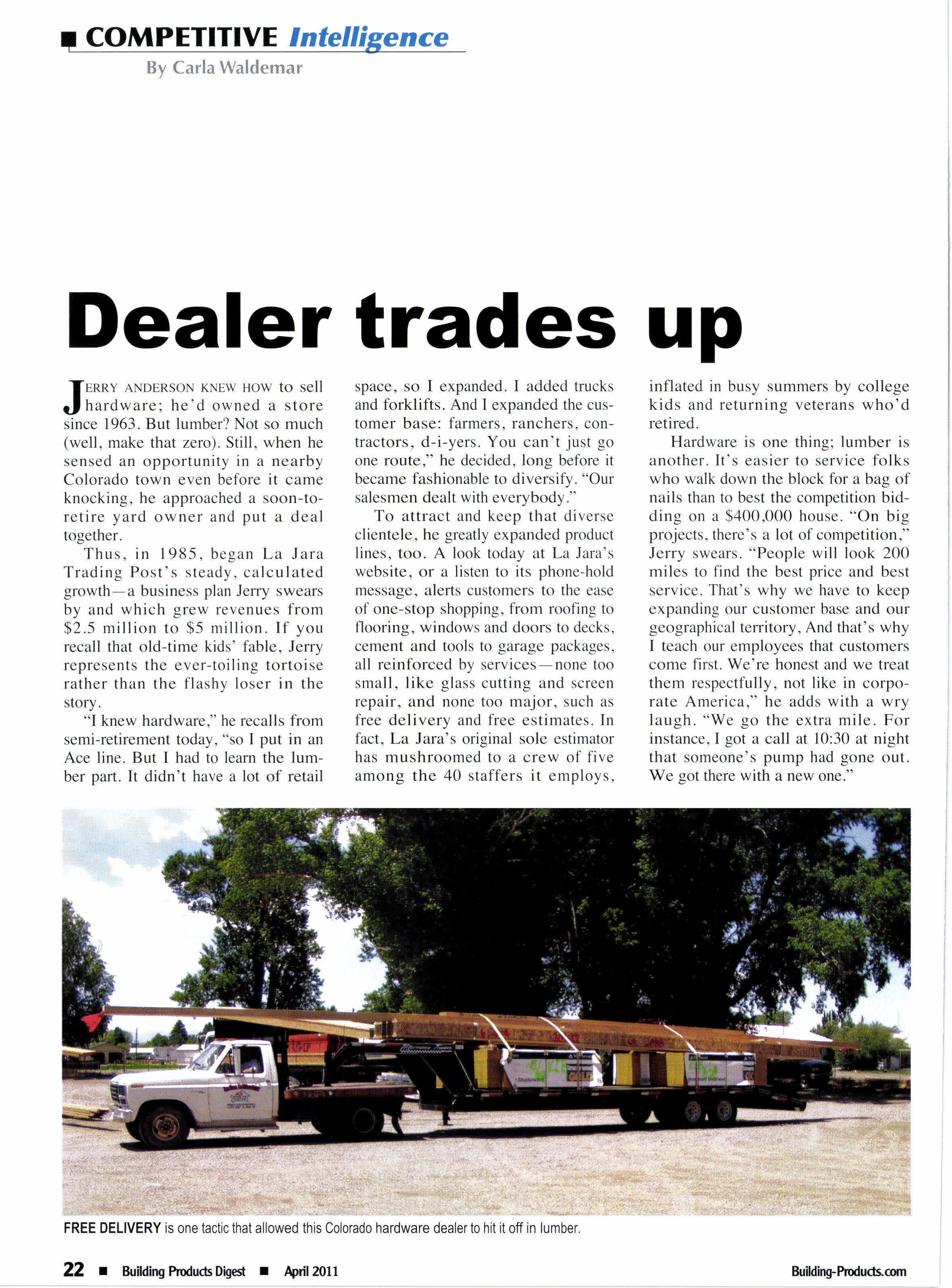

fennv ANDERSoN rrew uow to sell j hardware: he'd owned a store since 1963. But lumber? Not so much (well, make that zero). Still, when he sensed an opportunity in a nearby Colorado town even before it came knocking, he approached a soon-toretire yard owner and put a deal together.

Thus, in 1985, began La lara Trading Post's steady, calculated growth-a business plan Jerry swears by and which grew revenues from $2.5 million to $5 million. If you recall that old-time kids' fable, Jerry represents the ever-toiling tortoise rather than the flashy loser in the story.

"I knew hardware," he recalls from semi-retirement today, "so I put in an Ace line. But I had to leam the lumber part. It didn't have a lot of retail

space, so I expanded. I added trucks and forklifts. And I expanded the customer base: farmers, ranchers, contractors, d-i-yers. You can't just go one route," he decided, long before it became fashionable to diversify. "Our salesmen dealt with everybody."

To attract and keep that diverse clientele, he greatly expanded product lines, too. A look today at La Jara's website, or a listen to its phone-hold message, alerts customers to the ease of one-stop shopping, from roofing to flooring, windows and doors to decks, cement and tools to garage packages, all reinforced by services-none too small, like glass cutting and screen repair, and none too major, such as free delivery and free estimates. In fact, La Jara's original sole estimator has mushroomed to a crew of five among the 40 staffers it employs,

inflated in busy summers by college kids and returning veterans who'd retired.

Hardware is one thing; lumber is another. It's easier to service folks who walk down the block for a bag of nails than to best the competition bidding on a $400,000 house. "On big projects, there's a lot of competition," Jerry swears. "People will look 200 miles to find the best price and best service. That's why we have to keep expanding our customer base and our geographical territory, And that's why I teach our employees that customers come first. We're honest and we treat them respectfully, not like in corporate America," he adds with a wry laugh. "We go the extra mile. For instance, I got a call at 10:30 at night that someone's pump had gone out. We got there with a new one."

The company's free delivery service requires a big chunk of driving commitment in the long, nalTow mountain valley in which La Jara sits. And one day, it didn't happen. Jerry recalls that at 4 p.-.he had a contractor on the phone, "and he was madder than hell. He said we'd promised him a delivery at 8:30 that morning, so he'd hired extra crew. Turned out, we screwed up-everybody will make a mistake, and if you say you haven't, you're maybe lying-so I told him we'd pay his entire site workforce a day's wages. We kept our word, and we kept him as a customer. Things like that pay off. In a small town like this, everyone knows three or four other people to tell a story to."

A feminine voice takes up the tale. Jerry hands the phone over to his daughter, Sabrina Hufmann, one of four kids who took over the business in 2008. But Jerry gets one last word in on the handover, explaining, with a laugh, "At age 68,I began to notice that nobody was living forever, so I decided to sell the business while I could still remember my name. I asked the family who was interested. Of our 13 kids"-his, hers and blended-"four signed on. They'd started here in their grade-school years, raking the yard, cleaning the toilets. Some left to work in Denver, then returned. And we'd used some of the ideas they'd

opinions, which often are very different. (Dad acts as the tie-breaker," she adds.)

"Because we're family members, there's a different dynamic than in a traditional business," Sabrina says. "We're not only business partners, we're brothers and sister-which fosters conflict control. We hold an owners' meeting monthly-a recent one lasted till 2 a.m.-and I'll tell you what! We're a pretty good mix of personalities. But on any important decision, all four must agree."

And often, agree quickly. When the chance to take on a second location arose in 2009-the Stock Building Supply store in Alamosa, l0 miles distant, became available-"we had two days' notice to either jump on the bandwagon or miss the opportunity."

They snapped it up without regrets. "We needed to expand, so we did," Sabrina says. "It's a huge, huge yard in a good location. We kept the managers and expanded the departments and services. Hoyt and I laid it out with very different merchandising. (How could corporate America have been so behind? she gasps at what they inherited.) And it's been doing very well."

Part of the reason for its success is that. while the two stores are only l0 miles distant from each other, their demographics span a greater divide. Alamosa Building Supply sits in a far bigger town, which offers the opportunity to court commercial accounts, while La Jara's agricultural base has spawned a big new niche market-seed, which they store in a boxcar they purchased. "We've sold $100,000 worth so far, and the growing season hasn't even started!" Sabrina reports.

But La Jara Trading Post's biggest claim to dynamite niche marketing is its strong focus on special orders, whose numbers (and margins) are "huge, HUGE!" she attests. "One salesman alone just turned in 90 on his biweekly report."

The goal, of course, is to sell the whole package. And the long-tern goal-call it a mission statement, if you will-is "to stay ahead of the game," as Sabrina puts it. "We're always thinking, all four of us, coming up with ideas in order to improve and change. Change is hard, but you can't grow without it," she observes.

picked up, expanding our services, our product line, our facilities."

"I hadn't planned on a career here," confesses Sabrina, "even though I'd grown up in the place. When we were little, we were expected to do well in school and also workhere, or someplace else. I went off to Denver for a while. "On my first day back in La Jara, Dad called and asked me to help with inventory. Twenty-three years later, I'm still here," she laughs.

"When Dad sold out to the four of us, he gave us an opportunity-but nothing else was handed to us," she stresses. "We'd all worked long and hard-lots of blood, sweat and tears. What he did was offer us an option to buy him out-to launch a C Corporation."

Sabrina, the oldest, signed on as secretary. She manages hardware, inside sales, and inventory in the La Jara store, in collaboration with Jared, president, who co-manages the yard. Hoyt manages the new Alcoma location, which we'11 learn about in a minute, and Greg, the youngest, is beancounter for the corporation-altogether representing, says Sabrina, "a good range of abilities, age (19 years between Greg and me, 10 between me and Hoyt), personalities and

Some are relatively easy, like the company's recent, forward-looking decision to go "green." Others are harder to swallow, but necessary for survival, such as the partners' decision to take pay cuts until the economic hurricane blows over. Other cost-savings moves include eliminating overtime and profit-sharing bonuses this year. "But nobody lost a job," Sabrina can state with pride.

This corner of Colorado never rode the '90s wave of unequalled prosperity, but neither did it hit the skids as hard as other parts of the country. "So, when the economy turns around, we'll be fine," says Jerry, who's seen it all.

"We'11 ride the storm," his daughter agrees. "We've laid a good foundation, developed a solid customer base. It'll still be here to sell to our own kids."

Carla Waldemar\JrNrrv eERCENT oF THE pEopLE we compete against are I \ using the following approach on every call:

Quotron: "Good morning, Bob. How are you? I've got a 2x4 92-518-inch Sinclair Lewis stud that I can set to vou at $325/MBF. Can you use that?"

Customer: "No thanks, don't need it."

Quotron: "Anything else you need?"

Customer: "No thanks."

Quotron: "What's coming up next?"

Customer: "Nothing I can think of. Call me next week."

Quotron: "Okay. Thanks. Have a nice weekend."

Customer: "You too."

There is no engagement. There is no mystery or intrigue. No desire or spunk is shown. This Quotron is an information dispenser. He gives information and lets the c'ustomer decide. This is not salesmanship. This is being a quotron. These (sales)people get treated badly and blame it on the customer.

Since no information is ferreted out about the customer's next purchase, the next call and the call after that will go the same, ad infinitum, ad nauseum.

These quotrons sends a terrible message. They do not fight for the business. If we do not show that we want the business-by creating a sales event, engaging the customer, fighting for the order, asking follow up questions, and in general just not taking no for an answer-we send the message that we don't want the business.

Struggling sellers think that being super-quadruple-easyto-get-along-with will entice customers to buy from them. This "Whatever you want" attitude does not sell. Buyers don't think, "Wow, Nancy is easy to get along with, so I'm going to buy from her." They think, "Nancy has good prices, but she never asks for the order. As a matter of fact, she's easy to say no to. But she sure keeps that Son-of-aGun John honest, so at least she's doing that for us." (John is the SOG who is getting all the business.)

Salesperson: "Good morning, Bob. Last time we spoke

you said you were getting close to booking some studs. We went out yesterday and made a great buy on 10 cars of studs. The market is strong and we ere selling these well. We've got three left, so why don't we put a couple on the books for you?"

Customer: "What's the price?"

Salesperson: "That's the icing on the cake, Bob. We've been selling these to very competitive customers. I sold one this morning to this guy in Texas, and he doesn't even like to buy fiom me, so I know these are good. Before I give you the price, if we agree it's good, how many studs can you use?"

Customer: "You always say you have a good price, but, yeah, if the price is good, I can probably use a couple."

Salesperson: "A couple like 'three a couple'or a couple like 'two a couple'?"

Customer: "A couple like 'two a couple' and if you don't give me the price soon, it's going to be a couple like 'place them with someone else' a couple."

Salesperson: "We've been selling them at $325/MBF. What are your order numbers?"

Customer: "Okay. I'll take two. Use 'verbal Bobl' and 'verbal Bob2."'

Salesperson: "Thanks for these. Why don't you take us off the market on that last stud? You bought the first two because they are a good deal. Let's push the shipment on the third and put that one on also."

Customer: "Two is it. Aren't you ever satisfied?"

Salesperson: "I'm happy when you're happy, Bob, but I'm never satisfied. Thanks for the orders."

This seller puts on a performance for his customer. He makes his call "an event." The buyer may not like or agree with the seller's approach, but there is intrigue and engagement. Starting the conversation off with a positive story sets the (positive) tone for the call. Holding back the price creates tension and interest. The customer wants to know that price.

The first seller dispenses information. All that is left to say is, "I'll let you know." All questions asked and answered. No intrigue. No tension. No engagement. No sale.

We must draw the customer into our world. not the other way around. Inviting customers to our world is the job of the master seller and will a/ways produce better results than being a quotron in our customer's world.

James Olsen Reality Sales Training

James Olsen Reality Sales Training

uperior Dimensional Stability etter "Yarding" and Jobsite Performance reen Building Product

WPA Standardized and Building Code Approved asting Beauty and Lifetime Warranty

@ ProudSponsor LB)

background for more specific product criteria and attributes. Here's a partial list of what to consider:

Energy - Products that conserve energy, produce renewable energy, or are made from renewable energy sources.

Water - Products that conserve water usage, especially the use of fresh, potable water. Also, product alternatives that don't pollute water sources or aquatic eco-systems.

Toxic chemicals - Products that are made with nontoxic (or least-toxic), low-risk chemicals and other components.

Healthy and sustainable practices - Products that contribute to healthy and sustainable practices, such as rainwater harvesting. composting. etc.

that, when practiced well, makes good merchants great.

The last few years, there's been a rush by manufacturers to get their green innovations to market. Many are going to be clear winners and will make a difference in transforming the built environment. Unfortunately, along with the rush has been the slapdash-products presented as earning LEED credits, or being less toxic, or ecologically benign, when they are not. Whether by deliberate deception or honest mistake, green washing has created confusion and skepticism in the market.

It's not so easy to pick green winners, but there a.re practical steps that merchandisers can take to reliably evaluate the green-worthiness of any product. In general, the goal is to identify merchandise that meets certain criteria, both yours and your customers'. There are a variety of product certifications and, of course, LEED and other green building rating systems provide relatively clear criteria. But there is no master green products list to go by, and no matter how comprehensive, certifications and building rating systems are not going to cover all the product categories stocked in most stores and yards.

But if you're willing to roll up your sleeves and "green it yourself," there's another way to look at whether the merchandise you choose to sell is green worthy. Start by asking: Does it harm or benefit the environment? Does it pose health risks or promote healthy lifestyles? Are communities positively or negatively affected in its manufacture? Does it work? Will it sell? These questions should take in the entire life cycle of the product, which includes looking at the impacts relating to raw materials, manufacturing process, distribution, use, and disposal.

The broad categories addressing human health and safety, ecological safety, and social responsibility provide the

The evaluation process starts with the manufacturer, who should provide credible product information-preferably with third-party documentation supporting their green claims. But that may not be enough. Consult with independent experts and review third-party information on the Internet, too. There are several helpful databases online that will show what's known about specific chemicals. Comparing products in the same category will help to identify the "greenest" in class. Finally, there must be a judgment about whether or not the product does the job and will sell. Get a sample and take it for a test spin.

If green merchandisers are defined by product selection, they are also defined by products not selected. There are plenty of useful products for which there may be better or greener options. But there are also junk products for which the only "green" option is that they simply not exist. Every dealer in this supply chain has experience with junk, if only by accident. These are products so poorly designed, manufactured so cheaply, and are so obviously heading straight for the landfill that they cannot be justified no matter how low the price point.

Eliminating the worst junk from inventory is not only practical, it's also a virtuous step toward sustainability.

JaY TomPt Managing Partner William Verde & Associates @15) 32r-O848 info@ williamverde.com

Marvin's Building Materials & Home Genters latb next month will open store #27, a 35,000-sq. unit with aftached garden center and drivethru lumberyard in Monroeville, Al.

ProBuild is building a 45,000-sq. ft. yard in Morgantown, W.V., for an early summer opening.

Sunnvcrest True Value Hardwarie, Urbana, ll., is shutting down April 30 after 39 years.

Bob Cooper, owner since 1988, will transfer inventory and two employees to his store in W. Champaign, ll., Round Barn True Value.

Kincer-Miller Hardware, Wytheville, Va., is selling the last of its inventory and will close in June after 85 years.

Helpful Group opened its 17th Ace Hardware, a 14,000-sq. ft. store in Chickamauga, Tn.

Waddinqton True Value Hardware &-Buildinq Suoolv is the new name of Cas-welf Tiue Value, Waddington, N.Y., after its purchase by James and Karen Thew from Terry and Sue Caswell.

Menards opened a home center March22 in Manhattan, Ks., as well as a 240,000-sq. ft. replacement store with 10-acre lumberyard in Hammond, ln.

Future plans include a 200,000-sq. ft. replacement store in Schererville, In., and a unit in Owensboro, Ky.-its first in the state.

Menards acquired 2.2 acres next to its Richfield, Mn., store for expansion and is negotiating to buy 9 acres in Tinley Park, ll., to expand its local store to a chain-high 360,000 sq. ft.

Lowe's is adding 24,000 sq. ft. to its now-144,000-sq. ft. millwork plant in Lexington, N.C. Expansion of the 25year-old facility, which assembles unfinished cabinetry to be sold in the chain's stores, should be complete by summer.

The chain also will open a 103,000sq. ft. home center April 15 in N. Frederick, Md. (Teresa Yeargan, store mgr.), and will add more than 275 jobs this year at its customer support center in Wilkesboro, N.C.

The nation's largest pressure treater is forging a strategic alliance with one of the Southeast's biggest LBM wholesalers to distribute each other's products.

The initiative allows Great Southern Wood Preserving, Abbeville, Al., and U.S. Lumber Group, Atlanta, Ga., to expand their geographic distribution footprints, while providing new economies of scale in marketing and operations.

According to Jimmy Rane, chairman, president and c.e.o. of Great Southern, the alliance "will create a vehicle for growth at a time when the economy in general and new housing starts in particular continue to struggle."

Great Southern gains new mid-

84 Lumber shut down l0 underperforming locations from Missouri eastward and placed the vacated properties up for sale.

Stores closed March 7 were Brooksville, Deland and Fort Pierce, Fl.; Winder, Ga.; Springfield, Mo.; Southaven, Ms.; Farmingdale, N.J.; Tulsa, Ok.: Anderson, S.C., and Kams, Tn.

Spokesman Jeff Nobers said all markets, except for Tulsa, will be served from other locations in the region.

Bishop Hardware & Supply, Springfield, Il., has acquired Ace Hardware, Pontiac, Il., from Wallace "Walt" Meade, who is retiring after 34 years.

The store closed March I so the building could be expanded and remodeled, and a garden center added.

George Preckwinkle, president of Bishop, and his sister, Lucy Bagot, will operate the new location.

MiTek, Chesterfield, Mo., has acquired USP Structural Connectors, Burnsville. Mn.. from Gibraltar Industries, Hamburg, Germany.

USP designs, engineers and manufactures structural framing and bracing connectors for residential and light commercial construction.

"This great addition combines the diverse product line and innovation of

Atlantic markets for its YellaWood brand products through U.S. Lumber's distribution network, while U.S. Lumber's specialty products become available to Great Southern's dealer base in the Midwest, Southwest and the Caribbean.

Under the deal, an affiliate of Great Southem will become a minority investor in U.S. Lumber. Lawrence Newton remains c.e.o. of U.S. Lumber, and no management changes are expected.

Both companies are working together on several initiatives that will be launched in the coming months.

Great Southern operates 11 facilities throughout the South and Midwest, while U.S. Lumber has seven distribution centers.

USP with the commitment and depth of MiTek," said Tom Manenti, MiTek president and c.e.o. "Along with Sapphire, our industry-leading wholehouse engineering software, MiTek now has the capability to supply structural framing and bracing solutions that satisfy all critical aspects of a wood-framed building, from the roof to the foundation."

Gibraltar had owned USP since 1998.

At the same time, Gibraltar agreed to buy industrial sealant manufacturer D.S. Brown, N. Baltimore, Oh.

Russian forestry giant Ilim Timber Industry has agreed to acquire Tolleson Lumber Co., Perry, Ga., in partnership with a management team led by Rusty Wood.

"Tolleson's reputation in the industry and management's solid vision for future development became the key decision factors for us in choosing this company in North America. Tolleson will become a cornerstone for further expansion in the U.S., which is a part of our business strategy," said ITI chairman Boris Zingarevich.

With the addition of the two Tolleson sawmills, ITI's global production capacity now exceeds 1.65 billion bd. ft. and broadens to include southern yellow pine. Its goal is to become an industrial global leader in terms of presence in the key markets of Asia, Europe and America, efficiency, and volumes of production.

fiber, Nordic transforms treetips into the key component of its glued laminated product line. e nvtno = LAM* is featured in Nordic Lam'" Beams, Columns, TallWall Studs, the Nl-90x l-Joist Series, and Nordic's X-Lam cross-laminated timber panels-our latest innovation.

In addition to our ongoing commitment to sustainable forestry, Nordic continues to invest in advanced manufacturing processes to keep on the cutting edge of technology and product development.

Goosebay Sawmill & Lumber, Chichester, N.H., tost one building in a March 10 fire.

Guthrie Lumber & Distribution Co., Austin, Tx., has signed on to produce and distribute EcoBlu fire-, mold-, rot-, and termite+esistant EcoBuilding Good Wood lumber.

Huttig Building Products is now distributing Alpha ProTecf,'s REX Wiap Plus housewraps in the easi trom its 16 branches in Missouri and eastward.

Building Products Inc., Council Bluffs, la., is now distributing Curtner Lumber Co.'s Ozark Natural Paneling in the Midwest.

Century Lumber & Land is still working to tine up the $2.5 million needed to buy the old Alger-Sullivan Lumber complex in Century, Fl.

The new company holds out hope that it will be able to restart the crosstie treating plant and dry kilns in the near future (see Ocf. 2010, p.20).

Jeld-Wen is permanently shuftering its millwork diskibution center in Tampa, Fl., April 8.

Somerset Wood Products, Somerset, Ky., is expanding its Grossville Hardwoods flooring plant in Crossville, Tn., to accommodate a new product line,

Simonton Building Products is relocating its corporate headquarters to Columbus, Oh., but will maintain its customer service, marketing and lT departments at its offices in Parkersburg, W.V.

With move-in expected to be completed by June, the new headquarters will include a product showroom.

Great Northern Buildinq Products. Louisvitte. Kv.. has purchased the assets of Am-erican Slate Go., Watnui Creek, Ca., from ABG Supply, Beloit, Wi.

SRS Acquisition Gorp., McKinney, Tx., added its 9th Southern Shingles brahch, in San Antonio, Tx. (Tim Lynch, mgr.).

OMG Inc., Agawam, Ma., has acquired the intellectual property rights for Sinch Technology from Senco Brands, Cincinnati, 0h.

Sinch makes portable induction heating units for installing commercial roofing systems.

Biewer Lumber, St. Clair, Mi., now distributes composite decking from Fiberon, New London, N.C., in the Midwest, and has partnered with PureWood, Memphis, Tn., to manufacture SelectCut and ThermalGuard thermally modified wood.

American Lumber, Walden, N.Y., now distributes Solstice cellular PVC decking from Deceuninck North America, Monroe, Oh., in the Northeast and Mid-Atlantic.

Boston Cedar & Millwork, Holbrook, Ma., is now a fullline dishibutor for the Northeast for Railing Dynamics Inc., egg Harbor Township, N.J.

As part of a restructuring, Cheboygan Lumber Co., Cheboygan, Mi., late last month closed stores Mackinaw Building Center, Mackinaw City, Mi., and St. Ignace Do-It Center, St. Ignace, Mi., reducing the century-old chain to four locations.

Nine employees between the two stores are expected to be transferred to another location.

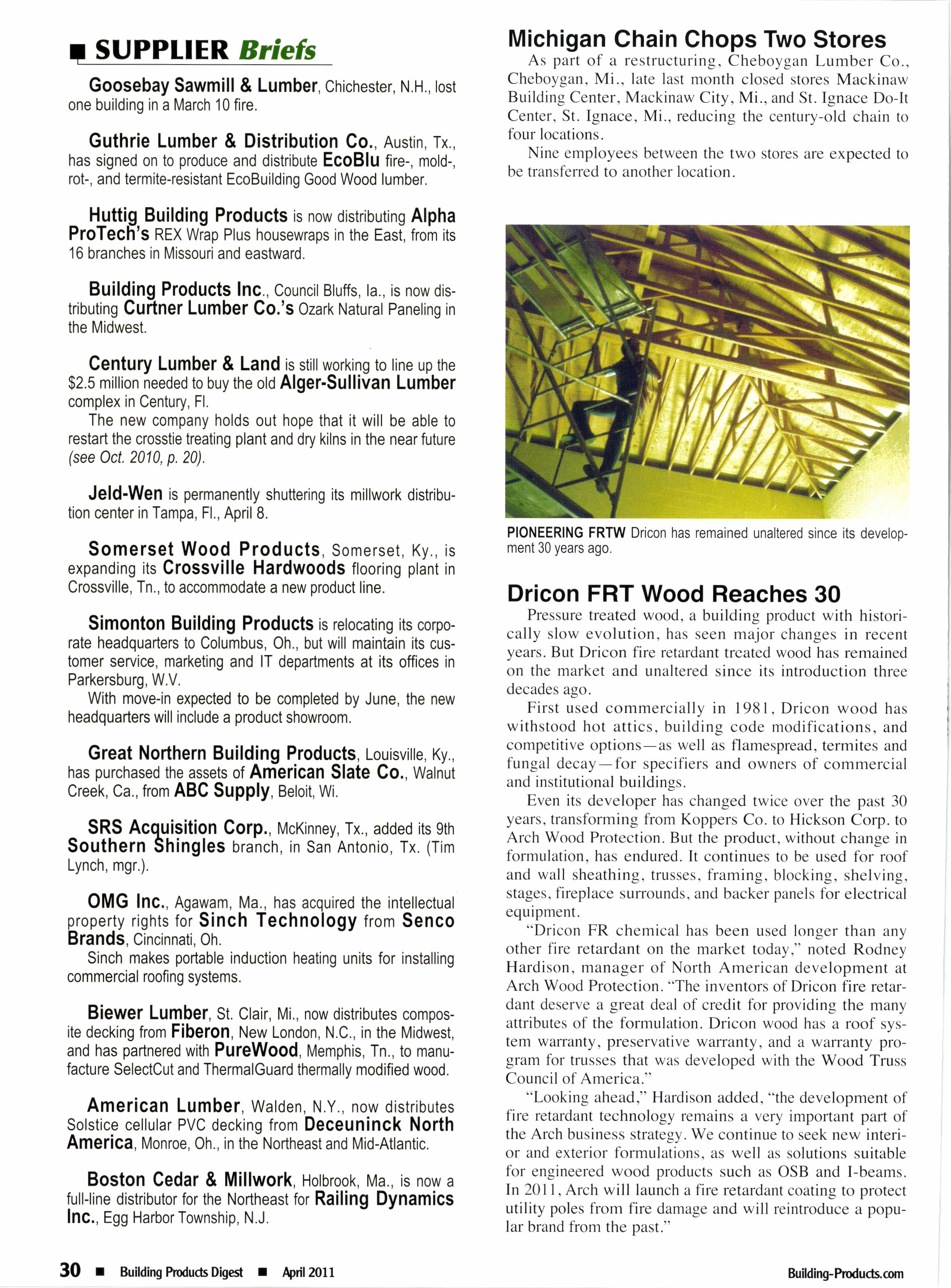

Pressure treated wood, a building product with historically slow evolution, has seen major changes in recent years. But Dricon fire retardant trcated wood has remained on the market and unaltered since its introduction three decades ago.

First used commercially in 198 l, Dricon wood has withstood hot attics, building code modifications, and competitive options-as well as flamespread, termites and fungal decay-for specifiers and owners of commercial and institutional buildings.

Even its developer has changed twice over the past 30 years, transforming from Koppers Co. to Hickson Corp. to Arch Wood Protection. But the product, without change in formulation, has endured. It continues to be used for roof and wall sheathing, trusses, framing, blocking, shelving, stages, fireplace surrounds, and backer panels for electrical equipment.

"Dricon FR chemical has been used longer than any other fire retardant on the market today," noted Rodney Hardison, manager of North American development at Arch Wood Protection. "The inventors of Dricon fire retardant deserve a great deal of credit for providing the many attributes of the formulation. Dricon wood has a roof system warranty, preservative warranty. and a warranty program for trusses that was developed with the Wood Truss Council of America."

"Looking ahead," Hardison added, "the development of fire retardant technology remains a very important part of the Arch business strategy. We continue to seek new interior and exterior formulations, as well as solutions suitable for engineered wood products such as OSB and I-beams. In 2011, Arch will launch a fire retardant coating to protect utility poles from fire damage and will reintroduce a popular brand from the past."

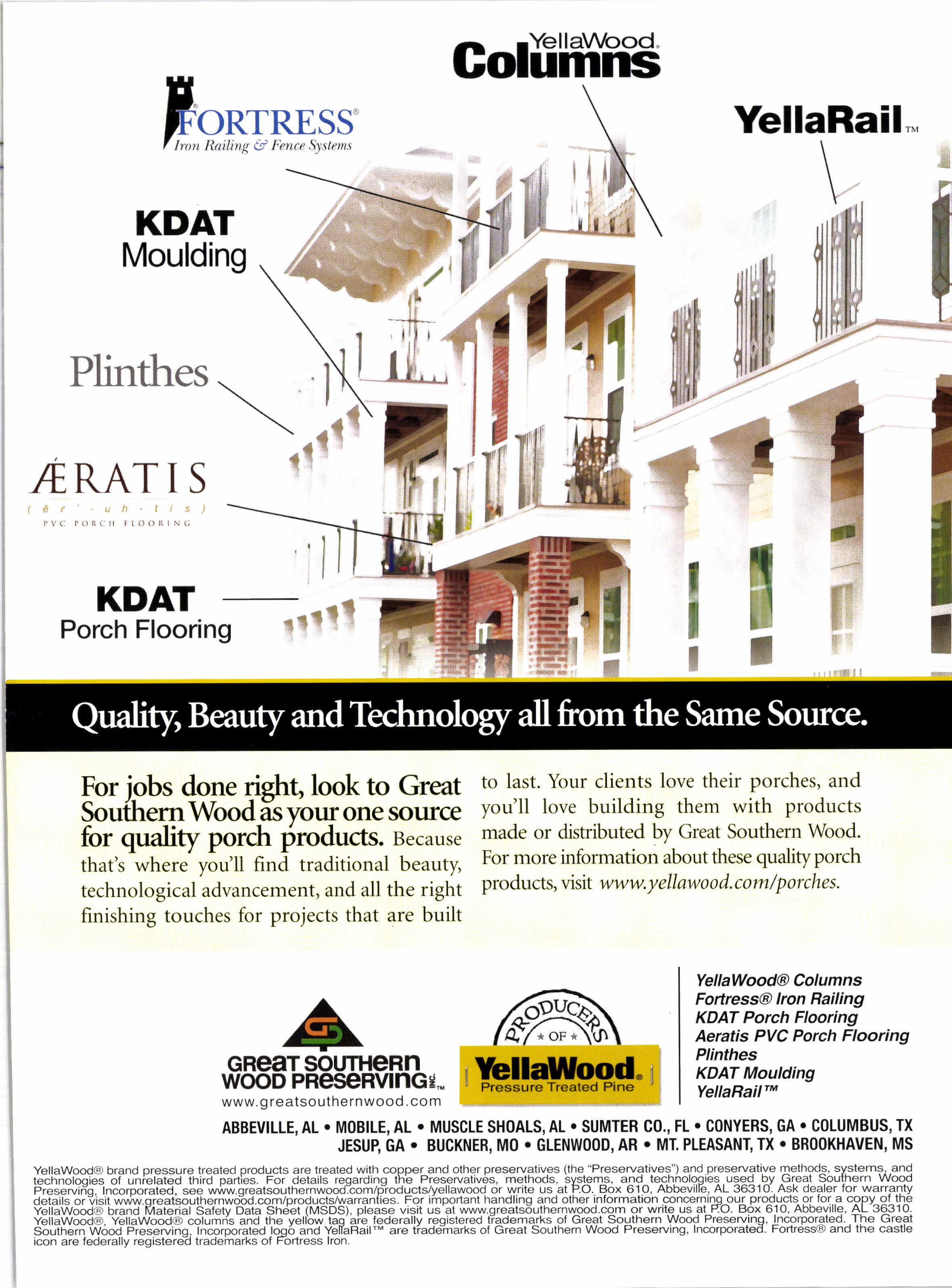

For iobs done right, look to Great Soufhern Wood ds vour one source for quality porch produas. Because that's where you'll find traditional beauty, technological advancement, and all the right finishing touches for projects that are built

to last. )bur clients love their porches, and you'Il love building them with products made or distributed by Great Southern Wood. For more information about these qualityporch products, visit www.y ellawo o d. com /p orches.

YellaWood@ Columns

Fortress@ lron Railing

KDAT Porch Flooring

Aeratis PVC Porch Flooring

Plinthes

KDAT Moulding

YellaRailru

si:e -wrlw.iiieatsout6ernwooo]cbmzp"roductslvellawood or write us at PO. Box 610. Abbeville, AL 3631o. Ask deqler for warranty detailsor"visitwnjw'qreatsouthernwofid'com/productS/warran{ies.Forimportanthand|ingandotherinformation.concernilg^oq!pro9y^ctS.9J|or.ac9Py^q!.te Yellawood@ brand Material Safetv Data Sheet (MSDS). please visit us at www.greatsoulhernwood.com or wrlle us al P.U. uox 6lu. ADoevllle. AL JqJlu. VeiiaWooOO, yettaWooOO cotumris and the yellbw tag'aie federally registered tiqdemarks of Great Southern Wood Preserv_inq. lncorporated. The Great Southein Wood Preservino. inioipbrateO loq6 and YefaRail '" are tiade"marks of Great Southern Wood Preserving. Incorporaled. Fodress@ and lhe castle icon are federally registere1 tradeiTarks of Fortress lron.

Elliott's Hardware is relocating its flagship store in Dallas, Tx., this month to a 13,000-sq, ft. buildingone-fourth its current size.

Arrow Ace Hardware, Rochester, Mn., hopes to open its 4th local store by the end of June.

Habitat for Humanity is opening a 10,644-sq. ft. ReStore discount LBM outlet May 6 in Topeka, Ks. (Andrew Faunce, mgr.); relocated its Brewton, Al., store to a larger building, and is remodeling its unit in Benton Township, Mi.

Safety Harbor Hardware, Safety Harbor, Fl., is closing by the end ofthe month, after 10 years.

Ace Hardware, chattanooga, Tn., suffered moderate damage in a Feb. 26 electrical fire haced to a malfunctioning paint mixer.

Aubuchon Hardware ctosed its 13-year-old store in Plainville, Ma.

Boise Cascade Building Materials Distribution is expanding its distribution operations in New Jersey, signing a lease for 307,000 sq. ft. of warehouse space near its current facility in Delanco.

The new 47 -acre site features two warehouses, 20 acres of yard space, and a rail spur.

The facility will allow for expansion of the current inventory and the addition of new product lines. "The expansion and the new products to be added show our growing commitment to both our vendors and customers in the trade area," said Bill Schellhorn, manager in Delanco. "In addition, the combined operations will be more efficient and safer than our current limited space provides."

Distribution division president Stan Bell said additional expansions and upgrades will be announced in the near future.

ACO Hardware, Michigan's largest independent hardware chain, is moving away from its hardware business to become more of a neiehborhood general store.

New offerings range from coffee and other food items, to wicker baskets and ceramic planters. The chain has also expanded its selection of pet food, automotive accessories, greeting cards, outdoor furniture, and barbecues.

"These are things we wouldn't have carried even two years ago," said president Dick Snyder, who joined the 67-store chain two years ago, after l8 years at Walmart.

Insulfoam, Carlisle, Pa., begins manufacturing this summer at a new 200,000 sq. ft. plant in Smithfield, Pa., that it will share will sister company Hunter Panels.

Insulfoam is North America's largest producer of engineered expanded polystyrene block-molded insulation products, while Hunter is a leading rigid polyiso insulation manufacturer.

This new plant will ship to New England, the Mid-Atlantic, and select Midwestern states. Existing Insulfoam facilities are in Florida, Nebraska, Colorado. Utah. Arizona. California. Washinston and Alaska.

After three years of declines, U.S. moulding consumption is expected to begin its turnaround this year, marking the start of a five-year bull run, according to International Wood Markets Group's new report, U.S Moulding Market Outlook: 201l201 5.

North American and offshore moulding producers endured three consecutive years of massive reductions in moulding demand that has left only the most strategic, well-financed, and efficient producers able to benefit from improving builder demand and