NELMARESOURCESHIDEANDGOSCAN. NORTHEASTERN LUMBER MANUFACTURERS ASSOCIATIONFINDALL5!

1848 Founded by Samuel Maze in Peru, Illinois

1886 Purchases First Nail Machine to Produce Nails from Pure Zinc

2023 Maze Lumber is the Oldest Lumberyard in Illinois

1900 First Manufacturer to Pack Nails in 50 Lb. Boxes

1905 First Manufacturer to Pack Nails in 5 Lb. Boxes

1914 Produces the First Hot-Dipped Nails by Hand

1930 Designs and Launches Spiral Shank Nail Product Line

1934 Designs and Launches Ring Shank Nail Product Line

1955 Develops Exclusive Stormguard Double Hot-Dip Galvanizing

1996 Founded S.S.E., our Collating Division

2006 Earns Miami-Dade County Approval on Selected Roofing Nails

2008 Certified by Scientific Certification Systems for Recycled Content

2011 Fifth Hot-Dip Galvanizing Production Line Installed

2011 Highlighted on ABC News, Diane Sawyer’s Made In America

2016 Installs Second Paint Production Line for Trim Nails

2023 EVERY Maze Nail still 100% Made in the USA

PRESIDENT/PUBLISHER

Patrick Adams padams@526mediagroup.com

VICE PRESIDENT

Shelly Smith Adams sadams@526mediagroup.com

PUBLISHER EMERITUS

Alan Oakes

MANAGING EDITOR

David Koenig dkoenig@526mediagroup.com

SENIOR EDITOR

Sara Graves sgraves@526mediagroup.com

COLUMNISTS

James Olsen, Kim Drew, Claudia St. John, Dave Kahle

CONTRIBUTORS

Bob Berlage, Simon Cameron, Jeff Easterling, Ian Faight, Brad Kirkbride, Susan Palé

ADVERTISING SALES (714) 486-2735

Chuck Casey ccasey@526mediagroup.com

Nick Kosan nkosan@526mediagroup.com

VIRTUAL EVENTS

Alek Olson • aolson@526mediagroup.com

CIRCULATION/SUPPORT info@526mediagroup.com

A PUBLICATION OF 526 MEDIA

151 Kalmus Dr., Ste. E200, Costa Mesa, CA 92626 Phone (714) 486-2735

BUILDING PRODUCTS DIGEST is published monthly at 151 Kalmus Dr., Ste. E200, Costa Mesa, CA 92626, (714) 4862735, www.building-products.com, by 526 Media Group, Inc. (a California Corporation). It is an independently owned publication for building products retailers and wholesale distributors in 37 states East of the Rockies. Copyright®2023 by 526 Media Group, Inc. Cover and entire contents are fully protected and must not be reproduced in any manner without written permission. All Rights Reserved. BPD reserves the right to accept or reject any editorial or advertising matter, and assumes no liability for materials furnished to it. Opinions expressed are those of the authors or persons quoted and not necessarily those of 526 Media Group, Inc. Articles in this magazine are intended for informational purposes only and should not be construed as legal, financial, or business management advice.

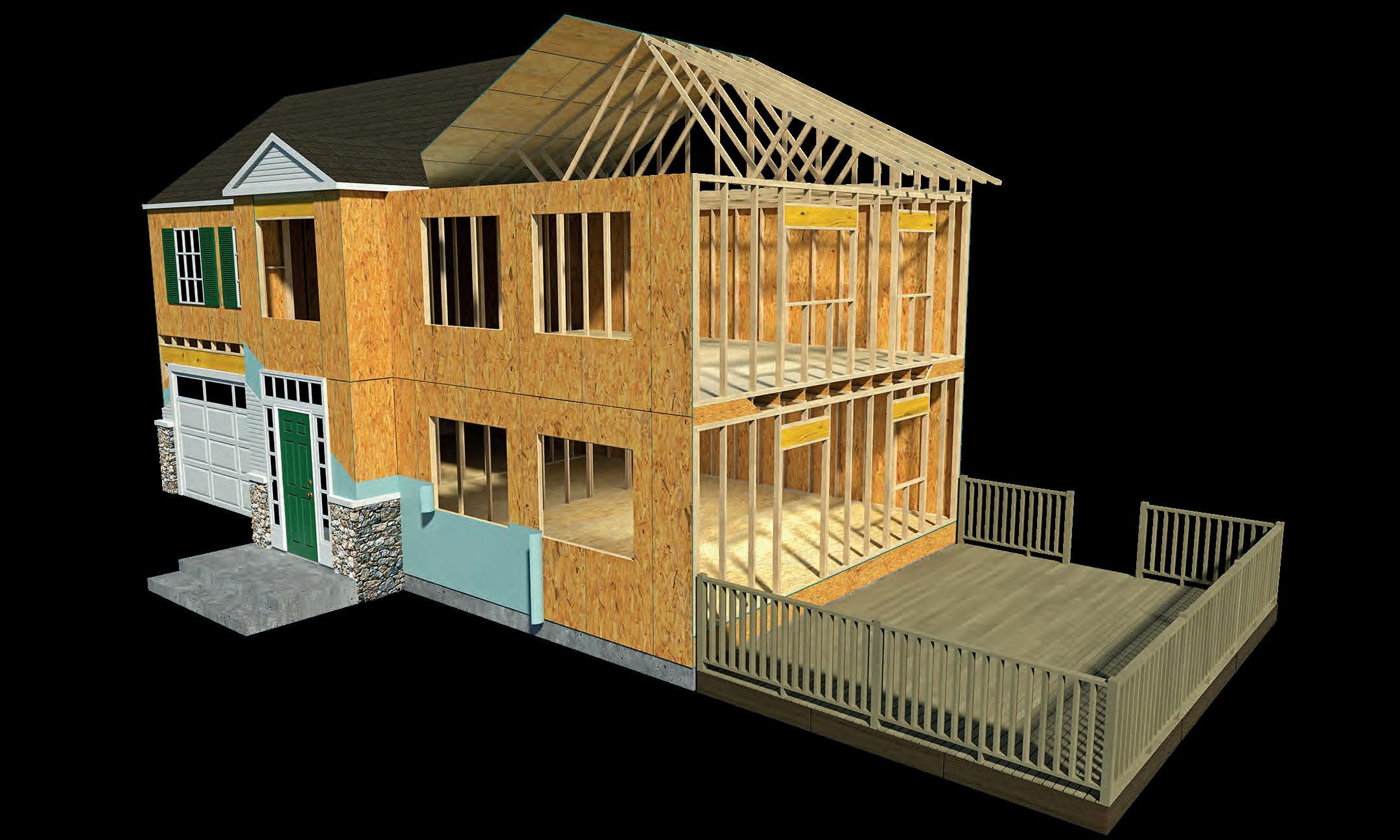

Smart and easy outdoor project design software. Many homeowners see the backyard as an extension of their house. Now you can help them make the most of it. Outdoor Living software from Simpson Strong-Tie makes it easy to plan a deck, pergola or fence in minutes. Our suite of apps — Deck Planner Software™, Pergola Planner Software™ and Fence Planner Software™ — guide customers to design safe, strong and beautiful outdoor structures. Every app provides a materials list so your sales team can offer quotes on the spot. Tiered licensing programs are available, giving you greater brand visibility and website traffic, weekly usage reports with detailed lead information, and integrated SKUs and pricing.

To see a free demo and learn more, visit go.strongtie.com/outdoorliving or call (800) 999-5099.

THE SUPER BOWL hasn’t even started and already there are winners in the room. Chris Stapleton is singing an amazing rendition of the National Anthem and everyone is looking at their watches as he holds the word “brave,” and then there’s celebration by half the room (under five seconds won). The song ends, and the other half of the room erupts in celebration (it was under 2:05 long).

I’ve realized that “odds” have always played a big role in my life. While I would say my current life has defied the odds, it is because I would also say the odds were against me growing up. Without realizing it as a child, calculating odds quietly in my head gave me peace in otherwise stressful situations. At 8, I’m walking to school when I see five boys who look like gang members coming toward me giving me “the look.” One on one, maybe. Two on one, unlikely. Five on one, horrible. Decision—run!

I’m 16 in high school and prom has been approaching. I still haven’t mustered the courage to ask anyone and time is ticking down while the “pool” of available candidates is also rapidly shrinking. The head cheerleader oddly hasn’t been asked, but neither has the lead trumpet player in the school band. As I approach Tiffany (cheerleader) after school, I’m running the odds (I’m pretty goofy at 16, I know there’s still a good assortment of guys who still haven’t been “committed” yet, and the rejection might make for a tough rebound). I quickly retreat, regroup and ask Monica instead (trumpet player who I think smiles at me pretty regularly around the halls). She laughed and said no. So much for odds…

As I moved into the next chapter of my life, odds also played into everything I did. There were always calculations going on—yes or no, left or right, attack or retreat. I’ve learned that this is something that is ingrained in many of us. It is at the root of our most precious instinct— self-preservation. In the back of our minds, we are always assessing scenarios, calculating cause and effect, and making decisions.

For example, you have about a 1:19,000 chance of being murdered in the U.S. (a bit surprising!), but in southern Africa, it is more like 1:1,600. We’ve all played the lottery, in which you have a 1:292 million chance of winning, but you have a better chance (1:222,000) of being struck by

lightning or dying from a bee or hornet sting (1:57,000). They also claim the odds of a business failing is almost 50%... coincidently, roughly the same odds as your marriage failing.

But odds don’t always factor things like perseverance, pride, work ethic, and loyalty. It doesn’t factor in the individual. I’m sure if the odds maker told you what the odds were of being successful in the commodity lumber market, you would have taken your savings and instead bet what color will the liquid be that is poured on the winning Super Bowl coach (blue was the odds favorite, but it was purple—the longshot at +1600!). I like things—and people—who beat the odds! In fact, I make it a point to surround my life with those types of individuals because beating the odds is what gives me comfort, and faith that everything is going to turn out OK.

The point is simply this: we seem to now live in a world where every place we turn, they are trying to remind us of the worst that can happen. They would have you believe that there is very little good news to report and the forecast looks all the more gloomy. But, remind yourself that the odds are you will wake up tomorrow and have another chance to continue pursuing your dream. You will work hard and those around you will be inspired, and influenced by what you do. You will go home to your family, and when you lay down you will know that it was a good day. And this is what I call the American Dream.

Each of you allow me to pursue mine, and you also provide me the inspiration to continue forward beating the odds! And, just in case you were wondering how your hot dog bet turned out, the over-under for hot dogs consumed at State Farm Stadium during the Super Bowl was 17,000…under won at 16,300.

As always, I am inspired and humbled at how each of you beat the odds every day! Keep up the good work and thank you for the opportunity to serve you!

PATRICK S. ADAMS, Publisher/President padams@526mediagroup.com

PATRICK S. ADAMS, Publisher/President padams@526mediagroup.com

NATURAL RESOURCE commodities are subject to a diverse array of market volatilities that affect price, supply and demand, and softwoods are no exception. One only has to look at the price and supply fluctuations softwood lumber has experienced over the last several years—the spring of 2021 and early 2022 in particular—to see just how extreme these swings can be. While rising interest and mortgage rates indicate a slow start to 2023, U.S.-based Forest Economic Advisors forecast this to be short lived, and see optimism on the horizon with an uptick in the economy.

While this is positive news for the softwood industry and bodes well for a return to more “normal” markets, it does beg the question as to how consumers perceive these wide swings in supply and price, and whether our industry can do anything to mitigate these fluctuations. One answer we at the Western Red Cedar Lumber Association are very encouraged to see is the growing popularity of engineered WRC products.

I’ll be the first to state that engineered products are not a silver-bullet solution to the inevitable ups and downs of this industry, but they do provide a wealth of benefits and fill a much-needed void, particularly when fiber is hard to source. Consumers will always gravitate to products that do their job well, offer good value and

are readily available. Engineered WRC provides all of these advantages and more.

A number of WRCLA members have opened new niche markets in North America with engineered WRC appearance products which are available in three main product categories: engineered clear solid western red cedar, engineered T&G WRC with a clear veneer overlay, and engineered knotty western red cedar—all of which are becoming more readily and consistently available and are creating new opportunities for architects, builders and designers.

Engineered clear solid western red cedar are finger-joined and edge-glued boards designed for trim, fascia and siding and are extremely well suited for exterior cladding. These are highly popular as they are readily available in long lengths, typically 16’ and 20’, and are extremely long-lasting and exceptionally stable.

As they have color variations and are made up of a number of small pieces, boards are usually sold preprimed and are available either re-sawn or smooth textured. Engineered clear is also an excellent use of clear fiber and maximizes fiber value utilization.

A second product category, engineered western red cedar T&G products with a clear veneer overlay, is intended for designs that require the rich look of clear

WRC. These are ideal for exterior cladding or soffits, as well as interior wall or ceiling details, and are manufactured with thin pieces of high-quality, clear, vertical grain WRC veneers applied to a substrate using the same techniques and glue that’s used to manufacture other engineered building materials rated for exterior use. Like the finger-joined and edge-glued products, clear veneer overlay boards are exceptionally stable, extremely long-lasting and will provide decades of service.

They are available in 1”x4” and 1”x6” T&G with a variety of edge details. These products are very environmentally friendly and many have been approved for use in soffit applications in Wildland Urban Interface (WUI) areas in California, Oregon and other areas that require fire-resistive construction.

The third and newest engineered WRC product is engineered knotty western red cedar. These are primarily for trim and fascia applications, and are manufactured from smaller pieces of wood into long length material that’s kiln dried. They are available in 16’ and 20’ lengths and in 8”, 10” and 12” widths. They can be nailed, sanded, and sawn just like solid stock. Engineered knotty western red cedar is also being run to siding patterns like bevel, T&G and shiplap, and these products are making in-roads in markets such as Texas, where generally only unseasoned products have been sold.

WRCLA members are also manufacturing application-specific products such as hollow, engineered, solid and FJ structural posts in 6”x6” or 8”x8” dimensions; highly sustainable engineered shingle panel systems; engineered trim, and resawn and rougher-headed textured siding available in long lengths and backed by 20-year warranties.

All the products and product categories above are creating new, competitive advantages over nonwood and off-shore market products, and are helping create a consistent and abundant supply of in-demand products. To be competitive as an industry, it’s of course essential we provide customers with what they want and need; but to be viable for the long term, it’s equally important

we educate consumers on the benefits and the impact of choosing softwood products.

Wood has the environmental advantage over non-wood products by being a renewable resource with wide material applications. Wood products are sourced from sustainably managed forests, store carbon and play a significant role in combating climate change. Engineered products provide these essential benefits with the added advantage of better waste utilization and fiber recovery.

Smaller, more sustainable and quicker growing trees can be used, so there is less reliance on first growth forests. Furthermore, engineered WRC can be manufactured in closed loop plants with little or no waste; all fiber is used for the fin-

ished product or as energy.

All in all, emerging wood products like engineered WRC have a strong future in meeting consumer needs, playing a major role in climate change mitigation, as well as addressing future supply and price fluctuations in the softwood market. BP

Brad Kirkbride is managing director of the Western Red Cedar Lumber Association. Established in 1954, the WRCLA is the voice of the cedar industry and has members in 132 locations throughout North America (www.realcedar.com).

THE SOUTHERN Cypress Manufacturers Association recently unveiled a new logo—debuting a revitalized and easily identifiable brand mark for cypress products. Coinciding with the fresh look, the SCMA also will launch a completely renovated website at CypressInfo.org, which will serve as a hub of inspiration and information for consumers and design professionals who are looking to learn more about cypress. And that’s why it also will serve as a valuable tool for lumber dealers who are looking to sell more of this beautiful, durable, and versatile species to end users.

“Times have changed,” says Cassie Lewis of Turn Bull Lumber Co., Elizabethtown, N.C., and current SCMA president. “And it was time to give the SCMA a modern look with a new logo that can easily be resized and used in a variety ways, including on social media, as well as in digital and print communications. The new logo features a familiar design element in a towering cypress tree, as well as some not-so-obvious ‘cypress knees’ at the foot of some letters, which is a nod to a bald cypress tree’s buttress or flared trunk base.

“And speaking of time, it’s been a decade or more since the SCMA last updated its website. A lot has changed since then, especially with the technology and devices we use to browse the internet. It was important to us to have a website that has a clean, eye-catching design that adapts to different screen sizes, and that is a resource that consumers and professionals find valuable and want to spend time on.”

The revamped CypressInfo.org will feature an improved user experience with fluid navigation to assist information seekers in finding information quickly.

A new Inspiration Center will target homeowners with trendy content on a variety of home design, furniture,

and décor topics; vibrant photography of indoor and outdoor applications; case studies featuring project architect and designer interviews; and DIY projects with video tutorials and articles for weekend doers and hobbyists.

The redesigned website also provides a Specification and Technical Data tab with a wealth of information for architects, designers, and builders. The section provides details on grade rules, drying guidelines, engineering design values, span tables, and working properties that design and building pros utilize every day.

There’s also an Installation and Finishing tab featuring siding and decking installation guidelines with handy tips and tricks. There, visitors also will find finishing information with best practices for sealing, staining, and painting cypress.

businesses, marketing collateral, a monthly member newsletter, and

ing products and browse the valuable resources and materials available to lumber dealers, visit CypressInfo.org. And be sure to follow the SCMA on Instagram at @cypress_info. BP

THIS YEAR marks my 50-year anniversary in the forest products industry, as well as my 40th year working in the redwood forests on the Central Coast of California. These pending milestones have caused me to reflect on my industry and my observations during this time.

One thing that stands out is how disconnected most of our population has become regarding the countless products we use. This includes how they are produced, where they come from, and what are the implications to the environment—and the planet, for that matter. This disconnectedness is not a harsh criticism. It is more a recognition of countless recent changes in society. Two hundred years ago approximately 85% of the population of the United States was procuring at least some of their own products necessary for survival. They grew gardens, had farm animals, had their own wells or water systems and cut trees for fuel and lumber.

Today, agricultural technology has advanced to the point where a small percentage of the population can produce these essential commodities for a vastly larger population. This has freed people and industries to expand in other areas. Jobs became available in large population centers, which went hand in hand with the technological/industrial revolution. Disconnectedness was a predictable outcome given this transformation.

In my career I’ve had numerous

conversations with people who are passionate about the issue of cutting trees. Some of these conversations have been congenial. Some not so much. The level of passion has been particularly elevated here on the Central Coast where the primary merchantable timber is coastal redwood. What are the most honest and factual things I can say in such discussions?

First, I try to explain our involvement as consumers. In 2007 the California Forest Products Commission calculated that the annual per capita consumption of forest products was 720 bd. ft. That is, a tree 24” in diameter at the base and 100 ft. tall. California has about 40 million residents. Imagine a stack of 40 million trees that size. That is what Californians consume in a year. They will consume the same amount next year and each year after that. As recently as 1980, California was self-sufficient in forest products. Today, 80% of the forest products Californians use comes from other states and countries. The disparity is not because California has run out of trees.

There are multiple factors. The cost of business is high in California. This includes complying with the California Forest Practice Rules, which are more stringent than other areas. California’s forest products infrastructure has declined. This contributes to products being imported. This should concern people who don’t want trees cut in their area. There are significant

environmental consequences associated with transporting products from distant lands. Not only does that transport produce significant greenhouse gas emissions, as Californians we usually have little or no say in how that logging is conducted.

Lastly, I try to explain that wood is one of the truly renewable and sustainable products we consume. Here on the Central Coast our local forests are annually producing forest mass four times faster than it is harvested. Recent wildfires have altered the equation, but the system will restore itself very quickly.

After my first two years falling timber on the Central Coast (198384), I meticulously kept track of every tree I cut. After two years, I calculated my average tree size was 720 bd. ft. Today, harvesting trees in the same area (and on many of the same acres) the average per-tree volume coming into our sawmill is over 1,300 bd. ft. From my perspective, this is a testament to our selective harvesting practices and proof that both wood and forests are truly sustainable. BP

Crumpler Plastic Pipe, Inc. is honored to be recognized as the Building Material Suppliers Association’s

In recognition of our commitment to BMSA members, our industry, and our community

WE NEED TO BE comfortable asking for things. So many sellers are not. Why?

Fear of Being Too Pushy. The number one fear of salespeople is the fear of being too pushy. This leads many to bend over so far backwards not to be pushy that they don’t ask for anything, or they ask in such an oblique way, it is not clear what they are asking for.

Fear of Rejection. We didn’t like “no” at 2, we didn’t like getting rejected at 17, and we continue not to like it as adults.

Parental/Societal Training. Many of us are taught not to ask for things all the time. We came from humble beginnings. We didn’t have a lot of money for extras. That didn’t stop me and my siblings from wanting those extras. “Gimme, Gimme, Gimme, that’s all you say, quit asking me for things all the time!” said my harried mother. This training is difficult to shake.

Sales is a transfer of emotion. Sellers that struggle transfer their uneasiness with the sales process to their potential customers and wonder why it seems like everyone they contact is in a hurry to end the meeting or the phone call.

Master Sellers, on the other hand, are comfortable. They know they bring value and transfer this comfortableness to their customers. “Talk to them like a brother,” Terry Lane told me in 1983 in our first and only 10-minute sales training before he threw me on the phone.

And when we listen to Master Sellers that’s exactly how they talk to their customers; they talk in a comfortable, easy and normal way that puts the customer at ease.

We need to ask specifically for the buyer’s name. Many sellers ask this way: “I was wondering if I could speak to the person who does the lumber buying.”

There are a couple of problems with this. Number one, unless the buyer answers saying, “Hello, this is Susan,” we can’t greet them by name. Number two, often sellers will launch into information gathering and then awkwardly have to ask for the buyer’s name at the end of the call. Number three, when we call back we can’t ask for them by name— essentially starting at ground zero.

The biggest mistake in prospecting is the failure to qualify on volume. If we fail to qualify customers on the volume they use, we will wake up six months from now with half of our account box being too small. It happened to me as a it happens to many sellers.

One of my sharpest students said, “When they dodge your question put a smile on your face and ask again in a different way.” She is correct. Example:

Us: “Bob, how much of that are you using on a monthly basis?”

Bob: “Oh, we go through a fair amount.”

Us: “Bob, I know you don’t know exactly, but ballpark how much do you use?”

Bob: “Well, it really depends on how many orders we are getting.”

Us: “OK, more or less than five truck loads?”

Bob: “Oh no, we use about 10 trucks a month.”

The wrong way:

“I’ve got a truck of 2x4 16’s I can get into you at $650/MBF, whaddya think?”

“I’ve got a truck of 2x4 16’s I can get into you at $650/MBF”… then silence waiting for the customer to buy…

The problem with both of these approaches is they work. They just don’t work as well as asking simply for the order. Master Sellers ask for the order in a relaxed and natural way. Their tone is naively, assumptively positive; it sounds like they know the customer will say yes.

Master Seller: “John, I’ve got three trucks of 2x4 #2 16’s. We are within 10% of a five-year low on 16’s, you love this stock, and the market is moving on 16’s, how many of these can you use?”

Nothing tricky or fancy; just asking like you asking your college roommate to go to a party with you.

We need to be comfortable asking. I don’t often quote the Bible, but I think Matthew 7:7 says it best: “Ask and you shall receive.”

James Olsen is principal of Reality Sales

Or. Call him at (503) 544-3572 or email james@ realitysalestraining.com.

FROM RETURN-TO-OFFICE, which was Glassdoor’s Word of the Year, to quiet quitting, 2022 introduced us to several new labor market concepts. It’s still too early to predict what terms will define our workplaces in 2023, but here are a few labor market trends to look for in the year ahead.

#1 – Where Are Your Employees? – Way back in 2019, that would have seemed a really dumb question. Now? Well, it’s complicated.

The number of employees working remotely on a full-time or part-time basis continues to increase. A recent McKinsey American Opportunity Survey reported that 58% of survey respondents work remotely at least

Q. Two of my employees are in a known romantic relationship. Should I acknowledge their relationship?

A. Finding love at work is a pretty common phenomenon. Despite the prevalence of consensual relationships at work, there are things you should consider including having employees read and sign a Consensual Relationship Policy. This policy could include that:

• the relationship is truly consensual.

• all parties to the relationship are aware of the company’s code of ethics, sexual harassment, and non-discrimination policies.

• all parties will conform to the company’s code of conduct policy and will maintain a strict professional demeanor while at work or at work functions.

• employees in a supervisor/subordinate relationship will be reassigned so that no formal line of authority exists within the relationship.

• the repercussions of not complying with the Consensual Relationship Policy includes discipline up to and including termination, and that the burden of adherence to the policy falls largely and squarely on the highest-ranking employee in the relationship.

part-time. 38% of respondents to the same survey work remotely full-time. That’s a really high percentage, especially considering that some industries with large numbers of employees (e.g., hospitality, construction) often can’t offer much opportunity for remote work.

One thing several workplace trends surveys have in common is that the need for flexibility is, and will continue to be, high on the list of what employees want. Flexibility doesn’t just mean the opportunity to work from home, but also includes four-day work weeks, split schedules (e.g., work in the morning, take time off to pick up kids from school, go back to work either in the office or from home), and other opportunities that allow employees more control over their schedules.

The location of employees is also linked to pay differences. Historically, it has been common for organizations to pay employees based on the employee’s location. A recent survey by the Economic Research Institute reported that 70% of responding employers use some type of pay differential by location. If you’re hiring remote workers, you will need some type of market data for the location of candidates in order to set a fair, competitive compensation level. There are also some remote workers who really don’t have a “home.” They might spend winters skiing in the west, a few months at the beach, and maybe a few months out of the US. Determining fair, competitive compensation levels for these employees will be a significant challenge for employers.

#2 – Workplace Surveillance – This is new to our “Issues and Trends” list, but it’s probably going to be on the list for quite a while. The rise in remote and hybrid work has resulted in a significant increase in workplace surveillance activities by employers. A recent survey conducted by Digital.com reported that 60% of employers with remote workers use some type of monitoring software to track employee activity and another 17% are considering it.

Sales of employee monitoring software have grown exponentially since 2020, and the market for this type of software is now valued at $1.1 billion.

Employee surveillance is a large component of what Microsoft’s Satya Nadella has termed “Productivity Paranoia.” Simply put, Productivity Paranoia refers to management uncertainty that employees are working as effectively as they can when they can’t physically see them.

Lawmakers and regulators are already considering actions to protect the privacy rights of employees. The Massachusetts State Legislature recently introduced a bill aimed at protecting employees from “non-consensual capture of information or communications within an individual’s home.” At the federal level, the Worker Privacy Act, originally drafted in 2020 and designed to require employers to report what types of employee data they collect and why, hasn’t gained much support for passage but may gain increased momentum as this issue becomes more important to both employers and employees.

#3 – Impact of Dobbs v. Jackson on Employers and the Workforce –It has now been eight months since the Supreme Court issued the decision that overturned Roe v. Wade. Few of the questions raised by this decision have been answered—and many more have arisen.

The decision returned the power to regulate abortion to individual states. More than a dozen states had “trigger bans” in place that would take effect if Roe v. Wade was overturned. Some of this legislation has been blocked at least temporarily by litigation, but eight states have now implemented total or near-total abortion bans.

Abortion is now classified as a crime in Texas and Oklahoma. This means that abortion providers may be charged with a crime, as can the woman receiving the abortion. This raises an important issue for employers—how can policies and benefits be put in place that support employees who may seek an abortion, but are unable to do so because of laws in the state where they live or work?

What employers need to do:

• Develop and implement compensation and related policies and practices that support a hybrid workforce and recognize the need for wage differences in different geographic areas.

• Develop and provide clear, consistent communications surrounding the use of employee surveillance. Keep abreast of state and federal legislation—this is largely an unregulated area that will come under increased legal and legislative scrutiny.

• Consider what short- and longterm actions you may need to take to attract and retain women in your workforce.

VERY SOON we’ll be confronting the next wave of change as our companies and our jobs lurch back to something resembling pre-covid normal. The question in the back of every executive’s mind is this: How do we handle the post-COVID changes?

Specifically, we’ll have to accommodate things like employees who have been working from home, customers who wouldn’t see salespeople, and a whole raft of other issues. While there will be as many adjustments as there are people, before we start reacting to what everyone else wants to do, it may be appropriate to spend a little bit of time conceptualizing what we want to have happen.

Every change is an opportunity to create a more positive, larger change. For example, I have often been involved in refining a sales force’s compensation plan. Every time we refine a sales compensation plan, it brings with it an opportunity to restructure the way sales territories are defined, or maybe the way tasks are split between outside and inside sales, or some larger and more impactful issue. So, the smaller change—sales compensation—opens the door to a larger, more systematic change.

That smaller change works sort of like a pry-bar when you are removing moulding. Once you’ve used it to open a small gap in the structure, that gap can be lengthened to encompass the whole piece. So, a smaller change in the structure of an organization often opens up the spec-

ter of a larger, more strategic and impactful change. It’s easier to make a big change in the middle of the implementation of a smaller change.

Most people want confident leaders, and confident leaders point the way to a different and better situation in the future. And, typically, it is the leader’s job to describe that situation and point others to it. In other words, leaders create the vision of a better future, and lead people to it. Leaders don’t react, they proact.

Let’s apply these two thoughts to the post-COVID adjustments: Now is the time to proactively define the structure and culture you want, and help your people adjust to the new reality. Rather than reacting to every employee, customer and vendor’s wishes, first create the structure you want, and nudge people toward it.

For example, you may say that in the post-COVID world, you want everyone to work in the office, together, at least two days a week. When some of those employees who have been working at home indicate they want to continue working from home, you describe your structure, explain your rationale, and have them adjust to it.

Or you may want your field salespeople to spend a day or two a week making remote sales calls via Zoom or other video technology. So, set up the system, put in place the tools to measure that, and let your salespeople know of your new expectations. Change the structure to meet your view of what the world will demand.

What you will have done is this: You will have used this small change to create a bigger, more impactful change. You will have described the world as you want it and nudged your people into it. Instead of reacting to every individual’s whims, you will have defined the future, and then led them to embrace that.

Leaders lead, and now is the time to lead. Take time to conceptualize the structure, routines and habits you want to incorporate into your business, describe them specifically, develop the rationale for them, then prod your people into them. When people start emerging from the COVID fog, be ready with a structure and culture for them to engage.

Rahm Emanuel, when serving as Obama’s chief of staff, was famously quoted as saying: “Never let a crisis go to waste.” While his content was politics, the principle applies in many circumstances—one of which is business management.

Use this opportunity to build the structure that will serve you well in the post-COVID world.

Deborah and Tracy Everson have agreed to sell Everson’s Hardware in Waconia, Mn., to Central Network Retail Group.

CNRG, a multi-format, multibrand retailer, currently operates 143 hardware stores, home centers and lumberyards in 16 states. Everson’s will be rebranded and operate as part of its Frattallone’s Hardware & Garden brand. Frattallone’s operates 22 stores throughout the Twin Cities and surrounding areas.

“After 56 years in business, we are excited to pass the store on to an organization with local leadership and long-standing ties to the local market. Frattallone’s is a strong brand with an excellent reputation. They are able to provide products, services, and high-quality customer service for Waconia both now and into the future,” Everson

said. “We are excited for their vision and look forward to seeing the store grow.”

The new store in Waconia will offer a full assortment of hardware, plumbing, electrical, outdoor power equipment sales & service, grilling, and paint as well as an expanded garden center.

Cole Lumber Co., Paducah, Ky., has purchased its eighth location and first outside of Kentucky—50year-old Portland Builders Supply, Portland, Tn.

Longtime employee Aaron Whitten will take over as manager of the Portland location for former owner Bruce Reid. The name will change to Cole and it will cut back its hardware inventories, while increasing its stock of lumber, doors and windows.

Linke Lumber, Filer City, Mi., has closed and liquidated after 95 years with the retirement of owners Sara and Rick Linke.

Lumberyard Plus True Value, Glidden, Wi., saw a portion of its roof collapse under heavy snow Jan. 16.

Drexel Building Supply will build a 200,000-sq. ft. facility in Kewaskum, Wi.

Westlake Ace Hardware will open a 20,000-sq. ft. store in Charlotte, N.C., in spring 2024.

Rocky’s Ace Hardware opened a new 19,000-sq. ft store in Centerville, Oh., on Feb. 17.

Aubuchon’s Saranac Lake, N.Y., location was leveled by a Jan. 25 fire.

Wahr Hardware, Manistee, Mi., closed after 108 years, after owner Don Wahr was forced to retire due to health concerns.

J&L Hardware moved to a bigger 21,000-sq. ft. facility in Ely, Mn., and rebranded as KJ’s True Value.

Ace Hardware, Brockway, Pa., has been opened by brothers Kevin and Mark Salandra.

O’Hara True Value Hardware, Ottumwa, Ia., is closing after 83 years with the retirement of owner Mike O’Hara.

Mid-Cape Home Centers now carries Tando Beach House Shake at its six Massachusetts locations.

Due to delays in permitting, Huber Engineered Woods has scrapped plans to build a new OSB facility in Cohasset, Mn., as previously announced in June 2021.

Huber intends to follow through in expanding its production capacity for ZIP System and AdvanTech panels, but will find a new state in which to build its sixth facility.

SRS Distribution has acquired Ohio/Kentucky distributor Marsh Building Products, Fort Thomas, Ky. Marsh was founded in 1989 by brothers Ken & Mike Middleton and is run today by Patrick McNickle, who will continue to lead the team under the Marsh banner. The company operates eight facilities across Ohio and Kentucky and currently employs a team of 130.

Owners Ken and Mike Middleton said the sale “was a carefully considered and purposeful decision to protect our most important asset—our people—and ensure they were being entrusted to an organization that shares the same values as we do.”

Nation’s Best, Dallas, Tx., added East Texas Hardware, Kilgore, Tx., to its expanding family of businesses.

“This represents our second location in Kilgore and, with a number of Nation’s Best-owned stores already in Texas, the addition of East Texas Hardware strengthens our strategic foothold in the Kilgore area and the state,” said Matt Lambert, regional VP of Nation’s Best’s South-Central Region. “Owners Jimi and Tamara Mankins have built a formidable business, with nearly two decades of experience serving the community. We are excited by the opportunities to leverage their know-how and grow the business even more.”

When the Mankins were looking to transition their business, they found Nation’s Best was well-aligned to not only honor their legacy but equally well-positioned to invest in the store for continued growth. “We’ve put our heart and soul into serving our friends and neighbors since 2005. Knowing that Nation’s Best would secure the future of East Texas Hardware and its staff was

very important to us,” the Mankins shared. “Years ago, Jimi used to work at nearby East Texas Lumber, another Nation’s Best-owned business, so we feel things are coming full circle.”

East Texas Hardware joins Advanced Windows Systems, East Texas Lumber, Gilmer Lumber, Groom & Sons’, Hometown Building Centers, and Simms Lumber, as Nation’s Best extends its presence in the state.

Per Nation’s Best’s strategy, East Texas Hardware will maintain operations under its existing name with its key leadership team overseeing operations alongside Nation’s Best, which will provide the strategic and financial support necessary to drive optimal growth and profitability.

Carter Lumber will invest $8.1 million to rebuild and expand its Bowling Green, Ky., facility damaged by a December 2021 tornado.

The expansion will provide an improved layout and more room to increase truss and wall panel production and engineered wood product distribution. The new facility should be completed by the end of the year.

Pleasants Hardware is adding its third location in three years—a 10,000-sq. ft. store in Powhatan, Va.

Opening this spring, the new location—Pleasants’ 10th—will have an expanded outdoor area for lawn & garden and nursery products, and will carry a wide product selection of top brands, including Scotts, Big Green Egg, Traeger, STIHL, Benjamin Moore, and Channellock.

MaterialsXchange has launched its new e-commerce platform.

The updated marketplace, at materialsxchange.com, offers a streamlined ordering process where suppliers can list products either as an “ask” or a “bid,” and buyers can receive alerts or order products directly. The technology, powered by Mickey, is designed to make the process for buying or selling wholesale and large-order LBM easier and more efficient—with real-time order tracking and pricing transparency.

ABC Supply opened a branch in Lawton, Ok., managed by Josh Wilson.

Cameron Ashley Building Products opened a new distribution center in Covington, La.—its third in the state.

Holden Humphrey Co., Chicopee, Ma., now distributes a full range of Kebony modified wood products in New England, New York, and northern New Jersey.

Boise Cascade is adding James Hardie fiber cement products at its distribution centers in Houston and Dallas, Tx.; Milton, Fl.; and Delanco, N.J. Boise Cascade currently stocks Hardie in 31 of its DC’s.

Hardie products will continue to be distributed throughout Texas by Dixie Plywood & Lumber from Dallas, Houston and San Antonio.

Wolf Home Products, York, Pa., is now distributing Benjamin Obdyke roof and wall systems to Connecticut, New York, New Jersey, Pennsylvania, Delaware, Maryland, Virginia, North Carolina, Ohio and Kentucky.

Badger, La Crosse, Wi., is now stocking Sylvanix Elements composite decking and Westlake Royal’s Zuri Premium Decking.

Minnesota Vinyl & Aluminum, Shakopee, Mn., is now distributing Vista Railing Systems cable railing in Minnesota.

Holcim agreed to purchase Duro-Last Roofing, Saginaw, Mi., for $540 million.

Genesis Products, Goshen, In., agreed to purchase TFL producer Funder America, Mocksville, N.C.

CertainTeed will build a new roofing manufacturing/distribution facility in Bryan, Tx.

Applegate • Greenfiber, Charlotte, N.C., is rebranding as simply Greenfiber.

Palmer-Donavin, Columbus, Oh., named Holmes Manufacturing, Millersburg, Oh., its Manufacturer Partner of the Year for 2022 and CertainTeed’s Mark McNabb Manufacturer Representative of the Year.

RoyOMartin sincerely thanks our customers, distributors and industry colleagues who have joined us on this journey for the last 100 years.

Since our humble beginnings when our founder Roy Otis Martin purchased the Creston Lumber Mill in Alexandria, Louisiana, (for a whopping $32,000), we have lived our mission to provide the highest quality wood products on building projects across the country. We’ve done it ethically and sustainably, and look forward to continuing our service into the next century.

Colin McCown, American Wood Protection Association executive VP, will retire at the end of the year. The executive committee is exploring all options for future management of AWPA and to ensure a smooth transition.

Randy Hanscom has been named president and general mgr. of Brand Vaughan Lumber Co., Tucker, Ga.

Niel Crowson has retired as chairman of the board for E.C. Barton & Co., Jonesboro, Ar. He will remain a director for 2023, to serve as an advisor to the board and newly appointed chairman, Mark Biggers, who succeeded Crowson as president in 2020.

Jason Pranghofer was promoted to VP of Siwek Lumber, Jordan, Mn. Samantha Siwek is now secretary and treasurer. They both join Dave Siwek in the ownership group.

Ben Richter, sales mgr., Beisser Lumber Co., Grimes, Ia., has been appointed vice president.

Mike Boretski, ex-Oldcastle, has been named general mgr. of BlueLinx, Tampa/Lakeland, Fl. Curt Parker has been promoted to GM in Memphis, Tn.

Mike Olosky, president and CEO, Simpson Strong-Tie, Pleasanton, Ca., has been appointed to Simpson Manufacturing Co.’s executive leadership team as CEO.

Dan Lindahl, ex-Newell Brands, is now director of sales, national builders for HB&G Building Products, San Antonio, Tx.

Nolan Moore, ex-Michigan Lumber, has joined Northville Lumber Co., Northville, Mi., as purchasing mgr.

Chris Voiss, ex-A&B Wood Design, is new to sales and business development at Garden State Lumber Products, Oakland, N.J.

Dean Valentine has been named production sales mgr. at Builders FirstSource, Wichita, Ks.

Sharon Clevenger has retired after 45 years in the industry, the last 12 as hardwood product mgr. with U.S. Lumber, Corry, Pa.

Toby Bostwick, ex-Fortress Building Products, has been named CEO of Ideal Aluminum Products, St. Augustine, Fl. He succeeds Michael Siegel and Doug Brady, who will remain on the board.

Mark Ballok joined the outside sales force at 84 Lumber, Columbia Station, Oh.

Allen Davidson, president, ADD Associates, Natick, Ma., has joined Sightline Commercial Solutions, Minneapolis, Mn., as Northeast regional sales representative.

Rick Johnson has been named the first-ever chief digital officer for Marvin, Warroad, Mn.

Lee Rathbun has been appointed yard mgr./general mgr. for Contract Lumber, Houston, Tx.

Rodney Miller, ex-Custom Window Systems, has been appointed CEO of Fi-Foil Co., Auburndale Fl.

Laura Byrne-Harris has been promoted to VP of merchandising & marketing for Westlake Ace Hardware, Lenexa, Ks. Jennifer Schadegg is now director of merchandising.

Nick Curnalia has joined the contractor sales team at Curtis Lumber Co., Norwich, N.Y.

Allison Flatjord was promoted to VP of e-commerce for Do it Best, Fort Wayne, In. She replaces Nick Talarico, who was promoted to executive VP of sales & marketing. Tracey Mazock is now managed marketing specialist. New are: Steve Tonelli, LBM business development mgr.; Cody Brigham, e-commerce store operations specialist; and Brigitte Ford, consumer marketing specialist.

Matthew Meenan is new to sales at Arnold Lumber Co., Wakefield, R.I.

Dylan Torbush is now assistant branch mgr. for Beacon, Indianapolis, In.

Charles Foster is now in sales with Stately Doors & Windows, Nashville, Tn.

Dave Johnson has been appointed Northeast region business mgr. for L&W Supply, Chicago, Il.

John T. Lucas has been appointed senior VP, chief HR officer for Stanley Black & Decker, New Britain, Ct.

Andy Arnsman has been promoted to director of sales-pro channel with ODL, Inc., Zeeland, Mi.

Christopher Woolley has joined GreatStar Tools USA, as VP industrial design & new product development, based out of subsidiary Arrow Fastener, Saddle Brook, N.J.

Laura Kohler was appointed chief sustainability & diversity, equity & inclusion officer for Kohler Co., Kohler, Wi.

Doug Audette has resigned as president and CEO of United Hardware Distributing Co., Maple Grove, Mn. Chad Grove takes over as interim president and CEO.

Chris Hegeman, mgr., Bliffert Lumber & Hardware, Milwaukee, Wi., accepted a two-year term as chairman of the board of the Wisconsin Retail Lumber Association, replacing Jake Buswell, operations mgr., All American Do It Center, Tomah, Wi.

James Tobin, National Association of Home Builders, will be a featured speaker at National Lumber & Buildng Material Dealers Association’s spring meeting & legislative conference March 28-30 in Washington, D.C.

SIMPSON STRONG-TIE was recognized by the Building Talent Foundation as a 2022 Industry Champion during the recent International Builders Show for its commitment, contribution and collaboration

building a sustainable workforce

Brian McPheely, Pratt Industries, Conyers, Ga., was elected chair of the American Forest & Paper Association, succeeding Christian Fischer, Georgia-Pacific, Atlanta, Ga. Howard Coker, Sonoco Products Co., is now 1st vice chair, and David Sewell, WestRock Co., 2nd vice chair.

Lois Price has instituted new cost-cutting measures at Mungus-Fungus Forest Products, Climax, Nv., according to co-owners Hugh Mungus and Freddy Fungus.

It takes a whole lot to earn the right to wear the Yella Tag. Backed by fifty years of proven knowledge and quality, YellaWood Protector® products are specifically formulated by the makers of YellaWood® pressure treated pine. YellaWood Protector® products provide long-lasting, rich color and the superior protection savvy homeowners demand. All with a limited warranty against chipping, peeling, water damage, mold, mildew and color fade. Since there are no long drying times or even in-store mixing or tinting required, you’ll love how easy it is to use.

yellawood.com/protectoryellawood.com/protector

------------ BY JEFF EASTERLING

------------ BY JEFF EASTERLING

Who are you, and what do you/your company do?

My name is Kim Merritt, and I am the director of the SPIB (Southern Pine Inspection Bureau) Treated Division and its Western Division, Western Wood Services (WWS). Our Treated Wood Quality Audit Programs provide third-party inspection services to help treated wood producers meet industry-approved standards. I also manage the SPIB Chemical Laboratory, which supports the wood products industry through our quality control analytical services, participating in standardization activities, training in good laboratory practices, and performing research and product evaluation testing.

The SPIB has a long history of over 100 years. In 1915, the Southern Pine Association was formed to provide a common set of grading standards for the Southern Pine lumber industry. Eventually, the SPA was divided into two organizations: the Southern Forest Products Association and the Southern Pine Inspection Bureau. Since 1941, the SPIB, a not-for-profit organization, has provided grade-marking inspection services and maintained the grading rules for the southern pine lumber industry.

What is the No. 1 challenge you see in the lumber industry today?

CHANGE. No one likes to change. Well, like it or not, our industry is changing. Preservative systems are evolving, plant laboratories are now required to perform more complex testing, and we should always be committed to improving our product evaluation.

Our industry is old, and our greatest challenge in quality control is to break the paradigm of doing things the same way because that is “how we’ve always done it!”

What’s the No. 1 thing retailers need to know about treated wood?

At the risk of sounding like the Saturday morning cartoon School House Rock, “Knowledge is Power!”

Treated wood must be used in the proper application. I encourage retailers, as they have the closest contact with the consumer, to be informed and committed to empow-

ering the users of our products with the knowledge they need to use the right treated wood in the proper application.

Any tips for retailers selling treated wood?

A wealth of information and educational resources are available to building material dealers and retailers, code officials, specifiers, homeowners, and all users of treated wood!

The American Wood Protection Association (www.awpa.com) has an entire section of its website dedicated to providing technical and educational materials regarding treated wood standards and the proper use of treated wood. These materials include a residential infographic that helps consumers understand treated wood labels and select the right preserved wood for their specific project.

Many other industry support organizations are dedicated to educating the public, such as SFPA (www. southernpine.com), Western Wood Preservers Institute (preservedwood.org), third-party inspection agencies, chemical manufacturers as well as the producers of treated wood. Here’s where I get on my soapbox and encourage everyone to take advantage of these organizations and use their support to inform and guide consumers—it will set up treated wood producers, distributors, and users for continued success and sustainability!

What trends in lumber/pine industry are you seeing?

It is an exciting time for me! From my perspective, I see a tremendous movement towards approaching quality control as a team. I’m incredibly proud of the partnerships between SPIB and our subscribers. SPIB subscribers are passionate about producing quality products and value the information SPIB provides to achieve their quality vision. This aspect of my job is what I enjoy the most.

The training, the sharing of data with our innovative web-based tools (Data Connection), and working together with our customers to ensure that, with hard work and dedication, the SPIB mark is and will always will be a symbol of quality! BP

– For more information on the SPIB, please visit spib.org.

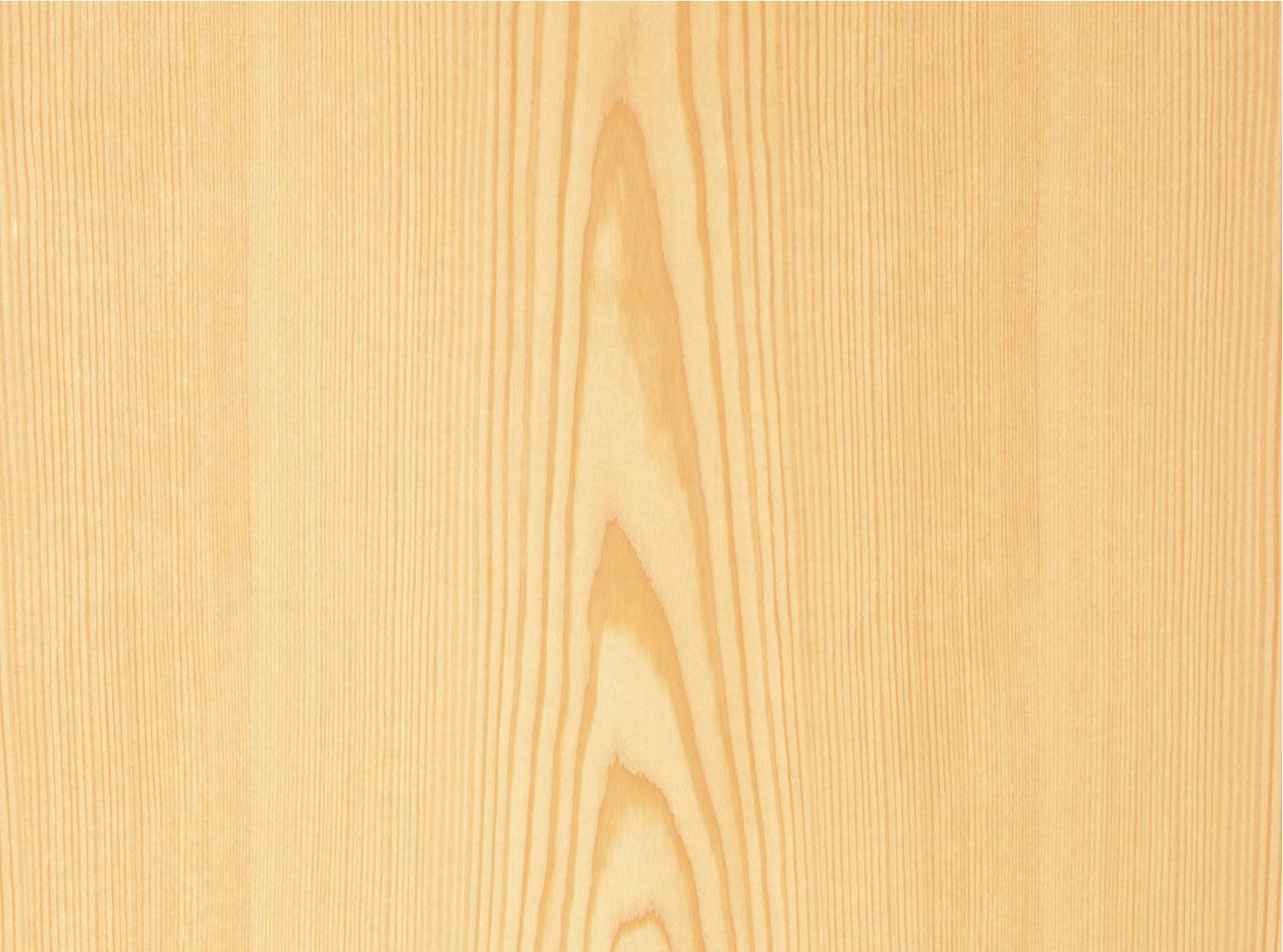

Read grade rules, span details, and get new promotional ideas for your business.

Sample the variety and versatility of eastern white pine.

Reach more customers by getting listed on NELMA’s Retailer Directory.

Listen to and watch product installation and comparison videos, plus grade representations.

Plastic, concrete or pine? Learn why consumers prefer natural over fabricated.

Use all your senses. Visit nelma.org for all things eastern white pine, spruce-pine-fir and other softwood species grown in the Northeast and Great Lakes region.

Ever wonder what the difference between SPF and SPFs stamped lumber is? Scan here to see. Simply open the camera on your smartphone or tablet, and hold it over this image.

@NortheasternLumberMfg

@WoodInspiration

@wood_inspiration1933

IT’S EASY TO get caught up in the everyday aspects of selling wood. As a retailer, especially when the housing and remodeling industry is doing well, it can be a challenge to keep everything together day by day, much less think and plan ahead for the future. So what to do when a customer has a question or needs a more specific answer than you’re prepared to give?

There are options. Perhaps your lumberyard likes to use the traditional point-of-sale take-home brochure or a handy fact sheet available on the counter. Maybe it’s become habit to turn to someone who has been with the company for a really, really long time? All of these work, and all are valid information sources, but we’d like to share a few that are a big more digital, a bit more modern. If you haven’t grabbed your cell phone, opened the camera app, and checked out the front cover of this issue, now is the time!

As the primary marketing and educational association for the wood industry from New England over to the Great Lakes, the Northeastern Lumber Manufacturers Association (NELMA) is the expert. Not just in all things eastern white pine and Spruce Pine Fir – South, but in wood in general. Headquartered in Maine, the association is the definitive resource on how to sell geographically relevant wood (think eastern white pine, SPFs, red pine, etc.). With a wealth of information and educational tools available in all formats—online, digital and print— NELMA should be a lumber dealer’s one-stop shop for all things wood.

Letting this magazine’s front cover lead the way, let’s dig deeper and explore the free wood education resources NELMA has to offer lumber dealers, all of which are available at NELMA.org.

Showcasing the important variations of characteristics permitted within each of the five grades of eastern

For each grade, the viewer will see a layer of six boards roll down the screen, pausing for callouts to explain wood characteristics intrinsic to each grade. It’s the perfect representation of what customers should expect within a specific grade purchase.

Need to sell some SPFs lumber and your customer wants to see it with their own eyes? You could walk out into the yard and pull a few pieces; you might also pull out a brochure or show a few photos from your phone. But do these options truly represent the depth and breadth visually of SPFs lumber? No, they do not.

Now there’s a cool new way of looking at SPFs lumber from NELMA: A Video Guide to Four Grades of SPFs. It’s lumber as you’ve never seen it before!

“The SPFs video, developed as a companion piece to the existing eastern white pine grades video, means that NELMA now offers a full visual catalog of a majority of lumber manufactured by our members,” said Jeff Easterling, president of NELMA. “This completes the

informational package. We’ve visually represented most of the grades and species of lumber produced by our members in an easy-to-understand and easy-to-consume format—and it’s the perfect tool for selling domestically and internationally.”

The nine-minute video offers a video representation of SPFs 2x4 lumber, with full explanations of what customers can expect within each grade. Rather than one or two examples of what the lumber should look like, the video offers real-life representations within the major grades of SPFs.

Presented from a bird’s-eye lumber grader’s view, the video shows real pieces of finished lumber coming down a conveyor belt. As each board slowly passes by on screen, digital callouts indicate what they’re seeing with each board. All defining characteristics within SPFs grading are represented visually to share the entire story. Characteristics within each grade are explained and visually shown so the informational connection can be made. The video can be stopped and replayed at will, bringing the interaction to life at the speed and level of each viewer.

First, customer product knowledge. The video mimics what can be found in layers from a unit of lumber. As it rolls by, the viewer gets a solid look at what each unit would look like when sold. After viewing the SPFs grade video, both you AND your customer will have seen and learned about all the various characteristics that make up certain grades.

Second, this level of knowledge just might reduce

Becoming a certified lumber grader can be a daunting task. The education process typically consists of voluminous amounts of information: the grade rule book, a large binder of information, classes, etc. Followed by laboring over hundreds of boards to learn the dozens of defect combinations that make a grade. Thanks to the Grader Academy, NELMA is turning this laborious process on its ear with a first-of-its-kind, multi-faceted, online educational program.

Located at NELMA.org, the NELMA Grader Academy is non-subscription, with no pay-to-use elements. Instead, users can find simple, easy-to-understand grading background information, rules, and more, available 24/7/365.

The Grader Academy program parallels the two most important softwood lumber species and species grouping in the Northeastern and Great Lakes regions: Eastern White Pine and Spruce-Pine-Fir. Courseware, designed to offer a natural learning approach, uses visual images to reinforce all elements of the grading process. Four series are available: Level 100 – Lumber Characteristics; Level 200 – Applying Characteristics to Lumber Grades; Level 300 – Grading Rule Exceptions and Applying Interpretations; and Level 400 – Advanced Learning: Making the Grade

Audience reach for the Grader Academy is endless, with future graders being the primary target. Beyond them, the information can be used to enrich knowledge bases among existing mill employees, wholesaler or dealer employees, those looking to move into lumber sales positions, and builders or other tradespeople.

callbacks. Ever had someone purchase lumber from you, only to have them attempt to return it because it “doesn’t look right” or it’s “not what they were expecting?” Teach them, show them what to expect with this video; as their understanding and knowledge rises, your callbacks will hopefully decrease.

Here’s an example: Let’s say a customer orders a unit of SPFs lumber. Not understanding lumber grading terms and variations, they order #2. When it arrives, they see knots they weren’t expecting, so they call the mill or retailer and complain about the product received. Being able to accurately represent SPFs lumber in video format provides both the answer you need and the education they need. Information that was once shared on static printed sheets is now a dynamic and educational video solution. The gap between education and marketing is bridged, resulting in happier retailers and more educated customers.

According to Easterling, “The multiple translations allow the end-user to increase their wood knowledge and better understand what products are produced by NELMA members. This video has multiple audiences across the industry: retailers can refer to it to educate their customers, and our members can direct customers from around the world to watch it and get a complete understanding of what SPFs grades are and what they look like.”

“Members have been asking for this for years, and here it is,” he concluded. “They love using the eastern white pine video as an educational tool, and this SPFs grade video will complete the knowledge cycle and ensure that customers know what to expect when their lumber delivery arrives.”

The free SPFs grade video may be found on the NELMAtv YouTube channel, right alongside the eastern white pine video mentioned above. Both the eastern white pine and the Spruce Pine Fir – South videos are available in multiple languages, including French, Chinese and Spanish, providing you with the perfect international selling tool.

Do you want PVC trim, or do you want the real stuff? Wood is environmentally friendly (ingredients: sun, soil, rain, seed), authentic (it doesn’t need to LOOK like wood because it IS wood), biodegradable, and renewable. No fossil fuels are harmed or used up in the making of eastern white pine, that’s for sure.

Have you signed up? It’s free! That’s right, it is completely free to register your business, the wood products you sell, and your full contact information on the NELMA Retail Directory. It’s an effortless way to ensure that

(Continued on page 36)

consumers and builders (and even architects) within the NELMA footprint can find you when they’re looking for where to buy lumber local to their project!

NELMA created this resource specifically for you, the retailer… so go register and let us drive consumers into the retail channel and directly to your front door!

NELMA’s Virtual Tours, launched in 2014, changed the way the industry viewed case studies. Gone were the days of copy and photos, replaced by interactive views and informational tags. Now the association has taken the next natural step by offering virtual “doors” for a new audience. “Our goal is to expose the varied uses of eastern white pine to as many of our audiences as possible,” said Easterling. “The Virtual Tour started out as a consumer effort, but quickly morphed into a way to share visuals with the dealer, residential and commercial building side as well.”

“Everyone knows beautiful eastern white pine is the perfect building product choice for residential construction,” he added. “It’s renewable—can’t get much more green than real wood—it’s beautiful, and it’s durable enough for almost any application. Showcasing high-use application like this a barn, multiple vacation homes, and a restaurant makes the point that it’s the perfect product choice for both the residential commercial environments.”

While you’re on the NELMA website learning more about our retailer tools, take a quick look around—there’s tons of information. Everything from technical info, span details, design values, and the online grade swatch to the super-cool Graders Academy—it’s all there.

“We’ve bucked the old trend of vanity websites for separate products and programs—our audiences don’t

have time for that anymore,” said Easterling. “Our members and their customers are asking for all information, all technical data in one place—so that’s what we did. Now nelma.org clearly and concisely encapsulates all interests for all NELMA audiences, from contractors, retailers and builders, to architects, students and homeowners. Everything they need is in one place in a clearer, cleaner, more accessible format.”

No matter your need, if you retail lumber, there’s something under the NELMA.org Retailers tab just for you. And please reach out to us if there’s something you’d like to see us add to help you do your job easier! BP

are Pine Passionate.

We source our wood primarily from New Hampshire and Vermont, and the majority comes from within a 50-mile radius.

Dual Weinig Powermat 2500 Moulders

Customizable Moisture Detection

Nelma grades and patterns

Specialized Dry Kilns

Enhance™ by Durgin and Crowell is our line of pre-coated, UV cured Eastern White Pine paneling product.

people, the environment, and our communities,” Martin says.

area in northwest Louisiana. Since then, holdings have grown exponentially to become one of the state’s largest private landowners.

THIS YEAR, RoyOMartin celebrates the founding of Roy O. Martin Lumber Co. Led by Indiana native Roy O. Martin, Sr., the company was borne after the entrepreneur’s purchase of an older sawmill and began without a single acre of land. Today, the name RoyOMartin represents a group of vertically integrated companies owned by the Martin family, focused on sustainable land and timber management and wood-product manufacturing businesses.

“For 100 years, the Martin family has built a business model demonstrating corporate responsibility benefiting its shareholders, stakeholders, team members, and our families,” states Roy O. Martin III, grandson of Martin Sr., who oversees the company’s operations as chairman, CEO and CFO.

In addition to being a leader in responsible forest-management practices with roughly 550,000 acres of highly-productive timberland, RoyOMartin and its subsidiaries operate three manufacturing facilities supported by nearly 1,300 employees: an OSB plant in Oakdale, La.; plywood and solid wood products plant in Chopin, La.; and an OSB plant in Corrigan, Tx., which is currently expanding by constructing a second mill at the site.

“RoyOMartin will continue producing forestry products that are essential to modern life and economic development in a way that protects

In 1923, after spending 11 years in the lumber industry in Indiana, Illinois and Tennessee, 33-year-old Roy Otis Martin Sr. wanted to go into business for himself. He wanted to buy a sawmill in an area where lumber was reasonably inexpensive. His search took him to Alexandria, La., where he’d heard about a mill for sale. He and his wife, Mildred Brown Martin, purchased the near-dilapidated Creston Sawmill for $32,000. It included the plant, office and equipment, but no land. On Nov. 10, 1923, the Roy O. Martin Lumber Co. was officially organized and incorporated, with Roy O. Martin as its president.

The company has thrived through a variety of changes and challenges in its 100 years—from sawmills and lumberyards to retail outlets, creosote treating, real estate, and wood-product manufacturing—to become a timber-and-manufacturing leader. In 1929, Martin Sr. made his first land purchase when he bought 6,500 acres in the Black Lake swamp

Through three generations, the Martin family has remained in management roles. In 1962, leadership passed to Roy O. Martin Jr. serving as president, followed by his brother, Ellis Martin, in 1978. The third generation took the helm in 1994 when Jonathan Martin (Ellis’s son) and, later, Roy O. Martin III assumed the positions of president and CEO.

Today, company leaders still abide by the same principles held by the founder: Respect, Integrity, Commitment, Honesty, Excellence and Stewardship. Those values, known by the acronym RICHES, guide everyday decisions.

With the ambitious start of his own company a century ago, Roy O. Martin, Sr. etched a deep mark in the “Great American Story” of the 20th century. His triumph was America’s success, and his legacy of family values and savvy business decisions carries on for years to come. BP

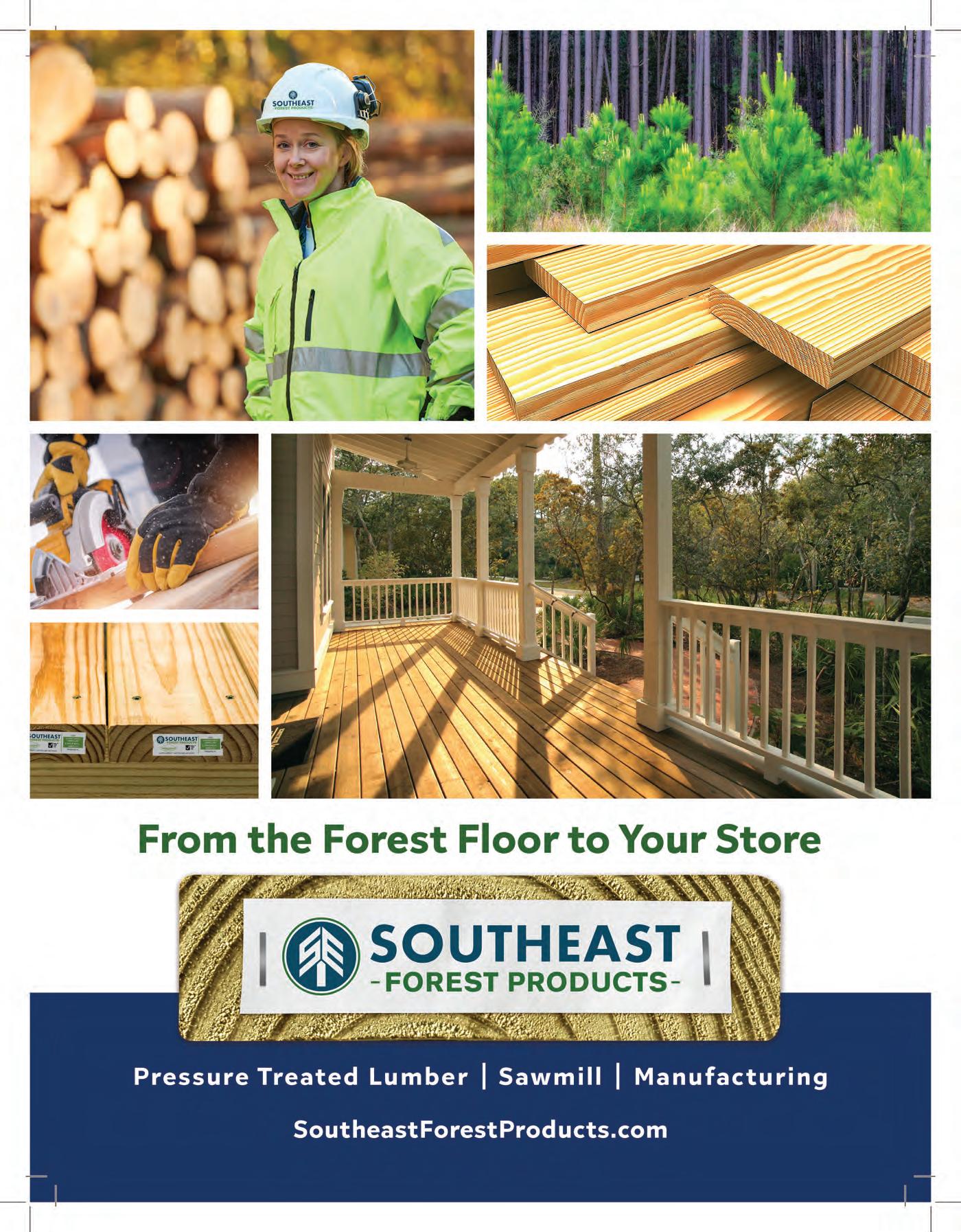

We’re quite proud of our knowledgeable staff and our “Can Do” attitude which prevails throughout our organization.

We proudly offer one of the most extensive inventories of treated lumber available to our industry.

Our primary focus is to manufacture and distribute the highest quality pressure treated wood products.

We use over 300 contract carriers to deliver your order the next day or as your needs demand.

Georgia-Pacific’s new ForceField Premium Tape is designed to seal joints and seams against air and moisture infiltration in walls and sloped roofs.

It conforms easily around curves and corners to provide excellent bonding to substrates, is AAMA 711-13 compliant for use as a flashing in rough openings, can be applied in temperatures as low as 20°F, and is compatible with many sealants.

Additionally, the tape offers a high-performance film with tear and impact resistance.

BUILDGP.COM

(866) 284-5347

Simpson Strong-Tie’s new ECB elevated column base features 2” standoff height for easy installation of waterproofing under wood posts, or lightweight concrete topping over wood surfaces when connecting column or post bases in multifamily construction.

Easily attached to wood framing foundations using Strong-Drive SDS Heavy-Duty Connector screws or anchored into concrete foundations with adhesive or mechanical anchors, the ECB provides added height allowing for the code-required 1” standoff above finish surfaces to prevent post decay.

Available in two sizes to accommodate both 6x6 and 8x8 hollow columns or solid sawn posts, the versatile ECB design allows for four-corner-hole installation in wood or single-center-hole installation in concrete, and is load rated, making it ideal for building stacked balconies on multistory, multifamily buildings that use a post to support an awning or roof.

STRONGTIE.COM/ECB

(800) 999-5099

Benjamin Obdyke has introduced HydroTape DS, an acrylic-based double-sided sealing tape for use with mechanically fastened housewrap that helps eliminate many of the issues and failure points of conventional seam tapes.

The 3/4” tape installs between the housewrap layers, adhering to the undersides of each layer where they overlap to help prevent blow-off during installation without interrupting moisture drainage or capturing bulk water. The tape’s acrylic adhesive is vapor permeable, ensuring any trapped moisture dries to the exterior. The adhesive also seals around fasteners to reduce air infiltration at penetration points.

Offered in 82-ft. rolls, HydroTape DS is split wound and has a release liner to ease application; the installer simply unwinds the tape onto the bottom housewrap layer, removes the release liner, overlaps the top housewrap layer, and applies pressure to create a strong seal.

BENJAMINOBDYKE.COM

(800) 523-5261

In direct response to a growing call for a stylish railing system that ensures ease of installation, Deckorators has introduced Aluminum Rapid Rail, featuring a contemporary design with square balusters and simple installation.

In addition to its innovative installation system, Aluminum Rapid Rail offers a quality powder-coated aluminum railing in a textured-black finish and contemporary design that complements a variety of home styles. It is available in 6-ft. and 8-ft. lengths.

DECKORATORS.COM

(800) 556-8449

The SkyFloor Modular Glass Deck System from Glass Flooring Systems, Inc. is designed specifically to be used in a deck application to allow light to shine through the deck into the space below.

The system comes with everything needed for installation and integrates easily into standard 16” on center framing. The walkable glass panels are available in two tested anti-slip texture options—the clear NanoDot and the opaque, more private LuxRaff Regular.

The systems are ICC certified and easy to install.

GLASSFLOORINGSYSTEMS.COM

(862) 701-5320

Ashlar Drystack fiber-reinforced polymer siding panels from Qora Cladding exquisitely replicate the appearance of stacked stone with narrow joints, brilliant coloring, and stunning earth tones, but with less cost and a fraction of the installation time than traditional masonry.

The panels are manufactured with Articell’s industry-first surfacing technology using a combined rigid foam core and a fiberglass-reinforced compound surfaced with genuine stone particles.

Each 48” wide x 18” tall Ashlar Drystack panel quickly installs using simple carpentry skills to create a seamless and natural appearance for residential and light commercial exterior accents.

QORACLADDING.COM

(301) 223-2266

Petersen’s new Pac-Clad HT high-temperature, self-adhering roof underlayment provides premium waterproofing protection against water and ice damming, while withstanding extreme weather conditions. Its self-adhering qualities reduce labor costs and installation times while providing increased protection compared to that of typical felt roofing underlayments. This strong, 40-mil, skid-resistant, high-tensile-strength rubberized asphalt membrane is designed to withstand temperatures up to 250°F and is available in either black or white. It will not crack, dry out or become brittle, even under the most extreme weather conditions, resulting in permanent protection and low lifecycle costs. The rubberized asphalt is laminated to an impermeable polyethylene film layer.

PAC-CLAD.COM

(800) 722-2523

Now available in select markets across the West Coast, Northeast and Mid-Atlantic, Trex Signature composite decking is crafted with the natural look of interior hardwoods but engineered to withstand the elements and demands of the outdoors.

Colors are Ocracoke, evoking the rich dark browns found on the secluded North Carolina island where nature is sheltered by sandy dunes and marshy shores, and Whidbey, featuring variated grey hues reminiscent of the misty cliffs of the island in Washington State where salt-washed fog rolls in like a morning blanket.

The line is backed by a 50-year limited residential warranty and complemented by a full range of Signature railing, including numerous design options like mesh rail, rod rail, and glass panels.

SIGNATURE.TREX.COM

(800) 289-8739

TYPAR’s new self-adhering wrap pairs the unique drainage benefits of DrainableWrap with the streamlined installation of a peel-and-stick application.

DrainableWrap Peel and Stick is available in 4’10”x 100’ rolls to cover more area than average peel-andstick wraps and can be installed in any direction without affecting performance. Additionally, it offers a wide cold temperature range and can be installed at temperatures as low as 10°F (-12°C).

TYPAR.COM

(800) 541-5519

Digger Specialties Inc.’s Westbury Riviera Series aluminum deck railing features a distinctive three rail design that enhances the curb appeal of residential and commercial properties. Backed by a lifetime limited warranty, the railing is code approved for both residential and commercial railing applications.

The line is available in 12 standard colors with the option to obtain custom colors through special order. Both smooth and textured surfaces can be selected. DSI’s proprietary 10-step powder coating process is the most stringent in the industry and ensures lasting color and surfaces.

DSI also offers matching gates for Westbury Riviera Series aluminum railing.

DIGGERSPECIALTIES.COM

(800) 446-7659

WFP Coast Timbers is the leading brand for pacific softwood appearance grade timbers. WFP Coast timbers are available in Western Red Cedar, Douglas Fir, and Hemlock and held to the highest manufacturing standard to ensure consistent quality all our customers can rely on for outdoor living, interior architecture, and industrial use.

ORGILL WELCOMED thousands of retailers to the Big Easy Feb. 9-11 for its 2023 Spring Dealer Market at the New Orleans Ernest N. Morial Convention Center. Attendees were treated to promotional buys, exciting new retail programs, world-class educational sessions, and a completely new model store that is the first of its kind.

The 18,120-sq. ft. model store was inspired by the actual Germantown Hardware store in Germantown, Tn. Located just a few short miles from Orgill’s headquarters, Germantown Hardware was an independently owned and operated store that was serviced by Orgill for decades. Nearly three years ago, the owners decided to sell the location to Orgill’s wholly-owned subsidiary Central Network Retail Group (CNRG). CNRG implemented a plan to expand, remodel and revamp the store’s offering.

To develop this plan, CNRG enlisted the help of Tyndale Advisors, Orgill’s retail consulting subsidiary. Now, Germantown Hardware serves as a living laboratory to test retail concepts and showcase best practices in areas such as assortment planning, category management and retail merchandising. The model store version of Germantown Hardware featured a 16,300-sq. ft. sales area and an 1,820-sq. ft. garden center with a layout and branding inspired by the actual remodeled store.

“This is the first time we have had a model store that is such a close representation of a real-world operation,” says Phillip Walker, president of Tyndale Advisors. “This is a great way that we can spotlight the leading-edge programs we are featuring at Germantown, but do it in a way that more of our customers can see it.”

Like the actual location, the model store was a traditional hardware store with a covered outdoor garden center. It had seasonal “flex” areas for categories such as outdoor living, grills, wild bird, and outdoor power equipment. It also had a destination paint department and showcases a variety of merchandising techniques

for maximizing inventory and highlighting impulse items.

“This isn’t just a representation of what we might be able to offer,” Walker said. “These are actual features that have been implemented in the real store.”

Attendees could see how Orgill’s FanBuilder customer loyalty program was implemented at the front of the store through a fully functional Epicor POS system, browse Brand Building promotional endcaps, and view the custom signage developed by Tyndale Advisors.