Like you, Roseburg is built to grow. That’s why we’re planting, investing, innovating and delivering more of what you and your customers want. Coast to coast.

For nearly 90 years, we have been providing sustainably sourced wood products from our timberlands that generate pride for the job and stand the test of time, inside and out. See how we are building and growing at www.roseburg.com. New! Southern Pine Dimensional Lumber Manufacturing in Weldon, NC New! Installer-friendly Armorite® Exterior Trim, engineered to weather the rigors of outdoor environments

TO BUILD. BUILT TO GROW.

The

PRESIDENT/PUBLISHER

Patrick Adams padams@526mediagroup.com

VICE PRESIDENT

Shelly Smith Adams sadams@526mediagroup.com

PUBLISHER EMERITUS

Alan Oakes

MANAGING EDITOR

David Koenig • dkoenig@526mediagroup.com

SENIOR EDITOR

Sara Graves • sgraves@526mediagroup.com

COLUMNISTS

James Olsen, Kim Drew, Claudia St. John, Dave Kahle

CONTRIBUTORS

Jeff Easterling, Brian Kelly, John Maiuri, Christian Moises, Susan Palé, Tamara Sutton

ADVERTISING SALES

(714) 486-2735

Chuck Casey ccasey@526mediagroup.com

Nick Kosan nkosan@526mediagroup.com

John Haugh jhaugh@526mediagroup.com

DIGITAL SUPPORT

Alek Olson • aolson@526mediagroup.com

Josh Sokovich jsokovich@526mediagroup.com

CIRCULATION/SUPPORT info@526mediagroup.com

A PUBLICATION OF 526 MEDIA GROUP, INC.

151 Kalmus Dr., Ste. J3, Costa Mesa, CA 92626

Phone (714) 486-2735

BUILDING PRODUCTS DIGEST is published monthly at 151 Kalmus Dr., Ste. J3, Costa Mesa, CA 92626, (714) 4862735, www.building-products.com, by 526 Media Group, Inc. (a California Corporation). It is an independently owned publication for building products retailers and wholesale distributors in 37 states East of the Rockies. Copyright®2024 by 526 Media Group, Inc. Cover and entire contents are fully protected and must not be reproduced in any manner without written permission. All Rights Reserved. BPD reserves the right to accept or reject any editorial or advertising matter, and assumes no liability for materials furnished to it. Opinions expressed are those of the authors or persons quoted and not necessarily those of 526 Media Group, Inc. Articles in this magazine are intended for informational purposes only and should not be construed as legal, financial, or business management advice.

Update your subscription

That includes not going behind it. The YellaWood® brand not only prioritizes our dealer relationships, but we prove it through our actions. We take great pride in our fifty-plus year history of only selling to dealers and not directly to their customers. See all the other ways the YellaWood® brand has your back. Visit yellawood.com/for-dealers

DOES EVERYONE look for “signals” as much as I do? Of course, I know the adventures of my past lives have conditioned me to always be surveying the landscape looking for the next sign of a storm approaching. But as adults, aren’t you always trying to avoid the storm in search for long stretches of calm water?

To say we live in interesting times these days is an understatement. We are “involved” in two global conflicts, raising duties on our largest trading partner, interest rates remain high, and no matter who wins this election, we will be left with half of the nation who is pissed off believing it is the end of our nation. Yet, the stock market is on a historic run, mergers and acquisitions continue at a rampant pace, unemployment remains low, and it seems the demand for lumber will not ease in my lifetime.

Have the world and times changed so much that the normal indicators of a storm no longer apply? Are we to believe that everything is fine? I ask this question honestly because I am no longer confident in my ability to see the storm. I think I see clouds, but those in positions of leadership and communication perhaps are just saying that gray is the new color of the sky and it isn’t a storm at all.

However, I look at our industry and it calms me. Demand for product continues to be strong and the pace of mergers and acquisitions tells me that people are confident in investing in future growth. I attend industry events and each time, the ratio of “us old guys” and new, young members of our industry continues to shift. Even in our own business, while the echoes of “media and print are dead” remain, our circulation, requests for print publications, expansion of digital, and investments from advertisers promoting to reach our audience has never been higher.

From this, we too are looking at pathways toward

how we can grow and serve our audience in deeper and more valuable ways. As we speak, initiatives are underway to develop tools that can bring more market intelligence to your fingertips. We are developing vehicles that deliver more of the information that you want, in the way you want it, when you need it. We are even exploring a few non-traditional ways of being your trusted resource for things you wouldn’t typically associate with a media company!

Next month, we will unveil something completely new that I promise, almost all of you will rely on to start your day, every day!!! Like everything we do, it was a simple idea, though not an easy one! But like you, we are gazing out onto the horizon looking for storms, as well as for new ways to serve our friends with something they can trust and that they need. Don’t even bother trying to guess what it is, but like everything we do, it is meant to serve you with what you need!

Regardless of how confusing the signals are, or how stormy or sunny the horizon is, I take comfort in being a part of this great industry. I have learned that in this business, when we refer to it as “our industry,” it means that we are in this together. We understand that for us to be successful, we all must be successful. Those who are experiencing good times help those who have hit bumps in the road and together, we oversee this industry to make sure it is filled with good people and ethical business leaders.

Keep scanning the horizon, looking for calmer waters, and especially stay tuned for our exciting new adventure next month! Thank you all for the honor of serving this industry!

PATRICK S. ADAMS, Publisher/President padams@526mediagroup.com

Like the foods we buy, when it comes to decking, we want natural and real. Redwood is always available in abundance of options. So stock the shelves! Unlike mass-produced and inferior products, Redwood is strong, reliable and possesses many qualities not found in artificial products. They maintain temperatures that are comfortable in all climates.

Redwood Empire stocks several grades and sizing options of Redwood.

PRODUCT PACKED to the rafters? New SKUs and no place to put them? Will you be forced to expand your facilities? Or maybe, just maybe, you can better utilize the space you already have.

How do you know when it’s time, if hidden opportunities may exist, and where do you begin? BPD asked three experts in the field—CT Darnell/Sunbelt Racks’ Clint Darnell, Johnson Design Services’ Ron Johnson, and Krauter Auto-Stak’s Chris Krauter.

Q: Are there signs to tell operators that their lumberyard could greatly benefit from a redesign?

Clint Darnell: The major signs we see over and over again include:

• High Cull Rates – Typically, excessive cull is due to damage from weather and improper storage and handling. This could be lumber stored outdoors on the ground, millwork propped up against walls wherever there is space for it, or storage systems that make it difficult to load and unload product.

• Poor Flow – The two biggest contributors to flow problems are the layout of the outdoor and indoor spaces and poor product organization. Ideally, you want to avoid slowdowns in foot and vehicle traffic and optimize efficiency in locating products for both employees and customers.

• High Labor Costs – When a facility is inefficient, it drives up labor costs because it takes more employees or more time to get the job done. Sometimes, inefficiency is also a matter of safety, and some operators can see excessive employee injuries, as well.

Most operators have a sense of their yard’s inefficiencies. But often, they don’t realize how much there is to gain by making improvements, or they assume the improvements would be cost-prohibitive.

Ron Johnson: Five issues generate a redesign:

• Run out of space and cannot add land as the town/ city has grown around them.

• Need more covered space for finished lumber, dry-

wall and millwork.

• Desire to at least place a roof over the lumber, especially treated to protect from the sun.

• Loading docks! Every yard that does have loading docks seeks them to improve the handling of doors, windows and cabinets. Truck depressions are the easiest to add and least costly.

• Stack carts for millwork. They save on damages from multiple handling and add efficiency as you can lift 20 pre-hung doors at a time.

Chris Krauter: A lot of times the lumberyard operator has a flow-through mentality passed down over the generations with wood bins, that type of thing. But how much time are you spending loading and unloading? Breaking backs? Pulling in and backing out? There are new systems, like Auto-Stak, that allow fewer employees to do more.

Q: What are the greatest methods for improving efficiency?

Krauter: To maximize efficiency, the first thing lumberyards need is organization—a continous flow of more and more SKUs.

You’ll see a lot of lumberyards that, over the years, kept tacking one new building onto the old ones, to create a cacophony, a series of buildings with no flow.

The most important thing is to be able to get in and out quickly through another way, and facilitate a more efficient flow of materials. Number two is to be able to get customers in and out quickly.

As well, a lot of buildings that are old are not very tall. It’s the verticality that you want to maximize. We see a lot that are 12, 14, 16 ft. tall. We like storage to reach 24 or 26 ft. tall at the eaves.

Darnell: When you organize your inventory, store it properly, and make it easier and safer to handle or load and unload. Then you’re going to see more efficiency.

Good design checks all those boxes, as well as reduces cull. This means a facility layout that’s right for that particular business, and storage solutions that are right for the inventory. Sales are likely to increase too because you’re providing a better customer experience.

Johnson: First, product layout that is “clustered” by the shipping order of a house package saves significant drive time. An example, the first shipment consists typically of treated sill, studs, sheathing and underlayment, floor joist and related hardware. Set the materials together with studs and sill next to plywood next to floor joist with the hardware close by. This stack configuration is about 100 ft. long. Think of a standard layout where the studs are with the lumber, the sill is with the treated and the plywood is in a warehouse or shed, the

CONVERTING to an Auto-Stak system can dramatically increase storage space. According to Chris Krauter, “A 100-ft.-wide cantilever rack can hold 32 SKUs, of which 16 can be accessed. A 100-ft. AutoStak holds 80 SKUs, of which you can pick them all.” (Photo by Krauter Auto-Stak)

floor joist is with the engineered. The distance a forklift will travel to pick the initial order is several hundred feet vs. 100’. It is advantageous to have a roof over the stacks either a “T” shed or three sided shed. It’s the single most impactful action a yard can take to reduce operational costs!

The same approach to drywall, drywall accessories, and insulation together, roofing and roofing accessories together, and so on. Easiest way to assemble the list is by reviewing pick tickets; they quickly identify what products always ship together.

A drive-thru enables this approach; it serves the on-site customer with the inventory merchandised traditionally. Both DIYers and pros love the way it works; you drive up the material you want, load yourself or be helped and every item is in the building except lengths over 16’ or non-weather sensitive products like rebar, blocks and pipe/culverts. And you pay on the way out! The most appreciated feature will be that it allows the lumberyard to add merchandise and spend less time on-site. We already mentioned the docks and stack carts!

Final major point: keep it simple in regards to racking and forklifts, cantilever racking, pallet racks, lay-

down rack constructed from pallet racks and standard forklifts with one exception, a narrow-aisle lift for millwork, even that can be used in any warehouse.

Krauter: Swallow hard and get a new plan. The big question is can you gut out and still maintain your flow of business? For many yards, that’s the tough part.

Darnell: Every lumberyard is different. So, when we work with an owner or operator, we always start by looking at their current facility and documentation and then asking a lot of questions. Where are they now and where do they want to be? What are their concerns with their current situation?

Then we get to work on costeffective solutions that address all the issues. This could be a mix of changes in layout, new storage sheds, racking systems that better suit their products and use space more efficiently.

A complete redesign is not always what’s needed. Improvements could focus on just specific areas, such as a better way to store windows and doors, or figuring out how to efficiently incorporate new products.

Johnson: First, contact the design firm you are considering. I recommend visiting sites and calling owners who have been through the process.

I provide a list based on the issues you wish to solve. I recommend a five-year or 10-year master plan; this places you on a path of steady improvements that you can budget for and avoids “undoing” something you have done. One year is always more expensive, but it is an option for those who do not feel comfortable going “all in” immediately.

The process involves plot plans, building plans, goals, budgets, inventory sales reports and staff interviews. With Zoom and Google Earth, we can avoid costly site trips, but that is available if you prefer.

Darnell: The specific gains will depend on the nature and scope of the redesign, but operators should see improvements across the board: reduced cull, better flow, and lower labor costs due to increased efficiency. Some of the customers we’ve worked with have reported:

• A 50% reduction in the time it takes to pick trim orders

• A 15% increase in SKU count

• A nearly one-third reduction in shipping fleet while delivering $8 million more in product

• A 20% increase in sales with a 35% reduction in labor costs

We’ve also heard that employee morale has gotten a boost. It may not be quantifiable, but that doesn’t make it any less important.

Johnson: Typically you will reduce operating costs by 20 to 30%, greatly reduce loss due to handling and theft, plus increase sales as the redesign creates opportunities to add more products. Retail 101: “If you want to sell more, have more to sell!”

One thing to add: a lumberyard is a distribution facility, not a storage facility. Plans that add racking to increase capacity do not impact efficiency. It is all about the merchandising! BPD

ENHANCE the natural beauty of wood.

ENSURE consistent quality in every board.

EXTEND the lifespan of your finished wood project.

ELIMINATE wasted project time, labor costs, and the mess.

WITH OPTIONS APLENTY, lumberyards are increasingly looking for particular features when they purchase new forklifts. Among the most in-demand are:

Lumberyards are boosting efficiency by choosing forklifts that integrate the latest technology, including regenerative braking systems, advanced energy management systems, onboard diagnostics, and telematics systems.

Dell White, sales/marketing manager for Sellick Equipment, says a big seller has been the ability to hydraulically position the forks. “Every time you have to manually change the fork position, such as from accommodating pallets to trusses, you lose capacity,” White explains. “Being able to hydraulically position from the operator’s seat saves times, reduces the possibility for injury, and increases productivity. We offer it on every model of every forklift, including truckmounted forklifts.”

Many warehouses are even turning to automated forklifts. Mitsubishi Logisnext’s advanced autonomous forklifts utilize laser-guided systems to navigate warehouse layouts and employ obstacle-detection technology for seamless operation.

Augmented reality technology is also being employed to improve forklift operation before employees

are even operating a forklift. Trainees can use AR headsets to simulate driving a forklift in a virtual environment, allowing them to practice driving and managing techniques safely.

Ready or not, the age of electric forklifts has arrived and, according to a new study by Adroit Market Research, electric held a dominant 65% share of the global forklift market in 2023. Once considered unable to stand up to the challenges of lumberyard environments, electric vehicles are stronger and more durable than ever before.

Yard operators are moving to electric due to their lesser emissions, reduced noise levels, and minimum operating costs compared to traditional diesel, propane or gasoline-powered internal combustion engine (ICE) forklifts. Every year, regulations designed to reduce CO2 emissions are becoming more stringent across various industries, especially in areas such as California that are pushing for zero-emission vehicles.

The Kalmar Heavy Electric Forklift is designed to lift 18- to 33-ton loads with zero emissions at the source.

In addition, electric forklifts are often more powerful and faster at accelerating than internal combustion engine forklifts.

Combilift’s new Combi-CB 155E is reportedly the

most powerful compact electric multidirectional forklift to date, combining next-gen performance with extensive battery life and exceptional ergonomics. According to CEO Martin McVicar, “The increased capacities that we are offering in our electric range will answer the demand for ever more powerful products which at the same time help companies to achieve their aims for more sustainable operations.”

The growth of electric has run alongside the widespread adoption of lithium-ion batteries, which offer extended lifespans, reduce the need for replacements, and minimize waste. Faster charging times enhance operational efficiency, allowing for more daily working hours. For example, Mitsubishi Logisnext Americas group has introduced its novel Triathlon Lithium-ion battery and charger offerings for the UniCarriers product range.

At the same time, hydrogen fuel cell technology is gaining some momentum as an alternative power source. It provides faster refueling times and extended operating ranges compared to electric forklifts.

“Electrification in heavy-duty applications—like the lumber industry— requires innovative solutions like lithium-ion batteries with opportunity charging or hydrogen fuel cells capable of supporting multi-shift applications that have traditionally relied on internal combustion forklifts,” notes Kaushik Ravichandran, product planning manager for Toyota Material Handling. “We believe it is our responsibility, as a full-line material handling solutions provider, to develop versatile new offerings that meet the needs of customers wanting to make the transition to electric without sacrificing throughput.”

A continuing focus on safety measures has led to further advanced safety features in forklifts, such as collision detection systems, proximity sensors, and automatic emergency braking. These inventions help reduce the risk of workplace accidents and injuries.

“Customers are looking for new ways to build a safety culture for forklift operators as well as pedestrians,” Ravichandran explains. “While there is no replacement for operator safety training, we have launched a portfolio of features under the Toyota Assist umbrella to make our products smarter than ever before. One example is Toyota’s SEnS+ Smart Environment Sensor Plus, which is exclusively designed for forklifts to detect objects and pedestrians in the detection range. The system supports your operation by notifying the operator with a warning buzzer and warning lights. In addition to the system notifications, the system can control the traveling speed and slow down the truck for pedestrians and objects in specific conditions.”

Forklift manufacturers are incorporating more features than ever before to help create a pleasant, stress-free in-cab environment. Innovations include more spacious

cabs, ergonomically designed seating and controls, generous glazing for excellent all-round visibility, hydraulic steering, and a tilting steering column.

Combilift recently developed the Auto Swivel Seat, which automatically engages and swivels the seat and armrest 15° to the right or left to accord with the direction of travel selected by the operator—reducing driver strain, particularly when traveling in reverse.

Sellick’s White notes that an increasing number of lumberyard operators are ordering forklifts with air-conditioned cabs. “It may sound crazy, but operators can be in there eight hours a day. If you have good drivers, you want to keep them happy and productive. Good equipment helps retain good employees.”

Material handling equipment manufacturers will continue to pioneer new technologies so long as their customers keep striving to make their operations more efficient and productive. BPD

THE SUPPLY CHAIN and logistics industry has experienced a technological transformation in recent years, with the development of innovative solutions impacting nearly every aspect of the supply chain. However, yard management is one area that is often neglected and a bit behind compared to the rest of the industry. Yard management is traditionally a paper-driven process, which, while once effective, can now hinder operators’ ability to efficiently manage resources. This leads to inefficiencies and increased costs, and in turn, frustrated employees and customers.

The supply chain shows no signs of slowing down and businesses are turning to third-party logistics pro-

viders (3PLs) for yard management solutions. 3PLs offer innovative solutions to organize yard operations and implement technology-driven tools like yard management systems (YMS). YMS provide real-time visibility into yard activities, enabling businesses to reduce costs and enhance customer satisfaction by improving service levels.

The global market for YMS systems is currently estimated at $5.2 billion and is expected to reach $11.9 billion by 2030. This exponential growth is expected as companies realize the benefits of YMS and warehouse management systems (WMS) and learn to capitalize on these emerging solutions to optimize their logistics operations.

Numerous challenges arise if a yard is poorly managed. A paperbased process lacks real-time visibility into yard activities and inventory. In addition, it can create an inefficient use of space, resulting in congestion and disorganization. These key issues are a result of ineffective coordination and communication between warehouse, transportation, and yard operations, complicating the tracking and management of trailer movements and detention times.

This organizational deficiency leads to operational inefficiencies, wastes resources, and brings up potential compliance issues concerning industry regulations and safety protocols. Over time, these shortcomings can negatively impact a business’ reputation and they risk a dissatisfied customer.

By harnessing a 3PL’s YMS, lumberyards can overcome these challenges. At a high level, engaging with a 3PL for yard management enhances customer service by ensuring on-time deliveries, minimizing lead times, and improving order accuracy. With optimized yard operations, meeting customer expectations becomes more achievable, fostering greater satisfaction and bolstering loyalty.

One specific solution is RFID tagging, GPS tracking, and automation to optimize yard space utilization. This provides real-time visibility into yard

activities, with accurate and timely information on inventory levels, trailer movements, and overall operations. This heightened visibility empowers stakeholders to make informed decisions, enhance planning, and quickly adapt to changing conditions.

Automated scheduling and task assignment solutions streamline trailer and cargo movements, resulting in expedited turnaround times and heightened productivity. This delivers several benefits including reduced detention times, minimized labor expenses through automation and optimized workflows, and decreased transportation costs due to improved trailer utilization and turnaround times, which ultimately results in cost savings.

Enlisting the support of a yard management provider presents opportunities for scalable growth. A keen provider tailors their solutions to evolve alongside their clients’ changing needs, whether it involves expanding operations, adjusting for seasonal fluctuations, or integrating emerging technologies.

When investing in a new technology or partner, businesses must consider the return on their investment. Is the expense worth the outcome? Effective yard management delivers reduced congestion, reduced idle time for assets, and ultimately, higher operational efficiency. Lumberyards can calculate savings from reduced detention times, enhanced space utilization, and lowered labor expenses. In addition, businesses can track improvements in inventory accuracy and order fulfillment rates.

Partnering with a 3PL ensures access to experts well-versed in all aspects of yard management, implementing strategic processes, tools, and staffing to establish more efficient and seamless operations. BPD

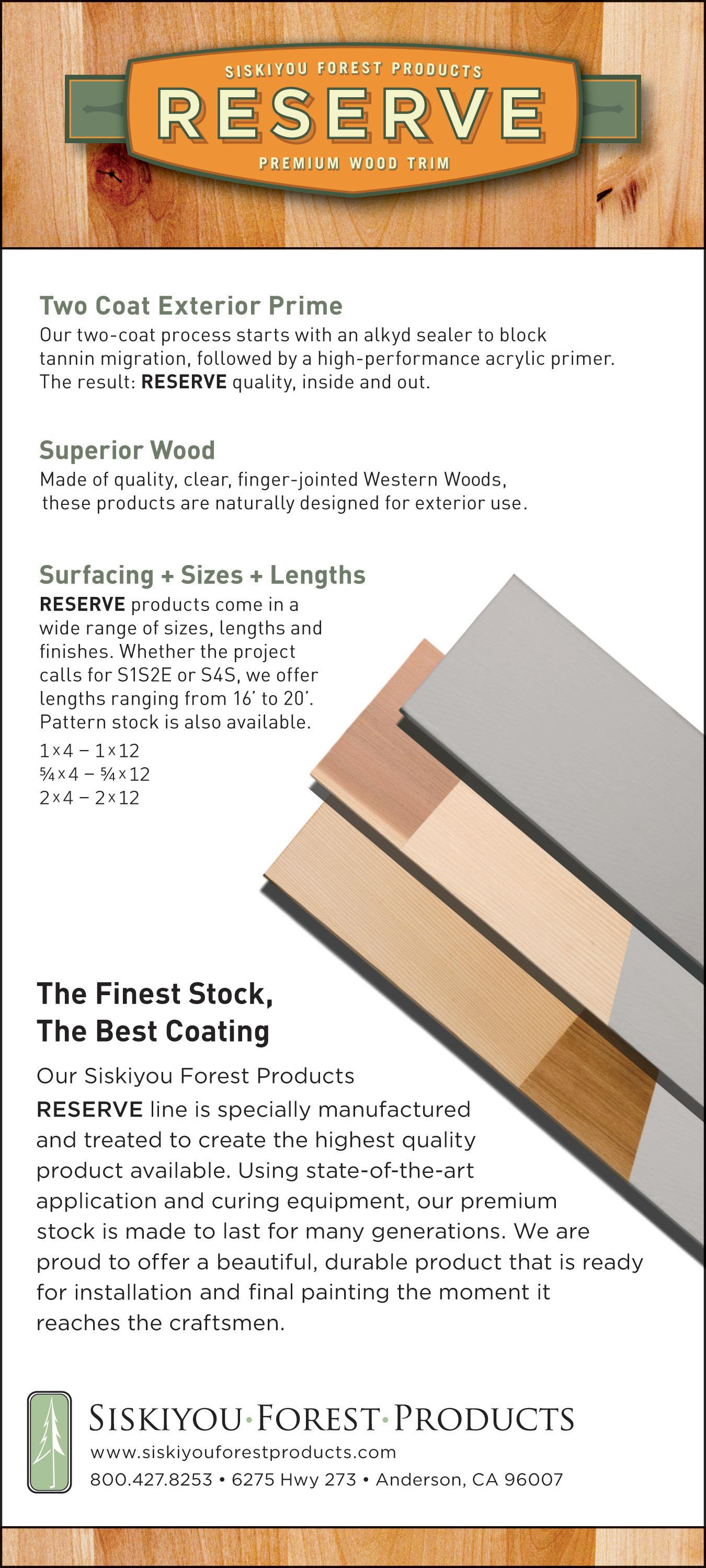

E-COMMERCE IS EXPANDING in the building materials industry, as it helps businesses attract more customers. For those looking to grow their online presence with an e-commerce site, it can be tough to know where to start. This article will cover some of the key elements to focus on when setting up e-commerce for your business.

Customers have come to expect 24/7 access to their orders and tracking information. However, it’s not just about access, but the ease and speed of finding the information they need. An engaging and user-friendly website should be easy to navigate, responsive, and appealing to the target audience. It should showcase the product and service offerings in a way that is easy for customers to understand.

A poorly designed website can deter potential customers and harm the reputation of the business. On the other hand, a well-designed website can provide a seamless self-service experience for customers and enhance a business’ reputation for quality service. It’s worth spending the extra time during set-up to focus on the user experience.

Here are some tips and best practices to help you get started. High-quality images and videos can showcase different angles, close-

------------ BY TAMARA SUTTONups, and special features of the product. Find out if your vendors have a product catalog with images you can use to save time setting up your site.

Videos can also enhance the customer experience by demonstrating the features and benefits of the product. To test effectiveness, you can start by making a few videos for some of your top-selling products. Then, track the sales to see if the videos increase customer engagement. If you see positive results, you can invest more time in creating videos for your other products.

Typography (fonts and size of the text) should be easy to read, consistent, and supported by most web browsers. Keeping your fonts the same throughout the site will help the customer focus on the product. The contrast between text and background colors should be high enough that it is easy to read.

Call-to-action buttons (CTA) should use clear and concise verbiage like “Add to Cart” or “Buy Now.” This will encourage immediate action from your customers. Give explicit directions about where users need to click and what to expect. Rather than a button marked “Account,” stating “Check my Account Balance” gives a clear understanding of where this button will take them. The call-to-action buttons should use contrasting

colors, appropriate sizing, and be consistent across the website.

Feedback is essential for improving your e-commerce site and adapting to your customers’ needs. Adopt a growth mindset and look for opportunities to improve or adjust your strategy. There are various ways to collect and analyze data from your site, such as using free tools like Google Analytics or asking your customers for their opinions. If you aren’t confident interpreting your results, hire a local marketing agency to provide you with actionable insights. Based on the data, you can make changes to your site that will enhance the customer experience and increase your sales.

To create a successful e-commerce site, you need to prepare, plan, and maintain it with the customer experience in mind. A user-friendly site that meets your business goals and customer needs will help you grow your online presence and sales. BPD

THE RETAIL INDUSTRY, especially within the traditional lumber and building materials (LBM) sector, is facing major changes that are reshaping how small- and medium-sized businesses (SMBs) operate and compete in a world tied to internet connection and mobile devices. Ultimately, this means changing business practices to meet new buyer demands and better compete against peers, online giants and big-box stores.

There’s a silver lining for LBM dealers. The rise of retail technology is not a threat but an opportunity to meet modern customer expectations, compete on a level playing field and thrive in this new era.

Where yesterday’s retail success depended on home centers and service counters combined with phone orders and the in-person shopping experience, today’s focus includes digitalization and online channels.

------------ BY JOHN MAIURIIt’s critical for dealers to not only service their existing business as buyer preference adapts to new technology but additionally improve customer satisfaction. LBM dealers who have not begun the journey toward digitalization need to act quickly because buyer behavior typically leans toward convenience and if your business is the only one not online, you are potentially at risk. The good news is online technology can do a lot of heavy lifting to help dealers compete and grow.

One of the most important steps for LBM dealers is simply to embrace the need for change. While digital engagement from a business software system directly to customer account holders, like contractors and perpetual DIY accounts, has been around, the surge in ecommerce as a channel to individual markets is now table stakes. Dealers need to grasp

the complexity of managing multiple solutions to address their business.

Finding the right tech designed specifically for pulling all business aspects into one system is critical for improving efficiency and getting comfortable with technology. Choosing the right business management software for the unique needs of an LBM business can be daunting enough, let alone the complexity of a deeply integrated digital engagement portal and ecommerce presence. However, the right choice in a modernization strategy will put your business in a stronger competitive position and allow you to service your market in a more convenient and efficient manner.

Digital technology empowers dealers to more efficiently service their market, manage trade accounts and acquire new customers—faster and easier. These tools open opportunities to create highly personalized shopping experiences by focusing on customers’ unique needs and prefer-

ences, creating further loyalty. Data analytics break down buyer behavior into actionable steps LBM dealers can take to improve their operations and evolve marketing strategies.

One example of how technology can enhance the customer experience and business efficiency is the Buy Online, Pick Up In Store (BOPIS) model that’s only possible with an industry-focused ecommerce platform. Research highlights a notable increase in buyer preference in the BOPIS model, which puts the customer first, combining physical shopping with the ease of online browsing. The benefits don’t end there, as dealers report additional in-store purchases from customers when BOPIS is available.

The success of BOPIS in the U.S., as highlighted by “The 2023 Global Digital Shopping Index,” which showed a significant increase in BOPIS usage from 23% in 2021 to 32% in 2022, only reinforces this growing trend.

For LBM dealers looking to stay ahead of their competition, applying digital practices and modern technology tools can also increase customer loyalty and boost sales. Plus, it’s much easier to create an engaging and efficient shopping environment for their customers while delivering convenience, speed and flexibility. Think of the efficiency of order placement via ecommerce as an alternative to telephone orders which are much more difficult to scale in volume, each phone order requires a staff person on the other end. Online BOPIS orders are created at the source by a single individual and flow directly into your business fulfillment operation process.

Integrating point of sale and order management technology into LBM businesses has been ongoing for over 40 years. As customer needs, trends and technologies change, LBM dealers need to stay informed and continue to adapt. Working digitalization into the mix, investing in employee training, exploring new replenishment and fulfillment models and putting customer needs first are

key strategies for today’s LBM businesses. Additionally, dealers looking to the future can strengthen their succession plans—whether they’re looking to pass on their successful business to the next generation or sell to someone new—technology is a great strategy for creating value and longevity.

Today’s retail technology tools present opportunity for traditional LBM dealers to level the playing field in a competitive space, create a buying experience that feels familiar, and get into the habit of pulling usable

insights from the data. As a result, there’s opportunity to grow, improve and prosper. All in all, the future is looking bright for LBM dealers. BPD

JOHN MAIURI

JOHN MAIURI

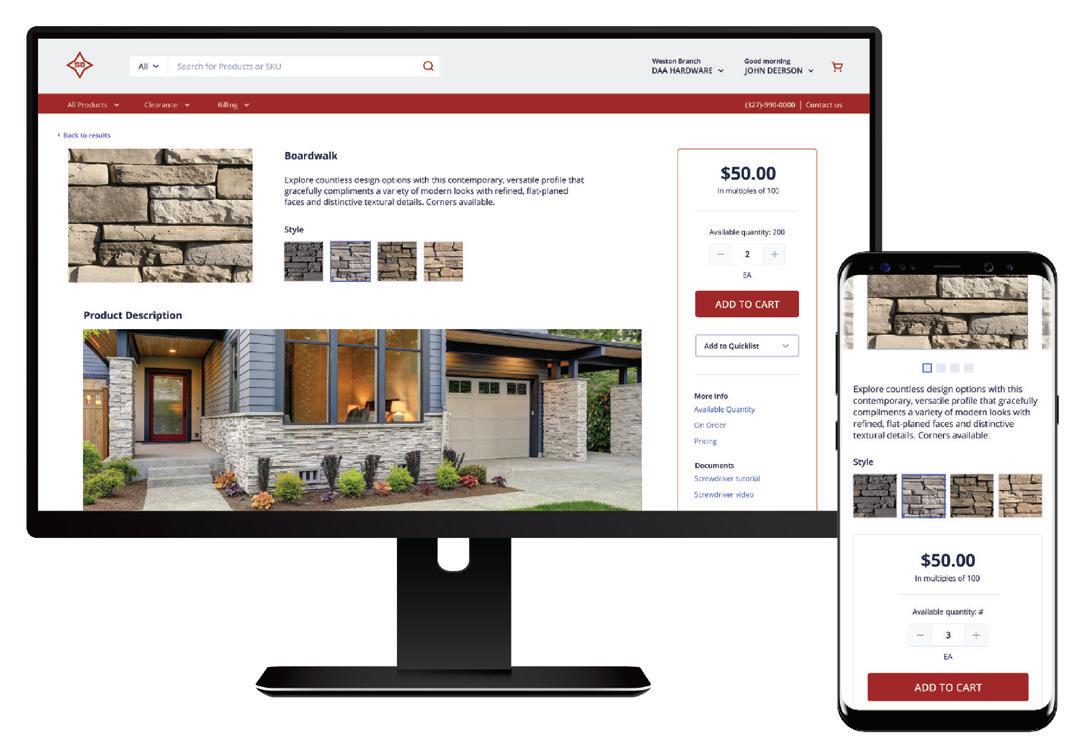

Storing millwork can be tough. Size variation, custom orders, temperature sensitivity—all can add to the challenges suppliers face as they seek efficient onsite storage solutions. That’s why Greg Zuern decided to try something completely different. Together with CT Darnell and Sunbelt Rack, Zuern Building Products consolidated all their millwork into one reimagined building for maximum efficiency. The results speak for themselves. Thanks to this change, they saw:

50% faster pick times

$8MM more in deliveries with fewer trucks and drivers

Maximized inventory efficiency and increased SKU count by over 15%

IN GENERAL, we want to match our customer’s volume, pace, tone and demeanor when communicating with them. That said, sales is a transfer of emotion more than information. Information is important, but by itself, especially in the competitive world of sales, information alone will rarely win the day.

If you work for Apple and your customer only wants Apple products, then you are not really in a competitive sales situation. But if we are selling a commodity or products that are similar, how the customer feels about us as a person will be the difference between getting or losing the business the majority of the time.

Life is a mirror, so how we treat people is how they are going to treat us. There are the exceptions—the Grumpasaureses of the world or adversarial buyers—and even these buyers can be converted over time, but in most cases customers will respond to us as we treat them. Remember that difficult customers are a gift from above because they keep most salespeople away. I love converting grumpy or difficult customers.

Below are four ways I see Master Sellers interact with customers that lead to their success:

I am not talking about unctuous overly servile, or solicitous niceness that comes across as fake and does not inspire confidence. I am talking about a relaxed open friendliness. Many sellers are too nervous to act friendly. Others are ashamed of being salespeople, so they think that being friendly will make them seem insincere, so they are too officious in their

approach. Introverted sellers will have to push themselves to be more open. Some salespeople are too aggressive, although this is a small percentage. The number one fear of salespeople is the fear of being too pushy, so many are too passive which does not come across as friendly. Master Sellers speak to customers as they do with their friends. A Master Seller I know said, “All my customers are my friends and if I lost them all tomorrow I would go out and make more friends.” Great advice.

Warm and friendly are similar, but warm is a more real, personal friendliness, and humans can feel the difference. I know a Master Seller who says some bold things to customers. I always wonder, “How does he get away with that?” The answer is his warmth. He sincerely cares about his customers, and it comes across in his speech. He speaks to his customers as he would to his favorite aunt or uncle, and they respond in kind.

If we are nervous or aggressive in our approach, customers will feel uncomfortable and will do their best to end our interaction as soon as possible and will unlikely buy from us. Sellers that are nervous or unprepared do not have a calm demeanor and customers feel it—even if the feeling is subconscious. Calm sends the message, “Everything is going to work out great.” (When you buy this).

One caveat of calmness is to not overdo it. We don’t want to be so calm that we appear indifferent. Calm enthusiasm may seem like an oxymoron

but that is what we are shooting for as salespeople.

Master Sellers have the belief that they will win the business. Winning the business is inevitable. This is part of pre-call preparation. We must convince ourselves before we make the call that the customer is going to buy from us and then talk like that from the first moment of the sales call until the final closing of the deal.

Just like being calm can be overdone, too much confidence will be perceived as arrogance which is not attractive and does not lead to business. “Command presence” and “quiet confidence” is what we are aiming for.

Just like Baby Bear’s porridge in the fable of Goldilocks, getting the right mix of friendly, warm, calm, and confident can be difficult to get just right. We all will have challenges in getting the mixture correct. Few of us possess all of these attributes naturally, but it is possible to improve these interpersonal skills. Over the years, I have watched many of my students do the same. Product knowledge (information) is important, but being relatable is much more important in our world of sales. BPD

THE GREAT RESIGNATION is over, the red-hot recruiting market has cooled a bit, and inflation is down. That’s some of the good news for employers in 2024. But don’t relax too much—compensation is still important. In a recent Compensation Best Practices Report published by Payscale, a majority of employers reported compensation as their biggest challenge—a bigger challenge than either recruitment or retention. And 53% of those employers reported that they would increase focus on development of a compensation strategy for 2024.

To address these challenges, it is time, as an employer, to ask some questions.

Salary ranges, also called salary bands or pay ranges, establish the pay parameters for a job role or group of roles. Salary ranges are based on market information in conjunction with the organization’s compensation strategy and philosophy. Pay ranges typically include a minimum, midpoint, and maximum amount.

If your organization is small, market pricing for individual positions can work well. But as a company grows, especially if it expands to multiple locations, finding market information for every job and location becomes difficult.

Salary ranges also provide the framework to promote consistency in offers to new hires and promotions and salary increases for existing employees. In the past, many organizations offered starting salaries to new hires based on salary history, but it is now illegal in 22 states to ask about an applicant’s salary history. And it’s likely more states will adopt this type of regulation.

Salary ranges can also help to address issues such as salary compression (when salaries of new hires equal or

exceed those of experienced employees in the same or similar role), pay equity (equal pay for equal work or work of comparable value), and pay transparency. More about the last one below.

How Will My Organization Address the Issue of Pay Transparency?

Pay transparency is defined by World at Work as “the degree to which employers are open about what, why, how and how much employees are compensated.” Pay transparency is often driven by legal requirements. Pay transparency laws vary by state, but generally focus on requirements that employers list salary ranges on job postings for open positions.

Compliance with legal requirements often means that current employees find out about pay ranges for their positions from job postings or external applicants. That can certainly cause problems. The same Payscale Best Practices survey noted above reported that 14% of responding employers have lost employees because those employees saw posted job ranges. And legal penalties can be significant. In the state of Washington, which allows remedy through the court system (as opposed to enforcement by a government agency), one law firm filed over 30 class action suits in one week.

But pay transparency is more than compliance. It’s about being proactive in your communications about compensation. That doesn’t necessarily mean that everyone gets to see everyone else’s salaries. That happens in some tech companies, but it’s not common or required. What it does mean is that employees should understand how they are compensated and the rationale that determines their pay. That might include variables such as:

• Compensable factors (skills, knowledge, education, certification, etc.)

• Performance

• Depth and breadth of experience

• Seniority and length of service

It’s time to be proactive about pay transparency. Even if there aren’t legal requirements in the locations where you do business, you need a compensation strategy that allows you to make offers to candidates and reward current employees within a fair, consistent framework.

In my consulting practice, I’ve often had managers and supervisors tell me that they don’t have an understanding of their organization’s compensation policies and practices. Sometimes the CEO is responsible for compensation decisions and doesn’t effectively communicate the rationale to anyone. That puts managers and supervisors in the awkward position of not being able to answer employees’ questions about their pay.

There are steps you can take to help your managers and supervisors. These include:

• Documenting and distributing your compensation philosophy, policies, and procedures

• Training managers to provide them with the skills and knowledge to answer employee questions and communicate consistently about compensation

• Maintaining an open-door policy to discuss compen-

Q. What do I need to know about hiring a summer intern?

A. If you plan to pay your interns at least minimum wage, you’re in good shape. If, however, you are planning to offer an unpaid internship, there are a few things you should consider.

Federal and state governments are cracking down on the use of unpaid interns, arguing that not paying interns for their labor violates the Fair Labor Standards Act (FLSA).

Even if you and your intern agree that the work experience is sufficient compensation for the labor, you must satisfy the requirements for it to be “bona fide” and thus qualify as an unpaid internship.

You may be subject to wage and hour penalties and back wages under the FLSA if you fail to pay your summer interns appropriately.

The Wage and Hour Division of the U.S. Department of Labor’s Fact Sheet #71 offers help for determining whether your intern is entitled to minimum wage or overtime pay and can be found at www.dol.gov.

For the record, we are strong proponents of internships, particularly as a means of identifying and developing new talent and future employees. Good luck!

sation questions and concerns with all employees (and encouraging your managers to do that too)

• Empowering your managers to make compensation decisions for their new hires and current employees

Managers and supervisors are ultimately responsible for the success of any organizational program or initiative. It’s essential that they understand their role and responsibilities in order to guarantee that success.

Total Compensation (also known as Total Rewards) includes not just base salary and other cash payments, but also the value of all employee benefits and perquisites that can be quantified. For many organizations, the cost of benefits, including healthcare premiums, retirement plan contributions, and paid time off can easily amount to 30%–35% of an employee’s salary. That means the total compensation for an employee making $100,000 would be $130,000–$135,000.

A 2023 survey conducted by beqom (a provider of total compensation management software) revealed that nearly half of surveyed employees don’t understand their total compensation.

Organizations generally do a pretty good job of communicating total rewards when posting positions or interviewing candidates—after all, those are great marketing opportunities. But these same organizations often don’t do a very good job of communicating total compensation to their current employees.

One way for an organization to improve total compensation communications is through a total rewards statement. A total rewards statement is an extremely effective tool to help employees understand the true value of working for the organization. Statements are personalized and typically produced and distributed once a year.

In the past, these types of statements have focused on quantifiable information. That includes financial information about base salary and bonus/incentive payments, and benefits information including medical plan contributions, PTO, 401(k) contributions, etc. But there is now a current trend to include non-quantifiable information in these statements. That might include things like opportunities for remote or hybrid work, flexible and in-advance scheduling, and educational opportunities.

Growing your business means recruiting and retaining top talent. That means developing compensation plans that are both fair and competitive. It’s a tough landscape to navigate, but answering these questions will help you get off to a good start BPD

at (877) 660-6400 or contact@theworkplaceadvisors.com.

SEARCHING FOR WAYS to reach more potential customers—and current customers—in your area? It might be time to take a marketing and communications inventory to see what you’re doing well, and where improvements may be made.

If the goal is to raise awareness of your lumberyard and increase traffic, you have several communications-based tools at your disposal. Most of them are easy to manage with your existing staff, as long as they’re willing to jump in and take responsibility! Let’s take a look at five easy ways for you to reach more customers.

What’s the first part of a house? The foundation! Before beginning any sort of outreach, take the time to develop and fine tune your messaging and build your informational foundation. What does this mean? Create a chart: who’s your audience? What do you want them to know about your lumberyard? Talk through a few key words you want them to know about you (these could include options like service, product diversity, local products, high levels of customer service, etc.). Once you have your keyword list, develop a few messaging points to be used throughout your communications. Here’s an example: “We want customers of XYZ Lumberyard to choose us because of our large product offerings, our quick delivery, and our fantastic customer service.” Everything you do, everything you post, everything you share should be tied back to these messages. Consistency is key: say the same thing over and over and you’ll get your point across.

If you’re truly committed to getting the word about your business out into the community and the market more, choose someone inside the company and develop them into your very own subject matter expert (SME). Translated: select someone who knows the industry inside and out, is well-spoken, and can speak about a variety of topics. Whenever the wood industry is in the news, offer up your SME to news outlets to give a local perspective. Maybe there’s a speaking opportunity with a local business group? Get out there and research ways to share your messages through a spokesperson of sorts, then be sure that person is fully versed in your messaging!

If you don’t have a social media page, now’s the time to get one. Start with Facebook and consider branching out

into Instagram to reach a larger age bracket.

But what to post? Variety, variety, variety! Make it engaging, make it fun, and mix it up. You can post about wood product sales coming up, or perhaps share a new product you now have in stock. Make the posts eye-catching: use graphics, use photos (fewer than 10 per post), and maybe throw in something silly to keep your engagement up (“Happy National Ice Cream Day from XYZ Lumber!”).

A few simple rules for your social media: keep the copy short, sweet, and to the point. Use appropriate spacing to increase readability. And please, PLEASE, be sure to use proper spelling and punctuation.

Potential topics: educate your audience on your services and take the opportunity to look into trends and share how you can solve them for your customers. (“Looking for wood paneling like the Maine Cabin Masters use? We can help!”) Photos are always popular—the more engaging and colorful, the better. Take a close look at a photo before posting it: ensure there’s no trash on the ground, everyone’s wearing safety gear as mandated, and there’s nothing strange happening in the background (we could tell you some serious stories about this).

Got a customer with a super cool project? Share their success story (with their permission) on social media. Everyone loves the inspiration of a good story.

Ready to take the next step in your promotional journey? Consider professionally designed and printed marketing tools. This could be a table placemat sharing eastern white pine patterns you offer, a nice little brochure detailing your services, or even a social media ad campaign.

One of the most impactful ways to raise your awareness level is to dive into the community. Sponsor a T-ball team and get a banner made for the outfield fence. Sponsor a local 5k and throw a koozie with your logo on it into the race’s swag bag. Join a local board and get involved in your community’s growth and economic development. The opportunities are endless!

Wherever you are in your marketing and communications journey as a lumber dealer, it’s time to jump in and try something new to boost your awareness. Start at your comfort level, and don’t be afraid to jump out and be the first to address a hot topic or developing trend. Take that first step! BPD

fastening just got easier.

Introducing the Simpson Strong-Tie ® Timber Drive ™ structural screw fastening system. Timber Drive is the revolutionary tool designed for ergonomic, standup operation while driving structural screws. It’s ideal for heavy-duty jobs that require repetitive fastening, such as bridges, docks, boardwalks and mass timber. You can use Timber Drive with corded or cordless driver motors to install Strong-Drive ® structural screws in a wide variety of sizes, thread types and heads. Save time and effort on your next heavy-duty fastening job with Timber Drive.

To learn more about Timber Drive, visit go.strongtie.com/timberdrive or call (800) 999-5099.

R.P. Lumber Co. separately acquired Mount Carroll Home Center, Mount Carroll, Il., and Custer Do it Best Hardware & Lumber, Custer, S.D.—its first location in South Dakota.

The Custer deal closed April 19; the Mount Carroll deal closed on May 17.

Bonnie Ramer, owner of Custer Do It Best Hardware & Lumber, said, “This lumberyard has been serving professional builders and DIY homeowners across the central and southern Black Hills for nearly 90 years. I was certainly not the first owner, but I truly believe R.P. Lumber is the right organization to call itself the next owner of this location.”

Fred Paschke, owner of Mount Carroll Home Center, expressed his sentiments alongside his wife, co-owner Deb, stating, “We’ve been friendly competitors and industry peers with R.P. Lumber for as long as we can remember. When we finally got the chance to meet them in person, we were immediately reassured we’d found the trusted successor we’d been seeking.”

The latest acquisition—R.P.’s fourth this year—brings the chain to 84 locations across six states.

Ace Retail Holdings has agreed to acquire Bishop Ace Hardware, a 13-store chain in central Illinois, with the deal set to close July 28.

According to Ace Retail Holdings, it will be a seamless transition of ownership, with the stores retaining their Ace branding, management, personnel and current product mix.

Locations are in Carlinville, Chatham, Dwight, Havana, Hillsboro, Jacksonville, Lincoln, Normal, Pittsfield, Pontiac, Taylorville, and two in Springfield, Il.

Bishop Ace Hardware owners Lucy Stafford and George Preckwinkle like to say they were literally “born into the hardware business” after their parents founded the business in 1960 in Springfield with one small, local hardware store.

Culpeper Wood Preservers, Culpeper, Va., has acquired Pleasant Garden Dry Kiln Co., Pleasant Garden, N.C.

With this acquisition, Culpeper Wood Preservers adds additional drying capacity for hardwoods and softwoods. This further enhances the capabilities and distribution coverage area for its pressure-treated wood into markets that stretch from the southeast to the northeast and through the Midwest. Culpeper now has 18 facilities within its footprint.

“We are excited about the acquisition and adding additional drying capacity to our company. This will allow our company to further broaden the capabilities of certain products,” said Jonathan Jenkins, president of Culpeper.

“My father started this company in 1966. For the 32 years he led this company, his vision was to ensure our employees and customers were always at the forefront of everything we do. And I’ve continued the same for the past 26 years. With this acquisition by Culpeper Wood Preservers, I am excited for the continued success of this facility,” said Jerry Millikan, owner of Pleasant Garden.

Lugbill Supply Center, Archbold, Oh., has acquired 70+-year-old Affiliated Lumber, Swanton, Oh.

Cassity Jones Building Materials celebrated the grand opening of its newest location in Aledo, Tx.

Stine Home & Yard held a May 3-4 grand opening in Pineville, La., to highlight its reconfigured layout, expanded products, and three new departments—appliances, grilling and STIHL outdoor power equipment.

Schmuck Lumber Co., Gettysburg, Pa., is building an adjacent Ace Hardware store.

Decks & Docks has purchased the outdoor supply arm of Excelsior Lumber, Butler, N.J.

Drexel Building Supply is constructing a new facility in Kewaskum, Wi.

Westlake Ace Hardware agreed to purchase 179-year-old Clarks Ace Hardware, with locations in Ellicott City and Columbia, Md. The stores will be rebranded as Westlake Ace, but retain current management, staff and much of their current product mix. The deal is set to close June 23.

Farmers & Builders Ace Hardware, Sylvester, Ga., has been opened by Greg Cochran and Matt Cochran.

Local Ace Hardware, Crookston, Mn., has been opened by Brandon Buckalew.

True Value Hardware, Cornersburg (Youngstown), Oh., permanently closed on April 30.

Bill’s Ace Hardware, Arlington, Va., held a grand reopening May 3-5 to show off its recent renovation.

Fourmens Ace Hardware remodeled its stores in Colby and Loyal, Wi.

Ritter’s Ace Hardware, Whitehall, Wi., has been opened by Andrew Ritter, with a grand opening held April 19-21.

Staples Ace Hardware, Staples, Mn., held a grand re-opening April 26-27 to show off its refresh.

True Value Hardware, Aiken, S.C., is closing after 60+ years with the retirement of owners Lyanne and Det Haislip.

McCoy Ace Hardware, Lexington, S.C., held a ribbon cutting/grand re-opening April 18-20.

Cronin Ace Hardware, Saint Johns, Fl., added a branch in Jacksonville, Fl., managed by Kyle Cronin.

Barton’s Home Outlet held a grand opening May 9 in Okolona (Louisville), Ky. (David Smith, store manager).

Menards opened a new store May 7 in Bowling Green, Ky., managed by Steve Hendricks.

Home Depot opened a new 106,700-sq. ft. home center with 28,000-sq. ft. garden center in the Wildwood, Fl., area of The Village of Florida on May 30.

Kellogg Supply Co. is now selling Tando Composites’ Beach House Shake at its four North Carolina home centers.

Anniversaries: Kenny Queen’s Hardware, Huntington, W.V., 50th ... Philips Ace Hardware, Valparaiso, In., 45th ... Zeeland Ace Hardware, Zeeland, Mi., 15th.

This practice is crucial to profitability. Here’s why:

n Every day that excess inventory is owned, it is either costing interest on borrowed money, which increases expense, or it is preventing the earning of interest on owned money, which decreases income. Whether capital is borrowed or owned, excess inventory is always eroding profitability.

n Let’s say a yard has sales volume of 110,000 BF/month. If brought in all at once by car, the inventory can turn once a month if needs are correctly projected. But if metered in by truck in 27,500 BF increments at one load per week as actually needed, that inventory will turn 4 times per month – and tie up only 1/4 as much cash.

n Now suppose this yard pays for the car 10 days after shipment and delivery takes 3 weeks. It paid for 4 times the inventory it needed, and won’t see any of it for 11 more days. But if it buys by truck with quick delivery, every stick could be sold before the invoice even comes due. In fact, three truckloads could be sold this way before the car could even have arrived, again using only 1/4 the capital.

n This strategy dependably multiplies turns and GMROI, dramatically improves cashflow, cuts carrying costs and frees up both capital and space for more profitable use. Margins are maintained through market moves and downside risk is significantly reduced because the inventory is turning faster than price changes can affect its value. There’s less inventory to count, and stock stays fresher, too.

Builders FirstSource, Dallas, Tx., acquired Schoeneman’s Building Materials Center, with four locations in South Dakota and Iowa.

Founded in 1888, Schoeneman’s has branches in Sioux Falls and Harrisburg, S.D., and Hawarden and Spencer, Ia. The chain reportedly will retain its current name, as a BFS brand.

Canfor Corp. entered into a purchase agreement with Resolute El Dorado Inc., an affiliate of Domtar Corp., to acquire its El Dorado, Ar., lumber manufacturing facility.

The $73-million acquisition, including working capital, will create synergies and vertical integration opportunities given its complementary geographic fit with Canfor’s existing operations in the region.

Leveraging Canfor’s experience and expertise, and with an anticipated further $50 million in planned upgrades, production capacity is expected to increase to 175 million bd. ft. per year.

The transaction is expected to close over the next several months.

Martco, LLC, parent company for timber sourcing and manufacturing company RoyOMartin, will invest more than $30 million to install technologically advanced production equipment at its OSB plant in Oakdale, La.

The mill is one of Allen Parish’s largest employers, and as a result of this expansion, the company will retain its 232 full-time employees. Louisiana Economic Development estimates the project will also result in nearly 600 indirectly supported jobs in the state, for a total of 832 retained and indirectly supported jobs.

Virginia Carolina Forest Products, Lawrenceville, Va., installed a USNR lineal grader to grade both a pine and a mixed rough hardwood lumber line in a new, more efficient application design.

The production lines run parallel to one another and the scan frame is

VIRGINIA CAROLINA Forest Products is using USNR’s lineal grader for both its hardwood and softwood lines.

placed on a rail system that intersects both. At the flip of a switch, the scan frame can easily move between the more heavily used planer line and the hardwood line. As each board reaches the landing table, an overhead board tracker projects the grade onto each board to be screened by a quality control technician.

The quick-switch setup will allow both lines to receive faster, more accurate grading for increased value.

Interfor Corp., Burnaby, B.C., plans to reduce its lumber production by approximately 175 million bd. ft. between May and September of 2024, representing just under 10% of its normal operating stance.

The temporary curtailments will impact all of Interfor’s operating regions, including the U.S. South, through a combination of reduced operating hours, prolonged holiday breaks, reconfigured shifting schedules and extended maintenance shutdowns. The curtailments are in response to persistently weak market conditions.

The company will continue to monitor market conditions across all of its operations and adjust its production plans accordingly.

Cameron Ashley Building Products opened a new distribution center in New Haven, Ct., to stock drywall, insulation, roofing and accessories. Nick D’Errico is distribution center manager.

“This new location adds to our already robust footprint in New England and will further enhance our ability to service our customers located in the gold coast of Connecticut and New York,” said district manager Phil Rose.

Two Rivers Lumber Co., Demopolis, Al., will invest $115 million to build a state-of-the-art SYP sawmill in Coosa County, Al.

Beacon has acquired General Siding Supply, with branches in Omaha, Lincoln and Grand Island, Ne.; Sioux City, Ia.; and W. Fargo, N.D. Owens Corning completed its acquisition of Masonite International and named Chris Ball president of its door business.

Separately, Masonite agreed to sell all its Architectural segment to subsidiaries of IBP Solutions, a newly formed portfolio company of Industrial Opportunity Partners.

White Cap acquired distributor National Ladder & Scaffold Co., Detroit, Mi., to become part of the White Cap suite of brands, branches and value-added services.

Watermill Group is investing in Musser Lumber and subsidiary Musser Biomass & Wood Products, Rural Retreat, Va.

Millboard is opening its first U.S.based office in Minneapolis, Mn.

Garnica opened its first U.S.based distribution center early last month in Savannah, Ga.

Coffman Stairs will distribute IG Railing frameless glass railing from its Plano, Tx., and Austell, Ga., warehouses.

Parksite is expanding its distribution of Silvermine Stone’s mortarless stone veneer into Maryland.

Parksite has also begun carrying AZEK’s new TimberTech Aluminum Framing.

Detroit Forest Products, Westland, Mi., will sell Envision Outdoor Living Products’ decking and accessories in Michigan, northern Ohio, and Indiana.

Coastal Forest Products, Bow, N.H., is expanding delivery routes to central New York, including Albany, Syracuse, Binghamton and surrounding markets.

AZEK’s TimberTech Advanced PVC Vintage and Landmark are the first composite decking lines to be designated as Ignition Resistant by California’s State Fire Marshal.

Avon Plastics has launched a new Armadillo Builder Rebate Program, designed to simplify the process for contractors to get sizeable rebates for brand loyalty to Armadillo products.

Each year, the Softwood Lumber Board invests industry funds to promote the benefits of and increase the demand for softwood lumber across all markets. In 2023 alone, the SLB achieved strong results on behalf of the softwood lumber industry. Last year, the SLB:

1.9 BILLION BOARD FEET (BBF) GENERATED OF INCREMENTAL DEMAND.

Which is the Equivalent to BY FACILITATING WOOD USE, PRODUCED A CARBON BENEFIT OF 5 MILLION METRIC TONS OF CO2 NOT BURNING

27,570 RAIL CARS OF COAL.

WoodWorks directly converted LIGHT-FRAME AND MASS TIMBER BUILDINGS 1,700 and influenced a total of PROJECTS TO CHOOSE WOOD

470

RESULTING IN 842 MM BF OF INCREMENTAL LUMBER IN 2023.

10 NEW STATES

Adopted the IBC 2021 code provisions in 2023 with AWC support, bringing the total states adopted to 29.

$1 = 104 BF

(the average incremental demand is 86 BF/$1 over the lifetime of the SLB from 2012 through 2023). OF INCREMENTAL DEMAND FROM SLB INVESTMENTS

13.7 BBF REACHED OF TOTAL NEW DEMAND RESULTING FROM SLB INVESTMENTS SINCE 2012.

THINK WOOD AND WOODWORKS CO-NURTURED LEADS THAT LED TO

51

PROJECTS BREAKING GROUND IN 2023

REPRESENTING 73.6 MM BF.

LEARN MORE ABOUT THE SLB’S ACCOMPLISHMENTS

Kelly Scott, ex-Builders FirstSource, has been named director of purchasing for Mill Creek Lumber & Supply, Tulsa, Ok. Michael Lake is now general mgr. of Mill Creek Commercial in Edmond, Ok.

Tonia Tibbetts has rejoined the lumber sales team at Robbins Lumber, Searsmont, Me.

Ben Zeigler, ex-HL Munn Lumber, is new to Sprint Lumber, St. Joseph, Ia., as commercial sales mgr.

Brock Adams has joined Madison Wood Preservers, Madison, Va., as territory mgr.

Chadd Furley, ex-Building Products Inc., has moved to the EWP sales team at Forest Products Supply, Omaha, Ne.

Jim Miller is the new president of Premier Building Supply of Kansas City, Lenexa, Ks. He succeeds new President following Chris Borrego, who was promoted to senior VP, Midwest and South for parent Kodiak Building Partners.

Paul Crips, ex-Allegheny Millwork, is the new to Carter Lumber, as GM over Nashville, Tn., market doors and trim.

Peter Dever, ex-US LBM, has moved to Builders FirstSource, Wake Forest, N.C., as senior buyer-commodity wood products. Vinny Parreco was promoted to outside sales in Easton, Md.

Emily Jackson, ex-Trex, is new to outside sales with U.S. Lumber, Charlotte, N.C.

Tom Striss, BlueLinx Holdings, Marietta, Ga., was promoted to director of structural lumber.

Brandon Ferman is new to lumber sales at Baillie Lumber, Hamburg, N.Y.

Eric Knox has been promoted to director of LBM sales for Do it Best, Fort Wayne, In. Ben Schwartz is a new forest product trader.

Roger Williams is new to outside sales at Perkins Lumber Co., St. James, Mo.

Emily Biggerstaff, ex-MRD Lumber, has joined the outside sales team at 84 Lumber, Douglassville, Pa. New co-mgrs. include: Ryan Potter, Winter Garden, Fl., and Trey Brown, Greensboro, N.C. Michael L. Wright is now plant mgr. of 84’s truss facility in Lugoff, S.C.

Tague Lumber, Malvern, Pa., was recognized by Guinness World Records for an extraordinary feat— successfully shattering the previous record for the most people simultaneously “knocking on wood.”

The event saw an impressive turnout of 552 participants, surpassing the previous record of 295.

Denise Mitchell is now with Louisiana-Pacific, as Mansfield, Ga.-based territory sales mgr.

David Sullivan has been appointed director of installed sales for Tibbetts Lumber Co., Clearwater, Fl.

Brandon Ray is new to Superior Outdoor Products, New Holland, Pa., as senior territory mgr. based in Columbus, Oh. His territory includes the Midwest, although he’ll serve as a fence leader for the company.

Brett Kelley, ex-ABC Supply, is new to Beacon Building Products, as territory sales rep in Milton, Fl. Halie Stuntz is now assistant branch mgr. in Austin, Tx.

Hayden France is a new account mgr. at Timberland Lumber Co., Brazil, In.

Prithvi “Prith” Gandhi, ex-TAMKO, has joined Beacon, Peabody, Ma., as executive VP and chief financial officer.

Nathan Hascher, East Teak Thompson Fine Woods, Donalds, S.C., has been promoted to VP of lumber purchasing, processing & pricing.

Matt Riley is a new Blue Springs, Ms.-based business development mgr.-building envelope for PrimeSource Building Products.

Alex Beasley, ex-84 Lumber, is the new mgr. of Southern Pine Lumber, Pinellas Park, Fl.

Mark Aromi has been promoted to director of commercial sales for Kebony North America. He is based in Atlanta, Ga.

Roger Dankel, executive VP, North American sales, Simpson Strong-Tie, Pleasanton, Ca., will retire June 30, 2025, after 31 years with the company. He will continue in his current role through the end of this year and stay on as an executive advisor for the first half of next year.

Mark Taggart, chairman, Toyota Industries Global Commercial Finance, is now also chief financial officer for Toyota Material Handling North America, Columbus, In.

Norman Willemsen, ex-Kebony, has been named CEO of MOSO, succeeding founder and former CEO René Zaal.

Kevin Patten has joined Integrity Decking Co., Green Bay, Wi., as a designer/sales rep.

Tricia Metz, ex-ProSource Wholesale, is now territory sales mgr. for MasterBrand in Tennessee.

Jason Olding, ex-WindsorOne, has joined Tando Composites as Greenwood, In.-based regional mgr. for the Midwest and South.

Dennis Easter has been appointed CEO of Wellborn Cabinet, Ashland, Al.

Susanne McGinnis is now marketing mgr. for Clubhouse/ TruNorth Decking.

Álvaro Gonzalez was named CEO of Garnica, Wilmington, De.

Brian Bonanomi was promoted to VP-lumber supply chain with Sterling Site Access Solutions, Phoenix, Il.

Eddie Crosslin, Crosslin Building Supply, Eagleville, Tn., and Matt Kuiken, Kuiken Brothers, Fair Lawn, N.J., have been appointed to the LMC board of directors.

John Fisher, southern pine & treated purchasing mgr., LMC, has joined Penn State’s BioRenewable Systems Advisory Committee.

Josh Brown, VP, Bliffert Lumber & Hardware, Milwaukee, Wi., was honored as a 2024 Notable Leader in Construction, Real Estate & Design by Milwaukee Business News

Marsha Dimes is overseeing charitable contributions at Mungus-Fungus Forest Products, Climax, Nv., report co-owners Hugh Mungus and Freddy Fungus.

Re Reddwwood i ood is

thrives in some of the most productive timberlands in the world. Redwood is known for its timeless durability without the use of chemicals. Due to its flawless formation, there has never been a Redwood recall. There is a grade of Redwood for every application, every budget, and every customer.

“Growing beyond measure.”

Call or visit us today. Our family of Redwood timberland owners will continue to be your reputable and reliable source of Redwood.

IT’S SUMMER, and everyone is ready to be on the water. If your customers are contemplating building or upgrading a dock or pier, have them consider southern pine lumber.

Why? Marine structures are exposed to especially harsh environmental conditions, and industry qualitycontrol standards for manufacturing and preserving southern pine assure long-term performance and minimize environmental impact. Advances in preservative treatments, modern design and construction techniques, and sustainable forestry management make southern pine a cost-effective, ecologically sound, and renewable construction material for marine construction.

In addition to residential projects, southern pine lumber is a natural choice for marine construction and can be used for commercial applications such as marinas, bulkheads, boardwalks and light vehicular bridges.

But design considerations, accurate specification of

lumber, timbers, and fastening hardware are just a few factors in achieving proper performance, serviceability, safety and longevity.

Marine projects using properly specified southern pine materials should provide a long service under all anticipated conditions. While alternative materials may offer short-term cost benefits, short-term savings may deprive the owner of long-term, low-maintenance use.

It’s recommended to consult licensed design and construction professionals experienced in the marine environment and review examples of their recent projects.

Marine construction is a complex process with many variables. It requires extensive knowledge of local conditions and should only be undertaken by qualified professionals. Water level extremes including storm surge, tidal histories, loadings, codes, construction practices,

materials, and soil analysis all must be considered.

Don’t Skip

Speaking of soil analysis, proper evaluation is critical to the design and long-term performance of the marine structure. Sandy (granular) soils usually are quite predictable yet are subject to scour and erosion. Clays (cohesive soils) may not be consistent in a given locale and may vary widely within a single project.

Even when viewed by an experienced design professional, soil analysis without the benefit of testing by a qualified soils testing laboratory is only approximate at best. The cost of a locally certified soils testing lab is offset by the advantages of accurate quality and strength data reports.

The American Wood Protection Association’s (AWPA) Use Category System (UCS) defines exposure categories that wood products are subjected to in service. The UCS helps users identify the exposure condition for specific products and end-use environments and then specify the acceptable preservatives and retention levels necessary for that application.

When purchasing treated southern pine under the UCS, material orders should include the service condition, specific end-use, preservative and retention level, and any special requirements such as pre- or post-treatment preparations, including conditioning and drying.

Boardwalks, piers and floating docks are just a few examples that typically call for treated southern pine materials. As with all marine construction, a familiarity with the correct materials and installation techniques is crucial to the long-term performance of the structure.

Based on the exposure and the structural component requirements, what are the preliminary determinations? Consider:

• Dimension lumber sizes and lengths

• Lumber grades

• Preservative retention

• Surface texture

• Moisture content

Lumber graded No. 2 is recommended for most general construction uses where moderately high design values are required. For applications where high strength, stiffness, and appearance are priorities, lumber graded No. 1 can be used.

Where higher strength is needed, No. 1 Dense may be specified; availability may be limited. For members that will be constantly submerged in brackish or salt water, “Marine Grade” lumber provides better resistance to marine borers and should be specified. Consider the specification of “Seawall Grade” material as a minimum for retaining wall sheeting.

(Continued on next page)

Because a waterborne preservative system is used, the moisture content and physical dimensions of southern pine lumber can vary after treatment. Wood swells in both thickness and width during treatment.

For example, a 2x6 at 19% moisture content prior to treatment measures 1-1/2” x 5-1/2”. This measurement can increase as much as 1/8” to 1/4” directly after treatment, depending on the density of the wood.

To reduce waste, decking should be specified, ordered, and installed in even 2-ft. lengths (4’, 6’, 8’, etc.). For optimum appearance and performance, the grade of decking material should be specified as No. 1 (for 2” nominal thickness). Treated lumber should bear the grade mark of an inspection agency accredited by the American Lumber Standard Committee (ALSC), as well as the treated quality mark indicating the use of preservatives standardized by AWPA or evaluated by ICC-ES.

Remember, any field cuts may impact the preservative treatment effectiveness. Whenever possible, have cuts such as mortises—the cuts at bottom of sheet piles or radius milling of edges—completed before treatment, or at least dip or brush

these surfaces with copper naphthenate before installation, in accordance with AWPA Standard M4.

Most treated southern pine is delivered to the supplier or job site in a wet condition, usually in excess of 25% moisture content. The actual size of this material (thickness and width) could vary depending on drying time after treatment and ambient temperatures. Accordingly, decking may need to be installed with pieces butted tightly together to avoid excessive gaps as the lumber dries in use.

As an alternative, treated southern pine lumber can be specified that is redried after treatment. This material can either be kiln-dried after treatment (KDAT) or air-dried after treatment (ADAT). This lumber is designated KDAT or ADAT on the quality mark or end-tag.

AWPA standards specify a moisture content of 19% for all KDAT and ADAT material. Generally, this lumber should be adequately spaced during installation to avoid buckling.

Proper fastening practices and