1 & 2 hour rated wall systems for commercial and multi-family construction.

Tested in accordance with ASTM E119. ASTM E119 testing evaluates the duration for which assemblies can either contain a fire, retain structural integrity, or both.*

Surface applied fire retardants like paints, stains, penetrants, and intumescent coatings ARE NOT building code compliant in applications where Fire Retardant Treated Wood is required. FlamePRO Fire Retardant Treated Wood is pressure impregnated, fully code compliant Fire Retardant Treated Wood. It is appropriate for use in all applications where Fire Retardant Treated Wood is required.

*For details refer to ESR Report 4244.

Everwood’s been treating wood since 1982. We have a remanufacturing facility, dry kilns and an automated treating plant ensuring consistent quality control in all our treating processes. We serve both stateside exporters and domestic markets including both independent, family-owned businesses, as well as large distribution centers.

Our service area extends from Texas to the East Coast, with the majority of our business centered in the Southeast United States.

Our location on the Gulf Coast provides a geographical advantage for the export market due to our convenient port access in Alabama, Mississippi and Florida. These ports offer our customers the ability to be competitive worldwide.

PRESIDENT/PUBLISHER

Patrick Adams padams@526mediagroup.com

VICE PRESIDENT

Shelly Smith Adams sadams@526mediagroup.com

PUBLISHER EMERITUS

Alan Oakes

MANAGING EDITOR

David Koenig • dkoenig@526mediagroup.com

SENIOR EDITOR

Sara Graves • sgraves@526mediagroup.com

COLUMNISTS

James Olsen, Kim Drew, Dave Kahle, Claudia St. John

CONTRIBUTORS

Simon Cameron, Jeff Easterling, Ian Faight, Brad Kirkbride, Goo Lee, Susan Palé

ADVERTISING SALES

(714) 486-2735

Chuck Casey ccasey@526mediagroup.com

Nick Kosan nkosan@526mediagroup.com

John Haugh jhaugh@526mediagroup.com

DIGITAL SUPPORT

Alek Olson • aolson@526mediagroup.com

Josh Sokovich jsokovich@526mediagroup.com

CIRCULATION/SUPPORT info@526mediagroup.com

A PUBLICATION OF 526 MEDIA

151 Kalmus Dr., Ste. J3, Costa Mesa, CA 92626

Phone (714) 486-2735

BUILDING PRODUCTS DIGEST is published monthly at 151 Kalmus Dr., Ste. J3, Costa Mesa, CA 92626, (714) 4862735, www.building-products.com, by 526 Media Group, Inc. (a California Corporation). It is an independently owned publication for building products retailers and wholesale distributors in 37 states East of the Rockies. Copyright®2024 by 526 Media Group, Inc. Cover and entire contents are fully protected and must not be reproduced in any manner without written permission. All Rights Reserved. BPD reserves the right to accept or reject any editorial or advertising matter, and assumes no liability for materials furnished to it. Opinions expressed are those of the authors or persons quoted and not necessarily those of 526 Media Group, Inc. Articles in this magazine are intended for informational purposes only and should not be construed as legal, financial, or business management advice.

Update your subscription

------------ BY PATRICK ADAMS

I WAS YOUNG, and like all young people, I knew it all. I was recruited into something far bigger, and more complex than my age, training, education or experience was suited to handle. It was a picture of being literally thrown into the “deep end of the pool” despite my youth not realizing how deep the water actually was.

Thankfully, an older, wiser man who would become a mentor/father figure for some reason took pity on me despite my youthful confidence and arrogance. I vividly recall a patient and calm piece of advice he gave me in the midst of a storm. He said, “Adams, keep in mind that you will always be the average of the five people that you spend the most time with. Be very careful about who you choose as those five people as you navigate through your life.”

That was it. Nothing more. No sermon or lengthy explanation. He simply walked away. In my youth, I probably spent about 15 seconds pondering that, but by some divine gift, I never forgot it. As I have navigated through the chapters of my adult life, I have thought about that advice more and more often to the point where I suppose I don’t even consciously think about it but rather live it. I’m now very selective about who I surround myself with and make sure they are people of strong character, who bring out the best in me.

My daughter is almost 14 and just one school year away from being in high school. She is a good kid, with a kind heart and we’ve done our best to raise her with strong values, beliefs and a sense of right from wrong. Between school, club volleyball, and everything else, she is a busy kid. In this chaos of jumping from one thing to another, this year I broke down and got her a cell phone, mostly for us to stay in sync with each other on the jam-packed schedules. It has every restriction and supervision technically possible on it in an attempt to leverage the convenience, while minimizing the risks.

In spite of these best efforts, kids will be kids and we have had some struggles. The powers and temptations of technology, the fearlessness of anonymous “keyboard cowboys,” and the naivete of youth create situations that

we never dealt with as kids. As parents, we are forced on the fly to navigate these uncharted waters to allow lessons to be learned, to build trust, while also managing my extreme protective instincts that are always looking five steps ahead.

I recently had the “five people” discussion with her and probably much like the reaction I had years back, hers was not much different. Whether it is kids or even adults in our lives, we have to remain conscience of how powerful the influence is of people around us. This I now believe is one of the hidden secrets to a great life where you are constantly improving, or your life ends up in shambles. It can be as easy as comparing your own life to someone around you who you believe “has it all,” and wishing you had the same. Perhaps it’s a vacation, or a home, or a job, or a spouse that in the glimpses you see, is far more ideal than your own.

This is the trap, isn’t it? We all see glimpses of other’s lives, but rarely see the entire picture—unless you choose the correct “five.” The correct five are honest, open and share the truth not only because that is who they are, but because they want the best for you as well. As hard as that is to achieve in adult life, what is the hope that my 13-year-old daughter can be wise enough to find the same?

I have never wished for an easy life, nor do I believe I have ever had one. But I have had a blessed life where at times that I didn’t know I was lost, I stumbled on someone who helped to get me back on a path. I hope each of you takes a second to inventory your five people and, knowing this great industry as I do, you all will smile realizing that you also are blessed to be surrounded by people who make you better and help you navigate through this complex life.

As always, it’s an honor to serve you and this great industry!

PATRICK S. ADAMS, Publisher/President padams@526mediagroup.com

------------ BY JOHN CHAMBERLIN

A RECENT STUDY funded by the Softwood Lumber Board (SLB) and executed by the American Wood Council (AWC) reveals the vast amount of construction nationwide is currently at risk from changes to the Wildland-Urban Interface (WUI) code changes and adoption, primarily in the decking and siding markets. But what about structural panels such as plywood and OSB used in walls?

With a steady increase in wildfires between the years of 2005 and 2022, we saw upwards of 100,000

structures lost to fires during this time frame. WUI, defined as areas where buildings and undeveloped wildland or vegetation meet and the potential to burn is increased, is a nationwide concern, although wildfires tend to be more active in the western U.S. Combine this fact with the higher population density in the west, and it’s clear why this is such a concern.

WUI codes, for the most part, don’t affect structural panels used in roofs, walls, and floor systems, but that doesn’t mean these aren’t areas of concern. As the

industry as a whole recognizes that climate change is a potential driver of more frequent wildfires, and more structures are damaged by fires (year over year), structural panel product choice for wall applications is becoming more and more important.

On the whole, whether it’s on the local or state or national level, there’s a general thoughtfulness building around the fire hardening of buildings, with the goal in mind of changing and adapting building practices so the end result is more resistant to fire.

California is currently leading the charge in the development of what these standards should look like moving forward. In San Francisco, it’s common to see three story, three over one, or three family multifamily townhomes, all predominantly constructed with wood. In order to protect the building occupants (not to mention the building interiors), you still want to build with wood, but a level of fire hardening is necessary for an added layer of protection. This is where gypsum enters the picture.

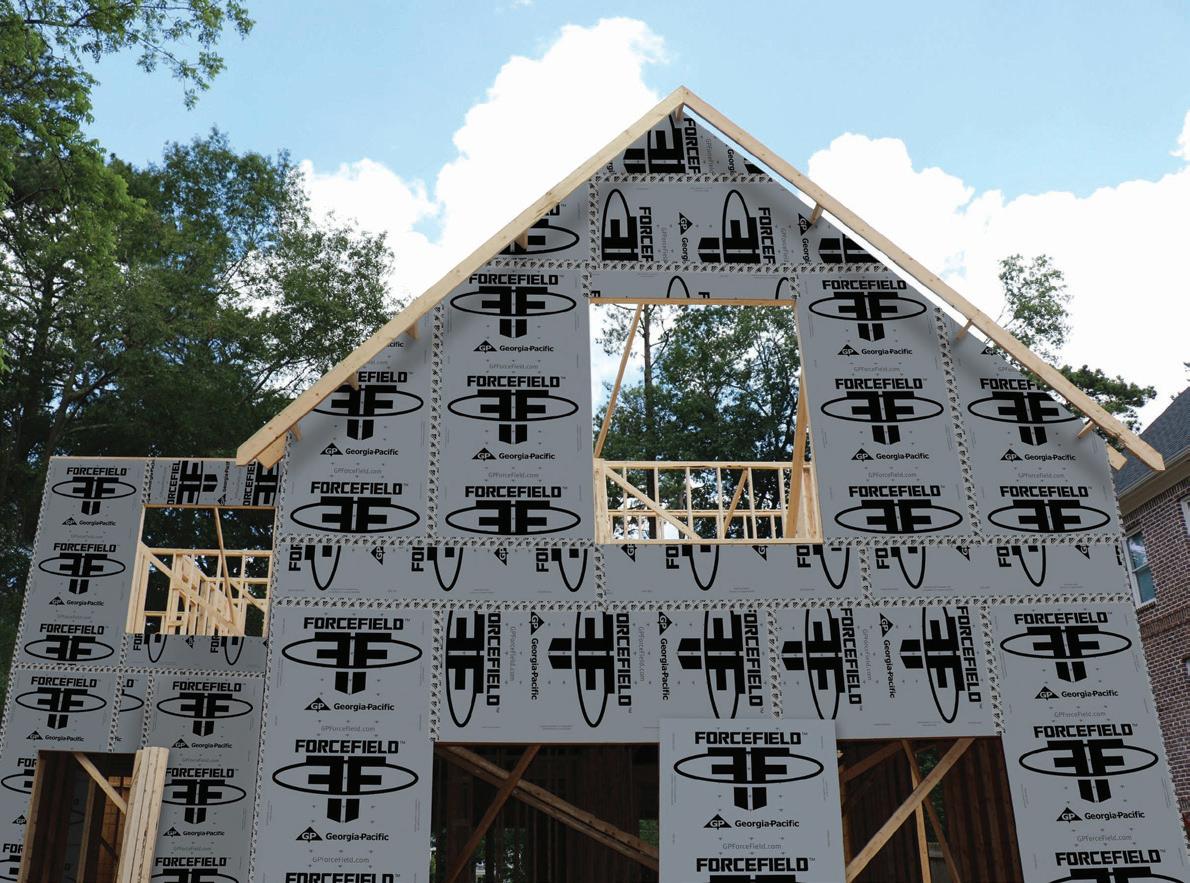

At the wood framing stage of construction, what we’re starting to see more and more is the addition of a layer of 5/8 gypsum around the frame itself as an extra layer of fire protection. At Georgia-Pacific, this has been on our radar for a while, to the point that we’ve developed technical guidance for builders interested in building up their building’s fire resistance with the addition of gypsum.

Taking it a step further, let’s look at the labor intensity involved in adding the gypsum step. If a builder is using housewrap, the result will be multiple trips around the building during the installation process. Choosing an integrated structural panel system (like

1 West Fraser

Headquarters: Vancouver, B.C.

OSB Mills (13): Huguley, Al.; Cordele, Ga.; Guntown, Ms.; Bemidji, Mn.; Allendale and Joanna, S.C.; Jefferson and Nacogdoches, Tx.; Grand Prairie and High Level, Alb.; Barwick, Ont.; Chambord and La Sarre, P.Q. [Plus Scotland, Belgium] West Fraser’s North American production of OSB rose 6% in 2023 to 6.38 billion sq. ft. 3/8” basis. Yet due to lower prices, sales were down more than one-third from $3.004 billion to $1.998 billion.

2 Louisiana-Pacific

Headquarters: Nashville, Tn.

OSB Mills (7): Clarke County and Hanceville, Al.; Watkins, Mn.; Roxboro, N.C.; Carthage and Jasper, Tx.; Fort St. John (Peace Valley), B.C.; Maniwaki, P.Q. [Plus Brazil, two in Chile]

Last year, LP's net sales of OSB fell by 50% to $1 billion due to 40% lower prices and 18% lower volumes. Sales of Structural Solutions value-added products fell from 1.803 billion sq. ft. in 2022 to 1.559 billion in 2023, while commodity OSB sales fell from 1.944 million sq. ft. to 1.512 billion.

ForceField Weather Barrier system from GeorgiaPacific) after adding the gypsum results in fewer trips around the building and less time spent on labor.

For peace of mind when building to WUI codes, choose a building products manufacturer that has done the research. We are unique in that we are the only manufacturer able to offer OSB and gypsum sheathings and provide the necessary technical guidance along the way.

As the call for more resilient construction across the U.S. grows, it’s clear where WUI fits into the algorithm, but let’s take it a bit more specific and discuss resilience against high winds and how the OSB market fits into this growing push.

With the growing frequency of high wind and storm events, the trend of seeing strong wind damage from storms is not going to plateau or peak anytime soon: it will only get worse.

Where the change needs to occur: the development and manufacture of more resilient products, combined with a local-level focus on the importance of resilient construction. As we watch insurance carriers pull out of entire states, this market growth cannot happen soon enough.

The Insurance Institute for Business and Home Safety (IBHS) is an independent nonprofit scientific research and communications organization supported by property insurers, reinsurers, and affiliated companies. Their goal is to provide top-tier science and translate this into action to prevent avoidable suffering, to strengthen home and businesses, to inform the insurance industry, and support thriving communities. Through their FORTIFIED program, which is a volun-

Headquarters: Seattle, Wa.

OSB Mills (6): Arcadia, La.; Grayling, Mi.; Elkin, N.C.; Sutton, W.V.; Edson, Alb.; Hudson Bay, Sask.

With a combined annual capacity of 3.15 billion sq. ft., Weyerhaeuser’s six OSB mills saw production dip about 1% last year to 2.933 billion sq. ft., while sales plummeted more than 40% to 944 million due to lower prices.

Headquarters: Atlanta, Ga.

OSB Mills (5): Fordyce, Ar.; Hosford, Fl.; Clarendon, S.C.; Brookneal, Va.; Englehart, Ont.

GP's five OSB mills can produce up to 2.8 billion sq. ft. of panels per year.

Headquarters: Charlotte, N.C.

OSB Mills (5): Commerce, Ga.; Easton, Me.; Broken Bow, Ok.; Spring City, Tn.; Crystal Hill, Va.

Huber's five OSB plants can produce up to 2.556 billion sq. ft. annually, with a sixth mill currently under construction in Shuqualak, Ms., on track for a 2026 start-up.

tary construction and re-roofing program designed to strengthen homes and commercial buildings against specific types of severe weather like high winds, hail, hurricanes, and tornados, we are starting to see a growing level of knowledge along with adoption of the program in states like Georgia.

Georgia HB 279 is a proposed amendment to Chapter 32 of Title 33 of the Official Code of Georgia Annotated, which relates to property insurance and the ability to provide for an insurance premium discount/rate reduction for property owners building new construction that “better resists tornado, hurricane, or other catastrophic windstorm events.” To be considered for an insurance adjustment, the newly constructed property (residential or commercial) must be certified as constructed in accordance with the FORTIFIED program standards.

How do these builders meet the qualifications? The short version: every sheathable area must be sheathed with a structural sheathing, like 7/16 OSB, commonly referred to as continuous sheathing or fully sheathed walls.

This effort by the IBHS represents a potential lift for all OSB manufacturers, with the true winners being those companies who develop thought leadership and innovative product solutions in response.

To date, Housing and Urban Development (HUD) and the American Plywood Association (APA) are both championing the importance of developing more resilient products to better product residential and commercial structures. Policy makers, like those

6 Tolko Industries

Headquarters: Vernon, B.C.

OSB Mills (3): High Prairie and Slave Lake, Alb.; Meadow Lake, Sask.

Tolko continues to work toward reopening its High Prairie OSB mill, after the building and equipment were consumed by a fire in May 2022. High Prairie is responsible for about a third of Tolko’s overall OSB capacity of 2.26 million sq. ft.

7 Arbec Forest Products

Headquarters: St. Leonard, P.Q.

OSB Mills (3) Miramichi, N.B.; Amos and Shawinigan, P.Q.

Arbec's three OSB facilities have a combined annual production capacity of 1.15 billion sq. ft.

8 RoyOMartin

Headquarters: Alexandria, La.

OSB Mills (2): Oakdale, La.; Corrigan, Tx.

In addition to building a second OSB mill in Corrigan, Tx., RoyOMartin also recently announced plans to invest $30 million modernizing its 17-year-old Oakdale, La., location.

9 Langboard

Headquarters: Quitman, Ga.

OSB Mill (1): Quitman, Ga.

Langboard OSB has a 440-million sq. ft. annual capacity.

INTEGRATED structural panel systems, such as Georgia-Pacific's ForceField Weather Barrier system, combine OSB sheathing with an air and water barrier.

in Georgia, are beginning to acknowledge there is a problem that needs to be fixed. It’s going to take an industry-wide focus on designing products with integrity and air and water tightness to truly affect change. Looking to programs like FORTIFIED is a great start, as we as an industry must do better, we must build better, and truly champion products that reduce labor and cost, but also make a difference. BPD

– John Chamberlin is senior product manager for DENS products for Georgia-Pacific (www.gp.com).

V Godfrey Forest Products

Headquarters: Marblehead, Ma.

Godfrey, which over the last 45 years developed four different OSB mills that it later sold, intends to build a new facility in Jay, Me. The mill, with an annual capacity of 850 million sq. ft., is slated to be completed in early 2026.

V Kronospan

Headquarters: Austria

The European panel manufacturer hopes to open its first OSB mill in the U.S. at the site of its MDF complex in Oxford, Al. Although the $350-million project was announced 15 months ago, apparently it is still in development.

V One Sky Forest Products

Headquarters: Prince Albert, Sask.

One Sky still hopes to build a new $250-million OSB mill adjacent to the Prince Albert Pulp Mill.

------------ BY GOO LEE

boards play a significant role in the housing sector, with applications including sheathing, cladding, furniture, and paneling. OSB is a type of wood structural panel manufactured from wood strands that are consolidated in a cross-oriented manner and bonded with waterproof thermoset adhesives. OSB offers superior durability and is relatively consistent and dense. It is mainly used in construction for structural purposes like wall sheathing, floor and roof systems.

OSB is projected to play a major role in the construction industry’s recovery from the lingering effects of the COVID-19 pandemic. According to Mordor Intelligence, OSB is popular due to its staunch and useful properties and lower cost. An April 2024 market report states that the global market for OSB, estimated at US $21.7 billion in 2023, is projected to reach $50.6 billion by 2030.

Adhesives play a crucial role in producing this important construction material. The impending EPA regulations will impact the OSB manufacturing, particularly the proposed risk evaluation for formaldehyde under the Toxic Substances Control Act (TSCA).

We are very concerned that we will not be able to make wood products in this country should the EPA put forward an occupational exposure value (OEV) of 11 ppb, which is well below indoor background levels and fails to reflect the standards of review set by TSCA for the use of the best available science.

The adhesives, which may contain low formaldehyde, used to make the OSB products are a critical component to comply with the product performances required by the applicable national standard such as PS 2-18 and building codes. The availability of these versatile and cost-effective wood products would be significantly impacted by the TSCA rule. The extremely

low proposed OEV for formaldehyde in the draft TSCA evaluation is below naturally occurring background levels and way below ambient concentrations routinely found in indoor environments.

Given the impact it could have on our industry—as well as a host of other industries—it is important to take the time to get it right. APA members are taking it seriously and very interested in the TSCA risk evaluation and the potential impact its conclusions could have on the use of adhesives to make these engineered wood products.

To continue making engineered wood products in this country—which should be a no-brainer given the host of positive benefits this industry provides to our citizens and the environment—there needs to be a serious and extensive review of the proposed OEV 11 ppb standard at this stage in the TSCA process. It is imperative to get it right now. We therefore ask for an examination of the EU’s derivation of 300 ppb as its OEV and how that can and should inform the EPA’s recommended OEV, as well as a critical review of the study used in support of the 11 ppb.

Formaldehyde is one of the most comprehensively studied and regulated chemicals in the world. Any evaluation of formaldehyde must start with the most reliable scientific evidence and the undeniable truth that formaldehyde is a natural component of the environment, which has become vital to sustainable engineered wood products like OSB.

If additional restrictions were put in place, it would not only impact the production of OSB, but dozens of other materials in the construction industry, like roofing shingles and insulation. BPD

– Goo Lee is certification operations manager at APA –The Engineered Wood Association (www.apawood.org).

DIFFERENTIATION is a key part of any marketing strategy. It distinguishes your product from your competition, creates brand loyalty, and communicates the uniqueness and advantages of your product.

We’re accustomed to seeing product differentiation in countless consumer and professional goods: cars, shoes, watches and packaged goods, to name just a few. Most of these categories routinely promote ------------

BY BRAD KIRKBRIDE

how their product is unique and stands apart from its competitors. This degree of differentiation isn’t as common in the lumber industry, but it needs to be.

Our mandate at the Western Red Cedar Lumber Association is to promote and advocate for western red cedar, and the cedar industry is a prime example of the importance of separating your product from other species and the need to clearly communicate its unique attributes.

WRCLA members’ products come under the Real Cedar brand and are supported by the association. Over the decades, a lot of work has gone into developing the brand and all that it’s associated with. From consumer advertising to professional education programs for architects, the WRCLA has adhered to a strategic communications strategy to demonstrate why western red cedar is the ideal species for specific applications.

With the exception of non-wood competitive products, the WRCLA has never created a negative or competitive campaign against any other natural wood species. Obviously, different species have their own properties and characteristics that make them well suited for specific applications. Western red cedar is no different. Real Cedar advertising has only focused on its own benefits and advantages.

It is this adherence to a consistency of messaging that underscores the value of differentiating Real Cedar from other species.

While it’s highly unlikely anyone would confuse WRC with, say balsa wood or an exotic hardwood cumaru, the prevalence of more similar species like Japanese cedar, or Sugi (Cryptomeria japonica) in North American markets has caused some confusion and a concern about

brand erosion for Real Cedar. As managing director of the WRCLA, I obviously have a vested interest in promoting WRC, but I’ll state that I have no issue with Sugi as a product per se; it’s well priced, it can look nice and is fine in certain applications. Where it can cause complications in the market, however, is when they ride the coattails of the Real Cedar brand, and are used in applications where WRC would be better suited, and then fail to perform to Real Cedar’s standards.

This is why the WRCLA is focusing on differentiating WRC from other species and emphasizing consumers to look for the Real Cedar logo.

The Real Cedar logo is the visual representation of the brand, and the brand has an excellent story behind it. Western red cedar (thuja plicata) is naturally resistant to the elements and is highly resistant to pests and decay, making it ideal for outdoor applications such as decking, soffits, siding, yardscape structures and finishing boards like fascia. The fact that there is no need to chemically treat or thermally modify the species to prepare it for outdoor use is a tremendous selling point for consumers, and an advantage few wood species can claim.

The versatility of WRC is another key component of the brand story, and a persuasive reason for consumers to purchase Real Cedar. The wide range of siding profiles, surface textures, dimensions and even color variations are all exceptional characteristics of the species and its products and help set WRC apart from other materials.

It is worth noting that recent studies in biophilia—the connection human beings have with nature and natural elements—show that there are significant health benefits to using natural wood products like WRC in the built environment, reducing stress and stress-related illness. Interestingly, faux-wood products do not provide the same benefit.

While the look of the product has traditionally been the most compelling feature of Real Cedar and its highest profile brand attribute, the sustainability of the species is undoubtedly becoming the most

important. As awareness of climate change continues to grow, consumers are increasingly taking broader actions to aid the environment. We only have to look at the surge in EV popularity, the decrease in plastic shopping bags or the move away from natural gas to see the adoption of these behaviors.

Homes and building materials with lower carbon footprints are also becoming part of this necessary shift. In the past, the WRCLA has focused on reaching architects and builders with messaging on WRC’s sustainability, carbon sequestration, and the role it plays in forest renewal. Wood product differentiation by both origin and product standards, i.e. FSC certification, are compelling, responsible and can be highly persuasive reasons for choosing one species over another.

With consumers becoming more receptive to these facts, and increasingly willing to make purchase decisions that help mitigate climate change, this messaging has now become a cornerstone of the Real Cedar brand.

All of these, as well as other benefits, form a part of the Real Cedar brand that distributors, retailers and consumers are exposed to. The logo also stands for the quality and consistency of the members that manufacture, distribute, and sell

Real Cedar products. While it is the product on the floor that’s being sold at the end of the day, knowing that product is supported by an international organization representing all aspects through its chain of custody is a valuable difference, particularly in markets where the strategy is to counter price-based competition.

Our industry needs product differentiation. It builds brand reputation; sells product features and benefits, and demonstrates value to the consumer. In the lumber industry, however, product differentiation is both a product marketing strategy and an important economic tool. Differentiation by origin and “green certification” creates additional consumer choices by demonstrating sustainable forest practices—the product comes from legal, responsible sources—as well as supporting local social and economic conditions, creating jobs and building communities.

The Real Cedar brand has real value. It’s why we’re telling the market that if it says “Real Cedar,” it is. BPD

– Brad Kirkbride is managing director of the Western Red Cedar Lumber Association (www.realcedar.com). Established in 1954, WRCLA is the voice of the cedar industry with members in 131 locations throughout North America.

------------ BY IAN FAIGHT

WHEN IT COMES to building materials, there are plenty of options in the marketplace for seemingly any application. And for end-users or design professionals who are looking to source real wood, look, price, and availability heavily influence purchase decisions. The good news for lumber dealers and distributors is that a beautiful and versatile species like cypress is not only affordable, it’s also readily available.

Native to the Southeast, cypress has long been an architectural fixture throughout the South, along the coasts, and up through the Mississippi Valley. Cypress is a unique species in that, while it’s technically a softwood, it grows and traditionally gets milled alongside hardwoods. It’s naturally resistant to the elements, decay, and insects, making it a great material to use for exterior applications, like siding, decking, porch flooring and ceilings, and structural applications. And it’s right at home inside, where good looks can really shine in practically any surface application from paneling and cabinetry to ceilings and beams.

“I truly believe cypress is the most unique and versatile species of wood in North America,” says Truss Beasley of Beasley Forest Products in Hazlehurst, Ga. “Its natural aesthetics, coupled with its friendly milling

behavior, make it an ideal choice for today’s homeowners who prefer a clear finish to enhance the natural beauty of wood, rather than apply dark stains or paints. Cypress offers a look that’s timeless and highly desirable for projects inside and outside the home.

“In our area, cypress is consistently in high demand, and that can be said for select grade with a mostly clear face and the more rustic looks of #2 common grade and pecky cypress. The dealers we work with are increasingly looking for products that are readily available and in demand. Cypress fits the bill and we’ve gained business because of it.”

Mike Shook of Norcross Supply Co. in Norcross, Ga., agrees. “Select grade cypress boards and tongue-andgroove patterns remain in demand in our area,” he says. “Our company also is experiencing strong demand for 1x6 tongue-and-groove cypress boards in the #2 common grade. We’ve noticed that as competing products, such as western red cedar, have seen prices tick up or become limited in supply, more dealers are discovering cypress as of late.

There’s also been an increase in cypress timber inquiries over the last several months. “Large timbers offer an impressive visual presence that attracts high-

end residential and commercial projects,” Shook adds. “Homeowners are choosing to invest in their backyards and outdoor living spaces by building pool pavilions and pergolas with timbers. Interiors, too. Exposed structural applications are very popular right now, and you see them on all the popular renovation TV shows and throughout magazines.”

As we enter election season and the Federal Reserve weighs options, there’s been a noticeable slowdown in the overall retail lumber business. “There are definitely election jitters causing homeowners to delay moving forward with projects,” Shook adds. “If interest rates come down a point or two, I believe we’ll see a surge in remodeling projects—and that’s great for our cypress business and the industry as a whole. And I am optimistic that demand for real wood products and shifts toward cypress will not only continue, but grow in more and more markets.

“Cypress remains a premier building material. In my eyes, there is not a better look in the business than a clear coat on cypress—and that includes other species and wood-look products. The finish showcases and brings out the natural beauty and unique grain pattern of the wood—especially the heartwood.” BPD

– Ian Faight is the managing director of the Southern Cypress Manufactures Association. For more information on cypress building products for interior and exterior applications, visit the Southern Cypress Manufacturers Association website at cypressinfo.org.

• Stain, scratch and fade resistant

• made of 95% recycled materials

• capped all 4 sides for maximum protection

• decking is dual-sided unlike most composites

• 25 year transferrable warranty

ZERO IS A NUMBER and silence is a note. The rest in music adds to the rhythm, structure, expression and feeling of a song. It can create or relieve tension which adds to the beauty of a piece of music; makes it more enjoyable, comfortable and interesting to listen to.

The same can be said for the use of silence in communication, in our case, sales communication. The Master Seller uses silence to create curiosity, to allow their customer to relax and really understand the value of their proposal. They use silence to create camaraderie and rapport. Many sellers speak too quickly and leave no space between words and sentences. This creates a rushed, “I’m only here for the order” feeling, making the customer want to end the interaction as soon as possible usually with a “no” or “I’ll let you know.”

Have you ever had someone give you a feeble or too strong handshake? Both put us off and make us wonder why their parents didn’t raise them right. The feeble handshake projects weakness and the too strong handshake projects insecurity; a sense of trying too hard to impress.

Our greeting in our sales calls are what I call a “verbal handshake” and is equally important in making our first impression. I have listened to and been on thousands of sales calls. Sellers with good “verbal handshakes” outperform those who don’t by a large margin.

Our greeting should be open, friendly—we have a slight smile—in person or on the phone, the slight smile projects confidence. This confidence transfers to the customer. The smile

------------ BY JAMES OLSEN

is slight, we don’t overdo it which projects insincerity. Our pace is relaxed. We enunciate clearly and leave space between our words and sentences.

“Good morning. My name is Jack Johnson. I am with Johnson Forest Products. I am calling you from Sacramento, Ca. How are you today?”

This greeting sets us apart from the multitude of salespeople that talk too fast and don’t give enough information creating a “Who the heck is this?” feeling from the prospect. Students ask me, “Why so much information?” Because the prospect wants to know even if subconsciously so.

When a customer ends a sentence most salespeople speak too soon. We need to count to two at the end of our customers’ sentences. This sends the message that we are listening to them, not that we are just waiting for them to finish so we can talk. You will be shocked how many of our customers will continue to talk if we give them the space to do so. This creates rapport and gives us additional information about our customers’ desires, which helps us better align our sales approach to their needs.

This is the number one thing that I have to “un-teach.” It shocks me, but most salespeople interrupt their customers all the time. Nothing breaks rapport more.

When a customer interrupts us, stop talking. If they are so excited that they can’t wait to speak, let ‘em roll. If a customer makes a noise, stop talking. Often these small noises are an intro to the sentence they want to

speak. Being a great listener is disarming and a competitive advantage.

When a customer gives us an objection, it is imperative that we don’t interrupt. Many sellers chime in with an “OK” before the objection is even finished. Complete silence and then count to two or three. Overcoming objections is one of the most difficult things we do as salespeople. Once someone has said no it is difficult to get them to change their mind, but if a customer does not feel completely listened to and understood, the odds of changing their mind are infinitesimally small.

We listen to their objection, count to three, then say, “I completely, understand how you think that way and in most cases I would agree with you, but let me tell you why, in this case you might consider my proposal.” We must have an even, relaxed and sincere tone when delivering this message to have any chance of changing their mind.

After we ask for the order, SILENCE. It’s the customer’s turn to talk. Let them.

Silence is a power tool—use it. BPD

JAMES OLSEN

------------ BY SUSAN PALÉ

THE ECONOMY CONTINUES its solid growth, inflation is lessening, and unemployment remains low. There’s lots going on from a legislative perspective too. As we work our way through Q3 and into Q4, here are some things we think you need to know!

The first half of 2024 saw significant job growth, with an average of 255,000 jobs added each month, surpassing the 213,000 jobs added per month in the second half of 2023. In January, 353,000 jobs were added, primarily in professional/business services, healthcare, and retail trade. The healthcare sector continues to lead in job growth, offering numerous opportunities for both clerical and administrative, as well as clinical positions.

Wage growth, while slower in the first quarter of 2024, is expected to remain close to 4% for the full year. The increases in the cost of wages and benefits have closely tracked each other from March 2018 to March 2024. Although major compensation research organizations typically release wage growth projections in the fall, early estimates suggest an additional 4% wage growth in 2025.

Competitive wage growth is essential for retaining top talent in a tight labor market. Companies that proactively increase wages are better positioned to reduce turnover and attract skilled workers.

When evaluating wage growth, it’s important to consider total compensation, including benefits. Many organizations are enhancing their benefits packages to complement wage increases. Comprehensive healthcare plans, retirement contributions, paid leave, and wellness programs are increasingly seen as essential components of a competitive compensation package.

Trends in benefit offerings show a growing emphasis

on mental health support, flexible working arrangements, and family-friendly policies.

Despite a recent uptick, the unemployment rate remains low. The unemployment rate for July 2024 was 4.3%, an increase from 4.1% in June 2024. This compares to the recent low of 3.4% in April 2023 and the high of 14.8% in April 2020. The USDOL considers an unemployment rate of 4% or less to be “full employment,” indicating potential recruiting challenges for employers as the number of positions exceeds the number of available candidates. Many economists view this uptick in the unemployment rate as a sign of a cooling job market, potentially signaling the Federal Reserve to cut interest rates. Lower interest rates can make borrowing cheaper, encouraging businesses to invest in expansion and hiring. Therefore, now might be an opportune time for companies to consider ramping up their recruiting efforts.

Effective July 1, extensive changes to salary thresholds for “white collar” and highly compensated employee overtime exemptions took effect. The USDOL estimates that as many as 4 million workers could be impacted by these changes.

In April, the Federal Trade Commission issued a new ruling that bans enforceability for the vast majority of workers covered by noncompete agreements. The Commission determined that such agreements negatively impact competitive conditions in labor markets, inhibit new business formation, and lead to higher prices for consumers.

Following the hottest year on record, the Occupational Safety and Health Administration is expected to announce a ruling designed to protect more than 50 million

Q. We just issued updated handbooks to all employees. We have asked everyone to sign and return the Receipt of the Handbook Acknowledgement form for their files. However, one employee refuses to sign and send it back to us even after we have sent multiple requests and reminders. What should we do?

A. If employment is at-will, the company has the right to change most policies at any time. Employees are expected to follow the policies of the company as long as they are legal. While it is best practice to have signed acknowledgement forms in each employee's file, it is not required to enforce those policies.

Next steps may depend on why the employee is not signing the form. If they say they have not read the handbook, ensure they have been given enough time to do so, giving them a deadline to return it. If they have questions or concerns about certain policies, talk with them to resolve these.

However, if the employee has been given multiple chances to return the form and/or to discuss concerns, they are still expected to follow the updated handbook. You should document in writing that the employee is expected to follow all policies of the company including those in the new handbook and their failure to return the acknowledgement does not change that requirement. Then put that document and any response into their employee file.

workers exposed to high heat conditions where they work. The ruling would apply not only to farm and construction workers, but also to those who sort packages in warehouses and cook in commercial kitchens. Although not finalized, the ruling is expected to require additional breaks, access to water and shade, and air conditioning.

As noted above, base pay increases are expected to remain at about 4% through 2025. A recent Payscale survey asked participants how base pay increases were determined. A large majority responded that merit/performance continues to be the primary driver, but 57% reported market pressure as another important consideration and 40% cited internal pay equity as a determiner.

Variable compensation continues to be a supplement to base pay in many organizations. A recent survey conducted by the Academy to Innovate Human Resources reports that 77% of U.S. businesses currently have some type of variable pay program (they come in all shapes and sizes), and another 9% are expected to add this type of program in 2024.

Pay transparency is defined by World at Work as “the degree to which employers are open about what, why, how and how much employees are compensated.” There are legal pay transparency requirements in several states, but more companies are becoming increasingly open about their compensation policies and practices to improve recruitment and retention.

Many organizations wait until the last minute to do their compensation planning for the following year. Don’t

be one of them! Here’s a short list of third-quarter activities that will help position you for year-end:

• Collect market information for your positions, with special focus on those that present recruitment and/or retention challenges.

• Plan market adjustments based on results.

• Review current compensation programs/policies/procedures for needed changes and revisions.

• Identify communication and/or training needs.

• Begin salary planning for the annual increase process.

• Begin salary planning for bonus and incentive payouts.

Staying informed and proactive about these trends and changes will help ensure your organization remains competitive and compliant in the ever-evolving labor market. When in doubt, connect with The Workplace Advisors to guide you. BPD

Susan Palé, CCP, is vice president for compensation with The Workplace Advisors. Reach her at (877) 660-6400 or contact@theworkplaceadvisors.com.

------------ BY KIM DREW

Who are you and what do you do?

My name is Chip Wade, and I am an engineer, TV host, designer, and contractor. I am the lead creative of Wade Works Creative, an architecture, design, and real estate production company located in Atlanta, Ga. With 20+ years in the building industry, I’ve worked on cutting-edge projects all over the country.

What are three challenges you see in the lumber industry/lumber retail industry today?

(1) As it has been for decades, lumber is currently marketed, viewed, and sold primarily as a commodity only. We’re not seeing much product differentiation, no real warranty

difference, nothing to really set one species apart from another one. What each purchase all comes down to is customer service and how easy it is to do business with each other.

(2) Across the industry, there is a lack of understanding as to how a full-service, cost-effective approach for selling materials and services for a job in parallel to lumber, even at a break, could provide a solid customer service differentiator.

For example: most lumberyards only stock and carry limited items solely focused on the lumber itself: sheet goods, fasteners, doors, etc. This is a solid way of sticking to the core of a business.

But there are so many more opportunities to drive sales with items a bit more parallel to the lumber! Things like decking, trailer rental, additional building materials/supplies, etc. Perhaps even connections with other dealers for things like gravel or landscape supplies. The point is, it’s time to take advantage of what’s becoming more important to the younger building professionals, and that’s the ease of identifying one place to get more of what they need efficiently and effectively.

(3) With so many composite and exterior-rated materials entering the marketplace, the real beauty of natural wood is taking a new, exciting focus, especially when it comes to interior warmth and style. This is spurring creativity in fun new ways as the focus shifts to how wood can be used in new interior applications.

What is the number one thing retailers need to keep in mind when working with customers?

In today’s market, just like we’re seeing with Amazon, it’s all about ease of transaction and customer service. Those two things, managed and delivered well, are what win repeat business.

Any tips for effective communications with customers?

Bottom line: it’s important to show that you care about each and every customer with which you come into contact. If a customer has a jobsite in the area, show up for a visit—don’t try to sell anything, but ask genuine questions showing interest in their project. Ask what you might do to make their experience with your company better.

Don’t forget to ask about the things you don’t necessarily see, like the comprehensive delivery workflow of product to the jobsite. Be willing to try something different if that’s what they need.

Over the last several years, I’ve seen building and even general construction customers leaning into higher quality, consistent material to leverage in their products. Along the same vein, we’re seeing builds beginning to have a more consistent and high-quality deliverable at the end of the day.

– For more information on Chip and/ or Wade Works Creative, please visit www.wadeworkscreative.com. BPD

Re Reddwwood i ood is

thrives in some of the most productive timberlands in the world. Redwood is known for its timeless durability without the use of chemicals. Due to its flawless formation, there has never been a Redwood recall. There is a grade of Redwood for every application, every budget, and every customer.

“Growing beyond measure.”

Call or visit us today. Our family of Redwood timberland owners will continue to be your reputable and reliable source of Redwood.

US LBM has acquired L.D. Mullins Lumber Co., a building products distributor serving builders and remodelers in South Florida.

Founded in 1946, Mullins Lumber is located in Riviera Beach, Fl., and will operate as part of US LBM’s Raymond Building Supply.

With the acquisition, US LBM now operates 18 locations in Florida.

Scott and Lev Mullins, who have led the organization since 2005, will continue running day-to-day operations in Riviera Beach.

“The entire Mullins Lumber team is looking forward to the great opportunities our partnership with US LBM will generate for our associates, customers and the community,” said Scott Mullins.

“South Florida continues to be a growth market for new construction, and the addition of Mullins Lumber and their great team allows us to augment and expand our operations and support for builders in the area,” said US LBM president and CEO L.T. Gibson.

Herreid Lumber, Herreid, S.D., has been acquired by Geoff and Hailey Brandner from Tom and Irene Badger, who have retired after 17 years at the helm.

North Shore Lumber, Two Harbors, Mn., hosted a grand opening on June 29. The former Two Harbors Lumber Co. was purchased by Adam Johnson from Gene and Donna Gangestad, who have retired after 60 years with the company.

84 Lumber recently opened a 41,250-sq. ft. door shop in Lawrence, Pa., and is targeting a Nov. 1 opening for a new door & window showroom in Annapolis, Md.

Liverpool Ace Hardware, Liverpool, N.Y., held a grand opening event Aug. 16-18 (Chris Belliboni, owner/operator).

Benge's Ace Hardware, Carmel, In., was opened Aug. 17 by owner Brent Benge and president Christopher Williams.

Rivers Ace will open a 5th store in Holland, Mi., this month at the former site of Van Wieren Hardware, which closed July 13.

True Value Hardware, Salem, Ma., is closing.

Elder's Ace Hardware will open store #33 in Mt. Juliet, Tn.

Ace Hardware, New Hope, Pa., held an Aug. 2 grand opening (Jaswinder Singh, manager).

Aubuchon Hardware added a store in Lisbon Falls, Me., managed by Susan Morgan.

Carroll's Ace Hardware, Fort Mill, S.C., held a grand opening Aug. 16-18.

Ace Hardware of Otsego, Mn., held a grand opening event July 2627 (Bill Olsen, store manager).

Crest Hardware, Brooklyn, N.Y., closed its doors Aug. 30 after 62 years.

Home Depot opened a new 107,891-sq. ft. store on July 25 in west San Antonio, Tx.

Habitat for Humanity of Wood County is buying a 14,000sq. ft. storefront in Bowling Green, Ky., to open a ReStore discount outlet by January 2025.

Do it Best is rolling out expanded capabilities for selling lumber online, offering customers a more streamlined and efficient shopping experience.

“Our data showed that lumber was among the top searches on our site, indicating a clear market demand,” said Brianna Wells, divisional manager of ecommerce: marketing & merchandising. “Many of our members sell lumber, and we saw an opportunity to boost their sales by catering to consumers who prefer to pre-buy online before visiting the store.”

According to Wells, the initiative provides additional sales channels for members and improves the shopping experience for their customers: “Our enhanced platform features over 1,500 lumber items, and we’re adding new products daily based on member requests. Customers need detailed product information to make quick decisions, and our online listings provide that.”

Do it Best collaborates with its members to ensure their unique product offerings are available online. This includes integrating their POS systems with the ecommerce platform for real-time updates on pricing and inventory. “We’re committed to maintaining current inventory and pricing to ensure a

reliable and accurate shopping experience for customers,” explained Corbin Prows, divisional manager of ecommerce platform operations.

This initiative aims to meet the evolving expectations of modern consumers. “It’s not just about convenience anymore,” explained Wells. “It’s about necessity. If customers cannot find what they need online, they’ll seek out retailers who provide that information.”

Do it Best will monitor key performance indicators such as direct online sales and overall site traffic to measure the success of the online lumber sales. Additionally, the company will track the influence of online visibility on in-store purchases. “We’ve already seen a positive trend with customers placing same-day pickup orders, then buying additional items in-store,” said Prows. “This integration significantly benefits our members.”

“We’re dedicated to collaborating with our members to broaden the variety of lumber products available for online purchase,” Wells stated. “Our goal is to help our members remain competitive in a dynamic market, and by consistently improving our online offerings, we can equip them with the necessary tools for success.”

Boise Cascade's Building Materials Distribution Division broke ground on a new 34-acre, rail-served site in Hondo, Tx.

Mid-Am Building Supply has doubled the size of its Mount Pleasant, Ia., location to 19 acres.

AHF Products is idling its solid hardwood flooring plant in Warren, Ar., on Sept. 27 and moving production to facilities in Beverly, W.V., and West Plains, Mo.

Beacon purchased Passaic Metal & Building Supplies Co. (PAMPCO), Clifton, N.J., with five branches in New Jersey and one in upstate New York.

Pella Corp. divested its two luxury businesses, selling Duratherm Window, Vassalboro, Me., back to prior owner Tim Downing and Reilly Architectural, Calverton, N.Y., to Stately Doors & Windows, Dallas, Tx.

Great Southern Wood Preserving is now distributing Allura fiber cement siding, soffits and trim from its Columbus and Tyler, Tx., locations.

Parksite, Batavia, Il., now offers Outdure’s QwickBuild aluminum deck framing system in Illinois, Ohio, Maryland, New Jersey, New York, Connecticut, North Carolina, Florida and North Dakota.

Duxxbak, Green Bay, Wi., appointed AmeriLux International, De Pere, Wi., to become the master distributor for Duxxbak composite decking products.

MFM Building Products is adding 33,000 sq. ft. to its warehouse in Coshocton, Oh.

Weyerhaeuser acquired a total of 84,300 acres of high-quality timberlands in Alabama for $244 million, through multiple deals.

MOSO Bamboo has achieved WUI certifications for its Thermo and N-durance boards for use in Wildland Urban Interface (WUI) areas across the U.S.

Arxada has published its second annual Sustainability Report: “The Power of Science and Sustainability.”

Derby Building Products launched a new Tando Composites website at tandocomposites.com.

On day one we started with just a truck and a commitment to be the best. When the YellaWood® brand says you can trust us to deliver, those aren’t empty words; they’re actually proven words. And words we take seriously. Which is why we’ve been striving to give our very best every day for over five decades now. We can say with confidence that the Yella Tag can deliver like no other because it’s been shown to do just that. See all the other ways the YellaWood® brand has your back. Visit yellawood.com/for-dealers

Nick Aylor was named director of purchasing for Culpeper Wood Preservers, Culpeper, Va. He succeeds Jeff Lineberger, who has retired after 25 years in the role.

Geoffrey Norton is a new buyer for Builders FirstSource, Dallas, Tx. Matt Lufkin has been promoted to VP-forest products.

Alphonso Jones, ex-Lowe’s, has been appointed store mgr. of Sutherlands Lumber, Pearl, Ms.

Benjamin Zupan, ex-American Woodmark, is a new Northeast territory sales mgr. for Roseburg. He is based in Middlesex County, Ct.

Christine “Chrissy” Kay, ex-Builders FirstSource, has joined Tibbetts Lumber Co., Lecanto, Fl., as millwork coordinator/purchaser. Mike Baske, ex-Builders FirstSource, is now with Tibbetts in outside sales in Fort Myers, Fl.

Cassius Gushiniere Sr., ex-Countertops Direct, is new to sales at Mortimer Lumber, Port Huron, Mi.

Nikki Mathe, ex-Lowe’s, is now with MoistureShield, as territory mgr. for Georgia.

Mike Sims, ex-Trussworks Mid-America, has been named VP of sales & operation for Capital Truss & Lumber, Hindsville, Ar.

David DePalma has joined the lumber sales team at Ring’s End Lumber, Bethel, Ct.

Matt Vaccaro has moved to Vaccaro Lumber & Hardware, Forrest City, Al., as VP of operations & sales.

Benjamin Doyle Pita, ex-Concord Lumber, is the new general mgr. of Koopman Lumber & Hardware, Hudson, Ma.

Gareth Rumley, ex-84 Lumber, has been named general mgr. of Carter Lumber, Columbia, S.C.

The U.S. Department of Commerce announced the final determination of a combined anti-subsidy and anti-dumping duty rate of 14.54% in the fifth annual review of Canadian softwood lumber imports into the U.S. The new tariff is nearly twice the previous “all others” rate of 8.05%.

“This even higher level of unfair trade by Canada could not have come at a worse time for domestic producers,” stated Andrew Miller, chairman of the U.S. Lumber Coalition and CEO of Stimson Lumber. “Lumber demand and prices are at record lows and mills across the country are struggling to keep afloat.”

The Coalition says the ruling confirms increased levels of unfair trade, which are making a bad situation worse by accelerating and deepening market downcycles, resulting in today’s extreme low lumber prices, forcing U.S. mill closures and layoffs.

Kurt Niquidet, president of the BC Lumber Trade Council, responded, “These duties continue to be unjustified and unfair. Commerce has departed from long-standing methodologies. These rates will hurt U.S. consumers by increasing the cost of lumber and building materials at a time when concerns about affordability continue to impact consumers on both sides of the border.”

Larry Jones was promoted to general mgr. of Westlake Ace Hardware, Hutchinson, Ks.

Taylor Stroh has been named president of Meland Lumber, Northwood, N.D.

Justin Snipes, ex-Lowe’s, is the new store mgr. at Landscapers Supply & Ace Hardware, Greer, S.C.

Michael Nestor was named lumber mgr. for Harpeth True Value Home Center, Franklin, Tn.

Josh Stevens is now in contractor sales for 84 Lumber, Huntsville, Al. New mgr. trainees include Jessy Baltz in Richmond, Va., and Matthew Cullen in Syracuse, N.Y.

Trever Adwell has been named yard mgr. of Carter Lumber, Bowling Green, Ky.

Scott Sproat has joined MOSO North America as architectural sales director, covering all territories in the U.S.

Mark Womack is now store mgr. of Rocky’s Ace Hardware, Springfield, Ma.

Chad Zeigler is new to SnapDragon Associates, Bedford, N.H., as executive recruiter and team mgr.

Tyler Pulec, ex-Flannel Man Woodworks, is now business development mgr. for Seward Lumber, Seward, Ne.

Josh Brown was promoted to chief operating officer for Bliffert Lumber, Milwaukee, Wi. Dave Dejewski is now CFO.

Jon Hawkes is new to inside sales at Moynihan Lumber, North Reading, Ma.

Jeff Wood has moved to US LBM, Atlanta, Ga., as senior VP of supply chain.

Jennifer Forest was appointed CFO of Martin Sustainable Resources and its wholly-owned subsidiaries Martco LLC and Martin Timberlands, Alexandria, La.

Blake Domin joined Chelsea Building Products, Oakmont, Pa., as Midwest regional sales mgr. for Everlast siding.

Patrick Bracken, LMC, has been promoted to Northeast regional mgr., overseeing the New England market. Paul Sbragia is now North Central regional mgr., heading up Michigan, Indiana, Illinois, Wisconsin, Minnesota, Iowa and the Dakotas.

James Garman, ex-84 Lumber, is now inside sales coordinator for Big D Lumber, Burleson, Tx.

Drew Hayden is new to Southern Lumber & Millwork, Charleston, S.C., as sales coordinator.

George Bandy has been named vice president and chief sustainability officer for Andersen Corp., Bayport, Mn.

Mark Rich has been appointed VP of sales & general mgr. of Sound Seal, Agawam, Ma. .

Daniel Bricker, LBM Advantage, New Windsor, N.Y., has been promoted to forest products mgr., overseeing both the commodity framing lumber and panel departments. Justin Smith is now forest products mgr. in the Conroe, Tx., office, and Keith Gritters is forest products mgr. in Grand Rapids, Mi., succeeding Randy Spriensma, who retired on Aug. 2. David Merryman is now national accounts & data operations mgr., based in New Windsor.

Cason Shrode, CEO, Cassity Jones Building Materials, Tyler, Tx., is now 1st VP and Jimmy Pate, owner, Pate’s Hardware, Comanche, Tx., 2nd VP of the Lumbermen’s Association of Texas. New to the LAT board are: Mark Chatfield, Doman Lumber; Jerry Lightfoot, Orange County Building Materials; Lynn Noesser, BlueLinx; and Charles Pool, Main Street Lumber.

Tara Bull has been demoted at Mungus-Fungus Forest Products, Climax, Nv., according to co-owners Hugh Mungus and Freddy Fungus

BY JEFF EASTERLING

WHAT'S YOUR FAVORITE lumber-selling tool?

Maybe it’s a sell sheet located on the showroom floor, a poster near the register, perhaps a screen showing product ads or informative shows, or maybe even a human expert who seems to have all of the answers. As the lumber industry constantly changes, ebbs and flows, keeping your selling points fresh with a variety of tools is key to successful sales numbers.

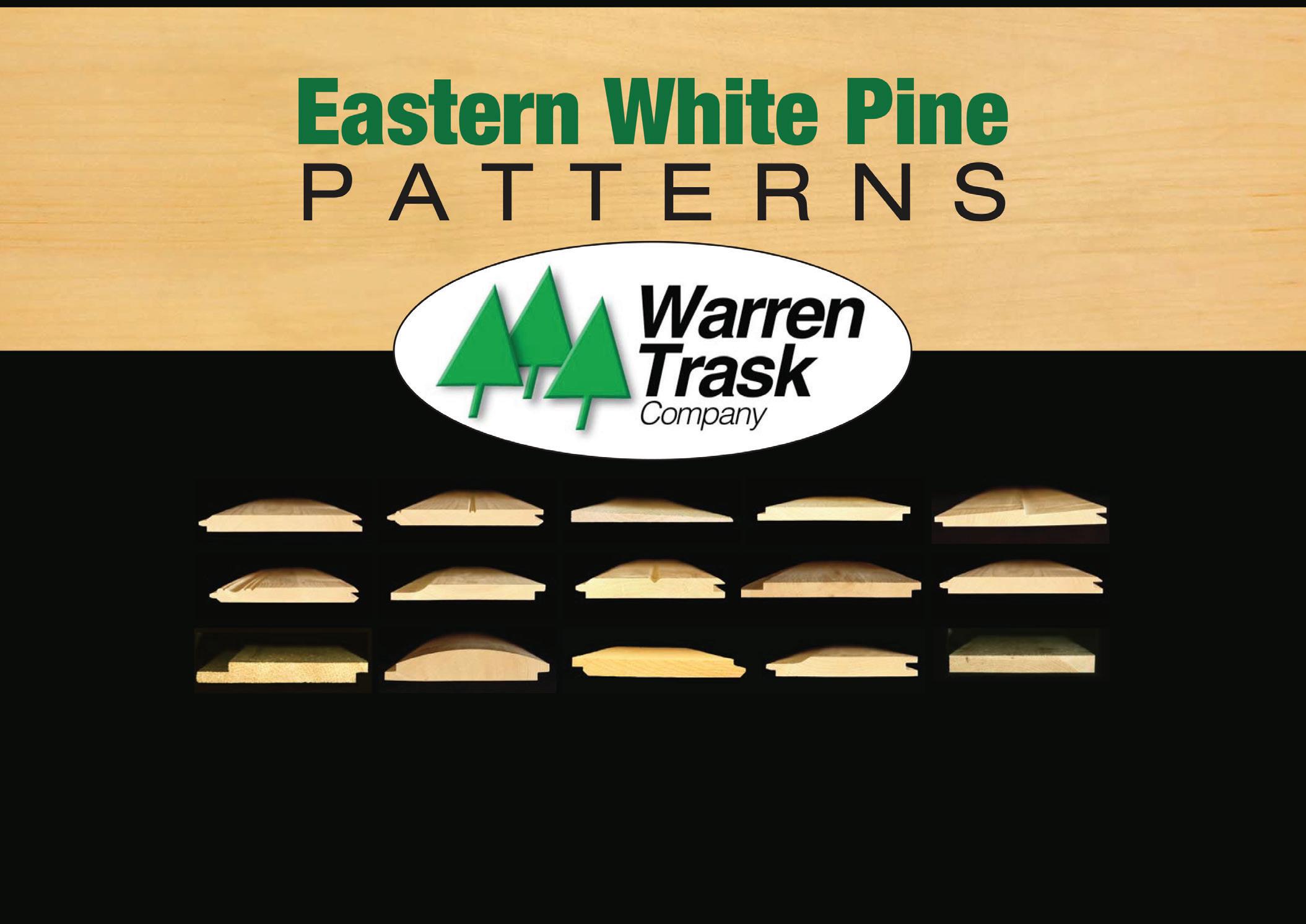

Over here at the Northeastern Lumber Manufacturers Association (NELMA), one of our goals is to research, brainstorm, and develop ways to help you, our favorite lumber dealer, sell a stick of lumber. Sell many sticks of lumber, actually. As the rules-writing agency for eastern white pine lumber and the grading authority for the SPFs grouping of species that includes eastern spruce, balsam fir, red pine, and other commercially important softwood lumber species grown in the Northeast and Great Lakes regions, our job also includes standing as the leading agency for export wood packaging certification and the marketing voice for the regions’ wood products industry.

That last part of the sentence is why we’re here today: as the marketing voice for softwood lumber from the Northeast across to the Great Lakes, our job is to create selling tools to help you sell our members’ products easier, more efficiently, and successfully.

Over the past few decades, we’ve come up with some practical ideas, and some seriously out-there concepts. You’ve probably seen most of them on the pages of this magazine. Let’s take a quick trip down memory lane, starting with the practical (and super popular).

Retail Directory. This is the easiest selling tool for you—and it’s free! Simply register your business, share the wood products you sell, include full contact information, and your listing in the NELMA Retail Directory is complete. Super easy and informative way to ensure that your potential customers (architects, builders, con-

sumers) can find you, and find the products they need to complete a project. Let us help you sell a stick or two of lumber and head to www.nelma. org to register today.

Lumber Swatch. Without a doubt, it is one of the most popular pieces we’ve ever created. We can’t keep them in stock at trade shows, much less in the office—no telling how many of them we hand out in the space of a year!

Think of a painter’s swatch, but with wood profiles. If your customer is looking for a specific kind of wood, show them this and let them choose the one that most appeals to them. If there’s an easier way to help a potential customer make up their mind and buy, we haven’t found it. Yet.

Video: Eastern White Pine vs. PVC. Let’s talk trim for a minute. Which is better: the real stuff, or PVC? We think you probably already know the answer: real wood. Wood doesn’t need to *look* like wood because it *is* real wood, made with sun, soil, rain, and a seed. PVC is made with fossil fuels. This short, easy-to-watch video takes the raw facts about PVC vs Eastern White Pine and shares them in a fun way. Take a look at the NELMA YouTube channel when you have a second and check it out for yourself. www.youtube.com, @nelmaTV

Siding Installation Videos. Brand new and ready to help educate, we worked with our good friends the Maine Cabin Masters to develop a series of how-to videos on siding installation, using a shed in the backyard of our own office. Want to know more? There’s a full arti-

cle about it in this issue on page 40, or you can visit the NELMA YouTube channel to check out all six videos.

Virtual Tours. The best way to show a customer what wood will look like in their project is to actually show them. We’ve done that with our series of Virtual Tours on the NELMA website (www.nelma.org). These videos change the way we view and use case studies as we replace hand-held photos with interactive videos and informational product tags. Each of seven virtual doors opens to a different project showcasing the many and varied uses of eastern white pine.

NELMA.org. Don’t sleep on our website itself! Check out the Retailer tab—made just for you—for technical information, span details, design values, and the fun Graders Academy online game. Learn more about the history of eastern white pine with our Kings Broad Arrow information and how our pine was one of the catalysts leading to the American Revolution. We’ve worked hard to clearly and concisely encapsulate all interests for our retailer audience and put everything in one place in a clear, clean, accessible format.

Video Guides. On our website, you’ll find two helpful video guides, each highlighting the important variations of characteristics permitted within each of the grades of eastern white pine. The Five Grades of Eastern White Pine and The Four Grades of Spruce Pine Fir – South videos each showcase a layer of multiple boards on screen,

pausing for callouts to spotlight wood characteristics intrinsic to each species and grade. Want to show your customers what to expect with their eastern white pine or SPFs purchase? Show them these videos and watch them absorb customer product knowledge. And an added bonus: imparting this level of knowledge to your customers (not to mention your staff) just might reduce callbacks. When you teach the customer what to expect and their knowledge rises, your callbacks will hopefully decrease.

Pine-Scented Air Freshener. Does it smell like pine in here? It sure does! A couple of years back, you might have seen one of our air fresheners packaged with this magazine. The point? To not only surround yourself with the pleasing scent of eastern white pine, but to keep NELMA and our members’ species in mind when making a sale. Let us know if it worked!

Aliens. Yep, we once used aliens to help you sell a stick of lumber. How? It’s all about choosing geographically relevant lumber. When lumber comes from all

on Warren Trask for the

Eastern Pine

and widest selection of Pattern Stock! Since 1924, Warren Trask has been committed to being the number one source for Eastern White Pine. Call on Warren Trask for all your Eastern White Pine needs. 1-800-752-0121 ■ 63B Bedford Street, Lakeville, MA 02347 ■ www.wtrask.com

over the place, it’s often not grown as well, and it doesn’t perform as well as locally grown lumber. Plus, shipping lumber to the U.S. from another country creates a massive carbon footprint. Better to choose locally grown, locally harvested, and locally transported for a better planet.

Bigfoot. Remember when we put Bigfoot on the front of this magazine, made videos with him carrying a stick of lumber (pretty sure he bought it and used it for the ceiling in his home), and talked about him throughout several articles? What was that about?

Bigfoot was a metaphor: when searching for the elusive lumber customer, what should you be looking for, what do you need to know, and how can you stand out from other dealers? The answer was clear: tune in to the multiple tools available to you free from NELMA—like our customer research and the retailer directory—for success in reaching new customers.

Smells Like Knotty Pine. Did you see our ad for Knotty Pine perfume several years ago? Did you think it was a real product? This attention-getting ad generated calls to NELMA from people wanting to buy the perfume. But it was a tongue-in-cheek strategy to get potential customers to the NELMA page to educate them about eastern white pine and SPFs… and it worked. Sometimes the craziest ideas actually work!

Skip & Wane. The lumber industry’s first-ever cartoon is centered around an opportunity for us to poke fun at the competition in a more direct, light-hearted way, with the goal being to compare eastern white pine and SPFs to the competition with the real wood being the clear winner (which it is).

Cartoon readers might not even realize they’re being educated about the product differenc es, but hopefully they’ll walk away knowing just a little bit more about the strength, durability, renewability, and beauty of real wood.

In today’s building products industry, it’s harder than ever to get people’s attention. The solution? Integrated marketing to drive education and customer behavior. Creativity is king when it comes to catching people’s attention, especially when you’re selling a commodity like lumber. We hope we’ve made an impact so far with some of our crazy ideas… what should we do next to help you sell a stick of lumber? BPD

Jeff Easterling is president of Northeastern Lumber Manufacturers Association, Cumberland Center, Me. Reach him at info@nelma.org.

We source our wood primarly from New Hampshire and Vermont, and the majority come within a 50-mile radius,

Dual Weinig Powermat 2500 Moulders

Customizable Moisture Detection

Nelma grades and patterns

Specialized Dry Kilns

Enhance™ by Durgin and Crowell is our line of pre-coated, cured Eastern White Pine paneling product.

At Durgin and Crowell, we promise to be dedicated to offering our customers the personal service that is essential to delivering the highest quality, fully sustainable Eastern White Pine, on time, and to the specs desired. We provide hands-on solutions because we are Pine Passionate.

NOW AVAILABLE from the Northeastern Lumber Manufacturers Association (NELMA): a brand-new (2024) edition of the Standard Grading Rules for Northeastern Lumber, one of the most important tools in the toolbox for the wood industry in the Northeast and across to the Great Lakes region.

NELMA releases an updated grade rule book on average every three to four years; the last time one was released was August 2020. NELMA is one of six rules-writing agencies in the U.S. and Canada accredited by the American Lumber Standard Committee to write grade rules certified as conforming to the American Softwood Lumber Standard PS20.

Minor revisions to the National Grading Rule (NGR) and their interpretations that impact the grading of dimension grades have been incorporated into this new 2024 edition.

Traceable all the way back to the early history of the New England colonies and the founding of this country, lumber grading rules have been around since the 1600s. As the population grew, so did the increased demand for the use of lumber as a building material. It wasn’t very long until the necessity for simple grading rules to be established became evident. The final step in the genesis of these lumber grading rules: they were designed to establish the growing trade activity between the buyer and the manufacturer.

NELMA was founded in 1933, and shortly thereafter—January 1, 1937, to be exact—NELMA published the first eastern white pine grading rules.

This first-ever booklet was entitled Standard Grading Rules for Northern White Pine and Norway Pine, two ever-popular species we know today as eastern white pine and red pine.

One year later, in 1938, Standard Grading Rules for Eastern Spruce and Balsam Fir was published by NELMA specifically for use by the lumber industry in the northeast. Both of these species, now known as part of the SPFs grouping, were important construction species in the early 1900s, just as they remain so today.

Taking a deeper look at the grading rules topic: do we still need a grade rule book, and does it really need to be updated? The short an-

swer to both questions is a resounding yes. The Standard Grading Rules for Northeastern Lumber stands as the industry’s definitive guide to comprehending the multiple various grades of lumber and timbers produced from wood species grown in the northeast and over to the Great Lakes regions of the United States. The book remains the keystone to learning about and understanding the proper ways to use each grade of lumber.

If you’ve never seen the book, informative sections highlight various species, their moisture content, special board grades, design values, and much more. A handy glossary shares simple explanations of terms and abbreviations used throughout the 250+ page guide.

Updates to the book are necessary to allow space for new information to be included and shared. Remember when Norway spruce was added to the approved species list in 2016? Without an update to this book, proper grading information for this first new species added in over 100 years wouldn’t have a wide platform for sharing. It’s important for users to stay timely and up to date with the information they need to do their jobs well.

The 2024 edition of Standard Grading Rules for Northeastern Lumber is available now from NELMA. A free download of each section is available online at www.nelma.org, or a print copy may be purchased from the “Library” publication store section of the NELMA website, or by contacting NELMA at (207) 8296901. BPD

According to digital tracking company Statista, podcasting is no longer something done on the side and targeted for small audiences. The last few decades have seen a rapid rise in podcasting, both with groups producing them and listeners tuning in. A few facts:

• In 2006, less than 25% of the U.S. adult population even knew what a podcast was.

• By 2022, this awareness number had risen to a whopping 80%.

• How many Americans have ever listened to a podcast? Right about 62%.

• In 2023, almost 70 million people listened to podcasts, and this number is projected to reach the monster number of 110 million listeners by the time 2029 rolls around.

• Podcasts can be listened to in multiple ways, to include the widely recognized iTunes and Spotify, with Spotify taking the top spot as the most popular app used in the U.S. for podcasts.

Who’s listening? You most likely won’t be surprised at the answer. In 2020, the 12-34 age group consisted of 49% of listeners, followed (at a distance) by those in the 35-54 age range, with the 55+ crowd at the end of the pack. By 2022, these numbers had settled out at 50%

(12-34), 43% (35-54), and 22% (55+).

“Given that our members and their employees often spend long stretches of time on the road, in a car, or on a plane, it made total sense for us to give them the information they need in the way that they need it,” said NELMA president Jeff Easterling. “This up-to-date format has already received lots of good comments from our members, so we’re hitting the mark.”

The AskNELMA Podcast is the next gen form of communication taking the place of the e-newsletter, comments Easterling. “In talking to our members, we’re finding emails are grabbing less and less of their attention, as they need to be in the mill, in meetings, or traveling to meetings.”

Focusing on content across association news, events, business updates, interviews with industry experts, and timely topics, the new podcast (which launched in 2Q 2024), will be produced quarterly to let members and friends of the industry know what’s happening with NELMA.

The AskNELMA podcast is available on both Spotify and iTunes, and also via a link at www.nelma.org./ podcast. The podcast is created for NELMA members primarily, but open to anyone who wants to know more about what the association is doing. BPD

Read grade rules, span details, and get new promotional ideas for your business.

Sample the variety and versatility of eastern white pine.

Plastic, concrete or pine? Learn why consumers prefer natural over fabricated.

Reach more customers by getting listed on NELMA’s Retailer Directory.

Listen to and watch product installation and comparison videos, plus grade representations.

Use all your senses. Visit nelma.org for all things eastern white pine, spruce-pine-fir and other softwood species grown in the Northeast and Great Lakes region.

Discover the difference. Learn the stark contrasts between building with wood or PVC. Scan here to see. Simply open the camera on your smartphone or tablet, and hold it over this image.

@NortheasternLumberMfg @WoodInspiration @wood_inspiration1933

NORTHEASTERN LUMBER Manufacturers Association has launched a brand-new five-part video series detailing exterior eastern white pine siding installation featuring members of the popular Magnolia Network

show Maine Cabin Masters. The videos are free and available on NELMA’s YouTube Channel.

For the video content, the Maine Cabin Masters visited NELMA headquarters in Cumberland, Me., and re-sided a storage shed belonging to the lumber association. The project was chronicled from start to finish in one 11-minute umbrella video entitled NELMA Shed Project; five smaller pieces of the project were broken out into their own videos as well. These are: Part 1 – Trim Removal; Part 2 – New Trim Install; Part 3 – New Siding Install; Part 4: New Door Install; and Part 5: Finished Shed Reveal. The entire project was completed using multiple grades and patterns of eastern white pine in an array of orientations.

“The purpose of this video series is to provide free education to homeowners on how to side or re-side a project using real wood,” said Jeff Easterling, president of NELMA. “Eastern white pine is a huge part of every Maine Cabin Masters project, and we’re grateful to have worked in partnership with them for several years—this project was something we’ve talked about for a while, and now it’s become a reality.”

All five parts of the video series, plus the overarching project video, are available free at NELMA’s YouTube channel @NelmaTV.

Founded in 1933, NELMA (Northeastern Lumber Manufacturers Association) is the rules writing agency for western white pine lumber and the grading authority for other commercially important Northeastern and Great Lakes softwood lumber species that includes eastern spruce, Norway spruce, Balsam fir, and red pine. In addition, NELMA is a leading agency for export wood packaging certification and the marketing voice for its lumber manufacturing members.

For more information, please visit the NELMA website at www.nelma.org. Find NELMA on Facebook, Instagram (@woodinspiration1933), twitter (@inelma), and Pinterest (Wood Inspiration). BPD

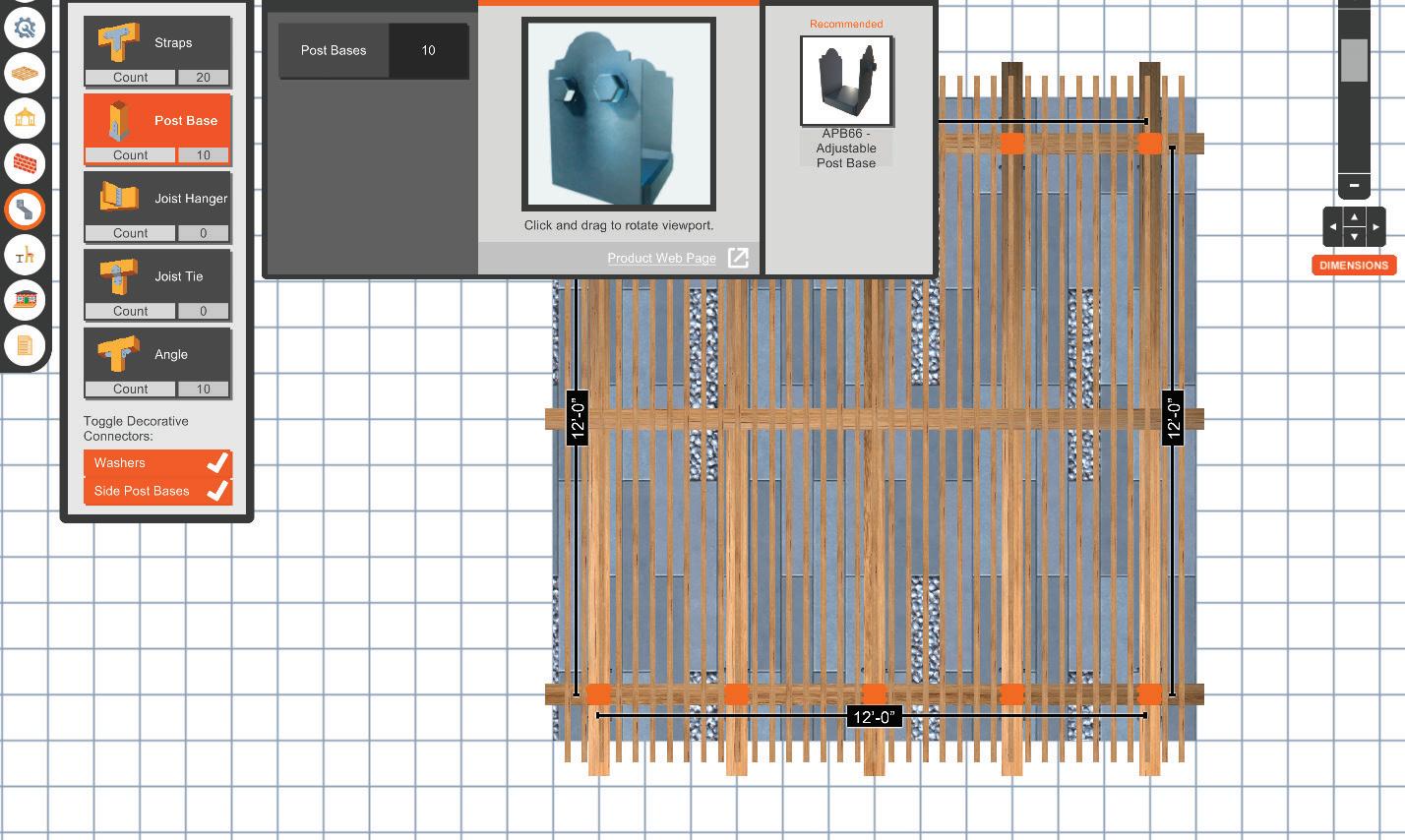

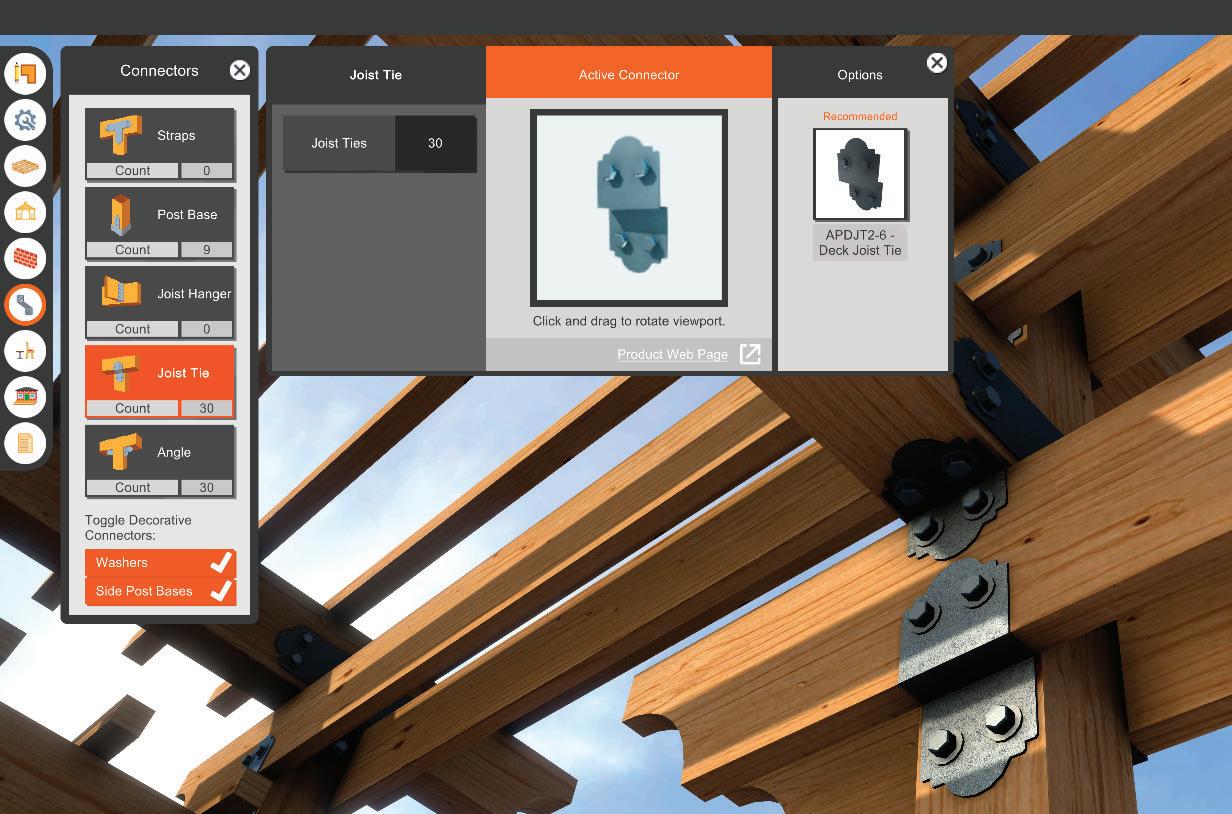

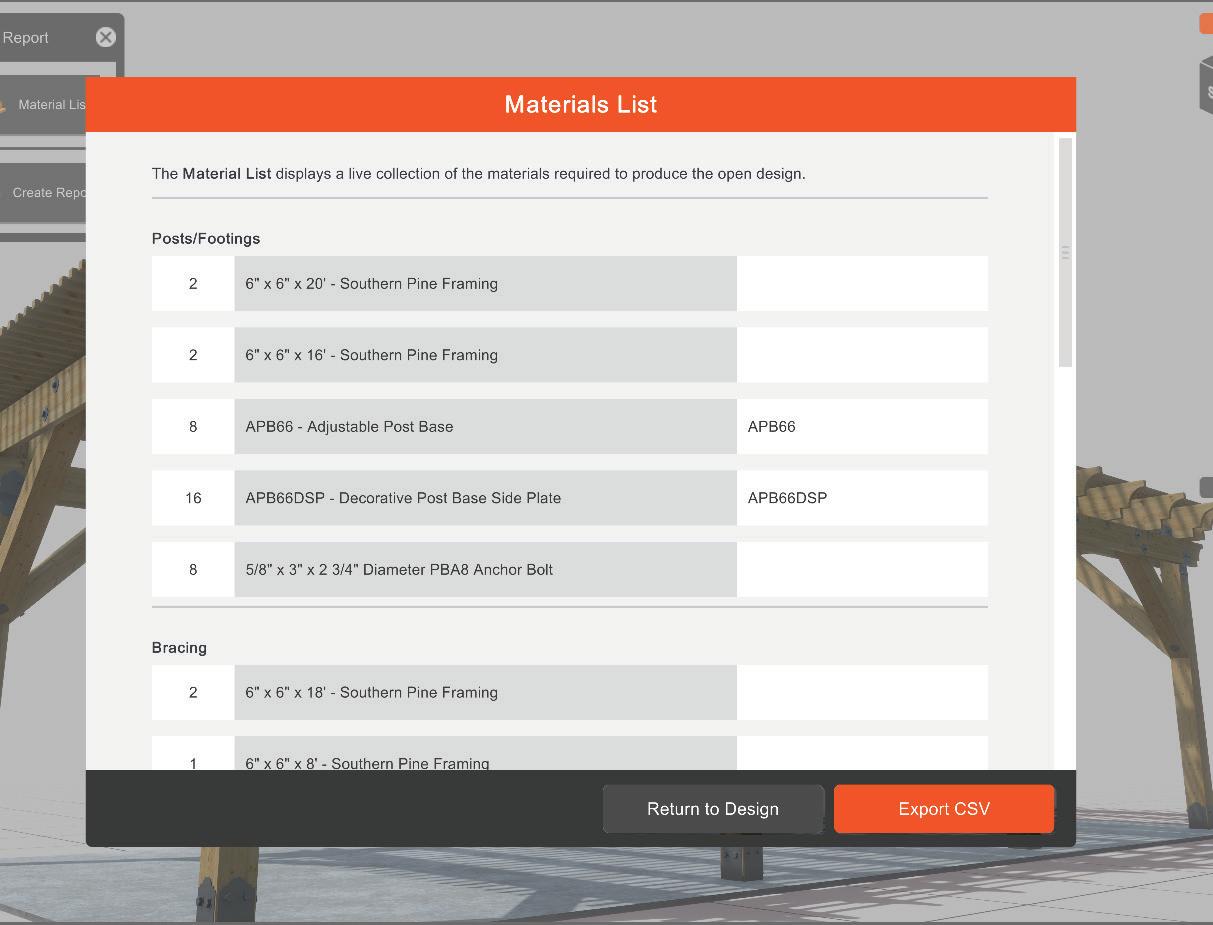

Help your customers build their dream backyard with Deck Planner Software™ and Pergola Planner Software™ from Simpson Strong-Tie. Easily design a strong and beautiful deck, pergola or other popular structure in just minutes using prebuilt templates or custom dimensions. Work in 2D or 3D environments and select wood species or additional features from a full library of options. Then just print out the plan view and materials list. Your clients, and your business, will thank you.

To learn more about our free downloadable software, visit our website at go.strongtie.com/pergolaplannersoftware or call ( 800) 999-5099.