REDESIGN YOUR LUMBERYARD • E-COMMERCE & TECH TIPS FOR LBM DEALERS June 2024 THE VOICE OF LUMBER MERCHANTS AND BUILDING MATERIAL DEALERS & DISTRIBUTORS IN THE WEST — SINCE 1922 Digital Edition Sponsored by Now the beauty of a home lasts as long as the love for it. Siding: SQUARE EDGE PANEL Trim: VARIOUS SIZES 800.417.3674 | The TruWood Collection, manufactured by Collins Products LLC WUI Approved | Ask us about our FSC® products | FSC-C002971 TruWood leads the way in beautiful, long-lasting engineered wood siding and trim. And thanks to EcoGuard® – a naturally occurring additive – our products resist fungal decay and termite damage decade after decade. So you can protect your family, as well as your investment. TruWood. Engineered to perform. Designed to protect. Contact Visit TruWoodSiding.com and discover what’s Tru to you. Get Tru.

Like the foods we buy, when it comes to decking, we want natural and real. Redwood is always available in abundance of options. So stock the shelves! Unlike mass-produced and inferior products, Redwood is strong, reliable and possesses many qualities not found in artificial products. They maintain temperatures that are comfortable in all climates.

Redwood Empire stocks several grades and sizing options of Redwood.

Call us at 707.894.4241 Visit us at buyRedwood.com DECKING Composite can’t compare.

REDWOOD

REDWOOD

DECKING

PRESIDENT/PUBLISHER

Patrick Adams padams@526mediagroup.com

VICE PRESIDENT

Shelly Smith Adams sadams@526mediagroup.com

PUBLISHER EMERITUS

Alan Oakes

MANAGING EDITOR

David Koenig dkoenig@526mediagroup.com

SENIOR EDITOR

Sara Graves • sgraves@526mediagroup.com

COLUMNISTS

James Olsen, Claudia St. John, Dave Kahle

CONTRIBUTORS

Brian Kelly, John Maiuri, Alexandria Osborne, Susan Palé, Tamara Sutton

ADVERTISING SALES (714) 486-2735

Chuck Casey • ccasey@526mediagroup.com

John Haugh • jhaugh@526mediagroup.com

Nick Kosan • nkosan@526mediagroup.com

DIGITAL SUPPORT

Alek Olson • aolson@526mediagroup.com

Josh Sokovich • jsokovich@526mediagroup.com

CIRCULATION/SUPPORT info@526mediagroup.com

A PUBLICATION OF 526 MEDIA GROUP, INC.

151 Kalmus Dr., Ste. J3, Costa Mesa, CA 92626 Phone (714) 486-2735

CHANGE OF ADDRESS Send address label from recent issue, new address, and 9-digit zip to address below. POSTMASTER Send address changes to The Merchant Magazine, 151 Kalmus Dr., Ste. J3, Costa Mesa, CA 92626. The Merchant Magazine (ISSN 7399723) (USPS 796-560) is published monthly at 151 Kalmus Dr., Ste. J3, Costa Mesa, CA 92626 by 526 Media Group, Inc. Periodicals

Postage paid at Newport Beach, CA, and additional post offices. It is an independently-owned publication for the retail, wholesale and distribution levels of the lumber and building products markets in 13 western states. Copyright®2024 by 526 Media Group, Inc. Cover and entire contents are fully protected and must not be reproduced in any manner without written permission. All Rights Reserved. We reserve the right to accept or reject any editorial or advertising matter, and assumes no liability for materials furnished to it. Opinions expressed are those of the authors or persons quoted and not necessarily those of 526 Media Group, Inc. Articles are intended for informational purposes only and should not be construed as legal, financial or business management advice.

Volume 103 • Number 6

4 • the merchant magazine • June 2024 building-products.com SUBSCRIBE TODAY OUR MARKET MOVES QUICKLY—SO DON’T GET LEFT BEHIND! The Merchant is available on a qualified requester basis to senior management of U.S.-based dealers and distributors specializing in lumber and building materials, and to others at the rate of $22 per year. Subscribe now at www.building-products.com/subscribe. SUBSCRIBE NOW AT WWW.BUILDING-PRODUCTS.COM/SUBSCRIBE THE MERCHANT MAGAZINE SUBSCRIBE TO RECEIVE PRINT, DIGITAL, ENEWSLETTER & MORE! The LBM supply chain’s leading publication for qualified industry decision makers! • Update your subscription • Sign up key colleagues • Enroll multiple locations

6 • the merchant magazine • June 2024 building-products.com ------------| CONTENTS June 2024 STAY CONNECTED ON SOCIALS: @BPDMERCH THE OFFICIAL PUBLICATION OF PROUD SUPPORTERS OF VOL. 103 • NO. 6 |-----------DIGITAL EDITION CHECK OUT THE WWW.BUILDING-PRODUCTS.COM REDESIGN YOUR LUMBERYARD E-COMMERCE & TECH TIPS FOR LBM DEALERS June 2024 Now the beauty of a home lasts as long as the love for it. TruWood leads the way beautiful, long-lasting engineered wood siding and trim. And thanks to EcoGuard naturally occurring additive our products resist fungal decay and termite damage decade Designed to protect. Contact Visit TruWoodSiding.com and discover what’s Tru to you. Get Tru DEPARTMENTS 08 ACROSS THE BOARD 26 TRANSFORMING TEAMS 28 NEWS BRIEFS 32 MOVERS & SHAKERS 48 DATE BOOK 44 NEW PRODUCTS 48 IN MEMORIAM 49 ADVERTISERS INDEX 50 FLASHBACK 24 OLSEN ON SALES FEATURES 14 INDUSTRY TRENDS What lumberyard operators want in their forklifts 22 INDUSTRY TRENDS Equip your LBM business for future success with the latest retail technology 18 MARGIN BUILDERS Third-party management solutions help dealers improve their bottom lines 20 MANAGEMENT TIPS Keys to consider when diving into e-commerce 47 EVENT RECAP Western Wood Products Association presents Master Lumberman Awards during annual meeting 10 FEATURE STORY

ABC’s of redesigning your lumberyard 14 22 10

The

CONFUSING SIGNALS

------------ BY PATRICK ADAMS

DOES EVERYONE look for “signals” as much as I do? Of course, I know the adventures of my past lives have conditioned me to always be surveying the landscape looking for the next sign of a storm approaching. But as adults, aren’t you always trying to avoid the storm in search for long stretches of calm water?

To say we live in interesting times these days is an understatement. We are “involved” in two global conflicts, raising duties on our largest trading partner, interest rates remain high, and no matter who wins this election, we will be left with half of the nation who is pissed off believing it is the end of our nation. Yet, the stock market is on a historic run, mergers and acquisitions continue at a rampant pace, unemployment remains low, and it seems the demand for lumber will not ease in my lifetime.

Have the world and times changed so much that the normal indicators of a storm no longer apply? Are we to believe that everything is fine? I ask this question honestly because I am no longer confident in my ability to see the storm. I think I see clouds, but those in positions of leadership and communication perhaps are just saying that gray is the new color of the sky and it isn’t a storm at all.

However, I look at our industry and it calms me. Demand for product continues to be strong and the pace of mergers and acquisitions tells me that people are confident in investing in future growth. I attend industry events and each time, the ratio of “us old guys” and new, young members of our industry continues to shift. Even in our own business, while the echoes of “media and print are dead” remain, our circulation, requests for print publications, expansion of digital, and investments from advertisers promoting to reach our audience has never been higher.

From this, we too are looking at pathways toward

how we can grow and serve our audience in deeper and more valuable ways. As we speak, initiatives are underway to develop tools that can bring more market intelligence to your fingertips. We are developing vehicles that deliver more of the information that you want, in the way you want it, when you need it. We are even exploring a few non-traditional ways of being your trusted resource for things you wouldn’t typically associate with a media company!

Next month, we will unveil something completely new that I promise, almost all of you will rely on to start your day, every day!!! Like everything we do, it was a simple idea, though not an easy one! But like you, we are gazing out onto the horizon looking for storms, as well as for new ways to serve our friends with something they can trust and that they need. Don’t even bother trying to guess what it is, but like everything we do, it is meant to serve you with what you need!

Regardless of how confusing the signals are, or how stormy or sunny the horizon is, I take comfort in being a part of this great industry. I have learned that in this business, when we refer to it as “our industry,” it means that we are in this together. We understand that for us to be successful, we all must be successful. Those who are experiencing good times help those who have hit bumps in the road and together, we oversee this industry to make sure it is filled with good people and ethical business leaders.

Keep scanning the horizon, looking for calmer waters, and especially stay tuned for our exciting new adventure next month! Thank you all for the honor of serving this industry!

PATRICK S. ADAMS, Publisher/President padams@526mediagroup.com

8 • the merchant magazine • June 2024 building-products.com ------------| ACROSS THE BOARD

WUI-CERTIFIED LUMBER IS THE FUTURE OF CONSTRUCTION.

BUILD SMARTER WITH WESTERN WOODS.

We’ve updated our WUI-Certified Products Brochure for the 2024-2025 fire season . This brochure is your go-to guide for all of our premium WUI-certified lumber products. Our team has been hard at work filling this years brochure with new product certificates and new insights into the Wildland Urban Interface - giving you a deeper understanding as to why WUI-certified lumber is the future of construction. Your success is our success, and you can count on Western Woods to get you there.

Excellent products. Unrivaled service. It’s what we do.

+ + + + SCAN TO DOWNLOAD

+ + StainedTongue+Groove2”x8”siding. CALL US 800-822-8157 VISIT US westernwoodsinc.com

ABC’S OF REDESIGNING YOUR LUMBERYARD

------------ BY DAVID KOENIG

PRODUCT PACKED to the rafters? New SKUs and no place to put them? Will you be forced to expand your facilities? Or maybe, just maybe, you can better utilize the space you already have.

How do you know when it’s time, if hidden opportunities may exist, and where do you begin? BPD asked three experts in the field—CT Darnell/Sunbelt Racks’ Clint Darnell, Johnson Design Services’ Ron Johnson, and Krauter Auto-Stak’s Chris Krauter.

Q: Are there signs to tell operators that their lumberyard could greatly benefit from a redesign?

Clint Darnell: The major signs we see over and over again include:

• High Cull Rates – Typically, excessive cull is due to damage from weather and improper storage and handling. This could be lumber stored outdoors on the ground, millwork propped up against walls wherever there is space for it, or storage systems that make it

difficult to load and unload product.

• Poor Flow – The two biggest contributors to flow problems are the layout of the outdoor and indoor spaces and poor product organization. Ideally, you want to avoid slowdowns in foot and vehicle traffic and optimize efficiency in locating products for both employees and customers.

• High Labor Costs – When a facility is inefficient, it drives up labor costs because it takes more employees or more time to get the job done. Sometimes, inefficiency is also a matter of safety, and some operators can see excessive employee injuries, as well.

Most operators have a sense of their yard’s inefficiencies. But often, they don’t realize how much there is to gain by making improvements, or they assume the improvements would be cost-prohibitive.

Ron Johnson: Five issues generate a redesign:

• Run out of space and cannot add land as the town/

10 • the merchant magazine • June 2024 building-products.com

------------| FEATURE STORY

YARD LAYOUTS must be well organized to maximize efficiency. (Photo by CT Darnell)

city has grown around them.

• Need more covered space for finished lumber, drywall and millwork.

• Desire to at least place a roof over the lumber, especially treated to protect from the sun.

• Loading docks! Every yard that does have loading docks seeks them to improve the handling of doors, windows and cabinets. Truck depressions are the easiest to add and least costly.

• Stack carts for millwork. They save on damages from multiple handling and add efficiency as you can lift 20 pre-hung doors at a time.

Chris Krauter: A lot of times the lumberyard operator has a flow-through mentality passed down over the generations with wood bins, that type of thing. But how much time are you spending loading and unloading? Breaking backs? Pulling in and backing out? There are new systems, like Auto-Stak, that allow fewer employees to do more.

Q: What are the greatest methods for improving efficiency?

Krauter: To maximize efficiency, the first thing lumberyards need is organization—a continous flow of more and more SKUs.

You’ll see a lot of lumberyards that, over the years, kept tacking one new building onto the old ones, to cre-

ate a cacophony, a series of buildings with no flow.

The most important thing is to be able to get in and out quickly through another way, and facilitate a more efficient flow of materials. Number two is to be able to get customers in and out quickly.

As well, a lot of buildings that are old are not very tall. It’s the verticality that you want to maximize. We see a lot that are 12, 14, 16 ft. tall. We like storage to reach 24 or 26 ft. tall at the eaves.

Darnell: When you organize your inventory, store it properly, and make it easier and safer to handle or load and unload. Then you’re going to see more efficiency.

Good design checks all those boxes, as well as reduces cull. This means a facility layout that’s right for that particular business, and storage solutions that are right for the inventory. Sales are likely to increase too because you’re providing a better customer experience.

Johnson: First, product layout that is “clustered” by the shipping order of a house package saves significant drive time. An example, the first shipment consists typically of treated sill, studs, sheathing and underlayment, floor joist and related hardware. Set the materials together with studs and sill next to plywood next to floor joist with the hardware close by. This stack configuration is about 100 ft. long. Think of a standard layout where the studs are with the lumber, the sill is with the treated and the plywood is in a warehouse or shed, the

building-products.com June 2024 • the merchant magazine • 11

CONVERTING to an Auto-Stak system can dramatically increase storage space. According to Chris Krauter, “A 100-ft.-wide cantilever rack can hold 32 SKUs, of which 16 can be accessed. A 100-ft. AutoStak holds 80 SKUs, of which you can pick them all.” (Photo by Krauter Auto-Stak)

floor joist is with the engineered. The distance a forklift will travel to pick the initial order is several hundred feet vs. 100’. It is advantageous to have a roof over the stacks either a “T” shed or three sided shed. It’s the single most impactful action a yard can take to reduce operational costs!

The same approach to drywall, drywall accessories, and insulation together, roofing and roofing accessories together, and so on. Easiest way to assemble the list is by reviewing pick tickets; they quickly identify what products always ship together.

A drive-thru enables this approach; it serves the on-site customer with the inventory merchandised traditionally. Both DIYers and pros love the way it works; you drive up the material you want, load yourself or be helped and every item is in the building except lengths over 16’ or non-weather sensitive products like rebar, blocks and pipe/culverts. And you pay on the way out! The most appreciated feature will be that it allows the lumberyard to add merchandise and spend less time on-site. We already mentioned the docks and stack carts!

Final major point: keep it simple in regards to racking and forklifts, cantilever racking, pallet racks, lay-

down rack constructed from pallet racks and standard forklifts with one exception, a narrow-aisle lift for millwork, even that can be used in any warehouse.

Q: Where do they start?

Krauter: Swallow hard and get a new plan. The big question is can you gut out and still maintain your flow of business? For many yards, that’s the tough part.

Darnell: Every lumberyard is different. So, when we work with an owner or operator, we always start by looking at their current facility and documentation and then asking a lot of questions. Where are they now and where do they want to be? What are their concerns with their current situation?

Then we get to work on costeffective solutions that address all the issues. This could be a mix of changes in layout, new storage sheds, racking systems that better suit their products and use space more efficiently.

A complete redesign is not always what’s needed. Improvements could focus on just specific areas, such as a better way to store windows and doors, or figuring out how to efficiently incorporate new products.

Johnson: First, contact the design firm you are considering. I recommend visiting sites and calling owners who have been through the process.

I provide a list based on the issues you wish to solve. I recommend a five-year or 10-year master plan; this places you on a path of steady improvements that you can budget for and avoids “undoing” something you have done. One year is always more expensive, but it is an option for those who do not feel comfortable going “all in” immediately.

The process involves plot plans, building plans, goals, budgets, inventory sales reports and staff interviews. With Zoom and Google Earth, we can avoid costly site trips, but that is available if you prefer.

Q: What kind of savings/improvements can operators expect?

Darnell: The specific gains will depend on the nature and scope of the redesign, but operators should see improvements across the board: reduced cull, better flow, and lower labor costs due to increased efficiency. Some of the customers we’ve worked with have reported:

• A 50% reduction in the time it takes to pick trim orders

• A 15% increase in SKU count

• A nearly one-third reduction in shipping fleet while delivering $8 million more in product

• A 20% increase in sales with a 35% reduction in labor costs

We’ve also heard that employee morale has gotten a boost. It may not be quantifiable, but that doesn’t make it any less important.

Johnson: Typically you will reduce operating costs by 20 to 30%, greatly reduce loss due to handling and theft, plus increase sales as the redesign creates opportunities to add more products. Retail 101: “If you want to sell more, have more to sell!”

One thing to add: a lumberyard is a distribution facility, not a storage facility. Plans that add racking to increase capacity do not impact efficiency. It is all about the merchandising! MM

12 • the merchant magazine • June 2024 building-products.com

Introducing the Simpson Strong-Tie ® Timber Drive ™ structural screw fastening system. Timber Drive is the revolutionary tool designed for ergonomic, standup operation while driving structural screws. It’s ideal for heavy-duty jobs that require repetitive fastening, such as bridges, docks, boardwalks and mass timber. You can use Timber Drive with corded or cordless driver motors to install Strong-Drive ® structural screws in a wide variety of sizes, thread types and heads. Save time and effort on your next heavy-duty fastening job with Timber Drive.

To learn more about Timber Drive, visit go.strongtie.com/timberdrive or call (800) 999-5099.

Structural Fastening Solutions | Products, Software and Service for Smarter Building

Heavy-duty fastening just got easier.

© 2024 Simpson Strong-Tie Company Inc. TMBRDR23

Precision Placement™ nosepiece for connector fastening.

WHAT LUMBERYARDS WANT IN THEIR FORKLIFTS

------------ BY DAVID KOENIG

WITH OPTIONS APLENTY, lumberyards are increasingly looking for particular features when they purchase new forklifts. Among the most in-demand are:

Automation

Lumberyards are boosting efficiency by choosing forklifts that integrate the latest technology, including regenerative braking systems, advanced energy management systems, onboard diagnostics, and telematics systems.

Dell White, sales/marketing manager for Sellick Equipment, says a big seller has been the ability to hydraulically position the forks. “Every time you have to manually change the fork position, such as from accommodating pallets to trusses, you lose capacity,” White explains. “Being able to hydraulically position from the operator’s seat saves times, reduces the possibility for injury, and increases productivity. We offer it on every model of every forklift, including truckmounted forklifts.”

Many warehouses are even turning to automated forklifts. Mitsubishi Logisnext’s advanced autonomous forklifts utilize laser-guided systems to navigate warehouse layouts and employ obstacle-detection technology for seamless operation.

Augmented reality technology is also being employed to improve forklift operation before employees

are even operating a forklift. Trainees can use AR headsets to simulate driving a forklift in a virtual environment, allowing them to practice driving and managing techniques safely.

Electric

Ready or not, the age of electric forklifts has arrived and, according to a new study by Adroit Market Research, electric held a dominant 65% share of the global forklift market in 2023. Once considered unable to stand up to the challenges of lumberyard environments, electric vehicles are stronger and more durable than ever before.

Yard operators are moving to electric due to their lesser emissions, reduced noise levels, and minimum operating costs compared to traditional diesel, propane or gasoline-powered internal combustion engine (ICE) forklifts. Every year, regulations designed to reduce CO2 emissions are becoming more stringent across various industries, especially in areas such as California that are pushing for zero-emission vehicles.

The Kalmar Heavy Electric Forklift is designed to lift 18- to 33-ton loads with zero emissions at the source.

In addition, electric forklifts are often more powerful and faster at accelerating than internal combustion engine forklifts.

Combilift’s new Combi-CB 155E is reportedly the

14 • the merchant magazine • June 2024 building-products.com

------------| INDUSTRY TRENDS

most powerful compact electric multidirectional forklift to date, combining next-gen performance with extensive battery life and exceptional ergonomics. According to CEO Martin McVicar, “The increased capacities that we are offering in our electric range will answer the demand for ever more powerful products which at the same time help companies to achieve their aims for more sustainable operations.”

Batteries

The growth of electric has run alongside the widespread adoption of lithium-ion batteries, which offer extended lifespans, reduce the need for replacements, and minimize waste. Faster charging times enhance operational efficiency, allowing for more daily working hours. For example, Mitsubishi Logisnext Americas group has introduced its novel Triathlon Lithium-ion battery and charger offerings for the UniCarriers product range.

At the same time, hydrogen fuel cell technology is gaining some momentum as an alternative power source. It provides faster refueling times and extended operating ranges compared to electric forklifts.

“Electrification in heavy-duty applications—like the lumber industry— requires innovative solutions like lithium-ion batteries with opportunity charging or hydrogen fuel cells capable of supporting multi-shift applications that have traditionally relied on internal combustion forklifts,” notes Kaushik Ravichandran, product planning manager for Toyota Material Handling. “We believe it is our responsibility, as a full-line material handling solutions provider, to develop versatile new offerings that meet the needs of customers wanting to make the transition to electric without sacrificing throughput.”

Safety

A continuing focus on safety measures has led to further advanced safety features in forklifts, such as collision detection systems, proximity sensors, and automatic emergency braking. These inventions help reduce the risk of workplace accidents and injuries.

“Customers are looking for new ways to build a safety culture for forklift operators as well as pedestrians,” Ravichandran explains. “While there is no replacement for operator safety training, we have launched a portfolio of features under the Toyota Assist umbrella to make our products smarter than ever before. One example is Toyota’s SEnS+ Smart Environment Sensor Plus, which is exclusively designed for forklifts to detect objects and pedestrians in the detection range. The system supports your operation by notifying the operator with a warning buzzer and warning lights. In addition to the system notifications, the system can control the traveling speed and slow down the truck for pedestrians and objects in specific conditions.”

Operator Comfort

Forklift manufacturers are incorporating more features than ever before to help create a pleasant, stress-free in-cab environment. Innovations include more spacious

cabs, ergonomically designed seating and controls, generous glazing for excellent all-round visibility, hydraulic steering, and a tilting steering column.

Combilift recently developed the Auto Swivel Seat, which automatically engages and swivels the seat and armrest 15° to the right or left to accord with the direction of travel selected by the operator—reducing driver strain, particularly when traveling in reverse.

Sellick’s White notes that an increasing number of lumberyard operators are ordering forklifts with air-conditioned cabs. “It may sound crazy, but operators can be in there eight hours a day. If you have good drivers, you want to keep them happy and productive. Good equipment helps retain good employees.”

Material handling equipment manufacturers will continue to pioneer new technologies so long as their customers keep striving to make their operations more efficient and productive. MM

building-products.com June 2024 • the merchant magazine • 15

COMBI-CB 155E from Combilift incorporates many of the latest features lumberyard operators are looking for.

OPTIMIZE YOUR LOGISTICS

------------ BY BRIAN KELLY

THE SUPPLY CHAIN and logistics industry has experienced a technological transformation in recent years, with the development of innovative solutions impacting nearly every aspect of the supply chain. However, yard management is one area that is often neglected and a bit behind compared to the rest of the industry. Yard management is traditionally a paper-driven process, which, while once effective, can now hinder operators’ ability to efficiently manage resources. This leads to inefficiencies and increased costs,

THIRD-PARTY YARD MANAGEMENT SOLUTIONS HELP LUMBERYARDS IMPROVE THEIR BOTTOM LINES

and in turn, frustrated employees and customers.

The supply chain shows no signs of slowing down and businesses are turning to third-party logistics providers (3PLs) for yard management solutions. 3PLs offer innovative solutions to organize yard operations and implement technology-driven tools like yard management systems (YMS). YMS provide real-time visibility into yard activities, enabling businesses to reduce costs and enhance customer satisfaction by improving service levels. The global

market for YMS systems is currently estimated at $5.2 billion and is expected to reach $11.9 billion by 2030. This exponential growth is expected as companies realize the benefits of YMS and warehouse management systems (WMS) and learn to capitalize on these emerging solutions to optimize their logistics operations.

The importance of efficient yard management

Numerous challenges arise if a yard is poorly managed. A paperbased process lacks real-time visibility into yard activities and inventory. In addition, it can create an inefficient use of space, resulting in congestion and disorganization. These key issues are a result of ineffective coordination and communication between warehouse, transportation, and yard operations, complicating the tracking and management of trailer movements and detention times.

This organizational deficiency leads to operational inefficiencies, wastes resources, and brings up potential compliance issues concerning industry regulations and safety protocols. Over time, these shortcomings can negatively impact a business’ reputation and they risk a dissatisfied customer.

How using a 3PL for yard management can help

By harnessing a 3PL’s YMS, lumberyards can overcome these

18 • the merchant magazine • June 2024 building-products.com

------------| MARGIN

BUILDERS

TECHNOLOGY-DRIVEN TOOLS like yard management systems can provide real-time visibility into yard activities, enabling businesses to cut costs and improve service to customers.

challenges. At a high level, engaging with a 3PL for yard management enhances customer service by ensuring on-time deliveries, minimizing lead times, and improving order accuracy. With optimized yard operations, meeting customer expectations becomes more achievable, fostering greater satisfaction and bolstering loyalty.

One specific solution is RFID tagging, GPS tracking, and automation to optimize yard space utilization. This provides real-time visibility into yard activities, with accurate and timely information on inventory levels, trailer movements, and overall operations. This heightened visibility empowers stakeholders to make informed decisions, enhance planning, and quickly adapt to changing conditions.

Automated scheduling and task assignment solutions streamline trailer and cargo movements, resulting in expedited turnaround times and heightened productivity. This delivers several benefits including reduced detention times, minimized labor expenses through automation and optimized workflows, and decreased transportation costs due to improved trailer utilization and turnaround times, which ultimately results in cost savings.

Enlisting the support of a yard management provider presents opportunities for scalable growth. A keen provider tailors their solutions to evolve alongside their clients’ changing needs, whether it involves expanding operations, adjusting for seasonal fluctuations, or integrating emerging technologies.

Measuring ROI of third-party solutions

When investing in a new technology or partner, businesses must consider the return on their investment. Is the expense worth the outcome? Effective yard management delivers reduced congestion, reduced idle time for assets, and ultimately, higher operational efficiency. Lumberyards can calculate savings from reduced detention times, enhanced space utilization, and lowered labor expenses. In addition, businesses can track improvements in inventory accuracy and order fulfillment rates.

Partnering with a 3PL ensures access to experts wellversed in all aspects of yard management, implementing strategic processes, tools, and staffing to establish more efficient and seamless operations. MM

Brian Kelly currently serves as VP of support services for Premier Transportation (premiertransportation.com). His expertise spans carrier and 3PL consolidation, pool distribution, cross dock, layout optimization, carrier management, multi-functional P&D and distribution fleets, and leading in supply chain investigations, security, loss prevention, and asset protection.

building-products.com June 2024 • the merchant magazine • 19

BRIAN KELLY

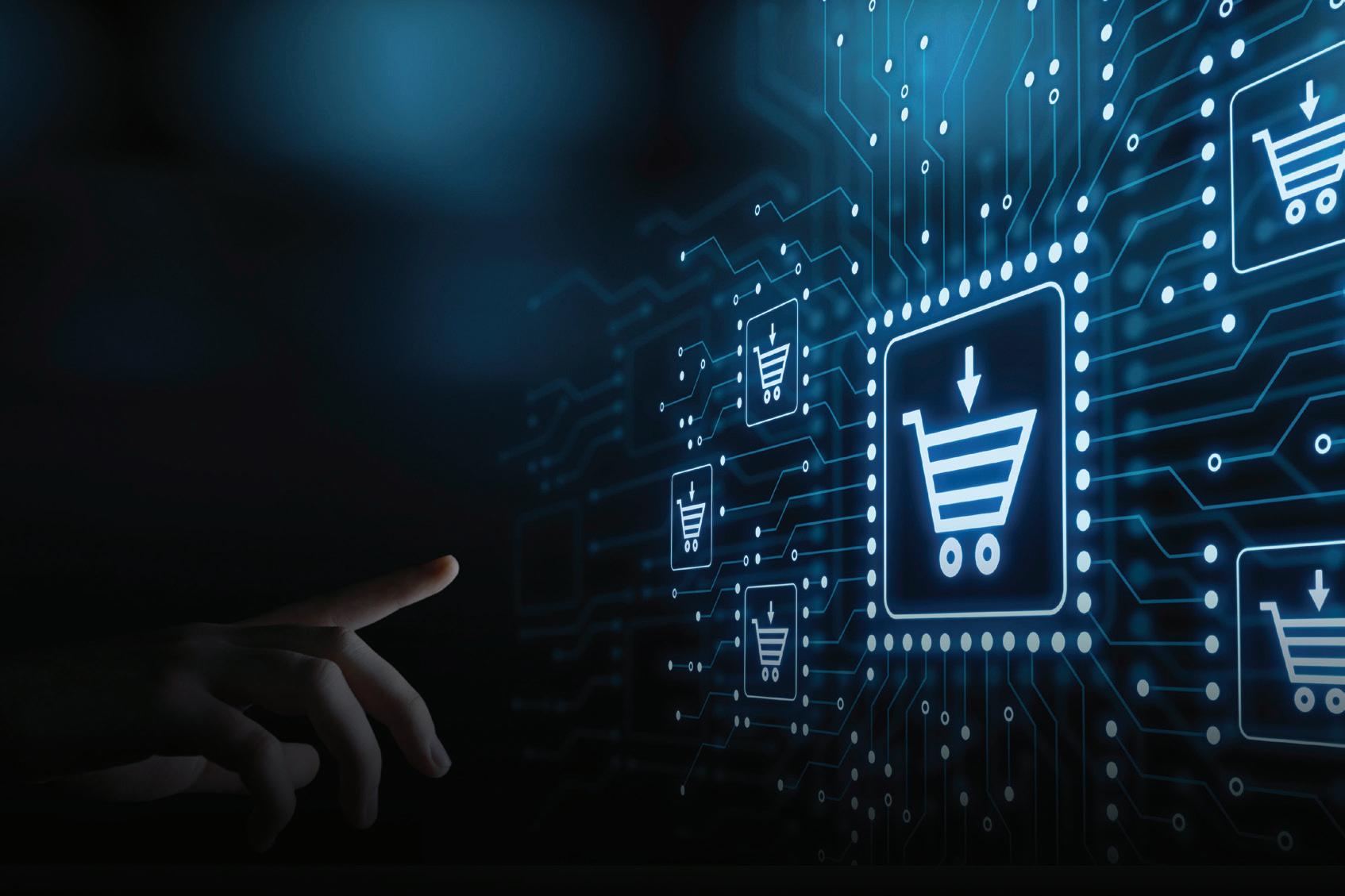

KEYS TO CONSIDER WHEN DIVING INTO E-COMMERCE

E-COMMERCE IS EXPANDING in the building materials industry, as it helps businesses attract more customers. For those looking to grow their online presence with an e-commerce site, it can be tough to know where to start. This article will cover some of the key elements to focus on when setting up e-commerce for your business.

Customers have come to expect 24/7 access to their orders and tracking information. However, it’s not just about access, but the ease and speed of finding the information they need. An engaging and user-friendly website should be easy to navigate, responsive, and appealing to the target audience. It should showcase the product and service offerings in a way that is easy for customers to understand.

A poorly designed website can deter potential customers and harm the reputation of the business. On the other hand, a well-designed website can provide a seamless self-service experience for customers and enhance a business’ reputation for quality service. It’s worth spending the extra time during set-up to focus on the user experience.

Here are some tips and best practices to help you get started. High-quality images and videos can showcase different angles, close-

------------

BY TAMARA SUTTON

ups, and special features of the product. Find out if your vendors have a product catalog with images you can use to save time setting up your site.

Videos can also enhance the customer experience by demonstrating the features and benefits of the product. To test effectiveness, you can start by making a few videos for some of your top-selling products. Then, track the sales to see if the videos increase customer engagement. If you see positive results, you can invest more time in creating videos for your other products.

Typography (fonts and size of the text) should be easy to read, consistent, and supported by most web browsers. Keeping your fonts the same throughout the site will help the customer focus on the product. The contrast between text and background colors should be high enough that it is easy to read.

Call-to-action buttons (CTA) should use clear and concise verbiage like “Add to Cart” or “Buy Now.” This will encourage immediate action from your customers. Give explicit directions about where users need to click and what to expect. Rather than a button marked “Account,” stating “Check my Account Balance” gives a clear understanding of where this button will take them. The call-to-action buttons should use contrasting

colors, appropriate sizing, and be consistent across the website.

Feedback is essential for improving your e-commerce site and adapting to your customers’ needs. Adopt a growth mindset and look for opportunities to improve or adjust your strategy. There are various ways to collect and analyze data from your site, such as using free tools like Google Analytics or asking your customers for their opinions. If you aren’t confident interpreting your results, hire a local marketing agency to provide you with actionable insights. Based on the data, you can make changes to your site that will enhance the customer experience and increase your sales.

To create a successful e-commerce site, you need to prepare, plan, and maintain it with the customer experience in mind. A user-friendly site that meets your business goals and customer needs will help you grow your online presence and sales. MM

20 • the merchant magazine • June 2024 building-products.com

------------| MANAGEMENT TIPS

TAMARA SUTTON

Tamara Sutton is the director of product design at DMSi (www.dmsi.com).

TUF-TRED®

OFFERING:

• Superior skid resistance

• Surface durability

• Weatherability

• Moisture resistance

• 4x8 panels, ¾" thick

• ADA Approved

Swanson Tuf-Tred is ideal for interior or exterior stair applications where skid-resistant surfaces are desirable.

Phone: 541-492-7516 Email: greg.bess@swansongroup.biz Swanson Group Manufacturing 1651 South F Street Springfield, OR 97477

www.swansongroup.biz

TUF-TRED ® IS A SKID-RESISTANT, TEXTURED, OVERLAID PLYWOOD

EQUIP YOUR LBM BUSINESS FOR FUTURE SUCCESS WITH THE LATEST RETAIL TECHNOLOGY

THE RETAIL INDUSTRY, especially within the traditional lumber and building materials (LBM) sector, is facing major changes that are reshaping how small- and medium-sized businesses (SMBs) operate and compete in a world tied to internet connection and mobile devices. Ultimately, this means changing business practices to meet new buyer demands and better compete against peers, online giants and big-box stores.

There’s a silver lining for LBM dealers. The rise of retail technology is not a threat but an opportunity to meet modern customer expectations, compete on a level playing field and thrive in this new era.

Understanding the Shift: The New Retail

Model

Where yesterday’s retail success depended on home centers and service counters combined with phone orders and the in-person shopping experience, today’s focus includes digitalization and online channels.

------------ BY JOHN MAIURI

It’s critical for dealers to not only service their existing business as buyer preference adapts to new technology but additionally improve customer satisfaction. LBM dealers who have not begun the journey toward digitalization need to act quickly because buyer behavior typically leans toward convenience and if your business is the only one not online, you are potentially at risk. The good news is online technology can do a lot of heavy lifting to help dealers compete and grow.

Embracing Technology: The Path to Continued Competitiveness

One of the most important steps for LBM dealers is simply to embrace the need for change. While digital engagement from a business software system directly to customer account holders, like contractors and perpetual DIY accounts, has been around, the surge in ecommerce as a channel to individual markets is now table stakes. Dealers need to grasp

the complexity of managing multiple solutions to address their business.

Finding the right tech designed specifically for pulling all business aspects into one system is critical for improving efficiency and getting comfortable with technology. Choosing the right business management software for the unique needs of an LBM business can be daunting enough, let alone the complexity of a deeply integrated digital engagement portal and ecommerce presence. However, the right choice in a modernization strategy will put your business in a stronger competitive position and allow you to service your market in a more convenient and efficient manner.

Digital technology empowers dealers to more efficiently service their market, manage trade accounts and acquire new customers—faster and easier. These tools open opportunities to create highly personalized shopping experiences by focusing on customers’ unique needs and prefer-

22 • the merchant magazine • June 2024 building-products.com

------------| INDUSTRY TRENDS

ences, creating further loyalty. Data analytics break down buyer behavior into actionable steps LBM dealers can take to improve their operations and evolve marketing strategies.

The BOPIS Revolution: Optimizing Phone-In Orders

One example of how technology can enhance the customer experience and business efficiency is the Buy Online, Pick Up In Store (BOPIS) model that’s only possible with an industry-focused ecommerce platform. Research highlights a notable increase in buyer preference in the BOPIS model, which puts the customer first, combining physical shopping with the ease of online browsing. The benefits don’t end there, as dealers report additional in-store purchases from customers when BOPIS is available.

The success of BOPIS in the U.S., as highlighted by “The 2023 Global Digital Shopping Index,” which showed a significant increase in BOPIS usage from 23% in 2021 to 32% in 2022, only reinforces this growing trend.

For LBM dealers looking to stay ahead of their competition, applying digital practices and modern technology tools can also increase customer loyalty and boost sales. Plus, it’s much easier to create an engaging and efficient shopping environment for their customers while delivering convenience, speed and flexibility. Think of the efficiency of order placement via ecommerce as an alternative to telephone orders which are much more difficult to scale in volume, each phone order requires a staff person on the other end. Online BOPIS orders are created at the source by a single individual and flow directly into your business fulfillment operation process.

A Continuous Journey to Ensure Success

Integrating point of sale and order management technology into LBM businesses has been ongoing for over 40 years. As customer needs, trends and technologies change, LBM dealers need to stay informed and continue to adapt. Working digitalization into the mix, investing in employee training, exploring new replenishment and fulfillment models and putting customer needs first are

key strategies for today’s LBM businesses. Additionally, dealers looking to the future can strengthen their succession plans—whether they’re looking to pass on their successful business to the next generation or sell to someone new—technology is a great strategy for creating value and longevity.

Today’s retail technology tools present opportunity for traditional LBM dealers to level the playing field in a competitive space, create a buying experience that feels familiar, and get into the habit of pulling usable

insights from the data. As a result, there’s opportunity to grow, improve and prosper. All in all, the future is looking bright for LBM dealers. MM

JOHN MAIURI

JOHN MAIURI

One. Stop. Shop.

Storing millwork can be tough. Size variation, custom orders, temperature sensitivity—all can add to the challenges suppliers face as they seek efficient onsite storage solutions. That’s why Greg Zuern decided to try something completely different. Together with CT Darnell and Sunbelt Rack, Zuern Building Products consolidated all their millwork into one reimagined building for maximum efficiency. The results speak for themselves. Thanks to this change, they saw:

50% faster pick times

$8MM more in deliveries with fewer trucks and drivers

Maximized inventory efficiency and increased SKU count by over 15%

building-products.com June 2024 • the merchant magazine • 23

John Maiuri is president of ECI Software Solutions’ LBMH Division (ecisolutions.com).

Scan for the full story and video © WTD Holdings, Inc., 2024. All rights reserved. CT-Darnell.com • Sunbelt-Rack.com • 800-353-0892 CTD_ZuernAd-full-Horiz-050724.indd 1 5/7/24 11:25 AM

FRIENDLY, WARM, CALM AND CONFIDENT

------------ BY JAMES OLSEN

IN GENERAL, we want to match our customer’s volume, pace, tone and demeanor when communicating with them. That said, sales is a transfer of emotion more than information. Information is important, but by itself, especially in the competitive world of sales, information alone will rarely win the day.

If you work for Apple and your customer only wants Apple products, then you are not really in a competitive sales situation. But if we are selling a commodity or products that are similar, how the customer feels about us as a person will be the difference between getting or losing the business the majority of the time.

Life is a mirror, so how we treat people is how they are going to treat us. There are the exceptions—the Grumpasaureses of the world or adversarial buyers—and even these buyers can be converted over time, but in most cases customers will respond to us as we treat them. Remember that difficult customers are a gift from above because they keep most salespeople away. I love converting grumpy or difficult customers.

Below are four ways I see Master Sellers interact with customers that lead to their success:

Friendly

I am not talking about unctuous overly servile, or solicitous niceness that comes across as fake and does not inspire confidence. I am talking about a relaxed open friendliness. Many sellers are too nervous to act friendly. Others are ashamed of being salespeople, so they think that being friendly will make them seem insincere, so they are too officious in their

approach. Introverted sellers will have to push themselves to be more open.

Some salespeople are too aggressive, although this is a small percentage. The number one fear of salespeople is the fear of being too pushy, so many are too passive which does not come across as friendly. Master Sellers speak to customers as they do with their friends. A Master Seller I know said, “All my customers are my friends and if I lost them all tomorrow I would go out and make more friends.” Great advice.

Warm

Warm and friendly are similar, but warm is a more real, personal friendliness, and humans can feel the difference. I know a Master Seller who says some bold things to customers. I always wonder, “How does he get away with that?” The answer is his warmth. He sincerely cares about his customers, and it comes across in his speech. He speaks to his customers as he would to his favorite aunt or uncle, and they respond in kind.

Calm

If we are nervous or aggressive in our approach, customers will feel uncomfortable and will do their best to end our interaction as soon as possible and will unlikely buy from us. Sellers that are nervous or unprepared do not have a calm demeanor and customers feel it—even if the feeling is subconscious. Calm sends the message, “Everything is going to work out great.” (When you buy this).

One caveat of calmness is to not overdo it. We don’t want to be so calm that we appear indifferent. Calm enthusiasm may seem like an oxymoron

but that is what we are shooting for as salespeople.

Confident

Master Sellers have the belief that they will win the business. Winning the business is inevitable. This is part of pre-call preparation. We must convince ourselves before we make the call that the customer is going to buy from us and then talk like that from the first moment of the sales call until the final closing of the deal.

Just like being calm can be overdone, too much confidence will be perceived as arrogance which is not attractive and does not lead to business. “Command presence” and “quiet confidence” is what we are aiming for.

Just like Baby Bear’s porridge in the fable of Goldilocks, getting the right mix of friendly, warm, calm, and confident can be difficult to get just right. We all will have challenges in getting the mixture correct. Few of us possess all of these attributes naturally, but it is possible to improve these interpersonal skills. Over the years, I have watched many of my students do the same. Product knowledge (information) is important, but being relatable is much more important in our world of sales. MM

JAMES OLSEN

JAMES OLSEN

James Olsen is principal of Reality Sales Training, Portland, Or., and creator of SellingLumber.com. Call him at (503) 5443572 or email james@realitysalestraining.com.

24 • the merchant magazine • June 2024 building-products.com

------------| OLSEN ON SALES

#1 Inventory Management Profit Strategy:

Stock No More Than Needed to Properly Service Demand

This practice is crucial to profitability. Here’s why:

n Every day that excess inventory is owned, it is either costing interest on borrowed money, which increases expense, or it is preventing the earning of interest on owned money, which decreases income. Whether capital is borrowed or owned, excess inventory is always eroding profitability.

n Let’s say a yard has sales volume of 110,000 BF/month. If brought in all at once by car, the inventory can turn once a month if needs are correctly projected. But if metered in by truck in 27,500 BF increments at one load per week as actually needed, that inventory will turn 4 times per month – and tie up only 1/4 as much cash.

n Now suppose this yard pays for the car 10 days after shipment and delivery takes 3 weeks. It paid for 4 times the inventory it needed, and won’t see any of it for 11 more days. But if it buys by truck with quick delivery, every stick could be sold before the invoice even comes due. In fact, three truckloads could be sold this way before the car could even have arrived, again using only 1/4 the capital.

n This strategy dependably multiplies turns and GMROI, dramatically improves cashflow, cuts carrying costs and frees up both capital and space for more profitable use. Margins are maintained through market moves and downside risk is significantly reduced because the inventory is turning faster than price changes can affect its value. There’s less inventory to count, and stock stays fresher, too.

building-products.com June 2024 • the merchant magazine • 25 (800) 654-8110

Maximize your profit with this safe and efficient strategy. Call Idaho Timber for highly-mixed trucks and just-in-time delivery.

COMPENSATION QUESTIONS YOU NEED TO ASK (AND ANSWER)

------------ BY SUSAN PALÉ

THE GREAT RESIGNATION is over, the red-hot recruiting market has cooled a bit, and inflation is down. That’s some of the good news for employers in 2024. But don’t relax too much—compensation is still important. In a recent Compensation Best Practices Report published by Payscale, a majority of employers reported compensation as their biggest challenge—a bigger challenge than either recruitment or retention. And 53% of those employers reported that they would increase focus on development of a compensation strategy for 2024.

To address these challenges, it is time, as an employer, to ask some questions.

Is It Time to Develop Salary Ranges?

Salary ranges, also called salary bands or pay ranges, establish the pay parameters for a job role or group of roles. Salary ranges are based on market information in conjunction with the organization’s compensation strategy and philosophy. Pay ranges typically include a minimum, midpoint, and maximum amount.

If your organization is small, market pricing for individual positions can work well. But as a company grows, especially if it expands to multiple locations, finding market information for every job and location becomes difficult.

Salary ranges also provide the framework to promote consistency in offers to new hires and promotions and salary increases for existing employees. In the past, many organizations offered starting salaries to new hires based on salary history, but it is now illegal in 22 states to ask about an applicant’s salary history. And it’s likely more states will adopt this type of regulation.

Salary ranges can also help to address issues such as salary compression (when salaries of new hires equal or

exceed those of experienced employees in the same or similar role), pay equity (equal pay for equal work or work of comparable value), and pay transparency. More about the last one below.

How Will My Organization Address the Issue of Pay Transparency?

Pay transparency is defined by World at Work as “the degree to which employers are open about what, why, how and how much employees are compensated.” Pay transparency is often driven by legal requirements. Pay transparency laws vary by state, but generally focus on requirements that employers list salary ranges on job postings for open positions.

Compliance with legal requirements often means that current employees find out about pay ranges for their positions from job postings or external applicants. That can certainly cause problems. The same Payscale Best Practices survey noted above reported that 14% of responding employers have lost employees because those employees saw posted job ranges. And legal penalties can be significant. In the state of Washington, which allows remedy through the court system (as opposed to enforcement by a government agency), one law firm filed over 30 class action suits in one week.

But pay transparency is more than compliance. It’s about being proactive in your communications about compensation. That doesn’t necessarily mean that everyone gets to see everyone else’s salaries. That happens in some tech companies, but it’s not common or required. What it does mean is that employees should understand how they are compensated and the rationale that determines their pay. That might include variables such as:

26 • the merchant magazine • June 2024 building-products.com

------------| TRANSFORMING TEAMS

• Compensable factors (skills, knowledge, education, certification, etc.)

• Performance

• Depth and breadth of experience

• Seniority and length of service

It’s time to be proactive about pay transparency. Even if there aren’t legal requirements in the locations where you do business, you need a compensation strategy that allows you to make offers to candidates and reward current employees within a fair, consistent framework.

What Do Managers and Supervisors Need to Know About Compensation?

In my consulting practice, I’ve often had managers and supervisors tell me that they don’t have an understanding of their organization’s compensation policies and practices. Sometimes the CEO is responsible for compensation decisions and doesn’t effectively communicate the rationale to anyone. That puts managers and supervisors in the awkward position of not being able to answer employees’ questions about their pay.

There are steps you can take to help your managers and supervisors. These include:

• Documenting and distributing your compensation philosophy, policies, and procedures

• Training managers to provide them with the skills and knowledge to answer employee questions and communicate consistently about compensation

• Maintaining an open-door policy to discuss compen-

Q. What do I need to know about hiring a summer intern?

A. If you plan to pay your interns at least minimum wage, you’re in good shape. If, however, you are planning to offer an unpaid internship, there are a few things you should consider.

Federal and state governments are cracking down on the use of unpaid interns, arguing that not paying interns for their labor violates the Fair Labor Standards Act (FLSA).

Even if you and your intern agree that the work experience is sufficient compensation for the labor, you must satisfy the requirements for it to be “bona fide” and thus qualify as an unpaid internship.

You may be subject to wage and hour penalties and back wages under the FLSA if you fail to pay your summer interns appropriately.

The Wage and Hour Division of the U.S. Department of Labor’s Fact Sheet #71 offers help for determining whether your intern is entitled to minimum wage or overtime pay and can be found at www.dol.gov.

For the record, we are strong proponents of internships, particularly as a means of identifying and developing new talent and future employees. Good luck!

sation questions and concerns with all employees (and encouraging your managers to do that too)

• Empowering your managers to make compensation decisions for their new hires and current employees

Managers and supervisors are ultimately responsible for the success of any organizational program or initiative. It’s essential that they understand their role and responsibilities in order to guarantee that success.

Do Employees Understand Their Total Compensation?

Total Compensation (also known as Total Rewards) includes not just base salary and other cash payments, but also the value of all employee benefits and perquisites that can be quantified. For many organizations, the cost of benefits, including healthcare premiums, retirement plan contributions, and paid time off can easily amount to 30%–35% of an employee’s salary. That means the total compensation for an employee making $100,000 would be $130,000–$135,000.

A 2023 survey conducted by beqom (a provider of total compensation management software) revealed that nearly half of surveyed employees don’t understand their total compensation.

Organizations generally do a pretty good job of communicating total rewards when posting positions or interviewing candidates—after all, those are great marketing opportunities. But these same organizations often don’t do a very good job of communicating total compensation to their current employees.

One way for an organization to improve total compensation communications is through a total rewards statement. A total rewards statement is an extremely effective tool to help employees understand the true value of working for the organization. Statements are personalized and typically produced and distributed once a year.

In the past, these types of statements have focused on quantifiable information. That includes financial information about base salary and bonus/incentive payments, and benefits information including medical plan contributions, PTO, 401(k) contributions, etc. But there is now a current trend to include non-quantifiable information in these statements. That might include things like opportunities for remote or hybrid work, flexible and in-advance scheduling, and educational opportunities.

Growing your business means recruiting and retaining top talent. That means developing compensation plans that are both fair and competitive. It’s a tough landscape to navigate, but answering these questions will help you get off to a good start MM

at (877) 660-6400 or contact@theworkplaceadvisors.com.

building-products.com June 2024 • the merchant magazine • 27

SUSAN PALÉ

Susan Palé, CCP, is vice president for compensation with The Workplace Advisors. Reach her

DIXIELINE TO ENTER ORANGE COUNTY

After 110 years in San Diego, Dixieline Lumber & Home Centers is opening its first location in Orange County, Ca.—at the former site of Ganahl Lumber in Dana Point.

Later in the year, Dixieline will also be adding a location in Palm Springs, Ca.

A division of Builders FirstSource, Dixieline operates nine locations in San Diego County, from Chula Vista to as far north as Solana Beach.

Dixieline has traditionally served areas outside of San Diego, including Orange and Riverside counties, but through outside salesmen rather than from physical locations.

The property in Dana Point had been operated by Ganahl from 1995 (when it was acquired from Capistrano Lumber) until Aug. 4, 2023, when Ganahl relocated to a new,

larger facility in nearby San Juan Capistrano. Dixieline is sprucing up the older yard.

Dixieline began hiring sales personnel in March and started advertising positions for supervisory and yard workers in April. Already hired to outside sales are: Kurt McFall, formerly with Pella Corp.; Aaron Castaneda, previously with ARDEX and Jones Wholesale Lumber; and Gabe Quesada, Jr., ex-Ganahl. The opening is expected some time in June.

According to Dixieline, “This marks an exciting new chapter for our company as we bring our expertise and commitment to excellence to the vibrant communities of Orange County. We look forward to serving and connecting with our new customers in this thriving region.”

KODIAK ACQUIRES IDAHO’S VALLEY LUMBER

Kodiak Building Partners, Englewood, Co., has acquired Valley Lumber & Rental, a prominent provider of hardware and building supplies in Victor, Id., and surrounding areas.

“Our partnership with Kodiak opens exciting opportunities for growth and innovation,” said Valley Lumber & Rental president Whitney Gardiner. “We’re eager to leverage Kodiak’s expansive network of resources to enhance our services and meet the evolving needs of our customers.”

Established in 2003, Valley Lumber & Rental has been a cornerstone business in Teton Valley, Id., for over 20 years, surviving economic challenges and remaining a well-known anchor in the community. Through donations to non-profits, participation in construction industry education programs, and its status as the largest business of its kind in the area, Valley has contributed mightily to the local community and construction landscape.

“Our acquisition of Valley Lumber & Rental underscores Kodiak’s commitment to growth and investment with great partners in thriving markets like Teton Valley,” said Kodiak CEO Steve Swinney.

“By partnering with Valley Lumber & Rental, we’re positioned to tap into the force in the universe that makes things happen—all you have to do is get in touch with it, stop thinking, let things happen, and be the bear.”

As Kodiak and Valley Lumber & Rental begin to work together, they will focus on empowering Valley Lumber & Rental to build on its success and continue delivering excellent service and products to its customers. With Kodiak’s partnership, Valley Lumber & Rental aims to expand its market reach with greater outside sales support, enhance retail sales and leverage shared industry knowledge to improve efficiency.

Whit Gardiner will continue to lead Valley Lumber & Rental, which will become a part of Kodiak’s growing Northwest region.

Founded in 2011, Kodiak Building Partners is a leading acquisition firm specializing in acquiring and supporting locally owned and operated building materials companies. Kodiak’s operation employs thousands of people across the country to serve contractors, builders, remodelers and consumers.

, Parr Lumber, Hillsboro, Or., broke ground on a new location in Damascus, Or.—its 47th in the Pacific Northwest.

Parr also completed the expansion of its Ridgefield, Wa., yard, increasing the space from 5 to 7 acres and adding two optimization saws.

84 Lumber relocated its western team headquarters from Phoenix, Az., to Dallas, Tx.

K-119 Tools & Equipment, San Bruno, Ca., has closed after more than 45 years with the retirement of owner Joseph Chien.

Highland Lumber Sales, Anaheim, Ca., purchased a 48,235sq. ft. warehouse in Fullerton, Ca., for $13.35 million from Omni Metal Finishing, Fountain Valley, Ca.

Second Chance Building Supply, Lynden, Wa., has been opened by thrift store Second Chance.

Capital Lumber in Tacoma, Wa., and Woodburn, Or., is now distributing a full range of UFP-Edge siding and trim in Washington, Oregon, Northern Idaho, and Alaska.

Hall Forest Products, Puyallup, Wa., has added EvaLast’s Infinity decking products to its existing Apex inventory.

Kohler has begun production at a new kitchen/bath products manufacturing facility in Casa Grande, Az.

OX Group Global of the U.K. has acquired woodworking clamp/ jig manufacturer Armor Tool, San Diego, Ca.

AZEK’s TimberTech Advanced PVC Vintage and Landmark are the first composite decking lines to be designated as Ignition Resistant by California’s State Fire Marshal.

Avon Plastics has launched a new Armadillo Builder Rebate Program, designed to simplify the process for contractors to get sizeable rebates for brand loyalty to Armadillo products.

Starfire Lumber Co., Cottage Grove, Or., has partnered with the Cottage Grove Community Medical Center Foundation to start a Community Health Fund, helping to ensure healthcare access and accessibility in South Lane County.

28 • the merchant magazine • June 2024 building-products.com

------------| NEWS BRIEFS

Re Reddwwood i ood is

in some of the most productive timberlands in the world. Redwood is known for its timeless durability without the use of chemicals. Due to its flawless formation, there has never been a Redwood recall. There is a grade of Redwood for every application, every budget, and every customer.

“Growing beyond measure.”

Call or visit us today. Our family of Redwood timberland owners will continue to be your reputable and reliable source of Redwood.

THE POSSIBILITIES KEEP GROWING: Call us at 707.894.4241 Visit us at buyRedwood.com Natu re’s majestic pi l la rs.

REDWOOD

o s

ne o e of t f thhe s e sttrroonnggeesst a t annd f d faasstteesst g t grroowwiinng s g sooffttwwood spe ood specciieess. . It

on

thrives

MILLWORK SHOWROOM OPENS IN WASHINGTON

On May 14, Builders Alliance opened a Frontier Millworks showroom next to its Frontier Building Supply yard in Freeland, Wa.

The new showroom features curated displays and on-hand millwork specialists to answer questions and guide visitors through the selection process.

STIMSON CLOSING PLUMMER SAWMILL

This month, Stimson Lumber Co. will wind down operations at its mill in Plummer, Id., as it exhausts its remaining log inventory.

Stimson CEO Andrew Miller attributed the closure to a lack of a dependable source of supply. As well, several key employees are retiring. At its peak, the mill employed more than 100; it’s now 22. Current workers at the mill reportedly will be offered positions at Stimson’s other five facilities in Idaho and Oregon. Production, which used to reach 100 million bd. ft. a year, had dwindled to about 35 million bd. ft. annually.

Stimson has leased the facility from the Coeur d’Alene Tribe since taking over for Plummer Forest Products in 2006.

The mill, while “highly efficient,” produces studs (primarily for big box stores) made from smaller tress, 4-7” in diameter.

The mill site will continue to be used as inventory storage and railroading facility for nearby mills in St. Maries and Priest River, Id.

NATION’S BEST BUYS GAMBLES OF COLORADO

Nation’s Best, Dallas, Tx., has added its 57th location, and second in the state, with its purchase of Gambles Hardware in Hotchkiss, Co., adding to its growing national footprint of locally-focused home improvement stores.

“When owner Kimberly Shay expressed an interest

in selling her family’s hardware store so she could refocus her efforts on her other businesses in town, we stepped in to take a closer look at Gambles Hardware knowing that store could be a great fit within the Nation’s Best model,” said Tina Green, regional VP of operations for Nation’s Best’s West Region. “She and her late husband built up a solid store that aimed to serve all the community’s needs. The store is clean, welcoming, well-organized, and broad in its mix of diverse products across its 7,000 sq. ft. of retail space.”

Founded in 1942, Gambles Hardware has built its 82-year reputation as the first-choice source for home improvement goods and services in Hotchkiss. They are known for their strong selection of plumbing & electrical products, gardening, and paint, as well as authorized dealers for in-demand brands.

Robert Debs, who oversees acquisitions for Nation’s Best, noted that the company intends to remain active on the acquisitions front this year. “Nation’s Best has no plans to slow down. With almost 60 stores now in operation under the Nation’s Best family of over 30 distinct brands, we have honed our winning formula for success. We are looking forward to continuing to demonstrate the value and relevance of independent home improvement across the country,” he adds.

As part of Nation’s Best’s strategy, Gambles Hardware will maintain operations under their existing name with its key management team overseeing company operations alongside Nation’s Best, which will provide the strategic and financial support necessary to drive optimal growth and profitability. Nation’s Best will also lease back the property from the owners, an approach that they have found favorable to both parties.

US LBM PURCHASES NO. CAL. TRUSS MAKER

US LBM, a leading distributor of specialty building materials in the United States, has acquired Better Built Truss, a top manufacturer and supplier of structural roof and floor components in Northern California.

Founded in 1964, Better Built Truss operates two facilities in Oakdale and Ripon, Ca. Primarily, Better Built Truss designs, manufactures and supplies roof and floor truss components to contractors, developers and multifamily, commercial and residential builders in Northern California.

Jeff Qualle, who has led the business since 1996, will continue to run day-to-day operations.

With this acquisition, US LBM now operates 12 locations in Northern California, including three structural component manufacturing facilities; the company also operates Homewood Truss, which is located north of Sacramento, Ca.

“The team at Better Built Truss has great relationships with area builders in California, and a long history of providing exceptional service and solutions,” said US LBM President and CEO L.T. Gibson. “We continue to see demand for structural building components in Northern California, and the addition of Better Built Truss allows us to increase our capabilities and expand our customer base in the area.”

30 • the merchant magazine • June 2024 building-products.com

FRONTIER Building Supply now has a sister millwork showroom in Freeland, Wa.

PHOENIX, ARIZONA NOVEMBER 13-15 Join NAWLA to connect with leading buyers and suppliers at the 2024 Traders Market: nawla.org/tradersmarket 2 0 2 4

MOVERS & SHAKERS

Amy Warren, ex-Weyerhaeuser, has joined International Wood Products, Clackamas, Or., as vice president of marketing. She succeeds Edy Schaller who, as she prepares for retirement, will serve as senior vice president–special projects.

Robert Gordon, ex-Southeast Building Supply Interests, has been named president of Direct Lumber and Door of Colorado, Denver, Co.

Amanda Fiocchi has been promoted to retail supervisor at Builders FirstSource, Forest Grove, Or. Wyatt Martin is now field millwork buyer for BFS in American Fork, Ut. Marcin Jasinski is new to outside sales in Simi Valley, Ca. Donny Weesner, Builders FirstSource, Auburn, Wa., has been promoted to buyer.

Kari Rollason, ex-Cornerstone Building Brands, is new to OrePac Building Products, as San Diego, Ca., territory sales mgr. Lance Brown is now operations mgr. in Wilsonville, Or.

Jordan Worthington, ex-Ziggy’s Home Improvement, is now plant mgr. of Parr Lumber’s door shop in Liberty Lake, Wa.

Travis Kincaid has been promoted to general mgr. of Plywood Supply, Kenmore, Wa.

Dan Graham, ex-Friedman’s Home Improvement, has joined Gold Beach Lumber Yard, Eugene, Or., as director of merchandising & marketing.

Caitlin Chambers, ex-Fred Tebb & Sons, is a new lumber trader at Patrick Lumber, Portland, Or.

Brian Chaney has been promoted to senior vice president of Wood Products for Weyerhaeuser Co., Seattle, Wa. He takes over for Keith O’Rear, who retired from the position on June 3 and will serve as a strategic advisor to the company through the end of 2024. Emma Mayfield, ex-Gold Beach Lumber, is a new buyer & material mgr. for Weyerhaeuser, based in Eugene, Or. Ramon Rosas is new to outside sales from Fresno, Ca.

Richard Ecraela, ex-American Home & Floor, has joined the millwork division outside sales team at Honsador Lumber, Honolulu, Hi.

Lance Girtman is new to inside sales at Capital Lumber, Woodburn, Or.

Kevin Ordean was promoted to director of forest operations for Restoration Forest Products, Bellemont, Az.

Ryan Hunt, ex-Grainger, is now distribution center mgr. of Cameron Ashley Building Products, Salt Lake City, Ut.

Jason Butterfield has been promoted to associate VP of Wasatch Timber Products/Sunpro, Heber City, Ut.

Jessica Bauman is new to Peterman Lumber, Fontana, Ca., as manufacturing project mgr.

Roger Dankel, executive VP, North American sales, Simpson Strong-Tie, Pleasanton, Ca., will retire June 30, 2025, after 31 years with the company. He will continue in his current role through the end of this year and then stay on as an executive advisor for the first half of next year. Udit Mehta is Simpson Manufacturing Co.’s new chief technology officer.

Chris Forrey has been promoted to VP, finance & investor relations at Boise Cascade, Boise, Id.

Lauren Benson has joined Dixieline Lumber & Home Centers, San Diego, Ca., in sales support & marketing.

Prithvi “Prith” Gandhi, ex-TAMKO, has joined Beacon, Peabody, Ma., as executive VP and chief financial officer.

32 • the merchant magazine • June 2024 building-products.com

------------|

Wood lasts longer with GREEN’S COPPER-GREEN® Wood Preservative For use wherever wood meets water or soil. PREVENTS DETERIORATION FROM: TERMITES • ROT • DECAY • FUNGUS Seals wood, kills termites and wood-eating insects. Recommended for NEW or OLD construction. FOR EXTERIOR USE ONLY TM We’re looking for stocking partners! For a great product in your store, contact: Hal Harlan or Guy Woods – 510.235.9667 • greenproductsco.net

Tiffany Brown, ex-Elite Floor Coverings, has moved to the outside sales team at Intermountain Wood Products, Seattle, Wa.

Jan Twamley, market mgr., Beacon Building Products, Anaheim, Ca., has retired after more than 30 years with the company.

Keith Eibel, director of chips and of Roseburg’s Coos Bay, Or., shipping terminal, is retiring July 31 after 16 years with Roseburg. John Holte will succeed him in both roles.

David McElroy has been promoted to director of operations for Central Valley, Woodland, Ca.

Jennifer Doty is a new design consultant with Meek’s Lumber, Chico, Ca.

Rob Wickens was appointed operations mgr. at Westcoast Moulding & Millwork, Surrey, B.C.

Eric Knox has been promoted to director of LBM sales for Do it Best, Fort Wayne, In. Jared Hufford was appointed director of strategic initiatives. Ben Schwartz is a new forest product trader.

Mark Aromi has been promoted to director of commercial sales for Kebony North America. He is based in Atlanta, Ga.

Norman Willemsen, ex-Kebony, has been named CEO of MOSO, succeeding founder and former CEO René Zaal.

Susanne McGinnis is now marketing mgr. for Clubhouse/ TruNorth Decking.

Álvaro Gonzalez has been named CEO of Garnica, Wilmington, De.

Mark Taggart, chairman, Toyota Industries Global Commercial Finance, is now also chief financial officer for Toyota Material Handling North America, Columbus, In.

Bill Staley, CEO of Belco Forest Products, Shelton, Wa., was named the recipient of a 2024 Lifetime Achievement Award by The Vistage Group, the world’s largest CEO coaching and peer advisory organization for small and midsize businesses.

Marsha Dimes is overseeing charitable contributions at Mungus-Fungus Forest Products, Climax, Nv., report co-owners Hugh Mungus and Freddy Fungus

building-products.com June 2024 • the merchant magazine • 33

888-807-2580 Bend, OR www.pelicanbayfp.com DISTRIBUTION LOCATIONS Colton / Fontana / Modesto / Salinas / Stockton, CA PRODUCTS & SERVICES Framing Lumber / Pallet Stock / Industrial Lumber / Softwoods Hardwoods / Cedar / Fencing / Decking / Redwood Custom Cut Stock / Treated Lumber / Tile Battens 3-Hole & Slotted Vents / Custom Cutting / Remanufacturing Heat Treating / Fire & CCA Treating “Focused on the future with respect for tradition”

CRENSHAW LUMBER, Gardena, Ca., was honored for 75 years in business by buying group LMC. (Left to right) Colin Klein, LMC’s western regional manager, who presented an award to Crenshaw’s Lindsay Olson, James Cederholm, Larry Olson, David Olson, and Ethan Olson.

MISSOULA RECEIVES NEW DO IT BEST STORE

Zootown Hardware & Garden, Missoula, Mt., has been opened by Damon Leishman, who will also serve as general manager.

A week after “soft opening,” the store held an official grand opening on April 12.

Stocked through Do it Best to maximize buying power, the store carries about 15,000 SKUs across its 5,000-sq. ft. showroom and 10,000-sq. ft. garden center. It has a staff of 16.

After he spent more than 20 years serving in the U.S. Army, Leishman and his family were ready to return to their Montana roots.

With an Ace Hardware and big-box home centers on the other side of town, Leishman wants to position his business as a “complement” more than competition, focusing more on professional products, including lumber, tools, paint, concrete and garden supplies. A rental department will offer higher-skill equipment.

Until the 1990s, the location at the Southgate Mall had served as an Ernst Home Center, after which the mall converted it to a storage facility.

CONSTRUCTION PROGRESSES ON ROSEBURG MILLS

One year after announcing a $700 million investment in its manufacturing operations in Southern Oregon, Roseburg Forest Products reports that construction at two new plants in Dillard, Or., is well underway.

Dillard Components will be the first of the new plants to come online, with startup expected in late summer 2024. The plant will convert specialty medium density fiberboard (MDF) panels manufactured at Roseburg’s MDF plant in Medford, Or., into Armorite Trim, a finished exterior trim product for residential and shed use. This is an innovative new product that Roseburg recently introduced to the market.

Dillard MDF will use wood residuals from Roseburg’s

local mills and other regional suppliers to manufacture standard MDF panels, as well as thin high density fiberboard (HDF), often used in cabinetry, doors, and other applications. The plant will produce panels with a thickness range from 2 mm to 28 mm.

Once fully operational, the two new plants will employ approximately 120 people in the community where Roseburg was founded nearly 90 years ago.

“As equipment orders arrive and construction progresses, it’s exciting to see our plans for these investments take shape and become reality,” said Tony Ramm, senior VP of manufacturing. “Roseburg was first established in this area in 1936, so investing in these projects at home is especially meaningful to the company. We look forward to seeing how they contribute to the future of the company and our team members, and the economic health of Southern Oregon.”

The two plants together will be capable of producing the following:

• MDF panels: 175 million sq. ft. per year on a 3/4” basis, or 310,000 cubic meters per year

• Primed Armorite exterior trim: 70 million sq. ft. per year on a 3/4” basis, or 124,000 cubic meters per year

• Interior moulding: 90 million ft. per year

Roseburg currently owns and operates three MDF plants in North America.

The two new Dillard plants represent a significant portion of Roseburg’s $700 million investment in its Oregon manufacturing assets. The investment also includes improvements at existing Roseburg plants in Oregon, such as significant upgrades at our plywood plant in Riddle, Or., including two new lathe lines and a new hardwood plywood line, and a new dryer at our plywood plant in Coquille, Or.