MORE CHOICES. ADDED WTIUE.

The California Redwood Company's recent acquisition of remanufacturing and distribution capabilities in California provides retailers with a:

. Full selection of premium redwood products

. The qudity and eonsistency of delivery that you have come to expect from The California Redwood Company

. Marketing support for retail partners

Wb are committed to being your complete supplier of quality redwood products. Now as both manufacturer and distributor we are able to deliver iarge or small orders quickly and ensure quality control. Contact us for more detaiis on our comprehensive product offering.

Dedicated partners to the building products industry sinee r8go.

,r*",

www.californiaredwoodco. com

Partners You Can Grow With

One year ago, The California Redwood Company made a commitment to provide our retail partners with premium products and. dedicated marketing support. When you're talking redwood... talk to us. 'W'e're here to help you g"ow your redwood business.

Benefits to Retailers:

'Dreara Builder" - This proprietary leadinE edge B-D tool is located orr ourwebsite and provides customers the ability to envision redwood decls in a variety of settings. The user ca* select preferred sryles of wood, stain, decking pro&le and raiiings to create their {avorite deck sryle prior to making a purchase. teads frorn our website will be forwarded to our retaitr Dartners for sale generation.

Soeial media networking tools to prornote Srour business

Dedicated team of marketing professionals to support your nee&

www.cdiforniaredwoodco.eom

CONIACI: info@caii{orniaredwoodco.corn TOLL-FREE: r-3ffi-7

Special Features ln Every lssue Online

THr MrncHlNT oN Fncraoox SrRncH "THe MrncHRNt MncAZrNE" oN Fnceeoor.cov

CHANGE 0F ADDRESS Send address label ftom recsnt issue if possible, new address and $digit zip to address beloil.

POSTI{ASTER Send address chanoes to The Merchant Magazine, 4500 Campus Dr., Ste.480-, Newport Beach, Ca. 9266G1872.

The l{erchant ilagazine 0SSN 7399723) (USPS 790-560) is published monthly at '[500 Campus D]., Ste.480, Nerport Beach, Ca. 926E0-1872 by Cu0er Publishing, Inc. Periodicals Postage paid at Newport Beach, Ca., and additional post ofices. It is an independen{yowned publication for the retail, wholesal€ and distribulion levels of the lumber and building products markets in '13 westem states. Copyright@20l1 by Cutler Publishing, Inc. Cover and entire contenb are fully protected and must not be reproduced in any manner withoul written permission. All Righb Reserved. lt reserves the dght to accept or rejecl any editodal or advertising matter, and assumes no liability for mat€rials tumished to it.

A THIil GOATIIIG OF PROTEGTIOil gE$OIID PMITTEGTIOTilffi

{ VEA}I, THAT'$ $IIIAT WE THOUGHT. I

MoistureShield@ has solid protection all the way r,---,---a to the core of each and every board.

I Competitors use a thin layer of protection.

Competitors have an inner I

C core which is vulnerable to mold and mildew.

tock MoistureShield@ products and provide your customers with a decking product that is uaranteed to last. Some folks wrap their decking boards in a thin coat as "protection" from te elements. Not MoistureShield. Our boards are orotected to the core.

Learn about beccming a MoistureShield Freferred Dealer at nr$istureshield.com.

Itts not your itts me!

Ifr. Tuts ts so DIFFICULT to write, but I lack the guts to tell you personally, Llhence this letter. I feel badly, but we must break up. I just cannot reciprocate how you want me and our relationship to be. I need my time and space. You'll get over me and surely will find someone else to be with, someone who can communicate better than I can.

But you have become obsessed with me. You want constant reassurance about how good we are as a couple. Clearly, we are in a dffirent place about our relationship. Yes, I know you will feel bad for a while, but time will heal, you'll get over me, and surely will find someone else

Since we met, you just won't leave me alone. I did not take the hint that you wanted to be with me forever. I ignored the alarm bells.I should have realized early on that when you kept showering me with presents and you tried to find ways for me to keep coming by, something was wrong.I even gave you an assurance in an email that everything was fine and I could not be any happier. But, this was just not enough for you, as now we are on the fifth go-around of you asking me the same old questions.

You keep calling, emailing and writing. You have become very needy and insecure, and you won't take no for an answer. I try to ignore you, but somehow you find a way to track me down wherever I am, and you keep coming back to the same old thing again and again. You were-are-great, but I have others I need to worry about.

My wtfe is beginning to get suspicious and ask questions: "Who keeps tweeting you? " "Who keeps trying to get hold of you day and night? " "Why do they keep calling?" "Why do they want to be 'friends?"' She is worried that "like" can very quickly turn to love. But I am resisting you. All my waking hours are spent dealing with this infatuation with what am I doing, how much do I earn, did I enjoy how you handled me, and is there anything else you can do for me, and when are you going to see me again! I have a stack of emails on top of the calls you left on my phone. It is all too much!

We clearly are on a dffirent wave length. Yes, we had an intensive relationship for a few hours. And it was truly good for me, as I clearly was missing something in my hfe at the time. But once is enough!

So let's end it here and now. Goodbye and thanks for giving me your all. I will never forget you!

Why is it whenever I buy something these days-whether the cost is $5 or $50,000-I have to face a barrage of emails and telephone calls surveying me about how great my expenence was? And once is no longer enough. They just keep coming. Even when you ignore them, they don't take the hint! Does it really matter how I feel?

No one ever responds to anything I say anyway, especially when "my experience" was not great. Don't you just love being asked to take a survey before you even speak with anyone, after being on hold for an hour? In some cases, we're even told how we must mark the form at the hishest level or else they will get dinged by whomever.

Here's my response: I may be important to you, but you are not to me. Get over yourself! I DO NOT CARE!

Alan Oakes, Publisher ajoakes@aol.comwww.building-products.com

A publication of Cutler Publishing 4500 Campus Dr., Ste. 480, Newporl Beach, CA 92660

Publisher Alan 0akes ajoakes@aol.com

Publisher Emeritus David Cutler

Director of Editorial & Production David Koenig dkoenig@building-products.com

Editor Karen Debats kdebats@buildin g-products.com

Contributing Editors Dwight Cunan, Carla Waldemar, James Olsen, Jay Tompt, Mike Dandridge

Advertising Sales Manager Chuck Casey ccasey@building-products.com

Administration DirectorlSecretary Marie 0akes mfpoakes@aol.com

Circulation Manager Heather Kelly hkelly@building-products.com

How to Advertise

Chuck Gasey

Phone (949) 852-1990 Fax 949-852-0231 ccasey@building-products.com

Alan Oakes www.building-products,com

Phone (949) 852-1990 Fax 949-852-0231 ajoakes@aol.com

CLASSIFlED

David Koenig

Phone (949) 852-1990 Fax %9-852-0231 dkoenig@building-products.com

How to Subscribe

SUBSCRIPTIONS Heather Kelly Phone (949) 852-1990 Fax 949-852-0231 hkelly@building-products.com or send a check to 4500 Campus Dr., Ste. 480, Newport Beach, CA 92660

U.S,A.: One year (12 issues), $22 Two years, $36 Three years, $50

FOREIGN (Per year, paid in advance in US funds):

Surface-Canada or Mexico, $48 Other counhies, $60 Air rates also available.

SINGLE COPIES $4 + shipping BACK TSSUES $5 + shipping

lmplications of the lalling home ownership rate

A*" STATISTIc rHAT IS RourINELy reported, but not very \-Iwell understood, is the homeownership rate. This number reflects the percentage of the occupied housing stock that is owned versus rented, and is updated quarterly by the U.S. Census Department.

Homeownership rose steadily from 1994, when it was around 64Vo,until it peaked in2O04 above 69Vo. The rise was in part due to the aging of the population since older households have a higher propensity to own. More important was the boom in "creative" lending standards during the bubble phase that helped younger households become "owners." For instance, the ownership rate for the 25-to-34 age group rose from 42Vo in 1995 to 49Vo in 2005. However, because many of these households could not sustain ownership, the rate has fallen below 44Vo. The ownership rate for the older age groups did not rise or fall nearly this much.

Since 2004, the overall rate has been dropping rapidly and was at 66.4Vo in the first quarter of 2011. You might ask, "So what?" As it turns out. this number is crucial to our outlook for single-family housing starts. Since a singlefamily housing start uses significantly more lumber and OSB than a multifamily start, the projected ownership rate will be very important to the RISI demand outlook over the next 10 years.

To see how important the homeownership number is, note that between 1995 and 2005, the occupied housing stock grew from 97.1 million units to 109.5 million units. This required construction of 12.4 million housing units in that period to accommodate the growth in households, plus another 3 to 4 million units to replace demolished units.

Because the ownership rate rose by 5Vo in that period, the housing starts "demanded" were single-family units or condo units. The number of owned units increased from 62.3 million units in 1995 to 75.4 million units in 2005.In other words, the entire "demand" increase in that l0-year period was focused on single-family or condo units.

The number of occupied rental units fell between 1995 and 2005 despite relatively high multi-family starts. Removals and conversions to condos more than offset the starts levels.

Bottom Line #1: The implied single-family srarts demanded over the l0-year period, given the rise in ownership (plus an imputed removal rate of 260,000 units), was 1.57 million units. The actual single-family average over

the period was 1.66 million units, plus a boom in condo units. This is why single-family house prices surged dramatically in the period. Rising prices encouraged the very aggressive response of builders to supply the "demand."

The decline in the ownership rate since 2005 is the reason why the single-family unit market is in such serious shape. The combined effect of a slowdown in household formations (due to falling employment) and a decline in the ownership rate led to a dramatic decline in the demand for single-family (and condo) units.

Owner demand rose 1.3 million units per year from 1995-2005, but has been falling 75,000 units per year over the last five years. Even when you add an estimate for removals (assumed to be 290O00 units/year), the demand for single-family (plus condo) units has only been 0.21 million units/year, while actual construction has averaged 0.73 million units/year. That is why we still have an excess inventory of single-family units. And it is why single-family house prices continue to fall.

Bottom Line #2: This is why there is no hope for a sustained single-family housing recovery in 2011, because the ownership rate is still falling.

As will be seen in RISI's forthcoming revised housing start outlook, the outlook for homeownership will play a crucial role in the housing start outlook for 2011 to 2020.

- Dr. Lynn O. Michaelis, executive economist and adviser for RISI, can be reached at (781) 734-8910 or lmichaelis@risi.com.

Treated decking ready for challenge from rrnext generationtt a lternatives

f\eunNo FoR TREATED wood decking, which due to its I-faffordability has picked up market share during the recession, may take a hit from the next generation of composite products, according to a new study by Principia Partners. Wood treaters, however, don't necessarily agree, since the new products are even more expensive.

Total demand for decking and railing in the North American residential market was up slightly in 2010 compared to 2009, and is expected to increase more than 57o in 2Dll, to $3.4 billion. Growth is driven largely by price increases for most all plastic-based decking and railing, as well as continued product mix shift from lower-priced uncapped wood-plastic composites (WPCs) to premium capped WPCs and cellular vinyl decking.

"The market has enthusiastically embraced the new ultra-low maintenance (ULM) decking products," said Principia's Steve Van Kouteren. "Ultra-low maintenance properties and the new improved aesthetics drove demand for capped WPC decking by nearly six-fold in 2010 vs. 2009. In addition, the darker cellular PVC decking with

variegated colors, led by AZEK, Fiberon, TimberTech, and Trex, increased cellular PVC growth by nearly 40Vo in 2010. We expect these trends to continue through 2011 .*

Altogether, the ULM decking category, which includes capped WPCs and cellular vinyl, now accounts for nearly 457o of total synthetic decking demand, up from l57o in 2008. Growth in demand for ULM decking, along with the expansion of channel partnerships and a customer base that favors larger, established players, have increased industry concentration.

For example, the top four players increased their market shares and now account for over 75Vo of the market, compared to 657o in 2008. The top l0 suppliers now account for over 95Vo of the market, compared to 9OEo in 2008.

"Wood decking and railing, including pressure treated, cedar, redwood, other softwoods, and imported hardwoods, still command the major share of the decking and railing market, on a volume basis, and have maintained their market share position against plastic-based decking and railing products since 2005," Van Kouteren said. "In fact, wood had stopped market share losses to plastic alternatives and actually increased share by a few points in 2009. We believe that the new ULM composite and cellular vinyl decking products, now being offered at various price points, will reignite market share growth for synthetic decking and railing over wood. However, the capped products need to perform as advertised."

"I would generally agree that ULM products will win in a lot of solid wood applications," said George Layton, director of sales & marketing for Canfor Southern Pine, Myrtle Beach, S.C. "Manufacturers are now making better products, and with the baby boom generation getting older and wanting less maintenance and Generation Y'ers not knowing how to maintain an outdoor deck, solid wood decking material will play a more limited role. Cost is still alarge driver, and wood will continue to win when that is a consumer's largest concern."

Indeed, the study admits price has been the determining factor. According to Principia, "Wood prices, a key driver in demand for wood alternative products, dropped wildly through the worst of the downturn, creating the largest price spread between engineered composites versus treated

lumber. Persistent high petroleum prices affected costs of raw material feedstock for wood alternative materials. The result has been a growing price gap between wood and wood alternatives affecting intermaterial competition."

In addition, price isn't the only advantage wood has over composites, according to James Riley, chief marketing officer at Great Southern Wood Preserving, Abbeville, Al. "The new preservatives that are now on the market, like the micronized treatment that we use in our YellaWood brand products, enable us to produce a product that's lighter in color, making it easier to paint and stain and giving the user considerable flexibility," Riley said. "It also provides environmental certifications consumers expect today.

"Wood protection companies are not only offering new products with improved stability, but more environmentally friendly preservatives with lower or no heavy metal content," said Keith Harris, v.p.-marketing for Cox Industries, Orangeburg, S.C. "These new preservatives are available in high-end wood products, for instance 2x6 virtually clear decking, which delivers the true beauty of real wood. After all, consumers realize plastic alternatives are trying to mimic the look of real wood. Combine this with a coordinated effort from wood trade organizations and U.S. forestry commissions to deliver the message that real wood is the only truly sustainable and renewable building material available, and I think wood decking can hold its position and perhaps grow market share among discerning consumers that value the feel and beauty ofreal wood products."

"Consumers definitely want a low maintenance decking product, but some treated wood producers, including Pacific Wood, are close to introducing lower maintenance treated wood products that contain powerful water repellants and longer-lasting pigmentation, as opposed to the more quickly degraded stains and dyes," said Elaina Jackson, chief operating officer for Pacific Wood Preserving Cos., Bakersfield, Ca. "This water repellant pigmented wood, when combined with textured deck boards, can result in a very low maintenance wood deck, with the powerful selling point that it is indeed real wood."

At McFarland Cascade, Tacoma, Wa., sales of pressure treated decking have held up better than pricier alternatives. "I do see the capped products doing well, but I'd question their ability to affect the sales of treated decking that would fall in the range of one third the price or less," said sales manager Phil Schumock. "More than likely, the capped

products will cannibalize the mid-range, uncapped WPC decking products, while mid-grade cedar/redwood and treated decking will compete for the entry level market."

Cox's Harris added, "Obviously, there will continue to be a battle for decking market share, but lumber remains cheap and it doesn't look like the price will change dramatically anytime soon, so even the lower-cost alternatives remain substantially more expensive than real wood. In fact, petroleum prices could have a larger impact on plastic products, depending on their formulation."

Principia expects overall decking and railing demand to grow by aboutBVo per year, on a value basis, through2Ol3. The high growth rate is partly due to price increases for plastic-based products, continued product mix shifts, and solid growth in new home construction and remodeling in 2012 and 2013. However, there is considerable downside risk in the forecast as housing prices and the inventory of foreclosed homes dampen the demand for new homes, as does the stalling of the economic recovery.

"So far this year," said Steve Lillard, Madison Wood Preservers, Madison, Va., "we have seen an across-theboard decrease in demand for decking. Having experienced a great first quarter, April and May were off substantially. The small amount of remodeling and the low availability of credit or cash seem to be the largest hurdles to overcome. Whereas I do believe wood has a larger price advantage than in years past, it is being over-shadowed by the socalled'recovery."'

In the final analysis, the rise of ULM may hinge on a rejuvenated construction industry-which would also benefit wood. Treated might get a slightly smaller percentage of the pie, but the pie would be a whole lot bigger.

CAPPED C0MPOSITES and other ultra-low-maintenance alternatives are forecast to reignite growth among alternative decking products. - Photo by Bergen DecksOregon wood treater returns to penta

saw the EPA declare the plant a Superfund site in 2000. PWP purchased the site out of bankruptcy court in 2002, with the provision that the EPA and Oregon DEQ protect it from liability associated with contamination caused by Taylor. In exchange, PWP would take over remediation and maintenance of the site and use CuNap, ACQ, borates and fire retardant, instead of penta, CCA, creosote and ACZA.

With the site's remediation complete and CuNap no longer available to treat wood transmission and distribution poles, the reintroduction of penta made sense to regulators and most of the community, based upon public comments.

According to EPA attorney Jennifer Byrne, "PWPO has been a very cooperative partner in EPA's implementation of the Superfund remedy at this site. Since 2002, PWPO has consistently performed its obligations under the original agreement, including inspection and maintenance of asphalt covers and operation and maintenance of the qroundwater extraction system."

tTl"t Mosr wtDELY usED PRESERVATIVE preservative for I the manufacture of wood utility poles has been approved for use at Pacific Wood Preserving of Oregon, Sheridan, Or.

The plant is reintroducing pentachlorophenol as part of its agreements with the U.S. Environmental Protection Agency, the Oregon Department of Environmental Quality (DEQ), and the U.S. and Oregon Departments of Justice. The preservative previously used at the plant, copper naphthenate, is no longer being manufactured, and a substitute was needed.

"We couldn't be more pleased" with the announcement, said Roland Mueller, general manager of production for Pacific Wood Preserving Cos. "This will mean job security for our existing employees and likely the addition of new jobs going forward."

PWPO employs approximately 50 full-time employees and anticipates hiring an additional l0 to 20 employees over the next two years. "PWPO will begin treating with Penta immediately," Mueller added.

Penta had been used at the facility by prior owner Taylor Lumber & Treating, which filed for bankruptcy and

EPA received more than 120 comments from the community supporting the plant's reintroduction of penta. The move was opposed by just one commenter-a Portland, Or., law firm that represented an anonymous client. EPA concluded that the use ofpenta at the site "will benefit both the State of Oregon and EPA through PWPO's performance of operation and maintenance activities that would otherwise have to be paid for by the governments."

DEQ also received overwhelmingly positive comments.

"This is a great example of government and business working together for the benefit of the taxpayers, employees, customers and community," said PWP's Mueller. As a result of the amended agreements, PWPO will be able to maintain, and hopefully grow, employment.

The Oregon facility treats primarily Douglas fir poles, servicing national and international markets. Customers are large investor-owned utilities, contractors for these utilities, municipalities and rural electric districts. It also manufactures treated lumber and timbers for sale in the Pacific Northwest and Hawaii.

Its parent company also owns wood treating facilities in Califomia, Nevada and Arizona, as well as a manufacturing plant in Texas.

Penta recently underwent EPA's periodic "data re-registration" process, which required updated toxicity, health and safety research. Penta is an EPA-registered pesticide.

Since 1925, the Masonite brand has been known worldwide for its commitment to product innovation, manufrcturing excellence and customer service which still holds true today.

'We're bringing more options with Masonite's extensive line of interior and exterior entry systems. Vith one of the worldt largest research and development facilities in the industry, it's no wonder why homeowners, builders, remodelers and architects rcly on Masonite to create homes of distinction. For more information visir www.masonire.com

Forward, promote!

Vou ALREADY xNow the three most I important factors in selling a house: location, location, location. Well, what about selling a remodeling job? Promotion, promotion, promotion.

That's the successful principle that's spelled out "survival" (and, even better, "success") to two sister companies in Port Angeles, Wa., during these challenging times. Hartnagel Building Supply, founded in 1960, and Angeles Millwork & Lumber Co., doing business since 1906 and onetime rivals, were purchased by the same individual back in the '80s.

Three years ago, when it was time for him to pass the gavel, in order to remain a robust fixture in the local market, staffers rose to the cause and each company became employeeowned.

The two yards serve slightly different markets but join hands to attain

greater buying power, clubbing in on truck loads and pallets to complement each store's unique inventory. Angeles caters primarily to larger building contractors, with a stronger contractor sales department and more commercial and government accounts, while Hartnagel, which also serves the pros, maintains a stronger retail presence. Each store employs about 20 people, and between the two there's a little whiff of friendly competition, says Donna Pacheco, manager of advertising and promotions for both entities.

It's precisely those promotions that are balancing the books today. With custom-home building at a standstill, the company was searching for ways to connect with homeowners, says Donna, "to create a demand for projects. We came up with the idea of holding a replacement windows seminar open to the public."

Another Donna-Donna Hoyt, queen of the windows division-took it on herself to gather complete info on the weatherization rebate programs being offered, then geared it to grab the attention of (she guessed-and rightly) the clueless public.

She approached city and utility district officials to gain their participation and talked a local bank into offering rock-bottom loans for weatherization projects. (A flyer points out that a a project involving 10 windows and a sliding door, which yesterday cost $2,500, could now clock in at a mere $675 when all discounts and rebates, plus an in-store coupon, were applied. Not bad!)

Then she invited Hartnagel's qualified contractors to be present, another smart move. "Homeowners didn't have any idea whom to call," Marketing Donna reports, "so this way, they could come in and meet them face-to-face to make their choice. We put all the players together in one place." Payoff: Several of these remodeler customers reported picking up business as a result of the seminar-and guess whom they rewarded with their business?

As frosting on the promo scheme, the city has continued sponsoring ads on the local radio station pushing energy conservation, referring listeners to contractors and to. ahem. building suppliers-i.e., Hartnagel.

Well, one good promotion deserves another. "Let's see what we can do with roofing," Pacheco next decided, knowing Angeles Millwork is the largest roofing supplier on the Olympic Peninsula. "Our roofing contractors were hanging around, looking for work. So we invited them and put all our products on display in our instore sample showroom and played

matchmaker again." The roofing guys returned the favor, showing their appreciation.

And last month (I'll bet you can see this one coming) there was a spring decking event. Plans were to feature several composite decking vendors and five contractors who are strong deck builders, even listing their names on advertising materialanother benefit for them because, Pacheco has discovered, homeowners who cannot attend a specific event still ask for info and referrals so the gift keeps on giving. Vendors help out with ad costs and give-away items, too.

In March - just becauseHartnagel promoted an open house to spotlight one of their contractor customers who was setting out to achieve a personal best. Contractor Chris Duff, a local kayaking legend, was gearing up for an attempt to row singlehandedly across the treacherous, 500-mile stretch of open ocean between Scotland and Iceland. "People crowded him for three hours straight," says Donna. And while the company didn't track sales, chances are strong that the altruistic endeavor paid off in bankable goodwill.

Glory accidentally descended on the paint department, too. As a True Value member, the organization had always done a good retail trade in paint. But a competitor down the street, Parker Paint, gobbled up all the commercial accounts-until it decided not to. When it went out of business, the company asked Hartnagel to Bulldlng-Producb,om

take on its brand, too. "This was a great opportunity to strengthen our commercial accounts and our relationships with paint contractors," says Donna.

But the big excitement came two years ago when a civic meeting was called to revitalize the town and grow local brands. A lady stood up and declared, "Our buildings need a facelift. Let's paint the town!"

"So, of course, we said, 'We're in! Let us help.' We approached our vendors about a better pricing program for the project and got such a good discount from them that we could offer the paint practically at cost. People donated the labor and half of Port Angeles was painted. It had a huge effect!"

But to promote the heck out of a recession, you've got to have something solid shoring up those deals. Underneath the bells and whistles, the nuts and bolts...and that requires a reputation for stand-out service. Folks know they can count on these yards for everything from cutting keys to setting a ridge beam with a boom truck. "We know each contractor's needs and the way they want things, so we're not going to dump stuff on the curb," Donna insists. "We're really known for our metal and composite roofs, so we're going out of our way to connect with our contractor customers and vendors, to be able to

wheel and deal and get the best price. We also run a custom metal shop, " she adds.

That's the domain of Brian Furfort, who'll custom-cut and bend downspouts and flashing: "Our customers have him on speed dial."

Then there's Tod, "the door doctor," who's been around for 20 years. Windows? "Go to Donna Hoyt."

That's part of the payback of a company that's employee-owned. "Everyone's got a personal stake in it, so they work extra-hard for our customers and with each other, too. It keeps our contractors loyal. Our guys become their friends; they know the way they want their accounts handled. They'll come in here first thing in the morning, hang out, have a cup of coffee, feel at home."

And maybe pick up jobs-for both Hartnagel and Angeles Millwork have made the firm choice to stay away from installation-"a conscious and continuing decision not to compete," as Donna explains. Instead, free estimates, free take-offs-even free garage plans. Okay, another gimmick. And another one that works. Customers pay for the plan but get their cash refunded with the purchase of a lumber package. "We promote it every spring to create awareness, to get people thinking. Then they ask about our other packages...."

Rentals represent another vigorous niche-"a cash cow for us for a long time. Now, we're revamping the department for a new jump-startnew equipment, new energy. We need to build new awareness with a neighborhood campaign," says the gal who runs campaign central.

Survival is all about creating demand among homeowners, either to spur them to enter the brotherhood of do-it-yourselfers or refer them to professionals if it's a bigger project. Consequently, "business is picking uP," reports Donna. "We're optimistic."

Gombine rail with truck to combat high gas prices

about 5.4 lbs. of carbon dioxide per 100 ton-miles, compared with approximately 19.8 lbs. for trucks. Companies that integrate the two modes of transportation-for instance, by going from truck to train to truckleave a much smaller carbon footprint on the environment. "That's important for businesses in this era when everyone is thinking green," said Rich.

According to Rich, another advantage ofrail transportation is reliability, capacity, and safety. Trains run on predetermined schedules. In contrast, the availability of trucks can vary considerably at different times of the year and in various parts of the country due to freight availability and regional fuel price volatility.

IIftrs ESCALATING gas prices, Y Y stricter government highway safety regulations, and increased demands to protect the environment, manufacturers are aggressively seeking the most efficient means for transporting products to market. Intermodal freight transportation is becoming pivotal to the transportation industry as it offers streamlined costs and important efficiencies to benefit businesses and the general public.

Intermodal transportation is the process of integrating rail and truck services to move product to market efficiently. Intermodal utilizes the nation's rail network to transport cargo, such as lumber, that would have otherwise been moved via tractor trailer.

"We capitalize on the fact that one train pulled by two locomotives can haul the same amount of freight as 300 tractor trailers of products hauled by 300 drivers," said Robert Rich III, president of ROAR Logistics, a midsized intermodal marketing company

and third-party logistics provider based in Buffalo, N.Y. "The door-todoor transit time may be extended by two to three extra days, but the cost savings can be substantial over traditional truckload shipping. Intermodal transportation is gaining significant momentum because of the savings, coupled with the environmental and highway safety benefits. It is clearly a mode of transportation that manufacturers in the lumber industry should strongly consider."

Rich added, "By integrating truck and train, intermodal allows companies to capitalize upon the transit efficiencies of trucks and the cost efficiencies of rail. Given the escalating conflicts in the Middle East, the price of oil could remain high for quite some time. This makes it imperative for companies to look at all transportation modes for cost savings."

Another reason intermodal transportation is becoming increasingly popular is the reduced impact it has on the environment. Trains emit onlv

In addition, the Federal Motor Carrier Safety Administration's new Compliance, Safety, Accountability regulations (CSA2010), issued in December 2010, will further accelerate the trend toward rail and intermodal freight. Designed to enhance highway safety, CSA is an initiative to improve large truck and bus safety, and ultimately reduce crashes, injuries and fatalities that are related to commercial motor vehicles.

The new regulations stand to increase the operating costs of truck carriers by enforcing stricter safety ratings, as well as stringent restrictions on driver hours. These additional costs are ultimately passed on to consumers and, as a result, make intermodal transportation an even more attractive alternative to traditional highway transportation.

According to Rich, "Rail is becoming a 'new frontier' again. Shipping is very complex with myriad alternatives. Choosing the right mode for the type of shipment is crucial."

Endless Possibilities

An untair fight

fueclNe rHAr you are going into the ring (or an alley) lwith one arm tied behind your back. Doesn't sound like much fun, does it? But that's exactly what struggling sellers do without knowing it, while master sellers work all the way to the bank.

The biggest muscle in our body is our brain, but the most powerful muscle is our heart. Many sellers go into the (selling) ring with their hearts tied behind their back. The biggest difference between the master seller and those who underperform is that the master seller is all in-heart and soul-while struggling sellers think of what they do as part of their lives, something they do when they are not living.

When I ask mediocre sellers (not socially, but as their sales mentor), "How's it going?" often they talk to me about their families, sports or what they did on the week-

we fail; they only count the wins-as do our bosses, our families, and our social circle.

Master sellers keep playing after their competitors sit down. Struggling sellers apply basketball rules to a sales game, quit too early, and can't figure out why they are losing. Are there great sellers who make it look easy? Yes. But if we take a look at their lifetime work hours, we find that somewhere along the line they have given the extra time and effort it takes to be great.

TWo Against One

Wouldn't it be great to compete against someone who had no outside help, while we were able to talk to as many brilliant people we wanted to? That's what reading is. Reading is a conversation with a smart person. It is also a conversation we can stop when we want, start when we want, and review when we want.

$.pproximately lOVo of the population reads more than two books a year. Reading is not only a conversation/ consultation with someone who is smart: it is also a form of weight lifting for the brain, making it stronger.

Salespeople who dominate take themselves and what they do for a living seriously. They study sales. Those who struggle treat selling as an addendum to their lives.

American History

end. When I ask master sellers how they are doing, they invariably talk about their business, goals and what they are doing to sell more, more, more.

Do master sellers care less about their families? No. They just know that there is a time and place for every kind of talk and that work is a place of accomplishment, not an extension of our social life. Would you talk about what you did on the weekend while you were in the middle of playing a football game? A chess match? A musical performance? Of course not, because these activities demand our total concentration. Selline does also.

The Fifth Quarter

If we were to play basketball against the best player in the world and he stopped playing after the fourth quarter and allowed us to play one more quarter by ourselves, we would always win. Always.

Those who succeed in sales do just that. They play an extra quarter-and it's legal. There is no fourth quarter. Sales is the only game where they don't count the misses, only the makes. We can take as many shots as we want! The sales statisticians don't mark down how many times

We are taught that the reason America won the Revolutionary War and the reason we lost the Vietnam War is because of commitment, not equipment. In both cases, the winner had inferior equipment and still overcame a less committed enemy. In both cases, the victor had no other options and the loser did.

In the American Revolution, the English soldier wanted to go back to England and the American soldier had no place else to go (except prison). In the Vietnam War, the American soldier wanted to so back to America and the Vietnamese soldier had no place else to go.

Sellers who succeed have the same attitude-they have to succeed, they will not allow themselves to think what might happen if they don't. It's just not an option. The salesperson who struggles is always thinking of going back to school or changing

It's an unfair fisht.

James Olsen Reality Sales Training (s03) s44-3s72 james @realitysalestraining.comIT'S GLEAN. IT'S GREEJ{. lTtS EcoPr6ln.

Why Use Thermally Modlfied Wood?

EcoVantage starts with Southern Yellow Pine or Douglas Fir and through our patented EcoPr€m Process alters the wood at the cellular level using only heat and steam. This removes excess moisture, sugars and resins, that make most wood susceptible to the elements and insects.

GREENER

Our products are all sourced from sustainable U.S. forests and EcoPrdm is GreenSpec approved.

STRONGER

Lightweight, great outdoor durability. EcoPr€m Products contain lower moisture content and the cells of the wood have been compressed... so it's stronger and lighter!

STRAIGHTER

Resists Cupping, Twisting, Warping and Splitting due to our patented thermal modification process, and you won't need to buy 25-30% overage for warped or twisted material!

EternaGlad

EternaClad siding material provides the beauty of old fashioned wood siding, and shutters in Modern Ship Lap, German Lap, Tongue and Groove or Log Siding. It is available with a natural finish or choose from two rich stain colors.

EcoDeck

EcoDeck is a creative deck and railing system which is user friendly and easy to install... Saving you time and money.

RyteScape

RyteScape is a full line of landscape structu res which include fencing, pergolas and arbors that are super easy to install!

StayTru

StayTru is a structurally sound framing materialthat has no chemicals to leach into your soil or garden... lt's excellent material for building Docks, Piers, Walkways, Boardwalks, Planters.... In the Ground or in the Water!

Gleaning up with green paint

TTtue NEw NoRI N{.q,L looks to be a mix of fewer home sales, but more remodelling and redecorating. Meanwhile, all indications are that green products and materials continue to enjoy strong demand. And if customers are more discerning when evaluating socalled "green" purchases, they're also looking for more local solutions, or at least made in the U.S.A. To me, these conditions paint a clear picture about how to change with the times and boost sales in the second half of the year. Yep, I'm talking about paint.

Let's assume every LBM dealer sells paint and other brush-on coatings. By now, every dealer should have at least one low-VOC offering. Nearly every major manufacturer offers at least one line, so there's really no excuse. But making the minimum effort with one line of marginally "green" paint is leaving money on the table. The industry has matured and there are lots of good options available. Now that economic conditions are encouraging more sprucing up, it's also time to spruce up your paint department.

In addition to directly contributing to the top line, a strong paint department can bring in new customers and boost sales in other product categories, too. Therefore, evaluating and refreshing a strategically important category like this deserves an appropriate level of understanding and commitment. And every case is unique. So, there's much more to say about this topic than I can squeeze into the remaining space of this column.

But with that caveat, there are two things to look at when improving this category: mix and merchandising. The product mix should have a strong anchor brand that will bring in customers and deliver credibility. While national manufacturers may have a quality low or no-VOC line and a suite of economic incentives to close the deal, it

might be more beneficial to bring in a strong "green-only" brand, either instead or in addition. Brands such as Yolo, AFM Safecoat, and Mythic have steadily built up big reputations with both health-conscious and sustainability-minded homeowners and professionals.

With an anchor established, fill in with niche products. With growing demand for non-toxic, all-natural products, adding a natural or clay paint line could make sense. Earth Paint or Ecos Paint might be good options. And for protecting the natural look of wood, whether walls, floors or exteriors, there are natural options, too. Vermont Natural Coatings, made with poly whey, and Rubio Monocoat, made with flax, are two worthy options, as is Penofin Verde, made from rosewood oil. There are more options out there, including ones from small local manufacturers that might be just the thing for the "locavores" in the community.

As with any good mix of new products, effectively merchandising them is essential. If you're bringing in a new product line, work with the manufacturer to help with promotional pricing, advertising, and an in-store event. Just as important, make sure all your staff is fully briefed with relevant product knowledge.

Communications strategy is also important. Make sure advertising and promotional messages are aligned with current remodelling and redecorating trends: accentuate healthy living, comfortable home environments, and natural aesthetics. Point out that "green" paints deliver added benefits, such as having low or no odors, which should be important for the pro customer, too. In the store, create hang tags, signage and end-cap displays that get people thinkins.

And finally, don't miss obvious cross-selling opportunities. For example, put natural paints tosether with non-toxic putty, reusable drop cloths, and recycled paint trays.

JaY TomPt Managing Partner William Verde & Associates (415) 321-0848info@williamverde.com

Cal Redwood Buys Siskiyou Lumber

The California Redwood Co., Eureka, Ca., has acquired the assets of remanufacturer/wholesale distributor Siskiyou Lumber Products.

Siskiyou's operation in Woodland, Ca., and fence plant in Ukiah, Ca., will operate as part of California Redwood, distributing redwood, Douglas fir, and treated lumber.

"The acquisition provides us the opportunity to get closer to consumers and allows us to offer a full range of premium redwood products directly to retail," said Cal Redwood v.p. and general manager Carl Schoenhofer. "To better access core redwood markets and effectively service consumers, we will continue to use a combination of both internal and traditional distribution channels."

Softwood Check-Off Program OK'ed

Domestic manufacturers and importers have approved a check-off program for softwood lumber.

The resolution was supported by 67% of voters, representing 807o of U.S. softwood lumber production.

"This vote demonstrates that softwood lumber manufacturers across North America are committed to working progressively together to build a better future for the industry," said Jack Jordan, chair of the 21-member Blue Ribbon Commission for Check-off and executive v.p. of Jordan Lumber & Supply, Mount Gilead, N.C. "It is a gamechanging investment in the future growth of softwood lumber markets in North America."

A board of manufacturers will oversee the program, which will work to increase the use of softwood lumber in new markets and encourage the development of innovative technolosies.

Parr Lumbet, Hillsboro, Or., paid $2.3 million for 4.61 acres with a 21,488-sq. ft. warehouse in Marysville, Wa., to open its 35th lumberyard.

Parr also holds an option to buy another 2.39 acres for $624,650 within five years.

Sears plans to spin off its 80% share in 89-unit Orchard Supply Hardware.

OSH also expects a September opening for a new 60,000sq. ft. store in San Jose, Ca.

Weed Building Supply & Home Center, Weed, Ca., hosted a grand opening celebration June 10 for its new Great Outdoors display of pavers, decorative block, and decorative retaining wall.

Lowe's broke ground on a 130,000-sq. ft. store in Sparks, Nv.

Los Altos True Value Hardware. Los Altos. Ca.. is closing its Decorative Plumbing showioom to expand its hardware offerings.

After sharing space with Los Altos Hardware for 20 years, manager Marci Skinner will move Decorative Plumbing to Belmont Hardware, Belmont, Ca., to oversee a new showroom.

Big Jo True Value Hardware, Santa Fe, N.M., was named Employer of the Year by Santa Fe Professional Business Women.

Weyco Sells Hardwoods Unit

Weyerhaeuser Co., Federal Way, Wa., has agreed to sell its worldwide hardwoods and industrial products division to New York private equity firm American Industrial Partners.

Northwest Hardwoods is based in Tacoma, Wa., with operations in the U.S., Canada, China, Japan, and Hong Kong. The deal is expected to close next month.

"As a stand-alone company, we expect to offer our customers flexibility, fast market response times, continuity of supply and an entrepreneurial 'can do' attitude," said David Weyerhaeuser, v.p. of sales and marketing at Northwest Hardwoods.

The division employs about 1900 workers and manufactures 15 species of hardwood lumber, from seven sawmills, four concentration yards, four remanufacturing plants, and one log yard, all in the U.S. Last year, revenues for hardwood lumber were $223 million, an 8.2Vo increase over 2009.

"Revenues are related to housing starts and general repair and remodeling in the housing sector," said AIP's John Stanwood. "As these depressed markets improve in the years ahead, the company is well positioned to meet the demand with its excellent hardwood timber supply relationships and extensive, modern and low-cost manufacturing footprint."

Quolity Western Cedor Products

Nu Forest Products, Healdsburg, Ca., has acquired the Accuruff trademark and equipment to produce the high-grade rough-sawn lumber, formerly- oivned Oy-Forest Grove Lumber Co., McMinnville, 0r.

Hampton Affiliates temporarilv idled sarimill Tillamook Lumbei, Tillamook, Or,, in late June, due to log supply.

Serious Materials, Sunnyvale, Ca., was renamed Serious Energy.

Bright Wood's moulding plant in Madras, Or., suffered an estimated $280,000 damage in a June 17 fire that started in an electrical panel.

Weverhaeuser Co. aoreed to seu its Westwood Shippin! tines division to J-WesCo, d hotding company formed by a consortium of Japanese stevedore companies that have been key service providers to Westwood for more than 25 year.

Roseburg Forest Products, Roseburg, Or., agreed to purchase Flakeboard's particleboard and laminating facility in Simsboro, La., and next month will shutter its particleboard mills in Orangeburg and Russellville, S.C.

Gapital Lumber, Atbuquerque, N.M., is now distributing iLevel by Weyerhaeusol engineered wood products in New Mexico, including ilevel Trus Joist TJljoists, TimberStrand LSL, Microllam LVL, Parallam PSL, ilevel Shear Brace, and ilevel Edge and Edge Gold floor panels.

Pacific Award Metals. Baldwin Park, Ca., was acquired uy Gibraltar Industries, Hamburg, N.Y.

Founded in 1962, Pacific Award manufactures metal roof ventilation, trim and flashing at six plants in California, Washington, Arizona and Colorado.

_ OMG has been acquired Tiger Claw, Bristol, Ct., to become part of its FastenMast€r division.

Anniversaries: Burton Lumber & Hardware, Salt Lake City, Ut., 100th Economy Lumber, Campbell, Ca.. 75th ... Western Wood Preserving Go., Sumner, Wa.,40th.

When evaluating the cost ol upgrading to stainless-steel fasteneis, "r.66,6mlsali:ris probably not the {irst word that c0mes t0 mind. However when compared to the overalllob, the small addilional cost of stainless steel is inexpensive insurance against corrosion and unattractive staining that can occur with other fasteners. Stainless-steel fasteners are reliable and long lasting, and reduce costly callbacks, which means happier customers and repeat business^ And by choosing ' Simpson Strong-Tie3 fasteners you receive our commitment t0 quality. performance and service. For outdoor construction, make sure your fastener is stainless steel. lt's worth ii. Learn more by visiting www.strongtie.com/fasten or by calling (800) 999-5099.

Filling the Void for End-Cut Solution

With Merichem Co.'s recent announcement of its exit from the copper naphthenate business (see May, page 22), there is an opening for a brush-on preservative that effectively protects cut ends and drill holes in pressure treated wood.

Most manufacturers of preserved wood require application of end-cut solution to validate their residential warranties when western species are involved, and they recommend it for all species. Producers of heavy duty materials, such as poles and piling, also apply surface coatings to protect inner wood that is exposed after sawing or boring.

One prime candidate for replacing copper nap is an established preservative with the poetic though tonguetwisting name of copper-8-quinolinolate. It has long been listed in standards of the American Wood Protection Association as a pressure treatment, and is recognized for its value as a topical coating. Copper-8-quinolinolate enables wood to resist termites and wood-ingesting insects, while inhibiting mold and fungal decay.

Copper-S-quinolinolate for use as end-cut solution and preservative stain is found in Outlast Q8 Log Oil from CTA Products Group, Southaven, Ms. The product name suggests its roots-it was developed to protect logs for log homes. Its formulation includes trans-oxide pigments for UV control and water repellent to reduce moisture effects.

Six pre-mixed colors are available. If other shades are desired, the product can be colored with machine tints.

Outlast Q8 Log Oil is registered for sale in 49 of the 50 states; it is expected to have necessary approvals in the lone remaining state, California, in the near future. It is

currently being sold by dealers in the Pacific Northwest and is used by manufacturers elsewhere.

It has been accepted as a warranty-complying end-cut solution by the licensors of Wolmanized Outdoor wood, and is available from treating companies that produce Wolmanized wood and from Arch Wood Protection. Inc.. Atlanta, Ga.

More information is available at www.outlastcta.com.

FOR COATING CUT ENDS of preserved wood, Outlast Q8 Log Oil is an alternative to copper naphthenate, which is no longer being produced.

EWP Outlook Housing slump holds back growth for engineered wood products

tTl"t ECoNoMIC nscpsstoN-and I- housing market depression-continue to dog manufacturers and distributors of engineered wood products. Forecasts for a recovery have been pushed out to 2012, forcing wood products to stay in a holding pattern against the depressed housing starts.

"While most of us have known for a long time that housing is a major portion of the business cycle, some economists and politicians are just now figuring it out," said Craig Adair, market research director for APA. "They're still wondering why first quarter growth was so anemic and why the economy is in a 'soft patch."'

Adair explained that new house construction and remodeling have traditionally made up about 57o of the U.S. GDP and last year it only repre-

sented2.5Vo.

"A major point of economic weakness is housing, which continues to be mired in a recession triggered by excessive debt. It's becoming more evident that the remedy for housing is time," Adair said. He noted that because engineered wood products are so closely related to new home construction, it may be another year or so before the industry sees a meaningful rebound.

If there's any good news, it is that the bottom for glulam timber, I-joist and LVL production most likely occurred in 2009. Engineered wood production volumes increased in 2010 as housing starts increased from 554,000 in 2009 to 587000 in 2010. APA's forecast is for housing starts to decline to 545,000 in 2011 and then

rebound to 680900 in20l2.

The outlook for glulam timber is better in 2012 than in 2011 because glulam is also closely tied to nonresidential construction and this market has been declining for a couple of years and is forecast to increase next year. North American production is forecast at 186 million bd. ft. in 2011, a decline of 5Vo. A rebound of 2O7o to 223 mlllion bd. ft. is forecast for 2012.

I-joist market share is predicted to remain the same as 2010, capturing 4OVo to 45Vo of raised floors. This is down from the 50Vo mark achieved in 2008. As housing improves, I-joist market share should grow back to 507o. With a weak housing market in 201 1, production of 430 million linear ft. is forecast, a decline of 9Vo, or 4l million linear ft. The forecast for 2012 is a30Vo increase to 557 million ft.

In the structural composite lumber family, LVL production is expected to follow the demand for beams and headers and l-joist flanges. Production is forecast to decline lOVo in 2011, to 37.0 million cu. ft. For 2012, an lSVo increase is expected, to 43.7 million cu. ft.

Meanwhile, plywood and OSB are expected to hold their own in 2011 because they are used in so many diversified markets. While housing starts may falter this year, the projected volumes for repair and remodeling, nonresidential building construction, and industrial uses are better. Overall, structural panel production is expected to total about 26 billion sq. ft. this year, the same as 2010. The structural panel outlook is for a 9Vo rncrease in 2Ol2,as all end-use markets expand.

s Your Market Demands... Swanson Responds.

A customer approached us with a problem. he needed a radiant barrier panel... but the job spec called for veneer plywood and not OSB. After consulting with mill management and our overlay supplier - sales had an answer. Yes, we can do this.

The result is TruBlock, a radiant barrier veneer panel that reduces attic temperatures and saves on energy costs. lt also has the superior strength, stiffness and performance of Douglas-fir plywood. Our customers ask- and Swanson responds.

Swanson Group Mfg - Glendate Plywood Mill has recently been certified as a JAS mill as prescribed by the Japanese Agricultural Standard Law (JAS)

When global markets demanded plywood - Swanson Group took action and responded quickly. The world asks - and Swanson responds.

Riddles to Rebuilding

Opportunities and challenges for North American EWPs in post-quake Japan

II /nI- rHE MASSTvE earthquake and Y Y tsunami that struck northern Japan on March 11 provide long-term market opportunities for North American manufacturers of structural wood panels and other engineered wood products?

The answer is not as clear cut as might be expected, cautions Charlie Barnes, international market director of APA. "Reconstruction will be a huge undertaking for many years, and that will generate substantial demand for wood products," Barnes notes. "But there are also obstacles to market entry, and manufacturers must know the ropes."

The magnitude 9.0 earthquakeamong the top 10 most severe earthquakes ever recorded by seismographs-and the resulting tsunami wreaked unimaginable devastation to a large northern region of the island country. The death toll estimate exceeds 15,000, with more than 8,500 people still missing as of June 1

Estimates of recovery and reconstruction costs are expected to exceed $309 billion, making this the world's most expensive natural disaster and dwarfing the 1995 Kobe earthquake.

The likelihood of an increase in demand for imported wood products is suggested by several key factors. Among them:

More than 400,000 people lost their homes and perhaps as many as 150,000 buildings were destroyed, according to Wood Resources International, the U.S.-based forest industry consulting firm.

Japan, even before the disaster, was one of the largest importers of wood products in the world. The country imported wood materials (both raw material and finished wood products) valued at more than $10 billion in 2010. That was 207o morc than in 2009.

The earthquake and tsunami destroyed or severely damaged several Japanese plywood plants that together accounted for approximately 35Vo to 4OVo of the country's annual softwood plywood production, and about l0 to l5qo of the country's total softwood and hardwood plywood supply (both domestically produced and imported).

The temporary but significant loss of a substantial portion of domestic

plywood production capacity, coupled with the huge volume of structural wood panels that will be required for rebuilding, will definitely have an impact on structural wood panel demand, Barnes points out. But that demand will be moderated. he said. by several factors. For example:

The sheer magnitude of the cleanup effort and the challenges ahead in restoring power, transportation, port facility, and other infrastructure will stretch demand over a long period of time. According to the head of a Japanese government panel drawing up plans, rebuilding of communities and businesses in quake and Tsunamidevastated areas is likely to take shape in three to five years, but it will easily take 10 years for reconstruction to be completed even in areas that are quick to recover. Japan's national debt could reach I807o of its gross domestic product; however, most of this debt is owned by other Japanese institutions.

Short-term demand has been and likely will continue for some time to be dominated by prefabricated emergency relief housing, not primary wood products.

Imported panels are overwhelmingly required to be 3x6 feet in keeping with the longstanding Japanese construction module and practices. Panels also must be certified to the Japanese Agricultural Standard (JAS). Few North American mills currently produce to the 3x6 module and only four APA member OSB mills and one APA member plywood mill were JAS

Engineered Wood Products

Whclt ircrpperrs r,vlrcn 75 yeur':,:f experience i: carnbint:cl wiil'r odvcrrrc.ccl. sfcrte-of-ihe-ori nrclrufoclur.inc icci-rn,:logy? The rcsuli is Rosi:blrcl RigidLcrrtr' LVL, ihe periec-t cirr.:icr,, ior L-,se in lreaeler, becrn,:;lucl crnC colunrrr consiluciion.

Key Feotures

Alonufociurecl u:inc,,1 iicifrt v;eirthl wesiern sr:hwar:d veneers iirol ccrre lrorn susioirrobly rrrcrrrcgcd iore:tlor-lri: in Cregor: crnd Noriirerr

Co liforn io

Less shrinl<irrg, wnrpin91. s1:lilting crnd clrcrkirri1

Sealed to resisl moislure clorriur.1c

AFA qucrIity cr:sulec{

FSC certified crvailable

Greoler de sign v*lues {oi' sl-.ccr' sircnr'i1h

consisle rrcy

Prod uci & Perfornrcr nee Wc; rrcr nt,v

lF 800.347.7260

certified at the time of the earthquake, as were seven APA member glulam plants.

It can be expected that Japan will seek to rebuild its damaged plywood manufacturing capacity as quickly as possible.

North American panel producers have historically faced formidable competition from Asian suppliers, particularly Malaysia and Indonesia, which together accounted for approximately 777o of Japanese plywood imports in 2010. China accounted for another 197o. Japanese imports of North American plywood, by contrast, represented less than two-tenths of l7o of total plywood imports last year.

While not expected, then, to be a bonanza for the North American panel industry in general, Japanese post-earth-

quake supply and demand dynamics could represent opportunities for manufacturers already doing business there, or those willing and able to cultivate the market.

As a Registered Overseas Certification Body accredited by the Japanese Ministry of Agriculture, Forest and Fisheries, APA is authorized to certify member products as meeting the JAS standard, including formaldehyde emissions limits considered among the strictest anywhere in the world. Since the earthquake, some 20 APA member plywood and OSB manufacturers have inquired to APA about JAS certification requirements and procedures, and many have initiated the certification process.

Japanese usage and imports of OSB are increasing, but are still small compared with plywood volumes, especially for floor and roof sheathing applications. The country has no OSB manufacturing capability of its own and last year imported 240.6 million sq. ft. (3/8") of the product. Of that volume, nearly 8O7o was supplied by Canadian companies, and the product could well play a growing part in the reconstruction effort as well as the overall new housing demand throughout Japan.

That prospect was recently enhanced by Japanese government recognition of higher OSB shear wall values, which will be of obvious importance in acceptance of the product in post-earthquake reconstruction efforts. The ministerial approvals issued to APA in February of this year were the result of more than one year of testing in both Japan and North America. The new values reflect a 6O7o increase in shear wall multiplier factors for post-and-beam construction and a 20Vo increase for platform frame construction. The approvals were made possible with the support of funding from the federal Natural Resources Canada

RESTORING disaster-torn Jaoanese communities will require millions of feet of wood products.

RESTORING disaster-torn Jaoanese communities will require millions of feet of wood products.

and Forestry Innovation Investment, British Columbia's market development agency for forest products.

Glulam timber also has worked its way into the Japanese market, with the country last year importing 553,354 cubic meters of the product (approximately 360 million bd. ft.). That was down nearly a third from the record mark of 805,562 cubic meters in20O6, in response to the global economic downturn. However, glulam imports in 2010 rose 2lvo from the previous year and almost 377o from 2008. As with plywood, North America supplies only a tiny percentage (less than l7o) of Japanese glulam imports, so the potential for market share growth is considerable. Austria and Finland historically are the two largest suppliers, accounting last year for some 62Vo of all glulam imports.

Mid- and long-term demand estimates for structural wood panels can be at least partially established by looking at the number of wooden housing units built in tsunamiimpacted prefectures in 2010. That normal-year number44,250-yields a housing demand potential for the region of some 243 million sq. ft., based on average house size and historical panel utilization rates.

It is also noteworthy that wooden house construction in Japan has gained market share since 2005-rising from about 447o to nearly 5lVo last year. Over the same period, however, total housing starts have declined by 357o.Post and beam construction (based on 3x6, 3x9, and 3x10 ft. modules) dominates the wood construction market; 2x4 construction (based on 3x6 to 3x8-ft. panel modules) represented only about one-quarter of the wooden housing starts in 2010.

In addition to JAS certification accreditation, APA has a

longstanding technical, regulatory and market development presence in Japan that can be of considerable value to member companies looking to gain Japanese market entry or broaden their foothold in the country.

APA maintains a Canadian OSB Japan Office in Tokyo and also is a partner with the Softwood Export Council and Southern Pine Council in support of an American Softwood Japan Office, also in Tokyo. That presence gives APA an ability to serve as a conduit for requests from the Japanese construction community to supply structural wood products, a function that has increased since the earthquake, Bames noted.

For confi dence underfoot - and overheadbu i lders tr ust Ainsworth E n g i n ee red. For flooring systems that lay flat and true. For stairs that won't cup, sag or squeak. For cost-competitive, sustaina bly sourced products, reliably supplied, choose quality. Choose Ainsworth.

Auantifying Green

Life cycle assessment provides new evidence of woodts green credentials

A LrFE cYCLE assessment (LCA) la,project completed recently by the Ontario-based Athena Sustainable Materials Institute provides powerful new evidence for the environmental merits of wood versus concrete.

The analysis compares the environmental footprints of two versions of the same house-one with a raised wood floor, wood walls, and a wood roof, the other with a concrete slab floor system, concrete masonry unit first-story walls, wood-frame second story walls, and a wood roof. Both houses were designed with woodframe interior walls.

The all-wood version was the winning design in the Carbon Challenge 2010 Florida Design Competition, a program sponsored by APA-The Engineered Wood Association in conjunction with the Raised Floor Living program. a cooperative promotion campaign between APA and the Southern Forest Products Association.

Life cycle assessment is now widely recognized as the most scientifically credible and accurate measure of the environmental impacts of various building materials. By quantifying those impacts from "cradle to grave" -extraction, manufacturing, transportation, installation. use. maintenance, and disposal or recyclingLCA provides a common basis for objectively assessing and comparing the environmental credentials of dissimilar building designs and materials.

The Athena analysis encompassed two key end-of-life assessment criteria: emission of greenhouse effect

gases that are thought by some to contribute to global warming and fossil fuel consumption. The two house designs were modeled in Athena's Impact Estimator software and compared under two end-of-life scenarios. Under the first scenario, the house is demolished and materials are disposed in a landfill that captures landfill gases and then burns that gas to produce electricity to be put back on the power grid. The second scenario involved demolishing the house and disposing of all non-wood materials in a landfill while burning the wood products directly in order to produce electricity for the grid.

Two secondary data sources-the

U.S. Life Cycle Inventory Database (U.S. LCI) and Ecoinvent-were used to model the disposal of materials and their energy recovery at the landfill. (U.S. LCI is a public/private partnership developed by the Department of Energy and the National Renewable Energy Laboratory. Ecoinvent is a life cycle inventory database of the Swiss Ecoinvent Centre, formerly Swiss Center for Life Cycle Inventories.)

The material take-off is applicable to a 2,122-sq. ft., two-story house with an assumed minimum life expectancy of 60 years, located in Orlando, Fl.

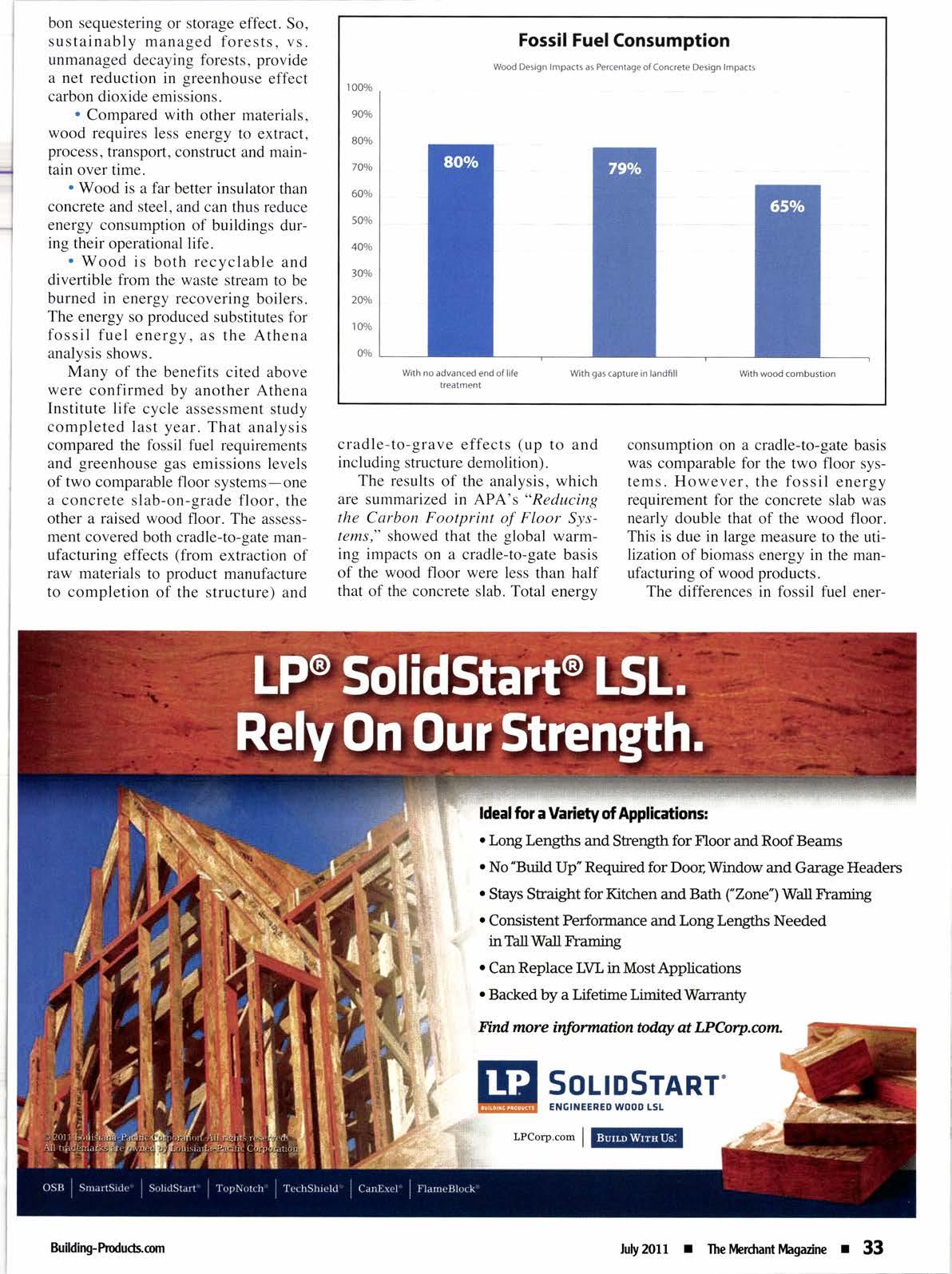

The charts on pages 33 and 34 show the use of fossil fuels and global warming potential of the wood house design as percentages of the fossil fuel use and global warming potential of the concrete design, under three scenarios: (l) with no advanced end-oflife treatment, (2) with gas-capturing landfill disposal, and (3) with wood combustion. As can be seen, the raised wood floor design yields substantially smaller fossil fuel use and global warming potential rates-and thus a smaller carbon footprint- compared with the concrete design.

The results of the analysis are not surprising in light of all that is commonly known about the environmental merits of wood as a building material. For example:

. Wood in forests, particularly in young vigorous forests, absorbs carbon dioxide, making growing forests an efficient carbon sink.

Once harvested and converted to wood products, wood fiber has a car-

bon sequestering or storage effect. So, sustainably managed forests, vs. unmanaged decaying forests, provide a net reduction in greenhouse effect carbon dioxide emissions.

. Compared with other materials, wood requires less energy to extract, process, transport, construct and maintain over time.

Wood is a far better insulator than concrete and steel, and can thus reduce energy consumption of buildings during their operational life.

. Wood is both recyclable and divertible from the waste stream to be burned in energy recovering boilers. The energy so produced substitutes for fossil fuel energy, as the Athena analysis shows.

Many of the benefits cited above were confirmed by another Athena Institute life cycle assessment study completed last year. That analysis compared the fossil fuel requirements and greenhouse gas emissions levels of two comparable floor systems-one a concrete slab-on-grade floor, the other a raised wood floor. The assessment covered both cradle-to-gate manufacturing effects (from extraction of raw materials to product manufacture to completion of the structure) and

Fossil Fuel Consumption

cradle-to-grave effects (up to and including structure demolition).

The results of the analysis, which are summarized in APA's "Reducing the Carbon Footprint of Floor Systems," showed that the global warming impacts on a cradle-to-gate basis of the wood floor were less than half that of the concrete slab. Total enersv

consumption on a cradle-to-gate basis was comparable for the two floor systems. However, the fossil energy requirement for the concrete slab was nearly double that of the wood floor. This is due in large measure to the utilization of biomass energy in the manufacturing of wood products.

The differences in fossil fuel ener-

ldeal fior a lbdety of Applicationsr

. Long Lengths and Strength for floor and Roof Beams

r No "Build Up" Required for Door, Window and Garage Headers

. Stays S8aight for Kitdren and Bath (Zone") Wall Framing

r Consistent Performance and Long Lengths Needed inlhtlltrall lfaming

r Can RepLace LVL in Most Applications

. Backed by a Lifetime LimitedWarranty

Ffutd more inlormotion bday ot LPCorp.ann SolrDSrART'

gy consumption and global warming impacts between the two floor systems were shown to be even more dramatic on a full cradle-to-grave basis due to the lower carbon imprint of wood under end-of-life scenarios, as the latest Athena end-of-life analysis demonstrates.

The conclusions of both Athena Institute life cycle assessments have

been corroborated by many other LCA studies, including most notably analysis by the Consortium for Research on Renewable Industrial Materials (www.corrim.org).

The latest Athena Institute LCA analysis, which was conducted under contract for APA, is part of a major ongoing initiative by the association to elevate design and construction com-

Why Are More Builders Choosing X-Beam?

Rosboro X-Beam is the industry's first full framing-width glulam in architectural appearance. The 24F-Y4 X-Beam is available in l-Joist compatible and conventional depths.

munity appreciation of wood's environmental credentials and to safeguard and advance acceptance of wood products in the growing number of local and national green building standards.

APA, for example, recently completed a series of Carbon Challenge design and construction seminars in Florida as part of its Carbon Challenge program. It has also developed a Green Verification Report service that provides member manufacturers a mechanism for reporting eligibility for points under the National Green Building Standard, International Code Council (ICC) 700-2008, and LEED 2009 for New Construction.

The association also participates in the Research & Technology Committee of the Green Building Strategy Group, an industry initiative formed to coordinate the forest and wood product industry initiatives related to green building. On behalf of the Research Committee, APA last year secured funding from the USDA Forest Products Laboratory to establish a Life Cycle Assessment Working Group, which is comprised of representatives from industry, academia, research organizations, and government.

Growing Today. Building Tomonow'

PO Box 2O,Springfield, OR 97 477

Technicaf Support: l -877 -457 -4139

Email: info@rosboro.com Web: www.rosboro.com

For sales information. call toll free: 888-393-2304.

X-Beam looks great, saves builders money, and is ready for next-day delivery.

rD^-t^^ rfosnoro

Home cooling costs are a concern of every homeowner. Signif icantly reducing these costs starts with Eclipse* Radiant Barrier Panels from RoyOMartin. Eclipse'u produces a superior radiant barrier from the sun's scorching radiant heat. Eclipse* Radiant

--

l,araqt,ergx!, Stop wasting time with traditional house wrap. lnstall Eclipse* Radiant Barrier like conventional wall sheathing. Seal seams, corners, and window and door openings to ensure a superior thermo/vapor sidewall building system.

Engineered for greater strength and less deflection over conventional OSB sheathing, RoyOMartin's 7/16 size TuffStrand

OSB panels are a certified* alternative to 3/8size structural I panels. Fewer SKUs means improved inventory efficiency.

Garbon Ghallenge Free APA seminars pitch cutting-edge theory with practical applications

AsERTES oF FREE residential design and construction la.seminars presented by APA and its partners drew crowds of building professionals across the Southeast this spring. The seminars demonstrated practical applications for saving energy and resources in home construction, and showcased the design strategies employed by the winners of last year's Carbon Challenge Design Compe-tition, a contest that sought a single-family house design with the smallest environmental footprint.

Attendees to the free half-day presentations earned continuing education units (CEUs), while hearing multiple

industry experts address a variety of topics, including advanced framing with wood, optimizing lumber usage and costs, improving energy efficiency, and strategies for cost-effectively designing and building homes with a lower carbon footprint.

"We're pitching cutting-edge theory for tomorrow, along with practical applications that can be used in home design and construction today," said APA senior engineered wood specialist Bob Clark, a seminar presenter. "Several knowledgeable speakers participated in this series, and I think the presentations resonated with the building and design professionals in our audience."

C.W. Macomber, an APA engineered wood specialist and seminar presenter, agrees that the response was very positive. "We solicited written feedback from the attendees following the presentations," Macomber said. "On the evaluation forms, we received comments like 'the presenters are all very personable and approachable,' and '(the seminar) was well planned, exciting, and moved quickly.' One attendee wrote that '(it's) more intelligent than regular CEU courses."'

Two of the seminar speakers, Damon Roby of True Design Studios and Mike Beny of Apex Technology, were among the Carbon Challenge winners-Roby was the competition's Grand Prize Design Winner, while Berry, an engineer, served as Roby's energy consultant. In their presentation, Roby and Berry discussed realworld strategies for maximizing operational energy efficiency and carbon performance.

"Damon and Mike demonstrated how to use these concepts in practical applications," said Clark. "The

response to them was very positive. The audience liked hearing how they can immediately put these theories to use."

Roby's design was among the six winners recognized at a Carbon Challenge Design Competition awards ceremony on January 13,20ll at the 20 l1 NAHB International Builders Show in Orlando, Fl . The winning designs were so impressive. says Clark, that APA wanted to showcase them in the seminars. "The winners really put a lot of thought into the carbon footprint and operational energy of these homes, as well as proper design and constructability," said Clark. "If any of these six designs were built, it would have a positive impact on the carbon footprint of home construction today."