Battery cell, module and pack level charge/discharge cycle testing solutions designed to provide high accuracy measurement with advanced features. Regenerative systems recycle energy sourced by the battery back to the channels in the system or to the grid.

Battery simulation for testing battery connected devices in all applications to confirm if the device under test in performing as intended. Battery state is simulated which eliminates waiting for the charge/discharge of an actual battery. Real time test results include voltage, current, power, SOC%, charge/discharge state and capacity.

To learn more about our Battery Test Solutions visit chromausa.com

chromausa.com | 949-600-6400 | sales@chromausa.com © 2022 Chroma Systems Solutions, Inc. All rights reserved.

NI announces its highest-performing EV battery cycler to date

Li-Cycle opens battery recycling facility in Alabama

COMSOL’s Multiphysics software adds tools for vehicle electrification

Skeleton Technologies launches supercapacitor/battery

AM Batteries secures $25 million in financing for its dry-electrode technology

New DC-DC converter features GaN Systems power transistor

Avery Dennison introduces two new adhesive products for EV batteries

Bosch begins motor production at Charleston plant

LG Chem to build major cathode plant in Tennessee

MAHLE Powertrain to open EV test facility in Michigan

Keysight Technologies launches new DC emulator for testing EV fast charging

ZF’s new e-axle for pickup trucks features 800 V SiC inverters

AMP raises $17 million for its energy management platform

Metis’s Battery Safety Sensor earns ISO certification, enters UK production

Interplex releases new stackable multi-row board-to-board connectors for EVs

Piedmont Lithium wins $142-million DOE grant for Tennessee lithium project

Fleets tested Volvo VNR Electric Class 8 tractors for three years: Here’s what they learned

Amazon to invest a billion euros to electrify its fleet in Europe

Bollinger and Wabash to develop last-mile refrigerated delivery truck

EU confirms 2035 zero-emission sales mandate for new cars and vans

Electrify America launches a new brand-neutral EV marketing campaign

Mercedes-Benz unveils electric trucks for construction site applications

Automakers and infrastructure providers ask UK government for ZEV mandate

Rental agency Sixt to buy 100,000 BYD EVs for European market

Komatsu presents 20-ton-class Proterra Powered electric hydraulic excavator

EPA announces first grants from School Bus Program to 389 school districts

VinFast secures $135 million for electric public bus fleet

Deutsche Post DHL orders 2,000 electric delivery vans from Ford Pro

Foxconn launches new pickup and crossover EVs

Buick to introduce its first Ultium-based EV in China

New Mercedes eSprinter delivery van demonstrates 300-mile range

Volta Trucks and Siemens partner on Truck as a Service offering

Domino’s to roll out fleet of 800 Chevy Bolts nationwide

CHARGED Electric Vehicles Magazine (ISSN: 24742341) October-December 2022, Issue #62 is published quarterly by Electric Vehicles Magazine LLC, 2260 5th Ave S, STE 10, Saint Petersburg, FL 33712-1259. Periodicals Postage Paid at Saint Petersburg, FL and additional mailing o ces. POSTMASTER: Send address changes to CHARGED Electric Vehicles Magazine, Electric Vehicles Magazine LLC at 2260 5th Ave S, STE 10, Saint Petersburg, FL 33712-1259.

PG&E to offer vehicle-to-grid export rate for commercial EVs

Electrify America unveils megawatt-level battery energy storage system

Shell acquires German commercial EV infrastructure provider

Franklin Electric introduces switchgear for DC fast charging stations

NAPA collaborates with Qmerit to offer EV charging solutions

GSA expands contract with Eaton to include EV infrastructure

Québec charging network launches heavy vehicle charging pilot

Fermata launches new V2X bidirectional charger

TeraWatt to build truck charging corridor along I-10 from Long Beach to El Paso Electric Era’s new turnkey EV fast charging solution for convenience stores

Delta Electronics demonstrates 400 kW solid-state transformer-based charger

FLO to provide up to 40,000 chargers for GM’s dealer charging program

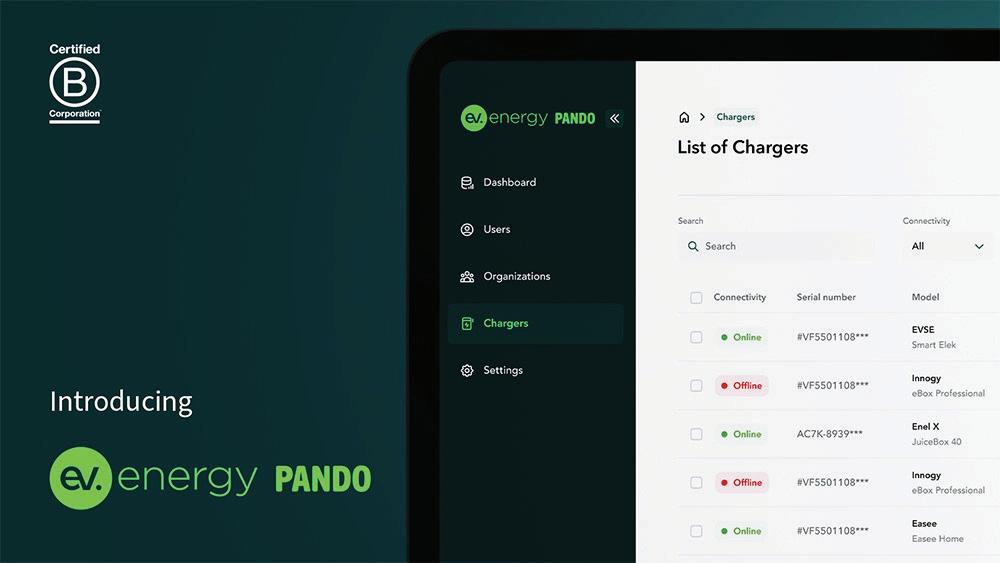

SAE International launches initiatives centered on EV charging station reliability ev.energy’s new Pando is a cloud-based EV charging management platform

ADS-TEC’s ChargeBox Dispensers provide battery-buffered indoor charging

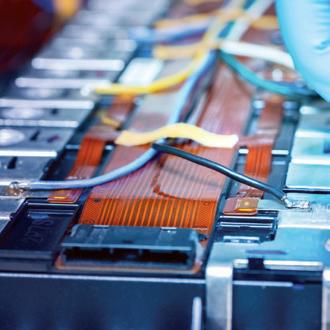

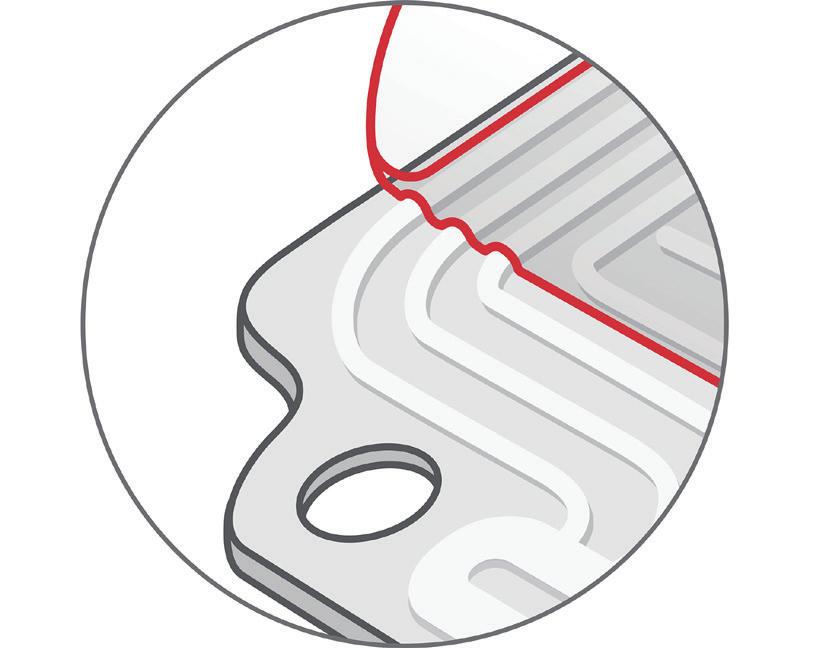

Our flexible printed circuits do more than link battery cells to EV electronics. They flex during charging cycles, creating a sleeker, lighter solution that boosts miles per charge.

Put our long history of technical knowledge and consultation to work for you. From engineered materials to innovative circuitry, our vertically integrated solutions are uniquely created to help your concepts take shape.

sheldahl.com

For Letters to the Editor, Article Submissions, & Advertising Inquiries

Contact: Info@ChargedEVs.com

Bourgeois

Bourgeois

1. PUBLICATION TITLE: CHARGED ELECTRIC VEHICLES MAGAZINE. 2. PUBLICATION NUMBER: 18170. 3. FILING DATE: SEPTEMBER 29, 2022. 4. ISSUE FREQUENCY: QUARTERLY 5. NUMBER OF ISSUES PUBLISHED ANNUALLY: 4. 6. ANNUAL SUBSCRIPTION PRICE (IF ANY). 7. COMPLETE MAILING ADDRESS OF KNOWN OFFICE OF PUBLICATION: CHARGED ELECTRIC VEHICLES MAGAZINE, 2260 5TH AVE SOUTH, #10, ST PETERSBURG, FL 33712. CONTACT PERSON: CHRISTIAN RUOFF. TELEPHONE: (727) 522-0039. 8. COMPLETE MAILING ADDRESS OF HEADQUARTERS OR GENERAL BUSINESS OFFICE OF PUBLISHER: CHARGED ELECTRIC VEHICLES MAGAZINE, 2260 5TH AVE SOUTH, #10, ST PETERSBURG, FL 33712. 9. FULL NAMES AND COMPLETE MAILING ADDRESSES OF PUBLISHER, EDITOR, AND MANAGING EDITOR: PUBLISHER, EDITOR, AND MANAGING EDITOR: CHRISTIAN RUOFF, 2260 5TH AVE SOUTH, #10, ST PETERSBURG, FL 33712. 10. OWNER. FULL NAME: CHRISTIAN RUOFF. COMPLETE MAILING ADDRESS: 2260 5TH AVE SOUTH, #10, ST PETERSBURG, FL 33712. 11. KNOWN BONDHOLDERS, MORTGAGEES, AND OTHER SECURITY HOLDERS OWNING OR HOLDING 1 PERCENT OR MORE OF TOTAL AMOUNT OF BONDS, MORTGAGES, OR OTHER SECURITIES: NONE. 13. PUBLICATION TITLE: CHARGED ELECTRIC VEHICLES MAGAZINE. 14. ISSUE DATE FOR CIRCULATION DATA BELOW: #61, JULY-SEPTEMBER 2022. 15. EXTENT AND NATURE OF CIRCULATION. A. TOTAL NUMBER OF COPIES (NET PRESS RUN). AVERAGE NO. COPIES EACH ISSUE DURING PRECEDING 12 MONTHS: 11050; NO. COPIES OF SINGLE ISSUE PUBLISHED NEAREST TO FILING DATE: 11,650. B. LEGITIMATE PAID AND/OR REQUESTED DISTRIBUTION (BY MAIL AND OUTSIDE THE MAIL): (1) OUTSIDE COUNTY PAID/ REQUESTED MAIL SUBSCRIPTIONS STATED ON PS FORM 3541: 9469; 9562. (2) IN-COUNTY PAID/REQUESTED MAIL SUBSCRIPTIONS STATED ON PS FORM 3541: 0; 0. (3) SALES THROUGH DEALERS AND CARRIERS, STREET VENDORS, COUNTER SALES, AND OTHER PAID OR REQUESTED DISTRIBUTION OUTSIDE USPS: 0; 0. (4) REQUESTED COPIES DISTRIBUTED BY OTHER MAIL CLASSES THROUGH THE USPS: 0; 0. C. TOTAL PAID AND/OR REQUESTED CIRCULATION (SUM OF 15B (1), (2), (3), AND (4)): 9469; 9562. D. NON-REQUESTED DISTRIBUTION (BY MAIL AND OUTSIDE THE MAIL): (1) OUTSIDE COUNTY NONREQUESTED COPIES STATED ON PS FORM 3541: 0; 0. (2) IN-COUNTY NONREQUESTED COPIES STATED ON PS FORM 3541: 0; 0. (3) NONREQUESTED COPIES DISTRIBUTED THROUGH THE USPS BY OTHER CLASSES OF MAIL: 132; 55. (4) NONREQUESTED COPIES DISTRIBUTED OUTSIDE THE MAIL: 895; 829. E. TOTAL NONREQUESTED DISTRIBUTION [SUM OF 15D (1), (2), (3) AND (4)]: 1027; 884. F. TOTAL DISTRIBUTION (SUM OF 15C AND E): 10469; 10446. G. COPIES NOT DISTRIBUTED: 581; 1204. H. TOTAL (SUM OF 15F AND G): 11050; 11650. I. PERCENT PAID AND/OR REQUESTED CIRCULATION (15C DIVIDED BY 15F TIMES 100): .9045; .9153. I CERTIFY THAT 50% OF ALL MY DISTRIBUTED COPIES (ELECTRONIC AND PRINT) ARE LEGITIMATE REQUESTS OR PAID COPIES. 17. PUBLICATION OF STATEMENT OF OWNERSHIP FOR A REQUESTER PUBLICATION IS REQUIRED AND WILL BE PRINTED IN THE ISSUE OF THIS PUBLICATION: ISSUE 62, OCTOBER-DECEMBER 2022. 18. I CERTIFY THAT ALL INFORMATION FURNISHED ON THIS FORM IS TRUE AND COMPLETE. CHRISTIAN RUOFF, PUBLISHER, SEPTEMBER 29, 2022.

Publisher Associate Publisher Senior Editor Account Executive Technology Editor Graphic Designers

Christian Ruoff

Laurel Zimmer Charles Morris

Jeremy Ewald Jeffrey Jenkins

Tomislav Vrdoljak

Jeffrey Jenkins

Charles Morris

Christian Ruoff

Tom Lombardo

John Voelcker

Volvo Trucks North America Kelly Ruoff Sebastien

Publisher Associate Publisher Senior Editor Account Executive Technology Editor Graphic Designers

Christian Ruoff

Laurel Zimmer Charles Morris

Jeremy Ewald Jeffrey Jenkins

Tomislav Vrdoljak

Jeffrey Jenkins

Charles Morris

Christian Ruoff

Tom Lombardo

John Voelcker

Volvo Trucks North America Kelly Ruoff Sebastien

We’ve made some major changes to the Charged web site (www.chargedevs. com), including a long list of cosmetic and substantive improvements. e main change you will notice is in how we now organize our content.

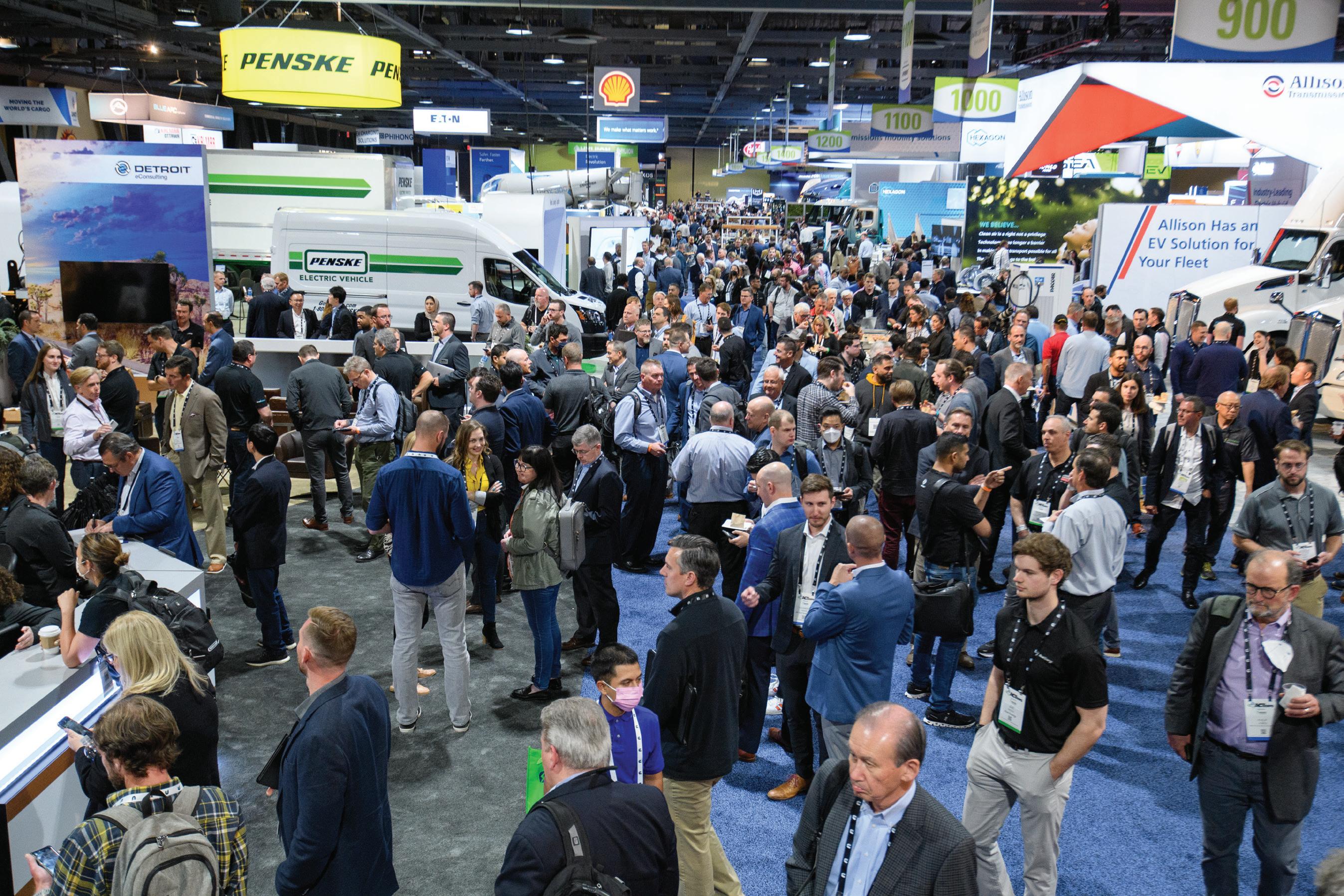

For over ten years, Charged has covered the EV industry in-depth in three general areas: e Tech, e Vehicles, and e Infrastructure. Now that the world is nally starting to catch up with our EV obsession and we see rapid acceleration in deployments of large-scale EV and charging projects, we’ve decided to start grouping our content into two main buckets: EV Engineering and EV Fleets & Infrastructure.

e simple goal of the site update is to show readers more relevant content based on the speci c topics they are interested in.

So, for example, when engineers visit our site to watch a webinar about the latest in battery testing technology or how to unleash SiC power device e ciency, they’ll be shown more content suggestions related to those elds of engineering.

Similarly, when a municipal project manager visits our site to read an article about common mistakes to avoid with electric transit buses or managing a eet’s charging schedule to maximize uptime, they’ll see more content related to deploying EV eets and infrastructure.

e new site changes are not just about organization—we’re also greatly expanding our content o erings. e bigger and better format re ects the explosive growth of the EV industry—there’s so much going on that we had to increase our coverage.

Our strong suit has always been our original content, including interviews with experts, opinions, deep dives, and, increasingly, material in webinar and video formats. You can expect to see a lot more of this in the new year. For example, in addition to our EV Engineering virtual conference and webinar series, which has grown enormously popular, we’re also expanding the eet electri cation video series to help those out in the world who are struggling to deploy various EV and charging projects quickly.

As we move into a new Year of the EV, things are moving quickly on multiple fronts.

• Electri cation of heavy-duty vehicles is a hot topic, and industry players are getting together to map out a new transport ecosystem—see John Voelcker’s article on the nal presentation of the Low Impact Green Heavy Transport Solutions project, page 52.

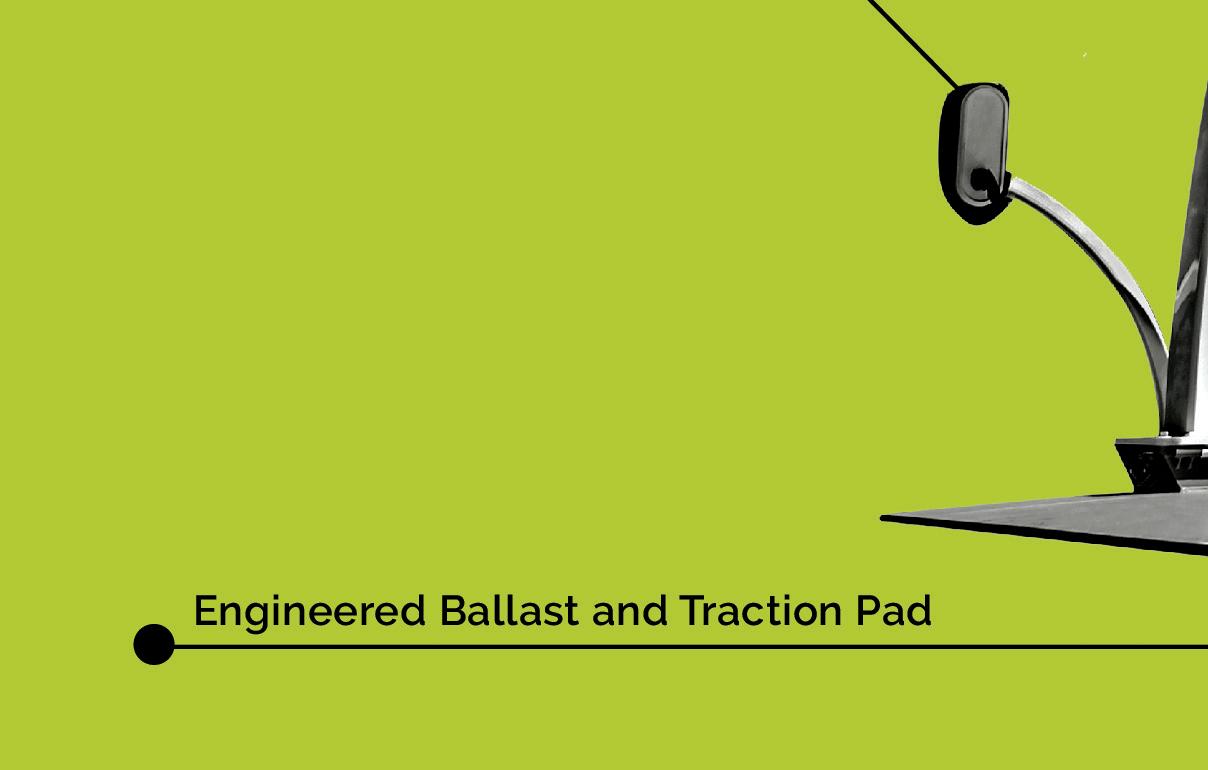

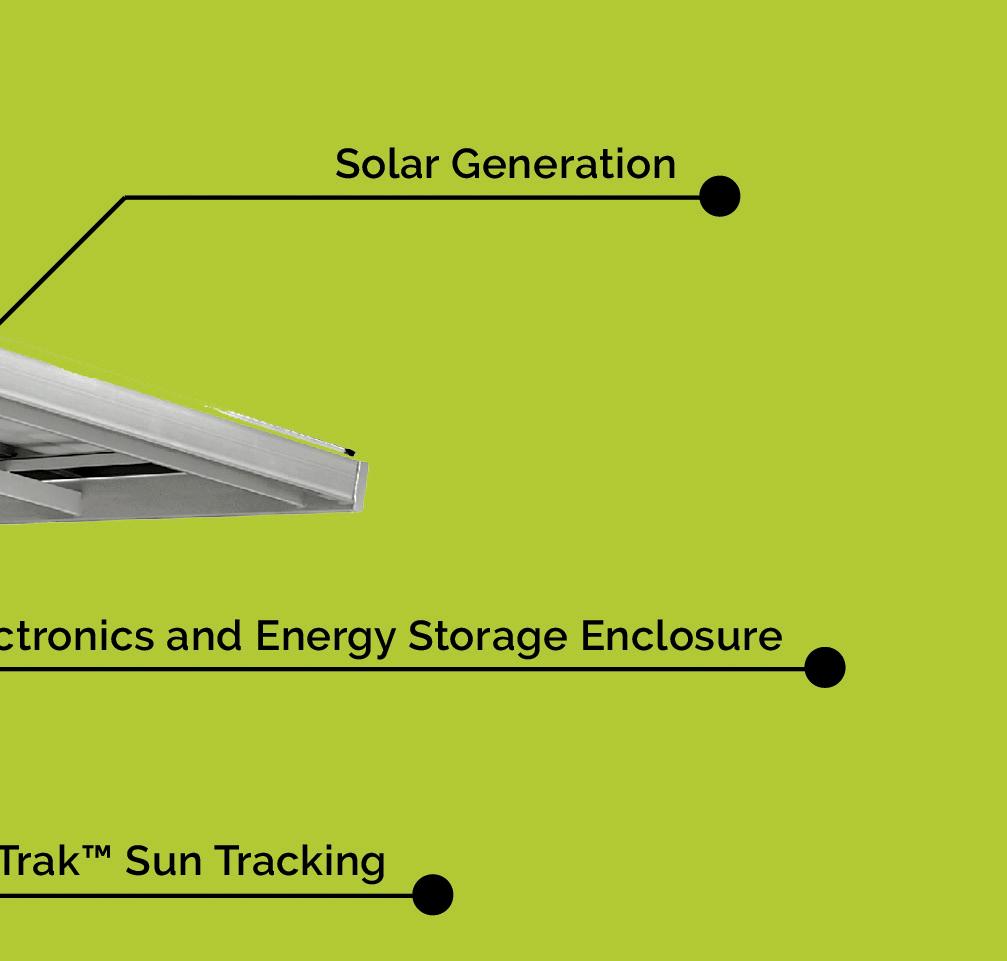

• Meanwhile, charging station manufacturers are o ering products that revolutionize the process of installing infrastructure—see our Q&A with the CEO of Beam Global, page 72.

• Even as vehicles and infrastructure evolve rapidly, engineering remains at the heart of it all—Je rey Jenkins o ers a technical discussion of high-power interconnects and disconnects, page 22.

• One of the biggest near-term challenges our industry faces is building out the battery manufacturing capacity in time to meet short deadlines—on page 28 you will nd six tips for creating high-throughput battery production in record time.

EVs are here. Try to keep up.

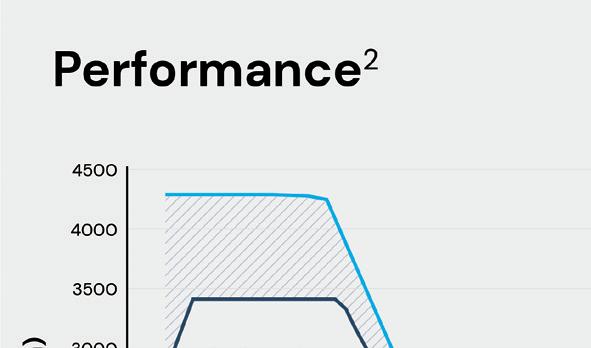

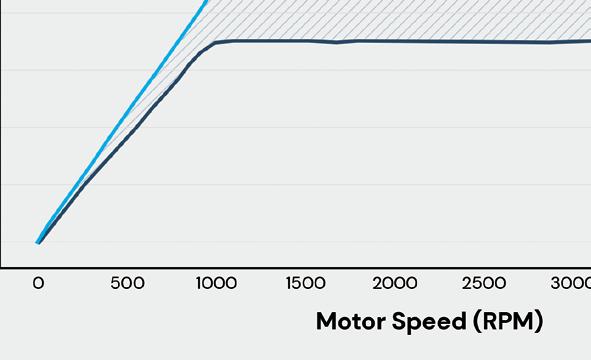

Battery labs need power—lots of power—in order to test batteries by cycling them over and over. NI, a provider of automated testing and measurement systems, keeps turning up the voltage. e company has just unveiled its highest-voltage EV battery cycler to date, the High Power System-17000.

is 150 kW battery cycler is designed to support existing EV architectures “while leaving room for future higher-voltage variants as technology continues to evolve.” It features new synchronization capabilities, as well as a modular design that’s designed to o er battery labs increased layout exibility and lower maintenance costs.

In order to support applications beyond battery cycling, such as inverter testing and dynamometer applications, the HPS-17000 has standardized power- and application-speci c breakout sections in the cabinet. is is also designed to enable local service technicians to act quickly should a malfunction occur.

Time-sensitive networking technology allows multiple HPS-17000s to synchronize down to the microsecond, so cyclers positioned tens of meters apart can reliably operate in parallel. is synchronization also extends to high-accuracy current and voltage sensor units, so battery design and test engineers can readily correlate cycler actions with external measurements at microsecond-level resolution.

Additional features include: modes ranging from 400 V to 1,500 V; high-frequency test signal production; support for EIS and ACIR applications; parallel operation via time synchronization over Ethernet; and time-stamped setpoint streaming for large, distributed deployments.

Battery recycler Li-Cycle has announced that its Alabama Spoke plant in Tuscaloosa has started commercial operations.

e Alabama Spoke uses Li-Cycle’s patented technology to recycle and directly process full EV battery packs without any dismantling through a submerged shredding process that produces no wastewater. Li-Cycle says its full pack processing capability improves e ciency, and can process the growing variety of EV battery architectures, including cell-to-pack formats that have limited options for dismantling.

e Alabama Spoke is strategically located to support the recycling needs of the company’s growing battery supply customer base in the southeastern US, where several battery and automotive manufacturers are establishing operations. is growth is expected to produce a signi cant amount of battery production scrap and endof life batteries that will require recycling.

“Li-Cycle is creating an essential domestic supply of recycled material to support EV production and assist automakers in meeting their domestic production content requirements,” said co-founder and CEO Ajay Kochhar.

Together with its two other North American spokes— located in Kingston, Ontario and Rochester, New York—Li-Cycle now has a total input processing capacity of 30,000 tons per year, or the equivalent of batteries from approximately 60,000 EVs. By the end of 2023, the company expects to have a total of 65,000 tons per year of processing capacity across its Spoke network in North America and Europe.

e primary output product of Li-Cycle’s Spokes is black mass, consisting of valuable metals, including lithium, cobalt and nickel, which the company will convert into battery-grade materials at its rst Hub facility, which is under construction in Rochester. Li-Cycle expects the Hub to be capable of processing 35,000 tons of black mass annually, with battery materials equivalent to approximately 225,000 EVs. Li-Cycle aims to begin commissioning the Rochester Hub in 2023.

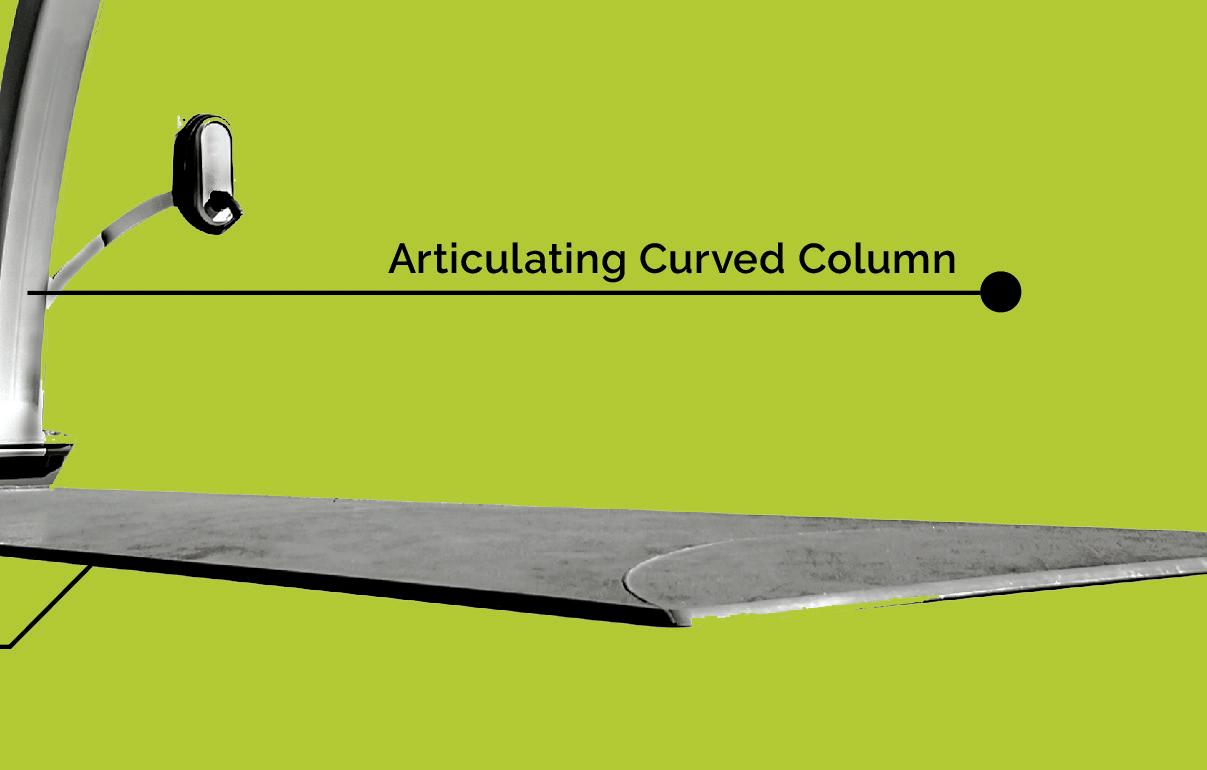

Skeleton Technologies has introduced a new product that combines supercapacitors and batteries, and has joined a coalition of nine members, including oil giant Shell, that aims to electrify mining equipment.

e SuperBattery doesn’t use any cobalt, copper, nickel or graphite. e company says it can last for 50,000 cycles. It is currently being used or tested in hybrid and fuel cell vehicles and charging infrastructure.

“Skeleton’s patented Curved Graphene material allows for 100 times faster charging compared to standard lithium-ion batteries,” says the company. “Used in o -road vehicles, SuperBattery can be charged in less than a minute, therefore requiring much less charging time spent per day: less than an hour, whereas 6.5 hours are needed with a lithium-ion battery.”

Skeleton says it plans to begin mass production of the SuperBattery in 2024.

“We are proud to work alongside Skeleton—and our consortium members—to develop a new pilot o ering of electri cation solutions for o -road vehicles and to demonstrate how partnership and close collaboration can help mining businesses meet their environmental goals,” says Shell VP Grischa Sauerberg.

“ e pilot o ering combines ultra-fast charging with Skeleton’s new SuperBattery, in-vehicle energy storage, and power provisioning and microgrids,” says Skeleton.

AM Batteries (AMB), a pioneer in lithium-ion dry-electrode technology, has closed a $25-million Series A nancing round led by Anzu Partners. Other investors include TDK Ventures, Foothill Ventures, Toyota Ventures, Zeon Ventures, SAIC Capital, VinFast, Doral Energy-Tech Ventures and Creative Ventures.

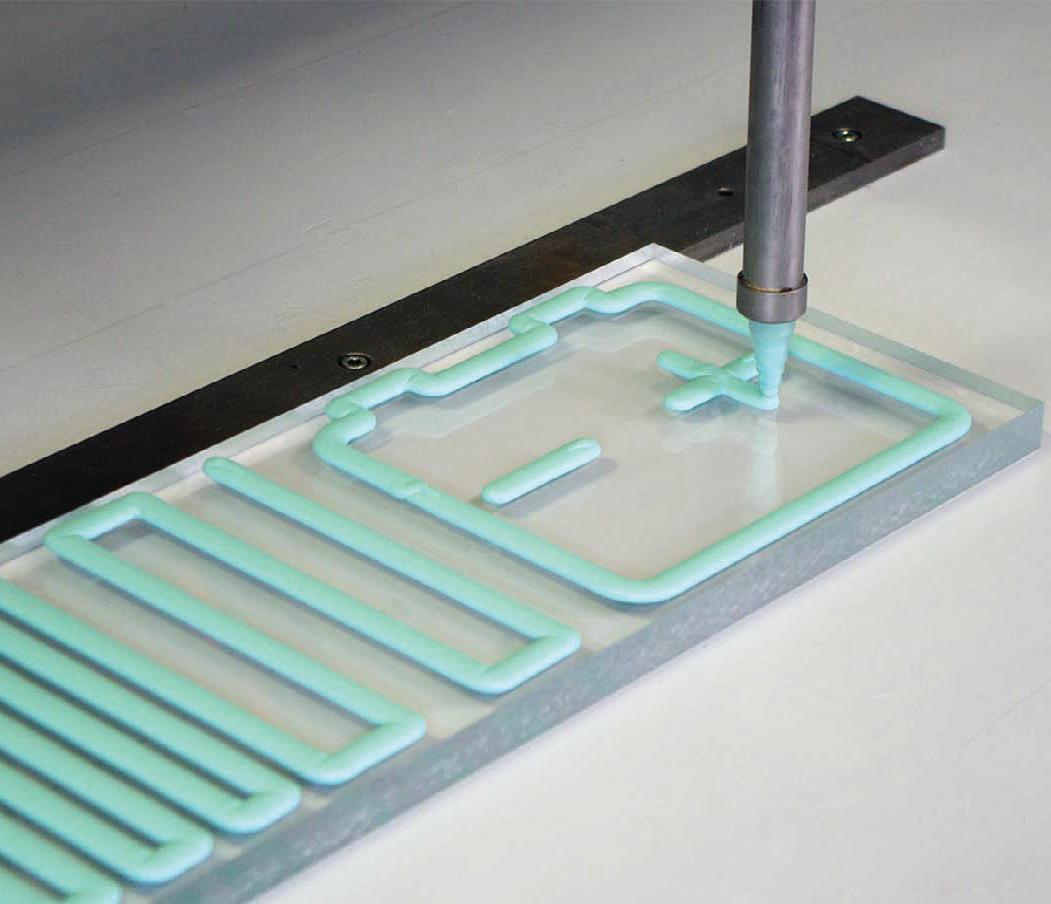

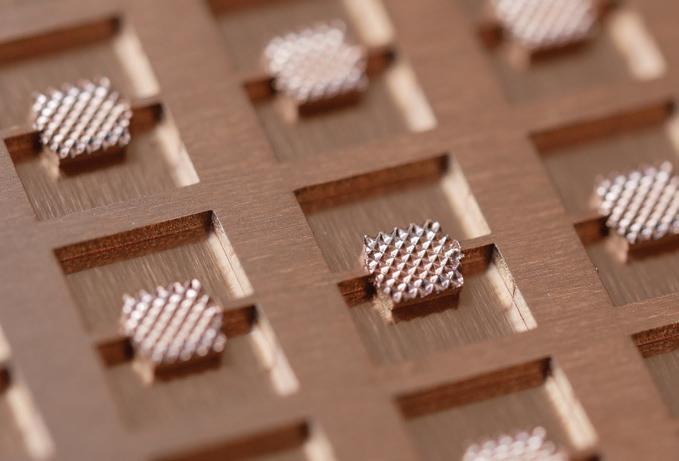

AMB will use the funding to expand its team and accelerate its commercialization e orts, advance its roll-to-roll manufacturing pilot line to a production-grade line for customers, and extend its dry-electrode manufacturing platform to new battery chemistries and technologies such as solid-state batteries. Massachusetts-based AM Batteries was founded in 2016. e company says its dry-electrode manufacturing technology allows for the coating of Li-ion battery electrodes with no need for harmful solvents or energy-intensive evaporation. Compared to the conventional slurry casting approach, AMB’s dry-electrode process “completely eliminates solvent recovery and electrode drying, which reduces energy consumption of a battery plant by 50%, saves 40% of capital equipment in electrode manufacturing and potentially produces higher-energy, faster-charging and lower-cost lithium-ion batteries.”

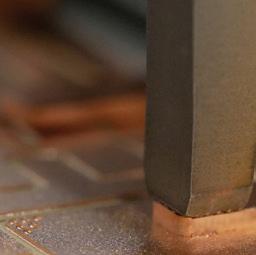

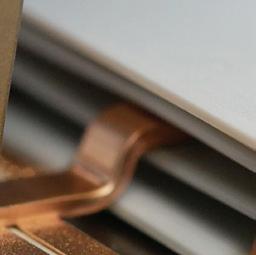

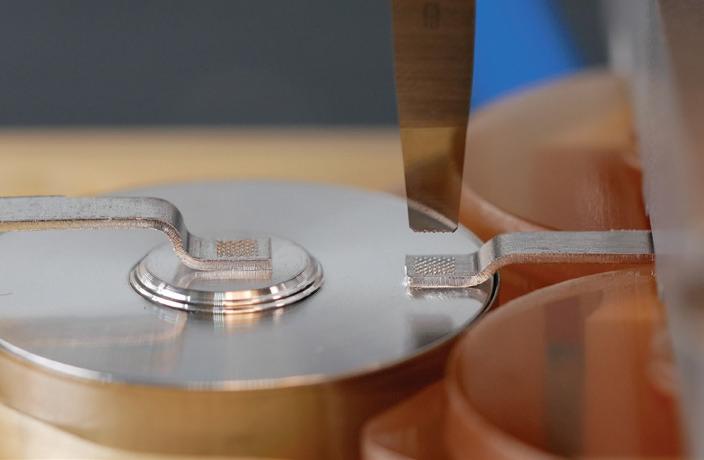

To manufacture battery electrodes, AMB uses an electrostatic spray deposition technique by which the cathode and anode active materials are electrostatically charged and deposited onto metal foil current collectors, which are then processed to their nal state.

“One of the fundamental problems for battery manufacturers today is re ning manufacturing techniques to remove the toxic solvents used in wet-coating of electrodes,” said Yan Wang, AMB co-founder and CEO. “ e progress we have made at AMB is a major step forward in solving this problem.”

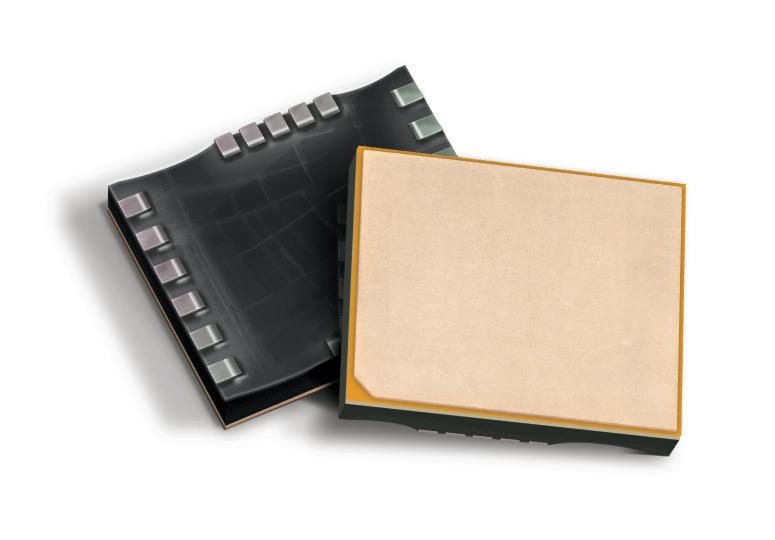

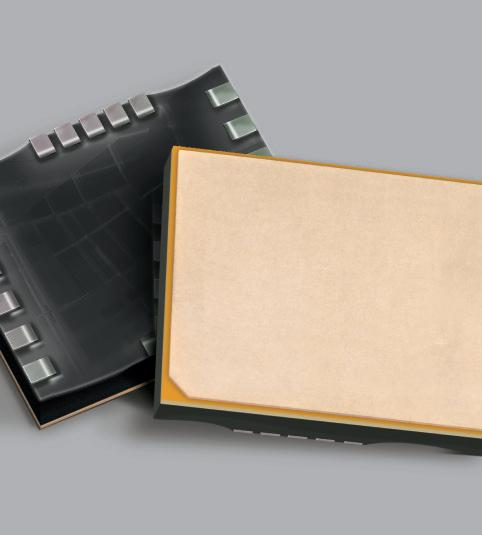

A new DC-DC converter from Renesas Electronics includes a GaN-on-silicon power transistor made by GaN Systems.

e GS61008P is a 100 V enhancement-mode power transistor that provides a 46% reduction in system size, according to GaN Systems.

Renesas’s new DC-DC bidirectional converter is designed for 48 V mild hybrid vehicles and electric motorcycles, and includes an automatic phase drop function, an ISL78226 PWM controller and a half-bridge driver.

“A combination of GaN with the automatic phase drop function achieves highly e cient power conversion even at low loads, exceeding 94% power e ciency over a wide load range of 400 W to 3 kW,” says GaN Systems. “ e half-bridge driver ISL78420/444 provides an easy and cost-e ective method of driving GaN transistors.”

GaN Systems says the converter enables “a 46% reduction of the PCB area by leveraging the excellent switching capabilities of GaN Systems’s transistors—enabling a high-e ciency power converter with a high switching frequency of 500 kHz. is allows the use of very small 1.3 µH inductors, which leads to a signi cant decrease in size and weight.”

Tape and adhesive company Avery Dennison Performance Tapes has introduced some new tape and rubber adhesive products for EV applications.

e single-sided, conformable and dielectric tape can provide electrical insulation for EV batteries.

“ is dielectric material uniformly maintains its thickness, and the polyurethane facestock prevents electrical arcing, which can lead to shorting and res in the battery pack,” says the company. “ e single-coated tape design is durable and creates an instant bond, eliminating the need for cure or dry times.”

e Flame Tough Rubber adhesive is a ame-retardant and halogen-free adhesive which is recommended for runaway barrier, compression pad and electrical insulation applications. e adhesive meets the UL 94 VTM and UL 94 standards. It’s part of the Flame Tough rubber adhesive product line, and the company says it has higher tack and adhesion than the line’s acrylic and silicone adhesives.

e new adhesive will be available in transfer tape and double-coated versions.

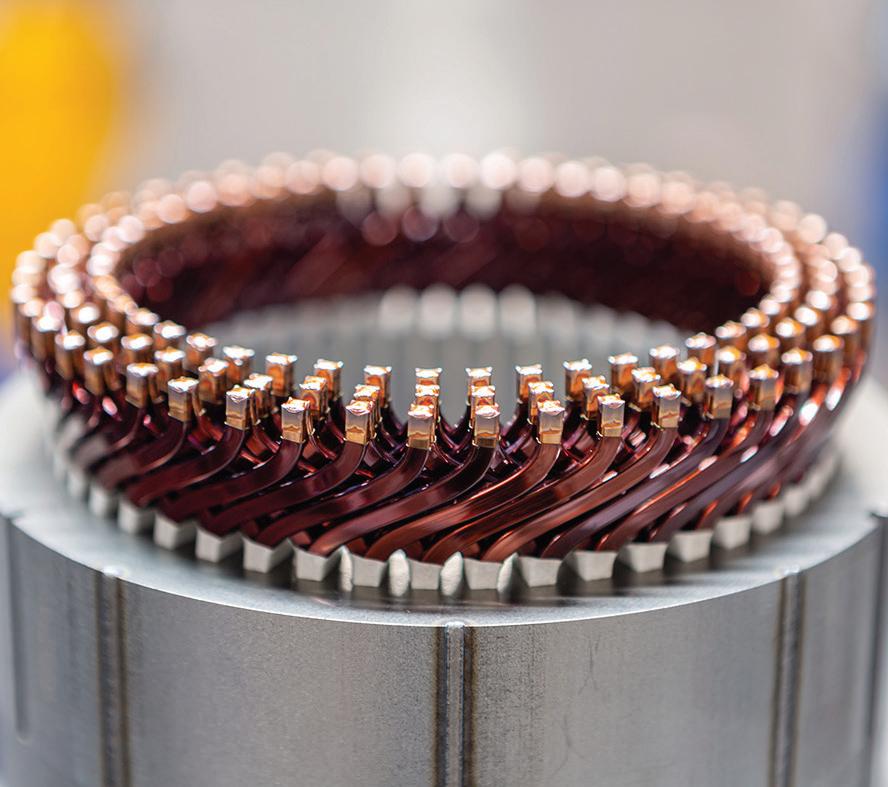

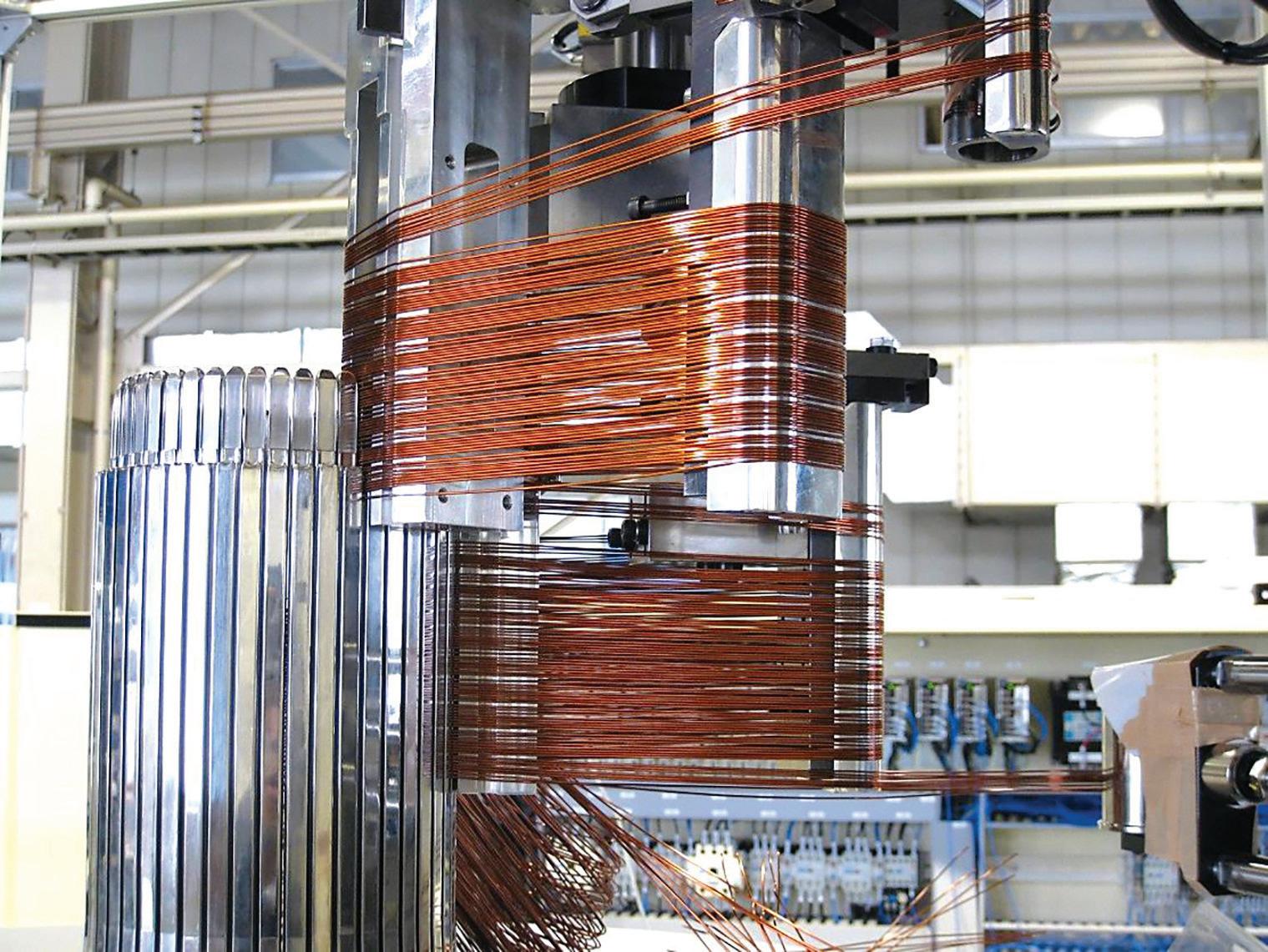

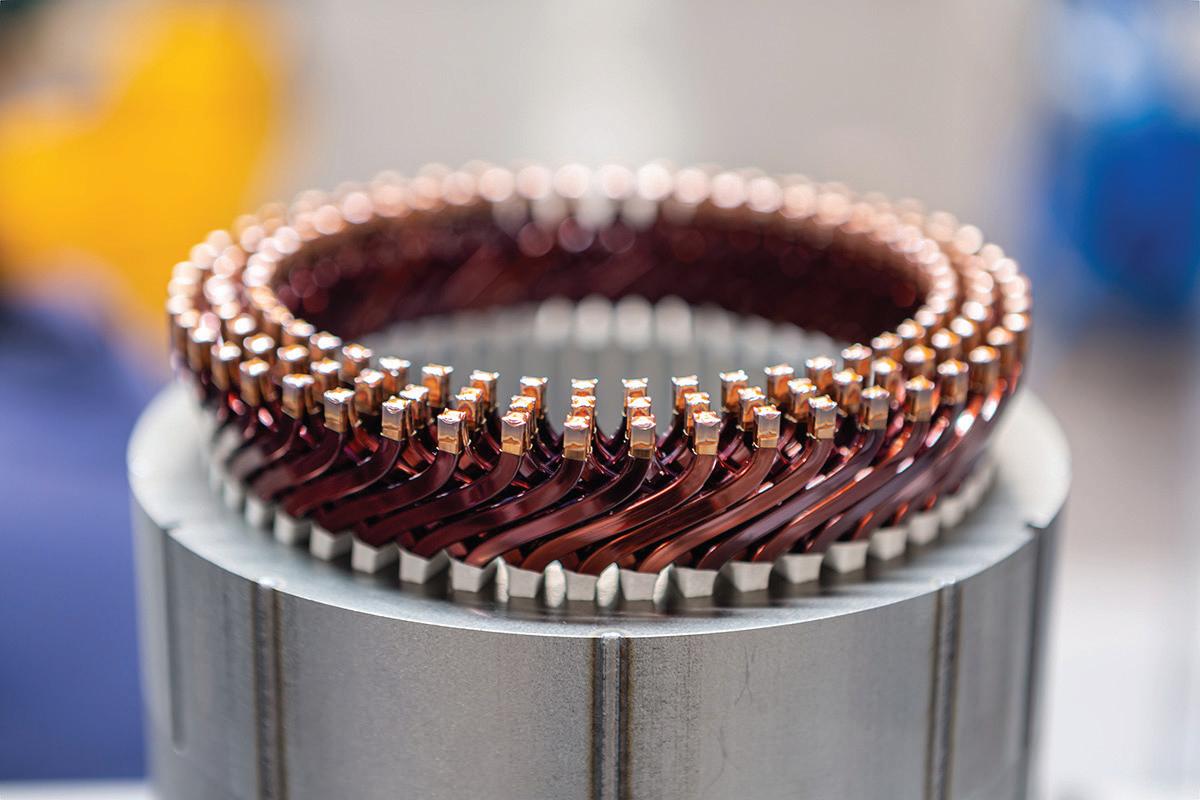

Bosch has begun production of electric motors at its Charleston, South Carolina manufacturing facility. e company plans to invest an additional $260 million to further expand production of electri cation products at the site.

Bosch is producing rotors and stators, and assembling the motors, in a building where diesel powertrain components were once made. e company announced in January 2020 that it would wind down production of diesel components, and work to expand its electri cation-related business.

Now the company says it has secured additional electromobility orders that require expansion at the plant—an additional 75,000 square feet will be added to the existing 200,000-square-foot facility to make room for future production. e expansion, including the deployment of new high-tech manufacturing equipment, is expected to be complete by the end of 2023.

Bosch’s range of motors can deliver anywhere from 50 to 500 kW of power, and 150 to 1,000 Nm of torque. Voltages range up to 850 V, and applications include passenger cars and light commercial vehicles.

“We have grown our electri cation business globally and here in the North American region,” said Mike Mansuetti, President of Bosch in North America. “We’ve invested more than $6 billion in electromobility development, and in 2021 our global orders for electromobility surpassed $10 billion for the rst time. Local production helps to advance our customers’ regional electri cation strategies, and further supports the market demand for electri cation.”

As part of the site transformation, Bosch has provided reskilling and upskilling opportunities to associates to prepare for the production of electric motors. e company is also collaborating with local schools to add electrication topics to the curricula. e Bosch Community Fund has made $2.5 million in grants for STEM education in the Charleston area since 2013.

Image courtesy of Bosch

LG Chem has signed a memorandum of understanding to establish a new cathode manufacturing facility in Clarksville, Tennessee.

Manufacturing plants for batteries and other EV components are popping up all over the country these days, and the announcements invariably mention President Biden’s In ation Reduction Act, which o ers incentives for companies to establish supply chains here in the good old USA. LG Chem says its new Tennessee facility will allow it to “proactively address the changing dynamics of the global battery material market and with legislation such as the In ation Reduction Act.”

“LG Chem’s decision to invest $3.2 billion in Clarksville is a testament to Tennessee’s unmatched business climate, skilled workforce and position as a leader in the automotive industry,” said Tennessee’s Republican Governor Bill Lee. “I thank this company for creating more than 850 new jobs.”

e 420-acre plant is expected to have an annual production capacity of 120,000 tons of cathode material by 2027—enough to power 1.2 million EVs. Construction will begin in the rst quarter of 2023, and mass production is expected to start in the second half of 2025.

e new facility will produce NCMA cathode materials containing nickel, cobalt, manganese and aluminum for next-generation EV batteries. LG Chem says the plant will incorporate its most advanced production technology, including the ability to produce more than 10,000 tons of cathode material per line. e company plans to automate the entire production process, and to establish a quality analysis and control system that will be “the benchmark for all other cathode plants in the world.”

LG Chem says the new facility will rely completely on renewable energy provided by solar and hydroelectric power.

MAHLE Powertrain is planning to establish a new EV powertrain testing facility at its engineering center in Plymouth, Michigan.

e company is investing $4 million in the facility, which is designed for testing, developing and calibrating two- and four-wheel drive platforms.

“As well as full powertrain testing and calibration work, the facility will enable the development of powertrain systems, the calibration of transmissions, hybrid and battery-electric powertrain con gurations, Real Driving Emissions (RDE) measurements and electric vehicle range determination,” says MAHLE.

e facility will include dynamometers for up to 7,000 Nm of instantaneous torque per wheel with an average torque response time of 0.5 ms, a 623 kW battery emulator with a future expansion capacity of more than 1 MW, a test cell for ADAS assessments, and a testbed for US and EU emissions rules.

e facility will be able to accommodate a maximum wheelbase of 4.5 meters, and will be capable of testing at temperatures from -10° to 40° C.

“ is investment underscores our determination to provide world-class services to our clients through the provision of state-of-the-art facilities and expertise,” says Managing Director of MAHLE Powertrain USA Hugh Blaxill. “ e new facilities will extend our unique capabilities to cover client requirements both in the US and globally, and will prove an invaluable resource for light-duty and heavy-duty manufacturers alike. Crucially, this means we are able to conduct a signi cant amount of development and validation work without requiring a large number of prototype vehicles to be built by the manufacturer.”

Test and measurement technology company Keysight Technologies has introduced a new DC emulator product series, which is designed for EV fast charging applications.

“Our next-generation high-power DC emulators, based on silicon-carbide technology, are greater than 96% e cient and provide more power and higher voltages in less space, when compared to similar systems,” says Keysight VP omas Goetzl. “When combined with the SL1047A Charging Discovery System, it enables our customers to test all aspects of high-power DC fast charging in their labs.”

e SL1800A series Scienlab Regenerative DC Emulator can emulate EV batteries up to 1,500 V and up to 900 A, and can accommodate DC charging testing up to 270 kW.

e company says the emulator also has a “regenerative system that returns power to the grid when acting as an electronic load during EV battery emulation/ charging tests.”

Superior lifecycle thermal protection combined with the mechanical performance of a compression pad.

Ultrathin, Lightweight Solutions

Optimum thickness for maximum energy density.

PyroThin can accommodate thermal and mechanical requirements of pouch and prismatic cell architectures.

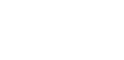

ZF has introduced an e-axle designed for Class 1-6 pickup trucks in the North American market.

e eBeam Axle is composed of a motor, transmission, solid axle, and the company’s 800 V SiC inverters. It is intended for 400 and 800 V systems, and is capable of supporting up to 350 kW and 16,000 Nm per axle.

“ e eBeam Axle allows for the same level of performance as traditional internal combustion engine-powered pickup trucks, speci cally in towing capacity, torque and smooth acceleration required for hills or steep inclines, while providing quiet operation, one-pedal driving, unchanged ground clearance and the ruggedness expected from a pickup truck,” says the company.

EV energy management specialist AMP has closed a Series A funding round that raised $17.25 million. e funds will be used to speed up the development of ampOS—a connected energy management platform composed of the company’s ampCloud, battery management system and a bidirectional onboard charger. e company says its technology is aimed at accurately assessing the health of battery packs, providing improved battery pack management, supporting V2G and informing nancial services involved in warranties and insurance for EVs.

“Our company’s technology will shrink the upfront and operating costs of both the mobile and stationary battery sectors,” says AMP CEO Anil Paryani.

Metis Engineering has earned ISO certi cation for its Production Battery Safety Sensor, which designed to monitor the health of a lithium-ion battery pack and detect cell venting. e sensor was developed using ISO26262 processes, and has been tested to ISO Automotive Standards by Applus+ 3C Test, an independent testing house.

Manufacturing of the production version of the Battery Safety Sensor has begun in the UK to ll orders from OEMs and Tier 1 suppliers, which are using them in ASIL B applications.

“Our Battery Safety Sensor measures pressure change and volatile organic compounds (VOCs) for the detection of cell venting, which is an early stage of thermal runaway,” said Metis Engineering Managing Director Joe Holdsworth. “It also monitors humidity, dew point and air temperature parameters to ensure that the battery continues to operate in optimum conditions.”

e sensor is designed to pick up a range of environmental parameters to ensure that the battery continues to operate in optimum conditions, and has an optional accelerometer to record shock loads. is data can be used to crosscheck with other inputs, such as cell temperatures, to check for cell venting. e sensor relays the data over a con gurable CAN interface to a control unit, such as the vehicle’s ECU, to alert the driver that cell venting has occurred. e sensor can also trigger a process to cut the circuit to the battery pack, allowing it to cool down and prevent thermal runaway.

Metis says its Battery Safety Sensor typically detects venting within seconds.

“ e early detection of cell venting is vital to the safety of the vehicle’s passengers and everything in the immediate proximity. We hope that this sensor o ers an a ordable part of the solution,” said Holdsworth.

Interplex, a manufacturer of interconnect products, has released a new product that allows multiple connector units to be stacked together.

e company’s Multi-Row Board-to-Board (BTB) connector product features a proprietary “snap-in biscuit design.” According to Interplex, this allows interconnections to be appropriately sized, eliminating the need for custom-built units.

e new BTB connectors feature copper alloy 0.4 mm miniPLX press- t pins with low levels of contact resistance (<1 mΩ) and a 3 A current-carrying capacity.

e new connectors are available in board stacking heights from 7 mm to 30 mm, and can have between one and six rows, with up to 30 contact terminals per row. According to the company, they’re capable of withstanding high humidity levels (8-hour cycling up to 10% RH), shocks (35 g for 5 to 10 ms across ten axes) and vibrations (8 hours per axis). ey support a working temperature range of -40° to 150° C (-40° to 302° F).

Interplex expects its new BTB connectors to be used primarily in EVs—speci cally for electric power steering and ECUs.

Piedmont Lithium has been selected to receive a $141.7-million grant from the DOE, one of the rst wave of projects aimed at expanding domestic supply of battery raw material funded by the Bipartisan Infrastructure Law.

e funding will support the construction of Piedmont’s Tennessee Lithium project, which has a budget of approximately $600 million and a goal of establishing lithium hydroxide production capacity of 30,000 metric tons per year.

e Tennessee Lithium project is located in McMinn County, Tennessee. e aim is to produce lithium hydroxide from spodumene concentrate using a process developed by Finnish rm Metso Outotec, which Piedmont says will deliver lower emissions than traditional processes.

Construction is to begin in 2023, and production expected to commence in 2025.

Piedmont is also developing projects in Quebec, Ghana and North Carolina. When its current portfolio of lithium assets becomes fully operational (by 2026), the company expects to be producing 60,000 tons per year of lithium hydroxide in the US. Piedmont estimates that the new US battery plants currently in the pipeline will require a collective 600,000 tons per year.

“ e US government is putting investment dollars behind its policies to support energy independence and national security, and we are grateful to be selected to help spur critical, domestic development of the EV battery supply chain,” said Piedmont CEO Keith Phillips. “Over 80% of lithium hydroxide production today occurs in China. is grant will accelerate the development of the Tennessee Lithium project as a world-class lithium hydroxide operation, which is expected to more than double the domestic production of battery-grade lithium hydroxide in the US.”

e subtle—and entirely informal—di erence is that an interconnect is directly or manually operated (inserting a plug into a jack, for example) while a disconnect is indirectly or automatically operated, for example the moving contacts in a light switch, circuit breaker or contactor, or the fusible link in a fuse (which is “operated” by opening up from overcurrent). is might seem to be a distinction without (much of) a di erence, but a notable one is that the typical interconnect uses contacts that slide past each other, whereas most disconnects use contacts that meet (or pull apart) directly, with minimal to no sliding component to their motion.

Generally speaking, the four main design objectives for high-power interconnects and disconnects are: 1) minimizing contact resistance; 2) resisting mechanical wear from each operational cycle; 3) preventing contact degradation from all operational and environmental causes (e.g. arcing, corrosion, etc.); 4) maintaining safety during both normal and abnormal (fault) conditions.

One of the rst considerations is how to bring the contacts together to close the circuit (i.e. the “make” operation), and how to pull them apart to open it (i.e. “break”). In the case of plug and socket type interconnects which conform to a standard, such as CHAdeMO or J1772 for EV charging stations, these details are going to be dictated to the design engineer, with precious little room for deviation even in those all-toofrequent cases in which the standard doesn’t quite anticipate all the challenges imposed by physical reality.

e next parameters to consider are the circuit conditions, primarily: the voltage and current to be handled; whether it is AC or DC; and whether the circuit is predominantly resistive, inductive or capacitive in nature. While it’s probably obvious that making or breaking under heavy load should be avoided if many cycles of operational life are desired, it’s perhaps less well appreciated that contacts designed for high current can become progressively more

In the electrical/electronic world, the terms interconnect and disconnect both refer to a means of joining two sides of a circuit together.

resistive from repeatedly making/breaking under no-load conditions (aka “dry switching”). is is due to the buildup of sul des and/or oxides on the contact surface, which requires either a su cient current ow during the make operation to punch through them (read: a su cient voltage di erence), or a strenuous sliding/wiping action, which will itself result in accelerated wear of the contact surfaces (a case in which the cure is arguably as bad as the disease). Otherwise, when circuit conditions are predominantly inductive, it is the break operation that is most stressful, because of the arc that will jump across the opening contacts if it is not suppressed with a snubber of some sort (e.g. a metal oxide varistor, resistor-capacitor circuit, etc.).

Conversely, when circuit conditions are predominantly capacitive—as typically applies to the input to a charger or an inverter—then it is the make operation that is most hazardous, due to the extreme current which will ow if the voltage di erence is not reduced with a pre-charge circuit just prior to closing the contacts (with, for example, a smaller relay and resistor wired across the main contacts).

e nal circuit condition that greatly a ects interconnect/disconnect design is whether AC or DC is being switched. AC of a given power level is far easier to deal with, because the voltage and current periodically cross through zero (e.g. 100/120 times per second for 50/60 Hz, respectively), which will tend to extinguish any arcs that might form during the break operation (there is less bene t to switching AC during the make operation, since it is practically impossible to synchronize the closing of a contactor—much less a human inserting a plug into a socket—with the zero-crossing of the AC voltage waveform). Note, however, that at a high enough voltage and/or with an insu cient contact separation distance (exacerbated by

separating the contacts too slowly during the break operation), mains-frequency AC will happily re-strike an arc 100/120 times per second. Two solutions o en employed in higher-voltage disconnects are magnetic blowouts, in which magnets placed on either side of the contacts push the arc away as they separate; and lling a sealed contactor with sulfur hexa uoride, a gas with a dielectric strength approximately 2.5 times higher than air (however, it is a potent greenhouse gas—the “no free lunches” rule strikes again).

As is so o en the case in engineering, optimization of one parameter comes at the expense of another, and so it is with electrical life vs mechanical life vs corrosion resistance for the contacts in an interconnect or disconnect. For plugand-socket interconnects (by far the most common type), the contact surfaces will almost certainly slide past each other during the make/break process, and this is where the heartache of mutually exclusive goals begins. e rst pair of contradictory goals is that minimizing the contact resistance requires the contacts in plug and socket to meet with high force, but that then makes the plug too di cult to insert or remove from its mating socket. For plugs/sockets that are only infrequently mated—such as for a dryer or electric range—straight blades in the plug that must force apart curved leaf-spring contacts in the socket are acceptable, despite requiring 10 kg or more of force to mate in the case of dryer and range interconnects.

An AC charging station port on an EV handles a similar maximum amount of power to an electric range (i.e. 240 VAC / 50 A), but requiring a similar 40+ pounds of force to insert the plug into its charging port would not be welcomed by any EV owner (to say nothing of the fact that the combo would wear out a er 100 or so uses). One practical solution is to use round pins that mate with sockets that are

It’s perhaps less well appreciated that contacts designed for high current can become progressively more resistive from repeatedly making/breaking under no-load conditions (aka “dry switching”).Eaton’s ‘Breaktor’ device for EVs combines the high-voltage protection device functions of fuses, pyro switches and contactors into a single coordinated device Image courtesy of Eaton

a cylindrical hyperboloid in shape (strongly resembling a “Chinese nger trap”), as this will achieve a much higher total contact area between each pin and socket, while requiring even less insertion/removal force. A cylindrical hyperboloid socket is much more expensive to manufacture, of course, but this is a case in which the less expensive solution—straight blade interconnects—is simply unworkable, rather than merely not as good.

To continue the theme of tradeo s, improving the mechanical and/or corrosion-resistance properties of a contact material tends to come at the expense of lower conductivity, so it is very common to make the contact out of one metal or alloy, and then plate another metal/alloy onto it. For contacts that can be protected from the atmosphere (e.g. inside a sealed contactor), the emphasis can shi from achieving the highest corrosion resistance to minimizing both metal transfer from arcing and contact resistance, but the contacts in the plugs and sockets of EV charging stations must contend with all three requirements: good corrosion resistance; good mechanical fatigue and wear properties; and low contact resistance (albeit with less need to minimize material transfer from arcing…or that should be the case, anyway).

e highest conductivity (aka lowest bulk resistivity) is obtained with silver, of course, but the best corrosion resistance is obtained with the platinum group metals, or gold. While silver can be a good choice of contact material inside of a sealed contactor, or for bolted-together connections (such as

bus bars), it too readily forms oxides/sul des (aka tarnish or patina) if exposed to the atmosphere/pollution, and it is also quite a so metal in its pure form, so it wears poorly and tends to deform, rather than spring back, from impact, meaning it’s not the best choice, whether contacts come together directly or slide past each other. Alloying silver with copper greatly improves the mechanical properties compared to either pure metal, but then the conductivity drops below that of pure copper (around 92% IACS for sterling silver). Of the platinum group metals, palladium is most commonly used both in alloys and as a plating for contacts, as it has excellent corrosion resistance and decent hardness without being too brittle, making it a preferred choice for sliding contacts. On the minus side, its conductivity is much worse than that of pure copper (16% IACS) and it is exceptionally expensive, of course. Rhodium has better conductivity than palladium (about 38% IACS), and is much harder as well (about 3x to 4x), but that also means it is more brittle, so perhaps it’s an even better choice for sliding contacts, rather than those that meet with considerable impact force.

e nal consideration is operational and environmental safety, which mainly consists of not exposing live conductors, if applicable, and not catching on re due to overload, an external ignition source, arcing, etc. e latter objective can be met by only using materials which are non-combustible and which won’t melt at too low a temperature. Operational safety can be much more di cult to achieve for interconnects that are handled by a person, like the charging plug for an EV fast charger, compared to devices located inside a charger or inverter, such as a contactor or a fuse. A decent—if not foolproof—solution is to simply shield the contacts on the live side of an interconnect in two dimensions (so that sliding along the third axis is still

possible). is is the strategy employed by every electrical outlet found in the home, a er all, and though it has arguably stood the test of time, it is still possible to stick a foreign object into the outlet terminals, or only partially insert the plug into the outlet, thereby exposing the live circuit to a child’s (or a fool’s) ngers. Consequently, a more thorough solution is to use retractable shutters over the pins, sockets, or both, which automatically retract upon insertion of the plug into its receptacle.

Lastly, the means by which wires are terminated into their respective contacts is critical to overall safety (and e ciency). At low currents, a spring-cage, or “screwless,” clamp is a very reliable solution, as the spring ensures that the wire strands are pressed against the terminal cage despite vibration or cold- ow displacement of the copper. Screw clamps are used at current levels from a few amps up to around 10 or so, because they can apply far more compressive force for a given housing volume. From 10 amps to several hundred, crimping a lug onto a stranded wire cable is the termination of choice, as it has the lowest possible resistance, good resistance to vibration, and good to excellent corrosion resistance. For extra longevity and corrosion resistance, lugs can be lled with dielectric grease before inserting the cable and crimping it. e grease is forced out from every interface between the cable wires and the lug wall, e ectively sealing o the crimped area from air, liquids, etc. Much the same would be accomplished by soldering the cable into the lug, but that is never done—at least not for cables that will be subjected to exing or vibration—because the solder causes embrittlement and fatigue cracking of both itself and the copper wires over time. De nitely not something you want happening to a DC fast charger cable carrying a few hundred amps!

Two solutions often employed in higher-voltage disconnects are magnetic blowouts and filling a sealed contactor with sulfur hexafluoride, a gas with a dielectric strength approximately 2.5 times higher than air.Sensata Technologies’ GXC and MXC series of smart contactors Image courtesy of Sensata Technologies

By Tom Lombardo

By Tom Lombardo

Batteries represent nearly one third of the total price of a typical EV, and there’s a push to get that down to 20% or less by the end of this decade. In an e ort to lower costs and accelerate production, the EV industry has been searching for ways to make the assembly process more e cient and to decrease the time it takes to create a battery assembly line. New highly-automated battery assembly lines usually take months to develop. Can that be accelerated?

In 2020, precision automation company DWFritz needed to develop a complex battery production line for a leading North American battery manufacturer. e requirements included high speeds, a tight footprint and an accelerated development time.

Considering the complexity of the project and the short development time, DWFritz decided to form a strategic partnership with automation supplier Bosch Rexroth. Together, the two companies operated in a concurrent engineering environment, allowing for rapid design iteration

and accelerated execution.

“In the past, we would have used several di erent suppliers,” explained DWFritz President Mukesh Dulani, “but just to start the collaboration between di erent suppliers, in this case, would have taken us at least 10 to 15 weeks. For this project, we only had 12 weeks of design and engineering time and 8 weeks for procurement, so we had to work with a partner like Bosch Rexroth who could supply the technology and the engineering support for us to be successful.”

No matter the cell size or form factor, battery manufacturing is a complex, multistep process that brings together dissimilar materials to form the battery’s cathode and anode, then combines them with the insulator into a nished package.

“ e line had to operate at very high speeds,” said DWFritz VP of Sales Chris Povich. “Space was also a challenge. Even though the line is more than a hundred feet long, it had to be designed to t into a very tight

footprint. And the motion platform had to handle very robust motion-control demands—one system alone had in excess of 50 axes of motion.”

Together, the two partners say they managed to create a new battery manufacturing line that met the client’s requirements and set a new benchmark for building out production capacity.

To learn some tips for creating new production lines quickly, Charged recently chatted with Bosch Rexroth’s Mark Ziencina.

Q Charged: With all the new activity and incentives for local production in EV manufacturing, demand must be pretty high for your automation expertise.

A Mark Ziencina: e demand is absolutely incredible. I’m the Vertical Manager for Battery and EV at Bosch Rexroth, the automation division of Bosch. I have 28 years of factory automation experience in components and capital equipment, and what we’re experiencing now is through the roof. Our group specializes in solutions for the battery and EV segments, drawing from our past experience with battery technology and working with a variety of partners and customers in the battery and EV markets.

e challenge is to keep up with the demand, and I’m not even talking about the chip shortages and other supply chain issues. Everyone agrees that globally, this market is going to be growing at about a 23% compound annual growth rate. However, in North America, we see it growing a lot faster than this, because we’re trying to catch up with China and other Asian countries who jumped into the market early.

With all the incentives and new requirements, as well as all the money pouring into the EV market, everybody

needs equipment now. Everybody wants batteries. ey all want it at the same time. So, it’s a good problem to have, and with enough experience you can learn how to get it done with available resources.

Q Charged: Rexroth recently published a case study about its partnership with DWFritz, detailing how you were able to cut time to implementation for new cell production. What do you think are the most important tips to accelerate time to market?

A Mark Ziencina: DWFritz was looking for an automation supplier for that cell project that had all of the various solutions that they needed, such as material transfer conveyors, Cartesian systems, and linear actuators that had high precision, extreme reliability, and the ability to work in cell assembly environments. ey were also looking to execute the project in a very short time frame, as opposed to the standard 12-month execution time.

ey chose us, and we became an extension of their engineering department. Our applications engineers worked side-by-side with their design engineers to shrink the design time through concurrent engineering, multiple iterations, and a lot of back and forth.

Tip #1: Limit the number of strategic partners and suppliers to form a small group with experience operating in a concurrent engineering environment to allow for rapid design iteration and accelerated project execution.

Tip #2: Use a digital twin design that allows you to test the systems while you’re waiting for the hardware to arrive and be installed.

For all of these manufacturers, time to market is critical right now. Partnering with the right equipment builder and the right automation supplier will help to meet those goals, as opposed to managing a basket of di erent suppliers who do not have the holistic view of the project and may or may not have the depth of experience in these applications and processes.

On this project, a completely virtual development environment enabled the team to create a digital twin of the communication platform between Manufacturing Execution System (MES), the so ware that runs manufacturing operations in a factory, and automation controllers, saving an enormous amount of time.

Q Charged: How did the footprint requirements of the manufacturing line a ect the development time?

A Mark Ziencina: Small footprints can create a lot of challenges that delay design time if the team doesn’t have the right experience. For example, we used our MTpro layout so ware to design conveyors that t into the tight machine footprint and also provided the machine-to-machine connection. In some instances, the machine was so jammed with automation—40 to 50 axes of motion in one frame—that there was not enough space for a control enclosure to t all of the drives. So, we went with our cabinet-less technology, which has motors with onboard servo drives, to eliminate the need for a huge box full of servos. Everything was distributed throughout, which facilitated a more compact system.

Q Charged: In terms of length of the projects, what has been the historical development time for a standard cell line, and what is the industry pushing towards now?

A Mark Ziencina: Depending on the complexity of the project, typically, it was 12 to 14 months to execute an entire line, maybe a year and a half. Now everyone wants to

Tip #3: Use an open machine control architecture that allows real-time data access and machine-to-machine communication. This keeps all of the production modules in sync and allows operators to monitor and control the processes.

shrink this down to 6 to 8 months or less. So the challenge is, what can we pull from our past experience? What modules and solutions do we have in our product portfolio that could shrink that design time?

We work on the design side as well to o oad that from the customer’s and the manufacturer’s plates. Drawing from our knowledge of cell, module and pack assembly applications, we choose solutions, customize them for the particular product, and shrink that down.

We also pool all of the raw materials required for our products. We can closely estimate how many conveyors, for example, will be required for a project and have them in stock so we’re not waiting on parts. So, while the design is still ongoing, we bring in the materials, and then as soon

Tip #4: Work with automation and equipment suppliers during the product design stage to address the subtle design details that affect the assembly development process.

as the design is complete, we can start sending the nal drawings to the manufacturing oor. We do everything we can to shrink the design window and the production execution window by working very closely with the customer.

Q Charged: What are the most common material bottlenecks that typically delay a project?

A Mark Ziencina: Everything is in short supply—even small

Multiphysics simulation helps in the development of innovative battery technology by providing insight into mechanisms that impact battery operation, safety, and durability. The ability to run virtual experiments based on multiphysics models, from the detailed cell structure to battery pack scale, helps you make accurate predictions of real-world battery performance.

» comsol.com/feature/battery-design-innovation

Tip #5: Choose suppliers that are well-versed in multiple open-protocol technologies and customizable offthe-shelf modules. This allows users to write their own application-specific modules, avoids the need to design everything from scratch, and provides the ability to reuse the modules in future product lines.

things like T-nuts for aluminum framing. But most commonly, it’s the chip shortage that’s really impacting all the automation suppliers. Lead times on motor controllers can be 12 months or more. Worldwide, there is no manufacturing sector that is isolated from the chip shortage. Preparing, planning ahead, and reserving that capacity ahead of time is key, because it can really impact the installation and ramp up of these new lines and new capacity.

Q Charged: What other factors are important to assure a successful execution?

A Mark Ziencina: It’s really important to pick reputable suppliers that have a global footprint and a local presence, plus experience in the battery manufacturing

space. Additionally, experience with standardization to open protocols is key because you have to bring many solutions under the same umbrella. is assures compatibility without tying you to one particular supplier. ere are so many manufacturers with di erent platforms for control architectures, and every manufacturer tries to lock their customers into their speci c ecosystem. We went directly against that with our ctrlX open architecture controller design, for example, which can be programmed in any of the common languages. It’s compatible with anyone’s products. It includes apps that users can write themselves, so they’re not locked into a certain programming environment. You don’t have to nd specialists who know a speci c language or development platform—you can get programmers to program in Python, C/C++, Java, or whatever they like, to get the entire automation executed. Our controls directly communicate all the way up to the MES. It’s important to pick the right architecture and standardize so you don’t have to support and stock a lot of di erent products.

Tip #6: Use Industry 4.0 technology such as smart sensors, vision algorithms and component tracking systems to perform inspections throughout the assembly process.

This helps to pinpoint problematic areas and provides upstream feedback that can bring about production line changes to account for incoming material variability, precision assembly tolerances and high-throughput demands.

Learn more Considering the extent of current e orts to ramp up EV production capabilities and source battery components made in North America, we can expect to see a number of manufacturers trying to fast-track their assembly lines.

ey may want to take a lesson from the DWFritz/Bosch Rexoth partnership.

ese two companies recently presented at the 2022 Charged Virtual Conference on EV Engineering. To learn more about the project, check out the webinar recording.

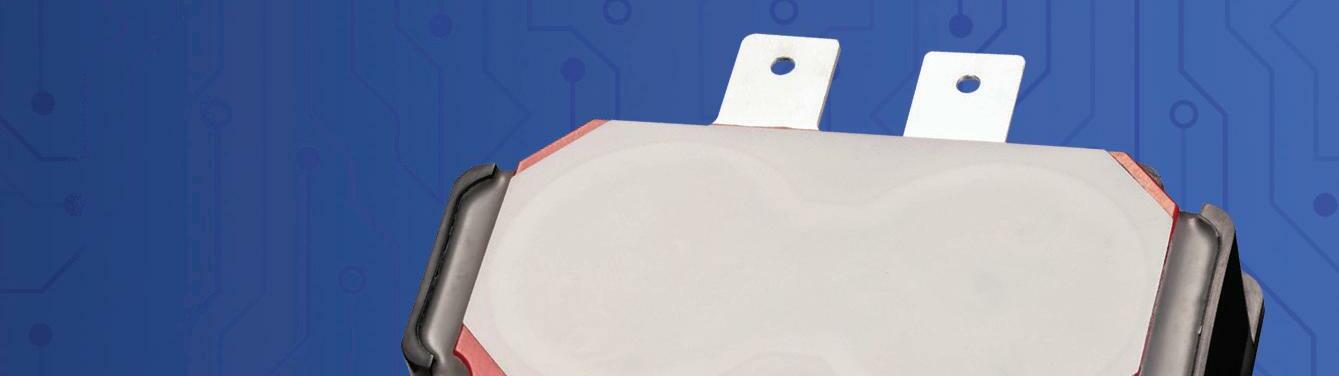

Battery disconnect unit featuring Breaktor®

Power levels in electric vehicles are increasing. EVs need to drive farther and charge faster. What does this mean for system safety? Expertise is critical when managing, distributing and protecting electrical systems. Eaton’s advanced battery disconnect units (BDUs) feature integrated Breaktor® circuit protection technology, enabling EV manufacturers around the globe deliver the safest vehicle systems possible.

Because that’s what matters.

Learn more at: Eaton.com/eMobility

We make what matters work.

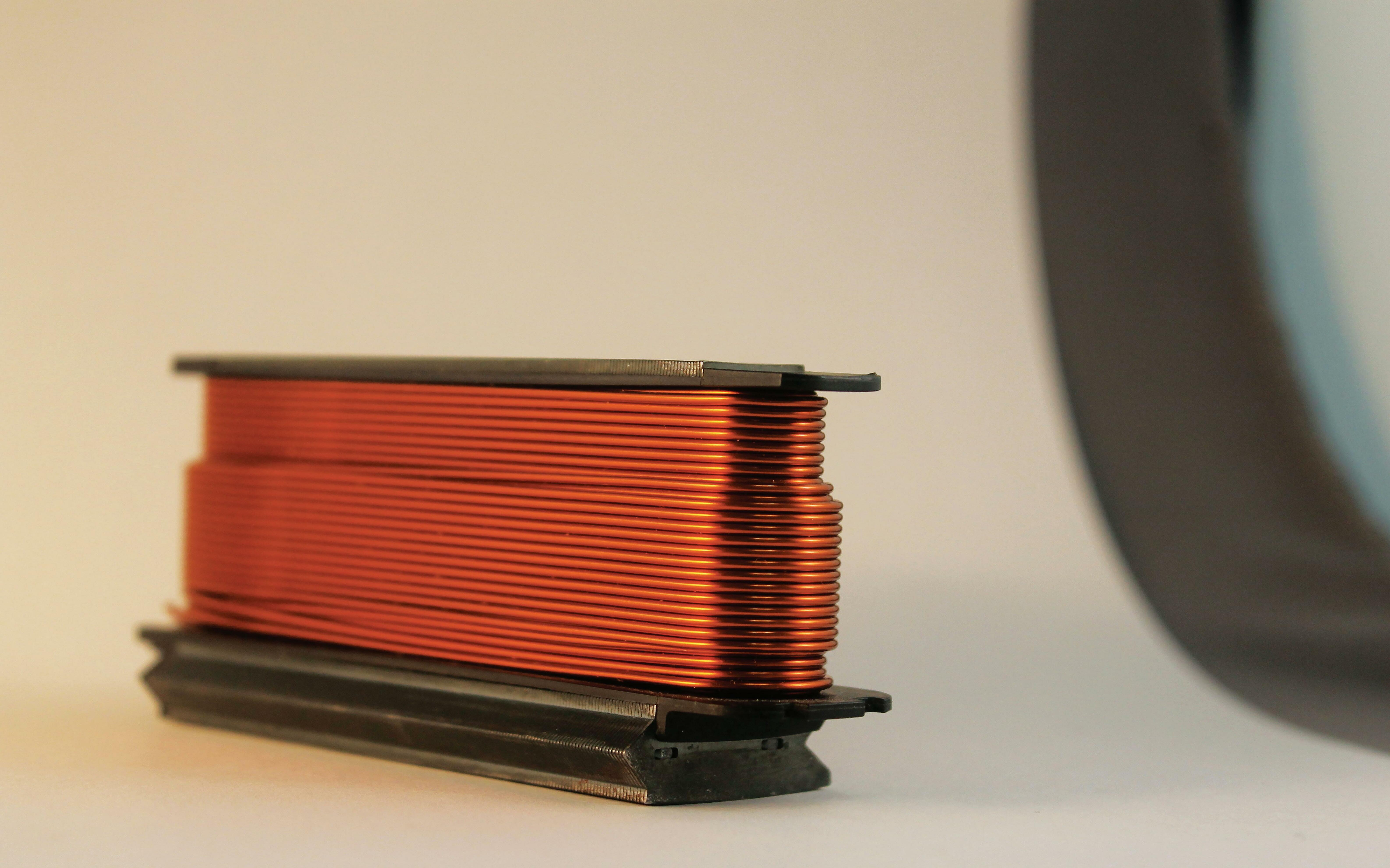

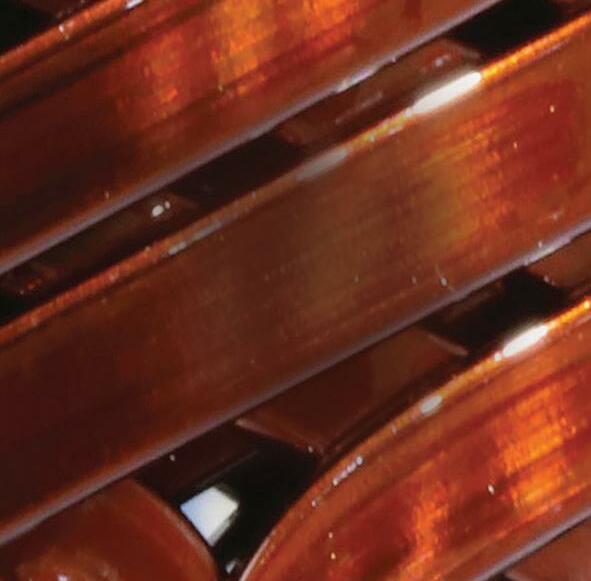

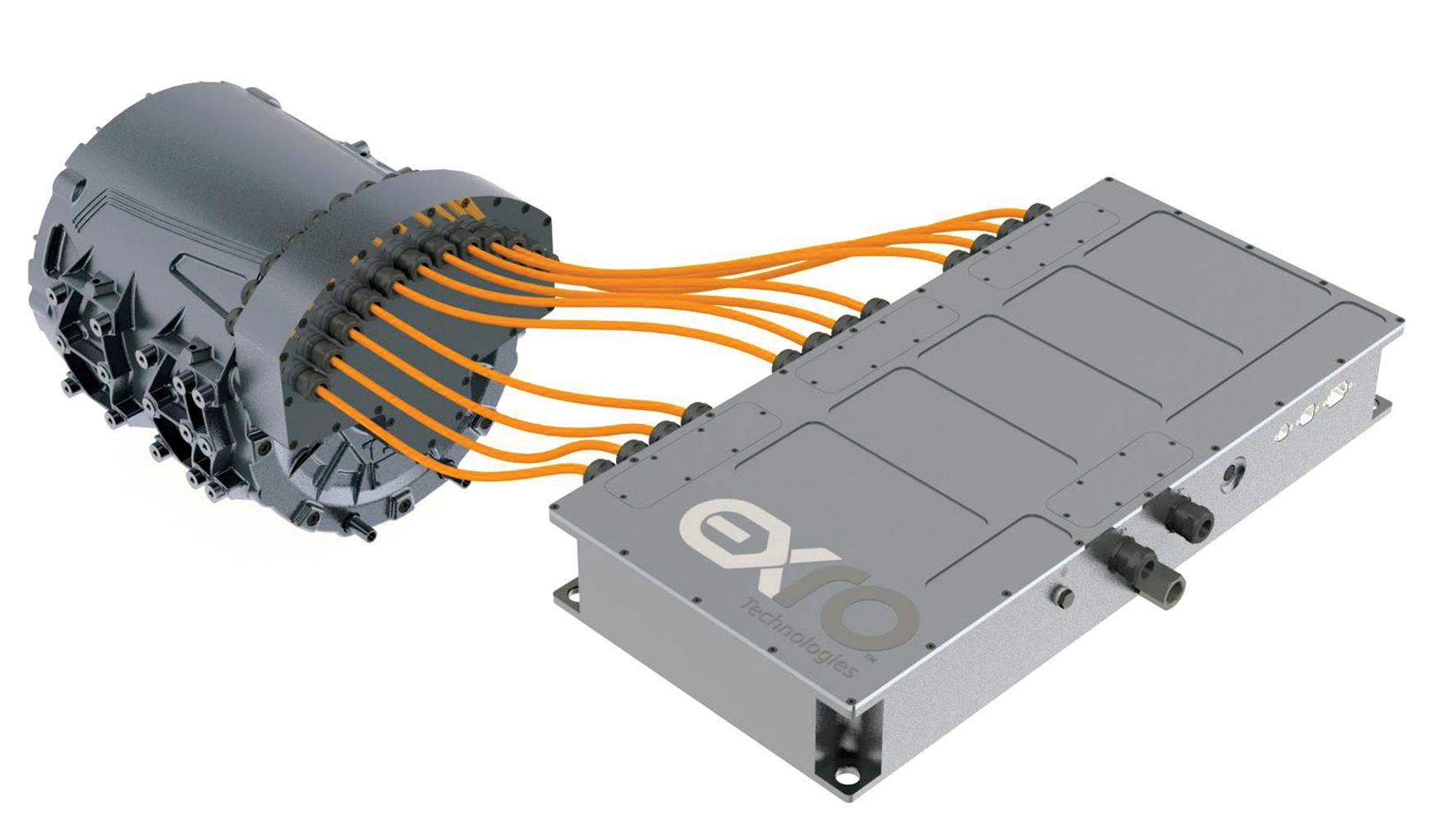

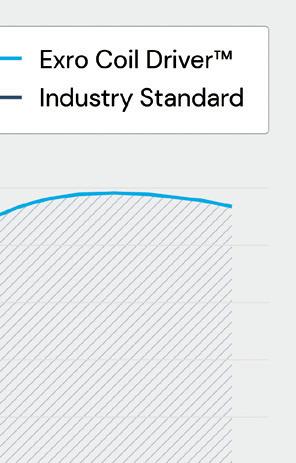

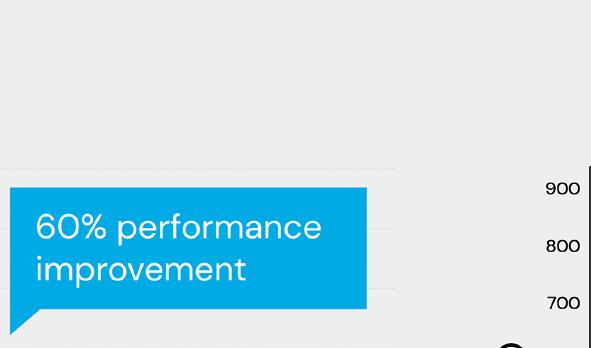

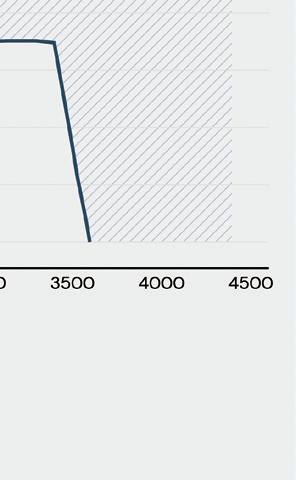

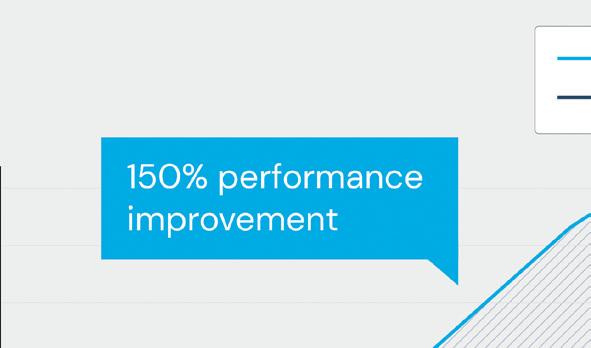

Engineers are always looking for cost-e ective ways to get the most range out of an electric vehicle’s battery pack. Exro Technologies is triangulating on a solution with three core concepts: motor control, battery charging and powertrain optimization. Exro’s patented Coil Driver technology took home the Gold in the 2022 Edison Best New Product Awards in manufacturing, logistics and transportation. e original idea has now launched its own spin-o technology that enabled fast AC charging, eliminating the vehicle’s onboard charger and facilitating vehicle-to-everything (V2X) capabilities.

Exro’s newest partners include Vicinity Motor Corporation, which is piloting Exro’s high-voltage Coil Driver in its Lightning eBus, and evTS, which will use Exro’s low-voltage Coil Driver starting in 2023. Exro has innovation and manufacturing centers in Calgary, Phoenix and Ann Arbor, and a growing list of partners and products.

Charged recently chatted with Josh Sobil, Exro’s Chief Commercial O cer, to learn more about the company’s technology, its history and its vision for the future.

Q Charged: Exro started with an idea for a unique motor control system. Can you tell us how it works?

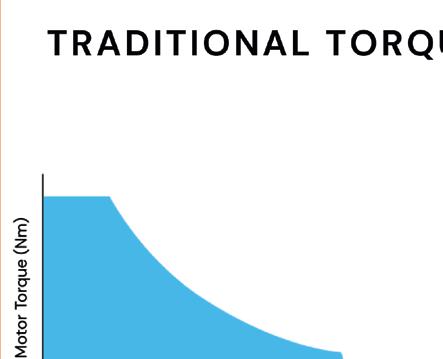

A Josh Sobil: Electric motors are designed to deliver either high torque or high speed, depending on the way in which

the coil windings are con gured. Applications that need both torque and speed usually require either a motor/gearbox combination or more than one motor, adding weight, cost and complexity to the system. Exro’s core technology is a unique motor control system, the Coil Driver, in which the motor coils are wound so that they can be recon gured on the y to e ciently provide the requisite torque or speed, without the need for a gearbox or multiple motors. e theory behind the Coil Driver is the ability to drive the machine in two di erent con gurations. You can start the machine in a series con guration, which provides a high current density and a very high torque. en it can switch to a parallel situation, which reduces the impedance of the coils and delivers more power while maintaining the motor’s e ciency. e key advantage is the ability to expand that e ciency map or that torque envelope, and get more out of the same frame, so we can reduce the machine’s cost and improve its performance. e Coil Driver gives the engineer another option to tweak the design of the powertrain and get more out of the machine.

ere are cases where we use smaller machines to get the same amount of power and torque that’s required out of a given drive cycle, or we get rid of components like the twospeed gearbox in applications that only need a low gear to provide ve to ten seconds of very high starting torque. We see a lot of that in the commercial vehicle space. Any time you can remove components and improve e ciency, it’s an advantage to our customers [because] they can either reduce the size of the battery or remove other components that might be more costly.

Exro Technologies is building a future in which an EV’s motor, drive, gearing and AC charging system are integrated into one highly compact and efficient system.

You can start the machine in a series confi guration, which provides a high current density and a very high torque. Then it can switch to a parallel situation, which reduces the impedance of the coils and delivers more power while maintaining the motor’s effi ciency.

“ ”

A Josh Sobil: It shi s in about ten milliseconds. We have noticed a little kick, but in a commercial vehicle or a car, it wouldn’t even register because the inertia would just absorb it. On a motorcycle or something small, there might be a little kick, but we can program it so you don’t feel it.

at’s part of our secret sauce—the ability to switch very quickly without a torque interruption, especially in commercial vehicle applications. Having a torque interruption is quite a big deal because you’ve got so much inertia to overcome. Anytime you’re on a hill and you interrupt the torque it’s just more work that you have to do, and more stress and strain on the actual system. So, the faster you can switch, the more advantageous it is.

Q Charged: Where did the Coil Driver idea come from? What’s the history behind it?

A Josh Sobil: It’s kind of your classic startup story. e founder, Jonathan Richie, was a garage inventor, as they say, with an interest in wind power. He was looking at the fact that windmills generated power at various torques and speeds, only a few of which would be at the optimal setting. At one time, it might only be working at 85% e ciency, versus 96% e ciency at exactly the right load. So he thought, “If I could change the circuit inside the machine [on the y] then maybe I could get di erent operating

points to have higher e ciencies [across the whole operating curve]. If I could start to meld those together, then I could see an overall increase in generator e ciency.”

As a startup in a garage, the challenge was breaking into a wind generation market that’s working with megawatt-level machines. Designing products for that market was prohibitive from the start. at’s not to say that it’s not a good use case—I think it will be, but there was also an EV market opportunity that was building. An EV motor has a pro le where, if you look at a machine’s torque curve and then plot all of the operating points that an EV actually operates under, it almost lls the entire torque map. So we determined that this is probably a more accessible market, just from a commercialization standpoint. For example, we could design a hundred-kilowatt inverter for an o -highway application, which is a lot less stringent than even an automotive application or a wind power application. So there are ways to get into the

Q Charged: Can you feel the shi when you switch the topology of the drive, like shi ing gears?Images courtesy of Exro Technologies

EV market, although the barriers to entry are absolutely massive. We’re looking to our partners to help bring us into the bigger automotive sector.

Q Charged: ere must be a cost-bene t analysis that you work through with the di erent applications, like o -highway or commercial trucks. What’s the main application that you’re working on right now?

A Josh Sobil: We’re looking at urban and highway applications, which require a very high peak e ciency across the entire operating range—what’s called an e ciency island—and that’s exactly what the technology does. So if the vehicle is operating at low speed, we can deliver the torque to get started, maybe to climb a very steep incline. at might provide a new route that a garbage truck can take in the city, improving the e ciency of the overall operation. And there’s an expansion of that curve so that the e ciency is better at highway speeds as well. at’s de nitely where we see the Coil Driver shine. ere are applications that require a lot of torque down low, but they also need power at highway speeds. at’s a very typical trade-o in any electric machine. A gearbox gives high torque, but it can’t increase power. So we’ve seen a lot of interest in the o -highway sector, and even in

motorcycles, which need a lot of power at the high end, but also want to be light. e powertrain is a key component of the vehicle’s weight—the battery and the motor are going to be very heavy components. If we can lightweight the motor and still deliver the power and torque, then it’s a good application. We’re also working with partners in the passenger car sector. By removing the onboard charger and integrating three-in-one con gurations, we’re reducing both cost and weight. And that’s what we’ve seen the OEMs wanting. When you show an e ciency bene t, they’re going to ask,

We’re looking at urban and highway applications, which require a very high peak effi ciency across the entire operating range—what’s called an effi ciency island—and that’s exactly what the technology does.

“ ”

“How much smaller can I make my battery?” at’s the dollar factor that they’re going to apply.

Q Charged: You mentioned removing the onboard charger. How does Exro’s technology a ect battery charge control?

A Josh Sobil: at feature was a byproduct of the way the topology was built up. What’s interesting is the ability to do this with an AC frequency, so you don’t need a DC supply to charge quickly. If you have a very high continuous power that you can send through the powertrain, you can charge at a considerably higher power than what you might get out of a DC fast charger. It’s something that we’ve been testing and proving out, and we’re expecting to release it in our second generation of drives. We’ve now got a patent pending for the ability to charge through the Coil Driver.

All of our high-voltage products can accept this, so you could use it in a passenger vehicle as well. We’ve demonstrated charging above 20 kW right now, just with the standard Coil Driver. Once we move to the higher powers, then we have continuous power ratings up into the hundreds of kilowatts, so this is something you could put on a passenger car. You would need to look at the infrastructure and ensure that the plug was appropriate, but it would replace the EV’s onboard charger.

E ectively we’re using the drive itself as the onboard charger. It’s a four-quadrant drive, so we can run power in both directions. e same way you would regenerate while you’re braking, you can convert AC power to DC power through the drive. And that’s fundamentally all we’re doing. An inductive component is needed to do that, so we use the motor’s inductance.

Q Charged: Why doesn’t everyone design a motor drive that can also be used as the onboard charger?

A Josh Sobil: Good question. Fundamentally, because the motor would produce torque, so you can’t use the machine unless it produces no torque. If you were to apply the current through a typical motor, it would naturally start turning. With the Coil Driver, since we can control the individual coils, we apply the current in an opposing fashion, so the torque cancels itself inside the machine. You have to make sure to cool the drive,

obviously, because you’re going to have current and you’re going to have losses, but those are the main di erences.

And I should also [point out that] there are others that have looked at doing this with a six-phase drive by opposing three of the phases. So we’re not the only ones that can do this, but it’s an added feature to what we’ve been able to do with just the topology of the drive itself and the way that we connect it to the machine. We don’t change anything in the drive, and fundamentally a drive can connect as a recti er in that same way, but it’s the way that we connect that allows us to produce zero torque out of the machine. at’s a native advantage to the technology that, in all honesty, we realized a bit a er the fact. We were focused on the torque envelope and e ciency and then we thought, “ ere’s discussion out there about using the drive as a charger, so could we use this?” So we made sure it worked and about a year ago we applied for the patent. Now it’s becoming a focal point because it’s a huge cost-saving feature.

Powertrain optimization Exro o ers engineering services to help its customers design or modify motors to accommodate its Coil Driver technology. e company provides a co-development platform to customize inverter controls that reduce the need for multiple motors and/or gearboxes and optimize battery usage.

Q Charged: So when you call it a three-in-one system, what three components are you referring to exactly?

Effectively we’re using the drive itself as the onboard charger. It’s a four-quadrant drive, so we can run power in both directions. The same way you would regenerate while you’re braking, you can convert AC power to DC power through the drive.

“ ”

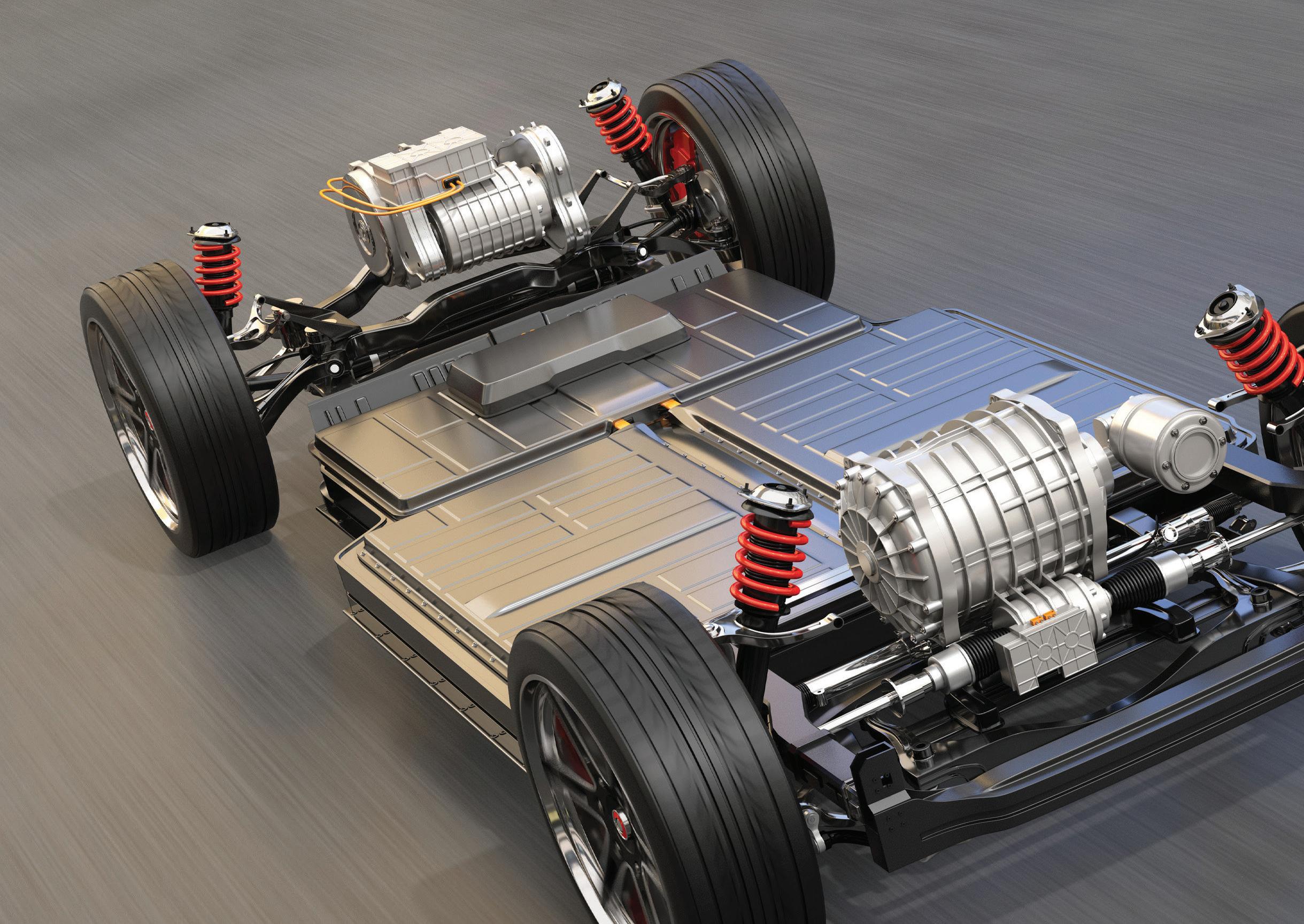

A Josh Sobil: e term three-in-one system refers to the drive, motor and gearing as an integrated drive unit. ey’re known as e-axles or integrated drive units on the automotive side. And then you can imagine how much more compact it is without the charger, so you can do everything with that integrated drive system. at’s our vision—our roadmap for the future is really around being able to integrate everything in the EV’s powertrain. Trying to lightweight, downsize and make everything more compact at a system level has a desirable impact on cost.

Q Charged: Suppose you’re talking to a potential customer and they just want to increase the e ciency of an electric garbage truck. As a general example, how would you estimate the potential e ciency gains with your Coil Driver system?

A Josh Sobil: What we’ve been simulating—and it obviously depends on the drive cycle a little bit—shows that commercial trucks tend to have around a 3-4% range increase. If you can remove 4% of a 200 kWh battery, at $135 a kilowatt-hour, then you’re saving roughly $1,000. Or you can keep the same size battery and get 4% more range at no extra cost.

We’ll be starting some real-world drive cycle testing this winter. We’re excited about that. It’s coming with one of our partners for an e-axle on a commercial truck.

Q Charged: So, you have the custom power electronics design and you couple that with a custom-wound motor. Will you always supply that combination as a package?

A Josh Sobil: Depending on the customer, yes, we’ll sell it as a system. Some customers will design their own machine and we will couple the inverter to their motor.

Fundamentally, we are not a motor manufacturer, but the technology requires that in some cases we have a machine to sell. We are not changing the magnetic design of the machine—we’re changing the way we connect to its coil groupings. It’s more of a mechanical interface for the cables. e drive itself just replaces a standard inverter, but what you would see are twelve connections—four per phase—going into the machine.

Q Charged: e fundamental hardware di erence is that you have an inverter with a lot more switches than a standard one, right?

A Josh Sobil: Exactly. We’re still using standard switching devices—the topology of the drive is what’s di erent. e circuit is unlike any other drive that’s out there because we’re driving individual coils, so it doesn’t look like a typical three-phase drive. But we still use silicon carbide (SiC) devices. In our high-voltage inverter, we’re using a standard PCB design and manufacturing methods. Eventually, we’ll get to a bare die construction on the drives.

Q Charged: What phase of commercialization are you in now? What are the next steps for Exro?

A Josh Sobil: Right now, we’re in our launch phase starting in ‘23. We have some early partners that have placed orders for equipment. ey want to see samples at the end of this year so they can start to validate into the next year. We’re building a drive manufacturing facility in Calgary and plan to produce drives for commercial and o -highway applications by the third or fourth quarter of next year.

A Josh Sobil: Fundamentally, the company is focused, obsessed and passionate about power electronics. We are also working on ways to optimize power on the battery side. We’ve developed a battery control system that manages individual cells, very similar to managing individual coils, so it’s taking that granular philosophy and transferring it over to the storage side. It’s in our R&D pipeline, and we’re going through the UL approval process on that storage unit.

Q Charged: Do you have any other products in addition to Coil Driver?

The circuit is unlike any other drive that’s out there because we’re driving individual coils, so it doesn’t look like a typical threephase drive.

“ ”

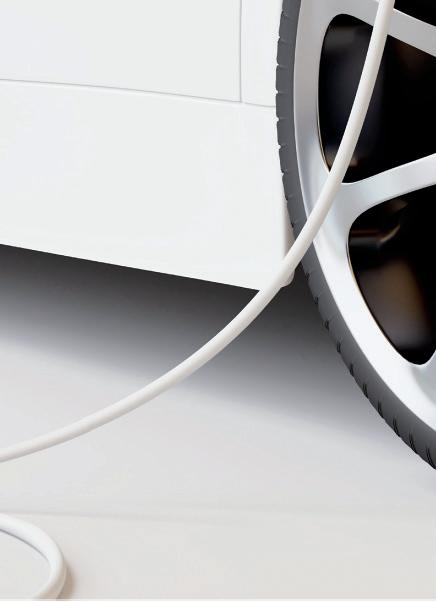

Amazon is moving full speed ahead to electrify its European vehicle eet. e delivery diva will invest a billion euros ($975 million) over the next ve years in electric vans, trucks and low-emission package hubs in Europe.

Amazon said the plan is to expand its electric van eet in Europe from the current 3,000 vehicles to over 10,000 by 2025, but didn’t say what percentage of its last-mile delivery eet those gures represent.

e company also hopes to purchase some 1,500 heavy-duty electric trucks (such as the Tesla Semi, Freightliner eCascadia or Volvo VNR Electric) to move goods between ports and logistics centers.

Amazon didn’t say what brands of EVs it’s looking at, but it has ordered 100,000 electric delivery vans from Rivian, and a few of these have been spotted on the streets making deliveries. e retail leviathan has also ordered EVs from Mercedes, Lion Electric and Volvo.

In addition to purchasing new vehicles, the online octopus will deploy thousands of additional EV chargers at European facilities, and will double the size of its European network of “micro-mobility” hubs. Amazon currently makes deliveries via electric cargo bikes or on foot, using centrally located hubs in 20 European cities.

Bollinger Motors (now a subsidiary of Mullen Automotive) has teamed up with truck body and trailer manufacturer Wabash to develop a refrigerated truck body on an electric chassis.

Wabash has developed a lightweight composite technology called EcoNex Technology, which it says will seamlessly integrate with Bollinger’s Class 4 electric chassis cab and deliver signi cant weight savings, leading to increased payload capacity and lower costs.

EcoNex is made with a high-e ciency foam core, encapsulated in a polymer ber-reinforced shell and a protective gel coat. Wabash says it can boost thermal performance by up to 30%, while reducing weight by up to 20%, and that the structural strength eliminates the need for metal or wood.

“Wabash’s EcoNex composite technology reduces the amount of electricity needed to maintain cold temperatures,” said Mark Ehrlich, VP of New Business Development at Wabash. “ e all-electric truck we’re developing with Bollinger Motors will be highly e cient, with more uptime and less charging compared to conventional construction.”

“I’m excited to help green up the journey from farm to table,” said Robert Bollinger, founder and CEO of Bollinger Motors, who was inspired to start the company while he owned a farm in upstate New York.

Amazon to invest a billion euros to electrify its fleet in EuropeImage courtesy of Amazon Image courtesy of Bollinger Motors

e European Commission has agreed to set a zero-emission sales mandate for new cars and vans by 2035. As the average age of passenger cars in the EU is just under 12 years, this policy should put the bloc on track to reach the target of converting its eet to zero-emission-only by 2050, the date by which capitals have agreed to be net-zero. Separate legislation covering CO2 standards for trucks and heavy vehicles is on the agenda for next year.

“ e agreement…sends a strong signal to industry and consumers: Europe is embracing the shi to zero-emission mobility,” said EU Green Deal Chief Frans Timmermans.

Politico expressed surprise that the decision was reached so easily. “Previous EU e orts to regulate incremental improvements in vehicle fuel e ciency standards dragged on for years, with acrimonious lobbying and demands for exemptions and special conditions. is time around, it’s taken just over 15 months since the legislation was presented in July last year to nalize the 2035 phaseout target.”

“ ere is a huge consensus” within the car sector that it’s time to move, one industry executive told Politico. “Nobody is questioning that there needs to be an increase in the targets…Instead it’s just the how and when.” is doesn’t mean there was no wrangling: France lobbied to exempt plug-in hybrids from the ban; Italy sought to protect its luxury supercars; Renault, BMW and Volkswagen said they need more time; and Hungary, Italy, Romania and Slovakia, along with Germany’s Free Democratic party, pushed for a loophole that would allow sales of vehicles running on e-fuels to continue. In the end, these proposals were rejected, and a deal con rming the 2035 target was reached.

Critics of the mandate raised a number of concerns. Some quite rightly pointed out that making the 2035 target work will require massive investments in charging infrastructure and securing sources of raw materials. Others fear that, as ICE vehicles are phased out Europe, they’ll simply be shipped to developing countries.

Some opponents warned of various nightmare scenarios. German conservative MEP Jens Gieseke fears that the high prices of EVs might lead to a “Havana e ect,” saying, “A er 2035, our streets might become full of vintage cars, because new [electric] cars are not available or not a ordable.”

Other naysayers fear that the EU rules will bene t up-and-coming Chinese carmakers. At the recent Paris Motor Show, China-based brands such as BYD and Great Wall unveiled new EVs aimed squarely at the European market. With that issue in view, the Commission plans to take a lenient stance when it dra s new Euro 7 regulations that will cover non-carbon pollutants such as nitrogen oxides, ammonia and particulate matter.

Electrify America has launched a new brand-neutral marketing campaign titled “As Seen on EV.”