9 minute read

Rupert Resources: The benefits of aggressive drilling

Rupert Resources:

The benefits of aggressive drilling

Advertisement

by Jane Lockwood, Spotlight Mining

Aggressive spending on drilling during exploration is usually a good strategy for advancing a project quickly, and nowhere demonstrates that fact better than Rupert Resources’s (Rupert) (TSXv:RUP, OTCQX:RUPRF) almost 4 million oz (113.4 tonnes) Ikkari gold discovery in Finland. This project is remarkable not just for its size and quality, but also because the company took it from discovery to a maiden resource estimate in just 18 months, during a global pandemic, no less.

Rupert has consolidated a 595 km2 (229.73 mi2) land package in the Central Lapland Greenstone Belt, an area that only began to draw serious attention in 2009 with the opening of Agnico Eagle’s Kittila mine, now the largest primary gold producer in Europe. Since then, there has been something of a gold rush in the area, and Rupert has come out on top. Thomas Credland, Rupert’s Head of Corporate Development, explained the company’s early interest in the region:

‘Central Lapland already hosted a number of other orogenic gold and base metal deposits comparable to greenstone belts such as the Abitibi in Canada, Birimian of West Africa and Eastern Goldfields of Western Australia, but it was apparent that it was extremely immature in terms of exploration activity - probably 100 years behind.’

The entire area around Ikkari is a swamp with no outcrop, and beneath that is glacial till from the last ice age that overlies the bedrock to a depth of between 5–40 m (16.4–131.2 ft). This meant that there was no option but to drill on the site, in contrast to Kittila and Rupert’s other deposit in the region, Pahtavaara mine, which were both discovered in outcrop. Between 2017 and 2019, Rupert focused on characterizing their assets on a broad scale. Naturally, they employed geophysical methods to get a better picture of what lay under the ground but, most importantly, they stumped up the cash for percussion drilling down to the base of the glacial till and got geochemical analyses from the interface between the till and the bedrock. This was vital as it was the only way to really know what sort of rock was hiding under all that cover.

Thomas Credland explained that Rupert’s strategy in the area was guided by the discovery of Anglo American’s nearby polymetallic Sakatti deposit, which hosts the dizzying array of Ni-Cu-Co-PGE-Au-Ag mineralization. Base-of-till drilling was used to discover Sakatti, and Rupert took note of this success. The company also had a new geological model to work with, which suggested a 25 km (15.53 mi) regional structure underlay part of their property. Rupert geologists had identified a possible basin margin in the south-west of their land package, which was confirmed when they drilled sediments in that area, as opposed to volcanic rocks in the east of the property. The company performed ‘tram line’ drilling – two lines of sampling 100 m (328 ft) apart, covering a large area. They then followed up anomalous results with more closely-spaced holes, and the Ikkari resource was one of those.

At Ikkari, a single anomalous sample with 0.2 ppm gold was investigated with infill drilling on a 50 x 25 m (164 x 82 ft) grid, which turned up a cluster of samples with up to 1 ppm Au. At that stage, Rupert knew they had a significant geochemical anomaly on their hands, so from April 2020, they began focusing more drilling there. The first hole (hole 120038) intersected 54 m (177 ft) grading 1.5 g/t Au, and subsequent holes showed that the mineralized area was large, with an initial strike length of more than 500 m (1640 ft) and was also high-grade in parts. At Ikkari, 100% of holes to date have hit gold mineralization.

It quickly became clear that the feature controlling gold mineralization at Ikkari was the unconformity between the komatiite-dominant Savukoski Group and the sedimentary Kumpu Group. As COVID-19 shut down much of the world, Rupert took extensive health and safety precautions at their site and drilled on. In September 2021, just 18 months after Ikkari’s discovery, they were able to define an estimated mineral resource of 3.95 million oz (111.98 tonnes) for the deposit, with cut-off grades of 0.6 g/t Au for open pit mining and 1.2 g/t Au for underground.

Rupert has not slowed down after this major success and are now targeting their drilling efforts in a 60:40 ratio at Ikkari and other discoveries. News at the end of November announced grades from tighter drill spacing at Ikkari of up to 7.7 g/t Au over 30 m (98 ft), and at the satellite Heinä Central deposit, which was not included in the resource estimate, both high-grade copper and gold have been found over multiple intervals.

It’s clear from Rupert’s example that aggressive drilling from the start of an exploration campaign can pay off immensely. Thomas Credland said that investors understood the need for such an approach due to the lack of outcrop and the fact that the non-productive overhead of the program becomes proportionally bigger the fewer meters that are drilled, so other juniors looking to make substantial discoveries in fresh territory might want to take note. C

↑ Drilling is still ongoing at the property, with the company working to both expand and better define the resource ↑ Extensive drilling resulting in plenty of core has been the key to rapid resource estimation at Ikkari

For more information

Visit: www.rupertresources.com

Gold fever in Guyana

by Ian Foreman, Principal at Foremost Corporate Services

An exciting new gold player from Vancouver, Canada – Alerio Gold Corp. (Alerio) (ALE:CSE) – has recently acquired highly prospective gold projects in Guyana, South America. Guyana is a democratic state that is still a member of the Commonwealth and has English as its official language. It is a mining-friendly country with a government that has supported the mining industry on many levels for years. Guyana is known for its significant endowment of natural resources. Gold has historically accounted for a large 35% of the country’s exports, with production exceeding 625 000 oz (17.72 tonnes) in 2019.

The location of Alerio Gold’s Tassawini project situated in the Barama-Waini District, Guyana

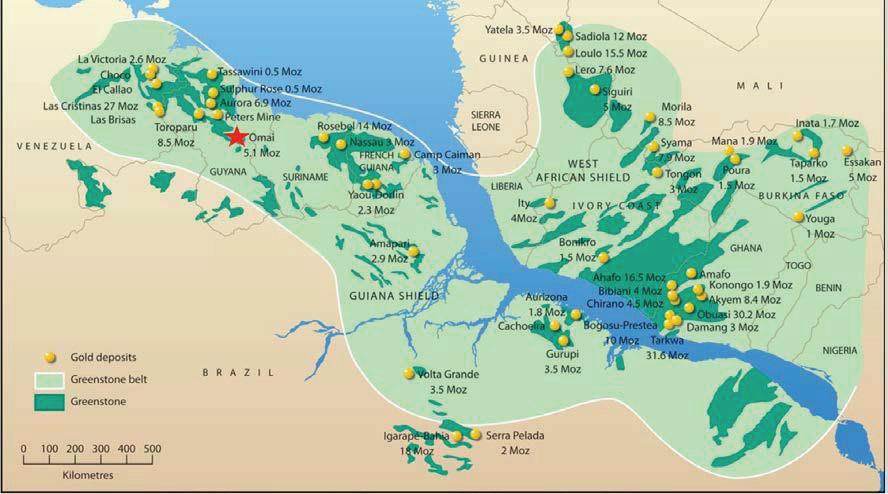

The mining sector has been a major piece of Guyana’s history, and its democratically elected government has long held a pro-mining stance, encouraging investment in the responsible extraction of natural resources through a stable Mining Act. Guyana is situated in the heart of the Guiana Shield — a 1.7-billion-year-old geological formation that shares much of its geological makeup with the West African Shield. Due to this interpreted tectonic relationship, many explorers are betting on the similar geological terrains known from decades of exploring and mining in the precious metals-rich West African Shield. Well-known players such as Newmont, Reunion, Troy, Omai Gold and G2 Goldfields have long since developed Guyana. The Guiana Shield has long been a target for prospectors and holds an estimated 140 million oz (≈ 3970 tonnes) of gold - the best-known deposit being the Aurora Mine with resources of over 6.9 million oz (≈ 195 tonnes) of gold. In addition, Omai Gold is once again a major part of this new resurgence of interest in Guyana with plans to re-establish the Omai gold mine.

The Tassawini Property

Alerio has recently secured the licenses for the Tassawini Gold Project in Guyana. The property has a historical resource estimate of 499 000 oz (14.15 tonnes) of gold. CAD 34 million has already been invested in exploration and development on the property, and current management is pushing progress to further expand exploration on a total of 1381 hectares of land with the medium-term goal of developing a producing mine. The infrastructure on site is very good as the project is located on a navigable river.

Historic exploration at the Tassawini Property concentrated on a core of gold targets that include Tassawini West, Tassawini South, Tassawini East, Black Ridge, Mine Creek and Sonne. There are in an excess of nine additional targets that have yet to be tested. Mineralized zones with reported true widths of 10 m (32.81 ft) to over 50 m (164 ft) have been defined by diamond drilling. Preferred host lithologies are highly deformed silica-invaded phyllite and black metamudstone. Gold mineralization occurs in or close to the contacts with the intrusive units. In most cases, the mineralized envelopes dip between 45° and 75° to the north and northwest, and plunge at an average of 15° to 25° towards the southwest. However, at Tassawini South, the mineralized envelopes are nearly horizontal as they are controlled by the contacts with the intrusive bodies. In detail, all the mineralized zones are extremely complex in shape, but they have been interpreted to be linked as they appear to belong to one single larger system that was disrupted by intrusive bodies and faults.

The gold mineralization occurs in spatial association with silica, pyrite and arsenopyrite in zones of silicification and carbonation alteration. Gold deposition and/or remobilization are controlled by deformed micro-quartz and quartz-carbonate veining related to linear high strain zones, fold hinges and intrusive contacts.

↑ There has been extensive artisanal mining within the Tassawini project ↑ An outcrop at Tassawini showing the complex folding within the mineralized envelope

The Guiana Shield

The Guiana Shield spans over 2000 km (1242 mi) and stretches from western Venezuela, through Guyana, Suriname, and French Guyana and ends in northern Brazil. The shield is composed of a Palaeoproterozoic granite-greenstone terrain with a general east to northeast trending structural trend. This terrain is considered to be the extension of the West-African Palaeoproterozoic Birimian Supergroup metasedimentary/greenstone terrains, which, in northern Guyana, was originally mapped as part of the Lower Proterozoic Barama-Mazaruni Supergroup (approx. 2200-2000 million years in age). The Barama-Mazaruni Supergroup consists of metasedimentary/greenstone terrains intercalated with Archean-Proterozoic gneisses that were then intruded by Trans-amazonian granites as well as mafic and ultramafic rocks (see McConnell and Williams, 1969). The geology at Tassawini is dominated by a series of lower to upper greenschist facies altered fine-grained

metasedimentary rocks that have been intruded by a series of granitoids. The dominant lithologies are phylite, finely banded fine-grained metaclastite, carboniferous schist, and garnet-sulphide-graphitic rocks. These rocks are interpreted as originally being deposited as siltstones and mudstones in a carbonate-sulphide iron formation that was formed under reducing submarine conditions. This proto-sedimentary sequence is part of a manganese-rich proto-basin that can be traced from the Tassawini property over 100 km (62 mi) to where manganese was historically mined. Within this sequence are localized disconformable incursions of turbidic wacke as well as coarser sedimentary units such as sandstones and conglomerates.

Additional information

Alerio also holds the Harpy project, an early-stage exploration play. It is adjacent to the Aurora gold deposit owned by Guyana Goldfields that was recently purchased by Zijin Mining for USD 323 million. Alerio is looking to progress both of these projects and make further acquisitions in 2022. C ↑ The Guiana Shield and the West African Shield showing significant gold deposits

References

McConnell, R. B., and Williams, E., 1969, Distribution and provisional correlation of the Precambrian of the Guiana Shield. Paper presented at the 8th Guiana Geol. Conf., Georgetown, Guyana.

For more information

Visit: www.aleriogold.com