Message from the President

finalists

Team of the Year

Education enables greater job readiness

graduates

training calendar

Achievements

Dux

of the Year

Back to basics on data security

Ostapenko

the key differences between supply chain

finance and dynamic discounting

The credit manager as a futurist

Radok MICM CCE

Reviewing history is necessary, but looking forward is

most important

Cheesman

Update from across the ditch:

New Zealand’s 2022 credit challenges

Lacey MICM

Managing credit risk – Part 1

Logue MICM CCE

Public examinations – getting to the truth

Davis

Trevor Goodwin LICM CCE – Australian President

Lou Caldararo LICM CCE – Victoria/Tasmania & Australian VP

Rowan McClarty MICM CCE – Western Australia/Northern Territory

Gail Crowder MICM – South Australia

Peter Morgan MICM CCE – New South Wales

Debbie Leo MICM – Consumer Julie McNamara MICM CCE – Queensland

Nick Pilavidis FICM CCE Level 3, Suite 303, 1-9 Chandos Street, St Leonards NSW 2065 PO Box 64, St Leonards NSW 1590

Tel: (02) 8317 5085, Fax: (02) 9906 5686 Email: nick@aicm.com.au

Nick Pilavidis FICM CCE | Email: nick@aicm.com.au

NSW – Gary Poslinsky MICM

Qld – Stacey Woodward MICM

SA – Clare Venema MICM CCE

WA/NT – Jeremy Coote MICM

Vic/Tas – Michelle Carruthers MICM

Claire Kasses, General Manager

Tel Direct: 02 9174 5727 or Mob: 0499 975 303

Email: claire@aicm.com.au

Anthea Vandertouw | Ferncliff Productions

Tel: 0408 290 440 | Email: ferncliff1@bigpond.com

THE EDITOR reserves the right to alter or omit any article or advertisement submitted and requires idemnity from the advertisers and contributors against damages or liabilities that may arise from material published. CREDIT MANAGEMENT IN AUSTRALIA is published by the Australian Institute of Credit Management, Level 3, Suite 303, 1-9 Chandos Street, St Leonards NSW 2065. The views expressed in CREDIT MANAGEMENT IN AUSTRALIA are not necessarily those of Australian Institute of Credit Management, which does not expect or invite any person to act or rely on any statement, opinion or advice contained herein (whether in the form of an advertisement or editorial) and neither the Institute or any of its employees, agents or contributors shall be liable for any opinion contained herein. © The Australian Institute of Credit Management, 2022.

Are you dispute ready? 46

Setting yourself up for success in litigation

Anna Taylor MICM and Nick Boyce MICM

Can a personal guarantee be set aside due to the 50 mental impairment of the guarantor? Fiona Reynolds MICM

Winding up and bankruptcy – courts require technical 53 compliance – for good reason!

James Neate LICM CCE and Alice Carter MICM CCE

Understanding credit reporting 56

What is a credit reporting agency? David Johnson MICM

The rise of advanced, automated credit decisioning 60 systems in 2022 Lynne Walton MICM

Tips on how to manage risks in your debtor book 64 Barbara Cestaro MICM

The Editor, Level 3, Suite 303, 1-9 Chandos Street, St Leonards NSW 2065 or email: aicm@aicm.com.au

Customer Engagement and Technology Drive strategic change in CFOs office with

autonomous finance Ron Jethani

Welcome to the October edition of the Credit Management magazine which coincides with our premium event of the year, the National Conference. Our most anticipated event of the year has returned as a face-to-face event for the first time since 2019.

This year we are privileged to hold the conference at the Sofitel Hotel, Brisbane which I am sure will be a great experience for us all. During the conference I look forward to speaking to many of you and sharing our credit experiences and stories.

The conference is the single largest education and networking event for professionals in the various sectors within the credit industry. We have an excellent program encompassing both commercial and consumer credit with presentations of the highest quality which will only enhance the Institute’s reputation further amongst credit professionals.

On behalf of my fellow board directors, I thank all delegates who are attending the conference and the service providers who support us with their exhibition booths that help keep us up to date with the latest products and services. I particularly wish to acknowledge Equifax the Premium Sponsor for the 2022 AICM National Conference.

During the conference there will be a number of presentations including the announcements of the winner of the Young Credit Professional Award, which is sponsored jointly by CreditorWatch and ARMA, and the Credit Team of Year sponsored by Equifax. We will present certificates to our new Certified Credit Executives including the Dux award, and an acknowledgment of CCE’s who have recertified. We will also announce the winner of the Student Award of the Year

and the Presidents Trophy for the best performing State Division. Congratulations to our finalists and winners of YCP, Credit Team of the Year, CCE Dux and Student of the Year.

For those members who cannot attend I hope to see you at a conference next year or in years to come.

Much has happened since our last in-person conference on the Gold Coast in 2019 and since the AICM Board implemented a 3-year strategy plan which has further advanced the Institute as the key professional body for credit professionals. In the last 12 months we have seen our membership numbers grow strongly to the highest level since 2004 indicating our members support for the Institute, and our ongoing relevance and importance to education, events, award recognition and legislation advocacy for members.

I am proud to say your Board and National office team have worked tirelessly on many initiatives this past year with just a few of the implementations being:

l A new website and management system

l Introduction of a “Job board” on the AICM website

l Launch of a supplier directory on the AICM website

l Enhancement of the Credit Network forum on the AICM website

l Improved induction program for new Councillors

l Review and amendment of the criteria for Fellow membership category

The last of the 2022 WINC events was held in Tasmania, a State we continue to expand our service and membership base. That function completes a fantastic achievement for the WINC events this

with close to 800 participants attending nationally and over $24,000 raised for the benefit of Endometriosis Australia and Dress for Success.

The Board continues to set strategies for the future to seek out new opportunities and initiatives, and to implement our key priorities to ensure we continue to grow and maintain our position as thought leaders and point of reference for all credit professionals.

The Board and National Office team are well supported by the Councils in each division which consist of hardworking volunteers who continue to provide excellent education and network events for members and their colleagues. If you are interested in working with our local divisions or a sub-committee, please speak with a councillor in your State who will be happy to chat to you about the role you can play.

Congratulations to Division Presidents who have been elected for the 2022-23 financial year, a number who are in their first year and welcome to new division councillors who joined for the first time being officially appointed at the AGMs. I can’t speak more strongly as to how working in a team assists you with your career and personal development and with networking opportunities. In addition, it is extremely rewarding.

Once the National Conference is over Divisional Councils and the National office team with move onto planning the next prestigious event on our national calendar, the Pinnacle Awards, which will be held in all Divisions during November and December 2022. We encourage you to consider nominating for one of the categories in these prestigious awards.

The Institute’s training programs continue to evolve and are providing

excellent education to our many members with a variety of options at every price point, including Registered Training Organisation Certificates and Diploma, Seminars, the National Conference, and our Credit Toolboxes and Workshops.

The Institute will continue to grow into the future to ensure our relevance, position and posterity. But we should not forget our past and I encourage members that may have old AICM photos or items to send them into National office so as we can save them and remember our past.

As usual, I thank all volunteers who are involved in organising our events including the highly successful WINC event, our YCP judges and facilitators, and the presenters at our various education events. Without you we cannot be the successful Institute we are.

In closing I advise the National Conference will be my last official event in the capacity of National President. My maximum 4-year term is completed and after 6 years on the Board and as in terms of the Constitution I will retire. A new National President will be elected to commence in the role after the National Conference. I have enjoyed my time as National President and the changes and progress that has been achieved during those years. I look forward to the new President, board members, Nick and the National Office team continuing to move the Institute forward as a highly credentialled organisation for the credit professions.

Thank you and stay involved in the Institute which is a fabulous professional body and one to be proud of.

– Trevor Goodwin LICM CCE National President

“The Institute’s training programs continue to evolve and are providing excellent education to our many members with a variety of options at every price point, including Registered Training Organisation Certificates and Diploma, Seminars, the National Conference, and our Credit Toolboxes and Workshops.”

Laminex has been Australia’s leading supplier of locally made high-quality laminates and decorative surface materials for over 85 years. Receiving between 200 and 700 payments per day, the Banking Team had heavy workloads. The 100% manual processes made for very long workdays, especially at month-end, when payment allocation was the priority task. EFT bulk payments and complex remittance advice processing with hundreds of lines were the catalyst for Laminex to search for a solution that could automate the daily tasks for the Banking Team, with the objective to auto-allocate 70% of eligible payments at 12-month mark and enable remote work.

In 2021, Laminex Australia implemented Esker’s Cash Application solution, immediately benefiting from the AI technology to automate daily remittance advice processing. The team embraced the new cloud-based solution from day one and transitioned from data entry processing to verification and review very quickly. With Esker’s solution taking over an average of 52% of auto-allocation at only six months post-implementation, the time to allocate payments has reduced from 8-10 hours to only 4-6 hours, boosting the team’s well-being by leaving more time for higher value tasks. A further downstream impact is that statements and reporting are now up-to-the-minute accurate, and year-end liabilities on the balance sheets also reflect the most current information.

§ up to 50% reduction in processing time

§ 95% decrease of unallocated cash at month-end

§ 74% of auto-allocation objective achieved by 6-month mark

We found the solution extremely easy to use, that’s why the team has adapted so quickly to it.”

Operational Team Leader, Laminex

One significant change since implementing Esker’s solution is that the Banking Team is under much less pressure to complete payment allocations each day. They have more time to focus on their other duties and learn new tasks because Esker is saving us hours every day. They enjoy using Esker and the benefits it has provided.”

Operational Team Leader, Laminex

The Young Credit Professional of the Year Award (YCPA) program is the largest and most prestigious Young Credit Award program in Australia and provides a great opportunity for young Credit Professionals to gain recognition both for themselves and their employer.

AICM is proud of our YCP award that started in our Western Australian division 32 years ago and was adopted at a national level in 1997. The award and its recipients are held in the highest regard by all credit professionals and can be found in influential senior positions within the industry.

By entering the YCPA program and discussing their career achievements and ambitions participants gain both valuable insight to the potential for

their future advancement and support from other young Credit Professionals and experienced Credit Practitioners.

Thanks again to our event sponsors Credit Clear and CreditorWatch.

Congratulations to the state winners, who will now participate in the national YCPA judging in November.

Each of the divisional winners receives: $1000 to spend on AICM professional development to use within 12 months.

The national winner will be announced during the National Conference in Brisbane and will receive the above, plus $1000 cash and $2000 in AICM professional development.

Let’s meet our division winners...

The judges had an extremely difficult decision selecting a 2022 winner from such a strong group of candidates. Never has QLD received so many applications and was a challenge selecting these top 6 finalists.

Lachlan was an engaging candidate and an extremely passionate credit professional. His knowledge was evident in his confidence and strong ability to speak to the questions without pause for thought or delay. One of the key points when selecting a winner for the judges was how they will contribute to driving industry change, challenge the norms and impart knowledge through ongoing mentorship.

Lachlan demonstrated his problem-solving abilities and held clear views on how improvements within his business and the industry as a whole can be implemented. He is already working with industry bodies to voice his views.

The judges were impressed with Lachlan’s customer-centric approach, and how he prides himself on such a high quality of work and values his customers. The judges are confident that Lachlan will do well at the Nationals in October and will be a great role model for future young professionals.

1. Lachlan is proud to be the key person implementing a GRC system and PRA Group Australia at 23 years old.

2. Lachlan led a regulatory change project for modern slavery, design and distribution obligations, breach reporting and dispute resolution requirements.

3. Lachlan is a starting player for the Division 1 Bethel City football club.

Clare presented well, showed great confidence in her answers and impressed the judges with her achievements thus far. Not only does she have a broad understanding of issues in her current and past roles but was able to identify a multitude of real-life examples to address the questions by the judges. One of the key points when selecting a winner for the judges was how they will contribute to driving industry change, challenge the norms and impart knowledge through ongoing mentorship. Clare is clearly passionate about the credit industry and her role in it. She demonstrated her ongoing involvement in the industry and has a desire to contribute to the growth of the AICM into the future and engage young people in credit. Clare is a worthy representative of the division for the National YCP.

Clare is proud of gaining the achievement of CCE

Clare is currently serving as Vice President, minute taker and Councilor of Media for the SA Division Council.

In Clare’s spare time she enjoys going to the gym and enjoys indulging in true crime podcasts.

Maddi was enthusiastic and loved the opportunity to be in front of the judges. Her passion for credit and responsible lending to help businesses thrive is clearly evident, and her hunger to learn from credit professionals around her early on in her career has served her well in her various roles and recent promotion after just 12 months of employment.

One of the key points when selecting a winner for the judges was how they will contribute to driving industry change, challenge the norms and impart knowledge through ongoing mentorship. Maddi demonstrated foresight and a healthy curiosity about how the credit industry is changing.

She has first-hand experience of the role of AI, introducing us to ‘Hector’, an AI driven analytical tool that reduced the time it would have traditionally taken to analyze data on a file from 1 hour to 1 minute. Yet acknowledging that such technology wouldn’t ultimately replace humans, just free them from the more mundane tasks so they could make better use of their time.

She demonstrated a clear understanding of credit risk and data science, knowing how to assess and interpret financial data whilst taking into consideration the impact of the external environment and balancing small business hardship. Maddi’s genuine communication style and interest in upskilling her team were demonstrated in her interview and proved she is a great role model for young professionals.

1. Maddi was recently promoted to Credit Team Leader.

2. She won the CEO’s Choice Top Performer Award in August 2020.

3. Maddi is currently studying for a Diploma of Business.

All judges were unanimous in the decision of selecting James as the 2022 NSW winner. James responded to the judge’s questions phenomenally well and came across as very professional and polished.

James was the stand-out candidate and appreciated the opportunity to be in front of the judges. James displayed a passion for credit, AI and automation and acknowledged how these tools can be leveraged to improve business outcomes.

His manager, Joanne Edwards explained that James’ eagerness to learn, develop his skills, and continue his training has encouraged his upwards movement within the company. He is also incredibly dedicated to his personal development and studies.

James holds strengths in stakeholder relationship management and acts as the central point of data, supplying business performance data to the operational functions and business executives, including Wisr’s Chief Commercial Officer, Chief Operating Officer, and Chief Marketing Officer. He is an integral part of his team and organisation and contributes to Wisr’s continuous growth trajectory.

1. James spent 6 months early in his career becoming a master of Power BI, before the business ended up changing to Tableau (which meant he got to start the learning process all over again)!

2. James is currently participating in the CFA program, patiently awaiting the results of his Level 1 exam.

3. In James’s spare time he plays AFL for Sydney Uni, however he has managed to tear his ACL, so now has taken up the role of assistant coach.

The National Credit Team of the Year Award (CTOY) is an opportunity for credit teams to be distinguished for the great work, results, culture and learning they do daily. Since 2008 the Credit Team of Year Award has recognised the outstanding culture, skills, and achievements of Australia’s leading credit teams.

The 2022 Credit Team of the Year was announced Wednesday 19 October 2022 after the AICM National Conference welcome.

The judges commented on the outstanding performance of the Wyndham Destinations Team.

The Wyndham Destinations team delivered an outstanding application. Their presentation was professional, thorough, polished, and wellrehearsed. They demonstrated a fantastic team culture focussed on rewarding, motivating, and developing staff whilst managing the difficult

balance between achieving targets and providing a supportive environment where staff are working with tough hardship scenarios. They delivered strong individual and group performance and displayed with confidence a strong adherence to their organisation’s value and culture.

Congratulations to our 2022 Credit Team of the Year winner:

Thank you to the 2022 Credit Team of the Year sponsor Equifax and judges:

l Debbie Leo MICM, General Manager Sales Corporate Accounts at Equifax

l Louise Nixon MICM, Commercial Litigation and Regulatory Partner at Turks

l Rhys Buzza MICM CCE, Finance Shared Services Manager Reece Group

The Consumer Finance Team at Wyndham Destinations Asia Pacific is a team of 68 finance professionals, working across Australia and Southeast Asia, who manage the accounts of approximately 71,000 timeshare owners/members of Club Wyndham South Pacific, Club Wyndham Asia and Innovative Holiday Club by Club Wyndham.

All owners/members of the three clubs pay annual levies and some Club Wyndham South Pacific owners also pay to be part of a benefits program, Lifestyle by Wyndham, while some owners/members across all three clubs also take out finance with Wyndham Destinations/Finance by Wyndham in order to purchase their timeshare.

The team is multi-disciplined and includes divisions dedicated to Lending, Cash Management, Specialised Services, Operational Support, Training and Quality and a fully staffed Call Centre. The team manages an AU$275 million loan portfolio with approximately 13,000 individual accounts and is estimated to generate one-tenth of the business’ revenue.

l Cherese Aitken MICM – Supervisor, Lending & Cash Management

l David Howard MICM – Manager, Lending & Specialised Services

l Jennifer Paterson MICM – Manager, Operation Support

l Kelly Bull MICM – Manager, Contact Centre

l Lorelle Brauer MICM – Supervisor, Specialised Services

l Paul Taylor MICM – Supervisor, Training & Development

Achievements included:

l Creation of new processes to allow the team to complete most tasks electronically and become a paperless office.

l Creating a WynCares website for owners to visit and seek assistance regarding any questions they may have.

l Cross-skilling of the Contact Centre Team to allow them to make reservations for owners and ensure one call resolution.

l Development of a new role, Customer Liaison Officer, to ensure our owners have a more positive experience when purchasing as they interact with one person from start to finish.

l Development of a program to encourage the career development and upskilling of our team to encourage retention within the department, but also internal promotion.

The latest research from NCVER reveals that VET qualifications enable graduates to be more job ready compared to higher education qualifications.

VET and higher education pathways – do outcomes differ for the same occupation? NCVER examined the employment outcomes of individuals with VET qualifications and those with higher education qualifications to evaluate if they are doing the same tasks and have the same salary and career pathways.

Findings show that due to their technical nature, VET qualifications enable new graduates to ‘hit the ground running’ when entering occupations compared to higher education qualifications.

Australia’s vocational education and training (VET) sector continues to deliver excellent results and outcomes for its students not only within the credit industry but the economy at large.

When compared with employment outcomes for university graduates, VET continues to produce superior results, and has proven itself to be a more

flexible, accessible and adaptable platform for educating and skilling Australians. Importantly, given the rising cost of formal education, VET is also a more cost-effective training option for both businesses and individuals to obtain a formal nationally recognised qualification.

Ensuring individuals and employers get the highest return on investment in education and training. Understanding the return on investment (ROI) in education and training helps individuals, enterprises and governments to determine changes in the employability of workers following training or to provide a measure of productivity improvements within firms.

VET graduates secure employment opportunities and find work Statistics from the report outlined that studying with registered training organisations providers like AICM increase the chances of securing employment after completing their qualification. While only 67% of university students find work after graduating, nearly 80% of VET students secure employment. This is because AICM focus on providing practical skills that are required within the workplace and specialise in credit Industry focused units. ➤

“

Employers and industry are integral to a quality VET system. Registered training organisations (RTOs) are responsible for systematically monitoring, evaluating and continually improving their training products with the help of industry and employers.

Employers and industry are integral to a quality VET system. Registered training organisations (RTOs) are responsible for systematically monitoring, evaluating and continually improving their training products with the help of industry and employers. This enables continuous improvements in the training being offered and benefits employers who have job ready candidates.

The decision is now up to you The good news is that deciding to invest in your career/ future is never a bad decision. If you are ready to study with AICM and obtain a nationally recognised qualification contact us for further information aicm@aicm.com.au we are here to help. AICM offers training courses which change according to the needs of the credit industry and with its high level of flexibility enables it to provide practical programs that will provide you with valuable knowledge and skills no matter at what stage you are with your career.

AICM would like to congratulate its recent graduates:

FNS30420 – Certificate III in Mercantile Agents

Sharlain Larkin New South Wales CCSG Jackson David India Genpact

Steffen Winter New South Wales Swift Collect

Linzi Sorrell WA FNSCRD401 – Assess credit applications Mediterranean Shipping Company

Natasha Morris NSW FNSCRD511 – Respond to personal insolvency situations Snap-on Tools

Stacy Ridge NSW FNSCRD404 – Utilise the legal process to recover outstanding debt Smeg

FNSMCA314 Locate individuals

with

– Diploma

Thursday

Diploma

BSBMGT502 Manage people performance

Understanding corporate insolvency

FNSCRD503

Promote understanding of the role and effective use of consumer credit

Understanding credit risk

How to trade with trusts with trusts

Understanding Financial Hardship

CCE acknowledges experts in the industry and is AICM’s commitment to maintaining professional excellence in the field of credit management. CCE is obtained by completing an assessment and provides credit professionals with confirmation of their knowledge and experience.

The 2022 CCE dux has been awarded to Maureen Greaves from Harrington Bobcat & Excavation for achieving the highest grade for the 2022 year. Her submission gained high marks and her submitted essay showcased exceptional knowledge of credit.

Maureen displayed the following: z Maureen provided a strong analysis on the situation when a small business that has purchased a second entity and the issues which arise when trying to combine separate Terms and Conditions into one concise and easy format to be utilised by both businesses. It provided a sound understanding of knowledge when dealing with a complex issue.

Student of the year 2022: FNS40120 Certificate IV in Credit Management

David MacIntosh was a distance education student and throughout the duration of the qualification, the submitted work displayed good knowledge of each course. It provided a sound understanding of how this knowledge merges into the workplace environment.

David completed the 12 units in 3 and a half months, his submissions displayed clarity with his explanations and the research performed reinforced his commitment to the credit industry. Each assessment task submitted was of the highest standard.

David has met all of the selection criteria and demonstrated throughout the course a commitment to the pursuit of knowledge and professional development.

Credit management is the provision of credit and related services to individuals (consumer credit) and business (commercial credit).

This may include:

` Evaluating applications for a credit facility(s) using tools such as credit scoring, evaluation techniques

` Monitoring and managing these facilities

` Collections and the recovery of monies owed through legal and non legal remedies

` Management of cashflow and financial reporting.

Credit professionals are also involved with bankruptcy and corporate insolvency. Risk management and compliance management underpin the role of a credit professional.

Credit professionals have a wide range of career opportunities ranging from roles related to accounts receivable through to managing billion-dollar ledgers with national and international responsibilities.

of credit card services

across all industry sectors

organisations

companies

As a National registered training organisation AICM is able to offer nationally recognised qualifications through a variety of pathways. Currently, we offer the Certificate III in Mercantile Agents, Certificate IV in Credit Management and the Diploma of Credit Management.

` Our programs are available in trainer led workshops and distance education formats.

` Streamline your qualification training by receiving recognition for your current skills.

` We offer training to suit all levels within the credit profession.

FNS30420

Certificate III in Mercantile Agents

Beneficial to individuals who are working for a mercantile agent and/or collections role in companies and financial institutions.

` Mercantile Agent

` Accounts Receivable

` Clerk/Officer

` Collections Officer

` Customer Service Officer

` Recovery Clerk/Officer

FNS40120

Certificate IV in Credit Management

Ideal for individuals who have experience in credit and need to enhance their skill to contribute more to an organisation. This qualification addresses issues relating to credit applications and securitisation, compliance, managing bad and doubtful debt and customer service.

` Credit Officer

` Credit Controller

` Credit Analyst

` Recoveries Officer

` Reconciliations Officer

` Credit Services Officer

` Credit/Lending Officer

` Credit Team Leader

` Credit Manager

FNS51520

Diploma of Credit Management

Provides the opportunity to deal with key credit issues such as personal and corporate insolvency, developing credit policies and compliance. Learners are then able to select from a range of electives which address consumer credit, factoring and discounting, managing customer service, managing individuals and managing change.

` Senior Credit Officer

` Senior Decision Manager

` Debt Manager

` Credit Executive

` Credit Analyst

` Credit Operations Manager

` Senior Credit/Loans Officer

` Chief Credit Officer

` Group Credit Manager

` Credit Risk Manager

The AICM is the leading provider of financial services training specialising in credit in Australia.

For more information about training or membership, contact: 1300 560 996 or aicm@aicm.com.au

By Eugene Ostapenko*

By Eugene Ostapenko*

With a major data breach once again front and centre in the headlines, managing data security has never been more important for credit managers. The loss or inaccuracy of financial data, in particular, can have a devastation effect on an organisation or individual, and so finance departments and IT security departments must have a strong working relationship.

Here are my five important steps to take towards better financial data security.

You must have a plan. Any good IT security plan is built on a solid understanding of the data you manage, your operating environment, your regulatory obligations and your customers’ needs. Once you’ve done your due diligence and have a good handle on these four areas, you can start to develop your plan – and don’t forget to include a realistic budget before seeking the necessary approvals. More on this later.

In my own organisation, the

customer lens is one of the key drivers behind our information security strategy. We are constantly listening to our customers to plan our security program, and helping them to meet their own security objectives.

IT security is complex and difficult in any environment. In addition to improving internal protection, strive to make interactions with your customers as simple and safe as possible.

One of the effective ways to do this is to invest in a selfservice capability to provide transparency to prospective and current customers on your information security posture. This should allow customers to evaluate your security implementation procedures.

To reduce compliance effort for customers, we also invested heavily in obtaining a number of independent attestations and certifications confirming our strong security posture. These

“Any good IT security plan is built on a solid understanding of the data you manage, your operating environment, your regulatory obligations and your customers’ needs.”

include ISO 27001, SOC2 Type 2, PCI DSS and IRAP. They are all independent, industry-recognised certifications that will reduce the need to undertake security audits, and where still required, greatly reduce the time your customers need to spend on their own security assessments.

My team and I are continually monitoring information security threats. One of the prominent threats at the moment is credentials compromise, where malicious actors try to guess or steal passwords.

A typical response to these attacks in the past has been to keep making passwords longer, adding special characters or changing them

frequently. These measures make access to our systems increasingly complex and bring limited protection.

To find the right balance between ease of use and security, we have launched a single sign-on capability. We can give customers the option to use the same username/password/token they use for their internal systems when accessing ours. This access can also be co-controlled by their own

teams, thus easing the compliance burden and making it easier to do business with us.

My strong view is that company culture is critical when it comes to building and maintaining a robust security posture. Make security visible: speak to your teams regularly, present at staff forums, send security awareness

“

...company culture is critical when it comes to building and maintaining a robust security posture. Make security visible: speak to your teams regularly, present at staff forums, send security awareness newsletters and be collaborative around risks.

newsletters and be collaborative around risks.

If data and its security are the focus for your organisation, you may even want to consider building its protection into your company values and behaviours so your team can live it on a daily basis.

Finally, always be prepared for security breaches. It’s a little bit like home safety – by putting locks on doors, your risk goes down, but don’t put all your eggs in one basket! There’s still a chance for bad people to get in – so you have to understand this and be prepared to fight against intruders.

I often tell the story of a neighbour who had his push bike stolen. It was a $5000 bike, protected by $30 chain that someone broke after jumping his fence. After that, he realised the inadequacy of this protection and reassessed the value of his property – realising the deeper investment he needed to make to protect his asset. The bottom line is, if you have multi-million-dollar

data assets, you have to have an in-depth strategy to protect them, and an appropriate budget along with it. Typically, between 10 % and 15% of your IT budget is a common standard.

*Eugene Ostapenko Head of Information Security illion E: eugene.ostapenko@illion.com.au T: 0421 000 155 www.illion.com.au

In late 2018, the Board of Directors of the Australian Institute of Credit Management (AICM) proudly approved the establishment of the AICM Education Foundation.

The AICM Education Foundation has been established to provide financial assistance to credit professionals and students striving to continue their education. Funds are gathered from generous donations from the AICM and Credit Community, as well as fundraising activities and events of the AICM and it’s supporters throughout the year including but not limited to the annual AICM Conference.

The Education Foundation will also bolster the vision of the AICM to be the primary learning, knowledge and information source for credit professionals and support the AICM’s objective of providing opportunities for growth throughout their careers.

For more information on the foundation, make contributions or interest in supporting the Management Committee contact the AICM National office (aicm@aicm.com.au, 1300 560 996 or click here).

“...always be prepared for security breaches. It’s a little bit like home safety – by putting locks on doors, your risk goes down, but don’t put all your eggs in one basket!”

Between supply chain woes, inflation pressures and the lingering effects of COVID, it’s taking businesses longer and longer to get paid. Fortunately, dynamic discounting and supply chain finance can help free up funds faster.

Slow payment can have a real and negative effect on businesses. According to a QuickBooks survey, 65% of mid-sized businesses –those with 25 to 200 employees –report spending 14 hours per week collecting payments and chasing late payments.

And that can have an impact on growth: 89% of the businesses surveyed by QuickBooks said late customer payments had set back their long-term goals. Even when payments are made on time, longer payment terms can be challenging – some businesses don’t have the

luxury to wait 60 or 90 days for working capital.

Supply chain finance and dynamic discounting speed up the payment process while delivering sizable benefits to both buyers and suppliers. In this post, we’ll compare the advantages of each approach and how they can affect your cash flow.

What is dynamic discounting? With dynamic discounting, suppliers offer a discount to buyers that agree to use cash on hand to pay their invoices early. The size of the discount will vary. Generally speaking though, the earlier the payment, the bigger the discount.

Dynamic discounting is much more flexible than static discounts.

Under static terms like 2/10 net 30, a buyer can claim a fixed 2% discount only in the first 10 days

“Supply chain finance and dynamic discounting speed up the payment process while delivering sizable benefits to both buyers and suppliers.

after the invoice is issued. With dynamic discounting, discounts could be made available at Day 11, 15 or even 21.

Plus, under static discounting, buyers – especially large enterprise buyers – tend to have more leverage and can often dictate the discounts they want. Dynamic discounting allows suppliers and buyers to seamlessly agree to a rate that works for both parties.

Buyers like dynamic discounting because the discount reduces their cost of goods sold (COGS). That discount usually represents a larger rate of return than other investment opportunities, and it’s risk-free.

And, by paying suppliers early, the buyers are helping to ensure those suppliers are financially healthy and able to fulfill future orders.

The other benefits to dynamic discounting? No outside financing is involved, and thanks to the flexibility and the lack of a middleman, dynamic discounting is expected to be one of the fastest-growing financing solutions in the market.

Supply chain finance (SCF), also known as supplier finance or reverse factoring, can also help buyers pay their suppliers faster.

Under an SCF program, a buyer

will typically finance early payment of its suppliers’ invoices through a bank or other financier. The supplier gives a discount in exchange for early payment, the same way as with static or dynamic discounting. The buyer typically pays the financier back on the invoice’s original due date or later. For buyers trying to hold on to their cash, SCF can be a lifesaver.

Supply chain finance improves liquidity for both parties, allowing suppliers to get quicker access to what they are owed and buyers to have more time to pay their invoices.

There are a couple of important technical differences between dynamic discounting and supply chain finance.

Dynamic discounting is typically used when the buyer has cash

“Supply chain finance improves liquidity for both parties, allowing suppliers to get quicker access to what they are owed and buyers to have more time to pay their invoices.”

on hand. Supply chain finance is utilised when the buyer wants to offer early payment but needs to conserve cash.

With supply chain finance, early payment is financed through funds from a bank or some other third party, and that financing is based on the strength of the buyer’s credit, not the supplier’s. Dynamic discounting doesn’t require the buyer to borrow funds.

Supply chain finance has additional drawbacks for suppliers, though C2FO has addressed these obstacles with specific products and solutions.

Suppliers that are invited into a supply chain finance program usually have to agree to be “all in” – all of their invoices for that particular buyer must be funnelled

through the program. With C2FO, suppliers and buyers can tap into early payment whenever they choose.

With many supply chain finance programs, there is no room for negotiating the discount; however, C2FO allows suppliers to set a discount that they find acceptable through patented Name Your Rate® technology.

Dynamic discounting and supply chain finance are two different solutions for the same problem: How can businesses access the working capital they need, quickly and easily? Depending on the situation, each approach can offer significant value to buyers and suppliers.

With C2FO, companies don’t have to choose. C2FO makes it easy for buyers to switch between these solutions as needed so they can continue to pay invoices ahead of schedule, without interruption.

If you’re currently selling to Woolworths, Chevron, Newcrest or Costco, you can accelerate as many of your receivables as you like. There are no fees, contracts or commitments to participate in these voluntary programs. You simply place an offer on the website and select the $ value or date range of receivables that you’d like to be paid earlier to assist with your cash flow. Simply Google your ‘customer name + C2FO’ for more information and to register. There are many new customers currently being added to the platform so stay tuned.

*Simon Beck C2FO Senior Director, Australia E: simon.beck@c2fo.com T: +61 417 983 653

“With supply chain finance, early payment is financed through funds from a bank or some other third party, and that financing is based on the strength of the buyer’s credit, not the supplier’s.”

Historically, we have come to understand the Credit Manager’s role was one that required the skills and understanding of a credit manager and/or accounts receivable manager, accounting, legal clarification, debt collection, insolvency customer service professionals and so on.

The one vital area that is not often recognised, and causes a lot of grief within a business, is that of projecting the future, in other words, that of being a “futurist.”

A futurist is defined as a person who reviews information and projects its implications for a future outcome, mainly for their business and even their industry. Typically, the information analysed includes

current and previous laws and legislation, local and global trends, marketplace behaviour and media reporting etc. This information is then extrapolated into scenarios relating to market risks and opportunities which, may not be currently evident but possibly projected as being relevant in the future.

On reviewing our work as a credit manager, isn’t that what one of our core responsibilities?

The role of the credit manager, after all, is where they interpret information from the world around them, add projected forecasts to make logically COMMERCIAL decisions; including the likelihood of their customer consistently meeting the terms of their agreed trading agreement.

The assessment is then matched against the information provided by a prospective customer when evaluating their application for credit. This same principle also applies when reviewing the ongoing trading performance of an existing customer whenever their trading relationship raises doubt and may require adjustment.

Herein lies one of the primary problems experienced by credit managers because all too often management, marketing and sales

are focused on the NOW to meet short terms goals of sales and budgets. Meanwhile whilst the credit manager has to focus on the now, he/she has to also look at the FUTURE as part of their decision making, for example the customer’s capacity or willingness to pay their accounts. After all, they know alltoo-well that a profit is not made “until the money is in the bank.”

In Australia, as they all know, that profit is not secure until the money has been in the bank account for six-months-and-one-day from receipt.

Note: this situation may change with the latest legislation proposals, so it would be most prudent to act on the old timeline for some time yet.

To manage both the current and future viability of your business, all managers and their employees will need to review and reconfigure the way your business functions. This will require changes-in-thinking, acting, and accepting new ideas and operational procedures. This is sure to challenge many who have successfully conducted business, using their proven methods for many years.

Furthermore, all levels of

Kim Radok MICM CCE“A futurist is defined as a person who reviews information and projects its implications for a future outcome, mainly for their business and even their industry.”

management and staff must be encouraged to function as “team” to help the business survive and prosper. The reality is that the real enemy for all employees of the business are outside the business, not fellow employees within their business. The enemy include:

1. inefficient suppliers;

2. slow-paying, difficult and/or fraudulent customers;

3. criminals of all types;

4. government regulations created by politicians and bureaucrats;

5. self-appointed do-gooders who have never managed a business, and/or demand businesses, act or support the general demands of society, yet provide no commitment of supporting the businesses which do, etc.

This, may of course, upset traditionalists, or those with vested interests in maintaining a strong departmental “silo” structure. The problem for management will be to get the former advocates of operational “silos” on-board with this aspect; which will require a skilful inhouse commitment to minimise disruption. It is, however, an important issue, that must

overcome to help the business survive into the future.

Due to the numerous negative factors which lie ahead, all businesses, must change to match the new-world-order of business. One of the functions to help manage the new business environment will be the increased importance on gathering knowledge of the current business environment.

In addition, you will need to understand the ramifications of the likely announcements from regulatory bodies, politicians and economists in critical areas of business such as “fair contracts”, insolvency issues and the viability of collecting unpaid invoices, etc.

In order to achieve these objectives, all business managers

and employees will need to be involved in gathering information from the media, their networks and professional organisations; and by talking with and visiting customers. Any information obtained must be shared with all managers within their business to enable all dealings with customers are conducted in a consistent manner and with due respect for everybody’s role and responsibilities.

If required, an information gathering template might be useful for those businesses which have not yet commenced such actions. This template should be ideally designed in consultation between the CEO, CFO, sales, risk and credit manager. The information would then be collated and recorded for use by a responsible person with in the business and available to all managers.

“To manage both the current and future viability of your business, all managers and their employees will need to review and reconfigure the way your business functions.”

The role of the futurist credit manager will be more important than ever in the coming years. There is no doubt with all the factors already highlighted by many business owners, business professionals, accountants, economists and others in the media, the next few years are going to be at best, a real challenge.

The world is going to be far different than pre COVID. The futuristic credit manager, ideally supported by business owners, management, marketing and sales managers, should all work together in a holistic manner to help their business survive and prosper.

As a consequence of all these factors, the credit manager will need to provide a level of comfort

that when a new customer is signed up, or an existing customer’s affairs reviewed, payment of their accounts will be in line with the business’s expectations. To achieve this object, the credit manager will need to be aware:

1. that the customer’s previously positive payment history may not continue into the future;

2. that all business documentation, trading terms, credit applications and customer evaluation processes are up-to-date, completed properly and well maintained;

3. of which previous business tools and processes will be useful, and those that are no longer of value;

4. of the current and future consumer and business environments;

5. of any pending government

and bureaucratic legislation and regulations, trends and announcements;

6. operating in a balanced manner with access to the necessary tools and employee resources available to conduct their work properly and professionally;

7. of marketing and sales communications and how the content affects other functions and operations of the business when dealing with customers;

8. their authorisation to challenge management’s validity toward a doubtful customer during and after the current credit application process has been approved;

9. create an understanding with management, marketing and sales of the value of “NO” when receiving applications for credit from customers with doubtful reputations;

10. creating personalised sales & payment options for customers, etc.

The modern futurist credit manager will require additional resources that are often currently supplied or available. For instance:

1. technological tools designed to help the credit manager conduct their day-to-day work, plus the data to make logical, commercially viable decisions;

2. the authority to challenge and seek additional information when making decisions which are for “… the good of the business”;

3. information and data to prove strategically, dealing with a difficult or slow paying customer is of value to the business;

4. the ability to institute proactive strategic procedures to manage the many likely contacts from insolvency administrators for preferential payments in the coming years;

“The role of the futurist credit manager will be more important than ever in the coming years.”

Historically, we have come to understand the Credit Manager’s role as been one that required the skills and understanding of a credit manager and/or accounts receivable manager, accounting, legal, debt collection, insolvency customer service professionals and so on.

The one area that has not been often recognised, and in turn causes a lot of grief within a business for credit managers, is that of a futurist. In essence, when you review the work of a credit manager, isn’t this essentially one of the core responsibilities of our work?

The role of the credit manager after all is one where we take information from the world around us today, plus projected developments in the future, and try to make sense of it when making a valid COMMERCIAL decision.

The assessment is then matched against the information provided by a prospective customer when evaluating their application for credit. This same principle also applies when reviewing the ongoing trading performance of an existing customer whenever their trading relationship raises doubt and may require adjustment.

Herein lies one of the primary problems experienced by credit managers as management, marketing and sales are focused on the NOW. Meanwhile the credit manager has to focus on the now,

yet has to also look at the FUTURE as part of their decision making, for example, the customer’s capacity or willingness to pay their accounts. They know all-too-well that a profit is not made “until the money is in the bank.”

The future ahead for all businesses will be one that presents many negative consequences if not managed properly. The role of the futuristic credit manager, will gain increasing importance. It would be wise then, that they be recognised and supported by management to minimise negative outcomes, whilst seeking to maximise sales and retain profits.

*Kim Radok MICM CCE Credit MattersE: info@creditmatters.com.au www.creditmatters.com.au

5. to work with sales and marketing to seek more PROFITABLE sales opportunities via appropriate incentives, etc.

With the AICM conference just around the corner, I was reminiscing of past conferences. It got me thinking that it was not so long ago we were relying on trade references and receiving credit information via fax (some of my early days at NCI!). But how times have changed, now, there is an array of technological solutions to help with assessing potential customers, existing customers, and more.

There are many aspects to credit management. Generally, there is not one factor which fixes all concerns and assesses risk.

There is one thing that has remained constant over the 30 years that I’ve been in the credit management industry. From time to time, out of the blue and despite the best credit practices, business insolvencies do occur.

The question is, how can you

use all the technology available to your advantage with the aim of minimising the chance of a bad debt?

Every day we experience varying levels of credit assessment tools, resources and spend being placed into credit management. However, there are a number of elements the best credit managers and businesses get right:

1. Have watertight terms and conditions and make sure they are signed.

2. They set out credit limits and have clear payment terms.

3. They gather information about that business’s credit history. This is retrospective, so keep in mind things do change. Past performance is not always the best indicator of future performance, circumstances and trading environments evolve.

Kirk Cheesman MICM“From time to time, out of the blue and despite the best credit practices, business insolvencies do occur. The question is, how can you use all the technology available to your advantage with the aim of minimising the chance of a bad debt?

4. They put in place measures to safeguard their business from a potential insolvency. Ongoing customer monitoring and alerts for early warning signs have become key elements with increasing data and technology.

5. If payments are late or a dispute arises, they ensure they have a third party on hand to elevate the pressure on getting paid quicker.

6. Register their security interests – if you supply goods, ensure you are protected in the event of an insolvency and have the means to recover your unpaid goods, or to negotiate with an administrator on recoveries for those goods

7. They use trade credit insurance. This will protect cash flow and ensure, in the event of a loss, their hard-earned profits are not lost for ever.

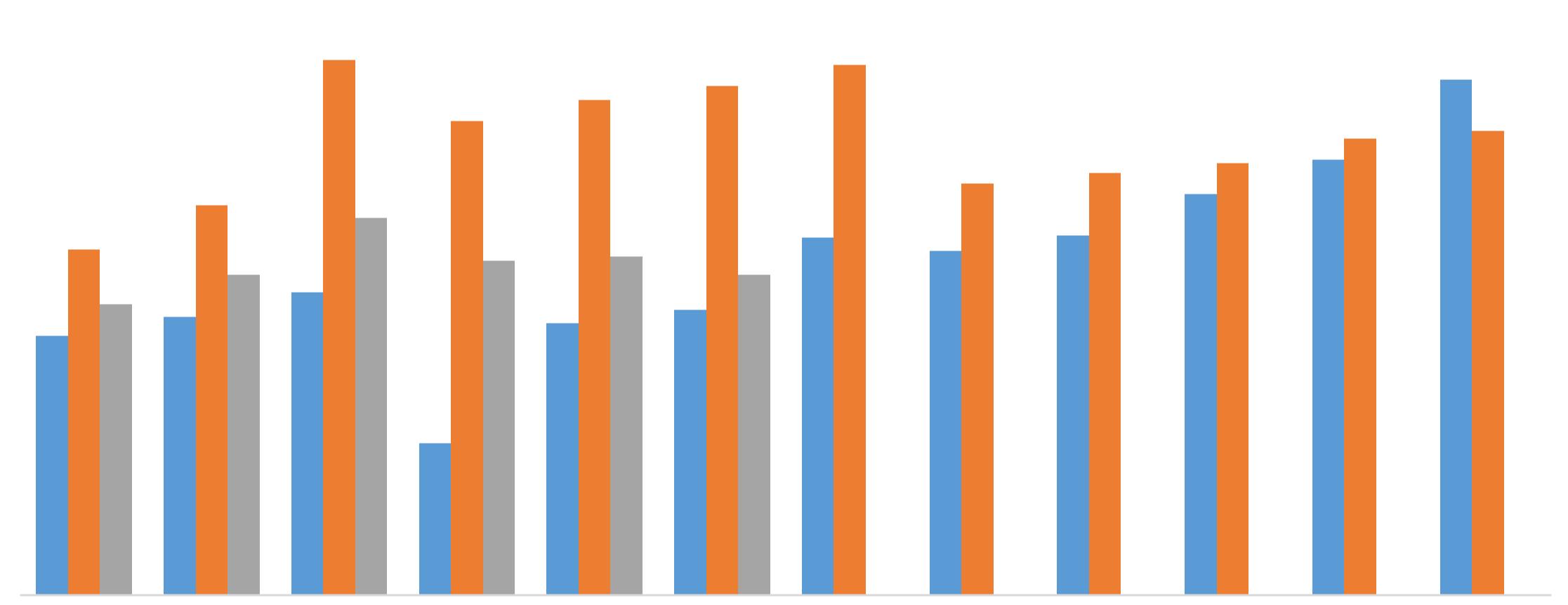

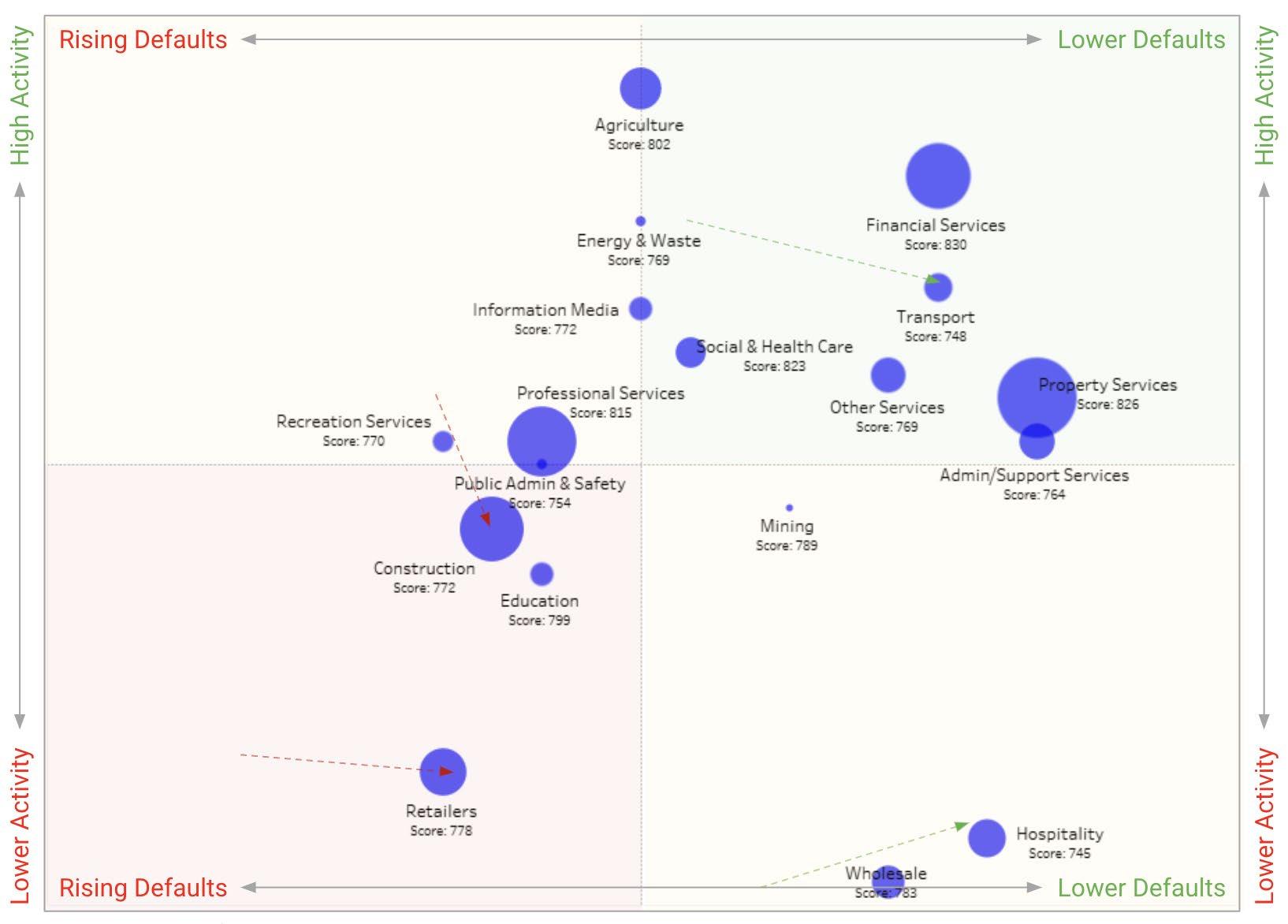

Data collected by NCI in 2022 indicates there is an increased chance of you experiencing a bad debt over the next year. Claims, collections, extended debts, and overdue reports from our clients suggest there are turbulent times ahead for credit managers.

Recently we surveyed NCI clients and of all the concerns they had, the worry of overdue debts and their client’s entering insolvency was number 3, surpassed only by concerns around increasing costs and labour shortages.

Now is the time to review the best practice points above to ensure that when you receive a letter from an Insolvency Practitioner regarding one of your customers, your business is in the best possible position to weather the storm.

National Credit Insurance (Brokers) Pty Ltd E: kirk.cheesman@nci.com.au T: 1300 654 500 www.nci.com.au

*Kirk Cheesman MICM Group Managing Director

“Every day we experience varying levels of credit assessment tools, resources and spend being placed into credit management. However, there are a number of elements the best credit managers and businesses get right.”

It’s evident the Pacific isn’t immune from the challenges facing the global economy caused by inflation, supply chain issues and the rising cost of living.

Here in New Zealand, we saw annual inflation hit a thirty-year high of 7.3% for the June 2022 quarter, stemming from strong demand in direct opposition to constrained supply across a range of sectors and industries.

The softening of consumer credit demand and rising arrears have delivered a sobering effect to our local credit sector.

As consumer confidence fell, credit demand reduced for new products across the board, as households cut back on discretionary spending to help navigate the rising cost of living.

In fact, consumer credit demand was down 10% year-on-year in June 2022. Simultaneously, we’ve seen consumer arrears start to creep up year-on-year across the board.

Against the usual seasonal trends, consumer arrears were up 12% year-on-year in April 2022, 11.7% year-on-year in May 2022 and 14% year-on-year in June 2022.

five years, demonstrating that on the whole New Zealand is managing debt extremely well. But this creep shows the reality of our economic climate.

The climb in arrears levels is focused on unsecured consumer lending. While home loan arrears have fallen as we see New Zealanders putting their mortgage repayments first.

We’re also seeing a change in how younger people are engaging with credit in New Zealand.

Applications for new credit cards have been trending down as younger Kiwis lean towards alternative products such as Buy Now Pay Later. This is due to the perceived cost of having a credit card, and the ‘uber-like’ customer experience the younger generation loves.

In fact, 54% of credit consumers under the age of 30 years old actively use Buy Now Pay Later products, compared to 25% that use credit cards.

Overall, arrears levels have come down consistently during the last

Coming off the back of the hot property markets seen in 2020

Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

and 2021, it appears this year things are starting to cool – with a marked downturn in both mortgage applications and lending.

The value of all new household lending was down 36% year-on-year in June 2022, while new residential mortgage lending was down 34% during the same period.

This, in part, is also due to changes to the Credit Contracts and Consumer Finance Act (CCCFA) at the end of last year, which introduced stringent new rules

for banks and lenders to protect vulnerable lenders.

What this did, however, was see mortgage and lending approvals fall as applicants were deemed too risky and saw applications declined for extremely strict spending misgivings, like online shopping.

This cooling of the market could spell trouble for buyers who purchased during the hot market of the last few years.

The number of Kiwis servicing

mortgages valued over $1 million has doubled in the three years since 2019 – climbing from 50,792 in Q3 2019 up to 102,954 in Q3 2022.

What about the Kiwi business sector?

It’s not just consumers feeling the pinch, with these economic conditions also impacting New Zealand businesses.

Increases in operating costs and supply chain issues have resulted in profit margins for

Kiwi businesses shrinking, even in sectors where demand has been strong1

Company closures were down 37% in June 2022, compared to the previous quarter, while company liquidations were also down 14% year-on-year in June.

Looking at specific sectors, retail and construction are challenged by defaults and lower activity, while tourism and hospitality are starting to show an upswing in activity and lower defaults as international travel and travellers begin to grace our shores.

Looking ahead to the future So, what’s next for New Zealand? For a large percent of the population, this will be the first time they’ve experienced interest rates and inflation at these highs. Our data shows the fall in consumer confidence has translated into less credit demand for consumers and business.

It’s important to place current economic conditions in the broader context of New Zealand. As at the end of June, the OCR was still well off peak of 8.25% in 2007 and 2008, and most pundits are forecasting

Age Group

99+ 96-98 93-95 90-92 87-89 84-86 81-83 78-80 75-77 72-74 69-71 66-68 63-65 60-62 57-59 54-56 51-53 48-50 45-47 42-44 39-41 36-38 33-35 30-32 27-29 24-26 21-23 18-20

an OCR peak lower than this during this current economic cycle. Making comparisons to the GFC times, we’re seeing better credit data

coupled with responsible lending obligations, which is giving New Zealand more layers of protection. If unemployment stays low and credit

Jan-19 Jul-19 Jan-20

Jan-22

continues to be responsibly lent and borrowed, New Zealand is well positioned to deal with the drag of high inflation and interest rates.

E: monika.lacey@centrix.co.nz www.centrix.co.nz

1 https://www.westpac.co.nz/assets/ Business/tools-rates-fees/documents/ economic-updates/2022/Other/EconomicOverview-Aug-2022-Westpac-NZ.pdf

This is the first in a series of articles discussing the importance of credit risk management to all businesses that provide trade credit. In Part 1 we discuss the cost of bad debts, the correct approach to opening a new account and the role of a collection agency in recovering overdue debts.

A businesses accounts receivable is often one of its largest assets and provides the cash-flow necessary to prosper and grow in these challenging and changing times. Quality credit management is a key element of strong cash flow. If practiced correctly, it will support the company’s cash flow requirements and contribute to growth and profitability by minimising the incidence of overdue accounts and bad debts.

The 4 key elements of quality credit management revolve around:

l Credit documentation

l Account set-up and maintenance

l Credit risk assessment, including verification of customer information

l Overdue account procedures

This series of articles will outline a quality approach to credit risk management, which can be adapted

to suit the specific requirements of almost any business, particularly those in the SME market.

Whenever an organisation provides credit, there is a risk that the account may not be paid on time. In addition, the longer a debt remains outstanding, the likelihood of it never being paid increases. Quality credit management is a combination of good internal procedures, quality documentation and swift, decisive action.

The table opposite identifies the cost to business of writing off bad debts and illustrates the additional sales revenue required to offset a bad debt. As can be seen, if a business generates a profit of 10%, and suffers a bad debt of $10,000.00, it will need to increase sales by $100,000.00 to negate the effect of the bad debt. What is not represented here, are the indirect costs associated with carrying the bad debt. These indirect costs include the cost of replacement capital, the labour and costs associated with chasing the debt and the opportunities lost as a result of diverting labour and capital to chase overdue accounts.

The good news however, is that it is not expensive to

“Whenever an organisation provides credit, there is a risk that the account may not be paid on time. In addition, the longer a debt remains outstanding, the likelihood of it never being paid increases.

An investment of time and a commitment to implementing quality practices, procedures and documentation will pay handsome dividends almost immediately.

improve the management of credit. An investment of time and a commitment to implementing quality practices, procedures and documentation will pay handsome dividends almost immediately.

A key part of a good credit policy involves selecting the right partners to assist you along the way. This includes your choice of collection

agency. Generally, the services of a collection agency will include: l Recommending the best and most cost effective debt recovery strategy for each matter;

$1,000 $50,000 $33,300 $25,000 $20,000 $16,660 $12,500 $10,000

$5,000 $250,000 $166,667 $125,000 $100,000 $83,333 $62,500 $50,000 $10,000 $500,000 $333,333 $250,000 $200,000 $166,667 $125,000 $100,000 $15,000 $750,000 $500,000 $375,000 $300,000 $250,000 $187,500 $150,000

$20,000 $1,000,000 $666,667 $500,000 $400,000 $333,333 $250,000 $200,000 $50,000 $2,500,000 $1,666,667 $1,250,000 $1,000,000 $833,333 $625,000 $500,000

l Making demands for payment using a range of contact chanels;

l Locating debtors and conducting field calls when required;

l Handling inbound debtor queries resulting from the demand process;

l Establishing and managing both formal and informal debtor payment arrangements;

l Commencing legal action, and carrying out enforcement when necessary;

l Identification of debtor assets;

l Reporting on the performance of individual matters as well as the overall portfolio;

l Liaising with field agents, process servers, solicitors and the courts;

l Assisting clients to improve their terms of trade.

One of the most important aspects of credit management occurs right at the beginning of the business relationship. The quality and accuracy of information obtained prior to extending credit often determines how successful an organisation will be at recovering its debt.

The account set-up procedure should include a checklist to ensure each new account is established consistently and that all paperwork and account verification procedures are followed. The purpose of developing a structured approach to opening new accounts is to filter high-risk debtors and reduce that risk, and at the same time, identify quality customers with whom sales opportunities can be optimised.

Some clients use automated application processing tools to ensure a consistent approach to opening new accounts and assessing credit risk.

As a minimum, the following processes should be introduced:

X A credit application must be completed, signed and returned by the prospective client. If information you request is not supplied, the account shouldn’t be opened until all the information is provided. The Accounts Receivable Officer should contact the new customer by telephone in order to obtain any missing information, following which, the verification process can commence. Part 2 of this series discusses credit applications and terms and conditions of trade as well as identifying a number of specific credit risk related clauses, which will improve your prospects of recovery and reduce collection costs.

X The legal structure of each new entity should be verified before the account is opened. Correct identification of an organisations legal name, ACN and/or ABN will save time and money down the track if an account becomes overdue. If information obtained from the client varies from the information in the credit reporting database, this should be clarified with the client before opening the new account.

X Check the company name and ACN with ASIC, to ensure that it is incorporated and that the details supplied are correct. Also do an ABN search on the company name, and if you find the ABN’s last 9 numbers are completely different from the ACN, then you have identified

that the entity is in fact a trustee company and should be set up that way in our system.

X Consider conducting a credit check to identify adverse information such as reportable court actions and payment defaults.

X If trade references are obtained, they should be checked to verify the customer’s capacity and willingness to pay.

X As soon as all the required information is obtained and verified, the new account is ready to opened.

As a supplier, you should never feel pressured into opening a new account until you are satisfied that the prospective customer is worthy of your credit.

Finally, keep credit on the agenda at management meetings. Discuss major accounts regularly, as well as the slow payers. Encourage everyone to be on the lookout for warning signs that a business is struggling, and act swiftly and decisively if problems are identified.

*Mark Logue MICM CCE AMPAC Debt Recovery E: m.logue@4ampac.com.au T: 0409 749 709

Mark is a debt collection specialist and the joint managing director of AMPAC Debt Recovery. He has more than 30 years experience in the debt recovery and credit reporting sector, covering all segments of industry and commerce throughout Australia and overseas.

“

A credit application must be completed, signed and returned by the prospective client. If information you request is not supplied, the account shouldn’t be opened until all the information is provided.”

If you are a business or individual who has registered a security interest on the PPSR it is important that you remember to:

• regularly monitor and review your registrations to ensure that they still need to be on the PPSR; and

• take steps to promptly discharge any registrations which are no longer required – usually within 5 business days of the debt or loan it secures being repaid.

Zahra is looking to purchase a new car from a motor vehicle dealership, and trade in her current car. She has been on a waiting list for months and has finally been notified that the new car is available to be purchased.

Before finalising the transaction, the car dealership performs a search of the PPSR against the serial number of Zahra’s old car, only to notice a registration in favour of Bank ABC. Zahra knows that this registration relates to an old loan, which was paid out in full earlier in the year. She contacts Bank ABC and asks them to discharge the registration. Bank ABC advises Zahra that they will look into it internally.

Zahra follows up Bank ABC over the next few weeks and eventually issues an amendment demand to Bank ABC. Bank ABC then register a financing change statement to discharge the registration from the PPSR. However, by this time, the car dealership has already sold the vehicle to the next person on the waiting list.

Through the dispute resolution process, we regularly see registrations over personal property being left on the PPSR after the loan or obligation which they secure has been repaid.

This can cause serious problems for parties who own that property or purchasers who want to buy it.

For example, if you have registered against a motor vehicle and the owner wants to sell it, a purchaser is likely to refuse to buy it until your registration is removed. It may also stop the owner using that property as security for a loan or other transaction.

In most cases, this is accidental, as the secured party has forgotten to end the registration. However, we do investigate allegations of misuse, such as where secured parties intentionally leave registrations on the PPSR without a valid reason for doing so. This example is not only against the law but it could expose you and your business to a civil penalty under the Personal Property Securities Act 2009 (Cth).

Whether accidental or deliberate, failure to discharge the registration in a timely manner means that the affected party needs to spend unnecessary time and money disputing the continued PPSR registration by issuing an amendment demand and then potentially escalating this issue to AFSA or the Courts for a resolution. All this takes up excess time and public resources.

By Damien Davis MICM*

By Damien Davis MICM*

A public examination is a powerful tool which may significantly advance the prospects of recovery in formal insolvency appointments. Parties subject to a formal public examination process are required by a court of law to answer questions under oath, and/or provide much needed information and documentation to assist with investigations and recoveries being undertaken by Insolvency Practitioners and others. Public examinations are inherently inquisitorial in nature and the issues covered can be extremely broad in application. Likewise, the penalties for inadequate compliance with the requirements of being formally examined under oath can be quite severe.

Examinations in corporate winding ups or pursuant to other insolvency events are covered by Section 596A and 596B of the Corporations Act 2001 (Cth) (Corporations Act). Examinations in bankruptcy proceedings are covered in Section 81 of the Bankruptcy Act 1966 (Cth) (Bankruptcy Act). Broadly speaking, public examinations conducted pursuant to each of these acts

mirror each other in application and process. However, the outcomes –successful or otherwise – tend to vary significantly from case to case.

The Corporations Act details that an “eligible applicant” who may apply for an examination includes: l ASIC; or l A liquidator or a provisional liquidator of a corporation; or l An administrator of a corporation or an administrator of a deed of company arrangement; or l A person authorised in writing by ASIC.

In addition, whilst Receivers of companies, company shareholders and trustees of unit trusts are not specifically listed as being eligible applicants under the Corporations Act, depending on the circumstances, they have all previously been held to be eligible applicants through case law.

Similarly, the application of prior case law suggests that creditors of a corporation may seek authorisation from ASIC to

“A public examination is a powerful tool which may significantly advance the prospects of recovery in formal insolvency appointments.”

be considered an eligible applicant for the purposes of applying for a public examination.

From a personal insolvency perspective through the Bankruptcy Act, a creditor with a provable claim in a bankrupt estate is automatically considered to be an eligible applicant.

As part of the application process, the Liquidator or other eligible applicant will file an affidavit with the court outlining the background for the summons, as well as a copy of the draft summons.

The affidavit, including any supporting material is not available for public review unless otherwise ordered by a court.

Where the application relates to a person who is or was an officer of the corporation, during the two (2) years prior to the commencement of the winding up, then the

“Parties subject to a formal public examination process are required by a court of law to answer questions under oath, and/or provide much needed information and documentation...”

summons is mandatory pursuant to Section 596A of the Corporations Act. That is to say, the court must issue the summons if it is satisfied that the necessary pre-requisites have been met.

Where the examinable person is not an officer (or former officer) of the corporation, a summons may be issued pursuant to Section 596B of the Corporations Act where the court is satisfied that the person has;

l taken part or been concerned in examinable affairs of the corporation and has been, or may have been, guilty of misconduct in relation to the corporation; or

l may be able to give information about examinable affairs of the corporation.

The fact that proceedings are on foot against an examinee will not automatically prevent an examination from being issued, even where the examination touches on or explores issues to be covered in the existing proceedings.

The types of individuals ordinarily examined pursuant to Section 596B of the Corporations Act may include: the company’s accountants and auditors, the bank manager of the branch where the company’s bank accounts are kept, and others such as solicitors, insurers, directors’ spouses, and

taxation officers. A person does not need to be a defendant or potential defendant in proceedings brought by or in relation to the corporation, in order to be summoned for examination.

A point to note is that examinations do not have to be directly beneficial to the company in external administration, its creditors or contributories as a whole. A claim which will benefit only some shareholders has been held by the High Court of Australia to be consistent with the public interest to allow an examination to proceed. Similarly, shareholders wanting to examine an officer for the purposes of pursuing a claim against those officers or advisers is a legitimate use of the power contained under Section 596A.