d-mars.com is proud to continue our partnership with the community, publishing positive content and success stories promoting the advancement of our African American businesses and civic and community leaders.

This month’s cover story highlights the 9th Annual Top 30 Influential Women of Houston Awards. This year’s honorees are dynamic and driven to make a difference for the betterment of the communities in which they live and work. What should be most celebrated about this

Abrams, First African-American female major-party gubernatorial

group is that they are a sisterhood, not looking to step on other women for success, but being a stepping stone for all women to win.

Like the previous years, this year’s deserving recipients are leaving a legacy of servant-leadership. Never being complacent, our honorees continue to pursue the highest level of achievement, encouraging others around them to do the same.

As always, thank you for your continued support of d-mars.com, progressing our publication’s efforts to highlight the communities in which we serve, live, and work. Partnering together, we succeed in making positive things happen.

Kimberly Floyd

Eugenie Doualla

Angel Rosa

Fontejon

Casteel

Kimberly Floyd

Eugenie Doualla

Angel Rosa

Fontejon

Casteel

Business

and

Council

Black

the Community

& CAREER

a

on

Black Americans

Get a Good Night

Research

Benefits of Proper Rest

Prescribing

Drugs Now the Norm,

in BIPOC

HIV Testing Should Be an Important and Normal Part of Your Self-care Routine

American Cancer Society Urges

Black Community to Pay

Attention to Prostate Health

Wallet Recession-Proof?

Investing?

of Education

Study Finds Community College System

To Produce

Outcomes for Black

for Finding a Medicare

for Pregnant Women?

Might Not

Worries:

Tips for Getting Started

Young Adults

Invest in a Life

Policy

of America

Payment

It

“Because I learned long ago that winning doesn’t always mean you get the prize. Sometimes you get progress, and that counts.”

By d-mars.com

By d-mars.com

The effects of the global pandemic have led to economic uncertainty, and small businesses are the most vulnerable due to their lack of resources. According to a survey by Goldman Sachs, 89% of small business owners say broader economic trends, such as inflation, supply chain issues, and labor shortages are having a negative impact on their business. Due to a variety of issues related to these trends, consumers are also spending less.

With consumer spending trending downward and operational costs going up, small businesses will need to reduce costs and attract new customers to stay com petitive. Digital advertising is a cost-effective way to achieve these goals and you don’t need to be an expert to get impactful results. Here are three tips to make the most of your marketing budget:

Modern consumer behaviors have changed drastically over the last few years, including how people shop and make purchasing decisions. Whether your customers have switched to working from home or embraced new tools and technologies, it is important to understand these trends.

Put yourself in your customer’s shoes. Where are they spending their time - and are they making purchase de cisions at different times of the day? What do they care about most in today’s environment? For example, 85% of consumers say they’ll only consider a brand if they trust the brand. As you think about your ad strategy, look be yond just product features and pricing. Using advertising tactics that reflect your values helps create meaningful

connections with potential custom ers. This could in clude everything from audience tar geting to keyword selection to ad copy. And staying connected to your customer also means incorporating social media into your strategy. Having a social media presence and creating a schedule to post regularly will allow you to reach your customers where they are spending time.

To learn more about your customers, ask for feedback through surveys, in-person, email, or even through social communities. Also, leverage insights from sources like your own website traffic reports and industry reports on consumer trends. Keeping these learnings in mind will help you make more informed decisions on what messaging will resonate and where your marketing dollars should be spent.

Small businesses need to be strategic about how and where they advertise to reach those most likely to pur chase their product or service by showing up at key points in the decision-making process. These can often span more than a dozen points across devices (PC and mobile) and websites or apps and take place over days, weeks or months. This requires businesses to take a mul ti-channel approach to their digital advertising, placing advertisements across search engines, websites, videos, and social to reach people at different points in their shopping journeys. Building and managing campaigns across these different types of ad products and sites, not to mention learning the ad tools that power these, may sound complex. However, it can be a lot easier than you

it's like to be a small-business owner is through Junior Achievement, an organi zation that works to provide school-aged children with lessons in financial literacy, work and career readiness, and entrepre neurship. Because Junior Achievement educators directly work with students in communities across the country, they have unique insight into ways to support the next generation of small-business owners.

d-mars.comn school, students are learning new skills that will help them achieve their dreams. For a grow ing number of them, these dreams in clude owning their own business. Small businesses are an important part of the American economy and have accounted for two out of every three jobs added in the past 25 years, according to the Bureau of Labor Statistics. Investing in budding entrepreneurs today will help create strong small businesses in the future.

One way students learn about what

In fact, according to a Junior Achievement survey, nearly 9 out of 10 (86%) teens indicated they had some level of interest in starting their own business. These students may decide to start their own businesses after graduation or bring their entrepreneurial ambitions into their college endeavors.

Schools provide important lessons about the skills and drive needed to own a busi ness, but the learning doesn't stop when the last school bell rings. Role models in the community can also significantly make a positive impact in forging a path for future small-business owners.

If you have children of your own or friends with children, ask them about their entrepreneurial interests. Tell them about your reasons for supporting small businesses and take them to these stores in

expect thanks to modern tools that help you build and manage campaigns across different websites and apps.

You can save time and run multi-channel campaigns with a one-stop solution like Smart Campaigns from Microsoft Advertising, which helps small businesses get started with digital advertising and connect with the right customers online. Its new redesign provides a simple and efficient way for advertisers of all sizes and budgets to run ads across devices on Microsoft properties such as MSN, Bing, and Outlook.com, and partner properties, including sites like Yahoo, AOL, DuckDuckGo, and more. Plus, the new Multi-platform feature makes it easy to run ads across leading advertising and social media platforms, including Google Ads, Twitter, Facebook, Instagram, and LinkedIn, all managed from one convenient place.

Time is a limited and diminishing resource, especially for small businesses. To save time and help reduce the stress of promoting your business, consider automated marketing and advertising tools that require minimal maintenance and help streamline the process. These tools often work within a certain set of parameters that you define, along with your desired outcomes. They use various signals and machine learning capabilities to make adjustments in real-time to give your ad the best chances of showing to the right person at the right time in the right place. Tools that use automation take the complexity out of daily advertising campaign manage ment to allow you to focus on other business priorities like quality, customer satisfaction, and retention.

Maximize your time and resources while growing your business by leveraging these three tips in your digital marketing.

your community. Oftentimes the owners are present, and if they aren't too busy, are happy to discuss their experiences.

entrepreneurs. For example, the Start Small, Grow Big program by The UPS Store is designed to support future small-business owners and entrepreneurs by enabling customers across their network of 5,100+ locations to donate to Junior Achievement USA upon checkout. All donations benefit Junior Achievement programs in the com munities in which they are received. Learn more at TheUPSStore.com/StartSmall.

If you own a small business yourself, consider hiring students and interns. This can help you during busy seasons while also exposing young adults to what it's like to run a small business. If developing a hiring program like this doesn't work for you, consider being a mentor instead. Your local business association or college would likely love volunteers and you'll feel good about making a difference.

Put your money where it matters by shopping at businesses that are helping

Whether part of a school assignment or just for fun, consider ways children can get a taste of what it's like to own a small business by choosing an age-appropriate project you can assist them with. You might help young kids run a yard sale or lemonade stand. Adolescents might start an online storefront for their arts and crafts, or perhaps for their tutoring or childcare services. Whatever the project, talk about goals, budgeting, customer service and other important components of a good business plan.

The future is bright as the next genera tion of small-business owners are learning important life skills and dreaming big. With these steps, you can help ensure their early visions empower them in the future.

way, if a team member goes down due to a work-related injury or illness, the costs of medical expenses and lost wages won't land squarely on you.

f you run a business, you probably already know that no two businesses are alike. An online jewelry business or web design service based in your home won't have the same needs (or hazards) as a food truck or florist shop. From homebased enterprises to businesses run out of a vehicle or a brick-and-mortar location, each has different needs for protecting everything you've built from the ground up. That's why insurance matters: Making sure you have a sound insurance plan to safeguard your specific business helps you continue to thrive, even when things don't go according to plan.

If you do business on the road, it's a good idea to add a commercial auto policy, which covers your owned or leased business vehicles that you or employees use on the job - and when you're in transit between sites. Ask your insurance agent about a commercial auto policy or getting rated as a business vehicle on your personal auto policy to make sure you're covered. You also can add liability coverage for drivers using vehicles not titled to them.

How to find the right insurance to protect your business

It's vital to know what kind of insurance your busi ness needs. While it's best to talk to an insurance agent about your unique needs as a business owner, here are important questions to get you started:

Is your business based in your home?

If so, you may think your homeowners insurance has you covered - but it probably doesn't. Your home owners insurance may have a limit of only a couple thousand dollars for equipment or merchandise used at home for your business in case of fire or theft, for example. Fortunately, you can either: add a homeowners policy endorsement to your existing coverage or get a State Farm® business insurance policy to cover your home-based business.

A homeowners policy endorsement may work for your business if you:

A homeowners policy endorsement may work for your business if you:

* Have less than $4,999 worth of business property at your home-based business.

* Don't invite customers to your home-based business.

* Only have $750 worth of personal property intended for business use outside your home.

Do you need a business insurance policy for your home-based businesses?

While your homeowners insurance policy might pro vide liability protection for certain incidents, this will not extend to home-based, business-related activities. For example, if a customer comes to your home to pay for goods or services and suffers an injury, you may not be covered.

A business insurance policy may be best if you:

A business insurance policy may be best if you:

* Provide services directly to customers in your home, such as tax preparation or hair services

You may never be sued as a business owner, but lawsuits are fairly common and can cost you tens of thousands of dollars - or more. Commercial liability insurance gives you added protection, so you don't have to pay out-of-pocket for expenses like legal costs, medical bills, or damage to other people's property that you may be

Because your business grows from year to year, it's

As part of its ongoing commitment to support small business owners nationwide, State Farm served as a Presenting Sponsor of The Black Women's Expo (BWe) in Chicago, Illinois, this summer. BWe is the nation's longest-running exposition where women gather to share

National Preparedness Month was last month, and FEMA and the Ad Council have released new Ready Campaign Public Service Announcements (PSAs), developed specifically to target Black and African American communities as part of FEMA’s ongoing approach to advance accessibility and cultural competency in boosting the nation’s preparedness.

FEMA Administrator Deanne Criswell and Deputy Administrator Erik A. Hooks visited Howard University, a found ing member of the HBCU Emergency Management Workforce Consortium, for a series of events kicking off National Preparedness Month and announcing the new Ready Campaign.

Black communities are on the front lines of climate change and related ex treme weather events. A report from the Environmental Protection Agency shows that socially vulnerable populations, in cluding Black and African American communities, may be more exposed to the highest impacts of climate change. Specifically, with global warming, Black and African American individuals have a 10% higher risk of living in areas with the highest projected inland flooding damages compared to reference populations.

“Black and African American com munities often suffer disproportionate impacts from disasters. This is some thing that we must work to change and that starts with how we prepare,” said

Administrator Criswell. “Our 2022 Ready campaign speaks directly to the communi ties who need our help the most and who deserve equitable access to preparedness resources that protect people and property. By continuing to advance accessibility and cultural competency in our preparedness messaging, we can make sure that every one is ready when disaster strikes.”

The Ready Campaign PSAs, entitled “A Lasting Legacy” will run nationwide in both Spanish and English, and are meant to help mitigate these discrepancies by encouraging Black communities to protect the lives they have built and the legacies they will leave behind through preparation and disaster readiness. These new PSAs build upon the work the FEMA is doing to advance equity and ensure everyone gets the help they need before, during, and after a disaster.

“Preparing for disaster is not just about protecting people and property, it’s about safeguarding the lives we’ve built and the legacy we will leave to our children and the generations to come,” said FEMA Deputy Administrator Erik Hooks. “With this campaign, FEMA reaffirms our commitment to equity and says loud and clear that every community deserves to be protected from hazards.”

FEMA’s Ready Campaign PSAs were developed pro bono by Creative Theory agency in coordination with the Ad Council and are available today in TV, radio, print, out-of-home and digital for mats. Throughout the month, the Ready

Campaign will emphasize unique aspects of preparedness, such as making a plan, building a kit, and teaching communities how to engage their families in emergency preparedness.

“We all want to protect our families, whether that’s our grandparents or our grandchildren,” said Ad Council Chief Campaign Development Officer Michelle Hillman. “This latest creative work is grounded in the importance of family and reminds us that preparation can make sure that our loved ones endure whatever disasters life sends our way.”

This round of creative work for the Ready Campaign builds upon the annual month-long campaign activities to engage communities and promote the steps to prepare for disasters. Last year’s theme was “Prepare to Protect” and was designed to resonate with Latino communities.

As a direct result of that campaign, the Listo.gov—the Spanish version of Ready. gov—had a 500% increase in visits to the “Make a Plan” page and a 400% increase in visits to the “Build a Kit” page.

This is the latest round of work in 19 years of educating the public about disas ter and emergency preparedness.

For more information and to get started on your emergency plan, visit ready.gov/plan or listo.gov/plan.

Source: National Newspaper Publishers Association (NNPA)

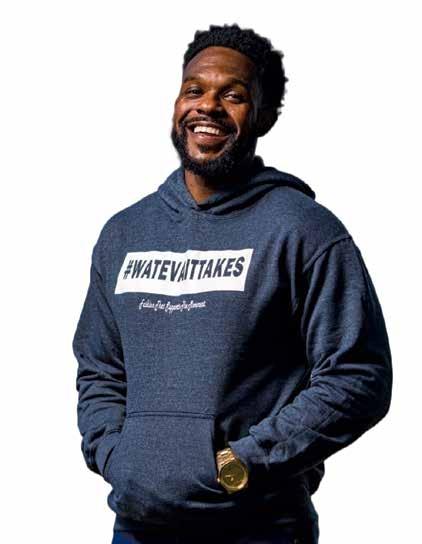

Sheldon Theragood is the author of the inspiring book, “Whatever It Takes, Walking Through God’s Purpose.” Sheldon is also a motivational speaker, youth mentor, police officer, and philanthropist. He is a native Houstonian who received his Bachelor of Arts in Communications from Texas Southern University and a Master of Arts in Counseling from Prairie View A&M University. He is also a proud member of Kappa Alpha Psi Fraternity, Inc.

Sheldon intentionally goes about fulfilling his purpose and calling in life to inspire youth and offer hope to distressed adolescents who have lost their way and help those who are less fortunate. His first job as a juvenile detention officer at a Harris County youth lock-up facility is what fueled his interest in helping children. Hearing their stories of despair, defeat, and discouragement, he found himself offering them sound advice, reinforced with positive messages of hope, faith, and love which can be found in his book. He then realized his purpose in life was more than just being employed at the detention center and helping guide those adolescents.

“Whatever It Takes, Walking Through God’s Purpose,” was published last year. After realizing that it was not in God’s plan for him to play in the NBA or even college basketball, Sheldon shares how he went from a high school basketball player with NBA dreams to a police officer, youth mentor, and advocate. He shares his journey of how it took going through life’s challenges to realize that there was much more to life than playing sports. He encourages young people to set goals in their lives, to have a plan, and diligently seek what it is that God has planned for them. Sheldon’s story of how he walked in God’s purpose and did whatever it took for him to fulfill

his goals will inspire every one to - Never give up! Keep pushing forward! Create a plan and have a backup plan!

TheraGood Deeds is a Houston-based 501c3 non profit organization estab lished in 2010. The nonprof it organization founded by Sheldon provides mentoring, counseling, and outreach opportunities focused on making a positive impact in the lives of youth, affection ately referred to as Future

Achievers. TheraGood ensures that Future Achievers are continuously evolving and moving forward in becoming positive, productive, and self-sufficient individuals as they encounter the rapidly changing dynamics of today’s society. Under Sheldon’s leadership, TheraGood Deeds has evolved from a one-on-one mentoring program to having ongoing opportunities for these Future Achievers to experience outreach opportunities and personal de velopment. Some of the outreach efforts include a backto-school supply drive, feeding the homeless, providing toiletry bags at Thanksgiving, hosting a Christmas toy drive and party for kids, plus so much more.

Sheldon hopes “Whatever It Takes, Walking Through God’s Purpose,” will be a motivation for everyone to find their purpose. To purchase the book, visit the website at sheldontheragood.com.

You can follow him on Instagram and Facebook @ Sheldontheragood. Check out his podcast “Wateva It Takes.” Sheldon has been and is an inspiration for all. If you would like to have Sheldon speak to your youth groups from middle school up to the college level, contact his Publicist at brandilynnpr@gmail.com.

By Stacy M. Brown NNPA Newswire Senior National Correspondent

By Stacy M. Brown NNPA Newswire Senior National Correspondent

Following President Joe Biden’s announcement canceling student loan debt of up to $20,000 for specific borrowers, the U.S. Department of Education said applications for relief under the plan should be submitted by Nov. 15.

Department officials said they’ve made the application process simple, and if bor rowers fail to apply by Nov. 15, they’d still have until the end of 2023 to file for forgiveness.

However, by waiting until after Nov. 15, borrowers risk having to resume payments after the federal pause in repayment ends on Dec. 31.

Biden said it’s vital for the more than 43 million eligible borrowers to take ad vantage of the loan forgiveness plan.

“All this means people can start to fi nally crawl out from under that mountain of debt to get on top of their rent and utilities, to finally think about buying a home or starting a family or starting a

business,” Biden stated.

And while earlier reports revealed that about 13 states could still tax borrowers on the amount of debt forgiven, Mississippi and Virginia are the latest to come off that original list as officials said they would refrain from levying taxes on individuals who receive loan forgiveness.

How do you know if you’re eligible for debt cancelation? Here are the criteria set forth by the Department of Education:

• Your annual income must have fallen below $125,000 (for individuals) or $250,000 (for married couples or heads of households)

• If you received a Pell Grant in college and meet the income threshold, you will be eligible for up to $20,000 in debt cancellation.

• If you did not receive a Pell Grant in college and meet the income threshold, you would be eligible for up to $10,000 in debt cancellation.

What does the “up to” in “up to $20,000” or “up to $10,000” mean?

• Your relief is capped at the amount of your outstanding debt.

• For example: If you are eligible for $20,000 in debt relief but have a balance of $15,000 remaining, you will only receive $15,000 in relief.

• Nearly 8 million borrowers may be eligible to receive relief automatically because relevant income data is already available to the U.S. Department of Education.

If the U.S. Department of Education doesn’t have your income data, the Administration will launch a simple application available by early October.

• Please sign up on the Department of Education subscription page if you want notification of when the application is open.

Once borrowers complete the application, they can expect relief within 4-6 weeks.

Everyone is encour aged to apply, but there

are 8 million individuals for whom the Education Department has data and who will get the relief automatically.

Borrowers are advised to apply before Nov. 15 to receive relief before the pay ment pause expires on Dec. 31, 2022.

The Department of Education will con tinue to process applications as they are received, even after the pause expires on Dec. 31, 2022.

and move them up.

The mission of Houston Airports is to connect the cultures of the world to the most diverse city in the world. By connecting people, we believe we uplift them all by making infinite opportunities, experiences and relationships possible. That is diversity at its best.

Although we o er flights to hundreds of destinations around the world, our true goal is to take every traveler to only one place. And that place is up.

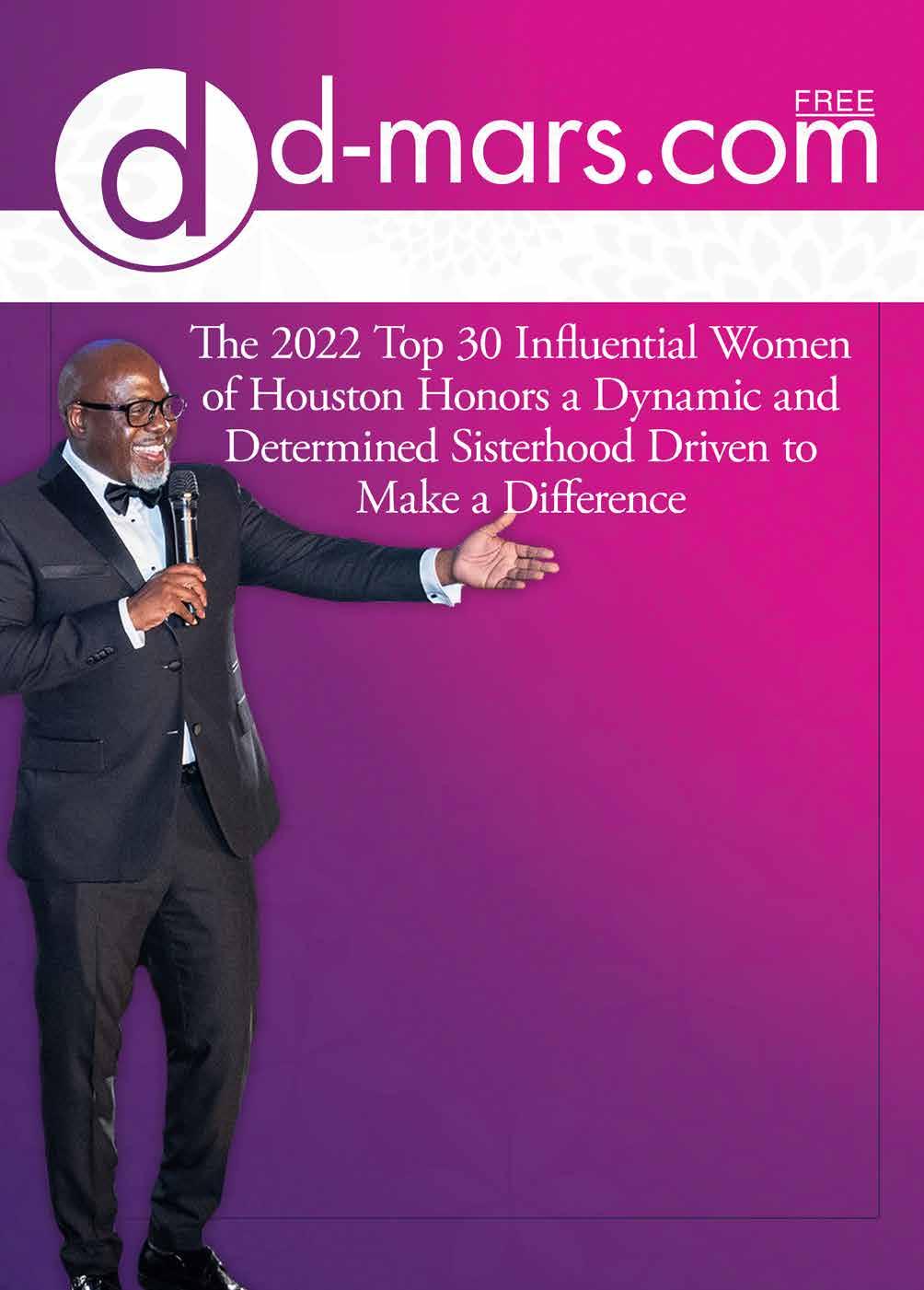

P. Hobby AirportThe d-mars.com 9th Annual Top 30 Influential Women of Houston Awards continues to pay tribute to a distin guished sisterhood of women around Houston and the nation who are dynamic and driven to make a difference in the communities in which they live and work.

d-mars.com Publisher and CEO Keith J. Davis, Sr. aka “MR. D-MARS” and Kim Floyd, Chief of Staff and Managing Editor, along with the d-mars.com team, worked tirelessly with Honorary Co-Chairs Camille G. Cash, M.D., Amber Mostyn and Dr. Mya Smith-Edmonds for an unforgettable VIP cocktail reception and award event at the Royal Sonesta Galleria Hotel, paying tribute to deserving women who exemplify tenacity, discipline, servanthood, and diligence. This year as years before, the hon orees are proven in defying limitations, forever changing the landscape of business and communi ty that is leaving a great legacy for global change.

The VIP reception sponsored by Branwar Wines kicked off the weekend’s celebration that brought together past honorees and special guests to support and network with this year’s outstand ing Top 30 sisterhood. Words of encouragement and congratulations were expressed during the reception program, with the honorees receiving special gifts.

KHOU-11’s Shern-Min Chow served as the Mistress of Ceremonies on award night, continuing to be a welcome part of this annual event and celebration. The Honorable Sheila Jackson Lee Award was presented to Lucrecia Smith, Senior Executive Assistant at the American Red Cross - Texas Gulf

Coast Region, for more than 36 years of service to the organization and the community.

Special entertainment was provided by Kailyn Milan and Miracle Love as they performed “When You Believe” by Mariah Carey and Whitney Houston.

Elected officials, dignitaries, and special guests included:

• Congresswoman Sheila Jackson Lee

• State Rep. Ron Reynolds

• Dr. Cesar Maldonado, HCC Chancellor

• Monica Flores Richart, HCC Board Vice Chair, District I Dr. Pretta VanDible Stallworth, HCC Trustee, District IX

• Bridgette Smith Lawson, Fort Bend County Attorney

• Judge Joel Clouser

• Dr. Stephen C. Head, Chancellor of Lone Star College System

• Dr. Irishea Hilliard, Senior Pastor of New Light Church Judge Joe Stephens

• State Rep. Mary Ann Perez

d-mars.com remains committed to shining the spotlight on the servant-leadership and accom plishments of women who are making a positive impact locally, nationally, and globally. “Our hono rees are women who have received opportunities because they create them, not afraid to go against the status quo. They understand that their posi tion is more than a job or a career, but a calling for the advancement of other women and those their position serves,” says MR. D-MARS. “While we are inspired by them, prayerfully this award helps confirm that the work they have done is not in vain. These women make a difference, and we continue to expect great things from them.”

If you want to nominate a dynamic woman as a 2023 honoree who is making a positive impact, please visit www.Top30Women.com.

There’s a good reason for that. With more than 3,000 Medicare Advantage plans, over 700 Part D Prescription Plans available and an array of carriers offering Medicare Supplement plans, there’s a lot to consider.

“Whether this is your first time enrolling in Medicare or you’ve been through the process before, it’s easy to get confused by the big picture, not to mention all the details,” says Ryan Kocher, Medicare growth officer at Cigna.

This Medicare Annual Election Period (AEP), Kocher is demystifying the enrollment process by sharing the same tips he offers to his own friends and family members:

1. Don’t wait. Understanding Medicare can protect your health and finances in the years to come. If you are transitioning from a commercial plan, work with an expert on your company’s insurance plan to avoid gaps in coverage as well as late penalties.

2. Nail down the basics. There are many different plan types. Here’s a breakdown:

• Original Medicare, offered through the U.S. gov ernment, includes all providers who agree to participate in the program.

• Medicare Supplement plans are plans offered by many private insurers that complement Original Medicare. For an additional premium, these plans cover costs such as copays and coinsurance not covered by Original Medicare. There are a number of standardized options available.

• Standalone Prescription Drug Plans, offered by private insurers for a monthly premium, provide drug coverage not covered by Original Medicare or Medicare Supplement.

• Medicare Advantage (MA) plans cover everything covered by Original Medicare, and most also include dental, vision, and hearing benefits. They often include prescription drug coverage, and other extras like overthe-counter drugs, transportation to doctor’s visits and pharmacies, and fitness plans. MA plans are often avail able at no extra cost.

3. Review your plan annually. During the AEP (October 15-December 7), it’s important to review your current Medicare plan, even if you

like it. This is because plan details are subject to change every year. Review the Annual Notice of Changes, which is mailed to you by your insurer each September. This document spells out plan changes for the upcoming year.

4. Compare all the costs. Be sure to factor in all the associated costs of a given plan, not just the monthly premium. Out-of-pocket costs, such as co-pays and deductibles, should also be considered. Additionally, note the prices and rules around the prescription drugs you take.

5. Check network requirements. Before signing up for a particular plan, check to make sure that your favorite health care providers are in its network. While you may be able to go out of network for care, be pre pared to pay more if you do.

6. Ask questions. Don’t settle on a plan until you understand it. If you have questions, reach out to your broker, insurer, physician, and even those friends and family members who have Medicare for help.

7. Use your plan. Now that you have a plan, make the most of its benefits. Schedule all the screenings, vaccines, and other preventive health measures recom mended by your doctor. Early intervention can help detect conditions early when they can be more effectively treated.

For more information about Medicare, visit Medicare.gov, Cigna’s website at www.cigna medicare.com, or the state health insurance assistance program in your area.

“Don’t be daunted by the Medicare enroll ment process. Being a careful shopper can ensure you find a plan that accommodates your wallet and your well-being,” says Kocher.

By d-mars.com News Provider

By d-mars.com News Provider

Health care is essential for everyone throughout their life. To further equity, improve outcomes and increase access, it is important people are able to get the care they need when and where they need it. However, the American health care system can be complex. Medicaid is a government-sponsored program to help provide low and often no-cost health coverage to those who qualify, but a recent study found there is confusion around what Medicaid is and who it supports.

When many people think of Medicaid, they think of low-income pregnant women and babies. What you may not know is Medicaid covers 1 in 5 Americans - everyone from children, those living with a disabil ity, and low-income elderly. Here are some additional misunderstandings about Medicaid from the experts at UnitedHealthcare:

Myth: People stay on Medicaid for life

Fact: Most people are on Medicaid for less than three years. It can provide the security you need when you need it most.

Myth: Medicaid is for pregnant women

Fact: Yes, Medicaid supports pregnant women, covering 43% of all U.S. births, but it continues to provide health coverage to support post-partum needs

and children. Medicaid provides health coverage to 37 million children, and nearly 67% of children under the age of five that are covered get a yearly well-child appointment.

Myth: Only people in poverty are on Medicaid

Fact: Medicaid helps people with limited financ es, but more people may qualify than they think. In fact, three-quarters of Medicaid members have a household income of $50,000 38 states have adopted Medicaid Expansion, which covers childless adults with incomes up to above Federal Poverty Level.

Myth: To qualify for Medicaid you have to be unemployed

Fact: A recent survey by UnitedHealthcare showed that more than half of those polled be lieve Medicaid recip ients are unemployed, but 62% of able-bodied Medicaid members are working or in school and 12% are looking for work.

Myth: Young adults coming off their parents' insurance can't use Medicaid

Fact: Due to Medicaid Expansion in some states, more people may be eligible for Medicaid coverage now people covered through Expansion are childless adults - a population

There is a lack of understanding around what Medicaid is and who it supports, and many people may not realize they could qualify for Medicaid, even while

If you don't qualify for Medicaid where you live, you may be able to

er way, like through your employer or your state's Health Insurance

likelihood of heart disease and stroke.

staggering 90 percent of people fail to achieve a good night’s sleep, according to new international research presented at the European Society of Cardiology (ESC) Congress 2022.

The study found that suboptimal sleep was associat ed with a higher

The authors estimated that seven in ten of these cardio vascular conditions could be prevented if everyone was a good sleeper.

And while researchers homed in on the sleep behaviors of 7,200 people — comprised mostly of Europeans — Americans also aren’t sleeping.

Black Americans suffer worse from short sleep or sleep apnea.

Earlier this year, the JAMA Open Network indicated that the problem continues to worsen for African Americans.

JAMA researchers discovered that Black Americans get less sleep than white people, a deficit of 15 minutes a day in childhood that grows into almost an hour in adulthood.

Additionally, an Oxford study found that far more Black and Hispanic people than white people report routinely get ting less than 6 hours of sleep, well short of the recommended 7 to 9 hours for adults.

“Sleep is a privilege,” Dayna Johnson, a sleep epidemiolo gist at Emory University, told Science.org. “If we can target sleep, we might be able to reduce the burden of all types of diseases among racial minorities.”

Science Direct found that more than a dozen studies have iden tified racial discrimination as a contributor to sleep disparities.

“Black people reported more discrimination and more se vere insomnia symptoms than white people, and a statistical analysis determined discrimination accounted for 60% of their insomnia severity,” researchers wrote at Science Direct. Researchers also discovered that environmental factors also cut into sleep. For example, multiple studies have found that Black, Hispanic, and other individuals of color tend to reside in areas where they are exposed to approximately twice as much ambient light at night as white people.

“Exposure to artificial light from the street and commercial buildings has been found to suppress melatonin—a hormone that helps initiate sleep,” Researchers wrote. “That causes people to fall asleep later at night, resulting in poorer sleep overall.”

Science.org also found that Black, Hispanic, and Asian people in the United States are also exposed to disproportionately high levels of particulate air pollution.

The researchers reported that exposure to this type of pollution can cause inflammation of the nose and throat, and some evidence suggests chronic exposure can worsen sleep apnea and increase daytime sleepiness.

he current trend of polypharmacy – the simultaneous use of multiple drugs by a single patient for one or more conditions – reflects racism and discrimination in the treatment of Black, Indigenous, and people of color children and teens, according to Dr. Carolyn Coker Ross, an intergenerational trauma expert and eating disorder treatment specialist.

“It has been documented in adults that Black patients with mental illness are more likely to receive substance care and more likely to be diagnosed with psychotic disorders than with depression and anxiety,” Dr. Ross stated.

“The lack of access and availability of ther apeutic options to treat mental illness and the lack of understanding and acknowledgment that mental illness in teens and children may have their roots in trauma.

“Medication will not fix the brain changes caused by childhood trauma experiences and may not even fix the symptoms. Beyond this, medication use in children and teens is risky at best and dangerous at its worst.”

Dr. Ross’ comments are in response to a new report revealing that anxious and de pressed teens are using multiple, powerful psychiatric drugs, many of which are untested in adolescents or for use in tandem.

In 2020, the journal Pediatrics reported

that 40.7 percent of people ages 2 to 24 who were prescribed a drug for attention deficit hyperactivity disorder also were prescribed at least one other medication for depression, anxiety, or another mood or behavioral disorder.

Further, researchers found more than 50 psychotropic medicines prescribed in such combinations.

“These patterns should spark further in quiry about the appropriateness, efficacy, and safety of psychotherapeutic polypharmacy in children and young adults, particularly within subgroups where the use is high,” the authors concluded.

While the use of multiple psychotropic medications counts as concerning in such a young population, it is also not surprising given the lack of other treatment options, Dr. Ross told the Washington Informer.

“Beyond this, however, is a lack of under standing about the root cause of many of the psychiatric conditions being diagnosed and treated with medications,” Dr. Ross asserted.

She continued:

“Both during and before the pandemic, BIPOC children and teenagers are exposed to more trauma and adverse events than any white children and teens.”

Given that depression and anxiety have

increased in recent years among youth, and young ones who have experienced trauma or childhood adversity (or ACEs – adverse childhood experiences) are more likely to experience depression and anxiety and other health and learning challenges, this is a sig nificant health and social justice conversation, added Sarah Marikos, the executive director of the ACE Resource Network (ARN).

“The issues on prescribing psychotropic medications for children, adolescents, and young people, and lack of access to behav ioral health supports for youth who have an increasing need for mental health support is one of the biggest health challenges our country is facing right now,” Marikos wrote in an email.

“This is partly why the U.S. Surgeon General issued an advisory on youth mental health at the end of 2021. When diagnosing and treating depression, anxiety, and ADHD, as well as many more common health con ditions, particularly among young people, it is important to have a trauma-informed approach.”

Marikos continued:

“Giving children and young people, or anyone really, a psychiatric diagnosis with medication has serious, potentially help ful, and potentially harmful consequences.

“And then there is night-time noise, which a 2017 study at hundreds of sites across the United States found is higher in neighborhoods with a higher proportion of Black residents,” they wrote.

The low prevalence of good sleepers “was expected given our busy, 24/7 lives,” said study author Dr. Aboubakari Nambiema of INSERM (the French National Institute of Health and Medical Research), in Paris, France.

stops and starts while sleeping.

Researchers in France used a healthy sleep score combining five sleep habits. They investigated the association between the baseline sleep score, changes over time in the sleep score, and incident cardiovascular disease.

Researchers recruited men and women aged 50 to 75 years and free of cardiovascular disease to a preventive medical center between 2008 and 2011.

The average age was 59.7 years, and 62% were men.

Participants underwent a physical examination and com pleted questionnaires on lifestyle, personal and family medical history, and medical conditions.

According to the news release, researchers used question naires to collect information on five sleep habits at baseline and two follow-up visits.

Each factor was given 1 point if optimal and 0 if not.

A healthy sleep score ranging from 0 to 5 was calculated, with 0 or 1 considered poor and 5 considered optimal.

Those with an optimal score reported sleeping 7 to 8 hours per night, never or rarely having insomnia, no frequent excessive daytime sleepiness, no sleep apnoea, and an early chronotype (being a morning person).

The researchers checked for incident coronary heart disease and stroke every two years for a total of 10 years.

At baseline, 10% of participants had an optimal sleep score, and 8% had a poor score.

“During a median follow-up of eight years, 274 participants developed coronary heart disease or stroke,” according to the release.

physical activity, cholesterol level, diabetes, and family history of heart attack, stroke, or sudden cardiac death.

They found that the risk of coronary heart disease and stroke decreased by 22% for every 1-point rise in the sleep score at baseline.

More specifically, compared to those with a score of 0 or 1, participants with a score of 5 had a 75% lower risk of heart disease or stroke.

The researchers estimated the proportion of cardiovascular events that could be prevented with healthier sleep.

They found that if all participants had an optimal sleep score, 72% of new cases of coronary heart disease and stroke might be avoided each year.

Over two follow-ups, almost half of the participants (48%) changed their sleep score: in 25%, it decreased, whereas, in 23%, it improved.

When the researchers examined the association between the change in score and cardiovascular events, they found that a 1-point increment over time was associated with a 7% reduction in coronary heart disease or stroke risk.

“Our study illustrates the potential for sleeping well to preserve heart health and suggests that improving sleep is linked with lower risks of coronary heart disease and stroke,”

Dr. Nambiema stated in the release.

“We also found that the vast majority of people have sleep difficulties. Given that cardiovascular disease is the top cause of death worldwide, greater awareness is needed on the importance of good sleep for maintaining a healthy heart.”

According to a news release from the ESC, previous studies on sleep and heart disease have generally focused on one sleep habit, such as sleep duration or sleep apnea, where breathing

The researchers analyzed the association between sleep scores and cardiovascular events after adjusting for age, sex, alcohol consumption, occupation, smoking, body mass index,

Diagnosis informs treatment.

Therefore, if the diagnosis is not right, the treatment may not work, or worse, it could be hurtful.”

“Diagnoses can also impact how young people think and feel about themselves and perhaps define themselves. Doctors and behavioral health providers who understand trauma and seek to understand their patients’ history and experiences, may mean a shift in diagnosis and treatment.”

The New York Times noted a nationwide study published in 2006 examined records of visits to doctors’ offices by people younger than 20 and found a sharp rise in office visits involving the pre scription of antipsychotic drugs — to 1.2 million in 2002 from 200,000 in 1993. In addition, the drugs were increasingly pre scribed in combinations, particularly among low-income children.

The newspaper added that between 2004 and 2008, a national study of children en rolled in Medicaid found that 85 percent of patients on an antipsychotic drug were also prescribed a second medication, with the highest rates among disabled youngsters and those in foster care.

She once worked at Cleveland Clinic Children’s Hospital in Ohio.

“While I believe physicians and psychi atrists are probably overprescribing these medications, I don’t believe they do so in tentionally,” Tietz stated.

“Unfortunately, they are often left with little choice. Cognitive behav ioral therapy (CBT) and other forms of counseling have been shown to be an essential part of managing mental health conditions,” Tietz continued.

“However, there are few professionals in the medical field today who practice adolescent psychiatry and can provide this benefit to our youth.

“This leaves prescribers with the task of trying to manage mental health con cerns strictly with medication.

“I believe any physician would tell you that they want to help the patient to the best of their ability. Unfortunately, right now, physicians have few tools besides medication to do this.”

People often don’t get the mental health services they need because they don’t know where to start.

Talk to your primary care doctor or anoth er health professional about mental health problems. Ask them to connect you with the right mental health services.

If you do not have a health professional who is able to assist you, use these resources to find help for yourself, your friends, your

family, or your students.

Emergency Medical Services, 911

If the situation is potentially life-threaten ing, get immediate emergency assistance by calling 911, available 24 hours a day.

If you or someone you know is suicidal or in emotional distress, contact the 988 Suicide & Crisis Lifeline. Trained crisis workers are available to talk 24 hours a day, 7 days a week. Your confidential and toll-free call goes to the nearest crisis center in the Lifeline national network. These centers provide crisis coun seling and mental health referrals.

Call or text 988 or chat 988lifeline.org.

SAMHSA’s Behavioral Health Treatment Services Locator is a confidential and anon ymous source of information for persons seeking treatment facilities in the United States or U.S. Territories for substance use/ addiction and/or mental health problems.

Sources: MentalHealth.gov. National Newspaper Publishers Association (NNPA)

“It’s a fact that our youth are experiencing more mental health concerns today than ever before,” offered Laura Tietz, a pediatric pharmacist.

“The importance of sleep quality and quantity for heart health should be taught early in life when healthy behaviors become established. Minimizing night-time noise and stress at work can both help improve sleep.”

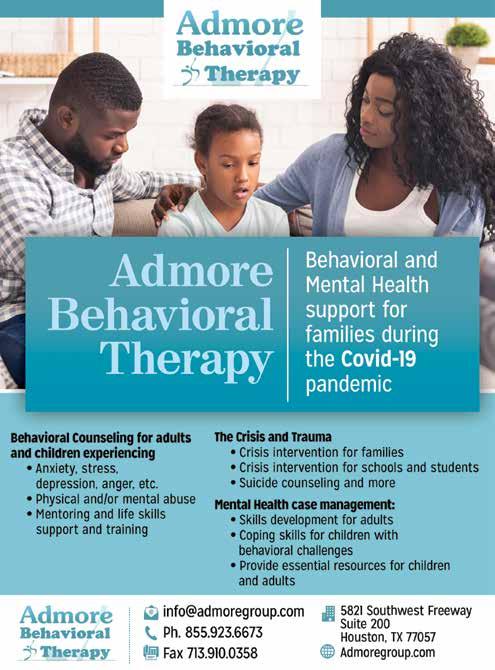

The COVID-19 pandemic introduced unprecedented challenges and altered ways of living across the globe. Now, more than two years later, the effects are still felt widely. Many non-emergent clinical services were limited or suspended during the early stages of the COVID-19 pandemic in the US, which may have adversely impacted epidemics of public health importance, such as HIV, and access to testing, which is a cornerstone of prevention efforts.[1] While adjusting to a new normal, it's time to reprioritize making routine HIV screening a normal and important part of self-care.

In 2019, an estimated one in eight people living with HIV in the US were unaware of their status,[2] and in 2016 nearly 80 percent of new HIV infections were transmitted by people who didn't know they had HIV or were not in care.[3] Further, HIV diagnoses have greatly declined during the COVID-19 pandemic. [4] According to a recent analysis, the number of Centers for Disease Control and Prevention (CDC) funded HIV tests conducted by the country's health departments plunged by nearly half from 2019 to 2020.[5] Another report indicates that HIV diagnoses dropped by 17% from 2019 to 2020, after declining by no more than 3% annually since 2016, likely due to disruptions to HIV-related services caused by the COVID-19 pandemic.4

To help normalize HIV testing, Gilead launched Press Play, a resource to encour age routine testing as a regular part of self-care and help deter negative emotions or stigma associated with HIV screenings. HIV testing is for everyone - the CDC recommends people between the ages of 13 and 64 get tested for HIV at least once as part of routine health care, and some people may benefit from getting tested more often.[6] Press Play provides information about what you can expect during an HIV test, next steps to take after a test, and other tools - including options for finding an HIV testing site or ordering a free at-home test - to help make test taking easier.

"With Press Play, our goal is to normalize routine HIV screening as an important part of self-care by providing resources to help you get tested and information on your options once you have your test results - no matter the outcome," said David Malebranche, MD, MPH, Senior Director of Global HIV Medical Affairs at Gilead. "Once you know your HIV status, you're on your way to moving forward. You can connect with your HCP to understand options to help prevent or treat HIV."

While it's natural to feel nervous about getting tested for HIV, no matter the test result, there is power in knowing your HIV status. By knowing your status, you are better equipped to discuss prevention or treatment options with a health care provider. Although there is currently no cure for HIV, there are several options available to help prevent or treat HIV.

The only way to know your HIV status is through testing. It's time to reintro duce testing into self-care routines and work together to help put an end to the HIV epidemic. To learn more about HIV testing, find HIV testing sites, or order a free at-home test, visit Press Play's website at hivtestnow.com.

[1] Moitra E, et al. Impact of the COVID-19 pandemic on HIV testing rates across four geographically diverse urban centres in the United States: An observational study. Lancet Reg Health Am. 2022;7:100159. doi:10.1016/j.lana.2021.100159

[2] Centers for Disease Control and Prevention (CDC). CDC fact sheet: HIV in the United States and dependent areas. Accessed May 31, 2022. https://www.cdc.gov/ hiv/pdf/statistics/overview/cdc-hiv-us-ataglance.pdf

[3] CDC. Gaps in HIV testing and treatment hinder efforts to stop new infections. Accessed March 18, 2019. https://www.cdc.gov/media/releases/2019/p0315-gapshinder-hiv-testing.html

[4] CDC. HIV Surveillance Report, 2020; vol. 33. Accessed May 31, 2022. https:// www.cdc.gov/hiv/library/reports/hiv-surveillance/vol-33/index.html

[5] Patel D, et al. HIV testing services outcomes in CDC-funded health departments during COVID-19. J Acquir Immune Defic Syndr. 2022. doi:10.1097/QAI.0000000000003049

[6] "Should I get tested for HIV?" Centers for Disease Control and Prevention. HIV: Getting tested. Accessed May 31, 2022. https://www.cdc.gov/hiv/basics/hiv-testing/ getting-tested.html

By d-mars.com

By d-mars.com

Prostate cancer is the second most common type of cancer diagnosed and the second leading cause of cancer death among Americans with pros tates. This year alone, more than a quarter million people in the U.S. will receive the diagnosis. With approximately 1 in 6 Black men expected to be diagnosed with prostate cancer in his lifetime compared to 1 in 8 White men, the Black community is dispro portionately impacted due to long-standing health inequalities.

To address this issue and save lives, the American Cancer Society recommends Black people born with a prostate speak with their doctor and make an informed decision about screening. There are usually no symptoms until the disease is advanced. Screening can catch cancer early and make it easier to find effective treatment options.

“Health inequalities within the Black community have been well documented,” said Tawana Thomas Johnson, senior vice president, and chief diversity officer at the American Cancer Society. “Reasons for these inequalities are complex but likely rooted in the structural racism that contributes to poverty, under-resourced communities, and the lack of access to high-quality health care. All these factors lead to Black people having a higher cancer burden due to greater obstacles to cancer prevention,

detection, treatment, and survival.”

While death rates from prostate cancer have dropped by more than 50% since the early 1990s, Black people still have the highest death rate for prostate cancer of any racial or ethnic group in the U.S., dying from this type of cancer at a rate double to white people. Studies also show Black people diagnosed with advanced-stage prostate cancer are significantly less likely to receive any treatment compared with white people, even when they have similar health insurance.

“We urge the Black community to work with us to ad dress these alarming statistics,” said Dr. Arif Kamal, the

chief patient officer at the American Cancer Society. “Talk to a doctor about screening and available screening options, and if di agnosed, use us as a resource to learn more about the research and resources available for the best cancer outcomes.”

Talk to a doctor about prostate cancer screening if you are:

Talk to a doctor about prostate cancer screening if you are:

• 40 or older and have more than one close family member who had prostate cancer 45 or older and Black or have a close family member who was diagnosed with prostate cancer before they turned 65

• 50 or older and have no family history of prostate cancer

From 1991 to 2019, there has been a 32% decline in cancer mortality due to early detec tion, research, advocacy, and patient support. The American Cancer Society offers multiple resources to support patients and improve cancer outcomes. This includes a 24/7 cancer helpline, free transportation to treatment, free lodging if treatment is needed away from home, online patient and caregiver peer support communities and information on current research.

Learn more at cancer.org/partneringforlife.

More than one in three Black community college students are in poverty, and widespread inequality in community colleges deep ened throughout the pandemic for Black students facing basic needs insecurity.

According to a new report from the Joint Center for Political and Economic Studies on the state of Black students at community colleges, an alarming 70 per cent of Black students experienced food or housing insecurity or homelessness during the COVID-19 pandemic.

The report highlighted that while Black students remain disproportionately rep resented in community colleges, policy barriers prevent the system from produc ing equitable outcomes.

“Black workers are struggling to make ends meet during this health and econom ic crisis. Community colleges provide a path forward to ensure workforce readi ness for all, but there are barriers holding back Black students from reaching their full potential,” Dr. Alex Camardelle, the director of workforce policy at the Joint Center, said in a news release.

“On average, Black students at commu nity colleges experience lower graduation rates and earn tens of thousands of dollars less after graduation while having to take on more debt than their peers to pay for school,” Camardelle stated.

He noted that things should be different.

“With targeted basic needs support, child care, improved transfer pathway policies, and better evaluations of commu nity college outcomes by race, our policy makers can do right by Black community college students,” Camardelle added.

“And the biggest takeaway of all — making community colleges tuition-free will benefit Black students the most.”

Joint Center researchers said basic needs insecurity is also closely associated with enrollment declines.

“While COVID-19 emergen cy funds authorized by Congress pushed community colleges to in troduce more support for meeting students’ basic needs, barriers to accessing those supports remain,” study authors found.

For example, 68 percent of Black male students at community colleges

experience basic needs insecurity.

Still, only 31 percent of those with needs accessed on-campus resources meant to connect students with aid because too few knew they were available or do not know how to apply, the researchers discovered.

Meanwhile, the authors concluded that Black student enrollment at community colleges has steadily declined over time and has dropped during the COVID-19 pandemic.

Among the chief findings:

• From fall 2019 to fall 2021, enrollment fell 18 percent for all Black students and 23.5 percent and 15 percent for Black men and Black women, respectively.

• Black community college students experience the lowest graduation rates when compared to their peers of other races and ethnicities.

• The gap between Black and white graduation rates more than doubled from a four-percentage point gap in 2007 to an 11-percentage point divide in 2020.

• The typical Black community college graduate earns $20,000 less per year than their classmates.

• White households with workers who hold a high school diploma earn $2,000 more than Black community college graduates.

• Over two-thirds (67 percent) of Black students borrowed money to pay for community college compared to 51, 36, and 30 percent of white, Hispanic, and Asian students, respectively.

Further, researchers found that Black community college graduates owe 123 percent of the original amount they borrowed 12 years after beginning their community college journey.

View the full report at jointcenter.org.

Source: National Newspaper Publishers Association (NNPA)

Is inflation continues to put a strain on budgets, talk of an upcoming recession has Americans worried about their finances. Prices on everyday items continue to rise and consumers are trying to find ways to make their dollar stretch further while safe guarding their money against the potential challenges a recession may bring. The future may be difficult to predict, but preparing now can help consumers protect their financial health during a recession.

A recent Experian survey found that two in three U.S. adults are concerned about a recession occurring in the United States. Consumers are most worried about the affordability of routine expenses, with 73% concerned

that the price of everyday items like gas, gro ceries, and rent will continue to rise to a level they can’t afford. Meanwhile, 55% harbor supply chain concerns, and 38% are stressed about the affordability of big, planned purchases such as a home or a car.

As recession worries grow, more Americans are sizing up their finances to see where they stand. Only 48% are con fident that they can financially handle a recession, and two in five believe that they’ll need to rely on credit to cover essential and unexpected expenses over the next three months. In fact, 27% have already increased their credit card debt within the past three months. This trend is accompanied by additional anxieties: two in three survey respondents are concerned to some degree that their credit score will negatively affect their ability to access credit in the next three months.

Being proactive is key to weathering financial storms, yet less than half of consumers have prepared for a recession when it comes to their finances and credit. Those who have are finding different ways to do so: 49% have cut non-essential expenses like entertainment and vacations, 45% have created a budget and 40% have paid down debt.

While these are effective actions, there are other steps consumers can take to understand their credit history and safeguard their credit.

Consumers should check their credit report and credit score regularly to know exactly where they stand in the event that they need to apply for credit, or simply to be better informed as they prepare to pay down their debt ahead of an economic decline. They can get a free credit report and credit score from Experian (Spanish-language credit reports are also available) as well as access to free financial tools, an auto insurance shopping service, and a credit card marketplace.

Those who need help increasing their credit score can sign up for Experian Boost. This free feature enables consumers to add their monthly payments for cell phone bills, utility bills, rent, and video streaming services to their credit history to potentially increase their FICO Score instantly. To learn more, visit experian.com/boost.

“Inflation and recession fears are putting pressure on consumer’s finances, but proactively planning for the worst can help consumers make it through potential challenges. Many consumers are already taking great steps to prepare, like creating a budget and paying down their debt, and we encourage them to utilize other avail able resources and tools to help,” says Rod Griffin, senior director of Public Education and Advocacy at Experian.

If you're unsure of how to start planning for your financial future through investing, you're far from alone.

In fact, it might surprise you to know that 80 million Americans are interested in investing but don't know where to begin. Yahoo Finance even reports that 54% of millennials have less than $5,000 of their money invested into stocks, bonds, real estate, or other hold ings. While many feel they lack the funds, others are intimidated or simply don't know how to initiate solid investments. But that lack of action could hurt their financial standing later in life, according to the report.

At the recent Create & Cultivate 2022 LA Conference, Maya Sudhakaran, Head of Growth and Acquisition of Plynk, noted that "One of the biggest things I've learned is that perfection is the enemy of good. There is so much intimidation and fear associated with dipping your toes into the world of investing, that most people don't do it."

Fortunately, investing doesn't have to be complicat ed, time-consuming, or financially burdensome, and it's never too late to learn. With that in mind, here are simple suggestions for getting started.

Invest the money you won't need today (or tomor row). The market has historically trended upward over long periods, but it can be unpredictable in the short term.

That's why it's safer to invest money you won't need for immediate needs like your rent, groceries, car payment, or emergency savings. Instead, use the funds available after you've paid your monthly bill, whether they amount to $10 or $100. That rule of thumb lets you plan for the future without jeopard izing your everyday financial well-being.

Understand you can start investing with just $1 This allows you to learn by doing versus feeling like you can't start investing at all. Until recently, the only way you could buy stock was by having the funds to buy an entire share, plus transaction fees. With the new investing app Plynk, you can invest in stock (or exchange-traded fund or mutual fund) with as little as $1 by buying a "fractional share." In essence, you're able to put your money into a portion of a company's stock rather than having to buy the whole share, helping you learn about investing by actually investing.

Invest in manageable amounts on a

regular basis. Rather than waiting till you have a sizable amount like $1,000 to invest each year, make the process seem more doable by setting aside $20 a week or $100 a month. That may seem even easier if you arrange for recurring investments; you'll still have control of what you buy but won't need to log in every time to place a trade.

Don't try to time the market. The choice of whether to sell and take a loss is yours, but consider this: Even professional money managers struggle to time the market successfully over short-term periods. That's why successful investors tend to tune out short-term "noise" and stay focused on their long-term goals.

Rather than trying to time the market, focus on choosing investments you believe in - then stick to your plan.

Be patient with yourself. Try not to get down on yourself if your investing schedule gets off track - that happens to everyone at some point. Just acknowledge it, reflect on it and get ready to regroup tomorrow, next week, or next month. What matters isn't that you missed a milestone or delayed making moves, but that you started in the first place. Understand that any progress adds up over time, no matter how small the increments.

You don't need to be a financial expert to start on the path toward achieving your future financial goals and to begin investing. Thanks to Plynk, the new, no-experience-required investment app for novices, you can begin with as little as $1. Even better, during the Learn & Earn promotion, available from August 18 through October 20, you can earn up to $50 in bonuses: $10 just for signing up with a brokerage account and linking your bank account, and up to a $40 investment match for learning by doing via the targeted articles in the app.

Find more info at plynkinvestcom.

By d-mars.com News ProviderLife insurance is for people of all ages, not just parents and grandparents. While life insurance needs vary by age and stage of life, it’s a good idea to invest in a life insurance plan while you’re young.

If you’re in your 20s and 30s, life insurance may not seem necessary, but it’s a useful tool to have at any age. Check out these three reasons provided by State Farm® why life insurance should be a priority for young adults.

As a young adult, life insurance probably isn’t top of mind, but it’s the best time to get coverage. Since you’re young and likely healthy, you’ll typically qualify for more affordable premiums. Because you have a relatively long life expectancy, insurers see you as less risk than older individuals.

You don’t have to apply for an expensive, comprehensive policy. Start with a small policy in your 20s that fits your budget to build the foundation of your financial security. You can always expand your coverage throughout your life.

When you experience a life change, like marriage or kids, you should evaluate and expand your coverage as needed. By the time you’re in your 30s, you may have children and a mortgage or plan, which makes the finan cial protection offered by life insurance more important than ever. For example, life insurance coverage can help cover your children’s education costs if tragedy hits and you are no longer there to provide for them.

If you don’t have kids or a house payment but are plan ning on expanding your family or purchasing a home, don’t wait to bolster your coverage. Now is the time to make sure you are fully insured, as rates typically rise with age.

It’s not pleasant to think about you or a family member passing. Still, should the unexpected happen, you’ll want to be covered. According to the Life Insurance Marketing and Research Association (LIMRA), too many families are at risk of financial insecurity should their primary wage earner pass away. In fact, the association found that 44% of U.S. households would feel financial hardships within six months of their primary wage earner’s passing.

A life insurance policy provides your family with security in the event of your passing and provides you with peace of mind knowing they’ll be covered after you’re gone. In addition to paying for college and providing income to your loved ones, it can help them cover funeral, burial, and cremation costs. According to State Farm, the average funeral typically costs around $8,000, a hefty expense to try to cover when you’re already grieving the loss of a loved one. Final expense insurance (or burial insurance) can help relieve the financial impact of a funeral.

These are just three reasons why you should invest in a life insurance policy while you’re young and can qualify for lower premiums. If you want to protect your future now but have questions about what coverage you need and can afford, visit www.StateFarm.com or the State Farm app to talk with an insurance agent.

ank of America announced a new zero down payment, zero closing cost mortgage solution for first-time homebuyers, which will be available in designated markets, in cluding certain African American and Hispanic neighborhoods in Charlotte, Dallas, Detroit, Los Angeles, and Miami.

According to a news release, the Community Affordable Loan Solution aims to help eligible individuals and families obtain an affordable loan to purchase a home.

“The Community Affordable Loan Solution is a Special Purpose Credit Program which uses credit guidelines based on factors such as timely rent, utility bill, phone and auto insurance payments,” officials stated in the release.

“It requires no mortgage insurance or minimum credit score. Individual eligibility is based on income and home location.”

Prospective buyers must complete a homebuyer certification course provided by select Bank of America and HUDapproved housing counseling partners prior to application.

Officials said the new program is in addition to and complements Bank of America’s existing $15 billion Community Homeownership Commitment to offer affordable mortgages, industry-leading grants, and educational opportunities to help 60,000 individuals and families purchase affordable homes by 2025.

Through this commitment, Bank of America has already helped more than 36,000 people and families become homeowners, having provided more than $9.5 billion in low down payment loans and over $350 million in non-repayable down payment and/or closing cost grants.

To date, two-thirds of the loans and grants made through the Community Homeownership Commitment have helped multicultural clients to achieve homeownership.

Bank of America also has a 26-year relationship with the Neighborhood Assistance Corporation of America (NACA), through which the Bank has committed to providing an additional $15 billion in mortgages to low-to-mod erate income homebuyers through May 2027.

According to the National Association of Realtors, today there is a nearly 30-per centage-point gap in homeownership between White and Black Americans;

for Hispanic buyers, the gap is nearly 20 percent.

And the competitive housing market has made it even more difficult for po tential homebuyers, especially people of color, to buy homes.

“Homeownership strengthens our communities and can help individuals and families to build wealth over time,” said AJ Barkley, head of neighborhood and community lending for Bank of America.

“Our Community Affordable Loan Solution will help make the dream of sustained homeownership attainable for more Black and Hispanic families, and it is part of our broader commitment to the communities that we serve.”

In addition to expanding access to credit and down payment assistance, Bank of America said it provides edu cational resources to help homebuy ers navigate the homebuying process, including:

First-Time Homebuyer Online EduSeries, a five-part, easy-to-understand video roadmap for buying and financing a home, available in English and Spanish.

• ComFree financial education content, including videos about managing finances and how to prepare for buying a new home.

Bank of America Down Payment Center– site to help homebuyers find state and local down payments and closing cost assistance programs in their area. Bank of America participates in more than 1,300 state and local down payment and closing cost assistance programs.

• Bank of America Real Estate Center–site to help homebuyers find properties with flags to identify properties that may qualify for Bank of America grant programs and Community Affordable Loan Solution™.

For more information, contact Bank of America at 1-800-641-8362.

f you dream of homeownership, having your mortgage application denied can be devastat ing. If this does happen to you, it’s important to remember that you’re not alone. Thirteen percent of all purchase mortgage applications -- a total of nearly 650,000 -- were denied in 2020, according to federal government data.

Before quickly reapplying for a loan, it’s important to first understand the reasons your loan was denied. The lender is required to disclose that information to you within 30 days of its decision. You can also call your lender for further explanation. Having this knowledge will help you work toward building your eligibility for a mortgage.

In some instances, the situation involves a quick fix, such as providing missing or incomplete documenta tion. However, if the reasons cited for your application denial involve down payment cost, a low credit score, an adverse credit history, or a high debt-to-income ratio, here are six steps you can take toward recovery:

1. Consult a Housing Counselor. Consider speaking to a community-based credit counselor or a HUDcertified housing counselor. They can help you create a plan to increase your savings, decrease your debt, improve your credit, access down payment assistance, or take advantage of first-time homebuyer programs.

2. Improve Your Credit. In a 2022 Freddie Mac survey of consumers who denied a mortgage applica tion in the past four years, three in five cited debt or credit issues as reasons given for their initial denial. If this describes you, take time to improve your credit profile before applying for another loan. Good credit demonstrates responsible money management and gives you more purchasing power, opening doors to better loan terms and products. Visit creditsmart.

freddiemac.com to access Freddie Mac’s CreditSmart suite of free financial education resources that can help you understand the fundamentals of credit and prepare you for homeownership.

3. Pay Down Debt. In the application process, lend ers will look at your recurring monthly debts, such as car payments, student loans, and credit card loans. By lowering or paying down monthly debts, you can build a positive credit history and lower your debt-to-income ratio. Not sure where to start? Tackle your debt with the highest interest rate first.

4. Obtain Gift Funds. If you’re short on money for your down payment, you may be able to use gift funds from a family member to decrease the amount you need to borrow.

5. Find a Co-Signer. A co-signer applies for the loan with you, agreeing to take responsibility for the loan should you default. The co-signer’s credit, income, and debts will be evaluated to make sure they can assume payments if necessary. In addition to ensuring your co-signer has good credit, you should make sure they are aware of this responsibility and have sufficient income to cover the payment.

6. Look for a Lower-Cost Home. Remember, you should only borrow an amount you feel comforta ble repaying. You may need to look for a lower-cost home than you’re financially prepared to purchase and maintain.

For more information and additional resources, visit myhome.freddiemac.com.

If your home loan application is denied, don’t panic. There are ways to build your eligibility so that next time, your mortgage application is more likely to be approved.

imilar to how the ways we listen to music and watch movies have changed, cellular networks are evolving too. In fact, all major wireless pro viders plan to shutter their 3G cellular networks this year.

3G networks are the wireless equivalent of being on dial-up internet access years ago. Built in the early 2000s, 3G networks are slower, less efficient, and not equipped to support the way we use smartphones today. Americans increasingly depend on their ability to connect to the internet for just about everything and the latest generation of wireless, 5G , is capable of delivering mas sively faster speeds, enabling and improving everything we rely on our smartphones to do.

As wireless companies continue to invest in building out their 5G networks, 3G networks will be shut down to make room for this new technology and, ultimately, deliver a vastly superior wireless experience. That’s be cause there’s a limited supply of available spectrum -- the airwaves that wireless signals use. Wireless companies can take the airwaves once used for 3G and start using them to add more bandwidth to 5G. And more spectrum means better coverage and faster speeds for consumers.

If you have a phone that still relies on 3G, your wireless provider will contact you before their planned shutdown, and you’re most likely eligible for a free device upgrade.

Even if your phone isn’t from the 3G era, if you aren’t yet one of the mil lions who’ve upgraded to 5G , the end of 3G means it’s time to trade up for a new device that can take full advantage of faster 5G networks, according to in dustry experts. Keeping affordability and connec tivity in mind, wireless providers are always of fering deals.

Research 5G coverage and speeds from the providers where you live and like to travel. The wireless industry has changed significantly since the 3G era, so you may be surprised to learn which network is delivering the fastest and most reliable coverage today. T-Mobile was the first wireless provider in the United States to launch nationwide 5G and, thanks to its merger with Sprint in 2020, it now has the largest, fastest, and most reliable 5G network, covering nearly everyone in the country.