BUSINESS JOURNAL d-mars.com ® Entrepreneur | Business | Education and Career | Finance | Legal | Real Estate | Technology | Insurance FREE September 2022 | Inspire, Inform & Educate | 181th Edition INSIDE 10-11 A Million Dollars Will ‘Level Up’ Thousands of Houston Area Residents Out of Digital Divide 06 22 Meta Selects Texas Southern University as Research Partner to Enhance Instagram Experience 26 Want To Become Financially Healthy? Learn How Tech Tools Can Help Are You Financially Healthy? Meet Lawrence G. Hodges III, WMPC® Founder & CEO of Legacy Visions Wealth Management, LLC

Experience Our World of Advertising, Marketing, Media and Communication 2 | September 2022 MonkeypoxVirueladelMono Stay¡MantenteAlert!alerta!ANYONE CAN GET IT. CUALQUIERA PUEDE CONTAGIARSE. WHAT YOU CAN DO? Stay Informed Contact your doctor to get tested Get vaccinated if eligible Stay at home if you have monkeypox. WHAT ARE THE SYMPTOMS? Unusual rashes or lesions Fever & headaches Swollen lymph nodes Muscle aches Seek medical help immediately if you think you’ve been exposed or have symptoms. Busque ayuda queinmediatamentemédicasicreehaestadoexpuestootienesíntomas. ¿QUÉ PUEDES HACER? Mantente informado Contacte a su médico para hacerse la prueba Quédate en casa si te contagiaste de viruela del mono. Vacúnate si eres elegible CUÁLES SON LOS SÍNTOMAS? Erupciones o lesiones inusuales Fiebre y dolor de cabeza Ganglios linfáticos inflamados Dolores musculares Headache Fever Swollen lymp nodes Muscle Aches Lesions Chills Exhauston Backache Call HoustonHealth.org832-393-4220

d-mars.com is proud to con tinue our partnership with the community, publishing positive content and success stories pro moting the advancement of our African American businesses and civic and community leaders.

This month’s cover story is on Lawrence G. Hodges III, a Wealth Management Certified Professional® and Founder and CEO of Legacy Visions Wealth Management, LLC. Legacy Visions Wealth Management is a full-service financial firm helping clients pursue financial

PUBLISHER’S MESSAGE SERVICES

independence, a successful retirement, and a lasting legacy.

“I was desperate to understand money. Not to make it, to understand it. I wanted to know how it worked, and I wanted to know so that I would have enough and would be able to make good financial decisions.”

—Mellody Hobson, president and co-CEO of Ariel Investments and the chairwoman of Starbucks Corporation EDUCATION & CAREER Meta Selects Texas Southern University as Research Partner to Enhance Instagram Experience Frito-Lay Invests $500,000 in Scholarship Program With the United Negro College Fund To Provide College Education for Black and Hispanic Students Emory University Announces the first African American Studies Ph.D. Program in the U.S. Southeast To Become Financially Healthy? How Tech Tools Consumers Need to Know the Future of In-Person a Recession, Many Express Misgivings a Looming Downturn

As recent statistics show Black Americans typically experience higher levels of eco nomic insecurity than Americans overall, Lawrence is committed to serving our community in the area of improving our finances, guiding us to take the necessary steps that can enable us to achieve our short-term and long-term financial goals.

As always, thank you for your contin ued support of d-mars.com, progressing our publication’s efforts to highlight the communities in which we serve, live, and work. Partnering together, we succeed in making positive things happen.

Experience Our World of Advertising, Marketing, Media and Communication September 2022 | 3

BEHIND THE JOURNAL CONTENTS OUR

D-MARS.COM INFO

PUBLISHER & CEO Keith J. Davis, Sr. CHIEF OF STAFF & MANAGING EDITOR Kimberly Floyd ACCOUNTING MANAGER Eugenie Doualla ART DIRECTOR Angel Rosa DIGITAL MARKETING MANAGER Erick Fontejon OPERATIONS COORDINATOR Bria Casteel SENIOR PROJECT COORDINATOR Lindsey Ford ASSISTANT SALES REPRESENTATIVE Tiffany Brown PHOTOGRAPHY Grady Carter L.C. Poullard DISTRIBUTION Mike Jones CONTRIBUTING WRITERS Stacy M. Brown Marla d-mars.comLewis

MR. D-MARS Visit Us Online www.d-mars.com dmarsmarketingd-mars.com dmars_comdmars_com MAIN OFFICE 7322 Southwest Fwy., Suite 800, Houston, TX 77074 ADVERTISING | MARKETING MEDIA | COMMUNICATION Phone: (713) 373.5577 Fax: (713) 750.9472 Email Us: contact@d-mars.com CERTIFIED: HMSDC Port of Houston METRO City of Houston HISD HUB VBE DBE • Business Journal • Health & Wellness Journal • Community Weekley Report • Black Pages Online Business Directory • Top 50 Black Health, Medical & Wellness Professionals • Top 50 Black Professionals & Entrepreneurs • Top 30 Influential Women of Houston • Top 25 Prime & Subcontractors for Diversity • Business Connection • Business Development • Business Consulting • Graphic Design • Photography • Printing • Web Design • Online & Email Marketing • Public Relations • Social Media • Advertising • Writing • Promotional Marketing COVER STORY Are You Financially Healthy? Meet Lawrence G. Hodges III, WMPC® Founder & CEO of Legacy Visions Wealth Management, LLC 10-11 04 BUSINESS 04 Announcing the Business & Democracy Initiative: New Coalition Will Empower Business Leaders To Stand Up for American Democracy 04 Denny’s Joins “Pathways” Program To Support Black Franchise Ownership 06 COMMUNITY 06 A Million Dollars Will ‘Level Up’ Thousands of Houston Area Residents Out of Digital Divide 08 DOJ Charges Officers in Death of Breonna Taylor 12 OP-ED: Diversifying American Media Ownership Must Become a National Priorit 13-20 HEALTH & WELLNESS 14 10 Ways to Reset Your Routine and Build a Healthier Lifestyle 15 Feeling Down About Thin or Shedding Hair? Simple Steps To Healthier, Fuller Locks 16 This School Year, Prioritize Your Child’s Whole HealthPhysical and Mental 17 What You Need To Know About Heel Pain 18 Senate Dems Pass Huge Climate, Health, and Tax Bill 19 As Monkeypox Hits African American Community Hard, Biden IncreasesAdministrationVaccine 22

22

22

24

26 FINANCE 26 Want

Learn

Can Help 26 What

About

Banking 26 Fearing

About

30 REAL ESTATE 30 Understanding the Real Estate Counteroffer 30 Why Wait? Get Into a Home Sooner With Private Mortgage Insurance

Announcing the Business & Democracy Initiative: New Coalition Will Empower Business Leaders To Stand Up for American Democracy

By d-mars.com News Provider

Recently, a coalition of business leaders and organizations announced the Business & Democracy Initiative, a new partnership ded icated to protecting the integrity of our elections and rebuilding trust in democratic institutions, because a strong economy requires a strong democracy.

The Business & Democracy Initiative's founding part ners are top business leaders and advocates: the Black Economic Alliance, the Leadership Now Project, and Public Private Strategies. Leaders in America's business community view democracy and voting rights as an economic issue. Fully 45 of the top 50 global compa nies operate in a democracy, according to research by Freedom House. The Business & Democracy Initiative will engage business leaders to shift the conversation around our democracy, drive corporate change, and secure the next generation of American prosperity

New research by Morning Consult on behalf of the Business & Democracy Initiative shows the business community wants to be active in protecting American democracy, and their customers will support them. The results show:

• 96% of business leaders say the existence of a well-functioning democracy is "important" to a strong economy.

• 80%+ of business leaders think that businesses should act to protect democracy and act to ensure safe and fair elections.

• 51%+ of business leaders say their business is more likely than they were five years ago to encourage employees to take a stance or speak out in support of democracy, or to take a public stance as a business.

• 64%+ of consumers say that a business with a public commitment to democracy shows the business cares about its customers, its employees, and has the right values.

"With our nation's democratic system under more stress than ever, the business community is a criti cal voice in the fight to preserve our free, open, and democratic system," said Rhett Buttle, founder of Public Private

Strategies. "We believe that a strong democracy is the cornerstone of a dynamic and inclusive American economy, and we will be engaging with stakeholders across all levels of business to advocate for reforms that strengthen our democracy."

"Business leaders across the country are concerned about the health of our democracy. They understand that our economic dynamism depends on a capable and accountable government," said Daniella Ballou-Aares, CEO of the Leadership Now Project. "The Business & Democracy Initiative will provide business leaders with the knowledge and platform to lead on the issues — from preventing election crises to expanding civic engagement — and secure a strong economy for the next generation."

"As businesses continue to expand their influence on the American public, they have an increasing respon sibility to proactively preserve and protect American democracy," said David Clunie, Executive Director of the Black Economic Alliance. "Through the Business & Democracy Initiative, the Black Economic Alliance and our partners will help the business community utilize its increasingly expansive reach to help fortify the integrity of our democracy, which is necessary to achieve an inclusive and sustainable economy for all Americans."Readthefull survey report and learn more about the Business & Democracy Initiative at businessand democracy.org.

Source: The Business & Democracy Initiative

Denny’s To“Pathways”JoinsProgramSupport Black Franchise Ownership

By d-mars.com News Provider

Recently, Denny's announced its commitment to the Pathways to Black Franchise Ownership program created by the Multicultural Foodservice & Hospitality Alliance (MFHA). Denny's and MFHA have enjoyed a successful 25-year alliance and, as a new Pathways to Black Franchise Ownership partner, Denny's will help MFHA reach its goal of cre ating 100 Black-owned franchises by 2023.

The Pathways to Black Franchising program aims to make systemic change and drive greater wealth in the Black community by empowering African American entrepreneurs to operate high-performing franchise businesses. Research from the US Census Bureau and the International Franchise Association shows that African Americans make up only 8% of franchise business owners, and, together, Denny's and MFHA will work to close that gap by providing participants with specialized training, coaching, mentoring and other support to help them open both single and/ or

Denny's has invested more than $2 billion in underrepresented suppliers, including hiring minority-owned small business operators and entrepre neurs as consultants.

"At Denny's, diversity, equity and inclusion are key components of our business strategy and that includes every part of our organization from our board of directors to our franchisee association," said Denny's CEO John Miller. "Our expanded partnership with MFHA will help close the ownership gap for Black business owners and bring new faces and fresh thinking to Denny's. We're humbled to be able to create more opportunities for Black business owners who are historically underrepresented in the restaurant industry."

"MFHA is excited to welcome Denny's to the Pathways program," said Gerry Fernandez, Founder, and President of MFHA. "Together, we can make a lasting impact by helping Black entrepreneurs achieve their dream of owning their own restaurant, uplifting their commu nities, and building wealth for their family and future generations."Pathwaysto

Black Franchise Ownership was launched in 2020 with the goal of creating 100 Black-owned franchises by the end of 2023. MFHA is working closely with the National Restaurant Association, the National Restaurant Association Education Foundation (NRAEF), and the International Franchise Association to expand the program.

For more information, please visit https://mfha.net/Pathways/. Denny’s

franchisemulti-unitbusinesses.JoiningPathwaysmarksanotherchapterinDenny'slong-standingcommitmenttodiversity,equity,andinclusion.Since1993,

Experience Our World of Advertising, Marketing, Media and Communication 4 | September 2022

BUSINESS

Source:

BUSINESS

Experience Our World of Advertising, Marketing, Media and Communication September 2022 | 5

A Million Dollars Will

‘Level Up’

Thousands of Houston Area Residents Out of Digital Divide

By d-mars.com News Provider

If you’ve ever played a popular 80’s video game, then you know about the disadvantages your character has right out of the gate. You can’t jump as high or as far, and it’s easier to lose the level and have to start all over again. But in the first few seconds, there’s usually always a chance to ‘level up’ your character. Instantly, you can jump higher and farther, run faster and if you encounter an enemy, you still have another chance at winning the level.

There are thousands of Houston area residents who — from a digital perspective — aren’t ‘leveled up” and therefore struggle to participate in the digital economy. Some Houstonians still don’t know how to surf the web, write emails or create a resume. Others don’t even have a reliable and fast internet connection in their homes. The digital divide is still big. According to the 2020 U.S. Census Bureau’s American Communities Survey, one in ten households, or 687,086 households, in the greater Houston area do not have an internet subscription or do not have a computer.

They want to ‘level up’, and they are about to get it.

Comcast, the Houston area’s largest internet service provider, is giving more than one million dollars this year to local organizations that help students, adults, and people with disabilities ‘level up’ their computer, career development, and tech education skills. The million-dollar investment will also support ongoing efforts to build awareness about low-cost or no-cost connectivity programs like Internet Essentials and the federal government’s Affordable Connectivity Program(ACP).

“These investments are a part of Comcast’s ongoing efforts to make a real difference in southeast Texas by giving families an opportunity to thrive in this digital age,” Ralph Martinez, Comcast Houston’s Regional Senior Vice President, said. “The Internet is where life happens. It allows students to expand their educational aspirations and it empowers parents to explore better job openings so they can ultimately deliver a better quality of life for their families.”

So far, Comcast has given grants to eight Houston area organizations. More announcements will be made later this year.

• United Way - Funding will be used to provide tech experts (Digital Navigators) to help people in need of digital skills training.

• BakerRipley - Funding will support computer skills, software, email, and internet safety training for low-income adults in the Houston area.

• Comp-U-Dopt - Funding will support students participating in Early Adopters, STEAM Team, and Learn2Earn, which brings technology education to area youth. Comp-U-Dopt will also use the funding to provide tech experts (Digital Navigators) to help people in need of digital skills training.

• Easter Seals of Greater Houston - Funding will support the development of a curriculum for people with disabilities to help them successfully learn to use digital technology to gain and maintain employment.

• The Boys and Girls Club of Greater Houston - Funding will help high school students gain tech nical and leadership skills through the Workforce Readiness Program.

• AAMA - Funding will be used to purchase tech nology and equipment to support students through the training program at the Work and Learn Center, with an emphasis on digital literacy and design.

• Dress for Success - Funding will be used to pro vide Houston-area women with the resources needed to obtain long-term employment through access to job readiness training, digital skills workshops,

computers, and mobile labs.

• AVANCE-Houston - Funding will support the adult literacy program and continue to build pathways to economic mobility for families in the community.

·

“We are passionate about doing our part to help close the digital divide and committed to helping establish a more equitable foundation for learning, working, and succeeding,” Martinez said.

Comcast remains steadfast in its efforts to connect people to moments that matter, to connect families to opportunities in Southeast Texas. For more than a decade, the company has offered Internet Essentials to help low-income Americans access reliable, high-speed internet. Comcast is now a proud champion of the federal government’s new Affordable Connectivity Program. ACP gives qualifying households up to $30 towards their monthly internet bill. With ACP, Comcast’s Internet Essentials internet service is free.

As more Houston area residents get the ‘level up’ they need, just like in their gameplay, they will have more chances to keep advancing—better jobs, better educa tion, innovation, opportunities, and yes, more fun and better gaming.

Source: Comcast Houston

Experience Our World of Advertising, Marketing, Media and Communication 6 | September 2022 COMMUNITY

Experience Our World of Advertising, Marketing, Media and Communication

Experience Our World of Advertising, Marketing, Media and Communication

September 2022 | 7

DOJ Charges Officers in Death of BREONNA TAYLOR

By Stacy M. Brown NNPA Newswire Senior National Correspondent

Say her name.

Breonna Taylor’s family may finally get justice after the Department of Justice charged four current and former police officers in Louisville, Kentucky, who were involved in the fatal March 2020 raid on her apartment.

The DOJ accused the officers of lying to obtain a warrant that was used to search her home when they knocked her door down and opened fire.

U.S. Attorney General Merrick Garland announced that members of an investi gative unit within the Louisville Metro Police Department had included false information in an affidavit that was then used to obtain a warrant to search Taylor’s home.Hetold reporters at a hastily called news conference that prosecutors believed the officers “violated federal civil rights laws, and that those violations resulted in Taylor’s death.”

Three of the officers also misled inves tigators who began looking into Taylor’s death, Garland said, including two that he said had met in a garage in the spring of 2020 and “agreed to tell investigators a false story.”

“On March 13, 2020, Breonna Taylor should have awakened in her home as usual, but tragically she did not,” said Assistant Attorney General Kristen Clarke.

Police Department (LMPD) Detective Joshua Jaynes, 40, and current LMPD Sergeant Kyle Meany, 35, with federal civil rights and obstruction offenses for their roles in preparing and approving a false search warrant affidavit that resulted in Taylor’s death.

The second indictment charges former LMPD Detective Brett Hankison, 46, with civil rights offenses for firing his service weapon into Taylor’s apartment through a covered window and covered glass

Thedoor.third charging document — and information filed by the Department of Justice — charges LMPD Detective Kelly Goodlett with conspiring with Jaynes to falsify the search warrant for Taylor’s home and to cover up their actions afterward.

The first indictment — charging Jaynes and Meany in connection with the allegedly false warrant — contains four counts. Count One charges that Jaynes and Meany, while acting in their official capacities as of ficers, willfully deprived Taylor of her constitutional rights by drafting and approving a false affidavit to obtain a search warrant for Taylor’s home.Theindictment alleges that Jaynes and Meany knew that the affidavit contained false and misleading statements, omitted material facts, relied on stale information, and was not supported by probable cause.

This count alleges that the offense resulted in Taylor’s death.

Count Two charges Jaynes with conspir acy, for agreeing with another detective to cover up the false warrant affidavit after Taylor’s death by drafting a false investi gative letter and making false statements to criminal investigators.

Count Three charges Jaynes with falsi fying a report with the intent to impede a criminal investigation into Taylor’s death.

Count Four charges Meany with making a false statement to federal investigators. The second indictment —against Hankison — includes two civil rights charges alleging that Hankison willfully used unconstitutionally excessive force, while acting in his official capacity as an officer, when he fired his service weapon into Taylor’s apartment through a covered window and covered glass door.

wall of Taylor’s home and into the apart ment unit occupied by her neighbors.

Both counts allege that Hankison used a dangerous weapon and that his conduct involved an attempt to kill.

The information charging Goodlett with conspiracy contains one count. It charges Goodlett with conspiring with Jaynes to falsify the warrant affidavit for Taylor’s home and file a false report to cover up the false affidavit.

All of the civil rights charges involve alleged violations of Title 18, United States Code, Section 242, which makes it a crime for an official acting under the color of law — meaning an official who is using or abusing authority given to that person by the government — to willfully violate a person’s constitutional rights.

A violation of this statute carries a stat utory maximum sentence of life imprison ment where the violation results in death or involves an attempt to kill.

The obstruction counts charged in the indictments carry a statutory maximum sentence of 20 years; and the conspiracy counts carry a statutory maximum sen tence of five years, as does the false-state ments charge. Actual sentences, in case of conviction, are determined by a judge.

The charges announced today are separate from the Justice Department’s Civil Rights Division’s pattern or prac tice investigation into Louisville Metro Government and the Louisville Metro Police Department, which Attorney General Garland announced on April 26, 2021, the DOJ news release stated.

The charges are criminal against indi vidual officers, while the ongoing pattern or practice investigation is a civil inves tigation that is examining allegations of systemic violations of the Constitution and federal law by LMPD and Louisville Metro, the DOJ noted.

The civil pattern or practice investiga tion is being handled independently from the criminal case by a different team of career

Further,staff.the charges are also separate from the charges previously filed by the Commonwealth of Kentucky against Hankison related to the shooting at Taylor’s home.

The federal charges allege violations of the U.S. Constitution, rather than of state

“These indictments reflect the Justice Department’s commitment to preserving the integrity of the criminal justice system and to protecting the constitutional rights of every AccordingAmerican.”toaDOJ release, the first in dictment charges former Louisville Metro

The indictment also alleges that Jaynes and Meany knew that the execution of the search warrant would be carried out by armed LMPD officers and could create a dangerous situation both for those officers and for anyone who happened to be in Taylor’sAccordinghome.to the charges, the officers tasked with executing the warrant were not involved in drafting the warrant affi davit and were not aware that it was false.

Count One charges him with depriving Taylor and a person staying with Taylor in her apartment of their constitutional rights by firing shots through a bedroom window that was covered with blinds and a blackout curtain.

Count Two charges Hankison with depriving three of Taylor’s neighbors of their constitutional rights by firing shots through a sliding glass door that was covered with blinds and a curtain; the indictment alleges that several of Hankison’s bullets traveled through the

“Theylaw.also allege excessive use of force with respect to Taylor and a person staying in her apartment; violations not included in the Commonwealth’s case,” DOJ offi cials wrote in the news release.

“Since the founding of our nation, the Bill of Rights to the United States Constitution has freehavethatguaranteedallpeoplearighttobesecureintheirhomes,fromfalsewarrants,unreasonablesearches,andthe use of unjustifiable and excessive force by the police.

Source: National Newspaper Publishers

Photo Source: National Newspaper Publishers Associatio n (NNPA)

A mural in Minneapolis, Minnesota, depicting three Black Americans who were killed by police officers in 2020: George Floyd, Tony McDade, and Breonna Taylor. This mural was painted by Leslie Barlow as part of the Creatives After Curfew program organized by Leslie Barlow, Studio 400, and Public Functionary.

Photo credit: Elvert Barnes Photography BLACK LIVES MATTER Art on Wrought Iron Gates at Lafayette Park along H Street.

Experience Our World of Advertising, Marketing, Media and Communication 8 | September 2022

Association(NNPA) COMMUNITY

Experience Our World of Advertising, Marketing, Media and Communication

Experience Our World of Advertising, Marketing, Media and Communication

September 2022 | 9 COMMUNITY

Changing the Statistics & Helping Community Build Generational Legacy Visions Wealth Management, LLC

By d-mars.com News Provider

By d-mars.com News Provider

Are you financially healthy? Here are some questions to help you determine whether or not you’re financially secure. Do you pay bills on time? Do you have credit card debt, and if so, how much? Do you have an emergency fund? While some answer these questions with a confident yes, for others, it makes them cringe.

According to the Pew Research Center’s recent survey, most Black adults say their household finances meet basic needs with either a little or a lot left over for extras, even during economic disruptions due to COVID-19. Fewer than half of Black adults say they have an emergency fund, and some have taken multiple jobs to make ends meet. The survey also finds that Black Americans typically experience higher levels of economic insecurity than Americans overall. This insecurity has worsened during the pandemic amid health and financial challenges, which include a relatively high unemployment rate for Black workers.

So, where are you when it comes to financial security? If you answered no, then it’s time to get to work so you can create a strong financial future for yourself and the generations to come after you. And if you answered yes, then great, but don’t get comfortable, as there is always room for improvement. Many African Americans are making money and are entrepreneurs and business owners, but the question still remains, “What do I do with the money to build gener ational wealth?”

We hear much talk about generational wealth from financial experts, but do you believe you can really achieve it? Lawrence G. Hodges III is a Wealth Management Certified Professional® and Founder and CEO of Legacy Visions Wealth Management, LLC who says, “Creating generational wealth is a very real possibility for those who commit to being disciplined and intentional about how they manage their financial resources. Having a financial plan that embodies your goals and values plays a critical role in finding the ideal balance between enjoying the fruits of your labor during your lifetime and leaving a legacy for future generations. Having a plan can transform an inheritance into a lasting legacy.”

For almost two decades Lawrence has been in the finance industry. Working as a bank teller at Fifth Third Bank while attending the University of Toledo, Lawrence’s interest in the finance industry was peeked, also elevating his understand ing of personal finances. “Working as a bank teller inspired me to seek a career in financial services. I observed how the bank’s financial advisors were able to help people build generational wealth. That experience led to me changing my major from computer science engineering to financial services,” Lawrence says.

Upon graduation in 2008, Lawrence pursued a career as a financial advisor with Edward Jones in Toledo, Ohio. “It was a tough time to try and build a business from the ground up, especially in an area that was so severely impacted by the economic conditions at that time. I decided that I needed to be in a market with a healthier economy and a larger, more diverse population in order to build a strong foundation and thrive as an advisor just getting into the business,” says Lawrence.

Making the move to Houston in 2010, he continued to move up the ranks in the finance world as Vice President of Investments and Private Client Advisor for JPMorgan Chase. In this role, he provided goal-based financial planning and investment management services to affluent families in Houston’s Greater Third Ward and Clear Lake. With almost two decades of expertise and a respected track record as a finance expert, in 2021 he founded his firm Legacy Visions Wealth Management, LLC.

Legacy Visions Wealth Management is a full-service fi nancial firm helping clients pursue financial independence, a successful retirement, and a lasting legacy. Through his wealth management firm, Lawrence focuses on you and the unique set of financial circumstances that you and your family face, as he knows that every client’s financial situation

is different. Because he takes the time to understand your personal needs, your financial plan is not cookie-cutter, but a customized wealth management strategy aligned with your short-term and long-term goals and objectives.

Lawrence is committed to serving our community in the area of improving our finances, guiding us to take the nec essary steps that can enable us to achieve our short-term and long-term financial goals. He says, “I am passionate about making a positive impact in the lives of my clients and the communities that I serve. What I do through my firm is more than just helping people invest their money. It’s about serving a purpose to help my clients pursue financial freedom and to help them define their vision of the legacy they want to leave for their family and future generations.”

Experience Our World of Advertising, Marketing, Media and Communication 10 | September 2022

Helping Our Generational Wealth LLC

setup varies by complexity and the cost can be paid in installments to better fit your budget. Clients who do not desire a comprehensive financial plan have the option to choose a specific area of their finances that they would like advice on for an hourly consulting fee. To get started, all you have to do is visit my website and schedule a complimentary consultation. I’m happy to answer any questions you have so you are comfortable before you start your path to financial freedom.

D-MARS: How do we know we can trust you as our financial advisor?

LVWM: With 14 years of experience in guiding clients through their unique financial journeys and managing millions of dollars of clients’ wealth, I pride myself on serving every client with integrity and maintaining a standard of care that puts clients’ best interests at the forefront of every recommendation. I am an Investment Advisor Representative with licenses including Series 7, Series 66 (Held at LPL Financial), and Group 1 (Life, Health, and Variable Insurance). In addition to my securities and insurance licenses, my bachelor’s degree is in Financial Services with a minor in Business Law from the University of Toledo. I also hold a Wealth Management

Other races and cultures have been very intentional about having multigenerational wealth. I want to help us save and invest with the same purpose. Having a plan and being disciplined enough to execute the plan are critical steps to achieving financial success. The sooner you start being intentional about making wise investments, the greater your opportunity is to build significant wealth. I’m here to help you take the steps necessary to achieve your financial goals and build wealth that can last for generations.”

—Lawrence G. Hodges III, Founder and CEO of Legacy Visions Wealth Management, LLC

compliance services. Therefore, my recommendations are supervised by LPL Financials’ compliance department rather than someone in-house. Because LPL Financial has no proprietary products to sell, I have the freedom to offer thoughtful guidance and investment recommendations without being held to company quotas or pressure to recommend a particular product over another.

I pray for the progress and well-being of my clients and that my services make a positive impact on their lives. The Lord has truly blessed me to be in a position that allows me to provide for my family by helping others, and I’m thankful for those who make the decision to give me the opportunity to earn their trust.

D-MARS: What are your short- and long-term goals for the firm?

LVWM: Currently, I’m focused on establishing relationships with families, business owners, and organizations in our community that are seeking guidance and education on investing and/or financial planning. Going into next year, my focus will be on expanding my team locally. I am also looking to establish relationships with Texas Southern University, the University of Houston, and other local colleges to offer internships for minority students who are interested in pursuing a career as a financial advisor. One of my long-term goals is to expand the firm’s footprint nationwide. Houston, Texas, is just the beginning.

D-MARS: Any community involvement you want to LVWM:mention?

Prior to establishing LVWM, I served as president of the Financial Empowerment Ministry at Wheeler Avenue Baptist Church. I am still an active member today. I am also a member of Alpha Phi Alpha Fraternity, Incorporated.

D-MARS: What is the best advice you have received or heard when it comes to money?

D-MARS: Who is your clientele?

LVWM: My clientele is multicultural as well as multigenerational, with the majority being African American families. Many of my clients are either nearing retirement or have already retired and have hired me to manage their retirement investments and guide them as they live out their goals with the confidence that they won’t outlive their money.

I also work with many entrepreneurs and young professionals who are seeking a customized financial roadmap that illustrates how to efficiently build wealth, make informed financial decisions, and pursue their short-term and long-term goals in their desired timeframe. In order to make my financial planning services more accessible, there is no requirement to utilize our investment management services to be a client. Therefore, the financial plan does not center around how much you have available to invest today but rather revolves entirely around investment planning, tax planning, and protection planning that you can begin today to maximize your financial situation as your life evolves. The cost of the plan

Over the years, I’ve observed that trust is a major factor in why many African Americans are hesitant about working with a financial professional. For years, our society has fostered myths that talking about money is taboo and that we should not discuss our finances with others. It can be difficult to trust someone else to manage your hard-earned money. For many, the perception of the stock market being highly risky has led to apprehension or outright avoidance of investing in the market, even with a professional involved. It can also be uncomfortable to share personal financial information with a third party. Reluctance can play a major factor because being transparent about our finances can bring to light that we may not be as aware of our current financial situation or we are not where we feel we should be. I’m a firm believer that transparent, shame-free conversations about money are one of the first steps in gaining financial freedom. That is one of the most critical steps in the process. I cannot effectively help you get to where you want to be if I don’t first have a clear understanding of where you are financially today. Working with me, you can trust that your information will be kept confidential and that this is a trusted space where clients feel no judgment. My clients are like family to me.

LVWM: One of my favorite mantras when it comes to money is a quote from American businessman and author Robert T. Kiyosaki. He said, “It’s not how much money you make, but how much money you keep, how hard it works for you, and how many generations you keep it for.” That is my mindset when it comes to managing my money and helping my clients manage theirs. We should be more intentional about building generational wealth. One of my favorite mantras when it comes to money is a quote from American businessman and author Robert T. Kiyosaki. He said, “It’s not how much money you make, but how much money you keep, how hard it works for you, and how many generations you keep it for.” That is my mindset when it comes to managing my money and helping my clients manage theirs. We should be more intentional about building generational wealth.

To schedule a complimentary initial consultation or to learn more about Lawrence G. Hodges III and Legacy Visions Wealth Management, LLC, please visit www. legacyvisionswm.com. Have specific questions?

Contact Lawrence directly by e-mail at Lhodges3@ legacyvisionswm.com, or call (832) 431-1243.

Securities and advisory services offered through LPL Financial, a registered investment advisor, Member FINRA/SIPC. LPL Financial and Legacy Visions Wealth Management, LLC are separate entities.

Source: Pew Research Center

* As reported by Financial Planning Magazine, June 1996-2021 based on total revenue.

Q&A With Lawrence G. Hodges III, WMPC® the founder and CEO of Legacy Visions Wealth Management, LLC:

Experience Our World of Advertising, Marketing, Media and Communication September 2022 | 11

mixmywithdealer.*independentisLPLbyarbitrations,licensinghistory,ofthatisprofessionalconfirmsbackgroundresearchBrokercheck.finra.orgpotentialServices.AmericandesignationProfessional®Certified(WMCP)fromtheCollegeofFinancialIencourageclientstovisittomyprofessionalwhichthatIhaveacleanrecord.Thesiteacredibleonlineresourcegivesyouasnapshotabroker’semploymentinvestment-relatedinformation,andcomplaints.MyfirmissupportedtheresourcesofFinancial,whichthenation’slargestbroker/MyrelationshipLPLFinancialprovidesfirmwitharobustofservices,including

By Jim Winston and Dr. Benjamin F. Chavis Jr. NNPA

Thus far, 2022 has been a year of multiple so cioeconomic and political challenges for all Americans across the nation. Yet for African Americans and other communities of color, this year represents both challenges and opportunities from a business ownership perspective. In particular, for Black-owned media businesses, there is a growing sense of resilience even in the face of continued profound racial disparities and societal inequities.

The communications and media industry in America especially should be one of the leading industries that adopt the “good business” sense to embrace the values and benefits of Diversity, Equity, and Inclusion (DEI). This is not about charity or benevolence. Diversity is objectively good for business.

The National Newspaper Publishers Association (NNPA) and the National Association of Black Owned Broadcasters (NABOB) are working together to encourage the media and advertis ing industries to become more proactive and committed to diversity from the C-suites to the decision-making managers. But more needs to be done to increase and enhance the ownership of media businesses by African Americans and other minorities.

Economic equity in media requires equal access to in vestment capital, technical advances in communications infrastructure, and inclusion in other industry innova tions. As increased changes in the racial demographics of the nation continue to accelerate in the United States, American media must be more representative of the growing diversity of the nation.

It is noteworthy, therefore, that one of the recently

OP-ED: OwnershipAmericanDiversifyingMediaMustBecomeaNationalPriorit

announced major media mergers has Standard General, a minority-owned firm, pending regulatory reviews and approvals by the Department of Justice and the Federal Communications Commission, acquiring TEGNA, a company owning 64 television stations around the country. Soo Kim, a successful Asian American business leader, who serves as Standard General’s founding and managing partner, emphasized “We’re open to exploring new partnership models to get diverse viewpoints and perspectives on the air and to make sure people have the resources to do it.”

We agree with this sentiment as multiracial ownership of American media businesses will continue to be viewed as a strategic forecast for the future economic well-being of the nation. We intend to raise our voices in support of the positive economic and social-equity consequences

“At a time when more people, particularly Black peo ple, are distrustful of the media, diversity in media ownership,” the Leadership Conference argues, “has become more important than ever for the functioning of our democracy. Diversity in ownership is part of that solution.” We agree with the Leadership Conference on the Civil and Human Rights position on this issue.

Lastly, as our nation prepares for the upcoming Midterm Elections in November, there are many who are predicting low overall voter turnout. Millions of dollars will be spent on Get-Out-The-Vote (GOTV) campaigns. Those who desire to increase GOTV among African-Americans and other communities of color will have to engage Black-owned media as the “Trusted Voice” of Black America in order to increase voter turnout.

Jim Winston is President and CEO of the National Association of Black Owned Broadcasters (NABOB) headquartered in Washington, DC.

Dr. Benjamin F. Chavis Jr. is President and CEO of the National Newspaper Publishers Association (NNPA) headquartered in Washington, DC.

Source: National Newspaper Publishers Association (NNPA)

of diversifying American media.

The Leadership Conference on Civil and Human Rights has pointed out, “Access to the media by the broadest sector of society is crucial to ensuring that di verse viewpoints are presented to the American people, but racial and gender disparities in media ownership dating back to the beginning of the civil rights era con tinue to persist.” Again, overcoming these disparities should be a national media industry priority.

Experience Our World of Advertising, Marketing, Media and Communication 12 | September 2022

COMMUNITY

Experience Our World of Advertising, Marketing, Media and Communication September 2022 | 13 September 2022 | Inspire, Inform & Educate | 34th Edition INSIDE 16 As Monkeypox Hits African American Community Hard, Biden Administration Increases Vaccine d-mars.com FREE ® BIOTECH | BUSINESS | CAREER | EDUCATION | HEALTHY LIFESTYLES | MEDICAL | MENTAL HEALTH | POLICY | RESEARCH | SPORTS MEDICINE HEALTH & WELLNESS JOURNAL 19 15 Feeling Down About Thin or Shedding Hair? Simple Steps To Healthier, Fuller Locks 14 10 Ways to Reset Your Routine and Build a Healthier Lifestyle This and-WholeYourPrioritizeYear,SchoolChild’sHealthPhysicalMental

10 Ways to Reset Your Routine and Build a Healthier Lifestyle

By d-mars.com News Provider

Life is messy and full of distractions. How many of us planned to go to bed early only to stay up streaming our favorite shows? What about scheduling time to work out, then getting caught up in work and running out of energy? Even when you're highly motivated, it's easy to get sidetracked. That's OK. The key is finding ways to reset, bring yourself back into bal ance, and set yourself up for lasting success.

Motivation is a driving force for change, but not all motivation is equal. Some mo tivation is controlled by outside forces like praise, while a powerful one comes from within and is tied to your values. For ex ample, you may choose to be active because you love a certain activity. When a habit is personally meaningful, you are more likely to sustain "Buildingit. healthy habits takes time and dedication, but doesn't have to be over whelming," says Alyssa Burnison, MS, RD, LN, and the director of program and nutri tion, lead registered dietitian, and licensed nutritionist at Profile Plan. "Incorporating just one of the following tips can make a world of difference."

1) Give yourself a break: The first step in the reset process is to give yourself a break. Life is hard and we all slip up from time to time. Forgive yourself, approach your journey with compassion, and don't waste time on shame, frustration or guilt. You're here now and ready to commit to yourself.

2) Start the planning process: Prior planning prevents poor performance. Take stock of what condition your hab its are in. Have you slipped up on good habits and need to rebuild them, or do you need to start from scratch? Do you have to eliminate bad habits before you can build new ones? Write down your good and bad habits so you can monitor them throughout your process.

3) Make motivation part of your rou tine: Be sure you've defined your "why" - the reasons you want to build new habits. Then, find ways to remind yourself of your why. Put notes on a mirror or a kitchen cabinet. Change your phone background to a photo or quote that motivates you. Find any way that reminds you why your efforts are worthwhile.

4) Start small: Setting a large goal can be intimidating and feel unachievable. Instead, break larger goals into smaller, specific steps that will work for you. You don't need to hit the gym for an hour

every day to see results. Start by finding ways to increase activity throughout the day. Take the stairs more often or park further away from the building. Small changes add up quickly.

5) Link a new habit to an existing one: The easiest way to make a new habit stick is to connect it with an ingrained one. Instead of just walking to get your mail, extend your trip and walk a few blocks as well.

recipe ideas. Try a new exercise like rock climbing. Build a relaxing bedtime routine you can look forward to.

8) Don't give up too soon: It takes time to build a routine. You won't create healthy habits by doing them once or twice. On average, it takes at least two months, and sometimes up to a year, for a new habit to become routine.

9) Track your progress: To make a new habit stick, you have to build accountabil ity. Make a plan, then track your progress. Habit trackers will help you monitor your meals, build your self-care plan and track your progress toward your healthy habit goals. You can create your own or find one to download online. Profile's can be found at profileplan.com/profile-planner.

6) Cut comparison: Comparison is your biggest enemy. No two people have the same journey, and you are sabotaging yourself by comparing your progress to others'. Focus on reminding yourself how far you've come.

7) Make it exciting: Whether you're trying to eat better, exercise more, or sim ply build healthy habits like better sleep hygiene, make it exciting for yourself by trying new things. Visit food blogs for

10) Find support: Create your own cheering section by asking friends and fam ily to support you. Make healthy recipes together or go for group walks. If you need even more help, coaches can be an amazing resource for support and guidance.

"Embrace just a few of these ideas and you'll be headed in a healthier direction," says Burnison. "You can always add on as you make progress - that's what our coaches tell Profile Plan members."

Source: BPT

Experience Our World of Advertising, Marketing, Media and Communication 14 | September 2022

HEALTH

Feeling Down About Thin or Shedding Hair? Simple Steps To Healthier, Fuller Locks

By d-mars.com News Provider

Hair is an important part of your personal style every day and when a special event is approach ing, such as a wedding, reunion, or big birth day, it can help you look and feel your best. If you're experiencing thinning hair or hair loss, it's important to know you're not alone. There are some steps you can take to get healthier hair and boost your confidence, so you can look and feel like the best version of yourself. "If you've noticed your hair doesn't seem as thick as it used to be or more is falling out than normal, don't be alarmed. Learning about the causes of hair loss and how you can keep your hair healthy can make a pos itive impact, no matter your age," said Dr. Elizabeth Houshmand, board-certified dermatologist and Viviscal spokesperson.

Hair shedding versus hair loss

It's normal to shed between 50 and 100 hairs a day, according to the American Academy of Dermatology Association. You may temporarily shed more than this for a few months due to stressors such as giving birth, losing a significant amount of weight or recovering from an illness or operation. As your body readjusts, shedding should go back to normal levels.

Hair loss is different because it occurs when the hair stops growing - this can be caused by things such as medical treatments like chemotherapy, where hair will start to grow again when the treatment stops, or he reditary hair loss, where you have inherited genes that cause hair loss.

Dr. Houshmand shares some ways to help maintain hair health and encourage thicker, fuller, healthier hair: Nourish from the inside: Healthy hair starts from within, so it's important to look at your diet and eat nourishing foods. Protein is particularly important be

Wash every other day: A dirty scalp can be itchy and irritating, leaving hair dry and brittle. Washing every oth er day is the ideal frequency for most people to promote hair health. Use a balanced shampoo and conditioner that gently cleanses the hair and scalp, leaving your hair looking fuller and thicker, like Viviscal Gorgeous Growth Densifying Shampoo and Conditioner. Learn more at Viviscal.com.

Mind wet hair: Remember, wet hair is weaker and therefore more vulnerable. Switch up your bathing rou tine by detangling before your shower rather than after to protect strands. Additionally, consider using a microfiber towel when drying your hair, which is gentler and wicks water away much faster than a standard cotton one.

Celebrity hairstylist and Viviscal ambassador Marissa Marino agrees with Dr. Houshmand about the impor tance of a proactive approach to healthy hair. She added the following insight based on her expert experience:

Cut heat: When possible, cut down using heat styling tools or turn the heat down to the lowest effective setting. Explore alternatives that don't use heat, such as rollers.

cause it's a building block for hair, so stock up on lean meats, Greek yogurt, beans, and nut butters. Some foods you may not realize are high in protein include avocado, peas, quinoa, and chia seeds.

Boost vitamin intake: Supplements can make a big difference in hair health. For example, Viviscal Hair Growth Supplements are clinically proven and spe cifically formulated with AminoMar™, a proprietary marine collagen complex, along with key vitamins to help achieve thicker hair in as little as three months. This 100% drug-free formula helps with hair diameter and hair shedding.

KNOW the signs RECOGNIZE the patterns END the cycle of DOMESTIC VIOLENCE

Knowing the facts about domestic violence, recognizing the predictable patterns and talking about it can help end the cycle of domestic violence and abuse. If safe, call 1 (800) 799-SAFE (7233) or visit www.hawc.org

Go loose: That slick ponytail or braid may look chic, but it can damage your hair if worn on a regular basis. These styles pull at the roots and can cause breakage mid-strand.Deepcondition: On wash days, leave the conditioner on your hair for longer periods of time so it really nour ishes hair. Strive for 3-5 minutes before rinsing. Use this time to relax, meditate and destress.

"It's time to normalize the conversation about thinning hair and hair loss," said Marino. "These conditions are common and with a few simple steps, you can help your hair be its healthiest yet."

Source: BPT

Experience Our World of Advertising, Marketing, Media and Communication September 2022 | 15 HEALTH

This School Year, Prioritize Whole Health - Physical and

By d-mars.com News Provider

By d-mars.com News Provider

As back-to-school season gets underway, it's important to ensure that your child is ready for the school year, both physically and emotionally, by scheduling a well-child visit.

Annual well-child visits are doctor appointments for preventive health services which are essential for ensuring a child's growth and tracking developmental milestones. The well-child visit is also the time for routine immunizations to prevent diseases like measles, polio, hepatitis B, chickenpox, whooping cough, and other serious diseases."Likevaccines, which prevent physical health conditions, speak ing with your child's primary care physician regularly about men tal health concerns is also an essential part of overall preventive care," said Rhonda L. Randall, D.O., and chief medical officer at UnitedHealthcare. "Your annual wellchild visit is also an opportunity to have a conversation with your child's physician. It's best to have these conversations when problems or warning signs first appear, so your physician can take the appropriate steps to best treat them."

If you're not sure what questions to ask your child's primary care physician dur ing an annual well-child visit, consider the following:Askwhat vaccines are appropriate for your child's age - and how to make up any that have been missed. You can refer to the list of child and adolescent vaccines recommended by the Centers for Disease Control (CDC) at CDC.gov/vaccines. In addition to other childhood vaccines, both flu and COVID-19 vaccines are recommended by the CDC for everyone 6 months of age and older. If you are concerned about childhood vaccines, ask the pediatrician about common side effects, which are typically very mild, such as pain or swelling at the injection site, and can include low-grade fever or rash.

Discuss changes in your child's behav ior. Some common warning signs that your child's mental well-being isn't where it needs to be include persistent sadness, withdrawing from or avoiding social interactions, display ing outbursts of extreme irritability, drastic changes in mood, behavior, or personality, changes in eating habits, difficulty sleeping, frequent headaches or stomachaches, diffi culty concentrating, changes in academic performance or avoiding or missing school.

opportune time to make sure your physician is aware that your child is a student-athlete and address any concerns like nutrition, prior injuries, and family history.

Ask for recommendations for other health care professionals, if needed. For example, if your child hasn't seen the dentist in a while, if their vision screening indicated that they need to see an eye doctor, or their mental health screening has raised concerns, ask which health care professionals in your plan's network they would recommend.

"If you haven't already, now is the time to schedule an appoint ment with their pediatrician, to give your child a healthy start to the school year," added Randall. "Regular well-child visits are essential in making sure your child is up to date on immunizations and that their developmental milestones are on track - including their mental well-being."

Like vaccines, which prevent physical health conditions, speaking with your child’s primary care physician regularly about mental health concerns is also an essential part of overall preventive care,” said Rhonda L. Randall, D.O., and chief medical officer at UnitedHealthcare. “Your annual wellchild visit is also an opportunity to have a conversation with your child’s physician. It’s best to have these conversations when problems or warning signs first appear, so your physician can take the appropriate steps to best treat them.”

Ask for guidance on how best to support your child. Whether you have concerns about your child's nutrition, exercise, sleeping patterns or behavioral changes, your child's pri mary care physician is a great place to start. With so many young children experiencing mental and emotional health challenges, it's important to create opportunities for them to share how they are really doing. Remember that these can be sensitive topics for your child to discuss. Empathy and patience go a long way to help children and adolescents feel listened to and comfortable.

Don't forget to bring your sports physical forms. It's great if your child participates in school sports. The wellness visit is an

To learn more about recommended preventive care for your child, visit UHC.com.

Source:

Experience Our World of Advertising, Marketing, Media and Communication 16 | September 2022 HEALTH

BPT

Prioritize Your Child’s and Mental

What You Need HeelKnowToAboutPain

By d-mars.com News Provider

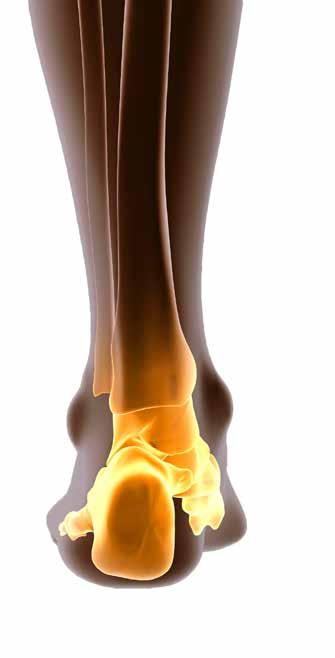

Very common in adults and on the rise in chil dren, heel pain continues to be the number one reason patients seek care from foot and ankle surgeons. While experts say there are many reasons for heel pain, including bursitis, Achilles tendonitis, bone bruises, fractures, growth spurts, and nerve pain, the most common cause is plantar fasciitis, a condition that one in 10 people will suffer from in their Accordinglifetime.tothe American College of Foot and Ankle Surgeons (ACFAS), plantar fasciitis can have serious repercussions if left untreated. Here’s what to know:

What is Plantar Fasciitis?

Plantar fasciitis is an inflammation of the band of tissue (the plantar fascia) that extends from the heel to the toes in which the fascia becomes irritated and then inflamed. Symptoms include pain on the bottom of the heel, pain in the arch of the foot, and swelling on the bottom of the heel. For many, the pain is worse upon arising and increases over a period of months.

A telltale sign of mechanical issues in the foot, those with overly flat feet or high-arched feet are more prone to developing plantar fasciitis. Lifestyle factors can also play a role. Wearing non-supportive footwear on hard, flat surfaces puts abnor mal strain on the plantar fascia. This is particularly evident when one’s job requires long hours on the feet. Obesity and overuse may also contribute to plantar fasciitis.

How is it Treated?

“We typically treat plantar fasciitis conservatively, at first,” said Michael J. Cornelison, DPM, FACFAS, a foot and ankle surgeon and president of the American College of Foot and Ankle Surgeons. “This can include a combination of remedies, including rest, exercises that stretch the calf muscles, orthotics, icing the heel, over-the-counter medications like ibuprofen, supportive footwear, and physical therapy.”

Most patients respond well to conservative treatments. However, depending on the severity of the plantar fasciitis, additional therapies may be required, including:

• Injection Therapy: Growth factor injections and platelet-rich plasma injections are used to boost the body’s healing response and help repair injured tissue.

• Shockwave Therapy: This in-office treatment uses sound waves delivered over the skin to slightly damage the tissue and stimulate the body’s natural repair process. This helps the plantar fasciitis heal and relieves pain symptoms without making an incision. Patients can expect to be up and moving immediately after treatment, but it may take three to six months to see results.

• Ultrasonic Treatment: In this newer procedure, a small incision is made into the heel of the foot and a probe directs ultrasonic energy at the fascia to break down bad tissue and help the healing process. A diagnostic ultrasound tool is used to create an image of the inside of the foot and guide the probe. Patients may need to wear a boot immediately after the procedure for up to two weeks and they can expect to see im provements anywhere from three to six months after the procedure.

• Surgery: Also called a plantar fasciotomy, this minimally invasive, minimally traumatic surgical treatment involves making a small incision through the heel into the damaged tendon to try to lengthen it and relieve tension. Patients tend to recover in six to 10 weeks, but it may take up to three months to resume exercise and more vigorous activities.

No matter what kind of treatment a patient undergoes, the underlying causes that led to the condition may remain. Preventive measures, such as wearing supportive shoes, stretching, and using custom orthotic devices, are the mainstay of long-term treatment for plantar fasciitis.

For more heel pain information and to find a foot and ankle surgeon near you, visit FootHealthFacts.org, the patient education website for the American College of Foot and Ankle Surgeons.

Source: StatePoint

Experience Our World of Advertising, Marketing, Media and Communication September 2022 | 17

HEALTH

Senate Dems Pass Huge Health,Climate,andTax Bill

By d-mars.com News Provider

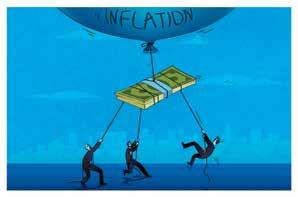

Senate Democrats took a crit ical step toward reducing in flation and the cost of living by passing the Inflation Reduction Act.

Proponents said the measure would make a big difference for many Americans by locking in savings on health insurance premiums and reduc ing the cost of prescription drugs by allowing Medicare to negotiate lower prices.Thebill, when signed by President Joe Biden, should also lead to creating fam ily-sustaining jobs and cutting energy costs by making the most significant investment in history in combating cli mate change, Democrats have claimed.

The country will pay the bill’s $739 billion price tag by making corporations pay their fair share. Those making less than $400,000 annually won’t see tax increases.VicePresident Kamala Harris cast the tie-breaking vote in a deadlock Senate to ensure passage.

“I’m thrilled we were finally able to pass this historic, once-in-a-generation investment in our country’s future that will lower costs for Georgians, create clean energy jobs and reduce the defi cit all at the same time,” said Georgia Democratic Senator Reverend Raphael Warnock.“I’mespecially proud the legislation includes two provisions I introduced to cap insulin costs for Medicare patients at $35 a month and to limit the cost of prescription drugs for seniors. This bill will strengthen health care access and lower health care costs for people across Georgia.”Warnock said the legislation would make a real change in people’s lives.

“From saving seniors money by allow ing Medicare to directly negotiate drug prices, to expanding vital health care subsidies, to greening the economy, this legislation will make a lasting impact on Georgians’ lives,” Warnock stated.

Experts and economists said the Inflation Reduction Act would save American households thousands of dollars.“This bill will reduce the cost of pre scription drugs, make health insurance more affordable, cap out-of-pocket costs, reduce your energy bill, reduce the fed eral deficit, and bring down inflation,” Florida Democratic Rep. Val Demings said.“As the daughter of a maid and a janitor, every dollar mattered in our household, and I’ll always fight to pro tect working families.”

Demings said the deal builds on work

she did in the House to allow Medicare to negotiate the cost of prescription drugs, bring down energy costs, and create significant new jobs by fighting climate“Senatechange.Republicans tried and failed to block this legislation because it takes on their biggest backers: prescription drug companies, fossil fuel companies, and billionaire tax cheats,” Demings remarked.“I’mgoing to put Florida families first and support policies to bring down costs for working people even if it cuts into the profit margins of these special interests.”

Senate Republicans, all of whom op posed the package, lashed out.

“This is not about inflation reduction. This is all about Democrats spending on things they want to spend money on,” Utah GOP Sen. Mitt Romney asserted.

“It’s another taxing and spending bill,” heBideninsisted.said he ran for president promis ing to make government work for work ing families again, and that is what this bill“Thisdoes.bill caps seniors’ out-of-pocket spending for prescription drugs at $2000 per year – no matter what their drug bills would otherwise be, seniors will not have to spend more than $2,000,” Biden

“Additionally,stated 13 million Americans, covered under the Affordable Care Act, will see their health insurance premiums reduced by $800.”

Biden continued:

“This bill tackles inflation by lowering the deficit and lowering costs for regular families. This bill also makes the largest investment ever in combatting the exis tential crisis of climate change.

“It addresses the climate crisis and strengthens our energy security, creating jobs manufacturing solar panels, wind turbines, and electric vehicles in America with American workers. In addition, it lowers families’ energy costs by hun dreds of dollars each year.

“Finally, it pays for all this by estab lishing a minimum corporate tax so that our richest corporations start to pay their fair share. It does not raise taxes on those making under $400,000 a year – not one cent.”

Source: National Newspaper Publishers Association (NNPA)

Experience Our World of Advertising, Marketing, Media and Communication 18 | September 2022

HEALTH

Monkeypox

Hits African American Community Hard, Biden Administration Increases Vaccine As

By Stacy M. Brown NNPA Newswire Senior

The Biden-Harris administration announced it would increase America’s supply of monkeypox vaccine by making an additional 1.8 million doses of Bavarian Nordic’s Jynneos vaccine available for ordering (on According8/22/22).toaWhite House Fact Sheet, the Department of Health and Human Services has set aside 50,000 doses of vaccine from the Strategic National Stockpile, which enables health departments that host large-scale events could request in addition to their existing allocations and supply.

The Centers for Disease Control and Prevention re leased data from 43 states, the District of Columbia, and Puerto Rico, which revealed that African Americans comprise 26 percent of monkeypox cases compared to 12 percent of the population.

The CDC noted that Hispanic people accounted for 28 percent of cases while comprising 19 percent of the population.Additionally, CDC officials reported that areas with high numbers of cases that did not submit case reports are more racially and ethnically diverse.

“As such, the reported data may understate disparities,” CDC officials noted.

“Moreover, the share of cases among Black people has risen in recent weeks, suggesting widening dis parities for this group.”

According to the White House, the BidenHarris Administration has delivered near ly 1 million doses of JYNNEOS vaccine to jurisdictions – the world’s most extensive JYNNEOS MPV vac cineRecently,program.the Food and Drug Administration an nounced the Emergency Use Authorization of the JYNNEOS vaccine to be administered intradermally in individuals 18 years of age and older determined to be at high risk of MPV without compromising the level of immune response achieved or the safety of the vaccine.

“The action means that each vial of vaccine can be used for up to five doses since the appropriate dose

for intradermal administration is 0.1mL versus 0.5mL required per dose administered subcutaneously,” Administration officials remarked.

The CDC also released a “robust set of resources and tools to help jurisdictions train providers and health care professionals on how to administer the vaccine intradermally.”Administration officials said in less than ten days fol lowing FDA’s EUA on intradermal administration, some of the country’s largest counties have transitioned com pletely to intradermal administration of the JYNNEOS vaccine for eligible adults, including Los Angeles County, California, and Fulton County, Georgia.

The increased availability of vac cine doses has enabled more juris dictions to offer second doses to eligible individuals.

The JYNNEOS vaccine is ad ministered in two doses, four weeks apart, for maximum protection, White House officials offered.

They said the Biden-Harris Administration has also significantly increased the availability and con venience of orthopoxvirus tests, ex panding the capacity of tests from 6,000 tests per week to 80,000.

Further, the Administration has taken a number of steps to make TPOXX, a treatment for MPV, more ac cessible to prescribe, and today’s announcements build on those actions.

“The number of additional doses made available to a jurisdiction will be based on the size and nature of the event and the ability to reach attendees at highest risk for MPV,” Administration officials said.

Source: National Newspaper Publishers Association (NNPA)

Experience Our World of Advertising, Marketing, Media and Communication September 2022 | 19

HEALTH

Experience Our World of Advertising, Marketing, Media and Communication

Experience Our World of Advertising, Marketing, Media and Communication

20 | September 2022

Experience Our World of Advertising, Marketing, Media and Communication

Experience Our World of Advertising, Marketing, Media and Communication

September 2022 | 21

Meta Selects Texas Southern University as Research Partner to Enhance Instagram Experience

By Stacy M. Brown NNPA Newswire Senior National Correspondent

Texas Southern University has been selected to be part of the launch of a new research project by Meta. This research, led by Meta’s Civil Rights and Responsible AI Teams, is being done with the goal of creating a better user experience for historically marginalized communities.

This effort will allow Meta to better understand the experiences different communities have on Instagram, how its technology may impact different groups, and what changes can be made to promote fairness on the platform.“TexasSouthern University is proud to join the Meta Civil Rights Team to be positioned at the intersection of technology and urban research. Our faculty and team members in TSU's Division of Research and Innovation, along with our other schools and colleges, will collaborate to ensure this partnership is a success to benefit com munities of color,” said Michelle Penn-Marshall, VP for Research and Innovation at Texas Southern University.

TSU is one of four universities and partner institu tions included in the research endeavor. The others are Northeastern University (Boston), the University of Central Florida (Orlando), and Oasis Labs. Over the next several months, Instagram users in the United States may be prompted to share their race or ethnicity. If they choose to participate, they’ll be directed to a survey hosted by the international research group YouGov. The responses will be split and shared between four partner institutions, without any identifying information.

“For a long time, we’ve been working to better

understand and improve the experiences that people from marginalized communities are having on our apps,” said Roy L. Austin, Jr., VP and Deputy General Counsel, Civil Rights at Meta. “But since it’s always difficult to address something without measuring it first, we’ve partnered with leading researchers, civil rights and academic experts, and universities that serve these communities to do exactly that. With those partnerships, we’re rolling out this survey in a privacy-protective way as part of our ongoing work to continue building our

By d-mars.com News Provider EDUCATION & CAREER

rito-Lay announced a partnership with the United Negro College Fund (UNCF) that will further enable Black and Hispanic students across 10 U.S. cities to attend college. The snack leader is investing $500,000 in need-based scholarships to help reduce the financial barriers to attending and graduating col lege. Students are encouraged to apply beginning now and until submissions close on September 29.

The scholarship will be accessible to stu dents in Atlanta, Chicago, Dallas, Detroit, Houston, Los Angeles, Orlando, Phoenix,

San Francisco, and Washington, D.C. Each scholarship will provide assistance of up to $5,000 each to 100 Black and Hispanic"Investingstudents.inthese students means in vesting in tomorrow's success. It's a priv ilege to play a role in their futures," said Steven Williams, CEO PepsiCo Foods North America. "At Frito-Lay, we're proud to celebrate diversity at every level of our organization and remain committed to supporting future generations through resources that enable them to continue their education journey and achieve longtermThissuccess."isone of the largest scholarships in Frito-Lay history and an extension of Frito-Lay's commitment to the PepsiCo Racial Equality Journey initiative, which

products more responsibly for everyone who uses them.” Users are not required to participate in the survey. Responses will be encrypted and de-identified. Neither TSU nor any of the other partner institutions will be able to tie responses back to any specific accounts.

For more information, please visit TSU.edu.

will contribute $570 million to address issues of inequality over the next five years. This also represents the first part nership between Frito-Lay and UNCF, which has a 75-year legacy of helping to provide equal access to education for all Americans."We'rethrilled to partner with Frito-Lay

to support underrepresented groups in the communities that we call home," said Maurice E. Jenkins, Jr., executive vice president, and chief development officer, UNCF. "This partnership helps us to fur ther act on our vision of a nation where all Americans have equal access to a college education that prepares them for rich in tellectual lives, competitive and fulfilling careers, and engaged citizenship."

The eligibility for scholarship selec tion requires that a student be Black or Hispanic and be enrolled full-time at an accredited four-year college. To view the full list of criteria and to apply, please visit scholarships.uncf.org.

Source: Texas Southern University

Source: Frito-Lay

Source: Texas Southern University

Source: Frito-Lay

Experience Our World of Advertising, Marketing, Media and Communication 22 | September 2022

North America

F EDUCATION & CAREER

Frito-Lay Invests $500,000 in Scholarship Program With the United Negro College Fund To Provide College Education for Black and Hispanic Students

Experience Our World of Advertising, Marketing, Media and Communication

Experience Our World of Advertising, Marketing, Media and Communication

September 2022 | 23

Emory University Announces thefirst African American Studies Ph.D. Program in the U.S. Southeast

NNPA Newswire Senior National Correspondent

mory University in Atlanta has announced the first African American Studies Ph.D. Program

“We are accepting applications beginning in September 2022,” Carol Anderson, the Charles Howard Candler Professor of African American Studies at

In an overview posted on Emory’s website, the university noted that “as an interdisciplinary graduate program, the African American Studies Ph.D. Program is a highly selective course of study combining the expertise of an esteemed group of more than 50 core and affili ated graduate faculty with research specializations in disciplinary and interdisciplinary fields such as African and African American Studies, American Studies, Anthropology, Art History, Comparative Literature, CreatingEducationalWriting,Studies,English,History,Music,Political

Science, Religious Studies, Sociology and Women’s, Gender, and Sexuality Studies.”

The university said the program provides rigorous train ing and preparation for Ph.D. students interested in careers within and outside of academia.

“Our program is organized around the four pillars upon which AAS as a field rests: interdisciplinarity, intersec tionality, community engagement, and transnationalism,” officials

“Additionally,wrote. each student enrolled in the program will be equipped with specialized training in AAS through one of three cognate fields: Gender & Sexuality, Social Justice & Social Movements, and Expressive Arts & Cultures.”

Beginning with the first AAS Ph.D. cohort in Fall 2023, officials said they expect to enroll four new Ph.D. students eachTheyear.school also anticipates that each student will complete the degree within five to six years.

According to the fact sheet, all Ph.D. students are fully funded for five years with an annual stipend of at least $31,000, a tuition remission, and health insurance. Though each student is guaranteed funding and support for five years, funding for a sixth year – if needed – will be possible.

For more, please visit www.emory.edu.

Source: National Newspaper Publishers Association (NNPA)

Experience Our World of Advertising, Marketing, Media and Communication 24 | September 2022 EDUCATION & CAREER

Experience Our World of Advertising, Marketing, Media and Communication

Experience Our World of Advertising, Marketing, Media and Communication

September 2022 | 25

Want To Become Financially Healthy? Learn How Tech Tools Can Help

By d-mars.com News Provider