BREAK FREE FROM DEBT

E XCE LL ENCE IS D OIN G

ORD IN A R Y THING S

E XT R AO RD I N A RI LY

W E L L

– John W. Gardner

E XCE LL ENCE IS D OIN G

ORD IN A R Y THING S

E XT R AO RD I N A RI LY

W E L L

– John W. Gardner

There is a pattern to the debt counselling year. There is the December and January “quiet times”. With holidays on the go, many people do not want to start dealing with their debt till February onwards. And so many Debt Counsellors and their staff also take a few days off over this time to recharge their batteries.

Then we dive into the busy time with is February and March as consumers pull the trigger and reach out for help. Everyone is busy, busy. Then comes the dreaded April madness where many people who have been in the process for some time suddenly make weird decisions and quite a bit of time is spent trying to help keep their debt review on track.

The rest of the year features two main highlights.

The first being the annual conference held by the Debt Counsellors Association of South Africa. This is held each year up in Gauteng and is aimed mainly at members. I recently had the opportunity to attend and catch up with lots of familiar faces. While the content each year varies it is always great to get to hang out with hundreds of other Debt Counsellors who

are dedicated to helping consumers and credit providers. In this issue, you can get a feel for what it is like to attend.

As a Debt Counsellor, I personally find it very interesting and love to get to spend time with credit providers, service providers and colleagues. A special shout out to Vanessa who organises the event each year. Your hard work always pays off and everyone had a great time again this year. Well done. Be sure to check out the pics and round up for a taste of the action.

The next highlight, and one the Debtfree team is heavily involved with, is the Annual Debt Review Awards. The Awards gala is being held in October this year and will be live streamed again so that those across the country can watch (on YouTube).

We also have a few updates about that this issue (and be sure to read next month’s issue where we will go in depth about who is in the running for the top rated spots this year). And then, please do tune in and watch on the 20th of October for the results.

Then before you know it December rolls around again and the year just disappears. Sometimes it can feel like time is slipping by and we are not really achieving anything.

Well, if you are in debt review then this is not the case. After all, each month you are in the process is one step closer to your ultimate goal of getting out of debt. But as we all know, having a goal is not the same as achieving that goal. So, what can help us stay on track? What can help us reach our goals? In this issue

we delve into that topic and pick up a few tricks and suggestions that can help keep us motivated when we really don’t feel like it.

Sometimes debt review can just feel like its “too hard”, “too slow” and “too tough”.

If you are feeling like that right now then check out the article to see if it can help you find a way forward. After all, time flies and if you can stick to the process, remain in the pattern, then pretty soon you will successfully reach your goal and be debt free.

Each month you pay a small amount to your Debt Counsellor for their ongoing service in caring for you and your debt review. This small fee covers their time, running costs, calls, emails etc.

The amount is set at 5% of your monthly debt repayment (capped at R450 so it can never be more than that even if you can afford to pay more).

The NCR say that since 2007 most people pay around an average of R300 but each person’s fees are unique.

We’ll get your interest rates right down. You’ll make one consolidated payment a month. You’ll have more cash to live on. Your assets will be legally protected. Sorted.

0861 365 910

www.debtbusters.co.za

info@debtbusters.co.za

Debtfree Magazine considers its sources reliable and verifies as much information as possible. However, reporting inaccuracies can occur, consequently readers using this information do so at their own risk. Debtfree Magazine makes content available with the understanding that the publisher is not rendering legal services or financial advice. Although persons and companies mentioned herein are believed to be reputable, neither Debtfree Magazine nor any of its employees, sales executives or contributors accept any responsibility whatsoever for their

activities. Debtfree Magazine contains material supplied to us by advertisers which does not necessarily reflect the views and opinions of the Debtfree Magazine team. No person, organization or party can copy or re-produce the content on this site and/or magazine or any part of this publication without a written consent from the editors’ panel and the author of the content, as applicable. Debtfree Magazine, authors and contributors reserve their rights with regards to copyright of their work.

Consumers who want to make the payment side of things easier and use a PDA will pay a small fee to them each month. This is set out in regulations from the Department of Trade and Industry (DTIC).

Money saved on things like multiple debit orders to various credit providers and other fees can rather be set against these PDA fees.

The PDA will ensure your debt repayments go to the right accounts on the right days using the right payment references.

Check your PDA statement for details on your fees.

Have you applied to go under debt review? Are you restructuring your monthly expenses? Would you like to insure your debt?

Why not insure all your outstanding accounts in a single ONE Credit Protection Policy?

Have you applied to go under debt review? Are you restructuring your monthly expenses? Would you like to insure your debt?

BENEFITS OFFERED:

• Death – we settle the account

Why not insure all your outstanding accounts in a single ONE Credit Protection Policy?

• Temporary Disability – we pay your installment for 12 months

• Permanent Disability – we settle the account

BENEFITS OFFERED:

• Critical Illness – we pay your installments for 3 months

• Death – we settle the account

• Retrenchment – we pay your installments for 12 months

• Temporary Disability – we pay your installment for 12 months

• Permanent Disability – we settle the account

At a rate of R2.95 per R1000 unsecured/short-term credit and R2.00 per R1000 on mortgages and you can now insure your debt for less.

• Critical Illness – we pay your installments for 3 months

• Retrenchment – we pay your installments for 12 months

The following financial obligations or debt can be covered on the ONE Credit Protection Policy:

• Credit Cards

• Overdrafts

At a rate of R2.95 per R1000 unsecured/short-term credit and R2.00 per R1000 on mortgages and you can now insure your debt for less.

• Personal Loans

• Home Loans

• Retail Accounts

The following financial obligations or debt can be covered on the ONE Credit Protection Policy:

• Rental Agreement

• Credit Cards

• Maintenance Orders

• Overdrafts

• Personal Loans

For further information please speak to your Broker, Debt Counsellor or alternatively contact your regional ONE office.

• Home Loans

• Retail Accounts

• Rental Agreement

0861 266 562 admin.debt@one.za.com

• Maintenance Orders

Terms and Conditions Apply

For further information please speak to your Broker, Debt Counsellor or alternatively contact your regional ONE office.

0861 266 562

In something of a sad pattern, the petrol price, which recently dropped very so slightly will now be going up.

Yup, it seems the weak Rand and greedy fuel monopoly is hitting us all again and Petrol will soon almost cost an extra R2/ litre and Diesel will cost around R3/ litre more.

1. Avoid unnecessary idling (eg. while waiting). Rather turn the car off

2. Check your tyres – flat tyres use more fuel.

3. Drive conservatively (you don’t need to be the fastest person on the road)

4. Avoid carrying unnecessary weight.

5. Remove roof or bicycle racks not in use.

6. Use air conditioning sparingly.

Have you ever set a goal but struggled to achieve it? If so, you are not alone.

For example, many people who enter debt review with the goal of getting out of debt, drop out of the process. Some drop out as early as the 2nd month. Others stick with the process for 3 years, and then suddenly fall off the bandwagon.

Maybe you have had other goals in the past, like exercising regularly or losing some weight.

If you currently have a goal that are working on, but have not yet achieved it, it is important that you know that you are not a failure. If you are working on it, (yes, even intermittently) then you are making progress.

Even reaching a simple goal often requires a lot of time and hard work. The fact that you still want to reach your goal, shows that you want to give your best.

Let’s take a look at how you can set and reach realistic goals, such as paying off your debt. While the thoughts in the article may also apply to other goals, let’s talk about debt and debt review in particular.

It is important that you do not expect more from yourself than what you can realistically achieve, that would be foolish.

Your goals should be reasonable, according to what your current circumstances allow you to achieve.

For example, if you have a lot of debt, it would be unrealistic to set yourself the goal of paying it all off in one go, or after just a few months. Often, credit providers add so much interest to debts, it can feel like you will never catch up.

No, it would be much more realistic to plan to repay that debt over a longer time period. This is why in debt review, debts are often paid off over 60 months, although credit providers might ideally want them settled within a year or 18 months.

Motivation plays a key role in reaching any goal. A motivated person has a strong incentive or desire to work toward their goals.

Having strong motivation is like a strong wind that pushes a sailboat toward its destination. If the wind carries on blowing, the sailor will definitely reach their destination, and with a strong wind, they may even arrive sooner than expected.

In the same way, the more motivated we are, the more likely we are to reach our goals.

So, what can you do to feel more motivated?

Even just thinking about and talking about your goal can help you increase your motivation to achieve it.

Sharing your goals with others can also help motivate you to reach them. As a bonus, once your family and friends know about your goals, they may be able to offer practical support in achieving them.

When you see that you have already made progress (even if only a little progress) it can help you build your desire to follow through and keep going.

For example, checking your statements monthly during debt review can help you see how far you have already come.

Many plans are designed over 60 months, what month are you on? Can you track your progress? It will help build your motivation to keep on making progress.

Even if you have just started the process, that is massive. Asking for help and getting it is a very big step towards success. Now it is just up to you to keep going.

Have you thought about what it will be like to not owe anyone anything? Not one cent.

You may never be a millionaire (we wish!) but hardly anyone these days can even say they are debt free, but you could be.

So, keep thinking about what that would mean for your life. Imagine being able to use every cent that you earn for your own benefit. Never having to check balances and wonder if your payments will go off this month. No moving funds from one card to another.

Imaging never having to worry about scary collections calls, emails or letters.

Focus on these benefits, and you will feel more and more determined to stick with your goal to get out of debt.

If you spend time with people who are sick, it is likely that you too will become sick, this is something the COVID 19 pandemic taught us.

Spending time with people who waste money or do not spend wisely can also have a bad influence on us and can rub off on us.

Instead, spend time with people who also want to live a debt free lifestyle, and are not focused solely on what they own.

Realistically, though, we all have days when we do not feel motivated. Sometimes when things are tough, you may begin to think of debt review as the problem, rather than the solution. Does this mean you are going to fail?

No, in the olden days when sailors were at sea, one day the wind would be strong and move them quickly, but other days it would be weak and they may not feel like they were making any progress.

On days like that, they may have had to take out the oars and start rowing themselves, so that they could keep making progress (even if it was just a little). Soon, they would move to an area with more wind and be underway at full speed.

Our motivation can be like that wind; your level of motivation may vary on different days, on some days, we may feel no motivation to work on getting out of debt. But if we were to work towards our goal only when we felt motivated, we might never actually reach it. Rather, we need to be like ye olde time sailors, and find other ways to make a little progress, even when not motivated. This may mean we need to be strict with ourselves and show self-discipline but the results are worthwhile.

When we have lots of debt it can be difficult to be generous to our family and friends.

We constantly have to count pennies. It always hurts to have to say no to your kids when they want something, or to have to skip going out with friends because we just can’t afford to.

If you had no debt, then this would not be the case. We could afford to be more generous (within reason, of course). So, consider how achieving your goal of getting out of debt will also benefit your family and friends.

Self-control is also required in order to move us to accomplish a task especially if it is difficult, or if we do not feel motivated.

The ability to ‘push through’ the tough times or times when you do not feel motivated will help you reach your goal. It can also help you in other areas of your life.

So, sometimes you will need to be strict with yourself and just do what needs to be done, even when you don’t really feel like it.

Developing this quality is vital for success.

When setting a goal, it is important to know that there is never going to be a perfect time to start.

Do not wait for perfect circumstances, if you wait for the right time to get out of debt, well, you never will. You can always find a reason to put it off. Another unplanned expense, another obligation that needs to be sorted out.

Even those already in debt review, face this challenge.

If you have a goal, like saving some money each month towards annual expenses (like a car license or back to school items) then don’t wait till next month, just start now. Otherwise next month, will turn into the month after that and you will never save anything.

If you have a goal then today is the day to start working on it.

We may lack motivation because our goal seems too hard to achieve.

Remember when you thought about getting out of debt?

That was a massive goal that probably seemed impossible. So, you simply took the first step and asked someone for advice. From there, you were able to get help to set small monthly goals towards paying off your debts.

If your goals seem too big, can you break down your goal into smaller ones? A baby does not start off running. Even Usain Bolt had to learn to crawl before he could run.

Unfortunately, no matter how motivated or disciplined we are, we may still have setbacks.

For example, “unexpected events” may come along and kick us in the teeth.

Our best laid plans can go off the rails. When that happens it can drain us of confidence and motivation.

What can help us to deal with a setback?

If a runner trips and falls, do they just pack it up and head home, or do they get back up and carry on running.

After all, they have made great progress and it would be a waste to now stop due to a temporary setback.

And yes, we may face many setbacks, but just like when we were babies learning to walk, our determination can help us to get back up over and over, and eventually reach our goal.

For example, did an appliance break down and how you need spend unplanned funds towards repairing or replacing.

You may have to wait for several weeks before you can afford to do so, what an inconvenience. Still, it does show us the importance of setting aside a few rand each month towards the unplanned and unexpected.

Going forward, this can be part of your plan. Even if it is hard, you now know see the benefits due to this setback.

You can reach your goal, just like a sailor who happily reaches his destination. But remember, many sailors also enjoy the journey.

Similarly, as you continue working toward your goal, do not forget to enjoy each day. Debt review as a process very much focuses on ensuring we have what we need to care for our family’s basic needs each month. So, even when progress towards settling all our debt is slow, we can enjoy having what we need and caring for our needs.

This is not to be downplayed, it is vital.

It is important to have goals in life. Once you know what you are working towards, you can take practical steps to reach your goals.

Debt review in particular can help you reach your goal of becoming debt free. It can also help you cover your monthly running costs, while still slowly settling your debts.

So, if you have entered the process, think about all the progress you have already made, and focus on what it is going to be like when you get out of debt.

Even if you do have bad days where you don’t feel particularly motivated or where setbacks make things tough, please exercise selfcontrol and stick with the process. Continue to chip away at your goal of becoming debt free and you will make progress one step at a time.

Having no debt is almost like being the richest person in the room these days. Therefore, be determined to stick with the debt review process, and continue making progress towards whatever goals you set for yourself, it will be worth it!

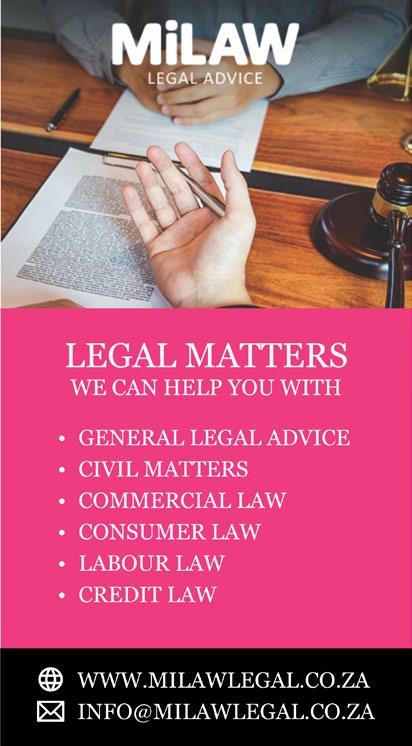

Because debt review is a legal process that goes either via the National Consumer Tribunal or the Magistrates Court it is necessary to get legal assistance. When applying for debt review, your Debt Counsellor will recommend an attorney they find to be effective. If you decide to use their services, they will tell you in advance what the legal fees will be.

Traditionally, these are drawn as PART OF your new adjusted debt repayment in the 2nd month of your debt review. So, you will not have to find extra money somewhere to cover these costs.

All credit providers know about the legal side of debt review and what these costs are. The fees will also be shown in your proposals and court documentation.

We understand the importance of having a reliable and efficient attorney to represent you in court, attend to matters urgently and handle cases that require specialised knowledge.

We

based

Lights, camera, industry action! The Birchwood Hotel and OR Tambo Conference Centre recently played host to the most anticipated event –the Annual DCASA conference.

From riveting discussions on industry trends to deep-dives into strategies that keep the debt review world ticking, the conference showcased an assembly of speakers, attendees were treated to a feast of knowledge.

The exhibitors included; the 3 Payment Distribution Agencies, creditors, Absa, FNB, Standard Bank, Nedbank, Consumer Friend, One Sure Credit, VCCB, DC Credit Protect, as well DebtFree Digi Magazine.

Did you unleash your inner supermodel at our photo booth? Please do share your experience with us.

Networking wasn’t just a buzzword – it was a full-blown experience. Amidst the aroma of coffee and the hum of conversations, industry leaders rubbed shoulders with enthusiastic participants, sharing insights, strategies, and perhaps even a joke or two.

The energy was contagious, and the knowledge shared was invaluable. Visit our LinkedIn page to catch a glimpse of the conference’s energy, insights, and connections.

Mark those calendars! The Annual Debt Review Awards 2023 are on the horizon, and we are so excited to see you there.

OF SOUTH AFRICA HELD THEIR ANNUAL MEMBERS CONFERENCE IN GAUTENG ON THE 23RD OF AUGUST 2023

The annual DCASA event was well attended by hundreds of Debt Counsellors and many credit providers, PDAs, the NCR, NCT and many others.

All who attended the Annual DCASA conference were well aware that debt review is an amazing process that has helped hundreds of thousands of consumers deal with their debt in a responsible and manageable manner. Many of the guests have been in the industry since 2007 when the National Credit Act first introduced debt counselling. The audience was a mix of the Debt Counsellors who are assisting consumers and the credit providers who work hand in hand with these Debt Counsellors in making arrangements to help these consumers.

The annual DCASA conference is primarily aimed at association members and gives these members a chance to network with one another, engage with various credit providers and industry service providers who were present.

The conference also offers updates on what the association has been doing over the last 12 months to help make members’ lives better.

This the conference was held at the Birchwood Hotel & OR Tambo Conference Centre. This was the same venue as was used last year. The venue is easy to reach, has plenty of parking and is spacious. It feels less crowded and confined than previous venue choices.

Guests were arriving from 7:30am as the, long, day got off to an early start with much information to cover.

After a few humorous words from the MC for the day Mr. Lew Williams the day kicked off with an official welcome from Mr Reinhard Pettenberger (DCASA President). Reinhard is a long time Debt Counsellor (his practice is known as Debt Therapy) and is well known for being passionate about protecting the industry from rouge elements that undermine the reputation of the process.

Reinhard then handed over to Mr John Nickols who specializes in assisting people with trauma and anxiety counselling. Most of the guests reported that this was their favourite presentation of the day.

John is a trauma counsellor who is quick to take his clients to also engage with a Debt Counsellor. This is because of the link between out of control finances and stress levels.

John discussed the various causes of and reactions to trauma and stress and drew a direct link to dealing with debt. He highlighted that the flight or fight reaction kicks in when consumers deal with such pressures. He also discussed how some people get stuck, unable to process the challenges on their hands.

Through an account of a troubled clients who he met in the past he highlighted how trauma counselling and Debt Counselling go hand in hand. The experience spoke to many in the audience who could relate.

Then it was time for an industry update which was handled by Reinhard. The indepth update looked at several ongoing topics such as meeting with credit providers (as an association) and what is happening at the NCR’s Credit Industry Forum.

Reinhard reported that as of January 2023 the CIF are only discussing 3 topics including DCRS enhancements (to handle things like really big long term loans from banks) and DC Fees. There is some interplay between the fees and how DCRS works so it is wise to try work on these topics at the same time. Still without clarity on fees there may be delays addressing DCRS changes. One big change being worked on is DCRS handling massive loans (like those now offered by SBSA) that may take longer than 60 months to repay.

Reinhard also discussed statistics as shared by the NCR about the industry. For example, it is said that there are around 1554 active Debt Counsellors at present. The NCR say that since 2007 over 1.8 Million people have applied for help through debt review (interestingly the credit bureaus stats are off by about 400 000 people there). At present just over 200 000 people are using a PDA to pay off their debts.

Since 2007 the average aftercare fee paid to Debt Counsellors by a client each month is R300 putting the average debt repayment somewhere around R6150. While those are interesting stats there were no recent stats looking at the last 12 months for example. Rather this is everyone ever since 2007 averaged together.

DCASA have been busy meeting with various credit providers about various topics (such as the much disliked Capitec Bank advertising about debt review). DCASA have also met with MFSA and Imas (who were very helpful and have since made some significant changes to their processes to align better with the 2009 NCR task Team agreement).

DCASA is also working with VCCB credit bureau to offer members the opportunity to provide consumers with free credit bureau reports. This initiative can also help identify some consumers who may need debt review help.

Also revealed was a small R50 increase coming in membership fees, there will be more coming webinars and a booklet to help new members. The DCASA NEC and team have been very busy it seems.

Economist Mr Siphamandla Mkhwanazi discussed local and economic factors that are causing the financial stress being experienced by consumers and mulled over what may happen next. He anticipates that the rather sluggish economy will continue to further hinder employment recovery this year and that next year may not be much better. The bottom line is that, while there are opportunities for improvement there are also many factors which may play against recovery. With elections coming next year we can be sure of some excitement and plenty political manoeuvring. The DCASA conference was happening at the same time as the BRIC conference not to far off in Sandton, Gauteng.

Guests then had some time to engage with the various credit providers and suppliers to the industry who were exhibiting at the event. Debtfree Magazine was, of course, on hand to offer to help Debt Counsellors educate and inform their clients at no cost.

Then there were some practical reminders by Social Media Manager Yolanda Fourie about the digital side of Debt Counsellors businesses. Though the material in the presentation was perhaps not new to anyone at the conference it did highlight that with billions of people online and on social media businesses who do no have a online strategy are falling behind.

Due to the fee structure as suggested by the National Credit Regulator for the debt review process (which most DCASA members use) Debt Counsellors constantly need to take on more clients to remain profitable. So, a big topic at such gatherings is how do you find new

people to help. Western Cape Branch Representative Ms Nadia de Weerdt encouraged members to grow their business from within and to embrace what makes them unique to find their unique clients. Each Debt Counsellors should find their own unique angle to leverage their skills and only by applying your authentic self to your practice will you be both happy and grow.

Then it was time for some lunch at the near by food hall. This also offered the opportunity to network and catch up some more.

The next presentation received something a mixed response from the audience as Mr Pieter van Zyl spoke about how debt review and sequestration. He spent a little time discussing the differences between debt review, sequestration and voluntary surrender of estate. He then discussed voluntary surrender of estate in some detail. Of the three he seemed most in favour of voluntary surrender of estate over other options.

Q&A

After a whole day of interacting between the various Debt Counsellors and credit providers many guests had specific questions that they wanted to see addressed (such as: can we have more declaratory orders and what do we do when we can’t get a paid up letter for such and such reason?)

These questions were posed to a wide panel of industry specialists from the NCT, NCT, credit providers, Debtfree Magazine , Debt Counsellors, Credit Bureaus and Attorneys.

While not every item was addressed to everyone’s satisfaction (some matters were better suited to other forums), an attempt was made by those on the panel to at least try and answer the questions. Many further conversations and follow ups will happen based on the Q&A session. So, it was a great success overall and a nice part of the day.

Generous sponsors such as DCCP, DC Partner, Hyphen PDA, Maximus and others gave out small prises to guests throughout the day (between presentations). At the end of the day as guests prepared to head home or to hang out for the evening and relax there was a flurry of prize handouts. Many guests had left business cards in bowls or completed a form etc to enter these competitions during the day.

So, the day ended with a little bit of fun and excitement. And that was before anyone got dressed in an inflatable Sumo suit. Then the fun and games really began.

Groups of Consumers across Namibia Marched on the 26th of August (also known in Namibia as Heroes Day).

Disappointed consumers were protesting the removal of a section of the draft consumer credit bill that featured their equivalent of debt counselling from the bill. In an effort to raise awareness of this last minute omission, various marches were arranged across the country.

Organisers say that efforts to have the section re-included will continue until acted upon.

Investor Michael Burry, made famous in the movie The Big Short, has begun to make investment bets that the US Stock Market is about to crash.

Burry has joined many others in saying that the US Stock Market is about to burst and now he is putting his money where his mouth is. Burry is famous for being one of the first to bet against the markets back in 2008 before the housing market crash.

He is currently using more than 90% of his portfolio to bet that a crash is coming.

‘‘The reason Zero Debt are industry leaders is that they get 80% acceptances on their initial proposals to credit providers, right away. They also make excellent use of the DCRS proposal system in negotiations with credit providers.

Zero Debt regularly succeeds in convincing credit providers to reduce their high interest rates down to less than 5% on their client’s debts.

This means that Zero Debt clients obtain their court orders and can pay off their debts quickly. They ensure dedicated clients get their clearance certificates and are soon able to start their debt free life.

The post of Chief Executive Officer of the National Credit Regulator has been put up for applications by the Minister of Trade and Industry.

The post comes with a renumeration package between R2.1 mill – R2.4 mill per year and a 5 year term.

Applications can be sent to NCRCEO@tianaconsulting.co.za and enquiries can be directed to DRambau@thedtic.gov.za.

Applications close on the 4th of September 2023.

Be sure to join the members facebook chat for the latest news & updates

facebook.com/groups/allprodc

www.allprodc.org

The NCR’s CIF is once again up and running.

Do you want your voice to be heard and to get updates about all CIF matters?

Email: Alanm@moneyclinic.co.za

Recently, ABSA bank’s distressed consumer department held an online meeting with Debt Counsellors.

The goal of the meeting was to foster greater understanding between Debt Counsellors and ABSA’s debt review department and to allow Debt Counsellors to engage directly with specific ABSA team members about specific cases.

Well Attended

The online meeting was well attended with nearly 200 Debt Counsellors online during the event. ABSA had 9 members of their team available to address issues from across the entire department.

Having a wide range of staff from the various internal teams enabled ABSA to swiftly address specific issues raised by different Debt Counsellors throughout the 4 hour long session.

Jaco and his team jumped right in with little preamble and once all the usual funny technical sound and connection issues were handled the meeting got swiftly underway.

Everything, from CoBs (info about the client’s debts) to making arrangements when clients have a sudden change in circumstances were discussed. From the legal side of the process to the end of the process, when a consumer is given a letter to say their debts are paid up, were all on the table. And at each point in the discussion Debt Counsellors were encouraged to make observations, raise points and help identify possible issues.

Debt Counsellors love being “part of the conversation” and having a large credit provider being so willing to engage was great.

Also of note, was ABSA’s willingness to deal with issues right away (where possible) and to put their cards on the table. This was very refreshing.

Throughout the meeting, specific consumers’ cases were mentioned and the ABSA team undertook to deal with a wide variety of small issues specific to these individual cases. Email addresses were exchanged and action taken immediately.

Small snags are not uncommon in any involved process like debt review. With lots of moving parts comes the risk of lots of potential hiccups. Still, it was clear that almost all who attended were very impressed with the ABSA team’s work and attendees had few complaints overall. Many Debt Counsellors complimented ABSA on their fast turnaround times, easy access to necessary information and said that they were very satisfied with the way ABSA handle queries.

The meeting was a great success and it was nice to be able to engage directly with the ABSA team as they continue in their efforts to service both their clients and the Debt Counsellors who assist them.

DREX simplifies the exchange of data and makes managing the debt review process less admin intensive.

The below links take you to step-by-step guides on how to use the DC Portal on DREX.

How to Register on the DC Portal

Introduction to the DC Portal

cessing a Consumer's Profile

How do you leave Debt Review?

How do you have the Credit Bureau remove the Debt Review listing on your credit report?

Leaving Debt Review Is Not As Simple As To Simply Stop Paying.

Consumers can only leave the debt review process at certain times and in certain ways.

This free e book will help you navigate this process and avoid many of the common mistakes people make when wanting to leave debt review.

If you are curious about how you can leave debt review properly and with no risk to your assets then be sure to download and read this free booklet

EASTERN CAPE

Effective Intelligence

sardagh@e-intelligence.com

Fides Cloud Technologies craig@fidescloud.co.za

Finch Technologies chris@finchinvestments.co.za

I-Bureau Services abrie@ibureau.services

IDR South Africa

shane@v-report.co.za

iFacts

sonya@ifacts.co.za

Inoxico support@inoxico.com

Kudough Credit Solutions

chrisjvr@kudough.co.za

Lexisnexis Risk Management kim.bastick@lexisnexis.co.za

Managed Integrity Evaluation

marelizeu@mie.co.za

Maris IT Development marius@marisit.co.za

National Validation Services info@nvs-sa.co.za

Octagon Business Solutions gregb@octogon.co.za

Omnisol Information Technology info@verifyid.co.za

Payprop Capital johette.smuts@payprop.co.za

PBSA seanb@PBSA.CO.ZA

Right Cover Online cto@rightcover.co.za

Searchworks 360 skumandan@searchworks360. co.za

ThisisMe juan@thisisme.com

TPN Group michelle@tpn.co.za

Trans Africa Credit Bureau clintonc@transafricacb.co.za

Transaction Capital Credit Health

DavidD1@tcriskservices.co.za

VeriCred Credit Bureau sumein@vccb.co.za

WeconnectU

johann@weconnectu.co.za

Zoia Consulting sipho@dots.africa

Lightstone chrisb@lightstone.co.za

Loyal1

tshepiso@loyal1.co.za

Smart Information Bureau

info@smartbureau.net

C O N T A C T D E T A I L S

This letter serves to communicate to the Credit industry to use the following contact details for the Nimble Group when processing Debt Review related applications, enquiries, queries and, complaints escalation process.

Kindly take note Nimble Group hereby consents to service all legal documents applicable to Debt review herein by way of email.

Email & Task Type

Forms 17 1 and 17 7

Forms 17 2, Proposal Summaries, Cascade plans & Court orders

Forms 17.2 Rejection, 17.W & Form 19

Forms 17 3, General queries, settlements, balance, refunds, statements, Paid up letter request & reckless lending allegations, payment allocation queries & Complaints

DEBT REVIEW INBOUND CONTACT NUMBERS:

+27 87 250 5533

+27 21 8300 711

DEBT REVIEW ENQUIRIES ESCALATION MANAGEMENT ORDER CONTACT DETAILS

Kindly note that escalations must only be done once you have sent your request to the above-mentioned contact email addresses and if your requests are out of SLA in lieu Debt Review forms response business days stipulated in the NCR Act

Kind Regards,

Contact Details

drcob@nimblegroup co za

drproposal@nimblegroup co za

drtermintation@nimblegroup.co.za

drqueries@nimblegroup co za

1st line escalation

Aletta Tokollo Molelekeng

Debt Review: Team Manager

D: +27 11 285 7247

E: AlettaM@normanbissett co za

2nd line escalation

Denvor Rank

Operations Manager: Process Recoveries

O: +27 21 830 0750 (Ext 6062)

E: denvorr@nimblegroup co za

3rd Line escalation

Zivia Koff

Specialised Process Manager

D: +27 21 492 4554

E: ziviak@nimblegroup co za

Denvor Rank

Operations Manager: Process Recoveries

We trust this communication finds you well and that it will improve our service to you

It

Further

Table

Order of Escalation

Person Designation

Forms 17s, Court documents

1 Jolene Pieters

E-mail address

Team Leader: Debt Review (Court Orders/Forms/Inclusions) JolenePieters@capitecbank.co.za

2 Cindy Mauritz Manager: Debt Review CindyMauritz@capitecbank.co.za

3 Carolina Visser Manager: Process Recoveries CarolinaVisser@capitecbank.co.za

Proposals

1 Meghan Bruiners Team Leader: (Proposals) MeghanBruiners@capitecbank.co.za

2 Cindy Mauritz Manager: Debt Review CindyMauritz@capitecbank.co.za

3 Carolina Visser Manager: Process Recoveries CarolinaVisser@capitecbank.co.za

General Enquiries, Refund/cancellation requests , Termination queries, Updated COB’s, Payment queries

1 Nathan Slaverse Team Leader: Enquires Nathanslaverse@capitecbank.co.za

2 Carolina Visser Manager: Process Recoveries CarolinaVisser@capitecbank.co.za

Insurance replacements

1 Mfundo Xaba Officer: Market Conduct Oversight MfundoXaba@capitecbank.co.za

2 Dries Olivier Manager: Market Conduct and Oversight DriesOlivier@capitecbank.co.za

Reckless Lending Queries

1 Whitney Jardine Team Leader: Recoveries Risk Support WhitneyJardine@capitecbank.co.za

2 Zayaan Jurgens Manager: Recoveries Risk Support ZayaanJurgens@capitecbank.co.za

Credit insurance claims

1 Grant Griffith Jessica Rademeyer Kanyisa Mbiza

Team Leader: Insurance Claims GrantGriffiths@capitecbank.co.za JessicaRademeyer@capitecbank.co.za KanyisaMbiza@capitecbank.co.za

2 Brigitte October Performance ManagerInsurance Claims BrigitteOctober@capitecbank.co.za

Telephonic queries lodged

1 Laetitia Pretorius Team Leader: CCS Queries LaetitiaPretorius@capitecbank.co.za

2 Tracey Govender Manager: Recoveries Administration TraceyGovender@capitecbank.co.za

Sincerely,

086 066 7783

17.1, 17.2, Proposals, General correspondence: debtcounselling@africanbank.co.za

To register for Legal Web Access: lwac@africanbank.co.za

Reckless Lending investigations: RLA@africanbank.co.za

DETAILS COMING SOON

NEDBANK DRRS

Debt Counselling Query Resolution Contact Points and Escalation Options

Fax or Email submissions (Level1)

Email: DebtCounsellingQueries@nedbank.co.za

Fax: 010 251 0055

Call centre (Level 1: Alternative)

Tel: 0860 109 279

Attended to by Queries Team Leader (Level 2: First Escalation)

Dcescalation1@nedbank.co.za

To be used as a first point of contact for all written communication

To be used as a first point of contact for all telephonic communication

To be used only where no resolution is found from first point of contact after 5 business days

Attended to by Senior Manager (Level 3: Final escalation)

Dcescalation2@nedbank.co.za

To be used only where no resolution is found from the first escalation after 2 Business days