Vietnam

HCMC REAL ESTATE MARKET INSIGHTS Q3/2022 | © CBRE, Inc. CBRE

HCMC REAL ESTATE MARKET INSIGHTS Q3/2022 | © CBRE, Inc. CBRE V ietn am

HCMC REAL ESTATE MARKET INSIGHTS Q3/2022 | © CBRE, Inc. MARKET INSIGHTS Q3 2022 – HO CHI MINH

HCMC REAL ESTATE MARKET INSIGHTS Q3/2022 | © CBRE, Inc.

HCMC REAL ESTATE MARKET INSIGHTS Q3/2022 | © CBRE, Inc.

HCMC REAL ESTATE MARKET INSIGHTS Q3/2022 | © CBRE, Inc.

HCMC REAL ESTATE MARKET INSIGHTS Q3/2022 | © CBRE, Inc. ▪ ▪ ▪ ▪ ▪ ▪

HCMC REAL ESTATE MARKET INSIGHTS Q3/2022 | © CBRE, Inc. • • • •

HCMC REAL ESTATE MARKET INSIGHTS Q3/2022 | © CBRE, Inc.

HCMC REAL ESTATE MARKET INSIGHTS Q3/2022 | © CBRE, Inc.

HCMC REAL ESTATE MARKET INSIGHTS Q3/2022 | © CBRE, Inc. (%) • •

HCMC REAL ESTATE MARKET INSIGHTS Q3/2022 | © CBRE, Inc.

HCMC REAL ESTATE MARKET INSIGHTS Q3/2022 | © CBRE, Inc.

HCMC REAL ESTATE MARKET INSIGHTS Q3/2022 | © CBRE, Inc. MARKET INSIGHTS Q3 2022 – HO CHI MINH

HCMC OFFICE MARKET

HCMC REAL ESTATE MARKET INSIGHTS Q3/2022 | © CBRE, Inc.

HCMC OFFICE MARKET Market Snapshot Office HCMC Q3 2022 HCMC OFFICE Snapshot Q3 2022 SUPPLY NLA (sqm) ASKING RENT (*) US$/sqm/month VACANCY RATE (*) (%) 9.6% ▼ -0.2 ppt q-o-q ▼ -0.3 ppt y-o-y US$ 62.9 ▲ 2.9% q o q ▲ 7.0% y o y 4% ▲ 0.2 ppt q o q ▲ 2.1 ppt y-o-y GRADE A GRADE BGRADE A CBD 332,093 sqm 1,015,916 sqm475,253 sqm 6% ▼ -4.1 ppt q-o-q ▼ -4.7 ppt y-o-y US$ 45.9 ▲ 2.2% q o q ▲ 8.7% y o y (2 new projects: 26,932 sqm) US$ 25.9 0.0% q-o-q ▲ 3.1% y-o-y

HCMC OFFICE MARKET

MARKET

(20,000) (10,000) 0 10,000 20,000 30,000 40,000 50,000 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 2019 2020 2021 2022 Net Absorption Rate (sqm) Hạng A Hạng B HCMC OFFICE

Cho thuê mới Gia hạn Mở rộng Chuyển địa điểm Thu hẹp HCMC OFFICE MARKET

HCMC OFFICE MARKET

0% 10% 20% 30% 40% Tài chính/ Ngân hàng Bảo hiểm Dịch vụ Sản xuất Công nghệ thông tin Bán lẻ/Thương mại/ TMĐT

HCMC OFFICE MARKET

HCMC OFFICE MARKET

HCMC OFFICE MARKET

HCMC OFFICE MARKET

Retail

HCMC REAL ESTATE MARKET INSIGHTS Q3/2022 | © CBRE, Inc.

Market MARKET INSIGHTS Q3 2022 – HO CHI MINH

HCMC REAL ESTATE MARKET INSIGHTS Q3/2022 | © CBRE, Inc. Source: CBRE Vietnam Research & Consulting

HCMC REAL ESTATE MARKET INSIGHTS Q3/2022 | © CBRE, Inc. ạ ạ

HCMC REAL ESTATE MARKET INSIGHTS Q3/2022 | © CBRE, Inc. • •

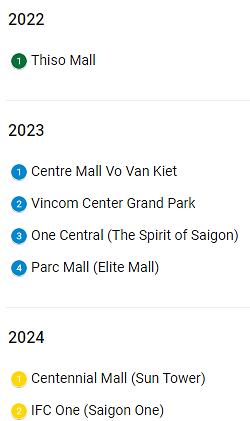

HCMC REAL ESTATE MARKET INSIGHTS Q3/2022 | © CBRE, Inc. HCMC RETAIL MARKET Market Snapshot Retail HCMC Q3 2022 HCMC RETAIL Snapshot Q3 2022 SUPPLY NLA (sqm) ASKING RENT (*) US$/sqm/month VACANCY RATE (*) (%) 38 USD ▲ 2.7% q-o-q ▲ 15.6% y-o-y CBD NON-CBD 945,275 sqm132,353 sqm 6,2% ▼ -0.1 ppt q-o-q ▲ 4.3 ppt y-o-y 185 – 250 USD Prime location: 250 350 USD ▲ 4.4% q-o-q ▲ 52.1% y-o-y 11,4% ▼ 1.2 ppt q o q ▲ 0.1 ppt y-o-y

HCMC REAL ESTATE MARKET INSIGHTS Q3/2022 | © CBRE, Inc. 0% 3% 6% 9% 12% 15% -60,000 -30,00030,000 60,000 90,000 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 2019 2020 2021 2022 Vacancy Rate (%) Net Leasable Area (sqm NLA) Net Absorption Vacancy Rate - CBD Vacancy Rate - Non-CBD

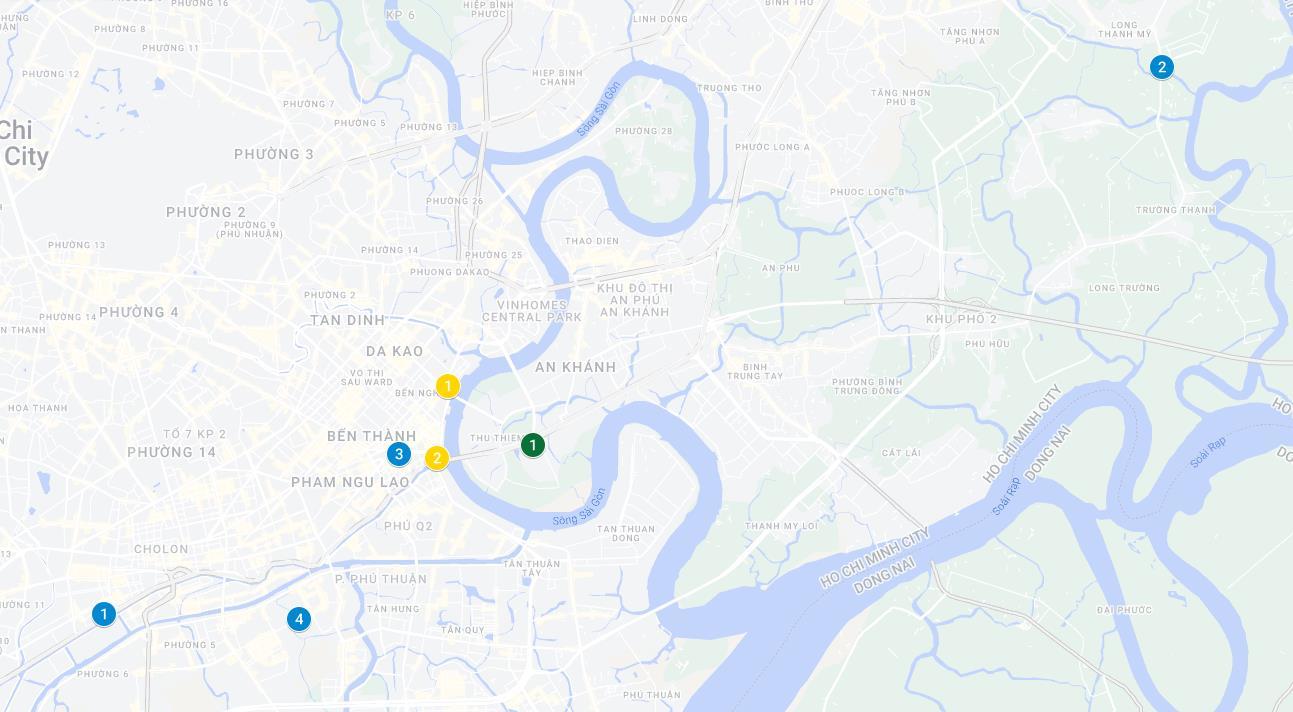

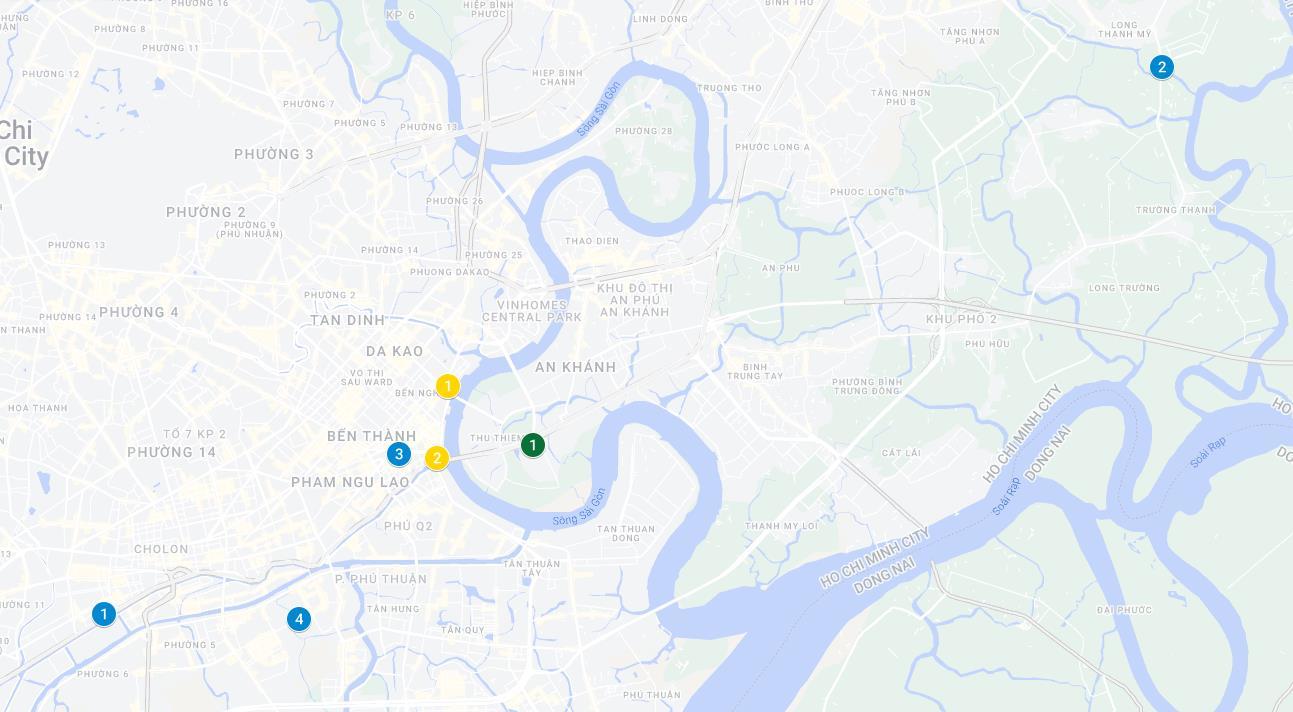

HCMC REAL ESTATE MARKET INSIGHTS Q3/2022 | © CBRE, Inc. 2022: 35,000 sqm NLA 2023-2024: Over 170,000 sqm NLA of future supply

Market Outlook

Asking Rent (US$/sqm/month)

Rent

HCMC REAL ESTATE MARKET INSIGHTS Q3/2022 | © CBRE, Inc.

0% 6% 12% 18% 24% 30% 0 50 100 150 200 250 2019 2020 2021 2022F 2023F 2024F Vacancy Rate (%)

Asking

- CBD Asking Rent - Non-CBD Vacancy Rate - CBD Vacancy Rate - Non-CBD

With limited new supply and demand for prime locations remaining firm, space in city centres and along prime high streets will remain keenly sought-after in the coming time.

Physical retail stores will focus on facilitating consumer experience by integrating in-store utilities and enhancing online order fulfilment capabilities, a trend already evident within the F&B sector

Concerns about challenges and inflationary pressures in the coming time may affect the recovery of retail sector as costs of raw materials, production costs and consumer goods prices expect to increase further, affecting consumer spending and consumer confidence especially for non-necessities.

HCMC REAL ESTATE MARKET INSIGHTS Q3/2022 | © CBRE, Inc.

Prime assets to remain well sought after

Market Outlook Consumer experience a top priority Inflationary pressures may dampen outlook

HCMC REAL ESTATE MARKET INSIGHTS Q3/2022 | © CBRE, Inc.

Residential Market

HCMC REAL ESTATE MARKET INSIGHTS Q3/2022 | © CBRE, Inc.

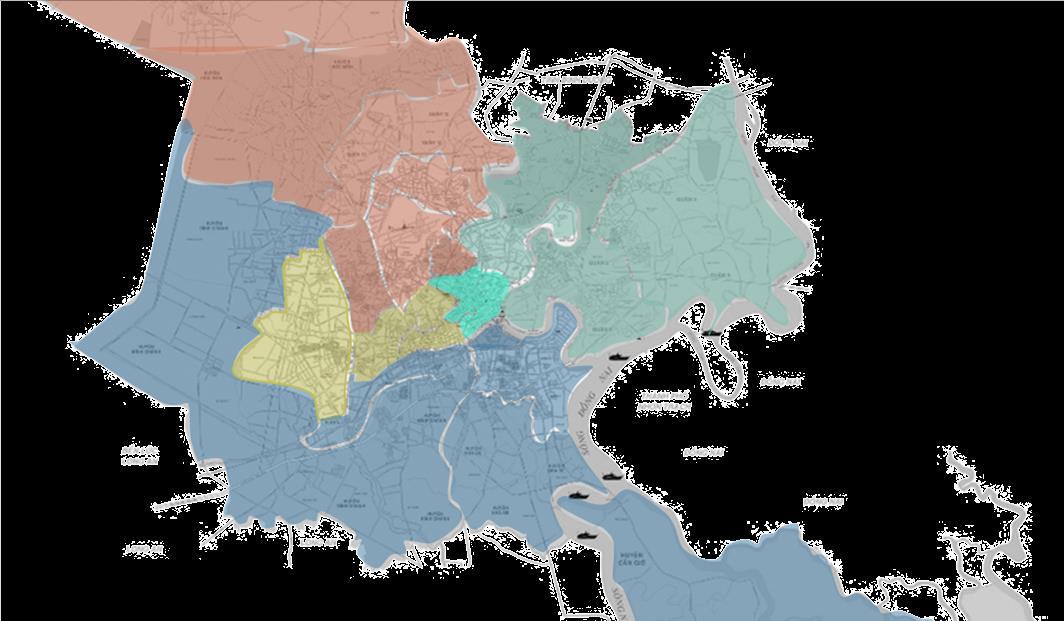

MARKET INSIGHTS Q3 2022 – HO CHI MINH

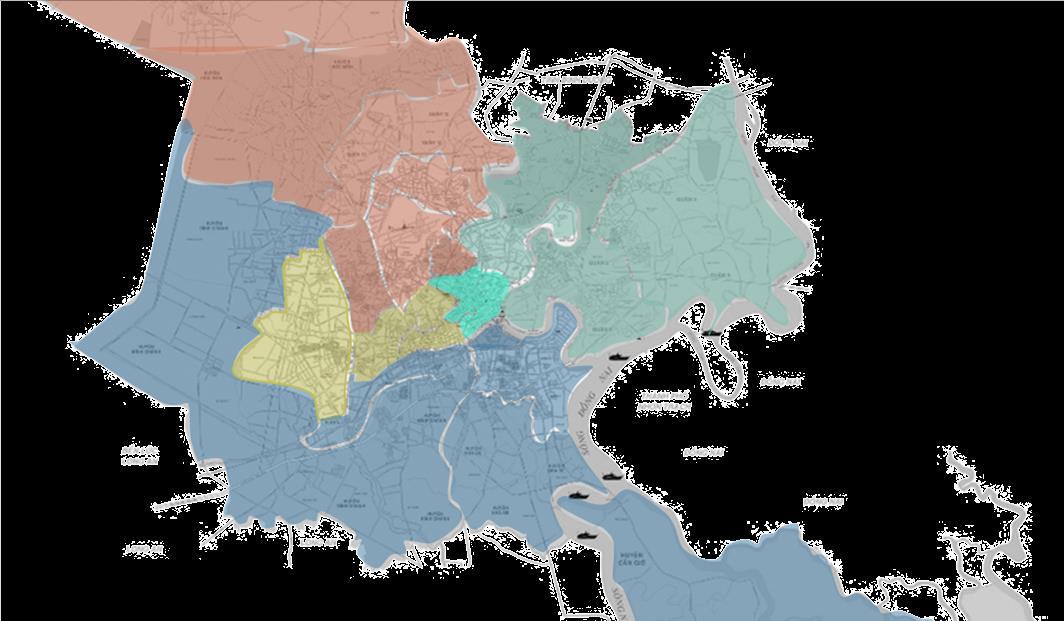

HCMC, Map of New Supply, Q3 2022

HCMC REAL ESTATE MARKET INSIGHTS Q3/2022 | © CBRE, Inc. New launch supply (units) 379 units ▲+14 -o2,171 units ▼ 4 o ▲ 3 300 units ▼ 57 o ▼ 5 0 2,851 units ▼ 0% o ▲+ 9 Average Primary Price* (US$ psm) US$ ,966 US$ 6,553 ▲+9 -o▲ 5 US$ 2,60 ▲+ 6% -o▲+1 8 US$ 1,718 ▲+5% -o▲+11 US$ 24 ▼ 5 -o▼ 3 US$ 2,545 ▲ 4% ▲ 12% Sold units 393 units ▲+91 -o▲12x y-o-y 5,843 units ▼ 39% -o▲4x y-o-y 0 units ▼ 37% -o▲2x y-o-y 6,726 units ▼ 36% -o▲4x y-o-y

HCMC REAL ESTATE MARKET INSIGHTS Q3/2022 | © CBRE, Inc.

HCMC REAL ESTATE MARKET INSIGHTS Q3/2022 | © CBRE, Inc.

HCMC REAL ESTATE MARKET INSIGHTS Q3/2022 | © CBRE, Inc. ▲ ▲ ▲ ▼ ▲ ▲ ▲ ▲ ▼

District

District

Thu Duc

HCMC REAL ESTATE MARKET INSIGHTS Q3/2022 | © CBRE, Inc. District 1

2 District 7

9

HCMC REAL ESTATE MARKET INSIGHTS Q3/2022 | © CBRE, Inc.

HCMC REAL ESTATE MARKET INSIGHTS Q3/2022 | © CBRE, Inc. Salto Residence Thu Duc city Collect bookings Park Avenue District 11. ~ 70 units Vivian Le Jardin Thu Duc city. 15 units Moonlight Avenue Thu Duc city. ~ 800 King Crown Infinity Thu Duc city. ~300 units Collect booking Eco Smart City Thu Duc city. ~1400 units Thủ Thiêm Zeit River Thu Duc city. ~871 units

Mizuki Park

Binh

Chanh

Simcity Thu Duc city

Celesta Avenue

The Classia

The Classia

The Global City

HCMC REAL ESTATE MARKET INSIGHTS Q3/2022 | © CBRE, Inc.

Senturia An Phu

HCMC REAL ESTATE MARKET INSIGHTS Q3/2022 | © CBRE, Inc. ▲ ▲ ▲ ▲ ▲ ▲

HCMC REAL ESTATE MARKET INSIGHTS Q3/2022 | © CBRE, Inc.

For more information regarding this presentation please contact: CBRE Vietnam Co., Ltd. – Research & Consulting T: +84 28 3824 6125 | +84 24 6288 6379 E: research.vietnam@cbre.com