For bulk handling by the tonne in the port, Schlüter für Baumaschinen delivered a new SENNEBOGEN electric material handler to Freiberg to Valet u. Ott GmbH & Co. KG. Thanks to the installed electric drive, the 835 E not only impresses with its low operating costs, but also with its special rail undercarriage, which was specially adapted to the rails already existing in the port at the customer's request.

SENNEBOGEN Maschinenfabrik GmbH

Sennebogenstraße 10 D-94315 Straubing, Germany

T: +49 9421 540-0

E: info@sennebogen.com

W: www.sennebogen.com

PUBLISHERS

Jason Chinnock jason@dc-int.com

Andrew Hucker-Brown andrew@dc-int.com

EDITORIAL

Louise Dodds-Ely Editor louise@dc-int.com

Jay Venter Deputy Editor editorial@dc-int.com

Samantha Smith Directories directories@dc-int.com

Bernice van Wyk Office Manager accounts@dc-int.com

SALES

Matthew Currin Senior Sales sales2@dc-int.com Executive

Zack Venter Advertisement Sales sales@dc-int.com Executive

CORRESPONDENTS

Brazil Patrick Knight

India Kunal Bose

Europe Barry Cross

UK Maria Cappuccio

UK Michael King

UK Richard Scott

ADMINISTRATIVE OFFICE

Business Publishing International Corporate Park, 11 Sinembe Crescent La Lucia Ridge, South Africa, 4051

Tel: +27 31 583 4360

Fax: +27 31 566 4502

Email: info@dc-int.com

Twitter: twitter.com/drycargomag

HEAD OFFICE

Trade Publishing International Limited Clover House, 24 Drury Road, Colchester, Essex CO2 7UX, UK

Tel: +44 (0)1206 562552

Email: info@dc-int.com

Website: www.drycargomag.com

Twitter: twitter.com/drycargomag

ISSN 1466-3643

Insta: www.instagram.com/drycargointernational

Trade Publishing International Ltd does not guarantee the information contained in Dry Cargo International, nor does it accept responsibility for errors or omissions or their consequences. Opinions expressed herein are not necessarily those of Trade Publishing International Ltd

© Trade Publishing Int’l Ltd 2023

During the past twelve months a number of adverse influences affected commodity import demand around the world. Global seaborne dry bulk trade appears to have decreased slightly as a result. Currently signs of a pickup in 2023 are limited.

Among likely restraints on trade expansion in the year ahead, prospects for the world economy are subdued. A revival in China could assist a more positive trend to evolve, but elsewhere prospects are not bright. Inflationary pressures, in particular, and tightening monetary policies accompanying these in many countries, could continue to dampen economic activity for some time. International Monetary Fund economists envisage that a third of the global economy will be in recession during 2023.

GRAIN & SOYA

After a period of strong growth, world trade in grains and soya ceased growing in 2021/22 and looks set to remain flat again in the current 2022/23 trade year ending third quarter 2023. According to US Department of Agriculture estimates published a few weeks ago, trade in wheat, corn and other coarse grains, plus soyabeans and meal could total 664.4mt (million tonnes) in 2022/23, unchanged from the previous year.

While wheat and coarse grains trade is likely to be lower in the current period, soyabeans and meal could increase. One reason for changes in the world market is large variations in China’s purchases. During the past 2021/22

year both grain and soyabeans imports into China declined, reducing the volume by 18mt or 11%, to 142.7mt based on USDA data. But in the current period signs suggest that a recovery in soyabeans buying amid rising consumption could occur.

Global seaborne coal trade was well supported in the past twelve months, following the 2021 partial recovery from the previous year’s steep downturn. What is likely to happen in 2023? Current tightness in the international energy market, which appears set to continue in the months ahead and perhaps through the entire year points to coal trade being firmly underpinned, possibly resulting in a slight rise.

Several forecasts suggest that growth of up to 2% could be seen this year. Revised predictions by analysts at the Australian Government’s industry department, published in late December, show that world steam and coking coal trade (including land movements, but mostly seaborne) may increase by 25mt or 1.9%. After an estimated 1,347mt in 2022, the total is expected to rise to 1,372mt. Although China’s import volume may decline, other countries are likely to more than compensate.

The background envisaged for steel industry activity in many countries, over the year ahead, indicates that constraints on demand for many of the products manufactured by steel users

may remain subdued. In the construction, machinery, vehicles and household appliances sectors and elsewhere business and consumer spending is likely to be restrained by ongoing macro-economic trends.

In Europe, Japan, South Korea and some other producing countries importing iron ore and coking coal signs of strengthening steel output are still awaited and may not appear in the short term.

For China, the biggest raw materials importer, an economic upturn enabled by the relaxation of coronavirus-control restrictions is widely expected to unfold, accompanied by extra government support measures which could benefit steel production, but residential property sector weakness remains a constraint.

Fertilizer movements are an important element of the minor bulks segment. World seaborne trade in potash, phosphate (rock and processed), sulphur and urea evidently was down sharply last year to around 175mt, and may remain weak this year.

Growth in the Handysize (10–39,999 deadweight tonnes) bulk carrier fleet is estimated at about 3% in 2022. Over the next twelve months a deceleration could occur, despite newbuilding deliveries probably remaining steady, if scrapping of old or uneconomic tonnage revives.

Since the initial rebound in global seaborne dry bulk trade emerged after a downturn accompanying the coronavirus pandemic, the trend has weakened. Provisional data suggests that a reduction occurred in the past twelve months, and prospects for the year ahead point to only a minor improvement.

Events during 2022, which greatly constrained import demand for many commodities in countries around the

world, emphasized the potential for unforeseen changes in influences. The intensified range of uncertainties arising and the negative effects of these are mostly still ongoing, casting a shadow over the outlook for dry bulk trade through 2023. Nevertheless there are signs indicating possible limited strengthening, based on a cautiously optimistic view.

Estimates for trade in the past year of 2022 are subject to perhaps sizeable

revision. As shown by table 1, global seaborne dry bulk commodity movements appear to have decreased by 1–2%, following an increase of well over 3% in 2021 when an upturn from the pandemic’s adverse effects occurred. Varying performances among the main elements were seen last year. Coal trade may have increased marginally, while other commodity trades diminished.

Recent clues for 2023 suggest that the

Our bespoke solutions are designed to meet each customer’s specific requirements from a tool kit of proven components, utilising the expertise of a team of specialist in house design engineers.

We lead the loading chute industry & set the standard for dust emissions and environmental pollution control in dry bulk handling.

Our worldwide reputation is built on high quality, well-engineered, robust, high performance chutes, backed up by excellent customer service and global lifetime product support.

outlook is fairly flat, with a possibility of resumed albeit slow growth. Disruptive events restraining import demand for commodities in a number of countries remain prominent, and some or all of these could continue for some time. Yet, assuming that events having such an adverse impact in past months moderate, dry bulk trade may begin to pick up again.

Changing patterns of economic activity in many countries directly affect dry bulk imports, as emphasized by variations in the past few years. Consequences are visible when large changes in the pace of consumer, business or government spending are closely linked to production volumes, in industries using dry bulk

commodities mainly or partly obtained from foreign suppliers.

At the beginning of 2022 predictions focused on the beneficial effects of the global economy’s recovery from the recession caused by the pandemic. Economic activity was expected to grow briskly. But the war in Ukraine, followed by energy shortages, sharply increased inflation and China’s slow progress led to forecasts of global economic growth being revised downwards. World gross domestic product (an overall measure of goods and services output) is estimated to have approximately halved in 2022, from 5.9% growth in the previous year, to 3.1% according to calculations by the OECD organization.

Great uncertainty surrounds assess-

ments of prospects for 2023, amid continuing hostilities in Ukraine, ongoing energy supply shortfalls, an unclear outlook for China’s recovery, and indications of recession in some countries. Forecasts published by the OECD several weeks ago, shown in table 2, reflect a sombre view of unfolding events. World GDP growth could slow further this year, to 2.2%, based on minimal increases or recessions in the USA and Europe, slow improvement in Japan, and an acceleration in China.

In the OECD’s latest report analysts commented that “the global economy is reeling from the largest energy crisis since the 1970s”. According to the authors “global growth has lost momentum amidst high inflation”. Along with weak growth and persistent inflation, elevated risks are

apparent. Recovery may not begin until later this year or in the following twelve months.

Trends in the steel industry affect a large proportion of global dry bulk commodity trade movements. Demand for steel is influenced by consumer, business and government spending patterns in an economy. Changes in steel production volumes result in numerous countries where steel is made, causing in turn consumption and imports of iron ore, coking coal and some other raw materials to vary.

In 2022 steel production changes in major raw materials importing countries were mostly downwards. During the first eleven months of last year, volumes compared with those seen in the same period a year earlier were down by 1% in China, 6% in South Korea, 7% in Japan and 10% in the European Union. The notable exception to this array of reductions was India, which achieved a 6% expansion.

The steel industry raw materials trades, especially iron ore, are dominated by China’s import demand. Over the past twelve months China’s steel production and related consumption and imports of iron ore reflected subdued demand for steel. Two factors especially were apparent. There were adverse effects on overall economic activity from measures imposed to control outbreaks of coronavirus, while weakness in the residential property market which consumes large volumes of steel in housing construction was a more specific influence.

Prospects for global steel production volumes in the next twelve months are not clear because of the prevailing uncertainties about economic activity. A possible outcome is suggested by the recent shortrange steel demand outlook published by the World Steel Association. According to this view, there is limited potential for steel demand in many of the main producing and raw materials importing countries to strengthen in 2023. India, a leading coking coal importer, is the main exception which

could achieve continued robust expansion. Actual steel production volume changes are not forecast by the WSA in this analysis.

Movements of the principal steel industry raw materials, iron ore and coking coal, comprise one-third of all global seaborne dry bulk cargo trade. In 2022 iron ore trade apparently decreased by about 2%, compared with the preceding year, to around 1,490mt (million tonnes) as shown in table 1. Coking coal trade (not shown separately) evidently was roughly flat at about an estimated 260mt.

Iron ore movements are dominated by China’s imports, contributing almost threequarters of world seaborne volume. In 2021 the China imports total (including some overland movements) was 1,126mt. During 2022 the volume received appears to have been about 1% lower. Elsewhere last year, in the other prominent importing countries — the European Union, Japan and South Korea — imported volumes apparently fell by much larger percentages, perhaps exceeding 5%, amid weaker steel output trends.

Within the coking coal segment trade is much smaller than the iron ore volume, while imports are more evenly distributed and not dominated by China. In 2022 China’s quantity, under 15% of the total, evidently declined. In other large importing countries outcomes were mixed. Japan and India may have seen small reductions, while in Korea and Europe advances occurred.

The overall result appears to have been only a minimal change in the volume of world seaborne coking coal trade.

Looking at the year ahead, what is the outlook for global steel industry raw materials trade? Currently potential for expansion seems very limited amid adverse influences affecting world economic activity, which are likely to restrain steel demand and production levels in many countries. This perspective suggests a fairly flat trend evolving. Raw materials imports into the European Union, Japan, South Korea, India and a number of smaller buyers may not increase substantially. In China also it seems unlikely that a stronger imports trend will resume.

Almost four-fifths of seaborne coal trade is comprised of steam — also known as thermal — coal. Consumption and import demand is mostly associated with power station usage in a wide range of countries, and it is also used in cement manufacturing plants and other industrial processes.

Tentative estimates suggest that in 2022 world seaborne steam coal trade may have increased marginally by 1% to reach about 970mt, following the previous year’s upturn. Changes among major importing countries varied greatly in both direction and magnitude.

The year was characterized by a global energy shortage exacerbated by the effects of the Ukraine conflict on European energy supplies in particular. Although the

worldwide shift towards cleaner fuels continued, coal’s contribution to energy security saw a strengthening.

During the past twelve months the post-pandemic global economic recovery’s momentum weakened. Nevertheless energy supplies remained tight, supporting steam coal demand and imports in numerous countries. But the positive effect on trade movements was still restricted by government policies aimed at reducing coal usage. Intensifying environmental pressures to cease or severely curtail coal burning, especially in power stations, were instrumental in preventing a stronger advance in coal trade.

Contrasting large changes in annual steam coal import volumes last year were especially visible in China, where a big fall was seen, and India where a big rise occurred. Among other Asian importers increases were evident. In Europe imports probably increased by around one-third, mainly as a consequence of severe gas shortfalls. Some of the factors strengthening global import demand are set to be sustained through 2023, suggesting that world seaborne steam coal trade could remain well supported and possibly continue rising.

The definition of global seaborne trade in grain and soya usually includes wheat, corn and other coarse grains, and soyabeans, all comprising large quantities. Related

soyameal is usually included in the minor bulks trade segment, together with other oilseeds and meals. In 2022 there was a reduction in grain and soyabeans trade, as shown in table 1, when an estimated 3% decline to about 510mt resulted.

Trade statistics for this commodity group are typically compiled on a ‘split year’ basis, known variously as a ‘crop year’, ‘marketing year’ or ‘trade year’, reflecting the sequence of world harvests and timing of new export seasons. The profound impact of weather variations, often unpredicted, affecting crops harvested by export suppliers as well as domestic crops in importing countries is a notable feature of the annual trade picture. Import demand changes from year to year are often a consequence.

As viewed on the usual crop year basis world trade in wheat and coarse grains during the past 2021/22 year ending June 2022 was marginally lower, by less than 1%, at 424mt. International Grains Council figures show that a large reduction in imports by China and some other Asian countries was almost offset by increases elsewhere around the world. China’s reduction followed a huge expansion in the previous twelve months which improved supplies for the domestic market.

Indications for the current 2022/23 crop year point to a large reduction in global grain trade. The IGC is estimating a 4% decline, mainly reflecting a further large fall in China’s imports from the exceptionally

high volumes seen previously, coupled with other decreases, partly offset by higher imports into the European Union.

Combining statistics for soyabeans and soyameal, data assembled by the US Department of Agriculture shows that global trade declined by 3% in the 2021/22 marketing year ending September 2022, to 222mt. The largest buyer is China, with over two-fifths of the world total. Demand from Chinese importers, mostly consisting of beans, was lower in the past twelve months, while beans and meal imports by other major buyers — Asian countries and the European Union — remained stable.

World soyabeans and meal trade within the present 2022/23 marketing year may recover. The USDA is predicting a 4% increase amid stronger imports into a wide range of countries. A large part of the incremental volume is likely to reflect extra demand for beans from Chinese processing (crushing) mills, rising from 92mt in the past year to reach 98mt, almost returning to the peak annual volume.

Many minor commodity movements are included in this extensive category of seaborne dry bulk trade. Widely varying types of commodities contribute, some of which provide large volumes while others are relatively small. In total the segment is huge, with estimates suggesting that it comprises around two-fifths of all world seaborne dry bulk trade.

Cargoes associated with manufacturing industries and construction activity comprise the biggest part of the minor bulks group. These are the ‘industrial’ bulks.

Agricultural or related cargoes form the remainder. Global seaborne minor bulk trade overall increased by 5% in 2021 to reach about 2,100mt as momentum recovered from the pandemic’s adverse effects. This was followed last year by a weakening pattern in numerous components when economic activity faltered, possibly resulting in the total diminishing by about 3%. Prospects for 2023 show only limited signs of revival.

Among individual commodity components the largest are steel products and forest products, both including many different varieties. Other prominent elements in the ‘industrial’ sub-group are bauxite and alumina, steel scrap, cement, coke and petroleum coke, salt, and nickel and other ores. Agricultural or related bulk cargoes consist of sugar, oilseed meals, rice, plus raw or semi-processed fertilizers.

In the past year negative influences affecting global seaborne minor bulk trade were widespread, exacerbated by slow industrial growth in China — a top importer of minor bulks — and some other countries. Steel products (coil, plate, sheet and other items) and forest products, the two biggest elements of world trade may have declined by 4–7%. Cement trade also apparently was much lower but, by contrast, bauxite/alumina trade was buoyant.

Usually a starting point for assessments of future dry bulk trade volumes is prospects for economic activity and demand for the products of various industries in the countries having the biggest impact on

global commodity import demand. As already discussed many countries may experience slower growth during 2023 or, in some cases, perhaps recession in the early months of the year. Such a pattern could have an unfavourable impact on commodity import movements.

Assumptions about China are particularly relevant to expectations for global seaborne dry bulk commodity trade, because this country’s imports are estimated to comprise well over one-third of the world total. After unusually sluggish economic growth in 2022, a strengthening trend is widely expected, but depends greatly on further progress in controlling the covid pandemic. If this is achieved, dry bulk commodity imports seem likely to increase.

Among wider influences, fairly clear signs suggest that one restraint on future dry bulk trade growth is likely to be obvious over time, although not necessarily in 2023. The outlook for iron ore and coal, two segments contributing half of the total seaborne dry bulk trade volume, is not favourable. Iron ore trade may have reached a plateau, while coal trade is surrounded by longer term downwards pressures even though trade is currently holding up. For grain and soya movements, and some minor bulk elements, prospects seem more positive.

The critical role of the Great Lakes-St. Lawrence Seaway system in the global supply chain has been brought into sharp focus over the last few years. On 24 January, the Canadian St. Lawrence Seaway Management Corporation (SLSMC) and U.S. Great Lakes St. Lawrence Seaway Development Corporation (GLS) jointly announced that more than 36mt (million tonnes) of cargo transited the system during the 2022 navigation season.

US and Canadian producers helped v mitigate global issues affecting fertilizer supplies, which drove significant growth in potash, up over 100% compared to 2021.

Dry bulk commodities, including coke, v salt and potash, contributed over 11mt of the 2022 total.

Petroleum products were up nearly v 28% over last year, due to increased passenger travel.

US grain exports increased, and v although month-over-month Canadian grain performed well, it did not match last year’s results. The effects of the 2021 drought in the Canadian prairies impacted export movements at the beginning of the 2022 season. That said, the improved 2022 grain harvest

2022 End of Navigation Results

is expected to result in a strong start for 2023.

An increase of vessel transits, including v expanded cruise ship activity in the Great Lakes helped contribute to tourism and economic development in Canada and the United States.

“Seaway traffic results show positive trends amongst certain commodities, which demonstrates our system’s ability to quickly adapt to changes in the market,”

said Terence Bowles, President and CEO of the SLSMC. “It’s this agility that enables the Seaway to respond to changes and act on emerging opportunities, such as shifting trade patterns resulting from global events. In addition, we are working closely with partners to develop lands along the Seaway, which will benefit both the economy and local communities.”

“Through decades of investment and reliability, the Great Lakes are uniquely positioned to weather upheavals in the

global supply chain,” said Adam Tindall-Schlicht, Administrator of the GLS. “The Seaway System is a leading example of a worldwide economically-resilient and environmentally sustainable shipping corridor, and optimism is high for expansion of trade on the Great Lakes in 2023.”

The last commercial transit of the 2022 navigation season through the Montreal-Lake Ontario (MLO) section of the Seaway occurred on 1 January. As for the Welland Canal, it closed on 9 January 2023, marking the conclusion of the fourth year of the Welland Canal season extension pilot program.

From now until the opening of the 2023 season, the SLSMC and GLS will carry out maintenance work on critical lock and maritime assets, ensuring the Seaway system continues to deliver safe and reliable service year after year by managing its assets efficiently.

Though there continues to be some uncertainty with regards to economic growth in 2023, the Seaway Corporations will work on key initiatives to further support expanding trade on the Great Lakes. These include facilitating the establishment of green shipping corridors, expanding land development along SLSMC-owned canals, and developing innovative technologies, such as the Vessel Information System.

“It’s this spirit of continuous improvement and agile performance that make the Seaway a relevant transportation system today, and an integral part of future solutions,” added Bowles.

The Great Lakes-St. Lawrence Seaway system is a ‘marine highway’ that extends 3,700km from the Atlantic Ocean to the Great Lakes. Shipping through the Seaway supports over 329,000 jobs and $59 billion in economic activity in Canada and the United States. Binational marketing development efforts, including the ‘HwyH2O’ initiative, aim to enhance Great Lakes-St. Lawrence Seaway System utilization and increase marine cargo shipping.

The St. Lawrence Seaway Management Corporation was established in 1998 as a not-for-profit corporation by the Government of Canada, Seaway users and other key stakeholders. In accordance with provisions of the Canada Marine Act, the Corporation manages and operates the Canadian assets of the St. Lawrence Seaway, which remain the property of the Government of Canada, under a long-term agreement with Transport Canada.

The Great Lakes St. Lawrence Seaway Development Corporation (GLS), an operating administration of the U.S. Department of Transportation, is a wholly owned government corporation created by statute on 13 May 1954, to construct, operate, and maintain that part of the St. Lawrence Seaway between the Port of Montreal and Lake Erie, within the territorial limits of the United States. Formerly the Saint Lawrence Seaway Development Corporation (SLSDC), the GLS was legally renamed as part of the 2021 Consolidated Appropriations Act as signed into US law on 27 December 2020.

CG rendering of the 210,000dwt ammonia fuelled bulk carrier (courtesy of MOL and MITSUI).

ClassNK has issued an Approval in Principle (AiP) for a large ammonia fueled 210,000dwt bulk carrier jointly developed by Mitsui O.S.K. Lines, Ltd. (MOL) and MITSUI & CO., LTD (MITSUI).

Ammonia is expected to be used as a ship fuel for decarbonization since it does not emit CO2 when combusted. Meanwhile, adequate safety measures are imperative as it has been pointed out that ammonia is toxic to humans and corrosive to materials. ClassNK has been involved in projects aiming for zero-emission ships using ammonia fuel in terms of safety assessment, and has issued its ‘Guidelines for Ships Using Alternative Fuels’ as a necessary standard to minimize the risks related to ammonia-fuelled ships for the ships, crews, and environment by stipulating requirements for installation, controls, and safety devices.

MOL and MITSUI have jointly determined the size and specifications for the vessel, and its design has been entrusted to Mitsubishi Shipbuilding Co., Ltd. ClassNK carried out the review of this jointly developed design in line with Part C of its guidelines and issued the AiP on verifying conformity to the prescribed requirements. In addition, risk assessment (HAZID) will be conducted to confirm that no unacceptable risks exist at the basic design stage and to identify items to be considered in the detailed design.

ClassNK will continue to support those companies as the certification body and will strive to provide appropriate standards for ammonia-fueled ships through the expertise gained from the collaboration.

At the initial stage of designing or before the specific target ship to be implemented is decided, the design is examined based on the existing regulations such as international conventions and ship classification rules, and an Approval in Principle is issued as proof of conformity with requirements. It also prevents rework of regulatory aspects in the postprocess, shortens the examination time at the time of class registration, and can be used as a technical basis for external appeal of the design status.

Over the past year it became gradually clearer that broad influences were providing less support for the global bulk carrier market than seen during the preceding twelve months. After a remarkable improvement in the freight rates trend through much of 2021, last year’s performance was inferior. Moreover, current signs for 2023 point to another year when progress may be limited.

Various changes which unfolded in the course of last year, affecting the demand for and supply of cargo carrying capacity in the bulk carrier sector, combined to weaken the demand/supply balance and restrain market freight rate levels. Although changes in the period ahead are likely to differ, the combined effect may be similar albeit perhaps less restricting. This pattern may allow a somewhat more positive freight rates trend than seen in recent months to evolve. However, expectations for many aspects are speculative.

In 2023 a deceleration in the world bulk carrier fleet’s expansion is predictable. An ingredient probably will be greatly increased scrapping, prospects for which are not yet entirely certain. This shift in the

carrying capacity trend amid substantial newbuilding deliveries probably will prove necessary, to accompany the prospective minimal dry bulk trade and tonnage demand growth envisaged, presently seeming quite likely.

Other influences also will be instrumental in shaping how the trend of freight rates evolves over the next twelve months. One of these is changes in trading patterns affecting tonne-miles performed. Another is port congestion and loading or discharging delays, the significance of which has been receding recently, boosting the effective availability of ship capacity in the market.

Bulk carrier fleet growth during the past twelve months was slightly below its annual expansion rate in preceding years. The world bulk carrier fleet’s deadweight tonnage, a measure of carrying capacity, increased in 2022 by an estimated 2.9%. A substantially lower volume of new ships joining the fleet was recorded, while the amount of old or uneconomic ships leaving also diminished. Consequently the net deadweight capacity added decreased, as

One year ago, at the end of 2021, the world fleet of bulk carriers (including all ships with capacity of 10,000 deadweight tonnes and over) consisted of 12,750 vessels totalling 945.9 million dwt, according to data compiled by Clarksons Research. Twelve months later at the end of 2022 this fleet was about 27m dwt larger at 973m dwt, based on estimates which are subject to revision.

A much lower newbuilding deliveries total was a feature of fleet changes in 2022. The newbuildings volume, provisionally calculated at 31m dwt, may be revised upwards when more complete information is available. This figure is almost one-fifth below the 38m dwt seen in the preceding year. Accompanying this rise was decreased scrapping, measured by reported sales for demolition, totalling about 4m dwt, down by about a quarter.

Among the main vessel size groups (Capesize, Panamax, Handymax and Handysize) fleet growth rates last year varied between 2% and 4%. Enlargement was slowest in the Capesize segment, comprising ships of 100,000dwt and over, forming two-fifths of the entire world bulk

By contrast, within the Panamax 70–99,999dwt size group, including Kamsarmax 80–89,999dwt bulk carriers, growth was almost 4%.

Elsewhere expansion rates were in the middle of the range. The Handymax 40–69,999dwt segment (including Ultramax ships exceeding 60,000dwt as well as Supramax bulkers of 50–59.999dwt) grew by 3%. In the Handysize segment of smaller 10–39,999dwt bulk carriers, growth was also 3%.

Actual changes in transport capacity available are not always accurately illustrated by static deadweight capacity figures, however. Changes in world fleet capacity to move cargoes also depend on how productively ships are employed. Large influences on this aspect are ships’ voyage speeds, ballast (empty) voyage patterns, and duration of port visits, data for which involve complex calculations. The advantage of using deadweight tonnage as a measure is that it is simple and available promptly, and is therefore a useful broad indicator of transport capacity for cargoes.

Average voyage speed in the fleet is an important influence. Even a modest change in the bulk carrier fleet’s average speed, resulting in the time taken to complete a voyage increasing or decreasing, substantially affects annual transport capacity available. A declining speed trend has been evident in recent years, resulting in reduced average annual numbers of voyages completed and therefore lower productivity. After an upturn in the average in 2021, a reversal seems to have occurred in 2022, modifying deadweight capacity growth.

Following a recovery in global dry bulk trade in 2021 when the severe adverse effects of the pandemic receded, further brisk growth was widely expected. But unforeseen events around the world resulted in declining trade last year. A

detailed trade overview is contained in another article in this edition of DCI (‘Dry bulk trade growth falters’ — see p4 onwards), so the following comments are a brief overview.

Global seaborne dry bulk trade expanded by well over 3% in 2021, before decreasing last year by an estimated 1–2%. Among the main segments, coal was the strongest performer in 2022, growing by an estimated 1% after a robust performance in the previous twelve months. Elsewhere negative results were prominent. Iron ore appears to have declined by about 2%, while both the grain and soya, and the minor bulk commodities segments apparently saw reductions of around 3%. The 2022 overall dry bulk total is provisionally calculated to have risen by about 95 million tonnes, down to 5.4 billion tonnes.

Lower import demand in China was a feature of last year’s weakness, amid very slow economic growth reflecting the ongoing coronavirus pandemic and property market downturn. The volume of dry bulk imports into China is estimated to have fallen by 4–5% in 2022, including lower coal, grain and soyabeans, and some minor bulk commodities. This outcome is especially significant because China comprises almost two-fifths of global dry bulk commodity import volumes.

From a shipping market perspective, another aspect also determines demand for the services provided by bulk carriers, how much ‘employment’ is created. Trade volumes transported are the usual focus, because these can be measured relatively easily and are a convenient proxy for vessel demand. But voyage distances are influential as well. The distances affect the number of cargo-carrying trips performed annually by a ship. Any significant change in the annual average voyage distance performed by each deadweight tonne of cargo-carrying capacity has an impact on vessel demand.

Incorporating these measurements within a ‘tonne-mile’ unit includes both cargo (trade) volume and voyage distance,

providing a more accurate gauge of demand for transport capacity. However, statistics compiled on this basis are often not as readily available or as timely, because additional information and extensive calculations are required. In 2022, according to preliminary estimates by Clarksons Research, the annual tonne-miles percentage decrease was about one percentage point smaller than the tonnes volume decrease, implying that bulk carrier demand was reduced by less than cargo tonnes.

The balance between demand for, and supply of, carrying capacity in the bulk carrier freight market slackened in the past twelve months, contributing to a weaker freight rates trend. As already discussed dry bulk commodity trade diminished, while the world fleet of ships carrying these cargoes expanded briskly.

For much of the extended period since the global economic depression experienced after the world financial crisis more than a decade ago, together with its adverse impact on trade volumes, surplus capacity was evident in the bulk carrier sector. Over-expansion of the bulk carrier fleet prevailed amid excessive optimism by shipowners and other players about recovery prospects. Consequently the world fleet remained under-utilized.

When the pandemic began, the impact initially was a huge setback for progress towards a sustainable bulk carrier market recovery which could boost freight rates. Vessel employment was weakened, while the fleet of ships available continued to grow. But then, in 2021, strengthening trade volumes and other favourable influences affecting the market balance were a feature. Last year this pattern was not fully maintained, causing a freight market setback.

There is considerable uncertainty about how the freight market trend will evolve in the period ahead. Evaluations must include effects from the direction and trend of the

market demand/supply balance, and the complications of many temporary influences. Estimates suggest that minimal or no growth in dry bulk trade could be exceeded by slower growth in the bulk carrier fleet. Other influences could modify this relationship, but it seems likely that a sustained freight market strengthening is not yet foreseeable.

In 2022 bulk carrier freight rates varied within a wide range. Rates obtained by all the main bulk carrier sizes moved in broadly similar directions although, as often happens, changes tended to be larger in the Capesize segment than elsewhere. Market Capesize freight rates are often especially volatile, reflecting short-term employment fluctuations in the two commodity trades — iron ore particularly, and coal — on which these bulk carriers mostly depend.

Early in 2022 the bulk carrier freight market experienced downwards pressure but strengthened towards mid-year. Capesize charter earnings during this period were frequently exceeded by those secured by the smaller Panamax and Supramax ships. From around mid-year onwards up to the end of the year a weaker trend became established. During this period the unusual pattern of Supramax and Panamax earnings at higher levels than those of Capesize vessels persisted, reflecting subdued iron ore trade employment for the larger vessels.

The evolving bulk carrier market freight rates trend is represented by the Baltic Dry Index (BDI), although this index does not fully illustrate the sector. The BDI,

calculated daily by the Baltic Exchange, is based on a basket of time charter hire rates for various bulk carrier sizes and typical employments on the specific long-distance international routes included. It is an indicator of changes in the cost of transport for dry bulk cargoes.

From around 2,300 at the beginning of 2022, the BDI quickly fell to about 1,400. It then climbed by about 2,000 points over several months to around 3,400 in May. But this recovery proved unsustainable as the demand/supply balance deteriorated. From June onwards a lower market ensued, down to around 1,000 before improving to 2,000 at the beginning of the fourth quarter after which a reduction to the 1,200–1,500 level was seen.

Events around the world during the past twelve months have complicated any assessment of bulk carrier freight market prospects in 2023. The expected pattern of post-pandemic global economic recovery with benefits for seaborne dry bulk trade volumes was not fulfilled last year, and the disruption experienced seems likely to continue, at least partly through the period ahead.

Some optimism has been expressed among market observers about tonnage supply. Bulk carrier fleet growth is widely expected to decelerate markedly, restraining excess capacity. But the tonnage demand side of the balance is not yet showing convincing signs of strengthening much. So it is unclear whether an upturn in dry bulk trade volumes and tonne-miles performed will be

sufficient to match or exceed the lower pace of fleet expansion envisaged. A weakening balance is still a possibility.

Complicating this outlook is the role of ‘disruptions’ in bulk carrier employment patterns which have adversely affected the fleet’s carrying capacity. Recent signs suggest that logistical and operational delays and disruptions are diminishing, enabling the fleet to provide more efficient transportation activity. Port congestion and delays in a number of countries are reported to have eased in past months, enabling bulk carriers to improve productivity, effectively expanding supply and acting as a restraint on freight rates.

Several prominent uncertainties affecting the trade picture are evident. The return of inflation as a major challenge, leading to weaker real incomes, with adverse effects on growth in spending and economic activity, may continue to restrict import demand for dry bulk commodities for some time. This trend has been exacerbated by the war in Ukraine coupled with the sanctions imposed on Russia, directly constraining global energy and food supplies. How long these events will persist is debatable, although economists indicate that inflation rates may improve during 2023.

Another imponderable is when China’s economy will resume a more ‘normal’ rate of growth. The outcome clearly depends greatly on how the ongoing Covid pandemic, and the policies implemented to control it, affects the future pace of economic activity. A successful easing of restrictions during the next few months potentially could provide an economic

boost, which is likely to be reflected in additional bulk commodity import demand. Nevertheless, over two-thirds of the China volume consists of iron ore and coal, two commodities potentially facing downwards pressures in the longer term although not necessarily declining in the next twelve months.

On the supply side of the freight market, one relatively plausible expectation for 2023 is slower growth in the bulk carrier fleet. Newbuilding deliveries are unlikely to contribute to this deceleration because signs point to these increasing from last year’s level, based on interpretations of shipyard orderbook schedules. The scheduled newbuilding deliveries total for

2023 is well above the actual volume delivered in the past twelve months.

But the scrapping volume potentially could increase substantially from the minimal volume seen in the past twelve months. If this occurs, it could result in a diminished annual net deadweight capacity added to the fleet, implying a much slower growth rate. After the past two years when unusually low scrapping totals were seen, an increased level is foreseeable.

Higher scrapping of old or uneconomic vessels may seem predictable. But forecasting recycling volumes more specifically is largely based on guesses. It is a speculative exercise because market sentiment among shipowners — reflecting recent, current and expected future freight market rates, and how secondhand vessel

prices are evolving — is often a major influence on demolition sales decisions which is not predictable.

However, two main influences in 2023 could boost scrapping. The bulk carrier fleet is ageing. The average age is increasing because of low demolition sales in recent years and there is a significant volume which has reached an advanced age. More shipowners may decide not to incur the extra costs of extensive surveys and maintenance involved in older vessels with a limited remaining lifespan. Another influence is that international maritime regulations aimed at cutting greenhouse gas emissions are tightening in 2023. Compliance costs may not be justifiable on some older bulk carriers, resulting in extra sales to the recycling yards.

Investors in middle aged dry bulk tonnage may be cheered by the impact of sustained higher recycled steel values, according to research commissioned by the Baltic Exchange.

Analysis of the dry bulk carrier values undertaken by consultancy Zuoz Industrial looks at the potential impact of longer-term higher ship recycling values on five year old tonnage. With recycled steel an increasingly popular choice, thanks to its lower carbon footprint when compared with virgin steel, the paper discusses whether higher steel recycle values are a longerterm trend. Although down 20% since its April 2022 high, the price of lightweight steel is ~$520/ldt and more than double the historic average since 2009.

“Should the current multi-year higher cycle value turn out to be a fundamental risk trend supported by some of the evolving demand factors, the fundamental risk of investing middle aged dry bulk tonnage, particularly in softer freight markets, will have decreased,” says report author Urs Dür.

The Baltic Exchange publishes a set of investor indices for the major dry bulk sectors which includes the Baltic Residual Risk Index, a ratio of the residual value of the vessel against its recycling value, and the Baltic Residual Value Index, which calculates the value by taking the written down cost

of a five year old vessel by fixing the earnings on the basis of a five year timecharter and adding back the operating costs.

The Baltic Exchange Investor Indices (BII) are an easy to use online analytical dashboard displaying data relevant to vessel investment decisions, residual value, health of earnings, spot and five-year timecharter earnings, purchase & recycling values, and running costs.

They offer a high level of clarity and

transparency for investors in Capesize, Panamax, Supramax and Handysize vessel types. Tanker and gas carrier assets will also be added to the service at a later date.

Subscribers to the Baltic Exchange Investor Indices are offered a health of earnings index which compares spot income with daily running costs; a residual value index which provides an implied write-down value of the vessel over five years; and an implied residual risk assessment which gives the recycling steel value of the vessel as a ratio of its residual value.

The Baltic Exchange is the world’s only independent source of maritime market information for the trading and settlement of physical and derivative contracts. Its international community of over 600 members encompasses the majority of world shipping interests and commits to a code of business conduct overseen by the Baltic.

Baltic Exchange members are responsible for a large proportion of all dry cargo and tanker fixtures as well as the sale and purchase of merchant vessels.

In November 2016, the Baltic Exchange was acquired by Singapore Exchange, bringing together complementary strengths of Singapore and London, two of the world’s most important maritime centres.

The first ship of the year, Cape Alexandros, arrived at 11:00a.m. on 4 January 2023, from Rotterdam in the Netherlands and remained anchored in the bay awaiting loading. On Thursday morning, 12 January, a ceremony was finally held to present Captain Antonios Chatzigeorgiou with the commemorative cane traditionally awarded to mark the first ship’s arrival.

The captain said he was deeply honoured by the gift, adding that it was his second visit to the Port of Sept-Îles in 29 years. He also expressed admiration for the St. Lawrence–Great Lakes and Saguenay maritime corridors, worthy praise from someone who has visited more than 80 countries and spent his career sailing the world’s major shipping routes.

The brief ceremony at IOC Rio Tinto’s port facilities was attended by Marie-Josée Carrier, Senior Advisor, Communications and External Relations; Marie-Noëlle Péloquin, Operations Coordinator, Terminal; Marco Blanchette, Terminal Maintenance Superintendent representing IOC Rio Tinto; and Pierre Gagnon,

President and CEO of the Port of Sept-Îles. Josée Carrier also presented the captain and his crew of 25 with a well-stocked basket of local products.

The 292-metre-long Liberian-registered Cape Alexandros was built in South Korea in 2010 and belongs to the Greek shipowner Golden Union Shipping Co SA. It sailed back to Rotterdam with 170,700 tonnes of concentrate and iron pellets.

The tradition of the cane, now in its 36th year, celebrates the first ship to drop anchor in port waters each year and highlights the impact of port activities in the community.

To be eligible, ships must arrive directly from abroad and be bound for a foreign port.

In 2012, on the 25th anniversary of the cane ceremony, the traditional gold-headed cane got a makeover, with an exclusive new design showcasing the region’s resources. Inspired by a 3D version of the Port of Sept-Îles logo, the polished anodized

aluminium cane is reminiscent of the blue highway. The redesigned pommel contains a fragment of iron ore whose luster is reflected in a hemisphere of acrylic. It also features a distinctive gold element: the seven-star Port of Sept-Îles logo representing the seven islands in the Bay of Sept-Îles has been painstakingly reproduced in 10-karat gold.

Boasting diverse, state-of-the-art facilities, the Port of Sept-Îles is one of North America’s largest ore-handling ports, with a projected volume for 2023 of nearly 40 million metric tonnes. It is also recognized as the largest primary aluminium port terminal in the Americas in terms of operational volume. Sept-Îles port facilities play a vital and strategic role in the economy of Eastern Canada. The Port is also deeply committed to sustainable development and has pioneered the first environmental observatory on the St. Lawrence to monitor the marine ecosystem.

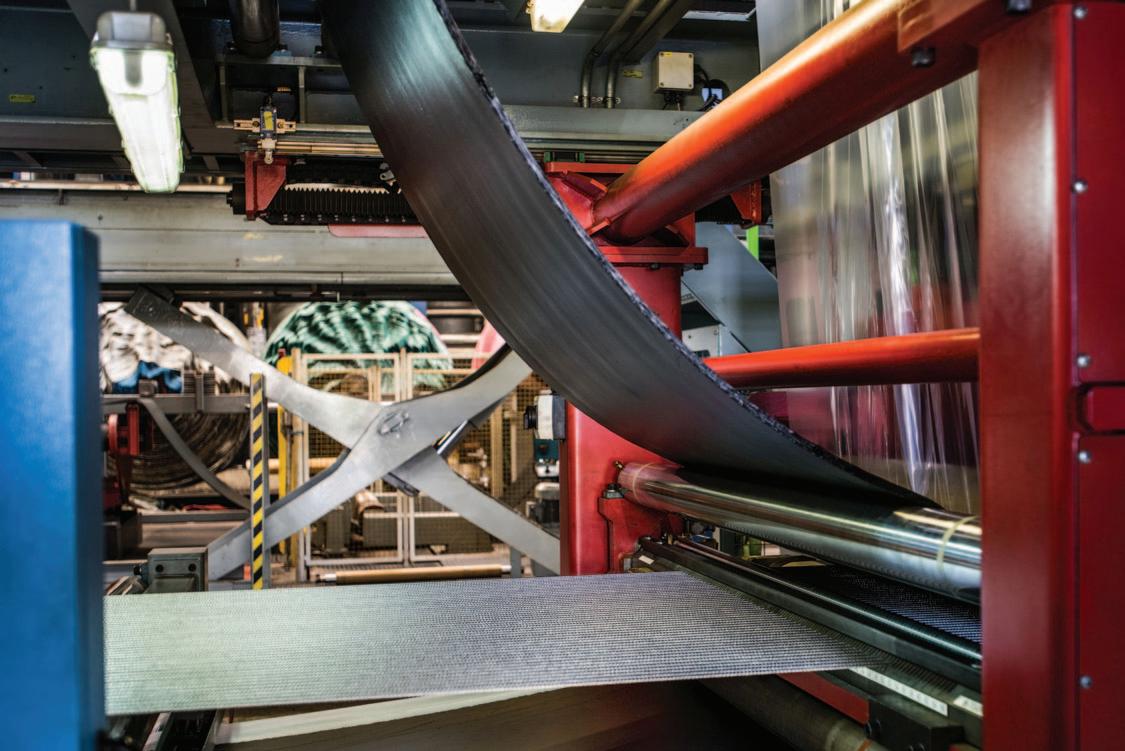

Bothra Shipping Services has placed an order for three Konecranes all-electric Gottwald mobile harbour cranes. These will be deployed at the company’s dry bulk terminals at the Port of Kakinada, which is located on India’s east coast. The cranes are due for delivery in the second quarter of the current year.

Bothra Shipping, which is one of India’s largest port operators, owns and operates

the eight million tonne capacity Kakinada Deep Water Port Coal Terminal as well as a six million tonne fertilizer handling terminal at the Port of Kakinada.

Following the deployment of the new Sixth Generation MHCs, the company aims to increase bulk handling rates whilst at the same time reducing both local carbon emissions and increasing operational performance.

The Konecranes ESP.7B MHCs have a working radius of 51 metres and a lifting capacity of 125 tonnes. They will be able to make use of already existing high-tension electric supplies on the quays where they operate. This is key since none of the units have an onboard diesel generator set. The cranes feature a four-rope hoist system that gives them a 63-tonne grab load curve when handling dry bulk.

Compañía Española de Laminación, which is a subsidiary of Celsa Barcelona, one of the six business units of the Celsa Group, has requested a 13,027m² concession at the Port of Barcelona’s West Quay. It intends to use this area as a hub for the interchange of steel products between maritime and terrestrial transport modes.

In line with existing legislation, the Port of Barcelona is now required to invite within the next month competing proposals from other groups that potentially would like to use the same area.

Compañía Española de Laminación first began trading in 1957. Nowadays, it has an annual 2.5 million tonne production capacity for steel. This is divided among various products, including corrugated and plain bars, wire rods, flat bars, angle squares and structural sections. To make these, it uses two electric furnaces with a capacity of 140 tonnes each and two continuous casters. BC

Maria del Rosario Soto, president of the Port Authority of Almeria, is in the process of identifying possibilities within the port to improve and increase its infrastructure and services for the handling of new dry bulk commodities.

During a visit to the port, Soto noted that “the Port of Carboneras has all the necessary conditions to attract new traffic flows.”

For the half year to end of June 2022, the port authority recorded dry bulk traffic of 1.9mt (million tonnes), which was a decrease of around 14%. By the end

down just 8% on the year. BC

The Port of Liverpool has been ranked as the UK’s top port for port-centric logistics potential in a new industry study.

Property adviser Knight Frank analysed and ranked 41 UK ports based on 13 criteria, assessing their potential for future logistics investment and development, in its latest Future Gazing report.

The Port of Liverpool topped its table, after the port ranked first for forecast export growth and was placed in the top ten percent for access to consumer markets, skilled labour, availability of land, port capacity, import growth potential and size of the existing logistics market.

Peel Ports Group Commercial Director Stephen Carr said: “We’ve long argued that the Port of Liverpool is one of the UK’s best-located ports, and we have built on that with significant investment over many years to create jobs and enable more efficient supply chains. These benefits have been greatly enhanced recently by

confirmation from the Government that the Liverpool City Region has gained final Freeport status approval, meaning the benefits for supply chains locating to the region are even greater than ever.”

Knight Frank researched each port’s potential role in shortening supply chains and mitigating supply disruption. Its report looked into 13 different categories including a port’s capacity, connectivity, as well as the overall investment at the site and import and export growth potential.

The Port of Liverpool received the highest overall score in its rankings.

Peel Ports has made significant investment at the port in recent years, building on the completion of Liverpool2 — a £400 million deep-water container terminal. The report also recognized the importance of the port’s grain terminal to the UK’s agri bulk industry.

The location of the port is of strategic importance to major importers and

exporters of goods as it offers unrivalled connectivity to Ireland and access to a catchment area of over 35 million people.

Peel Ports Group is one the UK’s largest port operators, owning and operating six of the UK’s most important ports (Liverpool, Heysham, Manchester Ship Canal, Medway (Sheerness/Chatham), Clydeport and Great Yarmouth). It also operates a container terminal in Dublin and owns BG Freight Line, which provides short sea container services between the UK, Ireland and mainland Europe and Peel Ports Logistics, one of the UK’s leading shipping and freight forwarders.

Peel Ports handles approximately 70 million tonnes of cargo every year. 14% of the total UK major ports traffic flows through ports operated by the Group. Headquartered in Liverpool, it employs around 2,000 staff.

The Toledo-Lucas County Port Authority has announced a 2.24% increase in tonnage through the Port of Toledo in 2022, when compared to 2021. A total of 11,684,394 short tons travelled through the Port of Toledo last year — the highest tonnage the seaport has seen since 2007. The port set a record for aluminium handled at the General Cargo Dock, operated by Midwest Terminals, and grain had the strongest year-over-year growth with an increase of 14.79% over 2021. The 2022 season was also the first full operating one for the Cleveland-Cliffs’ Toledo Direct Reduction Plant, driving iron ore tonnage up nearly five percent from the

previous year.

The Port Authority invested heavily in infrastructure in 2022. At the General Cargo Dock, over $5 million in repair work has been completed on the dock wall. An additional $10.6 million of work is in progress, which is being funded through the U.S. Maritime Administration’s Port Infrastructure Development Program and the Ohio Department of Transportation’s Maritime Assistance Program.

At the Toledo Shipyard, $640,000 was invested to stabilize a retaining wall and construct pads for the shipyard’s offroad crane to service the dry docks. The port has also received $9 million from the

Ohio Environmental Protection Agency to create additional capacity at the Port Authority’s storage and reuse facility for dredged material. These improvements will provide the Port Authority with 20 years of storage capacity for dredged material.

With 73.6mt (million tonnes) of cargo transshipment from maritime shipping (+7%) and 64.5mt from inland shipping (+7%) in 2022, companies in North Sea Port experienced their best year since the merger in 2018. Dry bulk continues to increase. The US replaced Russia as the biggest trading partner.

Five years ago, Zeeland Sea Ports (Vlissingen and Terneuzen) in the Netherlands and the Flemish/Belgian Port of Ghent merged to form a single port. North Sea Port became the new brand name of the 60km-long cross-border Dutch-Flemish port. It instantly became one of Europe’s top ten ports. “Our aim was to grow in various areas to make sure

we could maintain that position as a newly established port, and indeed to continue our development into a top European port. With a new record year since the merger five years ago, the companies in the port have further cemented that position. That’s pretty remarkable after Brexit, two years of the pandemic, the impact of the Ukraine-Russia war and the energy crisis,” points out North Sea Port CEO Daan Schalck.

In 2022, five years after the merger, North Sea Port posted the best year yet in its still fledgling history in terms of seaborne cargo transshipment: up 7%, a further 3%

up on the previous record year of 2019. Imports increased by 6%, exports by 9%. The import-export ratio was 72–28%.

Schalck says: “With another record year, North Sea Port is cementing its position as the number ten port in Europe. That’s pretty remarkable after Brexit, two years of the pandemic, the impact of the Ukraine-Russia war and the energy crisis.”

North Sea Port has traditionally been a real bulk port. Dry bulk continues to show marked growth, even compared to the preCovid period. Liquid bulk and general cargo remain below their pre-Covid levels. Dry bulk again accounted for more

than half of seaborne cargo transhipment in 2022: 54% (39.9mt +10% compared to 2021). That growth came from commodities including oilseeds, crude iron, fertilizers and coal (+32%), for which additional stocks were built up due to EU sanctions in connection with the Ukraine-Russia war. Grain transshipment declined.

Liquid bulk accounted for 24% of the total in 2022 (17.6mt, +5%). The increase was particularly marked in the transshipment of biodiesel, diesel, liquid fertilizers and kerosene. The share of break bulk was 14% (10mt, +5%). This increase is attributable to growth in the transhipment of steel plates and bananas (shift from containerized transport).

The roll on/roll off (ro/ro) segment grew by 5% (3.7mt +2%). This rise was due to increased transportation of cars. The share of trailers remained the same.

Containers made up 3% of seaborne cargo transshipment (2.6mt, –9%; there was also a fall measured in TEUs, to 230,000 TEUs [–31,000 TEUs]). The reason for the decline was the reduced transportation of bananas in containers (shift to transportation as break bulk).

Broken down by commodity type, there is an increase in solid mineral fuels (including coal), petroleum and petroleum products, metal industry products, raw minerals and construction materials, fertilizers, vehicles and machinery. Agricultural products, food products, ores and metal residues and chemical products remained static.

Schalck says: “In these uncertain times, North Sea Port has posted its best year since the merger five years ago — partly because of the build-up of additional stocks, partly because of the increased supply of raw materials as industry maintains its activity levels.”

Russia is no longer the most important trading partner in terms of seaborne cargo transshipment. With a 15% contraction (–0.9mt, total 5.4mt) as a result of EU sanctions, it fell back to second place, behind the United States, which saw a 27% growth (+1.3mt, total 6.3mt). The United Kingdom took third place (+4%, +0.2mt, total 5.2mt) followed by Brazil, Canada, Sweden, Norway, Spain and Finland, with France completing the top ten.

Trade with Ukraine halved. As a result of companies' search for alternative markets, trade with Canada (+31%), Australia (+123%), Algeria (+42%) and

Germany (+42%) increased sharply. Europe accounted for 57% of trade (–4%), North America for 15% (+3%), South America for 14% (–3%), Africa for 7% (+2%), Asia for 4% (+1%) and Oceania for 3% (+1%).

YEAR FOR SECOND YEAR IN A ROW

Inland navigation transshipment also set a new record in 2022: 64.5mt, up 7% (on top of a 9% increase in 2021). Imports increased by 8%, exports by 7%. The import-export ratio was 41–59%.

Interestingly, ro/ro transport by inland waterway vessels rose sharply to 0.5mt. Inland waterway breakbulk transshipment likewise increased dramatically (+40%, +1mt), while liquid bulk transshipment also grew (+19%, +5.5mt). Dry bulk shrank (–9%; –2.2mt), as did container transport (–9%; –0.2mt).

The record year for inland waterway transshipment does not stand in isolation. No less than 58% of all transport between the port and the European hinterland in all directions is conducted via inland shipping.

With a seaborne transshipment volume of 73.6mt and 64.5mt of cargo transshipped via inland navigation, North Sea Port recorded a total transshipment of 138.1mt in 2022, compared to 129.1mt tons in 2021. Over 9mt more, in other words. 2021 also saw an increase of more than 10mt (compared to 2020).

The expectation was that the pandemic losses of the previous two years would be made up in 2022, and they were. The Ukraine–Russia war and the accompanying energy crisis represent a significant shock to world trade. In these uncertain times, North Sea Port has posted a new record year, its best since the merger five years ago. This is partly because of the build-up of additional stocks, partly because of growth in various types of goods, reflecting the fact that industry is maintaining its activity levels.

North Sea Port expects 2023 to be less of a bumper year, but still a solid one, with seaborne cargo transshipment experiencing similar volumes in the four quarters, well above 70mt. The hope is that energy prices will fall. Investment is expected to continue at a similar level.

As Hudig & Veder Group, we are keen on creating an ultimate logistical plan for our customers by combining different departments and disciplines within our ABC-concept.

Our ABC-concept can therefore be best described as an existing supply chain under control of Hudig & Veder. Agencies, Chartering, Forwarding, Bulk & Projects, we offer the optimal collaboration between our business departments.

DRY CARG

international

– Henry Ford

“A man who stops advertising to save money is like a man who stops a clock to save time”

As of 1 January 2023 Jeroen van der Neut has been appointed as Managing Director of the new Dry Bulk division of the HES International Group. Since 2020, Jeroen van der Neut has been the Managing Director of HES Bulk Terminal Amsterdam. In this new structure, he will be responsible for all dry bulk terminals in the HES International Group which are located in Netherlands, Belgium, Germany, Poland, France and the UK.

Van der Neut joined HES Bulk Terminal Amsterdam (former OBA) as interim Managing Director as from May 2020 and permanently assumed the Managing Director position as from 1 January 2022. During his presence HES Bulk Terminal Amsterdam has redefined its strategic focus, which aims to strengthen its Agri & Minerals activities as well as to develop logistic services solutions in support of bulk production processes at the terminal. As part of that strategy, HES Bulk Terminal Amsterdam acquired IGMA in 2021 and a term sheet was signed in September 2022 for the intended relocation of fertilizer producer ICL to the HES Amsterdam Bulk Terminal for the construction of a brand new and modern plant.

HES International Group has a strong

ambition to further diversify the business portfolio by seizing opportunities from the ongoing energy transition and wants to further strengthen the existing market position in agri, minerals, iron ore and liquids. This will come with a strong focus on proactively generating new, more sustainable business and at the same time delivering on continuous HSSE, operational and commercial improvements. Through the Dry Bulk division a strong commercial focus will be created where available market capacity is used as optimally as possible.

Van der Neut will be at the helm of the Dry Bulk division of the HES International

Group and his team will furthermore consist of Koert Kroon as Finance Director and Perry Thijssen as HR Manager. In close cooperation with the local Management Teams of the terminals they will be responsible for the further expansion and transformation of the Dry Bulk division.

Contributing to the world of tomorrow, is a major focus at HES. With 18 terminals in six countries at strategic located ports in Europe, HES is an important switch in the continuous delivery of essential building blocks for everyday life needed to develop, sustain and improve the world around us. The company’s professional staff ensure that bulk commodities are safely stored, handled and processed 24/7 for customers from all corners of the globe.

HES International has a strong ambition to further broaden its product portfolio and also wants to respond optimally to the opportunities that the energy transition offers for products such as hydrogen, refrigerated gases and chemical recycling. In addition, HES wants to further strengthen its existing market position in agri, minerals and iron ore.

HES International wants to create longterm growth and value for all stakeholders including employees, customers, shareholders and the communities and countries in which it operates. This is underpinned by its focus on safety and its

core values of integrity, respect, accountability, openness and entrepreneurialism.

HES International is headquartered in Rotterdam and has already been carefully handling bulk raw materials since 1908. Macquarie Asset Management, via

Macquarie European Infrastructure Fund 5, and West Street Infrastructure Partners III, managed by the Goldman Sachs Asset Management Infrastructure business, each indirectly control 50% of the shares of HES International B.V.

Deployed

www.dinobulktruckloader.com

YOU ARE RUNNING A TIGHT SHIP

Now let’s tell the world.

The main port served by Maja Stuwadoors

B.V. is Amsterdam. In 2022, Maja rented only one floating crane on a fixed base to a colleague stevedore in Rotterdam.

In 2022, the company handled 360,000 metric tonnes of agribulk and 3.25mt (million tonnes) of minerals. This represents a decrease compared with 2021. There are two main reasons for this fall — the war in Ukraine adversely affected the throughput of agribulk, and problems related to the Covid-19 pandemic and resultant economic issues — especially the soaring energy prices — were behind the drop in minerals.

The main volumes handled by Maja are

scrap and fertilizer; the company is not a major player in the coal market. There was a sharp increase in coal coming to Amsterdam, due to reducing gas supply from Russia. Maja’s colleague stevedores in Amsterdam are much better equipped to handle this volume, so this massive flow was handled by them. Maja offered some assistance with its floating cranes. It is to be expected that this flow will decrease significant in the future when things start to get back to normal. This will, of course, affect Maja’s position in Amsterdam as its fellow stevedores try to find new markets to compensate for this (coming) decrease. The equipment of a bulk stevedore is the

same, it is not so difficult to enter the markets in which Maja specializes.

A recently new development is the arrival of so-called ‘big material handlers’, such as the Sennebogen 885 and Mantsinen 300, which are now installed in the port of Amsterdam; these machines are direct competitors to Maja’s floating cranes. They are easier to operate, offer higher production per hour, have less fuel consumption and maintenance.

In 2023, Maja will start to operate a terminal with a berth of 215m and a draught of 11.1m. On this terminal a Liebherr 550 mobile harbour crane will operate.

Family business and grab specialist Nemag was founded in 1924. The company’s power to innovate leads to increased efficiency in the bulk handling operations of its customers. Its expertise and

experience means is the reason for its stellar reputation among dry bulk handling organizations around the world.

Nemag supplies a full range of four-rope operated mechanical grabs —for loading

and unloading: ores, grains, scrap, minerals, aggregates and other dry bulk goods. Together with its high quality rope connections systems, Nemag always has a productive solution.

Ever since its foundation, Nemag from the Netherlands has believed strongly in the power of innovation to increase the efficiency of customers’ bulk handling operation. This belief has won Nemag countless industry and non-industry awards.

To meet the specific requirements of its customers, Nemag has developed a range of dry bulk grabs. Each grab has its own advantages for specific applications. Increased production, low operational costs, enhanced safety, environmentally friendliness and reduction of the use of trimming equipment have been taken into consideration when developing grab solutions.

In close co-operation with leading bulk terminal operators, crane manufacturers, technical universities and other stakeholders in the industry, Nemag continues to develop new products for the dry bulk industry. The aim is always to reduce handling costs per tonne of dry bulk materials transferred.

The latest software technology like 3D CAD, Multi Body Dynamics (MBD), Discrete Elements Methods (DEM) and Finite Elements Methods (FEM) support

Nemag’s team of designers in optimizing all of its grabs. High tensile steels, wearresistant steels and advanced bearing technology enables the company to design extremely productive, light weight and durable grab mechanisms.

Nemag inventions include the scissor grab, specialized rubber-lined lip sealing systems for handling powdered cargo, the patented Nemag quick-release link and the Nemag rope pear socket for high strength wire ropes, the introduction of a new generation of environmentally friendly clamshell grabs, and last but not least, the patented and awards winning nemaX grab. Nemag is rewarded by the Dutch Chamber of Commerce with the 20th position of most innovative companies (MKB) in the Netherlands.

Alongside innovation, customer support and a very intensive after-sales service are of paramount importance to both Nemag and its customers. A global network of specialized representatives supported by Nemag specialists are ready to assist customers worldwide.

Leading steel plants, bulk handling companies and crane manufacturers in over 60 countries worldwide are part of Nemag’s customer base for decades: companies which, just like Nemag, stand for innovation, quality and reliability.

A Nemag grab lasts longer than average and requires little or no maintenance. Because these grabs have to function optimally for long periods of time and under the toughest possible circumstances, Nemag offers a service and repair team. This team can adequately be of service to you in practically all situations. For Nemag, service and maintenance matters. Nemag always keeps in touch with its customers and offers complete and ongoing after sales support.

Guaranteeing the quality is embedded in the production process. The Nemag system for quality control checks the company’s own products and methods, but also that of its suppliers. Links and sockets are tested by independent laboratories on a regular basis. Newly built grabs, repaired grabs and all links and sockets are tested before they leave the factory.

Nemag has proved to manufacture products with a long life cycle and an extremely low break-down rate. It has at its disposal a great store of knowledge about which grab technique is best suited for the efficient handling of bulk goods. Its highly qualified technicians and engineers apply this technical knowledge and expertise to their designs to optimize its existing products and develop new ones.

When buying a Nemag product, customers also buy a 100% service guarantee that doesn’t end when the warranty period expires.

Whether it is a grab, a Quick Release Link or a Rope Pear Socket, Nemag products are always on the move. Nemag’s employees value direct contact with all its clients and regularly visit customers around the world. It is happy to assist in the long life cycle of its customers’ grabs and is happy to prove that its quality control does not stop after delivery. For international clients, Nemag has an extensive network of selected representatives that take care of the professional after-sales service. Nemag takes service and repairs very seriously. DCi

The downturn in the global economy and the economic impact of the Russian war of aggression against Ukraine meant challenges for the ports of Bremen in 2022. In the third year of the Coronavirus pandemic, the ports again suffered from the disruptions in global supply chains, caused first and foremost by the Chinese ‘zero-Covid policy’.

Moreover, the sanctions against Russia and the effects of the war are also obstructing the global flow of goods and container logistics. “The quays and terminals in Bremen and Bremerhaven are essential for the German economy. This was once again demonstrated very clearly in recent months by the energy crisis as a consequence of the Russian attack on Ukraine and the continuing severe impact of the pandemic,” said Dr Claudia Schilling, Senator for Science and Ports. “But despite all these challenges, the port and logistics industry, just like the employees

on board the vessels and at the docks, ensured supplies to the German and European population during these difficult times. And we, as the Federal Land of Bremen, will continue to satisfy our responsibility for the ports of Bremen by equipping the quays and terminals to cope with future requirements.”

Based on assessments by the Senator for Science and Ports, Bremen and Bremerhaven are expected to report a decline in seaborne freight of 64.5mt (million tonnes) [–7.4%] in 2022. The total throughput forecast for 2022 breaks down into throughput at the port facilities in Bremen-City, which handled 12.2mt (–5.4%), and in Bremerhaven at 52.4mt (–7.9%). The downturn in throughput in Bremerhaven is due to the decline in container throughput, which amounted to

47.3mt (–8.5%). The number of containers, expressed as standard containers (TEU), decreased to 4.6 million TEU, a year-onyear decrease of 8.1%.

Automobile handling in the year 2022 is expected to reach a figure of 1.6 million vehicles (–4.4%). The main reason for this decline is the disruption in supply chains. The impact of the war is particularly apparent in the figures for bulk goods: compared with just under 650,000 tonnes of coal and 914,000 tonnes of refined petroleum products in traffic to and from Russia in 2019, during the first ten months of 2022 these figures dropped to 101,000 tonnes of coal and 311,000 tonnes of refined petroleum products.

The trend for cruise shipping in Bremerhaven was highly satisfactory. A total of 110 vessels called at the terminal, an increase of 190% compared with 2021, a year which suffered very severely from the Coronavirus pandemic.

Despite the downturn in seaborne freight throughput, the railway is again expected to be the strongest transport mode for container hinterland traffic again in 2022.

The Senator for Science and ports welcomes this positive result not only from the point of view of climate protection, but also as one of the tangible successes of the port policies implemented by Bremen’s current government: in addition to the extension of the terminal railway network, the major project ‘Construction of a new Columbus Quay’ (€80 million) is in progress, the western quay at Kaiserhafen III (€32.7 million) and Quay 66 (€17.7 million) have been completed and the Senate has also resolved to refurbish Kalihafen, the former potash port.

Senator Schilling stated, “Since 2019 we have invested unprecedented sums to renew the port infrastructure and thus ensure that the ports of Bremen remain internationally competitive in years to come. Our plan for the future is set out in the new Port Development Concept 2035, which enjoys the support of all major players in the port and logistics business. We will show that we mean business by

investing €50 million a year to equip our port facilities to cope with new challenges. Ports are the driving force of the Germany economy, and that is why we, together with the other German coastal states, are demanding that the federal government assumes more financial responsibility for the German seaports. Moreover, it is vital that the adjustment of the Outer Weser fairway, which is of central importance for the container terminal, is implemented as soon as possible.”

The plans for key future projects, such as the development of Container Terminal

CTI to IIIa, the target of becoming a climate-neutral port location by the year 2035 and of evolving into a hub for the energy transition, are making good progress: amongst other things, the results of the study to assess the potential of the southern part of Fischereihafen and on the subject of hydrogen will be presented within the next few months.

Senator Schilling added, “We will make enormous investments in our ports over the coming decade. The port policies are on the right track to overcome these challenges.”

At the start of December 2022, The Belledune Port Authority (BPA) signed a Memorandum of Understanding (MoU) with Germany’s seaport, the Port of Hamburg, to collaborate on the movement of dry and liquid bulk commodities, and manufactured products, between Canada and Germany, with a focus on clean fuels and green products.