RWANDAN DEVELOPMENT BOARD BANK OF GHANA An Emblem of Ghanaian Independence KENYA BANKERS ASSOCIATION Transforming Kenyan Banking strategic Investment in rwanda Inspired by YOUR SUCCESS UK £4.95 CAN $7.95 USA $7.95 EUR €5.95 SA ZAR 69.00 RISK & FINANCE www.littlegatepublishing.com

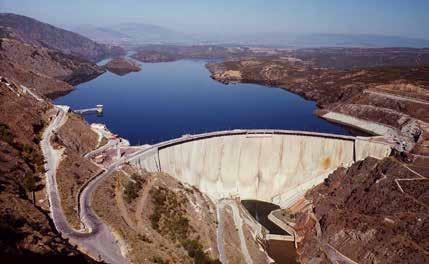

partner . row's top and acclaimed infrastructure projects. e face them with confidence capacity for innovation.

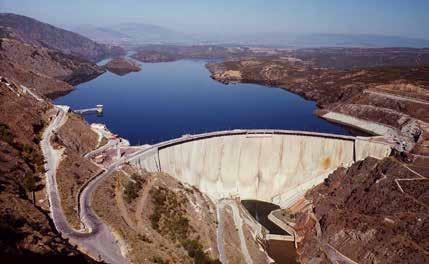

A CCIONA, a trusted partner .

A CCIONA, a trusted partner .

A CCIONA, a trusted partner .

A CCIONA, a trusted partner .

A CCIONA, a trusted partner .

A trusted partner.

Delivering tomorrow's top infrastructures.

Delivering tomorrow's top infrastructures.

Delivering tomorrow's top infrastructures.

Delivering tomorrow’s top infrastructures.

a trusted partner row's infrastructures.

Delivering tomorrow's top infrastructures.

We continue to successfully complete highly complex and acclaimed infrastructure projects. The challenges are tough and demanding, and we face them with confidence thanks to our leadership, experience and capacity for innovation.

We continue to successfully complete highly complex and acclaimed infrastructure projects. The challenges are tough and demanding, and we face them with confidence thanks to our leadership, experience and capacity for innovation.

We continue to successfully complete highly complex and acclaimed infrastructure projects. The challenges are tough and demanding, and we face them with confidence thanks to our leadership, experience and capacity for innovation.

Delivering tomorrow's top infrastructures. We continue to successfully complete highly complex and acclaimed infrastructure projects. The challenges are tough and demanding, and we face them with confidence thanks to our leadership, experience and capacity for innovation.

ACCIONA.CA

ACCIONA.CA

ACCIONA.CA

ACCIONA.CA

ACCIONA.CA

ACCIONA.CA

INNOVATION • DEDICATION • EXCELLENCE

INNOVATION • DEDICATION • EXCELLENCE

INNOVATION • DEDICATION

INNOVATION • DEDICATION • EXCELLENCE

INNOVATION • DEDICATION • EXCELLENCE

INNOVATION • DEDICATION • EXCELLENCE

acciona.ca DEDICATION • EXCELLENCE

We continue to successfully complete highly complex The challenges are tough and demanding, and thanks to our leadership, experience and

We continue to successfully complete highly complex and acclaimed infrastructure projects. The challenges are tough and demanding, and we face them with confidence thanks to our leadership, experience and capacity for innovation.

We continue to successfully complete highly complex and acclaimed infrastructure projects. The challenges are tough and demanding, and we face them with confidence thanks to our leadership, experience and capacity for innovation.

Heads of Departments

Editor-in-Chief Carley Fallows editor@littlegatepublishing.com

Space Management Emlyn Freeman emlynfreeman@littlegatepublishing.com

Media Coordinator Andrew Williams andrew@littlegatepublishing.com

Lead Designer Alina Sandu Research Kristina Palmer-Folt Editorial Research Amber Winterburn

Corporate Director Anthony Letchumaman anthonyl@littlegatepublishing.com

Founder and CEO Stephen Warman stevewarman@littlegatepublishing.com

For enquiries or subscriptions contact info@littlegatepublishing.com

+44 1603 296 100

ENDEAVOUR MAGAZINE is published by Littlegate Publishing LTD which is a Registered Company in the United Kingdom.

Company Registration: 07657236

VAT registration number: 116 776007

343 City Road 60 Thorpe Road London 79 Norwich

EC1 V1LR NR1 1RY

Littlegate Publishing Ltd does not accept responsibility for omissions or errors. The points of view expressed in articles by attributing writers and/or in advertisements included in this magazine do not necessarily represent those of the publisher. Any resemblance to real persons, living or dead is purely coincidental. Whilst every effort is made to ensure the accuracy of the information contained within this magazine, no legal responsibility will be accepted by the publishers for loss arising from use of information published. All rights reserved. No part of this publication may be reproduced or stored in a retrievable system or transmitted in any form or by any means without the prior written consent of the publisher.

Copyright© Littlegate Publishing Ltd 2023

Editor’s Note

Money may not literally make the world turn around, but love it or hate it, it’s become the lifeblood of our society. With that as the case, taking good care of that money - whether you’re saving it, investing it, or calculating the risks of what you do with it – is extremely important, and in the world of business, doubly so.

In this quarterly magazine, we collect together all of our interviews and articles that delve into the world of risk and finance: between these pages, you will find profiles on banks from around the world, both major and more grassroots, where we explore the ways different regions and religions approach banking and the surprising ways in which many of these banks are looking to make a difference in the lives of their customers; insurance companies; risk management companies and their methods for calculating hazards at incredible accuracy; financial advisors; investment groups and many more. Anything and everything financial, we’re gathering it here, so you can enjoy the highlights from Endeavour Magazine that suit your interest (no pun intended!).

In the words of Robert Kiyosaki, American businessman and financial educator: “It’s not how much money you make, but how much money you keep, how hard it works for you, and how many generations you keep it for.”

Endeavour Magazine | 3

7 Bank of Ghana An Emblem of Ghanaian Independence 13 Rwandan Development Board Strategic Investment in Rwanda 19 Caribbean Association of Banks Promoting Financial Success 25 Kenya Bankers Association Transforming Kenyan Banking 33 SASLA Open for Discussion 39 TTAIFA A Guiding Light 45 Merx Group Putting Clients First Bank of Ghana Features 4 | Endeavour Magazine

SASLA

Caribbean Association of Banks

SASLA

Caribbean Association of Banks

Endeavour Magazine | 5

Kenya Bankers Association

AN EMBLEM of GHANAIAN INDEPENDENCE Bank of Ghana chevron-square-right https://www.bog.gov.gh/ phone-square +233 30-2666174 envelope-square bogsecretary@bog.gov.gh

From the get-go, it is clear how the Bank of Ghana does not shy away from challenges and adversities, and rather works to ensure that the machine that is Ghana’s financial system runs smoothly. This is endorsed by the bank’s eventful history which is entangled with political freedom and independence from British colonial rule. Consequently, in the past 65 years, they have overcome adversity to build a highly capable and stable financial institution for the people of Ghana.

The history of the Bank of Ghana is certainly an interesting one. The founding of the Bank came from a willingness for political independence and a revival of the country after Ghana broke from colonial British rule in 1957. This is an aspect of the Bank that its employees and members are very proud of, and with good reason, as the bank’s roots as a single centralised institution came to represent the powerful meaning of freedom and independence. However, the initial theorising of a centralised bank first occurred in 1947, under the Bank of the Gold Coast. At this time, a group of leading Ghanaian politicians argued that the establishment of a national bank with centralised functions was needed, in order to provide a financial backbone for the government. Furthermore, the bank could also begin catering for its significant indigenous aspects of the economy.

Given its founding narrative, it is fitting that the Bank of Ghana was opened just days before the declaration of Ghanaian independence, on the 4th of March 1957. Subsequently, by July 1957, the new head office was officially commissioned. To mark the occasion, the Leader of Government Business (the Prime Minister) proudly stated that the bank was the start of a new horizon in newly independent monetary administration, stating that “It is essential to our own independence that we have a government-owned bank and that the central bank follows a policy designed to secure our economic independence.”

The objectives stated by the Leader of Government Business are aptly described in the Bank of Ghana Ordinance (No. 34) of 1957. This was a highly significant document that encompasses the Bank’s role as a national institution, as well as holding the bank accountable, criteria that are still important today. A snippet from the Ordinance reveals the primary objectives of the Bank of Ghana: “to issue and redeem banknotes and coins; to keep and use reserves to influence the credit situation with a view to maintaining monetary stability in Ghana and the external value of the Ghana pound; and to act as banker and financial adviser to the Government.”

Evidently, this succinctly demonstrates how the Bank of Ghana take great pride and responsibility in the role of bringing stability to the country.

Subsequently, the Bank of Ghana Ordinance has been modernised over time to incorporate

Bank of Ghana 8 | Endeavour Magazine

changing financial, national and international situations. Most prevalently, The Bank of Ghana Act (2002) enabled the institution to effectively manage its price and inflation rights, so that it could further grow. Furthermore, the 2002 Act also facilitated the bank’s transition to inflation targeting and setting its interest rates, signifying an even greater form of independence.

A prominent aim that the Bank of Ghana has always held firm, is its formulation and implementation of monetary policy, which helps it reach certain targets in the stabilisation of the value of the currency, the balancing of payments, and the regulation of payment and settlement systems. More specifically, according to the Monetary Policy Framework, the Bank of Ghana also supports the general economic policy of the Government, as well as promoting economic growth and development. This involves details monitoring of the banking and credit system.

The Monetary Policy is overseen by a specialist committee, set up in 2002 and consisting of seven members. The Monetary Policy Committee (MPC)

An Emblem of Ghanaian Independence

meets twice a month over a three-day period to analyse the country’s economic conditions and inflation outlook. This allows the committee to make the important decision of the alteration of the country’s inflation rates, conducted on a vote basis.

In order to create change, the MPC has an implementation framework as a strategy to carry out the final changes to the Monetary Policy Rate (MPR), as well as operationalising procedures that support the development of monetary policy transmission. The MPR is the rate at which short-term monetary policy operations are conducted with counterparts, including commercial banks and neighbouring institutions.

The MPC is a great example of how the Bank of Ghana strive towards transparency and accountability. This enables the committee to assess inflation expectations effectively within the target band. To promote transparency, the

Bsystems is a global IT company with over 15 years of innovation aspiring to become the leading Business and Technology solution provider in Africa

Ă Software Development - Web and Apps

Ă Systems integration

Ă e-KYC Solutions

Ă Collateral Registry Systems

Ă Payment Systems Provider

Ă Agency Banking - POS Solutions

Ă Payment Application - Peoplespay App

bsystemslimited.com

PeoplesPay® is a mobile payment application developed for the purpose of digitizing payments and collection services for its subscribers. The app is hosted as a mobile app and web application with same interface and user experience. �

Endeavour Magazine | 9

committee releases a ‘Data Pack’: a summary of the macroeconomic and financial sector data that was used during MPC’s decision-making process. Releasing the information into the public domain allows the people of Ghana to understand the reasoning behind certain decisions and provides clarity on the rate of inflation, which is something that is seldom seen elsewhere.

Following a policy meeting, the MPC also holds press briefings to explain the decision for the respective interest rate in greater detail, as well as any other monetary policy courses of action. The meeting facilitates an open forum between the bank and Ghanaian media, regarding the world economy, exchange rates, domestic prices and much more. After each press briefing, the transcript is also released to the public.

Alongside the assessment of Monetary Policy, the Bank of Ghana effectively manage and control bank Notes and coins, to track the development of the currency. When looking at the historical

narrative of Ghanaian currency, the importance of the country’s independence is once again a key part of the currency’s evolution. Post-independence, as the new monetary authority, the Bank of Ghana issued its own form of the Ghana pound. However, it was not until early 1965 that Ghana decided to depart from the British colonial monetary system to create its own currency. Thus, Cedi notes and Pesewa coins were introduced on the 19th of July 1965 to replace Ghana pounds and pence. A further turning point occurred when the portrait of the currency was changed due to the overthrow of the CPP government in the late 1960s.

Today’s banknotes have a single portrait on the front, consisting of six distinguished Ghanaian figures who spearheaded Ghana’s independence. This seems incredibly fitting given the intrinsic purpose of the Bank of Ghana as a product of the country’s independence. As such, not only does the Bank of Ghana effectively regulate and oversee a great financial machine, but they are also steeped in important history that makes its monetary policy and regulation all the more important.

are

Bank of Ghana Outnovate! No Boundaries, Infinite Possibilities

engage@heritorslabs.com +233 673 788 3783 heritorslabs.com 20 Dr. Tagoe Avenue East Legon, Accra Ghana 10 | Endeavour Magazine

Heritors Labs

a game-changing product development house, software engineering enclave, research centre and innovation services hub.

STRATEGIC INVESTMENT in RWANDA Rwandan Development Board chevron-square-right https://rdb.rw/ phone-square +250 727775170 envelope-square info@rdb.rw

Rwandan Development Board

The landlocked country of Rwanda is home to a variety of services and exports that position it as a leader in the global markets for both business and travel. Bordered by Uganda, Tanzania, Burundi and the Democratic Republic of Congo, Rwanda is home to the Rwanda Development Board (RDB), a government institution, which plans to accelerate the country’s economic development by aiding in private sector growth. The RDB, established in 2008, provides support through several services to ensure that Rwanda remains one of the most competitive places to do business in both Africa and the world.

RDB’s mission is to transform Rwanda into a global hub for business, investment, and innovation, which they plan on achieving by fast-tracking the county’s economic development through the continual support of private sector growth. The development board began as a merger of 8 government institutions, which came together to become a One Stop Shop for business and investments. Since then, they have expanded their global expertise and shown on an international level the quality practices which position Rwanda as a leading economy open for international business. As a result, the value of investments registered has tripled from USD 400 million in 2010, to US 2.006 billion in 2018. Services offered by RDB under their One-Stop Center include business and investment registration, visa facilitation, environmental impact assessment (EIA), tax incentives management, investment promotion, investment deals negotiation, export and special economic zones (SEZ) development, tourism and conservation, and private sector skills development.

RDB also offers a variety of exports that continue to play a crucial role in the economic expansion of the country by contributing greatly to gross domestic product (GDP) figures. One of the key products produced and exported in Rwanda under RBD is coffee. Coffee plays a significant role in the economy of the country, as 20,00-22,00 metric tons of coffee is produced every year. Supplying major markets in the US, Europe and Asia, Rwandan coffee has grown to be a massive online export for Rwanda, particularly through its partnership with the e-commerce giant Alibaba.

This partnership has seen the sales volumes of Rwandan coffee grow 700% on Tmall, Alibaba’s crossborder B2B platform. Furthermore, the country is also a key exporter of tea. Since 1952, Rwanda has been growing tea and has now come to be a major contributor towards the country’s foreign exchange earnings. Producing 30,00 metric tons annually, tea growing has allowed Rwanda to claim a major stake in the African Tea Trade Association with its record prices, whilst accessing international markets in the Middle East, Pakistan, United Kingdom, and Kazakhstan.

The RDB also oversee the mining, horticulture and handcraft goods and services going out of the

14 | Endeavour Magazine

country which all play key roles in the development of Rwanda. However, it is the manufacturing and agriculture processing that play some of the most crucial roles in the country’s development. Agriculture processing contributes up to a third of Rwanda’s GDP and is a major source of employment and income in Rwanda. Rwanda’s location makes it a great climate for agriculture, so can produce a diverse range of agricultural commodities suitable for processing both within and outside of the country. Within Rwanda, agriculture processing provides food and other necessities to its people through their advancing technologies which reinforce the high-quality standard of their products. Outside of Rwanda, pyrethrum is exported worldwide as its flowers are used as a natural insecticide for pests and plant diseases.

Manufacturing is also a growing industry in Rwanda, and as of 2019, accounted for 17% of the country’s GDP. Through their gradual diversification from basic manufacturing, RDB has helped develop the manufacturing sector towards the growing production of fast-moving consumer goods,

Strategic Investment in Rwanda

KG 622

Lemigo hôtel (compound)

Kimihurura

� +250 -783451278

� info.dokmairwanda@gmail.com

� dokmairwanda.com

DOKMAI RWANDA LTD

DELIVERED WORLDWIDE

Made in Rwanda

Endeavour Magazine | 15

Rwandan Development Board

construction materials, furniture laboratory equipment, electronic goods, and automotive manufactured goods. The economy of Rwanda depends heavily on this sector and therefore is a crucial pillar of RDB’s focus on its exports due to the big markets that can be accessed in the East African Community (EAC). Therefore, the importing and exporting of manufactured goods has placed Rwanda in a key strategic position for the development of the country’s economy due to its high-quality processing and production of goods.

To continue to develop the Rwandan economy, the Government of Rwanda announced the launch of the Manufacture and Build to Recover Program aimed to attract more private sector investments to the country. The project was first introduced in 2020, to boost economic recovery efforts by attracting private sector investments with specific incentives for the manufacturing, agriculture, construction, and real estate development sectors.

Since the programme began it has brought in over USD 1.7 billion and created over 36,000 jobs. Therefore, in line with the announcement of the extension of the project in March 2023, the RDB has ensured that members of the private sector

continue to benefit from the specialised incentives that the program offers, and shows its continuing commitment to the economic development of Rwanda.

There is clear evidence that the RDB has had a significant impact on the economy of Rwanda, as it has grown expansively since its establishment with a current annual GDP average rate of 8% for the past decade. Furthermore, the GDP per capita grew to USD 787 in 2018, from USD 774 in 2017. The target per capita set by the RDB is USD 1,382, which they aim to achieve by 2024. As a country, Rwanda consistently emerges as the top global reformer in the annual World Bank Doing Business Reports, and so with the data to support them, RDB continues to strive for greatness to put Rwanda’s economy in first position. Rwanda is a growing force in global markets for a variety of services and exports, and with the help of the RDB, it is smashing GDP targets. Consequently, Rwanda remains among the most competitive African countries to do business in due to the efficient goods and labour markets in which they facilitate, which when combined with the country’s stable political situation, sees Rwanda as a hub for steady and reliable economic growth.

16 | Endeavour Magazine

PROMOTING financial SUCCESS Caribbean Association of Banks chevron-square-right https://cab-inc.com/ phone-square (758) 452-2877 envelope-square cab@candw.lc

Striving to provide a collective and unified voice for banks, the Caribbean Association of Banks (CAB) aims to protect, promote, and strengthen the regional banking sector. CAB leads the way in providing a support system through education and advocacy to benefit the economy. With 81 member banks, CAB operates internationally as a voice for the development of Caribbean financial sectors, with the goal to place these banks into the worldwide sphere of banking.

In 1974, CAB was established in response to the demand for an association body that would take control of development across the Caribbean financial sectors, which previously relied heavily on external providers to oversee and develop the industry. The goal of CAB is to meet the demand of the people of the region financially, whilst promoting both regional and international regulatory standards and requirements. Now CAB boasts a total asset base of US $41 billion (as of December 2019) across its members spanning 20 territories. CAB facilitates contact between its members and key decision-makers in the region through its 2,000 industry contacts, to place its members in crucial conversations to help the development of the banking sector across the Caribbean. Therefore, as an association CAB operates with and on behalf of its members to provide a united voice both locally and internationally. Consequently, CAB has established itself as a hub for banking, technology, market intelligence, and services; all with the end goal of protecting and promoting the region’s banking stability.

Caribbean Association of Banks 20 | Endeavour Magazine

Education is crucial for CAB, as through education CAB can train more employees in the financial sector to bolster the economy towards global recognition. As part of its education program, CAB has partnered with The Caribbean Governance Training Institute (CGTI) to offer a series of governance training courses. The courses are offered to CAB’s 81 members to provide them with online delivery of 6 modules, spanning 3.5 hours each with the goal of fitting around the lives of the members’ employees.

Furthermore, CAB has partnered with a variety of educational facilities to supply scholarships, including 3 at the University of the West Indies for a BSc in Banking and finance, 2 chartered MBA scholarships with Bangor University and a scholarship to the graduate school of banking at the University of Wisconsin. Consequently, CAB provides its members, and their employees, with global opportunities for personal educational development, with the goal that it will benefit

and bring economic development through job opportunities in the country. Therefore, the overarching goal of education and training throughout CAB is to strengthen the Caribbean’s financial sector.

A key initiative of CAB is regarding de-risking, which is a crucial concern presented by CAB at the Annual Caribbean Financial Roundtable. The association outlined how Caribbean banks are facing more stringent enforcement of regulations, compared to their counterparts in North America which are faced with milder punishments for infringement of regulations. De-risking has had a significant impact on the Caribbean region resulting in a significant loss of correspondent banks within the region, as many have no longer been able to facilitate inter-regional and international payments. The Annual Caribbean Financial Roundtable looked to explore the potential solutions and develop a set of actions in response to this threat on a global scale. CEO Wendy Delmar, speaking on de-risking, said “We are pleased that we have been afforded many opportunities to partner with FIBA, Atlantic

Promoting

Endeavour Magazine | 21

Financial Success

Council and a host of other organisations to bring awareness to the issue, as well as to have gotten some traction with reviews of legislation at the US Congressional level. While there have been some small wins in that we have seen more reputable US banks expressing interest in the region, we are still not satisfied with the level of re-engagement or reboarding currently taking place”. The conference held by the Financial and International Business Association clearly highlights the way de-risking is negatively affecting the Caribbean region. However, it is clear that through CAB’s advocacy that a resolution is being sought for its members exemplifying the crucial role CAB plays in advocacy across the region’s banking sector.

In an effort towards the future of banking, local banks are pushing towards the future of payment transaction solutions, all with the support of CAB as a governing body. The Central Bank of Trinidad and Tobago (CBTT), under CAB, has put provisional registrations in place for two companies, including Telecommunication Services of Trinidad and Tobago (TSTT) to use electronic money or ‘e-money’ for payments and transactions.

In a press release from February 2023, the two companies under CBTT will be able to enlist new customers in a controlled environment to use e-money, an electronic store of monetary

value which can be accessed on a technological device to make payments to entities other than the e-money issuer. This money can be used for payment transactions for those with and without bank accounts. CBTT has registered with PESH Money Limited, a privately owned local company which is aiming to provide its customers with e-wallets for peer-to-peer transfers via mobile wallets to mobile phone users. Furthermore, CBTT has also extended the provisional registration to PayWise Limited too for a further 6 months.

Therefore, we can see even on a regional level the banks under CAB are working to bring new and innovative solutions to banking, which with the support of CAB allow them to expand from local banks into leading financial service providers.

Overall, CAB is supporting the development of banking across the Caribbean and continues to proactively work with all its member banks to be a voice of advocacy across the region’s banking sectors. As an association body, they are working with each bank individually to promote development towards the future technologies of banking to ensure continued profitability and stability. Therefore, with a focus on education and opening up the region to international banking by challenging de-risking regulations, CAB is supporting the continued success of the banking industry across the Caribbean towards a future of strong economic development.

Caribbean Association of Banks 22 | Endeavour Magazine

Transforming KENYAN BANKING Kenya Bankers Association chevron-square-right https://www.kba.co.ke/ phone-square +254 20 2221704 envelope-square info@kba.co.ke

Kenya Bankers Association

Kenya Bankers Association (KBA) leads the way in its advocacy for developing and championing the banking industry in Kenya through its support across local and international financial sectors. KBA aims to help the banking industry and financial sector through innovative technological advancements and strong ethics. As the umbrella body working on behalf of its banks and microfinance banks, KBA now represents a total asset of USD 60 billion across Kenya. Therefore, it is no wonder why KBA strives ahead with its operations to constantly improve and regulate the financial sector to ensure that the hardearned money and resources of Kenyans are protected securely by the association member banks.

Founded in July 1962 by the Registrar of Trade Unions, KBA was established to help its member banks to negotiate terms and conditions of the service of its unionized employees, whilst attempting to input standardized management practices for consistency and regulation throughout the industry. Over time the role of the KBA has evolved and broadened, now to include its role in developing the industry towards economic growth. The KBA facilitates their expanding role by working with the government and developing sector regulations set by the Central Bank of Kenya (CBK). Now the KBA has a new ambition statement which summarises its role in the financial and banking industry: ‘One Industry. Transforming Kenya’.

The KBA currently represents 47 members across the country, all of which are held to a high and professional standard of banking, so that Kenyans know that the banks under the KBA governing body are ones to trust. KBA continues to ensure the safety of its customers by running various campaigns to ensure financial safety awareness is always a priority. One prominent campaign is their ATM safety awareness campaign ‘Kaa Chonjo!’. The campaign seeks to empower its consumers with the secure use of online, mobile and card transactions. Therefore, as an overarching company KBA are ensuring that the customer’s security and faith in the KBA members is a key priority. The campaign hopes to contribute towards alleviating fraud throughout the financial sector. Furthermore, they ensure the safety of transactions for their banks by enhancing the security of transaction channels to reduce the risk of them being subjected to fraud.

KBA continues to innovate the transaction channels of its customers in a recent upgrade of the Automated Clearing House (ACH) system to the ISO 20022 Standard. The upgraded system will provide opportunities for banks and other financial sector players by facilitating the efficient transfer of payments. It will provide a platform for global interoperability of payments, which will innovate services and reduce time on cheque clearing considerably. This upgrade comes as part of KBA’s strategic plan between 2019 and 2023 to facilitate more efficient and affordable financial services through advancing its technological innovations.

26 | Endeavour Magazine

15 SECONDS APPROVAL ON YOUR VEHICLE LOAN. ncbagroup.com Go for it Terms and Conditions Apply NCBA Bank is regulated by the Central Bank of Kenya. Get conditional approval within 15 seconds. Visit ncbagroup.com to start your journey.

Kenya Bankers Association

KBA’s adoption of this will not only enhance the payment insights for its members, but it will support the banks’ risk management initiatives, which in turn will inform the policy decisions in the future towards a more responsive financial sector.

KBA aims to be the voice of banking across Kenya by being a leader in innovation throughout the financial sector. They plan to do this by reinforcing the industry’s ability to be a primary driver of economic development as they innovate their operations towards economic success through research and analysis. The KBA has established The Center for Research on Financial Markets and Policy which aims to research and providing key commentary on critical policy matters that impact the financial markets in Kenya. The research centre communicates with key financial market experts, the banking sector, and the policymakers in Kenya towards a future of success.

Overall, KBA leads the way in its innovation towards facilitating highly secure and reliable banking services throughout its association members. The regulation of these members places the Kenyan financial sector in line with global leaders, whilst ensuring technological advancements allow them to manage funds both locally and internationally in a much more efficient way. Therefore, KBA’s operations ensure that the financial sector of Kenya is flourishing, all the while their customers feel safe using a bank under their association due to its reputation of leadership, innovation, knowledge, and strong ethics.

30 | Endeavour Magazine

OPEN FOR DISCUSSION SASLA chevron-square-right https://www.sasla.co.za/ phone-square 27 11 344 5890

The notion of buying, selling, and investing is a fundamental aspect of international financial services. To be conducted efficiently it takes careful regulation and management, which can be incredibly difficult to navigate. More specifically, the security lending industry is a vital part of the regulation of financial services as it allows investors to temporarily lend securities to borrowers, which can be lent in the form of government shares or public services, to guarantee that the financial market remains stable.

The South African Securities Lending Association (SASLA) is an important forum, created with the purpose of representing the common interests of security lending companies in South Africa. Thus, SASLA facilitates discussions between companies, regulators, and the government, so that specific requirements are met in the nation’s securities lending market.

Historically, it is major financial entities that have been the primary facilitator of security lending, subsequently acting as the main agent on behalf of their clients. However, in more recent years, thirdparty agencies and associations have emerged in the market, offering alternative security lending options to their members. SASLA is a prime example of financial development in South Africa, as it has become rather indispensable in ensuring that security lending companies in South Africa can conduct lending in a responsible manner and depart from the rigid forms of borrowing and security lending which have been present in the past.

Having been in operation since 1989, SASLA provides guidance in the competitive development

SASLA 34 | Endeavour Magazine

of the secured lending market, by closely working with South African regulators and many market committees. Consequently, with the guidance of SASLA, security lending companies can offer their customers up-to-date and strategic borrowing strategies which help boost financial development and profit.

Thus, by overseeing such operations, and providing a place of advice, SASLA has a noticeable impact on regulation and development. Evidently, with a membership comprising over 20 banks, insurance companies, pension funds, asset managers and service providers, it has an average lendable value of 1.3 trillion ZA (approximately USD $71 billion). To add to this, SASLA has a highly significant Lender-to-Broker on Loan Value of 137.6 billion ZAR (approximately USD $7.5 billion). Evidently adding a noticeable difference to the South African security lending market.

As previously mentioned, the SASLA industry forum was specifically founded to represent the common interests of security lending companies. More specifically, this entails that the requirements needed for the lending and loaning of stocks and shares are conducted effectively. To this end, SASLA were instrumental in the creation and development of the SA Securities Lending Code of Guidance and the Schedule to the Global Master Securities Lending Agreement (GMSLA). Although this is impressive, their most notable achievement is the successful lobbying of the National Treasury for an exemption of collateral exemptions from Securities Transfer Tax, as well as other tax impacts. This was also conducted in conjunction with the Banking Association of South Africa, the Association for Savings and Investments South Africa, and Johannesburg Stock Exchange. This demonstrates how SASLA have a generous influence on the financial services of South Africa and can successfully address the grievances of its members.

PARTNER WITH THE LARGEST PROVIDER OF CUSTODY AND RELATED INVESTOR SERVICES IN AFRICA

Also trading as Stanbic Bank Terms and conditions apply. The Standard Bank of South Africa Limited (Reg. No. 1962/000738/06). Authorised financial services and registered credit provider (NCRCP15). GMS-17502 10/21 It Can Be is a registered trademark of The Standard Bank of South Africa Limited.

As Africa’s largest custodian, we are uniquely placed to be your ideal banking partner for investor services. Our custody, clearing, trustee, securities lending and investment administration solutions ensure e ciency, control and security of your local and global investments at every turn. Find out more about our Investor Services at www.standardbank.co.za/cib

Corporate and Investment Banking

Open

Endeavour Magazine | 35

for Discussion

On a similar strand, SASLA also has a great liaison network with South African regulators, alongside other financial organisations such as the JSE, Strate, the Financial Services Board and National Treasury. In reference to the latter, SASLA has represented the industry in front of the National Treasury for a number of reasons, including tax exemption required for outright transfers of noncash collateral. Additionally, SASLA has also been involved with the Financial Services Board on the draft securities lending note as a vital part of the country’s Pension Fund Act. Accordingly, SASLA is a key part of many regulators and financial boards, as the association actively works to make the South African lending network a fairer and more responsible place.

As witnessed, there are many benefits that can be drawn from being a part of the association. Not only do members have access to an influential body of institutions and regulators, but they also have access to exclusive information on several pertinent issues in the sector. Primarily, by accessing the information via the website, members can promote the concept and understanding of security lending and borrowing to the wider public. This is not only highly advantageous for the Association, but the industry as a whole.

More recently, SASLA has broken into the global network, known as the Global Alliance Lending Association (GASLA), which was formed in September 2021. GASLA was founded with the purpose of being a collaborative working group, consisting of leading global security lending entities. As one of five international associations, GASLA facilitates a strong voice across global lending markets and believes in transparent practices, which also include the integration of environmental, social, and governed factors that respond to the world’s growing pressure to create a more accountable global market. Similarly, GASLA holds a conviction in the necessary digital evolution which enhances efficient, liquid, and sustainable capital markets.

As part of the championing of the global security lending industry, GASLA promotes positive change in the industry, which can only be achieved through beneficial engagement with stakeholders, regulators, policymakers and much more. This creates a presence of inclusivity within the Association. Hence why GASLA has consciously

worked with a diverse variety of lending market participants to promote the best practices possible and support the integration of corporate governance policies on important topics such as voting, stewardship, and active ownership. Thus, SASLA has created and is a significant part of a global network that promotes a united voice across borders, to have a meaningful and pertinent impact on the global security lending and borrowing industry.

It is therefore clear how far-reaching SASLA is in the development of South African security lending. As such, they are a vital counterpart to any companies who want to deliver the best security lending services to their customers, providing quality advice and countless insights into the condition of the market, so that lenders can make the best and wisest choice to facilitate the competitive development of the industry.

SASLA 36 | Endeavour Magazine

A Guiding LIGHT TTAIFA chevron-square-right https://ttaifa.com/ phone-square +1 868 624 2940 envelope-square info@ttaifa.com

The notion of what makes a good business is an age-old question. Although there is no definitive handbook, there are particular entities that exist to give your business a helping hand. More specifically, in Trinidad and Tobago, TTAIFA is always available to provide their clients with expert advice and enhanced professional programs, which boost skills and general business practice. Their educational initiatives are unmatched across the world, with resources and agents that will be there for any need or requirement in the world of business. Furthermore, the company’s status as a not-for-profit organisation seeks to support business advisors in the best way that suits them, acting as an effective guide to an association of over 1,200 companies.

Trinidad and Tobago Association of Insurance and Financial Advisors (TTAIFA) have become a key leader in the Trinidad and Tobago insurance sector. However, TTAIFA’s story first began in 1975, at which time they were known as Life Underwriters Association of T&T. The corporation found its main premise in life insurance, which still continues to be a focus today. And yet, from its humble beginnings, it has expanded its horizons to include a broad scope of insurance sales representatives, financial advisors and sales managers across the twin islands.

Acting as an association means that TTAIFA places great dedication on the professional development of its expanding membership, which is achieved via professional development courses created in collaboration with the prestigious American College and LIRMA (a trade association for international insurance). TTAIFA also provide guidance in the form of professional development seminars, which include Law & Regulations; Insurance Business; Ethics; Health & Wellness; and New Insurance Acts. As is evident, they provide

TTAIFA 40 | Endeavour Magazine

a wealth of information to help clients navigate a path through the complex intricacies of insurance management. A number of the qualifications that business associates gain with TTAIFA include the FSCP (the Financial Services Certified Practitioner); AMTC (Agency Managers Training Course); and MFA (Master Financial Advisor). TTAIFA is also showcasing the latest innovations in educational programs by offering their clients CPD (Continuing Professional Development) webinar packages, which correlate with the expanding flexibility of the modern working world.

A great testament to their work can be found in the fact that the five leading life insurance companies in Trinidad and Tobago have chosen to partner with TTAIFA, providing these top companies with greater agency and forms of business practice on a regular basis. Consequently, many companies witness an up spike in sales results almost immediately after the leading personnel have completed TTAIFA comprehensive training programs.

TTAIFA role as an association is put in even higher regard due to the recent legal requirement which

dictates that company licenses should be renewed every year. Having been put in place by the Central Bank of Trinidad and Tobago, it places TTAIFA in a firm position as a necessity for the success of any insurance company in the area.

Over the past few years, the life insurance industry has faced many difficulties. Namely, the impacts of the global pandemic caused many unexpected losses of life, which subsequently led to an abundance of unexpected life insurance claims. In a time of uncertainty, which the pandemic can definitely be classed as, clients both with and without policies look to life insurers as a potential source of stability and security. This meant that TTAIFA had to seriously consider how they run their operation. For example, Insurance Sales Representatives were strongly advised by the Association to touch base with their prospects and clients. Admittedly, the pandemic was a challenging time for TTAIFA, and yet many provisions were put in place to comprehensively handle the change. Namely, they switched all their courses to online webinars, with the approval of the programs’

A Guiding Light Endeavour Magazine | 41

international awarding bodies, moderators, and seminar presenters. And yet, such adaptions have been received well, with approx. 98% of TTAIFA’s members expressing that they much prefer online guidance. As part of the company’s move to an online world, they have made processes such as registration and payment much smoother. More recently, they have also offered assistance to Trinidad and Tobago’s regional insurance associations, via online resources.

As a way to bolster morale and bring the Association together, TTAIFA host annual awards and initiatives for the insurance industry in Trinidad and Tobago. Such events include, National Award Ceremonies, in which awards are dispensed to top agents and sales managers. Most recently, the TTAIFA 42nd Annual Awards (2022) was named ‘Celebrating Resilience’. It championed many brilliant employees who have conducted exceptional work in restoring TTAIFA to its former glory, and tenaciously tackling any challenge that arises.

A further initiative that TTAIFA has great involvement in, is Life Insurance Awareness Month, which takes place annually in September. The month of September has enjoyed this title for over

50 years, of which TTAIFA has been part of for the previous three years. Put simply, Life Insurance Awareness Month helps educate the public on the importance of life insurance for themselves, and their family’s well-being. The spreading of awareness is achieved through media campaigns in the newspaper, television, and social media.

As a significant life insurance company, it is paramount that there is a code of conduct, which maintains accountability and responsibility. It is therefore apt that TTAIFA educates their advisors with holistic knowledge development in the following areas:

• T – “Transforming Advisors into Professionals and Prospects into Advocates.”

• T - “Technically Disseminating Information”

• A – “Advocating Ethical and Best Practises”

• I – “Inspiring and Informing”

TTAIFA 42 | Endeavour Magazine

• F – “Focusing on Building Family Financial Strength”

• A – “Alliances (with regulators, for the benefit of financial advisors and the industry”

Equally as important to TTAIFA, is the ‘Code of Ethics’, which dictates that each company is handled responsibly. This is very important for the work of life insurance brokers, as they are dealing with delicate and highly confidential information. Therefore, the Association must safeguard any information regarding personal or business affairs. TTAIFA are high flyers in the life insurance industry, as they bring together hardworking companies so that a wealth of knowledge can be exchanged. Furthermore, the advising of businesses and the professional development of the working body of Trinidad & Tobago is of the greatest importance. Thus, TTAIFA promotes an attitude of guidance and humility amongst all associate members.

A Guiding Light Endeavour Magazine | 43

PUTTING CLIENTS FIRST Merx Group chevron-square-right https://merxcm.com/ phone-square enquiries@merxcm.com

Based primarily in Asia, Merx Group has a great passion for creating a bustling and lively corporate space for its network of clients. Their 20-year history is a testament to their dedication to inspiring and managing amazing business spaces. Such success is conducive to the important work that they do for each client, which is supported by an extensive knowledge of the business and design sector, as well as a thriving independent consultancy. Each sector amalgamates to create a company that puts their clients first.

With over two decades of operation, it is no surprise that Merx has a highly impressive portfolio of projects that feature world-leading brands and industries. With a clear conviction to “Inspire Spaces” throughout Asia, Merx can take pride in specialised client services and highly functioning project management operations.

A key pinnacle of Merx can be found in the people-focused network that carries the business forward. Through strategies of innovation and cost efficiency, they have been able to ensure a client-focused project that offers a hand in every part of the journey from pre-planning, briefing, design, sourcing and procurement, negotiations, build, relocation and post-completion. This allows Merx to confidently transform all client’s vision into an inspiring space.

When looking at the overall picture of the Merx group, it is easy to see how they have had a strong trajectory of progression, whilst still maintaining

www.s-techs.com|info@s-techs.com|+852 2838 8877

Mike Kavanagh, Chief Operating Officer|mike.kavanagh@s-techs.com

S&techs is a full service Main Contractor and Construction Manager headquartered in Hong Kong. Formed in 2000, S&techs has grown to become one of the regions foremost Contractors specialising in interior fit-out, refurbishment and Out-of Ground construction projects on a Lump Sum, Construction Management and / or Design & Build basis.

S&techs has completed multiple projects in the Commercial, Banking & Finance, Legal, Retail, Hotel & Hospitality, Education. Healthcare, Mission Critical and Industrial & Manufacturing Sectors

S&techs offers construction services throughout the Asia-Pacific region

Hong Kong|Singapore|Tokyo|Shanghai|Suzhou Shenzhen|Foshan|Taipei | Wuhan

S&techs offers construction services throughout the Asia-Pacific region

Hong Kong|Singapore|Tokyo|Shanghai|Suzhou Shenzhen|Foshan|Taipei | Wuhan

Merx Group 46 | Endeavour Magazine

their clients and the Merx team as the focus of the business. As such, the company revolves around three key points: services, sectors, and geography. It is this strategic trifecta that contributes to the provisions of procurement, cost and advisory services. Such stature spans the industrial sector, as well as retail, workplace, and hospitality sectors. Amongst many strategies, Merx constantly works to open new offices and expand both domestically within the business but also geographically. This can be traced back to 2006, when they opened offices in Malaysia, and later in Dubai and Hong Kong in 2008, and finally Myanmar in 2016. More recently, the group membership has broadened to alliance agreements in the Philippines, Australia and Japan. Further progression within the company is signified by the independent consultancy firm, now becoming a known brand within the company. This milestone is indicative of the dynamism and agility that has established the company as a key player in the workplace corporate office sector. Further expansions can be witnessed in specialist niches including the business jet hangar space.

Noteworthy also is Merx’s membership to the Asian Business Aviation Association. This ensures a clear path towards prosperity in the business jet arena, which is supported by their already foundational work in Jet Aviation. Such a venture is further endorsed by comanaging the construction of a state-of-theart maintenance facility and hangar business aviation parking at Clark in the Philippines.

It is also imperative to note the important presence Merx has in the hospitality sector. For example, they have had a great involvement in the Club Med resort in Kota Kinabalu, which means they can take pride in a unique design centred on ecological principles and sustainable luxury. Furthermore, Merx is also celebrating over a decade of working with Marina Bay Sands in Singapore, one of the world’s greatest resort developments. Over in Hong Kong, Merx is also currently involved with projects like Morning Star and the Australian Trade Commission, with broader expansion taking place in areas such as Macau and the Greater Bay area.

Putting Clients First Endeavour Magazine | 47

When looking at the Merx portfolio, particularly in the Hong Kong area, corporate offices and workplace construction projects dominate the main operations of the business. A particular indicator of major growth within the workplace sector is demonstrated by the acquisition of Dyson headquarters - a major project in Singapore. Such a well-known client is brilliant for Merx’s reputation, particularly when working on the historic St. James Power Station, overseeing its conversion into a state of the art and R&D space. It is therefore evident how this has become one of Merx’s proudest moments, particularly as St James’s Power Station is one of Singapore’s oldest buildings and consequently holds a ‘monument’ classification.

Merx stands out from many of its competitors through a core business identity and constant innovation of its brand values that make the company what it is. As such, it is the human element of the company that motivates the team and develops their values, whether it be their staff, clients, or the vast number of people using the Merx space. This allows there to be equality throughout their staff, which is not reliant on competitive hierarchical positioning, but rather the from the growing knowledge of member, creating a symbiotic relationship amongst all the staff.

Unlike many other businesses, there is a model of leadership present that encourages active involvement from all members of staff across the

board. Such a close-knit network ensures the active delivery of projects and great involvement of Merx leadership team. Therefore, it is the hands-on approach of the management and shareholders, combined with a client-based focus, that works to create the perfect storm and guarantees success for Merx.

Alongside the people focused entity of the business, Merx also utilises innovative technologies that streamline their many operations. This is completed through the use of third-party beneficial software. Again, this differentiates Merx from the rest as not many other businesses can meet this level of technology. These technologies are orchestrated in a way that maintains monitoring, control, and visibility. Namely, the software is utilised so that 360-degree photos can be formulated that let the clients ‘walk the site’ even if they are thousands of miles away. Examples of this can be found in the Merx Octagon platform. As a project and tracking board system, Octagon provides complete visibility for its clients and improves the overall experience.

The Merx Group have guaranteed success over the last twenty years by continuously working towards a client-based focus that has led them to become key movers in the workplace corporate office sector and beyond. This is primarily shown in a willingness to experiment with different products and strategies in the industry, continuously seeking ways to improve. And yet, this enthusiasm has no signs of stopping, as the company is putting together a four-year plan that includes new geographies and organic growth.

Merx Group 48 | Endeavour Magazine

Looking for the best? www.liebherr.com info.lex@liebherr.com • www.facebook.com/LiebherrConstruction

SASLA

Caribbean Association of Banks

SASLA

Caribbean Association of Banks

S&techs offers construction services throughout the Asia-Pacific region

Hong Kong|Singapore|Tokyo|Shanghai|Suzhou Shenzhen|Foshan|Taipei | Wuhan

S&techs offers construction services throughout the Asia-Pacific region

Hong Kong|Singapore|Tokyo|Shanghai|Suzhou Shenzhen|Foshan|Taipei | Wuhan