BHC: Collaboration for a sustainable housing strategy

BECI: Working on the transformation agenda

Botswana Housing Corporation is a parastatal under the Ministry of Transport and Public Works. The Corporation was established by an Act of Parliament (CAP 74.03) of 1971. In brief, the Corporation’s mandate as outlined under section 14 of the BHC Act is as follows:-

a) To provide for the housing, o ce and other building needs of the Government and local authorities;

b) To provide for and to assist and to make arrangements for other persons to meet the requirements of paragraph (a).

c) To undertake and carry-out and to make arrangements for other persons to undertake and carry-out building schemes in Botswana.

On 1st April 2012, the Corporation’s mandate was expanded in accordance with Presidential Directive Cab 20 (B)/2010. The directive pronounced that all Government housing implementation programmes be transferred to BHC to operate as Government’s Single Housing Authority (SiHA). In compliance with the directive, BHC is as from 1st April 2012 responsible for the construction of SHHA turnkey projects, Public O cers Housing Initiative and Youth Housing.

BECI is an export credit agency set up in 1996 as a 100% subsidiary of Botswana Development Corporation Limited (BDC). BECI offers the below risk solutions tailored to support business growth:

• Bonds and Guarantees

• Domestic Trade Credit Insurance

• Export Trade Credit Insurance

• Medium and Long Term Export Credit Insurance

• Outward Investment Insurance

MLT protects businesses and Financiers from non-payment by foreign buyers for credit terms spanning up to 15 years. MLT protects your business from the risk of non-payment by a foreign buyer due to political and/or commercial reasons. This cover therefore facilitates bank finance for export credit loans and can allow for negotiation of better rates with the project financier.

Who Qualifies?

Botswana Businesses taking part in projects of a capital nature in a foreign country, requiring some form of financing; with payment terms spanning between 3 and 15 years.

What Is Covered?

MLT proctects businesses from losses owing to political and commercial risks.

Political risks covered include confiscation, currency convertibility expropriation, creeping expropriation, nationalization, Transfer of earnings to Botswana war and civil war.

Commercial risks covered protracted default and insolvency.

OII is an economic development instrument used to level the playing field between doing business in Botswana and doing business in a foreign country. OII protects an investor against risks which are outside his/her control in the host country where investment is made.

Who Qualifies?

Botswana Businesses investing in foreign countries.

What Is Covered?

Investment insurance cover protects against events, actions or occurrences which are generally known as political risks which result in an investor suffering financial loss.

Political risks covered include expropriation, creeping expropriation, nationalization, war and civil war. +267 3188015 mlt@beci.co.bw or beci@beci.co.bw www.beci.co.bw

EDITOR Ephraim Banda

EDITOR Ephraim Banda

While contemplating on what to write as an editor’s note for this issue, I remembered a recent conversation I had with the President of New Era College, Mr. E Ghodrati. His words were simply profound.

“To succeed in anything in life, especially in business, one must have a vision.” That’s it. The words are loaded with the power to bring about change in an individual’s life.

All information is supplied without liability. Although the publisher has taken all precautions to ensure that the information is correct at the time of publication, the publisher and their agents do not accept any liability, direct or indirect, for material contained in this publication.

No part of this publication may be reproduced in any form or by any means without prior written permission of the copyright owners.

Simply put, we need to have a vision of what we desire to accomplish in life and business. You have heard others teach that you should begin with the end in sight. In other words, it means to have a vision, to visualize, or to have a definite mental picture of what you want the end of your undertaking to be like.

The holy word says that without a vision, people perish. This is explicit; without a vision, life becomes a gamble. It’s like shooting in the dark and hoping to strike it big. Having a clear vision determines the right amount of effort or strategy to exert and execute an endeavour.

things you see and take for granted today were once only figments of imagination and some of the people who accomplished them were at one point thought to be lunatics, daydreamers, and other unmentionable things.

As you visualize, remember not to waiver; believe, focus, and take the right steps with conviction that you will achieve the loftiest of dreams and you will sing a new song.

Thank you for grabbing our February-March issue. It’s loaded with great articles full of applicable knowledge and insights. And as you go through this issue, remember to focus on possibilities. We believe in you!

It’s time to own your vision and believe in your ability to attain it. Do not be limited; expand your scope, and as you clearly see it in your mind, then it will be. Always remember that the great Ephraim Banda

In partnership with New Era College of Arts, Science & Technology, the Ghodrati Foundation offers academic scholarships of up to 45% for private students and up to 100% for sports scholarships. These scholarships are offered towards all learning programmes at the college and on full-time basis only.

FACULTY OF ENGINEERING

Bachelor of Engineering (Hons) in Telecommunications

*Bachelor of Engineering in Electrical & Electronics

Bachelor of Science in Geology

Diploma in Telecommunications Engineering

Diploma in Mechanical Engineering

Diploma in Electrical & Electronics Engineering

Diploma in Construction Engineering

FACULTY OF COMMERCE

Bachelor of Commerce in Marketing Management

Bachelor of Commerce in Financial Management

Bachelor of Commerce in Digital Marketing

Bachelor of Science in Forensic Financial Accounting

Bachelor of Commerce in Accounting

Bachelor of Commerce in Business Information & Technology Management

Bachelor of Commerce in Entrepreneurship

Bachelor of Business Administration in Logistic & Transport Management

Bachelor of Commerce in Supply Chain Management

Certificate in Computerised Accounting & Finance

FACULTY OF SPECIAL & INCLUSIVE EDUCATION

Bachelor of Education in Inclusive Education

The Ghodrati Foundation is a private non-profit organization founded on the conviction that everyone deserves the chance to improve their lives, regardless of their circumstances. Our vision is to contribute to the socio-economic development of Botswana.

Since its inception, New Era College has taken bold strides to produce job ready graduates and been an ardent advocate of STEM. Our team had a conversation with Daruosh Ghodrati, Vice President for Administration and Finance at NEC to garner insights on the College and its milestones.

Strides: Please tell us about yourself (brief Bio) and your role at New Era College

Ghodrati: I’ll keep it short and sweet. I was born in Canada and raised right here in Gaborone, my family moved to Botswana in 1991, and before that we were in Zambia. Having spent most of my life in Gaborone, it’s safe to say I call GC my home.

Since 2012, I have held management positions at New Era College leading various departments and teams, notably Director of Operations, then Director of Operations and Finance. I am currently the Vice President for Administration and Finance responsible for leading the division of administration and finance. Some of the key focuses of my office is to champion major change and growth initiatives, oversee financial and operational direction, provide cross-functional team leadership, identify opportunities and partnerships, develop and implement policy, and work closely with the office of the CEO in driving the institution’s strategy.

Strides: What inspired the founding of New Era College?

Ghodrati: New Era College has always believed that building a strong foundation takes time. This is why our attention has always been in offering technical and vocational learning programmes that are the bedrock of any developing economy. Even as we speak, there is a major shortage of citizen artisans and technicians that are desperately needed in several sectors such as mining and manufacturing, to name a few. Since our inception in 2009, our learning programmes have educated and trained thousands of job ready graduates who are employed at the largest corporations and firms in the country, not to mention many who have started their own companies and are employing others. In the last 12 months, we have received accreditation of several engineering, commerce, and science programmes at both the degree and diploma level. Our commitment to the industry stands stronger than ever. We are here to offer internationally recognized learning programmes that are relevant and distinctive.

Strides: What are some of the achievements, highlights, and challenges the College has experienced over the years?

Ghodrati: We like to benchmark our achievements and successes by observing the journey of our students and the careers they build for themselves.

No matter big or small, every employer you speak to has nothing but positive feedback to share about our graduates’ education and knowledge in their field. This if you ask me, is our biggest achievement. Not to mention we have become synonymous with engineering, job ready graduates, and STEM.

Of course, it goes without saying that New Era College has had its share of challenges over the years, and like any driven organization, we have shown that we have what it takes to weather the storm and strive for quality.

Most recently, the regulatory environment in education and professional occupations have undergone major change impacting their standards. This has prompted New Era College to adapt and comply with these new standards. At every turn, we have not only met, but exceeded the requirements and obligations set out by the regulators. Early on, it came to our attention that some members of the public had doubts of what this implied and had challenges understanding the rigorous process set out by the regulators. We observed the same people asking themselves “how should we now perceive and treat institutions like New Era College who have been operating under previously set standards?” Well, what I can tell you is that in any industry, it is important to note that new regulatory requirements are a much-needed exercise and are always led by the regulator’s determination

to expand their regulatory scope. When new requirements are enacted, service providers should be given an opportunity to meet such standards. However, it does not invalidate the standards that they had previously met and been operating under. As an ETP, our primary concern and motive is to always meet the standard as set by our regulators, especially when the outcome means offering the highest quality education available to customers. I am proud and delighted to inform you that New Era College continues to stay ahead of the curve and offers learning programmes that are accredited and endorsed by the relevant regulators and industry. We have over 70 industry partners that work closely with us by absorbing our students for industry-based learning and employ our graduates across various sectors. Our engineering degree programmes are developed using the Washington Accord and we plan to peg more of our programmes to internationally recognized standards, across all faculties. Our graduates are doing wonderful things in the industry and business sector and this is a testament of our vision coming to life.

Strides: Covid-19 has affected the teaching and learning environment globally, how has New Era College adapted to this challenge?

Ghodrati: As any entity, challenges brought about by the Covid-19 pandemic affected the way we teach and learn. It’s safe to say it changed our mode of delivery forever. Lockdowns forced us to establish a work from home policy, which catered all College staff working remotely. Furthermore, we had to consider the student population and find ways to enhance teaching and learning so that valuable time would not be lost. Therefore, it was pertinent we offer fully virtual classes during the lockdown period. From the start, we knew that connectivity was going to be an issue for some of our students who had returned to their home villages. To address this, we went into a partnership with mobile companies, where students were provided with sim cards loaded

with data bundles to allow them to access the Student Portal, download class material and attend classes from the comfort of their homes. Staffs were also provided with subsidized internet packages to allow them to work from home. Till today, these home internet packages are still active and providing staff with home internet. Moreover, the College instituted a Health Committee mandated to address Covid-19 related matters and mitigate risk across the boboard.

Strides: Employers have said New Era College graduates are well-rounded and skillful in their crafts, how do you do it?

Ghodrati: New Era College places great emphasis on offering the TVET model of teaching and learning. This simply means that we are concerned about the kind and quality of graduate we produce for the market in terms of their skill, experience and knowledge. In addition, our diploma programmes are outcome-based. Furthermore, we equip our learning facilities with industry-relevant laboratories and equipment. We are required to invite the industry to evaluate our learning facilities that then provide feedback for the sake of improvement and industry alignment. Our approach to experiential learning involves both theoretical and practical work, guided by input from

professionals and industry experts. Our students spend 70% of the course material undergoing practical work and assessment, with 30% in theory. The practical experience is then tested through a mandatory course called industry based learning, a six-month long work placement with a reputable industry partner. Based on feedback from the industry partners, the College reviews student placements and engages industry partners in programme and syllabi rereview.

Strides: Do you have any partnerships worth speaking about with the industry and other ETPs locally and internationally

Ghodrati: Yes, we believe so much in meaningful industry and academic partnerships. Over the years, we have partnered with both local and international organisations to expand our reach and academic horizons, and provide opportunities to our students, alumni and staff. Some of our notable industry partnerships include Botswana Telecommunications Corporation, Green Energy & Sustainability Association, Zambia National STEM Foundation and over 70 industry based learning partners. We also have academic partnerships with INTI International University (Malaysia), and Shenyeng Aerospace University (China). Through our existing and newly

developed industry partnerships, our goal is to develop an apprenticeship program for technical occupations that is recognized and sought after by the industry. An apprenticeship model will ensure our graduates attain a minimum number of hours working in their field under a certified mentor. This would ensure that graduates will gain the necessary experience needed to apply for their professional certification.

Strides: The College has been recognized for empowering women in engineering, how important is this to you?

Ghodrati: The College believes in providing a level playing ground and equal opportunity for all member of our community. While we know engineering, especially vocational trades have traditionally been male-dominated; New Era College has always maintained a strong position that girls and women deserve the opportunity and require the support to enter the engineering and trades job market. In recent years, we are proud to acknowledge that several management positions at New Era College have been filled by women of different ages and backgrounds. Moreover, we have two female Head of Schools in the Faculty of Engineering who have led substantial growth during their tenure. Through examples like these, our students have the opportunity to develop an open and progressive mindset that will help develop and empower the necessary characteristics worthy of future leaders. It is also worth pointing out that as of last semester, a majority of our enrolled students across engineering programmes were female.

Strides: New Era College is viewed as a champion in advancing STEM Education in Botswana and the Southern African Region, tell us more about this

Ghodrati: In 2018, we launched a STEM education and training program that aimed to motivate a new generation of scientists and engineers committed to developing innovative solutions for the global stage. Five years later, the STEM education and training program has

evolved into STEM Kits Botswana, a social enterprise entrusted with inspiring learners, educators, and communities across Botswana. We offer two models (The STEM Club and the Tinkering Lab) to our clients which are both designed to provide practical competency in electronics, robotics, and programming. In addition, the STEM program nurtures and promotes necessary life skills such as communication, collaboration, problem-solving, creativity, troubleshooting and fault finding. We currently work closely with private and public schools and are looking to partner with other institutions of learning, such brigades, colleges, and universities. Through our STEM program, we have been able to inspire learners including our own engineering students to design and prototype innovative solutions to serve their communities, specifically in agriculture and domestic settings. STEM Kits Botswana is also present in Zambia and Kenya and our hope is to keep expanding to promote STEM education across the continent.

Strides: Tell us about your partnership with the Ghodrati Foundation

Ghodrati: This is a special partnership that cannot go unmentioned. We have been fortunate enough to provide access to higher education through the Ghodrati Foundation to young Batswana who have not been eligible for sponsorships through formal government programs. The Ghodrati Foundation scholarship covers up to 45% of tuition fees for self-sponsored students. The Ghodrati Foundation Sports Scholarship covers up to 100% tuition fees for active athletes. To date, the College has spent over eight million pula in tuition fees and other associated fees towards its beneficiaries. This has reduced some burden from the Government of Botswana in educating young Batswana and addresses Sustainable Development Goal four (SDG 4) which speaks to the provision of quality education to all. Moreover, the College continues to take part in Corporate Social Investment initiatives which are

aimed at community building and addressing social misfortunes within the community and nation at large.

Strides: Where do you see the College going in the next 5 years?

Ghodrati: New Era College has always believed itself to be a niche provider of education and training in engineering and technology. Over the years, we have stayed true to our purpose. Yet, it is our ambition to transform our college into a research-intensive institution. While this means we will eventually be identified as a university, our commitment to offering relevant and technical programs which are practical-intensive, and depend on experience-based learning, will remain our focus and why our students will continue to be the most employable graduates in the country.

Strides: Any words to possible partners and students?

Ghodrati: Since 2009, New Era College has taken its place as the first private engineering institution in Botswana. Consequently, we decided to expand our list of programmes with the condition that we offer relevant disciplines that will serve the current and future economy of the country and region. Our student population is our advantage, as we don’t have overcrowded classrooms and our students get focused and special attention from faculty members. We offer a 6-month industry-based learning placement program which is the longest offered in the country. We prioritize sports and athletics and have some of the highest performing athletes in the country, not to mention national athletes that often represent Botswana on the international stage. We offer financial assistance up to 45%, sport scholarships up to 100% along with newly established education grants. These are just some of the reasons why we invite the engineers, scientists, and business leaders of tomorrow to come study at New Era College. You know where to find us, but in case you don’t, re mo Block 8, Gaborone.

New Era College of Arts, Science and Technology, established in 2009 as the first private tertiary institution in Botswana offering engineering qualifications, has a historical commitment to technical and vocational education and training (TVET), aimed at producing research and innovation to play a positive role in the economic transformation of the country and to contribute to the education sector. Recently, the college has become one of the first education

and training providers to comply with the new National Credit and Qualifications Framework set by the Botswana Qualifications Authority, by developing new and aligned learning programmes that are now accredited by the regulator. As a result, the college has created three new faculties: the Faculty of Commerce, which has nine bachelor’s programmes and one certificate programme; the Faculty of Forensic Sciences, which has one bachelor degree; and the Faculty of Education, which has one bachelor

degree programme.

The college’s emphasis is on producing job-ready graduates and it has always worked to bridge the gap between academia and industry through various avenues, such as the industry-based learning programme, as well as through regular industry engagements with partners. The College is proud of its homegrown ideas that enhance stakeholder engagement and provide a platform for skills and knowledge exchange. These include the Women in Engineering

Round Table Talk, National STEM Hackathon, and the industry partner Business Breakfast. The faculties at the college house committees known as the Industry Advisory Boards, whose responsibility is to advise and provide relevant feedback on the content taught by the faculties, which helps the college improve the quality of its learning programmes and assists it in bridging the skills gap. At the college, all students are required to take an assessed course on industry-based learning (IBL), or attachment, for a continuous period of six months, which is the longest IBL period provided by any institution in the country. This course is offered in collaboration with established and reputable organizations and companies in and out of the country and these are seen as the College’s industry partners.

The Faculty of Engineering was the first to be found-

ed at the college, offering qualifications in diverse programmes like Electrical & Electronics, Construction, as well as Telecommunications. Dubbed the Home of Engineering, the college spread its brand countrywide to gain popu-

larity among young engineering enthusiasts and pioneered the journey to breaking myths around the field. Today, thousands of Batswana engineers have graduated from New Era College, forming part of the minds and skills behind the success of different

entities in Africa. The college’s alumni are spread all over the country in government departments, private companies, and parastatals. Moreover, some of them have proceeded to establish their own successful entities. It has been proven through the

On Cover: Daroush Ghodrati NEC Vice President Administration and Finance

Advocating for STEM, NEC leadership with students

On Cover: Daroush Ghodrati NEC Vice President Administration and Finance

Advocating for STEM, NEC leadership with students

college’s tracer study that more than ninety percent (90%) of its alumni are either in formal employment or are entrepreneurs. In 2022, three (3) New Era College alumni were selected to represent Botswana at the Forbes 30 under 30 summit held in Kasane.

As an education and training provider of choice, the college aspires to attract and recruit high-caliber students through different initiatives and recruitment streams. Generally, the majority of the population at the college are studying through grants and loans provided by the Government of Botswana. While this has sustained the college for many years, the college deliberately designed a sustainable sales and marketing model, which reduces dependency from one source and promotes proactivity in student recruitment, enrolment, and retention. For this to be successful, the college established new industry partnerships and most importantly, academic partnerships with like-minded and in most cases high-ranking local and international education and training providers. The arrangement provides exposure for New Era College students and staff through different platforms like mobility programmes, joint research collaborations, skills development through conferences, workshops and training as well as knowledge and cultural exchanges.

New Era College of Arts, Science and Technology has formed a number of partnerships with institutions and organizations from around the world, which have helped to expand its global reach and enhance the quality of education offered to its students. Some of the notable partnerships include INTI International University from Malaysia, Shenyeng Aerospace University in China, Botswana Telecommunications Corporation, Green Energy and Sustainability Association in Botswana, Association of African Universities, Zambian National STEM Foundation, and many more. These partnerships have provided students with access to a diverse range of faculty, new learning resources, state-of-the-art facilities, and joint research projects. This has

enabled the development of new ideas, technologies, and solutions to some of today’s most pressing challenges.

In 2017, the College also partnered with the Ghodrati Foundation to provide education to underprivileged students in Botswana. The partnership aligned with the College’s vision of giving back to the community by providing education and opportunities for all. The College has been able to provide scholarships to deserving students who may not have had access to such opportunities otherwise, and has so far spent over eight million pula since the partnership began. Additionally, the partnership has identified talent through sport and established the

Ghodrati Foundation Sport Scholarship, which is specifically aimed at supporting young Batswana sports people. “We have taken it upon ourselves as a college to provide scholarship opportunities to young Batswana, especially those who may have not been able to meet the minimum requirements for government sponsorships, hence the partnership with the Ghodrati Foundation. We have also extended this opportunity to young active athletes, who are expected to study and continue being active in sports, this will help build high performance athletes for the college and subsequently for the country.”

The partnership also extends to other initiatives that address the social chal-

lenges faced by Batswana. For instance, the two entities have worked together to support local charity organizations in various initiatives, such as assisting teenage mothers to return to mainstream society. One such initiative, centered around Gender-Based Violence, was recognized by an international organization and awarded the Best Village Support Initiative in 2022.

New Era College believes in providing quality education that produces well-rounded graduates who possess confidence, resilience, inclusivity, and respect for people. These graduates are equipped with the necessary skills to excel in their chosen fields and careers, and to take advantage of opportunities that come their way.

New Era College believes in providing quality education that produces well-rounded graduates who possess confidence, resilience, inclusivity, and respect for people.

Glory Ifiegbu, Head, of the Department of Telecommunications Engineering at New Era College believes that innovative ideas are fundamental to providing cutting-edge solutions to daunting engineering tasks. She is also convinced that committed collaborations with relevant industry stakeholders have the power to curtail the skills mismatch the Telecommunications sector is facing.

Strides recently had a tete-a-tete with this astute Engineer to garner insights on her success secrets and what strides New Era College is taking to churn out well-rounded Telecommunications graduates.

Strides: Briefly, tell us about yourself, your professional background, and what motivated your decision to pursue an engineering career.

Ifiegbu: I am Glory Ifiegbu, Telecommunications Engineering Head of Department. I have a Master of Science in Information Technology Management (MSc in ITM) and I am currently pursuing a doctorate in Computer Systems Engineering in the field of Education.

The decision to pursue the Engineering field was not an easy one looking at the situation of women in the world and during the time I enrolled on the programme, there were not so many women enrolling in Engineering at the time as it was a men-dominated field.

My motivation in Engineering is the intuitive reason to pursue Engineering as it is a profession that propels one to apply methods to solve real-time problems, I was intrigued by chemical Engineering at then because there was a lot of money involved and I wanted to become a chemical Engineer, however, I had to settle for Computing System

Engineering because of pressure that Chemical Engineering was a male-dominated field.

Strides: What was your response when you made it as HOD and what do you think gives you the competitive edge in this position?

Ifiegbu: I was surprised as I didn’t expect sudden recognition and upliftment by the president and leadership of New Era College. Before I got the appointment as the Head of Telecoms at NEC, I was one of the laid-back employees who just focused on the task without minding management positions, but in 2017, it happened, as my first appointment. When I was appointed, I was elated, I felt recognised and important, and that was a special feeling. It is good when you work hard because it pays that in the long run.

We face competition everywhere; in the classroom, at home, in relationships, and at work. These competitions arise as a result of the change in the environment. So it helps me to keep finding more innovative ideas and ways to simplify tasks and make learning more effective and interesting. For example, the challenges we faced with COVID-19, saw us competing with other education providers. To ensure we remain relevant, we have to come up with better ways to continue learning, like using online learning, which we are still utilising to this day.

On the other hand, I am convinced that several factors give me the edge to remain relevant. I am focused, devoted, creative, solution provider, committed, dedicated, honest, integrity, sympathetic, empathetic, objective in my decisions and opinions, customer-oriented, hardworking (earnestness towards my

work), continuously improving and God fearing. All of these keep playing a significant role in making me relevant. On top of these, self-motivation is also important because it propels me and energises me to accomplish more goals despite demotivation that may rise from the competition and other unsavoury circumstances.

Strides: The telecommunications sector is developing quickly. How do you collaborate with business leaders to make sure your students are equipped for a fast-paced workplace?

Ifiegbu: Having my students experience what the workplace embodies is my way of preparing them. Telecommunication giants like BTC are always willing to accept my students and show them what will be expected of them. But of course, and this is very true in the telecommunications sector, times change, and nothing stays relevant for a long time. So, giving them a chance to see how real businesses are coping with the struggle for relevance in this day and age, encourages my hope In becoming creative problem solvers, that can become key figures in any company of their choice.

We have several ways of engagement of the business sector during programme development. i) To identify the gaps that can be addressed by training, both for short and long-term programmes. It ensures that our programmes/courses are relevant Post Training Programmes Evaluation. ii) A follow-up of our postgraduates in the various organizations to get information on how they are performing. This ensures that the courses/programmes remain relevant. The college is ready to make appropriate adjustments as informed by the eval-

uation process. Our Alumnae are also engaged in the process of fact-finding. IBL Programme: iii) As part of training requirements, IBL plays an indispensable part in both students and employers are interacted. Regular visits to the place of work give valuable and unbiased information, as it allows the trainers not only to depend on the reports but to have an opportunity to observe what is in the field.

We use the findings and recommendations to make necessary changes or reinforce the requirements identified. These activities give an assurance that our programmes/courses remain aligned with the fast-changing business environment.

Strides: The Ghodrati Foundation at New Era has been advocating for women and girls in STEM. What impact has this initiative had on the enrolment of female students in your department as well as their overall performance?

Ifiegbu: New Era College practices an inclusive system, so I will not only focus on women and girls but on the overall population. STEM stands for Science, Technology, Engineering and Mathematics. It capacitates students to be creative, innovative, problem solvers, analysers, independent thinkers, and have the ability to work as a team. New Era College embraces STEM in all facets of teaching and learning. New Era College adopts a STEM approach in the delivery of teaching. For example –our new revised degree programme has ensured that there are hands-on practice opportunities for the students. There seems to be a large gap between degree

and diploma graduates because the latter is known to have hands-on experience. However, in the implementation of STEM and as a supporter of STEM, we have taken this into the classroom, to say that all courses which require students to apply and integrate, must have a hands-on training approach.

The Ghodrati Foundation has been beneficial to both boys and girls; it has helped us enrol more students. A significant number of students have been able to complete their studies with the assistance of the Ghodrati Foundation. In terms of performance, it has helped students to be able to complete the programme without dropping out of the programme for poor performance in the examination. So it has played a huge role in students’ overall performance towards completion of the programme.

Strides: What has been your experience working with the recipients of the Foundation’s scholarship, and would you share a testimony on how the scholarship has been impacting the lives of these individuals?

Ifiegbu: There are two categories of recipients of this scholarship – one people who have external support like a good job or a parent or a guardian, and two – students who do not have any external support. I will talk about the ones with no external support – using one of my students Oratile by name as an example, he failed after semester one into the programme, and when he approached my office, he was devastated, you could see that he didn’t know what to do, I took him through some counselling session and made him aware

of the Ghodrati Foundation. When he came back, his face was lighted and full of smiles. Within 2 days he registered to complete the failed course. He has to look for a part-time job; we worked out how he could use his salary to pay instalments to complete the fees. Two of my other students who failed in the final year were able to complete the programme with the help of the Ghodrati Foundation. I am pretty sure that these students would not have made it through if the Ghodrati Foundation was not in existence. I, therefore, solicit more donations and support towards this foundation so we can extend it to more categories of students.

Strides: Drawing from your experience, what is the recipe for success in your area of specialisation for both men and women?

Ifiegbu: The number one recipe for success in life is faith in God. You also need to embrace hard work, continuous self-improvement, dedication, commitment, firmness in your decision, teamwork, and kindness. You must have the interests of the stakeholders (students, sponsors, employees, and employers) at heart as a manager.

Strides: Lastly, how do you motivate yourself and your team when facing challenging assignments?

Ifiegbu: Be Optimistic all the time. You will face life challenges but focus on finding the solution and not on the problems. It is said no man is an island, so be a team player, appreciate when they achieve success, be fair when exercising some form of penalty and be transparent.

New Era College embraces STEM in all facets of teaching and learning

Botswana Post is considering establishing a postal bank offering all banking services in response to the advancement of digitization technology, which has recently affected the traditional business operations of postal services.

Botswana Post Chairman, Nathan Kgabi, said this is how they could underpin the future sustainability of the company by greatly expanding the range of services available to customers because the communications business is becoming more competitive. “Picture it: a new, state-owned bank based on our vast postal network that offers a wide bouquet of services one would normally find at a bank,” he said, adding that it is a unique national resource stable financial partner who creates economic support, community cohesion and social upliftment opportunities.

He highlighted that postal banking is common in many parts of the world, and it’s time to seize this opportunity

in Botswana. “At Botswana Post, our leadership team has a proven track record. We have shown that we can manage change, complete an organisation-wide digital migration and roll out new products that delight our customers and have what it takes to venture into post-banking in a meaningful way.”

During 2021–2022, Botswana Post launched a virtual teller machine in five locations countrywide. This is a self-service solution that effectively replaces the customer’s need to transact over the counter. Open 24 hours a day, the Virtual Teller Machine makes it even easier to buy airtime, and electricity units, pay for DStv and renew Post Box subscriptions.

The postal service’s profits have recorded a 211 per cent increase to P64 million, recovering from a loss of P53 million in 2021 due to the execution of its digital strategy during the financial year ended 2021–2022. Botswana Post Chief Finance Officer, Ofentse Mabote, stated that the agency segment of the business houses a suite of services

which are highly technologically driven. “Overall, this category grew by 6.9 per cent. Leading the charge were payments and collections services which grew by 12.1 per cent and the Electricity Commission at 15 per cent.”

He revealed that airtime commissions and money transfer commissions declined by 40.9 percent and 11.4 percent respectively. “These two lines are hampered by high competition and low airtime stocking levels.” Mabote said in response to this competition, Botswana Post is developing increased money transfer channels and improving its efficiencies, which will allow the company to improve its margins in future. He said Botswana Post continues to implement its technology-driven strategy, building smart partnerships with third parties to optimise its revenue generation opportunities. “We are improving our systems to create efficiencies that will help upgrade our customer service, reduce costs and improve profitability.”

Launched recently, First Capital Bank’s zero-cost savings account called the Lefika Savings Account has been designed with personal customers’ needs in mind, and aims to support their savings goals, whilst building and encouraging a culture of saving in Botswana.

In launching the product, First Capital Bank said the account offers customers the opportunity to save regularly in the medium term and access funds only in times of need.

First Capital Bank notes that the Lefika savings account is one of the many customer solutions from the bank designed to address existing customer needs in the market to offer them relevant solutions that are focused on their financial needs.

First Capital Bank Country Manager for Retail lending, Thatayaone Matlapeng said the bank is focused on meeting its customer’s financial needs by introducing nimble and relevant products.

“The launch of Lefika Savings account is testament to our commitment to walk the journey with our customers as their trusted financial advisors. Our aim is to make banking as convenient and simple for customers, so that they can have peace of mind knowing that their future is secured. As First Capital Bank we are focused on our customers’ financial needs and we are introducing relevant products that help our customers to grow not only their businesses, but their personal savings too,” said Matlapeng.

According to Head of Retail Liabilities, Lonyalo Seabe, the zero-cost product is dynamic as it caters for more than customers’

“The launch of Lefika Savings account is testament to our commitment to walk the journey with our customers as their trusted financial advisors.

savings needs.

“Lefika savings account will give customers the opportunity to save at ease and get the most out of their savings, with an added benefit of free P5000 funeral cover,” said Seabe, adding, “The Lefika savings account has been developed in response to the voice of the customer. It offers customers the opportunity to save at no cost. As we support our customers to achieve their ambitions, no fees will be levied for monthly maintenance as well as for both deposits and withdrawals on all Lefika savings accounts.”

The Lefika savings account can be opened at all First Capital Bank branches or Consumer Service Centres nationwide.

Country Manager, Retail lending

Thatayaone Matlapeng

After leading from the front in delivering much-needed support to the distressed business community during the COVID-19 Pandemic, Export Credit Insurance & Guarantee Company (Botswana) Pty Ltd (BECI), is upbeat that the time has come to realign through a holistic Transformation Agenda aimed to reposition it to craft cutting-edge solutions that transcend insurance and deliver tangible economic growth for the country.

Rocky Ramalefo, the Sales & Marketing Manager at BECI and this publication had the privilege to discuss pertinent issues around the COVID-19 Guarantee Scheme and BECI’s strategic plan post-COVID-19.

Strides: BECI administered the COVID-19 Loan Guarantee Scheme on behalf of the government in the course of the pandemic. Briefly share with us the highlights of the scheme, how much of the allocated funds were accessed, and what has been the overall performance of the scheme so far.

Ramalefo: The scheme was to assist companies which were affected during the COVID-19 lockdowns and through the intervention, banks helped companies on matters of operating or working capital arising from the limited cash flows which arose during the lockdowns. Companies needed the jump starts in terms of working capital. The idea the government had in mind for introducing the P 1 billion scheme was quite generous. However, the disbursement to companies was dependent on the assessment of companies needs by the banks.

All the commercial banks including the National Development Bank (NDB) participated in the scheme.

P260 million was disbursed as loans, and because the scheme guarantees only 80%, the guaranteed funds issued is P208 Million and the rest be-

ing 20% was on the banks. 91 facilities were approved representing a 20.1 % utilisation of the P1 billion allocation for the scheme. Although the facility was not utilized to the expected levels, we comparatively had a better utilisation percentage when compared to countries in the region. For example, In South Africa, they had a much bigger allocation yet they had less than 20 % utilisation. We also had a great number of inquiries, but we didn’t have the mechanisms in place to record each one of them as the banks were the first point of contact. The participating banks assessed the applications and approached us to guarantee the facilities for those eligible for the scheme.

It’s worth noting that the Tourism sector was at the top of the adversely affected sectors of the economy as it is reliant on the movement of people. The

sector utilised 43 % or P110 Million of the total funds disbursed. FMCG, wholesale and retail came second at 14 % while agriculture and manufacturing came third at 13 %. Construction came fourth at 10% while other sectors like mining, energy, transport, financial services and education utilised the remaining 8%. Currently, some of the facilities are fully paid for. The companies can sustain themselves through the opening of the economy and service the facilities. In the meantime, the loss ratio is 2.4% which is manageable.

The facility has been restructured and extended to March 2026 to help meet the supply chain challenges post the pandemic. These supply chain challenges are prevalent in the Agricultural sector as they need to source inputs such as fertilizers and seeds from nations that are affected by the Russia-Ukraine war.

Strides: SMEs are the engine of economic growth in Botswana and across the globe; what was the response of this important business segment to the initiative, and do you have figures in percentage as to how much of the disbursed funds were accessed by SMEs?

Ramalefo: When processing the applications, much of the work was done by the banks but the companies cut across from small medium to large enterprises. The facility was not focused on the size of the entity but on the need. You may find out that even a larger entity just needed so much to generate some cash flows to be able, in some instances, to pay salaries.

On the other hand, I am sure most of the beneficiaries in the Agricultural sector were SMEs. Note this is the sector that was facilitated by NDB with over 40% of the approved facilities.

Strides: How did your partnerships with financial institutions and business advocacy bodies like Business Botswana, BEMA, BITC, and others, which were established before the pandemic, help in your work of administering the scheme?

Ramalefo: These partnerships were of an advantage for us in administering the scheme. We consulted Business Botswana to help us seamlessly chart the way forward as regards the scheme guidelines because they had input on other schemes along the same line which were running parallel to cushion against the effect of COVID-19 pandemic.. So they had an input in the process. However, the key institution we were dealing with are banks and the Bankers Association of Botswana (BAB). The Bankers Association of Botswana helped in the coordination of the negotiation of the scheme’s terms and conditions. The other key entity was the Ministry of Finance which was tasked with this intervention.

Strides: Should we expect the launch of new insurance schemes or products, collaborations, or the signing of memoranda of understanding as a result of your experience working with the participat-

ing banks, the Bankers Association of Botswana, and companies during the pandemic?

Ramalefo: The formulation of the scheme has put BECI in a positive stance with the banks. There is a lot of engagement with the banks to continue with a similar facility for businesses because the challenges are still abound beyond the pandemic and the lockdowns. We have crafted new products which talk to credit or financial guarantees. We need such facilities to be able to support companies especially those with a leaning towards regional expansion and the export market. They need to be funded and banks need to be guaranteed of their financed capital.

We have engaged other institutions, in terms of the Memorandum of Understanding to provide the solutions that we realise are needed in the market. Although there was hesitation from insurance companies to provide financial guarantees in the past, we’ve seen this change in the recent past. There’s been a lot of interest from others in the market in terms of insurance, especially the American Reinsurance market in terms of providing the capacity to issue or to provide support for financial guarantees, however with an underlying trade transaction. Therefore, we should be able to see a lot of funding from banks for viable projects with the support of insurance instruments that would take care of any losses or unforeseen losses that could affect the banks’ loan books.

We have seen the creation of opportunities that if we explore enough, will get us relevance in the market for increased trade, especially as we envisage increased trade activity along the African Continental Free Trade Area (ACFTA). We have a new strategy which talks about supporting government initiatives and other trade financing products. These days most companies are not just interested in insurance, they want to be supported in terms of

Strides: As an insurer, what lessons did you learn from your own experience and that of your peers in the region and elsewhere on the globe?

Ramalefo: We noted that financing from the banks was distressed, and while the government was ready to support the banking sector, it doesn’t entirely mean the government was issuing grants. The government issued guarantees for legible and viable companies, however there were also issues of viability that the bankers had set for one to be able to utilise the scheme. The banks were limited in terms of how much exposure they could take on, even with guarantees. That is the downside of the scheme because the whole economy was struggling. The banks were challenged because they also had to finance other loans and therefore, they were cautious of overexposing their balance sheets. Nonetheless, they came to the party and by their participation, companies got the requisite assistance. Although there wasn’t engagement with other insurance companies in this instance, we have of late, however, seen a lot of interest from insurance brokers, especially on financial guarantees.. We are well-positioned to assist with financial guarantees to be able to support this expansion and access for any other required trade information.

At BECI, we are working on our transformation agenda. We are positioning ourselves to be of much relevance to the market and as such realigning. We have engaged with a technical partner to help us provide the requisite skills for supporting the economic growth of the country though insurance products. We have a developmental mandate behind at the core of our mandate. As such, we need to align our product offering with the government reset agenda as well, to be able to facilitate and support where government initiatives require insurance.

Stanbic Bank Botswana continues to deliver innovative solutions and services in line with the Bank’s move to a more digitised future. As banking trends and customer needs demand greater agility and innovation, the Bank has launched its Digital Lending solution, named Toro Loan, which allows personal accounts clients to accept and receive instantaneous disbursements for pre-approved unsecured loans on their internet banking profiles.

A first of its kind in Botswana, Toro Loan aligns and is in sync with Stanbic Bank’s digital transformation and innovation journey making true strides with tangible outcomes.

Stanbic Bank continues to enhance both the customer experience and the nation’s journey into a more digitised future, building the bank of tomorrow, today. The Bank has in recent months solidified its customer-centricity approach, investing in enhancing the customer experience through nuanced solutions and a major upgrade of its core banking system, which has unlocked greater potential for the business.

Speaking about the new offering, the Head of Consumer and High Net worth Clients and Acting Head of Business and Commercial Banking, Portia Motshegare said the bank remains passionate to be a key stakeholder in Botswana’s overall growth as well as in improving lives.

“At Stanbic Bank Botswana, we remain passionate about driving Botswana’s growth and improving lives. Our Vision is to create value for our clients and the communities we serve by providing access to digital, financial and related solutions that support sustainable growth,” said Motshegare, adding, “We have a robust strategy to deliver on this. We understand that we must place our customers at the centre

of all that we do and we are excited to take this a step further by enabling their dreams through a simple click of the button. This is part of our strategy to become even more customer-centric, enhance our customer experience, and provide truly relevant, inclusive and value adding solutions for our clients. This is the bank of the future, and we are working to pre-empt the wants and needs of our customers, and to truly deliver to our commitment.”

Digital Lending works the same way as a traditional lending approach, but with more convenience. Existing Clients of Stanbic Bank with active salary accounts have access to the Toro Loan offer and they can decide if they want to proceed. By selecting their preferred amount within the pre-approved limit range, costs will be calculated, and Ts & Cs shared for signing with a One Time Password (OTP).

Funds are then disbursed into their

account immediately, thus delivering on the fact that dreams are but a click away. Digital Lending is safe and secure to use, it benefits from the Bank’s investment in state-of-the-art security and privacy protocols and standards. All customer information and data remain safe and protected.

“Economies and indeed financial services sectors continue to evolve in today’s rapidly changing environment. We will not be left behind, for we continue to innovate for progress and to drive Botswana’s growth, focusing on the customer need and experience, rather than simply developing products. Regular engagement with our customers has revealed more insight into their needs, wants, hopes and aspirations. We are here to work to make those hopes and dreams a reality through innovation and relevance. As we like to say at Stanbic Bank, IT CAN BE,” elucidated Motshegare.

Since its inception, the Botswana Housing Corporation (BHC) has been taking strategic strides to fulfil its mandate of providing housing, offices, and building needs to the government and all of its clients. To keep up with the ever-changing nature of the housing space, BHC has been participating in forums that foster connectivity and collaboration opportunities at home and in other nations.

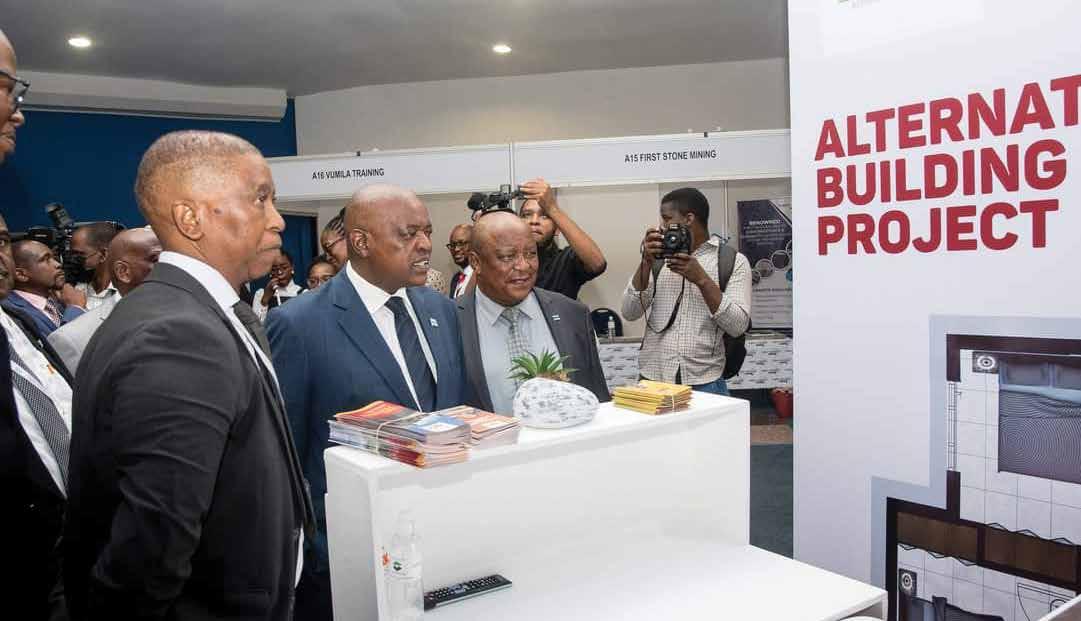

Recently, the Corporation was a pivotal stakeholder at the Ministry of Transport and Public Works 2023 Housing Pitso hosted in league with the private sector. The Pitso was themed “Affordable and Sustainable Housing for All: A Collaborative Approach with the Private Sector.”

The Pitso was officially opened by the State President Dr Mokgweetsi

Eric K Masisi and attended, among other dignitaries, by the Minister of Transport and Public Works Eric Molale, the BHC Board Chairperson, Moemedi Gabana, the BHC Acting CEO, Nkaelang Matenge, and Director of UN-Habitat Regional Office for Africa, Oumar Syllas.

In opening the Pitso, President Masisi said access to adequate housing was integral to an inclusive society and sustainable settlements that Botswana aspires to achieve as espoused in the 2036 National Vision.

The president noted that the Pitso was to find ways to utilise capacity in the private sector to solve the housing shortage.

“The private sector is a crucial partner without which the goal of providing adequate housing to Batswana

cannot be achieved.” “The development of housing estates countrywide attests to the business community’s important role,” said Masisi.

On his part, Minister of Transport and Public Works, Eric Molale, said his ministry’s strategic plan objectives entail quality of life, safety, equal opportunity, policy and legislation, innovation and research, and strategic partnerships.

Molale said the theme of the Pitso was relevant as a house is an investment; it enhances family safety, is a value chain driver, is a nation builder, and touches the basic principle of value addition in economic growth.

The minister indicated that after the Pitso, his ministry was going to finalise the Draft Housing policy as well as present other housing recommendations to the office of the President for consideration.

Moemedi Gabana, Botswana HousingCorporation Board Chairperson, said collaboration was the ultimate platform through which the Corporation can conceive and implement a comprehensive housing strategy.

“Forums such as this one are a great opportunity to dialogue, share experiences, and identify solutions that can better be tailor-made to suit the needs of our people,” said Gabbana, adding, “It is important that we find solutions that are appropriate to our nation and the region.”

Since 2012, Botswana Housing Corporation has delivered a total of 6,762 houses to low-income households, while an additional 687 were delivered to public officers through the Turn Key Development Scheme. From 2017, a total of 3,835 units were delivered under the Destitute Housing Programme. 7,745 houses had been improved under the Home Improvement Scheme since 2008.

HE Dr Mokgweetsi Erick K Masisi

Hon Eric Molale

HE Dr Mokgweetsi Erick K Masisi

Hon Eric Molale

With the inevitable effects of climate change on ecosystems and communities, the business world is quickly realising it can do well by doing good. Sustainability is increasingly becoming a crucial concept in all aspects of a business. A growing number of organisations are considering ways to incorporate a balance among environmental, economic, and social value creation in their operations and business models. But what exactly does it mean to be sustainable in a business?

In Business, sustainability refers to the practice of operating without negatively impacting the environment and the community as a whole. It is the management and coordination of environmental, social and economical

demands and concerns to ensure responsible, ethical and continuous success. An environmentally aware business recognizes its responsibility to the environment and community by contributing to the structure within which it operates through sustainable business practices. Businesses must ensure a long-term vision that recognizes that we cannot conduct business operations outside of taking care of the environment in which our businesses exist.

Apart from making a positive impact on the community and the environment, implementing sustainable business strategies improves a business’ brand image and can help drive its success. Almost every investor today considers environmental, social, and governance (ESG)

metrics to analyze an organization’s ethical impact and sustainability practices. Factors such as a company’s carbon footprint, water usage, and community development efforts are examined by investors to determine if the business would be a worthy investment. According to research by Deutsche Bank, which evaluated 56 academic studies, “companies with high ratings for environmental, social, and governance (ESG) factors have a lower cost of debt and equity; 89 per cent of the studies they reviewed show that companies with high ESG ratings outperform the market in the medium (three to five years) and long (five to ten years) term.” When a business fails to assume the responsibility of sustainability, this is

not only detrimental to its operations but will also lead to issues such as environmental degradation, inequality, and social injustices.

A sustainable business observes “the triple bottom line”, a concept that was first coined in the year 1994 by John Elkington, founder of a British consultancy called SustainAbility. Through this concept, Elkington argues that businesses should set three unique and separate bottom lines, the measure of profit and loss, the measure of social responsibility, and the measure of environmental responsibility. The triple bottom line, therefore, comprises the three Ps, which are profit, people, and

planet. It aims to measure the financial, social and environmental performance of the corporation over a period of time. Thus, a sustainable business earns its true profit by being socially responsible and ensuring a sustainable use of environmental resources.

Why is sustainability important in business?

Sustainability has become an operational and strategical imperative, it helps solve and mitigate ecological, social and economic problems through the strategic management of resources. The growing number of countries announcing pledges to achieve net zero emissions and carbon neutrality is illustrative of why it is critical for

businesses to prioritize sustainability. According to The World Counts, Strip mining is one example that portrays the destruction and harm caused to people and the environment. Also known as surface mining, strip mining involves the stripping away of earth and rocks to reach the coal underneath. If a mountain happens to be standing in the way of a coal seam within, it will be blasted or levelled - effectively leaving a scarred landscape and disturbing ecosystems and wildlife habitat. Due to this invasive and destructive activity, wildlife species face severe impacts resulting from their habitats being destroyed. These effects would not exist if business were more responsible in their operations. Simply put, if businesses don’t act responsibly as members of the global community, the majority of many species will not survive past the 21st century. Environmental Sustainability notes that “the human-caused rate of extinction of species of both plants and animals at present is hundreds of times higher than the natural rate in the past.” It is time to act now. This calls for an urgent need for businesses to become part of the solution, cut down emissions and waste, and contribute towards a healthier and livable planet.

Companies with high ratings for environmental, social, and governance (ESG) factors have a lower cost of debt and equity;

Dr. Wilbert Mutoko

is a Strategist, Professional Speaker, Educator, Coach, Consultant, and Author. He writes in his personal capacity. You can connect with him on LinkedIn, YouTube, Instagram, TikTok, Facebook or send feedback on email: wilbertmutoko@ gmail.com

Finally, the year 2022 is over and congratulations we are now in 2023. We are cognizant of the fact that the world is still going through difficult times, but leaders do not fold their hands and watch. Good leaders are hungry and thirsty to find new ways of doing things. Therefore, this is time for leaders to strategize and raise hopes of their firms to recuperate and/or thrive. However, strategizing is not effective without new information. As J.F. Kennedy once remarked, leadership and learning go hand in hand. Thus, any leader who stops learning is assured of less impact. This article suggests five top books that leaders should read in 2023 to equip themselves with the relevant information and inspiration needed to take their firms to the next level. The books are not arranged in any order of importance.

1. She thinks like a boss: Leadership: 9 Essential Skills for New Female Leaders in Business and the Workplace. How to Influence Teams Effectively and Combat Imposter Syndrome by Jemma Roedel

This book will inspire both new and experienced female CEOs to stand up for their rights and speak out where it is necessary. It gives leaders, including male leaders, the guts to share their thoughts where necessary without feeling any remorse.

The book has empowered leaders across the world to make better decisions and get promoted in firms where it looked difficult or impossible.

3. Start with Why: How Great Leaders Inspire Everyone to Take Action by Simon Sinek

This book helps leaders to ask pertinent questions that in the end bring about effectiveness in the workplace and in business. Some of the questions include why some organizations are more profitable, successful, influential, and innovative than others. Furthermore, leaders are challenged in the book to think about why some firms command loyalty of employees and customers, while others do not. Finally, the book urges leaders to acquire more influence to increase their chances of success.

2. Stop Overthinking: 23 Techniques to Relieve Stress, Stop Negative Spirals, Declutter Your Mind, and Focus on the Present by Nick Trenton

The book empowers leaders to get out of their self-imposed prison of past negative thoughts, feelings, and experiences. The book suggests that most leaders fail to be creative because they over think. The reader learns how to break loose from destructive patterns of thought and become stress free, resulting in coming up with new ways of free thinking.

4. The Power of One More: The Ultimate Guide to Happiness and Success by Ed Mylett

In this book, the author argues that every person is much closer to success than assumed. It reveals that most people look down on themselves and get discouraged that they have not achieved enough. As a leader, you will learn from the book how to use the power of one more strategies to solve challenges and achieve levels of success that you never imagined.

5. Endurance by Alfred Lansing

The book is written in traditional story-telling style. If you love poetic and novel style, this is your book. The author outlines the dangerous voyages of British explorer, Ernest Shackleton in 1914. From the book, you will learn how to endure and come out as a survivor from catastrophic events.

In this article we have looked at five books recommended for leaders to read. It is my sincere belief that these books will add value to your already blossoming library. Remember that leadership and learning are twin sisters. I wish you the best of every success as a leader. Together we will sail through the crisis. Feel free to email me any feedback and/or suggestions for the future articles.

“Leadership and learning are indispensable to each other.” – John F. Kennedy

The phenomenon of child abuse is prevalent all over the world. It is important therefore for parents to do their best to protect their children from any form of abuse. Child abuse ranges from physical to emotional abuse and this can have long lasting psychological consequences to the abused child who might be affected to the extent of behavioral change which might lead to development of a criminal mind which can lead to disastrous consequences which can lead to failure in life and disturbing other people’s lives through temperaments, mistrusting people and general inferiority complexes.

Children are human beings in their initial stages of development, as such, it is important to protect the child’s rights. Ever child has the right to basic nutrition shelter and basic health care services and children should be protected from maltreatment, neglect and abuse. As already alluded to children are human beings growing to become adults in the society and should be treated with the humanity they deserve. This is important because then they will be responsible leaders and responsible citizens who will also be able to nature the future generations. Children must be treated equally and without discrimination of any nature whether based gender intellect or any other form of discrimination.

Every child should be afforded the opportunity to play and participate in activities which suit their age and development stages and abilities. All children must be afforded the opportunity to take part in their culture especially their native cultures like the Tswana culture and any other culture observed in the Constitution of Botswana. It is every child’s right to have a name a birth certificate education that is, to go to school in order to develop their minds whether or not they pass at school or fail is immaterial. It is imperative to take a child through secondary education. It enhances their reasoning capacity and contributes towards mental development to the benefit of the whole community. It helps social interfacing of the child and prevents certain crimes.

The best interests of the child are paramount it means that they can not be summarily rolled back to place certain other interests in replacement of such children’s rights. Matters relating to children will always come first and it is the yardstick to measure whether the children’s rights are being fully observed. Parents must therefore protect their children not because they fear the law but to fulfill their natural obligation of loving and caring for their children. Parents must provide financially towards the wellness of their children in order to properly take care of their children.

It is an obligation for every parent to provide a safe home for the child to live in and being cherished.

It is the duty of parents to protect their children from child abuse particularly if the child is being bullied ill-treated and dehumanized by other children or any other person by calling the child ugly names which do body shaming like shortie, big head, thick lips, fatty, stick or toothpick for the slender and disliked nicknames like monkey chimpanzee, baboon etc, even on social media platforms such as Facebook Instagram and WhatsApp; verbally abused and threatened with violence. Children need to be protected from sexual abuse, sexual violation and rape. In homes where there are instances of family violence, such should be reported to the police or to social workers who can intervene in order to preserve the dignity and well being of the child and for securing the child’s future.

Every parent should see to it that they protect their children to secure the well being of their children. It is a criminal offence to abuse children and as such if parents notice any form of abuse, they must deal with it or report it to the police. Sometimes it becomes necessary to effect criminal procedures to achieve justice for the affected child. The High Court is the upper guardian of all minors, it will definitely step in to protect the lives of all children.

By Coach Princess

By Coach Princess

The beginning of the year usually comes with financial challenges. Some of the challenges are self-inflicted, while others are circumstantial. self-inflicted due to careless spending over the holiday season. circumstantial due to factors usually beyond one’s control, for example, school fees, taking care of ill relatives, and correcting failed projects. Whatever the case may be, we ought to raise our heads high and do the best that we can to get back on our financial feet. In this article, we consider some ways to keep ourselves financially sane at the beginning of the year.

need to re-arrange the payments, get more income, or borrow. Furthermore, it is advisable that you make a budget for the rest of the months so that you can clearly see how the whole year will look financially.

Re-arrange payments

means making more money by plaiting hair or designing logos. Preferably, it is important for you to earn money using ways that are familiar to you. In January, you cannot afford to do any guesswork lest you mess up the whole year.

feedback, contact Coach Princess by email: coachprincess5@ gmail.com

The starting point for every journey is planning. Similarly, when it comes to finances, it is essential to create an annual budget. Write down how much money you have now and how much you expect to have in January. For example, if you have P1500 in your hand and your salary is P15, 000, add the two. That is a total of P16,500. Then, write down how much money is required to cover each payment, such as rent or mortgage (P6,500), groceries (P2,500), utilities (P600), school fees (P2000), a haircut (P600), transportation (P1,000), and creditor payments (P5,500).

Total payments: P18,700.

That means the cash inflow of P16500 is less than the spending of P18,700 by P2,200. You will

You may have to reconsider which payments to make first so that you do not remain in trouble. You could negotiate with the school so that you pay half the school fees at the end of January and the remainder in February. You could also negotiate with the creditors so that you delay paying them until a later date. Never run away from creditors, but rather negotiate with them. Furthermore, if possible, you can postpone the hairdo and plait a simple hairstyle for now.

Find ways to earn extra income. Alternatively, you can find ways to earn extra income. It depends on what you can do. For some, it could mean doing piece jobs or selling designs or earning some online money; for others, it

Another way to ensure your financial situation does not get out of hand is to cut unnecessary spending. For example, avoid unnecessary journeys that waste fuel, agree to share a car with workmates where possible to reduce transport costs, carry homecooked food rather than buying food at work, and let your children carry food to school rather than buying food and drinks at school.

I hope that this article has encouraged you to handle your finances better. I hope the article makes a difference in your life. We'll see you in the next article. Stay strong and safe.

"Money, like emotions, is something you must control to keep your life on the right track." Natasha Munson

Virtual markets supported by the growth of e-commerce have inspired the Botswana Export Manufacturers Association (BEMA) to grow its multi-vendor e-commerce website designed to create an online marketplace simultaneously used by both sellers and buyers.

Developed in 2020, the platform provided a safe and opportune way for people to buy and sell products virtually during and after COVID-19 lockdowns. It has now passed its pilot phase and is set for expansion.

It has grown to become one of Botswana’s leading online shopping platforms. The growth is both in terms of the user base and in the range and number of products on offer.

“So far, the platform has sold over 1500 products and generated revenue of over P350 000 from August 2020 to December 2022,” said BEMA Chief Executive Officer, Mmantlha Sankoloba, adding, “We aim to grow the revenue to monthly sales of P1 500 000 by increasing the product offerings, inviting more sellers, and marketing the platform locally and internationally.”

The online store allows vendors to operate as separate shops with a dedicated area of the store backend where vendors can manage their product catalogues, shipping or courier, their orders, and payment transactions.

Sankoloba said the platform is the most efficient and lowest-cost sales channel in the African market.

BEMA Store currently sells downloadable files such as e-Books, music, movies, and videos, as well as physical goods.

“The leading category of local products sold on the platform is music, both downloadable and physical CDs, followed by fashion or clothing,” said Sankoloba.

And so far, BEMA Store has attracted both local and international buyers. The international buyers are from South Africa, Zimbabwe, Malawi, Norway, Europe, China, and the Americas.

Supported by Absa through the Visa payment platform, BEMA intends to onboard more payment options such as PayPal, coupon payments, and EFT.

“BEMA Stores is currently working on integrating with the Pan African Payment Settlement System (PAPSS) developed by AFREXIM Bank in line with AfCFTA,” said Sankoloba.

Sankoloba believes that BEMA Store is a perfect solution for selling, as it offers sophisticated e-commerce tools with a minimum of investment to clients.

“We have introduced new effective marketing campaigns;

goods on the site are exposed to a high volume of traffic. “We believe that by selling on the BEMA Store e-commerce platform, sellers can benefit a great deal,” said Sankoloba.

She highlighted that through BEMA Store, sellers get expanded access to the global market without any geographical limits, and customers can browse your store at any time and order goods 24 hours a day, seven days a week.

“Establishment and operation costs are much lower because an online store does not require a physical shop and can be operated from any location at any time. In addition, compared to traditional physical stores, other costs such as marketing and other fixed costs are almost nonexistent.”

Meanwhile, BEMA is collecting data from its online customers that will be analysed to gain a better understanding of consumer buying preferences and demand. Based on this, marketing activities will be conducted to improve the transaction rate of orders.

Strides Writer StridesFROTCOM'S DRIVER APP

Chat feature that allows real time communication between the driver and the office.

FROTCOM'S NEWEST SOLUTION TO OPTIMIZING COMMUNICATION BETWEEN THE OFFICE AND YOUR DRIVERS.

Access to forms which can be filled, edited and sent to the office via the app.

Access to driver behavior to help improve driving patterns.

Absa Bank Botswana has won four awards at the 2022 Global Banking and Finance Award.

• Best bank for Financial Inclusion Botswana