Grow forward with us in Reverse.

See for yourself why Fairway is turning heads in the reverse mortgage industry and leading the way forward.

Fairwayreverse.com/careers

Steve Jacobson Founder & CEO

At Fairway Independent Mortgage Corporation, we provide our team members with the very best in training, support, tools and resources to empower them to thrive in our positive, inclusive work environment and achieve new levels of success in their careers.

The reverse mortgage loan product—one of a variety of loan products we offer to meet our customers’ needs—is respected here, as is our Reverse sales force, and you will feel valued for your contributions. We consider reverse mortgages to be a vital piece to solving the retirement income puzzle in this country, and we are widely recognized for being a powerful and active advocate for them.

We are proud of the growth, culture and success of this company, and we hope you join our exceptional team.

Steve Jacobson, CEO

Steve Jacobson, CEO

2

It’s not about the loans we do; it is about the hearts we change and the people we help.

— Steve Jacobson, CEO

At Fairway, we are dedicated to creating a fun, enlightening environment for our team members and clients alike. We aim to provide great customer service, speed and support by being kind, humble and giving 100% every day. It’s what we do and who we are.

Contents

A Message From the CEO 3 Table of Contents

Join Our Winning Team 5 Core Values

2

4

3

6 Support 7 Training 8 Marketing 10 Technology 11 12 Referring and Originating Fairway Gives Back 3

Introduction

3 (FY 2022 / Source: Reverse Mortgage Insight)

• High-quality loan processes and procedures

• Early delivery of closing documents and loan funds

• Some of the fastest turn times in the industry

• Outstanding customer service

• BBB rating of A+

• Competitive and flexible pricing

• Employee Stock Ownership Plan (ESOP)

• Generous compensation plan

• Comprehensive benefits package *Includes satellite locations

$42+ BILLION VOLUME IN 2022 2 RETAIL HECM VOLUME LENDER

4

LICENSED IN ALL 50 STATES Since 1996 YEARS OF SERVICE, SPEED & SATISFACTION

Join Our Winning Team Over

Expect the best.

7

6,800+ TEAM MEMBERS 2,000+ PRODUCERS 650+ BRANCHES* HECM FOR PURCHASE VOLUME

Core Values

Fairway’s Core Values define who we are and what we strive to accomplish every day. The values define how we work, how we interact with each other and guide us in determining how we best serve our customers and team members.

1. Humility First

We are grateful for the opportunities we have and continue to work hard, always striving to be better and do better.

2. Foster Growth & Knowledge

We understand the importance of education and training and extensive onboarding support for new team members—and we deliver access to discounted industry events further nurturing professional growth.

3. Have Fun

We enjoy work and the people we work with. We always strive to have fun each and every day.

4. Create an Amazing Experience for You

From the day you walk through the door as a new team member, it’s our goal to provide a smooth and seamless transition for you—and your customers and business partners—to ensure an amazing experience.

5. Speed To Respond

This is the mantra of Fairway’s Support Teams, which continuously distinguishes us in the marketplace.

6. Seek Wise Counsel

We value the input and perspectives of others, so we can make the best decisions possible.

7. Respect, Listen & Stay Balanced

We encourage open communication between our Reverse originators, also known as “The Street,” and our support staff.

8. Commitment To Serve

We are committed to serving our branches and origination teams, allowing them to focus on originating and closing loans.

9. Consistent, Honest Communication

Communication to our team members and management is fully transparent, with daily posts being sent to communicate events, trainings, underwriting guideline changes, new programs and more.

10. Family Focused

We are committed to protecting the wellbeing of our team members and consistently promote a healthy work/life balance.

5

Support

We are committed to providing our loan officers with exceptional customer service that flows to the end user—providing an outstanding home loan experience for all.

Join us as a reverse mortgage loan officer and receive full corporate support from our dedicated Reverse team, which includes:

• An Experienced National Executive Team

Fairway combines the experience of individuals who have decades of experience in the HECM space with forward mortgage veterans who understand the need for ease of use and speed to respond.

• Regional Executive Support –Reverse SVP Team

Top industry professionals and originators serve in regional SVP roles to assist Fairway reverse originators in growing their businesses. Providing mentorship, coaching and earned experience, the SVP’s focus is to help you increase your volume and your revenue.

• Regional Reverse Processing Centers

The Reverse Processing Centers are dedicated to providing a smooth loan process and having some of the fastest turn times in the industry. At Fairway, nothing is more important than closing well and on time.

• National Sales Support

From doc prep to help navigating complex borrower scenarios, your Sales Support Reps will walk you through every step of the loan process to ensure you and your borrower the best possible experience.

• Reverse Scenario Support

The Reverse Support team is your go-to resource for all reverse mortgage guidelines and scenario questions for files that are not currently in process.

• A Dedicated Reverse Underwriting Team

You’ll have direct contact with your Reverse Underwriter throughout the process – this is a Fairway standard. Together we create better loans and easier customer interactions.

• Business Development Assistance

Subject matter experts in business-generating channels, from financial planners to real estate professionals and banks and credit unions, will help you coordinate a personalized strategy and direct you to the resources you need to achieve your goals in those channels.

• Reverse Marketing & Reverse Events

The Reverse Marketing team is your one-stop shop for all things marketing—from compliance and general marketing advice to copywriting, digital advertising, graphic design, compliance and much more. The Reverse Events team will help you schedule, develop and follow up on any of your in-person or webinar meetings. These teams are ready to work with you to help bring your ideas to life—with the speed and service you deserve.

6

Training

At Fairway, we view training our employees as an investment, not an expense. We truly care about the success of every one of our thousands of loan officers. We invest heavily in products, services, training and technology to give our loan officers a competitive edge in the mortgage loan market.

Become a Fairway reverse mortgage loan officer and experience a culture of leadership, cross-functional collaboration and learning that sets the standard.

You’ll have access to:

• One-on-one coaching and training from some of the most knowledgeable and experienced professionals in the reverse mortgage industry: Tane Cabe, Tom Evans, Craig Barnes and more!

• Weekly educational Zoom calls geared to help you grow your business in the Reverse space. You’ll learn about the intricacies of the reverse mortgage product, current industry trends, marketing updates, sales tips, collaboration strategies and much more.

• Fairway University, our digital platform where training can be completed anytime, anywhere.

• IGNITE, our own leadership and sales coaching company, where top-producing Fairway loan officers and managers help coach you up to the next level.

7

Marketing

At Fairway, we provide you with access to marketing resources that are second to none. Our team of marketing professionals is committed to your success and will work with you to develop and implement winning marketing strategies.

You’re going to love working with our in-house creative team. If you can dream it, they can create it. Custom collateral that complements your marketing strategies is always just an email away. You can also access our extensive library of existing marketing collateral and customize it as your own in a flash.

• Brochures

• Business cards

• Emails

• Postcards

• Presentations

• Flyers

• Videos

• And more!

Plus, our marketing team works directly with the legal department to ensure all collateral is compliant and within brand standards.

Full-service Creative 8

Free Microsite

All Fairway loan officers and branches receive a free website maintained by Fairway and optimized for search to help you drive new business.

Social Media

We help you get set up and trained on social media so you can maximize the effectiveness of your efforts while remaining in compliance.

Marketing Support for Your Centers of Influence

Grow your relationships with financial advisors, real estate professionals, financial institutions and homebuilders by leveraging our playbook of proven strategies.

Nurture Track Emails

Our turnkey, automated email series, which drive to our reverse mortgage explainer videos, make it easy for you to stay top of mind with your B2B and B2C contacts.

Events in a Box

Love hosting events but don’t love handling the majority of the prep work? “Events in a Box” offers turnkey event planning in your local market. You can select from a menu of events that are fun and educational to maximize connections and referrals (e.g., Sips & Tips, Lunch and Learn, Brewing a Better Retirement, Reverse the Day and “Retire Right” Cinema). Features marketing support that includes a complete suite of flyers, emails and social media ads to drive attendance.

9

Technology

At Fairway, we listen to the wants and needs of our loan officers, clients and associates. Our platforms are designed to provide ease of use to everyone involved in the reverse mortgage experience – from the customer to sales to ops.

We also invest heavily in marketing technology resources to support our reverse mortgage loan officers:

3 Search Engine Optimized Fairwayreverse.com Website Platform

3 A Variety of CRM Options and Support

3 Direct Digital Advertising Opportunities To Drive Leads for High Performers

3 Reverse Marketing Hub/Educational Platform

3 And Much More!

RMI—Reverse Market Insight

RMI is free of charge for all Fairway reverse mortgage loan officers as a tool to discover the available market opportunity in each market from a nation, state or zip code view. Help your branch drive critical business decisions with the reverse mortgage industry’s premier data and analytics provider. RMI will show you that we were the country’s #2 reverse purchase provider in 2022.

Customer/Partner Interaction Platforms

Fairway Reverse offers a variety of CRM solutions to suit your needs, including marketing automation, templated content, collateral customization and more. Group and personalized training and support are readily available, as well as integrations into the platforms you need for success (Outlook, LOS, BombBomb, Twilio and many more.)

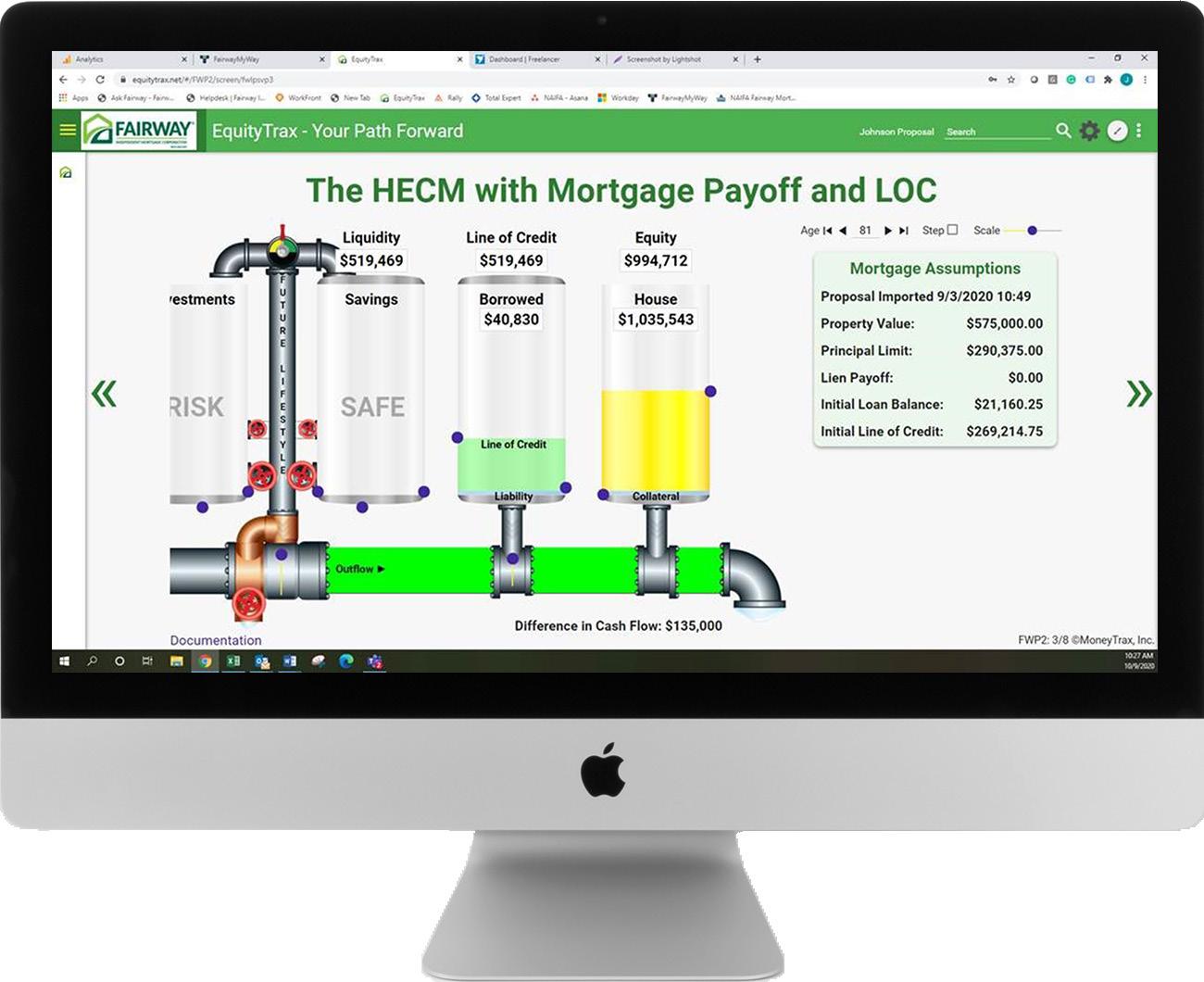

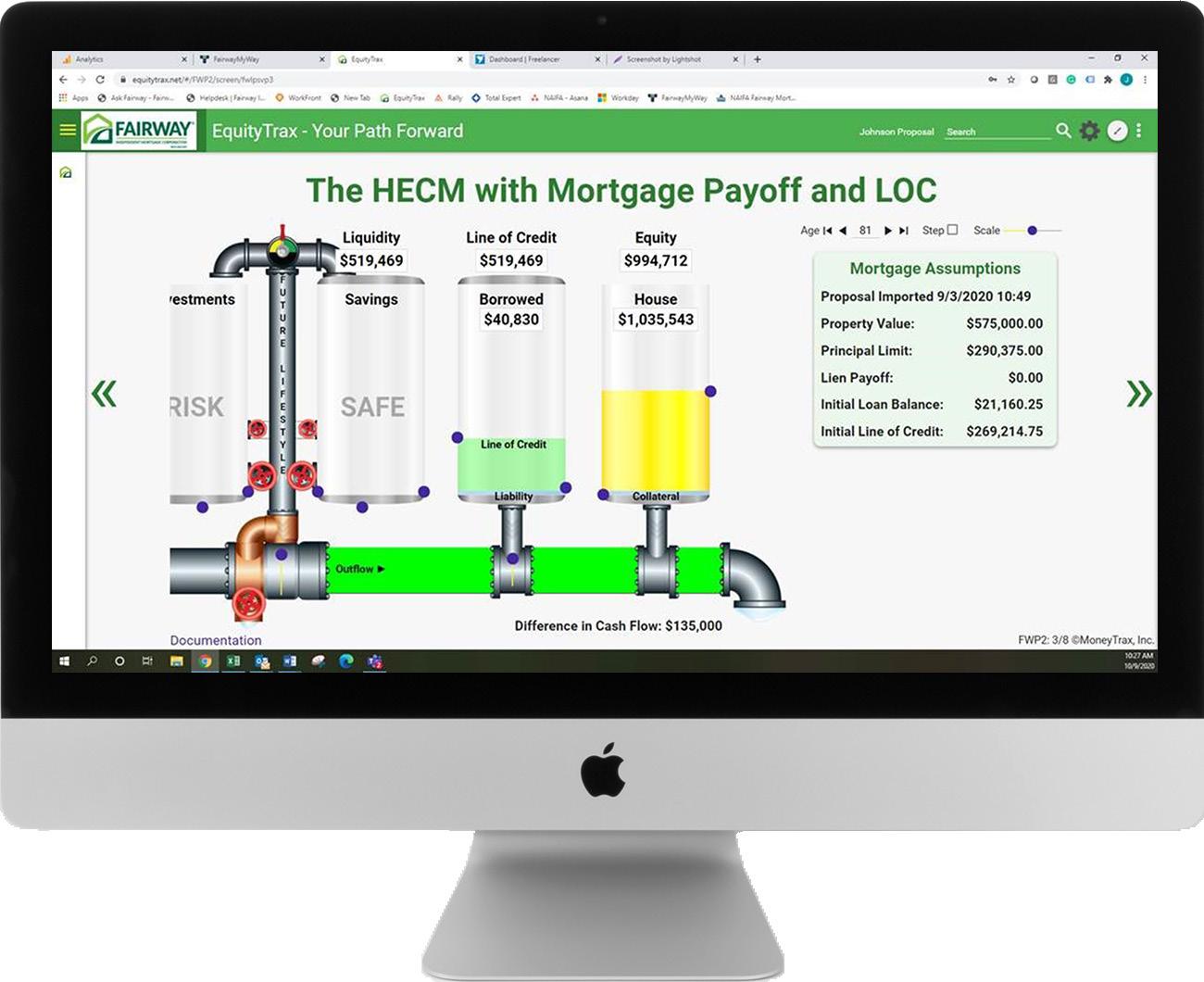

EQUITYTRAX

EquityTrax

EquityTrax is a visual, strategic home equity planning tool designed to definitively show consumers how best to leverage housing wealth. Fairway has exclusive rights to the EquityTrax System, and we are now the preferred lender of choice for the Circle of Wealth® Advisors nationwide. It’s a simpleto-use, consumer-centric program that lets a prospect quickly grasp the complexities of a reverse mortgage and clearly shows how they can achieve the future outcomes they want.

10

Referring & Originating Reverse

Whether you’re looking to originate reverse mortgage loans or refer them, Fairway has great options for you.

Remember, sometimes your past older-adult clients will have moved to a state you are not licensed in. Our referral program allows you to always serve your clients well, wherever they are.

Ultimately, we want to give you the flexible options you need to make a big difference in the lives of older-adult homeowners and homebuyers — so it’s a win-win for all.

Originate Reverse Loans

3 More Intensive Training

3 Must Pass Assessment Test

3 No Cost for Training

3 Highest Effort

3 Larger Cut of Net Revenue

3 Proven Process

Referral Earnings Potential Per Reverse Loan that Closes:*

• Total of 25% of net revenue earned on the loan

• You receive 15% and your branch receives 10%

• Average net revenue per loan: $8-$13k

• On average, your cut could be $1,500 - $2,500 per loan

11

Loans

Basic Training 3 Not Required To Take Assessment Test 3 No Cost for Training 3 Lowest Effort 3 Smaller Cut of Net Revenue 3 Proven Process

Refer Reverse

3

*You may be eligible for a Fairway referral fee if you are a licensed Fairway loan officer and refer a client to another Fairway licensed loan officer, which results in a closed and funded reverse mortgage loan with Fairway. Restrictions apply to closed-end/fixed rate reverse mortgages. Subject to federal and state regulations on loan originator compensation. For questions about the loan referral fee, contact the LO comp team or check Fairway’s Loan Referral Policy.

Fairway Gives Back

One of the most amazing things about

Fairway is the heart and willingness of its employees to give back. Fairway is a culture that has evolved entirely by the people who work within it. Initiatives such as Fairway Cares and American Warrior Initiative (AWI) allow Fairway to make a positive difference in our communities and in people’s lives both within and outside the company.

12

Fairway Cares

Fairway Cares is a program under the Fairway Foundation, a 501(c)(3) organization, providing individuals, their families and caregivers with hope, encouragement and relief in a time of loss.

Fairway Cares is not only a movement but a group of people dedicated to encouraging and helping those most in need. Whether it’s sending a family on an all-expense paid vacation to Disney World because it’s the wish of their little boy with cancer, assisting with childcare and medical expenses for a Marine veteran and his wife who has stage-4 cancer or donating to the people in the South who have lost everything in the flood waters, our Fairway team goes above and beyond to help those in need.

Through the Fairway Cares Foundation, we also developed the Hidden Beauty Retreat and Steph Angel House to give people who are going through pain and hardship a special place to enjoy a time of peace and solitude.

The good and giving people of Fairway go above and beyond to show they care. They give their time, their money and their resources all because #FairwayCares.

To learn more about Fairway Cares, please visit www.FairwayCares.org.

13

Interested in joining the Fairway Family? Contact us today. Fairwayreverse.com/careers Join the most forward-thinking reverse mortgage team in the country. Copyright©2023 Fairway Independent Mortgage Corporation. NMLS#2289. 4750 S. Biltmore Lane, Madison, WI 53718, 1-866-912-4800. This is not considered an advertisement as defined by 12 CFR 1026.2(a) (2). All rights reserved. Equal Opportunity Employer. Equal Housing Opportunity.

Steve Jacobson, CEO

Steve Jacobson, CEO