F&C Magazine

MRW I read some of the content posted on F&C in 2022!

MRW I read some of the content posted on F&C in 2022!

What a year 2022 has been!The biggest news that affected our industry IMHO was that the REM Review was not proceeding under the new Labour government.The collective sigh of relief was palpable. Brokers were doing the right thing, the powers that be were shown the data to back up that argument, the new government agreed. End of story.

How good is it to do “in person events” again?

Apparently you guys like Whiskey!

Below is from our Melbourne event.

Broker Market share also hit 71.1% - the highest level … EVER! Well done!You all deserve a pat on the back. Next year, your clients will need you more than ever as we head into unsettling times. We will have a whole generation of homeowners (and brokers) who knew nothing but rates going down.As we approach what many call a FIXED RATE Cliff, many people (about 30% of mortgage holders) won't feel the effects of increased rates till later next year.

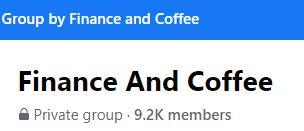

Of the total population of 9,208 members (as at 1 December 2022), 8,065 have logged on at least once in the last 90 days. However, the daily number of logged in members is very interesting.The dips are the weekend (Sat or Sun).The peaks being around middle of the week.

Whilst people log on to see what is happening in the group, the activity (Questions, comments and Likes) naturally corresponds with the peaks,Thursday approx 8 PMAEST being when there seem to be a lot activity.

If you are not contributing to the community by way of asking questions or providing advice, what the bloody hell are you doing on F&C? We now have the ability to ask annoying questions - as in no one except the admin team knows who the poster is. This allows newbies to ask questions without fear of judgement or negative replies.

We do something that is counterintuitive to most “groups” in that we regularly “cull” our membership. Did you know we remove approx 200 members every month?As a result we have maintained a membership of approx 9,100 for the past 2 and a half years.

1: we haven’t seen any activity from them in a long time (90 days) and therefore consider them not to be contributing in any meaningful way.

2They are no longer a broker or in the industry.

3:Their employer doesn’t like them to be on here. So speak to them about this.

4: Dien just doesn't like you and this is a perfect time to do it.This is a popular one and surprisingly Dien gets offered loads of recommendations on whom to cut, it’s quite funny.

Did we mention that Brokers achieved 71% market share this year? Despite all the headwinds from channel conflict, to negative media stories, brokers came up on top because customers choose to vote with their feet.

Granted if we looked at where the loans were placed, the BIG 4 still tops, the point however is that the customers choose to approach the broker first to place said loans speaks volumes! Why have bank’s lost customer loyalty year on year?

Another big issue to arise in 2022 is the Cost of Living Pressure on everyday items due to supply issues. Interest rate rises also added to the headaches. We now have a whole generation of homeowners having to deal with rate rises for the very first time. “Highest rate inTen years”… “Fixed Rate Cliff” are readily dragged out as clickbait stories.

Without a doubt there will be some who will find themselves in hardship next year. But will this drive more customers to brokers or back to the Banks’Direct Channel?

Around about the 21st of March, the government of the day announced that REM Review wasn't going to happen. This was right before the election. Thankfully the new Labour Government also committed to the same thing. Why fix something that was not fundamentally broken in the first place?

Since the Royal Commission, Mike Felton has been working long hours to represent the industry. He never really stopped working until the government (as well as the then opposition) announced that the REM Review was no longer needed. With the industry now in “calmer” waters, Mike announced his retirement in May.

Despite all the headwinds…Broker market share cracked the 70% level and went to 71.1% between July and September 2022.That is huge! Customers voted with their feet?Absolutely!

Big organisations got hacked this year.This calls into question… how secure are brokers’own files? Do you have the appropriate insurance to cover you in case you got hacked?

In 2022, the RBAincreased interest rates 7 times. In real terms, consumers have not seen borrowing costs this high since 2008! RBAGov comes out and admits they “got it wrong” and didnt think people took their predictions seriously when getting a mortgage. More “pain” is predicted in 2023.

Have you noticed how much your coffee has gone up recently? During the period September 2021-2022, headline inflation inAustralia shot up by a huge 7.3% TheABS also reported that the cost of non-discretionary items increased by 1.8% in the September 2022 quarter alone….This is crazy!

Amyriad of factors has lead to some items going crazy expensive (remember the $10 lettice?). We had floods that wiped out crops and other supply chain issues locally and internationally that have all caused massive price increases across the board. This all adds to Housing Stress.And just in time for Christmas? ….APotato shortage!

35% of housing Debt is inside a Fixed Product.APRILNOV 2023 will create a high level of mortgage stress / Arrears as most of the low 2-3 year Fixed loans revert to the SVR at the time.This will no doubt bring more mortgage stress and cost of living issues to mortgage holders..

ixed Price Building Contracts + cheap credit allowed for a flurry of activity. However, all that came to a screeching halt when key building materials such as steel and timber ran into supply issues and increased by more than 40 per cent in one year. Its no surprise then some building companies collapsed.

Great for customers, who would say no to that? But have the banks created a “Churn” beast that they dont actually know how to control because theyALLfear to lose market share to their competitors?

This also calls into question how much a loan actually costs the bank to set up? So why is Clawback in place?

Why do lenders do what they do when brokers come to them and ask for pricing so they can keep their customers there? Usually the answer is “no”. But once a discharge is submitted, retention comes in to try and keep the client, often agreeing to the same terms requested by the broker initially!

Despite the negative press, Channel Conflict, Cashback Offers, Clawback, being paid sometimes 60 days post settlement and sometimes shit turnaround times…. Brokers still achieved over 70% market share… which means you are doing something right by your customers.

ALot has changed, but a lot has stayed the same.

“Search and you will find”, while most know that there is a “keyword” search function, some new to the community (or new to FB) still don't realise that such a thing exist.As a result we see the same questions being asked.

Granted the “search is not perfect”, it is still interesting that the same questions keep on popping up year after year.

It is only when we are brave enough to ask questions that we are able to learn.

Unfortunately in today’s digital era, nasty replies are common place leading to people being afraid to ask questionswhich is sad.That said, the best thing to happen to the group this year is the ability for you to post as “anonymous”. Did you know that you are 40% less likely to get a negative reply?The following are the most commonly asked questions in F&C in 2022.

Who can do 85 - 90% No LMI?

Add to that they are either teachers or medicos or allied health.

Which lender offers a rebate?

Fun fact: one MM is offering as high as $10k on a $2m loan (as we go to publish).

Which lender allows casual income less than 3 months?

Or new role, less than 3 months. Or OTin new role.

Which lender will honour the rate? In a increasing rate market, brokers are rightly concerned about not only the rate but the loan size at pre-approved stage.

Looking at changing aggregators.

Usually done as an Annon post.

Lender channel conflict by their direct team to customers or via incentives to referrers where up to 0.4% is offered for leads.

Or getting deals done that didnt pass servicing with brokers.

Who does fully assessed Pre-Approvals?

Who will do Expat / Non Resident Lending Or Income from Overseas?

Which lender doesnt credit score?

Or a variation of clients having a bad score but still wanting a Prime rate.

FHLDS - who has spaces left?

Which lender has increase their rates following the RBA announcement?

Business loans in servicing. Who will discount them? Or business add backs.

What will 2023 bring? If you have been following the news, a common theme is that more pain is around the corner.

Interest Rates are expected to continue to climb to curb inflation. Cost of Living wont get any better as supply chain issues do not look like they are going to be fixed any time soon. More builders will probably go under.The dreaded Fixed Rate Cliff is expected to have a huge impact on those coming off historically low Fixed Rate loans.This could force some homeowners sell up. Which then in turn will put downward pressure on home prices.

In summary: a lot of bad shit is in store. But it all cant be doom and gloom right?

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur..

At the end of the day, if someone sells, someone will still buy property, finance a business loan or get a new car.At 71% market share, it's a good chance they will do it via a broker.

Tech upgrades and new players will come into the broker space because “speed” will be on everyone’s mind. Given the increase in paperwork for each loan, new players will try to deliver to win the hearts and minds of both broker and their customers.

We asked a few of our friends about what 2023 may look like. Each has a different perspective on how things might turn out given their background.

Twelve months ago, no one was predicting official interest rates would be rising at all during 2022. Even the Governor of the Reserve Bank ofAustralia (RBA), Dr Philip Lowe, was repeatedly stating that he didn’t see economic conditions would force the central bank to increase its then cash rate of 0.1% until at least 2024.

The Russian invasion of Ukraine in February, 2022, changed the global economic ball game and since then central banks around the world have been lifting their official rates to combat inflation, with the RBA’s cash rate finishing the year at 3.1%.

I believe interest rates will continue to rise in the first half of 2023 as the RBAmaintains it battle to bring inflation under control and back to its target range of 2-3%. We should see a short period of stability once this milestone is hit, then I anticipate a small reduction towards to end of the year as the RBAreleases some monetary pressure once they have a handle on inflation.

In this climate of rising interest rates, house prices will continue to fall and should bottom out at 20%. This is slightly less than the overall gains from September, 2019, where we saw an increase of almost 25% during the COVID-19 peak.

The rental market will continue to be tight with housing supply still a massive issue due to the shortage of workers in the construction sector. With the federal government further opening up borders, the migrant inflow will add to the pressures on the rental market.

Consumers looking to purchase property or refinance will look for the best possible deal as they try to save as much money as possible in a tightening market. This will lead to a large increase in refinancing, which we are already starting to see.There may be a desire to look to cheaper and non-mainstream brands to achieve this.

In these situations, brokers will see opportunities to assist investors and first home buyers. Investors will be looking to get into the market due to the increase in demand for rentals with low vacancies and good returns exacerbated by increases in migrant workers. First home buyers will see an opportunity to enter the property market with reduced house prices and consequently reduced capital requirements.

When it comes to trends in home and business lending, I expect to see continued growth from the non-major banks in 2023 as customers and brokers seek real choice.

While we know brokers are always aiming to present loan options that best suit their customers’needs, refinance opportunities will be especially important in the year ahead as fixed rates expire.

And a main component of any future trend is evolving technology – in this case, technology that supports great advice.

My view is customers still want the tailored, expert advice from brokers that is so critical, but technology will continue to support a great experience.

Digital processes will be key in helping brokers identify opportunities for their customers, as well as ensuring that customers have a streamlined loan application and approval process when securing their desired home or business loan.

This year has been a year of incredible growth and improvement for us at Suncorp Bank, and we couldn’t have done it without continuous feedback from our broker partners.

On behalf of Suncorp Bank Broker Partnerships, I’d like to wish you and your families a safe and festive holiday season.

To finally be able to see each other in person has been an absolute highlight for me.

But, when it comes to credit reporting, we are seeing a lot more people getting in trouble due to the cost of living going up, and simply not keeping up with their repayments.

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur..

I predict that with the 35% of home loans that are currently on a fixed rate switching into variable in 2023, that we are going to see more and more families struggling with their repayments, and, in turn, more and more bad repayment history information

reports.

During the holidays, I would highly recommend that brokers go through their fixed rate client lists, and make sure that they are all going to be OK moving into a higher variable rate…before they get in trouble.

The flow on effect of higher living costs brings me to also predict that we will see the need to remove small defaults more and more heading into 2023. So far, we’ve gotten away with ignoring small energy defaults etc with letters of explanation.Towards the end of this year though, most of our clients are just needing 1 small default under $1000 removed, just to be able to get out into a lower rate loan.

Finally, I predict that lending is going to get tougher in 2023, from a credit reporting perspective, with more and more Lenders checking ALL credit reports, not just Equifax. Remember, the VERYFIRSTSTEPyou need to take as a broker is to check credit reports. And it’s not just Equifax anymore.You need to be checking Illion, Experian & Creditor Watch.

N.B We’ve seen a lot more negative listings on Creditor Watch reports that are not on the Equifax reports, and brokers have wasted weeks on getting a loan prepared, only to have it knocked back because they haven’t checked Creditor Watch.

From me and the entire team at Credit Fix Solutions, we wish you an amazing Christmas and a prosperous NewYear ahead.

Here’s my view on 2023 and predictions:

● Broker market share to continue to grow: Broker market share to continue upward trajectory and hit 75%

● Investor market opportunity to increase : Investor market is certainly an opportunity for brokers and borrowers as there is a lack of property stock in the market …. Basic supply and demand, meaning high demand and low supply will drive up the dollar value of rent. Refinance market opportunity to increase: Refinance market is certainly another area of opportunity for brokers as borrowers increasingly come out of historically low fixed rate periods.

● Continued emergence of ‘BoutiqueAggregators: Market is ripe for continued emergence and rapid growth of ‘BoutiqueAggregators’due to the significantly higher ‘value and service proposition’provided. For Solo brokers – Wellbeing focus: Solo brokers to join forces with others to share costs, reduce stress levels, leverage best practices and improve operational efficiencies/infrastructure whilst focussing on their own wellbeing and fostering a greater sense of belonging.

● Inflation: Inflation to be bought back in line to a reasonable level of between 3.5%4.0% as a result of increased interest rates and curbed spending.Acceptable level of between 2.0% - 3.0% to be achieved in 2024. Interest Rates: RBAofficial cash rate to peak at 3.85%

● Software/CRM’s: Further enhancements and integrations to enable greater simplicity. Tech will continue to be key!

Outsourcing to a VAhas remained in strong demand by Brokers during 2022, due to the cost effectiveness. Here is my predictions in outsourcing for 2023:

Data Security and CyberAttacks:

In the wake of multiple high profile cyber-attacks and data breaches in 2022, Brokers andAggregators alike are paying careful attention to Offshore Outsourcing VirtualAssistant (VA) providers to ensure they can do everything to keep client sensitive data safe and secure.

Best practise in this space is often created as a result of the company working within ISO 27001 guidelines, however there are some key areas that Brokers should ask about when considering working with an outsourcing provider:

Storage of Client Sensitive Date: This must remain onshore to comply with Australian Privacy Principles 8.1. Understanding how data is handled to avoid incorrect storage is important.

Personal Device Policies: Best practice is to ensure that your VAis not able to access or use their personal devices at any time while working.

Multi FactorAuthentication: Should be always enabled for systems access.Avoid the use of mobile numbers, as it may be easy to port an international number without authorisation.Authentication apps are best used in this Instance.

Working in an Office: Although the world has adapted to WFH, it can be fraught with compliance risks when outsourcing.The only way to be confident is to use a provider who runs all operations from an office environment, with appropriate security measures in place.

Brokers are looking carefully at process and workflow to build more efficient Businesses:

Many Brokers are aware that to get the most efficiencies out of their day, they need to establish processes and workflows. Not only will this help them understand where time is being spent, it may also create the opportunity to improve processes to get more time back for business development or personal time.

Solo brokers who don’t have the time to create processes are turning to VAproviders like Affordable Staff more often, due to their experience in hiring high quality staff, but also to have additional resources in the business to document processes.This is a trend that will continue strongly in 2023 as business owners focus on operational excellence as a growth strategy.

The objective of this article is to share my experience and intel with industry colleagues, which will hopefully provide a better perspective of what may occur over the next 12 months through a wider lens I forecast that there will be several critical factors that will challenge our industry over the next 12 months.

Australia and other accounting bodies have been advising their members not to provide any certificate, letter or assessment attesting that their client will be able to meet their financial obligations under a credit contract unless they are appropriately licensed under anACLAlso, PI insurers have given notice to accountants that they will not cover claims where the accountant is not appropriately licensed under anACL.

2. Climate Change & War: Will continue to have a serious impact on logistics and raw

produce supplies.Acurrent example is with the potato shortage & other agricultural raw products. Due to the colossal damage to the planet due to extreme weather, insurance premiums have skyrocketed placing additional pressures on SME’s.

3. Balance sheets for banks: Bad debt or residual of non-performing COVID debt will come to fruition in 2023. Many lenders have assistedAustralians with COVID relief on loan repayments.This will now cease, resulting in non-performing debt being called up by the banks.

4. Retail/office vacancies: Commercial vacancy rates are at an all-time high in Australia. Commercial property investors will continue to have challenges with vacancies, which will ultimately impact their ability to repay debt.

5. Inflationary pressures

An ongoing challenge during 2023, ultimately affecting the cost of doing business.SMEs will also experience pressure from rising wages, with industry groups demanding that wages keep up with inflation.

6ATO: Outstanding tax debt levels are at an all-time high, exceeding $59billion. I believe that this issue will only get worse during the 2023 year. Directors’Penalty Notices are escalating dramatically in response to increased outstanding tax debt levels. I see this all further leading to enormous stress and pressure on SMEs.

The following are some of the critical components that I believe are currently making it more

difficult for builders to remain solvent:

- Supply chain issues are delaying the completion process for construction, which in turn means higher holding costs and lower profits

- Inflation, making cost of materials have a negative impact on the profitability of builders

- Labour costs are also increasing, due to a shortage of qualified staff and other industry challenges

- Rapid increase in interest rates puts additional pressure on builders

The combination of these factors will result in dramatic increases to construction costs and increased liquidations in this industry during 2023.

Many residential and commercial loans will be coming off fixed rates during 2023, causing enormous pressures on individuals, businesses and families. I am concerned that, if the RBA has a greater influence over the economy than is necessary, the current rate hikes may become too aggressive and potentially damaging.

9. Impact of cash-back offers Will lead to a spike in refinances. Many individuals and families will be facing the full brunt of interest rate hikes during 2023. For families to cope with these hikes, they will be looking for upfront cash offers from banks to help with their cash flow.This will have a significant impact on brokers in writing new business and consequently dealing with clawbacks.

10. Opportunity for brokers & the silver lining.Throughout the 30 years I’ve been in the finance business, I have experienced enormous opportunity in turbulent times. It is during these times that people, businesses and families need to restructure and consolidate, which creates real opportunities in our industry.

What brands will try to win your business as a broker in the new year?

But dont forget, most of you are also a small business owner, so here are some names that may tickle your fancy in 2023.

Salestrekker. take a note of this CRM, they are launching a new version with supercharged automation and direct lodgments. Think about how much time it will save you!

As we approach the Fixed Rate Cliff on top of cost of living issues, more consumers will find themselves with defaults.. So who you gonna call?

If you don't know about these guys, you haven't logged onto F&C that often have you? Punch in “which lender has the most generous servicing” 80% of the comments will tell you to look up these guys.

Have you got on the Suncorp train recently?

Q4 saw user posts raving about the lightening speed to approval.Afar cry from 4 years ago.

One of the darlings of 2021, this year saw them transition over under the NAB umbrella. What will 2023 hold?

What will they do next to the group?The best thing to come out of 2022 was the ability for members to safely ask questions without fear of judgement via the anonymous option.

As Branded Franchises get sold off to bigger brands, this one is doing the opposite and growing at a rate of knots! Best part is, you can partner up with them for Self employed deals.

Originally the gold standard in 3rd party, the wheels came off and made brokers sad.That is set to change in 2023 as they seek to regain market share.

Yes they messed up and got Hacked.The negative press only means they will be offering really good incentives to sign up.

As boarders open up internationally, we will see more expat / non resident lending being done. Have you taken a look at these guys yet?

Kumo Space. Online Events platform where PD Days will look and feel like they do in real life. Dont want to speak or listen to the presenters?You can speak to another broker!

Crypto collapsed off the back of a major exchange (FTX) could cause other smaller exchanges to also go. Just as the banks were accepting Crypto, will they reverse it in 2023?

Fan favourite, they won Major Lender of the year in 2022. By Q4 there wasnt many posts about them doing magic. Or have brokers come to expect the best from them?

Alex Bank:Australia’s newestADI as of December 2022! Watch this space as they will come to be friends with brokers!

Having just released a SMSF product, there is most likely more to come in 2023. What cant they do?

Dont forget no LMI 90%

a digital lender designed by brokers for brokers. Helping you compete in a digital marketplace whilst making a positive impact.

Green loans or loans incentivising making your home energy efficient will come more into play as the cost of utilities skyrocket.Also monthly LMI.