See

The Find Geelong is a community paper that aims to support all things Geelong. We want to provide a place where all NotFor-Profits (NFP), schools, sporting groups and other like organisations can share their news in one place. For instance, submitting up-and-coming events in the Find Geelong for Free.

We do not proclaim to be another newspaper and we will not be aiming to compete with other news outlets. You can obtain your news from other sources. We feel you get enough of this already. We will keep our news topics to a minimum and only provide what we feel is most relevant topics to you each month.

We invite local council and the current council members to participate by submitting information each month so as to keep us informed of any changes that may be of relevance to us, their local constituents.

We will also try and showcase different organisations throughout the year so you, the reader, can learn more about what is on offer in your local area.

To help support the paper, we invite local businesses owners to sponsor the paper and in return we will provide exclusive advertising and opportunities to submit articles about their businesses. As a community we encourage you to support these businesses/columnists. Without their support, we would not be able to provide this community paper to you.

Lastly, we want to ask you, the local community, to support the fundraising initiatives that we will be developing

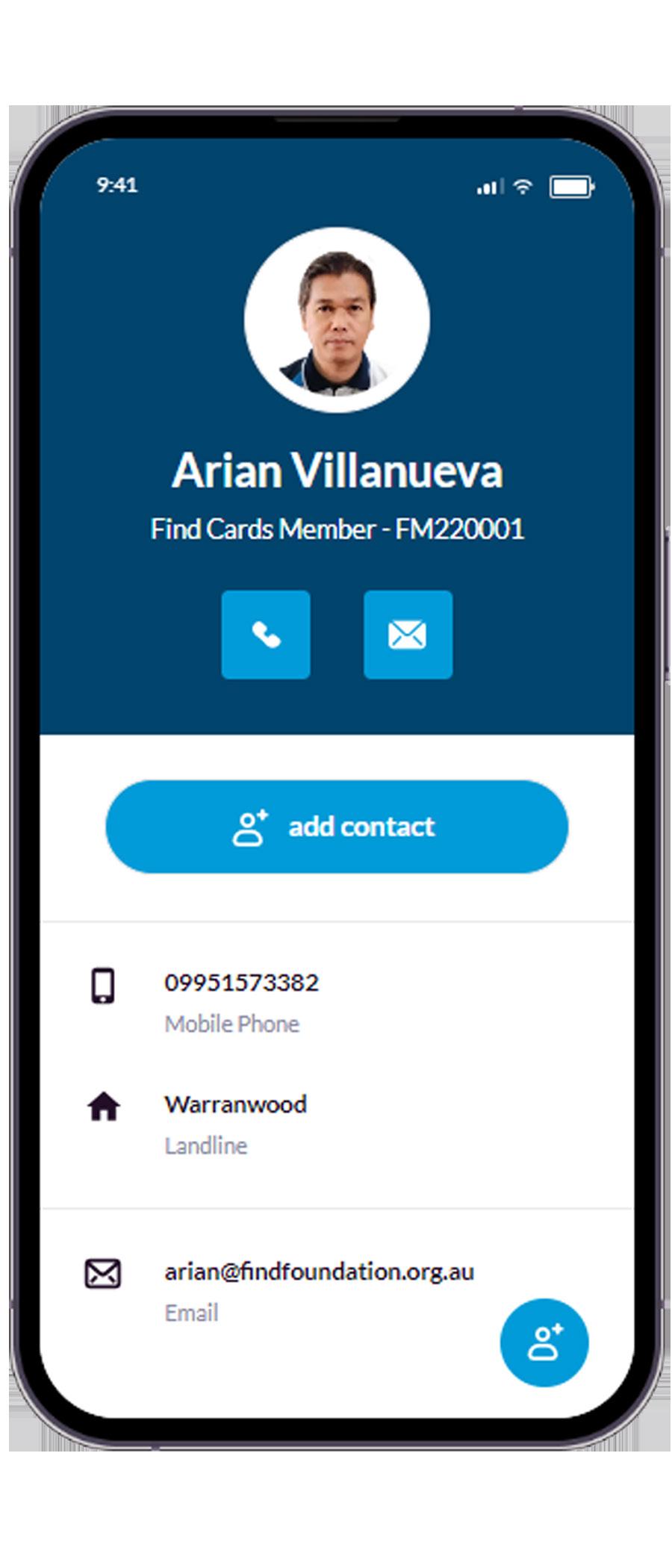

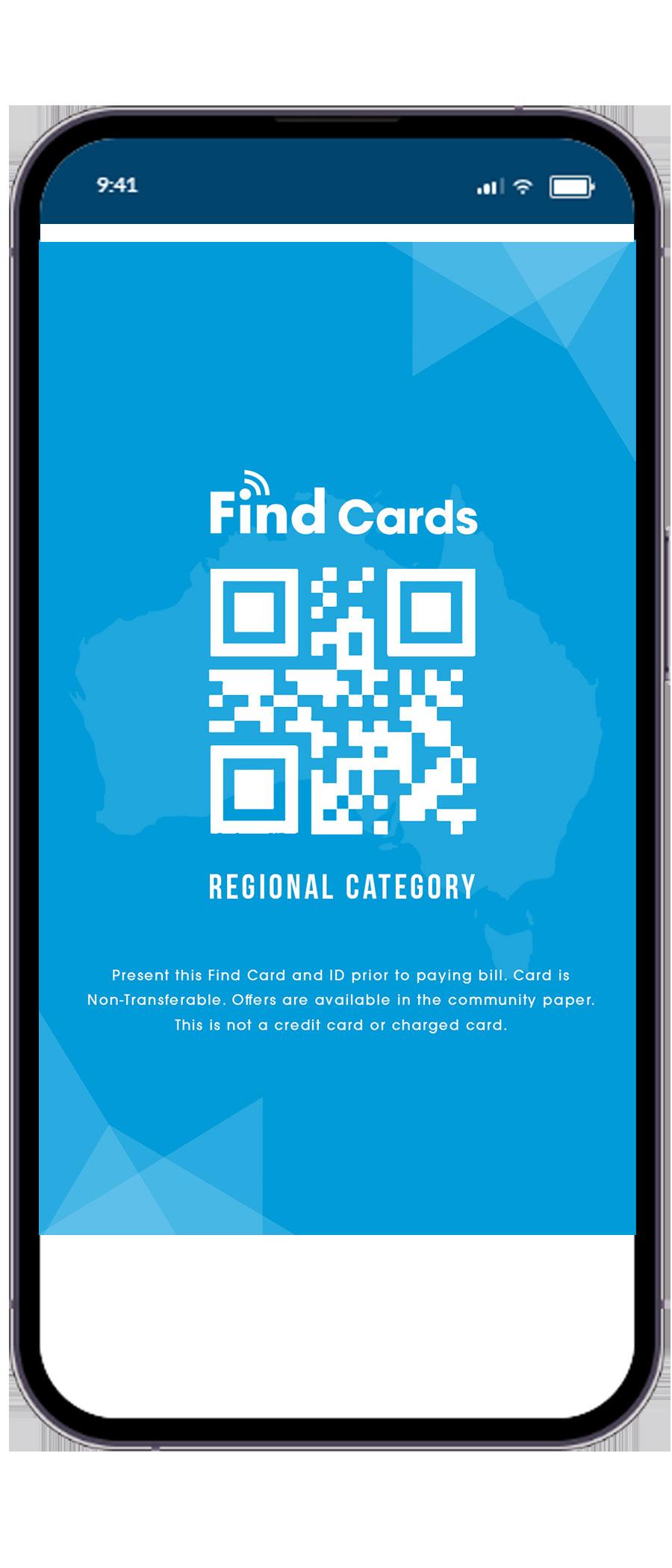

and rolling out over the coming years. Our aim is to help as many NFP and other like organisations to raise much needed funds to help them to keep operating. Our fundraising initiatives will never simply ask for money from you. We will also aim to provide something of worth to you before you part with your hard-earned money. The first initiative is the Find Cards and Find Coupons – similar to the Entertainment Book but cheaper and more localised. Any NFP and similar organisations e.g., schools, sporting clubs, can participate.

Follow us on facebook (https://www. facebook.com/findgeelong) so you keep up to date with what we are doing.

We value your support, The Find Geelong Team.

EDITORIAL ENQUIRES: Warren Strybosch | 1300 88 38 30 editor@findgeelong.com.au

PUBLISHER: Issuu pty Ltd

POSTAL ADDRESS: 248 Wonga Road, Wararnwood VIC 3134

ADVERTISING AND ACCOUNTS: editor@findgeelong.com.au

GENERAL ENQUIRIES: 1300 88 38 30

EMAIL SPORT: editor@findgeelong.com.au

WEBSITE: www.findgeelong.com.au

The Find Geelong was established in 2019 and is owned by the Find Foundation, a Not-For-Profit organisation with is core focus of helping other Not-For-Profits, schools, clubs and other similar organisations in the local community - to bring everyone together in one place and to support each other. We provide the above organisations FREE advertising in the community paper to promote themselves as well as to make the community more aware of the services these organisations can offer. The Find Geelong has a strong editorial focus and is supported via local grants and financed predominantly by local business owners.

The City of Geelong is one of Victoria’s largest regional capital cities. Geelong had a population of approximately 230,000 as at the 2019 Report which includes 16,000 businesses. Geelong’s location is in strong growth corridor, making it an ideal location for businesses to explore options outside of the capital city.

The Find Geelong acknowledge the Traditional Owners of the lands where Geelong now stands, the Wadawuarrung people of the Kulin nation, and pays repect to their Elders - past, present and emerging - and acknowledges the important role Aboriginal and Torres Strait Islander people continue to play within our community.

Readers are advised that the Find Geelong accepts no responsibility for financial, health or other claims published in advertising or in articles written in this newspaper. All comments are of a general nature and do not take into account your personal financial situation, health and/or wellbeing. We recommend you seek professional advice before acting on anything written herein.

ADVERTISING RATES (INCLUDE GST)

We encourage consumers to support businesses and products within their local communities. The idea behind this is to promote economic growth, sustainability, and a sense of community by prioritising local businesses over larger corporate chains or online retailers. When people shop locally, they contribute to the local economy, create jobs, and help maintain the unique character of their neighborhoods.

Here are a few reasons why buying local and shopping local is often emphasised:

1. Economic Impact: Local businesses play a vital role in generating economic activity within a community. Money spent at local shops, restaurants, and service providers circulates within the area, creating a multiplier effect that can lead to increased employment and prosperity.

2. Community Building: Supporting local businesses fosters a sense of community pride and identity. It can create a stronger bond among residents, business owners, and other stakeholders, contributing to a more vibrant and connected community.

3. Environmental Benefits: Buying local can often reduce the carbon footprint associated with transportation and distribution, since goods don’t need to travel as far to reach consumers. This can help lower emissions and promote sustainability.

4. Unique Offerings: Local businesses often offer unique and distinctive products or services that may not be available through larger chains. This can contribute to a diverse and culturally rich marketplace.

5. Preservation of Character: Local businesses help maintain the unique character and charm of a neighborhood or town. They often contribute to the distinctive atmosphere that makes a place special.

6. Personal Connections: Shopping locally allows for more personal interactions between customers and business owners. These connections can lead to better customer service and a stronger sense of trust.

7. Job Creation: Small and local businesses are significant job creators. When consumers spend money locally, they contribute to job growth and help improve the overall employment situation in the community.

8. Cyclical Spending: Money spent locally tends to stay within the community longer, as local business owners and employees are more likely to reinvest their earnings back into local products and services.

To participate, individuals can consider shopping at local farmers’ markets, boutiques, restaurants, and other small businesses. Supporting community events, festivals, and artisans also helps promote local culture and entrepreneurship.

Remember that while buying local is encouraged, it’s important to find a balance that meets your needs and preferences. Some items might only be available through larger retailers, and online shopping can offer convenience for certain products. However, making a conscious effort to support local businesses whenever possible can have a positive impact on your community and the broader economy.

I went to a party recently and met a café owner. It was the first time I met this gentleman and during the party he let it be known to those around me that he had recently purchase a new BMW. Further on into the night I also overhead him let it slip to a few people that he liked to hire young people in his café and that there was a ‘bit’ of a cash trade going on, “if you know what I mean.”

When he finally spoke to me, he asked me what I did for work, and I explained I was an accountant and did a few other things. I then asked him if he owned the BMW at the front. As expected, his stood up a little bit taller and poked out his chest with pride, confirming it was his vehicle. I asked him if he had bought the vehicle with cash, and he readily confirmed he had. I then asked him if he had registered and/or insured his vehicle. He stated matter of fact that he had.

I then went on to explain how the ATO was carrying out data matching exercises; looking at vehicle registration and car insurance and matching it with small business owners’ earnings…well, to say the colour went out of his cheeks was an understatement. I left him there to consider my words.

People need to be aware that the ATO is continuously gathering data to and will be matching it with ATO internal data holdings to “identify relevant cases for administrative action”.

This time the ATO is gathering information about your motor vehicle registrations across all States and Territories for the next three financial years: 2022-23 to 2024-25.

Information will be acquired from motor vehicle registry authorities where their records indicate that both:

• a vehicle has been transferred or newly registered during the 2022-23, 2023-24 and 2024-25 financial years; and

• the purchase price or market value is equal to or greater than $10,000.

The ATO has been vigorously data matching information to try and determine if there are any ‘anomalies’ with tax returns and are likely to take action where they deem it necessary.

By Warren Strybosch

By Warren Strybosch

The ATO has released the 2023 individual tax return format and instructions, including the instructions for the tax return supplement which is the area of the return that deals with tax deductible super contributions.

As the 2023 financial year is the first year where eligibility to claim a tax deduction for personal contributions made by those between the ages of 67 and 75 relies on meeting the work test or work test exemption, we were uncertain how this declaration was going to be administered by the ATO.

There is no stand-alone declaration in the income tax return that must be made by clients 67-75 stating that the work test (or exemption) has been met.

The same self-assessment principals that apply to the other areas of the Australian tax system also apply to the work test requirement. The responsibility to ensure the tax return and other tax forms comply with tax laws is placed on the individual and the ATO may review a return and increase or decrease the amount of tax payable via their auditing processes.

The instructions to the tax return supplement provide some information ‘in the fine print’ on the restrictions placed on those 67 to 75 claiming a tax deduction however for most, it will be important to seek assistance from an accountant to ensure the tax return is completed accurately.

What is crucial is that those wishing to claim a deduction for personal contributions placed into super, are to make sure they have submitted an Intent to Claim form to the relevant super fund and a letter of acknowledged has been received from the same super fund accepting the personal contribution as a concessional contribution. It is important that the Intent to Claim is made prior to the return being lodged or before the end of the next financial year in which the contributions were made otherwise the super fund will not accept the Intent to Claim request and potential tax deductions will be denied.

For those over the age of 75 who might still be working, there is a restriction on what contributions can be placed into superannuation as follows:

1. Concessional Contributions (Before-Tax Contributions): If you are 75 years or older, the super fund cannot accept any voluntary (concessional and nonconcessional) contributions from you apart from mandated (super guarantee) employer contributions which can be contributed at any time regardless of age.

2. Non-Concessional Contributions (After-Tax Contributions): Individuals aged 75 and older were allowed to make non-concessional (after-tax) contributions to their super up until the 28th day of the month following the month in which they turned 75. After that point, non-concessional contributions are not allowed.

If you are unsure as to whether you can claim a deduction for personal contributions and how much you can place into your super in any given year, simply ask your accountant to provide you with a concessional contribution report. This can be obtained from the ATO portal within minutes and it can provide useful information to you before the end of the financial year and help you determine if you should contribute additional funds to your superannuation.

Beer drinkers are being warned to brace for more expensive pints as the industry is hit with another tax increase.

Alcohol prices are not exempt from rising costs of living and the tax is adjusted twice a year in line with inflation.

The latest increase represents a 2.2 per cent rise in just six months and since May 2022 the beer tax has gone up by more than 10 per cent.

It means Aussies partial to a full-strength pint will pay nearly $1 extra in tax while publicans will face an additional $80 tax for a keg.

Australia has also overtaken Japan to have the third highest beer tax in the world, behind notoriously expensive Norway and Finland.

Brewers Association John Preston said Australia’s tax hikes had become out of control.

“We don’t believe these increases are now actually raising any more money for the government, they are just hurting beer drinkers and our pubs and clubs,” he said.

“While the treasurer inherited these automatic half-yearly beer tax increases, we’re calling on the government to step

in and take some action before a trip to the pub or a dinner out with the family becomes an unaffordable luxury for most Australians.”

It’s a similar story for spirits lovers with the tax tipping over the $100 per litre mark for the first time.

Distillers and spirits manufacturers are calling for a freeze on alcohol excise rises as the price peaks at a milestone it had not been expected to hit before 2029.

Maeve Bannister (Australian Associated Press)In the past, it was common for employers to base their SGC on their employee’s OTE, reduced by any amount of salary that was sacrificed to superannuation. By way of example, if an employee had OTE of $100,000, but they entered into a salary sacrifice arrangement to forego $10,000 of salary and have it contributed to super as a pre-tax contribution, SGC would be based on the revised OTE of $90,000.

Some employers would even go a step further and use the voluntary salary sacrificed amount (which is classed as an employer contribution) to reduce their own SGC obligations.

However, from 1 January 2020 the law changed so that employers are no longer able to reduce the base on which SGC is calculated, by amounts salary sacrificed to superannuation. Returning to the example mentioned above, the employer is obliged to base their SGC on an OTE of $100,000.

It is important for employers to make sure that if any employees are salary sacrificing their pay that the employee is still receiving their full entitlement to SGC prior to the arrangement taking place.

Are you in a position of leadership and looking to be impactful in your role? Unlike the narrative that leaders must be authoritative, you can be influential through purposeful conversation. This read will offer insights on influential leadership and ways to improve your conversations at work.

Purposeful conversations are transformative in the business environment. As a leader, your communication must align with your organisation’s objectives.

For example, you can improve employee performance by continuously communicating business goals. It bridges the gap between the company expectations and duties of each employee.

That said, here is why purposeful conversations are important;

• Improves innovation, strategies, and ideas: purposeful conversations make your team intentional in their thinking and roles.

• Offers varied viewpoints: communicating with a purpose expands the audience’s thinking spurring them to productivity and performance.

• Seeks deep understanding of a topic: purposeful conversations accommodate fresh ideas, deliberate on possible outcomes, debate opposing viewpoints, and tackle grey areas.

No one is born with excellent communication skills, but you can learn the art of conversations to be a better leader. Whether engaging with stakeholders, executives, junior staff, or clients, every conversation matters.

Here are tips to help you become an influential leader through your communication;

When communicating with colleagues, aligning the conversation style with the message you want to convey is critical. You do not want to talk for hours only to discover that your audience did not grasp the information.

Understanding the people you are addressing would help you choose the right words and responses during a conversation.

Knowing your colleagues is essential for purposeful conversations. It includes learning who they are and what they like doing for recreation. Being intentional with workplace relationships sets a good example to others: Colleagues will be open to embracing your leadership style and vision.

Making eye contact with a person during conversation will help connect with them at a deeper level. However, prolonged contact can be intimidating to some people, and you should, therefore, shift from one person to another in a room. Still, ensuring intermittent eye contact, helps the other person concentrate and get the message which helps in influencing them.

We can also build connections through our words. Some words resonate better with some people. Knowing which words to use on which colleague, is the next step once you’ve become more familiar with their personal style.

Using the words that they connect with, through your own tone and style is key

here. It is impossible to have authentic conversations if you are not true to yourself.

Besides your words, body language can convey a particular message to another person.

As a leader, you will command more respect if you relax, keep your head up and open your body while talking to colleagues. Avoid tapping your feet or crossing your arms; it sends the wrong impression.

Just as importantly, take note of your audience’s body language. For example, a person who seems uneasy and flinching may be uncomfortable with the conversation. Awareness of others’ cues will help you to adjust your communication style for the best outcome.

For effective conversations, be concise and objective. Many explanations can further counter your communication by

confusing people or deviating from the objective.

Keep your sentences short and to the point. Use the words that resonate.

You can achieve purposeful conversations and save time by planning what you will discuss.

5. Listen Actively

Leadership is not about giving orders to people and expecting them to do it without questions asked. On the contrary, you must be an active listener to be an influential leader. It includes knowing when to talk and when to stop.

Communication is two-way; ensure you understand the information before responding to anything.

There will likely be periods of silence, and you should let the other person process their thoughts before continuing the conversation. Some people need more time than others to process and respond, so bring this to your awareness. Also, avoid interrupting the other person as they try to make their point.

Continuous communication about your expectations and the company goals is important for leaders. It ensures purposeful conversations by clarifying employee duties and reducing the chances of confusion, as they will know what to do in their role in the organisation. Not to mention the opportunity it will give them to offer suggestions, enhancements or feedback.

Communication breakdowns have dire effects on businesses, affecting employee productivity, engagement, and motivation. As a decision-maker, you can enhance your leadership skills through training and learning from others.

Join us in our upcoming workshop –Lead with Impact-Strengthening our Conversations - and learn about how to become an influential leader through purposeful conversations. Visit our signup page to register for this powerful workshop, presented for the 4 th year running at The Geelong Small Business Festival.

...Imagine a team where each individual is so strong in self that their focus is how to move together as one...

• Private Domestic Travel Expenses

• Airport Lounge Membership

• Meals and Entertainment

• Motor Vehicle Expenses

• Novated Lease

It’s important to note that the specific salary packaging benefits available to you may vary depending on your employer’s policies and the type of not for profit organisation you work for. We recommend consulting with your HR department or a salary packaging provider to explore the options available to you based on your circumstance.

While salary packaging is generous, there are limits set by the government. For not for profit employees, the maximum expense amount allowed for each Fringe Benefits Tax (FBT) year is $15,900.

Accessing your salary packaging funds

By Dan NichollsIf you’ve heard about salary packaging but you’re not entirely familiar with how it works, this article is for you. We’ve collated our most frequently asked salary packaging questions from employees. We aim to give you an overview of all the salary packaging basics you need to know to understand this employee benefit. It’s all about maximising your earnings and reducing your tax burden.

The salary packaging basics

At its core, salary packaging is a way to convert a portion of your taxable income into tax-free benefits. By partnering with a salary packaging provider, you can allocate pre-tax earnings to cover various expenses. This means more money in your pocket while covering essential expenses, such as car expenses, health insurance, mortgage, rent, credit card, meals and entertainment, accommodation and even memberships and subscriptions.

Is there a catch?

Not at all! Salary packaging is entirely legitimate and approved by the Australian Taxation Office (ATO) Your employer partners with a salary packaging provider, who is an expert in tax regulations. It’s a risk-free and straightforward process for you with the right provider.

Salary packaging may not work for you because of your personal circumstances. Please be sure to seek the advice of an independent financial expert if you are not sure.

If you work for a not for-profit organisation, public health, or in the charity sector, you’re probably eligible for salary packaging benefits. As long as you pay income tax, and your employer policy allows, you may take advantage of this opportunity.

Here’s how it works… instead of using your take-home pay to cover expenses, you use pre-tax dollars. By doing so, your taxable income decreases, leading to lower income tax payments. This can translate into significant savings, making salary packaging a smart financial move.

There is a wide range of options. You can use salary packaging to cover mortgage repayments, rent, living expenses, health insurance, and even a car via a novated lease. The flexibility allows you to choose the benefits that suit your lifestyle best:

• Mortgage repayments

• Private Home Rental

• School and University fees

• Personal Loan repayments

• Household and Living Expenses

• Health Insurance Premiums

• Credit Card Payments

• Medical, Dental and Optical Expenses

• Life Insurance Premiums

• General Insurance Premiums

• House and Contents Insurance Premiums

• Higher Education Loan Program (HELP)

• Private Overseas Travel Expenses

Claiming your salary packaging benefits is hassle-free. Your employer, in collaboration with the salary packaging provider, will deduct the agreed-upon amount from your pre-tax income. You can also opt for a salary packaging card, which allows you to make payments conveniently without keeping track of receipts.

Changing or suspending your salary packaging arrangement

Life can be unpredictable, and sometimes you might need to change or suspend your salary packaging arrangement. In most cases, this is possible. However, it’s essential to communicate with your employer and the salary packaging provider to ensure a smooth process when making changes.

If you leave your employer, your salary packaging arrangement with them will stop. If you have a novated lease, it will be cancelled, and you’ll need to make lease payments directly. However, you can transfer your novated lease to a new employer.

Still have questions about the salary packaging basics?

If you’re still unsure about the salary packaging basics, we’re here to help with real people ready to answer any of your questions. Give us a call at The Salary Packaging People on 03 5229 4200 or send us a message online.

When we start a small business, we often employ people to help in the business without having a clear direction of who they want, or what they really need them to do. Sadly, we often ask friends or family members to help us get started who do not have the skills we need to really help. They do the tactical jobs that need to be completed, without a strategic path.

Before hiring anyone know in your mind

1. What tasks do they need to do?

2. What skillsets do they need to have?

3. How many hours a day or week do you need them?

4. Do they need a specific licence i.e., RSA/ forklift operator etc.?

5. What do you need to provide them with for them to be able to complete the tasks assigned?

The key to finding the right staff to hire, are those who are skilled in the areas you either, are not good at, or do not like doing. This will free up your time to work ON your business to ensure continued growth. Use their expertise to complete the tasks needed without using up more of your time than necessary.

When your business gets to the point of needing staff consider the 5 key elements above then address the issues in the advertisements or provide that information to the recruitment company you use.

The advertising for staff should be very clear in the Position Description, to include:

• The personality fit you are looking for within the business

• The actual job function they will be required to do.

° Duties

° Outcomes

• The skill sets required for the role

• Licences and qualifications where applicable

• Type of employment Part time / full time / casual.

• Short term long term

• Business standards and values

During the interview inform them of your requirements and intention for them and listen carefully to their answers to wellformed questions to determine the right fit.

Inform them of:

• The standards and values of your business to be upheld

• The flexibility you are looking for

• Physical abilities

• Business structure

• Opportunities for advancement

When you are interviewing applicants, listen carefully to their answers. Sometimes those with carefully planned answers, are only looking for something for now, not a long-term solution Spending the time and effort to train staff who have no intention of staying is counterproductive.

There are many, who do not interview well, but with a little support and compassion will be very loyal to you and your business. Spend time with these applicants, talk to them about their lives, their hobbies, their interests and their ambitions. Take the time to talk to them in the interview it may save time in the long term.

Before you interview check them out online, Face Book, Instagram, Tic Toc, LinkedIn etc. If you have interviewed previously was there a candidate that was really good but you were not in apposition to appoint two new staff at the time.

Your staff are you, in the eyes of your customers. Choose carefully, they can make or break your business. If you do not have the confidence to select the right staff, then use the skills of recruitment agencies. The fees you pay will be well be worth it, to achieve the goals you have set yourself.

Over the last few months particularly, there has been a lot of confusion and miscommunication, this has been highlighted over and over again. You have a vision for your business. Many of us have had to “pivot” but have not passed on the clarity of the new goal posts to our staff.

Where some staff have been laid off due to the downturn in business, this not only causes concern with the remaining staff about their security, but in many cases, no one has explained who is picking up the workload of those no longer employed. Your staff are not mind readers.

Be very clear when making staff changes to talk to those remaining about ALL the changes that affect your business and the impacts on their role.

Keeping the remaining staff engaged is pivotal to your success in several ways.

1. Keeping the staff positive and engaged for the clients you still have.

2. Inspiring staff to maintain standards and help train new staff.

3. Engaging the staff to stay focused on the long-term and proactive to customer requests.

4. Encourage loyalty to you, your business and your customers.

5. Enabling you to strive for continual growth through innovation.

If you have really good staff members they may have friends that have the skill sets you need Ask them before advertising. That will achieve two goals

1. Demonstrate you trust your staff and

2. Save time and money in the long run.

Deb Fribbins By Allison Groot

By Allison Groot

HubSpot defines a video script as: A script that contains the dialogue, plans, and action for your video.It’s a crucial tool that gives you and your team cues and reminders about the goal, timeline, and the results you want for your video.

All of the above is true and is all good and well if you have hired a professional team to concept, write and produce a video for you.

But… what if you don’t have these things or a budget available to you?

I repeatedly get asked “Why do I need a script” The simple answer is - so you know what you or the voice-over artist is going to say. If you are filming and writing the content yourself, it will help you to have structure and deliver the message you want to say. It also allows you to engage your audience and look confident on camera.

As with all scripts you need to think about what you would like to say.

Are you talking about your products, your business and about you or would you like it to have more of an overview of your services? Either way you need to write a logical flow down so your clients can follow it.

Other words to define script writing are: copy, content, and text.

Writing a script can be really helpful when talking about up-and-coming sales or new products but most of all it helps to establish you as an authority.

If you are unsure how to start writing a script simply start with dot points about the subject matter and build from there. Think about what defines your business and how this can be said with your video idea and create a story around that.

Quick Tip:

Dot points are a great way to help you create a structure but are also great at reminding you of your key points. Try even bolding your key points/text so you can emphasis the words.

If you would like to know more about how Yes Today Media can help you make engaging video scripts or write your script for you. Give us a call.

Apply the primer immediately after the previous surface preparation. This will help prevent flash rusting or dust accumulating. If what you are painting is outdoors (for example, roofs, furniture or sheds), a second coat of primer will add an extra layer of protection against oxidisation.

Metal paints come in oil-based and water-based brush-on or spray-can versions. Oil-based paint is trickier to work with but the results are last longer. Waterbased acrylic paints can be easier to apply but may be difficult to find in spray form for exterior use.

By Steve DahllofIf you have metal garden furniture, aluminium window and door frames or an outdoor shed, cooler temperatures are a good time to paint them.

Like all painting, preparation is the key to success. Here are a few handy tips for getting the best appearance and protection for the metal surfaces around the home or office.

1. Clean the metal surface

Using sandpaper or another gentle scraping tool, remove all dust, dirt, debris and grease. A mild detergent should be sufficient but for more persistent deposits, mineral spirits will do the trick. Wipe the surface with a damp cloth and leave to dry thoroughly. Don’t use water as it doesn’t clean metal effectively.

2. Get rid of peeling or loose paint

This applies to preparing all surfaces for painting – get rid of old paint that is loose or peeling. Otherwise, the new paint won’t stick. Use a hand wire brush, a scraper or sandpaper and gently sand back. Too much pressure and the metal surface may be gouged, leading to an uneven finish.

Some people like to use power tools for this part of the cleaning process but beware – this method may end up polishing the metal surface, leaving nothing for the new paint to adhere to. You will need to rub a scuffing pad along the metal surface; the pads will lightly scratch the surface, allowing the primer to stick.

3. Remove the rust

Rust is a sign that the metal is not totally sound. You may need to replace the roof or frames if there is structural damage. If there is rust in just a few places, apply a high-quality primer with rust-inhibiting properties by brushing or sanding. Painting over rust will damage the metal paint by causing it to rust as well.

4. Use the appropriate primer

Check that the primer you choose is compatible with the paint you’ve selected. Follow the instructions on the label as different primers have differing drying times.

Water-based primers are not appropriate for metal surfaces but there are many other options. Rust-inhibiter primers, iron oxide primers and galvanised primers are more suitable, depending on what you are painting.

The easiest way to paint metal surfaces is with spray paint. (However, though it’s faster and easier, it doesn’t create as firm a finish.) If you decide to spray paint, hold the can 15 to 30 centimetres away from the metal surface – this prevents the paint from pooling. Using a long sweeping motion, spray whatever it is you want to paint. (Don’t be tempted to hold the can in one place.) If you notice excessive dripping, wipe everything clean and

Whenever you are painting metal surfaces, make sure you protect yourself. Wear a dust mask or respirator, protective goggles and gloves. Work in a well ventilated area – outdoors if possible. If you use power tools (for instance, when getting rid of rust), insert quality ear plugs to protect your hearing.

For more painting advice on painting in winter, contact Dahllof Painting Services at sjd67@bigpond.net.au. We will be happy to answer all your inquiries.

By Ethan Strybosch

By Ethan Strybosch

Setting the right price for your products or services is a crucial decision that can significantly impact the success and growth of your business. While some may believe that lower pricing attracts more customers, the truth is that correctly pricing your services, even at a higher level, can offer numerous advantages that lead to greater profitability and success. In this article, we will explore the benefits of pricing your service correctly, and why higher pricing can be a better strategy for your business.

1. Perceived Value:

One of the main advantages of higher pricing is that it conveys a sense of premium quality and value. Customers often associate higher prices with superior products or services, which can create a perception of exclusivity and desirability. When your offerings are priced higher, potential customers are more likely to view your business as a provider of high-quality solutions, increasing the likelihood of converting them into loyal, long-term clients.

2. Improved Profit Margins:

Higher pricing naturally leads to improved profit margins, allowing your business to maintain healthy financials and invest in its growth. With better margins, you can reinvest in marketing,

research, and development, as well as customer service improvements, which ultimately enhances your competitive advantage and overall business performance.

3. Better Customer Relationships: Contrary to common belief, customers are often willing to pay more for exceptional service and a superior experience. When you charge higher prices, you can afford to allocate more resources to enhance customer support and provide personalized attention, leading to stronger relationships with your clientele. These satisfied customers are more likely to become brand advocates, spreading positive word-ofmouth and driving more business your way.

4. Targeting the Right Audience:

Pricing your service correctly allows you to target the right audience effectively. A higher price point can attract clients who value quality over affordability, and who are willing to pay for the unique benefits your service provides. This targeted approach not only simplifies your marketing efforts but also helps build a loyal customer base that aligns with your business’s values and offerings.

5. Distancing from Competitors: A well-placed higher price can distinguish your business from competitors, establishing a sense of uniqueness in the market. Lower-priced services often engage in price wars and discounts,

eroding profitability and diminishing perceived value. By pricing your services higher, you demonstrate your confidence in the value you deliver and encourage customers to choose you based on quality rather than price alone.

6. Capacity for Innovation:

Higher pricing provides your business with a financial cushion, enabling you to invest in research and development. With more resources at your disposal, you can innovate and stay ahead of the competition. This willingness to invest in improvement fosters a culture of innovation within your organization, keeping your services fresh and relevant to changing customer needs.

7. Sustainable Growth:

While lower pricing might attract an initial influx of customers, it can be challenging to maintain the volume needed to sustain profitability in the long term. On the other hand, correctly pricing your services higher ensures a stable revenue stream, supporting sustainable growth and expansion opportunities. This stability allows you to weather market fluctuations and make strategic decisions for long-term success.

In conclusion, pricing your service correctly is a critical aspect of your business strategy. While lower pricing might seem attractive initially, the benefits of higher pricing, such as perceived value, improved profit margins, better customer relationships, and sustainable growth, far outweigh the short-term gains of attracting bargain-hunting customers. By positioning your services at a higher price point, you can establish your business as a provider of premium solutions, attract the right audience, and pave the way for lasting success in a competitive marketplace.

It’s the grand opening party were you’ll find us celebrating the launch of Creative Design Hair and Beauty. There will be lots of giveaways, raffles to win and nibbles and drinks to be enjoyed as a thank you for the support of my business.

We are welcoming new clients to come and discover the fun and friendly atmosphere here at Creative Design Hair and Beauty.

Check out this great opening special, we are here to wow you with great hair, at an affordable price.

We are a salon that uses high quality products and great knowledgeTo have your hair looking and feeling better then ever. We specialise in all things blondes, balayage, all colours, cuts, facial waxing and also weft hair extensions. We use and stock a extremely high quality hair extension company based in Melbourne. Please come and experience it for yourself.

HAIR DRESSER

0410481511

creativedesignhairartistry@gmail.com

www.creativedesignhairbeauty.com.au

By Warren Strybosch

By Warren Strybosch

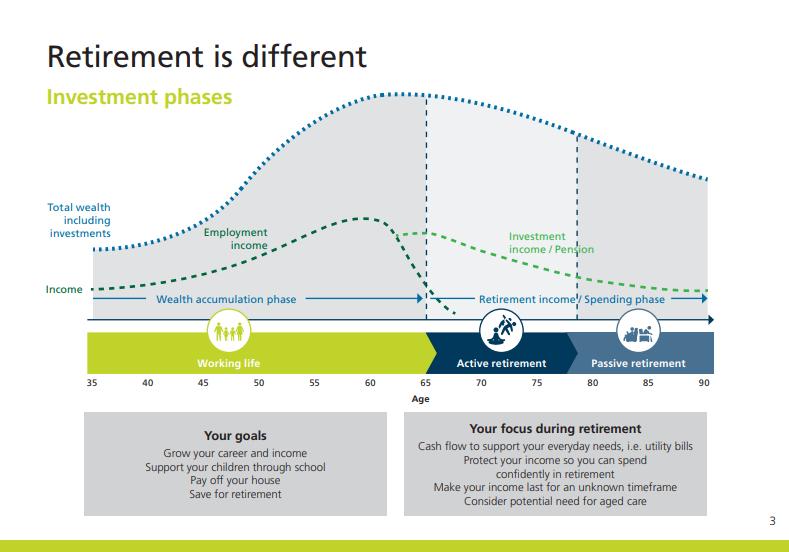

Superannuation can be used to start an account based pension once a person retires (or meets another condition of release). This allows income to be received as a series of regular payments (usually monthly, quarterly, half yearly, or yearly).

If over preservation age but still working, the person may not have full access to superannuation but may be able to start an account-based pension under the Transition to Retirement (TTR) rules. A TTR pension may also be referred to as a Transition to Retirement Income Stream, or TRIS.

Once a person reaches 65 or informs their super fund that they have met a condition of release before turning 65, their TTR pension becomes a ‘TTR pension in retirement’. This means their pension is subject to the same conditions that apply to an account-based pension.

The person can select how much income to receive each financial year. This allows flexibility to meet individual needs. The only rules for how much pension must be taken are:

• An income payment must be made at least once each financial year.

• A minimum level of income must be paid each year based on a percentage of the account balance at commencement and each 1 July. If the income stream commences part-way through a financial year, or is commuted before the end of a financial year, the minimum income payment is pro-rated for that year.

Every withdrawal (income or lump sum or death benefit) from a pension is split into taxable and tax-free components in the same ratio that applied when the pension commenced. The tax on each component depends on the person’s age as shown in the table below.

For a TTR pension, the maximum income is 10% of the account balance and no lump sum withdrawals can be made.

The pension will cease when the account balance reduces to nil, or the person requests the money be rolled back to accumulation phase or another pension account. The pension can be commuted (stopped) at any time with the money rolled back to accumulation. Withdrawals cannot be made in cash unless a condition of release has been met.

Earnings added to a pension account are taxed at the same rate as applies to the accumulation phase of superannuation.

1300 88 38 30 | warren@findwealth.com.au www.findwealth.com.au

Financial Planning is offered via Find Wealth Pty Ltd ACN 140 585 075 t/a Find Wealth.

Find Wealth is a Corporate Authorised Representative (No 468091) of Alliance Wealth Pty Ltd ABN 93 161 647 007 (AFSL No.236815).Part of the Centrepoint Alliance group https://www.centrepointalliance.com.au/

Warren Strybosch is Authorised representative (No. 236815) of Alliance Wealth Pty Ltd.

This information has been provided as general advice. We have not considered your financial circumstances, needs or objectives. You should consider the appropriateness of the advice. You should obtain and consider the relevant Product Disclosure Statement (PDS) and seek the assistance of an authorised financial adviser before making any decision regarding any products or strategies mentioned in this communication.

Whilst all care has been taken in the preparation of this material, it is based on our understanding of current regulatory requirements and laws at the publication date. As these laws are subject to change you should talk to an authorised adviser for the most up-to-date information. No warranty is given in respect of the information provided and accordingly neither Alliance Wealth nor its related entities, employees or representatives accepts responsibility for any loss suffered by any person arising from reliance on this information.

toxins. To help with liver function, foods such as green leafy vegetables and berries are high in antioxidants and which can help with detoxification.

If you wake at any time during the night:

• Limit alcohol to just one drink

• Exercise during the day

• If you wake with a ‘busy mind’, spend some time journalling about your stressors the next day

• If it’s 3-4 am, come and see me for some liver herbs

Along with herbs for the liver, nervous system tonics, adrenal tonics, and sedative herbs may be really helpful and these as discussed in a naturopathic appointment.

If you are experiencing high stress, magnesium glycinate can really calm the nervous system. I have also seen great results with homeopathy which is prescribed depending on individual symptoms: with sleeplessness from joint pain, to restless leg syndrome, and a busy mind.

Insomnia includes trouble initiating sleep, maintaining sleep or early waking. It could be debilitating, or maybe it just affects your ability to function.

According to the Sleep Health Foundation, whilst only 15% of Australia adults the symptoms of clinical insomnia, over half of us suffer from sleep symptoms which affects quality of life.

Primary insomnia is caused by a range of issues such as HPA (hypothalamicpituitary-adrenal) axis hyperarousal usually as a result of chronic stress; circadian rhythm abnormalities; GABA (gamma-aminobutyric acid) dysregulation; and other excitatory pathways. Secondary insomnia is as a result of medical conditions, medications, and dugs (including alcohol, coffee and nicotine).

If you’re too switched on when you hit the pillow, try the following before going to bed:

• Don’t drink caffeinated drinks after midday

• Talk to someone about your worries

• Spend 30-60 minute before bed relaxing away from a screen

• Spend time in the morning in the sunlight and limit blue light in the evening

One thing that I see commonly in clinical practice is waking regularly around 3-4am, for some people it’s just for a quick trip to the bathroom, but for others, it can disrupt the sleep cycle enough to keep them awake for quite a while after.

3-4am is the time of night when your liver is involved in digestion, and I rarely see a case of this that isn’t resolved by taking herbs to strengthen and restore the liver. Since the liver is one of the main organs involved in detoxification, if it’s not functioning efficiently, it can struggle to process the drugs, hormones, and other

Here at Whole Naturopathy we have a range of effective treatments for both sleep, we spend time to understand how all of your health issues affect each other and treat the cause as well as the symptoms.

This advice is general in nature and not intended to be prescriptive. For individualised prescriptive advice, please see a naturopath or other health care practitioner.

BHSc (Naturopathy)

kathryn@wholenaturopathy.com.au

A recent tax ruling released by the ATO provides guidance on appropriate taxation treatment of labour costs related to construction and creation of capital assets. While the ATO acknowledges that labour costs are generally revenue in nature and deductible under s 8-1 of ITAA 1997, TR 2023/2 addresses situations in which labour costs incurred will be considered on capital account and hence non-deductible.

Relevant labour costs include salary and wages, payments to contractors and labour-hire firms.

Labour costs incurred by property developers who build capital assets on revenue account are excluded from this ruling.

This ruling applies to income years commencing both before and after 7 June 2023 (date of issue).

Announcement(7-Jun-2023)

Consultation period

Released(7-Jun-2023)

Starting from 1 July 2023, operators of sharing economy platforms will be required to report transactional information to the ATO.

The Taxable Payments Reporting System already applies to some businesses in industries where noncompliance is deemed to be high risk. By adding operators of sharing economy platforms to the regime, taxpayers who hold or use assets for short-term lease or contract work will also have their information collected.

The identification of users of sharing economy platforms means that, as an adviser, you should be informing taxpayers who earn income off these platforms about their tax obligations. This includes operators of shortterm accommodation, ride-sharing transport and food delivery platforms. Also, other task or time-based service platforms will be required to report for income years beginning on 1 July 2024.

An ATO tax determination has clarified that earnings from an individual’s “image rights” or “fame” can only be included in that individual’s assessable income. For professional sportspersons who are employed by a professional league, this determination from the ATO changes previously held guidance that allowed a safe harbour approach to alienate income to a related entity.

The tax determination was previously issued as TD 2022/D3 and applies to arrangements in place both before and after the date of issue, being 28 June 2023. However, the ATO will not utilise compliance resources where a taxpayer with fame has restructured their affairs in line with the determination prior to 1 July 2023.

The tax determination differentiates agreements for the use of “image rights” and “fame” from an individual with fame providing services to a third party.

The non-arm’s length income (NALI) measure announced by the Coalition government in 2022 will be amended to provide greater certainty to taxpayers. The intention of the proposal is to include a factorbased approach for trustees to be able to adequately calculate the amount of SMSF income that is NALI income. This factor-based approach applies to a situation where general expenses of the fund are not at arm’s length amounts.

The factor-based approach would apply to general fund expenses incurred after 1 July 2023.

Announcement(25-Aug-2021)

Consultation

Introduced(3-Aug-2022)

Passed(28-Nov-2022)

Royal Assent(12-Dec-2022)

Date of effect(1-Jul-2023)3)

Announcement(5-Oct-2022)

Consultation period(4-Nov-2022)

Released(28-Jun-2023)

nnouncement(24-Jan-2023)

Consultation(9-May-2023)

Introduced

Passed Royal Assent

Date of effec

The ATO has finalised a tax ruling which provides additional relevant guidance on the statutory residency tests for individuals and how the Commissioner may apply them under s 6(1) of ITAA 1936.

Taxation Ruling TR 2023/1 focuses on modernised ways of working, relevance of business or employment ties overseas and whether work duties can be performed from anywhere in the world.

Resident tax rates may be applied for individuals even where there are a tax resident in Australia for only a single day and pro-rata the tax-free threshold over the period of their residency in an income year.

The ruling concludes that residency depends on individual facts and circumstances and no bright-line rules or any single factor can be considered to be paramount.

Revenue NSW has determined that the current surcharge purchaser duty and surcharge land tax provisions for certain foreign residents are inconsistent with their nation’s international tax treaties with Australia.

In response to this, effective immediately, individuals who are citizens of New Zealand, Finland, Germany and South Africa, will no longer be required to pay surcharge purchaser duty and surcharge land tax.

The above list was extended on 29 May 2023 to include India, Japan, Norway and Switzerland.

Refunds may also be made available for payments made by the concerned taxpayers for residential property or land purchases on or after 1 January 2021.

Announcement(7-Jun-2023)

Consultation period Released(7-Jul-2023)

Announced: 21-Feb-2023

Updated: 12-Jul-2023

Revenue NSW has determined that the current surcharge purchaser duty and surcharge land tax provisions for certain foreign residents are inconsistent with their nation’s international tax treaties with Australia.

In response to this, effective immediately, individuals who are citizens of New Zealand, Finland, Germany and South Africa, will no longer be required to pay surcharge purchaser duty and surcharge land tax.

The above list was extended on 29 May 2023 to include India, Japan, Norway and Switzerland.

Refunds may also be made available for payments made by the concerned taxpayers for residential property or land purchases on or after 1 January 2021.

The digital games tax offset (DGTO) has received royal assent and is now law.

The DGTO is aimed at giving a boost to the digital economy as well as the digital gaming industry in Australia. This offset will allow eligible businesses to claim a refundable tax offset of up to 30% on qualifying Australian gaming development expenditure.

The offset will be implemented through the creation of Div 378 to the Income Tax Assessment Act 1997.

Rules on the application process have now been released to assist developers and the Arts Minister on the administration of the offset.

Announced: 21-Feb-2023

Updated: 12-Jul-2023

Announcement(23-Nov-2022)

Consultation Introduced(23-Nov-2022)

Passed(21-Jun-2023)

Royal Assent(23-Jun-2023)

Date of effect(1-Jul-2023)

In the bustling and vibrant region of the Geelong and the surrounding Surf Coast and the Bellarine Peninsula, Victoria, a remarkable and transformative force has quietly been leaving a profound impact on the community it serves. WDEA Works, an extraordinary non-profit organisation, is our honoured focus for this month, as we delve into their vision of inclusive thriving communities that has been touching lives, one step at a time.

WDEA Works is a not-for-profit organisation with a rich history that traces its roots back to Warrnambool in 1989. Founded with a noble mission, the organisation aims to assist individuals with disabilities in finding open employment opportunities.

Today, WDEA Works boasts an impressive team of more than 400 individuals spread across 36 sites in the Western half of regional Victoria, extending into South East South Australia and into Queensland. Their network of locations allows them to reach diverse communities, making a profound impact on the lives of countless individuals.

Over the course of the past three decades, WDEA Works has become a force for positive change, helping over 40,000 people find meaningful and inclusive open employment opportunities. Their commitment to improving lives and enriching local communities has left an indelible mark on the region, fostering a sense of empowerment and self-sufficiency among the individuals they support.

At the heart of Geelong, WDEA Works operates with a passionate commitment to address the diverse needs of the community. Their unwavering dedication to empowering individuals facing barriers knows no bounds, as they strive to create a more understanding and inclusive community.

WDEA Works firmly believes that every individual, regardless of the challenges they may encounter, deserves an opportunity to shine and contribute meaningfully to their community. They make sure their participants are ready for work by building skills and addressing barriers to employment. WDEA Works sources job opportunities and provide on-the-job training and long-term support for both employers and employees. They work in partnership with participants at a suitable pace to find employment which best matches their needs and capacity.

One of the most striking aspects of WDEA Works is their collaborative approach with local businesses, such as the inspiring partnership with Ghanda Clothing. Through this collaboration, WDEA Works has managed to create invaluable work opportunities for their clients. Engaging these individuals in various tasks, such as repricing sale stock and security tagging, not only empowers them but also fosters socialisation and the development of strong bonds with their co-workers. As a result, these individuals gain self-confidence and seamlessly integrate into the workforce, proving that they are an essential asset to any team.

With the growth in confidence, Ghanda Clothing provides opportunities for WDEA Works clients to progress to more complex tasks, including using RF scanners, just like any other capable warehouse staff. The numerous success stories from this partnership are a testament to WDEA Works’ dedication in nurturing talent and providing unwavering support, while businesses like Ghanda Clothing have been astounded by the incredible potential and dedication displayed by WDEA Works’ clients. The positive impact they bring to the workplace not only merits praise but also showcases the organisation’s commitment to empowering individuals to reach their fullest potential.

Emma and Nick, two remarkable representatives of WDEA Works Geelong, have played a pivotal role in bridging the gap between the community and local businesses. Their tireless dedication and unwavering commitment to the cause have earned them accolades from partner businesses, and more importantly, have empowered countless individuals to overcome their challenges and lead fulfilling lives.

The heartening aspect of this partnership is that Ghanda Clothing receives a subsidised wage for the first 12 months, making it an attractive proposition for local businesses to collaborate with WDEA Works. The opportunity to work with such capable and compassionate individuals has enriched the Ghanda team, leading to the discovery of some of their most reliable and dedicated workers.

While the impact of WDEA Works’ initiatives is undoubtedly far-reaching, there is always room for more support. As the organisation continues its inspiring work, it urges more local businesses within the surf coast region to come forward and get involved. By committing to hire even just one WDEA Works staff member per year, businesses can significantly contribute to the betterment of the Geelong community and play a vital role in transforming individual lives.

WDEA Works stands as a beacon of hope and progress for the Geelong community, championing the cause of inclusivity and offering unwavering support to those facing challenges. Their partnerships with local businesses, like the transformative one with Ghanda Clothing, exemplify the power of collaboration in nurturing a compassionate and diverse work environment.

Let us all unite in recognising the exceptional efforts of WDEA Works and support their mission to create a more inclusive, understanding, and empathetic society. Together, we can build a stronger and more resilient community that values the potential and abilities of each and every member. As we celebrate WDEA Works as the Non-Profit Organisation of the Month, may their dedication and impact continue to inspire us all to make a positive difference in the lives of others, one step at a time.

“We would highly encourage all local surf coast businesses to get on board and support the WDEA Works community. It’s incredibly rewarding to witness the growth and progress these individuals make within just 12 months of joining the workplace. Embracing diversity and empowering everyone to reach their fullest potential not only enriches our team but also fosters a more compassionate and inclusive community.” – Coby part of the Warehouse Management team at Ghanda Clothing.

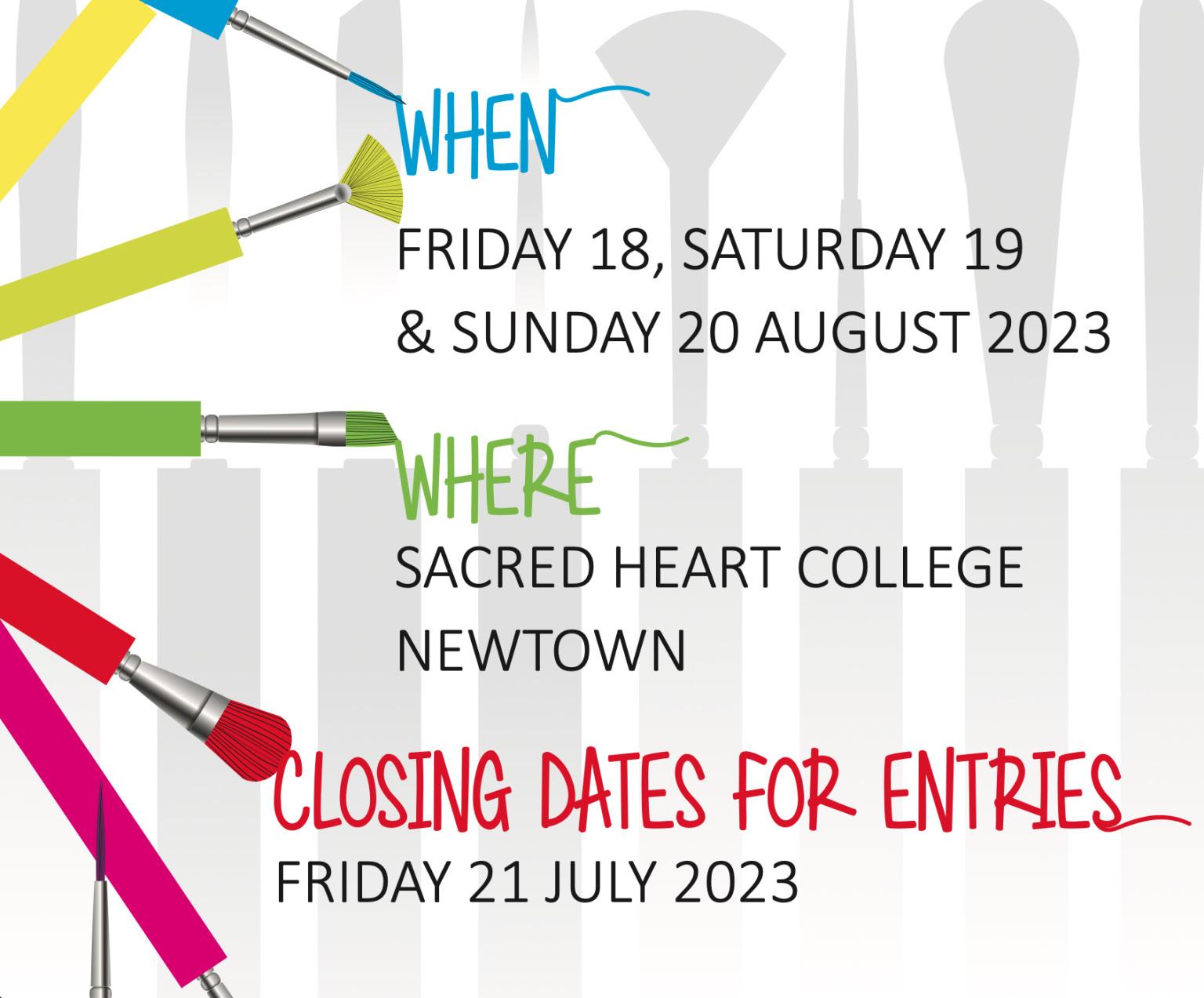

Saturday 19th

Sunday 20th

August. 10am - 4pm

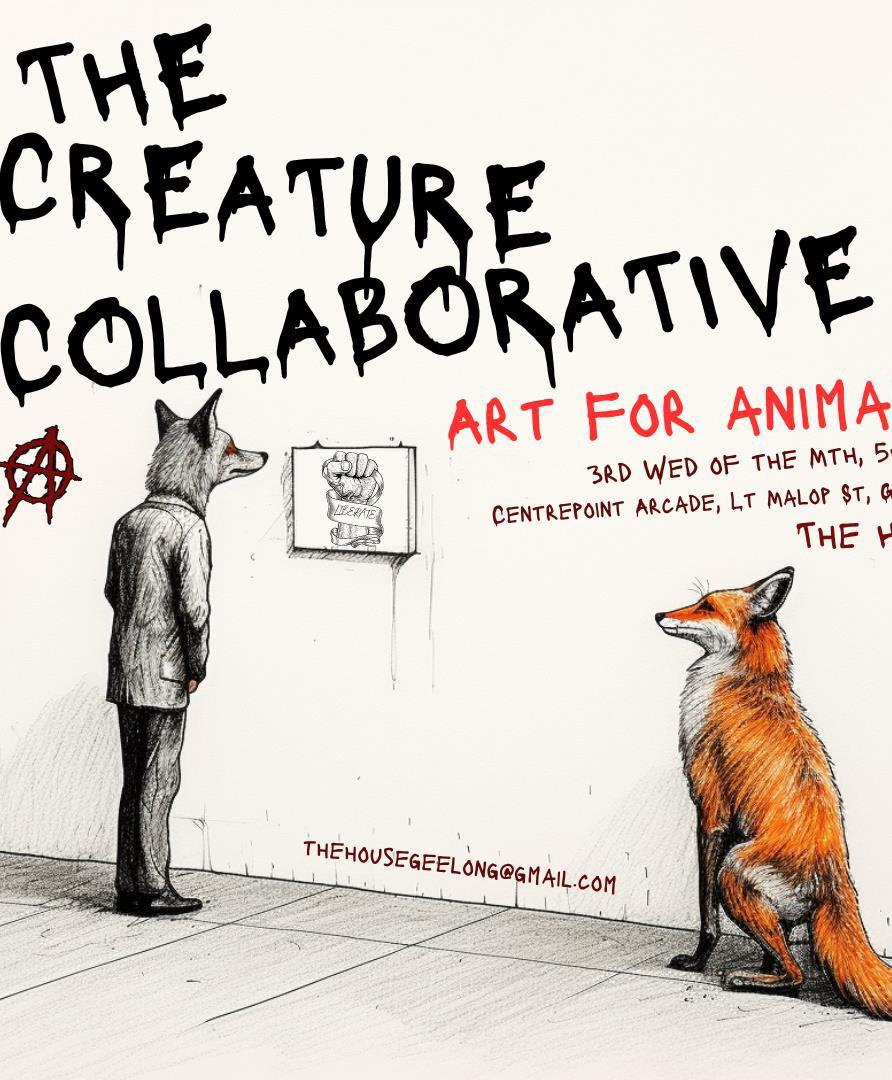

Geelong Art Show Inc. AO 1158 87T is a registered Not For Profit Charity that was started by a group of volunteers in 2021. The objective for this group is threefold:

1. To support local artists to showcase their masterpieces in Geelong.

2. To support Geelong art lovers to see these masterpieces in Geelong.

3. To provide all surplus funds to Australian Charities.

This year the charity of choice is for Cancer research. The money will go to the Australian Cancer Research Foundation through its Geelong subsidiary the Geelong Region Cancerians.

The inaugural Art Show will be open to the public on Saturday 19th and Sunday 20th August between 10 am and 4 pm each day.

Sacred Heart College is the venue, held in the McAuley Hall and beautiful Atrium entry off Aphrasia St .

There are over 230 entries in, oil, watercolour, acrylics, charcoal, pencil, ink or pastels. It is planned that these categories will increase over the years to cover more art mediums.

Nearly 385,000 women die annually in chilbirth, and many more mothers and babies suffer from infection. Nearly all of them live and die in developing countries.

Help reduce this figure by volunteering an hour or two to assemble birthing kits. Whatever time you can offer will assist us in getting 1000 kits made and off to assist mothers in third world countries.

SATURDAY 26 August 2023

9.00 am - 1.00 pm

Eastern Hub Geelong, 285A Mckillop Street, Geelong

Please email zontaclubgeelong@yahoo.com.au with your contact details if you can join us on the day and we look forward to seeing you.

Each Kit costs $5 (about the cost of a cup of coffee) and covers the materials for the kit and the training of traditional birth attendants who also distribute the kits. Donations are gratefully received to assist our members and volunteers to continue to assemble 1000 assemble kits annually.

Account details – Zonta Club Geelong Inc BSB 633-000 1565 99052

www.zontageelong.org.au

Zonta International is a leading global organisation that envisions a world in which women’s rights are recognised as human rights and every woman can achieve her full potential.

Much of parenting young children is about preparing and celebrating for milestones – first full night asleep, first haircut, first day at kindy, first “best friend”. Many of these milestones will be a big deal for parents, while the child will not even recognise the important step forward that has been taken along the journey of childhood.

As parents, our job is to balance encouraging your child to be self-reliant, to embrace the development, while still protecting them.

One major milestone is when your child can travel to and from school without you. Taking that big step can be a real challenge for the parent – how do you evaluate if your child is ready? How do you encourage them to be out in the community while making them aware of dangers? How do you react and respond to them, while not scaring them?

Travelling alone is a critical step toward a child’s emerging independence but children need skills and knowledge to keep them safe before they take that step.

As part of the Neighbourhood Watch 4 Kids program, Neighbourhood Watch Victoria has launched “Travelling safely in the community”, an e-learning platform that helps parents evaluate if their child is ready to travel independently within the community, whether it be to a school, park or playmate’s house and on foot, bike or public transport.

The platform provides both interactive online activity – such as videos, virtual neighbourhoods, downloads, that parents and children can do together or separately, to prepare for the child to be out and about.

Some of the recommendations for how to prepare children (and parents) for moving around the local community without an adult include:

You and your child should set an agreed route to and from school to take every day and go with them on a test run. Familiarise your child with dangers they may encounter on the route, like reversing cars, strangers, roundabouts and road crossings by using the Neighbourhood Watch 4 Kids virtual neighbourhood tool.

Fear triggers physical changes, like butterflies in the stomach, sweaty palms or wobbly legs known as “early warning signs”. Each child’s reaction to feeling unsafe is different so ask your child what they physically feel when they’re scared and recognise that feeling.

Draw up a list of five trusted adults and their contact details. These are people a child regards as safe and who they can talk to about anything. It’s good to show a child safe places in the neighbourhood, like a library or police station, if they feel unsafe.

And there’s more, including Games to play to teach them how to react in different scenarios. Head to Travelling safely in the community https://www.nhw4kidsvic.com.au/ and work together with your child to prepare you both for this huge milestone.

China had the first Botanical Garden in 138 BC, an enormous park with 2,000 different plants and hot houses. 2nd emperor Yang Di in Sui dynasty (581-618AD) built the largest gardens in history and searched far and wide for rare and beautiful plant s. 2,000 years of Chinese horticultural endeavour enrich gardens all over the world. Join your Guide at the GBG front steps to see how many of our plants have Chinese origins.

When: Sunday 13 August 2023

Time: 2.00 pm

Where: Meet your Guide at the front steps of the GBG

Cost: Gold coin donation

www.friendsgbg.org.au

ph (03) 5222 6053

‘CHINESE

’

In 1971 a couple of locals, Len Lewis and Kevin Ash had an idea for a bowls club in Leopold. The idea took hold, a committee formed and money raised. A location was needed that would have enough space for two bowling greens and a clubhouse. Finally this was located in Kensington Road, our current location and 5 acres purchased for $8500.

In May 1975 the club was officially opened as a family friendly sporting club by Brian Dixon, the then Minister for Youth, Sport and Recreation.

You can see the results for yourself on visiting our club.

There are so many people to thank over many years for their support, encouragement and voluntary help along with the the original crew that helped established the club.

Leopold Sporties, located in Leopold, Victoria, is a club based on sports. We offer Bowls, both social and Pennant, Golf, Racquet Ball and Squash.

FC Leopold was established in 2016 by Jared Larkins and Mitchell Vials. The club is based in Leopold, Victoria and played its first competitive games in 2017. In our first season we had over 100 registered players and expect those numbers to grow in 2018 and continue to grow into the future as the club continues to develop.

The club aims to provide a positive family friendly enviroment for our members to develop their skills off the field and to also become great people off the field.The club is run solely by volunteers and we are always looking to get members involved in helping the club grow and develop.

We are aiming to become a huge part of the Leopold community and look forward to growing the sport of football (soccer) in our beautiful town.

FC Leopold is a community club that fields senior mens teams, a senior womens team and multiple miniroos and junior teams in Geelong competitions.

FC Leopold are looking for enthusiastic members of the community who would like to contribute to the clubs ethos and family friendly feel - whether that is through being a committee member, volunteer, coach or player.

Like the page to keep up to date with the clubs progress as exciting things are happening with lights and a massive COGG funded pavilion project.

• Founder of Find Geelong

Warren Strybosch is the Founder of the ‘Find Group’ of companies offering the following services: Tax and Financial planning advice. He specialises in the preparation of tax returns e.g. sole trader, company, trust and SMSF tax returns. He has been short- listed for many awards over the years across tax and financial planning.

As a professional accountant & financial advisor, Warren provides his clients with honest and appropriate advice with the aim to put their needs first and foremost. He has a great team behind him that supports him in everything he does.

Warren’s ideal client would be someone who runs their own SMSF or business and would like an affordable accountant to manage their tax returns each year.

Increased parking is on the way for our region’s boating enthusiasts at the Clifton Springs Boat Harbour, a popular destination for recreational boating, yachting, fishing and offshore diving.

With Geelong and The Bellarine having the largest concentration of registered vessels (up to 10,000) in Victoria, the Clifton Springs Boat Harbour provides direct access to the stunning Corio and Port Phillip bays.

The Clifton Springs Boat Harbour Upgrade will increase the number of formal car parks and improve traffic flow at the site, with an additional 30 car-trailer-unit spaces and an asphalt carpark seal.

Identified as a high priority facility for delivery, the upgrade is funded by the Victorian Government’s Better Boating Fund through a $350,000 contribution and a previous Boating Safety and Facilities Program grant of $250,000. An additional $200,000 has been contributed from the Commonwealth Government’s Local Roads and Community Infrastructure (LRCI) Program.

The City of Greater Geelong is commencing site survey works today with the new carpark available for use in time for summer from December.

It’s anticipated there will be limited impacts to the ramp and main carpark access during the construction stage.

“The federal government is committed to supporting local councils in their delivery of community infrastructure through the LRCI program.

The LRCI program is all about making sure that our communities have the safe, reliable, and functional infrastructure they need.

And anyone who knows Clifton Springs will understand just how important boating is to the local community for work, recreation, and for driving tourism throughout the North Bellarine.

That’s why this collaboration between federal, state and local government is so important.”

“The Clifton Springs Boat Harbour allows locals and visitors to experience the beauty and wildlife of Corio Bay in a convenient location.

I’m a regular at the Clifton Springs Boat Harbour and like my fellow boaties, I’ve watched as the facility has become increasingly popular and struggled to meet demand.

Theparking upgrade will make a significant difference to the harbour, which has been identified as a growth area, and the City team is pleased to be delivering the works.

Council is grateful to Better Boating Victoria and the Commonwealth Government for prioritising this boat harbour, as it has immense recreational, economic and environmental value to the community.”

Upgrade works are underway to transform the Avalon Beach Boat Ramp, allowing for more community members to use the facility.

The $1.8 million project, funded by the reinvestment of boating licence and registration fees through Better Boating Victoria, is being delivered by the City of Greater Geelong.

The site is well utilised for recreational boating and fishing. When construction is expected to end in Spring (subject to weather conditions), the car park will have 36 Car and Trailer Unit spaces, new asphalt and line marking.

The two jetties are being extended to double the existing berthing capacity. Launching a boat will be even easier thanks to improvements to their configuration and structure.

Wave screens are also being rebuilt and replaced to provide greater protection to boaters during windy conditions.

The design of the Avalon Beach Boat Ramp Upgrade will reduce storm water runoff impacts to the surrounding environment.

The ramp remains closed during construction. Boaters can still launch at St Helens boat ramp to get out onto Corio Bay and Port Phillip.

For more information about the Avalon Beach Boat Ramp Upgrade, visit Better Boating Victoria

“These upgrades will improve safety in the area and ensure that Geelong boat owners will have access to the best facilities well into the future.”

“There will be a noticeable difference to the site when the upgrade is completed.

Geelong and The Bellarine has the largest concentration of registered vessels in Victoria, so it’s no surprise that many in the community are thrilled about the Avalon Beach Boat Ramp Upgrade.

Exciting changes are on the way, including expanding the number of car parking spaces from 11 to 36 and improved wave attenuation.

Council appreciates Better Boating Victoria’s significant funding investment to make boating and fishing more accessible for the community.”

“It is vital to have facilities that meet demand with a growing population and tourism sector.

Boating and fishing are increasingly popular activities that result in many positive physical and mental benefits for the community.

Thanks to community members, including key users of the boat ramp, providing feedback on the concept in September 2021, taking the boat out will be a much smoother experience at Avalon later this year.”

Greater Geelong residents and tourists alike will have increased access to Geelong’s historic Waterfront Carousel following a change in opening times to align with summer hours.

The new opening hours of 10:30am to 4:30pm from Monday to Friday will also improve the availability of the City of Greater Geelong’s Tourism visitor services information desk, proving beneficial to people flooding into the region, many via the Spirit of Tasmania, Searoad Ferries from Sorrento and the Port Philip Ferries from the Docklands.

The Carousel is open even longer on weekends by 30 minutes, from 10:30am to 5:00pm.

In a demonstration of the precinct’s popularity, the Visitor Information Centre serviced 21,063 visitors at the Carousel in the 2022-2023 financial year.

Steam driven before its conversion to electric, the portable wooden Carousel was built in 1892 and has become a popular Geelong landmark since its restoration and opening in the City 23 years ago.

The Carousel is located at Wadawurrung Country, 1 Eastern Beach Road, Geelong Waterfront and is available for event hire in addition to visitation at the times outlined.

Contact The Carousel by phone or email to learn more.

Mayor Trent Sullivan

“I urge residents and visitors to take the opportunity to enjoy the unique Waterfront feature.

The Carousel is an ideal meeting place for everyone, and we take pride in providing a memorable experience for people of all ages and abilities.

Now with the extended opening hours we have even more opportunity for members of our community, along with tourists to our region, to enjoy this colourful, fun, and historic site.”

“I join Mayor Sullivan in inviting a stop-off at one of the Geelong Waterfront’s premier landmarks.

The Carousel has become a much-loved part of our Geelong Waterfront since its restoration and installation by the Steam Packet Development Board in the 1990s.

The Carousel holds many memories including for myself, as I was married there in 2003 and I do hope that tourists will make a stop at this beautifully restored feature part of their journey through Geelong.

An added bonus is the fact that the Carousel is accompanied by a visitor services information desk that is well stocked with many other great ideas for those visiting our region.”

Around 350 local residents have joined forces to plant more than 3,000 trees for National Tree Day at a free City of Greater Geelong-run community event in Lara on Sunday 30 July 2023.

The event, held at Lavender Reserve in Lara, was made possible through the collaboration and support of Planet Ark, Blood Toyota, the Lions Club South Barwon and Lions Breakfast Club Drinks, dedicated volunteers and City staff members who worked tirelessly to organise and coordinate the day.

“I encourage the community to remember that National Tree Day was about more than just an annual event.

We need to use this as an opportunity to prioritise sustainable living and the shared responsibility we have in preserving our environment.”

Deputy Mayor Anthony Aitken“National Tree Day was a remarkable success, thanks to the unwavering support of our staff members and community, with a special mention to BAPS Swaminarayan Sanstha Hindu Geelong. The united effort of people from diverse backgrounds coming together to plant trees was truly heart-warming and reinforces our belief in a brighter and greener future for our region.

From families with young children to retirees, people from all walks of life got their hands dirty while planting trees, united by a common goal to enhance the local environment and leave a lasting positive impact in Lara.”

Greater Geelong residents are invited to play their part in creating a more accessible, inclusive, and welcoming community by helping shape the City of Greater Geelong’s new Access and Inclusion Action Plan 2024-2028.

People with disabilities are a vital part of Greater Geelong’s community as residents, employees, business owners, artists, volunteers, tourists and visitors.

The Access and Inclusion Action Plan outlines what the City will do to ensure its services and facilities meet the diverse needs of people with disability.

The Plan will be developed in consultation with people with disability, their families and carers, service providers and the Access and Inclusion Advisory Committee, and will outline the City’s actions to support the full participation of people in community life.

Community members can contribute to the conversation by visiting the Have Your Say page and using one or more of the feedback options below:

• Take our survey online. You can request a hard copy by contacting the officer listed in the ‘Who’s Listening’ section of this page or record an audio response and upload an audio MP3 file.

• Host a Conversation using our conversation kit with instructions.

• Attend a Community Meeting in person or online.

• By email to ccadmin@geelongcity. vic.gov.au or

• In writing addressed to:

• Community Inclusion Unit

• City of Greater Geelong

• Wadawurrung Country

• PO Box 104

• Geelong VIC 3220

The engagement closes at 5:00pm on Tuesday 5 September 2023.

“The City is committed to working with people with disability, their carers, and supporters to develop the new Action Plan

We aspire to be an inclusive, diverse, healthy and socially connected community, where everyone can participate fully; this plan will set us on track for continuing to increase access for all.

It’s vitally important that we hear from people with disability, family, friends, carers and service providers, along with the broader community.