The Find Geelong is a community paper that aims to support all things Geelong. We want to provide a place where all NotFor-Profits (NFP), schools, sporting groups and other like organisations can share their news in one place. For instance, submitting up-and-coming events in the Find Geelong for Free.

We do not proclaim to be another newspaper and we will not be aiming to compete with other news outlets. You can obtain your news from other sources. We feel you get enough of this already. We will keep our news topics to a minimum and only provide what we feel is most relevant topics to you each month.

We invite local council and the current council members to participate by submitting information each month so as to keep us informed of any changes that may be of relevance to us, their local constituents.

We will also try and showcase different organisations throughout the year so you, the reader, can learn more about what is on offer in your local area.

To help support the paper, we invite local businesses owners to sponsor the paper and in return we will provide exclusive advertising and opportunities to submit articles about their businesses. As a community we encourage you to support these businesses/columnists. Without their support, we would not be able to provide this community paper to you.

Lastly, we want to ask you, the local community, to support the fundraising initiatives that we will be developing

and rolling out over the coming years. Our aim is to help as many NFP and other like organisations to raise much needed funds to help them to keep operating. Our fundraising initiatives will never simply ask for money from you. We will also aim to provide something of worth to you before you part with your hard-earned money. The first initiative is the Find Cards and Find Coupons – similar to the Entertainment Book but cheaper and more localised. Any NFP and similar organisations e.g., schools, sporting clubs, can participate.

Follow us on facebook (https://www. facebook.com/findgeelong) so you keep up to date with what we are doing.

We value your support, The Find Geelong Team.

EDITORIAL ENQUIRES: Warren Strybosch | 1300 88 38 30 editor@findgeelong.com.au

PUBLISHER: Issuu pty Ltd

POSTAL ADDRESS: 248 Wonga Road, Wararnwood VIC 3134

ADVERTISING AND ACCOUNTS: editor@findgeelong.com.au

GENERAL ENQUIRIES: 1300 88 38 30

EMAIL SPORT: editor@findgeelong.com.au

WEBSITE: www.findgeelong.com.au

The Find Geelong was established in 2019 and is owned by the Find Foundation, a Not-For-Profit organisation with is core focus of helping other Not-For-Profits, schools, clubs and other similar organisations in the local community - to bring everyone together in one place and to support each other. We provide the above organisations FREE advertising in the community paper to promote themselves as well as to make the community more aware of the services these organisations can offer. The Find Geelong has a strong editorial focus and is supported via local grants and financed predominantly by local business owners.

The City of Geelong is one of Victoria’s largest regional capital cities. Geelong had a population of approximately 230,000 as at the 2019 Report which includes 16,000 businesses. Geelong’s location is in strong growth corridor, making it an ideal location for businesses to explore options outside of the capital city.

The Find Geelong acknowledge the Traditional Owners of the lands where Geelong now stands, the Wadawuarrung people of the Kulin nation, and pays repect to their Elders - past, present and emerging - and acknowledges the important role Aboriginal and Torres Strait Islander people continue to play within our community.

Readers are advised that the Find Geelong accepts no responsibility for financial, health or other claims published in advertising or in articles written in this newspaper. All comments are of a general nature and do not take into account your personal financial situation, health and/or wellbeing. We recommend you seek professional advice before acting on anything written herein.

ADVERTISING RATES (INCLUDE GST)

By Warren Strybosch

By Warren Strybosch

As the new financial year approaches, it’s time to prepare for a fresh start in managing your finances. Whether you’re an individual or a business owner, taking the necessary steps to get ready for the new year can set you up for success and help you achieve your financial goals. Here are some key areas to focus on as you gear up for the new financial year.

Firstly, review your financial statements from the previous year. Take a close look at your income, expenses, and investments to gain a clear understanding of your financial position. This analysis will help you identify areas of improvement and guide your decision-making in the upcoming year.

Next, set specific financial goals for the new year. Whether it’s saving for a down payment on a house, paying off debt, or increasing your business revenue, establishing clear objectives will provide you with a roadmap to follow and keep you motivated throughout the year.

Another crucial step is to update your budget or financial plan. Consider any changes in income or expenses that may affect your financial situation. Revise your budget accordingly and allocate funds to different categories, ensuring you have a balanced and realistic plan to follow.

Additionally, take advantage of any available tax benefits or deductions. Research new tax laws and regulations that may apply to your situation, and consult with a tax professional if needed. By maximizing your deductions, you can potentially reduce your tax liability and keep more money in your pocket.

Lastly, organize your financial documents and records. Ensure you have a system in place to keep track of receipts, invoices, and other important paperwork. This will make tax preparation and financial analysis much easier throughout the year.

Getting ready for the new financial year requires careful planning and attention to detail. By reviewing your financial statements, setting goals, updating your budget, optimizing your tax situation, and organizing your documents, you’ll be well-prepared for the challenges and opportunities that lie ahead. Embrace this fresh start as an opportunity to take control of your finances and work towards a prosperous future.

Volunteering rates have fallen across the country in recent years.

A seismic shift occurred during the COVID-19 lockdowns, and numbers haven’t fully recovered, due to factors such as the cost-of-living crunch and an ageing population.

So, it is important to properly recognise and thank those who give their time, energy and expertise to make their community a better place to live.

Council hosted a function during National Volunteer Week last month, to honour and celebrate the scores of volunteers we are fortunate to have at the City.

The 130-odd services that Council provides are all about improving the lives of the people who live in and visit Greater Geelong.

Across a range of these services and programs – including the arts, cultural venues, tourism, driver education, and family care – our committed volunteers help us make a significant difference.

We would not be able to provide the high level of service without them.

For example, over the past year, volunteers helped close to 23,000 people who attended a Geelong visitor Information centre.

They staffed the National Wool Museum for more than 1100 hours; and taught 19 learner drivers to gain their provisional licence.

Across kindergartens, neighbourhood houses, our international student support program, Study Geelong, and the Potato Shed, volunteers are doing the City proud.

While they give so much to others, we know there are many benefits for those who do volunteer.

It is often an important social outlet, and can bring them in contact with people who have common interests and shared values.

But we know to retain and grow our volunteer base, we need to offer a diversity of quality experiences, and fit in with the other demands of people’s lives.

If you’d like to know more about volunteering opportunities, please visit www.geelongaustralia.com.au/volunteer

The COVID-19 pandemic has brought about unprecedented economic challenges globally, with governments around the world implementing various measures to mitigate its impact. One such measure that has been proposed in some countries is the COVID Debt Recovery Plan “levy.” This levy is intended to help recover the significant debts accumulated during the pandemic and support economic recovery in the aftermath.

The COVID Debt Recovery Plan levy is a financial mechanism whereby a specific percentage or amount is imposed on certain individuals, households, or businesses to contribute towards repaying the debts incurred due to the pandemic. The idea behind this levy is to distribute the burden of debt repayment more equitably and ensure that those who have the means to contribute bear a fair share of the recovery costs.

With the increasing Victorian debt, the Labor government, in a bid to find ways to raise further revenue, have decided to source additional revenue via their so called, Covid Debt Recovery Plan, by taxing large businesses and those with additional land as follows:

• From 1 July 2023, large businesses with national payrolls above $10m a year will temporarily pay additional payroll tax. A rate of 0.5% will apply for businesses with national payrolls above $10m, and businesses with national payrolls above $100m will pay an additional 0.5%. The additional rates will be paid on the Victorian share of wages above the relevant threshold and are estimated to raise $3.9 billion to repay COVID Debt over four years.

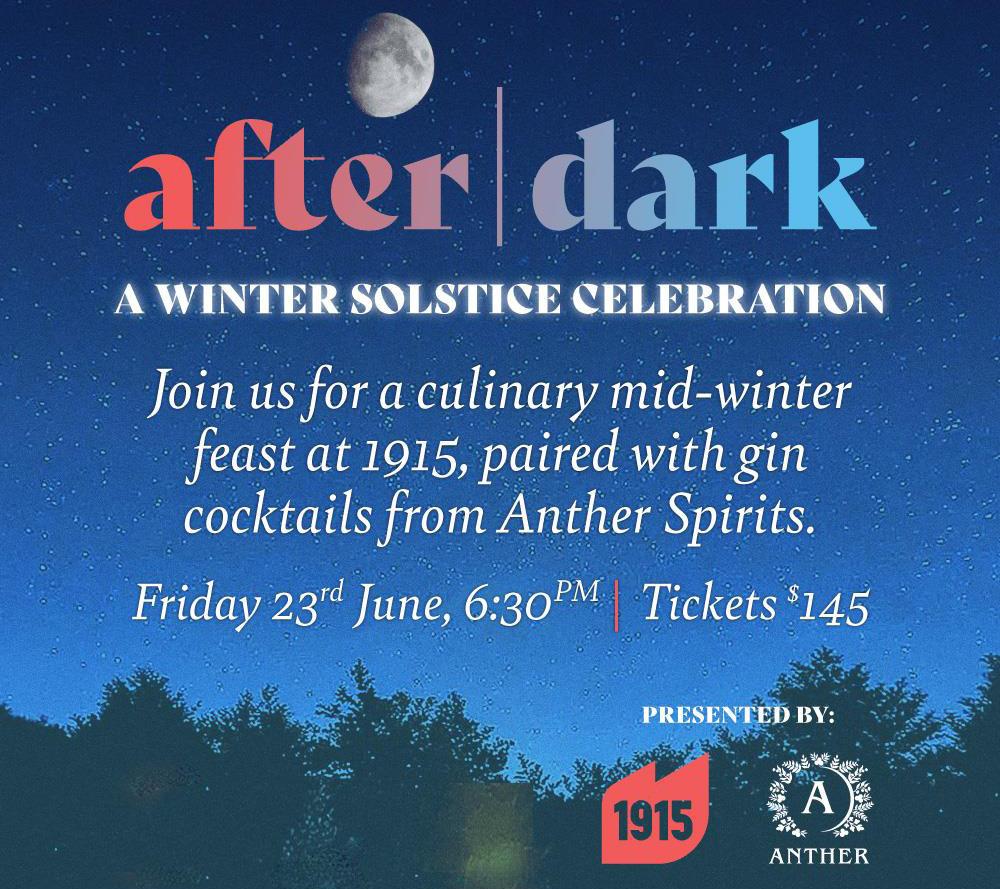

GSODA

See on page 47

• From 1 January 2024, the tax-free threshold for general land tax rates will temporarily decrease from $300,000 to $50,000. The family home will remain exempt from land tax. Those who pay land tax will attract a temporary additional fixed charge starting at $500 for landholdings between $50,000 and $100,000. There will be a $975 fixed charge for landholdings above $100,000 and the tax rates will temporarily increase by 0.1 per cent for both general and trust taxpayers with holdings above $300,000 and $250,000 respectively. These changes are estimated to raise $4.7 billion to repay COVID debt over four years.

Proponents of the COVID Debt Recovery Plan levy argue that it promotes fiscal responsibility and helps avoid long-term economic instability. By sharing the burden of debt recovery across the population, it

reduces the strain on government finances and prevents excessive borrowing, which could lead to inflation or increased taxes in the future. Additionally, it ensures that those who have profited or remained financially stable during the pandemic contribute their fair share towards rebuilding the economy.

However, critics of the levy express concerns about its potential negative impact on already struggling individuals and businesses. They argue that imposing additional financial obligations could hinder economic recovery by reducing consumer spending and stifling business growth.

Let’s face it. The Victorian government is nearly at a crisis point regarding their current debt levels. They know they must find more ways to increase revenue and so it makes sense to them to introduce a ‘levy’ and target big business and those more fortunate than us to cover the bill.

Juniors present Joseph and the Amazing Technicolor Dreamcoat

The Albanese government committed to legislating the national net zero authority last month to manage the transition.

Assistant climate change and energy minister Jenny McAllister said the agency would have three main tasks: coordinating support for workers during the transition, coordinating business investment and working with the most affected communities.

“We want to work with local government or state government, with local institutions that may have been established to deal with this challenge, with union representatives – all sorts of entities that have an interest in seeing our regions transformed,” she said.

Senator McAllister defended the appointment of three union voices to the board.

Former Labor climate change minister Greg Combet has been picked to head the agency tasked with easing the transition to a renewable energy-fuelled economy.

The ex-union boss will chair the Net Zero Agency, which the Labor government has established to ensure workers, industries and communities don’t miss out during the push to reach net-zero carbon emissions.

Mr Combet, who is the chair of IFM Investors and Industry Super Australia, will be joined by 10 other members on the advisory board.

Economists such as Professor Ross Garnaut and Professor Paul Simshauser have been selected, along with the head of the Australian Energy Regulator, Anthea Harris, the president of the Australian Council of Trade Unions, Michele O’Neil, and Rio Tinto Australia chief Kellie Parker.

HECS-HELP debts in Australia are designed to increase with inflation to ensure their real value is maintained over time. The Higher Education Contribution Scheme (HECS) assists students in financing their tertiary education, allowing them to defer their tuition fees and repay them later through the Higher Education Loan Program (HELP).

Inflation refers to the general increase in prices over time, which reduces the purchasing power of money. To account for this, HECS-HELP debts are indexed annually to keep pace with inflation. This indexing ensures that the amount owed adjusts to the changing value of money, preventing the erosion of the debt’s real worth. Consequently, borrowers are required to repay an amount that reflects the prevailing economic conditions at the time.

Looking back over the last 10 years, we can see how low the HECS indexation rate has been until 2022 and then here has been a significant jump in 2023.

(Source: ato.gov.au)

Whilst not great news for those students who are about to finish VCE and embark on a TAFE or university course and were considering accessing HELP loans, the

“These are important questions for workers and we want working people to know that they have a stake in the new economy,” she said.

She added there was also representation from business and economics professions to guide the transition of the energy market and economy.

The Net Zero Agency will start work next month.

good news is that the threshold that determines the income level at which borrowers are obligated to start repaying their debts has risen in line with inflation as well. The Government has released details of repayment incomes and rates for the HELP for the 2023-24 income year. The minimum repayment income is $51,550 for the 2023-24 income year. For full details, see here. This means that individuals earning below this threshold are not required to make any repayments towards their HECS-HELP debts. However, once an individual’s income surpasses this threshold, a portion of their income is automatically deducted through the taxation system to contribute towards the repayment of their debt.

By linking HECS-HELP debts to inflation and implementing a repayment threshold, the Australian government aims to ensure the accessibility and fairness of higher education funding, making it manageable for students while also maintaining the sustainability of the system. However, with increased food prices and living costs, it is going to be hard for those students when they finish their courses to have to pay rent, food, other living costs and to add to that their HELP-HECS loans.

Help the local community know you exist and what sets you a part compared to other aged care facilities, Financial Planners and other providers in the local area.

We have developed Find Aged Care Services (www.findagedcare.services) so you can promote your facilities and services to the general public. You can also place any job vacancies on our website that is available in your facilities.

For more information, please contact us at 1300 88 38 30 or email info@findagedcare.services

Have you thought about purchasing another asset for your business, but you are unsure if you should or not? Is there any benefit in doing so before 1st July 2023?

Here we try to explain what the changes are and whether or not you should consider purchasing an asset before 1st July 2023.

In summary, here are the changes:

• Temporary full expensing will end 30 June 2023.

• From 1 July 2023 to 30 June 2024, the instant asset write off threshold will be $20,000 per asset.

On Budget night we heard that the Instant asset write-off measure would end this financial year. From 1 July, it will revert to the previous instant asset write off scheme, but with a higher threshold.

Rather than dropping immediately to $1,000, the threshold will be $20,000 per asset until 30 June 2024, which means that eligible businesses with revenue under $10 million will be able to write off the full value of eligible assets up to $20,000 that are first used or are installed ready for use during FY 2023-24.

With the threshold applying per asset rather than per business, multiple assets up to $20,000 that meet the criteria can be written off immediately.

It might be time to talk to your accountant about any changes that might be coming, and how they will impact capital asset plans in our business.

Those planning to take advantage of temporary full expensing need to do so before EOFY, with the asset installed and

ready for use. Those considering purchases early in the new FY may consider bringing those plans forward to take advantage of the scheme, but cash flow impacts need to form part of the decision.

Other business owners who plan to invest in assets up to $20,000 in the next FY and take advantage of the instant asset write off should not count on the temporary measure extending beyond 30 June 2024 – the assets must be ready for use by that date.

Those businesses considering assets that are eligible for the Small Business Energy Incentive may consider waiting until after EOFY regardless of the end of temporary full expensing.

Eligible businesses will be able to claim a bonus tax deduction of 20% for spending on assets that supports electrification and energy efficiency that are installed during FY24 with a maximum claimable expenditure of $100,000. This sets a ceiling of $20,000 as the maximum bonus tax deduction.

Immediately deduct the full cost of eligible assets.

Bonus tax deduction of 20% of spending on eligible assets or upgrades.

Assets must not cost more than $20,000 per asset. Multible assets can be claimed.

Aggregated turnover of less than $10 million.

Must be first used or installed ready for use in FY24.

Must support electrician or energy efficiency. Up to $100,000 of total expenditure.

Sources: Instant asset write off | Small Business Energy Incentive

Annual turnover of less than $50 million.

Must be first used or installed ready for use in FY24.

The ATO is likely to issue fewer refunds as they tighten on expense claims related to rental properties,work claims and capital gains tax (CGT).

The Australian Taxation Office (ATO) has outlined its focus areas for the 2023-24 financial year, with particular attention being given to rental properties, work claims, and capital gains tax. These areas have been identified as priorities due to their potential for non-compliance and revenue leakage.

The ATO Assistant Commissioner, Tim Loh, has stated, “Within these areas we have identified common mistakes and are particularly focused on addressing these and supporting taxpayers and registered tax agents to get their claims right this year.”

Rental properties have long been a key area of interest for the ATO. With the rise of the sharing economy and the

increasing popularity of platforms such as Airbnb, the ATO is keen to ensure that taxpayers accurately report their rentalincome and claim only legitimate deductions. The ATO will be scrutinizing claims related to rental income, expenses, and depreciation to identify any instances of overstatement or fraudulent reporting. Taxpayers will need to maintain accurate records and ensure they understand the rules and limitations around rental property deductions to avoid potential audits or penalties.

“We expect fewer people will receive a refund or may receive smaller refunds than they were expecting, and more may have tax debts to manage.”

Mr Loh said nine out of 10 rental property owners were getting their returns wrong with errors such as omitting rental income, overclaiming expenses or claiming for improvements to private properties.

With 87 per cent of landlords using tax agents to prepare their returns, the ATO said its analytics systems could now highlight residential propery loans along with other rental data.

“We encourage rental property owners and their registered tax agents to take extra care this tax time and review their records before lodging their return,” Mr Loh said.

The ATO was especially concerned to ensure rental property owners understood how to correctly apportion loan interest expenses where part of the loan was used for private purposes.

“You can only claim interest on a loan used to purchase a rental property to earn rental income,” Mr Loh said. “If your loan also includes a private expense, such as for a new car or a trip to Bali, you can only claim an interest deduction for the portion relating to producing your rental income.”

In addition to rental properties, the ATO will be closely examining work-related expense claims. This area has always been a focus for the ATO, as it represents a significant portion of individual taxpayers’ claims. However, with the increasing prevalence of remote work and the blurred lines between personal and business expenses, the ATO aims to

ensure that taxpayers are correctly apportioning their claims and not inflating deductions. Taxpayers will need to keep detailed records, such as receipts and logbooks, to substantiate their claims and be prepared to provide evidence if requested by the ATO.

Capital gains tax (CGT) is another area where the ATO will be directing its attention. With the property market experiencing significant growth in recent years, there is an increased likelihood of taxpayers making gains on the sale of their assets. The ATO will be closely monitoring these transactions to ensure that taxpayers are correctly calculating their CGT liabilities and reporting them accurately. Taxpayers should ensure they are aware of the CGT rules, including the availability of any exemptions or concessions, to avoid unintended noncompliance.

Last year’s tax crackdown on crypto has morphed into a broader concern over CGT events for a wide range of assets.

The ATO said CGT applied to any disposal of shares, managed investments, properties and, of course, crypto.

“To ensure you are meeting your obligations and paying the right amount of tax, you need to calculate a capital gain or capital loss for each asset you dispose of unless an exemption applies,” the ATO said.

To support its focus on these areas, the ATO will be leveraging data-matching technology and advanced analytics to identify patterns and anomalies. This will allow them to target specific taxpayers or industries where non-compliance is more likely. The ATO will also be conducting education campaigns to inform taxpayers about their obligations and provide guidance on how to meet their tax obligations correctly.

Don’t fall into the trap of thinking we won’t notice if you sell an asset for a gain and don’t declare it,” Mr Loh said.

It is essential for taxpayers to be proactive in understanding their tax obligations, keeping accurate records, and seeking professional advice if needed. By staying informed and compliant, taxpayers can avoid potential audits, penalties, and the associated stress and financial implications. The ATO’s focus on rental

properties, work claims, and capital gains tax highlights the importance of accurate reporting and demonstrates their commitment to maintaining the integrity of Australia’s tax system.

(Source: https://www.ato.gov.au/Mediacentre/Media-releases/In-the-ATO-ssights-this-tax-time/)

For those trustees with complex trust structure set ups it is advisable to seek advice from an accountant or lawyer that specialises in this area.

You can call them on 1300 88 38 30 or email info@findaccountant.com.au www.findaccountant.com.au

on winning the Holistic Adviser of the Year again at the IFA Excellence Awards 2022.

The founder of the Find Group of companies draws on his diverse background, which ranges from teaching, to serving in the army, to taxation and accounting, to coach and help clients live their best financial lives. A multi-award winner, Warrens’s innovative approach in business means he was a champion of virtual financial advise long before the pandemic. Warren established the Find Foundation, which owns and operates accros Victoria.

The financial advisers featured in this guide are a diverse group: some specialise in responsible investment advice, some provide financial advise to specific professions, and some focus on addressing market gaps, mwith several finding themselves on the list for the very first time. But they all have one thing in common: they all wield influence that can create the blueprint for the future of financial advice in Australia. Not all of them are faniliar names but just because they are not making a lot of noise doesn’t mean they are not making waves. Meet our Power 50.

• Conduct morning briefings where gratitude and fun are highlighted. Gratitude promotes positive feelings and boosts personal and team morale. Organise fun morning huddles with games like trivia and karaoke to boost your team’s morale and promote positivity. This will help in the team-building process that promotes harmony and collaboration.

• Hold regular performance/feedback chats. Make sure to meet individual team members, chat about their performance, and listen to their feedback. These one-on-one chat sessions will help you to develop a smooth communication system and encourage openness.

• Solicit for feedback and be open to suggestions. For example, ask your team members what they stand for regarding a healthy worklife balance. In the event you get suggestions of remote working and grant that privilege, you will have successfully promoted a positive work culture of being understanding and compassionate.

• Encourage transparency as opposed to anonymous feedback. This will encourage problem-solving better as a team.

Work culture is a set of attitudes,behaviours, and beliefs in an organisation’s work environment. A positive work culture upholds compassion, responsibility, gratitude, and integrity. A positive work culture boosts employees’ morale, improving productivity and consequently leading to a high talent retention rate. Work culture is a feel, it’s how the place feels to all that cross its path.

People value this so much, studies show that many employees are quitting toxic work environments built by and due to negative work cultures.

I know what I’d prefer to create.

Here are some ways you can build a positive work culture for your business.

In leadership, it’s obvious that a leader must always lead by example. If you want to promote a positive work culture, you must set the pace and show your team how things should be done. For example:

• Display attitudes and traits that build a positive work culture, like responsibility and accountability.

• Appreciate your team.

• Communicate with your team consistently and develop mutual understanding.

• Put your team first and focus on their happiness. Building them will build the business.

Communication is the backbone of successful businesses. Open and regular communication will empower your team to voice their honest opinions without fear of retribution. For example:

Sometimes mistakes will happen in a business setting, which is inevitable, and an individual or an entire team may have to bear the consequences. Active accountability dictates that any action that violates the organisation’s policy may be penalised, and the perpetrator must take full responsibility. Apart from taking responsibility, an individual must make up for their mess, for example, by apologising, seeking and/or implementing an effective solution.

Active accountability promotes a positive work culture in that team members in a business are compelled to do the right thing and take responsibility if they are wrong. This reduces blame game, builds trust, and enhances collaboration to prevent likely mistakes.

This system pairs a new or inexperienced employee with an experienced employee who monitors and passes knowledge to their inexperienced counterpart. This initiative promotes a positive work culture

by encouraging collaboration and helps establish healthy workplace relationships. New recruits fit in quickly and gain confidence to start working. Additionally, because the “buddies” share knowledge, this system supports career growth and development.

This is the continuous upskilling of staff over multiple training sessions throughout their career instead of just once. You promote a positive work culture by using strategies such as ongoing training because it shows employees you value their growth and development. In fact, more job seekers are looking for organisations that consider their development. Therefore, training means job satisfaction, a boost in morale, and low turnover rates.

Acknowledge and reward employees for good performance. For example:

• Make your employees feel special by organising awards and giving out gifts and accolades.

• Promote exceptional employees.

• You can also conduct private meetings to tell them how you feel about their performance and congratulate them.

• Recognise your employees’ efforts publicly in front of their colleagues. Take note of how you do this. Some behavioural types prefer a quiet acknowledgement, some more of a fan fair.

Employee recognition is one of the top ways to boost organisational morale. This also promotes a positive work culture that rewards and values diligent workers.

Positive work culture is clear about its goals, vision, hierarchy, and the company’s operations. You must be willing to share useful information with your employees to earn their trust and loyalty.

Being transparent in your business’s goals, vision, and values gives your team clarity of focus and an understanding of their expectations. Therefore, you can be sure of accountability from your employees.

Be transparent about positions and roles in the business. Toxicity easily brews when employees realise they have been lied to about job positions, promotions, and wages. Also, make your business’s activities clear to your employees. Adding

new workers? Inform your current team. This will stop any suspicion of concerns like retrenchments or replacement.

Successful businesses are built on the foundation of positive work culture. Once your employees are comfortable in their work environment created by positive work culture, you will likely get the most out of them. Consistency is key when using the above strategies because it takes time to perfect positivity in the workplace. Always communicate because this paves the way for the rest of the strategies. Also, lead by example, as you are the one to inspire your team. Want to chat about how you can personally improve your workplace culture? Flick me an email and let’s do it, I’d love to support you with some quick wins and ideas.

Team/Leadership Coach Team Resilience Method

www.linkedin.com/in/leadership-development-coach/ sally@team-resilience.com.au

It’s always best to talk to a salary packaging provider who can provide expert advice about the industry that you work in and what benefits you can salary package.

The recent significant rises in the cost of living have most Australians looking for different ways to manage their household budgets. When you have a fixed income, this can prove challenging. You may not be aware but you should first look for relief from your workplace, but not just by asking for a salary increase. You should consider something else that is available to you – salary packaging. By taking advantage of salary packaging benefits, you can free up more of your income and legitimately gain relief from rising living costs. Here’s how salary packaging works and how it can help you.

Salary packaging is an employee benefit that allows you to pay for some of your living expenses out of your pre-tax income rather than from your after tax income.

Depending on the industry that you work in, the benefits that you could potentially salary package include everyday expenses such as:

• Groceries

• School fees

• Childcare fees

• Council rates

In addition, you could also package living costs such as:

• Mortgage repayments

• Private home rentals

• Credit card

• Loans

On top of these costs, depending again on the industry you work in, you may be able to pay for meals and accommodation through salary packaging. Some examples of this benefit are:

• Restaurant Meals

• Hotel accommodation

• Campsite costs

• Packaged holidays

• Airbnb

There are many other benefits that you may be able to claim through salary packaging to help you manage rising living costs.

Another salary packaging benefit for you, regardless of the industry you work in, is a Novated Car Lease. If you are in the market for a new (or used) car, you can salary package the costs to finance and run your car with pre-tax deductions rather than paying them all from your after tax income. Some of the car costs included in a Novated Lease are:

• Lease rentals

• Fuel

• Service & maintenance

• Tyre replacement

• Registration renewal

• Comprehensive Insurance

• Car washing

Salary packaging benefits can be the golden ticket to unlocking the full potential of your income. You may be able to take advantage of tax-free benefits to reduce the amount of tax you pay. Salary Packaging is regulated by the ATO as a legitimate way to use your taxable income to pay for some expenses and the result is you decrease the amount of tax you pay. This makes your income go further than before.

In most cases, salary packaging is administered on behalf of your employer by a salary packaging provider, external to your employer. A salary packaging provider will advise you on what you can salary package and tailor a solution for you based on the type of organisation you work for. They’ll work with your employer and you to administer your salary package.

If this information interests you and you’re looking to save money on your living expenses, The Salary Packaging People have the expertise to guide you. Contact us today or call 03 5229 4200 and unlock the full potential of your income.

Dan NichollsSalary Packaging Services

dan@salarypackagingpeople.com.au

www.salarypackagingpeople.com.au

Networking is integral to businesses, today more than ever. Networking can be very effective if you plan for the event before you attend. Whether in person, on Zoom or Teams or any of the other mediums available to us today be prepared before you leave the office. Which events are best for you and your business, and what you want to achieve from the event.

According to “YOUR DICTIONARY” https:// www.yourdictionary.com/networking “Networking is defined as the act of making contact and exchanging information with other people, groups and institutions to develop mutually beneficial relationships, or to access and share information between computers.”

There are several forms of networking today. By far the most beneficial for retailers is in person. Sharing information technologically can be very useful in many different ways. Here we are exploring the benefits of personal interactive networking in the community. There are five key steps to effective networking:

There are so many opportunities to network today, you could spend your life networking. Check out any event before you go. 1. Who is running the event? 2. What is their agenda? 3. Where is it held?

4. Is there ample opportunity to network in the room? 5. Who are the main participants The research about each of these 5 questions may change your approach to the event or the participants depending on the outcome you are looking for. Who is event designed for?

2. Be personally prepared

1. Research as much as practical who might be there? 2. Pack sufficient business cards with a pen ands any small promotional material that may be effective. 3.Have a well prepared elevator pitch that evokes questions. 4. Ensure your diary is up to date. 5.Arrive early and allow plenty of time

3. Choose your target Market

There are two key target markets are at most events Internal and external customers to your business. Focus on one or the other at a time.

Internal customers/ clients are those that can assist you working IN the business such as Accountants, Marketing gurus, IT specialists, suppliers etc etc. These people can support you to expand your. When we work successfully IN our business, we build a stable of experts around us who can support us, to support our clients.

External customers often our main target as we continue to work IN our business. Identify the clients who use your goods or service. What are their greatest needs and how can you support them so that they continue to come back, and refer you to their friends and family?

Prepare questions that will lead you the answers you need to qualify them as either clients you can support or that can support you. Are they appropriate to add to your stable.

Asking 5 questions showing interest in them and what they do using the basic 5 W’s, Who, What, When, Where and most importantly their WHY they are in business. Building rapport also builds trust. Do their Goals align with you? Do their achievements resonate with your standards? Do you have similar interests on which to build rapport? What other Networks are they in, can you get leverage or invitation from any of these. What are their Skill sets, do they have any that you need? You may end up good friends with these people on a personal basis but they are not the reason you are at a Networking.

Spend approximately 10 minutes with each of them before moving on. They will also have a nagenda to meet people that may not include you. Make a time to see them in their office, or your office, or over a coffee to follow up on your discussion. If they can’t do it on the spot or it is not appropriate with too many people around, follow them up the next day with a call to make that appointment.

Everywhere you go, every new person you meet is a networking opportunity. Be prepared with questions and a few elevator speeches that you can adapt to every situation.

If you would like support to address this in your business book a time for a complimentary Appointment With Purpose (A.W.P.) with Deb Fribbins. We will explore your options together. https://calendly.com/deb-fribbins/ appointment-with-purpose

Ok, I have been dancing around this subject matter for a while and thought I would spend some time talking about “why you should choose to hire a professional film crew”. So there are several reasons but the 3 biggest are TRAINING, EXPERIENCE and QUALITY.

TRAINING:

Camera Operators usually do 3 to 4 years of training to hone their skills with multiple cameras, understand lighting set-ups, recording audio, working with green screen and video editing.

A Director or Producer are also trained in the same skills but specialises in designing the videos look and feel, script writing, budgeting, storyboarding, storytelling, directing talent, running the shoot, and producing the project from conception to completion.

EXPERIENCE:

Video Production Companies have a range of crew members with different expertise and skill levels. From Senior to Production Assistant. This allows for growth but also to add value to the client by providing consistency even after a crew member leaves.

An experienced crew should work like they are one on set…almost symbiotic. Everyone knows what needs to be done, what each person’s role is and the expected outcomes for the client. It should also feel seamless, open to flexibility and with minimal issues.

QUALITY:

This is the key ingredient. To make a good video you need skills…yes… but to make a great video you need to understand your client - their key messages, branding and core of who they are. This applies every time you make a video.

I look at quality in 2 ways:

1. Technical: how it was filmed and the techniques used.

2. Storytelling: how the story is told and how it hits the mark/messages.

A great video should have all of these components and more. A professional film crew will always be able to provide this to you and offer guidance and recommendation on the best way to achieve it.

So why should you choose a film crew to film your next video?

The answer is simple they are trained professionals who love what they do and

have spent years learning and refining how to make the best video for you and your business.

Yes Today Media - Quick Tips: When you speak to a video production company, ask a lot of questions. If they are unable to answer those questions they may not be the right fit. Also, be prepared with a bit of information about your project before you call so they can quote you correctly for your project.

If you would like to know more about how Yes Today Media can make your video more professional using a talented and experienced film crew.

Director

Director

Colours are more than just the latest trend. We are strongly affected by the colours around us. They reflect our values and what atmosphere we wish to evoke in our homes.

Not surprisingly, after the shock of lockdowns and a worldwide pandemic (who saw that coming?), the colour trend for 2022 is for soothing tones, ones that generate calm and comfort, or for colours that engender optimism and hope.

If you are thinking of renovating your home or giving your interior a refresh, here is what the painting experts are predicting as the up-to-date colours for 2022.

is a neutral shade bordering on grey. Evergreen Fog blends with just about every colour on the spectrum and can be combined in exciting ways with metallics such as champagne gold, brass and matte black accessories to create a chic and welcoming space.

Another shade of green that is popular is one with sage tones called October Mist. This was chosen by its manufacturer as the Benjamin Moore Colour of the Year. Benjamin Moore’s press release states that ‘this gently shaded sage quietly anchors a space, while encouraging individual expression through colour’.

Sage tones create a more intimate feel. It is a great shade to use as a backdrop and – fortunately for those who don’t want to paint the interior of their homes too often – it won’t go out of fashion. It highlights furniture and other accessories in earthy or red colours.

Punctuate in purple

Green equals calm, natural, growth and gentleness. It’s a great colour for a study, quiet nook, a formal dining area – in fact, just about any area of the home. Greens can be bright, light colours that go well with pastels, or darker for a more formal environment.

‘Specifically, there’s been rising interest in greens. The green colour family is so diverse, from calming rich sages like Evergreen Fog to earthier tones and more dramatic emeralds,’ says Forbes Home.

Evergreen Fog is Sherwin William’s colour of the year for 2022. A calming, mid-tone green paint colour with a touch of blue, it

The Pantone Color Institute™ provides customised colour standards and forecasts colour trends forecasting, including the ‘Pantone Color of the Year’. For the first time ever, Pantone nominated one of its newest colours as the colour of the year for 2022. Very Peri is a colour ‘whose courageous presence encourages personal inventiveness and creativity’, according to Pantone. The shade falls under the blue colour family but with violet-red undertones, making it appear as a soft purple, mauve or lilac, depending on how you view it.

A soft calming shade, this would be great as a feature wall in a bedroom or as a secondary shade highlighting off-whites, stone and pale earthy tones.

Dulux has also chosen a blue shade as their Colour of the Year 2022. A cool blue paint colour called Bright Skies is described by Dulux as ‘an airy, light blue’. The colour was chosen as it ‘perfectly captures the optimism and desire for a fresh start that is the mood of the moment’. It blends well with wooden furniture and stoneware and its subtle tonings brighten considerably when sunlight falls across it.

Helen van Gent, head of Dulux’s parent company says, ‘This year, vibrant colours and light tones are re-emerging – a reflection, perhaps, of our need for positivity and a fresh approach.’

For more painting advice on painting in winter, contact Dahllof Painting Services at sjd67@bigpond.net.au. We will be happy to answer all your inquiries.

By Ethan Strybosch

By Ethan Strybosch

In today’s digital landscape, a welldesigned and captivating landing page can make all the difference between a visitor bouncing away or converting into a valuable customer. Landing pages serve as gateways to conversions, acting as the first point of contact for potential customers.

A good landing page begins with a clear and concise value proposition. Within seconds, visitors should understand the unique value and benefits offered by the product or service. A compelling headline should convey the primary value proposition, while supporting subheadings and concise bullet points can provide additional details. By clearly articulating the problem-solving capabilities and advantages, a landing page can effectively capture visitors’ attention and pique their interest.

Visual appeal plays a pivotal role in capturing visitors’ attention and guiding them towards conversion. A good landing page should incorporate visually appealing elements, such as high-quality images, videos, and infographics, to enhance the overall user experience. Well-chosen colours, fonts, and layouts that align with the brand identity create a sense of professionalism and credibility. A clutter-free design with ample white space ensures that visitors can easily navigate and focus on the key message.

An intuitive and streamlined navigation flow is crucial for guiding visitors seamlessly through the landing page. The page layout should direct attention towards the call-to-action (CTA) button or form, ensuring it remains visible without excessive scrolling. Navigation menus should be minimal or absent altogether, eliminating distractions that may lead visitors away from the intended conversion path. By simplifying the navigation process, a landing page enhances user experience and encourages visitors to take action.

Effective copywriting lies at the heart of a successful landing page. The content should be concise, persuasive, and tailored to the target audience. It should highlight the benefits and solutions provided by the product or service, addressing the pain points and needs of the visitors. The use of persuasive language, customer-centric messaging,

and storytelling techniques can evoke emotions and build a connection with the audience. A compelling call-toaction (CTA) should clearly state the desired action and create a sense of urgency or exclusivity to encourage immediate response.

Establishing trust and credibility is vital to overcome any hesitations or doubts that visitors may have. Incorporating trust signals such as testimonials, customer reviews, case studies, and industry certifications can reassure potential customers about the quality and reliability of the product or service. Trust logos, security badges, and privacy policies also instill confidence, assuring visitors that their information is secure. A transparent and authentic representation of the brand helps to foster trust and credibility, enhancing the chances of conversion.

In the mobile-dominated era, a good landing page must be mobile responsive. With a significant portion of website traffic coming from mobile devices, it is crucial to ensure that the landing page is optimised for various screen sizes and maintains its visual appeal and functionality across devices. Responsive design allows visitors to have a consistent and seamless experience, regardless of the device they use, maximising the chances of conversion.

The journey to a good landing page does not end with its creation; it requires ongoing optimisation. A/B testing different elements, such as headlines, CTA buttons, colours, and layouts, allows

for data-driven decisions to improve conversion rates. By measuring and analysing key metrics such as bounce rates, time on page, and conversion rates, marketers can identify areas of improvement and make informed changes.

Crafting a good landing page requires a thoughtful approach that incorporates various elements. From a clear and concise value proposition to engaging visual design, persuasive copywriting, and trust-building strategies, each aspect plays a crucial role in driving conversions. By continually optimising through A/B testing, personalisation and transparent communication, marketers can refine and enhance their landing pages, maximising their potential to convert visitors into customers. Remember, a successful landing page is not a one-time creation but a continuous process of refinement and improvement.

By Warren Strybosch

By Warren Strybosch

The ATO has reminded all retirees and SMSF trustees that the temporary 50% reduction in the minimum annual payment amounts for account-based pensions/annuities and similar products will not be extended to the 2023-24 financial year.

The temporary reduction of minimum pension drawdown rates was initially implemented to address the financial strain faced by retirees during the height of the pandemic. As the world grappled with the economic impact of lockdowns and restrictions, retirees faced reduced income and uncertain financial futures. In recognition of this hardship, governments sought to provide immediate relief by allowing individuals to draw down a lower minimum percentage of their pension savings, typically 50% of the standard rate.

However, as economies recover and financial markets stabilize, the need for these reduced drawdown rates diminishes. Governments and financial authorities have closely monitored economic indicators and assessed the prevailing circumstances to determine the appropriate time to revert to the prepandemic minimum pension drawdown requirements. The decision to end the temporary 50% drawdown rates reflects this evaluation and signals a return to a more normal pension landscape.

It might not seem an ideal time to increase the minimum drawdown rates given economic conditions and market performance have not improved as one had hoped since the pandemic. In fact, some might say it has worsened, with the cost of living increasing. It is hoped that retirees can expect more stable returns on their investments in the future, enabling them to meet their retirement needs without relying on reduced drawdown rates.

It is important to note that the decision to end temporary drawdown reductions does not imply a lack of support for retirees. Governments and financial institutions remain committed to ensuring the financial security and well-being of retirees. Individuals can still access various resources and seek guidance on managing their pensions effectively. Pension providers can continue to offer a range of investment options and there is advice that can be obtained to help retirees navigate their retirement years.

This means the minimum annual drawdown for 2023/24 will return to standard rates, as shown in the table below:

The temporary 50% minimum pension drawdowns, implemented as a response to the economic challenges of the COVID-19 pandemic, are set to end. If you are not sure how this change will impact your pension, future goals and longevity risk e.g., having enough in retirement, then consider having a review of your situation with an award-winning financial advisor from Find Retirement. You can call 1300 88 38 30 or email info@ findretirement.com.au to organise a free, no obligation meeting, to discuss your retirement needs.

Warren Strybosch Award winning Financial and AccountantWarren Strybosch

1300 88 38 30 | warren@findwealth.com.au www.findwealth.com.au

Financial Planning is offered via Find Wealth Pty Ltd ACN 140 585 075 t/a Find Wealth.

Find Wealth is a Corporate Authorised Representative (No 468091) of Alliance Wealth Pty Ltd ABN 93 161 647 007 (AFSL No. 236815). Part of the Centrepoint Alliance group https://www.centrepointalliance.com.au/

Warren Strybosch is Authorised representative (No. 236815) of Alliance Wealth Pty Ltd.

This information has been provided as general advice.We have not considered your financial circumstances, needs or objectives. You should consider the appropriateness of the advice. You should obtain and consider the relevant Product Disclosure Statement (PDS) and seek the assistance of an authorised financial adviser before making any decision regarding any products or strategies mentioned in this communication.

Whilst all care has been taken in the preparation of this material, it is based on our understanding of current regulatory requirements and laws at the publication date.As these laws are subject to change you should talk to an authorised adviser for the most up-to-date information. No warranty is given in respect of the information provided andaccordinglyneitherAllianceWealthnorits related entities, employees or representatives accepts responsibility for any loss suffered by any person arising from reliance on this information.

amanda@vanbeveren.com.au

As we head into winter, we find ourselves once again in the cold/flu season, although from what I have seen, it has begun earlier this year.

Whilst words like “virus”, “immune”, and “COVID” or “COVID-19” still invoke a stress response in most of us, the truth is that we will likely be more aware of viruses than we used to be for many years to come.

Like all viruses, the covid-19 virus mutates over time which prevents the body from recognising the virus and fighting it more effectively. For this reason, some people find themselves being infected a second or third time, and it’s no less severe than the first time.

There are also other seasonal viruses that do not test positive to a Covid test. Whether it’s due to a lack of exposure to viruses with 2 years of winter lockdowns, or whether the viruses are particularly aggressive this year, many people find themselves sick for longer than they normally would.

If you find yourself coming down with a fever, along with the herbs above you can also help your body fight the virus. In the early stages of a fever, the body increases the basal temperature in order to kill the virus, so long as you are comfortable and the fever is under 39C, assisting the increase in body temperature can help to reduce the length of the fever (seek medical advice if you are pregnant, treating an infant, uncomfortable, or have a medical condition where a fever could be dangerous). Wrap yourself in a warm blanket and have warm drinks such as lemon, ginger and honey tea. Ginger is anti-inflammatory and stimulates circulation, lemon is high in vitamin C, and honey is antimicrobial.

For a sore throat licorice root tea is soothing and if you have lost your voice, can help to get it back sooner. It’s important to listen to your body, if you feel like staying in bed and resting, it might just be what you need!

There are many natural remedies you can make to help prevent viral infection, reduce the severity, and reduce the likelihood of long term infections. Herbal teas are a great place to start. In terms of herbal medicine, they are a low dose, so you will need to drink them throughout the day and for at least a few days. If you like to sweeten your tea add a little manuka honey, it also has an antiviral effect.

The following herbs can be a great winter beverage to prevent colds and flu, some of them will be easy to find as teas, others you may need to buy as dried herbs and use a tea infuser. This list can help you to understand the difference between different immune herbs, by looking at their individual properties:

• Echinacea – antiviral, antibacterial, tonic, immune modulating, antiinflammatory

• Elder – anticatarrhal (eliminates mucous), anti-inflammatory

• Rosemary – antimicrobial, antiinflammatory, antioxidant

• Thyme – antiviral, antibacterial, expectorant

If you do find that you have recurrent viral infections a naturopath has lots of treatments to strengthen your immune system. Book an appointment today to get on top of it before your next infection.

This advice is general in nature and not intended to be prescriptive. For individualised prescriptive advice, please see a naturopath or other health care practitioner.

Kathryn Messengerkathryn@wholenaturopathy.com.au

A lot of property owners take a very casual approach to the upkeep and repair of their house or building. They usually wait for something to break, clog, overflow, leak, jam or fail catastrophically before addressing the problem. Others are satisfied with getting maintenance tasks done twice a year during autumn and spring.

However, smart property owners know that it’s crucial to take precautionary steps all year to prevent unexpected wear and tear issues that could crop up when the seasons change.

Remember, the different seasons might cause new and unforeseen maintenance concerns on your property. Therefore, it’s critical to keep everything in check all year and maintain your property according to the needs of every season.

If you’re not sure how or where to begin, we’ve put together a seasonal home maintenance checklist that will help ensure your property is in the best possible condition all year long.

Since there are only a few places in the country where snow appears during winter, seasonal home maintenance in Australia varies, especially during this period.

However, it can and does get chilly in most places, and torrential rains are quite common. So, even if you can’t control the weather, some proactive winter house upkeep can reduce your stress levels down the line.

• Check and clean your gutters to prevent them from overflowing and flooding your home.

• Get your air conditioning units serviced to get rid of dust, mould, or allergen build-up.

• Ensure your property is well ventilated to prevent it from accumulating stale and musty air, as well as developing mould problems.

Now’s the time to get your yard ready for the season once the earth has thawed and the trees have started to blossom. After all, spring cleaning and springtime go hand in hand.

Below are some of the tasks you need to take care of as you prepare your home for the upcoming warmer months.

• Get rid of mould or mildew and get a new exhaust fan if needed.

• Have your plumbing checked for damage and get it repaired.

• Check the gutters and roof for any signs of wear and tear or damage, and make sure to address all issues.

• Assess your garden or yard and see if any plants need pruning, treatment, transplanting or fertilising.

Before heading out to have fun as the sun, sand and sea beckon, take care

of the items on this summer home maintenance checklist.

This way, you won’t have much to do if you already followed the spring cleaning checklist and you can focus on simply enjoying the summer.

• Stay on top of pest control by hiring professionals to stop the proliferation of bugs and vermin.

• Get your fireplace or chimney cleaned if you have one.

• Check your home for mould and mildew, and have it removed immediately if you find any.

Due to the dryer weather and milder temperatures, autumn is a great time to perform property maintenance activities.

• Take care of your yard and ensure unwanted pests are eliminated.

• Check your furnace and adjust the flues in preparation for winter or very cold temperatures.

• Clean the HVAC filters or get them replaced to ensure your central heating system works smoothly.

Remember, your home is or probably will be the biggest investment you’ll ever make in your lifetime. Therefore, it’s essential you stay on top of all crucial tasks designed to protect your property from wear and tear, from spring to summer, autumn and winter.

If this article has inspired you to think about your own unique situation and, more importantly, what you and your family are going through right now, please contact your advice professional.

As part of the 2023 Federal Budget, the government has announced the introduction of “payday super”.

Aiming to provide better retirement outcomes for employees, from 1 July 2026, employers will be required to pay their employees super at the same time as their salary and wages.

This measure will also increase transparency for employees as well as the ATO for any unpaid superannuation entitlements.

Lower paid, casual and insecure workers will benefit the most by this measure are they are more likely to miss out when super is paid quarterly or less frequently.

As part of the 2023 Federal Budget, the government has announced the introduction of “payday super”.

Aiming to provide better retirement outcomes for employees, from 1 July 2026, employers will be required to pay their employees super at the same time as their salary and wages.

This measure will also increase transparency for employees as well as the ATO for any unpaid superannuation entitlements.

Lower paid, casual and insecure workers will benefit the most by this measure are they are more likely to miss out when super is paid quarterly or less frequently.

Businesses with an aggregated turnover of less than $50 million will be entitled to a 20% deduction for expenditure that supports electrification and more efficient use of energy.

This bonus deduction will be available for expenditure incurred from 1 July 2023 until 30 June 2024.

The additional deduction will be available for eligible expenditure of up to $100,000 and is therefore capped at $20,000 for each business.

The temporary measure will apply to eligible assets or upgrades first used or installed ready for use between 1 July 2023 and 30 June 2024.

With the temporary full expensing (TFE) incentive due to end on 30 June 2023, the federal government has announced the reintroduction of the small business instant asset write-off.

This measure will provide businesses with cash flow support and reduce compliance costs. Assets that cost $20,000 or less may be eligible for this incentive.

From 1 July 2023, small businesses with aggregated annual turnover of less than $10 million will be able to immediately deduct the full cost of eligible assets.

Eligible assets must be first used or installed ready for use between 1 July 2023 and 30 June 2024, and the write-off applies on a per asset basis.

A number of housing measures have been introduced in the 2023 Federal Budget to support social and affordable housing and improve access for home buyers.

These measures aim to combat the current social housing affordability difficulties that buyers face and provide easier access to home ownership.

From 1 July 2023, eligibility criteria for the Home Guarantee Scheme will be expanded to allow any 2 eligible people to be joint applicants for a guarantee, which has previously been restricted to spouses and de facto partners.

The government will also increase resources devoted to supporting social and affordable housing along with aiming to provide more houses under the Home Guarantee Scheme.

A number of measures aiming to support small businesses were announced by the Labor government as part of the 2023–24 Federal Budget.

As part of that, small businesses will be given an amnesty which will remit eligible failure-to-lodge penalties for late lodgments.

This measure will provide small businesses with cash flow support and reduce compliance burdens of applying for a remission.

At this stage this is a proposed measure and will require parliamentary approval to become law.

The federal government announced in its 2023–24 federal budget a measure that will provide small businesses with an additional 2 years to amend their income tax returns.

At present, the Commissioner may amend an assessment for small to medium business taxpayers for up to 2 years.

This proposed measure aims to help small businesses deal with the compliance burden of having to apply for an extension of their amendment period.

This measure, subject to receiving parliamentary approval, will commence from 1 July 2025.

The non-arm’s length income (NALI) measure announced by the Coalition government in 2022 will be amended to provide greater certainty to taxpayers.

The intention of the proposal is to include a factor-based approach for trustees to be able to adequately calculate the amount of SMSF income that is NALI income. This factor-based approach applies to a situation where general expenses of the fund are not at arm’s length amounts.

The factor-based approach would apply to general fund expenses incurred after 1 July 2023.

Many business people look for an active and fun community interest. There are many ways to support a cause while building friendships and business networks at the same time.

The Rotary Club of Kardinia is one of these action oriented groups who support many local community activities. Kardinia, one of 14 Rotary clubs in the Geelong region also distribute funding and support to local, national and international communities, with projects and donations providing an incredible $50,000 - $100,000, plus member time, every year.

Kardinia Rotary have recognised the evolving needs in the community and recently made some changes to make Rotary more accessible. The club have moved to the Royal Geelong Yacht Club with the new outlook providing an energising start to the day, with meetings for one hour each Wednesday morning from 7.30am.

The club includes a diverse mix of really capable and influential men and women and the weekly meetings provide an opportunity to discuss community issues, build friendships and plan community action.

Guests are always welcome at any weekly breakfast meeting to learn more about the club, it’s community involvement or Rotary itself. With the new location, there is no cost to attend a meeting while coffee and/or breakfast are available for purchase.

A snapshot of community action includes volunteer community event support such as the Surf Coast Trek and Surf Coast Century; active support for organisations including the Kids+ Foundation, Northern Bay College and Hope Bereavement; and, community projects including supporting local business through Geelong Gourmet Goodies along with Indigenous Nursing scholarships.

One of the great strengths of Rotary is through international involvement and disaster support with local action supporting:

- End Polio Now!

- Shelterbox disaster aid

- Flood and earthquake aid

- Rotary against Malaria

- Projects in Uganda, Indonesia and Tanzania

Rotary will soon lay claim to one of the most significant health achievements possible through the END POLIO NOW campaign. With only 2 regions in the world recording wild Polio virus infections in the last 6 months, Rotary and partners are on track to soon eradicate Polio forever. This all started in 1984 when Rotary set out set about the task. The Bill and Melinda Gates Foundation are now valuable allies, matching Rotary financial contributions with $2 for every $1 raised.

Rotary is proudly apolitical and non-religious. To find out more, make contact through:

www.kardiniarotary.org.au or

www.facebook.com/KardiniaRotary

Could you forgo a $5 coffee to potentially save two lives?

That’s all it costs to sponsor a birthing kit.

If you were to give up one cup of coffee and donate that amount, this small donation has the potential to save the life of both a mother and her newborn

from neo natal tetanus. Imagine how many lives could be saved by donating the equivalent of one cup of coffee per day or week for the next month.

The Zonta Club of Geelong is appealing to the local community for funds to allow them to continue to produce Birthing Kits. These amazing little kits are provided

to pregnant women living in rural communities and low-resource settings in developing countries, to assist in the reduction of infant and maternal mortality rates. These simple kits contain: a plastic sheet, gauze, soap, string, a scalpel, and a pair of disposable gloves.

Currently kits cost $5 each, which provides the materials for the kit and the training of traditional birth attendants, who also distribute the kits. The club produces 1000 kits annually.

The Zonta club of Geelong has been active in the Geelong community for over 40 years, raising funds to support activities such as making and donating breast care cushions to local women and men who have undergone breast cancer surgery, donating toiletries and other essentials to crisis accommodation and Geelong Mums, providing financial scholarships to high school girls who have overcome adversity to complete their Year 12 education or who show leadership skills for the Young Women in Public Affairs award.

Zonta International is a leading global organisation that envisions a world in which women’s rights are recognised as human rights and every woman can achieve her full potential.

Donations can be made via www.zontageelong.org.au click on the Donations tab.

Some years ago, American scientists developed the largest artificial environment ever built as a research project, called Biosphere 2. Everything grew well and much was learnt for scientific purposes. But one of the indirect findings was that although the trees had grown well and seemingly healthily, the limbs were weak. After a few years most of the branches of the trees broke off under their own weight. They had grown up easily and quickly but without wind resistance they hadn’t developed an inner strength to remain standing.

Fascinating. The parallels for us and our children are huge. In similar ways, if we grow up without a degree of difficulty and hardship, we too are liable to be weak without the strength to stand strong, when difficulties inevitably come our way.

Adversity and difficulties aren’t bad in themselves. In this world they are unavoidable. It’s how we deal with them and grow through them that counts.

By working through difficult times, we can become stronger people in the long run. Our children too, if well supported, will become more resilient and better developed individuals.

Some of the greatest achievements and works have come in the midst of turmoil and pain. Beethoven composed his greatest works while he was almost totally deaf and experiencing great sadness. There are many stories of heroism in the midst of adversity.

A few suggestions that may be helpful as you push through challenging days:

• Determine to face the problems with a positive mindset knowing that you will get through them

• Remember that tough times don’t last but tough people do

• Don’t be surprised that there are hitches – they’ve been around since the beginning of time

• Focus on the good things of life

• Practice gratitude – list all the things you can be thankful for and go out of your way to thank anyone and everyone for both the little and the big

• Be kind to the people around you – reaching out in kindness to others lifts your spirit

• Speak positively about people and situations – try to accept others mistakes remembering none of us are perfect

• Maintaining healthy relationships is worth the effort – make the most of every opportunity to build, support and encourage others

• Do you need help to cope with the effects of someone else’s drinking?

• Is the drinking of your partner, parent, child or friend worrying you?

• Did you grow up in a family affected by alcohol abuse?

Alcoholism, alcohol abuse, or problem drinking affects thousands of families in Australia and worldwide. Your inquiry is confidential and anonymous. If you are concerned about someone else’s drinking, we encourage you to browse our website for information about our programs.

To help families and friends of alcoholics recover from the effects of living with someone whose drinking is a problem.

Similarly, Alateen is our recovery program for young people. Alateen groups are sponsored by Al-Anon members. Alateen provides support for teenagers affected by the problem drinking of a parent or other family member.

Our program of recovery is adapted from Alcoholics Anonymous and is based on the Twelve Steps, the Twelve Traditions, and the Twelve Concepts of Service.

The only requirement for membership is that there be a problem of alcoholism in a relative or friend. Al-Anon/ Alateen is not affiliated with any other organisation or outside entity.

Al-Anon meetings are held in more than 130 countries, and there are around 26,000 Al-Anon and Alateen groups worldwide. There are meetings in every Australian state.

Our publications are based on the shared experience of our membership, and their willingness to apply AlAnon’s principles to their lives. Our literature is available in approximately 30 languages.

Families Facing Alcoholism - An informative publication published by Al-Anon Family Groups Australia. Available for purchase or download a digital copy here!

Whether the alcoholic is still drinking or not, Al-Anon and Alateen offer hope and recovery to people affected by the alcoholism of a relative or friend. You can contact your nearest Al-Anon office or the Australian General Service Office for meeting details and other information.

Almost all of us had questions before coming to our first meeting, but we all took that initial step toward recovery and decided to attend a meeting. Years later, many of us still come back because the meetings help us heal and offer hope.

Please read the frequently asked questions page (hover over the Home Tab to see FAQ link) to understand what happens at a meeting, and feel free to email us if you have any additional questions. Perhaps we can help you decide if Al-Anon is for you.

Remember: you are not alone and there is always hope.

If you are troubled by the drinking of someone close to you, please call 1300 ALANON (1300 252 666)

Ray Byers Victorian Southern Area Public Information Coordinator

Ray Byers Victorian Southern Area Public Information Coordinator

The vast majority of home burglaries are “opportunistic”. A potential thief sees a chance, like an open door, and takes the opportunity to nick a handbag or car keys.

Having your home broken into and possessions stolen, can be very distressing. Victims report feeling shock, anger, fear – even a sense of helplessness. Let alone the loss of property.

What is frustrating is that much of this crime – and therefore the distress it causes – can be avoided. All we need to do is remove the opportunity.

Keeping doors locked even when we are at home; making sure that our home looks occupied. Crime prevention just takes us knowing the simple steps we can take and taking them.

As part of the Neighbourhood Watch Victoria How Safe Is My Place program, supported by RACV, a fantastic online tool has been built to help you identify the things you can do to help reduce the risk of a thief breaking into your home and stealing your stuff.

The online “How Safe Is My Place” self-assessment tool is based on Crime Prevention Through Environmental Design or CPTED (pronounced sep-ted). CPTED is a multi-disciplinary approach for reducing crime through urban and environmental design and the management and use of built environments.

But let’s drop the jargon. CPTED is actually just commonsense. Things like not having high front fences that criminals can hide behind and blocks your neighbours from seeing if there is something suspicious going on.

“How Safe Is My Place” asks you a series of questions to get you thinking about the security of your property, coupled with hints and tips for things you can actively do to prevent crime.

When completed, Neighbourhood Watch will send you all of your results in a handy report so that you can prioritise your steps. You will also receive our Top 5 simplest tips for preventing home burglary in Victoria today.

Find out how safe your place is today – visit https://howsafeismyplace.com.au/

You may also like to download the How Safe is My Place app. The augmented reality app allows Victorians to determine how safe their home is from burglary and what they can do to improve overall security.

By asking a series of questions, just like in the game ‘I-Spy,’ the new How Safe is My Place app is an interactive and family-friendly way to get Victorian households to think about easy things that can impact how secure you feel.

Visit the App Store or Google Play store to download the app.

For more crime prevention information, visit Neighbourhood Watch Victoria at https://nhw.com.au/

Warming yourself from the inside out is just the tonic needed now that winter has arrived.

Laughter will do that. Laughing with other people puts a

Come along to Laughter

Club Geelong at Eastern Beach in front of the swimming enclosure on Saturday morning at 9:00am for a half hour of ‘internal jogging’ and your body will have a good workout, be energised and discover how meeting face to face in person sparks positivity.

Or Zoom in to an on-line laughter session on Tuesday morning at 8:00am