The Find Manningham is a community paper that aims to support all things Manningham. We want to provide a place where all Not-For-Profits (NFP), schools, sporting groups and other like organisations can share their news in one place. For instance, submitting up-andcoming events in the Find Manningham for Free.

We do not proclaim to be another newspaper and we will not be aiming to compete with other news outlets. You can obtain your news from other sources. We feel you get enough of this already. We will keep our news topics to a minimum and only provide what we feel is most relevant topics to you each month.

We invite local council and the current council members to participate by submitting information each month so as to keep us informed of any changes that may be of relevance to us, their local constituents.

We will also try and showcase different organisations throughout the year so you, the reader, can learn more about what is on offer in your local area.

To help support the paper, we invite local businesses owners to sponsor the paper and in return we will provide exclusive advertising and opportunities to submit articles about their businesses. As a community we encourage you to support these businesses/columnists. Without their support, we would not be able to provide this community paper to you.

Lastly, we want to ask you, the local community, to support the fundraising initiatives that we will be developing

and rolling out over the coming years. Our aim is to help as many NFP and other like organisations to raise much needed funds to help them to keep operating. Our fundraising initiatives will never simply ask for money from you. We will also aim to provide something of worth to you before you part with your hard-earned money. The first initiative is the Find Cards and Find Coupons – similar to the Entertainment Book but cheaper and more localised. Any NFP and similar organisations e.g., schools, sporting clubs, can participate.

Follow us on facebook (https://www. facebook.com/findmanningham) so you keep up to date with what we are doing.

We value your support,

The Find Manningham Team.

EDITORIAL ENQUIRES: Warren Strybosch | 1300 88 38 30 warren@findnetwork.com.au

PUBLISHER: Issuu pty Ltd

ADVERTISING AND ACCOUNTS: editor@findmanningham.com.au

POSTAL ADDRESS: 248 Wonga Road, Warranwood VIC 3134

GENERAL ENQUIRIES: 1300 88 38 30

EMAIL SPORT: sport@manningham.com.au WEBSITE: www.findmanningham.com.au

The Find Manningham was established in 2019 and is owned by the Find Foundation, a Not-For-Profit organisation with is core focus of helping other Not-ForProfits, schools, clubs and other similar organisations in the local community - to bring everyone together in one place and to support each other. We provide the above organisations FREE advertising in the community paper to promote themselves as well as to make the community more aware of the services these organisations can offer.

The Find Manningham has a strong editorial focus and is supported via local grants and financed predominantly by local business owners.

The City of Manningham is a local government area in Victoria, Australia in the north-eastern suburbs of Melbourne. Manningham had a population of approximately 125,508 as at the 2018 Report which includes 27,500 business and close to 45,355 households. The Doncaster and Templestowe Council administered the area until December 15, 1994.

are

a general nature and do not take into account your personal financial situation, health and/or wellbeing. We recommend you seek professional advice before acting on anything written herein.

By Warren Strybosch

By Warren Strybosch

One of the biggest tax topics for 2022 relates to trust distributions. In the past, clients who owned a discretion trust or family trust, could distribute income to another company, trust, or adult children without attracting any attention from the ATO. However, the ATO, has cracked down on who can receive distributions and it does not bode for many trustees. Trustees will need to understand the ATO’s position on trust distributions, more specifically, 100A of the Income Tax Assessment Act 1936 (ITAA 1936) and Taxation Ruling TR 2022/4 and the Practical Compliance Guidance PCG 2022/2 (Section 100A reimbursement agreements – ATO compliance approach) which the ATO clarified and confirmed its position on the 8th of December 2022.

The guidance issued by the ATO under TR 2022/4 and PCG 2022/2 is comprehensive and details several commonly encountered situations with trust arrangements. The key message is that the ATO’s core compliance approach to s100A will depend on where on a trust arrangement sits on the ATO’s three-coloured risk framework. Each zone in this risk framework represents a risk rating and denotes the level of ATO engagement that can be expected by trustees for their trust arrangement. Whilst the ATO’s approach is a softer one compared to their draft rulings released in February 2022, the manner in which income distributed to a corporate or adult beneficiary based on these new frameworks may still potentially attract ATO scrutiny regarding current and previously set up trust arrangements.

Whilst the TR 2022/4 focuses on the 4 basic requirements of s100A, the accompanying PCG 2022/2 outlines the ATO’s confirmed guidance on how it will assess trust arrangements for the potential application of s100A.

The ATO will be differentiating and managing risk for a range of trust arrangements based on which of the 3 zones a trust arrangement falls in:

1. White (low risk)– applied to pre-1 July 2004 arrangements.

2. Green (low risk) – covers several common familial scenarios including receipt of the entitlement within 2 years and the trustee's retention of funds and ordinary dealings.

3. Red – these are high-risk trust arrangements that include but are not limited to the circular flow of funds between a corporate beneficiary and trust which is a shareholder, as well as arrangements where entitlement to income has been ‘gifted’ back to the trustee (or a parent) or otherwise forgiven.

At this stage it is important to note two important differences between the previously drafted PCG 2022/D1 and the newly issued PCG 2022/2:

The number of zones in the risk framework has been reduced from 4 to 3 with the blue zone now removed.

The green zone has been expanded and is still considered to be low risk.

It is important that trustees try to understand where their trust arrangements sit in these zones. As such, the ATO has provided more practical examples to assist trustees to understand if they fall within one of the zones that might attract the ATO’s attention e.g., green or red zones. There are several examples set out in PCG 2022/2, however, the ATO’s consensus is that it will not dedicate compliance resources to white-zoned arrangements.

Green zone arrangements will not attract ATO scrutiny in terms of considering the applicability of s100A,

rather resources will be deployed to confirm that the trust arrangement meets the green zone features.

Being high-risk, red zone arrangements will be the focus of the ATO’s scrutiny with a strong level of engagement and deployment of resources expected.

PCG 2022/2 will have application both before and after its date of issue, however, for entitlements arising before 1 July 2022 the Commissioner will uphold his position in Trust Taxation – reimbursement agreement, issued in July 2014, to the extent that it is more favourable to the taxpayers circumstances than PCG 2022/2.

For those trustees with complex trust structure set ups it is advisable to seek advice from an accountant or lawyer that specialises in this area.

You can call them on 1300 88 38 30 or email info@findaccountant.com.au www.findaccountant.com.au

By

By

In the hot weather our fluid requirements increase and whilst just plain water is usually all that’s required, here are some healthy options to replace soft drinks, bubble teas, and smoothies which often contain mostly sugars.

If you don’t like it plain, experiment with adding 1 or more of the following to give it a bit of flavour: lemon or lime juice, cucumber, berries, ginger (place fresh slice or powdered in a little boiling water and allow to steep, then add cold water and ice). Berries can be added to ice blocks before freezing, then placed in drinks.

Matcha is green tea powder and whilst it can give you a caffeine hit, it is also high in antioxidants and studies show many health benefits. Be sure to buy unsweetened matcha, then add ¼ tsp

to a little boiling water, whisk, fill glass with cold water and ice. Drink it as it is or add fresh lemon juice or mint leaves to flavour.

This smoothie is actually a meal as it contains protein and fats as well as fruit and makes a great summer breakfast. If you’re short of time in the morning, you can make it the night before and store it in the fridge.

• 1 piece (or 1 cup) fruit such as banana, apple or berries

• ½ cup nuts and seeds, or ¼ cup natural protein powder

• 1 tab coconut oil, macadamia oil, or ½ avocado

• ½ cup leafy green vegetables such as kale, silverbeet, spinach or celery

• ½ cup other vegetables such as carrot or cucumber

• Spices for flavour, ginger, cinnamon, vanilla, cacao or lemon juice

• Top with milk, plant milk or water and blend.

To change it up, ty making a smoothie bowl, by placing your smoothie in a bowl and topping with fresh fruit nuts and seeds.

This advice is general in nature and not intended to be prescriptive. For individualised prescriptive advice, please see a naturopath or other health care practitioner.

BHSc (Naturopathy)

kathryn@wholenaturopathy.com.au

Suite 1, 24/1880 Ferntree Gully Rd

Mountain Gate Shopping Centre Ferntree Gully, Victoria

on winning the Holistic Adviser of the Year again at the IFA Excellence Awards 2022.

The founder of the Find Group of companies draws on his diverse background, which ranges from teaching, to serving in the army, to taxation and accounting, to coach and help clients live their best financial lives. A multi-award winner, Warrens’s innovative approach in business means he was a champion of virtual financial advise long before the pandemic. Warren established the Find Foundation, which owns and operates accros Victoria.

The financial advisers featured in this guide are a diverse group: some specialise in responsible investment advice, some provide financial advise to specific professions, and some focus on addressing market gaps, mwith several finding themselves on the list for the very first time. But they all have one thing in common: they all wield influence that can create the blueprint for the future of financial advice in Australia. Not all of them are faniliar names but just because they are not making a lot of noise doesn’t mean they are not making waves. Meet our Power 50.

Poverty is not just a financial measure –it can also affect health. But life insurance can help manage the risks.

More than 40% of Australians report such low levels of physical and mental wellbeing that they are defined as living in ‘health poverty’, according to new research.

It suggests many Australians are unaware of the risks they face given life and disability insurance levels continue to decline.

The comprehensive analysis by the ARC Centre of Excellence in Population Ageing Research (CEPAR) assessed more than 30,000 Australians’ views of their health across physical function, role function, social function, pain, mental health, and vitality.

“Our investigations of what aspects of health were contributing to health poverty suggests lack of role functioning and vitality were the most important elements,” the report found.

“They account for much of the change over time, the differences between groups, and the differences in trends between groups.”

While there are measures of poverty across several aspects of life, there is no established measure of health poverty, according to the report.

According to the CEPAR measure, the rate of health poverty fell between 2001

and 2009, but then quickly climbed again, in line with rising diabetes and drug-induced deaths.

The research found specific groups, including women and Indigenous Australians, were more at risk of health poverty.

Around 44% of women suffered from health poverty in 2001 compared to 40% of men. The gap grew larger (33% for men and 40% for women) by 2010, with women’s health poverty continuing to get worse, reaching a record high of 46% in 2018.

Indigenous Australians were also at risk, suffering extreme rates of health poverty of more than 60% by 2018.

While older Australians tend to have more health problems, the health poverty gap between older and younger people narrowed over the last two decades.

The report shows many Australians are at risk of health poverty, yet actuarial firm Rice Warner (recently merged with PwC) estimated Australians were underinsured by $1.8 trillion in 2017.

And the gap has widened. Rice Warner’s 2020 analysis revealed that the total sum insured has decreased by 17% and 19% for death and TPD cover respectively over the previous two years.

The table below estimates the actual average level of death and TPD insurance that 30 and 50-year-old parents need.

(The amount is lower for older parents as they have less time until retirement, lower expected debt, higher super savings, and spend less time looking after children.)

Table: Average insurance need per parent

Age

30 $561,000 $874,000

50 $207,000 $499,000

If you would like to review your current life insurance cover, contact your adviser.

A1 Trends in Health Poverty in Australia, 2001-2018 | CEPAR. (2021, July 30). Retrieved from https://cepar.edu.au/ publications/ working-papers/ trends-health-poverty australia-2001-2018 Rice Warner (2020, November 19) https://www.ricewarner. com/new-research-shows-a-larger-underinsurance-gap/

This information has been provided as general advice. We have not considered your financial circumstances, needs or objectives. You should consider the appropriateness of the advice. You should obtain and consider the relevant Product Disclosure Statement (PDS) and seek the assistance of an authorised financial adviser before making any decision regarding any products or strategies mentioned in this communication.

Whilst all care has been taken in the preparation of this material, it is based on our understanding of current regulatory requirements and laws at the publication date. As these laws are subject to change you should talk to an authorised adviser for the most up-to-date information. No warranty is given in respect of the information provided and accordingly neither Alliance Wealth nor its related entities, employees or representatives accepts responsibility for any loss suffered by any person arising from reliance on this information.

This is the fourth of five publications where we are running a series of sensory experiences in nature.

Each experience will take about 10 mins and you are encouraged to read through the instructions before you commence your time in nature to maximise your experience.

Find a spot outside where you can sit or lie down comfortably. This could be in your backyard, your local reserve or in a national park. You may like the familiarity of the same place you have practised before or you may like to try somewhere new.

Take a few moments to regulate your breathing and settle into your position.

We are going to practise ‘belly’ breathing in this exercise.

Put one hand on your belly.

Breathe in through your nose and feel the air moving through your nostrils and expanding your stomach, feeling your hand moving.

Breathe out and feel your stomach gently contracting to push the air out and your hand return to its original position.

If helpful, put your other hand on your chest to ensure that it isn’t moving.

Do this for a couple of minutes.

Relax your hands and allow your breath to continue naturally.

If you are comfortable, shut your eyes. If not, focus on a spot down in front of you. For the next 5 mins, tune in to what you can observe with your sense of smell.

Take some breaths and notice what you can smell?

Is there moisture in the air that you can smell? Pollen?

Can you smell the scent of flowers, leaves etc?

Pause for a moment and allow your sense of smell to take all of your attention. If you wish, touch some leaves, the earth, flowers and enjoy each individual smell for several moments. Do this from where you are positioned or move very slowly to a place where you can experience different smells.

Ensure that you pause for a minute or so with each smell.

Allow your sense of smell to become larger.

If your mind gets distracted, just draw your thoughts and attention back to what you are smelling.

Try to stay focused and enjoy the experience of tuning into your sense of smell.

When you choose to complete your experience, you may wish to take a moment of gratitude for nature and for the experience you have just had.

When you choose to complete your experience, you may wish to take a moment of gratitude for nature and for the experience you have just had.

is the founder of Admirari Nature Therapy who provide nature experiences for schools, business and individuals. For more information visit admirari.com.au

Tuning into our senses is an important way to disconnect from the fast pace of modern life.

Manningham Council will begin work to replace the external aluminium composite panel (ACP) cladding at MC Square in mid-February 2023. Construction is expected to take a year to complete and associated insulation works will also take place at this time to reduce potential future disruptions.

Manningham Mayor, Councillor Deirdre Diamante, said all MC Square services and entry and exit points would continue to operate normally while the cladding was replaced. “So many important services operate from our much-loved MC Square and we will do our best to minimise disruptions to service providers and guests during the works.”

In preparation for the cladding replacement, contractors will install scaffolding around the building and this will remain in place until construction is complete. “Your safety is our priority. The new panels and construction scaffolding comply with stringent building regulations and it is safe to continue visiting MC Square while works are underway” Cr Diamante said.

Due to the nature of the works, the community may notice some noise associated with the dismantling of cladding, drilling and the use of other power tools. Although construction will primarily involve the outside of the building, workers may occasionally work on small jobs inside, such as waterproofing and conducting engineering checks.

The cladding replacement follows the Victorian Building Authority (VBA) state-wide cladding review, which identified MC Square as the only Manningham Council owned building with combustible ACP cladding.

Manningham Council CEO, Andrew Day, said the overall risk relating to the building’s cladding was not an immediate and high enough risk that replacement can be covered by or managed by compensation from Cladding Safety Victoria.

“When it was constructed 10 years ago, the flammable cladding issue was not clearly identified and despite looking at all the courses available to council, there is no option to recover these costs.

Council has allocated $3.4 million to remove and replace the cladding from the 2021/22 and 2022/23 budgets to make the building compliant with current building standards.”

Project updates will be published on Council’s website during the works. For further information please call 9840 9333 or visit manningham.vic.gov.au/news/mc-square-exterior-claddingreplacement-works-faqs

today. We enjoy a very close relationship with Doncaster Police and are lucky to live in one of the safest municipalities in Victoria. This plaque is our way of saying thank you for your selfless efforts,” the Mayor said.

First Constable Robertson received the Senior Member of the Year award for his leadership qualities, work ethic, positive Senior Constable Malusa was honoured for taking on an active mentoring and coaching role with junior members, assisting with their investigations and for his positive attitude, work ethic and policing skills.

All three recipients were complimented for encompassing the Victoria Police Values and their positive influence at the police station.

The Mayor congratulated Mentor of the Year, Senior Constable Mathew Malusa, Senior Member of the Year, First Constable Bailey Robertson and Junior Member of the Year, Constable Olivia Nation for being voted the 2022 recipients by their peers.

“I’m so proud to have the honour of presenting this plaque

Manningham Council provided the plaque to be hung at the station in recognition of annual award recipients, Council’s ongoing relationship with Doncaster Police and members’ contribution to the community.

attitude, policing skills and assisting peers with investigations. Constable Nation was recognised as the Junior Member of the Year for her positive attitude, work ethic and eagerness to learn and take on investigations.

Manningham Mayor, Deirdre Diamante, dropped in for morning tea at Doncaster Police Station today, where she presented a plaque in honour of officers awarded the annual Doncaster Member of the Year accolade.

Manningham Mayor, Deirdre Diamante, dropped in for morning tea at Doncaster Police Station today, where she presented a plaque in honour of officers awarded the annual Doncaster Member of the Year accolade.

Manningham Council is celebrating a year of cutting emissions and costs through Australia’s largest local government emissions reduction project.

Manningham is one of 51 Victorian councils to have lowered their energy bills and reduced emissions through Victorian Energy Collaboration (VECO), a joint renewable electricity contract.

Thanks to the VECO project, the following Manningham Council buildings are now powered by 100 per cent green energy:

• The Pines Shopping Centre

• Manningham Civic Centre

• MC Square

• Manningham Depot

The councils’ collective investment in Victorian renewables through the project has delivered 25 per cent cheaper electricity and savings to be redirected to critical community services.

Approximately 172,000 tonnes of greenhouse gas emissions have been saved collectively since councils signed on to the

contract. This is equivalent to powering up to 35,000 homes or taking 66,000 cars off the road each year.

Manningham Council Mayor, Cr Deirdre Diamante, said the project showed the value of collaboration in local government.

“Working together has empowered us to deliver reduced energy costs for our ratepayers while addressing the climate emergency by reducing emissions.”

By the end of 2023, we hope that all Manningham highball stadiums and Aquarena will be transferred to the contract. By January 2025 our aim is to have all our buildings powered 100 per cent with renewable energy. Renewable energy for the project is being provided by Victorian wind farms, Dundonnell and Murra Warra II, through Red Energy.

Manningham Council is delighted to announce the appointment of 16 community members to its new Recreation and Sports Advisory Committee.

The new committee provides an opportunity for members to share their experiences and expertise to support sport and recreation outcomes and deliver on actions from the Active for Life Recreation Strategy 2010-25 which aims to provide our community with opportunities to stay healthy, active and participate in a diverse range of recreation activities regardless of age, gender, ability and cultural background.

Appointed member Jessica Li says the committee is a fantastic opportunity for like-minded people to come together to express views on recreation and sports matters and provides a platform to encourage creative and forward thinking.

“I feel so grateful to join the Committee – it is an exciting role to play a part of the future of recreation and sport in

Manningham. I want to encourage more girls to try different sports and reduce gender and culture bias in sports participation and investigate how to improve parents’ involvement in community sports clubs.”

The community, Councillors and senior Manningham Council officers will be represented on the committee, the Committee will have an important advisory role rather than decision making responsibilities, to have input into Council decision making.

Manningham Mayor, Cr Deirdre Diamante said: “Council is committed to hearing from the committee members and their shared lived experience. Their collective voice and feedback are essential to help support recreation and sport outcomes for the community.”

The appointed community members will serve as members of the new advisory committee through to 2024.

One of the most important steps in planning to save for your retirement is figuring how much you will need to spend each year to live a comfortable lifestyle. However, many people struggle when it comes to developing a budget for their future needs, particularly when their retirement is many years away.

The Association of Superannuation Funds of Australia (ASFA), have produced data to help pre-retirees understand how much they might need before they retire and what their likely budget might be if they wish to live a

comfortable or modest retirement.

For those who are about to retire and have reached the age of 65, it is estimated you will need about $545,000 as single person and $640,000 if you are a couple.

Category

Savings required at retirement

Comfortable lifestyle for a couple $640,000

Comfortable lifestyle for a single person $545,000

A comfortable retirement lifestyle enables an older, healthy retiree to be involved in a broad range of leisure and recreational activities and to have a good standard of living through the purchase of such things as: household

goods, private health insurance, a reasonable car, good clothes, a range of electronic equipment, and domestic and occasionally international holiday travel.

The lump sum estimates take into account the receipt of the Age Pension both immediately and into the future and assumes the retirees own their own home outright and are relatively healthy. The Age Pension is adjusted regularly by either the increase in the CPI or by a measure of wages growth, whichever is higher.

We have included below the ASFA’s detailed budget for those aged 65-84. It is a good guide as to too how much you will likely spend in retirement.

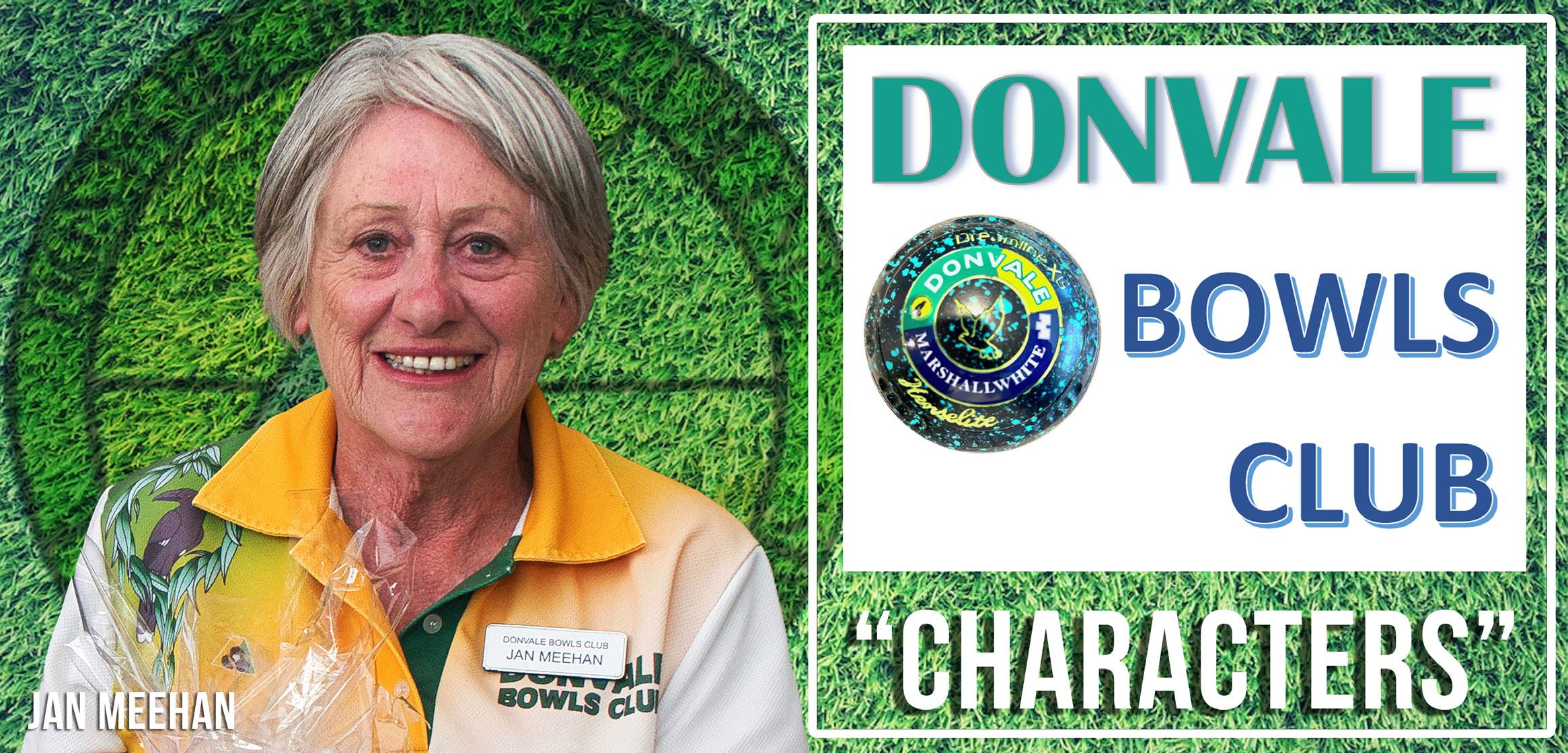

Donvale Bowls Club is indeed indebted and beholden to many of our beloved characters which define and distinguish it.

One such character at Donvale is Jan Meehan (Pictured) A brief insight into Jan’s working life, her involvement at Donvale Bowls Club, and the successful experiences it provided.

After leaving school she commenced work in the Australian Tax Office, it was here she met Michael, considered the “bad boy” of the section (he had a tattoo).

They married in 1971, fortunately the rules of the public service had just changed allowing women to continue employment after marriage.

In 1973 they moved to Warrandyte where her first son was born, she resigned from the ATO to become a full-time mother.

The next six years produced two more sons. During this time, she dabbled with a few occupations such as market research and childcare, including volunteering at her children’s kindergartens and schools.

A few years later (with the assistance of a very persuasive friend) she became instrumental in establishing a new kindergarten in Warrandyte and setting up information Warrandyte (a branch of the Citizens Advice Bureau) becoming a trained advisor with that organization at their Greensborough office while the Warrandyte office was established.

In 1986 she commenced part-time work in the Finance Department of the Fairfield Hospital, this provided an opportunity to experiment with word processing, data bases and macros in spreadsheets developing applications that revolutionised work practices, reducing hours from previous methods of work.

She loved the job but unfortunately the hospital closed in the early nineties due to government re-organization of the state health system.

Seeking another position in 1993 she sat the Commonwealth Public Service selection test and was offered a position at Brunswick Centrelink, working a further 18 years, moving through many positions in several offices.

During this period, she managed a team of Complex Assessment Officers on special projects identifying and assessing the many and varied financial arrangements people devise in relation to their social security payments.

She retired from paid work in 2011 returning to voluntary positions at Information Warrandyte, became involved in the Warrandyte Neighbourhood House, and arguably the most important role, baby-sitting her six grandchildren.

Jan and Michael have a passion for travel, travelling to many and varied places, particularly overseas.

Sharing her travel experiences on occasions writing travel articles for the Warrandyte Diary covering a road trip through India and later Sri Lanka.

A further interest Jan enjoys Cryptic Crosswords, Sudoku and puzzles, husband Michael believes this “obviously says something about her”, can anyone guess?

In 2014 Jan and Michael decided to try lawn bowling, how fortunate we are they chose Donvale.

Difficult to find a time during her tenure she has not been involved in some honorary and worthwhile capacity. Jan has now developed a new website for Donvale Bowls Club and does a tremendous job of keeping it up to date with a particular ability of being very creative. Together with Michael they represent a great team, ready and willing, regardless of the task or the challenge.