The Find Manningham is a community paper that aims to support all things Manningham. We want to provide a place where all Not-For-Profits (NFP), schools, sporting groups and other like organisations can share their news in one place. For instance, submitting up-andcoming events in the Find Manningham for Free.

We do not proclaim to be another newspaper and we will not be aiming to compete with other news outlets. You can obtain your news from other sources. We feel you get enough of this already. We will keep our news topics to a minimum and only provide what we feel is most relevant topics to you each month.

We invite local council and the current council members to participate by submitting information each month so as to keep us informed of any changes that may be of relevance to us, their local constituents.

We will also try and showcase different organisations throughout the year so you, the reader, can learn more about what is on offer in your local area.

To help support the paper, we invite local businesses owners to sponsor the paper and in return we will provide exclusive advertising and opportunities to submit articles about their businesses. As a community we encourage you to support these businesses/columnists. Without their support, we would not be able to provide this community paper to you.

Lastly, we want to ask you, the local community, to support the fundraising initiatives that we will be developing

and rolling out over the coming years. Our aim is to help as many NFP and other like organisations to raise much needed funds to help them to keep operating. Our fundraising initiatives will never simply ask for money from you. We will also aim to provide something of worth to you before you part with your hard-earned money. The first initiative is the Find Cards and Find Coupons – similar to the Entertainment Book but cheaper and more localised. Any NFP and similar organisations e.g., schools, sporting clubs, can participate.

Follow us on facebook (https://www. facebook.com/findmanningham) so you keep up to date with what we are doing.

We value your support,

The Find Manningham Team.

EDITORIAL ENQUIRES: Warren Strybosch

warren@findnetwork.com.au

Warranwood

The City of Manningham is a local government area in Victoria, Australia in the north-eastern suburbs of Melbourne. Manningham had a population of approximately 125,508 as at the 2018 Report which includes 27,500 business and close to 45,355 households. The Doncaster and Templestowe Council administered the area until December 15, 1994.

The Find Manningham was established in 2019 and is owned by the Find Foundation, a Not-For-Profit organisation with is core focus of helping other Not-ForProfits, schools, clubs and other similar organisations in the local community - to bring everyone together in one place and to support each other. We provide the above organisations FREE advertising in the community paper to promote themselves as well as to make the community more aware of the services these organisations can offer. The Find Manningham has a strong editorial focus and is supported via local grants and financed predominantly by local business owners.

The Find Manningham acknowledge the Traditional Owners of the lands where Manningham now stands, the Wurundjeri people of the Kulin nation, and pays repect to their Elders - past, present and emerging - and acknowledges the important role Aboriginal and Torres Strait Islander people continue to play within our community.

Readers are advised that the Find Manningham accepts no responsibility for financial, health or other claims published in advertising or in articles written in this newspaper. All comments are of a general nature and do not take into account your personal financial situation, health and/or wellbeing. We recommend you seek professional advice before acting on anything written herein.

Well, another season has come to an end and we farewell the 2022 footy season.

We want to congratulate Geelong Cats, one of the oldest teams in the AFL, for winning and taking home the 2022 premiership flag.

It was a one-sided affair but we have to acknowledge that Sydney where in the grand final compared to the other 16 other AFL teams who did not make it.

Irrespective of where you stand with the time of the Grand Final the best team won on the day. We wish Joel Selwood a happy retirement from football and congratulations to Geelong and the Norm Smith Medalist Isaac Smith.

With the footy season now ended we wish everyone all the best who play sports during the summer season.

Did you know that it was discovered around 12 years ago, that you can’t get fat from eating fats, there just isn’t a metabolic pathway!

They came up with this idea because fats give you more energy per weight than carbohydrates and protein. But what this actually means is that fats can fuel your body longer, than what carbohydrates can.

Good fat sources include avocado, butter, coconut oil, olive oil, oily fish, nuts, and seeds.

Protein is required for growth and repair of all cells, and should be included in every meal. It’s found in meat, eggs, dairy, soy, legumes, nuts and seeds.

Good sources of carbohydrates (carbs) are fruit, vegetables, and wholegrains. Carbs are particularly important for kids and teens as they grow and for adults that are active all day.

When you have a diet with plenty of fats, it’s easier for your body to use stored fats as a fuel source as the process is similar, but if you’re used to a diet high in carbs and low in fats, it can take a little while for your body to get used to using fat as a fuel source, so don’t suddenly change overnight.

Below are some reasons why you might be eating well, but not loosing weight, of have plateaued.

The thyroid gland determines metabolism in your body, how energy is used and stored. Hypothyroidism is the most common endocrine disorder and can cause weight gain or fluid retention, depression, fatigue, concentration and memory problems, high cholesterol, muscle weakness, cramps, SOB, menstrual irregularities, low libido.

Hyperthyroidism is the opposite, increased metabolic rate, can be due to stress or over supplementation with iodine.

If you suspect thyroid dysfunction, see your doctor about blood tests, and this will give you a starting point as to what’s

going on. Further testing can be done to fully understand how your thyroid is functioning.

Stress causes your body to retain weight, as historically, human stress involved a lack of food. Short term stressors are actually good for us, for example, exercise, where you push your body for a short time. This actually increases your resilience to stress. It’s the longterm chronic stress that’s a problem, which is becoming increasingly common as a result of life over the last couple of years. In response to stress, your body produces cortisol, which is helpful short term, but proinflammatory long term. This is why there is a correction between stress and heart disease, but also many other inflammatory conditions. Factor into your week activities that help you relax: time with friends, as well as activities that you do for fun.

Perimenopause begins around mid 40’s, at this stage the hormone oestrogen can fluctuate, whilst progesterone decreases. This can cause stress leading to weight gain amongst other things. Essential fatty acids are required to make hormones, so be sure to include quality fats sources in your diet. The pill can also disrupt your hormones and cause weight gain.

This is the hormone that puts your energy away in cells, used for all carbohydrates and somewhat for protein. When the cells are full, excess energy is stored in your liver (this allows you to go all night without eating), it then stores energy in adipose cells (fat). Adipocytes by nature are inflammatory leading to a number of health issues including heart disease and joint pain. Continually overeating carbohydrates can exhaust the insulin, making it harder to get energy for the cells, leaving you exhausted. This happens in the lead up to Type 2 Diabetes Mellitus, where being prediabetic you can cause you to gain weight and be exhausted, similar to hypothyroidism. This can be checked by a blood test and managed by diet if it is found early enough.

This can either cause stress or be as a result of stress, which once again, can cause weight gain. When you’re tired,

healthy food choices can be harder, and you can have less energy to prepare food.

If you have trouble falling asleep, try a night-time routine that includes winding down before bed, and blue light glasses for screens in the evening.

A sugar spike can keep you wide awake, so if you’re hungry in the evening choose high protein, high fats snack like nuts, and add a little dried fruit if you need to. Be sure all evening beverages are sugar free. Alcohol is also high in sugars and research has shown that one glass of wine can improve sleep, but more is often worse. If you need something calming in the evening, a herbal tea with a name like relax, sleep, calm, etc can be beneficial.

Don’t forget that too many coffees during the day can be affecting your night-time sleep. If you’re awake with a busy mind set aside time while you’re still awake to process thoughts, to do lists, or journaling, talking about problems with a friend, etc.

Diet

A low calorie diet can have your body

think that there are food shortages, and store energy as fat, whilst a high calorie, low nutrient diet will also store energy as fat. I recommend a diet high in fats and proteins, and low in refined carbohydrates.

If you crave sugar, try eating something sour or bitter like lemon juice or roquette.

When you eat sweet foods, go for natural forms such as fruit, dried fruit, honey, etc. With all of these you will hit a point where you don’t want anymore, as opposed to sugar, where you can just keep going.

Chocolate – cocoa is high in magnesium, so if you crave chocolate, are stressed, and have muscle pain, supplementing magnesium may be helpful. If you want

chocolate, go for dark chocolate, and try to work your way up to 85-90% cocoa.

Gymnema is an amazing herb for sugar cravings, just a few drops in your mouth and you can’t taste anything sweet for hours!

Once you’re eating good food, be guided by your body, if you wake up ravenous, eat, if not wait until you are hungry. We were never meant to be eating all day, eat a meal, then wait until your hungry before you eat the next one.

Whole Naturopathy can help with any of these issues, from diet guidelines, to hormonal regulation, and well as with natural supplements to provide further weight loss support.

This advice is general in nature and not intended to be prescriptive. For individualised prescriptive advice, please see a naturopath or other health care practitioner.

Australia can’t become fully powered by renewable energy without storage to support wind and solar, industry warns.

South Australia’s Hornsdale Power Reserve was the world’s first Big Battery, since overtaken by a larger plant in Victoria near Geelong, and the South Australian Virtual Power Plant (SA VPP) aims to link 50,000 solar and home battery systems to create another record-breaking asset.

“When the Big Battery was proposed it drew many critics, and was derided as being as useful as a big banana,” state energy minister Tom Koutsantonis told an industry forum in Adelaide on Tuesday.

“Those critics – many of whom did not understand the battery’s purpose – have been proven wrong and now batteries are being widely deployed, following the lead we took here in South Australia.”

But Clean Energy Council CEO Kane Thornton said many of Australia’s regulations still aren’t fit for energy storage, and cost pressures brought on by global supply chain woes aren’t helping.

“The business case for batteries remains challenging,” he told the forum. “For household-scale batteries, a lack of clear Australian product standards, the need to update installation standards and overcoming risk aversion from regulators and emergency services are all critical to accelerating deployment.” Updated and effective technical frameworks were also needed, along

with speeding up the process for connecting or upgrading batteries, Mr Thornton said.

Governments were also urged to provide more financial support for household batteries, with cost still the main barrier for most Australians.

For industrial-scale energy storage, the full capabilities are not yet properly defined, valued or remunerated, and needed a clear market signal such as an energy storage target, Mr Thornton said.

This could support storage in all its forms, such as new services markets and encouraging networks to develop support agreement contracts with storage providers.

But the South Australian government has “bold plans that will change the way we view storage in this country”,

Mr Koutsantonis said. “For householdscale batteries, a lack of clear Australian product standards, the need to update installation standards and overcoming risk aversion from regulators and emergency services are all critical to accelerating deployment.”

Updated and effective technical frameworks were also needed, along with speeding up the process for connecting or upgrading batteries, Mr Thornton said.

Governments were also urged to provide more financial support for household batteries, with cost still the main barrier for most Australians.

The state often tops 100 per cent of energy use from renewable energy generation but wind and solar can be curtailed – deliberately switched off at times – to keep the electricity grid safe.

Hydrogen will be added to the energy mix, supported by “dedicated hydrogen and renewable energy development” laws the minister said would soon be introduced to parliament.

A new hydrogen electricity generator announced last month will be the biggest in the world.

“During the day the electrolysers will soak up the abundant renewable energy from large-scale wind and solar to create hydrogen, and help provide additional grid stability,” Mr Koutsantonis said.

The hydrogen created by this process can be stored for use in the power generator, with savings passed on to steelmakers and other industrial users.

In the last few days, you may have become aware that Optus has disclosed that a cyber-attack against them has resulted in a hacker accessing the personal details of many of their customers. Details accessed may include name, date of birth, email, phone number, address, and ID numbers such as drivers license or passport numbers. If this can happen to a multi-million dollar global communications giant with a full time IT department, then it can happen to you.

This news should send a shiver down the spine of all small and medium enterprises as well, because similar data breaches experienced by small businesses put up to half of them out of business within 12 months. Reputational damage and associated lack of trust is certainly a revenue killer, even if the horrendous cost of rectifying a breach isn’t enough to bankrupt the business first. Fines and penalties will sometimes be a problem too, and there are potential EU General Data Protection Regulation fines, which may apply within Australia if the affected party is from an EU country.

So what might a Cyber Policy typically cover?

a. Business interruption financial loss due to a network security failure or attack, human errors, or programming errors

b. Cost of data loss and restoration including decontamination and recovery of files and hardware

c. Emergency incident response and investigation costs, supported by an insurer appointed contractor

d. Delay, disruption, and acceleration costs from business interruption event that stems from a cyber-related issue

e. Crisis communications with clients and reputational damage mitigation expenses

f. Civil Liability costs arising from failure to maintain confidentiality of data g. Civil Liability arising from unauthorised use of your network h. Computer/data network, or data extortion / blackmail (where insurable. Paying this may be illegal under certain circumstances) i. Online media civil liability j. Regulatory investigations expenses

As diligent as you may be at managing your clients’ data, system intrusions can still happen. Given that cyber-crime profits have eclipsed the global drug trade in turnover, I would say it’s a pretty fair assumption that the SME sector will take a beating sooner rather than later. Talk to your broker about Cyber

Insurance today, and protect yourself and your clients against extensive losses. For a health check of your business insurance, contact Small Business Insurance Brokers via email sales@ smallbusinessinsurancebrokers.com.au

Any advice in this article has been prepared without taking into account your objectives, financial situation or needs. Because of that, before acting on the above advice,you should consider its appropriateness (having regard to your objectives,needs and financial situation).

GENERAL INSURANCE

Small Business Insurance Brokers www. heightsafetyinsurance brokers.com.au 0418 300 096

Year after year, the ifa Excellence awards have rewarded the most exceptional financial advisers and businesses across the country, showcasing their achievements and honouring their efforts in contributing to the sector.

Recognising the contributions of the profession’s rising stars through to those in the most senior ranks of start-ups, established businesses and transformed businesses, our awards program enables thousands of professionals and businesses to boost their careers, reputation and businesses after winning an award.

The finalist list, which was announced on 5 October 2022 , features over 230 highachieving financial services professionals across 28 submission-based categories.

“Firstly I would like to congratulate all the finalists and thank everyone that applied for this year’s ifa Excellence Awards. The competition was very tough and we at ifa are thrilled to once again host a fun night out for all our well-deserving advisers after another fairly tumultuous few months,” says Wealth editor Maja Garaca Djurdjevic.

“We look forward to celebrating the excellent work being undertaken by advisers all across the country and those whose innovation has led the way for the sector."

Warren Strybosch, Founder at Find Group, said that he was humbled to be recognised and proud to be named as a finalist in the ifa Excellence Awards 2022.

"Find Group's recognition for our excellent contribution to the Financial Services Industry reinforces the strength of our service and dedication to connecting with the community and engaging with clients," added.

This award Recognise An Individual Who Offers Clients A Multitude Of Advice Services And Professional Disciplines, Such As Investment And Risk Advice, SMSF, Tax And Accounting, Legal And Estate Planning, And Mortgage And Credit Advice.

This Award Recognises The Individual Owner Or Managing Director Of a Boutique, Self-Licensed. Financial Planning Firm Who Has Built The Most Successful Business Over the Past Calendar Year. Success Will Be Measured By The Individual Adviser and Collective Advice Capabilities Of The Firm, Growth And Retention Of Advisers And Other Team Members, Plus The Success of the Business In Term Of Revenue And Profitability.

Do you own property in your Self Managed Superannuation Fund (“SMSF”)? If so, you will need to start suppling valuation reports to the auditor to justify the value of your property. In the past, auditors would have asked you to estimate the value of the property or rely on the rates notice, however, those days have now passed.

As the property is an important component of your SMSF, and likely the main asset of the SMSFs, determining the market value is now a compliance requirement by SMSF auditors.

The easiest way to obtain a valuation is to request a restricted property assessment by a qualified and independent property valuer.

What is a SMSF restricted property assessment?

It is a desktop assessment completed by qualified valuation professionals. The licensed valuer does not need to visit the actual property but can use real-time sales and leasing data in real time which enables them to provide an accurate and timely report. The report helps the trustee meet there obligation of providing the auditor with a property valuation that is reliable and represents a true or close to true market value assessment.

The ATO has stated that the valuations should be supplied on an annual

basis to the auditor. However, best practice is to obtain a valuation after ‘a significant event’ and as at 30 June of each financial year to comply with the relevant super laws.

All SMSF’s are required to provide a market value of assets held in their fund. ATO recommends engaging an independent valuation of properties that are owned within an SMSF especially:

• after a “significant event” which may include macroeconomic events, market volatility or natural disasters. COVID-19 could be considered a significant event and the trustees are recommended to take this into consideration when preparing this year’s financial reports.

• if either the value of the assets represents a significant proportion of the fund’s value or the nature of the asset indicates that the valuation is likely to be complex or difficult.

e.g. If it is a land-rich investment property, a number of different approaches may be required to determine what is the highest and best use for that property.

Yes and No. You will need to check with the real estate agent that they can demonstrate they are using current and relevant supportive data when preparing their valuation reports. If they can, great. If they cannot, then it would be best to find an independent valuer who can.

Most Restricted Property Assessments will cost around $330 for residential property where the property value is less than $1.5M. For properties above this amount and for commercial properties, where the value is less than $2.5M, and has less than 2 tenants, the price could be as high as $695. It is not uncommon for a valuer to charge up to $1100 for properties valued over $2.5M.

For SMSF trustees, the annual valuation requirement is another additional cost that must be incurred when holding property in a SMSF. Unfortunately, it is a legal requirement and must be completed annually otherwise the SMSF might become non-compliant. A noncompliant SMSF is something to avoid at all costs.

At Find Accountant, we provide SMSF tax advice. Our senior accountant is also an award-winning financial advisor. If you require SMSF advice or are considering whether or not to wind up your SMSF, then speak to Warren Strybosch at Find Accountant Pty Ltd.

Now is the time to take a good, hard look at your current financial situation and stop paying more than you should be on your Home Loan. So you want to refinance your home loan to get a better interest rate, but where do you go? The bank down the road looks like they have a good rate but you’re self-employed and had heard it was difficult to get a home loan. You may be right, but how do you know that you’re getting the best option available to suit your needs? Or you have a few debts that are getting out of control with rising interest costs. How do you try and improve your finance situation? That’s how a Mortgage Broker can help you.

A Mortgage Broker can help you filter out the Lenders that don’t suit your personal situation. Asking your friends or on a Facebook group will only provide you with the lender that is right for that person, and it probably only suited them at the time they applied. If they were to apply again six months later, they may find they are better off with a different lender altogether.

Each Lender’s credit policy is different and while one lender may be happy to lend to the self-employed, others can make it more difficult or may prefer PAYG applicants. Some will happily lend for properties in regional areas, other lenders may only lend against securities in metropolitan areas.

Time or Features – what’s more important?

Time can also be a factor when deciding which lender to go to. If you are looking to purchase a house, you may need a lender that is approving loans quickly. If you are refinancing, that may not be an issue and having the right rate and product features is more important. Mortgage Brokers are in touch with lenders every day and know which ones are able to respond quickly and which ones are taking a bit longer.

If you are refinancing and time is of the essence, after all you want to be paying the lower rate as quickly as possible,

there is a product called Fast Refi that some lenders offer as part of their process. Often it is your current lender that can hold up the process and delay settlement, meaning they get to receive your repayments a little longer. Lenders who offer the Fast Refi process bypass asking your current lender to transfer the title of your property before releasing the money to pay out your current loan. They simply repay your current loan and then request the current Bank to discharge their mortgage and transfer the property title to them. Not all lenders offer this but your Mortgage Broker will know which ones to deal with if that is an option you wanted to pursue.

Did you know that if you are in a certain occupation, some lenders will offer you extra benefits? For example some lenders offer to waive the costs of Lender’s Mortgage Insurance on loans where the applicant needs to borrow more than 80% of their property value. Some of these occupations include Doctors, Nurses, Paramedics and Dentists as well as Financial Planners, Accountants, Lawyers and Vets. If you

think you might be eligible for this type of loan, a Mortgage Broker will know which lenders to approach on your behalf.

Mortgage Brokers are required to always put your needs first and to consider each loan based on your personal requirements. This means you can be confident that, even in the long term, the loan you get will be in your best interests and will have taken into consideration your current plans as well as future ones. If you simply walk into a bank, even if they know their product isn’t the best one for you, they can only offer you their product, which could cost you dearly.

As a mortgage broker we act in your best interests. A lender has no obligation to do so. At SHL Finance we have always acted in our clients’ best interest and would love the opportunity to help you too.

Over the next 5 publications we will be running a series of sensory experiences in nature. Each experience will take about 10 mins and you are encouraged to read through the instructions before you commence your time in nature to maximise your experience.

Find a spot outside where you can sit or lie down comfortably. This could be in your backyard, your local reserve or in a national park.

Take a few moments to regulate your breathing and settle into your position. Take a big breath in, followed by another smaller ‘extra’ breath in, then exhale. Repeat a few more times.

Allow your breathing to find its natural rhythm once more.

For the next 5 mins tune in to what you can observe with your eyes.

Look around you, what do you notice?

Look close and far away.

Look for big things and look for the details.

Look for light and shade.

Look for colour and contrast.

Look for movement and stillness.

Allow your sight to move around and then see what it settles on. If your mind gets distracted, just draw your thoughts

and attention back to what you are seeing.

Try to slow your eyes down and enjoy the experience of tuning into your sense of sight. When you choose to complete your experience, you may wish to take a moment of gratitude for nature and for the experience you have just had.

Tuning into our senses is an important way to unwind and unplug from the ‘hurry’ of life.

“Those who contemplate the beauty of the earth find reserves of

strength that will endure as long as life lasts” Rachel Carson

Most Australians will lose an hour of sleep but gain – in theory – warmer weather, as clocks move forward for daylight saving.

At 2am local time on Sunday, Victoria, NSW, Tasmania, South Australia, and the ACT will fast forward to 3am.

Queensland, Western Australia and the Northern Territory do not observe daylight saving and the sunshine state is the only jurisdiction on the east coast that does not change time.

There have been renewed calls for another vote on daylight saving in Queensland, however, in February state government minister Yvette D’Ath rejected the idea.

At the time she said the issue was not a focus after a suggested referendum by the Brisbane lord mayor.

“We have listened to the people Queensland who have previously said they do not want daylight savings,” Ms D’Ath previously said.

Daylight saving ends when clocks are turned back one hour on the first Sunday of April.

* Where? … NSW, Victoria, South Australia, Tasmania and the ACT

* Why? … To extend daylight hours during conventional waking time in warmer months

* When? … Clocks go forward one hour on Sunday and back an hour on the first Sunday of April.

The 2022 Monster Community Raffle was a huge success, raising $12,000 for local community groups and $4000 for the Manningham Community Fund.

The 17th annual raffle draw was held on the evening of Thursday 8 September at the Templestowe Bowling Club and streamed live on the Manningham Council Facebook page.

More than 40 people turned out in person to watch Mr Rex Harvey take out the top prize, a $5000 Coles Myer voucher. A further five lucky winners shared in prizes valued at $5000.

Council partnered with Templestowe Bowling Club to deliver this year’s raffle and Manningham Mayor, Cr Michelle Kleinert thanked everyone who sold and purchased tickets for the fantastic cause.

“It was an exciting night, and the best part was knowing that together, we had raised $16,000 which will go back to into our local community,” Cr Kleinert said.

Raffle tickets were sold for $2.00 each, with community organisations receiving $1.50, and the remaining 50 cents donated to the Manningham Community Fund.

The Community Fund was established in 1923 and supports welfare services offered by charitable organisations in our community.

A full list of raffle winners is available on the Manningham Council website: www.manningham.vic.gov.au/news/monster-communityraffle

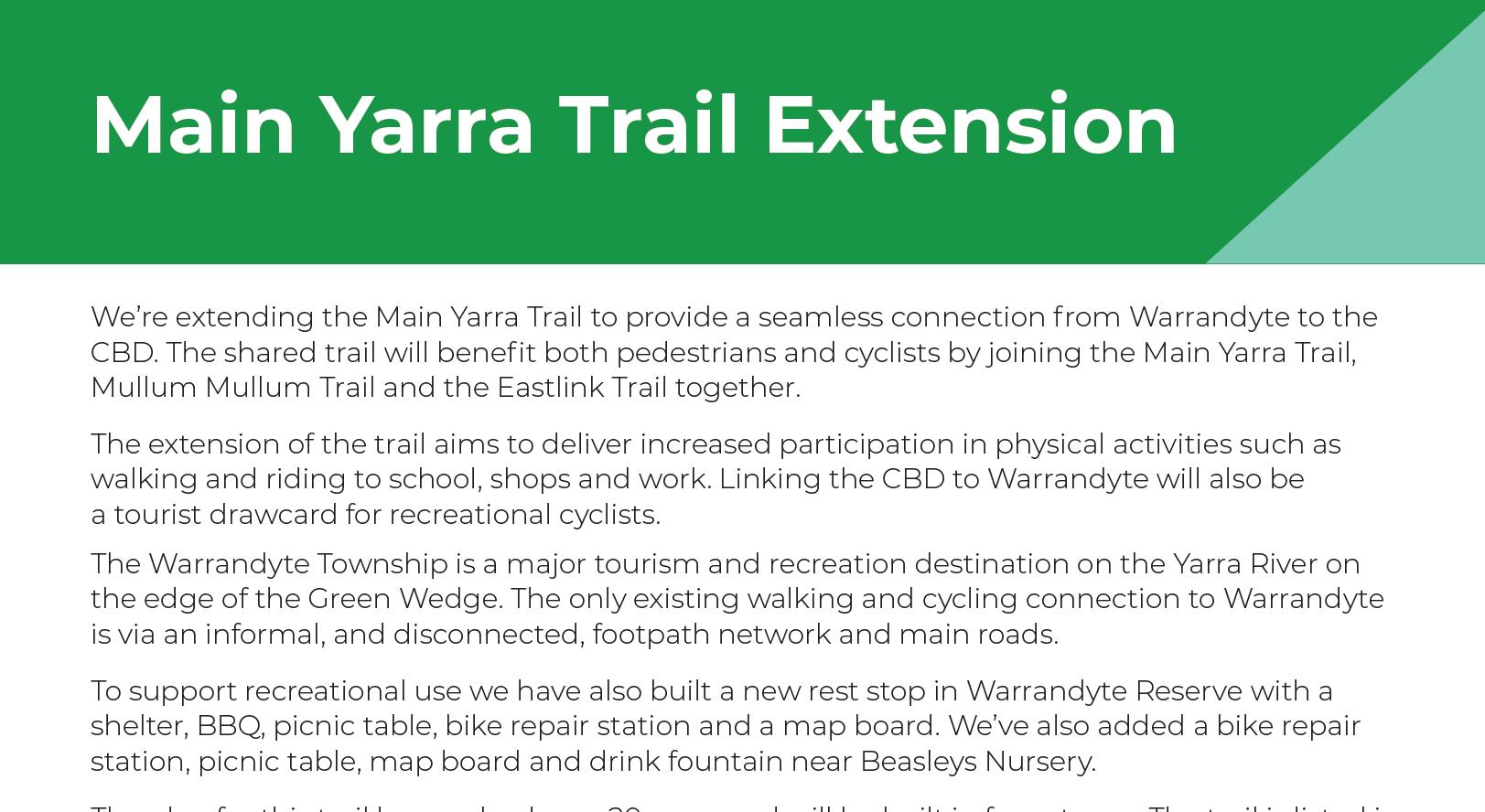

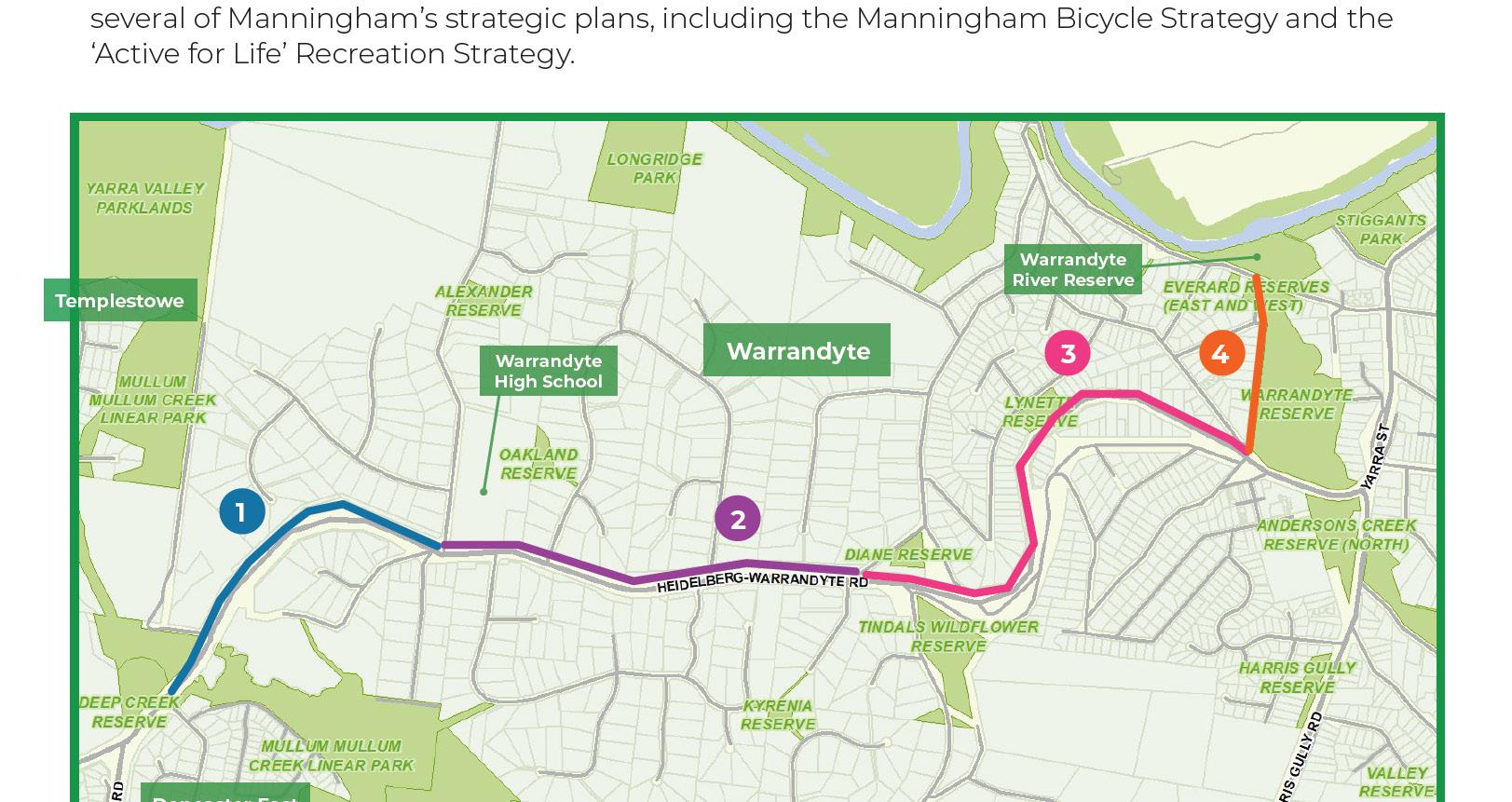

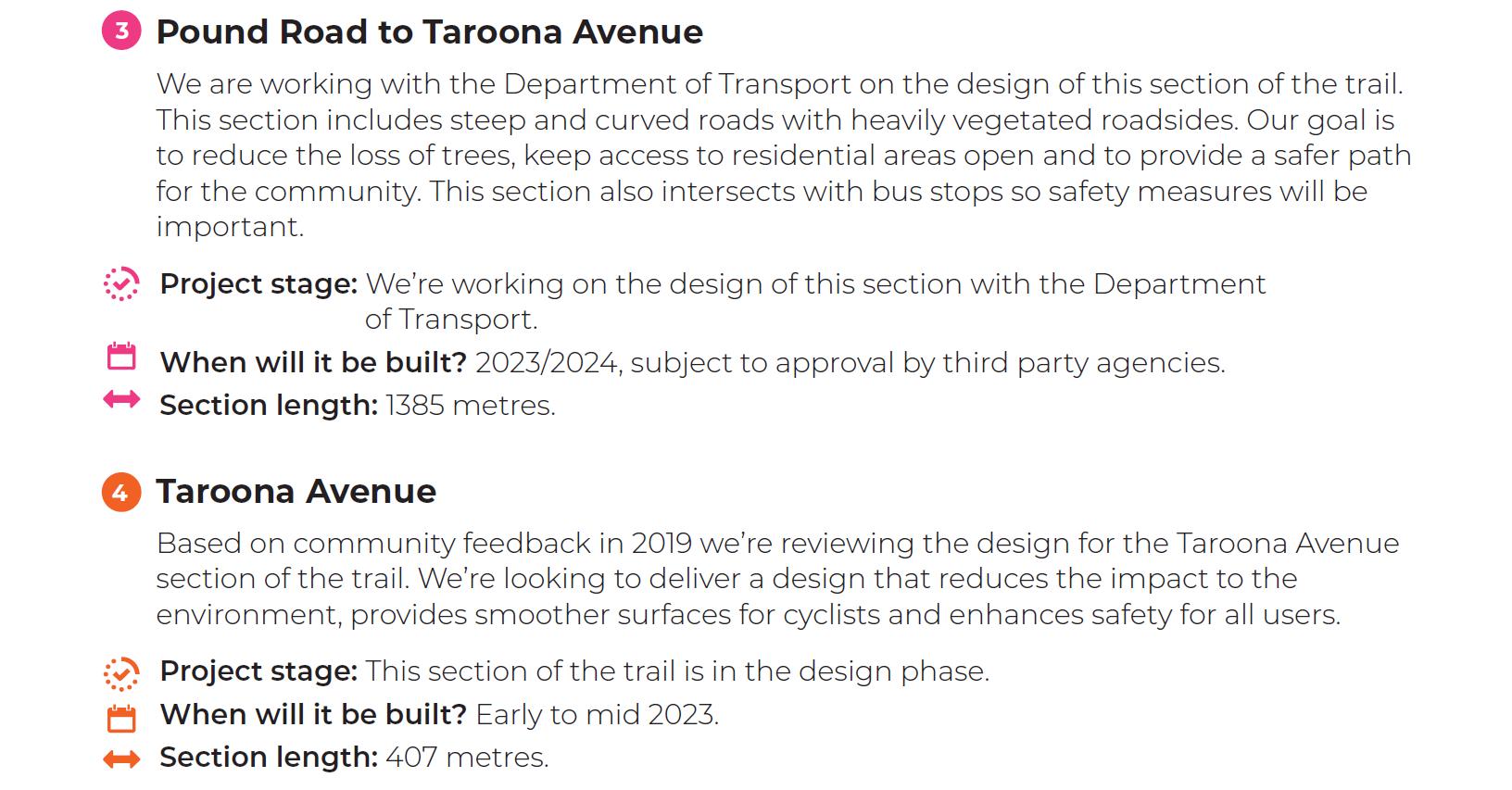

Manningham Council is hosting an information session on the proposed path along Taroona Avenue between HeidelbergWarrandyte Road and Everard Drive.

The path will form part of Council’s Main Yarra Trail Extension Project to facilitate the safe movement of pedestrians and cyclists through the local area in all weather conditions.

The information session will provide community members an opportunity to meet with Council officers and discuss possible solutions for completing this missing section of the Main Yarra Trail along Taroona Avenue.

Event details:

• Date: Wednesday, 26 October 2022

• Time: 5.00pm to 7.00pm

• Location: Warrandyte Community Hall, 8 Taroona Avenue, Warrandyte.

Manningham Council is extending the Main Yarra Trail to provide a seamless connection from Warrandyte to the CBD. The trail will benefit both pedestrians and cyclists by joining the

The extension of the trail aims to deliver increased participation in physical activities such as walking and riding to school, shops and work. Linking the CBD to Warrandyte will also be a major drawcard for recreational cyclists and tourists.

The plan for this trail has evolved over 20 years and the remaining sections will be built in stages. The trail extension is listed in several of Manningham’s strategic plans, including the Manningham Bicycle Strategy and the ‘Active for Life’ Recreation Strategy.

Manningham Mayor, Cr Michelle Kleinert said cyclists and pedestrians currently travel along informal and disconnected footpaths and arterial roads, which poses a safety risk. The Main Yarra Trail extension will provide a safe and connected path for cyclist and pedestrians to enjoy.

“The Warrandyte Township is a major tourism and recreation destination on the Yarra River on the edge of the Green Wedge. This trail extension will make it easier and more enjoyable for recreational cyclists and locals to access and enjoy all that the Warrandyte Township and river have to offer. This is a good thing for local business and local tourism.” the Mayor said.

For more information visit: yoursay.manningham.vic.gov.au/ main-yarra-trail

Manningham Council has launched a community survey to inform growth and improvements to The Pines Library services.

Manningham libraries have one the highest rates of physical book-borrowing in Victoria, and Council is keen to build on this success by gathering data on the community’s library needs. The Pines Library opened in 1987 and has around 165,000 visitors a year, making it the second-busiest library service in the municipality.

Manningham Mayor, Cr Michelle Kleinert said, “Contemporary library services are highly valued by communities and play a vital role in meeting the needs of migrant and multicultural communities and combating social isolation.

Main Yarra Trail, Mullum Mullum Trail and other Trails together. “They provide a safe haven for work, study and socialisation for people of all ages, and can also be a hub for accessing Council services in one location.”

The Manningham Council Plan 2021-2025 outlines goals and priorities to deliver better outcomes for the community.

“Well maintained and utilised community infrastructure is a goal to enhancing Manningham’s liveable places and spaces and we’ll use your feedback on The Pines Library to continue to improve and grow our services,” Cr Kleinert said.

The survey takes two minutes to complete and closes on Wednesday 19 October. Have your say now by visiting Manningham.vic.gov.au/pines-survey.

Manningham Council is creating a program of free and discounted sport and recreation activities and is asking community members what they would like included. Active Manningham is a dual-purpose program aiming to improve social and physical wellbeing and activate local facilities and open spaces.

Council is surveying people who live, work and play in Manningham about the activities they would like to participate in and where, barriers that prevent them from getting active and ideas for making recreation and sporting opportunities accessible and inclusive.

Manningham Mayor, Cr Michelle Kleinert, said Council hoped the program would empower

locals to get more active, more often, over the next three years.

“We would especially love to hear from people who don’t often take part in community sport and recreation about the kinds of activities or considerations that would inspire them to get involved.

“We will use your feedback to make the program appealing to people who feel the same way so more locals can keep active and improve their wellbeing.”

Complete the survey before Monday 24 October, by visiting: www.yoursay.manningham.vic.gov.au/active-manninghamprogram

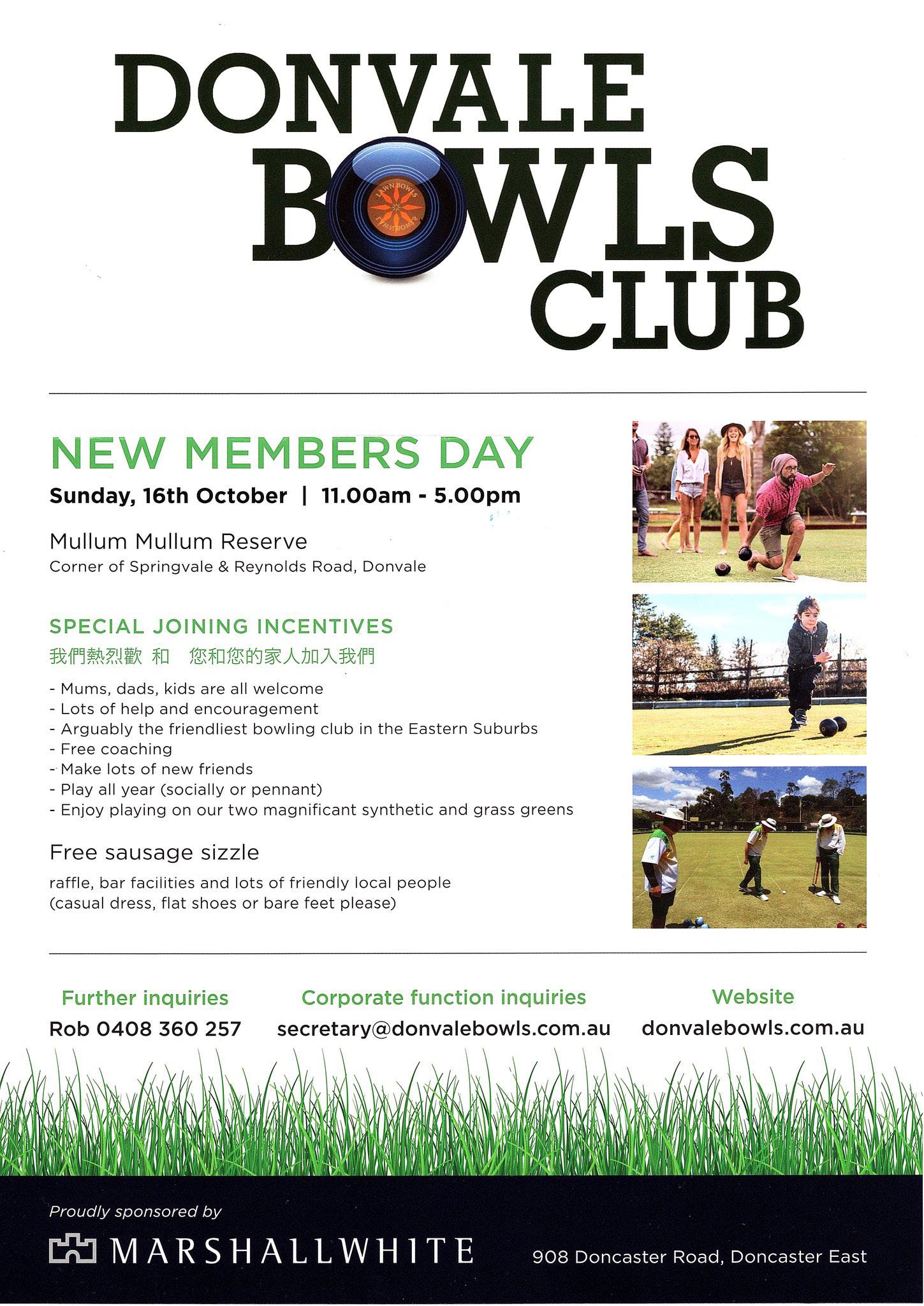

Donvale Bowls Club is indeed indebted and beholden to many of our beloved characters which define and distinguish it.

One such character at Donvale is Jeff Grant A brief insight into Jeff’s working life, his involvement at Donvale Bowls Club, and the successful experiences it has provided.

He was born in beautiful Benalla in 1947, so those with advanced arithmetic skills will know he is now 75. His dad was a builder, also owning the Benalla Brickworks, unfortunately falling on hard times the brickworks had to close.

Jeff recognizing at an early age, he did not inherit his dad’s tradesman genes or desires.

Loving the country life, he played a lot of sport (particularly tennis), spent many enjoyable hours fishing and shooting. He also loved football; many not surprised his lack of weight inhibited any progress beyond primary school…Go Dees! He completed the Leaving Certificate, started work with the Postmaster Generals Department, District Telephone Office in Benalla, January 1964.

To enhance his work prospects, he moved to Melbourne in 1967.

He became part of a small group responsible for preparing Telstra and other participant Telcos.

He finished his career with Telstra in 2006 as General Manager of Program and Project responsible for over 100 staff, including72 Project Managers.

In Melbourne one of his work mates played cricket for a work-based club, “they were a great bunch of blokes”, he

decided to play, never played the game before, settling in as a wicket keeper and opening batsman, lucky enough to pick up a few trophies along the way.

He joined the Association of Apex Service Clubs in 1972 which was to prove so beneficial for his personal development, providing many opportunities to contribute to the community.

With Apex he continued to serve in many clubs and district positions and was awarded Life Membership of the Doncaster Apex Club in 1987.

Like most team sports the camaraderie is great, hard luck stories and a few drinks after the game with teammates, created great memories.

In 1969 Jeff met a beautiful girl by the name of Marilyn Culpitt at a dance in the Moorabbin Town Hall. They married in December 1970, have two terrific kids (Ken now 49 and Julianne 47)

They have three fantastic grandchildren and are obviously very proud of their family.

Jeff joined the Donvale Bowls Club in 2007, one of the best decisions I have ever made, what attracted and reinforced that decision was the culture, the friendship and volunteering spirit, combined with both social and competitive bowling.

Officiating in many positions along the way, becoming Club President, and after many years, was awarded a Life Membership.

Such a long serving and decided asset Jeff together with his wife Marilyn have been to Donvale Bowls Club, their contribution immeasurable, their volunteering, willingness to participate and officiate, has no doubt resulted in the club’s ability to succeed and prosper.