The Find Maroondah is a community paper that aims to support all things Maroondah. We want to provide a place where all Not-For-Profits (NFP), schools, sporting groups and other like organisations can share their news in one place. For instance, submitting up-andcoming events in the Find Maroondah for Free.

We do not proclaim to be another newspaper and we will not be aiming to compete with other news outlets. You can obtain your news from other sources. We feel you get enough of this already. We will keep our news topics to a minimum and only provide what we feel is most relevant topics to you each month.

We invite local council and the current council members to participate by submitting information each month so as to keep us informed of any changes that may be of relevance to us, their local constituents.

We will also try and showcase different organisations throughout the year so you, the reader, can learn more about what is on offer in your local area.

To help support the paper, we invite local businesses owners to sponsor the paper and in return we will provide exclusive advertising and opportunities to submit articles about their businesses. As a community we encourage you to support these businesses/columnists. Without their support, we would not be able to provide this community paper to you.

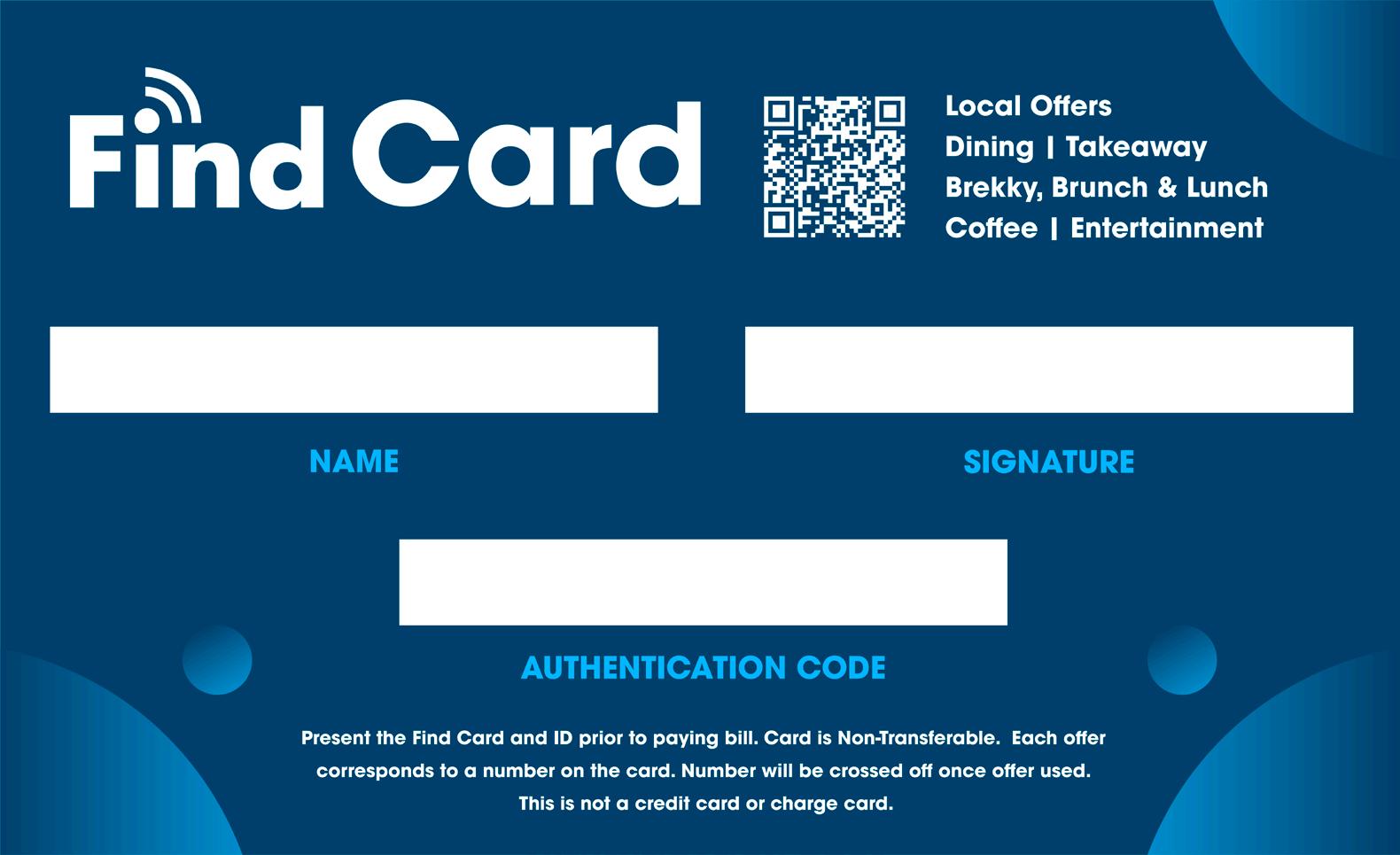

Lastly, we want to ask you, the local community, to support the fundraising initiatives that we will be developing

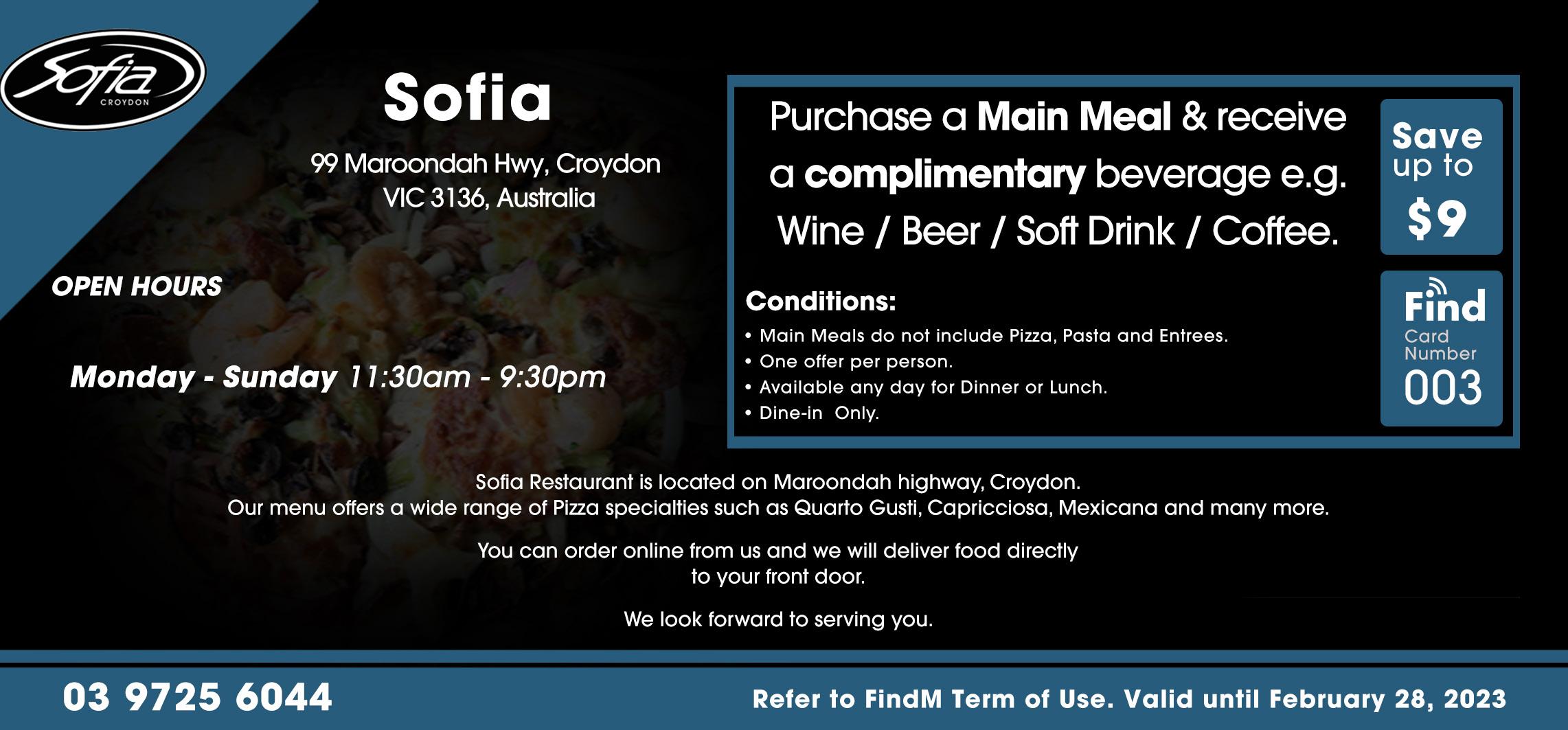

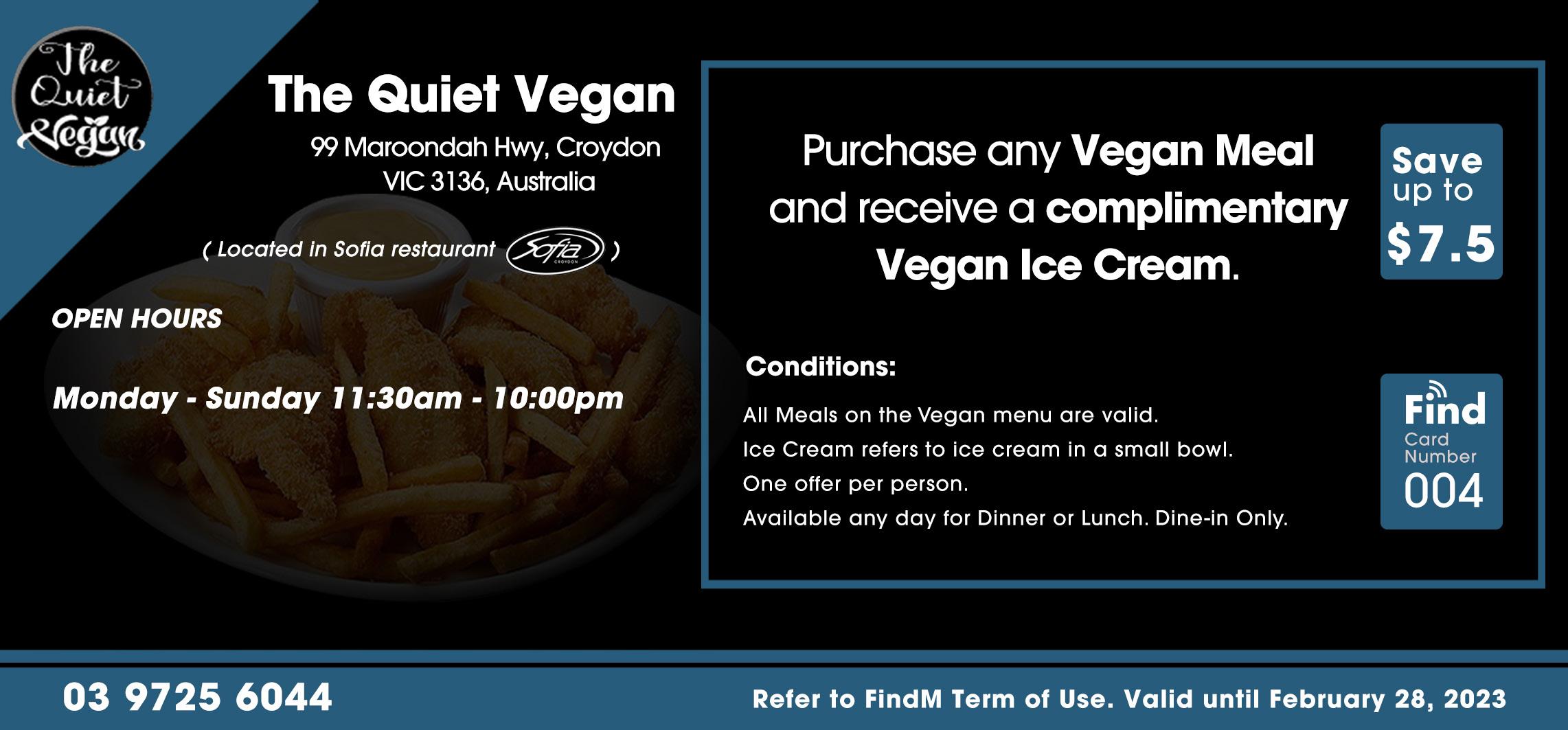

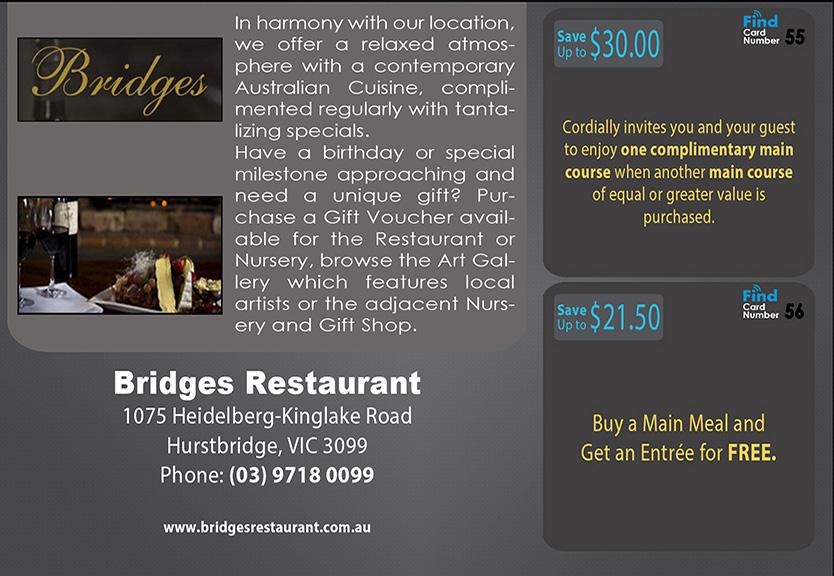

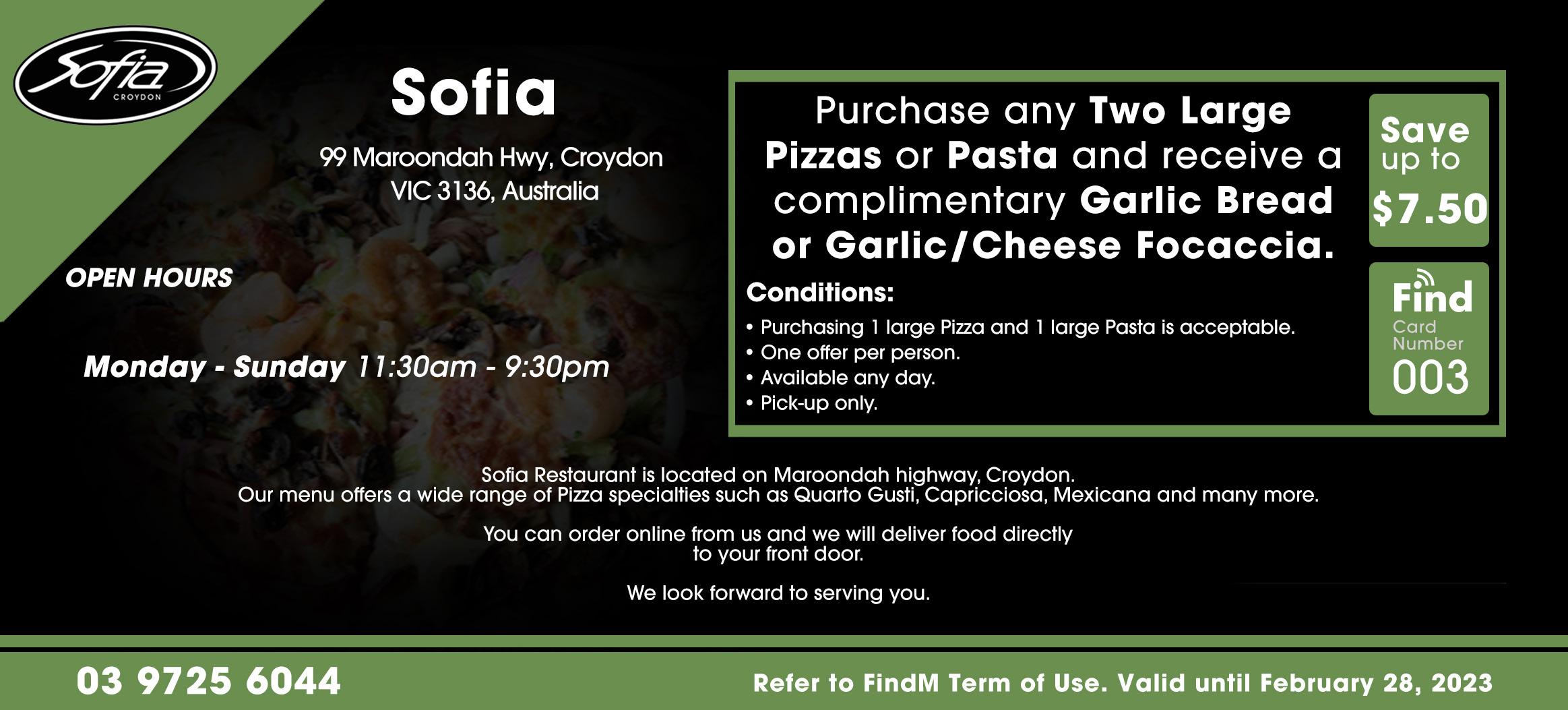

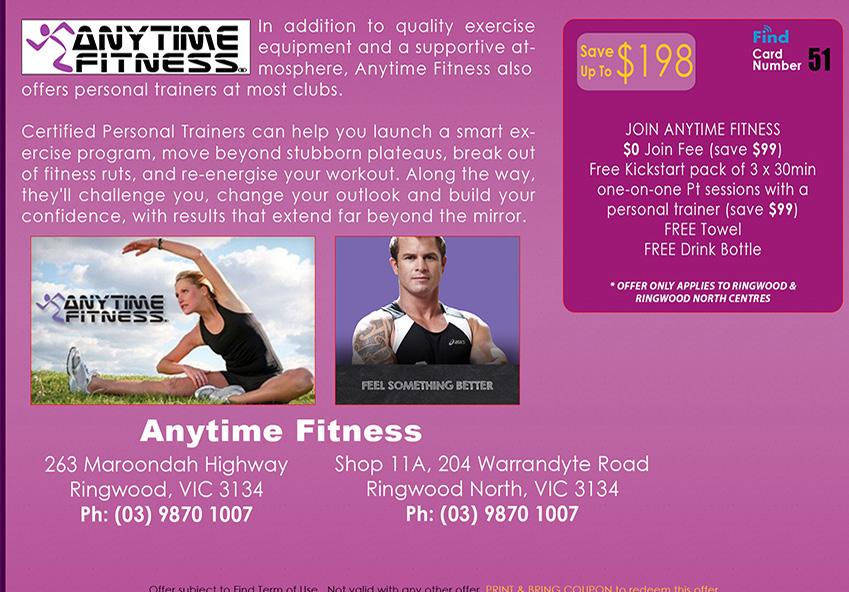

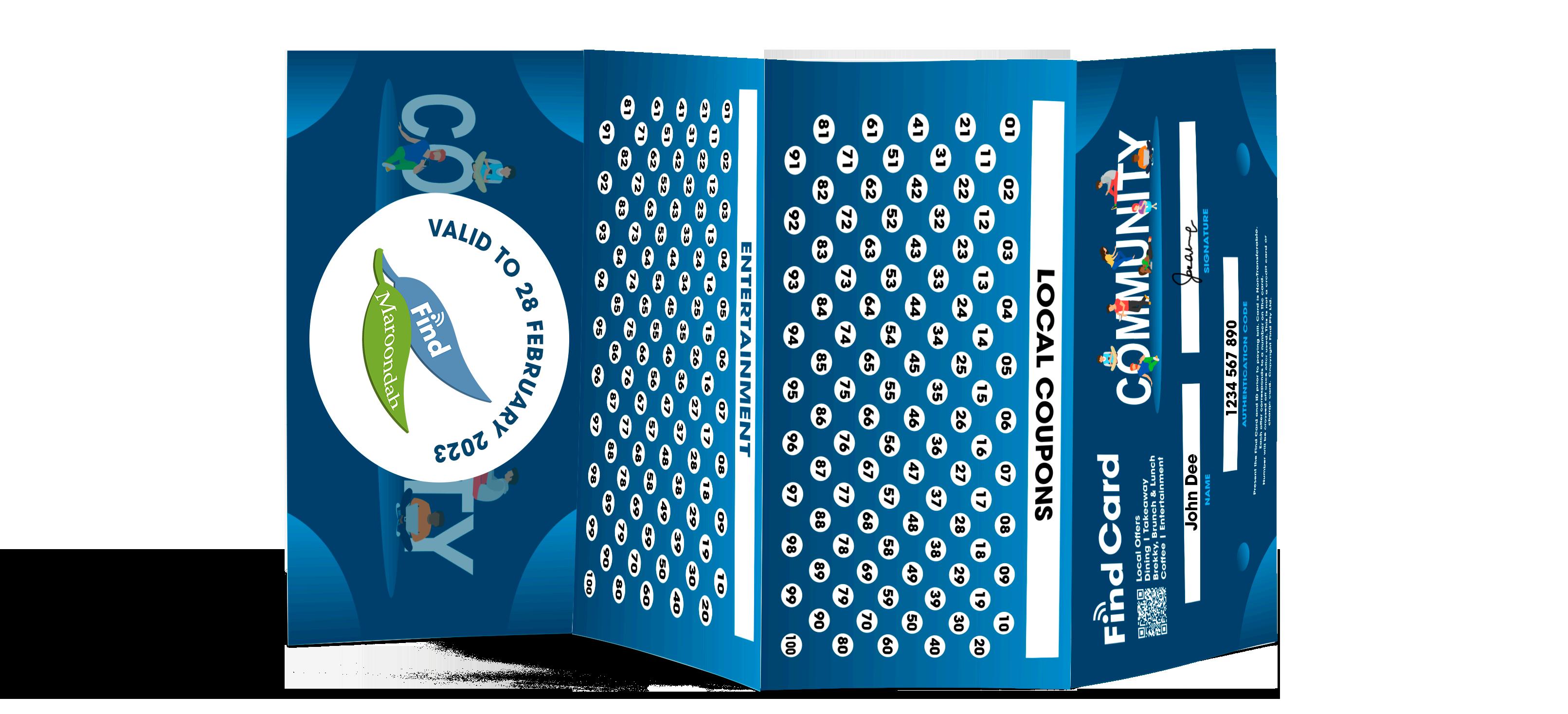

and rolling out over the coming years. Our aim is to help as many NFP and other like organisations to raise much needed funds to help them to keep operating. Our fundraising initiatives will never simply ask for money from you. We will also aim to provide something of worth to you before you part with your hard-earned money. The first initiative is the Find Cards and Find Coupons – similar to the Entertainment Book but cheaper and more localised. Any NFP and similar organisations e.g., schools, sporting clubs, can participate.

Follow us on facebook (https://www. facebook.com/findmaroondah) so you keep up to date with what we are doing.

We value your support,

The Find Maroondah Team.

EDITORIAL ENQUIRES: Warren Strybosch | 1300 88 38 30 editor@findmaroondah.com.au

PUBLISHER: Issuu pty Ltd

POSTAL ADDRESS: 248 Wonga Road, Warranwood VIC 3134

ADVERTISING AND ACCOUNTS: editor@findmaroondah.com.au

GENERAL ENQUIRIES: 1300 88 38 30

EMAIL SPORT: editor@findmaroondah.com.au

WEBSITE: www.findmaroondah.com.au

The Find Maroondah was established in 2019 and is owned by the Find Foundation, a Not-For-Profit organisation with is core focus of helping other Not-For-Profits, schools, clubs and other similar organisations in the local community - to bring everyone together in one place and to support each other. We provide the above organisations FREE advertising in the community paper to promote themselves as well as to make the community more aware of the services these organisations can offer. The Find Maroondah has a strong editorial focus and is supported via local grants and financed predominantly by local business owners.

The City of Maroondah is a local government area in Victoria, Australia in the eastern suburbs of Melbourne. Maroondah had a population of approximately 118,000 as at the 2019 Report which includes 9000 business and close to 46,000 households. The City of Maroondah was created through the amalgation the former Cities of Ringwood and Croydon in December 1994.

The Find Maroondah acknowledge the Traditional Owners of the lands where Maroondah now stands, the Wurundjeri people of the Kulin nation, and pays repect to their Elders - past, present and emerging - and acknowledges the important role Aboriginal and Torres Strait Islander people continue to play within our community.

Readers are advised that the Find Maroondah accepts no responsibility for financial, health or other claims published in advertising or in articles written in this newspaper. All comments are of a general nature and do not take into account your personal financial situation, health and/or wellbeing. We recommend you seek professional advice before acting on anything written herein.

Christmas is joy. It’s just a good news story that everyone can embrace.

Mary, a young woman without rights, wealth or status is given the honour of bearing the Saviour King. Joseph honours Mary by choosing to marry her even though the circumstances have changed, as he believes what the angel tells him - that Mary will be mother of the Son of God.

While we hunt for the perfect present for those we care about in places that are loud, crowded, and made for the wealthy. God gave to the world the perfect gift, Jesus, in a crowded and loud stable full of animals, to earthly parents who were not rich.

Each year on 25th December, we remember this holy gift, the birth of Jesus. We retell this awesome story – a star in the sky, the wise men who followed that star, of angles, shepherds and miracles. We sing songs about the ‘new born King’ and ‘peace on earth’ because that’s what was foretold about the coming of this king. A heavenly king who would one day die for us by being nailed to a cross, and then rise again three days later, defeating death and sin. Amazing!

Together with Emmanuel Christian Church Melbourne, we will be hosting Carols in the car park on Sunday 18th December as a way of celebrating this happy season. This will be a community time of fun and activities like face painting, a nativity hunt, giant games, a photo booth, and there will be noodles and BBQ food to purchase – starting at 5pm. Then at 5:45-7pm there will be carols singing and entertainment in our Pitt St car park (BYO chair), moving indoors if poor weather. This is a free event and we would love to see you there!

At Ringwood Church of Christ our Christmas Day service is at 9am on Sunday 25th December for no more than an hour to allow for other celebrations people may have planned for the day. The night before this, 9pm Christmas Eve, we will be having a quiet, reflective service for an hour. Everyone is welcome and encouraged to attend these services.

Christmas is a celebration but not everyone feels like rejoicing in this season, which can be a difficult time for many, so we are having a Blue Christmas service. This will be a reflective time of acknowledging grief and loss of loved

ones over recent years. Happening on Wednesday 14th December at 7:30pm running for 45 minutes. Again, this is open to anyone who would like to attend.

Advent means ‘coming; arrival’ and so these weeks before the day of Jesus’ birth we get ready to celebrate. However, the first Christmas was a scary and unusual time for those awaiting his birth. There is much in the Christmas story that everyone can relate to and Jesus is still relatable now. Through his example, we learn to love others as he loved people and we continue the good work of including those on the margins, walking with those who grieve, and bringing help and healing to those who are suffering.

So, this Christmas, after the tinsel comes down and the tree is packed away, our hope is that you will know the joy of Christmas all year round. The greatest gift there is, Jesus, is for everyone, everywhere, all the time.

13 Bedford Rd, Ringwood, Vic 3134

Phone: (03) 9870 8169 | ringwoodchurch.org.au

Christmas can be a busy time at Blue Cross, with kitten season kicking into gear, and families wanting to add a new furry member to the clan while everyone’s at home to help welcome them in.

Unfortunately, it’s also the time of year where animals without homes are forgotten amongst the hustle and bustle of festive preparations, and many of our older or larger cats and dogs get overlooked in favor of the influx of kittens we typically see this time of year.

Our animal carers work all the way through, from Christmas Eve to New Year’s Day so that the animals that find themselves without a family this Christmas, can feel loved and cared for.

Our goal this year is to raise enough money by selling our one-of-a-kind baubles, to be able to provide each and every one of our animals with a special gift or treat to unwrap on Christmas morning.

With any donation over $20 this December, you can choose one of our Christmas baubles to gift to yourself or a loved one!

We have a bauble for each cat and dog that is looking for a home this Christmas season. They would be perfect as a stocking filler, a thoughtful gift for an

By Jane Bennetts

By Jane Bennetts

animal lover or that person who already has everything, or simply a meaningful decoration to hang on your own tree.

Come down to the shelter at 26 Homestead Rd, Wonga Park, between 11am and 3pm 7 days, to make a donation and pick your decoration!

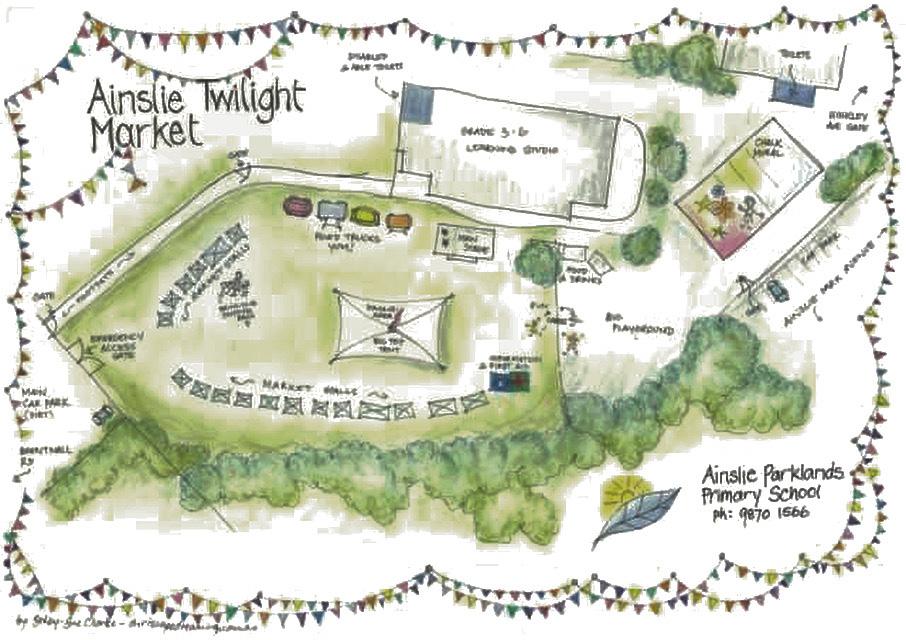

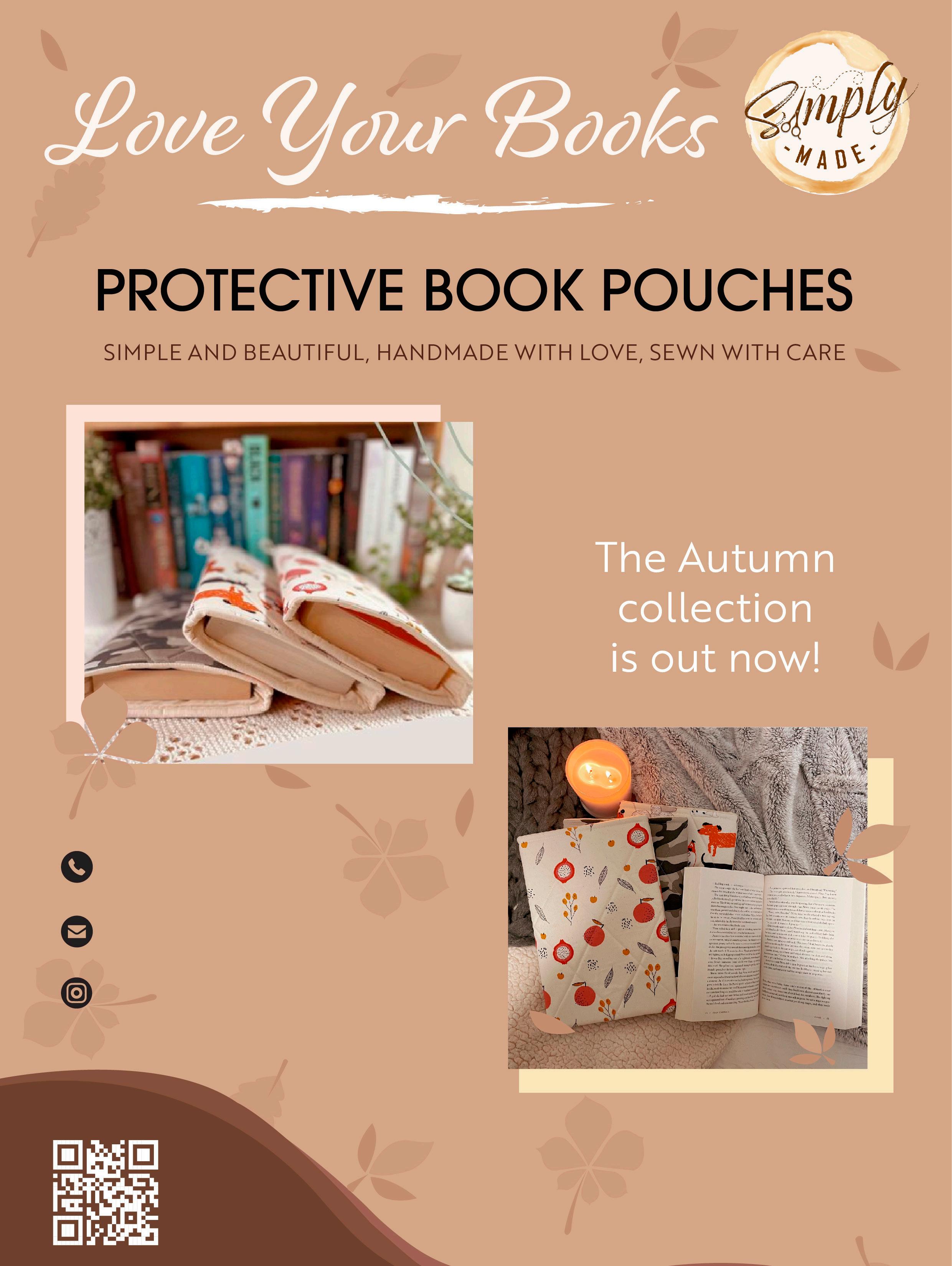

Ainslie Twilight Market was last Friday the 2nd of December from 4-8pm at Ainslie Parklands Primary School. We are a curated makers, bakers and growers market with a beautiful range of stall holders including boutique non-alcoholic drinks, fresh berries, pottery and so much more.

We invite the wider community, to come along and enjoy The Ainslie Twilight Market, a community event hosted by Ainslie Parklands PS. It is a fun festive night for everyone.

We had live music, including brass bands and the Cherry Tones Choir.

We also had old fashioned fun with lawn games, bocce, bubble performances and a community chalk mural.

We are an environmentally conscious market and have a focus on low waste.

Thank you for coming along last 2nd of Dec, and setting up a picnic, enjoying the food trucks and music all whilst supporting our beautiful Ainslie Parklands Primary School, Hinkley Ave, Croydon.

appstwilightmarket@gmail.com

Ainslie Parklands Primary School, Hinkley Ave, Croydon 3136

1 Tamar St Ringwood | 10 am every Sunday

Christmas Day Services is 10-10:45

Every Sunday during December we have a series entitled Christmas Anthems looking at the story of Christmas from Luke’s Gospel and how it impacted Mary, Shepherds, Simeon and Anna and it will conclude on Christmas Day. Services are held at 1 Tamar St Ringwood 10am and service is lived streamed on You Tube under Ringwood Community Church.

Our service includes, Carols, Bible Reading Children’s spot with activities and morning tea. Everyone is welcome to attend, not only in December but any Sunday morning. The Decorations including a tree and a manger are on stage with the cross behind the manger reminding us of the reason Jesus was born. This year we also have a gum leaves and gum nuts wreath.

WorkSafe Victoria and SafeWork NSW inspected 43 construction sites in Mildura and Buronga as part of a joint workplace safety blitz from 22 to 26 August.

The operation focused on raising awareness about the risks of falls from height and exposure to crystalline silica dust, which can cause deadly lung and respiratory diseases if inhaled.

Inspectors from both authorities also provided advice on issues such as electrical safety, hazardous substances, site security and Safe Work Method Statements (SWMS).

WorkSafe Victoria inspectors identified 19 safety issues that they were able to address on the spot. This included six where employers didn’t have a Crystalline Silica Hazard Control Statement for high-risk silica work.

In addition, WorkSafe Victoria issued seven improvement notices, as well as referring one duty holder for investigation for failing to control the risks of a fall of more than two metres.

SafeWork NSW inspectors issued five improvement notices for inadequate electrical testing, failure to have a site safety management plan and inadequate site signage.

WorkSafe Director Construction and Earth Resources Matt Wielgosz reminded duty holders of the importance of preparing for any high risk work by having appropriate safety processes and documentation in place, and reviewing this regularly.

Mr Wielgosz said "Workplace safety is not something you can set and forget, it should be the first priority in each task to ensure every worker can get the job done safely."

"Together with SafeWork, WorkSafe inspectors will continue to work with local construction workers and employers to help duty holders understand their obligations," added Mr Wielgosz.

SafeWork NSW Acting Director Construction Services Regional Nathan Hamilton reiterated that non-compliance around working at heights will remain a focus when visiting construction sites.

"Sadly, falls from heights, in particular falls under four metres, is the number one killer in the construction industry," Mr Hamilton said.

"Ladders not being fit for use and scaffolding which has been altered and not regularly inspected attribute to a number of falls related incidents and is an area we will continue to address."

The operation was part of the ongoing Cross Border Construction Program, which aims to highlight workplace health and safety issues in regional centres along the Victoria-NSW border.

at heights? Do you carry out regularly reviews to ensure that they remain fit for purpose and keep you and your employees healthy and safe? Are you doing what you need to create a safe workplace for your employees?

We assist business owners clarify what Does your business adequately plan for high-risk activities such as working they currently have in place, as well as where there are shortfalls. We then assist in developing effective systems and documentation, working

with businesses to ensure effective implementation. Checks are put in place to monitor ongoing effectiveness, to ensure that going forward they are sound and comply with the Act, and most importantly keep them and their employees informed, and healthy and safe. Please feel free to contact me, Mark Felton, at Beaumont Advisory on 0411 951 372 or mfelton@beaumontlawyers. com.au for an obligation and cost-free initial discussion.

Occupational Health & Safety www.thebeaumontgroup.com.au

By Kathryn Messenger

By Kathryn Messenger

Sunburn, scrapes, bites and stings often go hand in hand with enjoying being out in nature over the summer break. Below are some natural remedies that are supported by research, that you can prepare yourself this summer.

Calendula is part of the marigold family of flowers, and the flowering head can be used medicinally both internally and externally. Externally, both current research and traditional use, show it to aid in wound healing for ulcers, burns (including sunburn), incisions, and insect bites, reducing inflammation and healing time. The best way to prepare calendula is to soak the flower heads in an oil - nut oils are best as they are high in vitamin E which also improves skin healing. After a couple of months, strain the oil and apply it to burns and wounds, this can be used throughout the year. A cooled strong tea made from the flower heads and water can also be used topically on skin conditions if you have run out of time. If you keep it in the fridge, it will last for a couple of days.

Chamomile is another herb that can be used on the skin, and is more readily available. Once again, the flowering head is used and excellent results are seen when taken internally and externally. When consumed as a tea, it is calming to the digestive system, and externally for wound healing, eye inflammation, as well as for muscular and nerve pain. As with calendula it can be infused into an oil or used topically as a strong tea. For use as an eye bath, only use a cooled tea.

Aloe vera can also be used on skin conditions, and it is so easy to use. Simply break of part of the leaf and squeeze the gel onto wounds, bites, or burns (including sunburn). The gel contains vitamin C and E, as well as zinc, which have all been shown to improve wound healing.

If you suffer from travel sickness, don’t forget ginger. It has antinausea and antiemetic properties, and a recent study specifically on travel sickness found it to greatly improve both nausea and vomiting. Ginger can be consumed in a number of ways: from a tea, to a slice of fresh ginger, crystalised, glazed, or as a tablet.

A homeopathic first aid kit is an effective way to treat ailments yourself. My kit covers issues from digestion, skin, headaches, respiratory and more. For more details on my kit, go to my website. website

This advice is general in nature and not intended to be prescriptive. For individualised prescriptive advice, please see a naturopath or other health care practitioner.

BHSc (Naturopathy) kathryn@wholenaturopathy.com.au

Suite 1, 24/1880 Ferntree Gully Rd

Mountain Gate Shopping Centre Ferntree Gully, Victoria

For some time now if you have a SelfManaged Super Fund you have been able to borrow from a Financial Institution to buy a property for investment purposes. Many SMSF’s have taken advantage of this option to invest in bricks and mortar, however before you start heading to property inspections and dreaming of building a property portfolio to support you in retirement, there are some things you will need to know about how lending to an SMSF works and which lenders will support this type of finance.

Buying a property inside a SMSF comes with a particular set of rules and regulations to which the trustee of the SMSF must comply.

1. The property must not be lived in by fund members or any related party.

2. The property must be acquired for the sole purpose of providing retirement benefits to fund members.

3. The property cannot be rented to fund members or related parties.

There is one exception to the rules above and that is where a SMSF purchases a commercial property that is to be occupied by a fund member’s business. The business can occupy the commercial premises but must be paying market rent. Buying property inside a SMSF also comes with higher costs. To enable the SMSF to buy a property a special holding trust needs to be established, and the property is placed in the name of this holding trust, so there are additional costs for this to be set up.

SMSF members are also required to obtain legal and financial advice as part of the buying and borrowing process.

Borrowing for property using your SMSF comes with very strict conditions, and as such not many lenders currently offer loans to SMSF’s. These loans are classed as ‘limited recourse loans’ which means that if a SMSF defaults on a loan, the lender’s only recourse to repay the debt is limited to the property asset held in the SMSF. They cannot access any other assets within the SMSF.

Loans to SMSF’s are more costly to lenders who participate in this market, so interest rates and establishment fees applied to these types of loans are significantly higher than loans provided for buying property in your personal

name. Be aware that rates above 6% are common for these types of loans. There is no correlation between the rate applied on a standard Home Loan and the rates applied on a SMSF property loan.

SMSF’s are solely responsible for meeting the repayments on the loan. Rental income from the investment property combined with super contributions on behalf of the fund members are the primary sources used by lenders to determine the borrowing capacity of the SMSF. The cash liquidity position of the fund is also a contributing factor, as there must always be sufficient cash in the fund to meet the loan repayments even when the investment property is vacant.

Lenders are therefore more conservative when it comes to gearing levels for loans provided to SMSF’s. Most lenders will not allow a SMSF to borrow more than 80% of the property value, however this will depend on the type of property being purchased. In some instances, say for commercial property or residential property in some regional areas, the percentage may be reduced to 70% and potentially lower, so the SMSF would need to contribute more cash towards a purchase than a natural person.

Furthermore, a property purchased within a SMSF cannot be altered or renovated to change the character of the property until the SMSF loan is repaid. Borrowed funds can be used to cover repair and maintenance costs, but any alterations or renovations which are classed as improvements must be paid for through the accumulated funds of the SMSF and cannot change the asset type. For example, a property originally purchased as a standard residential home cannot be altered to become a medical practice as this changes the asset type to a commercial property.

Due to the highly regulated and specialised nature of this type of lending,

most lenders in the market do not offer SMSF lending as part of their suite of products. However there are a few lenders still remaining in this market, such as Latrobe Finance, Liberty and Think Tank.

There are also a number of private lenders who offer these products, however it is always best to speak with a mortgage broker who has experience in these types of transactions, as they will be able to help you navigate the complex lending process and ensure that you are able to access the most appropriate product to suit your needs.

If you have a SMSF, or are thinking about establishing one, please ensure that you get the right team of experts to provide you with advice before you make the decision to buy property and borrow through your fund. That would mean speaking with your financial advisor to determine whether to buy property would align with your investment strategy, and getting legal advice to ensure the SMSF structure is in place to allow for a property to be held in the fund.

Should the advice suggest that buying property inside your SMSF is the best option for your retirement planning strategy, and finance would be required to facilitate this, ensure that your mortgage broker has experience in SMSF lending. Due to the complex nature of these transactions a lot of mortgage brokers have not participated in this market. At SHL Finance we have assisted many SMSF’s through the complex finance process and work with your financial advisor to ensure the lending solution aligns with the investment strategy.

Please call Reece Droscher on 0478 021 757 for any SMSF lending requirements.

Before 1920 musicians from Ringwood and the surrounding district merely gathered together to make music. They would generally rehearse in one of the group’s home or if they were lucky, in a local mechanics hall. Some members had been in the army where they were taught music.

On 19th September 1921, the first committee was held to establish the Ringwood Citizens Band. Mr Bradley was appointed Bandmaster, Cr McAlpine President. The Secretary, Mr Blood a local grocer (his shop is now The Ringwood Cellars in Bedford Road). Sam Brown was a committee member and also played solo cornet. He played with the renowned Fire Brigade Band conducted by Massa Johnson. Sam arranged for some of the Ringwood Band members to have tuition from Massa Johnson for three shillings and six pence per lesson. Sam was involved with the Band until his death in 1962.

Bill Brown played trombone for some 40 years. The Brown family had a lemon orchard in Bond Street and were supporters on the Band for many years. Sam Brown would be called on by the RSL to play the “Last Post” on Anzac Day. He would climb the Clock Tower that then stood in Whitehorse Road opposite the corner of Warrandyte Road at daybreak for the dawn service. When Sam was not available Bill Brown would deputise on trombone.

Bill would often tell of a band member who cycled from Warrandyte with a bass strapped to his back in all kinds of weather.

By 1922 the Band was well established in the local community giving concerts at the mechanics hall and regular concerts in the park. Popular in those days were fancy dress dances. These dances were organised by the Band and the members would join in the frivolity of the occasion in fancy dress.

After the Second World War the Band was re-started after 4 years of absence. Sam

Brown once more played a leading role. Three brothers from the Polkinghorne family were recruited to the Band. Their father had been at one time bandmaster

1950s

In the 1950s, Peter Davison was appointed bandmaster. After six years Mr Boyle was appointed as bandmaster and he led the Band to success at the Victorian Championships. Mr Boyle had played in the Coburg Band with Peter Davison, Tom and Jack Kett. Jack had almost finished building a house in Ringwood and as an incentive to join the Ringwood band Mr Boyle sent him a sack of potatoes.

Complete the survey

We are working with State Library Victoria on an exciting research initiative to understand how public libraries contribute to the health and wellbeing of their communities. You're invited to participate in a survey that will ask how you feel about, and how much you value, the various programs and services offered by public libraries.

Your thoughts and feedback will help to improve the quality of library services across Victoria.

Over 5 publications we will be running a series of sensory experiences in nature. Each experience will take about 10 mins and you are encouraged to read through the instructions before you commence your time in nature to maximise your experience.

Find a spot outside where you can sit or lie down comfortably. This could be in your backyard, your local reserve or in a national park.

Take a few moments to regulate your breathing and settle into your position. Notice the pathway of your breath into and out of your body. Can you feel the air passing over your tongue, through your nostrils, down into your lungs. Can you feel your chest rising and falling, your diaphragm expanding or your abdomen moving? Notice the pathway in and then follow the pathway back out again. Choose one place to focus on and continue to breathe naturally as you focus on that part of your body. Hold your focus on your breath for a few minutes.

f you are comfortable, shut your eyes. If not, focus on a spot down in front of you.

For the next 5 mins, tune in to what you can feel with your body. Feel where and how your body makes contact with the ground.

Is it evenly placed on both sides of your body?

Can you feel a breeze on your skin? Where?

What direction is it coming from?

Can you feel the warmth of the sunshine on your body? Where?

What direction is it coming from? How does your skin feel in response to it?

Where do you feel the material of your clothes making contact with your body?

Can you feel moisture in the air?

If your mind gets distracted, just draw your thoughts and attention back to what you are feeling.

Try to stay focused on the exercise and enjoy the experience of tuning into your sense of feeling.

When you choose to complete your experience, you may wish to take a moment of gratitude for nature and for the experience you have just had.

Kayte Kitchen is the founder of Admirari Nature Therapy who provide nature experiences for schools, business and individuals. For more information visit admirari.com.au

is the founder of Admirari Nature Therapy who provide nature experiences for schools, business and individuals. For more information visit admirari.com.au

Tuning into our senses is an important way to disconnect from the fast pace of modern life.GENERAL INSURANCE By Craig Anderson

There are questions that have only a yes or no answer, and you will find some of these types of questions on your insurance renewal forms. For a Home and Contents policy, the question may be, “Is the property in poor condition or poorly maintained”, to which everybody invariably answers “No”. This may not in fact be true, and you may be unaware you are misleading your insurer.

For example, if you have a valley iron on your roof which is not visible from the ground and it is full of debris from an overhanging tree, or have cracked tiles, missing bedding, or loose flashing etc. then you have not maintained your house properly like you promised. As you have already sworn to the insurer as part of the legal contract of insurance that you do maintain it, you may have a claim rejected when the cause is determined by the assessor to be “poor maintenance”. Sudden and unexpected ingress of water due to storm damage should be covered, but if the main contributing factor that created the claim is poor maintenance, then do not be surprised if the claim is declined.

So how much should you reasonably be expected to know as a homeowner? The answer may vary, but good practice would have you (or your competent tradesperson) maintain anything that can be accessed even if out of sight. Typically, destruction caused by animal, bird, insect, vermin or rodent eating, chewing, clawing, pecking, nesting or soiling in a single incident or over a long period of time is excluded. This means you should be doing your best to prevent this from occurring, as the insurer will not be footing the damage bill.

Regular pest inspections and treatments are a great way to prevent and treat serious infestations. Given that the price of replacing a house is in the hundreds

of thousands and the cost to spray for termites is often below one thousand it seems like a good deal to me. Termites also like damp ground, so maintaining good stormwater drainage and keeping your sub-floor dry is a good thing to do. Preventing water saturation around footings, stumps, and slabs can avoid subsidence and heaving too, which if caused by blocked and broken drains over time, will not be covered either. Sudden and unexpected pipe ruptures are mostly covered, but years of seepage would not be. So ensure your stormwater, sewer, and mains water systems are checked and if necessary repaired before serious damage occurs.

Your policy is not a “cure-all” or “Magic Bullet” so you should understand the extent to which you are covered, and act accordingly. Policies vary depending on their type and the insurer who issues them, so do not assume anything, and if you need clarification (after reading the

PDS) ask the provider who sold it to you to provide it.

For a “health check” of your business insurance, contact Small Business Insurance Brokers via email sales@ smallbusinessinsurancebrokers.com.au

Any advice in this article has been prepared without taking into account your objectives, financial situation or needs. Because of that, before acting on the above advice, you should consider its appropriateness (having regard to your objectives, needs and financial situation).

www. heightsafetyinsurancebrokers.com.au 0418 300 096

Most people have never heard of a circular economy but experts say it’s what Australia needs.

A circular economy involves more than switching to renewable energy to cut carbon emissions or adding another bin with a different coloured lid to kerbside rubbish collection.

Rather, more reuse, repair, buying secondhand, re-engineering for longer use, leasing, donating and recycling could be built into the design, manufacturing and sale of goods.

The rising cost of living has triggered more awareness and anxiety about consumption and waste, Commonwealth Bank’s circular economy expert David Martin told a conference on Tuesday.

But the deeper motivations are different across the generations, he said.

Younger Australians say they want to go circular because of climate change, while baby boomers and older Australians want to send less to landfill, according to a CommBank survey of 5600 consumers.

He said there is a groundswell of support for the circular economy but it is yet to hit the masses.

Most (61 per cent) had never heard of the term, while 15 per cent had heard of the circular economy but didn’t know

what it meant, the consumer insights survey found.

“Another problem is that the amount of stuff we have is just so big and we see it every time we turn the corner in our house,” he said.

For example, an estimated 146 million unused items of clothing are gathering dust, despite many saying they have a regular spring clean and a quarter saying they have a clean out at least once a year.

“And 14 per cent never do it, which blows my mind,” he told the Australian Circular Economy Conference.

For businesses, the overwhelming feedback was there weren’t enough options to help customers reduce waste.

But consumers say they want businesses to do more. And just over a third of consumers were willing to pay more to support a business that was more sustainable.

Nicole Garofano, head of circular economy development at environmental organisation Planet Ark, said governments should be encouraging “citizen consumers” with more information and tax breaks for repairs.

“So every time we stand and look at the shelf, is there an opportunity to make those decisions – do I buy or not?” She said citizen consumers had a different mindset – it’s not just about consuming for convenience or prestige.

Recycling can break down bottles, mobile phones and other items and reprocess them into new materials, while a re-user can buy or sell clothes, vehicles or tools and circulate them through the economy.

Consumers may not be involved in the design stage, but they can make decisions about purchases.

Dr Garofano said they should consider if the product will last a long time, whether they have the right to repair and whether it can be deconstructed instead of ending up as landfill.

Leading chemical engineer Professor Ali Abbas, Australia’s first chief circular engineer, is working with the independent Circular Australia organisation on ways to change the economy and industry.

For example, when a household buys a new solar energy system, they could lease the solar panels and have them maintained and repaired for longer use and eventually recycled.

Breakthroughs in processing also mean manufacturers can start “designing out” waste and pollution to tackle complex crises, Prof Abbas said.

“It goes above and beyond decarbonisation and includes biodiversity loss,” he said.

But he said it cannot rely on scientific processes alone – economic structures and thinking will need to change.

Anticipating your baby’s first Christmas is really special and everyone loves it when there’s a new baby in the family at Christmas time. However, we know that the lead up to the season can leave mothers and their little ones feeling tired and frazzled. Preparing for Christmas always makes life extra busy and it can take a lot out of you both physically and emotionally. For most families it involves planing and organising gatherings with family and loved ones, which often involves travel. There can be increased pressure on finances, the weariness of battling crowded shopping centres, not to mention extra cooking and cleaning as we prepare for the festivities. For mothers and babies, this can be a recipe for “Christmas colic”. In other words, an unhappy, difficult to settle baby.

In order to set yourself up for a happy Christmas Day, consider the following tips:

1. Work out where your baby is going to sleep on Christmas Day.

If you’re planning to spend time in someone else’s home on Christmas day, it will pay dividends to have a good preemptive think about where your baby will take their naps. Whilst there may be a house full of willing relatives prepared to nurse, rock and cuddle your baby non-stop, this will only work for so long. Eventually your little angel will become overstimulated and exhausted from all that handling and at some point you will have to extract your baby from grandmas arms and find a suitable sleeping place. Ideally you’ll need the use of a quiet room, away from the hustle and bustle of the Christmas festivities, with either a bed for you to both lay down on, or a cot of some description (porta-cots can be great option and tend to work better than a pram in scenarios like this.) Alternatively, a baby carrier may be the very best thing.

In the end, it may just be the best decision to have everyone come to your house for Christmas. After all you’re the one with the new baby. The benefit is that your baby can nap in their normal sleeping environment and you don’t have to lug all of that extra gear with you and set it up in someone else’s house, when all you really want to do is relax and enjoy the gathering. That doesn’t mean that you do all the cooking either! Make sure to delegate when it comes to who’s bringing what food and accept all offers

of help. Especially help with washing dishes and cleaning up afterwards.

3. Consider alternate times to gather Meeting for breakfast or brunch may be a more suitable time for you and your baby. See if your family can be flexible and depart from traditional lunch or dinner this year. Babies are usually more rested and happier in the morning which can make everyone’s day more enjoyable.

4. Have realistic expectations

Chances are your baby’s first Christmas may not go exactly as you hope it will. Your own stress levels will probably be running higher, you may be extra tired, your baby may not have slept the night before, and you may have a long car trip before you get there. Expect your baby to find the day tiring and expect to find it tiring yourself. Then, if things don’t go quite to plan, you can be kind to yourself and willingly let go of the expectations that you may have had for the day. Be prepared to leave early if you need to. Parenting is not picture-perfect. It’s hard work and it’s messy at times and that’s okay. Next Christmas your baby won’t be a baby anymore!

Be mindful about noticing your baby’s earliest hunger cues, and try to respond to them promptly. Don’t delay. When there’s lots of people handling the baby, or your busy doing other things, its easy to miss their early, more subtle cues. However, its best not to wait til your baby is upset before feeding them. This will only make things more difficult in the end.

If you’re breastfeeding, just be mindful that what you consume, your baby does too. A lot of rich food or unaccustomed food can lead to fussiness later on. Better to not indulge in too much that varies greatly from your usual food choices.

And if you are planning to consume alcohol, you need to do so carefully around the timing of your feeds. It takes approximately 2 hours for a standard drink to leave your bloodstream and your breastmilk. That means you should not breastfeed your baby within two hours of consuming alcohol. The best time to have an alcoholic drink is just after feeding your baby so that you have as much time as possible for your body to break down the alcohol before your baby needs to feed again. It’s a really good idea to consider expressing a feed and taking it with you so that you don’t get caught out. Any milk you express whilst you have alcohol in your bloodstream is not safe for your baby and will need to be thrown away. Download the FeedSafe app by the Australian Breastfeeding Association, to help you calculate how long after consuming alcohol you can safely breastfeed again.

If in the end everything goes to pieces and you end up with an over-tired baby who hasn’t slept or fed well all day, just remember you can start again tomorrow. Plan a quiet day at home for the following day. Appreciate the time you’ve had with your loved ones and for the gift of your new baby and take some photos to remind yourself of your baby’s first Christmas. You’ll be glad for the memories in years to come.

Osteopath B.App.Sc(Clin.Sc)/B.Osteo. Sc/Grad Dip Paeds

LACTATION CONSULTANT

www.childrensosteopathiccentre.com

Like many sporting clubs within the City of Maroondah, The Ringwood Bowls Club has been looking to increase its membership throughout the year.

The combination of new membership campaigns, internal and external advertising, participation in the Maroondah Festival and the support of FIND Maroondah our numbers are on the rise.

Our campaigns have been built around the concept of meeting new people, making new friends and enjoying the companionship of other members of the RBC.

The theme did not concentrate on becoming a bowler – rather it was all about joining a sporting club socialising, meeting new people and participating in the regular social events conducted by the RBC.

All people joining the Club were invited to try their hand at bowling with the RBC providing the bowls and a fully qualified coach to assist in getting their bowling career underway.

The RBC offers its social members a venue where you can meet, have a cuppa and make new friends.

Many of our social activities offer you the opportunity to bring your family and friends along, have a meal at the club, purchase your drinks at reduced prices and above all have some fun.

The Ringwood Bowls Club will run further membership campaigns in 2023 and one of the aims will be to attract potential bowlers from a younger demographic.

In the mean-time If you go to our website – www.ringwoodbowls.com.au you will be able to see how to go about becoming a social member of the RBC, special offers available to club members via our many and varied sponsors and upcoming social activities.

Don’t sit alone at home, don’t sit around wishing to meet new people, don’t sit around expecting to make new friends, don’t sit around just watching television

If any of the above sounds like YOU then it’s time to contact the Ringwood Bowls Club.

Why not make it a New Year’s resolution –I AM GOING TO JOIN THE RBC

We would love to welcome you onboard.

Director Ringwood Bowls Club

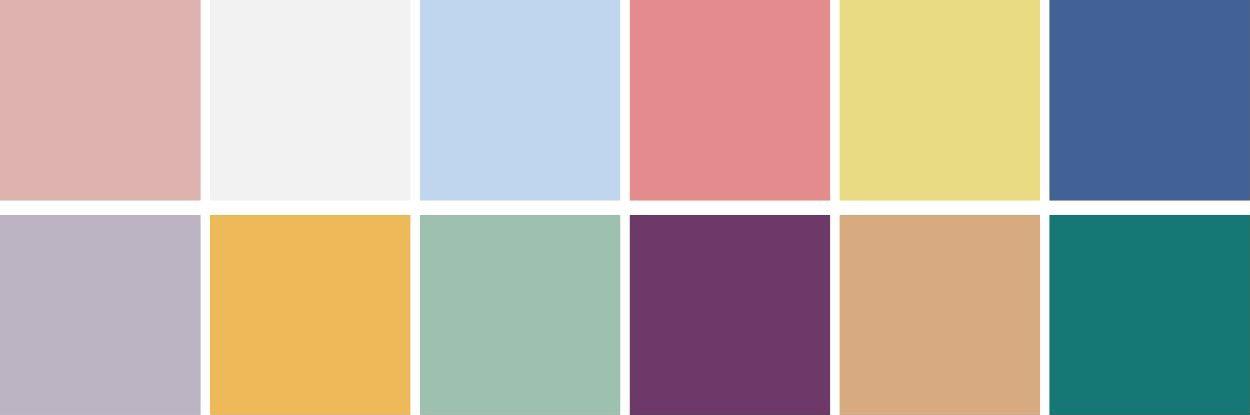

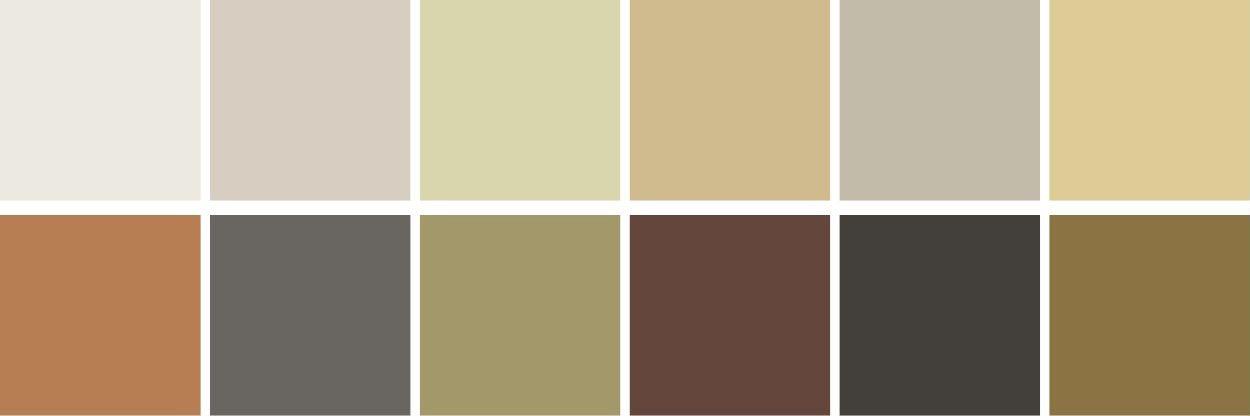

Are you thinking of redecorating the interior of your home? Now’s the season to refresh your walls and ceiling with a new coat of paint.

According to Dulux, the Covid crisis has generated a desire for connection and a yearning to live more authentically, which underpins the paint palettes of 2023. In a world recovering from turmoil, many of us want to experience harmony and stability, with creature comforts along the way.

Dulux has chosen tones from their extensive range to bring together three palettes of moody and earthy hues for balance, simple and warm tones to enhance connection, and bold brights for revival and energy. The new palettes are at once joyful and earthy, bright but more grounded than last year.

Choose one main colour that acts as a backdrop to a few contrasting but complementary colours. Together, these are called a palette and paint manufacturers make their paint tones in palettes so that they blend with each other and unify a space. Instead of having to work out which colour goes with which, an architect or interior designer will be able to help you choose the right colours to use as highlights, and offer advice on the most appropriate furniture to go with your new “wow” walls.

The Balance palette is refined, unifying a room through a combination of blues, greens and accents of deep garnet, which reflect the beauty of the ocean. A touch of luxury is achieved, adding warmth to contemporary and heritage architectural features. In terms of décor and materials, sophistication and modernity are key. Nature is again an inspiration, with patterns that draw from seashells and fern — complex, yet minimal.

Calm, warm and deeply intertwined, the Connect palette creates a space that feels welcoming, and its golden, earthen tones reflect a sense of homeliness and simple beauty. Texture is important here, with knits, wools and woven fabrics playing together to create cosiness and layers of richness. Old and new sit side by side, with vintage pieces alongside newer furniture with a modern bent.

Big, bright and bold, the Revive palette uses colour to create harmony while uplifting your spirits. Personal expression is at the core of the palette. Here, any colour goes: think peachy pinks, cobalt blues, lavender and glimmering emerald. Have some fun!

Simple furniture in natural materials like timber, leather and rattan look well with this palette, alongside stone flooring and bespoke, modern lighting made from recycled materials for a rustic and cosy look.

The Revive palette looks great in large spaces, characterised by unexpected colour combinations, graphic geometric patterns and chunky, wavy furniture.

Unsure which palette to go for? Contact KIR Architecture at contact@ kirarchitecture.com.au for help with all your interior design queries. We are always happy to answer any inquiries.

As we go forward into the festive season and the new year, it’s a good time to make resolutions and take stock. Our environment collectively is taking a severe battering and so are the inhabitants, both human and non human. We all must learn to live together and respect the habitat of our wildlife.

Baby birds are just out of the nest and learning how to fend for themselves, often on the ground. The immature crimson rosella has some camouflage, the green feathers, while it learns to navigate life in our world. A very good reason to keep cats enclosed at home, inside or in a cat enclosure.

Look up when camping, trees have become exceptionally unstable with the wet, and they can fall even without much of a breeze. Even pine trees can fall.

Keep your dog on a short leash, and don’t let it walk in grass over ankle height, in case of snakes. Even the neighbours grass will provide a place for snakes if there is water around too. Your dog might not even know it has been bitten, it happens so fast.

As you go outdoors in the holidays remember to use mozzie repellent and sunscreen. This year has been perfect for mosquito breeding and they are out in great numbers, sneaking up on any exposed skin.

Don’t squash the Huntsman. This spider loves to hunt and eat insects like mosquitos and moths, this one has a moth close by that has been attracted by the light. They are perfectly safe to keep in your home, and will not walk over you if you are asleep, they are too busy ridding your home of other pests like clothes moths, as you can see here, one moth has already been attracted to the light.

If you are well away from the city light pollution you might be lucky enough to enjoy looking at the stars at night, the milky way is an amazing sight.

This one is called a badge huntsman due to the face on his underside.

Take care of the bush, and don’t walk off the path, there are probably some tiny species of indigenous plant species that need to be protected. Native orchid, very tiny.

Have a great time over the holidays, even if you are helping some family members who have been flooded out or lost their home under a fallen tree. It is good just to be together. Croydon Conservation Society wishes you some free time to enjoy your local environment, wherever you are.

Sanzaro

Sanzaro

By Erryn Langley

By Erryn Langley

Spring and Summer are a time of renewal and regrowth, a time to dust off the cobwebs and let the sunshine in, and it’s also a good time of the year to take a look at your finances.

It’s been a challenging year on many fronts and spending a day getting on top of the state of your finances, putting some measures in place to make some savings, could be time well spent.

Try to arrange your financial spring clean on a weekday so you have scope to call banks, credit card issuers, health insurers, and other financial services providers who are easier to contact during office hours. And you will also need all your tools — financial records, current tax return, mortgage, credit card and bank statements — close at hand. Internet access is also important as there are many things you can do on line.

So, what are your objectives? Well, there are two sides to this coin. The first objective is to put more $$ in your pocket by saving a little more of and spending a little less of your income, without making your life a penny-pinching misery in the process. The second is to discover some cheaper ways, if they exist, to pay for some of life’s essentials.

Start at the beginning by reviewing your monthly budget — or constructing one, if necessary — so you can pinpoint the big expenses before trying to pare them back. Take your power bills, for

example. Some power companies will not only reward you with a discount for combining your gas and electricity, they will also allow you to pay them with a pre-set monthly direct debit, avoiding the shock of that big quarterly hit and smoothing your cash flow.

Monthly payments or saving targets can be an excellent budgeting tactic. In fact, you can even create your own monthly debit system for major expenses such as school fees, annual holidays and Christmas by estimating the cost and transferring monthly instalments to a separate savings account. You’ll most likely be able to setup automatic transfers with your bank so your savings build over time, without a second thought.

If you can manage it painlessly by cutting one or two unnecessary expenses, one good outcome of a budget review would be to save an extra 1 per cent of your salary — just $1 out of every $100 you earn — for a major objective like a renovation or even pumping up your rainy day fund. The best budgets can be ruined by unexpected emergencies, whether it is a burst water heater or a change in your financial circumstances.

Once

completed and have set up new direct debits and/or opened one or two new dedicated savings accounts, you should still have a few hours of your Financial Spring cleaning day left to look for some significant savings on financial services. Credit cards are a black hole in many budgets. Could you save by switching to a cheaper card? Are you paying off your card within the interest-free period? What about rewards programs

— if you are paying for them, are you using them? Some supermarket reward programs now offer a “double reward” so it may pay to investigate your options. You can compare cards online at several sites such as www.creditcards.com. And if you do decide to change card companies, you might find one that will give you an interest rate holiday for the first 3–6 months as a reward for switching.

A recent Choice survey found 82% of Australians are concerned about health costs, making it the main household cost concern. Your current health insurance plan may be worth reviewing because your family circumstances might have changed since you took out the plan, or the market may have newer, more flexible options providing better value. There are many sites that allow you compare plans, including a Government comparison website www.privatehealth.gov.au

And finally, have a think about your goals and dreams and make sure that any decisions you are making in the present are not at the expense of your future financial security.

All done? Congratulations on a day well spent!

1300 557 144 | erryn@findwealth.com.au www.findwealth.com.au

Financial Planning is offered via Find Wealth Pty Ltd ACN 140 585 075 t/a Find Wealth.Find Wealth is a Corporate Authorised Representative (No 468091) of Alliance Wealth Pty Ltd ABN 93 161 647 007 (AFSL No.449221).Part of the Centrepoint Alliance group https://www.centrepointalliance.com.au/

Erryn Langley is Authorised representative (No. 1269525) of Alliance Wealth Pty Ltd.

This information has been provided as general advice. We have not considered your financial circumstances, needs or objectives. You should consider the appropriateness of the advice. You should obtain and consider the relevant Product Disclosure Statement (PDS) and seek the assistance of an authorised financial adviser before making any decision regarding any products or strategies mentioned in this communication.

Whilst all care has been taken in the preparation of this material, it is based on our understanding of current regulatory requirements and laws at the publication date. As these laws are subject to change you should talk to an authorised adviser for the most up-to-date information. No warranty is given in respect of the information provided and accordingly neither Alliance Wealth nor its related entities, employees or representatives accepts responsibility for any loss suffered by any person arising from reliance on this information.

The FTX collapse is creating significant issues for SMSF trustees as they try to obtain valuations for lost assets and calculate the CGT payable on previously held Crypto.

FTX was a Crypto exchange platform founded by Sam Bankman-Fried. Most of his wealth, which peaked at an estimated $26.5 billion, was tied up in ownership of about half of FTX and a share of its FTT tokens.

In November 2022, FTX faced a liquidity crises. Rival exchange Binance considered buying portions of the company but after some due diligence, quickly pulled out of the purchase.

Soon after Binance pulled out there followed some tweets regarding FTX and questions about some missing billions that had disappeared from the exchange – keep in mind the exchange was to manage other people’s money and was not meant to be used to prop up other companies. Apparently, this is what happened. Funds were taken from FTX and used to prop up a fund manager that had lost millions and was looking to collapse. Unfortunately, even with the funds taken from FTX the fund manager collapse and the funds taken from FTX disappeared overnight. Millions of investors lost their crypto investments overnight; the whole exchanged just closed. It is estimated that 30,000 Australians have been impacted by the closure of FTX.

A key accusation leveled against Bankman-Fried is that he used customer funds from his crypto exchange to fund risky bets at affiliate trading arm Alameda Research

With the closure of FTX many SMSF investors who had money invested in Crypto on the FTX can longer download any data or transactions from the FTX exchange. The site is blocked and any trustees trying to obtain information regarding their Crypto assets that were previously held on the FTX exchange are going to find it rather difficult.

We’re currently in the middle of the financial year and we have already spoken to client’s whom we know have been using FTX to try and see if they can obtain any information regarding their trading prior to the closure. It is a responsibility of SMSF Trustees to keep accurate records of all investments held in a SMSF so, if they cannot obtain these records then they could be facing a potential breach and at this point in time we are not sure what the auditors or ATO are going to do about it.

We are hoping some clients were using software that tracked their individual trades up until the FTX collapse. Alternatively, those clients who did not use external tracking software might have to go through individual emails and try to recreate their record – basically, it is going to be a mess for accountants and auditors where FTX is involved. For funds or investors that have lost assets or who currently have crypto assets frozen, the ATO has

given some limited guidance on their community pages.

That ATO has stated that Cryptocurrency is a capital gains tax (CGT) asset and if it looks like a C2 event which effectively means that as long as there’s no chance of reclaiming that asset, that it is really lost, then you can potentially claim it as a capital loss. So you may be able to write off those losses as a capital loss. It is likely we are going to see a lot of losses across several SMSF for the 2023 financial year.

There is some discussion on ATO Community Forums that it would not be considered a G3 event which relates to liquidation of shares and where you generally have to wait for the liquidation notice. Which, if this is the case, will be a relief for investors, trustees, accountants and auditors alike.

If you are going to invest in Crypto, we strongly suggest using external software outside of the exchange that captures each trade and to run these reports regularly throughout the year.

You can call them on 1300 88 38 30 or email info@findaccountant.com.au www.findaccountant.com.au

Signarama was born in 1986 but it wasn’t until 1997 that the company made it to Australia. The signage franchise company – which operates under United Franchise Group – opened their first outpost in Australia, the following year in Preston, Victoria. Since then, Signarama has expanded that presence, opening up locations throughout every state in the country including Perth, Brisbane, and Sydney. What those locations have offered, in addition to high quality signage and branding products for the communities, is the opportunity for entrepreneurship. For those who have ever dreamed of owning their own business, Signarama has made that a reality for many; and has achieved the rank as the largest signage franchise company in the world.

And now, Signarama Australia has made it to the big 100 – the 100th company franchise in the country will open within weeks. The 100th store in Mosman, a suburb of Sydney, is the latest example of the tremendous growth and success that Signarama is experiencing, both in Australia and globally. That success is based on their variety of superior products and consistent, exceptional service; features Signarama is known for and that their customers say they appreciate and come back for.

Signarama's custom signs are designed to fit the needs of any business, organisation or individual for any event or project, whether it's a school carnival, a trade show, a corporate billboard, or a countrywide celebration. But while the company name says 'signs', Signarama has become so much more than that since it debuted more than 25 years ago.

Since that time, Signarama has evolved into a trusted resource that works with local businesses to discuss, strategise, and craft new ways to expand the number of inquiries to their businesses and create more sales opportunities. For communities throughout Australia, as it will do for Mosman, Signarama adds value to the local economy by creating jobs and supporting the business

infrastructure. When Signarama comes into a community, they become a vested part of that community and a marketing partner to the businesses they support. So, when you consider Signarama as 'the way to grow a business', it makes perfect sense how they’ve gone from 0 to 100 and with a lot to show for it!

From May 2023, Maroondah residents will be able to put their food waste to good use, with a food organics and garden organics (FOGO) waste collection service. Drop in to Croydon Library any time from 10.30am-1pm to learn more what the service means for you. (Free event)

The manufacture and installation of Bills Horse Troughs was sponsored by George Bills and his wife Annis, who set up a trust fund through George’s will, https://billswatertroughs.wordpress. com/. The fund was intended to honour the memory of the Australian horses that served in the First World War, as well as to provide for the welfare of the many horses still used for transport in Australia in the decades following the war. Bills Horse Troughs were manufactured in Australia from pre-cast concrete with steel reinforcements and, installed in New South Wales and Victoria as well as overseas. O’Sullivan Conservation was engaged by The Council to complete an off-site treatment of the trough located at the corner of Joynton Avenue and Elizabeth Street in Zetland. The trough was photo documented and condition assessed in place before being lifted from its base and placed on a customfabricated stillage. Following transport to the O’Sullivan Conservation workshop, it was again photographed, and condition assessed before cleaning. Heavily corroded steel elements were removed along with failed previous repairs and spalling concrete. The removed steel reinforcements were replaced in 316 stainless steel and the surfaces of all exposed steel elements were prepared

A few lucky Victorians could help give people with low vision and blindness a life-changing Christmas gift by becoming volunteer puppy raisers.

Guide Dogs Victoria is on the hunt for up to 20 people across the state – including in Melbourne, Bendigo, Ballarat, and Geelong – to sign up to care for the young dogs ahead of the new year.

Volunteers get to watch their pups grow over 12 months as they start going through training with full support from Guide Dogs Victoria.

before an anti-corrosion coating was applied. Carefully matched patch repairs were then added to areas of concrete loss before the application of a biocide and a concrete water repellent (silane siloxane). Patch repairs were allowed to further ‘weather’ and ‘tone down’ naturally over time in situ. The trough’s lettering was also inpainted to improve legibility, in keeping with practices documented on similar troughs. The conserved trough was transported

back to Zetland, where it was lifted from its stillage and set atop its prepared base with colour-matched mortar. A custom fabricated waterproof membrane was installed into the trough to act as a lining for the garden bed that The City of Sydney installed back into the trough. Following the completion of works a treatment report was provided to the City of Sydney, detailing all materials used and including recommendations for ongoing care.

Puppy raisers need to have a fully fenced yard and access to a car, and be able to go to training days in their local area.

They must be away from home for no more than four hours at a time, puppy development team leader Naomi Wallace said.

“We are looking for people that are home most of the time, who are interested in putting effort into training and socialising the dog,” she said.

“What you will get in return is a fantastic experience.” Volunteers will have a dedicated puppy development adviser on-hand and Guide Dogs Victoria will also supply food, veterinary care, and flea and tick prevention for the dogs.

Guide Dogs provides people with low vision and blindness the service animals at no cost. It takes more than two years and $50,000 to breed, raise, and train each dog.

By Warren Strybosch

By Warren Strybosch

You’ve probably heard the saying ‘change is as good as a holiday’. And sure, in some situations, altering your circumstances can be refreshing. But not all major life changes make you feel immediately clear, secure, and ready to take on the world. When everything you know is turned upside down, moving forward successfully is not a quick snap – it’s a transitional process.

Navigating through the darkness before the dawn is tough. Conversely, many people struggle with sudden good fortune. The good news is, countless people like you have been there before. They’ve struggled with decisions and made mistakes so that you don’t have to.

The most stressful life (and financial) events.

According to the Holmes Rahe Stress Scalei, the biggest life events you may have to overcome include:

Buying a home

Involuntary unemployment

Divorce or separation

planning

Pregnancy or gaining a new family member

Major changes to business

Moving into Aged Care

How to deal with sudden changes

So what do all these life events have in common? Basically, they induce psychological states where you’re more likely to be emotional and reactive than logical and rational. This can lead to poor outcomes which only fulfil your short term needs, or worse, cause further detriment to all involved. There’s only one way to remove yourself from that reactive state – mindfulness. Mindfulness means being self-aware, having the ability to see your situation from an outsider’s perspective, and thinking before you act. Here’s how you get there:

• Get a mentor. A friend, family member or amenable acquaintance who has been through what you’re going through. They’ll be able to give you a fresh perspective and (evidence-based) hope for the future.

• Take it one day at a time. And if you don’t think you can get through a day, try a shorter time period. As a wise TV comedienne recently said, “You can stand anything for 10 seconds. Then you just start on a new 10 seconds.”

• I n a similar vein, concentrating on small tasks, one at a time, can help make a seemingly impossible task seem much more manageable. For example, take income insecurity. You may be feeling anxious because you don’t know how to pay for all of the expenses you currently have. But listing your expenses in priority order can help clarify just how little you have to spend to get by.

• I t’s a good idea to have scheduled ‘down time’ while you’re going

• through a major change. Whether it’s meditation, exercise, a massage, shopping, or a good old snooze, mark it in your diary –and don’t let anyone cross it out. This can help prevent you from feeling overwhelmed at other times – such as when you’re making an important financial decision.

• Take action. Putting off work involved with a major life change just means the stress snowballs. Even taking a small step can help take the pressure off. For example, if you’re feeling a bit restless about being retired, enquire about a volunteering position. You don’t have to make a commitment, but you’ve opened yourself up to the possibility of contributing your skills to a cause.

• Ask yourself how much of your situation you can really control. Try to be objective – pretending you’re giving advice to a loved one can help. Letting go of what you can’t control allows you to spend mental energy on what really matters.

After you’ve made it through to the other side of a major life event, it’s important to reassess your financial situation. You may think that you’ve dealt with all the financial implications. But doing a review of your finances can still yield benefits...

If you’ve recently been through a big change, get in touch with us to help reassess and plan for a prosperous future.

Individuals may soon have the ability to claim a higher deduction for self-education expenses from the 2022–23 income year. New legislation has been tabled into parliament following the original announcement by the former government in the 2021 Federal Budget.

Currently, a self-education deduction is limited to costs above $250 each income year. This limitation, known as the s 82A limitation, will be repealed from the tax laws. This requires legislative approval.

The announcement is somewhat related to a Treasury discussion paper released in December 2020. However, other matters addressed in the paper, such as deductions for expenses unrelated to current employment, have not been taken further at this stage.

Starting from 1 July 2023, operators of sharing economy platforms will be required to report transactional information to the ATO. The Taxable Payments Reporting System already applies to some businesses in industries where non-compliance is deemed to be high risk. By adding operators of sharing economy platforms to the regime, taxpayers who hold or use assets for short-term lease or contract work will have their information collected. The identification of users of sharing economy platforms means that, as an adviser, you should be informing taxpayers who earn income off these platforms of their tax obligations. This includes short-term accommodation, ride-sharing transport and food delivery platforms. Also, other task or time-based service platforms will be required to report for income years beginning on 1 July 2024. The start date of the proposed changes have been delayed after the former Bill was prorogued at the last federal election.

Announcement(11-May-2021) Consultation

Introduced(3-Aug-2022)

Passed Royal Assent Date of effect(1-Jul-2022)

Announcement(25-Aug-2021) Consultation

Introduced(3-Aug-2022)

Passed Royal Assent Date of effect(1-Jul-2023)

The Commissioner of Taxation will be given new powers to direct a taxpayer to undertake a record-keeping education course in lieu of an administrative penalty. The new directive will be initially limited to small business owners in order to assist them in keeping up to date with tax obligations. The individual must then provide the Commissioner with evidence of completion of the course in order to avoid financial penalty. The new directive will be available after the Bill receives Royal Assent.

A business with aggregated turnover of less than $50 million will be entitled to a 20% bonus deduction for expenditure relating to a digital business adoption.

The bonus deduction will be available for expenditure incurred from 7:30pm (AEDT) on 29 March 2022 (2022 Federal Budget night) until 30 June 2023. There is a limit of $100,000 of eligible deductions able to be claimed by a business each income year but can be claimed on both business expenses and depreciating assets.

Small businesses will get a bonus tax deduction on top of the allowable deduction for training their employees.Businesses with aggregated turnover of less than $50 million will be entitled to claim a 120% deduction for eligible expenditure. Eligible expenditure refers to external training courses delivered to a business’s employees by a registered training organisation in Australia. The skills and training boost is available from 7:30pm (AEDT) on 29 March 2022 until 30 June 2024.

Announcement(3-Aug-2022) Consultation Introduced(3-Aug-2022)

Passed Royal Assent Date of effect

Announcement(29-Mar-2022) Consultation(29-Aug-2022)

Introduced Passed Royal Assent Date of effect

Announcement(29-Mar-2022) Consultation(29-Aug-2022)

Introduced Passed Royal Assent Date of effect

Sole traders and partners in a partnership may be able to utilise a safe harbour to deduct non-commercial losses against other assessable income. The PCG bypasses the Commissioner’s discretion under the noncommercial loss rules, where a business has been directly affected by floods, bushfires or the COVID-19 pandemic. The business will be required to show necessary evidence to support using the safe harbour. The safe harbour applies for the 2019–20, 2020–21 and 2021–22 income years.

Announcement(11-May-2022) Consultation period(21-Jun-2022) Released(14-Sep-2022)

Crypto assets are to be specifically excluded as a foreign currency with the release of exposure draft legislation. The proposed legislation maintains the current tax treatment of crypto assets such as Bitcoin and removes uncertainty following the decision of the Government of El Salvador to adopt Bitcoin as a legal tender. If the legislation receives royal assent, the new laws will be in effect from income years that include 1 July 2021.

Note: On 30 September 2022, reports have emerged that the Queensland government intends to scrap the newly legislated measure that would include interstate landholdings in land tax assessments. We will provide further explanations in due course once they are announced by the state government.

Queensland has become the first jurisdiction in Australia to change land tax rules relating to taxable landholdings. Under the proposed changes, a landholder will have their land tax calculated based on their total Australian landholdings. The calculation will then be pro-rated to reflect a taxpayer’s Queenslandonly taxable landholdings. The new legislation will commence from 1 January 2023, meaning that the first calculation under the new rules will take place for 30 June 2023 assessments.

A draft determination from the ATO has stated that earnings from an individual’s “image rights” or “fame” can only be included in that individual’s assessable income. This position from the ATO has changed from previous draft practical guidance which stated that professional sportspersons could use a safe harbour approach to alienate income to a related entity. If individuals already entered into an arrangement in good faith on the basis of PCG 2017/D11, the ATO will not devote compliance resources up to the 2022–23 income year. Also, the draft determination distinguishes “image rights” and “fame” from an individual providing services to a third party.

Pensioners and those on Veterans’ entitlements will be enticed back into the workforce with an increase to their work bonus concession balance.

This measure is being supplemented with an increase to the time limit for the suspension of pension entitlement from 12 weeks to 2 years. This means if a pensioner earns too much income over a period of time, their pension will be suspended instead of cancelled.

Further changes will also apply to an individual’s entitlement to the Commonwealth Seniors Health Card.

Announcement(6-Sep-2022) Consultation(6-Sep-2022)

Introduced

Passed Royal Assent Date of effect

Announcement(21-Jun-2022) Consultation Introduced(21-Jun-2022) Passed(24-Jun-2022 Royal Assent(30-Jun-2022) Date of effect(30-Jun-2023)

Announcement(5-Oct-2022) Consultation period(4-Nov-2022) Released

Announced: 25-Oct-2022 Updated: 26-Oct-2022

Maroondah City Council has a new Mayor, following an election by Councillors at a meeting of Council on Wednesday 9 November.

Cr Rob Steane was elected as Maroondah’s 27th Mayor during a special ceremony livestreamed to the Maroondah community.

Cr Tasa Damante was elected to the role of Deputy Mayor. The position will provide support to the Mayor in what will be a busy year for Council.

Cr Steane said it was a great honour to be elected to represent the Council in its third year of the current four-year term. This is Councillor Steane’s third Mayoral term and he will hold the position for the next 12 months.

“I am immensely proud to be given the opportunity to lead our Council for the next 12 months. Representing the community is a privilege and an exciting opportunity to make decisions that have a positive impact on our city’s future,” he said.

“I’d like to thank my fellow Councillors for entrusting me to lead this Council and our vibrant and diverse City over the next year,” Cr Steane said.

“Together I know we will strive to make Maroondah a better place for our community. I will continue to advocate for our community needs and build on the work that has been done over the years,” Cr Steane said.

“Regardless of the outcome of the state election in a few weeks time, I look forward to working with the new government, and to continue to advocate to our local members of parliament to ensure that they are fully aware of the needs of our community. Maroondah has had a good success rate with our advocacy efforts, which is highlighted by the number of programs and facilities that have been provided over the years.”

“After the impacts of the pandemic I am looking forward to 2023 continuing to be a year where together we support and reconnect our community.”

“Our job as Councillors is to represent the community, and the recent Maroondah Festival was a great opportunity for us to come together after some challenging years. What a wonderful sight it was to see so many people enjoying the sunshine and the atmosphere at what is our largest community event for the year.”

“And I’m looking forward to this year’s Maroondah Carols event on December 3, which will be another opportunity for our community to come together and celebrate the festive season.”

Cr Steane thanked the outgoing Mayor Mike Symon for his strong leadership, passion and dedication over the past 12 months.

“Maroondah is fortunate to have councillors with such a diverse knowledge base and a passion to bring about positive changes to our community,” he said.

“Cr Symon has led this Council with dedication and unwavering enthusiasm. His support to his fellow councillors and our community is to be commended.”

Cr Steane said one of his first priorities would be the continued implementation of the actions identified in the Council Plan, which is the blueprint for the four year Council Term, and is underpinned by the community vision, Maroondah 2040: Our future together. During Cr Steane’s term of office new facilities will be completed at Cheong, Ainslie and Jubilee Parks, which will

be used by a range of community and sporting organisations; work will continue as we develop the Croydon Community Wellbeing Precinct, in particular Hub A; and we look forward to creating a new Croydon Town Centre as we work in partnership with the Victorian Government to remove the Coolstore Road level crossing and create a new Croydon station and bus interchange.

“Each of these exciting projects will bring many new opportunities to Maroondah,” Cr Steane said.

Cr Steane invites members of the Maroondah community to attend or view the livestream of Council’s regular meetings to learn more about the processes of local government.

“The meeting schedule for 2023 will be confirmed at the 21 November Council meeting, and I would encourage residents, business people and students to attend these meetings, or view them on live stream, and take an interest in local issues,” Cr Steane said.

“Some may think voting in Council and other level of government elections is the only way for them to participate, but civic responsibility can extend to being a vital presence when Council conducts its business,” Cr Steane said

“I look forward to meeting many members of our community during my term as Mayor and to serving our community with energy, passion, commitment and integrity,” Cr Steane said.

Come and be a part of Maroondah’s much loved Christmas Carols event.

Maroondah Carols is the perfect opportunity for our community to come together and celebrate the festive season. There will be preshow entertainment, the Maroondah Carols Band, delicious food vendors, a free kid’s zone and a spectacular firework show that will light up the Maroondah night sky.

Find out more

Maroondah was one of 12 Melbourne-based Councils to participate in a nappy feasibility study to research and understand how to implement a best practice reusable nappy program. With Councils estimating that five to 15 per cent of household landfill bins contain disposable nappies (by weight), the study asked how to best reduce disposable nappy waste to landfill, support parents and carers and increase both first-time and continued use of reusable nappies. Read More

Find out more

November is National Asbestos Awareness Month, which acknowledges the dangers of asbestos-containing materials and aims to prevent asbestosrelated diseases through education.

With recent floods in Victoria and parts of Maroondah, Council is strongly urging property owners and residents to be aware of potential hazards caused by asbestos-containing materials that could have become eroded, disturbed, broken or friable, posing significant health risks if not managed and disposed of safely. Before cleaning up flood debris, renovating or making repairs, residents should visit