The Find Maroondah is a community paper that aims to support all things Maroondah. We want to provide a place where all Not-For-Profits (NFP), schools, sporting groups and other like organisations can share their news in one place. For instance, submitting up-andcoming events in the Find Maroondah for Free.

We do not proclaim to be another newspaper and we will not be aiming to compete with other news outlets. You can obtain your news from other sources. We feel you get enough of this already. We will keep our news topics to a minimum and only provide what we feel is most relevant topics to you each month.

We invite local council and the current council members to participate by submitting information each month so as to keep us informed of any changes that may be of relevance to us, their local constituents.

We will also try and showcase different organisations throughout the year so you, the reader, can learn more about what is on offer in your local area.

To help support the paper, we invite local businesses owners to sponsor the paper and in return we will provide exclusive advertising and opportunities to submit articles about their businesses. As a community we encourage you to support these businesses/columnists. Without their support, we would not be able to provide this community paper to you.

Lastly, we want to ask you, the local community, to support the fundraising initiatives that we will be developing

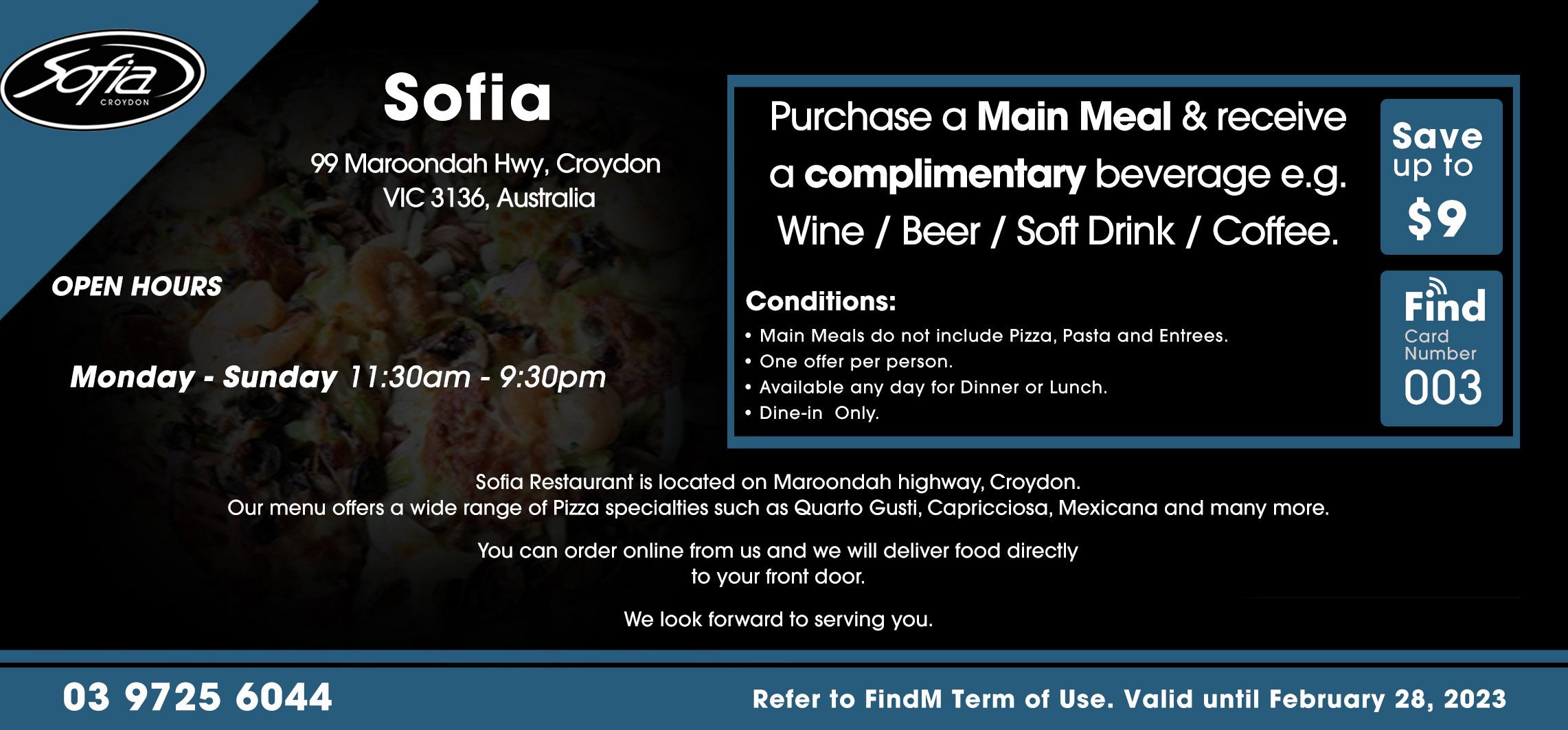

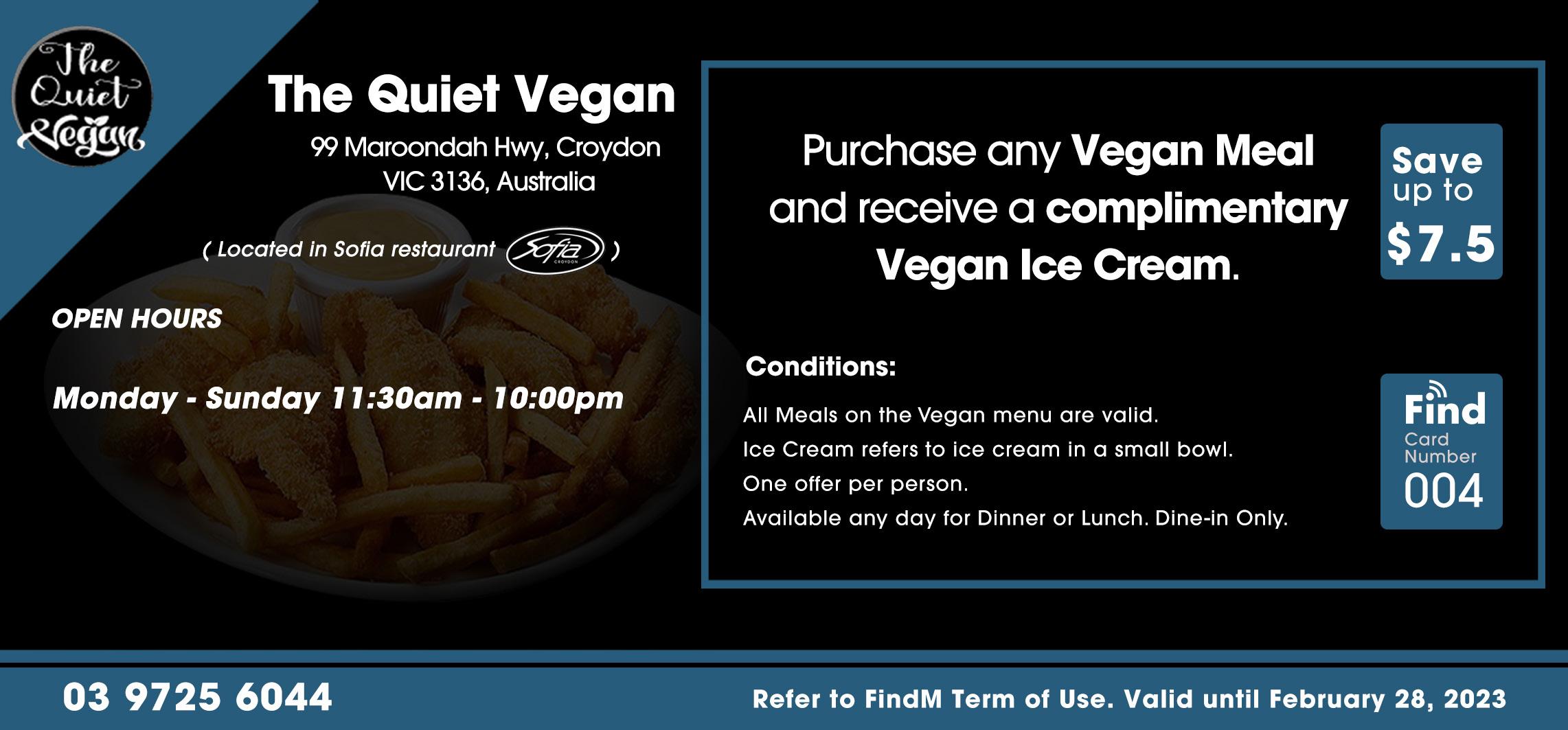

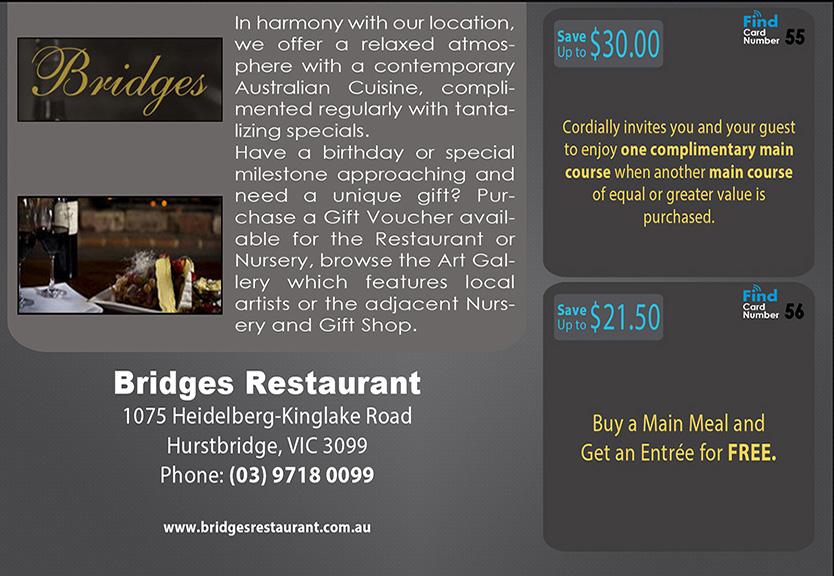

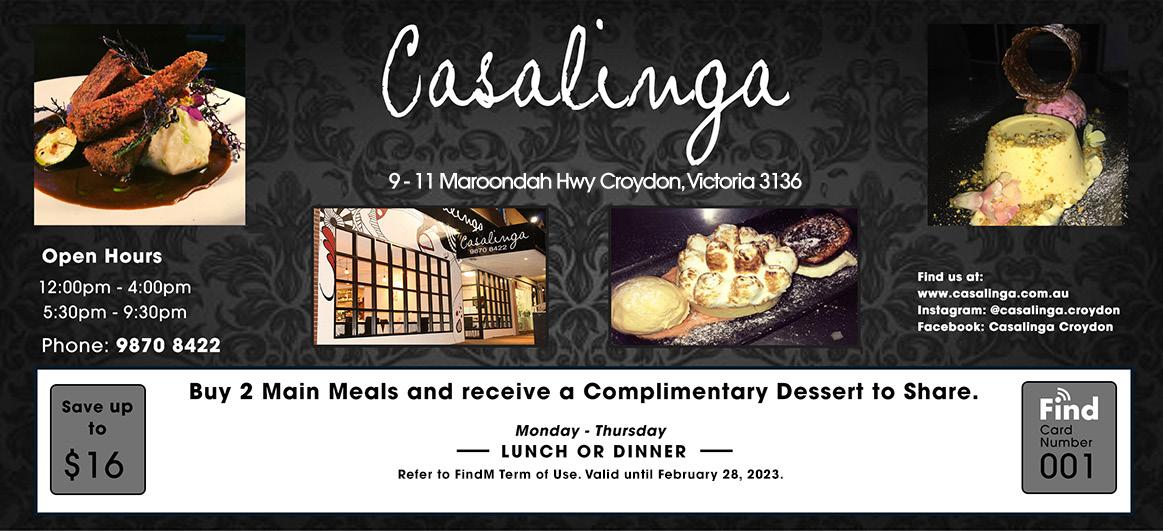

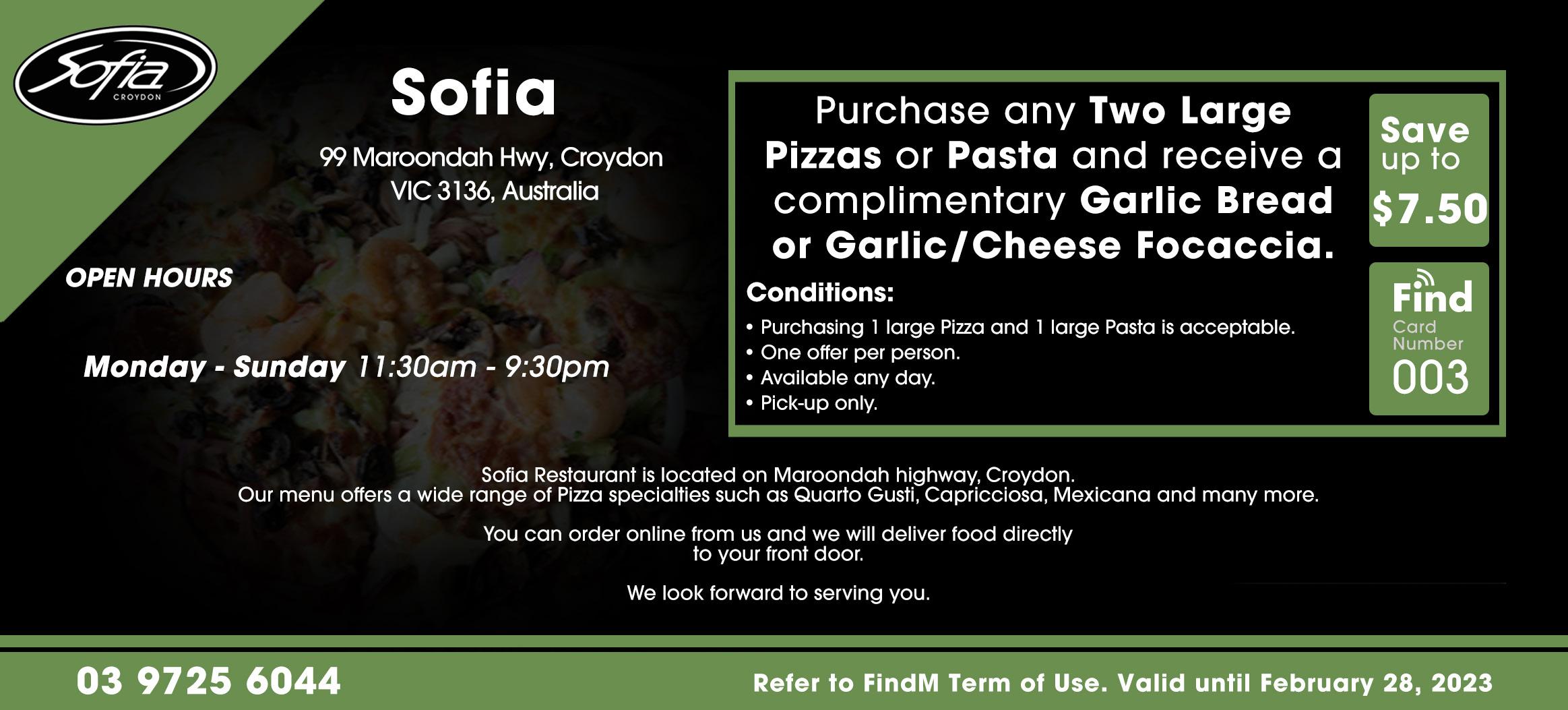

and rolling out over the coming years. Our aim is to help as many NFP and other like organisations to raise much needed funds to help them to keep operating. Our fundraising initiatives will never simply ask for money from you. We will also aim to provide something of worth to you before you part with your hard-earned money. The first initiative is the Find Cards and Find Coupons – similar to the Entertainment Book but cheaper and more localised. Any NFP and similar organisations e.g., schools, sporting clubs, can participate.

Follow us on facebook (https://www. facebook.com/findmaroondah) so you keep up to date with what we are doing.

We value your support,

The Find Maroondah Team.

EDITORIAL ENQUIRES: Warren Strybosch | 1300 88 38 30 editor@findmaroondah.com.au

PUBLISHER: Issuu pty Ltd

POSTAL ADDRESS: 248 Wonga Road, Warranwood VIC 3134

ADVERTISING AND ACCOUNTS: editor@findmaroondah.com.au

GENERAL ENQUIRIES: 1300 88 38 30

EMAIL SPORT: editor@findmaroondah.com.au

WEBSITE: www.findmaroondah.com.au

The Find Maroondah was established in 2019 and is owned by the Find Foundation, a Not-For-Profit organisation with is core focus of helping other Not-For-Profits, schools, clubs and other similar organisations in the local community - to bring everyone together in one place and to support each other. We provide the above organisations FREE advertising in the community paper to promote themselves as well as to make the community more aware of the services these organisations can offer. The Find Maroondah has a strong editorial focus and is supported via local grants and financed predominantly by local business owners.

The City of Maroondah is a local government area in Victoria, Australia in the eastern suburbs of Melbourne. Maroondah had a population of approximately 118,000 as at the 2019 Report which includes 9000 business and close to 46,000 households. The City of Maroondah was created through the amalgation the former Cities of Ringwood and Croydon in December 1994.

The Find Maroondah acknowledge the Traditional Owners of the lands where Maroondah now stands, the Wurundjeri people of the Kulin nation, and pays repect to their Elders - past, present and emerging - and acknowledges the important role Aboriginal and Torres Strait Islander people continue to play within our community.

Readers are advised that the Find Maroondah accepts no responsibility for financial, health or other claims published in advertising or in articles written in this newspaper. All comments are of a general nature and do not take into account your personal financial situation, health and/or wellbeing. We recommend you seek professional advice before acting on anything written herein.

Available Sizes:

Rates:

• Double Page Spread (408 x 276mm) $1650 Full Page (198 x 276mm) $1100

• Half Page Landscape (198 x 138mm) $715

• Half Page Portrait (95 x 276mm) $715

• Third Page (189 x 90mm) $550

• Quarter Page (97 x 137mm) $440

• Business Card Size (93 x 65mm) $275

• Ads Smaller than (85 x 55mm) and Below $121

• Design Services

We can create your ad for you. Prices start at $77 for the very first hour and $22 for each hour thereafter.

Next Issue of the Find Maroondah will be published on Friday March 10, 2023. Advertising and Editorial copy closes Friday March 03, 2023.

Whilst many SME owners are well aware of the most obvious risks to their business, I can’t say I’m surprised that quite a few are ignoring, or don’t know about the less obvious risks. In previous articles I’ve mentioned Management Liability, Cyber Liability, Professional Indemnity, and Business Pack insurance, but today it’s time to talk about E&O Insurance (Errors and Omissions).

This insurance is aimed at manufacturers, and reaches further than a standard Public and Products Liability policy, in the extent of cover it provides for their third party clients. It covers the financial liability to a third party where there is no physical injury or property damage, but where a claim arises due to a manufacturing error. The error may cause the faulty product to be withdrawn

from sale, creating a total replacement claim for the cost of the product, or cover product repair, reworking, or warranty repair. If the client has supplied the raw ingredients to the manufacturer, the claim may also cover that loss, and let’s not forget potential loss of earnings too from sales which are cancelled.

An extension to the policy to include product recall may be a good idea, if a faulty product could cause an imminent threat of personal injury or property damage. This exposure is obvious when it comes to foodstuffs and electrical goods, and could easily apply to many other products. The wording of the recall extension will be different from insurer to insurer, and they are not all the same where it comes to third party product distributor costs, so to ensure the policy chosen suits your business I suggest detailing the business activities to a broker who can find the best insurance fit for your exposure.

Earlier this week while out on patrol, members from the Melbourne Bicycle Unit were called to a shopping complex in the Docklands to assist a dog that had been locked in a parked car.

Riding up to the distressing scene, the dog was thrilled with their arrival. However, police were unable to locate the owner of the car. After speaking with security staff, it came to light the dog had been in the car for two hours (!!), with no water or food.

Multiple attempts and announcements for the owner to return were made with no contact, leaving the officers with no choice.

For a health check of your business insurance, contact Small Business Insurance Brokers via email sales@ smallbusinessinsurancebrokers.com.au

Any advice in this article has been prepared without taking into account your objectives, financial situation or needs. Because of that, before acting on the above advice, you should consider its appropriateness (having regard to your objectives,needs and financial situation).

Looking for Rope Access or Height Safety Insurance? Visit www. heightsafetyinsurancebrokers.com.au

Craig AndersonGENERAL INSURANCE

Small Business Insurance Brokers 0418 300 096

With help from South Melbourne Fire Brigade, police were able to gain entry to the car and save the little pup before the heat got to him.

The owner of the poor pooch will be fined $462 for leaving an animal unattended in a vehicle on a hot day, in addition to the cost of a new window for their car.

Great work to the members who saved this puppy’s life.

Elwynne KiftSecretary of Heatherdale Community Action Group Inc.

hcag@iinet.net.au

www.hcag.online

We can’t believe we have to keep reminding people, but here we are again.STOP. LEAVING. PETS. AND. KIDS. IN. CARS. ON. HOT. DAYS.

OCCUPATIONAL HEALTH & SAFETY

By Mark Felton

OCCUPATIONAL HEALTH & SAFETY

By Mark Felton

As a business owner, I want to once again stress that it is your responsibility to ensure the safety of your employees. One major responsibility here is the identification and reporting of Notifiable Incidents. By understanding the nature of Notifiable Events, as well as the required subsequent steps, you can ensure that you don’t create further issues with the investigating authorities, and continue to work towards a safe working environment for your employees.

WorkSafe Victoria defines Notifiable Incidents as one of the following:

• death of a person

• a person needing medical treatment within 48 hours of being exposed to a substance

• a person needing immediate treatment as an in-patient in a hospital

• a person needing immediate medical treatment for one of the following injuries: amputation, serious head injury or serious eye injury, removal of skin (example: degloving, scalping), electric shock, spinal injury, loss of a bodily function, serious lacerations (example: requiring stitching or other medical treatment)

Medical treatment means treatment by a person registered under the Health Practitioner Regulation National Law to practice in the medical or nursing or midwifery profession (doctor, nurse, midwife etc.).

You must also report the following incidents if they expose a person to a serious risk to their health or safety emanating from an immediate or imminent exposure to:

• an uncontrolled escape, spillage or leakage of any substance, including dangerous goods within the meaning of the Dangerous Goods Act 1985, or

• an implosion, explosion or fire, or

• electric shock, or

• the fall or release from a height of any plant, substance or thing, or

• the collapse, overturning, failure or malfunction of, or damage to, any plant, including plant in relation to a mine, that is prescribed by the Occupational Health and Safety Regulations 2017 (OHS Regulations), or the design of which must be registered in accordance with the OHS Regulations, or

• the collapse or partial collapse of a building or structure, or

• the collapse or failure of an excavation or mine or of any shoring supporting an excavation or mine, or

• the inrush of water, mud or gas in workings in a mine, underground excavation or tunnel, or

• the interruption of the main system of ventilation in a mine, underground excavation or tunnel.

What Should You Do in the Case of a Notifiable Incident?

If a notifiable incident occurs at your workplace, you should first ensure that everyone involved is safe and accounted for. Once you have done this, you need to notify WorkSafe Victoria so that they can investigate the incident and take any necessary action. Depending on the severity of the incident, this could mean contacting emergency services (e.g. police, ambulance) and WorkSafe Victoria.

If an incident does occur at your place of business, your first priority should be

ensuring everyone's safety. Once you've done that, you can begin working on containment and notification procedures.

Does your business have adequate measures in place to properly manage your own notifiable incident response? Do you regularly review these measures to ensure that they remain fit for purpose and keep you and your employees healthy and safe? Are you doing what you need to create a safe workplace for your employees? We assist business owners clarify what they currently have in place, as well as where there are shortfalls. We then assist in developing effective systems and documentation, working with businesses to ensure effective implementation. Checks are put in place to monitor ongoing effectiveness, to ensure that going forward they are sound and comply with the Act, and most importantly keep them and their employees informed, and healthy and safe. Please feel free to contact me, Mark Felton, at Beaumont Advisory on 0411 951 372 or mfelton@beaumontlawyers. com.au for an obligation and cost-free initial discussion.

Mark FeltonOccupational Health & Safety

www.thebeaumontgroup.com.au

By Reece Droscher

By Reece Droscher

Do you have a Christmas spending hangover? Spent more than you intended on presents for the family or went on that holiday that ended up costing a lot more than expected? Has your Home Loan repayment increased significantly or the credit card bill got you tossing and turning at night? Anyone with some personal debt has probably experienced this over the last few months, particularly with interest rate rises on Home Loans and the cost of living increases we are all suffering with at the moment. It is important to know that there are options to potentially help you mitigate these costs and leave you in a more comfortable position financially.

As a mortgage broker I regularly come across people who have had a Home Loan with the same lender for five years or more. They have simply been paying the required repayment without ever thinking about what the current interest rate is, the fees that are being charged and what other lenders may be offering. In the current environment it is a mistake to assume that your current Home Loan is providing you with the best value. By having your loan reviewed a Mortgage Broker may be able to present products from lenders offering lower interest rates

than you are paying currently. This could potentially save you thousands on interest costs or help you pay your loan off sooner.

Some lenders are offering up to $4k as a cashback payment for anyone who refinances a loan to them, so this can also be used to help clear some debt. There are certain conditions that apply to be eligible for the incentive payment, but most applications would meet the criteria for this payment.

Another benefit of having a review is to ensure the type of loan you have remains the most suitable to meet your current needs. Offset, redraw, the ability to make extra repayments or switching your rate between fixed and variable rates are all options your Mortgage Broker can review for you.

You may also have some smaller debts, such as credit cards or personal loans, that are charging higher interest rates but could be consolidated into your Home Loan. This could help repay these debts sooner by reducing the costs of these debts but would also simplify your finances, reducing the number of loans and repayments being made to multiple lenders.

Even without refinancing your Home Loan to another lender, your Mortgage Broker may be able to negotiate a better deal with your current lender. It costs a lender a lot more to attract new borrowers than to keep their existing customers, which is why they invest a lot of money in business retention teams. By looking at what competitors are offering your Broker can use this information to leverage a lower rate with your existing lender.

It is also important to note that a mortgage broker is required to act in their client’s best interest by law, which is different to the requirement on a lender when you deal with them directly. That is why the best person to review your Home Loan is your local Mortgage Broker. At SHL Finance we are already proactively helping our clients negotiate a better rate with their current lender, reviewing their existing loans and discussing ways to potentially save our clients thousands of dollars. We would love the opportunity to help you too.

How many sporting clubs would be satisfied with their current membership levels?

Maybe one or two but the majority would be seriously looking at how they can increase numbers.

Working on increasing membership numbers is a year-round challenge and requires a commitment from all current members – not just the board of directors.

What should clubs do about their declining membership numbers? Firstly it has to admit that it has a problem and then proceed to work out a plan that prioritises the need to increase membership.

Growing a club’s membership will become an almost impossible task if you think it can be achieved by one person. You need to look at forming a membership committee who can look at developing ideas that all members can participate in.

Would it be worthwhile contacting former members who left your club to join another club? Maybe the reason or reasons they left have been addressed

and former members are not aware of this. Why not invite them to the club and let them know that you would welcome them back and maybe offer them a one-off membership deal should they agree to return.

Would your club consider offering incentives for current members to recruit a new member? The reward could be a discount on their membership fee or a discount on purchasing a new uniform or equipment - don’t dismiss the idea without thinking about the financial benefits new members bring to your club.

Develop a membership brochure that provides information about your club and what potential members need to do to further their interest.

Promote membership within your own club and look at opportunities to take display space at community festivals.

Ask your sponsors if they would join with you in a membership drive and have your membership brochure readily available for customers to collect. If your club holds social functions throughout the year and encourage s members to bring friends and family to attend, make sure you have membership material available.

The same applies should your club have facilities that are hired out to community groups/schools or sponsors.

As your membership starts to increase keep your current members up to date. They will want to know that your club has acknowledged that declining membership is a serious problem and that it has been addressed and action has been taken and that the efforts being undertaken are attracting NEW members.

Don’t wait until it’s too late.

This follows more than 9,000 complaints in November 2022 and more than 8,000 complaints in October 2022.

AFCA has now received 45,704 complaints since 1 July 2022 – a 33% increase compared the first six months of the previous financial year (1 July to 31 December 2021), where AFCA received 34,476 complaints.

The banks and general insurers lead the way and there has been a drop in complaints related to personal insurance and superannuation.

December

Every once in a while, you hear stories about someone having access to cash from an undisclosed source. You are not 100% sure where they are getting the funds from, but you hear whispers that it might be coming from overseasbeing transferred into Australia on their behalf. Well, this is all about to change.

Over the years, the ATO’s data matching capabilities and ability to track funds have increased significantly. Now that banks must disclose transfers and any suspicious activities, it is becoming increasingly more difficult for people living in Australia to bring funds in from overseas.

The ATO, has warned everyone that they are increasing their surveillance in the area of money transfers coming into Australia. The ATO believes there are still people living in Australia receiving funds from overseas, who are masking the funds as something else, with the aim to avoid paying tax on that income they receive.

In 2014, the ATO provided an amnesty to those offenders who were receiving funds without disclosing it; to give them a chance to come forward and disclose their omitted offshore income and capital gains, without incurring penalties. However, it is unlikely the ATO will provide such an amnesty now.

The ATO has been working closely with many countries; entering into tax information exchange treaties for data gathering and data matching purposes. The ATO has more power now to access bank accounts to confirm the flow of funds and the ability to cross-check purchases with insurance policies and purchases with the amount of income being declared on returns.

The ATO has made it very clear that if anyone has funds flowing into Australia, they should have a tax strategy in place to account for those funds and pay the appropriate amount of tax that is due and payable. Otherwise, the ATO has warned that they may face audits, a please explain and possible penalties and fines; with large offenders being taken to court with the potential of facing jail time.

The ATO is really concerned with funds being transferred in the guise of a loan

from one unrelated party to another. These are a real concern to the ATO and will be monitored very closely. The ATO has gone so far as to say that they will even speak to the person who provided the loan and seek written confirmation that it is indeed a loan.

The ATO has stated that there are provisions in Australian which can be applied to treat a loan as income and people need to be aware that they might be required to pay a lot of tax if they cannot substantiate the funds transferred was actually a loan.

The ATO’s powers are far reaching and they have placed tax practitioners, accountants and other advisors on notice. The ATO has stated that they must make full enquiries to satisfy themselves that any funds transferred into Australia or received by a client are indeed what the client has reported. Otherwise, they themselves, might be caught up in the unauthorised or mischaracterised transaction and be considered duplicity in the client’s dealings; potentially placing themselves at risk of being fined or prosecuted as well.

“It’s timely as Australia continues to attract strong levels of investment, particularly in respect to real estate, both residential and within property development.”

“The ATO has now drawn a line in the sand and committed to scrutinising these transfers closely, so people should ensure they have received the proper tax advice before making a transfer.”

The ATO’s data resources meant another amnesty for offenders - along the lines of Project DO IT in 2014 - was unlikely, Mr Chye said. Project DO IT was a oneoff for individuals to disclose omitted offshore income, capital gains and over-claimed deductions with reduced penalties.

“The ATO has significantly more information-gathering powers than it did during the time of the amnesty, increasing its level of resourcing and entering into tax information exchange treaties with other jurisdictions,” he said. “People seeking to transfer funds into Australia therefore need to ensure their tax structuring is appropriate well before they physically transfer the

funds, or risk interrogation from the ATO and other authorities.”

He said individuals claiming transferred funds - in amounts from $2 million and $50 million - were a loan from an unrelated party should be aware that this would raise an alert at the tax office. “If taxpayers are saying it’s a loan, then the ATO will speak with the person providing the money as a loan,” he said.

“There are provisions in Australian law which can be applied unexpectedly that can treat a loan from overseas as income; if shareholders take money from the company as a loan but it’s not documented properly, for example, it can be treated as income.”

“The ATO’s powers are far reaching and intended to also put advisers on notice and encourage them to dig deeper with clients and their financial affairs, otherwise advisers could be unwillingly supporting mischaracterised amounts coming in, which carries the risk of prosecution.”

Mr Chye said Australia’s unique tax laws meant early investment in tax advice would pay off.

“It reinforces the need for an appropriate level of tax planning before any transactions are undertaken - it’s also an educational opportunity for many new entrants as it can set them up with building and structuring tax advice overtime,” he said.

If a taxpayer was concerned by their level of compliance Mr Chye recommended getting a review conducted to determine their current obligations and create a plan for the future.

“A voluntary disclosure can mitigate against substantial penalties, time, cost and angst of a protracted ATO review or audit,” he said.

The Australia Day 2023 Honours List recognises and celebrates 1,047 recipients, including 736 in the General Division of the Order of Australia and awards for meritorious, distinguished and conspicuous service.

'What does being recognised mean to me?' - hear from some recipients

The 736 recipients of awards in the General Division of the Order of Australia include:

• Honours list

• Information about recipients:

º 6 appointments as Companions of the Order

º 47 appointments as Officers of the Order

º 177 appointments as Members of the Order (surname A-L , M-Z, Honorary)

º 506 people were awarded the Medal of the Order of Australia (surname (A-E, F-L , M-R, S-Z, Honorary).

The 217 recipients of Meritorious Awards include recipients of the Public Service Medal, the Australian

Police Medal, Australian Fire Service Medal, Emergency Services Medal, the Australian Corrections Medal and the Australian Intelligence Medal.

• Honours list

• Information about recipients

Military Awards

The 30 recipients of awards in the Military Division of the Order of Australia include:

• Honours list

• Information about recipients

The 64 recipients of Distinguished and Conspicuous awards include:

• Honours list

• Information about recipients

Covid-19 Honour roll

An additional 77 Australians recognised for their contribution in support of Australia’s response to the COVID-19 pandemic have been added to the COVID-19 Honour Roll

Message from the Governor-General “Congratulations to the outstanding

Australians recognised in today’s Honours List. The recipients have had a significant impact at the local, national and international level and are, quite simply, inspiring,” the Governor-General said.

“They go above and beyond, are from all over the country, and contribute every day in every way imaginable.

These are the people who see us through good times and bad. They’re the first to show up and the last to leave.

“They’re almost always humble to a fault but I urge recipients, for today, to put aside that humility - it’s important they know how much they are valued.”

There are 736 awards in the General Division of the Order of Australia, with 48 per cent for women and 45 per cent for service to local communities.

“It is encouraging to see an increase in diversity in the Order of Australia. Each recipient has something in common –someone nominated them.

The Order belongs to each of us and we each have a part to play. The only way a person can be recognised is for someone to nominate them.”

Whilst it’s commonly known that excessive drinking causes liver damage, there are many other toxins that are processed through the liver. The human body is exposed to toxins daily from the air we breathe, the water we drink, plastics, chemical cleaning products, cosmetics, medications, recreational drugs, cigarette smoke, and the list goes on. At some point, the liver becomes overloaded, and the detoxification process is impaired.

• Liver damage

• Gallbladder disease

• Fatty liver and high cholesterol

• Migraines

• High blood sugar

• Allergies

• Poor digestion

• Nausea

• Sugar cravings

• Menstrual irregularities

• Eczema/dermatitis

• Stress

• Fatigue

The detoxification process

The liver detoxifies though three phases and is the most important organ in metabolism. The first phase is a process of chemical breakdown of the toxins; the second phase prevents oxidative damage to the body from the products produced in the phase one; and the third phase removes the final products of detoxification from the liver though the gall bladder to the bowels.

Antioxidants are an important part of the second phase of detoxification and can reduce inflammation which leads to liver dysfunction. All fruit and vegetables contain antioxidants, but the most effective vegetables are garlic, onion, cabbage, brussel sprouts, and broccoli; while berries, apples, citrus fruit, and grapes are the most beneficial fruit choices.

Fibre is important in regulating blood sugar, as fuel for a healthy gut microbiome, preventing constipation, absorbing bile and reducing the formation of gallstones. It is found in wholegrains, fruit and vegetables.

Fats are important to stimulate bile, reduce gallstones, and reduce inflammation. Essential fatty acids are found in fish, nuts, seeds, olive oil, and grass-fed meat. Avoid trans fats (found in many packaged snacks and fast foods) and deep fried foods.

Find something within your capabilities that you enjoy and move your body most days.

Sugar is closely associated with metabolic syndrome and liver disease. Reduce refined sugar and eat fruit or natural sugars as an alternative. Look out for chemical food additives in all processed foods: colours, flavours, and preservatives, and choose natural food products. If possible, eat organic foods which are free from herbicides and pesticides. Use natural cleaning products in your home, as well as personal cleaning products and cosmetics. Drinking filtered or spring water is preferred and spend time in nature breathing in the fresh air.

Herbal medicines are very effective in detoxifying the liver and these herbs can be combined with antioxidant and other herbs.

For the month of February we are offering:

• acute liver detoxification appointment

• 1 bottle of liver tonic (individually made for you and your symptoms)

Only $80 (normally $110)

Available in person in Ferntree Gully, or video telehealth appointment.

www.wholenaturopathy.com.au/liver-detox/

This advice is general in nature and not intended to be prescriptive. For individualised prescriptive advice, please see a naturopath or other health care practitioner.

Kathryn MessengerBHSc (Naturopathy)

kathryn@wholenaturopathy.com.au

Suite 1, 24/1880 Ferntree Gully Rd

Mountain Gate Shopping Centre

Ferntree Gully, Victoria

After a small hiatus, netball is back at Norwood Football Netball Club (NFNC) for 2023. With some new faces leading the charge, all hopeful to inspire women to get back into sport!

Netball was established at NFNC in 2014 and over the 7 year period the club successfully grew from 1 team (of 9 players) to having 4 teams taking the court every Friday night. In that time, NFNC was successful in their pursuit of a premierships in 2016 and 2017.

Preseason has kicked off down at Pinks Reserve and the ladies are gearing up for a massive year ahead. We have 3 Opens Aged teams taking the court in our return season to the Eastern Football Netball League. There are a number of past players returning and many new faces jumping on board proving Norwood Netball has been missed! To prepare for our season ahead our players will face off against Warburton Millgrove FNC on the 16th of Feb and the 16th of March. The practice matches will be located at Pinks Reserve between 6pm-9pm. This is a great opportunity for our ladies to have a chance to run around as a team before round 1 and to get a feel for competitive game play again!

You can come along to support our ladies who will be playing on Friday nights starting on March 31st across 5 venues.

To keep up to date on game times, location and results you can follow us on Facebook at Norwood Woodettes Netball Club or on Instagram at @ Norwood_Woodettes_NC

Our committee has been working hard behind the scenes to get Norwood Netball back up and running in 2023, whilst also planning for the years ahead.

We envision extending our age bracket to Juniors in the future and have set our sights on club expansion in the coming years. We aim to build a pathway for all ages for Norwood Netball.

and fundraising opportunities. To jump on board and be our first official Netball Club Sponsor please find our details below and enquire for further details.

We cannot take the court each week or expand our club without the support of our community and volunteers.

We would like to take this opportunity to thank those who have supported the restart of Netball at Norwood, including players going above and beyond to volunteer their time to get our club back up and running.

(Oxley

Fairhills

Having to rebuild from the ground has meant we need to raise much-needed funds for our club. To reintroduce women in sport to the Norwood Sporting Club we continue to look for sponsorship

To discuss the contents of this article further please reach out and send us an email at NorwoodWoodettesNC@ hotmail.com

We look forward to a strong and successful 2023 season.

By Erryn Langley

By Erryn Langley

Advisers are rallying around the prospect of upfront financial planning advice fees becoming tax deductible after the ATO announced a review of Tax Determination 95/60 recently.

The financial planning profession has faced some significant challengers over the past 10 years and more so in recent years. So much so, the number of licenced financial planners has fallen from 31,000 down to just under 16,000. No other profession has experienced such a loss of members, and with nearly 50% of financial planning members exiting in such a short period of time, government and other organisations are reviewing what went wrong and what they can now do to rebuild the profession.

Whilst the numbers have dropped significantly, most people, even the financial planners who have remained, believe the regulatory changes were necessary to move the financial planning industry away from a sales-driven culture into a profession focused on client needs and objectives first and foremost and making sure the client’s best interest are always placed at the forefront of any advice being provided.

Even so, with so many advisors leaving the profession, it has now resulted in more Australians finding it difficult to afford financial planning advice. With the increased regulatory burden placed on financial planners, their workload has tripled over the last 5 years, and with fewer financial planners able to provide advice, it is no wonder financial planning fees have increased. It is believed the average fee being charged across Australia is approximately $3,580 per client per annum. This means some advisors are charging less and some are charging more than the $3,580 per annum but one thing is for sure, this increase in fees and likely future

increases, is likely to place financial planning advice outside of the reach of most everyday Australians.

As such, the federal government, has once again, placed the idea of taxdeductible financial planning fees back on the table. This is exciting news for financial planners and clients alike and may be what is needed to enable more Australians to seek advice and help the profession encourage a new wave of financial planners to join the profession. Under an existing tax rule, a fee paid by investors for the creation of a financial plan isn’t tax deductible. However, the Australian Taxation Office (ATO) recently said it was reviewing this rule contained in Tax Determination 95/60.

Financial Planning Association of Australia (FPA) CEO, Sarah Abood, has welcomed the review after lobbying hard for the ATO to reconsider the ruling. One of the quickest and easiest ways to make quality financial advice more affordable for consumers would be to make it “taxdeductible in full”, she said.

“The ATO’s commitment to issue a new Tax Determination – indicating its willingness to modernise its long-standing view on this important issue – will provide more certainty to our members and the broader community of Australians who benefit from comprehensive financial advice,” she said.

(The amount is lower for older parents as they have less time until retirement, lower expected debt, higher super savings, and spend less time looking after children.)

Warren Strybosch, Founder of the Find Group of companies including Find Wealth and Find Retirement, recently stated that affordability is a genuine concern. “We need to find a way to make advice more affordable. The problem is that our costs are being driven up by forces outside of our control. We are doing what we can to reduce costs but

there is only so much that can be done. The government needs to step in and make this change. Only then will we start to address the issue of advice and affordability, Strybosch says.

We are excited about the opportunities that this change could provide our profession and will keep you posted in future articles if in fact this proposal becomes legislation. Professional Financial Planners want to see that Financial Planning is affordable for all Australians, as the evidence suggest that seeking financial planning advice can pay off. The Financial Services Council estimates that professional advice can leave people better off in retirement by as much as $91,000 or more.

Whatever your goals and ambitions, it’s really important to get moving now and start planning for your best financial future.

Erryn Langley1300 557 144 | erryn@findwealth.com.au www.findwealth.com.au

Financial Planning is offered via Find Wealth Pty Ltd ACN 140 585 075 t/a Find Wealth. Find Wealth is a Corporate Authorised Representative (No 468091) of Alliance Wealth Pty Ltd ABN 93 161 647 007 (AFSL No. 449221).Part of the Centrepoint Alliance group https://www.centrepointalliance.com.au/

Erryn Langley is Authorised representative (No.1269525) of Alliance Wealth Pty Ltd.

This information has been provided as general advice. We have not considered your financial circumstances, needs or objectives. You should consider the appropriateness of the advice. You should obtain and consider the relevant Product Disclosure Statement (PDS) and seek the assistance of an authorised financial adviser before making any decision regarding any products or strategies mentioned in this communication.

Whilst all care has been taken in the preparation of this material, it is based on our understanding of current regulatory requirements and laws at the publication date. As these laws are subject to change you should talk to an authorised adviser for the most up-todate information. No warranty is given in respect of the information provided and accordingly neither Alliance Wealth nor its related entities, employees or representatives accepts responsibility for any loss suffered by any person arising from reliance on this information.

What is it?

Mastitis is a common inflammatory condition affecting the breast tissue. It is estimated that one in four breastfeeding women experience mastitis at some point in time, most commonly in their first 26 weeks postpartum.

It usually presents with a red, tender, hot and/or swollen area of the breast and flu like symptoms such as fever, aches and chills. It can vary in severity from mild through to a more severe condition. It is possible to develop mastitis more than once in the same lactation as well as in subsequent lactations.

What causes it?

The most common form of mastitis is acute lactational mastitis (ALM). Sometimes there is an infectious agent - most frequently staphylococcus aureus. However often there is no clear infectious pathogen involved. In these cases, the most common cause is inflammation due to milk stasis. When there is inadequate milk removal from the breast, milk builds up within a lobe of the breast causing inflammation and the characteristic intense local pain of mastitis.

Acute lactational mastitis has a sudden onset of symptoms and usually runs a short course. The known risk factors for mastitis are the wearing of a tight bra, previous mastitis, no breastfeeding support, long times between feeds, hyperlactation, use of nipple shields and quick weaning. These situations lead to milk stasis and/or inadequate milk removal. In addition, nipple wounds are a risk factor for staph aureus infections.

How do I manage it?

The first step in the management of ALM is to keep the breasts as empty as possible. This means breastfeeding more often and making sure that baby is properly positioned and latched for effective milk removal. If baby is unwilling or unable to feed, milk removal must be done through hand expression or use of a breast pump.

Mastitis can be an extremely painful condition. Mothers need to be cared for and supported to continue breastfeeding while recovering from mastitis so as to not prematurely wean. They need lots of rest, which is vital for a quick recovery. They also need to remain well hydrated and to eat well. The use of cold compresseson the affected breast can be soothing as well as short periods of warmth on the breast just before feeding in order to help the milk flow. Practically, mums need help with their baby and any other siblings as well as help around the home, in order to allow her to have adequate rest.

If symptoms do not resolve within 12 to 24 hours or if the mother is feeling very unwell she should continue with the above measures and seek medical treatment. In these cases, antibiotics will be required. After commencing antibiotic treatment usually the symptoms of fever and chills disappear within 12 hours, although the pain, redness and breast lump will take longer to resolve.

If symptoms do not improve within 48 hours see your doctor again for further help. ALM can lead to a breast abscess if not managed correctly or treated adequately.

During mastitis, a mother’s milk will taste more salty but it is perfectly safe for her baby to drink. Putting her baby to the breast frequently is usually the most effective way to remove milk from the breast and resolve mastitis and should always be encouraged.

Recent studies have shown that the risk of developing lactational mastitis is significantly reduced by the daily consumption of fermented foods and drinks, including kefir and boza, homemade and conventional yoghurts and pickles. Consuming a diversity of these foods was also found to be protective. In contrast, the consumption of probiotic supplements for the management of mastitis is unproven.

See your lactation consultant or GP for further advice.

Dr. Joanna StryboschOsteopath B.App.Sc(Clin.Sc)/B.Osteo.Sc/Grad Dip Paeds LACTATION CONSULTANT

www.childrensosteopathiccentre.com

A nanomaterial exposed to highfrequency sound waves could be the key to extending the life span of mobile phone batteries to almost a decade.

Researchers at Melbourne’s RMIT university believe MXene can be an alternative to extensively used lithium for batteries in the future. MXene is a class of two-dimensional inorganic compounds first discovered in 2011 and is a highly adaptable material that can have a wide range of technological applications.

In the global shift from fossil fuels to other energy technologies, RMIT researchers believe MXene could prove to be an environmentally sound replacement for lithium, a key component of batteries.

However, the material tends to rust easily after use, hindering it’s electrical conductivity.

In their studies to address the limitations of the material, researchers found an efficient way to reuse rusted MXene.

Using sound waves at a certain highfrequency can remove rust from the nanomaterial, getting it to it’s original state. Associate Professor Amgad Rezk said the materials replacing lithium will

suffer degradation with time. “With acoustics, the ability to remove the rust will allow us to extend the life of the battery or recycle it in some sense,” he said. Co-lead author Hossein Alijani said exposing the oxidised Mxene film to the high-frequency vibrations for just a minute was enough to remove the rust.

“This simple procedure allows its electrical and electrochemical performance to be recovered,” he said.

The researchers hope the discovery could increase usage of MXene for batteries and in turn, extend a battery’s

use from about three years to up to nine years. A national battery recycling scheme was launched in early 2022 as households were only recycling 10 per cent of the batteries they used.

Planet Arc’s recycling campaigns manager, Rachael Ridley, said different battery types contained both toxic and valuable materials and recycling them could keep the toxic materials out of landfill to prevent soil and groundwater contamination.

“It also ensures the valuable materials in batteries are recycled into something new,” she said.

This is the fifth of five publications where we have been running a series of sensory experiences in nature.

Each experience will take about 10 mins and you are encouraged to read through the instructions before you commence your time in nature to maximise your experience.

Find a spot outside where you can sit or lie down comfortably. This could be in your backyard, your local reserve or in a national park. You may like the familiarity of the same place you have practised before or you may like to try somewhere new.

Take a few moments to regulate your breathing and settle into your position. For this breathing exercise, we will follow a pattern of 4 counts in, holding for 7 and then exhaling for 8.

Follow this pattern, allow it to take all of your focus and to help you unwind. Repeat for a few minutes.

Allow your breathing to find its natural rhythm once more.

For the next 5 mins we are going to practise tuning into all of our senses while we do a slow walk. You may only

move a few metres within the 5 mins, the point of the exercise being to tune in to your senses of sight, smell, hearing and feeling as you go. Draw your attention to the details, get in close to nature, take time to experience the full experience of each moment.

You are trying to slow down your senses, slow down your experience. Try not to allow distractions to come into your mind, be fully present to the experience. If you do get distracted, don’t stop, just tune back in and continue.

When you choose to complete your experience, you may wish to take a moment of gratitude for nature and for the experience you have just had.

isthefounderofAdmirariNatureTherapywhoprovidenatureexperiencesfor schools, business and individuals. For more information visit admirari.com.au

Have you heard of DoNotPay ? It is the first Artificial Intelligent (AI) robot that has been developed to help people in the US to get out of paying parking fees or infringements that were incorrectly issued.

The company was founded in 2015 and will defend its first court case this month. The program will analyze data from past cases to prepare a defense on behalf of person who was issued the parking fine. The AI will even respond to questions in court. DoNotPay has agreed to take on the burden of punishment and pay for the speeding ticket if they fail and the fine has to be paid.

DoNotPay will charge a person $36 to argue the case in court. If they win and continue to do so this will be new breaking technology that is sure to change the landscape of the court system and likely put pressure on lawyers who operate in this space.

DoNotPay believe this will revolutionize the legal system and this is only the beginning. If their AI programs can operate with few errors and more importantly win cases, they will be able to expand their AI into different areas. The benefits of this technology will be vast and it might mean we are seeing an end of litigation as we know it.

Turning into our senses is an important way to disconnect from the fast pace of modern life.

Australian Conservation Society has recently published some great news. Never heard of it? Here is why.

The night parrot has been thought to be extinct for the last 100 years, astonishingly, it was re-discovered in 2013 in Queensland, and the news gets better.

Recently in Western Australia an area of land in the far eastern side of the Great Sandy Desert near the Pilbara that is now known as Ngururrpa, meaning Country in the Middle, turned up a surprise or two. There are four language groups who call this vast area home. The Ngarti, Kukatja, Walmarjarri and Wangkatjungka people.

In 2020 75 % of this land was declared to be under Native Title, a vast area of 29, 717 Square Kilometres now under Indigenous Protected Area or IPA.

Across Australia there are at least 21 indigenous ranger organisations managing land and sea, and protecting threatened species.

This specially protected land is home to bilby, great desert skinks, brush-tailed mulgara and an elusive marsupial mole.

The sand plains are vegetated with sparse native wattle, some shrubland and spinifex grass.

Recently the Ngururrpa rangers began monitoring and surveying with night cameras and have discovered the largest population of night parrots ever known. This is really amazing and great news.

The night parrot measures 22 to 25 cm in length, and is mostly green feathered with extensive black and yellow markings and a yellow belly. They are nocturnal, and feed on the ground eating the seeds of the spinifex grass after rain.

Our Federal Government is right behind this with a “threatened Species Action Plan”, so that into the future we will not have more creatures become extinct and lose our precious biodiversity.

You can learn more at countryneedspeople.org.au. A big thank you to ACF for it’s publication called Habitat Volume 50 Number 2 November 2022.

Liz Sanzaro

Liz Sanzaro

By Warren Strybosch

By Warren Strybosch

Choice-related group, Super Consumers Australia (SCA) has pointed to the limitations of intra-fund advice noting that “any advice from the same company providing the product isn’t independent”.

Intra-fund advice is where a superannuation fund offers in-house advice to their members. The SCA did a so-called ‘road-test’ of the advice provided by superannuation funds to their members and the results were mixed with most funds falling short of providing the type of advice that the clients were looking for.

As a result of the exercise, SCA policy manager, Franco Morelli said people interested in getting advice from their fund needed to be aware of its strengths and weaknesses. However, he pointed out that a “weakness” of intra-fund advice

was that it could not make comparisons with other funds and their products.

“People looking for this information should be aware that they need to look elsewhere, like the government’s free fund comparison tool,” Morelli said.

“This advice also isn’t designed to offer you comprehensive advice which is tailored to you and takes into account a complete view of your finances, circumstances and retirement goals.

“Finally, be aware of the conflicts built into this type of advice. Any advice from the same company providing the product isn’t independent. A fund will have the incentive to get you to stay, or contribute more to their product.”

What has been encouraging is that some superannuation funds, like AustralianSuper for instance, recognise

and understand their limitations when it comes to providing advice to their members. They understand that they cannot provide comprehensive advice to their members and where the client’s situation is more complex e.g. when the client may require advice around shares, SMSF, and/or investment properties, AustralianSuper will refer their own clients to other financial planners, outside of AustralianSuper, to those financial planners whom they know and trust will provide sound advice in the best interest of their clients.

The SCA results were not surprising, but a lot of intra-funds already knew this to be the case. That is why the good intrafunds have already aligned themselves with financial planners that are not direct employees of their own superannuation funds, to provide the financial planning advice they know will be better suited to their client’s needs.

Art for wellbeing

Connect with others through creativity! Thinking differently helps increase confidence and improves mental and physical health. Come and try some creative activities (FREE). Bookings essential

Sahaja yoga meditation

Relax your mind and body and find balance in these free weekly meditation sessions. Dr Akshay and his team will introduce you to the meditative practice of sahaja yoga (FREE). Bookings essential

Fun and brains

Come along for some fun games and puzzles to socialise and exercise your mind. Join Henk from Mountain District Learning Centre for this fun weekly session (FREE). No need to book, just come along!

Australia’s 2600 caravan parks could be transformed into a national electric vehicle charging network covering regional and rural areas under a new proposal.

The Caravan Industry Association of Australia has issued a call for commercial and government assistance to install fast-chargers for electric cars on its sites as a way to address rising demand for the technology.

It comes after some electric vehicle drivers reported long waits to access chargers during the holiday season, with Evie Networks seeing recordbreaking use of its charging stations between Christmas and New Year’s Day.

Many of the largest queues were seen in regional locations and on major routes between capital cities, and the association’s general manager Luke Chippindale said part of the problem was that regional Australia had been ignored.

“A lot of the work has been done around metro areas but regional and rural areas have been overlooked,” he said. “Now is the time to act.” Mr Chippindale said installing fast-charging electric vehicle stations in caravan parks along major travel routes throughout Australia

could deliver a simple solution for the emerging industry. Some parks had already taken the initiative, he said, signing deals to install Tesla Superchargers on their properties. “Parks were some of the first-movers in this space to help keep people moving as well as being an end-point destination,” he said.

“We know that has been a big contribution to the market. People stop at these parks and at least have a coffee or build it into their travel plans.”

The association would prepare a market readiness report on the issue, chief executive Stuart Lamont said, including plans to install community batteries to share energy with consumers and power grids.

“Early conversations have been promising in terms of the technology options for a network and we know possibilities to be a major contributor are endless,” Mr Lamont said. “Unfortunately, these options require significant financial contribution and a will to be solution-focused.” Investments in electric vehicle charging were discussed in the federal government’s

National Electric Vehicle Strategy consultation paper, which attracted more than 500 submissions in October last year. Climate Council advocacy head Jennifer Rayner said policies from the consultation needed to address charging infrastructure as “it should be available and accessible as people need it”.

“It’s a real obstacle to people feeling comfortable to making the shift to an electric vehicle,” Dr Rayner said.

“In Europe, there has been a focus on making sure charging is readily available along major transport routes. During the holiday seasons, when people are moving around in different places, that away-fromhome infrastructure becomes really important.” Australia had more than 3600 public electric vehicle chargers in more than 2100 locations by June 2022, according to the Electric Vehicle Council.

The figure represents a 15 per cent increase since early 2021. Electric car sales have risen rapidly during that time, however, from 17,243 new car sales in 2021 to 33,410 last year.

Individuals will now have the ability to claim a higher deduction for self-education expenses. From the 2022–23 income year, legislation that limited the self-education deduction to costs above $250 each income year has been repealed. In order to claim a self-education deduction, an individual must demonstrate a necessary connection of the expense with their assessable income.

The announcement, which recently became law after receiving royal assent, originally came from the 2021 Federal Budget and is somewhat related to a Treasury discussion paper released in December 2020. However, other matters addressed in the paper, such as deductions for expenses unrelated to current employment, have not been taken further at this stage.

Announcement(11-May-2021)

Consultation

Introduced(3-Aug-2022)

Passed(28-Nov-2022)

Royal Assent(12-Dec-2022)

Date of effect(1-Jul-2022)

Starting from 1 July 2023, operators of sharing economy platforms will be required to report transactional information to the ATO. The Taxable Payments Reporting System already applies to some businesses in industries where non-compliance is deemed to be high risk. By adding operators of sharing economy platforms to the regime, taxpayers who hold or use assets for short-term lease or contract work will also have their information collected.

The identification of users of sharing economy platforms means that, as an adviser, you should be informing taxpayers who earn income off these platforms about their tax obligations. This includes operators of shortterm accommodation, ride-sharing transport and food delivery platforms. Also, other task or time-based service platforms will be required to report for income years beginning on 1 July 2024.

Announcement(25-Aug-2021)

Consultation

Introduced(3-Aug-2022)

Passed(28-Nov-2022)

Royal Assent(12-Dec-2022)

Date of effect(1-Jul-2023)

Australian Business Number (ABN) holders will now be required to be

accountable and comply with annual income tax lodgment obligations.

First announced in the 2018–19 Federal Budget as an integrity measure, this exposure draft legislation seeks to strengthen disruptions to black economy and tax avoidance behaviour.

Currently, ABN holders are able to retain their ABNs regardless of whether or not they meet income tax obligations. This measure will provide more accountability on enterprises by giving the regulator the ability to cancel ABNs. This means advisers need to ensure clients keep their lodgments up to date, or at least keep a clear line of communication with the ATO.

The ATO has finalised TR 2022/4 and PCG 2022/2 in relation to distributions made by trustees of discretionary trusts. This was complemented by TA 2022/1, which discusses parents benefitting from the trust entitlements of the adult children. All 3 documents focus on schemes where income is diverted from an intended beneficiary in order to reduce tax liabilities.

The rulings discuss these at detail and include significant attention to an important carve out for dealings that are “ordinary family or commercial dealings”. These dealings are excluded from the anti-avoidance provisions. Along with these regulatory resources, the ATO has reiterated its stance in many areas relating to s 100A. In particular, where situations would generally come under an ordinary family or commercial dealing. Trustees need to make sure that their distributions are in accordance with the expectations of the ATO, otherwise they may be subject to an audit. Helping them understand their obligations is paramount coming up to the end of the current income year.

Announcement(12-Apr-2019)

Consultation(29-Nov-2022)

Introduced

Passed

Royal Assent

Date of effect

Announcement(23-Feb-2022)

Consultation period(29-Apr-2022)

Released(8-Dec-2022)

Crypto assets are to be specifically excluded as a foreign currency within income tax and GST legislation.

The legislation maintains the current tax treatment of crypto assets such as Bitcoin and removes uncertainty following the decision of the Government of El Salvador to adopt Bitcoin as a legal tender.

When the legislation receives royal assent, the new laws will be in effect from income years that include 1 July 2021.

The individual tax residency rules will be replaced by a new framework with a primary physical presence test.

Under the new primary test, a person who is physically present in Australia for 183 days or more in any income year will be an Australian resident for tax purposes. Individuals who do not meet the primary test will be subject to secondary tests that consider a combination of physical presence and other measurable criteria.

These new rules contrast with the current rules which look at the ordinarily resides test as the primary indicator to reviewing Australian residency.

Changes to the individual tax residency rules will be required to go through the legislative process and will commence after royal assent has been given.

Announcement(6-Sep-2022)

Consultation(6-Sep-2022)

Introduced(23-Nov-2022)

Passed

Royal Assent

Date of effect(1-Jul-2021)

Announcement(11-May-2021)

Consultation

Introduced Passed Royal Assent

Date of effect

In 2019 the Australian tax residency of an individual was ruled incorrect by the Full Federal Court on appeal, reversing an earlier determination by the Commissioner of Taxation. A subsequent appeal to the High Court of Australia by the Commissioner was also dismissed.

This was a major case for expatriates living abroad, as the individual in question had been living in “temporary” serviced apartments in the Middle East. During the time in question, the taxpayer’s family had been living in Australia in a property jointly owned by the individual.

The case was overturned on account of the term “permanent place of abode” which is part of the Australian tax residency question. The ATO has recently provided further guidance with TR 2022/D2 for expatriates wishing to remain a non-resident of Australia for tax purposes when working overseas.

Announced: 27-Feb-2019

Updated: 20-Jan-2023

The Commissioner of Taxation now has new powers to direct a small business taxpayer to undertake a record-keeping education course in lieu of an administrative penalty.

The new directive will be initially limited to small business owners in order to assist them in keeping up to date with tax obligations.

The individual must then provide the Commissioner with evidence of completion of the course in order to avoid financial penalty. The Commissioner will be able to issue a tax-records education direction to an entity from 12 March 2023.

Announcement(3-Aug-2022)

Consultation

Introduced(3-Aug-2022)

Passed(28-Nov-2022)

Royal Assent(12-Dec-2022)

Date of effect(12-Mar-2023)

Maroondah’s most inspirational community members were honoured at an Australia Day event held at Ringwood Lake Park on 26 January.

Mayor of Maroondah, Councillor Rob Steane, announced the 2023 Citizen of the Year, Young Citizen of the Year and Community Event of the Year during a special awards ceremony, where 66 people also received their Australian citizenship.

Mayor, Cr Steane, said the awards recognise inspirational individuals in Maroondah.

“The annual Maroondah Australia Day Awards are a chance to acknowledge the commitment and achievements of outstanding individuals in our community, who have made positive contributions to the lives of others,” Cr Steane said.

“These awards recognise our residents who symbolise the Australian spirit, as they give tirelessly to our community but seek no reward or recognition for their efforts. I extend my sincere congratulations to all award recipients and our nominees for their outstanding achievements.”

Citizen of the Year – Dennis Johnston

Dennis Johnston was named 2023 Citizen of the Year for his long-standing involvement with and contribution to Biala Ringwood, an organisation dedicated to providing support and care for special-needs children up to 6 years old.

“I was absolutely thrilled, delighted, surprised and very honoured on behalf of Biala to receive the award. I had no idea I would win,” Dennis said.

Starting out in a voluntary capacity more than a decade ago and then joining Biala’s Committee of Management serving in the role of Vice-Chair and later Chairman, Dennis has provided leadership on all aspects of the organisation at board and operational levels.

Dennis credits his service to Biala’s “wonderful, selfless” team and to the “joy” of seeing the children they work

with leaving “happy and ready for school”.

“That’s the big value in working for an organisation like Biala - to see the children get a chance in life. And a lot of them do take up that opportunity and do very well for themselves later in life.”

Throughout the COVID-19 pandemic and lockdowns, Dennis showed impeccable leadership, resilience, care and initiative. Working with the committee, he led the development of ‘Biala in the Home’ as part the organisation’s respite program, ensuring that families continued to receive the support needed during lockdown

This included arranging toys and other resources to be delivered to homes and maintaining regular phone contact with families, along with “responding to the community’s needs and feedback” by providing additional services such as counselling and pastoral care.

Jackson Smith and Alyssa Solidaga are joint recipients of the Young Citizen of the Year award.

“It feels amazing to have received this award together, because Jackson and I have done everything together,” Alyssa said.

“It wouldn’t have been possible to do what we have done without the other person,” Jackson said.

Jackson and Alyssa have both demonstrated exceptional leadership in the community as active members of Maroondah Youth Wellbeing Advocate program - a program that advocates for the inclusion of young people’s voices through various projects and initiatives in Maroondah - as well as being Student Representative Council (SRC) captains at their school.

As Maroondah Youth Wellbeing Advocates they assisted in planning and emceeing Maroondah’s first Student Voice Forum and co-facilitated workshops. Together they also proposed, designed and delivered an interactive workshop about student voice for local Grade 5 students.

“We saw an opportunity to teach the Year 5s and it was a really rewarding experience,” Alyssa said.

“It was really special to see the impact we had made,” Jackson said.

Jackson excels in the performing arts and takes on leadership roles both on and off stage. He supports all aspects of his school’s productions and was recently nominated for a Lyrebird Award and a Music Theatre Guild of Victoria award for his outstanding performance.

Alyssa is currently philanthropy captain for her year level and has been successful in the role of philanthropy prefect for her final year of school in 2023. Through her work as philanthropy captain, Alyssa has led the running of multiple charity events raising money for FightMND and Teach Us Consent.

Working alongside each other as Student Representative Council members, they continue to support their peers to take action within their school and to encourage positive change.

They also encouraged others to get involved. “Sometimes it’s really scary, but you never regret any of these opportunities to get involved in the community,” Jackson said.

“Utilise the community resources available. Maroondah City Council has helped us so much, and we wouldn’t have achieved what we have without them,” Alyssa said.

The Chin Festival was the first Chin event to be held outdoors in Maroondah, attracting around 4000 members of the

community in a celebration of the 74th Chin National Day. Kham Liam accepted the award, which he said was “very surprising” and “very special for the Chin people”.

“This is beyond our expectations. We didn’t even expect to be on the nominations list. We are very honoured and it’s a great privilege.

“I’ve never heard of the Chin National Day being nominated for Community Event of the Year, so I think we are very lucky to be able to receive this award,” Kham said.

The Chin people all over the world celebrate this auspicious day in their own way. Cultural troupes from various tribes were brought together on this special occasion to promote understanding, sense of identity and unity. Held at Croydon Main Street on

In December 2021, Council consulted with the community and key stakeholders on how they use the existing Woodland Park in Croydon South and what they would like to see in the southern part of the Council-owned section of the former Croydon South Primary School land.

From the feedback provided, a draft enhancement plan has been developed and includes etc.

20 February 2022, Kham said the festival provided the opportunity for all cultures to witness, celebrate and have a better understanding of the Chin culture.

“When we talk about the Chin, there are many different dialects and different cultures. For the Chin National Day, we combined with other Chin people who speak different languages and have different cultures, so it was a time to celebrate our diversity and also promote all of the communities, cultures, customs, traditional values and practices,” Kham said.

“It was very important for people in the community to understand about the Chin, as well as the Chin being able to integrate into our multicultural society. This event and other Chin events will have a good impact on the community.” Congratulations to all our deserving recipients and nominees.

The Black Summer bushfires of 2019 and 2020 are still smoking in the mind. Intensified by climate change, these ‘megafires’ left behind the largest burnt expanse witnessed on earth in the modern record.

Join us for our Jubilee Ward - Celebrate Maroondah event this February.

100 years after Heathmont was named, the community is celebrating the character of this vibrant suburb and recognising the community-spirit and contributions of those who have shaped, and continue to shape, the character of the Heathmont community.

The Heathmont 1923-2023 Planning Committee is assisting a coordinated response to celebrations throughout 2023, fostering collaborative partnerships between Council and key community stakeholders.

We'll be hosting a range of activities and events related to the celebrations. We encourage you to join in the celebrations and to check back here regularly as new activities will be added throughout 2023.

There will be free rides, face painting, a sausage sizzle and entertainment to enjoy.

Coffee and ice-cream will also be able to be purchased from vendors on the day. This is a dog free and smoke free event.

For further information on the event or other Celebrate Maroondah events, contact Council on 1300 88 22 33.

Date and Time

Sunday, 26 February 2023 - 1.00pm to 4.00pm

View photos from our 2022 International Women's Day Breakfast on Wednesday

9 March with guest speaker Lauren Oliver, CEO of Mum's Who Wine.

About International Women's Day

IWD provides an important moment to showcase commitment to women's equality, launch new initiatives and action, celebrate women's achievements, raise awareness, highlight gender parity gains and more.

The day is celebrated and supported globally by industry, governments, educational institutions, community groups, professional associations, women's networks, charities and nonprofit bodies, the media and more.

Guest speaker

This year’s guest speaker is Lauren Oliver, the Founder and CEO of Mums Who Wine, a national organisation focused on encouraging and creating a space for mums to invest in their mental health and self care.

Prior to launching Mums Who Wine in 2017, Lauren practised for 10 years as an Insurance Litigation Lawyer, specialising in Psychiatric Injury Workcover claims. Lauren created Mums Who Wine following a genuine personal need to find mum friends and community whilst juggling a busy corporate career and “mum life”.

Since launching in 2017 Mums Who Wine has hosted over 200 events across

the country, raised over $40,000 for PANDA (Perinatal Anxiety and Depression Australia) and built and connected a powerful community of mums globally.

Find out more about Lauren Oliver:

Website: www.mumswhowine.com.au

Instagram: @mumswhowine_au

Facebook: Mumswhowine

Join us for Poolside Pride at Aquahub this February.

This summer, Aquahub is rolling out the rainbow carpet as we host the LGBTIQA+ community for a one-night only, pride-filled extravaganza! LGBTIQA+ people of all ages, their friends, families and allies are welcome. Come enjoy the fun and sun at Aquahub in a safe and inclusive environment, in the company of your LGBTIQA+ peers!

Find

Join us for our Wonga Ward - Celebrate Maroondah event this February. To encourage residents to get out and about in our local parks and reserves we're hosting a series of Celebrate Maroondah events at a variety of locations throughout Maroondah in 2023.

Find

After a hugely successful event in 2022, A day of jazz returns to the Ringwood Lake Soundshell.

A free community event returning to the Ringwood Lake Park on Sunday 26 February 2023 – a day of jazz with eight bands, coffee, food, face-painting.

In 2022, we celebrated live music and with some of Melbourne’s best jazz artists, all performing for you at Jazz At The Lake, a free event at the Ringwood Lake Park.

Read More

'Da Ancient One' by Alexander Knox is a public art commission that celebrates the popular Tawny Frogmouth bird.

This event celebrates the launch of Alexander Knox's recently installed sculpture in Melview Reserve. Alexander Knox is an award-winning artist who has completed many high profile commissions. Initated by the local Friends of Melview Reserve, the sculpture celebrates the Tawny Frogmouth bird, which is known to nest in the area.

Please join us to celebrate the launch of Da Ancient One, a recently completed public sculpture by Alexander Knox.

Event launch details:

• Melview Reserve, Melview Drive, North Ringwood

• Saturday 11 February

• 2pm to 3.30pm

Please RSVP to publicart@maroondah. vic.gov.au

Learn more about how to enrol your child in 3 and 4 year old kinder.

Families with children looking to enrol in kindergarten in 2024, or unsure of the process are encouraged to attend our free Kinder Expo. The expo is timed to work in with kindergarten enrolments for 2024, which open on Wednesday 1 March 2023.

The expo puts the spotlight on the preschool years, which is a time of enormous growth and development. Families can visit stallholders and speak to educators from local kindergartens to learn about the enrolment process.

Council’s Kindergarten Officers will be onsite to support families who may require translation assistance (Hakha Chin, Falam Chin, Burmese).

• the Maroondah Integrated Kindergarten Association (MIKA) - Maroondah’s central enrolment system

The launch celebrates the new addition of a sculpture based on the Tawny Frogmouth, a bird that often takes up residence at Melview Reserve.

Here, the Tawny Frogmouth acts as bush sentinel, with bright eyes that look

out towards the park. Alexander Knox is a well-respected public artist with numerous commissions throughout Australia including at AAMI Stadium and the Royal Children’s Hospital in Melbourne.

This project was initiated by the local Friends of Melview Reserve Group in partnership with Maroondah City Council, led by the Arts and Culture team in collaboration with Open Space, Bushland Revegetation and Operations teams.

The launch will consist of speeches that celebrate the project including guest speaker William Mitchell from BirdLife Australia. Complimentary ice-cream will be available from a gelati cart onsite.

Please remember to wear a hat and sunscreen in the warm weather.

For more information on this project and public art in Maroondah, please see our website: Public Art in MaroondahMaroondah City Council.

• how to enrol children in a MIKA kindergarten program

• Maternal and Child Health assessments

• immunisation

• the National Disability Insurance Scheme (NDIS)

Questions parents can have answered

• When do I enrol?

• How do I enrol?

• What options are there for kinder?

• What is the difference between them?

• What options do I have for funded kinder?

• How do I support my child through the transition to kinder?

• What does a kinder program look like?

This is a free event and no booking is required.

For further information on Expo, contact Council on 1300 88 22 33.

Join us for our International Women's Day breakfast on Wednesday 8 March 2023. About International Women's Day IWD provides an important moment to showcase commitment to women's equality, launch new initiatives and action, celebrate women's achievements, raise awareness, highlight gender parity gains and more.

Find out more

Come along and learn about Floral Friday in the Torres Strait Islands. Join Cecelia Wright (See Kee) and Jackie Bennett from Connecting the Dots through Culture to learn about Floral Friday and how you can embed Torres Strait Island perspectives into your practice in an authentic and fun way. The session will include practical elements and many examples of how you can embrace Torres Strait Islander activities and culture.

Find out more

Come along to our jewellery making workshop.

In this workshop you will create a couple of stylish earrings with wooden pieces that you can paint, collage and decorate with Posca pens. You’ll also create your own pendant using pressed flowers, a piece of artwork or collage which is then covered with a glass cabochon. Suitable for all levels.

Ten years ago, Dawne reached out to volunteer at Habitat for Humanity Victoria’s ReStore social enterprise, a decision she has never looked back on. A decade later, her volunteer family at ReStore is celebrating her inspiring journey of dedicated service, an exemplary model for all to consider ‘giving back’wherever they can.