The Find Maroondah is a community paper that aims to support all things Maroondah. We want to provide a place where all Not-For-Profits (NFP), schools, sporting groups and other like organisations can share their news in one place. For instance, submitting up-andcoming events in the Find Maroondah for Free.

We do not proclaim to be another newspaper and we will not be aiming to compete with other news outlets. You can obtain your news from other sources. We feel you get enough of this already. We will keep our news topics to a minimum and only provide what we feel is most relevant topics to you each month.

We invite local council and the current council members to participate by submitting information each month so as to keep us informed of any changes that may be of relevance to us, their local constituents.

We will also try and showcase different organisations throughout the year so you, the reader, can learn more about what is on offer in your local area.

To help support the paper, we invite local business owners to sponsor the paper and in return we will provide exclusive advertising and opportunities to submit articles about their businesses. As a community we encourage you to support these businesses/columnists. Without their support, we would not be able to provide this community paper to you.

Lastly, we want to ask you, the local community, to support the fundraising initiatives that we will be developing

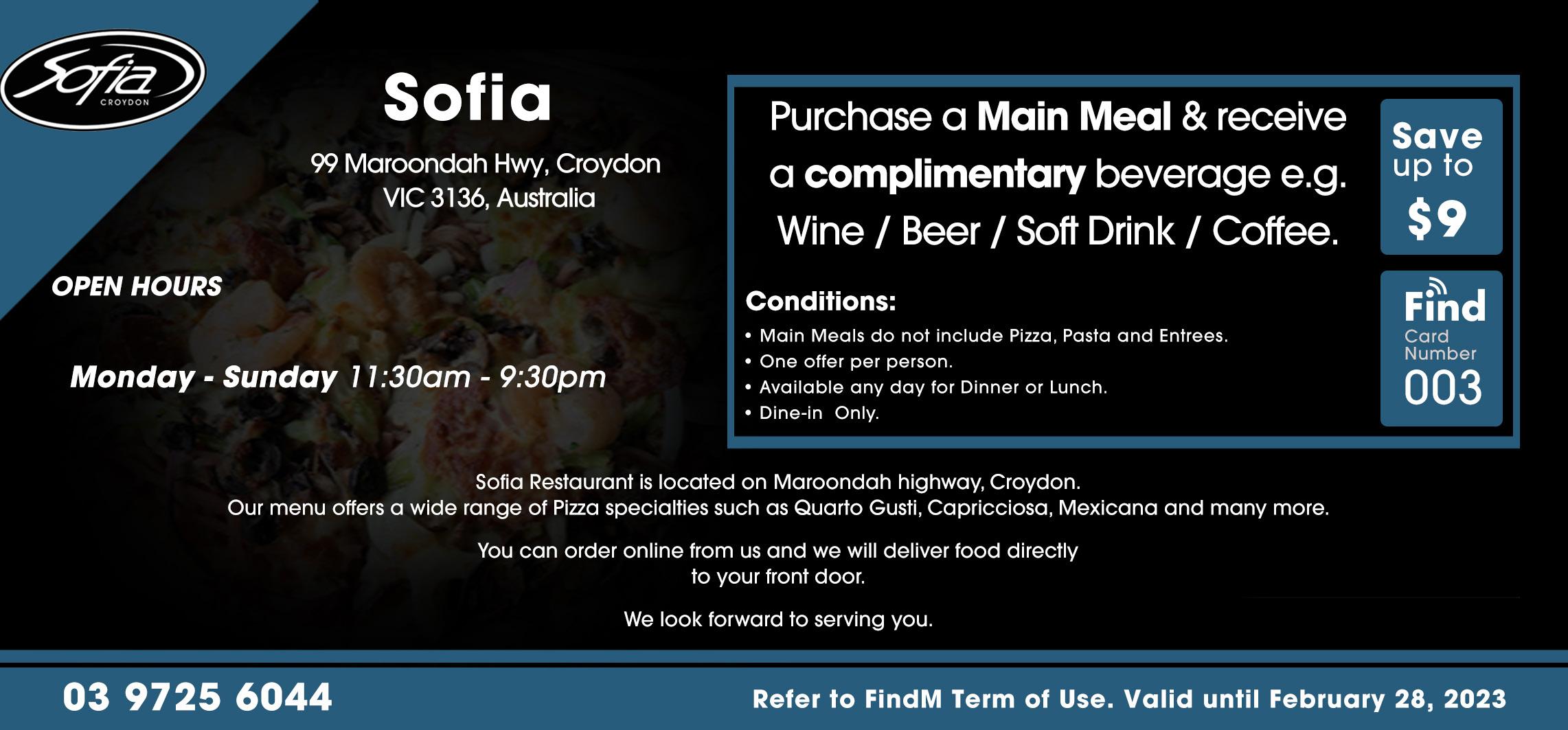

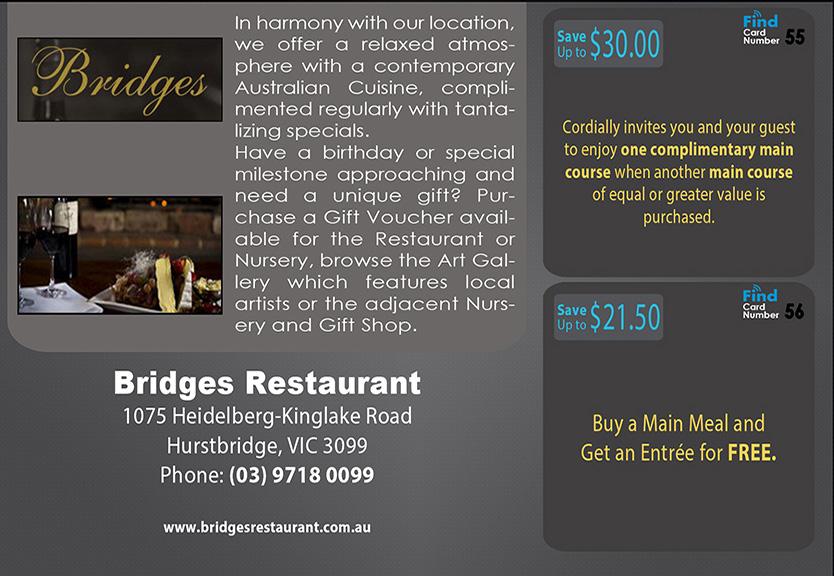

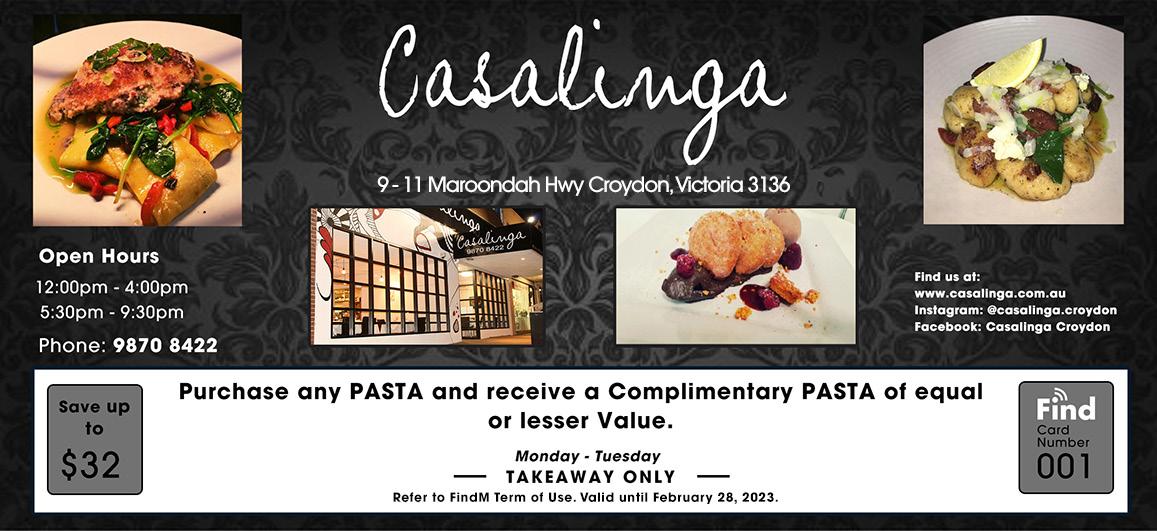

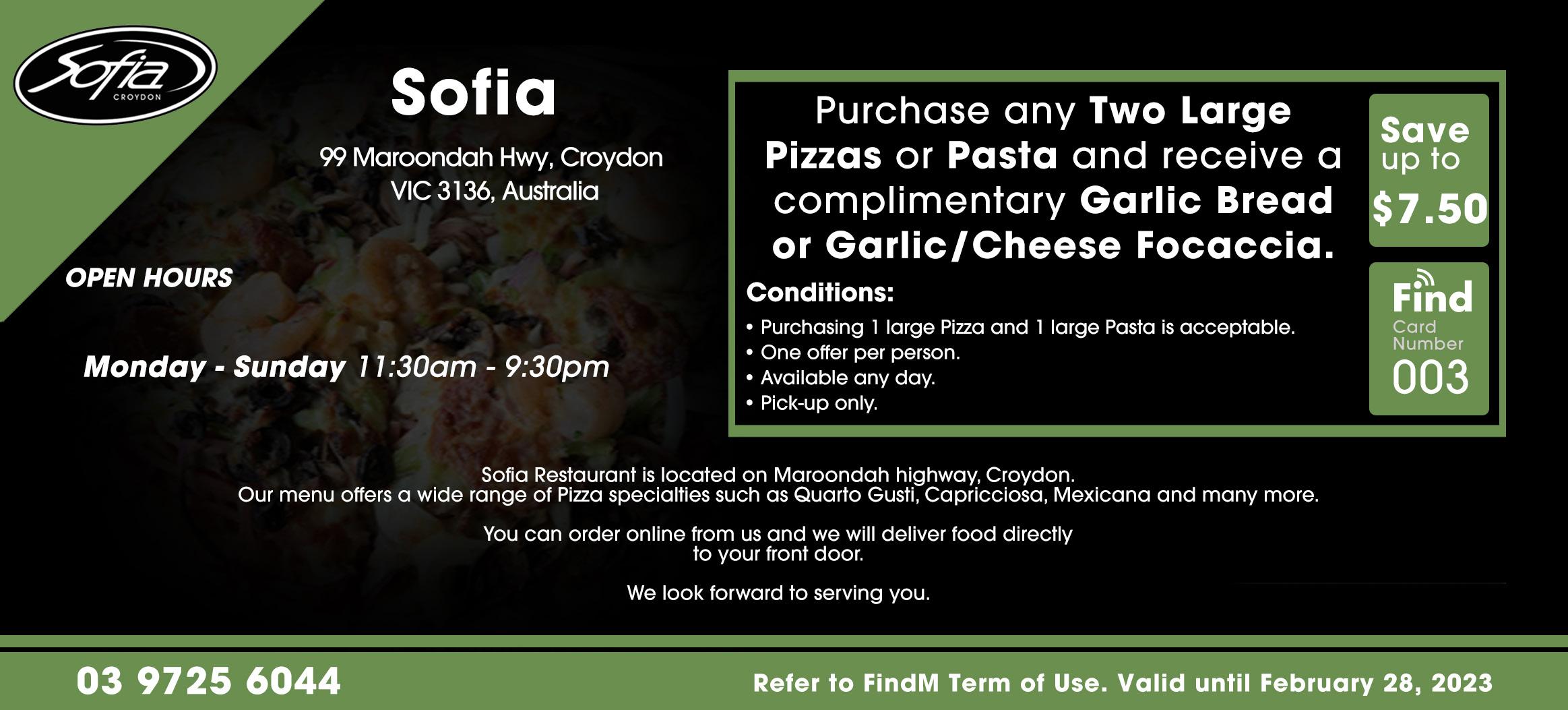

and rolling out over the coming years. Our aim is to help as many NFP and other like organisations to raise much needed funds to help them to keep operating. Our fundraising initiatives will never simply ask for money from you. We will also aim to provide something of worth to you before you part with your hard-earned money. The first initiative is the Find Cards and Find Coupons – similar to the Entertainment Book but cheaper and more localised. Any NFP and similar organisations e.g., schools, sporting clubs, can participate. Follow us on facebook (https://www. facebook.com/findmaroondah) so you keep up to date with what we are doing.

We value your support, The Find Maroondah Team.

EDITORIAL ENQUIRES: Warren Strybosch | 1300 88 38 30 editor@findmaroondah.com.au

PUBLISHER: Issuu Pty Ltd

POSTAL ADDRESS: 248 Wonga Road, Warranwood VIC 3134

ADVERTISING AND ACCOUNTS: editor@findmaroondah.com.au

GENERAL ENQUIRIES: 1300 88 38 30

EMAIL SPORT: editor@findmaroondah.com.au

WEBSITE: www.findmaroondah.com.au

The Find Maroondah was established in 2019 and is owned by the Find Foundation, a Not-For-Profit organisation with a core focus of helping other Not-For-Profits, schools, clubs and other similar organisations in the local community - to bring everyone together in one place and to support each other. We provide the above organisations FREE advertising in the community paper to promote themselves as well as to make the community more aware of the services these organisations can offer. The Find Maroondah has a strong editorial focus and is supported via local grants and financed predominantly by local business owners.

The City of Maroondah is a local government area in Victoria, Australia in the eastern suburbs of Melbourne. Maroondah had a population of approximately 118,000 as at the 2019 Report which includes 9000 business and close to 46,000 households. The City of Maroondah was created through the amalgation the former Cities of Ringwood and Croydon in December 1994.

The Find Maroondah acknowledge the Traditional Owners of the lands where Maroondah now stands, the Wurundjeri people of the Kulin nation, and pays repect to their Elders - past, present and emerging - and acknowledges the important role Aboriginal and Torres Strait Islander people continue to play within our community.

Readers are advised that the Find Maroondah accepts no responsibility for financial, health or other claims published in advertising or in articles written in this newspaper. All comments are of a general nature and do not take into account your personal financial situation, health and/or wellbeing. We recommend you seek professional advice before acting on anything written herein.

Available Sizes:

Rates:

• Double Page Spread (408 x 276mm) $1650 Full Page (198 x 276mm) $1100

• Half Page Landscape (198 x 138mm) $715

• Half Page Portrait (95 x 276mm) $715

• Third Page (189 x 90mm) $550

• Quarter Page (97 x 137mm) $440

• Business Card Size (93 x 65mm) $275

• Ads Smaller than (85 x 55mm) and Below $121

• Design Services

We can create your ad for you. Prices start at $77 for the very first hour and $22 for each hour thereafter.

Next Issue of the Find Maroondah will be published on Monday August 08, 2023. Advertising and Editorial copy closes Friday July 29, 2023.

Remembering our grandparents is a wonderful way to cherish the memories and the impact they had on our lives. Grandparents often hold a special place in our hearts, and reflecting on their love, guidance, and experiences can bring us comfort and nostalgia. Here are a few ways to remember and honor our grandparents:

Share stories: Recall and share stories about your grandparents with family members or friends. Talk about their accomplishments, adventures, or memorable moments. These stories

help keep their memory alive and allow others to learn from their experiences.

Look at old photographs: Take out photo albums or digital collections of pictures featuring your grandparents. Spend time flipping through the pages or scrolling through the images. This visual journey can evoke memories and spark conversations about the times you shared together.

Visit their gravesite: If your grandparents have passed away, you can visit their gravesite to pay your respects. Bring flowers or other items that hold significance to them or your family.

Spend a quiet moment reflecting on their life and the impact they had on you.

Cook their favorite recipes: Prepare a meal using a recipe that was cherished by your grandparents.

Cooking and enjoying their favorite dish can be a meaningful way to connect with their memory and keep their culinary traditions alive.

Create a tribute: Consider creating a tribute to your grandparents, such as a scrapbook, a digital photo montage, or a written piece about their life. Include memories, photographs, and any other mementos that hold significance.

Carry on their traditions: If your grandparents had specific traditions, customs, or values that were important to them, consider incorporating those into your own life. Whether it's celebrating certain holidays, practicing a hobby they enjoyed, or passing down their wisdom to future generations, honoring their legacy can be a meaningful tribute.

Remembering our grandparents allows us to honor their memory, preserve their legacy, and keep their love and wisdom alive in our lives.

By Ethan Strybosch

By Ethan Strybosch

Lead generation, the process of capturing and nurturing potential customers, is an indispensable strategy for service-based businesses seeking sustainable growth in today's competitive marketplace. By proactively identifying and engaging with prospective clients, businesses can unlock a plethora of benefits that fuel their success. Let's delve into the advantages that lead generation offers.

First and foremost, lead generation empowers service-based businesses to expand their customer base. By actively targeting and engaging with potential clients, companies can tap into previously untapped markets, both locally and globally. This enables them to reach a wider audience and establish a strong foothold in new territories, paving the way for increased revenue and market share.

Moreover, lead generation facilitates the acquisition of high-quality leads. Through targeted marketing campaigns and data-driven strategies, businesses can attract individuals who are genuinely interested in their services. These leads are more likely to convert into paying customers, boosting conversion rates and ultimately improving the return on investment (ROI) for marketing efforts.

Furthermore, lead generation fosters a more personalised and tailored approach to customer interactions. By gathering relevant data about prospects, businesses can understand their specific needs and preferences. This allows for the customisation of marketing messages and the delivery of personalised solutions, creating a more engaging and meaningful customer experience. Building strong relationships through personalised interactions enhances customer loyalty and promotes repeat business, leading to long-term profitability.

Additionally, lead generation aids in enhancing overall marketing and sales effectiveness. By utilising lead tracking and analytics tools, businesses can gain valuable insights into their marketing campaigns' performance. This enables them to identify successful strategies and optimise their marketing efforts, ensuring a higher return on investment. By streamlining sales processes and nurturing leads through targeted communication, businesses can shorten the sales cycle and improve conversion rates.

In conclusion, lead generation is a vital component of success for service-based businesses. From expanding customer bases and acquiring high-quality leads to fostering personalised interactions and enhancing marketing and sales effectiveness, the benefits are manifold.

By investing in robust lead generation strategies, businesses can position themselves ahead of the competition, driving growth and maximising their overall potential in the dynamic marketplace.

CTA buttons, colours, and layouts, allows for data-driven decisions to improve conversion rates. By measuring and analysing key metrics such as bounce rates, time on page, and conversion rates, marketers can identify areas of improvement and make informed changes.

Crafting a good landing page requires a thoughtful approach that incorporates various elements. From a clear and concise value proposition to engaging visual design, persuasive copywriting, and trust-building strategies, each aspect plays a crucial role in driving conversions. By continually optimising through A/B testing, personalisation and transparent communication, marketers can refine and enhance their landing pages, maximising their potential to convert visitors into customers. Remember, a successful landing page is not a one-time creation but a continuous process of refinement and improvement.

EthanWell-known law firm Slater and Gordon have reportedly lodged a class action against Optus, on behalf of more than 100,000 registered participants alleging their safety has been compromised.1 Data allegedly accesed by hackers may include name, date of birth, email, phone number, address, and ID numbers such as driver’s license or passport numbers. If this can happen to a multi-million dollar global communications giant with a full time IT department, then it can happen to your company.

This news should send a shiver down the spine of all small and medium enterprises as well, because similar data breaches experienced by small businesses put up to half of them out of business within 6 months.2 Reputational damage and associated lack of trust is certainly a revenue killer, even if the horrendous cost of rectifying a breach isn’t enough to bankrupt the business first. Fines and penalties will sometimes be a problem too, and there are potential EU General Data Protection Regulation fines, which may apply within Australia if the affected party is from an EU country.3

So what might a Cyber Policy typically cover?

a. Business interruption financial loss due to a network security failure or attack, human errors, or programming errors

b. Cost of data loss and restoration including decontamination and recovery of files and hardware

c. Emergency incident response and investigation costs, supported by an insurer appointed contractor

d. Delay, disruption, and acceleration costs from business interruption event that stems from a cyber-related issue

e. Crisis communications with clients and reputational damage mitigation expenses

f. Civil Liability costs arising from failure to maintain confidentiality of data

g. Civil Liability arising from unauthorised use of your network

h. Computer/data network, or data extortion / blackmail (where insurable. Paying this may be illegal under certain circumstances)

i. Online media civil liability

j. Regulatory investigations expenses

As diligent as you may be at managing your clients’ data, system intrusions can still happen.

Given that cyber-crime profits have eclipsed the global drug trade in turnover, I would say it’s a pretty fair assumption that the SME sector will take a beating sooner rather than later. Talk to your broker about Cyber Insurance today, and protect yourself and your clients against extensive losses.

If you think you may be affected by the recent Optus Data Breach go to

https://www.acma.gov.au/optus-databreach or ring 133 937

1. https://www.abc.net.au/news/202304-21/optus-hack-class-actioncustomer-privacy-breach-dataleaked/102247638

2. https://www.mybusiness.com.au/ resources/news/more-than-half-ofsmall-businesses-close-after-a-cyberattack

3. https://ovic.vic.gov.au/privacy/ resources-for-organisations/eugeneral-data-protection-regulation/

See Scope of the GDPR: Considerations for Victoria

For a health check of your business insurance, contact Small Business Insurance Brokers via email sales@ smallbusinessinsurancebrokers.com.au

Anyadviceinthisarticlehasbeenprepared without taking into account your objectives, financial situation or needs. Because of that, before acting on the above advice, you should consider its appropriateness (having regard to your objectives, needs and financial situation).

Craig AndersonGENERAL INSURANCE

Small Business Insurance Brokers

www. heightsafetyinsurancebrokers.com.au 0418 300 096

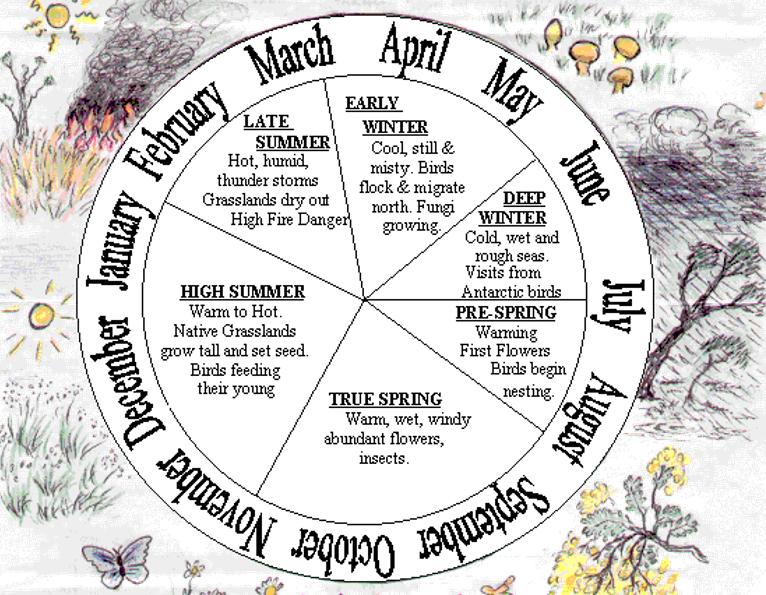

Recently I was aware of the Currawongs calling, so I managed to get a great sound recording of their carolling, and uploaded it to the Croydon Conservation Society FB page. Check it out.

https://www.facebook.com/groups/ CroydonConservationSociety

It seems from the replies that post received, that many of us in Croydon are very aware of the migration of these birds down from the high country after the first snow fall, when food and habitat is less hospitable for them.

Currawongs come to places with good tree cover, like Croydon and Warrandyte, and the plains around the foothills of the Dandenongs. This same pattern of movement also has been studied in NSW and Canberra, where Currawongs move to lower altitudes, and in a Northerly direction.

The Currawong has a distinctive call, and it is used to gather the group for mass migration. It can be heard again around early September when for about 2 to 3 days, they call and move closer together ready for a mass fly back to the high country for their breeding season and for summer. Their breeding site of choice, is high in the Great Dividing Range.

The word Currawong is onomatopoeic, with the cur ra being two syllables, and the wong- a long drawn out cry to end the call.

They eat small lizards, berries, insects and caterpillars, although they might attack and kill small young birds that are exposed due to lack of vegetation cover, especially of there is a shortage of insects This is a very good reason NOT to use insecticides in your garden.

The Pied Currawong is native to Australia and is an audible marker for a season

in the indigenous calendar. Indigenous people used native indicators of plant and animal behaviour to inform themselves.

This indigenous calendar is complied by Dr. Beth Gott of the School of Biological Sciences, Monash University. We acknowledge this work done by her.

While our current variable climate alterations are sometimes confounding this pattern as drawn, the indigenous calendar is not set like our own calendar, by the passage of specific days, it is dictated by sound, movement of creatures and observation.

If the birds arrive early, then the indigenous response is to take note and respond. For example, it may mean the need to move, for shelter and hunting, and it might start a week or 10 days earlier. This is what the first nations people refer to in part by their “Connection to Country”.

It is similar to reading bird sounds when out in the garden. If all birds fall silent and stay quiet, you may find by looking up that your are being surveyed from on

high by a Wedge Tailed Eagle. There is one that visits Croydon frequently.

We can all learn to care for Country, after all in spite of our notion of “ownership by the acquisition of a title” we are actually all just custodians, as our individual life is just a blip in the history of our Earth, and even on our own patch, we call home. Happy Currawong season to all.

Liz SanzaroAs a mortgage broker, one of the most common questions I receive from clients is whether they should fix the interest rate on their Home Loan. With interest rates having already risen 4% since April 2022, borrowers on variable rate loans are seeing their loan repayments increase significantly. Many borrowers on fixed rates will also see their repayments jump in the next few months as many come off their super low fixed rates. It’s been approximately 10years since we last saw rates at this level.

With commentary from the Reserve Bank indicating that they will use interest rates as a tool to reign in inflation, lenders have lifted their advertised fixed rates, particularly in the popular 2 and 3 year fixed rate products, to almost 7% now. This is much greater than the increases to variable rates, although with further increases in the cash rate expected this situation may change.

Fixed rate loans are priced differently to variable rates and the recent significant increases are due to issues not linked to local inflationary pressures, although this is part of the problem. Banks and other lenders need to borrow money to be able to then lend it out to Home Loan customers, as they don’t hold sufficient deposits in bank accounts to cover the demand for lending. They access this from a number of different areas, with a large proportion borrowed from overseas banks. As the cost of money from these sources has increased, the extra costs are being reflected in the rates offered by lenders here.

Given the current interest rate uncertainty is now the best time to fix the rate on your Home Loan? There are advantages and disadvantages to locking in your interest rate which would determine if fixing your rate is the best option for you.

1. Security

When you fix a rate on your Home Loan you are guaranteed that the rate will not change for the period you have fixed for. This means your repayments will also remain unchanged which is helpful for household budgets.

2.

If you are able to fix your rate at the

right time you will save money on interest, potentially thousands of dollars. FFor example, if you were to fix a rate today you could lock in a 6.54% for two years with some lenders. These same lenders have variable rates at 6.24%. so you are looking at a difference of 0.3% to lock in a rate. If the variable rate was to keep rising, by locking in now you could save interest, however there is a risk that fixing now could cost you money too.

3. Some Flexibility

Most lenders will allow borrowers to make additional repayments when they have a fixed rate loan without incurring a penalty. It is most common for any extra repayments to be capped at a maximum $10,000 per year.

Some lenders also offer the ability to have an offset account linked to the fixed rate loan to help reduce interest costs further, although these are generally only partial offsets usually 40%. For example if you had a $1,000 balance in an offset account only $400 of that balance would be offsetting your loan.

1.

If you become dissatisfied with your lender, decide to sell your home or you simply want to take advantage of better deals elsewhere, when you are locked in to a fixed rate you could be charged a substantial interest penalty to break the contract. A complex formula is used to determine what the loss to the lender would be if the fixed rate contract is broken which is outlined in any Home Loan Contract. This penalty could offset any benefit you received by locking in originally.

2. Most flexible features are unavailable

Flexible features that are standard on most variable rate loans are either not available or offered with reduced benefits on a fixed rate loan.

3. Potential to lose on the interest rate bet

Fixing a rate is effectively betting that the fixed rate will be lower than the variable rate for the time you choose to lock in for. In a volatile interest rate environment, where variable interest rates are dropping, if you have a fixed loan your rate will not reduce. The inflexibility of the fixed rate which is great in stable environments can be a curse at other times.

4. Potential for higher repayments once the fixed rate expires

A large number of borrowers have fixed their rates at historically low rates for the next few years. Once these rates expire the new interest rate will have increased significantly during this period, so their loan repayments could be much higher than what they have been used to paying. Borrowers may be in for a rude shock in the next year, depending on how long they locked in for when rates were much lower.

If you can’t decide which option is the best one for you it is possible to hedge your bets. Lenders also offer a split loan option which means you can have a portion of your loan at a fixed rate and the balance on a variable rate. By splitting your loan you retain the flexible repayment features of a variable rate loan, as well as having some of your loan locked away securely on a fixed rate for a few years.

It is always a great idea to speak with a mortgage broker who can guide you through the process, advise you on which loan structure would suit your needs best and recommend the most suitable lender to meet your requirements.

At SHL Finance we are available to speak with you at any time. We are already proactively helping our clients negotiate a better rate with their current lender, reviewing their existing loans and discussing ways to potentially save clients thousands of dollars. We would love the opportunity to help you too. Please call Reece Droscher on 0478021757 to discuss your options.

It may come as a surprise, but post-viral syndrome is not a new health issue. If you’ve lived a few decades, you may remember in the 1980’s and 90’s, that chronic fatigue was the term used to describe the long-term exhaustion which was usually caused by the Epstein Barr virus. Studies at the time found that muscle function, attention and memory were severely hampered, although the cause was largely unknown.

Similarly, whilst there are a range of long covid symptoms such as neurological, digestive, cardiovascular and autoimmune disturbances, for most people, fatigue is what has the greatest effect on the ability to function normally. As the term chronic fatigue suggests, the fatigue lasted for months after the initial viral infection. This obviously has an enormous impact on people’s lives, as their ability to carry out day-to-day tasks can be severely hampered.

Conventional medicine has little to offer in the case of chronic fatigue, and this is where natural medicines really shine.

Studies from the 1990’s show herbal medicine to be effective in treating post

viral syndromes and new research is emerging in how effective it is in treating long Covid.

In treating post-viral syndrome with herbal medicine, a combination of herbs are used so that the mix includes antiviral, adaptogen, and adrenal tonics. This way both the causes and the symptoms are being addressed.

I wrote about antivirals last month, please refer to that article if you would like to know more about antiviral herbs.

Adaptogens are herbs that help the body adapt to and recover from stress. The following adaptogens have been studied and found to be effective in post viral syndromes:

• Astragalus - immune regulation, increased immune cells, antiinflammatory, antiviral

• Withania - regulate inflammation, anti-viral, anti-stress, inhibit SARS CoV2

• Green tea - binds to the virus proteins and inhibits further damage

A study of a combination of herbal adaptogens specifically for long covid-19 showed significant relief of all long covid symptoms, but especially for pain, fatigue, cognition, anxiety, and depression.

Naturopaths and herbalists prescribe individually, so for example, if you have neurological or digestive issues along with fatigue, different herbs would be added to the mix to address these issues. If you’re suffering from post-viral syndrome, or fatigue of any kind, herbal medicines can make a significant difference to your recovery.

Here at Whole Naturopathy we have a range of effective treatments for both long covid, or fatigue of any kind. Book an appointment today to start seeing improvements.

Kathryn Messenger

Kathryn Messenger

BHSc (Naturopathy)

kathryn@wholenaturopathy.com.au

Suite 1 53/1880 Ferntree Gully Rd

Mountain Gate Shopping Centre

Ferntree Gully, Victoria

This advice is general in nature and not intended to be prescriptive. For individualised prescriptive advice, please see a naturopath or other health care practitioner.

Does your club have a business plan – a plan that outlines what your club is looking to achieve into the future?

Without one you could be seen as a rudderless ship, however with a business plan you will be in the position to move your club forward.

Don’t waste time looking back – what worked successfully at your club a few years ago should be respectfully classified as ‘history’ – what you need now is a plan to move your club forward.

It is important to let your members know that your club is working on developing a business plan, a plan that will involve all aspects of your club – revenue, membership, sponsorship, subscription fees to name a few – and importantly seek input from your members.

The plan should look at reviewing your club’s revenue streams and then look at what you need to do to increase revenue, increase membership, increase sponsorship whilst also looking at additional revenue streams.

The common denominator is the word INCREASE with the common goal being both increased revenue and membership.

Take the following into consideration:

Question: What category does our club fall into?

Answer: We are a Sporting Club

Question: What is our product?

Answer: Name of your Sport

Question: What is our brand?

Answer: That's the name of your Club

Ask yourself this – is our club being run as a business?

If the answer is NO then it is time for a re-think and most definitely the time your club needs to develop a business plan.

A business plan will detail what your club plans to do in the coming years as well as providing the opportunity on an annual basis to undertake a review of the plan to determine if your club is ‘on track’.

But don’t think you can do it alone… get your board involved, get your members involved – work collectively as a club and you will finish up with a business plan that has been well planned, endorsed by your members and implemented.

As a business owner and employer, it is your responsibility to ensure the health and safety of your employees within your workplace. This includes providing your team with a safe work environment and protection from hazards. You can achieve this by understanding your obligations under the Occupational Health and Safety (OHS) laws and by complying with them.

WorkCover Victoria recently reported that a building company has been convicted and fined a total of $390,000 after a worker died following a fall at a residential construction site in Templestowe.

Ourarchi Pty Ltd was sentenced in the Melbourne County Court in May 2023 after earlier pleading guilty to two charges under the Occupational Health and Safety Act. The company was convicted and fined $370,000 for failing to ensure that the workplace was safe and without risks to health and $20,000 for failing to ensure that the site where an incident occurred was not disturbed.

The court heard in April 2020, the 26-yearold worker was helping other workers install glass window panes from firstfloor scaffolding on the site when he realised he needed a particular tool. As he ran along the scaffolding to retrieve the tool, the worker lost his footing on an unsecured wooden plank and fell approximately two metres through a gap to the concrete floor below. The worker was taken to hospital with head injuries and later died. Following the incident, the company failed to ensure that the site was left undisturbed before WorkSafe attended.

The court heard it was reasonably practicable for Ourarchi to have reduced the risk of falls from the scaffold by installing kickboards and rails before it was accessed by workers; and by using and installing proper decking material.

WorkSafe Executive Director of Health and Safety Narelle Beer said the company’s failure to provide safe scaffolding was a serious departure from its legal obligations. “The risk of a fall from height, especially in the construction industry, is well known and so are the measures to reduce it – employers have absolutely no excuses.”

Since January this year, four people have died in Victorian workplaces after a fall from height while another 390 people have been seriously injured.

Dr Beer said it was extremely frustrating because falls from height were entirely preventable. “It doesn’t matter whether a project involves a day’s work or five minutes – it’s never ok to take short-cuts when working at heights.”

To prevent falls from height employers should:

• Eliminate the risk by, where practicable, doing all or some of the work on the ground or from a solid construction.

• Use a passive fall prevention device such as scaffolds, perimeter screens, guardrails, safety mesh or elevating work platforms.

• Use a positioning system, such as a travel-restraint system, to ensure employees work within a safe area.

• Use a fall arrest system, such as a harness, catch platform or safety nets, to limit the risk of injuries in the event of a fall.

• Use a fixed or portable ladder or implement administrative controls.

As a business owner, are you confident that you do not have shortfalls in your efforts to keep your workers healthy and safe? Do you have an understanding of your responsibility to ensure the safety of your employees? Are you confident that you can provide a safe work environment and comply with OHS laws?

Do you believe that you are effective in carrying out risk assessments, employee consultation and providing training? Do you regularly review these measures to ensure that they remain fit for purpose and keep you and your employees healthy and safe?

At Beaumont Advisory we assist business owners clarify what they currently have in place, as well as where there are shortfalls. We then assist in developing effective systems and documentation, working with businesses to ensure effective implementation. Checks are put in place to monitor ongoing effectiveness, to ensure that going forward, they are sound and comply with the Act, and most importantly keep you and your employees informed, and healthy and safe. Please feel free to contact me, Mark Felton, at Beaumont Advisory on 0411 951 372 or mfelton@beaumontlawyers.com. au for an obligation and cost-free initial discussion.

Mark Felton

Mark Felton

On 28 February 2023 the government announced they would be increasing the tax paid on superannuation fund earnings for high-value superannuation account holders.

This initiative will target people with a total superannuation balance exceeding $3 million and is expected to apply from the 2025-26 financial year. The scheme will not be implemented until 1 July 2025 - after the next Federal election.

At the present time, details of how the scheme will work are limited. The government has announced it will consult with the superannuation industry regarding implementation of the scheme.

The current situation

Superannuation funds pay tax on their investment earnings. The following table illustrates the rate of tax generally paid.

This proposal does not apply to individuals with a total superannuation balance of less than $3 million.

The total superannuation balance is the sum of all amounts a person holds in the superannuation system. It is calculated on 30 June each year and, at a high level, includes:

• amounts held in accumulation accounts, and in defined benefit schemes,

• amounts held in pension or income stream accounts, such as an account-based pension,

• amounts in the course of being rolled over from one super fund to another on 30 June,

• the amount of any outstanding limited recourse borrowing arrangement held by a selfmanaged super fund, in certain circumstances.

Any amounts contributed to superannuation as a personal injury contribution are excluded from the calculation of the total superannuation balance.

You can track your total superannuation balance by checking your MyGov account, or by contacting your superannuation fund.

A person’s total superannuation balance is critical when determining:

While the government’s announcement and media commentary suggest an additional tax will be paid on superannuation fund investment earnings, this is not entirely correct.

Firstly, the tax calculation is based on an adjusted movement in a person’s total superannuation balance rather than on the actual earnings of their superannuation accounts. As a result, the extra tax may become payable on unrealised capital gains.

Secondly, the tax will not paid by the superannuation fund – rather it is levied on the individual member, personally. Once a tax assessment is issued, members will have the option of paying the tax personally to the Australian Taxation Office (ATO) from their own savings, or having the tax payable released from their superannuation account.

Finally, while it is estimated that less than 80,000 Australians will be affected by the additional tax, this will grow over time as it appears the $3 million threshold will not be indexed to keep pace with inflation. Over time, more Australians will be subject to this additional tax.

People with a total superannuation balance that exceeds $3 million will pay an additional tax of 15% on a portion of the earnings on their superannuation.

• if they will be affected by the proposed change to taxation of superannuation fund earnings and, if so,

• how any additional tax will be calculated.

The calculation of tax payable when a person has a total superannuation balance exceeding $3 million is complex, however the following steps and worked example may help to illustrate how the proposed tax will be calculated.

TSB current FY - TSB previous FY + Withdrawals - Contributions = Earnings

Step 2 - calculate the proportion of earnings corresponding to funds above $3 million.

TSB current FY - $3 million

TSB current FY = Proportion of Earnings

Step 3 - calculate the tax liability.

15% X Earnings X Proportion of Earnings = Tax Liability

Example

Jolene had a total superannuation balance of $4,200,000 on 30 June 2026. Her total superannuation balance on 30 June 2025 was $3,750,000.

During the 2026 financial year contributions of $30,000 were made. During the year Jolene withdrew $100,000 from her super as a lump sum.

Step 1 - calculate earnings.

$4,200,000 - $3,750,000 + $100,000 - $30,000 = $520,000

Step 2 - calculate proportion of earnings.

$4,200,000 - $3,000,000 = 29%

$4,200,000

Step 3 - Calculate the tax liability.

15% X $520,000 X 29% = $22,620

For the 2025-26 financial year, Jolene will have a tax liability, based on the earnings of her superannuation fund, of $22,620.

If the calculation of earnings results in a negative (loss) amount, the loss is carried forward to future years.

The proposal announced by the government on 28 February will be subject to lengthy consultation before it moves to the next stage. Legislation will then need to be passed for the proposal to become law.

Currently, the government does not propose introducing the measure until 1 July 2025, which is after the next Federal Election is due to be held.

For people likely to be affected by this measure, take time to understand how it works and how you may be affected.

Important Information

There is still a lot of uncertainty around the measure and its eventual impact.

Taking immediate action, like withdrawing money from superannuation, is probably not a strategy that should be pursued at this early stage unless you had plans to withdraw your super irrespective of this proposal. Once money is withdrawn from superannuation, particularly for individuals with significant account balances, it is unlikely you will be able to recontribute it to superannuation.

Importantly, before taking any action in response to the government’s proposal, speak with your financial adviser or other financial professional.

Warren

You can call them on 1300 88 38 30 or email info@findaccountant.com.au

www.findaccountant.com.au

This information is of a general nature only. It does not take into account your particular financial needs, circumstances and objectives. You should obtain professional financial advice if you have not already done so before acting on this information. You should read the Product Disclosure Statement (PDS) before making a decision to buy or sell a financial product. Any case studies, graphs or examples are for illustrative purposes only and are based on specific assumptions and calculations. Past performance is not an indication of future performance. Superannuation, tax, Centrelink and other relevant information is current as at the date of this document. This information contained does not constitute legal or tax advice.

By Lynn Blackbell

By Lynn Blackbell

In the Music Appreciation Class at U3A Ringwood there is a member, Thomas who has had a stroke. . He attends class with his Carer Neville. Thomas walks in with the aid of a walking stick which he places against the wall. The same seat is always available to him.

Although Thomas can hardly speak but understands everything, he still manages to get the odd word out but it is often a struggle, however, whenever he enjoys a piece of music or anything else offered

By (Australian Associated Press)The gender pay gap between women and men is lower in the federal arena than in the private sector, although it’s still a long way from wage parity.

Women working in the commonwealth public sector are paid on average 88 cents in the dollar compared to men, a snapshot released by the Workplace Gender Equality Agency shows. This compares to 77 cents in the dollar for women working in the private sector. This translates to a total remuneration gender pay gap in the commonwealth public sector of 11.6 per cent, while in the private sector it’s 22.8 per cent.

“Policies like publicly-advertised salary levels, target setting, regular employee consultation and comprehensive access to paid parental leave help the public sector lead in workplace gender equality,” WGEA CEO Mary Wooldridge said on Monday. “However, these results also show that many of these policies have focused on women, rather than all

by the class, he gives them the thumbs up sign. Upon arrival he always smiles broadly and waves hello to everyone in the class which they all acknowledge.

All the other members of the class include him in their conversation and lots of times he responses with “happy signage”. During the course of listening to a CD, Thomas will indicate that he wishes to have a look at the CD cover to find out details of the piece being played, the singer, orchestra or instruments involved.

The music program each term endeavours to include a presentation on classical music by a class member and last year, via an email from Thomas’

employees. “This is particularly the case for support for parents and carers.” As a result, the uptake of paid primary carers leave by men is at a rate similar to the private sector – that is, 13.5 per cent in the public sector versus 13 per cent in the private sector. “To advance gender equality, we need to shift cultural norms and pervasive gender stereotypes that reinforce an unequal share of parenting

wife, he indicated that he would like to prepare a presentation on one of his favourite pieces, Beethoven’s Ninth Symphony if someone could read it out. This was duly achieved and read out by the class leader and everyone found it so interesting and really loved it and Thomas was very proud of his achievement.

Following the end of music class each week, Carer Neville takes Thomas for a walk and then out to lunch. Thomas’ wife tells us he was culturally rich and in the “blink of an eye” became disabled, but this has not stopped him enjoying life, albeit in a different way, and she says that the music class is the highlight of his week.

and act as a barrier to women’s full participation in the workforce,” Ms Wooldridge said. The new figures are based on voluntary reporting by 52 employers from the commonwealth public sector, the agency said on Monday. Commonwealth public sector employers with 100 or more employees will begin mandatory gender equality reporting to the agency later this year.

By Dr. Joanna Strybosch

By Dr. Joanna Strybosch

Tattooing has become a popular form of self-expression and body art. With an increasing number of people getting tattoos, there are some important considerations for individuals who are planning to breastfeed or are already breastfeeding. While there are potential risks associated with tattooing, it is possible to safely navigate the process without compromising the well-being of mother or baby.

Timing and Healing:

If you're considering getting a tattoo while breastfeeding, timing is crucial. It's generally recommended to wait until your baby is at least six months old before getting a tattoo. By this time, your breastfeeding routine and milk supply would be well-established, reducing any potential disruptions caused by the healing process.

Safety and Hygiene:

When getting a tattoo, prioritising safety and hygiene is essential, especially when breastfeeding. Ensure that you choose a reputable tattoo studio that follows strict sterilization practices and uses disposable, single-use needles. This helps minimize the risk of infection and ensures a safe environment for both you and your baby.

Make sure to communicate your breastfeeding status with your tattoo artist beforehand, as they may have additional recommendations or precautions based on their expertise and experience.

Placement Considerations:

While there are no specific restrictions on tattoo placement for breastfeeding mothers, it's worth considering the potential impact on your comfort and convenience. For instance, if you plan to get a tattoo on your breast or areola area, it's advisable to wait until after you've finished breastfeeding. Changes in breast size and shape during lactation could distort the tattoo or lead to undesirable outcomes.

Choosing a different location for your tattoo, such as the arms, legs, or back, can help ensure that your breastfeeding journey remains unaffected while still allowing you to enjoy your body art.

Ink and Allergies:

Some individuals may be concerned about potential risks associated with tattoo ink and breastfeeding. While rare, allergic reactions to tattoo ink can occur.

To minimize the risk, consider getting a patch test done before getting the tattoo to check for any adverse reactions.

If you're concerned about the composition of tattoo inks, it's advisable to consult with your tattoo artist. They can provide information about the ingredients and discuss any potential risks associated with the specific ink brand being used.

Conclusion:

Tattooing and breastfeeding can be safely navigated with proper planning and considerations. By choosing the right time, ensuring a clean and safe environment, and communicating with your tattoo artist, you can minimize any

potential risks and enjoy the body art you desire. Remember to prioritise your own well-being and the well-being of your baby throughout the process. If you have any concerns or doubts, it's always a good idea to consult with healthcare professionals or a lactation consultant who can provide personalised advice based on your specific situation.

A visit to Violet Town last year to meet Bruce Cumming and the Committee of the Violet Town Southern Aurora Crash showed exactly how the town moved together to help those who were injured and deceased..when the accident happened. Bruce showed us the gardens the township set up as memorial gardens , and the mural they have of the train. They now have a sleeper carriage which is currently being restored to be a carriage where a lot of memorabilia will be viewed. They now have 2 new information boards... The info boards will be so important to visitors to the township.

We applaud the Aurora Committee for their forward thinking, showing just how important it is to have information posts to show the history of the area.

By Aaron Bunch

By Aaron Bunch

(Australian Associated Press)

Millions of Australian households are being urged to prepare for wild weather events and emergencies after a survey revealed about half the population doesn’t have a plan.

One in five families has discussed the safest place to meet in an emergency and more than 12.3 million people have no emergency plan at all, according to the research. Australian Red Cross head of emergency services Andrew Coghlan says this needs to change.

“Emergencies can occur anywhere, at any time and when they happen there are lots of decisions to make,” Mr Coghlan said on Tuesday. “Last year alone, Australian Red Cross supported more than 130,000 people during emergencies such as bushfires, floods and severe storms.” The NRMA Insurance research found younger people aged 18 to 34 and city-dwellers were less likely to have an emergency plan.

It also revealed many Australians were not well connected to their neighbours, with one in three respondents stating they do not know them well enough to rely on them for support in an emergency. Apathy around emergency planning

was also evident in pet owners, with twothirds stating they do not know where they would safely keep their pets.

The findings follow the launch of the updated Get Prepared app for householders to create an all-hazards emergency plan, based on the Red Cross RediPlan disaster preparedness guide. The app stores information needed during an emergency such as key contacts, meeting places and important documents.

It also prompts people to consider how they would manage stress during and after an emergency. The advice to have an emergency plan is particularly important with a warmer and drier winter forecast than average, leading into a riskier bushfire season.

NRMA Insurance received 10,151 claims for wild weather damage to homes and vehicles nationally during autumn.

Most of these claims were for damage to vehicles (5478) with intense hailstorms in NSW causing extensive damage in late May. NRMA Insurance executive manager of claims Natalie Major urged households to take three steps to prepare for wild weather this winter.

“Make an emergency plan using the Get Prepared app, share your contact details with your neighbours and discuss your emergency plan with your household,” she said.

The findings are based on a survey of 3500 people across Australia.

By Erryn Langley

By Erryn Langley

Back in 2013, the Australian Taxation Office (ATO) issued a Taxation Ruling that addressed the rules around paying pensions.

While the Ruling applied to all superannuation funds, there are specific implications for SMSFs. On the surface, SMSFs appear to have additional flexibility when compared to APRA regulated funds.

Firstly, it is quite a common practice for the commencement of a pension to be backdated to an earlier date, often the previous 1 July. This may be for administrative simplicity or because the member balance at the end of the previous financial year is not available due the financial statements not having been prepared.

However, when considering the Taxation Ruling, and particularly paragraph 12, while a pension may commence before the first income payment is made, it cannot commence before a member has made a request or application for a pension to commence.

We recommend members requests to commence a pension should always be in writing or using an application form provided by the trustees of the superannuation fund, the fund’s administrator, or the fund’s document provider. The request should always be made before the pension commences.

The practice of backdating the commencement of a pension from a SMSF became more complex with the introduction of the transfer balance cap.

While some SMSFs have historically been able to provide their transfer balance account reporting when the fund submits its statutory return, this will change from 1 July 2023.

From 1 July 2023, all SMSFs will be required to lodge transfer balance account reporting by the 28th day of the month following the end of the quarter in which the reportable event (e.g. commencement, reversion, or commutation of a pension) occurs.

The ATO has advised that all unreported events that have occurred by 30 September 2023 must be reported by 28 October 2023. Likewise, for pensions that commence in the first quarter of the 2024

financial year (e.g. on 1 July 2023) will also need to be reported by 28 October 2023.

On a final note, when a SMSF commences to pay a pension to a member, the trustee needs to provide the member with a product disclosure statement that provides details of the pension being paid. Most SMSF document providers have a PDS specific to their trust deed.

Erryn Langley

1300 557 144 | erryn@findwealth.com.au www.findwealth.com.au

Financial Planning is offered via Find Wealth Pty Ltd ACN 140 585 075 t/a Find Wealth. Find Wealth is a Corporate Authorised Representative (No 468091) of AllianceWealthPtyLtdABN93161647007(AFSLNo.449221).PartoftheCentrepoint Alliance group https://www.centrepointalliance.com.au/

As these laws are subject to change you should talk to an authorised adviser for the most up-to-date information. No warranty is given in respect of the information provided and accordingly neither Alliance Wealth nor its related entities, employees or representatives accepts responsibility for any loss suffered by any person arising from reliance on this information.

As part of the 2023 Federal Budget, the government has announced the introduction of “payday super”.

Aiming to provide better retirement outcomes for employees, from 1 July 2026, employers will be required to pay their employees super at the same time as their salary and wages.

This measure will also increase transparency for employees as well as the ATO for any unpaid superannuation entitlements.

Lower paid, casual and insecure workers will benefit the most by this measure are they are more likely to miss out when super is paid quarterly or less frequently.

As part of the 2023 Federal Budget, the government has announced the introduction of “payday super”.

Aiming to provide better retirement outcomes for employees, from 1 July 2026, employers will be required to pay their employees super at the same time as their salary and wages.

This measure will also increase transparency for employees as well as the ATO for any unpaid superannuation entitlements.

Lower paid, casual and insecure workers will benefit the most by this measure are they are more likely to miss out when super is paid quarterly or less frequently.

Businesses with an aggregated turnover of less than $50 million will be entitled to a 20% deduction for expenditure that supports electrification and more efficient use of energy.

This bonus deduction will be available for expenditure incurred from 1 July 2023 until 30 June 2024.

The additional deduction will be available for eligible expenditure of up to $100,000 and is therefore capped at $20,000 for each business.

The temporary measure will apply to eligible assets or upgrades first used or installed ready for use between 1 July 2023 and 30 June 2024.

With the temporary full expensing (TFE) incentive due to end on 30 June 2023, the federal government has announced the reintroduction of the small business instant asset write-off.

This measure will provide businesses with cash flow support and reduce compliance costs. Assets that cost $20,000 or less may be eligible for this incentive.

From 1 July 2023, small businesses with aggregated annual turnover of less than $10 million will be able to immediately deduct the full cost of eligible assets.

Eligible assets must be first used or installed ready for use between 1 July 2023 and 30 June 2024, and the write-off applies on a per asset basis.

A number of housing measures have been introduced in the 2023 Federal Budget to support social and affordable housing and improve access for home buyers.

These measures aim to combat the current social housing affordability difficulties that buyers face and provide easier access to home ownership.

From 1 July 2023, eligibility criteria for the Home Guarantee Scheme will be expanded to allow any 2 eligible people to be joint applicants for a guarantee, which has previously been restricted to spouses and de facto partners.

The government will also increase resources devoted to supporting social and affordable housing along with aiming to provide more houses under the Home Guarantee Scheme.

A number of measures aiming to support small businesses were announced by the Labor government as part of the 2023–24 Federal Budget.

As part of that, small businesses will be given an amnesty which will remit eligible failure-to-lodge penalties for late lodgments.

This measure will provide small businesses with cash flow support and reduce compliance burdens of applying for a remission.

At this stage this is a proposed measure and will require parliamentary approval to become law.

The federal government announced in its 2023–24 federal budget a measure that will provide small businesses with an additional 2 years to amend their income tax returns.

At present, the Commissioner may amend an assessment for small to medium business taxpayers for up to 2 years.

This proposed measure aims to help small businesses deal with the compliance burden of having to apply for an extension of their amendment period.

This measure, subject to receiving parliamentary approval, will commence from 1 July 2025.

The non-arm’s length income (NALI) measure announced by the Coalition government in 2022 will be amended to provide greater certainty to taxpayers.

The intention of the proposal is to include a factor-based approach for trustees to be able to adequately calculate the amount of SMSF income that is NALI income. This factor-based approach applies to a situation where general expenses of the fund are not at arm’s length amounts.

The factor-based approach would apply to general fund expenses incurred after 1 July 2023.

Maroondah cricketers and netballers are enjoying a new place to train, with Maroondah Edge formally open.

Located in Jubilee Park, the centre boasts five lanes for indoor cricket training, making it a one-of-a-kind facility in the Eastern Region and the first of four indoor cricket training hubs to be built in the Melbourne metropolitan area.

The new centre was formally opened on Tuesday 4 July 2023, along with three other recent improvements and sporting developments. It overlooks the premier grade Russell Lucas Oval in Jubilee Park and adds to the existing facilities for local cricket, football, tennis, soccer and croquet, along with playgrounds and Aquanation.

Mayor of Maroondah, Councillor Rob Steane OAM, said the facility can be enjoyed by many members of the Maroondah community.

“Council is pleased to formally open Maroondah Edge. We are extremely proud of how the new facility meets the needs of many clubs in our community, and how this unique centre will help further raise the profile and skills of our female cricketers in the eastern suburbs,” Cr Steane said.

Teams from Ringwood Cricket Club, Ringwood Football Netball Club, Ringwood Spiders All-Abilities Sports Club, Cricket Victoria and the Ringwood District Cricket Association (RDCA) are enjoying the new cricket facilities, which opened for use in June.

Clinton Kennon, Head of Customer Experience at Cricket Victoria, said the new centre will cater for current and

future growth in cricket participation in Maroondah.

“Cricket Victoria is very excited to see this facility up and running. The new facilities at Maroondah Edge are fantastic and will be a real asset in the Jubilee sporting precinct and to the local community. It will also become a focal point for cricket in Melbourne’s east and one of the best indoor facilities in the state,” Clinton said.

“It’s a friendly, welcoming environment with fit-for-purpose facilities that will lead to positive experiences for everyone involved. We have witnessed some fantastic growth in women’s and girls’ cricket in Maroondah and progress in all-abilities offerings. These facilities set us up for generations to come.”

Vice President of Ringwood Cricket Club, Tamara Bourke, said the centre will be important for supporting players’ goals. “The new facilities are brilliant.

A lot of time and effort has gone into the development of Maroondah Edge, and we are very lucky and excited to have this new facility that can help all of our cricket community,” Chris said.

“It’s a space we can call our own and really promote as an elite premier facility that will help Ringwood Cricket Club become the envy of the competition.”

Chairman of the Ringwood Spiders All-Abilities Sports Club Committee, Paul House, said the new facilities are a welcome addition that will help encourage more all-abilities players to take up sport. “Maroondah Edge both complements and enhances what we already have with the new pavilion.

Both football and netball players are enjoying the ground and the social facilities.

“Our sister club, Eastern All-Abilities Netball Club, can now train at the same time as the Spiders Football Club. This allows both clubs to train at the one location for the first time and allows us to socialise after training and enjoy a meal and each other’s companysomething our committee has been working on and looking forward to,” Paul said.

“Our club has the best ground and facility in the Football Integration Development Association competition. With support from Council and other clubs in the area, we should see a growth in the all-abilities sector.” Members of the Ringwood Football Netball Club can also train alongside each other, which will help strengthen relationships throughout the club, said Netball Coordinator, Nicole Stagg.

“Maroondah Edge will help grow our sense of community. The netball teams can now train alongside the footballers, which makes it easier for them to feel a part of the club and build relationships with the other members,” Nicole said.

“We can also have dinners together after training, creating a sense of inclusiveness for the netballers and bringing everyone closer as a community. This can help bring more players and supporters to our games as well, which is a massive part of our club values.”

This project has been funded by Council in partnership with the Victoria Governement.

The scale and diversity of services provided by Councils is often unseen, but they have a significant impact on the everyday lives of people living in our community.

From school crossing supervisors, youth workers, librarians, maternal and child health nurses and customer service to parks maintenance officers, family support workers, town planners and engineers, each role here at Maroondah has its place and importance within our community.

Maroondah City Council thanked its employees in June, acknowledging and celebrating 38 employees for their significant length of service. “Service milestones are something that Council strongly believes should be recognised and celebrated, and at Maroondah we are proud to have employees who have served their community for an extended length of time,” said Mayor of Maroondah, Councillor Rob Steane OAM.

“This year we have four employees celebrating an impressive 30 years of continuous service at Maroondah, with nine reaching 20 years and a further 26 employees marking 10 years - that’s 560 years of combined knowledge and experience!”

There are hundreds of different jobs in Council requiring a wide variety of people. Many staff have tertiary qualifications, while others have developed specialist skills.

“Acknowledging the achievements of our employees also allows us to reflect on how local government supports local communities,” Cr Steane said.

“In Maroondah, this includes Council delivering over 120 services and programs for our community across all ages and abilities, delivering important infrastructure projects, and working in partnership with residents, businesses, organisations and other

A practical, hands-on workshop for artists to learn how to promote their practice with Instagram.

Instagram is a vital tool for artists, musicians, performers and arts groups to share their work, grow their audiences and promote themselves. In this practical session, a social media marketing specialist will guide you through the steps to create engaging content and make use of Instagram’s features such as Reels and Stories.

levels of government to support our community’s needs. “Having also been recognised for multiple national and state awards over the years is a testament to this work and our partnerships with the community and other key stakeholder partners,” Cr Steane said.

Work with us and make a difference

Local government is one of the largest employment sectors and has a diverse range of career opportunities.

View career opportunities and employment programs available with Maroondah City Council.

Plastic Free July helps millions of people be part of the solution to plastic pollution. One way to do this is to sign up for the Plastic Free July Challenge.

Small actions make a big difference. It can be easy as:

• choosing unpackaged meat, fish and deli items

• bringing your own shopping bags

• choosing reusable drink bottles

• choosing loose produce

• avoiding disposable coffee cups

• picking up and preventing litter

• storing food in reusable containers

• avoiding plastic wrap

Mayor of Maroondah, Councillor Rob Steane OAM, will be taking part and encouraged residents to also consider using less plastic.

“Plastic pollution harms the environment, wildlife and our health. That’s why I’m pledging to use less plastic, whether it be using my reusable drink bottle, choosing loose produce at the supermarket, or taking my reusable shopping bags with me,” Cr Steane said.

“I encourage residents to take part in Council’s Plastic Free July workshops

and events and to also consider using less plastic, as this can help create cleaner streets and oceans and help keep Maroondah looking beautiful.”

To celebrate Plastic Free July, there will be an interactive display at the Realm Customer Service Centre in Ringwood. You can learn more about simple swaps for everyday plastic items and sign up for the challenge.

Council is also hosting a series of events and taking part in Storytimes at Croydon Library, Croydon and Realm Library, Ringwood.

Various dates and times in July | Realm Library, Ringwood Town Square, and Croydon Library, Croydon

To celebrate Plastic Free July, Council is taking part in special Storytime events. Listen to a story about how even the smallest of humans can make a big difference and then participate in a fun plastic-free activity afterwards.

Find out more about Plastic Free July Storytimes.

Want to eliminate the need for singleuse fruit and vegetable bags? Join Zero Waste Victoria at this free interactive workshop and learn how to make your own reusable produce bags for your next grocery shop. Pop in and leave when you like; it takes about 30 minutes to make. All materials are supplied and no prior sewing skills are needed.

Find out more and register

Saturday 15 July | 11.30am to 1pm | Realm Library, Ringwood Town Square

Hear from Anna (aka The Urban Nanna) as she shares small waste management tips in the kitchen. Learn how simple, everyday choices can help make a big, positive impact on your overall sustainable footprint. This event is free. Spaces are limited and bookings are essential.

Find out more and register

Maroondah Nets hosts badminton and table tennis every Thursday during school terms. Maroondah Nets hosts badminton and table tennis every Thursday during school terms.

Have fun socialising with friends and keeping active over six courts, air conditioning and parking directly outside the front door.

Find out more

Neighbourhood Tales is an exhibition of photographs produced in Maroondah and surrounding suburbs between 2020 and 2022 by Selina Ou in collaboration with her two sons who appear in each of the images, sometimes together, sometimes alone.

Join us for one of our free sessions on preparing for an emergency for people with a disability. While these sessions are aimed at people with a disability and their carers, anyone interested in working on an emergency plan is welcome come along. Disasters can affect our health, our home, our safety, our family, our pets and our community. Having an emergency plan can help us to think about what is important to us. A plan can help us to know what we can do if we are affected by a disaster. A disaster could be a storm, fire, flood, heat wave, or a disruption to power, internet or phone service.

Read More

A love of the local school community inspired Carmel Black to supervise the school crossing at Yarra Road Primary School in Croydon North. Over four decades later, she is hanging up her high-vis jacket and stop sign for the last time.

“I might be one of the most fortunate supervisors, to have got that crossing,” Carmel said, reflecting on her 44 years of service.

The Yarra Road site school crossing was installed in 1979 after a two-year campaign by the school committee. While the crossing was a welcome addition, the crossing supervisor role remained vacant after three months of advertising.

Carmel offered to assist until the role could be filled, knowing it was essential for the school, which was on a narrow street with “a bad crest on the Wonga Park side and a dangerous corner on the Croydon side”.

What followed was an incredible 44 years of service, making Carmel one of Victoria’s longest serving school crossing supervisors in perhaps the longest ‘temporary’ position ever!

“I started the role, loved it, and I continued to do it. What inspired me the most was the children and keeping them safe, year in and year out.”

Since then, Carmel has enjoyed building connections with generations of students and their families while helping them cross the road safely.

“I’ve been connected to the school for so long, I’ve learnt a lot about the students.

“I always greet the children by their first names, and they love it. They say ‘Mrs Black is so nice. She remembers it’s my birthday, she remembers my name and she’s interested in what I’m doing.’”

While there have been many highlights, Carmel has most enjoyed how much the students have shared with her.

“The students tell me their achievements and I go to school activities like carols, productions and graduation nights. The Grade 6s want me to be there to say farewell to them before the next step of their life.”

Principal of Yarra Road Primary School, Ken Darby, said Carmel has made “tremendous contributions” to the school community and her presence will be missed.

“Carmel has become an iconic figure, deeply connected to the school and its surroundings. Her innate ability to connect with everyone she encounters, her genuine care for the children’s safety, her attentiveness to details, and her ability to create a friendly and welcoming atmosphere have made her an invaluable asset to our school community.

“Carmel’s professionalism, patience and unwavering commitment have set the standard for excellence in her role, and her dedication can be attributed to her genuine love for the Yarra Road Primary School community,” Principal Darby said.

“Carmel’s retirement marks the end of an era, and we are forever grateful

for her unwavering dedication and service. She will be sincerely missed by the Yarra Road community.”

Carmel is one of Council’s 95 dedicated school crossing supervisors, who oversee 73 primary and secondary school crossings throughout Maroondah. Rain, hail or shine, they help pedestrians of all ages to safely cross the road.

Mayor of Maroondah, Councillor Rob Steane OAM, congratulated Carmel for her contribution to Maroondah, which saw her receive an Australia Day Community Service Award in 2015.

“What an incredible achievement to have served the local community for 44 years. We are grateful for Carmel Black’s unwavering care, professionalism and dedication, which has helped to keep hundreds of Maroondah families safe over the years.”

“Maroondah City Council are great to work for and have always been helpful,” Carmel said. “I really don’t know where the years have gone. It doesn’t feel like 44 years!”

After retiring at the end of Term 2, Carmel is looking forward to a few sleep ins, catching up with friends and family, gardening and reading without needing to watch the clock. Support from the school community has been “a bit overwhelming” - a testament to the role Carmel has held all these years.

“I haven’t just been a school crossing supervisor; I’ve been part of the school team and part of the family.”

Maroondah’s older residents can enjoy great food, great company and great fun during dinner parties held at Council’s Kerrabee social support base.

Kerrabee hosts four dinner parties throughout the year to help residents feel more connected with the community as they share an evening meal together and take part in fun games and activities.

For a small fee, Maroondah residents aged 65 years and over, or 50 years and over for Aboriginal and Torres Strait Islander residents, can enjoy a twocourse meal, friendly conversations, entertainment and/or activities. Transport options are also available to assist residents to feel confident to attend.

For many, the dinner parties are much more than a meal.

“The parties are fantastic. It’s so important for us to have this evening out. We’ll get out to lunch with family, but we never get out of an evening, so it’s just terrific,” Beth said.

“I like the atmosphere at the parties - the friendly faces, the way we are looked after, and the effort put in,” Andree said.

The parties are part of Council’s social inclusion and wellbeing program

Mayor of Maroondah, Councillor Rob Steane, said the program provides support to senior residents who have support needs, a disability, or who are socially isolated.

“Council’s social inclusion and wellbeing program is so important for residents who, due to limited capacity, disability, isolation or other factors, may feel lonely.

“By providing opportunities to get out and about and make new connections, the program helps residents feel more independent and more connected with the community,” Cr Steane said.

Along with dinner parties, Kerrabee offers social opportunities and activities that can include woodwork, craft, gardening, exercise, games, outings, guest speakers and entertainers.

“I’m here once a week for the support group and we’ve got some outings, which I really look forward to,” Andree said.

“We do all sorts of things. Sometimes we have daily exercises and lots of outings. Sometimes we have lunch somewhere or go to Bunnings. There is a different activity every time.”

Max has been attending Kerrabee for about 18 months. He enjoys the “good camaraderie” and the range of activities on offer.

“We do heaps of activities. We have an outing once a month and we get to choose those.

Council also offers guest speakers. They had a volunteer come along from the Stroke Foundation. We have artists, we have singers - it’s really good,” Max said.

“The Council program is excellent. We’re so lucky in Maroondah to have a program like this. The staff are excellent and the people are really friendly.”

“The staff are fantastic,” Beth said. “They look after every care.”

The next dinner parties will be held in September and December.

To find out more about Kerrabee’s dinner parties or the social inclusion and wellbeing program, contact Jane, Council’s Program Leader Social Inclusion and Wellbeing, on 1300 88 22 33 or email kerrabee@maroondah.vic. gov.au

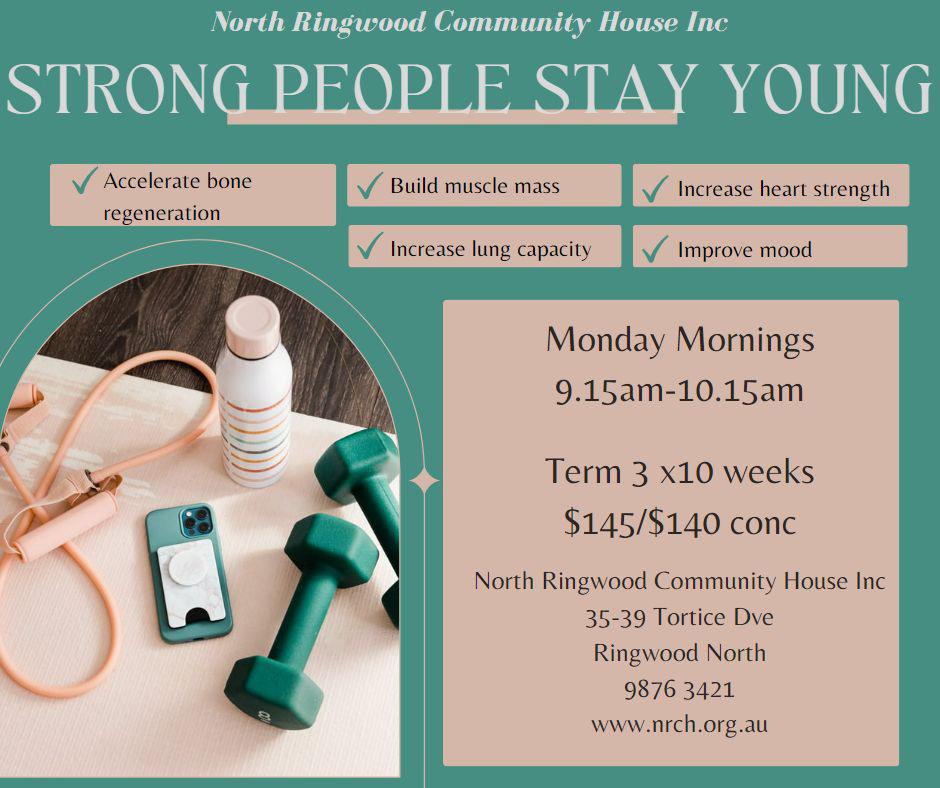

In 2015 North Ringwood Community House Inc moved to our new location within the Parkwood Hub on Tortice Drive in Ringwood North.

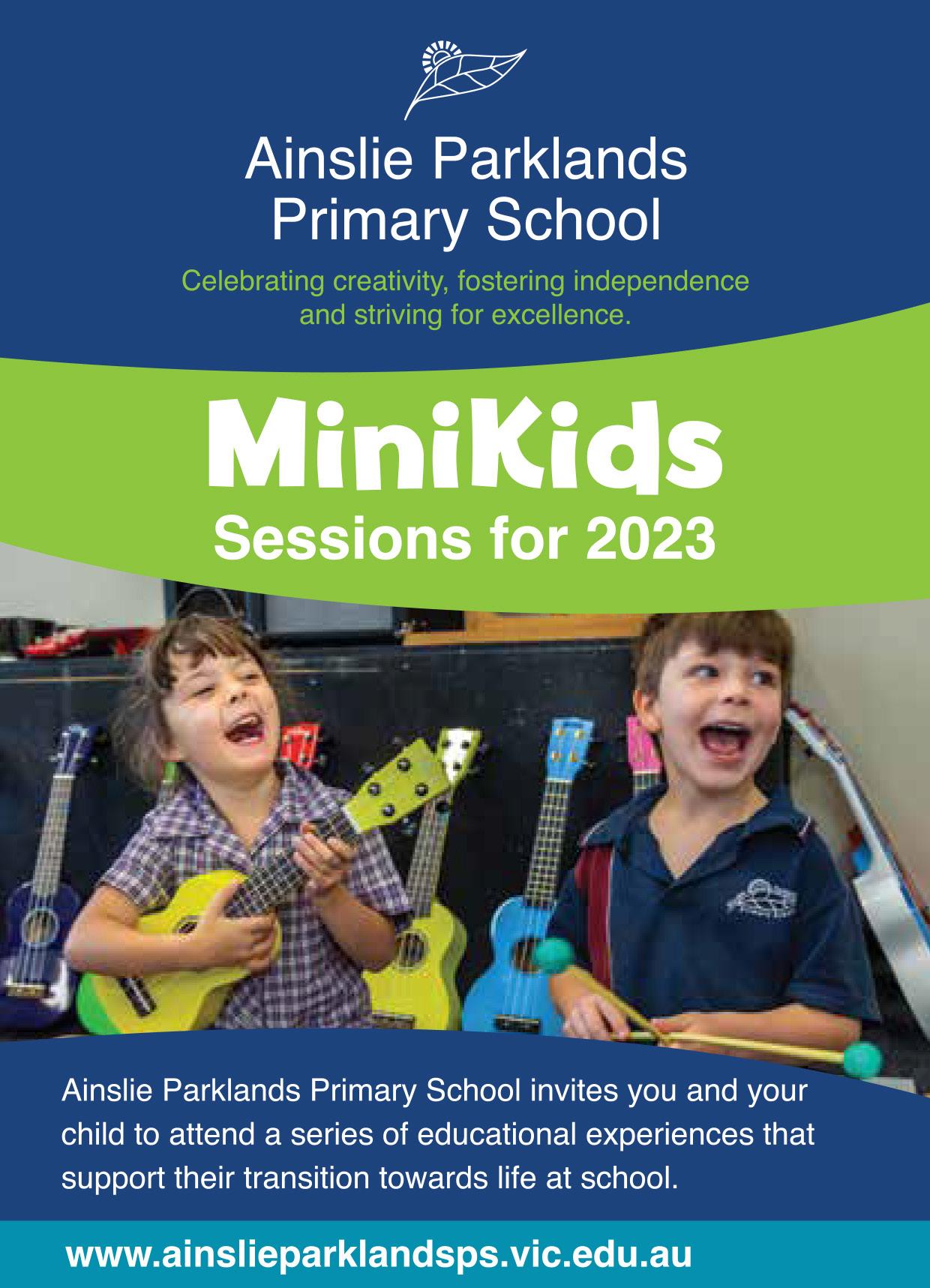

We offer a large variety of activities and classes including Fun Interval Training, Pilates, Meditation, Drawing, Ukulele, social groups, computer courses and many more. We are now taking enrolments for term 3.

We provide room hire 7 days a week for private functions, tutoring or your next meeting. We have a range of rooms that suit most needs.

We strive to provide a welcoming and an all inclusive environment by creating opportunities for lifelong learning and social connections. Our friendly and dedicated staff and volunteers ensure we maintain a supportive space and aim for all patrons to leave feeling valued and excited to visit again.

North Ringwood Community House Inc.

35-39 Tortice Drive, Ringwood North 3134

Telephone: 9876 3421

Website: www.nrch.org.au

Email: admin@nrch.org.au

ABN: 78 052 679 939

Registered Training Organisation: No: 6434

Do you have a will? Do you have children? Who will decide what happens to them if you die? Did you know - if you die without a will the law decides what will happen? Your wishes or your current situation won’t be considered.

Don't leave your legacy to chance. Join us for information on how to protect your children and your assets. Ensure your wishes are carried out both during your lifetime and after your death.

You will hear from a qualified professional from local law firm Hutchinson Legal, have a chance to ask questions and enjoy a complimentary light lunch with other community members. Don’t miss this opportunity to take control of your family’s future. Register now and secure your legacy.

Wednesday 17 May 11:00am - 2:00pm

Ringwood U3A is looking for volunteer tutors and/or class leaders for their 2023 courses.

If you have a skill, interest or hobby which you are willing to share with others, Ringwood U3A offers a friendly and relaxed environment where you can make new friends and share your interests with the other U3A members.

Ringwood is a small and friendly group which operates out of 2 convenient and comfort locations in Ringwood which are well equipped to host classes.

Alternatively if you are looking to join our U3A we offer varied courses which cover exercise, craft, discussion groups, wine tasting/education, games, languages and more.

To learn more, look at our website u3aringwood.org.au, email info@u3aringwood.org.au or ring 0481 591 224.

Boronia View Club will be meeting on Friday 21 July at 11.30am at Eastwood Golf club Liverpool Rd., Kilsyth with a 2 course lunch costing $27 followed by Jennie Wynd (Victorian Advisor-Melbourne VIEW Clubs) speaking about "The Smith Family support program". There will be a bookstall, trading table and raffle with all monies raised going to the Smith Family learning for Life program to help needy Australian children with their educational requirements. The club is looking for new members so ladies of all ages and backgrounds please come along and you will be most warmly welcomed. There is also opportunity for outings, film mornings, book club, coffee mornings etc.

Enquiries to Judith on 9764-8602

Have you ever thought about becoming a foster carer?

VACCA are seeking carers from all walks of life to care for Aboriginal children from the ages of 0 to 18. VACCA offers Emergency, Respite, Short and Long Term Care.

Reach out today for more information using the link www.vacca.org/page/get-involved/foster-care

If life is what happens when you’re making other plans, retirement is no exception. Thanks to health issues, redundancy and family responsibilities you might be saying goodbye to working life before you’re good and ready.

If you are in a position to put your plans for retirement into action, health, wealth and happiness are all up there as things to think about. From finances to feelings about leaving work, this article is all about the things to keep in mind when planning for life beyond the 9 to 5.

A job can be more than a way to get paid. When colleagues and career mean more to you than the money, moving on can be tough. If you’re expecting retirement to leave a big gap in your life, planning new routines, rewards and friendships will boost your sense of optimism and wellbeing. By thinking about this ahead of time, and even taking steps to explore options, you can feel like you’re swapping a positive experience of working life for something even better.

“I retired 3 years ago when I decided I’d had enough of work! I love being retired, it’s all about freedom to do what I want, no routine, and not having to be on guard all the time like at work.”