Are

our next Copywriter?

Are you our next Bookkeeper?

By Warren Strybosch

The Find Maroondah is a community paper that aims to support all things Maroondah. We want to provide a place where all Not-For-Profits (NFP), schools, sporting groups and other like organisations can share their news in one place. For instance, submitting up-andcoming events in the Find Maroondah for Free.

We do not proclaim to be another newspaper and we will not be aiming to compete with other news outlets. You can obtain your news from other sources. We feel you get enough of this already. We will keep our news topics to a minimum and only provide what we feel is most relevant topics to you each month.

We invite local council and the current council members to participate by submitting information each month so as to keep us informed of any changes that may be of relevance to us, their local constituents.

We will also try and showcase different organisations throughout the year so you, the reader, can learn more about what is on offer in your local area.

To help support the paper, we invite local business owners to sponsor the paper and in return we will provide exclusive advertising and opportunities to submit articles about their businesses. As a community we encourage you to support these businesses/columnists. Without their support, we would not be able to provide this community paper to you.

Lastly, we want to ask you, the local community, to support the fundraising initiatives that we will be developing

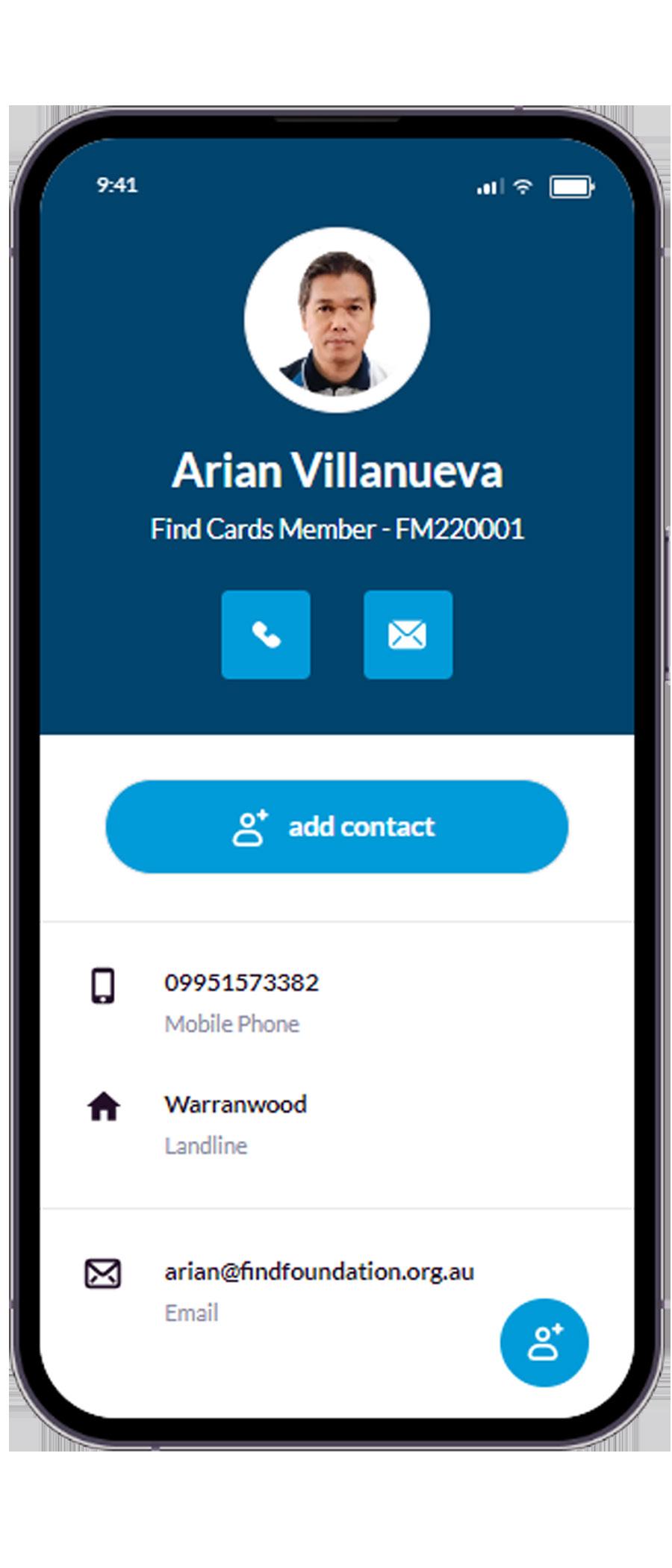

and rolling out over the coming years. Our aim is to help as many NFP and other like organisations to raise much needed funds to help them to keep operating. Our fundraising initiatives will never simply ask for money from you. We will also aim to provide something of worth to you before you part with your hard-earned money. The first initiative is the Find Cards and Find Coupons – similar to the Entertainment Book but cheaper and more localised. Any NFP and similar organisations e.g., schools, sporting clubs, can participate.

Follow us on facebook (https://www. facebook.com/findmaroondah) so you keep up to date with what we are doing.

We value your support,

The Find Maroondah Team.

EDITORIAL ENQUIRES: Warren Strybosch | 1300 88 38 30 editor@findmaroondah.com.au

PUBLISHER: Issuu Pty Ltd

POSTAL ADDRESS: 248 Wonga Road, Warranwood VIC 3134

ADVERTISING AND ACCOUNTS: editor@findmaroondah.com.au

GENERAL ENQUIRIES: 1300 88 38 30

EMAIL SPORT: editor@findmaroondah.com.au

WEBSITE: www.findmaroondah.com.au

The Find Maroondah was established in 2019 and is owned by the Find Foundation, a Not-For-Profit organisation with a core focus of helping other Not-For-Profits, schools, clubs and other similar organisations in the local community - to bring everyone together in one place and to support each other. We provide the above organisations FREE advertising in the community paper to promote themselves as well as to make the community more aware of the services these organisations can offer. The Find Maroondah has a strong editorial focus and is supported via local grants and financed predominantly by local business owners.

The City of Maroondah is a local government area in Victoria, Australia in the eastern suburbs of Melbourne. Maroondah had a population of approximately 118,000 as at the 2019 Report which includes 9000 business and close to 46,000 households. The City of Maroondah was created through the amalgation the former Cities of Ringwood and Croydon in December 1994.

The Find Maroondah acknowledge the Traditional Owners of the lands where Maroondah now stands, the Wurundjeri people of the Kulin nation, and pays repect to their Elders - past, present and emerging - and acknowledges the important role Aboriginal and Torres Strait Islander people continue to play within our community.

Readers are advised that the Find Maroondah accepts no responsibility for financial, health or other claims published in advertising or in articles written in this newspaper. All comments are of a general nature and do not take into account your personal financial situation, health and/or wellbeing. We recommend you seek professional advice before acting on anything written herein.

By Gen Alcampor

In the heart of Victoria’s education landscape, the Victorian Certificate of Education (VCE) stands as one of the most important academic qualifications for high school students. With nearly 50,000 students undertaking their final exams each year, the VCE not only marks the end of secondary education but also plays a crucial role in shaping students’ futures. Covering a range of academic subjects and vocational studies, the VCE is a comprehensive program that demands dedication, perseverance, and resilience from students across Victoria. For many, it represents the culmination of years of study and serves as a gateway to higher education or the workforce.

The VCE is typically completed over the last two years of secondary schooling, Year 11 and Year 12. Students choose from over 90 subjects, ranging from core disciplines like English, Mathematics, and Science to more specialised areas like Art, Media, and Environmental Studies. The flexibility of the VCE allows students to tailor their studies to align with their interests, abilities, and future goals. Some students may opt for vocational subjects through the Victorian Certificate of Applied Learning (VCAL), which offers a more hands-on learning experience, while others focus on academic courses that prepare them for university pathways.

At the heart of the VCE experience is the Australian Tertiary Admission Rank (ATAR). The ATAR is a ranking system used by universities across Australia to assess applicants for various undergraduate courses. Based on students' final VCE scores, the ATAR provides a numerical rank between 0 and 99.95, indicating their performance relative to other students. For many students, achieving a high ATAR is crucial as it directly impacts their chances of admission to competitive university programs, including medicine, law, and engineering. However, while the ATAR holds significant weight, students are encouraged to focus on both academic achievement and personal growth throughout the VCE process.

The VCE is not without its challenges. High expectations and the pressure to perform well can lead to significant stress among students. Balancing rigorous study schedules, extracurricular commitments, and social lives can be overwhelming, with many students struggling to maintain a healthy work-life balance. In recent years, the Victorian government and schools have recognised the importance of mental

health support for VCE students, introducing initiatives to address these pressures. Schools now offer a range of resources, such as counselling, study skills workshops, and time management programs, to help students cope with the demands of the VCE.

Additionally, the COVID-19 pandemic disrupted the learning experience for many VCE students, with remote learning becoming the norm for much of 2020 and 2021. For students preparing for their final exams, the shift to online education posed unique challenges, with limited access to in-person support from teachers and peers. Despite these setbacks, Victorian students showed resilience and adaptability, with many developing new study habits and finding creative ways to stay motivated during challenging times.

VCE is as much a community effort as it is an individual journey. Teachers, parents, and classmates play a significant role in supporting students through this demanding period. Teachers work tirelessly to ensure that students receive the resources and guidance they need to succeed, often going beyond the classroom to provide extra tutoring or encouragement. Parents, too, form a crucial support system, helping students manage their time, prioritise tasks, and stay focused. Some communities even organise "study camps" or workshops for VCE students, providing a space for focused learning and collaborative study.

In addition to academic support, schools have made strides in promoting overall well-being for VCE students. Physical activities, mindfulness programs, and social events are encouraged as part of the VCE experience to help students manage stress and maintain their mental health. These initiatives are essential in fostering a positive and balanced approach to studies, reinforcing the message that well-being is just as important as academic success.

As the demands of the modern workforce evolve, so too does the VCE. The Victorian government has introduced new subjects and is considering changes to the curriculum that reflect emerging fields such as information technology, sustainability, and health sciences. These updates aim to ensure that students are equipped with the skills and knowledge needed in an increasingly globalised and digital world.

The emphasis on STEM (Science, Technology, Engineering, and Mathematics) has grown, as has interest in creative and vocational pathways. Programs like VET in Schools (VETiS) and School-Based Apprenticeships allow VCE students to gain practical skills and experience while completing their studies, providing alternative routes into the workforce and higher education. These initiatives highlight the VCE’s commitment to inclusivity and adaptability, preparing students not only for exams but for life beyond school.

By Liz Sanzaro

Who is looking out for the elderly, the young, the disabled and others who have urgency issues. It seems like a Public Toilet is just too hard in some places for our new way of living. Maroondah Council has ruled out putting one into Staley Park, behind Costco, in Seymour Street as part of the renewal of that area.

It will be the only close pocket park for residents from the expected highrise apartments to be accommodated adjacent to Seymor St, as the Maroondah master plan shows. Good feedback regarding the new proposed plans for the park, have suggested more planting, some excellent play equipment for children, and the removal of the skate park, which currently attracts undesirable elements to the area. In short it will be a restful green space, for families and anyone wanting to enjoy some time outside.

But Council stopped short of saying yes to a toilet facility, citing vandalism and drug issues. Along with picnic facilities and a free water filling station, one would expect a toilet to be provided. Instead, the Council has suggested people can cross Ringwood St and navigate into Eastland to use their facilities. Council has had the plan for Staley Gardens open for community comment recently.

Not a well lit, or safe looking environment, for many to feel comfortable. Really this is appalling for people who are ageing, infirm, mums with toddlers, anyone with mobility issues or urgency issues.

However further research indicates that as a society we are slowly realising the need for those for whom a regular toilet is unusable.

Maroondah is already home to seven Changing Places facilities. These are located at:

• Realm, Ringwood Town Square

• Eastland, Ringwood (two facilities)

• Ringwood Lake, Ringwood

• Jubilee Park, Ringwood

• Maroondah Nets, Heathmont

• Croydon Town Square, Croydon

If you are likely to need to use a hoist at one of these facilities you will need to bring with you your own sling.

Other ways to develop pride in public facilities is this beauty of Urinals at a garden centre in the UK https://www. bartongrange.co.uk/

Changing Places are a key component of Victoria’s Universal Design approach to ensure the built environment is accessible for all Victorians with 83 Changing Places, including portable facilities (Marveloo or Placeable Pod) have been funded across Victoria.

President of Croydon Conservation Society liz@sanzaro.com | www.croydonconservation.org.au

As we anticipate ageing in place, looking after the disabled with inclusiveness so that they may travel with a carer to public exhibitions, art galleries, sports functions etc. There is an increased need to provide for everyone, the meaning of “inclusiveness”.

I need to go NOW!

Likewise at Ringwood East Station there will be no public toilet at the station, instead anyone requiring a toilet will have to navigate across Railway Avenue, then up the alleyway alongside the IGA to the rear carpark, to use that facility, if it is within opening hours.

By Jodie Moore

I think receipts must be the bane of every small business as well as individuals. Why should you keep them? Where should you keep them?

Over the past few years, the ATO has become a lot more stringent on individuals and businesses, both large and small, being able to substantiate their expenses. A proper receipt will show an itemised record of what was purchased as well as the GST component. Not everything purchased will be claimable, so the ATO needs to know what was bought to make this determination.

Receipts need to be kept for 5 years from the date your tax return is lodged. They can be stored electronically or in a shoebox, whichever is your preference. Storing them both electronically and physically can help reduce the risk of losing them – physically losing them in a flood or fire, or electronically losing them by your data becoming corrupted.

You are probably in the process of doing your tax returns for the year or looking

to do them within the next couple of months. Be prepared for your accountant to ask you for your receipts even if they haven’t done so in the past. This is an ATO requirement, not the accountant being pedantic so please don’t shoot the messenger

If you truly do not have receipts for an item, let your accountant know. Depending on what it is, they may still be able to claim it, but you will be required to explain why you don’t have a receipt should you be audited. The ATO may accept other forms of substantiation in combination with others.

For example, it may not be enough to show the transaction on your bank statement as that doesn’t show the item and GST, however you may be able to combine it with an advertisement cutout or website screenshot showing the item with the price and date.

It is up to the ATO as to what they will accept so be prepared now by either correctly storing your receipts, making a diary entry as to the item/s purchased, price, GST etc, providing evidence as to what the bank transaction was for or any other way that you can to show the information the ATO requires.

Keeping your receipts though isn’t just about making the ATO happy. It helps you to reconcile your expenses and bank statements, monitor the costs of your business, produce your financial reports to better understand your business, avoid conflict by being able to provide evidence should the need arise, claim more deductions and many other reasons.

If you use accounting software such as Xero, you can use the app to upload your receipts straight into Xero for easy reconciliation and storage. If you don’t use software you could take a photo of every receipt and save them in a folder on your desktop. When storing receipts as physical copies, it is worth the additional time now to have some sort of system. This will help with locating them later on. This can be simply paperclipping them by month or storing them by category (motor vehicle, donations, work clothes etc). Finding a system that works for you will pay dividends in the future should you need to locate a specific receipt, and it really doesn’t need to take up a lot of time.

How you store them is up to you, just make sure they are easily accessible at tax time.

By Ethan Strybosch

Volunteers are the backbone of many non-profits, providing essential support and resources to help further your mission.

Here’s a step-by-step guide to managing volunteers effectively:

1. Set Clear Expectations

From the outset, define specific roles, responsibilities, and goals for each volunteer. Clear expectations help ensure that everyone understands their contributions and how they align with the organisation's objectives. This clarity can significantly enhance engagement and accountability.

2. Provide Comprehensive Training

Equip your volunteers with the necessary tools and knowledge to succeed in their roles. Offering thorough training sessions not only prepares them for their tasks but also boosts their confidence. Regularly update training materials to reflect new processes or policies, ensuring that volunteers always have the most current information.

3. Show Appreciation Regularly

Acknowledge and recognise the hard work and contributions of your volunteers. Regularly expressing gratitude— whether through shout-outs at meetings, personalised thank-you notes, or volunteer appreciation events— can strengthen morale and loyalty. Celebrating milestones and successes together also fosters a sense of community and belonging.

4. Offer Growth Opportunities

Encourage volunteers to develop their skills and take on leadership roles. Providing opportunities for advancement can motivate dedicated volunteers to deepen their commitment. Consider implementing mentorship programs or offering workshops to help them grow professionally while benefiting your organisation.

5. Maintain Open Communication

Foster an environment where volunteers feel comfortable sharing their feedback and concerns. Regular check-ins can help address any issues before they escalate and allow you to gather valuable insights on their experiences.

6. Create a Community

Build a supportive community among your volunteers. Organise social events, team-building activities, or group projects to enhance relationships and foster collaboration. A strong community can lead to higher retention rates and a more engaged volunteer base.

7. Evaluate and Adapt

Periodically assess your volunteer management practices to identify areas for improvement. Gather feedback from volunteers about their experiences and adjust your strategies accordingly. This continuous improvement approach can help ensure that your volunteer

program remains effective and responsive to their needs.

By implementing these tips, your nonprofit can cultivate a dedicated and effective volunteer team that enhances your mission and supports your organisation’s growth.

Engaged volunteers are not only more productive but also become ambassadors for your cause, spreading awareness and enthusiasm within the community.

at the company tax rate and again at your marginal tax rate). If your tax rate is less than the company tax rate (currently 30%) you will receive a refund for the extra tax paid by the company. If your tax rate is higher you may need to pay some extra tax.

By Erryn Langley

By Warren Strybosch

There are a number of steps to follow to build a portfolio that suits your financial goals and preferences. These steps are illustrated in the diagram below:

Property: An investment in property provides you with ownership in a property or a number of properties through a managed structure. Property investments allow you to benefit from the rent received by the properties as well as the change in the valuation of the property over time. The returns of these properties will depend on the quality of the tenant and the rent paid as well as the location and type of property such as residential, industrial or commercial.

Bonds (fixed interest): A bond is a tradeable debt security, usually issued by a government, semi-government or corporate body to raise money. Investors in the bond have effectively lent money, for which they receive a fixed rate of interest over a set period of time. The bond is repaid with interest on the predetermined maturity date.

For example, if you invest in a 5 year bond paying 3% coupon you will pay $1,000 to invest in the bond. In return, you will receive $30 (3% of $1,000) each year. At year 5, you receive the coupon of $30 plus the original $1,000 outlay.

It is possible to experience capital losses from a bond investment if it is cashed before maturity and interest rates have risen or capital gains if the reverse occurs. They are not as safe as cash.

Determine the structure for holding the investments

Determine the most suitable investment strategy for your circumstances

An explanation of these key steps is provided below.

Understand the Key Asset classes

It is important to understand the main asset classes and how they can affect the returns and risk of your portfolio. The types of asset classes include:

• Shares

• Property

• Bonds (or fixed interest as they are often called)

• Cash

There may be asset types within each asset class. For example, within shares, there is a choice of Australian and international shares and within international shares, there is choice of specific regions or countries like China or emerging market shares.

Generally ‘growth’ assets like shares and property provide the prospect of higher returns over the long term compared to ‘safer’ assets like bonds and cash. However growth assets have a higher level of risk including the risk of capital loss and more ups and downs in returns particularly over the short term.

‘Growth’ assets are only appropriate if you have an investment time horizon of at least five years due to their higher level of inherent risk.

Shares: Shares represent part ownership in a company and usually provide income payments through dividends and can produce growth if the share price increases.

For Australian companies, these dividends can be franked, which means that you receive a tax credit for the tax already paid by the company so that you are not taxed twice (once

Cash: Cash is one of the safest investments. Cash compared to other assets tends to provide lower variability in returns, high level of security on the capital invested and acts as a more defensive investment. This reduces investment risk so the money is available when you need it, with a minimal potential for capital loss.

The returns from the various asset classes are provided in the form of income and/or growth resulting from a change in the price of the investment. Some investments like cash will only provide income returns while the return from other investments may include a mix of income and capital growth.

Income returns can include interest from cash and bonds, rental income from property and dividends from shares. Managed fund may also pay realised capital gains as part of the income return.

This income is included in your tax return and is taxed at your marginal tax rate. If franking credits have been derived these will be passed onto you and can help to reduce tax payable.

If an investment is sold, this may create a capital gain or loss depending on whether the price of the security or unit price of managed funds has changed since investment. If a capital gain has been realised on units held for more than 12 months a 50% capital gains tax discount will apply unless the units were owned by a company.

You can invest in a mix of asset classes or securities as a means of ‘diversifying’ your portfolio. Diversification is a key investment principle used to manage the risks of a portfolio and involves investing in a variety of assets and investments that perform differently to each other over time. It is often described by the proverb “Don’t put all your eggs in one basket”.

It also allows you to have an exposure to a spread of assets and securities including both ‘growth’ and ‘defensive’ assets. It

means that you avoid taking big bets in one or a few asset class and/or investments that may adversely affect your returns if it underperforms.

Diversification can reduce the risk in your portfolio but it will not eliminate the risks. Your portfolio is likely to experience ups and downs in returns over time but by a lower level of variability.

You can access assets and/or securities by buying the investment directly or via a managed trust. Direct investments involve buying the security such as a specific share or property such that you are a part or full owner of the security. As an example, you can become an owner in a specific company by buying its shares on the Stock Exchange which entitles you to receive dividends and vote at General Meetings (depending on your share structure).

An alternative means of gaining exposure to assets is via a managed fund. A managed fund is a professionally managed investment portfolio that pools the money of multiple investors. A fund manager is appointed to manage the fund including selection of the underlying investments and maintaining client records. By pooling money with other investors you may gain access to investments not normally available if you invested directly or enable you to achieve a greater level of diversification.

If you invest money into a managed fund you will receive a number of ‘units’ in that fund. The number of units you receive is calculated as the amount of money you invest divided by the unit price on that day. This is why managed funds are also often called “unit trusts”. The unit price may increase or decrease in line with the value of the underlying investments.

Each investment approach has its advantages and disadvantages that you should consider. These will include the implications for fees and investment control.

Investing directly in securities may require you to actively review and manage the investments in your portfolio on a regular basis. You may be required to make decisions and changes to account for corporate action events in the case of buying shares directly such as takeovers, rights issues and share purchase plans. This can require you to have the time and inclination to manage your direct investments portfolio. On the flip side, the advantage provided by a managed fund is that you do not need to devote the time to be actively involved in the investment decisions.

There are a number of factors that you need to consider to determine the most appropriate investment for your personal preferences and financial goals. A key driver of this decision is your risk profile which measures your attitude towards risk. Your risk profile will depend on how you feel about a range of different issues such as:

• Your comfort and knowledge of investment markets. The higher your knowledge, the more comfortable you may be investing in riskier assets like shares and property.

• Your preference for capital growth (compared to capital preservation and/or income). The higher your preference for growth may be better suited to investing in riskier assets that offer a higher potential for capital growth.

• Your level of concern when markets suffer a loss. If you are likely to sell and feel stressed from this loss, then a lower exposure to risky assets may be suitable.

• How important it is to you for your investments to keep pace with inflation. If this is important to you, then shares and property are more likely to meet this need.

• Your investment time horizon. If you are investing for the long term (at least 5-7 years), then you may consider investing in shares and property. Generally, risky assets are not suitable if you are investing for shorter periods of time and a higher level of investment in cash and bonds may be more suitable.

There are various ways of owning investments and these can include in your own name, in your spouse or kids’ names, via a family trust, superannuation or private company. There are a number of issues to consider when determining the most appropriate structure to hold the investments and these include the following:

• Tax

• Fees and costs

• Liabilities and responsibilities

• Flexibility and complexity

• Estate planning

Once you have decided on your portfolio, there are various approaches to investing and withdrawing your money.

If you are concerned about the ups and downs in financial markets and are unsure about whether it is a good time to invest in risky assets, you can consider investing using a ‘dollar cost averaging’ approach. This involves investing a set amount regularly over a period of time rather than investing the full amount at a single point in time. In this way, you can avoid trying to time your entry into financial markets. By making regular investments over time you may be able to minimise the risk of investing all your money during a market peak. This can help to minimise investment risk and average the purchase price of your investments by buying more assets when prices are low and fewer assets when prices are high.

If you are withdrawing funds from your portfolio, you can use a regular drawdown strategy that has similar benefits to dollar cost averaging (but in reverse). That is, you can withdraw funds over time rather than withdrawing the full amount at a point in time. In this way, you can minimise the risk of withdrawing all your funds from financial markets at the bottom of the market.

Your portfolio can benefit from ‘compounding interest’ particularly if you reinvest your income returns. If the interest you receive is added to your initial investment, you can receive interest on the total amount and effectively receive interest on the interest reinvested. This is called ‘compound interest’ and has the effect of increasing your overall returns. The more frequently that interest is calculated, the higher will be the compounded returns.

Aotearoa New Zealand is a land of birds, from the smallest of wrens to the mightiest of moa. The ancestors of some species have been here for tens of millions of years, while others arrived only a few million years ago.

So a recent suggestion that moa and kiwi are recent immigrants from Australia, while wrens and kākāpō are New Zealand’s truly ancient birds, was sure to ignite controversy.

The contentious report was based on a scientific review of fossils found at St Bathans in Central Otago.

However, putting dates on arrivals requires a combination of both physical fossil evidence in deposits of a known age and genetic dating techniques that determine when the birds we know today diverged from their closest relatives.

Dating the arrival of birds in New Zealand

New Zealand is part of the larger continent of Zealandia, which finished separating from the supercontinent Gondwana some 57 million years ago.

Some familiar animals were likely present in proto-New Zealand at this time, including our unique silent frogs, the ancient tuatara and many invertebrates. Tens of millions of years of dispersal of both plants and animals followed.

Fossils and DNA allow us to explore these dispersal events in detail. Fossils can preserve evidence for millennia longer than DNA molecules, but DNA can shed light on many processes even when fossils are rare. This quality is particularly valuable since the chance of finding fossils decreases the further back we look in time.

Authors

Both approaches carry their own assumptions and biases that influence calculations of the range of arrival times.

Our team uses ancient DNA to date these arrivals, showing for example that the purple swamp hen ancestors of takahē and moho arrived in Aotearoa New Zealand around four million years ago from Australia, as part of a suite of openhabitat birds that included ancestors of the kakī black stilt, pouākai Haast’s eagle and kērangi Eyles’ harrier.

Other genetic studies have shown the ancestors of New Zealand wrens, the most primitive of all perching birds, split off about 50 to 60 million years ago. Wren fossils are part of the wonders unearthed at St Bathans, alongside remains of both moa and kiwi.

Genetic and morphological analyses of ratites (such as ostrich, kiwi, moa and elephant birds) suggest the ancestors of moa and kiwi reached Zealandia, separately, around 50 to 60 million years ago. Both groups filled the job vacancy in the ecosystem left by dinosaurs, becoming large and flightless.

The kākāpō, meanwhile, along with the kākā and kea, belong to a family that split off from all other living parrots very early on; they, too, are an ancient group. But genetic dating of their arrival in Zealandia remains unresolved, with studies variously putting it between 20 to 80 million years ago.

Precise dating of these splits presents a significant challenge. Nevertheless, the range between 30 million and a few million ascribed to the moa and kiwi by the recent announcement is not borne out by available evidence – and neither group is Australian as reported.

Moa are most closely related to the flying chicken-sized tinamous from South America, and kiwi are relatives of the giant extinct elephant birds from Madagascar. Indeed, Australia did not even exist as a discrete entity 50 to 60 million years ago; it was still firmly affixed to Antarctica and South America.

Exactly what routes the ancestors of moa and kiwi took to reach Zealandia remains unknown. They were part of a group of flying birds with a worldwide distribution called Lithornids, which lost flight many times independently and evolved into the ratites we know today.

The bones will speak

The St Bathans fossil deposit has given us an indispensable window into prehistoric New Zealand, and in many ways it is familiar – the bones of moa, kiwi, parrots, wrens and bats provide a reassuring continuity.

By Kathryn Messenger

I find it so interesting that one of the minerals that is removed from the sugar cane as it is processed is the same mineral that helps prevent sugar cravings, which is just another reminder that we should be eating foods in their natural form.

When white sugar is made, the juice from the sugar cane is stripped of all its nutrients so that we're left with just the simple carbohydrate. Raw sugar has a tiny bit added back in and brown sugar a little bit more. The problem here is that if the nutrients were never removed, we wouldn't be constantly craving the sugar, so let’s look at adding them back into our diet.

Blackstrap molasses, or simply molasses as it's known in Australia, is the by-product of refined sugar, and because so much of the water has evaporated in the process of making sugar, it's particularly high in nutrients.

One of the minerals that has been highly studied in both its ability to regulate metabolism, as well as reduce sugar cravings is chromium. Chromium improves glucose metabolism in those with type 2 diabetes, as well as reducing cholesterol levels. What's interesting is that this mineral is highly concentrated in molasses, whilst a diet high in sugar will deplete your body of chromium. This explains why sometimes once you start eating sugar, you can just keep going.

But it doesn't stop there, molasses is also high in iron, calcium, magnesium, and manganese, all of which are important for bones and muscles. It also contains phosphorus, potassium, zinc, selenium, copper, cobalt and iodine, some B vitamins, and antioxidants. Because of its high mineral content, molasses is often given to animals to keep them healthy, while we eat the sugar!

Now before you throw back a tablespoon of molasses, let me give you some tips on how to eat it, because it has some

pretty strong flavours and I don’t want you giving up before you get started.

Chai tea - because the spices in a chai have strong flavours, a teaspoon of molasses is a lovely sweetener without it being overwhelming.

Baked goods - in combination with other sweeteners, molasses can be a great choice here, especially when there are spices or fruit: banana bread, date and cinnamon muffins, etc

Asian cooking - when there is a sweetener required, molasses is a great choice.

If you need further help with sugar cravings or regulating your glucose, let me know.

By Warren Strybosch

With the changes in legislation around Working From Home (WFH) expenses and the recent court case whereby a taxpayer was denied a lot of expenses, we thought it would be best to review WFH expenses.

People are often confused as to what you can and cannot claim when doing work from home. It has become even more confusing now that there are two methods you can choose from.

Firstly, let’s look at who is eligible to claim WFH and then we will discuss the two methods you can use to calculate your WFH entitlement.

To claim working from home expenses, you must:

• be working from home to fulfil your employment duties, not just carrying out minimal tasks, such as occasionally checking emails or taking calls

• incur additional running expenses as a result of working from home

• have records that show you incur these expenses.

Where you incur running expenses for both private and work purposes, you need to apportion your deduction. You can only claim the work-related portion as a deduction.

Running expenses relate to the use of facilities within your home. These expenses are generally considered private and domestic expenses. You can claim a deduction for additional running expenses you incur as a direct result of working from home.

Additional running expenses may include:

• electricity or gas (energy expenses) for heating or cooling and lighting

• home and mobile internet or data expenses

• mobile and home phone expenses

• stationery and office supplies

• the decline in value of depreciating assets you use for work – for example

º office furniture such as chairs and desks

º equipment such as computers, laptops and software

• the repairs and maintenance to depreciating assets.

• In limited circumstances where you have a dedicated home office, you may also be able to claim:

• occupancy expenses (such as mortgage interest or rent)

• cleaning expenses.

If your employer pays you an allowance to cover your working from home expenses, you must include it as income in your tax return.

From 1 July 2022 there are 2 methods available to calculate your claim:

• Fixed rate method

º an amount (67 cents) per work hour for additional running expenses separate amount for expenses not covered by the fixed rate, such as the decline in value of depreciating assets

º you no longer need a dedicated home office.

The fixed rate method allows you to claim a set rate per hour you work from home and covers expenses that are often difficult to apportion. This includes:

• data and internet

• mobile and home phone usage

• electricity and gas

• computer consumables (for example, printer ink)

• stationery.

You cannot claim a separate deduction for any of the expenses the fixed rate includes.

You can claim a separate deduction for:

• the decline in value of assets used while working from home, such as computers and office furniture

• the repairs and maintenance of these assets

• cleaning (if you have a dedicated home office).

• Actual cost method

º the actual expenses you incur as a result of working from home.

You must keep records to show you incur expenses as a result of working from home. The type of records you need to keep will depend on the method you choose to calculate your expenses.

Most tax agents and accountants will now opt for the Fixed Rate method for two reasons: a) You don’t need a dedicated office space. Often taxpayers would argue they had a dedicated space when in fact the space might also be used for personal use e.g., a desk in the bedroom or a computer table in the corner of the loungeroom; and b) the actual cost method is, if you want to do it right, very time consuming and prone to error.

The actual cost method requires detailed calculations and records. For example, you will need to know and have records of the cost per unit of electricity and average units used per hour. For most taxpayers, they could not be bothered trying to work out the cost per unit of each electrical item in the area for which they work in and so the Fixed Rate method is now the preferred option.

Even so, some taxpayers get confused as to what they can and cannot claim and

believe the ATO won’t look to closely at WFH deductions they try and claim.

This was the case with one taxpayer who decided to claim several expenses without keeping accurate records under the Actual Cost Method. The taxpayer was taken to court whereby the AAT confirmed that a taxpayer was not entitled to deductions for expenses associated with working from home as they were of a non-deductible private or domestic nature and/or because record keeping requirements had not been met. In relation to home office expenses for several rooms in the house which the taxpayer claimed were used exclusively as an office, the AAT found that the rooms were “integrated” with other rooms in the house that were used for private or domestic purposes. The AAT also found that expenses incurred in relation to his spouse providing office and management services were of a private nature associated with running the home. The AAT also ruled that tax management costs paid to his spouse were not deductible as she was not a registered tax agent as required. In relation to motor vehicle expenses and deductions for computer equipment etc, the AAT found there was a lack of documentary evidence to support the claims. In conclusion, the AAT found that the taxpayer failed to show that the expenses claimed were incurred in gaining or producing assessable income. (Shugai and FCT [2024] AATA 3619, 10 October 2024.)

Even with the Fixed Cost Method, you must now keep a logbook of the actual hours you work each and every day at your home otherwise the deductions can be denied.

It is important that taxpayers understand that it is their obligation to provide satisfactory evidence to their tax agent or accountant if they wish to claim WFH expenses. It is not good enough to just provided an arbitrary number or amount to their tax agent or accountant who will be lodging the return. The tax agent/accountant has an obligation now to verify the information before it is lodged or they themselves could face disciplinary action for not doing so.

You can call them on 1300 88 38 30 or email info@findaccountant.com.au / www.findaccountant.com.au

This information is of a general nature only. Itdoesnottakeintoaccountyourparticular financial needs, circumstances and objectives. You should obtain professional financial advice if you have not already done so before acting on this information. You should read the Product Disclosure Statement (PDS) before making a decision to buy or sell a financial product. Any case studies, graphs or examples are for illustrative purposes only and are based on specific assumptions and calculations. Past performance is not an indication of future performance. Superannuation, tax, Centrelink and other relevant information is current as at the date of this document.This information contained does not constitute legal or tax advice.

WArren Strybosch

Realm and Croydon Library in Maroondah provide extensive community resources and services, attracting residents for more than just book borrowing. Located in Ringwood and Croydon, these libraries are part of the Eastern Regional Libraries network, which also includes the Knox and Yarra Ranges regions. Together, they host activities, events, and resources aimed at community engagement and lifelong learning.

Realm, situated within Eastland in Ringwood, offers a unique blend of library services, cultural experiences, and co-working spaces. It features over 45,000 books, e-learning programs, a dedicated children's area, and regular exhibitions in its art space. The library also organizes events such as author talks, youth programs, and thought leadership forums, positioning itself as a hub for knowledge and innovation in Melbourne's eastern suburbs. Additionally, Realm includes the Centre for Regional Knowledge and Innovation, which focuses on fostering learning and collaboration.

In the world of ecology, mutualism stands as one of nature's most remarkable relationships, where different species interact in a way that benefits them both. In a secluded spot in Australia known as Bungalook, mutualistic relationships are not just theoretical—they play out daily in a rich, thriving ecosystem. Bungalook, hidden away amidst lush greenery and ancient trees, offers a perfect stage for mutualism to flourish. This natural haven is home to various plant and animal species that have evolved unique relationships, helping each other survive and thrive. These partnerships are based on mutual dependency, with each participant offering something the other needs.

Tai Chi (Taiji) is often described as a slow, graceful martial art, practiced worldwide for its health benefits, meditative qualities, and philosophical depth. While many people begin their Tai Chi journey as a means of improving flexibility, balance, and mental focus, those who delve into advanced Tai Chi discover a richer, more complex experience that goes far beyond basic movement. Advanced practitioners focus on refining their technique, enhancing their internal energy (Chi), and applying Tai Chi principles to more sophisticated levels of practice.

It typically involves a deeper exploration of the form, techniques, and philosophy behind the practice. In the Paul Lam style, which is known for its focus on health benefits, the advanced level would likely build upon the foundational movements of the form, with an emphasis on internal energy, balance, and fluidity.

November 2024 –Maroondah – A heartwarming event filled with laughter, food, and friendship took place this week as the community hosted its annual Seniors Community Luncheon. The luncheon, which is held every year, brought together dozens of older adults from across the area, providing a muchneeded opportunity for socialization and connection.

It was a vibrant celebration, offering delicious meals and engaging activities for all attendees. From music performances to informative guest speakers, the event was designed to not only provide a tasty meal but to enrich the lives of seniors with a variety of social and recreational experiences. Local organizations and service providers were also present, providing information about healthcare services, senior living options, and upcoming community events. Many attendees took advantage of this opportunity to learn more about how to make the most of their retirement years.

The Burmese Storytime and Play event in Ringwood is a community-focused initiative aimed at engaging children and their families in educational and fun activities. Held at the Ringwood Church of Christ (13-15 Bedford Road, Ringwood), this event is designed to connect attendees with stories, music, and activities that reflect Burmese culture. In addition to the entertainment, it provides an opportunity for participants to access local support services, fostering a sense of community.

The “Elders Portraits” exhibit at Realm in Ringwood, Victoria, is a significant art installation celebrating the lives and contributions of two Indigenous Elders, Aunty Daphne Milward (Yorta Yorta) and Aunty Irene Norman (Wailwan). Created by artist Amanda Wright, these portraits are displayed on the large windows of Realm, a community hub located on Maroondah Highway, which lies on Wurundjeri Country.

This project honors both Elders as Maroondah residents and community figures with strong connections to the Mullum Mullum Gathering Place, an organization that supports Indigenous families and promotes cultural and social engagement. Through these portraits, Wright not only acknowledges the women’s lifelong contributions to their community but also highlights their friendship and shared commitment to cultural preservation and community development.

On 9 June, 2021, in the heart of the COVID-19 pandemic, a catastrophic storm tore through Victoria’s Dandenong Ranges. Dubbed “the worst storm on record,” it unleashed 300 millimetres of rain and winds up to 200 kilometres per hour, devastating the region. Over 1,000 residents were affected, with 168 homes destroyed, businesses flattened, and power outages impacting more than 6,500 homes. In the aftermath, the community was left grappling with homelessness, power cuts, and a critical lack of access to food.

Compelled by a desire to help, local chef Lillie Giang and a group of volunteers launched an emergency relief kitchen in Kalorama. For days, they cooked tirelessly for displaced residents, rescue personnel and volunteers from organisations like the CFA and SES. Lillie recalls, “We were cooking from morning to night, providing meals for the local communities that needed our help, as well as first responders and tradespeople on the ground.”

This spirit of community-led care gave rise to Feed One Feed All (FOFA), a notfor-profit organisation founded by Lillie, which continues to serve people in need across the Maroondah, Knox and Yarra Ranges municipalities. Today, FOFA produces around 1,200 meals each week, supporting a wide range of vulnerable individuals, from those experiencing financial distress and homelessness to victims of domestic violence and survivors of chronic illness.

Since its inception, Feed One Feed All has grown exponentially, reaching more people every day. Lillie and her team of dedicated volunteers work tirelessly to prepare nutritious, home-cooked meals for those doing it tough. “FOFA is all about community,” Lillie says. “We help those in need within our community; we rely on the generosity of the community to do this work, and FOFA itself has an extraordinary community of volunteers, which really is the secret to our success.”

Each meal is prepared with care and compassion, and distributed through local food relief agencies, providing sustenance to people who are struggling with various challenges. The meals reach people recovering from surgery, Aboriginal and Torres Strait

Islander communities, those facing financial disadvantage, people battling mental health issues, and many others in need of a hot meal and a moment of comfort.

From the large-scale, full-service operations of Hope City Mission to the community-led, connection-focused Mullum Mullum Indigenous Gathering Place, FOFA meals are helping other Maroondah not-for-profits support local residents in need. These readyto-eat meals, provided alongside food parcels and other essential support services for individuals and families, are packed with nutritious ingredients. Quick to prepare, they not only provide nourishment but also ease the stress and mental load of meal preparation, particularly for families, offering comfort and support where it’s needed most.

In the past year, FOFA has doubled its output from 600 to 1,200 meals per week, thanks to close partnerships with organisations like Foodbank and Outer East Foodshare. By utilising surplus food that cannot be sold by farmers and supermarkets, FOFA addresses both food waste and food insecurity. Local businesses also contribute weekly, while Resound Church generously donates kitchen space in Scoresby for meal preparation.

FOFA’s impact stretches far beyond food relief. “We are extremely grateful to the community for their support and donations,” says Lillie, “FOFA couldn’t exist without this support.”

As Christmas approaches, FOFA is gearing up for its annual appeal, with preparations underway to stock up on meals to support residents in need during the holiday season. For many facing hardship, this time of year can feel anything but joyful, and FOFA’s ready-to-eat meals aim to bring a bit of hope and comfort to those doing it tough. We’re calling on our community to help us deliver Christmas cheer, one meal at a time! If you're looking for a gift that'll truly make a difference, consider making a donation to FOFA in the name of someone special this Christmas. We’ll send them an eCard to share the impact of your gift, letting them know they’re part of something meaningful. Just $2.50 will provide one nutritious Christmas meal, turning your donation into a lifeline and a gift of hope for those in need. Visit fofa. org.au to choose an eCard today.

After the passing of his wife, Joe* found himself his life. The emotional weight of his loss was Centrelink put his age pension on hold for single person. Already living week to week, cover essential costs.

With mounting bills and not enough money back on heating in the middle of a cold Thankfully, a local social program connected provided him with FOFA’s ready-made meals, funds to pay his utility bills.

Joe provided feedback that these meals financial burden - they reminded him of the offering both nourishment and emotional

himself in one of the most difficult periods of was compounded by financial stress when for six weeks to reassess his eligibility as a week, Joe suddenly found himself unable to

money for groceries, Joe was forced to cut cold Melbourne winter to save on expenses. connected him with a FOFA partner, who meals, allowing Joe to use his remaining

brought him more than just relief from his the comforting meals his wife used to cook, support as he adjusted to life without her.

Gloria*, undergoing treatment for stage 4 cancer, was facing one of the toughest challenges of her life. As her body struggled to tolerate most foods, eating became difficult, leaving her weak and low on energy. The strain on her physical health started to affect her mental wellbeing, and the motivation to cook for herself seemed impossible, compounded by her body’s physical reaction to the smells of cooking food

With the help of a local support agency, Gloria provided FOFA a variety of home cooked nutritious FOFA meal options. She carefully tested each meal to find what her body could tolerate, and once her preferences were clear, Gloria continued to receive her favourite FOFA meals regularly, supporting her through treatment. This consistent support helped her regain some strength and alleviated the stress of meal preparation.

Through the power of community support, Gloria found comfort and strength when she needed it most, allowing her to focus on her fight with renewed determination.

*Names changed for privacy

As the demand for food relief continues to grow in the current cost-of-living crisis, Feed One Feed All remains committed to its mission of making a difference, one meal at a time. Whether through donations, volunteering, or partnerships, your support can make a meaningful impact.

FOFA’s mission is enabled by the generosity of financial donors. Every dollar raised goes toward purchasing ingredients, packaging, and supporting logistics, ensuring that no one in the community goes without a meal. Use the QR code or visit fofa.org.au/donate to help us make a difference, one meal at a time.

Volunteers are the heart and soul of FOFA. The kitchen in Scoresby hums with activity every Thursday and Friday, where volunteers help prepare meals. There are also corporate volunteering opportunities for groups of up to six people—an excellent way for businesses to give back to the community. Visit fofa.org. au/get-involved to learn more.

FOFA welcomes partnerships with local businesses and organisations. Whether it’s through food donations, financial contributions, or lending support through corporate volunteering, businesses can play a pivotal role in keeping FOFA’s vital services running. Email us at contactus@fofa.org.au to explore partnering opportunities.

Advertise your events for FREE on the following pages. Are you a NFP with an up-and-coming event? If so, email your event to editor@findmaroondah.com.au and we will place it in the paper for FREE.

The Williamstown Highland Gathering is thrilled to announce its upcoming event, a vibrant celebration of Highland Scottish and Celtic culture.

This much-anticipated gathering will be on Saturday, 26 October 2024, at the historic Seaworks precinct in Williamstown, a short train ride from Melbourne Central.

Event Details:

•Date: Saturday, 26 October 2024

•Time: 9:00 AM - 4:00 PM

•Location: Seaworks, Williamstown, Melbourne Victoria

•Cost: Children under 16 FREE, All concession holders $20.00, Adults $25.00 Join us for a day filled with the stirring sounds of bagpipes, the grace of Highland dancers, and the strength of athletes displaying their skills in a miniheavy games event.

Visitors will have the opportunity to explore a variety of stalls offering authentic Celtic food, drink, merchandise, and crafts, with plenty of activities to amuse the children all day.

Highlights of the Williamstown Highland Gathering:

• Celtic Music: Immerse yourself in the playing of the bagpipes and Celtic folk music on the stage and all day in the Pirate Bar.

• Celtic Dancing: Watch dancers of forms of Celtic dancing & all ages perform traditional and modern Celtic dances.

• Heavy Events: Cheer on athletes as they showcase their skills in classic and traditional events.

• Cultural Displays: Learn about Scottish and Celtic history and heritage throughinteractive exhibits and demonstrations.

• Unique Merchandise: Take home a piece of the Highlands with crafted goods.

The Williamstown Highland Gathering is a family-friendly event that celebrates the rich cultural tapestry of the Celtic people. It’s a perfect day out for anyone interested in experiencing the warmth and excitement of Highland Scottish hospitality.

Tickets are available for purchase online. For more information, please visit our website or contact our event coordinator.

The Williamstown Highland Gathering is an annual event that brings together the best of Scottish and Celtic culture in Melbourne.

The Melbourne Highland Games and Celtic Festival Inc. is a not-for-profit organisation of dedicated volunteers giving access to all who identify with and want to celebrate Scottish heritage and culture.

Contact: Event Coordinator: Secretary; Alistair MacInnes Email: mcinnes210@ozemail.com.au

By Warren Strybosch

Income received from a superannuation “account based” or “allocated” pension is often favourably assessed under the income test used by Centrelink and the Department ofVeterans Affairs to determine a person’s entitlement to government income support benefits. Such benefits might include the Age Pension, Disability Support Pension, Newstart Allowance, and the like. This means that a person currently receiving income support benefits may often be able to draw a reasonably significant amount of income from their account based pension without it having a detrimental effect on their government income benefit.

Legislation was passed in March 2014 that changed the way in which account based pensions are assessed for income test purposes. The change took effect from 31 December 2014. Account based pensions were brought into line with other “financial Investments”.

There are two groups of people who are affected by this change:

1. People who commenced receiving government income support benefits after 31 December 2014, whether or not they had an account based pension is place before January 2015; and

2. Those receiving government income support benefits before 1 January 2015, and they transfer their existing account based pension to a new superannuation provider, or commence a new account based pension after 31 December 2014.

Those people receiving income support as at 31 December 2014 and had an account based pension in place as at that date, will not be affected by the changes unless;

• Their income support benefit ceases for any reason, and is then recommenced, or

• they change pension providers, or

• stop and recommence an account based pension with their current provider.

There are no changes currently being made to the way the assets test applies to account based pensions.

Financial investments include money on deposit with banks, building societies, and credit unions, shares, managed funds and unit trusts, and money held in superannuation funds by a person of age pension age, where they have not yet commenced an account based pension.

When applying the income test, Centrelink or Department of Veterans Affairs will total up the value of a person’s financial investments and then “deem” an amount of income to be applied to those investments. The deeming rates change from time to time and are reflective of current interest rates. There are two deeming rates that apply depending on the amount of a person’s financial investments. The current deeming rates are:

Deemed income is used when applying the income test. The actual income earned on financial investments, whether it is above or below the deemed income, is ignored when assessing eligibility for income support benefits.

However, income received from an account based pension is currently assessed on different basis.

Income assessment of account based pensions

When an account based pension commences, the amount of capital used to commence the pension is divided by the life expectancy of the pension recipient (or the longer of the two pension recipient’s life expectancies, where a reversionary pensioner is nominated). The resultant amount is referred to as the “deductible amount”. This amount remains constant for the life of the account based pension unless a lump sum withdrawal is made from the pension account, at which time the deductible amount is recalculated.

The amount of account based pension income currently assessed under the income

test is the actual income drawn from the account based pension, after subtracting the deductible amount.

Let’s further consider the example of our pensioner couple mentioned previously. They also have an account based pension with a value at commencement of (say) $150,000. For the sake of the example we will assume the account based pension is held in the name of the wife who is 65. Her husband is 67. Her life expectancy is 21.62 years, and his is 16.99 years1F2. In this example, it is irrelevant whether the husband was nominated as a reversionary pensioner or not, as his life expectancy is the lesser of the two. The deductible amount, in this example, is $6,938 ($150,000 ÷ 21.62). If this couple were to draw $7,500 income from their account based pension, only $562 of that will be counted under the income test ($7,500 - $6,938).

If we now extrapolate the income assessable under the income test for our pensioner couple, their assessable income under the income test will be:

Applying the January 2015 rule

If our pensioner couple were:

• not to commence receiving their age pension until after 31 December 2014; or

• to move their existing account based pension from one pension provider to another after that date; or

• to stop their existing account based pension, perhaps to add more superannuation savings, and then start a new account based pension after 31 December 2014;

Then their new account based pension will be treated as a financial investment and will be subject to deeming. If this were to occur, their financial investments will now total $250,000 and their deemed income will now be:

account based pensions will depend on personal circumstances. For example, anyone drawing an account based income stream that is significantly more than their deductible amount may actually benefit by having their account based pension treated as a financial investment and be subject to deeming.

In addition to the income test, government income support entitlements may also be affected by the assets test. The test that results in the lower income support benefit is the test that is used. We have not taken the potential assets test implications into account for the purposes of this review.

Warren Strybosch Award winning Financial Adviser and Accountant

Based on deemed income of $144.35 per fortnight, this couples assessable income is still below the income free amount available under the income test, so their pension is unaffected, based on current deeming rates. However, as deeming rates increase over time, and given that they are currently at historically low level, this couple may see a reduction in the amount of age pension they receive in the future.

When legislation to have account based pensions included as financial investments for deeming purposes was enacted, the income test treatment of existing account based pensions was grandfathered. That is, provided the following conditions are met, the former income test treatment of account based pensions (i.e. actual

income received, less the deductible amount) will continue to apply.

To qualify for the grandfathering the pension receiving government income support must:

1. Be in receipt of a continuous government income support benefit as at 31 December 2014; and

2. Be receiving income payments from a continuing account based pension as at 31 December 2014.

Where a person holding a grandfathered account based pension passes away, and their account based pension was structured to automatically revert (transfer).

Conclusion

Whether a person will better or worse off under the changes to income testing of

Financial Planning, SMSF, Super, Insurance, PreRetirement & Retirement Planning (Financial Planning) are offered via Find Wealth Pty Ltd ACN 140 585 075 t/a Find Wealth, Find Insurance and Find Retirement. Find Wealth Pty Ltd is a Corporate Authorised Representative (No 468091) of Alliance Wealth Pty Ltd ABN 93 161 647 007 (AFSL No. 449221).Part of the

Centrepoint Alliance group (www.centrepointalliance.com.au/fsg/aw).

Warren Strybosch is Authorised representative (No. 468091) of Alliance Wealth Pty Ltd.

This information has been provided as general advice. We have not considered your financial circumstances, needs or objectives. You should consider the appropriateness of the advice. You should obtain and consider the relevant Product Disclosure Statement (PDS) and seek the assistance of an authorised financial adviser before making any decision regarding any products or strategies mentioned in this communication.

Whilst all care has been taken in the preparation of this material, it is based on our understanding of current regulatory requirements and laws at the publication date. As these laws are subject to change you should talk to an authorised adviser for the most up-to-date information. No warranty is given in respect of the information provided and accordingly neither Alliance Wealth nor its related entities, employees or representatives accepts responsibility for any loss suffered by any person arising from reliance on this information.

By Warren Strybosch

As a retirement and aged care advisor, I get asked questions throughout the year. Some of the more common questions are covered below:

1. How does my family home affect the Aged care fees?

The assessment of the home for aged care fees depends on who remains in the home after a person has moved into care, and what the home is used for on an ongoing basis. The assessable value of the person’s income and assets including the home may be used to determine the:

• accommodation fee, and • means-tested care fee (MTCF).

Where the person is partnered the person is attributed 50% of the couple’s combined income and assets. Assessment of the home for social security purposes differs.

Accommodation fee

The accommodation fee can be paid as:

• a refundable lump sum, ie Refundable Accommodation Deposit / Contribution (RAD / RAC)

• a non-refundable daily payment, ie Daily Accommodation Payment / Contribution (DAP / DAC), or

• any equivalent combination of the above.

The level of assessable assets that a person has at the time of entering care impacts the maximum amount the person can pay as an initial lump sum accommodation fee, and determines, whether the person is eligible for Government assistance with this fee.

The aged care resident has the choice as to how they wish to pay this fee. Generally, any amount of accommodation fee that a person doesn’t fund as a lump sum must be made up via payment of a daily accommodation fee. This applies regardless of whether the person chooses not to pay the fee as a lump sum or has insufficient assets to pay the entire amount.

The maximum accommodation fee that the aged care facility can ask a resident to pay as a lump sum is constrained to the extent that, after initial payment of a lump sum, the person must be left with a minimum level of assets. The current minimum asset threshold is $58,500. Any additional amount must be made up as a daily payment.

Unless occupied by a protected person, the former home is fully assessed when determining the maximum amount payable as a lump sum. A protected person includes a:

• spouse

• dependent child

• carer of the person who has occupied the home for at least two years immediately prior

• and is eligible for an income support payment at the time, or

• close relation of the person who has occupied the home for five years immediately prior and is eligible for an income support payment at the time.

A person need not be in receipt of an income support payment to be assessed as a protected person. It is sufficient that based on the person’s circumstances at the time of assessment, they meet all eligibility criteria. Income support payments include Age Pension, DSP, JobSeeker Payment, Service Pension and Carer Payment but does not include Carer Allowance.

For example, if a room has a published rate of $550,000 and the person has a family home worth $300,000 and $100,000 in their bank account, the full value of the home is included when calculating the maximum amount that could be paid as a lump sum accommodation fee, ie $341,500 could be paid as an initial lump sum accommodation deposit, so that the minimum asset level of $58,500 is retained.

The MTCF is calculated based on a person’s assets and income. It is determined at the time a person enters

care and is re-assessed on a quarterly basis or as circumstances change. The former home is only ever exempt for the calculation of the MTCF if occupied by a spouse or protected person. In all other circumstances, the home is assessed as an asset, up to the home cap. Depending on when the client first entered aged care, assessment of rental income from the former home differs.

2. My client is in residential aged care. His partner wants to temporarily move out of their principal home during home renovations and live with their daughter for 12 months.

Does the social security exemption for vacating the principal home in temporary situations extend to aged care assessment as well?

For social security purposes, if the principal home is temporarily vacated for any reason for up to 12 months, then the home continues to be the principal home and the income support recipient continues to be considered a homeowner (the temporary vacation exemption can be extended up to a further 12 months where the home is lost or damaged or where the person goes overseas and is unable to return, due to reasons beyond their control).

However, for aged care purposes, only under limited circumstances, temporary absence from the principal home can be relied on by a protected person to continue to exempt the home. These can be situations where a temporary absence is not intentional, and the situation may be beyond the person’s control. Examples include:

• respite care

• hospital patient

• mental or psychiatric institution patient

• boarding school student

• incarceration in certain cases

For other reasons like home renovations, the home is no longer exempt and therefore the home is assessed for that period of absence. Once the partner moves back to the principal home, the principal home exemption is regained.

3. I have some clients who reside in a retirement village.

If they decide to move into an aged care facility, how is the retirement village assessed for aged care purposes?

Where the retirement village is vacated to enter into a residential aged care facility, the assessment can depend on whether the client is single or a member of a couple. If only one member of the couple

moves into an aged care facility and the partner continues to reside in the retirement village, then the refundable amount of the entry contribution is exempt.

If the retirement unit is vacated by a single person or both the members of the couple, they are generally required to sell their unit (or share in the village). As part of a resident’s contract, an exit fee or deferred management fee may be payable upon exit. However, the sale of the unit may take weeks or even months in some cases before it can be sold. For the duration of the time between moving to the aged care facility and the unit being sold, the refundable amount of the entry contribution is assessed as an asset (50% for each member of a couple) subject to the home cap amount of $201,231.201.

Note: the assessment of the retirement village for aged care differs to that for social security purposes. The above assessment applies irrespective of whether the entry contribution was greater or lesser than the Extra Allowable Amount.

4. My client receives a home care package and currently pays an income tested care fee. If they are to move to residential aged care, does that amount count towards their means tested care fee annual cap and when does the annual cap reset?

Income Tested Care Fee (ITCF) and Means Tested Care Fee (MTCF) combined are subject to an annual cap over the 12-month period. ITCFs count towards the means tested care fee annual cap. The 12 month period commences and resets on the anniversary date on which the resident started receiving care for the first time across both Home Care and residential aged care.

As a result, the MTCF annual cap is reduced by any ITCF your client has already paid while receiving home care in the anniversary year they move into residential care. These fees also count towards the lifetime cap in residential care. Once the resident reaches the lifetime cap, they will not have to pay any MTCF/ITCF for the remainder of their time in care.

The current annual cap and lifetime cap for a residential aged care recipient is $33,309.29 and $79,942.44 respectively. These caps are indexed on 20 March and 20 September each year and are applied to residents based on the effective cap amount on the date it is reached.

It is important to remember that there are significant changes occurring within the aged care sector at present. It could be argued that it is nearly a complete rewrite of the aged care legislation. As such, the

above answers my vary after 1st July 2025 when the new legislation comes into play.

We encourage you to seek professional advice in this area when dealing with aged care matters.

“The

This information has been provided as general advice. We have not considered your financial circumstances, needs or objectives. You should consider the appropriateness of the advice.You should obtain and consider the relevant Product Disclosure Statement (PDS) and seek the assistance of an authorised financial adviser before making any decision regarding any products or strategies mentioned in this communication.

Whilst all care has been taken in the preparation of this material, it is based on our understanding of current regulatory requirements and laws at the publication date. As these laws are subject to change you should talk to an authorised adviser for the most up-todate information.No warranty is given in respect of the information provided and accordingly neither Alliance Wealth nor its related entities,employees or representatives accepts responsibility for any loss suffered by any person arising from reliance on this information.

We have made it cheaper and easier for you to get your returns completed & you can do it all from the comfort of your own home.

Here are the steps involved:

1. Email to info@findaccountant.com.au requesting your PAYG return to be completed. Provide us with your full name, D.O.B and address

2. A Tax engagement letter will be emailed to you for signing via your mobile (no printing or scanning required).

3. You will be then sent a tax checklist to complete online. Takes less than 5 minutes.

4. We will then require you to upload your documents to our secure portal.

5. Once we have received all your documentation, we will complete the return.

PROFESSIONAL SERVICES

• Architect ------------------------------ 00

• Find Accountant ----------------- 34

• Financial Planning ------------- 36

• Find Insurance -------------------- 35

• Bookkeeping ---------------------- 00

6. We will email you the completed return with our invoices. Once you sign the return and pay the invoice we will lodge the return on your behalf. Email your artwork to editor@findmaroondah.com.au If you wish us to create your ad, we will do this for a minimal cost. Go to www.findmaroondah.com.au/graphic-design to upload your details and we will create this for you.

• Editor|Copywriter --------------- 00

• General Insurance ------------- 35

• Life Coach --------------------------- 36

• Mortgage Brokering ----------- 36

• Signages ------------------------------ 00

• Solicitor/Lawyer ------------------ 35

If you have any questions, contact the editor on 1300 88 38 30 or Email warren@findmaroondah.com.au

*Available until your category is taken when a Tradie joins the Find Network Team.

At Find we can help you find the ‘right’ personal insurance. Our aim is to help you obtain and retain the personal insurances that are appropriate for you and at cost that you can afford.

Personal Insurances Include:

• Income Protection (IP)

• Life Insurances or Death Cover

• Total and Permanent Disability (TPD)

• Child Trauma Cover

When your insurance are in place, our services do not stop there. We will provide you with an after care service that includes policy notifications, insurance report, help desk, reviews and help at claim time. We provide ourselves in providing honest advice that you can rely on.

warren@findinsurance.com.au

www.findinsurance.com.au

• Coffee Machine Machine -- 00

• Garage Doors ---------------------- 00

• Builder ----------------------------------- 00

• Electrician ----------------------------- 00

• Painter ----------------------------------- 00

• Plasterer -------------------------------- 00