The Find Maroondah is a community paper that aims to support all things Maroondah. We want to provide a place where all Not-For-Profits (NFP), schools, sporting groups and other like organisations can share their news in one place. For instance, submitting up-andcoming events in the Find Maroondah for Free.

We do not proclaim to be another newspaper and we will not be aiming to compete with other news outlets. You can obtain your news from other sources. We feel you get enough of this already. We will keep our news topics to a minimum and only provide what we feel is most relevant topics to you each month.

We invite local council and the current council members to participate by submitting information each month so as to keep us informed of any changes that may be of relevance to us, their local constituents.

We will also try and showcase different organisations throughout the year so you, the reader, can learn more about what is on offer in your local area.

To help support the paper, we invite local businesses owners to sponsor the paper and in return we will provide exclusive advertising and opportunities to submit articles about their businesses. As a community we encourage you to support these businesses/columnists. Without their support, we would not be able to provide this community paper to you.

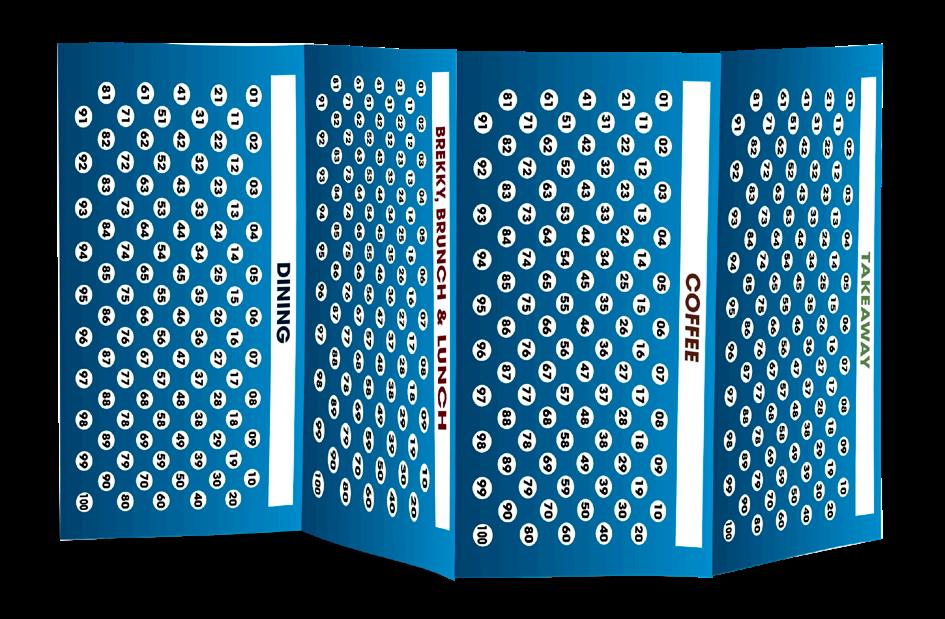

Lastly, we want to ask you, the local community, to support the fundraising initiatives that we will be developing

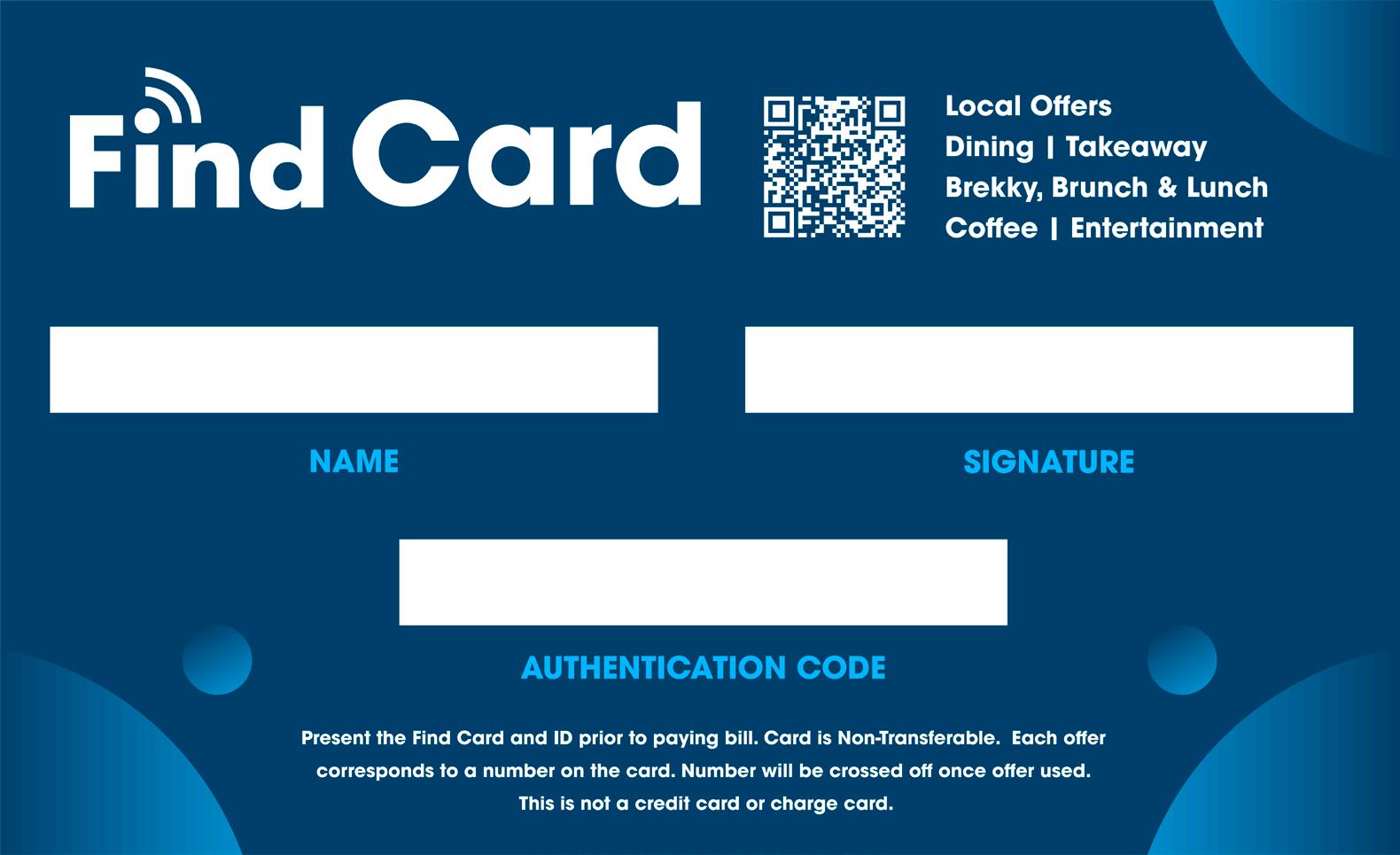

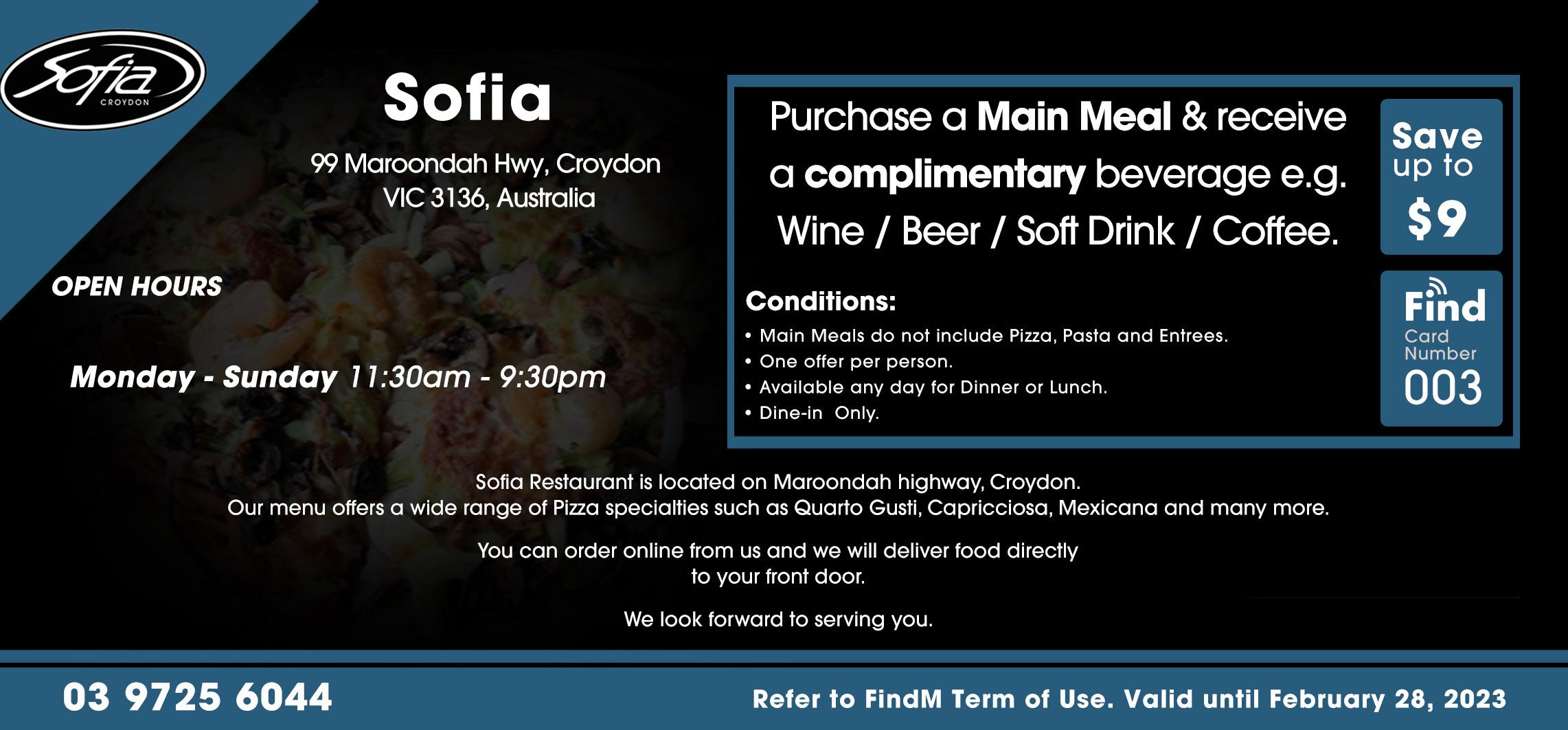

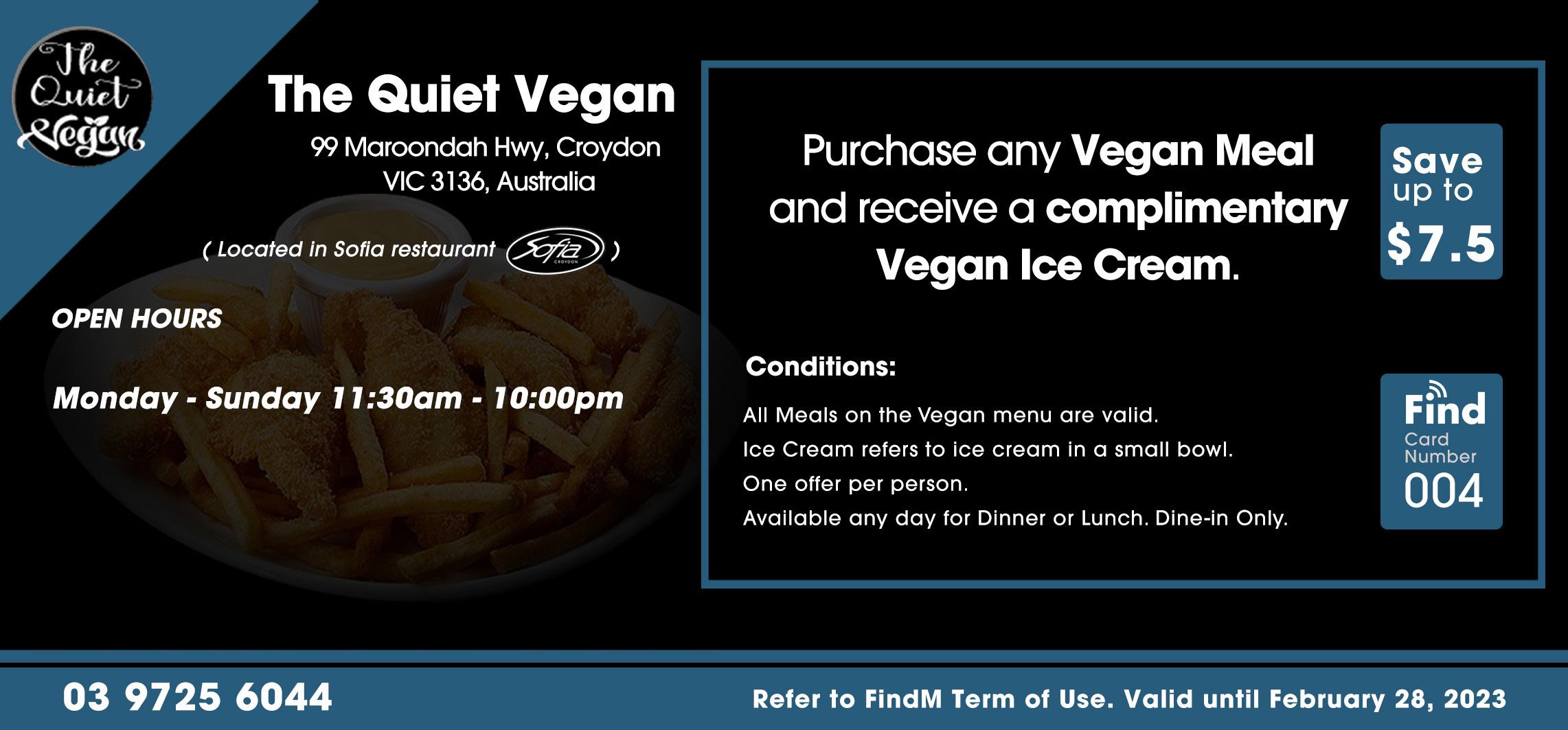

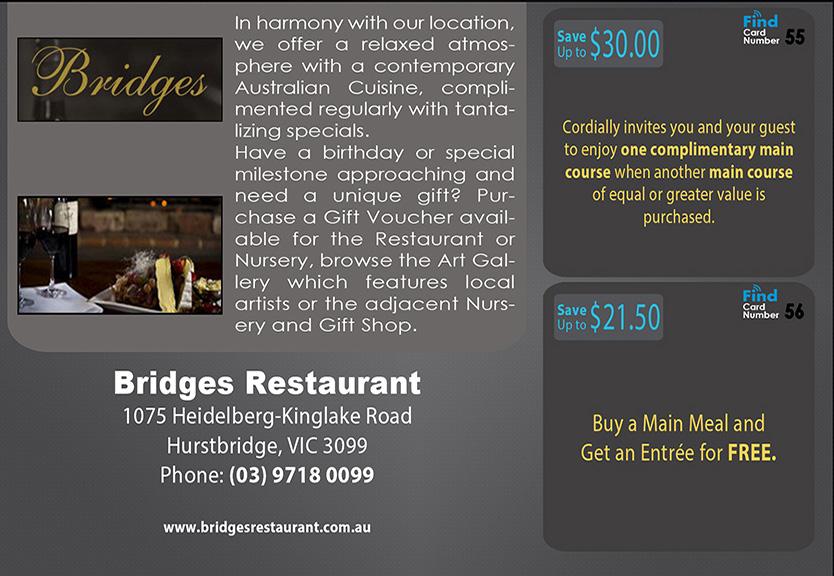

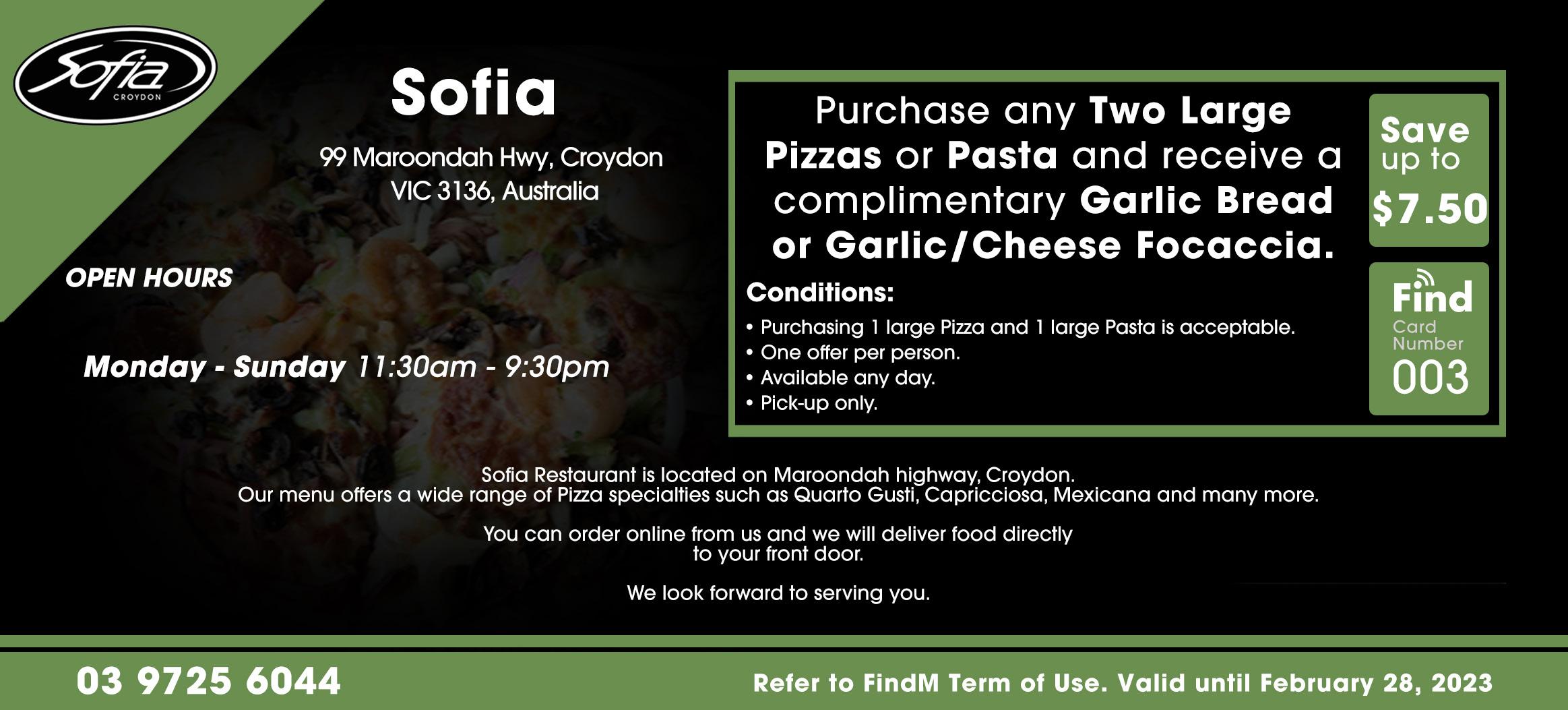

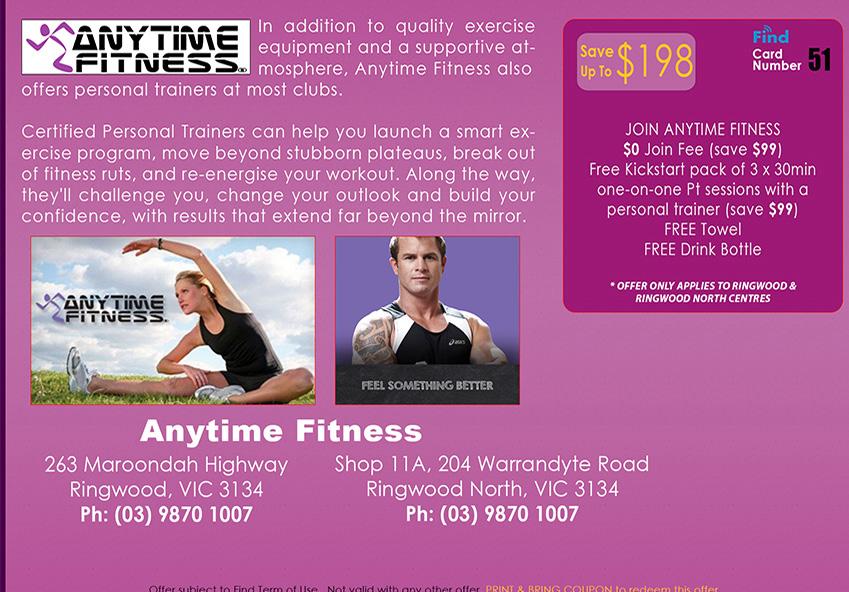

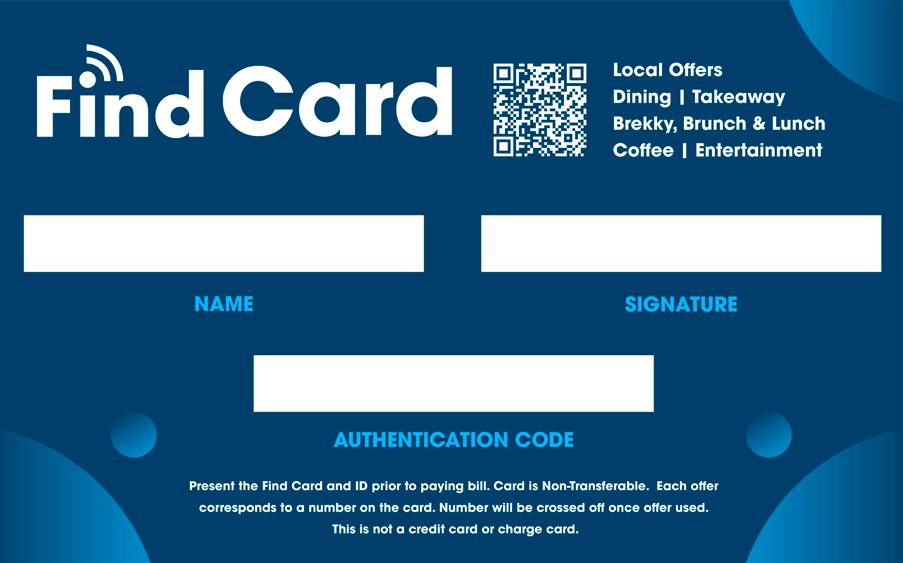

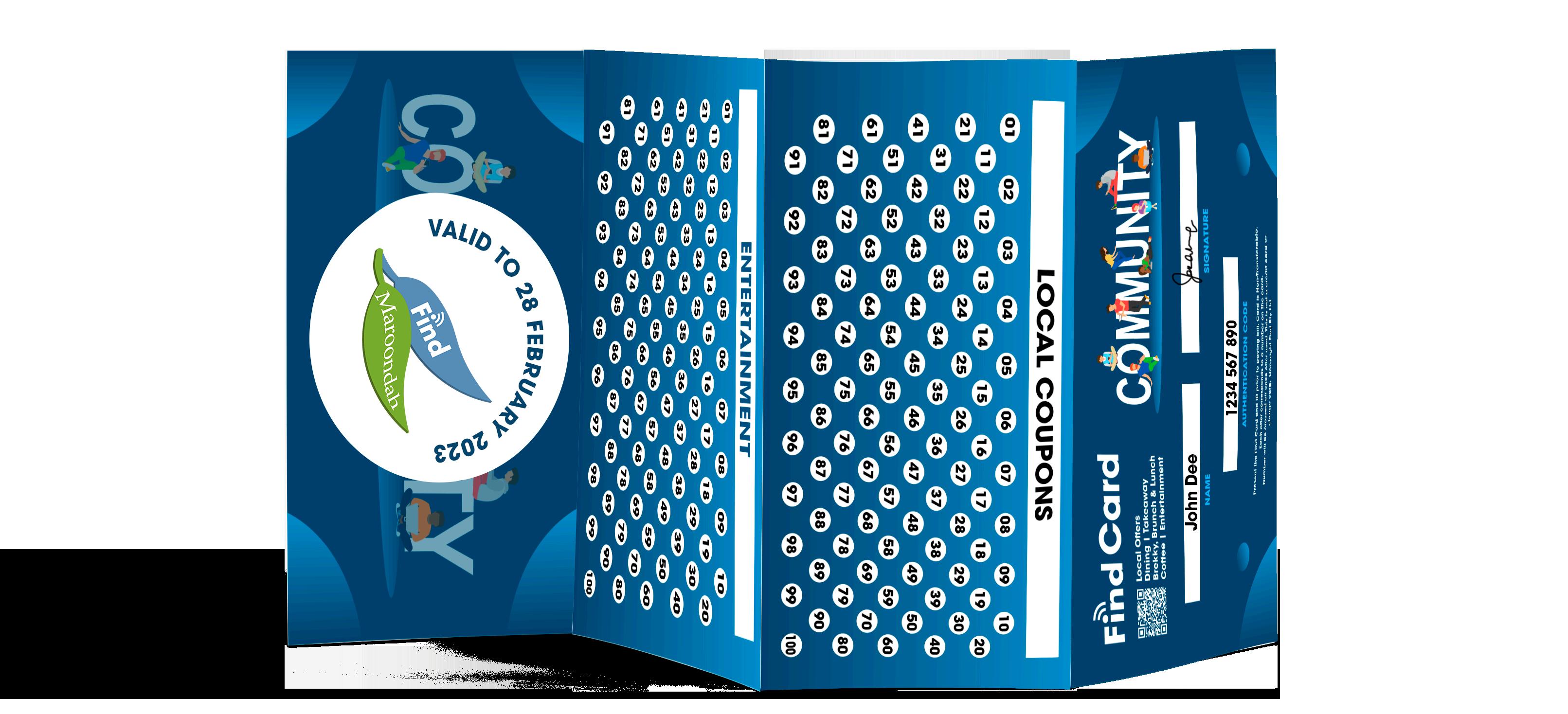

and rolling out over the coming years. Our aim is to help as many NFP and other like organisations to raise much needed funds to help them to keep operating. Our fundraising initiatives will never simply ask for money from you. We will also aim to provide something of worth to you before you part with your hard-earned money. The first initiative is the Find Cards and Find Coupons – similar to the Entertainment Book but cheaper and more localised. Any NFP and similar organisations e.g., schools, sporting clubs, can participate.

Follow us on facebook (https://www. facebook.com/findmaroondah) so you keep up to date with what we are doing.

We value your support,

The Find Maroondah Team.

EDITORIAL ENQUIRES: Warren Strybosch | 1300 88 38 30 editor@findmaroondah.com.au

PUBLISHER: Issuu pty Ltd

POSTAL ADDRESS: 248 Wonga Road, Warranwood VIC 3134

ADVERTISING AND ACCOUNTS: editor@findmaroondah.com.au

GENERAL ENQUIRIES: 1300 88 38 30

EMAIL SPORT: editor@findmaroondah.com.au

WEBSITE: www.findmaroondah.com.au

The Find Maroondah was established in 2019 and is owned by the Find Foundation, a Not-For-Profit organisation with is core focus of helping other Not-For-Profits, schools, clubs and other similar organisations in the local community - to bring everyone together in one place and to support each other. We provide the above organisations FREE advertising in the community paper to promote themselves as well as to make the community more aware of the services these organisations can offer. The Find Maroondah has a strong editorial focus and is supported via local grants and financed predominantly by local business owners.

The City of Maroondah is a local government area in Victoria, Australia in the eastern suburbs of Melbourne. Maroondah had a population of approximately 118,000 as at the 2019 Report which includes 9000 business and close to 46,000 households. The City of Maroondah was created through the amalgation the former Cities of Ringwood and Croydon in December 1994.

The Find Maroondah acknowledge the Traditional Owners of the lands where Maroondah now stands, the Wurundjeri people of the Kulin nation, and pays repect to their Elders - past, present and emerging - and acknowledges the important role Aboriginal and Torres Strait Islander people continue to play within our community.

Readers are advised that the Find Maroondah accepts no responsibility for financial, health or other claims published in advertising or in articles written in this newspaper. All comments are of a general nature and do not take into account your personal financial situation, health and/or wellbeing. We recommend you seek professional advice before acting on anything written herein.

At Find Maroondah, we want to wish all the VCE students well in their exams for 2022.

We are so thankful that you will be able to sit your exams in normal settings and not have to wear masks or try to complete exams online in your own homes.

Whilst VCE exams can be a very stressful time for many students, we want to encourage you all, that regardless of the outcome, this is only one short period of time in your lives, and it does not determine who you are as a person. Whether you do well or not, VCE is only one pathway into your chosen career –it does not have to be the end of your journey.

Do the best you can and remember that, whatever happens, there is another day, another week, and the rest of your lives to discover wonderful things.

All the best, from the Team at Find Maroondah.

It’s every worker’s dream: getting paid for more hours than they actually work.

And for Australian staff at Unilever ANZ, it’s about to become a reality.

The maker of Dove, Rexona, Continental and Streets products announced on Wednesday that from November 14, its workers would trial a four-day working week.

It follows a successful 18-month trial in New Zealand. Chief executive Nicky Sparshott says staff will retain 100 per cent of their salaries while working 80 per cent of the time.

But the business still expects its targets to be met.

“We are only asking our team members to find 20 per cent of the hidden capacity that sits in any business and slows us down,” Ms Sparshott told AAP.

“It is about removing non value-added costs, projects or processes and thinking differently about what meetings we participate in or how we can better communicate and collaborate.”

Under the 12-month Australian trial, staff won’t be expected to fit into a one-sizefits-all approach.

They will be able to choose the day they don’t work or spread the hours off across a number of days. “Some staff in New Zealand decided to take one day off a week and they completed their MBA on that day. Others decided to finish early each day so they could do school pickup,” Ms Sparshott said.

“We actually found that the trial in New Zealand was able to reduce meetings for an average staff member by threeand-a-half hours a week – that is 182 hours back in your life – so it’s a good starting point.”

Workers will also be able to split their four days between home and office.

Ms Sparshott said her staff were excited to take part in the trial. “This is an experiment. We can hypothesise about whether it will or won’t work,” she said.

“But for us, this is an important part of exploring how we can be a better business and a better workforce, and ensure we meet the evolving needs and expectations of our team while remaining competitive.” It comes after the Greens on Monday launched a proposal for a Victorian four-day working week trial in the seat of Richmond.

The trial would involve a $60 million fund to support public sector and private businesses to transition to a fourday model. “We’ve been tricked into believing that working five days a week is normal,” state party leader Samantha Ratnam said.

The trial would require businesses to transition full-time workers with no loss of pay or entitlements and either a proportional reduction in working hours or the equivalent pay rise for those already working part time.

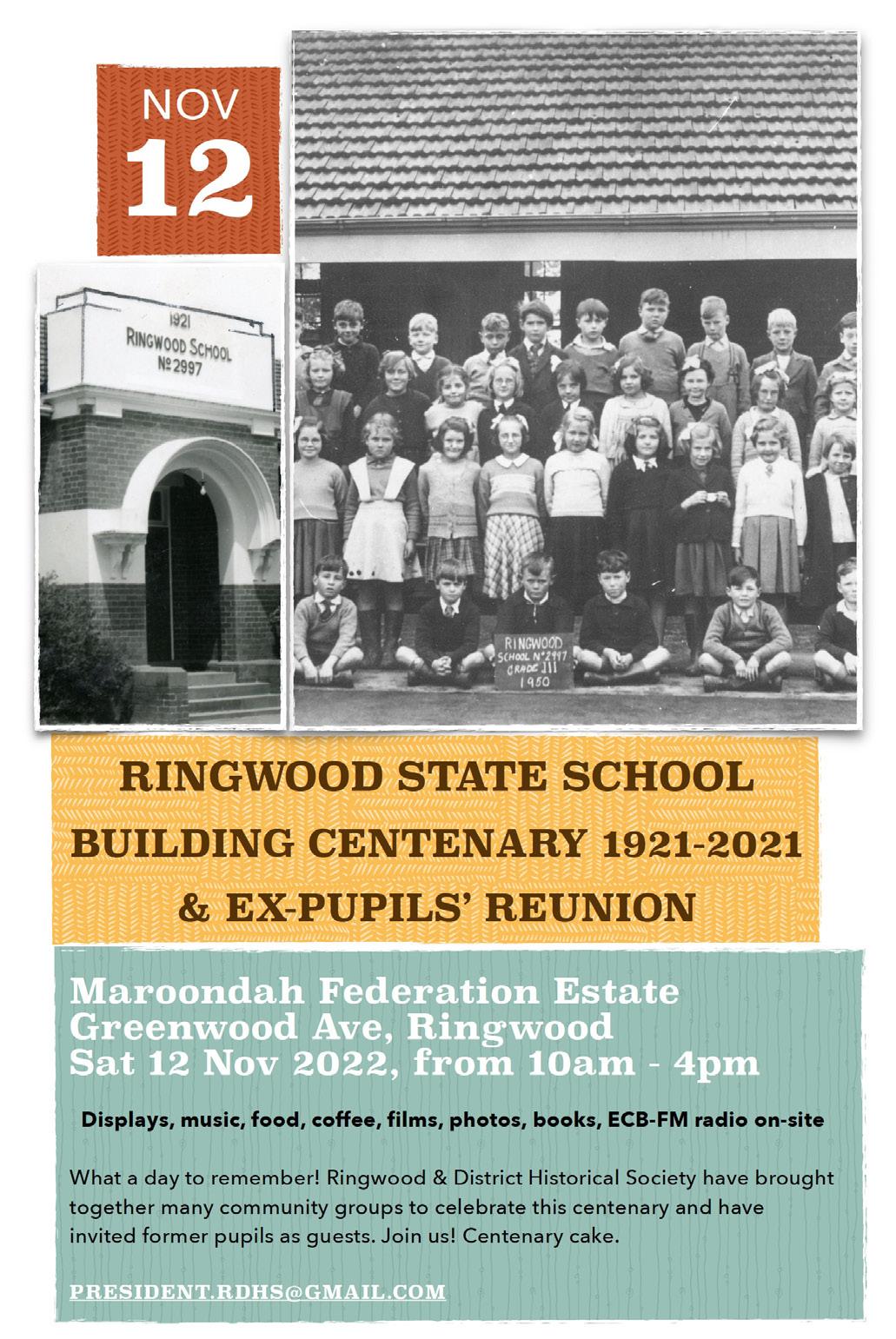

After 1872, interest was stimulated, among the people in the vicinity of the antimony mines, to obtain a school nearer than Vermont. Ore was first taken out in 1869 and the main shaft was sunk in 1874. On 4th December, 1873, a petition requested that a school be established at Sandy Gully, Ringwood, which is now Ringwood Lake. A fiveacre site was purchased to accommodate up to 54 pupils. The school, No.1451, was made of timber and erected, with a separate quarters for the teacher, on the 20th April,1874 at a cost of £351. It was located on the old road to Lilydale on reserved Crown land, which is now bordered by Everard and Dublin Roads, and Maroondah Highway.

The school was opened on the application of Mr. J. Maggs and others. This school in the coaching and prosperous mining days was well known as ‘Cass’ School’ and many a successful business man of these days owes his early tuition and training to the learned teacher with whose name it has ever been associated. The first head teacher was Mr. Edward Feehan Cass, from 10th September 1874, until 31st July 1893, when the school was amalgamated with State School, No.2997, Ringwood. For a period his wife , Mrs. Jane Cass, was an assistant at the school. On the closing of the school Mr. Cass was an assistant at Ringwood State School No.2997 until 30th October 1893 when he became head teacher of State School No.3081, Pascoe Vale. On the I7th June, 1903, four acres of land was revoked for school purposes and the remaining acre was retained and was used in the building of East Ringwood State School No. 4180.

One acre of land at the corner of Whitehorse Road and Ringwood Street was purchased for the school on 19th February 1889, and

the school was opened on 1st December 1889. It may be of interest to note that the timber Nunawading State School No.2242, at the corner of Heatherdale and Whitehorse Roads, Mitcham, was opened on 6th February 1880 and Eliza J. McIntosh was the head teacher. Many of the residents on “West Ringwood” attended this school. his School was closed on Nov 30, 1889 and the building was removed to State School No.2997, Ringwood, and used as a teacher’s residence. The foundation stone, for the new Ringwood school, was laid on I5th August 1889 by Mrs. J.K. Turnbull, with a silver trowel presented by Cr. Thos. Grant.

The first teacher was Mr. J. Sweeney who was later transferred to Bendigo. His successor was Mr. Hocking. Owing to the ever increasing population, the school became too overcrowded and it was decided to build a larger school. Eventually an area of approximately 3¾ acres was obtained in Greenwood Ave. and a new school erected in 1922 bearing the same number, 2997. All the pupils and teachers, including the head teacher, Mr. W. Broben, were transferred from the old Nunawading school to the new building which was opened early in 1922 by Sir Alexander Peacock, Minister of Education. The Railways employees at Ringwood made a present of a modern eight-day clock to the State School Committee, the inscription is - "Presented to the Ringwood State School on the Opening of the School by the Railway Staff, June 1922". The clock was behind the door of the main entrance to the School. On the closing of the original school one acre of land at the corner of White Horse Rd. and Ringwood St. was subdivided in 1924 and sold in lots to the Post Office (£900), State Savings Bank (£875),and Mr. Edward Miles (£3000).

The school was eventually closed in 1997. A day-long event will be held on Saturday 12th November 2022, to celebrate the centenary of the building of the Greenwood Avenue State School. Plenty of displays, music, food and history to entertain.

By Susan Pierotti

By Susan Pierotti

We’ve all heard it, and our grandparents even learned it at school: ‘Into the valley of death rode the five hundred’. This is a quote from Lord Tennyson’s famous poem, ‘The Charge of the Light Brigade’. It describes the slaughter of an English cavalry brigade in the Crimean War in the 19th century.

Did you know they were killed because of poor communications?

Let’s backtrack a bit. Russia throughout its history has sought a warm water port for its fleet, preferably one linked with the Mediterranean Sea. In the 19th century, Russia was extending its territory while its neighbour, Turkey, had an empire (the Ottoman empire) that was slowly but surely collapsing. Russia thought to expand into the Black Sea and used the Crimean Peninsula, the southernmost tip of the Ukraine, as its diving board into warmer climes. (Considering recent events, nothing has changed!)

Turkey asked Great Britain and France for help, which is why, on a late October day in 1854, the British, French and Turkish armies stared along a valley towards their Russian enemy. There were only two mounted cavalry brigades, one of which was the Light Brigade. As the name suggests, it consisted of light, fast horses and men without armour and guns but equipped with lances and sabres. They were trained and armed for maximum mobility and speed, not for a long march and certainly not for a hand-to-hand battle.

Lord Raglan commanded the entire army, Lord Lucan had overall command of the cavalry units and Lord Cardigan commanded the Light Brigade. Lucan and Cardigan were brothers-in-law –and they detested each other.

The problem began when Lucan received a message from Raglan stating:

“Lord Raglan wishes the cavalry to advance rapidly to the front, follow the enemy, and try to prevent the enemy carrying away the guns. Troop horse artillery may accompany. French cavalry is on your left. Immediate.”

Raglan had seen the Russians climbing a series of hills on the right where the British had secured their cannons, pointed to

shoot over the narrow valley with Raglan and the allies at one end and the Russian army at the other. This would have been an engagement ideally suited to the Light Brigade as their rapid advance speed would forced the Russians to either quickly abandon the cannons or be cut while they tried to flee with them.

What Raglan didn’t realise was that Lucan couldn’t see the Russians attempting to take away the huge guns up on the hilly rise. He was down on the flat plain and the only Russians he could see were ahead of him, an army armed with rifles but no big guns.

To make matters worse, the message had been drafted by someone other than Raglan. It was delivered to Lucan by a hothead anxious to fight who, when asked which guns, pointed to the wrong ones, the ones at the end of the valley with the Russian army.

Lucan didn’t bother to ask for further instructions but passed them on to the commander of the Light Brigade, Lord Cardigan.

You want me to do what?! Cardigan could have asked for clearer orders but that meant having to swallow his pride and ask Lucan for clarity. Instead, he obeyed the orders and rode in front of his 670 men down a narrow valley – Tennyson’s Valley of Death –surrounded on three sides with enemy

fire. Lucan was to follow with the Heavy Brigade but never sent the promised horse artillery, thereby sealing the fate of 118 men, with 127 wounded and 335 horses destroyed.

If you want to send a precise message, especially one that could save lives, don’t:

• get someone else to draft it

• assume the receiver will have all the information you have

• give someone to deliver it who gives the wrong information

• trust that people will overcome entrenched hostility to one another for the common good.

Clear communication is vital in this age of fast internet access. Why not seek out a writing professional to assist you with all your communication needs?

Email me at susan@creativetext. com.au for all your business external communication needs.

These symbols actually show you what is appropriate for each bin. Worth keeping this for future reference, since Council is retrofitting lids only to reduce expense and cut waste.

Apparently, Council has done an audit on what material is placed into out general rubbish bins and have concluded that more than 40% is either garden waste or food scraps and food wastage such as mouldy or past the use by date.

As organic material breaks down it releases methane which is a harmful greenhouse gas and is 25 times more damaging than carbon dioxide. The FOGO will ensure that all organic material no longer goes to landfill but in turn is made into a nutrient rich compost for use at Victorian farms and gardens.

Fogo stands for food organic and garden organics.

This will also clearly reduce the amount of material that actually has to go into landfill which is self is another serious issue in terms of waste reduction.

So what used to be your garden bins for green-waste garden pruning’s and weeds can now also take the fruit and vegetable scraps including garlic onion and citrus which you wouldn’t put in a compost bin as these foods are not worm friendly. Leftovers and plate scrapings including meat seafood poultry and bones both raw and cooked, dairy products and eggshells tea leaves and

coffee grounds, mouldy or expired foods pastries breads and desserts, are also classed as organic material, and are accepted into this waste stream. This bin will get a new bright green lid, to help distinguish it.

QUESTION? What if I already have a worm farm that takes all my vegetable scraps? You can continue to use your worm farm, or compost bin; but obviously you will not be putting meat fish chicken egg dairy bread citrus into that so those items will go in your large FOGO bin, unwrapped !!!

Do I have to have an under the bench container to keep FOGO scraps in? No, you can opt out, and in fact many people will, because this bin full of putrescible waste develops a very putrid odour in a short period of time particularly in hot weather. If you want to opt out of getting the small caddy and bin liners you can do so by completing Maroondah Council‘s online form before Sunday, 2 October, or maybe later, since you may only just be finding this out.

Email…. waste@maroondah.vic.gov.au

You can get around this stinky house bin, by either taking those materials the end of food preparation directly to your large bin or you can have sealed lidded bin outside the back door so the possums can’t get to it and you can empty this as often as necessary. Creative ideas will abound.

Other things will be changing too; from November your rubbish bin containing general rubbish will get a bright red lid this will bring us into alignment with Australian standards currently different municipalities have different coloured lids which is confusing when people move house, into different municipalities.

You should get a note in your letterbox to put your bin out on a particular date, which is when the lid swap will happen.

There will also be the recyclable bin it will have a yellow lid (also to be swapped) and should contain drink packaging, milk packaging, detergent plastic bottles, tin cans food cans and paper items.

Later on there are plans to separate glass from recycling, so you might end up with 4 bins, what fun!

The glass only bin will have a purple lid. All these changes are designed to help us reduce, recycle and make use of organic material for fertilizer, rather than allowing it to add Methane to our atmosphere. All for the greater good!

liz@sanzaro.com

www.croydonconservation. org.au

Does your business have a culture that encourages health and safety? There are ways for you as an employer to create a safe workplace:

One of the most important things you can do to create a safe workplace is to pay attention to safety hazards. There are many potential hazards in any workplace, so it's essential to be aware of them and take steps to mitigate the risks. Standard safety hazards can include slips, trips and falls; electrical hazards; manual handling injuries; and chemical and noise exposure. By being aware of these hazards and taking steps to reduce the risks, you can prevent accidents and injuries in the workplace.

Creating a safe workplace is an essential responsibility for any employer. By taking the time to identify and reduce potential hazards, you can keep your employees safe and prevent accidents and injuries in the workplace. Another critical step in creating a safe workplace is to ensure that your employees are adequately trained. You should ensure you provide adequate training on safety procedures and policies, and make all employees aware of the risks associated with their job.

As an employer, you are responsible for ensuring your workplace meets safety rules and regulations. If you see any safety hazards, make sure you address them immediately. Also, be sure to conduct regular safety inspections. By doing this, you can help prevent accidents and injuries in the workplace.

All responsible employers know that a safe workplace is also a productive workplace. They will be aware that a safety management system helps to protect employees from potential hazards, helps to boost morale and reduce absenteeism, and in doing so, increases productivity. In addition, a well-run safety management system can help to improve a company's bottom line by reducing workers' compensation costs and liability risks.

Ensure your employees are aware of the dangers in their workplace and how to avoid them. Encourage them to report any safety hazards to you. Provide effective training. Record training and confirm understanding. Provide regular reinforcement of learnings, and updates as required. Educating your employees

about safety can help create a safer workplace.

One of the best ways to create a safe workplace is to develop a culture of safety. This means that safety is a priority for everyone in the workplace. Encourage employees to work safely and report any safety concerns. By paying attention to potential hazards, providing adequate training, and enforcing safety rules and regulations, you can help create a safe workplace for your employees.

How effective are you at creating a safe workplace for your employees? We assist business owners clarify what they currently have in place, as well as where there are shortfalls.

We then assist in developing effective systems and documentation, work with employers to implement. Checks are put in place to monitor effectiveness, to ensure that going forward they are sound and comply with the Act, and most importantly keep them and their employees informed, and healthy and safe. Please feel free to contact me, Mark Felton, at Beaumont Advisory on 0411 951 372 or mfelton@beaumontlawyers. com.au for an obligation and cost-free initial discussion.

Have you ever listened to a song, really listened to it, and realised it meant something different to what you thought. You may have listened to it for years, even sung along with it in the car but not actually registered what the words meant?

I had this experience recently with a song by Kylie Minogue. It was released in 1990 as the lead single for her third album ‘Rhythm of Love’. ‘Better the Devil You Know’ is said to be about her leaving the tv series Neighbours and her relationship with her then boyfriend, INXS singer Michael Hutchence.

However, to me, the song sounds like it is encouraging people to stay with abusive partners. Have a look at some of the lyrics and see what you think –

[Verse 1]

Say you won't leave me no more; I'll take you back again; No more excuses, no, no;

'Cause I heard them all before; A hundred times or more

[Chorus]

I'll forgive and forget; If you say you'll never go; 'Cause it's true what they say; It's better the devil you know

[Verse 2]

Our love wasn't perfect, I know; I think, I know the score; You say you love me, oh boy;

I can't ask for more; I'll come if you should call

It continues on including other lines like “I'll be here every day, Waiting for your love to show”

I listen to the song and I hear “You don’t treat me nicely but you tell me you love me so that’s ok. If you leave me, I’ll welcome you back as long as you tell me you love me. There isn’t any point me leaving you because I might end up with someone just as bad or worse. At least by staying with you I know what I’m

getting. There is no way I could end up with someone better.”

What do you think? Is there a song that you have heard that makes you go hmmm? Email us at editor@findmaroondah.com. au with your thoughts.

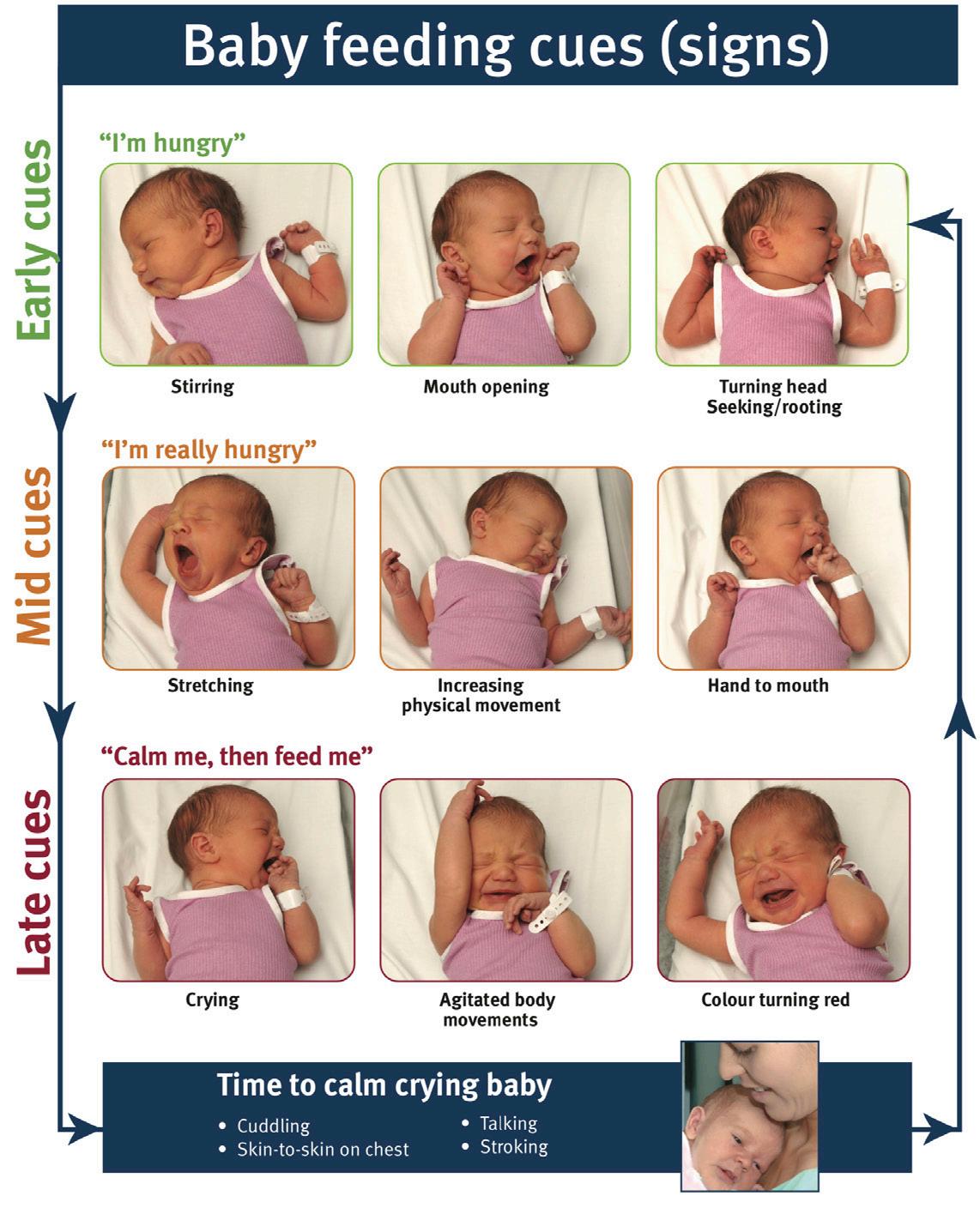

Newborn babies need to feed frequently - usually 8-10 times every 24 hours. Breastmilk breaks down in a babies tummy in about 90 minutes, therefore babies need to be fed often! Exactly how often a baby feeds each day and for how long varies from one baby and mother to the next, and from one feed to the next.

The most important thing is to respond to your baby’s feeding cues promptly and appropriately. Your baby will use body language and facial expressions to indicate that she is getting hungry and needs to be fed again. She will let you know in her own way, and as a new parent it is very helpful to get to know what these cues look like so that you can respond quickly to them.

It is much better to to learn to read your baby’s feeding cues and follow their lead than to watch the clock. A baby’s appetite varies throughout the day, just like it does for adults, so feeding times may vary from feed to feed. In addition, as babies get older, they get stronger and more efficient at draining the breast, so feed times usually become shorter.

It’s important to always allow your baby to fully finish the first breast before offering the second breast. Let your baby finish feeding and come off the breast by herself, rather than taking her off when she is still swallowing. Usually when you do this, your baby will be sleepy and content and may need a little rest before being ready for the second side.

Generally, feeds will be finished in under an hour. If feeds are regularly taking more than an hour, it could indicate a problem with the latch and seeking the advise of a lactation consult is indicated.

Feeding cues can be divided into 3 stages: early, mid and late.

The best time to feed your baby is when they are showing early feeding cues. By the time a baby is showing late feeding cues and is crying, they have become too worked up to feed well. In this heightened state, a baby in not able to shape their mouth and tongue to latch well nor is their nervous system in a good state for digestion. Now they will need a soothing cuddle and comforting to calm

Credit: www.health.qld.gov.au

and settle them down so that they can feed well.

Feeding your baby at the earliest sign of hunger helps baby develop confidence that you will always respond to their needs. Responding promptly to your baby’s cues contributes to her developing a healthy and secure attachment to you.

Early feeding cues are:

• Stirring from sleep

• Opening mouth/licking

• Turning head to the side/seeking the breast/rooting

Mid feeding cues are:

• Stretching

• Increasing physical movement

• Hand going to the mouth

Late feeding cues are:

• Crying

• Agitated body movements

• Turning red in the face

For more information about feeding cues and early newborn feeding behaviour, please see a International Board Certified Lactation Consultant (IBCLC) for individual advise.

Please refer to www.lcanz.org.au to find your local IBCLC.

Dr. Joanna StryboschOsteopath B.App.Sc(Clin.Sc)/B.Osteo. Sc/Grad Dip Paeds

LACTATION CONSULTANT

www.childrensosteopathiccentre.com

Throughout the year FIND Maroondah has included a number of stories with advice to Sporting Clubs covering a wide range of topics.

During 2022 has your Club taken time to look at:

What it is doing to attract new sponsors and what it should be doing to retain existing sponsors?

Has your Club reviewed its sponsorship packages?

Has your Club developed a Business plan?

What ideas has your Club looked at to increase membership?

Has your club taken the time to investigate why members have left or are thinking about leaving?

Reviewed your Clubs revenue streams? Ensuring that you have the right people on your board and that they are working as a team?

Keeping members informed about future plans for the club.

Conducting a member survey to find out if they have ideas that the board should consider?

Looked at using Social media (website, Instagram, face book) to publicise club activities?

No one says its easy and no-one wants to see a sporting club fold but you

can’tafford to sit back and work on the theory – it’ll be all right on the night.

Every Sporting Club has a history that should be both preserved and respected – but we need to look forward not backwards.

Don’t be afraid to put the microscope over your club – involve your members – the results may surprise you – they may also provide you with the advice you need for your club to move forward and be around for many years to come.

Does your club have a business plan – a plan that outlines what your club is looking to achieve into the future?

Without one you could be seen as a rudderless ship however with a business plan you will be in the position to move your club forward.

Don’t waste time looking back – what worked successfully your club a few years ago should be classified as ‘history’ – what you need now is a plan to move your club forward.

Let your members know that your club is working on developing a business plan, a plan that will involve all aspects of your club – revenue, membership,

sponsorship, subscription fees to name a few – and importantly seek input from your members.

The plan should look at reviewing your club’s revenue streams and then look at what you need to do to increase revenue, increase membership, increase sponsorship whilst also looking at additional revenue streams. The common denominator is the word INCREASE with the common goal being both increased revenue and membership.

Ask yourself this – is our club being run as a business?

If the answer is NO then it is time for a re-think and most definitely the time your club needs to develop a business plan.

Take the following into consideration:

What category does our club fall into? What is our product? What is our brand?

We are a Sporting Club Name of your Sport That’s the name of your Club

And do we have a business plan?

Running your Club as a business is the only way to go.

A business plan will show you how you plan to grow your sporting club in the coming years.

But don’t think you can do it alone…get your board involved, get your members involved – work collectively as a club and you will finish up with a business plan that has been well planned, endorsed by your members and implemented.

By Liz Sanzaro

By Liz Sanzaro

Our local collective voice has been side lined, by changes to the State Planning Scheme. The questionnaire below, is principally designed for our local State Government representative to complete so we know where they stand, in order to consider our voting choice on November 26th. Even if you just read it, it may help you understand what is at stake and who is making “executive decisions” on your behalf.

Since 2014, thirty-eight amendments to the Planning Framework have removed permit requirements and/or removed requirements to meet planning scheme provisions. These amendments have eroded the rights of communities set by the Planning and Environment Act to participate in planning decisions.

Since June, Croydon Conservation Society has been weekly emailing over thirty MP’s / MLA’s across greater Melbourne regarding the poor outcomes of Councils applying fines for illegal tree removal from private land. We will continue to push for law reform for just this one issue, until there is something that actually works. Here is are two of our emails.

1. WHY does a State-law exist, that can be used to prosecute tree vandals, but rarely is?

For reasons too many to list, Local Councils rarely enforce this law, and accept relatively small fines and a slap on the wrist for developers, who factor this small fine into the cost of doing business, and end up making the purchaser of the new development pay. How is this allowed to happen?

2. Just look at the consequences below of not setting aside a sufficient setback from a rural road. This Environmental vandalism is totally unacceptable.

Many residents feel like we are losing our precious character, amenity and vegetation are integral to living in leafy Maroondah.This was designated a special precinct zone in Drouin and did not have to go through local Council. The developer should have reserved land adjacent to the trees as a safety precaution and not been allowed to remove roadside vegetation to maximize profit. We need to stop this Environmental Destruction, Habitat and Biodiversity.

The questionnaire below addresses current issues with regard to Planning.

Dear State Election Candidate or Planning Spokesperson, Victoria’s Planning Framework aims to, “provide for the fair, orderly, economic and sustainable use and development of land”.

Planning Democracy has designed this questionnaire to help its network of concerned community groups understand where you and/or your party stand on using the Planning Framework to give communities a genuine say in protecting Victoria’s environment, heritage and natural resources.

1. Please respond to these community group and citizen perceptions:

1 Developers now have too much say in decision-making. Residents and communities have not enough.

Agree Disagree I need more info

2. Do you think the use of the planning framework is achieving its objectives?

(Numbers refer to a relevant objectives of the Planning and Environment Act 1987. The Acts objectives are attached. YES

8 Protecting built heritage. [S4:1d]

9 Protecting natural heritage and ecological processes. [S4:1b]

2

Certainty and consistency need to be achieved through mandatory planning provisions and prohibitions, not Ministerial amendments that remove the need for permits and community consultations.

3

Enforcement policy (e.g. for illegal vegetation removal) is weak, supports a cumbersome and costly process and imposes inadequate penalties that reward bad behaviour.

4

The right of Councils and communities to be heard in decision-making have been eroded by successive State Government amendments to the planning framework.

5 Developers and their associates need to be banned from making political donations.

6 The Parliamentary Inquiry into Planning and Heritage protection must be restarted by the new State Government2.

7

Melbourne’s Green Wedges and Agricultural Land Action Plan must be immediately released and implemented.

The Victorian Parliamentary Inquiry into Protections within the Victorian Planning Scheme was suspended by State Government through purported lack of time. The ‘Inquiry into the protections within the Victorian Planning Framework’ was published as an interim report on 2nd August 2022.

This Plan was produced in response to a 2018 election pledge to better protect Melbourne’s Green Wedges and Agricultural Land. It is complete but confined to the Planning Minister’s ‘desk’ for the past 12 months.

10 Protecting agricultural land. [S4:1b]

11 Achieving Ecologically Sustainable Development. [S4:1g]

12

Prohibiting and/or discouraging urban land-uses in Melbourne’s Green Wedges. [S4:1c]

13 Conserving and expanding urban tree cover. [S4:1c]

14

15

Promoting sustainable and affordable housing. [S4:1f(a)]

Sustaining the influence of resident and community voices in decision-making. [S4:2d,h&i]

16

17

Making development and infrastructure adhere to planning scheme aims and controls [S4:2b&e]

Imposing effective penalties and enforcement for breaches of permit conditions [S4:2k]

18

Supporting reviews of State and local planning provisions in the light of the Covid19 pandemic and climate change response. [S4:2a]

PLANNING DEMOCRACY is a group of concerned Melbourne residents headed by the Hon Kelvin Thompson.

CCS has been supported by this group in our work, to hopefully change or remove a State Law, that is failing us.

Liz Sanzaro

President of Croydon Conservation Society liz@sanzaro.com www.croydonconservation.org.au

By Reece Droscher

By Reece Droscher

One of the most common questions I am asked as a Mortgage Broker is: “Should I get pre-approval with a lender before I start shopping for a home?” The answer is definitely yes, but there are a few things you should be aware of before you go out and sign a contract to buy a house thinking that your finance is already approved by the Bank.

What is the benefit of getting preapproval?

There are several benefits to getting a broker to organise a pre-approval before you make an offer to buy a home.

1. The pre-approval will provide you with some security that, assuming your financial position remains unchanged, the lender is comfortable that you can afford the loan required and you would meet their lending criteria.

2. You will be aware of any conditions that you would be required to meet to obtain final approval, such as needing to reduce or cancel existing credit cards or buy-now-pay-later accounts so you can prepare to meet these conditions.

3. You will know your limits in relation to the purchase price, which is especially relevant should you be looking to buy a home at auction, and all of the costs associated with buying a home to ensure you will be able to complete the property settlement.

4. If you apply using a mortgage broker they will complete research on your behalf, taking into your account your requirements and the product features you would like to have, to determine which lender and product would be the most suitable to lodge an application with.

Is a pre-approval a guarantee that my loan application will be approved?

Although obtaining pre-approval with a lender provides you with some comfort that you will be approved should you buy a home within the conditions of the pre-approval, this is not a 100% guarantee of final finance approval. There are several issues that can cause a lender to back away from any preapproval commitment. Some of the most common are:

1. Changes in interest rates which may increase the required loan repayments, making the preapproval amount less affordable.

2. If a property valuation has to be completed any shortfalls in the valuation may impact on the lender’s pre-approval commitment.

3. Any new loans or other access to credit that you may take out between getting the pre-approval and buying a property can alter your eligibility for finance approval.

4. Changes to your income/ employment status.

How do I make sure that my preapproval will turn into final approval?

Working with a mortgage broker can ensure you have the best chance to turn your pre-approval into a final approval. They can work with you and the lenders to cover any potential hurdles in getting the pre-approval, or if your situation changes they can determine whether this will have any impact on your final approval before you buy a home.

Pre-approvals are usually only valid for 90 days, so a broker will also assist with keeping your pre-approval current by providing updated information to

the lender so they can re-assess and extend the pre-approval if you are still eligible.

It is also important to note that getting pre-approval with a lender does not lock you in to that lender. With volatile interest rates and changes to lending policies occurring, a mortgage broker will regularly review whether the lender is offering the most suitable product to meet their client’s needs. Remember, a mortgage broker is bound by their Best Interest Duty to always put their client’s interest first, so you can be assured that they will be recommending the lender and product that best suits your needs.

At SHL Finance we would welcome the opportunity to discuss your potential Home Loan requirements with you. Please call Reece Droscher on 0478 021 757 and he can help you navigate your way through the Home Lending market to realise your financial goals.

Please call Reece Droscher on 0478 021 757 to book in a review and discuss your options.

It’s likely that you’ve never given a moment’s thought to how many businesses are owned by Baby Boomers (people born between 1946 and 1964) and whether this matters. In Australia the last of the boomers born are now 58, and will no doubt be looking at what to do with their business before they retire. If they currently have Professional Indemnity or Directors and Officers cover for example, which both use ‘Claims Made and Notified’ wording, they need to budget for run-off cover. This is insurance purchased to cover previous activities, even if no new business activity will take place. Failure to plan for this expense may put a severe dent in their retirement savings. Worse still would be to drop the cover, then be pursued as a retiree and former company director for losses which are no longer insured.

Various insurance policies are written on a ‘claims made’ basis. This means that they will only respond to claims which are made against an insured, and notified to the insurer during the live policy period, regardless of when the work was undertaken by the named insured. If the policy expires (so not renewed when the company closes or is sold), no “new” claims can be made under the policy even if the circumstances leading to the claim occurred during a previous policy period. Claims already notified and accepted during the policy period should still be honoured, but new notifications would be rejected.

This is where a run-off insurance policy can prove to be invaluable.

Run-off insurance policies can be arranged prior to the cessation of a business or the completion of a project where a live “claims made” policy is still in effect. They can provide coverage to an insured for future claims made against them which arise from acts, errors or omissions which occurred prior to the inception of the run-off policy during the “normal “ policy period. Run-off policies

can be taken out on an annual basis or a multi-year basis with a single upfront premium payment. (Some insurers will do only one year at a time).

The following policy types are normally written on a “claims-made” basis and run-off insurance should be purchased if winding business up or finishing a specific project. 1. Professional Indemnity Insurance

Management Liability Insurance

Association Liability Insurance

& Officers Liability Insurance

IT Liability Insurance

Why do I need it when the company is already closed?

• Individuals can be held liable for their negligent actions as professionals, principals, partners, directors, officers and employees even if a company is no longer active on the ABN Register and wound-up legally.

• Obligations agreed to under contracts & deeds signed by the

company can survive the life of the company and attach to individuals such as directors.

• Some sale agreements require entities to purchase run-off insurance to cover past liabilities when the new owners don’t want to carry forward the liability.

For a health check of your business insurance, contact Small Business Insurance Brokers via email sales@ smallbusinessinsurancebrokers.com.au

Any advice in this article has been prepared without taking into account your objectives, financial situation or needs. Because of that, before acting on the above advice, you should consider its appropriateness (having regard to your objectives,needs and financial situation).

GENERAL INSURANCE

Small Business Insurance Brokers

www. heightsafetyinsurance brokers.com.au 0418 300 096

Year after year, the ifa Excellence awards have rewarded the most exceptional financial advisers and businesses across the country, showcasing their achievements and honouring their efforts in contributing to the sector.

Recognising the contributions of the profession’s rising stars through to those in the most senior ranks of start-ups, established businesses and transformed businesses, our awards program enables thousands of professionals and businesses to boost their careers, reputation and businesses after winning an award.

The finalist list, which was announced on 5 October 2022 , features over 230 highachieving financial services professionals across 28 submission-based categories.

“Firstly I would like to congratulate all the finalists and thank everyone that applied for this year’s ifa Excellence Awards. The competition was very tough and we at ifa are thrilled to once again host a fun night out for all our well-deserving advisers after another fairly tumultuous few months,” says Wealth editor Maja Garaca Djurdjevic.

“We look forward to celebrating the excellent work being undertaken by advisers all across the country and those whose innovation has led the way for the sector."

Warren Strybosch, Founder at Find Group, said that he was humbled to be recognised and proud to be named as a finalist in the ifa Excellence Awards 2022.

"Find Group's recognition for our excellent contribution to the Financial Services Industry reinforces the strength of our service and dedication to connecting with the community and engaging with clients," added.

This award Recognise An Individual Who Offers Clients A Multitude Of Advice Services And Professional Disciplines, Such As Investment And Risk Advice, SMSF, Tax And Accounting, Legal And Estate Planning, And Mortgage And Credit Advice.

This Award Recognises The Individual Owner Or Managing Director Of a Boutique, Self-Licensed. Financial Planning Firm Who Has Built The Most Successful Business Over the Past Calendar Year. Success Will Be Measured By The Individual Adviser and Collective Advice Capabilities Of The Firm, Growth And Retention Of Advisers And Other Team Members, Plus The Success of the Business In Term Of Revenue And Profitability.

As the weather warms up and both people and wildlife are more active, accidents are bound to happen. If you find an injured animal, there are small things you can do that can go a long way to helping the animal survive. Despite common misconceptions, cats are not the cause of most wildlife injuries. They mostly go for mice and rats, helping to keep the rodent population down. It is human activity that causes the majority of injuries to the local wildlife.

Your first choice should be to contact a qualified wildlife carer or your local vet.

Wildlife Victoria - (03) 8400 7300 24 hours a day, 7 days a week or use this link to report online. (https://www.wildlifevictoria.org. au/wildlife-information/report-a-wildlifeemergency)

Warriors 4 Wildlife - 1300 352 923 24 hours a day, 7 days a week or use the chat function on their website https:// warriors4wildlife.org/

If you feel the animal is in a compromising position, for example somewhere a predator has easy access, you may need to move it.

Wild animals carry mites, lice and diseases that can be transmitted to humans and your beloved fur babies at home. With a few simple precautions though, you can still help.

Make up a small kit of º disposable gloves, º hand sanitiser, º an old towel, º a disposable puppy pad, and º a decent sized box with air holes.

Alternatively, a plastic bag can be used instead of gloves to contain the animal’s limbs or wings while you wait for a wildlife carer or you take it to a vet. Keeping the animal away from your clothing and skin

can help with reducing the chance of contact with any lice or mites, however you can always quarantine those items of clothing if the animal needs to stay close for warmth. Putting hand sanitiser on your hands and arms can help stop the mites and ticks from sticking to you.

On a cold day: In the ventilated box, put the old towel at the bottom, a heat pad or hot water bottle in the towel (warm not hot), puppy pad and animal. If possuma beanie is adored for comfort by them.

On a hot day: towel in box, puppy pad on top and good ventilation, provide any water hydration that you can and regulate temperature.

If you come across a mother who has died, please always check her pouch for any babies. If you can transport the mother as well, it is best to keep the baby in the pouch until you can get to the vet or a qualified wildlife carer.

Emergency care for possums and birds is very similar if a vet isn’t open nearby. Boil water (250ml)

Add a small teaspoon of honey Cool down to room temperature and syringe a little into the animal’s mouth until you can get to closet vet or RSPCA.

It is common to find baby birds, known as fledglings, on the ground at this time of year. This is a very important part of their development as they learn to fly and take off from the ground. It is wise to keep an eye on them to ensure you can spot if they become injured, however do not approach them as their parents will be close by keeping an eye on them. If you are concerned at all, please contact a qualified wildlife rescuer for advice. They may want to come out and assess them to determine if there is anything to be concerned about.

Your vet will ask exactly where the animal was found so it can hopefully be rehabilitated and reunited with its family. If you do get bitten or scratched, please don’t forget to make sure your tetanus vaccine is up to date!

Special thanks to Kate McIntosh from Elsternwick Vet Clinic for this information.

Trying to achieve more than most people? Or maybe you’ve been doing that and have hit a wall?

Welcome to the world of adrenal exhaustion, or technically, the Hypothalamus-Pituitary-Adrenal (HPA) axis dysfunction, adrenal insufficiency, or hypercortisolism.

According to the Australian Bureau of Statistics in 2020-2021, 15% of Australians experienced high levels of psychological distress, and this was higher in women, and younger Australians (16-34 years). This is likely to be higher in Melbourne where the pandemic stress combined with lockdowns meant long periods of reduced social activities and parents trying to juggle work with homeschooling.

Our central nervous system has two modes: sympathetic nervous system (SNS) dominance, known as ‘fight or flight’, and parasympathetic nervous system (PSNS) dominance, ‘rest and digest’. During life we need to spend time in both modes, SNS to achieve and accomplish our goals, and PSNS to relax and enjoy life.

High achievers usually do exceptionally well when life is predictable and there is enough time for relaxing. But add some kids, financial pressure, or any other additional responsibilities to the mix and the time spent in PSNS mode often gets squeezed out of life. This is where the problem starts and people tend to either ignore the stress and push through, or relax by drinking, enjoying junk food, or finding another way to distract themselves. Either way is not good for your body.

• Feeling exhausted or fatigued

• Surviving on caffeine (which may be less effective over time)

• Sleep disorders (insomnia or daytime sleepiness)

• Anxiety or depression

• Memory or concentration difficulties

• Menstrual and reproductive dysfunction

• Hypertension (high blood pressure)

• Cardiovascular disease

• Immune dysfunction

• Metabolic disease

• Weight gain

There is so much that can be done with both nutritional and herbal medicine to help support you. There is a class of herbal medicines called ‘adaptogens’, and these herbs help you to adapt to both physical and mental stress. In clinical studies on athletes, those taking adaptogens can run and swim for longer and go further than the control group. In studies that use questionaries, those taking adaptogens report significantly lower levels of stress, anxiety, and depression. There are also herbs to support your adrenal glands and nervous system which can be accurately prescribed during a naturopathic appointment.

• Find things in your life that are fun

• Have activities you find relaxing

• Spend time in nature

• Do things with friends or family

• Spend time in gentle exercise

• Spend time away from a screen and relax before bed

• Eat nutritious food

• Reduce caffeine, sugar, and alcohol

• Learn time management techniques

• Remove life stressors where possible

• See a counsellor

Whole Naturopathy can help provide you with nutritional and herbal support for stress, exhaustion, and any other health issues that arise as a result of stress.

This advice is general in nature and not intended to be prescriptive. For individualised prescriptive advice, please see a naturopath or other health care practitioner.

BHSc (Naturopathy)

kathryn@wholenaturopathy.com.au

By Elwynne Kift

By Elwynne Kift

Cyril Callister in the early 1920s was tasked by Fred Walker with creating a yeast extract after imports of Marmite were halted due to World War I. After experimenting with brewer's yeast he created what became known as Vegemite which was first sold in 1923. After becoming successful in creating processed cheese using James Kraft's patent, The Walker Company became established as the Kraft Walker Cheese Co in 1926. Of this new company, Callister was appointed chief scientist and superintendent. After having three children between 1919 and 1927, because of his work developing Vegemite, Callister was awarded a Doctorate from the University of Melbourne in 1931. Sadly, Callister died in 1949 and is now buried at Box Hill Cemetery but left a Vegemite-sized legacy behind creating what became a national icon.

The founder of the Find Group of companies draws on his diverse background, which ranges from teaching, to serving in the army, to taxation and accounting, to coach and help clients live their best financial lives. A multi-award winner, Warrens’s innovative approach in business means he was a champion of virtual financial advise long before the pandemic. Warren established the Find Foundation, which owns and operates accros Victoria.

The financial advisers featured in this guide are a diverse group: some specialise in responsible investment advice, some provide financial advise to specific professions, and some focus on addressing market gaps, mwith several finding themselves on the list for the very first time. But they all have one thing in common: they all wield influence that can create the blueprint for the future of financial advice in Australia. Not all of them are faniliar names but just because they are not making a lot of noise doesn’t mean they are not making waves. Meet our Power 50.

SIGNAGES

By Glenn Martin

SIGNAGES

By Glenn Martin

Melbourne, Victoria – 26 July 2021 –Signarama has won two awards at the recent MYOB FCA Excellence in Franchising Awards in Victoria. The annual awards recognise outstanding achievements in the franchising industry, worth an estimated $155.1bn to the Australian economy (IBIS 2021).

Franchisees Michael & Kathy McGrath from Signarama Footscray & Melbourne CBD took home the award for Multi-Site Franchisee of the Year Award.

After having previously owned and operated an Australia Post location, the McGrath’s sold that business and joined the Signarama network in 2016 with their first location in Footscray. It took the McGrath’s just a couple of years to then acquire a second location in the heart of Melbourne CBD.

“We’re absolutely thrilled at receiving this award! Being situated in Melbourne, last year was one of the toughest situations we’ve had to face. But we remained optimistic and through the support of our excellent team, and our amazing customers we’ve come out stronger and didn’t just weather the storm, but were fortunate enough to excel.”

In recognition of his exemplary support of the Signarama franchisees (in particular throughout the bulk of Melbourne’s lockdown in 2020), Signarama Operations Advisor, Michael O’Connor was named as Field Manager of the Year.

“I’m over the moon. What our stores have experienced in the last 18 months and what they’ve achieved has been nothing short of exceptional. You cannot underestimate the amount of job satisfaction I get out of seeing our franchisees nurture and grow successful businesses. It’s 100% why we all do this.”

Having won the VIC/TAS state chapter awards, both Michael & Kathy McGrath and Michael O’Connor will now progress as finalists in the FCA’s National Awards to be held at the National Franchise Conference in Melbourne scheduled for October.

At Signarama, we can help you create the trade show display of your dreams with all the bells and whistles to make a lasting impression. Contact us today to discuss the many options available for your company’s next trade show booth. The only limit is your imagination!

From May 1, 2023 you will be able to add food waste to your green waste bin as part of the new Food and Garden Organics Service, or FOGO (Food Organics and Garden Organics). The aim of this initiative is to reduce food waste in landfill which currently accounts for 40% of all garbage and ends up producing methane gas, a greenhouse gas that is 25 times stronger than carbon dioxide.

In January 2023, the council will begin replacing the maroon lid on your current bin with the Australian standard limegreen lid.

In March 2023, each residential property will receive a FOGO kit. This consists of a kitchen caddy and roll of 150 compostable bags to make it easier for you to collect your food waste to put into the bin. Each roll should last you around 1 year depending on your usage. You can however collect more bags if you run out.

On May 1 2023, you will be able to begin using your FOGO bin to put your food scraps into in addition to your garden waste. You are encouraged to use the compostable bags provided by Maroondah Council to reduce odours.

You will be able to place the following food scraps into your FOG bin however a more extensive list will be provided in 2023:

• fruit and vegetable scraps including garlic, onion and citrus

• leftovers and plate scrapings

• rice, grains, cereals and bread

• meat, seafood, poultry and bones (raw and cooked)

• dairy products and eggshells

• tea leaves and coffee grounds

• mouldy or expired foods

• pastries, cakes and deserts

For more information or to sign up to updates, visit https://www.maroondah.vic. gov.au/Residents-property/Waste-rubbish/ Food-and-Garden-Organics-service

For those who own and operate a family trust, you would be aware of the increased interest the ATO has placed on these structures.

The ATO seems very interested in reducing the amount of distributions that are being passed on to adult children and other beneficiaries whereby the result is less tax being paid by the owners of those trusts; in most cases, this being the parents of adult children.

Since the inception of family trusts in 1970, trusts have been subjected to many changes with new laws being handed down by the Courts, the ATO and State and Federal governments, with the most recent one being centred around 100A.

However, with a recent Victorian Supreme Court of Appeal that has taken place, trustees now need to be aware of another potential change that is likely to take place. This change involves the minutes that must to be completed and signed before the end of each financial year in relation to distributions of income for that particular accounting period.

The Appeal decision in question relates to Owies v JJE Nominees Pty Ltd (ACN 004 856 366) (in its capacity as the trustee for The Owies Family Trust)

[2022] VSCA 142 (“Owies”) which was handed down in July this year. The decision now puts trustees on notice to genuinely consider all beneficiaries, and in particular the primary, named or specified beneficiaries when making their trust distributions. The failure to do so may result in certain trust distributions made in a particular year being voidable and higher taxes being paid.

This case highlights the point that for a trustee to genuinely consider a beneficiary as being entitled or not entitled to income for a particular accounting period, the trustee should as a minimum, make enquiries as to the primary, named or specified beneficiaries’ needs and circumstances.

It is not good enough now to simply get beneficiaries to sign a document releasing the trustee from having to paying any money to a particular beneficiary. The trustee must demonstrate that they have made enquiries regarding the needs and circumstances of the beneficiary to determine if that the beneficiary does not need those trust distributions. If it is found out that the beneficiary could have benefited from the trust distributions and these were withheld, then a future claim might be made against the trustees to pay the amounts withheld and/or the ATO might rule the distributions invalid resulting in the trust having to pay the tax for that given period, usually around 45%.

The absence of such evidence may assist a beneficiary in making a successful claim against the trustee for not receiving a (or receiving an inadequate) trust distribution in a particular year.

For the trustee to avoid an adverse court judgment against them for future trust distributions, the trustee may need to do one or more of the following:

1. Make enquiries each accounting period on the needs and circumstances for every primary/ named/specified beneficiary as a minimum;

2. Internally document their enquiries and considerations;

3. Consider removing certain primary beneficiaries from the trust - subject to review of the trust deed.

We believe that this case has such significance for all trustees and that we are likely to see a higher take up of beneficiaries approaching trustees for past distributions that were not paid to them.

You can call them on 1300 88 38 30 or email info@findaccountant.com.au www.findaccountant.com.au

Over 5 publications we will be running a series of sensory experiences in nature. Each experience will take about 10 mins and you are encouraged to read through the instructions before you commence your time in nature to maximise your experience.

Find a spot outside where you can sit or lie down comfortably. This could be in your backyard, your local reserve or in a national park.

Take a few moments to regulate your breathing and settle into your position.

Breathe in for the count of 5, hold your breath for the count of 5, breathe out for the count of 5, pause for the count of 5.

Repeat up to 5 times.

Allow your breathing to find its natural rhythm once more.

If you are comfortable, shut your eyes. If not, focus on a spot down in front of you.

For the next 5 mins, tune in to what you can observe with your ears.

Listen, what do you notice?

How many different sounds can you hear?

Are they far away or close by?

In what direction do they come from?

Are they repetitive or random?

Allow your sense of hearing to become larger.

If your mind gets distracted, just draw your thoughts and attention back to what you are hearing.

Try to stay focused and enjoy the experience of tuning into your sense of hearing.

When you choose to complete your experience, you may wish to take a moment of gratitude for nature and for the experience you have just had.

is the founder of Admirari Nature Therapy who provide nature experiences for schools, business and individuals.

For more information visit admirari.com.au

is an important way to slow down from the busyness of life.

What would happen to your partner or family if you passed away? Would this cause them financial stress, would they have to sell assets just to live, pay bills and buy essential items?

Many people don’t stop to consider this question because most people don’t like to think about worst case scenarios. Many people think ‘oh that it won’t happen to me’ or they think of insurance as an unnecessary expense.

Most people who own a car, have car insurance, and don’t even think twice about having it, yet many people do not have any or have very little life insurance (which is can also be known as death cover). Yet one of the best ways to protect your partner and your children if you were to pass away suddenly, is by ensuring that you have adequate insurance to protect them and their lifestyle.

Personal risk insurance can help protect you or your loved ones financially, to ensure you can all keep living the life you love in the event of illness, injury, or even worse death. This article focusses on Life Insurance.

However, it is important to point out that there are 4 different types of personal risk insurance cover:

• Life Insurance (also known as Death Cover) - Life Insurance provides a lump sum payment to help ensure your partner and families financial security in the event of your death, or if you are diagnosed with a terminal illness.

• Income Protection - Income Protection provides you an alternative source of income if you are unable to work due to an illness. This can help to keep your household with income, while you recover and until you are able to return to work.

• Trauma Insurance - In the event you’re diagnosed with certain serious medical conditions or illnesses (such a cancer, heart attack, stroke just to name a few), trauma cover provides a lump sum payment to assist you as you recover. During recovery there can sometimes be unexpected costs that may not be covered by Medicare or Private Health Insurance, such rehabilitation equipment, ongoing medical care, home modifications, living expenses and bills which is where a trauma payout can be very helpful.

• Total and Permanent Disability Insurance (TPD) - TPD insurance can provide a lump sum payment if you were to become permanently disabled due to accident or illness and are unlikely to ever be able to work again.

Life insurance can often be purchased through your existing superannuation fund which is referred to as Group Cover.

However, we encourage you to read the product disclosure statement and ensure you understand what you are covered for.

Financial advisers have access to many different insurance providers and products, we can offer you Retail Insurance cover.

There are advantages and disadvantages of both Group and Retail cover, a financial adviser can help you understand which option may be best for you.

Group insurance is a pooled insurance product offered by a super fund (or employer) to a group of people. The agreement is between one owner (the trustee of a super fund or an employer) and the insurer. Often, people will hold a default level of group cover via their industry superannuation fund. The amount of cover usually decreases as you get older with group life insurance.

And it often gets more expensive as you get older.

One of the advantages of Group cover is that sometimes you can be automatically accepted without having to provide further information about your health. However, if you want to take additional life cover above the standard level offered you may be required to answer a medical questionnaire.

An individual insurance product between the life insured and the insurer. Policies are channelled via intermediaries suchas financial advisors. The application process involves underwriting – which is an assessment of the risk profile of the life insured, which involves a medical component (e.g., personal/family history, potential collection of bloods etc). One of the main benefits of a retail insurance policy is that the terms and conditions are protected and cannot be unilaterally changed to your disadvantage.

An underwriter determines your overall risk by examining factors, such as your age, gender, medical history, current health status, whether you are a smoker or non-smoker, your occupation, and your recreational activities. They can then choose to offer you cover at standard rates, or they may offer you cover with a policy exclusion or add a premium loading if they determine you may be higher risk.

Should life insurance be indexed or not?

Retail insurance policies allow you to have the option of increasing your sum insured annually which is also know as indexation. The amount you are insured for will be indexed in line with inflation. You can however to choose to remove this indexation.

Most group insurance schemes tend to reduce the benefit amount as you get older. This is one of the critical differences between group and retail insurance.

Stepped premiums is when the cost of your cover is recalculated each year based on your age at your policy anniversary. Generally, this means your premium will increase each year as you get older. Group insurance generally only offer age-based/unitised or stepped premiums.

Retail life insurance policies on the other hand tend to offer a choice between stepped and level premiums. This is also one of the benefits of retail insurance policies is they allow you to select between stepped and level premiums or a hybrid of the two. This provides more flexibility for short-term or long-term insurance needs.

Level premiums are where premiums are calculated based on your age when any cover started. Your premium is generally averaged out over several years, which means you avoid increases in your premium due to age at each policy anniversary.

This means your cover is more expensive than ‘stepped premiums’ at the beginning of your policy, but generally gets cheaper (relative to stepped premiums) as your policy continues.

What should you do if you would like further information?

As you can see life insurance is complex yet critical for your family’s financial wellbeing. If you are considering a review of your insurance needs, please contact Find Insurance on details below.

We would be happy to have an initial phone conversation, or you can find out more information at our website https:// findaccountant.com.au/financialplanning/insurance/

1300 557 144 | erryn@findwealth.com.au www.findwealth.com.au

Financial Planning is offered via Find Wealth Pty Ltd ACN 140 585 075 t/a Find Wealth.

Find Wealth is a Corporate Authorised Representative (No 468091) of Alliance Wealth Pty Ltd ABN 93 161 647 007 (AFSL No. 449221). Part of the Centrepoint Alliance group https://www.centrepointalliance.com.au/

Erryn Langley is Authorised representative (No. 1269525) of Alliance Wealth Pty Ltd.

Thisinformationhasbeenprovidedasgeneraladvice.We have not considered your financial circumstances, needs or objectives. You should consider the appropriateness of the advice. You should obtain and consider the relevant Product Disclosure Statement (PDS) and seek the assistance of an authorised financial adviser before making any decision regarding any products or strategies mentioned in this communication.

Whilst all care has been taken in the preparation of this material, it is based on our understanding of current regulatoryrequirementsandlawsatthepublicationdate. As these laws are subject to change you should talk to an authorised adviser for the most up-to-date information. No warranty is given in respect of the information provided and accordingly neither Alliance Wealth nor its related entities, employees or representatives accepts responsibility for any loss suffered by any person arising from reliance on this information.

Elisabeth Murdoch Hall | Sat 11 Mar

Madeleine Peyroux is the type of timeless and expressive singer who transports listeners with the emotionality of her performance. Madeleine embarks on her Careless Love Forever world tour, coming to Australia in March 2023.

Classical guitarist MILOŠ makes his long awaited return to Australia. Dubbed by many as ‘The Classical Guitar Hero’, MILOŠ has astounded audiences world-wide with his virtuosic playing. Tickets on sale Fri 4 Nov.

Individuals may soon have the ability to claim a higher deduction for self-education expenses from the 2022–23 income year. New legislation has been tabled into parliament following the original announcement by the former government in the 2021 Federal Budget.

Currently, a self-education deduction is limited to costs above $250 each income year. This limitation, known as the s 82A limitation, will be repealed from the tax laws. This requires legislative approval.

The announcement is somewhat related to a Treasury discussion paper released in December 2020. However, other matters addressed in the paper, such as deductions for expenses unrelated to current employment, have not been taken further at this stage.

Starting from 1 July 2023, operators of sharing economy platforms will be required to report transactional information to the ATO. The Taxable Payments Reporting System already applies to some businesses in industries where non-compliance is deemed to be high risk. By adding operators of sharing economy platforms to the regime, taxpayers who hold or use assets for short-term lease or contract work will have their information collected. The identification of users of sharing economy platforms means that, as an adviser, you should be informing taxpayers who earn income off these platforms of their tax obligations. This includes short-term accommodation, ride-sharing transport and food delivery platforms. Also, other task or time-based service platforms will be required to report for income years beginning on 1 July 2024. The start date of the proposed changes have been delayed after the former Bill was prorogued at the last federal election.

Announcement(11-May-2021) Consultation

Introduced(3-Aug-2022)

Passed Royal Assent Date of effect(1-Jul-2022)

Announcement(25-Aug-2021) Consultation

Introduced(3-Aug-2022)

Passed Royal Assent Date of effect(1-Jul-2023)

The Commissioner of Taxation will be given new powers to direct a taxpayer to undertake a record-keeping education course in lieu of an administrative penalty. The new directive will be initially limited to small business owners in order to assist them in keeping up to date with tax obligations. The individual must then provide the Commissioner with evidence of completion of the course in order to avoid financial penalty. The new directive will be available after the Bill receives Royal Assent.

A business with aggregated turnover of less than $50 million will be entitled to a 20% bonus deduction for expenditure relating to a digital business adoption.

The bonus deduction will be available for expenditure incurred from 7:30pm (AEDT) on 29 March 2022 (2022 Federal Budget night) until 30 June 2023. There is a limit of $100,000 of eligible deductions able to be claimed by a business each income year but can be claimed on both business expenses and depreciating assets.

Small businesses will get a bonus tax deduction on top of the allowable deduction for training their employees.Businesses with aggregated turnover of less than $50 million will be entitled to claim a 120% deduction for eligible expenditure. Eligible expenditure refers to external training courses delivered to a business’s employees by a registered training organisation in Australia. The skills and training boost is available from 7:30pm (AEDT) on 29 March 2022 until 30 June 2024.

Announcement(3-Aug-2022) Consultation Introduced(3-Aug-2022)

Passed Royal Assent Date of effect

Announcement(29-Mar-2022) Consultation(29-Aug-2022)

Introduced Passed Royal Assent Date of effect

Announcement(29-Mar-2022) Consultation(29-Aug-2022)

Introduced Passed Royal Assent Date of effect

Sole traders and partners in a partnership may be able to utilise a safe harbour to deduct non-commercial losses against other assessable income. The PCG bypasses the Commissioner’s discretion under the noncommercial loss rules, where a business has been directly affected by floods, bushfires or the COVID-19 pandemic. The business will be required to show necessary evidence to support using the safe harbour. The safe harbour applies for the 2019–20, 2020–21 and 2021–22 income years.

Announcement(11-May-2022) Consultation period(21-Jun-2022) Released(14-Sep-2022)

Crypto assets are to be specifically excluded as a foreign currency with the release of exposure draft legislation. The proposed legislation maintains the current tax treatment of crypto assets such as Bitcoin and removes uncertainty following the decision of the Government of El Salvador to adopt Bitcoin as a legal tender. If the legislation receives royal assent, the new laws will be in effect from income years that include 1 July 2021.

Note: On 30 September 2022, reports have emerged that the Queensland government intends to scrap the newly legislated measure that would include interstate landholdings in land tax assessments. We will provide further explanations in due course once they are announced by the state government.

Queensland has become the first jurisdiction in Australia to change land tax rules relating to taxable landholdings. Under the proposed changes, a landholder will have their land tax calculated based on their total Australian landholdings. The calculation will then be pro-rated to reflect a taxpayer’s Queenslandonly taxable landholdings. The new legislation will commence from 1 January 2023, meaning that the first calculation under the new rules will take place for 30 June 2023 assessments.

A draft determination from the ATO has stated that earnings from an individual’s “image rights” or “fame” can only be included in that individual’s assessable income. This position from the ATO has changed from previous draft practical guidance which stated that professional sportspersons could use a safe harbour approach to alienate income to a related entity. If individuals already entered into an arrangement in good faith on the basis of PCG 2017/D11, the ATO will not devote compliance resources up to the 2022–23 income year. Also, the draft determination distinguishes “image rights” and “fame” from an individual providing services to a third party.

Pensioners and those on Veterans’ entitlements will be enticed back into the workforce with an increase to their work bonus concession balance.

This measure is being supplemented with an increase to the time limit for the suspension of pension entitlement from 12 weeks to 2 years. This means if a pensioner earns too much income over a period of time, their pension will be suspended instead of cancelled.

Further changes will also apply to an individual’s entitlement to the Commonwealth

Health Card.

Announcement(6-Sep-2022) Consultation(6-Sep-2022)

Introduced Passed Royal Assent Date of effect