Are

our next Copywriter?

Are you our next Bookkeeper?

By Warren Strybosch

The Find Maroondah is a community paper that aims to support all things Maroondah. We want to provide a place where all Not-For-Profits (NFP), schools, sporting groups and other like organisations can share their news in one place. For instance, submitting up-andcoming events in the Find Maroondah for Free.

We do not proclaim to be another newspaper and we will not be aiming to compete with other news outlets. You can obtain your news from other sources. We feel you get enough of this already. We will keep our news topics to a minimum and only provide what we feel is most relevant topics to you each month.

We invite local council and the current council members to participate by submitting information each month so as to keep us informed of any changes that may be of relevance to us, their local constituents.

We will also try and showcase different organisations throughout the year so you, the reader, can learn more about what is on offer in your local area.

To help support the paper, we invite local business owners to sponsor the paper and in return we will provide exclusive advertising and opportunities to submit articles about their businesses. As a community we encourage you to support these businesses/columnists. Without their support, we would not be able to provide this community paper to you.

Lastly, we want to ask you, the local community, to support the fundraising initiatives that we will be developing

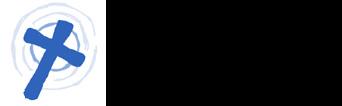

and rolling out over the coming years. Our aim is to help as many NFP and other like organisations to raise much needed funds to help them to keep operating. Our fundraising initiatives will never simply ask for money from you. We will also aim to provide something of worth to you before you part with your hard-earned money. The first initiative is the Find Cards and Find Coupons – similar to the Entertainment Book but cheaper and more localised. Any NFP and similar organisations e.g., schools, sporting clubs, can participate.

Follow us on facebook (https://www. facebook.com/findmaroondah) so you keep up to date with what we are doing.

We value your support,

The Find Maroondah Team.

EDITORIAL ENQUIRES: Warren Strybosch | 1300 88 38 30 editor@findmaroondah.com.au

PUBLISHER: Issuu Pty Ltd

POSTAL ADDRESS: 248 Wonga Road, Warranwood VIC 3134

ADVERTISING AND ACCOUNTS: editor@findmaroondah.com.au

GENERAL ENQUIRIES: 1300 88 38 30

EMAIL SPORT: editor@findmaroondah.com.au

WEBSITE: www.findmaroondah.com.au

The Find Maroondah was established in 2019 and is owned by the Find Foundation, a Not-For-Profit organisation with a core focus of helping other Not-For-Profits, schools, clubs and other similar organisations in the local community - to bring everyone together in one place and to support each other. We provide the above organisations FREE advertising in the community paper to promote themselves as well as to make the community more aware of the services these organisations can offer. The Find Maroondah has a strong editorial focus and is supported via local grants and financed predominantly by local business owners.

The City of Maroondah is a local government area in Victoria, Australia in the eastern suburbs of Melbourne. Maroondah had a population of approximately 118,000 as at the 2019 Report which includes 9000 business and close to 46,000 households. The City of Maroondah was created through the amalgation the former Cities of Ringwood and Croydon in December 1994.

The Find Maroondah acknowledge the Traditional Owners of the lands where Maroondah now stands, the Wurundjeri people of the Kulin nation, and pays repect to their Elders - past, present and emerging - and acknowledges the important role Aboriginal and Torres Strait Islander people continue to play within our community.

Readers are advised that the Find Maroondah accepts no responsibility for financial, health or other claims published in advertising or in articles written in this newspaper. All comments are of a general nature and do not take into account your personal financial situation, health and/or wellbeing. We recommend you seek professional advice before acting on anything written herein.

By Gen Alcampor

The AFL, originally known as the Victorian Football League (VFL), was founded in 1896 when eight breakaway clubs from the Victorian Football Association (VFA) formed a new competition. The first season was held in 1897 with Carlton, Collingwood, Essendon, Fitzroy, Geelong, Melbourne, South Melbourne, and St Kilda as the inaugural teams.

The league was initially confined to Victoria but began to expand outside the state in the latter half of the 20th century. In 1982, the South Melbourne club relocated to Sydney to become the Sydney Swans, marking the beginning of the league's expansion into other Australian states. The league officially rebranded itself as the Australian Football League (AFL) in 1990 to reflect its national status.

The AFL has since grown to become Australia’s premier professional football competition, with 18 teams representing every state and territory. Over the years, it has produced legendary players and

coaches, with iconic clubs like Essendon, Carlton, and Collingwood dominating in different eras.

The WAFL, originally known as the West Australian Football Association (WAFA), was established in 1885, making it one of Australia's oldest football competitions. It was renamed the West Australian Football League (WAFL) in 1907. The WAFL became the highest-level competition in Western Australia, featuring prominent clubs such as East Fremantle, South Fremantle, Perth, Subiaco, and West Perth.

While the AFL has since overshadowed the WAFL in national prominence, the WAFL remains a crucial part of Western Australia's sporting history. It has traditionally acted as a feeder league for the AFL, with many top players from Western Australia transitioning to AFL clubs. The competition has maintained a strong following, with iconic rivalries and a long history of successful clubs.

The introduction of AFL teams from Western Australia, like the West Coast

Eagles in 1987 and Fremantle Dockers in 1995, shifted some attention away from the WAFL, but the league continues to be a vital part of local football culture, producing top-tier talent and fostering community engagement.

Both leagues have a rich history that reflects the development and passion for Australian Rules Football across the nation.

In 2024, the AFL and WAFL saw remarkable champions rise to the top.

For the AFL, the Brisbane Lions triumphed over the Sydney Swans in an exhilarating match at the Melbourne Cricket Ground (MCG). The game was characterized by its intensity and high stakes, with both teams delivering standout performances. Ultimately, Brisbane's ability to seize key moments saw them secure the win. Their victory cemented the Lions as one of the premier teams of the AFL, marking an impressive conclusion to their season. This Grand Final victory reinforced their prowess and consistent form, adding to their legacy within the AFL.

By Liz Sanzaro

Australians call mates a “great galah”, as a reference to being not smart or a bit of a clown.

In fact the name Galah comes from the

it is better than mine so they wrestle each other.

Galah lovers find their antics very amusing, as their play is often creative. Lying on their back allows them to use both feet and a beak to investigate an item of interest thoroughly. Sometimes this is a good defence position also.

Galahs do tend to create large groups sometimes as many as 500 to 1,000 in open country and can fly long distances for food. In terms of male and female, the female has pink eyes while the male has brown eyes. Pairing for life, they need nesting hollows to breed. She will line her nest with Eucalyptus leaves and then produce between 2 to 6 eggs. Both parents take it in turns to sit on the eggs until hatched, then feeding hatchlings for 8 weeks. Unfortunately they have a high mortality rate when young, accidents like, falling from the nest, crashing while landing or being picked off by hawks.

There are many bird associations, like Backyard Birds and Birdlife Australia. In October you can become part of a big picture by counting different birds that visit your area, either at home, in a park or wherever you see them. Being held between 14th and 20th October it gives you good opportunity to provide statistics to show how well, or not so well our bird community is.

Registrations are NOW OPEN for your favourite event of the year – the Aussie Bird Count!

Mark your calendars for 14th-20th October and get ready to join Australia’s biggest birdwatching and citizen science event. Whether you’re a seasoned birdwatcher or just starting out, this is your chance to connect with nature in a fun and easy way.

Register here: https://aussiebirdcount. org.au/

Liz Sanzaro

President of Croydon Conservation Society liz@sanzaro.com | www.croydonconservation.org.au

MEDIA

By Ethan Strybosch

Navigating government grants can be overwhelming for non-profits, but it’s a crucial resource for funding impactful initiatives. If your organization is looking to secure funding, it’s important to understand the different types of grants available and how to maximize your chances of success.

There are three main categories of grants available to Australian non-profits:

1. Government Grants: These are offered by various levels of government to support sectors such as health, education, and community services. Notable examples include the Stronger Communities Programme, which funds local infrastructure projects, and Volunteer Grants, aimed at supporting volunteer initiatives.

2. Philanthropic Grants: These are provided by private foundations and trusts, and they often focus on causes such as education, arts, and social welfare. Key examples include the Myer Foundation, which supports projects with long-term social impact, and the Ian Potter Foundation, which funds initiatives in the arts, environment, and education sectors.

3. Corporate Grants: Many businesses offer funding to support community projects as part of their corporate social responsibility efforts. Examples include the Westpac Foundation, which backs programs focusedon employment and education, and the Telstra Foundation, which supports initiatives aimed at enhancing digital inclusion.

Securing funding requires strategic planning and attention to detail. Here are some key tips to improve your chances of success:

1. Research Thoroughly: Begin by thoroughly understanding each grant’s purpose, eligibility criteria, and application requirements. Resources like Grants Hub and Business.gov.au’s Grants Finder are invaluable tools for discovering opportunities.

2. Tailor Your Application: Customize each grant application to align your project’s goals with the grant’s objectives. Clearly demonstrate how your project meets the specific requirements of the grant.

3. Detail Your Impact: Your application should clearly outline the tangible impact the funding will have. Include

measurable outcomes, a detailed budget, and a clear plan for how the funds will be used.

To increase your chances of success, steer clear of common pitfalls such as:

• Missing Deadlines: Keep track of important dates with a dedicated calendar.

• Generic Applications: Avoid submitting one-size-fits-all applications. Instead, personalize each application.

• Lack of Clarity: Ensure your application is clear, concise, and free of jargon, with well-defined goals and methods.

By following these tips and avoiding common mistakes, your organization can better navigate the grant application process and secure the funding needed to make a lasting impact.

On Wednesday 18th September

The DAME NELLIE MELBA FAMILY CAR EMERGED !! The event was held at the Heatherdale Bowls Club , and the Hon Michael Sukkar, Federal Member cut the bright red ribbon., which was wrapped around the car..

Saffron- the great grand daughter of Dame Nellie Melba is coming over from England for the Melbourne Cup , and would like to see the car…

We all cheered and many , many photographs were taken.

The car is a Sunbeam Talbot 10 , four door sedan, gun metal grey in colour with beige leather seats It has a bonnet which lifts up on the two sides to inspect the engine. The engine was a marvel for people to see , and one can only imagine the joy which Dame Nellie Melba’s daughter felt when she was given this lovely 10hp car for her 21st birthday

For 70 plus years it was stored in the stables of Coombe Cottage in amongst some some horse carriages. This area , after the purchase of the car was converted to fine dining.

SO--- On the 8th November mid morning the Sunbeam Talbot 10 will be shown in all its glory to Saffron, at Coombe Cottage in Coldstream The dining room will be open , but bookings are definitely necessary.

The owner and his mate are very proud to have the car visit it’s homestead again. Wouldn’t it be lovely to see this car permanently In this district ?

HEATHERDALE COMMUNITY ACTION GROUP

By Craig Anderson

When business property insurance is taken, accurate valuations of business premises are essential to protect businesses from financial risk and legal complications. Australian experts highlight that without obtaining correct valuations, companies may face underinsurance or overinsurance, which can lead to severe financial consequences and prolonged claims processes.

One key reason for obtaining accurate valuations is risk management. As Australian Valuations explains, "Accurate valuation is a key component of risk management strategies. It allows for a realistic assessment of potential risks and provides the formulation of appropriate mitigation strategies." This includes ensuring that businesses are neither underinsured, which may lead to substantial financial losses if claims fall short of covering damages, nor overinsured, which results in unnecessarily high premiums(Australian Valuations).

Furthermore, legal compliance is a crucial factor. In Australia, businesses are often required by law to insure their premises for the full reinstatement or replacement value. CHU explains, "Owners corporations have a legal obligation to insure the building for the full reinstatement and/or replacement value." This legal requirement helps to avoid costly insurance disputes and penalties that may arise if properties are undervalued and underinsured(CHU).

Professional valuations are also vital in streamlining the claims process. According to B&A Valuers, "If property and business have been underinsured, whether intentionally or not, the insurer may also decide that the underinsurance is deliberate and refuse to accept the claim at all." They further stress that professional valuations ensure businesses avoid disputes over insurance payouts, which can otherwise lead to months or even years of delays(PropMach Valuation Service).

Another significant reason for regular and professional valuations is to account for fluctuations in construction costs. CHU emphasizes that recent hikes in building

materials and labour costs have put many properties at risk of underinsurance, especially when relying on outdated valuations. The recommendation is to conduct valuations more frequently than the mandatory five-year cycle to ensure insurance policies align with current replacement costs(CHU).

In addition, accurate valuations protect businesses from both financial and operational risks. Underinsurance may result in inadequate compensation during a claim, forcing companies to bear out-of-pocket expenses. Conversely, over insurance can lead to inflated premiums, draining resources unnecessarily. As B&A Valuers notes, "Most Australian businesses have only 50 to 75% of the correct replacement value for property, plant, and equipment"(PropMach Valuation Service). This underscores the importance of using professional valuers to obtain precise assessments.

Engaging a professional to regularly assess business premises ensures accurate valuations that mitigate financial risk, comply with legal obligations, and streamline insurance processes. By keeping valuations up to date, businesses can protect themselves from the repercussions of underinsurance

and over insurance, thus safeguarding their financial stability.

References:

1. Australian Valuations, The Importance of Valuing Your Assets for Insurance Correctly, 2023. Available at: australianvaluations.com.au

2. CHU, The Importance of Building Valuations, 2023. Available at: chu. com.au

3. B&A Valuers, Why You Need a Professional Valuer for Insurance Purposes, 2020. Available at: bavaluers.com.au

For a health check of your business insurance, contact Small Business Insurance Brokers via email sales@ smallbusinessinsurancebrokers.com.au

Any advice in this article has been prepared without taking into account your objectives, financial situation or needs. Because of that, before acting on the above advice, you should consider its appropriateness (having regard to your objectives,needs and financial situation).

By Erryn Langley

Financial planning involves working with a professional to navigate through the complexities of investment, taxation and changing rules and regulations. By working together you can navigate a pathway to reach your specific goals, preferences and aspirations.

Financial planning can help you through all stages of your life. The financial planning process involves the following six steps:

To gain the most value out of the financial planning process there are three fundamental issues that are important for you to consider and understand. These key components are discussed below.

The starting point for any plan is to set your personal goals. Financial goals are likely to be different for each person and need to reflect your specific preferences, aspirations and

needs. Your goals may vary from short-term goals (less than one year) like buying a car, paying off your debt or going on a holiday, medium term goals (1-3 years) such as saving for your children’s’ education or long-term goals (5 years or more) like saving for a comfortable retirement and leaving behind a legacy.

Your goals will be more real and achievable if you can apply the following attributes:

• Specific: Make them specific to you and your family.

• Measurable: Ensure there is a measurement in place to determine whether the goals have been met.

• Achievable: The goals need to be achievable so while you may set a stretched target which requires you to be diligent don’t set the target too high.

• Realistic: Your goals can be an aspiration but must still be grounded.

• Time-targeted: You need to set time targets to achieve your goals.

Once you have determined where you are heading, you can work with your financial planner to develop the pathway to achieving your goals.

Your planner explains the process they follow. They will find out your needs and ensure they have the capabilities and experience to meet them. They will also explain how they work and how they charge for their service.

Your financial planner will work with you to identify your short and long term financial goals, preferences and aspirations. These will serve as a foundation for developing your plan.

Your planner will take a good look at your current position-your assets, liabilities, insurance coverage and investment or tax strategies.

Once you’re comfortable with the recommendations, your financial plan will be implemented. This may involve working with other specialist professionals, such as an accountant or solicitor

Your planner recommends suitable strategies, products and services, and answers any questions you have.

It’s important that your financial plan remains up to date with changes to your circumtances, lifestyle and financial goals over time. Therefore your financial plan is regularly reviewed, to make sure you keep on track.

To put you on the path to building your wealth you need to start saving money. This may mean working out how to find more money. The best way to do this is to set yourself a budget. Setting a budget is important for everyone no matter your age or how much money you have. It is especially important for people who are struggling to meet their goals or who keep building up debt.

A budget is not about just cutting expenses. It is about finding a good balance between your income and your expenses and deciding what is important to you so that you have money left over to save. A budget is not a fixed forever plan. You can continue to make adjustments over time until you reach a comfortable outcome and have a good strategy in place that will meet your goals.

There are two sides to a budget:

• Your income – includes income from all sources such as salary, interest, rental income and dividends, but only include your regular income and make sure you use aftertax income or allow for tax payable in your expenses.

• Your expenses – includes mortgage repayments, bills and general living expenses.

Tip

Go through the following documents to check you have captured all of your income and expenses:

• Bank account statements

• Credit card statements

• Pay slips (for both income and deductions)

• Cheque book details

• Expense receipts

• Bills and insurance certificates

You could also consider keeping a diary to record all your expenses – and don’t forget all the little ones as this is where you can often make some significant savings.

Setting a budget is a simple step but sticking to the budget can be harder.

Below are ten tips for setting a good budget:

1. Make it realistic or you will never stick to it

2. Budget an amount for fun, leisure and personal expenses so you can avoid impulse buying

3. Save your pay rises, bonuses, special payments or tax refund

4. Look for small savings – for example, take your lunch to work, or use internet banking to reduce bank fees.

5. Pay by cash or EFTPOS to avoid credit card fees (and also avoid accumulating debt)

6. Reduce fees and charges – combine bank accounts to reduce fees

7. Put your change into a savings jar at the end of every day

8. Shop around and compare prices on insurance policies. Look for companies that offer discounts for multiple policies

9. Use lay-by options instead of debt and credit cards

10. Update your budget each year

When used properly, debt can be an effective tool that may help you to achieve your financial goals. Debt can be used to purchase a range of items before you have saved the full purchase price.

It is important to understand the difference between 'good' debt and 'bad' debt. Debt can help you buy the family home, purchase a car or consumer goods and also enable you to purchase investment assets such as shares, managed funds or a rental property.

Where debt is used to acquire investments such as shares or property, this is known as gearing. This is often referred to as 'good' debt because it gives you the potential to claim a tax deduction for borrowing expenses and assets that will hopefully appreciate in value over time.

Borrowing to invest (gearing) simply allows you to use a combination of your own money and borrowed funds to accelerate wealth over the long-term. However it is a higher risk strategy that magnifies both the gains and losses from your portfolio. The higher the proportion of borrowed funds compared to your equity, the greater the associated risks. Options to gear into investments include margin lending, home equity loans or geared managed funds that borrow internally.

'Bad' debt is non-deductible debt like borrowings for consumer goods such as cars and holidays. Even though a loan for the family home is non-deductible, it should not necessarily be viewed as 'bad' debt because the value of the home has the ability to grow over time. But looking at strategies to pay off this debt as quickly as possible will increase your wealth.

In any case, paying off non-deductible debt before deductible debt will usually be the most appropriate course of action for many people.

The cost of borrowing can be high so you need to be disciplined and consider strategies to reduce the total interest cost, reduce the term of the loan and improve your cash flows.

Some of these strategies may include:

• Making loan repayments more often

• Making additional payments

• Repaying non-deductible debt first

• Combining loans into one account with a lower interest rate

1300 557 144 | erryn@findwealth.com.au www.findwealth.com.au

Financial Planning is offered via Find Wealth Pty Ltd ACN 140 585 075 t/a Find Wealth. Find Wealth is a Corporate Authorised Representative (No 468091) of Alliance Wealth Pty Ltd ABN 93 161 647 007 (AFSL No. 449221).Part of the Centrepoint Alliance group https://www.centrepointalliance.com.au/ Erryn Langley is Authorised representative (No. 1269525) of Alliance Wealth Pty Ltd.

This information has been provided as general advice. We have not considered your financial circumstances, needs or objectives. You should consider the appropriateness of the advice. You should obtain and consider the relevant Product Disclosure Statement (PDS) and seek the assistance of an authorised financial adviser before making any decision regarding any products or strategies mentioned in this communication.

Whilst all care has been taken in the preparation of this material, it is based on our understanding of current regulatory requirements and laws at the publication date. As these laws are subject to change you should talk to an authorisedadviserforthemostup-to-dateinformation.Nowarrantyisgivenin respect of the information provided and accordingly neither Alliance Wealth nor its related entities, employees or representatives accepts responsibility for any loss suffered by any person arising from reliance on this information.

By Warren Strybosch

Funds

A Self-Managed Superannuation Fund (SMSF) is a superannuation fund with up to six members. SMSFs are generally established by family members wishing to consolidate their family’s superannuation savings.

The members cannot be employees of other members, unless they are relatives. Each member of the fund must take on the trustee role.

An SMSF is still governed by superannuation laws in the Superannuation Supervision Industry (SIS) Act and taxation legislation that relates to superannuation. These funds are regulated by the Australian Taxation Office (ATO).

An SMSF can either have individuals who act as the trustee or a corporate trustee. Strict rules apply as to who can be a trustee or director of a corporate trustee and each person must not be a disqualified person.

If members choose to have individual trustees, each member must act as trustee. No-one can be a trustee without also being a member unless the fund only has one member. In this case, a second person needs to be nominated as trustee.

Where an SMSF has a corporate trustee, each member must be a director of that company, and each director must be a member. If the fund only has one member, that person can be the sole director, or a second director may be appointed. If using a corporate trustee, it is generally best to use a company that has no other purpose.

A person cannot act as trustee (or director of a corporate trustee) if they are a disqualified person. This means they also cannot be a member of an SMSF. A disqualified person is someone who:

• Has ever been convicted of an offence involving dishonesty;

• Has ever had a civil penalty order under the Superannuation Industry (Supervision) Act 1993 made against them;

• Is an insolvent under administration (i.e. they are an undischarged bankrupt);

• Has been disqualified from acting as a trustee.

• Death of the member

• The member is under age 18

• The member has lost mental capacity

• The member wishes to hand over power to their EPoA

Legal advice should be sought in these situations to ensure the SIS rules are not breached and to ensure the correct process to appoint the replacement trustee is followed.

Declaration Trustees must accept the role in writing and verify that they are not a disqualified person.

All new trustees and directors of trustee companies are also required to complete a ‘trustee declaration’ within 21 days of being appointed a trustee. This form is available from the ATO. It does not have to be sent back to the ATO but must be retained for at least 10 years and be made available to the regulator if requested.

The trustees are required to formulate, regularly review and give effect to an investment strategy. The investment strategy is a document that outlines the key investment guidelines to be adopted by trustees when investing the SMSFs funds.

When preparing an investment strategy, consideration must be given to the following:

• The risks in making, holding, and realising investments and the likely return to be derived, having regard to the fund’s objectives and expected cash flow requirements;

• The composition of the SMSF’s investments to ensure sufficient diversification (as appropriate);

• The ability to liquidate investments to meet cash flow requirements as they arise;

• The ability of the fund to discharge its liabilities as they arise (including the ability to pay benefits to members as required);

• Whether the trustees of the SMSF should hold insurance cover for the members of the SMSF.

This strategy should be documented in writing and be reviewed regularly (at least annually). Investments that do not fit within the strategy cannot be held.

The ATO has produced a range of publications, videos and other information to help trustees of SMSFs.

Trustees are encouraged to access this information and review it. Information can be accessed from the ATO’s website (www.ato.gov.au).

You can call them on 1300 88 38 30 or email info@findaccountant.com.au / www.findaccountant.com.au

This information is of a general nature only. Itdoesnottakeintoaccountyourparticular financial needs, circumstances and objectives. You should obtain professional financial advice if you have not already done so before acting on this information. You should read the Product Disclosure Statement (PDS) before making a decision to buy or sell a financial product. Any case studies, graphs or examples are for illustrative purposes only and are based on specific assumptions and calculations. Past performance is not an indication of future performance. Superannuation, tax, Centrelink and other relevant information is current as at the date of this document.This information contained does not constitute legal or tax advice.

When dead animals are left lying around in nature, who takes advantage of the free feed – carnivores or herbivores? The answer may surprise you.

In Australia, people tend to think carnivores – such as dingoes, ravens, foxes and wedge-tailed eagles – lead the clean-up crew.

But our new research shows common brushtail possums – often thought to be herbivores – also dine on animal carcasses.

Understanding when and where brushtail possums scavenge is important. It can improve our knowledge of how carcasses are disposed of in nature, and how nutrients cycle through ecosystems.

Seeking a nutritious meal

Scavenging may provide specific essential nutrients otherwise lacking in herbivore diets.

Carcasses often contain much greater levels of crude protein than leafy greens do. Similarly, chewing on bones, may increase the intake of calcium and phosphorus, two key minerals essential for growth.

Scavenging on carrion may also help herbivores meet nutritional requirements in regions where typical food resources may be restricted during some seasons. Similarly, in times of drought, thirst may also drive herbivores to scavenge in an attempt to extract fluids from carcasses.

Though it may seem gruesome, scavenging is crucial to healthy ecosystems. Clearing carcasses from the landscape by feeding them back into food chains recycles nutrients into living systems.

Authors

Our previous research has found native marsupial herbivores feasting on the dead.

In alpine Australia, possums accounted for 61% of all recorded carcass scavenging – a proportion far surpassing species more typically considered carcass consumers.

In our latest research, we wanted to understand the factors that influence carrion consumption by brushtail possums in different ecosystems.

We monitored fresh eastern grey kangaroo carcasses across both alpine (Kosciuszko National Park) and temperate (Wolgan Valley, Greater Blue Mountains National Park) regions in New South Wales. We also compared sites in both open (grassland with no canopy cover) and closed (woodland) habitats, in cool and warm seasons.

At each carcass, we used a remote camera “trap” to record scavenging behaviours.

We found possums were one of the main scavengers, often feeding from carrion more than typical scavengers such as dingoes and ravens.

Possum scavenging rates varied by habitat and season. Regardless of region,

Patrick Finnerty

Postdoctoral research fellow in conservation, University of Sydney

Thomas Newsome

Associate Professor in Global Ecology, University of Sydney

possums scavenged exclusively in closed canopy habitats under the trees, probably for protection from predators and other scavengers such as dingoes, red foxes, and wedge-tailed eagles.

possums scavenged exclusively in closed canopy habitats under the trees, probably for protection from predators and other scavengers such as dingoes, red foxes, and wedge-tailed eagles.

Out in the cold

Possum scavenging activity varied according to the season.

In temperate regions, possums scavenged only in winter when other food resources were limited.

In alpine areas, where food is scarce even in summer, possums scavenged year-round. But they still ate more from carcasses in cooler months. This may be necessary for possums to get the nutrition they need when other normal food resources — such as leaves, flowers and fruit — are limited.

Competition between scavengers may also change with the seasons. For example, in alpine regions, we saw fewer large scavengers such as dingoes in winter, possibly reducing competition and making it easier for possums to access carrion.

During warmer months, insect activity increases. These tiny scavengers often start eating a carcass within minutes of its death, accelerating its decomposition. It means animals such as possums have less time to feed on the carrion.

Please note: In the 2024 Federal Budget, the government has announced the discontinuation of this proposed measure, as these integrity issues are being addressed through other administrative processes implemented by the ATO.

Australian Business Number (ABN) holders will now be required to be more accountable and comply with annual income tax lodgment obligations.

First announced in the 2018–19 Federal Budget as an integrity measure, this exposure draft legislation seeks to strengthen disruptions to black economy and tax avoidance behaviour.

Currently, ABN holders are able to retain their ABNs regardless of whether or not they meet income tax obligations. This measure will provide more accountability on enterprises by giving the regulator the ability to cancel ABNs. This means advisers need to ensure clients keep their lodgments up to date, or at least keep a clear line of communication with the ATO.

Announced in the 2024 Federal Budget, the ATO will have additional time to review suspected fraudulent business activity statements (BAS) refunds prior to their release.

The current required notification period of 14 days as set out in s 8AAZLGA(3)(a) of the Tax Administration Act 1953 will be extended to 30 days to align with time limits for non-BAS refunds.

The taxpayer will receive a notification from the ATO when a BAS refund is retained for further investigation.

This measure will take effect from the start of the first financial year after assent of the enabling legislation.

Announcement(12-Apr-2019)

Consultation(29-Nov-2022)

Introduced Passed

Royal Assent Date of effect

to become law and is now available to use for the 2023–24 income year.

Originally announced in the 2023 Federal Budget, the increased threshold applies from 1 July 2023, for small businesses with an aggregated annual turnover of less than $10 million.

The write-off applies to the cost of eligible depreciating assets, second element costs and general small business pools.

Eligible assets must be first used or installed ready for use between 1 July 2023 and 30 June 2024, and the write-off applies on a per asset basis.

Announced: 13-May-2024

Updated: 24-Jun-2024

Announcement(9-May-2023) Consultation(13-Sep-2023) Introduced(13-Sep-2023) Passed(25-Jun-2024)

Royal Assent(28-Jun-2024) Date of effect(1-Jul-2023)

Announcement(24-Jan-2023)

Consultation(9-May-2023) Introduced(13-Sep-2023) Passed(25-Jun-2024)

Royal Assent(28-Jun-2024) Date of effect(1-Jul-2023)

Announced: 14-May-2024 Updated: 22-Jul-2024

Individuals who receive an eligible lump sum payment in arrears after 1 July 2024 will not have to pay Medicare levy on that amount.

These payments are usually made to an individual for reasons such as compensation for previously underpaid wages.

If your client would be eligible for other offsets or rebates relating to arrears payments, and they otherwise would have a reduced Medicare levy, this exemption will be available for them.

The Federal government has introduced legislation into parliament to amend the Medicare Levy Act 1986, which will commence in the quarter following the date the bill receives royal assent.

Recently enacted legislation will make more carers eligible for government financial assistance and support.

The eligibility requirements will change from 20 March 2025, where the existing 25 hour per week participation limit to receive Carer Payment will be amended to 100 hours over 4 weeks.

Also, currently the participation limit applies to employment, volunteering and study. From 20 March 2025, only employment will count against the participation limit.

Further adjustments will be made, meaning that if an individual goes over these limits, the ramifications relating to future support will not be as severe.

Announcement(9-May-2023) Consultation(5-Apr-2024) Introduced(5-Jun-2024) Passed

Royal Assent Date of effect

Announcement(13-May-2024) Consultation

Introduced(29-May-2024)

Passed(4-Jul-2024)

Royal Assent(9-Jul-2024) Date of effect(20-Mar-2025)

Treasury has released exposure draft legislation on a 2023–24 Budget measure to extend the current 2-year amendment period to 4 years for income tax returns of small and medium businesses.

At present, the Commissioner may amend an assessment for small to medium business taxpayers for up to 2 years.

This draft legislation aims to help small businesses deal with the compliance burden of having to apply for an extension of their amendment period.

This measure, subject to receiving parliamentary approval, will commence for assessments issued on or after 1 July 2024.

Build-to-rent (BTR) developments that commenced after 7:30 pm AEST on 9 May 2023 may now benefit from an increased capital works deduction rate of 4% up from 2.5%. Announced in the 2023 Federal budget, this measure aims to improve incentives for investors to invest in BTR developments.

Also, from 1 July 2024 a reduction in withholding tax rate from 30% to 15% is available for foreign investors involved with managed investment trusts that invest in BTR accommodation.

The government tabled draft legislation proposing amendments to the ITAA 1997, TAA 1953 and ITAA 1936 to make the announced measures law.

Announcement(18-May-2023) Consultation(26-Jul-2024) Introduced Passed

Royal Assent Date of effect

Announcement(28-Apr-2023) Consultation(9-Apr-2024) Introduced(5-Jun-2024)

Passed

Royal Assent Date of effect

In an initiative to promote women’s economic equality, the government has announced plans to pay superannuation on paid parental leave (PPL) for government-funded payments from 1 July 2025.

If enacted, this measure will provide parents who access the PPL government scheme with super contributions paid into their nominated super account equivalent to 12% of their leave pay.

This measure comes after new legislation to expand Australia’s PPL by providing an additional 6 weeks of PPL, increasing to 22 weeks from July 2024, 24 weeks from July 2025, and 26 weeks from July 2026 has become law.

This measure is currently in parliament on its way to become law.

Announcement(7-Mar-2024) Consultation

Introduced(22-Aug-2024)

Passed

Royal Assent Date of effect

Paintings by artist Amanda Wright depict Aunty Daphne Milward and Aunty Irene Norman, Elders from Mullum Mullum Indigenous Gathering Place, Maroondah residents and long-time friends.

Gracing the Realm windows, the portraits were launched during Reconciliation Week in June with a Smoking Ceremony and Welcome to Country by Wurundjeri Elder, Uncle Bill Nicholson and performances by celebrated singer/ songwriter Kutcha Edwards and Yeng Gali Mullum, a music group directed by Aunty Irene.

During NAIDOC Week in July, the works were complemented by the From our Elders video installation by Blak Crow filmmaker Daen Sansbury-Smith in ArtSpace at Realm, which featured perspectives on Eldership from nine Elders including Aunty Irene and Aunty Daphne.

The portraits will remain on the Realm windows until the 30 March 2024.

About

Aunty Daphne Milward

Recipient of the Council of the Ageing Victoria Senior Achiever Award 2022, Aunty Daphne Milward is a proud Yorta Yorta woman and long-time Maroondah resident. She has an extensive list of achievements as an advocate for First Peoples in Victoria over more than fiftyfive years since

she helped establish the Aboriginal Advancement League in 1967.

She was a director of the Victorian Women’s Trust and a member of the Equal Opportunity Commission of Victoria. In 1995, she established her own consultancy firm, Mandala Consulting Services, specialising in community development and crosscultural awareness. Now in her eighties, Auntie Daphne is active as an Elder with Mullum Mullum Indigenous Gathering Place (MMIGP) and regularly engages with community and school groups. She exhibits as a member of the MMIGP arts group and performs with the Yeng Gali Mullum singing group. She recently began learning sign language so that she can sign Acknowledgments of Country.

Proud Wailwan woman, Mullum Mullum Indigenous Gathering Place Elder and Ringwood resident, Aunty Irene Norman is a weaver, painter, poet and leader of the Yeng Gali Mullum music group. She regularly runs workshops to share the weaving skills passed down to her by her paternal grandmother as a child in regional New South Wales.

Weaving, for Aunty Irene, is a skill that she shares to connect people to each other, their history, and their country. Aunty Irene frequently exhibits at The Koorie Heritage Trust, and has organised a number of group exhibitions for MMIGP

artists at Maroondah Federation Estate. Her portrait of Aunty Daphne Milward was part of the Archibald Prize Exhibition in 2016 at the Art Gallery of NSW in Sydney. She also teaches Indigenous Culture and Reconciliation in schools and the wider Community.

Amanda Wright is a Palawa artist whose family, on her mother’s side, is from Bruny Island, Tasmania. Amanda went to school in Boronia, before doing a Fine Arts degree at RMIT. Amanda comes from a family of artists, including her mother, her maternal grandfather, her sister and her mother’s cousin. When Amanda was three or four she recalls her uncle painting, and at that moment she decided that painting was for her. She has been painting ever since.

Amanda’s work is focused on tenderly conceived portraits of Aboriginal people that give a window into the subjects’ spiritual and emotional worlds. Her painting is inspired by her thoughts of her mother, grandmother and her great-grandmother, the circumstances they survived, their strength and their resilience. 'I found family and now I’m trying to find spirit. I just have to paint every day. I have so many ideas. Painting is all I have ever known.’ Amanda has been commissioned to created public art for Melbourne, Maroondah and Yarra Valley councils, and taken part in many group and solo exhibitions including as a member of Mullum Mullum Indigenous Gathering Place.

Pamela Irving’s Waste Not, Want Not Crew are environmental champions. They irreverently illustrate and question our relationship with consumables. They get confused by climate science and energy consumption, have a love/hate relationship with plastic, fear for their fish friends, eat way too much beef and indulge in fast food and fashion.

The Crew look at environmental concerns in a playful manner. They are constructed from our consumer waste, they are upcycled, sometimes circular, a little bit educational, a little bit funny, they’re hopeful and absurd. Story tellers about materiality, together, they are the Waste Not, Want Not Crew. Above all they deal with junk and detritus. What do you do with yours?

The Arts Lounge at Wyreena is an art space for artists to exhibit their work in a vibrant, accessible setting.

The Microforest: Mushrooms and Insects in Watercolour Microcosms offers an intimate view into the hidden worlds of mushroom microhabitats and the insects that thrive within them.

Created by Martha Iserman, a professional scientific illustrator with experience working for museums and research institutions in the United States, these large-scale watercolour paintings combine scientific precision with artistic expression. Each piece

intricately captures the vibrant interplay of fungi and insects, revealing the delicate ecosystems often overlooked beneath the forest floor. Martha’s deep understanding of nature and her background in scientific illustration bring both accuracy and wonder to these immersive works, inviting viewers to explore the unseen beauty of nature's microcosms.

Faria Firoz

In the series Crossing Horizons: Narratives of Migration and Adaptation, Faria explores the impact of migration, both personal and communal.

The artworks delve into the intricate web of emotions and experiences that encompass the transformative process of leaving one's homeland in pursuit of a new life. Through vivid imagery and symbolism, Faria invites viewers to reflect on the universal themes of change, isolation, and adaptation that resonate within the individual immigrant experience and the broader human narrative. Through these artworks, Faria hopes to foster conversations that transcend boundaries and inspire empathy, ultimately uniting us in our collective search for meaning and connection.

A fun, low-waste and smart way to access and borrow from over 4600 of the best fun, educational toys, games puzzles and activities and Party Hire equipment.

Maroondah Toy Library has been serving local families for over 40 years, providing access to high quality, educational toys, games and puzzles and party hire for children and adults of all ages. With over 4,600 toys in our collection, there’s something for everyone to enjoy.

We are located in Parkwood Community Hub in Ringwood North with ample parking spaces and a large park and play area adjacent. You can drop in and have a tour before you decide if a toy library membership is right for you. We are open Monday, Tuesday, Thursday and Saturdays each week. Whether you're a parent, grandparent, caregiver, or game enthusiast, Maroondah Toy Library is here to support your play and learning journey.

“I heard about the Maroondah Toy Library at my local Maternal Health Nurse appointment when I had my first baby. 2 kids and 4 years later, the toy library membership is hands down the BEST decision we made for the family. My kids grow out or lose interest in toys quickly and we don’t live in a massive house. Instead of buying all the Lego and balance bikes where you have to find the space to store them afterwards, the library offers me the option to rotate such high quality toys on a regular basis. My son loves our Saturday visits to the toy library every fortnight and we get hours of peace and quiet after a trip to the library as he plays with all the toys and puzzles we picked out that day” - Thilini, mum of two, member since 2020

Our Collection - our extensive collection is divided into 15 key areas:

‘Early Development’ offers a range of baby and infant toys to assist their entertainment and development. Brands include Fat brain, VTech, Little Tikes and more.

The ‘Construction’ range offers a wide selection of toys for busy little builders and includes quality brands from Meccano, Duplo and Magformers.

Our ‘Puzzle’ section is separated into age appropriate ranges and consists of a large variety of Ravensburger, Educo and more, for both children and adults.

‘Imagination’ as the word suggests, has a large selection of toys that lends itself to imaginative play including farm animals, fairies, doll houses to doctors kits, ice cream stands, play kitchens, fire houses and AFL games.

The ‘Home Play’ range includes dolls, prams, tea sets, vacuums, BBQ and grill sets to coffee machines and John Deere whipper snippers and chainsaws.

‘Transport’ has everything your four wheel or plane loving little one

could want from dump trucks, garbage trucks, to police cars, planes, traffic signs and roadway sets.

‘Sand & Water Play’ has a wide range of bath toys, water play tables, beach and pool sets and various open ended water play equipment from reputable brands such as Boon, Moluk and Little Tikes.

You can borrow a range of sensory toys from the ‘Art & Craft’ section such as sensory stones and clay rollers, mandala designers, Play-Doh toys to alphabet stamps.

The ‘Science’ range offers toys that lend to STEM play from puzzle globes and sand timers to science sets and binoculars.

A range of quality musical instruments are included in our ‘Music’ section from drums and xylophones to music mats and maracas.

Our ‘Preschool Skills’ is a popular borrowing section offering fun and educational toys to encourage fine motor and language skill development. This range includes mix and match games, threading sets, word play, numbers and shape sorting toys.

The Games range you have to see to believe, even better, why not drop into one of our games afternoons we organise at the library to test them out yourself? We have games for everyone, young to old and in between.

You can also borrow a large range of activity gyms, Micro two and three wheel scooters, Little Tikes Coupes, wheely bugs, and Kinderboards from the ‘Activity’ section.

An equally large range from the ‘Costume and Puppets’ section such as fireman, fairy, policeman, construction worker and ninja outfits and many puppets, wings and capes.

The ‘Sports’ sections has ball launchers, bowling sets, sensory balance pods, table top ball games, obstacle courses, tunnels and tents sets and more.

We also have a Party Hire selection where we loan out very affordable party hire items, including giant outdoor games, ball pits, soft play equipment, ride-on vintage cars and construction vehicles, fairy princess and construction dress ups, kid’s tables, trestle tables and lots more.

Memberships:

You don’t need to have children to be part of the Maroondah Toy Library. Yearly memberships starting from as little as $80 for a Board Games and Puzzles Membership where you can borrow 4-8 items for a 3 week period. Other memberships range from our Basic Membership - where you can borrow up to 4 toys (including games and puzzles) at $110 per year to Standard and Premium Memberships, where

you are able to borrow more items to suit your family. Please check our membership information: www.maroondahtoylibrary.org.au/ membership

You can also gift a toy library membership - why buy just one toy when you can gift them the whole store! A toy library membership is a perfect gift. Check out our website or visit us in the library to purchase a voucher.

Relying on volunteer support to keep the toy library operating, Basic and Standard Memberships require volunteer duty hours. In-library duty shifts are family friendly where you can help with day to day tasks such as counting and checking toys to be returned to the shelf, with your young ones helping or playing beside you. Duty hours can also be completed through shifts at fundraising events such as sausage sizzles or other community events. You can even delegate your duties to other family members or friends to complete on your behalf!

Maroondah Toy Library is a registered charity, we are largely volunteer run and rely on community support to continue our valued service. Please consider donating via our website to help support our operations. Donations over $2 are tax deductible: www.maroondahtoylibrary.org. au/donations

You may also be interested in volunteering your time and expertise. If you would like to support our back-of-house operations or have a skill to add to our volunteer committee we would love to hear from you. You will also get an opportunity to socialise with lots of welcoming and like-minded parents and community members when you volunteer at the library.

Maroondah Toy Library is currently seeking volunteers for our largest fundraiser for this year’s Lilydale and Yarra Valley Show 2024. Held on Saturday the 16th and 17th of November at the Lilydale Showgrounds. If you have a few hours to spare and are able to assist at the gates on any of the above dates we would love to hear from you. Each volunteer gets a FREE entry into the show. Please contact us at general@ maroondahtoylibrary.org.au for more information or sign up to assist at the show here volunteersignup.org/78LEC

We would love to welcome you and your family at the toy library, feel free to drop in during our opening hours to get a sense of what a toy library membership can do for you and your family.

Opening hours:

Monday 9:30am-1:30pm Tuesday 9:30am-1:30pm Thursday 9:30am-1:30pm Saturday 9:30-5:00pm

Website: www.al-anon.org.au

Contact: office@al-anon.org.au

• Blackouts experienced by the alcoholic can have profound effects on the family.

• The actions that accompany the blackouts are seldom remembered and therefore leave families (especially children) quite bewildered about their reality.

• One minute the family is dealing with uncontrollable violence, or emotional and /or sexual abuse, then the next morning the alcoholic is loving and friendly.

• The consequent breakdown of the family leads to very destructive ‘acting out’ behaviour, particularly in teenagers, and this is where Alateen, for children of alcoholics, proves so effective.

It is normal in the alcoholic family for almost every interaction to be destructive. No matter what is tried, things go from bad to worse. There may be hatred, rage and a desire for revenge – or apathy.

There can be tension and depression, thoughts of homicide, thoughts of suicide. And above all, FEAR. Living in such an atmosphere is not healthy, but how to avoid it? Stress and negativity can lead to physical illness and an inability to function normally in society. All this comes at a huge cost to our social system. Having had expectations of happy domesticity, families often process the violence as a private, family matter. This is a major element in what Barrett and McIntosh (1982) refer to as the “anti-social family”

The worldwide fellowship of Al-Anon Family Groups including Alateen for our younger members, offers help, hope, and recovery to those whose lives have been affected by someone else’s problem with alcohol.

The benefits of learning more about alcoholismand the effects it has onnot only the drinker but their family, friends and colleagues, are many. Attending open meetings where each speaker reveals their own experience of how alcohol has impacted their life, will provide insight and understanding of this family disease

. We welcome you, and those professionals who regularly come into contact with clients who have lived with or possibly still live with a problem drinker.

Advertise your events for FREE on the following pages. Are you a NFP with an up-and-coming event? If so, email your event to editor@findmaroondah.com.au and we will place it in the paper for FREE. Maroondah

The Williamstown Highland Gathering is thrilled to announce its upcoming event, a vibrant celebration of Highland Scottish and Celtic culture.

This much-anticipated gathering will be on Saturday, 26 October 2024, at the historic Seaworks precinct in Williamstown, a short train ride from Melbourne Central.

Event Details:

•Date: Saturday, 26 October 2024

•Time: 9:00 AM - 4:00 PM

•Location: Seaworks, Williamstown, Melbourne Victoria

•Cost: Children under 16 FREE, All concession holders $20.00, Adults $25.00 Join us for a day filled with the stirring sounds of bagpipes, the grace of Highland dancers, and the strength of athletes displaying their skills in a miniheavy games event.

Visitors will have the opportunity to explore a variety of stalls offering authentic Celtic food, drink, merchandise, and crafts, with plenty of activities to amuse the children all day.

Highlights of the Williamstown Highland Gathering:

• Celtic Music: Immerse yourself in the playing of the bagpipes and Celtic folk music on the stage and all day in the Pirate Bar.

• Celtic Dancing: Watch dancers of forms of Celtic dancing & all ages perform traditional and modern Celtic dances.

• Heavy Events: Cheer on athletes as they showcase their skills in classic and traditional events.

• Cultural Displays: Learn about Scottish and Celtic history and heritage throughinteractive exhibits and demonstrations.

• Unique Merchandise: Take home a piece of the Highlands with crafted goods.

The Williamstown Highland Gathering is a family-friendly event that celebrates the rich cultural tapestry of the Celtic people. It’s a perfect day out for anyone interested in experiencing the warmth and excitement of Highland Scottish hospitality.

Tickets are available for purchase online. For more information, please visit our website or contact our event coordinator.

The Williamstown Highland Gathering is an annual event that brings together the best of Scottish and Celtic culture in Melbourne.

The Melbourne Highland Games and Celtic Festival Inc. is a not-for-profit organisation of dedicated volunteers giving access to all who identify with and want to celebrate Scottish heritage and culture.

Contact: Event Coordinator: Secretary; Alistair MacInnes Email: mcinnes210@ozemail.com.au

By Warren Strybosch

When a member of a superannuation fund passes away, any benefit they have within superannuation must be cashed as soon as practicable.

The rules regarding who can receive a death benefit and how a death benefit can be paid are outlined in superannuation legislation as well as the trust deed rules of the superannuation fund. The trustee must take both sets of rules into consideration. Sometimes the rules of the superannuation fund can be more restrictive than the legislation.

A superannuation death benefit may only be paid to dependents of the deceased (as defined by superannuation rules) or to the deceased’s estate.

A dependent includes:

• The current spouse (including de facto and same-sex partners)

• Any child of the person (including adopted child or stepchild of a current relationship)

• A person with whom the deceased had an interdependency

Another person can only be paid if there are no superannuation dependents or an estate.

It is important to note that a stepchild who is a child of a former partner (following a relationship breakdown or death of the former partner) is no longer defined as a child of the person for the purposes of superannuation law and cannot receive a death benefit unless he/she was a financial dependent or had an interdependency relationship. Two people are regarded as having an interdependency relationship if:

• They have a close personal relationship, and

• They live together (unless the separation is due to disability), and

• One or each of them provides the other with financial support, and

• One or each of them provides the other with domestic support and personal care

A death benefit may be paid as a lump sum or an income stream, depending on the rules of the superannuation fund and the status of the beneficiary.

If the death benefit is paid to a child, a pension can only be paid if the child is under age 18, or aged 18-25 and

financially dependent upon the deceased, or meets disability rules (as described in subsection 8(1) of the Disability Services Act 1986). Unless the child meets the disability rules, the pension will need to stop and be converted into a lump sum when the child reaches age 25. This will be a taxfree lump sum.

There are two ways to nominate who is to be the beneficiary of a death benefit from the accumulation phase of a superannuation fund. These are:

• Binding death benefit nomination, or

• Non-binding death benefit nomination

The options available will depend on the options that are offered by the superannuation fund.

The general rule of superannuation is that the trustee has discretion to decide who to pay a death benefit to, but a binding or reversionary nomination can override this discretion. Provided the nomination is valid, the trustee will be bound to pay the benefit to the person(s) nominated.

For a binding death benefit nomination to be valid, certain conditions must be met including:

• The nomination must be made in

writing, and the signature of the person must be witnessed by two witnesses over the age of 18, who are not beneficiaries

• The nominated beneficiaries must meet the superannuation definition of an allowable dependent

• The allocation of benefits to beneficiaries must be clear

• The nomination must be current (many funds require the nomination to be remade at least every three years although some funds offer non-lapsing binding nominations)

The rules for how a binding nomination is to be made for a self-managed fund may be different and will be governed by the rules in the fund’s trust deed.

A non-binding death benefit nomination indicates the person’s preference for how a death benefit should be paid but it is not binding on the trustee of the superannuation fund. The trustee may take the instructions into account but will ultimately exercise their own discretion in determining to whom, and in what form, a death benefit will be paid. In such cases it is usual for the trustee to undertake a ‘claim staking’ process to identify potential beneficiaries. If a binding nomination is invalid, it is treated in the same manner as a non-binding nomination.

If a beneficiary has been nominated as a reversionary pensioner, on the death of the original income stream recipient, the income continues to be paid to the nominated reversionary pensioner.

Superannuation death benefits paid as a lump sum are paid tax-free to a beneficiary who meets the tax dependency definition. This includes:

• The current or former spouse (including de facto and same-sex partners)

• A child under age 18 or 18-25 and in full-time education

• A person with whom the deceased had an interdependency relationship at the time of death

• A person who was financially dependent on the deceased at the time of death

If paid to the estate, the taxation depends on who is the ultimate beneficiary from the estate.

Superannuation death benefits paid to adult children of a deceased member member will be taxable unless the beneficiary meets one of more of the conditions for tax dependency set out above.

The following table sets out the tax rates payable on lump sum death benefits paid to a non-tax dependent beneficiary. Medicare Levy, where applicable, is additional if paid to the beneficiary directly by the deceased member’s superannuation fund. Where a death benefit is paid to the deceased’s estate, for the ultimate

benefit of a non-tax dependent beneficiary, the Medicare Levy is not payable.

A taxable component – untaxed element may arise where a death benefit is paid from an untaxed superannuation fund, including a Constitutional Protected Fund, or where the death benefit is paid from a taxed superannuation fund and the death benefit includes proceeds of life insurance held by the deceased within their superannuation fund.

Where the death benefit is paid as an income stream the income payments are tax free if either the deceased or the beneficiary is over age 60. If both are under age 60, the taxable portion of the income is taxed at the beneficiary’s marginal tax rate, but a 15% tax offset applies. (Note: the tax rules may vary if the pension includes an element untaxed, e.g. as per some government superannuation funds.)

By Warren Strybosch

If you thought aged care was complicated then think again…it just become more complicated.

What is a real concern for me is the phasing out of the RAD. How this will impact future aged pension clients will be of significant importance given the RAD was not means tested. If you cannot use funds to purchase a RAD then people’s assets; namely their home, will be assessed under the aged pension asset test. This will result in many Australian’s not been able to keep or obtain the age pension.

Here is a summary of the new reforms being introduced:

The Government has introduced new Aged Care legislation to Parliament today.

The new legislation includes major changes to both Home Care and Residential Aged Care including fees and charges.

The new Aged Care Bill 2024 implements various recommendations made by the Royal Commission into Aged Care Quality and Safety, and replaces the existing Aged Care Act 1997.

Most proposed reforms commence 1 July 2025. Grandfathering applies to existing Residential Aged Care residents and Home Care participants.

The Government has stated that the new reforms have bipartisan support however it is draft legislation which has not passed as yet.

More than 50% of providers are reportedly losing money on accommodation which is limiting investment into new builds.

As the legislation has just been released we have only key announcements at this stage, including:

• Maximum accommodation price - amount that can be charged without approval increases from $550,000 to $750,000 from 1 January 2025.

• Introduction of RAD retention amount - aged care providers will retain 2% p.a. (up to a maximum 5 years) of a resident's lump sum accommodation payment (RAD or RAC) where they enter care on or after 1 July 2025

• Indexation of Daily Accommodation Payments (DAPs) - DAPs will be indexed twice per year for residents entering residential care on or after 1 July 2025

• RADs to be phased out - subject to a review in 2029-30, RADs to be phased out by 2035

• Basic Daily Care Fee - remains at 85% of single base rate Age Pension. From 1 July 2025, an additional means tested Hotelling Supplement of up to $12.55 per day will be charged. Not payable by fully or partially supported residents

• Means tested care fee replaced by a new means-tested NonClinical Care Contribution - a new lifetime cap of $130,000 (or maximum of 4 years) applies

• Family home - assessment remains unchanged

Home care fees

The new Support at Home program will start from 1 July 2025. The services will be divided into clinical care, independence support and everyday living costs.

1. Care will be approved under 10 package levels. The highest level will have a higher budget than the current Level 4 package.

2. Clinical care will be fully paid by government.

4. Full pensioners will pay 5% of independence support costs and 17.5% of everyday living costs. Self-funded retirees will pay 50% of independence support costs and 80% of everyday living costs.

5. Part-pensioners will pay between these levels with means-testing (assets & income) that aligns with age pension means-testing rules.

6. The lifetime cap (across both home care and residential care) will increase to $130,000.

7. Clients who start a Home Care Package after 30 June 2025 will only be able to accumulate unspent funds of up to $1,000 or 10% of package budget (higher of) across quarters.

Most of the changes to fees are proposed to come into effect from 1 July 2025 and will only apply to clients entering residential care from that date.

For Support at Home, people accessing a home care package (or on the National Priority System) as at 12 September 2024 will stay under the existing fee rules.

The next nine months could be busy if people needing care need advice and consider accessing care before the new rules start.

We have made it cheaper and easier for you to get your returns completed & you can do it all from the comfort of your own home.

Here are the steps involved:

1. Email to info@findaccountant.com.au requesting your PAYG return to be completed. Provide us with your full name, D.O.B and address

2. A Tax engagement letter will be emailed to you for signing via your mobile (no printing or scanning required).

3. You will be then sent a tax checklist to complete online. Takes less than 5 minutes.

4. We will then require you to upload your documents to our secure portal.

5. Once we have received all your documentation, we will complete the return.

6. We will email you the completed return with our invoices. Once you sign the return and pay the invoice we will lodge the return on your behalf.

• Architect ------------------------------ 00

• Find Accountant ----------------- 34

•

•

•

•

• Signages ------------------------------ 00

Email your artwork to editor@findmaroondah.com.au

If you wish us to create your ad, we will do this for a minimal cost. Go to www.findmaroondah.com.au/graphic-design to upload your details and we will create this for you.

Dimensions

x 98 mm - 1/8 Small

If you have any questions, contact the editor on 1300 88 38 30 or Email warren@findmaroondah.com.au

*Available until your category is taken when a Tradie joins the Find Network Team.

At Find we can help you find the ‘right’ personal insurance. Our aim is to help you obtain and retain the personal insurances that are appropriate for you and at cost that you can afford.

Personal Insurances Include:

• Income Protection (IP)

• Life Insurances or Death Cover

• Total and Permanent Disability (TPD)

When your insurance are in place, our services do not stop there. We will provide you with an after care service that includes policy notifications, insurance report, help desk, reviews and help at claim time. We provide ourselves in providing honest advice that you can rely on. •

warren@findinsurance.com.au

www.findinsurance.com.au

For every $50 spent at our dining retailers, receive a $10 gift card*

Enjoy More When You Dine at Eastland!

Discover more

The new Prada Linea Rossa Optical collection stays true to its distinctive sporty and casual appeal, continuing down the path of modern design with refined finishing.

Explore the collection at OPSM today.

Discover more

Experience Germany's iconic festival with traditional tunes, authentic feasts, and endless cheers!

Embrace the joy of longer days and vibrant styles! This season is all about bold prints, bright colors, and endless laughter under the sun.

• Lactation Consultant ----------- 39

• Swen Pouches ---------------------- 40

• Hair Dresser --------------------------- 00

• Chiropractor ------------------------- 00

• Beauty Therapy -------------------- 00

• Gym --------------------------------------- 00

• Massage Therapy ---------------- 00

Osteopathy in Australia is a government registered, allied health profession. Osteopaths focus on improving the function of the neuro-musculoskeletal system (bones, muscles, nerves and connective tissues) to optimise health and well-being.

Joanna is highly qualified and experienced in the osteopathic assessment and treatment of babies and infants.

She can assist with the following assessments:

• Gross motor development (milestones)

• Primitive reflexes

• Tongue function and it’s relation to sucking skills

• Biomechanics of the jaw and mouth

IBCLC lactation consultants are recognised around the world as the experts in lactation care. They provide evidencebased knowledge to assist mothers to establish and maintain breastfeeding. As professionals, they are charged with promoting, protecting and supporting breastfeeding.

Joanna can help with a broad range of lactation consulting services, including:

• Teaching a new mum how to hold and position her baby to breastfeed

• Assess the suck, swallow and breathing of an infant

• Assess for tongue function and determine any evidence of restriction (tongue tie)

• Pre and post-frenectomy breastfeeding support

• Help increase or decrease milk supply

An amazing day at the club!

Hundreds of dollars in cash prizes, so many raffle goodies, delicious food by Rod, barefoot bowls and some cracking weather!

Thank you so much to everybody who came down and supported the club.

It doesn’t go unnoticed and it is much appreciated. Watch this space for our next event!

Thursday Dinners are back this week for selection night.

This week will be a choice of Bolognese or Carbonara Pasta with a side of salad and garlic bread.

$10 a meal. Let us know below for catering purposes.

Simply upload your ad at www.findmaroondah.com.au/nfp-free-advertising or you can email the ad to the editor@findmaroondah.com.au and we will do the rest for you.

Senior

Karen

NextGen

Worship

Transform

Community

Children's