Are you our next Life Coach?

Are you our next Architect?

Are

Are

our next Copywriter?

Are you our next Life Coach?

Are you our next Architect?

Are

Are

our next Copywriter?

The Find Maroondah is a community paper that aims to support all things Maroondah. We want to provide a place where all Not-For-Profits (NFP), schools, sporting groups and other like organisations can share their news in one place. For instance, submitting up-andcoming events in the Find Maroondah for Free.

We do not proclaim to be another newspaper and we will not be aiming to compete with other news outlets. You can obtain your news from other sources. We feel you get enough of this already. We will keep our news topics to a minimum and only provide what we feel is most relevant topics to you each month.

We invite local council and the current council members to participate by submitting information each month so as to keep us informed of any changes that may be of relevance to us, their local constituents.

EDITORIAL ENQUIRES:

We will also try and showcase different organisations throughout the year so you, the reader, can learn more about what is on offer in your local area.

To help support the paper, we invite local business owners to sponsor the paper and in return we will provide exclusive advertising and opportunities to submit articles about their businesses. As a community we encourage you to support these businesses/columnists. Without their support, we would not be able to provide this community paper to you.

Lastly, we want to ask you, the local community, to support the fundraising initiatives that we will be developing

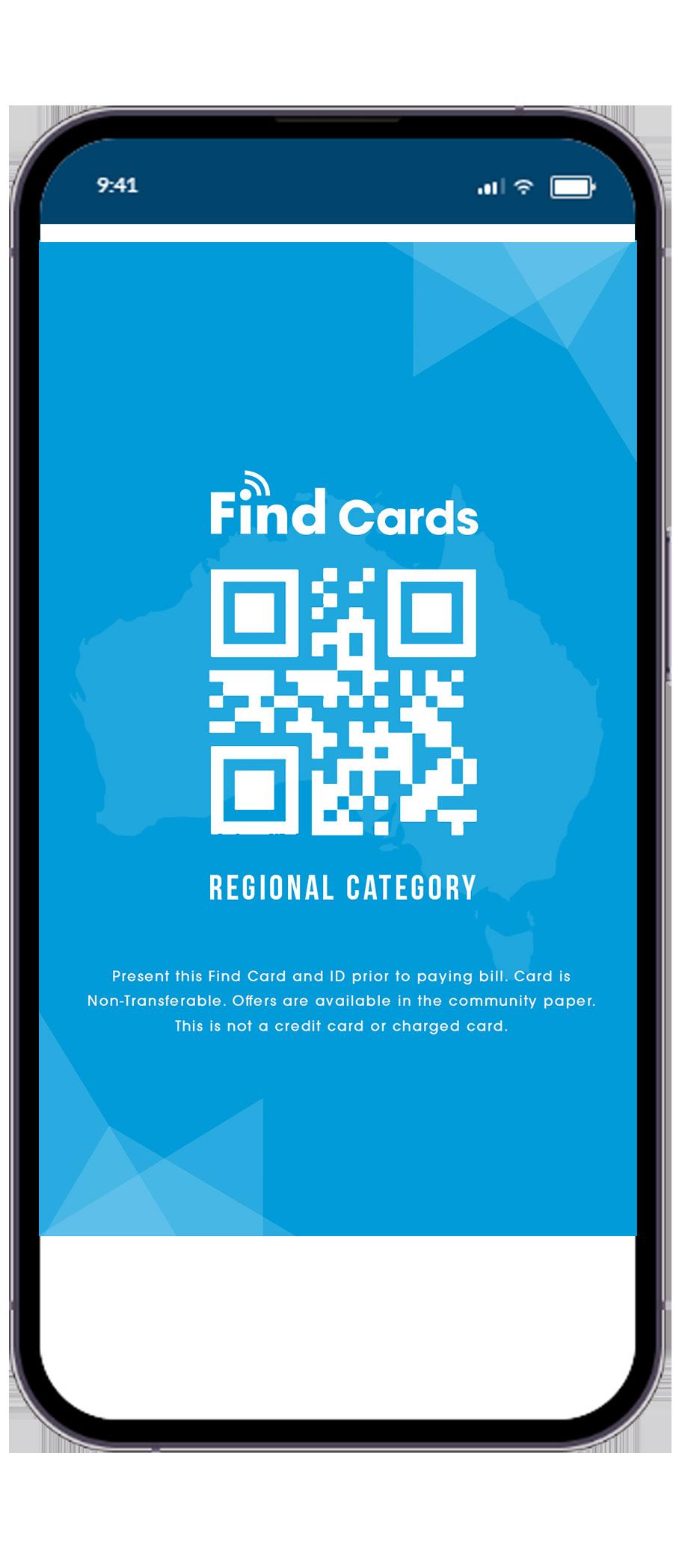

and rolling out over the coming years. Our aim is to help as many NFP and other like organisations to raise much needed funds to help them to keep operating. Our fundraising initiatives will never simply ask for money from you. We will also aim to provide something of worth to you before you part with your hard-earned money. The first initiative is the Find Cards and Find Coupons – similar to the Entertainment Book but cheaper and more localised. Any NFP and similar organisations e.g., schools, sporting clubs, can participate.

Follow us on facebook (https://www. facebook.com/findmaroondah) so you keep up to date with what we are doing.

We value your support,

The Find Maroondah Team.

Warren Strybosch | 1300 88 38 30 editor@findmaroondah.com.au

PUBLISHER: Issuu Pty Ltd

POSTAL ADDRESS: 248 Wonga Road, Warranwood VIC 3134

ADVERTISING AND ACCOUNTS: editor@findmaroondah.com.au

GENERAL ENQUIRIES: 1300 88 38 30

EMAIL SPORT: editor@findmaroondah.com.au

WEBSITE: www.findmaroondah.com.au

The Find Maroondah was established in 2019 and is owned by the Find Foundation, a Not-For-Profit organisation with a core focus of helping other Not-For-Profits, schools, clubs and other similar organisations in the local community - to bring everyone together in one place and to support each other. We provide the above organisations FREE advertising in the community paper to promote themselves as well as to make the community more aware of the services these organisations can offer. The Find Maroondah has a strong editorial focus and is supported via local grants and financed predominantly by local business owners.

The City of Maroondah is a local government area in Victoria, Australia in the eastern suburbs of Melbourne. Maroondah had a population of approximately 118,000 as at the 2019 Report which includes 9000 business and close to 46,000 households. The City of Maroondah was created through the amalgation the former Cities of Ringwood and Croydon in December 1994.

The Find Maroondah acknowledge the Traditional Owners of the lands where Maroondah now stands, the Wurundjeri people of the Kulin nation, and pays repect to their Elders - past, present and emerging - and acknowledges the important role Aboriginal and Torres Strait Islander people continue to play within our community.

Readers are advised that the Find Maroondah accepts no responsibility for financial, health or other claims published in advertising

International Day of Charity was established by the United Nations to raise awareness and promote charitable activities and humanitarian efforts worldwide. This day serves as a reminder of the importance of giving back to those in need and encourages people, organizations, and communities to engage in acts of kindness and charity.

International Day of Charity also serves to increase and enhance social responsibility across the entire world, increasing our support for charitable causes and bringing everyone together in solidarity.

The International Day of Charity honors the memory of Mother Teresa, who dedicated her life to helping the poor and disadvantaged in India. It provides an opportunity for individuals and charitable organizations to raise funds, volunteer their time, and contribute to various charitable causes, whether they are related to poverty alleviation,

education, healthcare, disaster relief, or any other humanitarian endeavor. Many people and organizations use this day to organize events, fundraisers, and charitable activities to support various causes and make a positive

impact on the lives of others. It's a day to celebrate the spirit of giving and generosity and to inspire individuals to take action to make the world a better place through acts of charity and kindness.

1.

2. Over the last few years I have been shortlisted and won awards across financial planning; including winning Holistic Advisor of the Year in Australia twice in the last 3 years. I have also spoken on podcasts and at conferences throughout Australia about financial planning and tax topics.

3. We have set up and run a Not-For-Profit called the Find Foundation (www.findfoundation.org.au); supporting other NFPs, schools, sporting clubs and other organisations via our community papers. Our community papers provide useful articles that aim to inform, help organisations tell their story, bring people together, and educate those in our local community.

4. We have set up the Find Network, a small business network group (www.findnetwork.com.au) to support and help SME thrive.

5. We have set up a new partnership with an overseas university. As someone who has already written financial planning course and lectured financial planning, we want to bring financial planning to others including those living overseas.

6. I am currently in the process of writing a financial planning/money book to help Australians do as much as they can to improve their own financial planning situation before they need to engage a financial planner.

7. I am an Australian business owner who works hard to make a real difference in the lives of those around me.

I hope you will consider the above being worthy of your vote. To vote, simply select my name, fill in your details and submit the form.

Setting the right price for your products or services is a crucial decision that can significantly impact the success and growth of your business. While some may believe that lower pricing attracts more customers, the truth is that correctly pricing your services, even at a higher level, can offer numerous advantages that lead to greater profitability and success. In this article, we will explore the benefits of pricing your service correctly, and why higher pricing can be a better strategy for your business.

1. Perceived Value:

One of the main advantages of higher pricing is that it conveys a sense of premium quality and value. Customers often associate higher prices with superior products or services, which can create a perception of exclusivity and desirability. When your offerings are priced higher, potential customers are more likely to view your business as a provider of high-quality solutions, increasing the likelihood of converting them into loyal, long-term clients.

2. Improved Profit Margins:

Higher pricing naturally leads to improved profit margins, allowing your business to maintain healthy financials and invest in its growth. With better margins, you can reinvest in marketing, research, and development, as well as customer service improvements, which ultimately enhances your competitive advantage and overall business performance.

3. Better Customer Relationships:

Contrary to common belief, customers are often willing to pay more for exceptional service and a superior experience. When you charge higher prices, you can afford to allocate more resources to enhance customer support and provide personalized attention, leading to stronger relationships with your clientele. These satisfied customers are more likely to become brand advocates, spreading positive word-ofmouth and driving more business your way.

4. Targeting the Right Audience:

Pricing your service correctly allows you to target the right audience effectively. A higher price point can attract clients who value quality over affordability, and who are willing to pay for the unique benefits your service provides. This targeted approach not only simplifies your marketing efforts but also helps build a loyal customer base that aligns with your business's values and offerings.

5. Distancing from Competitors:

A well-placed higher price can distinguish your business from competitors, establishing a sense of uniqueness in the market. Lower-priced services often engage in price wars and discounts, eroding profitability and diminishing perceived value. By pricing your services higher, you demonstrate your confidence in the value you deliver and encourage customers to choose you based on quality rather than price alone.

6. Capacity for Innovation:

Higher pricing provides your business with a financial cushion, enabling you to

invest in research and development. With more resources at your disposal, you can innovate and stay ahead of the competition. This willingness to invest in improvement fosters a culture of innovation within your organization, keeping your services fresh and relevant to changing customer needs.

7. Sustainable Growth:

While lower pricing might attract an initial influx of customers, it can be challenging to maintain the volume needed to sustain profitability in the long term. On the other hand, correctly pricing your services higher ensures a stable revenue stream, supporting sustainable growth and expansion opportunities. This stability allows you to weather market fluctuations and make strategic decisions for longterm success.

In conclusion, pricing your service correctly is a critical aspect of your business strategy. While lower pricing might seem attractive initially, the benefits of higher pricing, such as perceived value, improved profit margins, better customer relationships, and sustainable growth, far outweigh the short-term gains of attracting bargain-hunting customers. By positioning your services at a higher price point, you can establish your business as a provider of premium solutions, attract the right audience, and pave the way for lasting success in a competitive marketplace.

If you own a shop, factory, restaurant, or office building, you may not have considered the impact of a major power surge knocking out your electrical system or killing off expensive equipment you rely on to keep your business running and service your clients. Perhaps you own a business that is reliant on cool rooms such as a greengrocer, bakery or cafe, and you could face expensive repairs, interruption to trade, and stock losses. If this is the case then a closer look at machinery breakdown is essential. Deterioration of stock, consequential loss of profit and payroll, loss of rental, and additional cost of working are all sections of cover worth considering, and deserve their own articles. Below we look at the optional Fire and Other Perils section that’s sometimes overlooked.

It’s important to note that the definition of machinery has been broadened out by some insurers to cover today’s technologies from the electrical supply wiring throughout a building, circuit boards, electrical switchboards, HVAC (Heating Ventilation Air Conditioning) on-site sub stations, machines either whilst working or connected on standby and much more. Consider also that depending on the extent of Equipment Breakdown cover taken, for example, section Coverage A2 Electronic Equipment - Fire and Other Perils (Vero) even the data associated with electronic systems can be covered.

See wording extract below, and note the cause must be sudden and accidental. Gradual issues caused by a slow leak or poor maintenance would not be able to be claimed. Also note that losses can be caused by extinguishing a fire, so any damage done by an attending fire brigade is also covered. See https:// www.vero.com.au/policy-documents/ equipment-breakdown.html for the full wording to give context.

Breakdown

For the purpose of this optional coverage A2 and in contradiction to what is contained in Exclusions 4 and 8 in Section D Exclusions, the definition of Breakdown is extended to include sudden and accidental damage caused by or resulting from:

(a) fire,subterranean fire,smoke or soot;

(b) earth movement, earthquake, landslide, mud flow, subsidence, landslip or volcanic eruption;

(c) cyclone, tornado, hurricane, typhoon, storm, tempest, wind, hail, snow, ice, sleet, rainwater;

(d) tsunami, tidal wave, flood, high water, or other actions of the sea;

(f) collapse of any building or structure;

(e) escape of water or liquids;

(f) water or other means used to extinguish a fire;

(g) water or other means used to extinguish a fire;

(h) lightning;

(i) theft, burglary or attempted theft or burglary;

(j) impact by Vehicle or animal;

(k) impact by watercraft, aircraft or other aerial devices or articles dropped therefrom; (l) explosion; or

(m) riot, civil commotion, sabotage, vandalism or malicious acts of persons other than You but not Cyber Act.

The scale of claims can range from relatively minor such as a compressor failure on a cool room, to the loss of the entire electrical system throughout

a multi storey office building. Nine levels of tenants in an office block were temporarily relocated, then moved back in after a multi-level electrical strip-out and refit. The damage bill exceeded $10m, so the policy well and truly saved the building owner a fortune.

Consider how Machinery Breakdown cover could help your business cope with a similar catastrophe, and contact your broker for further advice.

For a health check of your business insurance, contact Small Business Insurance Brokers via email sales@ smallbusinessinsurancebrokers.com.au

Any advice in this article has been prepared without taking into account your objectives, financial situation or needs. Because of that, before acting on the above advice, you should consider its appropriateness (having regard to your objectives, needs and financial situation).

After recently reading a wonderful article from Birds in Backyards and looking at the survey, the results are unsurprising. Across Australia 1345 surveys were completed during March and April counting nearly 50,000 birds of 308 different species, mostly in the Eastern States. The top 10 in descending order of percentages are the:

One of Australia's "most hated birds" — the noisy miner — is now one of its most common, dominating urban environments and driving out smaller and more vulnerable species.

• Noisy miners are a native honeyeater species known for their aggressive behaviour

At a feeding station, every other bird stands back, even Galahs, Rosellas and King Parrots while this fellow has them foxed with an aggressive attitude. Sometimes the crested pigeon, will fan its tail puff out it’s chest and push them away.

In Maroondah the Noisy Minor is a fairly recent inhabitant, this will be due to our change in provision of habitat.

• The birds live in large colonies and drive out other species

• They are now so populous they've been listed as an environmental threat

Living in large cooperative colonies, the grey-feathered miner is a native honeyeater, famed for its aggression toward other species and ability to take over whole areas.

Griffith University researcher Carly Campbell, who has studied native birds in Australia's urban landscapes, said noisy miner numbers in Brisbane alone had tripled since the 1970s.

"They are quite territorial birds, and because we've created these large grassy areas with one or two remaining trees, what that really does for them is it allows them to really protect their space," she said.

This is why in Maroondah we need to revegetate our reserves with more planting of diverse species of plants to create biodiversity. Luckily Maroondah has a very healthy number of residents prepared to offer an hour or two twice a year to replant in your local reserve. After planting it may require a small amount of upkeep to remove ivy seedlings or Wonga vine. Watching a reserve regenerate is food for the soul.

A list of reserves you can choose from can be found by searching Maroondah Councils website looking for Natural Environment Community Groups

https://www.maroondah.vic.gov.au/ Development/Environmental-Sustainability/ Sustainability-engagement-and-partnerships/ Natural-environment-community-groups

Does these noisy residents live near you? They will be looking for developing fruit soon, if you want to keep any, you might need to net the tree!

Liz Sanzaro

Liz Sanzaro

President of Croydon Conservation Society liz@sanzaro.com | www.croydonconservation.org.au

We have all experienced the impact on our hip pockets from increases in the costs of daily living. From the grocery store to the petrol bowser living costs have gone up significantly without any real increases in wages, so money left over to save for a house or pay off debt is becoming harder to retain. This means that when you apply for a loan with a Bank to buy a home, refinance or complete some renovations, demonstrating that you have capacity to pay back the loan is also getting more difficult.

When assessing your ability to repay a loan the lenders are not just looking at your income, deposit and the security you are providing. They are also looking at what you spend on groceries, utilities, transport costs, entertainment, education and all of your other daily living expenses. The amount you spend on these costs will have a significant impact on how much you can borrow.

Most lenders use a standard measure called Household Expediture Method (HEM) to estimate a household’s living costs. The HEM is a benchmark figure that estimates how much someone in your location is likely to spend on living costs, taking into account family size and the number of children you have. It varies from person to person as, for example, a family of four living in the suburbs of a larger city is likely to spend more than the same family living in a rural location.

As HEM is used as an estimate, lenders will want to look at your particular spending habits against the HEM benchmark, which they will do by requesting that you supply them with your transaction account and credit card statements, usually over a three month period. Once they examine these statements they will see whether your spending is above or below the benchmark. If your spending is above the benchmark they will use this figure as your living expenses when assessing your borrowing capacity.

It may feel that, with all of the cost of living increases, stagnant wage growth and the increases in interest rates, getting finance approved is an impossible task except for the privileged few on high incomes and with big balance sheets. Yes the task is getting more difficult, but by doing a few simple things we can improve our chances of getting that loan approval.

1. Set up a budget and stick to it. This is a key lesson for most of us to learn. Keeping track of where you spend your money can help you identify where you can change your spending habits for the better.

2. Cut out as much discretionary spending as possible. By identifying where you spend your money you can look at ways to reduce your living costs. Perhaps bringing lunch to work most days rather than buying it, reducing the number of coffees per day or cancelling a streaming service when you already are paying for several others might be a starting point.

3. Reduce or cancel any limits on credit cards that you don’t use.

4. Cancel any Afterpay or Zippay accounts that you may have. These are treated like credit cards and have a negative impact on your ability to borrow.

Doing this well before applying for a loan will give the lenders evidence that you know how to track your spending and manage your finances, so affording a loan repayment can be demonstrated. If you can do this, and also show a consistent savings history, then you will be going a long way to ensure you receive a positive outcome on any loan application.

At SHL Finance we have helped a lot of our clients improve their situation by working with them to achieve their financial goals, and we would love the opportunity to help anyone who is wanting to improve their chances of being able to buy a future home.

Please call Reece Droscher

on 0478 021 757 to discuss all of your Home Loan needs. reece@shlfinance.com.au www.shlfinance.com.au

By Kathryn Messenger

By Kathryn Messenger

With some iron supplements people are left choosing between being exhausted or being constipated, neither of which are good for your health. Others opt for regular iron infusions, and whilst these can be great when your levels are very low, for most people, there are other ways to increase absorption of the important nutrient.

Iron is an essential component of hemoglobin, the protein responsible for transporting oxygen from the lungs to tissues and organs. Oxygen is required for the functioning of all cells, and a lack of supply to muscles and cells can result in feelings of fatigue, weakness, and shortness of breath.

What causes low iron?

Iron deficiency occurs either through inadequate intake, or excessive blood loss. As a result, the body struggles to make hemoglobin and other important enzymes that help carry oxygen. The body tries to compensate by absorbing more iron from the diet and reusing what it has, but if not treated, iron deficiency can worsen and lead to anemia, affecting overall health and well-being.

• Fatigue and weakness

• Pale skin and nail beds

• Shortness of breath

• Headaches and dizziness

• Cold hands and feet

• Brittle nails

• Difficulty in concentrating

• Heart palpitations

Keep in mind that these symptoms can vary in severity and may not always indicate iron deficiency, as there can be a number of different reasons for these symptoms.

If you eat meat, you will likely absorb enough iron from your diet and low iron is likely due to blood loss. If you’re not a menstruating female and haven’t had a recent accident or surgery, the cause of internal bleeding needs to be investigated further. If the cause is from you menstrual, herbal medicines and homeopathy can be really useful in treating the cause. This can be done by regulating hormone levels and reducing excessive blood loss.

• Red meat (beef, lamb, pork)

• Poultry

• Fish (especially tuna, salmon)

• Beans and legumes (lentils, chickpeas, kidney beans)

• Tofu

• Nuts and seeds (pumpkin seeds, sunflower seeds)

• Spinach and other leafy greens

• Quinoa

• Oats

• Dried apricots

• Dark chocolate

It’s important to note that iron comes in two forms: heme iron (found in animal products) and non-heme iron (found in plant-based foods). Heme iron is generally better absorbed by the body, but combining non-heme iron sources with vitamin C-rich foods can enhance absorption. So if you are a vegan or vegetarian you could do this by eating tomato or capsicum together with spinach.

Firstly, you want to use a gentle form of iron such as iron bisglycinate rather than ferrous sulfate which nearly always causes constipation. Secondly, recent research has shown that lactic acid

bacteria, particularly lactobacilli, are able to enhance dietary iron absorption. The specific strain of Lactobacillus plantarum 299v alters the bacteria in the intestine at the duodenum where iron is absorbed and therefore increasing the intake. Along with the results from the research, I have seen much better results from the combination of a quality supplement when used together with the specific probiotic.

All clubs at some stage or another lose members and it is important for the person leaving the club to let them know why they are leaving.

We acknowledge that there are a number of reasons:

• family commitments

• health

• retirement from playing sport

• moving out of the area

• unhappiness – major disagreements

• offered more money to play at another club

• new challenges

It is possible that the member has decided to leave because they have had a dispute with someone at the club – a member of the board or a selector and they no longer trust how the club is being run.

Whatever the reason, your club needs to know you have decided to move on. It may be a problem that the club is not aware of or a problem that has existed for some time and has gone unresolved.

If you are thinking about leaving your club make sure you really want to leave and don't end up regretting your decision.

Find and make the time to talk someone at the club – the president, board member, club secretary - discuss your

concerns and reasons why you are planning to leave BEFORE you let other members of the club know what you are planning to do.

If the club is aware of your problem give them time to investigate and if it is resolved to your liking then you can happily put your plans to leave to rest.

On the reverse side if your complaint or concern is not resolved write a resignation letter to the secretary of the club detailing the reasons and why you

have decided to leave.

Membership is the backbone of every sporting club and retaining members should be a key objective because we all know how hard it is recruiting new members.

Before moving on think about it – do you really want to part company and start all over again at another club –its your decision – make sure you don’t regret it.

As a business owner and employer, it is your responsibility to ensure the health safety of your employees within your workplace. This includes providing your team with a safe work environment and protection from hazards. You can achieve this by understanding your obligations under the Occupational Health and Safety (OHS) laws and by complying with them.

WorkCover Victoria recently reported that a Melton exhaust system manufacturer has been convicted and fined $40,000 after a worker had four fingers amputated while using inadequately guarded machinery.

MPI Global Pty Ltd was sentenced in the Sunshine Magistrates’ Court in late July 2023 after pleading guilty to one charge of failing to provide or maintain plant that was safe and without risks to health. The company was also ordered to pay costs of $6,478.

This is the fifth amputation-related WorkSafe prosecution in the past year, with outcomes totalling more than $380,000 in fines, enforceable undertakings and costs imposed by the courts. In the same period, WorkSafe accepted 126 claims for workplace amputation injuries.

In the latest case, the court heard that the worker was using a press machine to form steel plate to make muffler caps when the injury occurred in October 2020. There was a guard at the front of the machine that needed to be removed to access the steel plate and, while there was a safety rod in place to ensure the press did not come back down before the guard did, this rod had disconnected. The worker tried to reconnect the safety rod and resumed operating the press, which shortly afterwards crushed his hand, amputating four fingers. The worker underwent multiple surgeries and only two of his fingers could be successfully re-attached.

A WorkSafe investigation found it was common for the safety rod to come loose, meaning the press would start working without the guard being fully down. Workers would fix the safety rod by adding new nuts and bolts that were found around the workplace and not specifically designed to keep it in place. Workers had advised the company about a dozen times that the safety rod was broken.

The court found that it was reasonably practicable for the company to use an interlocked physical barrier on the press machine and to ensure the machine was regularly serviced, checked daily, and that components such as the safety rod were repaired.

WorkSafe Executive Director of Health and Safety Narelle Beer said the company’s disregard for safety had left a worker with life-altering injuries. “This case highlights the awful damage that can be done when employers fail in their duty to do everything they can to provide a safe workplace,” Dr Beer said. “There are absolutely no excuses for neglecting to properly guard machinery or undertake regular servicing and repairs to ensure they can be used safely.”

To manage risks when working with machinery and plant, employers should:

• Identify hazards, assess the risks associated with them, and eliminate or control those risks by isolating them or using an alternative.

• Train staff in the safe operation of machines and equipment and provide written procedures in the worker's first language.

• Develop and implement safe operating procedures in consultation with employees and health and safety representatives.

• Ensure safety guards and gates are compliant and fixed to machines at all times.

• Regularly service and inspect machines and equipment.

• Place signs on or near a machine to alert employees of the dangers of operating it.

As a business owner, are you confident that you do not have shortfalls in your efforts to keep your workers healthy and safe? Do you have an understanding of your responsibility to ensure the safety of your employees? Are you confident that you can provide a safe work environment and comply with OHS laws? Do you believe that you are effective in carrying out risk assessments, employee consultation and providing training? Do you regularly review these measures to ensure that they remain fit for purpose and keep you and your employees healthy and safe?

At Beaumont Advisory we assist business owners clarify what they currently have in place, as well as where there are shortfalls. We then assist in developing effective systems and documentation, working with businesses to ensure effective implementation. Checks are put in place to monitor ongoing effectiveness, to ensure that going forward, they are sound and comply with the Act, and most importantly keep you and your employees informed, and healthy and safe. Please feel free to contact me, Mark Felton, at Beaumont Advisory on 0411 951 372 or mfelton@beaumontlawyers.com. au for an obligation and cost-free initial discussion.

Mark Felton

Mark Felton

Occupational Health & Safety

www.thebeaumontgroup.com.au

With the event of the GFC, COVID and significant interest rate rises, tax debts have skyrocketed. It is now common for large businesses to be owing $500,000 or more in debt and more small businesses are starting to find themselves owing more in ATO debts than ever before. We are noticing more businesses and individuals are having to go on payment plans because they don’t have the ability to pay the surmounting debt. This is likely to get worse in 2026 when employers will be required to pay super at the same time as wages reducing the businesses cash flow even further.

Some of the hardest hit industries are construction, labour hire, hospitality, building, with other industries starting to feel the same pressure. Prior to Covid, it was common to see large companies with debt levels of around $300,000 and now this is getting above $600,000 with some companies now owing up to $1,000,000 in debt.

The ATO is concerned about the increasing debt levels and have warned all businesses, that they will be taking a harder stance where recovery of debt is concerned. Prior to COVID, the ATO took a supportive approach towards businesses who owned debt

but now the ATO has drastically ramped up Federal Court actions to recover $30 billion in overdue small business tax, which nearly doubled during the pandemic, ending its leniency policy. Already, the ATO has started 476 windup proceedings in the first seven months of 2023, compared with just 14 in the same period last year.

“The ATO is taking decisive and swift action with those clients choosing not to engage and who purposefully avoid their payment obligations,” an ATO spokeswoman said. “We will continue to offer help and assistance to those who genuinely need it, whilst activating targeted strategies to address the growth in collectable debt which arose during COVID.

“This year, we have a particular focus on recovering high-value and aged debts and requiring timely payment of employer obligations, including unpaid superannuation.

The ATO said it was returning to businessas-usual for overdue debts and while court actions were rising sharply they were still below pre-pandemic levels.

“Having allowed concessions during the pandemic, we are actively addressing the growth in collectable debt,” the ATO said. “Most tax debts are self-acknowledged, and relate to GST, pay-as-you-go withholding and superannuation guarantee charge.”

Businesses and individuals are encouraged to work with their accountants to try and meet their tax liability obligations, especially where it involves GST, PAYG and SGC. Even if the business cannot afford to pay their obligations, it is crucial they lodge their activity statements on time. The ATO is more likely to ‘help’ those businesses whose lodgements are up to date compared to those businesses who not only owe money but are not even trying to get their lodgement obligations up to date.

Important Information

This information is of a general nature only. It does not take into account your particular financial needs, circumstances and objectives. You should obtain professional financial advice if you have not already done so before acting on this information. You should read the Product Disclosure Statement (PDS) before making a decision to buy or sell a financial product. Any case studies, graphs or examples are for illustrative purposes only and are based on specific assumptions and calculations. Past performance is not an indication of future performance. Superannuation, tax, Centrelink and other relevant information is current as at the date of this document. This information contained does not constitute legal or tax advice.

on winning the Holistic Adviser of the Year again at the IFA Excellence Awards 2022.

The founder of the Find Group of companies draws on his diverse background, which ranges from teaching, to serving in the army, to taxation and accounting, to coach and help clients live their best financial lives. A multi-award winner, Warrens’s innovative approach in business means he was a champion of virtual financial advise long before the pandemic. Warren established the Find Foundation, which owns and operates accros Victoria.

The financial advisers featured in this guide are a diverse group: some specialise in responsible investment advice, some provide financial advise to specific professions, and some focus on addressing market gaps, mwith several finding themselves on the list for the very first time. But they all have one thing in common: they all wield influence that can create the blueprint for the future of financial advice in Australia. Not all of them are faniliar names but just because they are not making a lot of noise doesn’t mean they are not making waves. Meet our Power 50.

The ATO has released a statement to inform all employers that they must report. pre-sacrificed amounts and separately report the salary sacrificed amounts as follows: type S for amounts sacrificed to super; and type O for amounts sacrificed towards other benefits. (Previously with STP Phase 1 reporting, employers only reported post-sacrificed amounts.)

There are some exciting osteo team changes happening at the Melbourne Therapy Centre!

We are delighted to be retaining Dr Joanna Strybosch, Osteopath, Advanced Paediatric Osteopath and Lactation Consultant. Jo has been in practise for over 27 years, the past 12 years being at MTC, and will continue to be available for all your paediatric osteo and lactation needs.

Jo is passionate about supporting mums and bubs in the early months post-partum, with a focus on establishing breastfeeding and helping babies who have experienced difficult births. Combining her skills and training as an advanced paediatric osteopath and an IBCLC (lactation consultant), Jo offers a unique holistic approach to maternalinfant care.

For appointments with Jo click here:

https://joanna-strybosch-osteopath-lactation-consultant.au2.cliniko. com/bookings?business_id=1191171424325212564&practitioner_ id=1191171421187872811

We will also be welcoming Dr Stephania Tsotras, Osteopath. Steph comes to us with many years of experience as an osteopath as well as additional training in women’s health, pelvic floor and pelvic health, breast care and mastitis, paediatrics, pregnancy, post-partum care and cranial osteopathy.

Steph is skilled in internal pelvic assessment and treatment, pregnancy, paediatrics and dry needling. She has a clinical focus on pelvic floor issues, post-partum check ups, incontinence and prolapse. She also works with breast cancer patients to release scar tissue from mastectomies and lumpectomies.

Steph will be available for appointments at MTC from Monday 30th October 2023.

For appointments with Steph click here: https://joanna-strybosch-osteopath-lactation-consultant.au2.cliniko. com/bookings?business_id=1233939857491893136&practitioner_ id=1237321254701111948

Or call our friendly reception staff at MTC on 9876 3011. We look forward to supporting you.

The First Home Super Saver (FHSS) Scheme is an Australian government initiative designed to help individuals save money for their first home through the use of their superannuation fund. Here's how it works:

Voluntary Contributions: First introduced in 2018 FY, eligible individuals can make voluntary contributions to their superannuation account, specifically for the purpose of saving for their first home. These contributions are generally beforetax (concessional) contributions or aftertax (non-concessional) contributions and can be withdrawn at a later time) to use as a deposit for the purposes of purchasing or constructing their first home.

Concessional Contributions: You can make pre-tax contributions to your superannuation account, which are taxed at a lower rate than your regular income. These contributions are capped at certain limits.

Non-Concessional Contributions: You can also make after-tax contributions to your superannuation account. These contributions are not taxed when withdrawn for the FHSS Scheme.

Maximum Contribution Limits: There are annual and lifetime limits on the total

contributions you can make under the FHSS Scheme. Under the FHSSS, prospective first home buyers can make personal contributions to superannuation of up to $15,000 a year. Up to $50,000 of these contributions can then be withdrawn to finance a first home.

Withdrawal for a First Home: Once you have made eligible contributions and meet certain criteria, you can apply to release these funds to purchase your first home. The released amount includes your contributions and associated earnings, minus a withholding tax.

Criteria for Release: To be eligible for FHSS funds withdrawal, you must meet certain criteria, including being at least 18 years old, not having previously owned property in Australia, and intending to live in the property you purchase.

Under the existing laws, individuals have up to 14 days to request a release authority after they enter into a contract to purchase or construct a home.

However, new legislation was passed on Wednesday (6 September) that expands the timeframe for FHSSS users to request a release of savings (after entering into a contract) in order to access funds to complete their house.

Individuals will have up to 90 days to request a release authority after they enter into a contract to purchase or construct a home.

Speaking of the changes, Assistant Treasurer and Financial Services Minister Stephen Jones MP said the amendments would address "significant painpoints in the scheme" and "[make] it easier for young Australians looking to purchase their first home through the First Home Super Saver Scheme ".

The technical changes generally apply retrospectively to FHSS Scheme applications made from 1 July 2018

The ATO has finalised a tax ruling which provides additional relevant guidance on the statutory residency tests for individuals and how the Commissioner may apply them under s 6(1) of ITAA 1936.

Taxation Ruling TR 2023/1 focuses on modernised ways of working, relevance of business or employment ties overseas and whether work duties can be performed from anywhere in the world.

Resident tax rates may be applied for individuals even where there are a tax resident in Australia for only a single day and pro-rata the tax-free threshold over the period of their residency in an income year.

The ruling concludes that residency depends on individual facts and circumstances and no bright-line rules or any single factor can be considered to be paramount.

Revenue NSW has determined that the current surcharge purchaser duty and surcharge land tax provisions for certain foreign residents are inconsistent with their nation’s international tax treaties with Australia.

In response to this, effective immediately, individuals who are citizens of New Zealand, Finland, Germany and South Africa, will no longer be required to pay surcharge purchaser duty and surcharge land tax.

The above list was extended on 29 May 2023 to include India, Japan, Norway and Switzerland.

Refunds may also be made available for payments made by the concerned taxpayers for residential property or land purchases on or after 1 January 2021.

Announcement(7-Jun-2023)

Consultation period

Released(7-Jul-2023)

Announced: 21-Feb-2023

Updated: 12-Jul-2023

Revenue NSW has determined that the current surcharge purchaser duty and surcharge land tax provisions for certain foreign residents are inconsistent with their nation’s international tax treaties with Australia.

In response to this, effective immediately, individuals who are citizens of New Zealand, Finland, Germany and South Africa, will no longer be required to pay surcharge purchaser duty and surcharge land tax.

The above list was extended on 29 May 2023 to include India, Japan, Norway and Switzerland.

Refunds may also be made available for payments made by the concerned taxpayers for residential property or land purchases on or after 1 January 2021.

The digital games tax offset (DGTO) has received royal assent and is now law.

The DGTO is aimed at giving a boost to the digital economy as well as the digital gaming industry in Australia. This offset will allow eligible businesses to claim a refundable tax offset of up to 30% on qualifying Australian gaming development expenditure.

The offset will be implemented through the creation of Div 378 to the Income Tax Assessment Act 1997. Rules on the application process have now been released to assist developers and the Arts Minister on the administration of the offset.

Announced: 21-Feb-2023

Updated: 12-Jul-2023

Announcement(23-Nov-2022)

Consultation

Introduced(23-Nov-2022)

Passed(21-Jun-2023)

Royal Assent(23-Jun-2023)

Date of effect(1-Jul-2023)

The ATO released their corporate plan for 2023–24, and it highlights 8 key priorities, with superannuation guarantee (SG) compliance being one of them.

The administration of reporting and payment of SG entitlements has become a key focus as the ATO continues to expand its data digitalisation program and non-compliance remains a concern.

For small businesses, ATO’s data digitalisation approach aims to minimise errors, save time and promote accurate and timely SG compliance. In the remainder of 2023–24, the ATO will continue to monitor whether employers pay correct and timely SG entitlements and penalise the ones that fail to do so

Announced: 4-Aug-2023

Updated: 9-Aug-2023

The digital games tax offset (DGTO) has received royal assent and is now law.

The DGTO is aimed at giving a boost to the digital economy as well as the digital gaming industry in Australia. This offset will allow eligible businesses to claim a refundable tax offset of up to 30% on qualifying Australian gaming development expenditure.

The offset will be implemented through the creation of Div 378 to the Income Tax Assessment Act 1997. Rules on the application process have now been released to assist developers and the Arts Minister on the administration of the offset.

Announcement(23-Nov-2022)

Consultation

Introduced(23-Nov-2022)

Passed(21-Jun-2023)

Royal Assent(23-Jun-2023)

Date of effect(1-Jul-2023)

Starting from 1 July 2023, operators of sharing economy platforms will be required to report transactional information to the ATO. The Taxable Payments Reporting System already applies to some businesses in industries where non-compliance is deemed to be high risk. By adding operators of sharing economy platforms to the regime, taxpayers who hold or use assets for short-term lease or contract work will also have their information collected.

The identification of users of sharing economy platforms means that, as an adviser, you should be informing taxpayers who earn income off these platforms about their tax obligations. This includes operators of shortterm accommodation, ride-sharing transport and food delivery platforms.

Some specific exclusions have been announced, including new smaller entrants to the market, large operators and traditional short-term accommodation. Also, other task or time-based service platforms will be required to report for income years beginning on 1 July 2024.

Announcement(25-Aug-2021) Consultation

Introduced(3-Aug-2022)

Passed(28-Nov-2022)

Royal Assent(12-Dec-2022)

Date of effect(1-Jul-2023)

The ATO has finalised the luxury car tax (LCT) determination LCTD 2023/1 which provides guidance on determining the principal purpose of a commercial vehicle for LCT purposes.

A car is excluded from the definition of “luxury car” if it is both a commercial vehicle and is not designed for the principal purpose of carrying passengers.

The tax determination also explains that vehicle body types and modifications done may also determine the level of ATO’s scrutiny. Utility vehicles, where the passenger capacity is less than 50% of the load carrying capacity are excluded for the purposes of this guideline.

Announcement(23-Aug-2023)

Consultation period

Released

Paintings by artist Amanda Wright depict Aunty Daphne Milward and Aunty Irene Norman, Elders from Mullum Mullum Indigenous Gathering Place, Maroondah residents and long-time friends.

Gracing the Realm windows, the portraits were launched during Reconciliation Week in June with a Smoking Ceremony and Welcome to Country by Wurundjeri Elder, Uncle Bill Nicholson and performances by celebrated singer/songwriter Kutcha Edwards and Yeng Gali Mullum, a music group directed by Aunty Irene.

During NAIDOC Week in July, the works were complemented by the From our Elders video installation by Blak Crow filmmaker Daen Sansbury-Smith in ArtSpace at Realm, which featured perspectives on Eldership from nine Elders including Aunty Irene and Aunty Daphne.

The portraits will remain on the Realm windows until the end of the Victorian Seniors Festival on 31 October 2023.

About

Aunty Daphne Milward

Recipient of the Council of the Ageing Victoria Senior Achiever Award 2022, Aunty Daphne Milward is a proud Yorta Yorta woman and long-time Maroondah resident. She has an extensive list of achievements as an advocate for First.

Peoples in Victoria over more than fiftyfive years since she helped establish the Aboriginal Advancement League in 1967

She was a director of the Victorian Women’s Trust and a member of the Equal Opportunity Commission of Victoria. In 1995, she established her own consultancy firm, Mandala Consulting Services, specialising in community development and crosscultural awareness. Now in her eighties, Auntie Daphne is active as an Elder with Mullum Mullum Indigenous Gathering Place (MMIGP) and regularly engages with community and school groups. She exhibits as a member of the MMIGP arts group and performs with the Yeng Gali Mullum singing group. She recently began learning sign language so that she can sign Acknowledgments of Country.

Aunty Irene Norman

Proud Wailwan woman, Mullum Mullum Indigenous Gathering Place Elder and Ringwood resident, Aunty Irene Norman is a weaver, painter, poet and leader of the Yeng Gali Mullum music group. She regularly runs workshops to share the weaving skills passed down to her by her paternal grandmother as a child in regional New South Wales.

Weaving, for Aunty Irene, is a skill that she shares to connect people to each other, their history, and their country. Aunty Irene frequently exhibits at The Koorie Heritage Trust, and has organised a number of group exhibitions for

MMIGP artists at Maroondah Federation Estate. Her portrait of Aunty Daphne. Milward was part of the Archibald Prize Exhibition in 2016 at the Art Gallery of NSW in Sydney. She also teaches Indigenous Culture and Reconciliation in schools and the wider Community

Amanda Wright

Amanda Wright is a Palawa artist whose family, on her mother’s side, is from Bruny Island, Tasmania RMIT. Amanda comes from a family of artists, including her mother, her maternal grandfather, her sister and her mother’s cousin. When Amanda was three or four she recalls her uncle painting, and at that moment she decided that painting was for her. She has been painting ever since.

Amanda’s work is focused on tenderly conceived portraits of Aboriginal people that give a window into the subjects’ spiritual and emotional worlds. Her painting is inspired by her thoughts of her mother, grandmother and her great-grandmother, the circumstances they survived, their strength and their resilience. 'I found family and now I’m trying to find spirit. I just have to paint every day. I have so many ideas. Painting is all I have ever known.’ Amanda has been commissioned to created public art for Melbourne, Maroondah and Yarra Valley councils, and taken part in many group and solo exhibitions including as a member of Mullum Mullum Indigenous Gathering Place.

Being confined to the home in the 2020/2021 lockdowns in Melbourne, made me aware of my assortment of doilies. It started when my friend Janette came to visit in a brief period between lockdowns. She brought some flowers and I placed them in a vase on a doily on the table. I thought how lovely they looked.

My fascination with the doily stems from them being so intricate. Women who made these doilies more than eighty years ago spent hours doing the crochet work. It was part of how women spent their leisure time and even when television came about, they would make their doilies whilst watching television. This activity reminded me of my mother who was a great exponent of making doilies.

She would choose a pattern from a pattern book, buy the special thread, and after embroidering a design on fabric, crochet the edges. Choosing the colours to make a pleasing picture was part of the creative process.

My creative impulse was to paint a composition including the many doilies in my collection. I would start with cutting flowers from my garden, choosing a suitable vase, and then finally selecting a doily which reflected the colours and shapes in the flowers.

Then I would paint the background to complement the arrangement

I identified with the women who spent hours making the tiny details in the doilies as I tried to replicate the complicated designs of their needlework.

Firstly, I would pencil the design in lightly, before painting it in mainly watercolours and some gouache. It would take me on average about three to four days to finish.

When I started showing people my doily paintings, they became involved with the process. They rummaged in their own linen cupboards and found doilies that they then gave or lent me to put in my compositions. Some were from people’s overseas trips, e.g. Scotland and others were from country Victoria, e.g. Gundagai. It was a lovely way to connect with people when lockdown finally came to an end.

This activity helped me survive many weeks and months in lockdown and now I have a large body of work for others to enjoy.

Artist statement

Wild Birds is a celebration of the unique joy that birds bring us.

We see wild birds in their unique habitats around the globe in hand stitched wall hangings. As well there are three colourful flocks each engaged in the business of birds: flying, nesting and feeding … just for the joy of it!

Each bird, and there are close to 300, is crafted from scraps of cloth and wire - designed, coloured, shaped, sewn, stitched, manipulated, embellished - to become part of a flock.

The love of making, colour, and of birds chirrups through this exhibition.

Next date: Saturday, 23 September 2023 | 01:00 PM to 03:00 PM

The Pathways for Carers offers those caring for older people, or people with a disability or mental illness an opportunity to share walks together and to learn more about news, services and supports. Stay after the walk for a free coffee at Bark and Silk.

Anyone who is a carer of someone with a disability, mental health illness or older person is welcome to join us. We have a different guest walker attend each walk who talks about the services and programs their organisation offers carers and the people they care for. The walks are educational as well as offering the chance for some exercise.

Read More

Tee ReMade - School Holiday Keyring and Jewellery Making Workshop

Next date: Wednesday,20 September 2023 | 10:00 AM to 10:45 AM

Don’t throw that raggedy old t-shirt away - repurpose it!

In this hands-on workshop, the team from A Fitting Connection will show you how to turn your worn out t-shirts into fabulous new items, such as keyrings and necklaces. Great for DIY projects and homemade gifts.

Step into spring with a rousing concert featuring local folk treasures:

Play it Martha - Celtic folk with sublime vocals from Cora Browne

AJ Leonard and Jenny Rowlands - irresistible Hawaiian inspired melodies

The Victorian Folk Music Club’s Billabong Band - the oldest bush band in Australia!

This is a free event and presented in partnership with the Victorian Folk Music Club.

Join one of our monthly Book Club meetings to add insights, understanding and perspective to your reading. Transport

You can reach Yarrunga Community Centre using public transport.

Ventura Route 672 travels regularly between Croydon Station and Chirnside Park Shopping Centre. There are stops in both directions near the corner of Croydon Hills Drive and Yarra Road which is just over ½ km walk (8 minute) walk to the Centre. Find

Walking Cricket is a fun and social, modified version of cricket that doesn’t involve running, uses modified equipment and is played in a small enclosed area.

Aimed at participants aged over 50, Walking Cricket is designed to help people keep an active lifestyle irrespective of their age. It doesn’t matter if you’ve played cricket all your life or never played, Walking Cricket is suited to anyone and any fitness level.

Participation provides the opportunity to support and maintain mobility skills through walking, stopping, turning and transferring of weight, all of which aid improved balance and helps to reduce the risk of falls. Read More

Please note that Pram Walks will be moving to Mondays in Term 4 (starting 2 October 2023).

Join us for a pram walk! Enjoy some fresh air, make new friends and have a chat to our Maternal and Child Health team member as we walk an approximately 2km loop along Tarralla Creek Trail.

Council has made positive progress towards implementing Council Plan priority actions scheduled for the 2022/23 financial year.

At its August meeting, Council noted the progress made towards the delivery of priority actions identified in the Council Plan 2021-2025 (2022/23 Update).

Mayor of Maroondah, Councillor Rob Steane OAM, was pleased with Council’s progress.

“Council has made excellent progress during the past 12 months towards implementing a broad range of Council Plan priority actions for the year,” Cr Steane said.

“As these priority actions continue to progress, they will benefit a range of people throughout our community, as part of the 120-plus services provided by Council.”.

The Council Plan 2021-2025 is Council’s key medium-term strategic document that sets directions and priority actions to work towards the long-term community vision outlined in Maroondah 2040: Our future together. It plays a vital role in shaping Maroondah’s future over a four-year period and forms the basis for Council to make decisions regarding.

resources and priorities in response to community needs and aspirations.

The end of financial year report revealed that 29 priority actions scheduled were currently underway, four had been transitioned to core service delivery and three had been completed. The majority of priority actions are multi-year initiatives that will continue into future financial years Priority actions currently underway include:

• Implementing a range of action plans and strategies. These include the:

• Waste, Litter and Resource Recovery Strategy

• Arts and Cultural Development Strategy

• Sustainability Strategy, and

• Maroondah Liveability, Wellbeing and Resilience Strategy

• Reviewing Council’s Physical Activity Strategy and developing a Stadium Sports Strategy.

• Staged redevelopment works at the Karralyka Centre in Ringwood East.

• Implementing road improvement works in partnership with the Victorian Government.

• Working in partnership with the Victorian Government to support the removal of level crossings

• at Bedford Road in Ringwood, Dublin Road in Ringwood East and Coolstore Road in Croydon, and the construction of new stations at

• Ringwood East and Croydon.

• The staged redevelopment of the Croydon Community Wellbeing Precinct.

• Ongoing advocacy to other levels of government on behalf of the Maroondah community.

Priority actions completed include the design and construction of the Maroondah Edge indoor cricket training centre at Jubilee Park and the Parkwood Dog Park in Ringwood North. Infrastructure upgrades were also completed at sporting pavilions at Cheong Park, Ainslie Park, Dorset Recreation Reserve, and JW Manson Reserve.

The Council Plan is implemented through service delivery activities and initiatives across Council. Outcomes are measured and reported on regularly. Achievements will also be reported in the Maroondah City Council Annual Report 2022/23, which will be available on Council’s website in the coming months.

The Municipal Emergency Management Plan 2023-2026 for Maroondah has been endorsed by the Regional Emergency Management Planning Committee and noted by Council at its meeting in July.

The Municipal Emergency Management Plan (MEMP) addresses the prevention of, response to and recovery from emergencies within the municipality of Maroondah.

The plan is updated every three years and reflects shared responsibilities across government, emergency management agencies and communities.

The MEMP was accompanied by a Statement of Assurance to verify that the plan has been prepared in accordance with relevant legislation and best practice guidelines.

Mayor of Maroondah, Councillor Rob Steane OAM, encouraged community members to view the plan and other emergency management information on Council’s website.

“Council is pleased to see the Municipal Emergency Management Plan for Maroondah endorsed by the Regional Emergency Management Planning Committee. Community members who are interested in finding out more can view the plan on Council’s website,” Cr Steane said.

“Council’s website also contains a range of other resources and information about emergency. preparation and management, which I encourage our community to view.”

Developing the MEMP is a shared responsibility of the Municipal

Emergency Management Planning Committee, which is chaired by Maroondah City Council.

The Committee includes a range of response and recovery agencies and organisations such as Victoria State Emergency Service, emergency services organisations including Victoria Police and Fire Rescue Victoria, local businesses, and representatives from Council and the local community. Members have personal, industrial or organisational expertise in emergency management and collaborate on emergency management planning overall.

preparation and management, which I encourage our community to view.”

Developing the MEMP is a shared responsibility of the Municipal Emergency Management Planning Committee, which is chaired by Maroondah City Council.

The Committee includes a range of response and recovery agencies and organisations such as Victoria State Emergency Service, emergency services organisations including Victoria Police and Fire Rescue Victoria, local businesses, and representatives from Council and the local community.

Members have personal, industrial or organisational expertise in emergency management and collaborate on emergency management planning overall

Council will only be using recycled water for tree watering thanks to a collaborative project with Yarra Valley Water.

Council has partnered with Yarra Valley Water as the first customer to take advantage of its recycled water carting program, which will allow for 100 percent recycled water to be used across the municipality for Council’s tree watering program.

Advertise your events for FREE on the following pages.

Are you a NFP with an up-and-coming event? If so, email your event to editor@findmaroondah.com.au and we will place it in the paper for FREE.

Maroondah

Pots and pans sizzle and lively conversation flies as Mooroolbark Baptist Church prepares its weekly community meal.

Dubbed the Community Kitchen, the free two-course feed is a service open to anyone who would like to attend. A team of volunteers has been preparing it, amid a lot of laughter and camaraderie, every Monday night since March 2004 including public holidays.

Co-ordinator Denise Fulker says a team of about 26 “fabulous” people each play a part in getting the meal together. “Some people set out all the tables and chairs, and others set tables. We have four or five people who cook, and more who do the shopping and plan the meals,” she says.

“Then there are others from MBC who donate the money to buy the food, plus people who come to serve the meal at the tables on the night or help in the kitchen, and there are also some who help clean up at the end. It’s a big team effort but it’s something that we love to do.”

It is hoped that people who come together for the meal will enjoy the sense of community which gives the event its name.

“It’s about caring for each other, in all the ups and the downs of life – you know, just showing each other that someone cares and each person matters. They matter to us and, even more so, they matter to God.”

For Denise, it’s the people coming together from all ages and all walks of life that make Community Kitchen an enjoyable event.

“I just love people,” she says. “I’m happy to talk to anyone and I like getting to know people. It’s up to them how much they share but it’s just lovely to get together and chat over a meal.”

Around 55 people currently go along each week and it is hoped that more will attend. Before covid, up to 80 per week would regularly turn up, and around 120 people would go for special events like the annual Christmas dinner. Denise says people attend for all sorts of reasons.

“Some come for companionship, some because they’ve had a rough trot lately or something sad has happened in their lives. Some come along to enjoy a free hearty meal, and some because it saves them from doing the washing up for a night!

“Everybody has a story of some sort and people are so interesting to listen to. Sometimes it’s just that people want to share their story. And sometimes it’s just being with other people and not talking much at all.”

One attendee says sharing the meal together has given her new friends.

“I used to come to the meals because I didn’t have enough money for food but, now that I have enough money for food, I come for the friendships I’ve made with people. It’s truly a community meal.”

Another lady agrees that people attend for more than just the good food to eat.

“Basically … I’ve made friends here and it gets me out of my place for a while. I’m sick of talking to my cat!”

Another attendee says the meals are delicious.

“The people that run it do a wonderful job; they’re just amazing.”

Meals on the kitchen’s menu that have proved to be the most popular over the years include the cottage pie and the frittata.

Community Kitchen begins in the foyer of MBC at 5pm with help-yourself coffee, tea and a bite of afternoon tea. Someone shares a 3-minute devotion and then at 6pm everyone is invited into the hall to sit at the tables where the main meal is served, followed by dessert. The free meal ends by 7.30pm but there’s no obligation to stay until the end. Anyone is welcome, from the very young to the young-at- heart.

And not long after Community Kitchen finishes, from 8-9.30pm, an Alcoholics Anonymous group holds their meetings at the church. Group leader Rob Bruce says about 25 people of mixed ages attend and people with a drinking problem might find the group helpful.

Abbeyfield Croydon is the first purpose-built Abbeyfield house in an outer suburb of Melbourne Abbeyfield Croydon is a well maintained and affordable accommodation option for older people who are looking for a private bedroom, support,quality meals and companionship.

The home is situated in a suburban street in Croydon, in a lovely garden setting, close to shops and transport within easy walking distance. It provides safe, homely and affordable housing for older people in our community.

Abbeyfield Houses is a large group house but it is not an institution or a facility. It is an ordinary house in an ordinary street. Our house provide supported accommodation for up to 10 people aged 65 years or more who are looking for affordable independent living.

Abbeyfield residents live independently within a shared, supportive environment. The residents ‘come and go’ as they please, socialise with other residents as much as desired, enjoy the support of a housekeeper and remain engaged with the community.

All residents enjoy individual private suite comprising bedroom and ensuite and share a comfortable lounge room, dining room, garden, and laundry.

Nutritious meals are cooked onsite by the housekeeper and all maintenance and house costs are covered by Abbeyfield Australia.

All Enquires to admin@abbeyfield.org.au or 03 9419 8222.

Contact us to talk about living in an Abbeyfield house to help you stay independent, happy and active!

During August U3A’s Art Appreciation class visited local Ringwood artist Russell Halden.

Russell is a self taught artist working mainly in oil paint and working from photos he has taken on his extensive travels throughout Australia.

Russell was working on a new painting and he was very generous with his time and knowledge. He gave the class an interesting and informative insight into the basic construction of a painting.

As the class has mainly been studying contemporary Australian artists this year, it was great to see an artist while they had a work in progress.

Many thanks Russell, we really enjoyed your valuable input to our class knowledge. For more information 0481591576

Boronia View Club will be meeting on Friday 21 July at 11.30am at Eastwood Golf club Liverpool Rd., Kilsyth with a 2 course lunch costing $27 followed by Jennie Wynd (Victorian Advisor-Melbourne VIEW Clubs) speaking about "The Smith Family support program". There will be a bookstall, trading table and raffle with all monies raised going to the Smith Family learning for Life program to help needy Australian children with their educational requirements. The club is looking for new members so ladies of all ages and backgrounds please come along and you will be most warmly welcomed. There is also opportunity for outings, film mornings, book club, coffee mornings etc.

Have you ever thought about becoming a foster carer?

VACCA are seeking carers from all walks of life to care for Aboriginal children from the ages of 0 to 18. VACCA offers Emergency, Respite, Short and Long Term Care.

Reach out today for more information using the link www.vacca.org/page/get-involved/foster-care

Let's play with colour at Estland.

Spring Summer 2023 fashion has arrived - and this season we invite you to hide dull and seek bold!

There's nothing quite like colour to lift your mood and make you feel like a big kid again. So, join us as we dive into a world where vibrant hues bring joy and mood-boosting fashion is at the fore.

Say goodbye to dark and drab pieces, and hello feel-good fashion. Eastland is abundant in vibrant pieces waiting to be discovered—so, come and explore!

As a transition into retirement is made, there needs to be a much bigger focus on income stability and wealth protection rather than wealth accumulation. $

This information has been provided as a general advice. We have not considered your financial circumstances, needs or objectives. You should consider the appropriates of the advice. You should obtain and consider the relevant Product Disclosure Statment (PDS) anf seek the assistance of an authorised financial adviser before making any decision regarding any products or strategies mention in this communication.

Whilst all care has been taken in the preparatin of this material, it is based on our understanding of current regulatory requirements and laws at the publication date. As these laws are subject to change you should talk to an authorised adviser for the most up-to-date information. No warranty is given in respect of the information provided and accordingly neither Alliance Wealth nor its related entities, employees or representative accepts responsibility for any loss suffered by any person arising from reliance on this information.

Einstein once said: “We cannot solve our problems with the same level of thingking we created them. Likewise we cannot solve our current issues for the generations today with the same thinking, rules and conditioning of the past!

We invite a representative from each sporting club to submit team selections, results and any interesting stories relating to your club/sports. 1300 88 38 30 editor@findmaroondah.com.au For more information contact Warren on

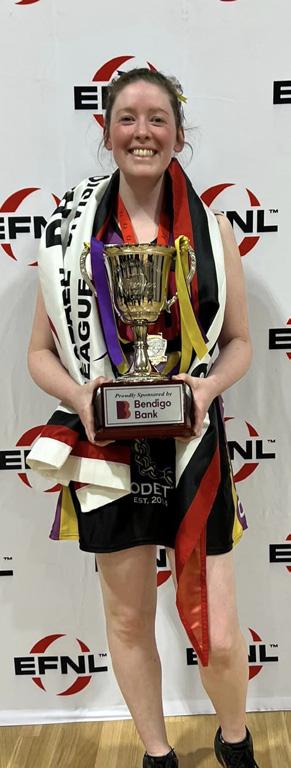

The ladies have done a phenomenal job all year and were able to hold off Chirnside to bring home the chocolates! It was a very hard fought game from the beginning, with a tight margin throughout. Golds defensive pressure was something else that night, from every inch of that court everyone played their role so well! Every single player has had a hand in that night’s success. Our very own Samantha Olsen was named tonight’s Best On Court taking home an extra piece of jewellery - the blue ribbon medal. Congratulations on the successful year Sam!

From its successful foundation in 2014, Norwood Netball have continued to show they’re a force to be reckoned with and in the 2023 relaunch adding to the clubs successful history!

Jaq, Jess and Nicole would love to pass on their sincere thanks to everyone involved for their support this past year. It has been a team effort from the presidents, players and supporters to bring back this clubs the homely feel it has always had. We thank our supporters who turned out in huge numbers for the match, there was not a spare seat in the house! We are so glad to have had your support this year and that night, your sideline cheer gave us the push we needed to get over the line!

Congratulations Ladies - soak in the glory you all deserve it!

What a year this has been with a fantastic finish and some silverware to bring home!

What a night to be a wooder!

Eastfield is excited to continue its commitment to girls cricket with the announcement of Grace coming on board to coach our girls team this season.

Grace has played cricket at Eastfield and is committed to helping grow and develop female sports for everyone to be able to play.

Come down and see grace this Sunday at the girls training session. Welcome aboard Grace!

We are excited to announce that Shehan Dhanapala has committed to Eastfield for the coming season.

Shehan played a few games in the ones at the end of last season, showing his class and experience with the bat and his cricket knowledge.

We look forward to seeing Shehan and his smiling face around the club this season. Lets get around him at training and continue to making him feel welcome.

The following statement is addressed to the City of Maroondah community and comes from church leaders who are the signatories below. We acknowledge that we don’t formally represent all churches and their leaders, nor at some points, the diversity of views within our own congregations.

Since the arrival of white settlers in 1788 to these lands now known as Australia, the Christian Church has had a paradoxical relationship with Australia’s First Peoples. Some churches approached the First Peoples with good intentions, standing with them in the name of justice, considering their wellbeing, culture, and language. However, others shared the values of the emerging colonial society, including paternalism and racism. They were complicit in the injustice that resulted in many of the First Peoples being dispossessed from their land, their language, their culture, and their spirituality.

As current church leaders in the City of Maroondah, we acknowledge this difficult history, and we make this statement to encourage our church communities and the wider community to engage in the important community conversation on the proposed Indigenous Voice to Parliament.

During this time, whilst so much is said and written, we encourage the City of Maroondah community to accept the generous invitation of our local First Peoples to engage with them and their planned activities, to carefully listen to their stories and to the voice of their Leaders.

We note that the proposed Voice to Parliament comes not through normal political channels, but as the result of a gracious invitation to the Australian people through the Uluru Statement from the Heart that says [in part], “We seek constitutional reforms to empower our people and take a rightful place in our own country. When we have power over our destiny our children will flourish. They will walk in two worlds and their culture will be a gift to their country.

“We call for the establishment of a First Nations Voice enshrined in the Constitution. “We invite you to walk with us in a movement of the Australian people for a better future.”

It is not our place to advise people how they should vote. However, we wish to encourage the community not to play into the polarised political world, but to rise above it and to engage with respect and kindness, even when we disagree with each other.

Prejudice, violence, and discrimination in any form do great harm to the fabric of our community. Jesus Christ, and others throughout history who have called for justice in non-violent ways, provide us with wonderful examples of how we must always seek justice; to speak out against injustice and to care for the oppressed and the marginalised.

As Christian leaders, we call the Church, in particular, to the way of reconciliation between the first and second peoples of our country and to see this as a sign and symbol of that coming reconciliation and renewal, which is the end in view for the whole creation.

Grace and peace,

Ps Kaye Reid, Ringwood Church of Christ

Ps Andrew Harris, Croydon Hills Baptist Church

Rev Peter Mallen, Croydon North Uniting Church and Croydon Uniting Church

Ps Scott Hawkins, Urban Life Church

Ps Tom Kenneally and Ps Kay Brown, Ringwood Community Church

Rev Andy Tiver, Ringwood North Uniting Church

Rev Lucas Taylor, Ringwood Uniting Church

Ps Mark Nidenko, Heathmont Baptist Church

Ps’ Cliff and Philippa Fielding, TLC Church

Rev Robert Humphreys, Maroondah Fellowship of Churches

Adam Bryant, Chaplain, Ringwood Secondary College

With thanks to the Mornington Peninsula Pastors Network for the wording of this statement.

NEWS! Simply upload your ad at www.findmaroondah.com.au/nfp-free-advertising or you can email the ad to the editor@findmaroondah.com.au and we will do the rest for you.

Hope City is a community partnering with Jesus to see His Church grow and to see people encounter God’s presence and be transformed by His Spirit and Word. We look to empower every believer in God’s purpose for their life so that the 7 Mountains of society will be impacted by God’s kingdom. We see a Church where every person experiences the goodness of God in their lives through energetic praise and intimate worship. Do you have an upcoming events? Place your EVENT AD here for FREE in our community online paper.

• English Sunday 10am

• Karen Sunday 1pm