Are

our next Copywriter?

Are you our next Bookkeeper?

By Warren Strybosch

The Find Maroondah is a community paper that aims to support all things Maroondah. We want to provide a place where all Not-For-Profits (NFP), schools, sporting groups and other like organisations can share their news in one place. For instance, submitting up-andcoming events in the Find Maroondah for Free.

We do not proclaim to be another newspaper and we will not be aiming to compete with other news outlets. You can obtain your news from other sources. We feel you get enough of this already. We will keep our news topics to a minimum and only provide what we feel is most relevant topics to you each month.

We invite local council and the current council members to participate by submitting information each month so as to keep us informed of any changes that may be of relevance to us, their local constituents.

We will also try and showcase different organisations throughout the year so you, the reader, can learn more about what is on offer in your local area.

To help support the paper, we invite local business owners to sponsor the paper and in return we will provide exclusive advertising and opportunities to submit articles about their businesses. As a community we encourage you to support these businesses/columnists. Without their support, we would not be able to provide this community paper to you.

Lastly, we want to ask you, the local community, to support the fundraising initiatives that we will be developing

and rolling out over the coming years. Our aim is to help as many NFP and other like organisations to raise much needed funds to help them to keep operating. Our fundraising initiatives will never simply ask for money from you. We will also aim to provide something of worth to you before you part with your hard-earned money. The first initiative is the Find Cards and Find Coupons – similar to the Entertainment Book but cheaper and more localised. Any NFP and similar organisations e.g., schools, sporting clubs, can participate.

Follow us on facebook (https://www. facebook.com/findmaroondah) so you keep up to date with what we are doing.

We value your support,

The Find Maroondah Team.

EDITORIAL ENQUIRES: Warren Strybosch | 1300 88 38 30 editor@findmaroondah.com.au

PUBLISHER: Issuu Pty Ltd

POSTAL ADDRESS: 248 Wonga Road, Warranwood VIC 3134

ADVERTISING AND ACCOUNTS: editor@findmaroondah.com.au

GENERAL ENQUIRIES: 1300 88 38 30

EMAIL SPORT: editor@findmaroondah.com.au

WEBSITE: www.findmaroondah.com.au

The Find Maroondah was established in 2019 and is owned by the Find Foundation, a Not-For-Profit organisation with a core focus of helping other Not-For-Profits, schools, clubs and other similar organisations in the local community - to bring everyone together in one place and to support each other. We provide the above organisations FREE advertising in the community paper to promote themselves as well as to make the community more aware of the services these organisations can offer. The Find Maroondah has a strong editorial focus and is supported via local grants and financed predominantly by local business owners.

The City of Maroondah is a local government area in Victoria, Australia in the eastern suburbs of Melbourne. Maroondah had a population of approximately 118,000 as at the 2019 Report which includes 9000 business and close to 46,000 households. The City of Maroondah was created through the amalgation the former Cities of Ringwood and Croydon in December 1994.

The Find Maroondah acknowledge the Traditional Owners of the lands where Maroondah now stands, the Wurundjeri people of the Kulin nation, and pays repect to their Elders - past, present and emerging - and acknowledges the important role Aboriginal and Torres Strait Islander people continue to play within our community.

Readers are advised that the Find Maroondah accepts no responsibility for financial, health or other claims published in advertising or in articles written in this newspaper. All comments are of a general nature and do not take into account your personal financial situation, health and/or wellbeing. We recommend you seek professional advice before acting on anything written herein.

By Mary Barnes

International Day of Charity, observed annually on September 5th, is a global celebration of compassion, generosity, and the power of human kindness.

Established by the United Nations in 2012, this special day aims to raise awareness about the importance of charitable giving and volunteerism. It serves as a platform to recognise the invaluable work of charities and nonprofit organisations worldwide, which tirelessly strive to address pressing social and humanitarian issues.

The day is also a call to action, encouraging individuals, communities, and businesses to come together and make a positive impact on the world. Whether it’s through volunteering, donating to a cause, or simply spreading kindness, every act of generosity counts. By supporting charitable initiatives, we can help alleviate suffering, empower marginalised communities, and build a more just and equitable society.

International Day of Charity is a reminder that we are all interconnected and that our actions have the potential to create a ripple effect of positive change. It inspires us to look beyond ourselves and consider the needs of others, fostering a sense of empathy and compassion. By celebrating this day, we honour the spirit of human solidarity and reaffirm our commitment to building a better world for everyone.

By Jodie Moore

Each month, I will bring you some simple bookkeeping skills to help you run your business with ease. Bookkeeping is an important part of running your business and one that not everyone puts enough time into. When done properly though, it can truly save you time and money.

What is bookkeeping?

1. the activity or occupation of keeping records of the financial affairs of a business.

Keeping your finances in order will allow you to monitor your business and quickly see potential issues before they arise and get on top of them when they do. It will allow you to see who owes you

money, who you owe money to and whois consistently slow to pay you amongst many other beneficial reports.

Let’s begin by looking at some Basic Bookkeeping terms:

Accounts Payable: this refers to the account which tracks the people, suppliers, banks and other third parties that you owe money to.

Accounts Receivable: this refers to the account which tracks the people, customers, companies and other third parties who owe you money.

GST paid – when you pay for goods and services, you will be paying GST to that business. It is good practice to keep track of this as you will need it if you are registered for GST when it comes time to lodge your Business Activity Statement (BAS). GST paid is considered an asset

Ultimately, International Day of Charity is about recognising that charity is not just an act of giving, but a powerful force for transformation. It is a catalyst for hope, a bridge between different cultures, and a testament to the resilience of the human spirit. Let us embrace this opportunity to celebrate the extraordinary work of charities and to inspire a new generation of philanthropists who will carry the torch of compassion into the future.

as you have already paid it and do not owe it to anyone.

GST received – when a client or business pays you for goods or services, a portion of the amount you receive will be the GST amount. This is not your money, it will need to be paid to the ATO when you next lodge your BAS. As you owe this money to the ATO, it is considered a liability. It is good practice to have a separate bank account to ‘store’ this money so that you have it readily available when it comes time to pay it to the ATO.

BAS - your Business Activity Statement is required to be lodged monthly, quarterly or annually depending on your business. This is a statement that works out how much GST you paid in that quarter against how much GST you received. If you received more GST than you paid, then you owe the difference to the ATO. If you paid more GST than you received, you will receive a refund.

Balance Sheet – this is a snapshot of your business at a particular point in time and includes your assets, liabilities and capital of your business.

Chart of Accounts – a list of all the accounts you use to categorise your financial transactions to record them in your general ledger. They act a bit like a map, categorising your transaction types into asset accounts, liability accounts, equity accounts, revenue accounts, and expense accounts.

By Liz Sanzaro

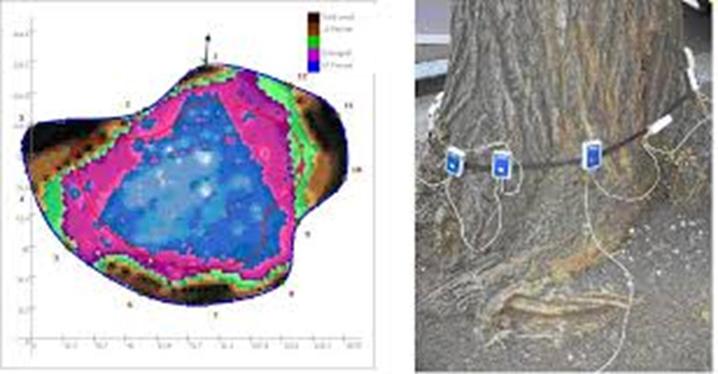

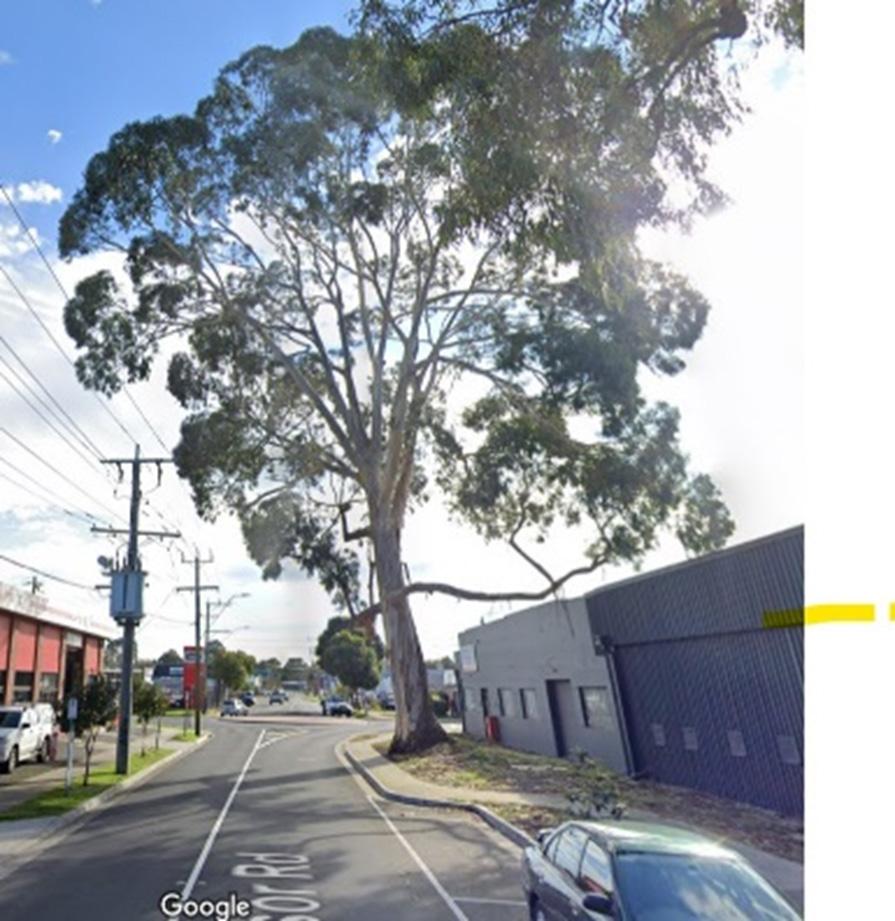

Trees often cause neighbour disputes when someone decides a tree is “dangerous” and has it removed. How adequately can an arborist actually tell if a tree is in good health? It takes skill, training and a responsible decision to get an accurate answer.

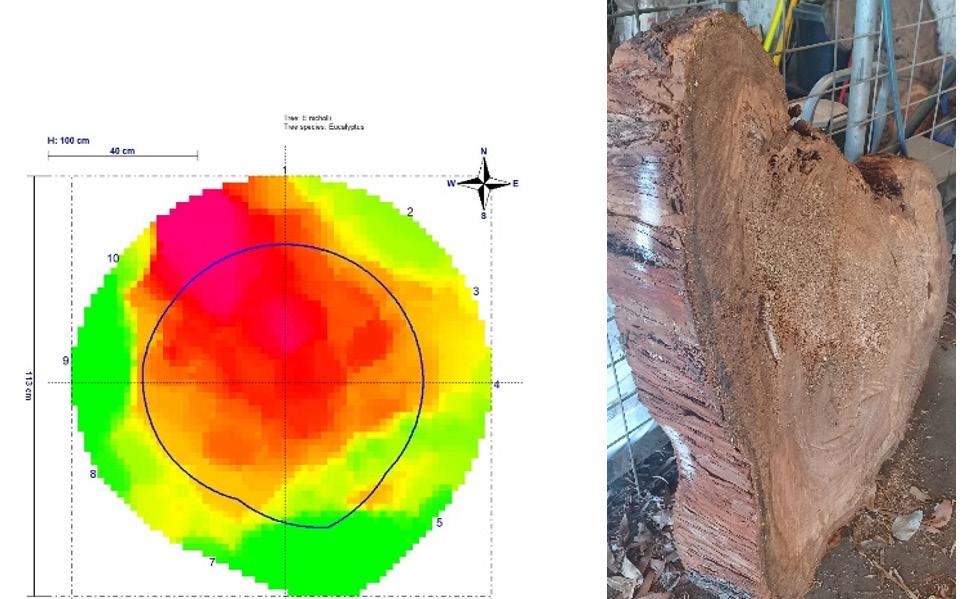

A recent acquisition of new technology by Council, means they are now able to assess a tree from inside out. Here is an account of what happened recently using a Tomograph on a Council owned street tree.

(This tree was first visually assessed by an arborist. Visual observation and previous inspection notes confirmed a history of large branch failure. The following was obvious

• tear -outs where a limb has torn away probably in high wind

• a visible seam of decay running down the trunk

• bracket fungi present

The presence of decay on it’s own is not reason to remove a tree. The position and percentage of the decay, the weight and wind loading on the tree, the location of the tree and risk to persons and property (target value) from falling limbs or tree failure, the local significance of that particular tree, must all be considered when assessing the viability of the tree and possible future tree management options.)

We all know and love the tree in Windsor Rd Croydon which has been accommodated with its own piece of land to ensure its ongoing health.

in advanced tree risk assessments. By evaluating the condition of the wood quality in the entire cross section, strength loss due to decay can be assessed. That data is then used to gain a better sense of what is happening to the tree and how that might affect the likelihood of failure component in a risk assessment.

Sensors are placed around the tree, attached to nails to hold them in place. Sound waves can then be passed through the tree much like an ultrasound of a human. The computer program then delivers a picture of a thin slice through the tree where the sensors are placed.

The sensors are placed at suitable intervals and held in place by small nails to ensure they don’t slip. Sensors then feed information to a computer program.

photographs of the cross section taken. The corresponding sections of the tomograph appear in red, pink and the yellow sections are beginning to exhibit early stages. The white paint mark indicates the height at which the tomograph was taken, so that the arborist could remove this corresponding section for exactly this purpose to show how accurate this new technology is.

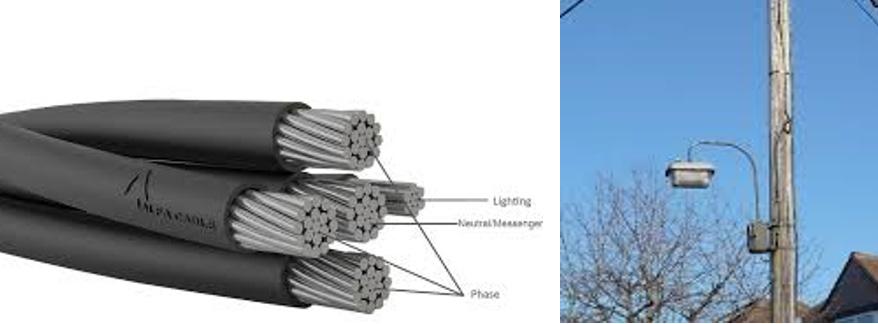

Occasionally you will see what seems to be a perfectly healthy tree being cut down by contractors for Local Council. You may think it is due to overhead wire intrusion, but this only requires pruning to give a 2 meter wide area around the wires. It is possible someone has used the Tomograph to accurately see the internal health of the tree.

Locations with numerous tall trees may be better provided with more secure overhead electrical supply using aerial bundling, where all the wires are replaced with what looks like a thick black strand of liquorice, twisted together. This is a great solution, but fairly expensive for Councils unfortunately.

Not all trees are required to be removed, depending on location. Some in parkland and not over a footpath where a limb has been lost, will most likely decay a little into the trunk, forming a hollow suitable for habitat. Even at ground level one of the greatest fun a child can have, is to be inside a giant healthy tree, there is one in Sherbrook forest, many people will be aware of as a photo opportunity.

To a trained eye this Eucalyptus Nicholii is decayed, the area is delineated to show the extent. For stability in taking the picture is rotated a bit from the next image, but it is the same tree.

The new equipment called a Tomograph, can determine a trees health by looking inside its trunk and even roots to see if it has pithy decay. The Tomograph is used

Here is the Tomograph image from the computer before cutting the tree down. The decay can be clearly seen in the

A very safe old tree with a healthy canopy. Croydon Conservation Society has been helping to save the trees of Croydon and district since 1964.

By Reece Droscher

If you were one of the many borrowers who fixed a rate on your Home Loan when rates were under 2%, you either have recently seen your fixed rate expire and have moved on to a higher variable interest rate, or are about to have this happen. Borrowers who had a fixed rate that has already expired have seen their loan repayments increase significantly. To try and minimise the impact of these changes to your cash-flow there are a few strategies that you can implement.

As a mortgage broker I regularly come across people who have had a Home Loan with the same lender for five years or more. They have simply been paying the required repayment without ever thinking about what the current interest rate is, the fees that are being charged and what other lenders may be offering.

In the current environment it is a mistake to assume that your current Home Loan is providing you with the best value. By having your loan reviewed a Mortgage Broker may be able to present products from lenders offering lower interest rates

than you are paying currently. This could potentially save you thousands on interest costs or help you pay your loan off sooner.

Another benefit of having a review is to ensure the type of loan you have remains the most suitable to meet your current needs. Offset, redraw, the ability to make extra repayments or switching your rate between fixed and variable rates are all options your Mortgage Broker can review for you.

You may also have some smaller debts, such as credit cards or personal loans, that are charging higher interest rates but could be consolidated into your Home Loan. This could help repay these debts sooner by reducing the costs of these debts but would also simplify your finances, reducing the number of loans and repayments being made to multiple lenders.

Even without refinancing your Home Loan to another lender, your Mortgage Broker may be able to negotiate a better deal

with your current lender. It costs a lender a lot more to attract new borrowers than to keep their existing customers, which is why they invest a lot of money in business retention teams. By looking at what competitors are offering your Broker can use this information to leverage a lower rate with your existing lender.

It is also important to note that a mortgage broker is required to act in their client’s best interest by law, which is different to the requirement on a lender when you deal with them directly. That is why the best person to review your Home Loan is your local Mortgage Broker. At SHL Finance we are already proactively helping our clients negotiate a better rate with their current lender, reviewing their existing loans and discussing ways to potentially save our clients thousands of dollars. We would love the opportunity to help you too.

Please call Reece Droscher on 0478 021 757 to discuss all of your Home Loan needs.

reece@shlfinance.com.au www.shlfinance.com.au

I decided to sit down with a gentleman who is well known for his love of classic and vintage cars and the discussion immediately became VERY interesting:

Q: What is your current project?

A: The “RE-EMERGE” of the Dame Nellie Melba family car.

Well, I was not really ready for this answer and was amazed at the historical value of this event.

Q: What is this car?

A: It is a Sunbeam Talbot 10 (1939) 4-door, 4-cylinder, 10hp –Gun metal grey in colour.

Q: That sounds great but what is the importance of this car to the community?

A: The history of this car is just so important to the Community of Melbourne and Australia! It was given to the grand daughter, Pamela, by Dame Nellie Melba’s son (Pamela’s father) on the occasion of her 21st birthday in 1939. Pamela became Lady Pamela Vestey.

Q: How did you purchase the car, and how did you hear about it? Let’s hear all about it.

A: The Manager of Coombe Cottage (Dame Nellie Melba’s home) in Coldstream contacted the Sunbeam & Talbot Owner’s Club to come and have a look at the car which was stored in the barn/hay shed (alongside vintage horse carriages). Two members from the Sunbeam & Talbot Owners Club came to have a look!! It was purchased in late 2023 and they have restored it to the original running condition.

Lady Pamela became the guardian of her grandmother’s legacy and the chatelaine of Coombe Cottage in 1973. Her sons, Sam and Mark, went to Yering Primary School; Lady Pamela returned to England so that her sons could attend Eton, the famed college to attend.

She was a widow at this stage – her husband, Baron William Vestey, had joined the Scots Guards but was killed in action in Italy on the 25th of June 1944. We believe there is a book written and published by Lady Pamela regarding her grandmother Dame Nellie Melba – Melba: A Family Memoir. A story in this

book tells of the lady gardeners organised by Edna Walling and also Pamela’s 10th birthday – a fancy-dress party.

Q: Let’s get back to the car – why did you buy the car?

A: Terry states that he and Malcolm fell in love with the car and its history and felt that he wanted to make sure it stayed in the Eastern suburbs of Melbourne where most of its history is. His mate Malcolm and he spent many hours in recent months enjoying the car restoration. Of course they could have some fun with their matemanship as well.

Q: What are you planning for the car now?

A: There is to be an official “Re-emergence” of the car into the community! It will be held on the 18th of September at the Heatherdale Reserve, Purches Street, Mitcham. Hon. Michael Sukkar is to cut the ribbon, and it will be an important day in the history of Melbourneand indeed Australia.

By Erryn Langley

Investment bonds, or insurance bonds as they are also known, are issued by life insurance companies. They have features similar to a managed fund combined with a life insurance policy. They can be a tax effective way to invest if certain rules about contributions and withdrawals are followed.

Investment bonds are used for a range of purposes including:

• A medium to long term lump-sum or regular savings plan

• A tax effective investment for investors or high income earners

• Investment bonds can be taken out by parents, grandparents and the like on the life of a child. The bond can be structured to automatically be transferred into the child’s name at a pre-determined age. This is referred to as ‘child advancement’.

• Estate planning. Because an investment bond is in essence a life insurance policy, it is subject to life insurance rules. This includes the ability of the owner of the investment bond to nominate one or more beneficiaries to receive the proceeds of the bond in the event of the death of the bond owner. By nominating beneficiaries under an investment bond, the bond does not form part of the estate of the bond owner and may be administered separately to their estate.

• Deceased estates that are required to invest bequests that will vest with beneficiaries at a later date.

Parties to an investment bond

There are three parties to an investment bond; the owner - who subscribes to the investment funds, the life insured – who may be the bond owner or someone else; and the issuer of the bond – the life insurance company.

Some bonds may include a fourth party, being a nominated beneficiary. The bond owner may nominate a beneficiary to receive the bond proceeds in the event of the death of the life insured.

Where a bond is issued on the life of a child, and its ownership is to vest in the name of the child at a future date, the bond is subject to Child Advancement Conditions. The owner of the bond may nominate an age, up to 25, at which the ownership of the bond will transfer to the child.

Insurance bonds are tax paid investments. This means earnings on the investment are taxed in the hands of the life insurance company at the corporate tax rate. Insurance companies are generally taxed at a rate of 30% however the actual rate of tax payable may be less than 30% when tax deductions, tax offsets, and tax credits available to the life insurer are taken into account.

Investment bonds can be tax effective for long term investors with a marginal tax rate higher than 30%. An investment bond is designed to be held for at least 10 years. If you hold the bond

Within 8 years

100% of the earnings on the investment bond are included in the investor’s assessable income and a 30% tax offset applies

In the 9th year 2/3 of earnings on the investment are included in the investor’s ªssessable income and a 30% tax offset applies.

In the 10th year 1/3 of earnings on the investment are included in the investor’s assessable income and a 30% tax offset applies.

After the 10th year All earnings on the investment are tax free and do not need to be included in the investor’s assessable income.

for at least 10 years, the returns on the investment, including additional contributions that meet the 125% rule, will be tax free. In some circumstances, investing in an investment bond for a shorter period may be an appropriate strategy.

If you withdraw money before 10 years is up, some or all of the income will be taxable and included in the investor’s assessable income. This amount is taxed at the investor’s marginal tax rate - however a 30% tax offset is allowed to compensate for the tax already paid by the life insurance company. Where an investor’s personal tax rate is less than 30%, any unused portion of the tax offset can be used to reduce tax payable on other income in the same financial year.

If you make a withdrawal within the first 10 years, the rate at which earnings in the investment bond are taxed will depend on when you make the withdrawal.

The investment earnings are calculated by referencing a formula contained in the Australian Taxation Office’s Income Tax Ruling 2346.

While investment bonds are often described as a ‘single premium’ or lump sum investment, many investment bonds accept both regular and irregular additional investments. Provided the amount invested in any one year – based on the anniversary of the bond commencing – does not exceed the previous year’s investment by more than 125%, it will be considered part of the initial investment.

If you exceed 125% of the previous years’ investment, the 10 year period will reset. If you do not make a contribution in any one year, a contribution in following years will reset the 10 year rule.

The life office issuing the investment bond may offer a range of investment options such as single asset funds i.e. cash, fixed interest, shares, property or a range of diversified options. Each option has different investment goals, timeframes, risk profiles and underlying assets.

The key risks are largely determined by the nature of the investment chosen. Risks to be aware of include:

• Market risk: The performance of the investment bond will be affected by the assets and securities that it invests into.

• Fees: These may vary depending on the investment bond and investment options chosen and include management and administration fees and buy-sell spreads.

Erryn Langley

This information has been provided as general advice. We have not considered your financial circumstances, needs or objectives. You

Whilst all care has been taken in the preparation of this material, it is based on our understanding of current regulatory requirements and laws at the publication date. As these laws are subject to change you should talk to an authorised adviser for the most up-to-date information. No warranty is given in respect of the information provided and accordingly neither Alliance Wealth nor its related entities, employees or representatives accepts responsibility for any loss suffered by any person arising from reliance on this information.

By Warren Strybosch

The property management data matching protocol has recently been extended by the ATO.

It is important for those who own investment properties or a second property to understand what information is being gathered by the ATO and to take note of the lodgement errors being made by property owners.

The ATO requires software providers to give details of rent and expenses for residential rental properties managed by a property manager.

The ATO has advised that the information gathered (including rental data from banks, landlord insurers, rental bond authorities and sharing economy providers) gives it insight to common investment property mistakes. In this regard, it said recent results from property data matching found the following common errors:

• instead of reporting gross rental income and claiming expenses, net rent (after expenses) is reported and the same expenses are claimed a second time

• properties are being omitted from returns

• where they are owned by multiple stakeholders, only one owner reports the property – when both are required to report

• not reporting the rental income received when purchasing an already tenanted property that the new owner intends on moving in to

• capital works or depreciating assets being claimed as repairs and maintenance.

The ATO said if property owners have forgotten to disclose any rent received or made mistakes with claiming expenses, they are encouraged to lodge an amendment as soon as possible otherwise they might face penalties and/or fines for providing the wrong information on their returns.

You can call them on 1300 88 38 30 or email info@findaccountant.com.au / www.findaccountant.com.au

This information is of a general nature only. Itdoesnottakeintoaccountyourparticular financial needs, circumstances and objectives. You should obtain professional financial advice if you have not already done so before acting on this information. You should read the Product Disclosure Statement (PDS) before making a decision to buy or sell a financial product. Any case studies, graphs or examples are for illustrative purposes only and are based on specific assumptions and calculations. Past performance is not an indication of future performance. Superannuation, tax, Centrelink and other relevant information is current as at the date of this document.This information contained does not constitute legal or tax advice.

By Kathryn Messenger

Part of it is due to poor diet advice. To some extent it is because sugar is highly addictive, as well as the fact that eating can be strongly driven by emotions.

We’re all basically wired to avoid pain and seek pleasure. After all, to some degree, it keeps us alive. If we’re used to short-term gratification, then why wouldn’t we go for chips and donuts rather than kale and hemp seeds (Ok, so I don’t eat kale or hemp seeds all that often.)

Rather than first focusing on your diet failure, let’s look at what’s going on at a deeper level. Are you stressed and your brain is looking for quick fuel? Are you sad and memories of cake or lollies remind you of happier times? Whatever the reason, if you look to firstly identify the cause, then work at making changes and treating yourself with kindness, you will likely see some better results.

If you do struggle with sweet cravings or carb cravings, there are a few things to look at.

• Was your last meal balanced, including carbohydrates, protein, and healthy fats?

• Did you eat enough at your last meal?

• Is it boredom eating, would a herbal tea or glass of soda water help?

• Do you have healthy snacks around for when you’re hungry?

My favourite healthy snacks are roast almonds, very dark chocolate and Chinese red dates. I also drink a lot of herbal teas, particularly in the winter when it’s cold. Be sure to have some healthy snack options around (and ideally no junk food options) for when those cravings hit. My favourite herbal teas are peppermint, nettle leaf, and licorice, but in the summer I would rather a glass of soda water with lemon juice.

Often a whole diet overhaul is difficult to maintain long-term. What one change

can you make for this week that challenges you, but doesn’t feel overwhelming? Set a reminder in your phone for next week and make another change. After just 1 month of this you may find you have established some great habits.

If you would like further support with weight loss, my weight loss course is based on the latest scientific research and will teach you how to eat to lose weight and keep it off for the rest of your life. If you have other health issues alongside a desire to lose weight, naturopathic medicines can help to support you with both of these together.

A 2024 Federal Budget announcement will provide additional support for businesses who participate in the Australian Apprenticeships Incentive System.

The last adjustment to this scheme was announced in the March 2022 budget, where the Phase Two incentive system payments would begin reducing from 1 July 2024.

The new announcement states that the reduction in incentive payments will not reduce for apprentices, trainees and their employers in priority occupations.

Announced as part of the 2023 Federal Budget, was a proposed expansion of the general anti-avoidance provisions for income tax.

This announcement intended to allow schemes that achieve an Australian income tax benefit to come into the scope of Part IVA, even if the dominant purpose was to reduce foreign income tax.

This announcement was set to apply from 1 July 2024, however, as per the 2024 Federal budget this has been pushed to income years commencing after amended legislation receives royal assent, regardless of whether the scheme was entered into before that date.

Announced:

In an initiative to promote women’s economic equality, the Labor government has announced plans to pay superannuation on paid parental leave (PPL) for government-funded payments from 1 July 2025.

As a result, the expected Phase Two incentive system payments for apprentices in a priority occupation will increase from $3,000 to $5,000 if it was due to received after 1 July 2024. Also, if an apprentice in a priority occupation is hired after 1 July 2024, there will not be a reduction in that incentive payment either. Announced: 7-Mar-2024

Announcement(9-May-2023) Consultation

Passed Royal Assent Date of effect

If enacted, this measure will provide parents who access the PPL government scheme with super contributions paid into their nominated super account equivalent to 12% of their leave pay.

An expansion to Australia’s PPL is also currently before the Senate, which will give families an additional 6 weeks of PPL, increasing to 22 weeks from July 2024, 24 weeks from July 2025, and 26 weeks from July 2026.

This measure is currently in the announcement stage and requires parliamentary approval to become law.

Please note: In the 2024 Federal Budget, the government has announced the discontinuation of this proposed measure, as these integrity issues are being addressed through other administrative processes implemented by the ATO.

Australian Business Number (ABN) holders will now be required to be more accountable and comply with annual income tax lodgment obligations.

First announced in the 2018–19 Federal Budget as an integrity measure, this exposure draft legislation seeks to strengthen disruptions to black economy and tax avoidance behaviour.

Currently, ABN holders are able to retain their ABNs regardless of whether or not they meet income tax obligations. This measure will provide more accountability on enterprises by giving the regulator the ability to cancel ABNs. This means advisers need to ensure clients keep their lodgments up to date, or at least keep a clear line of communication with the ATO.

Announcement(12-Apr-2019) Consultation(29-Nov-2022) Introduced Passed

Royal Assent Date of effect

The taxpayer will receive a notification from the ATO when a BAS refund is retained for further investigation.

This measure will take effect from the start of the first financial year after assent of the enabling legislation.

Announced: 13-May-2024

Updated: 24-Jun-2024

The Bill proposing to increase the instant asset write off threshold in Div 328 of ITAA 1997 has received Parliamentary approval to become law and is now available to use for the 2023–24 income year.

Originally announced in the 2023 Federal Budget, the increased threshold applies from 1 July 2023, for small businesses with an aggregated annual turnover of less than $10 million.

The write-off applies to the cost of eligible depreciating assets, second element costs and general small business pools.

Eligible assets must be first used or installed ready for use between 1 July 2023 and 30 June 2024, and the write-off applies on a per asset basis.

Announcement(9-May-2023) Consultation(13-Sep-2023) Introduced(13-Sep-2023) Passed(25-Jun-2024)

Royal Assent(28-Jun-2024) Date of effect(1-Jul-2023)

The non-arm's length income (NALI) measure announced by the Coalition government in 2022 has been amended to provide greater certainty to taxpayers.

The intention of the amending legislation is to include a factor-based approach for trustees to be able to adequately calculate the amount of SMSF income that is NALI income. This factor-based approach applies to a situation where general expenses of the fund are not at arm's length amounts.

The factor-based approach would apply to general fund expenses incurred after 1 July 2023.

The Federal government has introduced legislation to extend the instant asset write-off threshold for small businesses to $20,000 for another year.

Originally announced as part of the 2024 Federal Budget, the increased threshold applies for the 2024-25 income year and aims to help small businesses with improved cash flows and record keeping.

An immediate deduction for eligible assets (applied on per asset basis) will be available for small businesses with an aggregated turnover of less than $10 million.

Announcement(24-Jan-2023) Consultation(9-May-2023) Introduced(13-Sep-2023) Passed(25-Jun-2024)

Royal Assent(28-Jun-2024) Date of effect(1-Jul-2023)

Announced: 14-May-2024 Updated: 22-Jul-2024

These payments are usually made to an individual for reasons such as compensation for previously

If your client would be eligible for other offsets or rebates relating to arrears payments, and they otherwise would have a reduced Medicare levy, this exemption will be available for them.

The Federal government has introduced legislation into parliament to amend the Medicare Levy Act 1986, which will commence in the quarter following the date the bill receives royal assent.

Eligible assets must be first used or installed ready for use between 1 July 2024 and 30 June 2025. Recently enacted legislation will make more carers

The eligibility requirements will change from 20 March 2025, where the existing 25 hour per week participation limit to receive Carer Payment will be amended to 100 hours over 4 weeks.

Also, currently the participation limit applies to employment, volunteering and study. From 20 March 2025, only employment will count against the participation limit.

Further adjustments will be made, meaning that if an individual goes over these limits, the ramifications relating to future support will not be as severe.

Announcement(9-May-2023) Consultation(5-Apr-2024) Introduced(5-Jun-2024) Passed Royal Assent Date of effect

Announcement(13-May-2024) Consultation

Introduced(29-May-2024) Passed(4-Jul-2024)

Royal Assent(9-Jul-2024) Date of effect(20-Mar-2025)

A ground-breaking website and new set of resources are supporting autistic young people and their communities in safely navigating the influence of pornography.

With its unique focus and compassionate approach, Porn Is Not the Norm (PINN) provides a safe, supportive and inclusive space for autistic young people and their families to understand the complexities and realities of pornography.

The PINN website and resources, which were recently launched, combine informative articles, professional learning, expert advice and personal stories. They offer valuable insights and practical strategies to help autistic young people and their communities develop a healthy, informed perspective on respectful relationships and sexuality.

Mayor of Maroondah, Councillor Kylie Spears, said Council has supported the project since the beginning.

“Council is proud to have been involved in Porn Is Not the Norm since its development began in 2016. We are so pleased that the website and these new

resources have now officially launched and are now available to support our community,” Cr Spears said.

“PINN aims to foster open, honest discussions that help empower autistic individuals to make informed choices, develop healthy relationships and navigate the complexities of sexuality in a safe, respectful way.

“There are videos, courses, tip sheets and a resource package with activities for use with autistic young people, which provide a wealth of knowledge and resources for education, support and community engagement while aligning with the unique needs of autistic young people. The resources will be an important support for autistic people, parents and carers, as well as teachers and other professionals.”

About PINN

Porn Is Not the Norm (PINN) was developed through the initiative of Council’s Community Access and Inclusion Facilitator, Jack Mulholland, and Director of It’s Time We Talked, Maree Crabbe.

In 2016, they convened a small group of organisations in a consortium to discuss pornography’s impacts on autistic young people and the lack of existing resources tailored to suit their needs.

In the years that followed, a project team conducted research, delivered a series of educational events for parents, carers and professionals who work with autistic young people, and developed PINN, the multi-strategy project through which these new resources have been created.

Learn more about PINN by visiting their website at www.notthenorm.com.au.

The delivery of Porn Is Not the Norm was led by Maree Crabbe, Director of It’s Time We Talked, with significant input from Associate Professor Dr Wenn Lawson, Jodi Rodgers of Birds and Bees, and other members of the autistic and autism communities. PINN was delivered through disability service provider, Interchange Outer East, who received funding from Westpac Foundation in 2020.

This National Child Protection Week, 1 to 7 September, Council is recognising the important role that conversations play in helping to keep children and young people safe.

National Child Protection Week aims to engage, educate and empower people to understand the complexities of child abuse and neglect, and work together to prevent it. The campaign is led by the National Association for Prevention of Child Abuse and Neglect (NAPCAN), which shares information and events to empower communities to have conversations regarding children’s safety and wellbeing.

Mayor of Maroondah, Councillor Kylie Spears, said the safety and wellbeing of children and young people is everyone’s responsibility.

“Council is committed to being a child safe organisation where all children and young people are valued and protected from harm and abuse. The wellbeing and safety of the children and young people in our care will always be our priority, and we have specific policies, procedures and practices in place to support our people to achieve these commitments,” Cr Spears said.

“National Child Protection Week is a reminder that we are all responsible for ensuring children and young people

are protected. This year’s theme, Every Conversation Matters, emphasises the power of conversations in keeping children and young people safe and well.

“Whether these conversations are between children and their parents or caregivers; children and their peers, friends or neighbours; or between families and teachers, doctors or other professionals, these conversations have the power to help ensure children and young people are valued and protected from harm and abuse,” Cr Spears said.

“I encourage everyone in our community to consider the impact that our conversations can have on the safety and wellbeing of children, young people, and their families.”

How to support children and young people - for parents and caregivers From the very earliest of days, parents and caregivers can help ensure children and young people know about their rights and their safety.

By having age-appropriate discussions with children and young people, you can help them understand:

• All children have the right to be safe and well cared for

• Rights are things that help people have a safe, happy and healthy life

• Children should be aware that being safe means no-one should harm them

• Feeling safe involves trust and comfort with the people who are responsible for their care

• Children can speak with a trusted adult, or call the Kids Helpline on 1800 55 1800 for support at any time.

Conversations can help us understand issues, find solutions, learn more from our community, and help support children and young people’s development and social connections.

How to start a conversation - One Talk at a Time

Understanding how, when, and where to have these conversations is an important first step.

The National Office for Child Safety has a series of ‘One Talk at a Time’ videos available to encourage adults to have ongoing, proactive and preventative conversations with children, young people and other adults to prevent child abuse.

Watch the video for young children, or watch the ‘One Talk at a Time’ videos for ideas on how to start the conversation with older children and young people.

Twelve sporting clubs and community groups will be able to renew and improve their facilities sooner with support through Council’s Capital Funding for Community Groups for 2024/25.

A total of $209,000 will be distributed among the community groups for capital projects that will improve or promote greater community access, with $67,803 to be allocated from the 2024/2025 Sports Surfaces Capital Works Program and $13,585 from the 2024/2025 Solar Capital Budget.

Mayor of Maroondah, Councillor Kylie Spears, said the funds will support a variety of projects that will benefit our community.

“Council is pleased to support Maroondah’s community groups through our annual Capital Funding program.

“The funding is a great way for Council to assist community groups with improving existing facilities or planning and developing new facilities that will continue to meet the needs of our community, as well as the groups and organisations that use them.”

Ainslie Park Cricket Club received support for their cricket nets surface

renewal project - a much-needed upgrade, said Senior Secretary, Alan Moss.

“Our nets are now 10 years old and have seen increased traffic with the development of our girls and ladies cricket program. It was a priority for us to continue to provide a safe training facility,” Alan said.

“Council’s funding programs are of great benefit to local sports clubs. With increased costs and pressures to continually develop, recruit and provide a family-based environment, the funding is a great help.”

Burnt Bridge Tennis Club is another recipient for 2024/25. President, Tom Keegan, said the funds will support the first phase of the club’s tennis court redevelopment program.

"Burnt Bridge Tennis Club is very grateful to Council for its support. In partnership with Burnt Bridge Tennis Club and Tennis Australia, Council’s contribution to revitalise our show courts will be transformative,” Tom said.

“Revitalising our facilities means we can provide an improved court surface for play for members and the community.”

Council offers Capital Funding each year. Organisations can apply for capital funding in two categories:

Category 1 - projects less than $7,700, which are fully funded by Council.

Category 2 - projects over $7,700, which receive a 50 percent contribution from Council (with a maximum contribution of $75,000 Council contribution).

A variety of applications were assessed under the program, with priority given to projects that will satisfy a community need, broaden community access, increase opportunities for participation, address safety issues and risk management, or maximise the use of the facility.

Projects up to $7,700

• German Shepherd Dog ClubManson Reserve - Canteen Roller Door Replacement

• Heathmont East Preschool - Window Tint and Lockable Cabinet

• Dorset Golf Club - Design of Outdoor Community Alfresco

Projects over $7,700

• CRISP Nursery - PV solar

• Ringwood East Senior Citizens’ Centre - Solar panels

• Maroondah BMX - Start Hill Upgrade

• Ainslie Park Cricket Club - Cricket Nets Surface Renewal Project

• Croydon Tennis Club - Court Upgrade

• Burnt Bridge Tennis Club - Court 3 and 4 Revitalisation Project

• Heathwood Cricket ClubHeathmont Reserve Centre Wicket Upgrade

• 3rd Ringwood East Scout GroupKnaith

• Road Scout Hall Kitchen Upgrade

• Arrabri Community House -

Childcare Playspace Applications for the next round of funding will open in 2025.

Mayor of Maroondah, Councillor Kylie Spears, said the strategy aims to help community members to incorporate more movement into their daily lives.

“Physical activity is important at any age for good physical and mental health and wellbeing. Whether it’s part of daily routines, active travel, chores or sport, any form of regular movement can provide health benefits, such as helping to prevent chronic disease and promoting mental wellbeing, while also providing opportunities to make social connections,” Cr Spears said.

“In contrast, physical inactivity and sedentary behaviours are a risk factor for a variety of mental illnesses, including depression and anxiety, and age-related cognitive decline.

“This is why the Physical Activity Strategy sets actions for the next five years to address levels of inactivity

in our community. It seeks to support community members to be more active in many different parts of their lives and in ways that are accessible and that can be easily adopted. It also includes target actions to support specific groups who are significantly less active,” Cr Spears said.

“As the strategy notes, research indicates that any increased movement is beneficial, and breaking up time spent sitting with small amounts of movement during the day may actually be more beneficial than a large block of moderate or intense activity after sitting for a long period of time.

“With this in mind, Council will prioritise providing supportive environments to assist our community in adopting a more active daily lifestyle through active travel, daily routines and incidental physical activity, as well as organised sport and exercise.”

The Physical Activity Strategy 2024-2029 builds on the recommendations of the Maroondah Liveability Wellbeing and Resilience Strategy and input from the

Maroondah 2050 Community Vision, along with detailed consultation, research and the Physical Activity Strategy 2015-2020.

The strategy highlights challenges that prevent community members from being as physically active as they would like, as well as opportunities to help people become more physically active through active living.

The strategy also prioritises the development or the improvement of environments that encourage physical activity, while encouraging community members to take part in active living through active travel, play, gardening and incidental exercise, as well as participating in sport or an active pursuit for fitness or fun.

Our nursery was started over 30 years ago by a group of interested volunteers. The aim was to conserve local native plants, encourage revegetation to provide habitat for local wildlife and enhance biodiversity. In that time, we have educated and inspired many thousands of people to get involved in protecting and enhancing the biodiversity of our local environment. Now more than ever, the nursery is a crucial link in the chain of environmental organisations that support a healthy and thriving environment for our families and provide essential habitat for our local wildlife. The difficulties caused by Covid-19 and the lockdowns nearly forced the nursery to close its doors. However, the new Committee of Management has been hard at work since February, and the process of rebuilding and revitalising the nursery is well underway!

Our membership has more than doubled over the past six months, we have more than 50 volunteers on board, and the improvements being made to the nursery facilities are visible from the moment you enter the site. We’ve held working bees, received donations from Boral Quarries Montrose and Bunnings, and been successful in our grant applications to Melbourne Water, Yarra Ranges Shire Council and Carman’s Trees for Bees through the Wheen Bee Foundation. None of this would have been possible without the direction and unstinting personal effort of our Operations Manager, the structure of the Management Committee, supportive local government staff and a growing host of volunteers, new members and sponsors. We are now doing more than just surviving–we are beginning to regain momentum and are on the way to thriving!

The annual Spring Sale which runs throughout September is just around the corner. September is the ideal time to get plants established in the ground before the heat of Summer. Selected tube stock will be available at the reduced price of $3.00 retail and $2.50 members. Now is also a great time to put in orders so that we can grow what you need, ready for the 2025 planting

season. Our retail area is open to the public from Tuesday through Friday between 10am and 3pm and Sundays from 10am until 2pm.

With warmer days approaching, you might consider joining our growing volunteer workforce. Volunteer hours are between 9:00 am – 4:00 pm Tuesday to Thursday, 9:00am to 3pm Friday and 10.00 am - 2.00 pm on Sunday. From collecting seed to nurturing the plants, from preparing orders to assisting in the retail area, helping out with general maintenance, administrative duties and enjoying morning or arvo tea with the Candlebark team, there really is an opportunity for everyone to be part of the environmental work that we do.

If you would like to join us, we would love to hear from you!

If you are interested in being involved in a specific project, you might like to join us as we regenerate an area of remnant Yellow Box with bee-friendly local native shrubs, grasses, and lilies. Please contact the nursery to find out the working bee dates.

We also encourage those of you who support our aims and objectives to help us rebuild the long-term financial security of our organisation by spreading the word about our fundraiser with friends and colleagues.

Please check out the details here: https://gofund.me/ea0beea7

All donations, small or large, will help us meet the costs needed to upgrade our drainage and greywater systems at the nursery (~$7,000), repair/rebuild our service area patio (~$2,000) and bring our pot-washing area up to code (~$1,200). Other items on the to-do list include extending and upgrading the carparking area (~$1,800) and creating stock garden beds around the nursery perimeter to showcase our amazing local native shrubs, herbs, lilies and groundcovers (gardeners needed!).

Our grants subcommittee is working hard to secure funding for our two priority projects. The first is to buy and erect a large storage shed, which is desperately needed to house our clean tubes, pots, trays, tubs, tools and propagation materials (~$12-15,000, which includes site preparation, concrete flooring, erection and fit-out). The second is to fund the purchase and construction of a large poly-flute, self-ventilating seedling hot house to replace our existing structures and enable us to grow healthier plants all year round (~$11,000).

NOVEMBER AGM: YOU ARE INVITED!

This year’s AGM is going to be special!

We are looking forward to celebrating our 30th anniversary since incorporation and the many achievements of recent months with all our members, volunteers and the wider Candlebark community.

The AGM will be held on Sunday 24th November 2024 from 1.00 pm on the Candlebark Nursery site. Refreshments will be served.

Keep an eye on our Facebook page for the announcement of our Guest Speaker.

Please RSVP to the Secretary at info@candlebark.org.au by Monday 11 November so that we can arrange the catering.

Candlebark Community Nursery Incorporated

308 Hull Road, Mooroolbark 3138

Email: info@candlebark.org.au

Phone: (03) 9727 0594 or 0494 088 804

https://www.facebook.com/profile.php?id=61557484754633&__ tn__=-UC

Photographs: C. Listopad ©

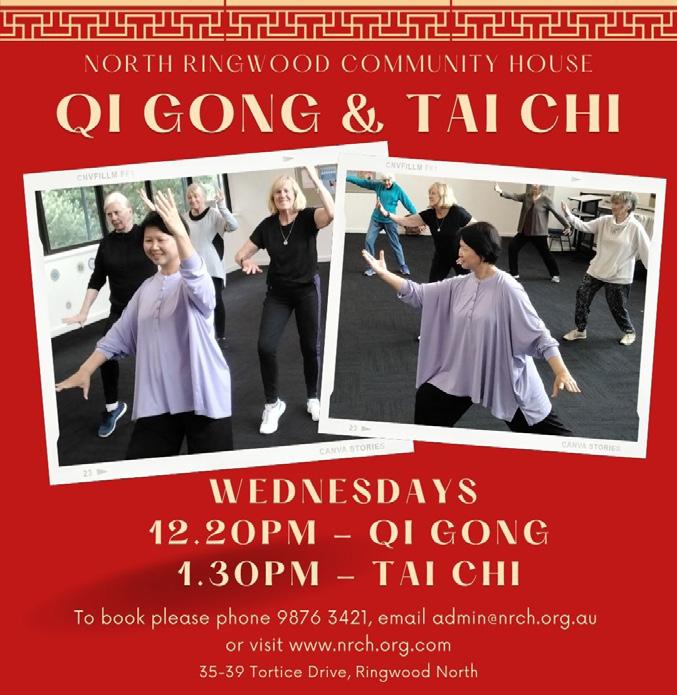

U3A Ringwood is a community organisation that offers a variety of educational and recreational activities for people who are over 55 and no longer working full time.

We are a small and friendly group that give our members an opportunity to pursue their interests and hobbies in a friendly and supportive environment.

Some of the benefits of joining U3A Ringwood are:

• You can learn new skills or enhance existing ones, such as Languages, Computer, Art, Music, History and many more.

• You can keep your mind and body active and healthy by participating in activities such as Yoga, Tai Chi, Exercise, Table Tennis and Line Dancing.

• You can meet new people and make friends by joining Discussion Groups, Excursions, Wine Appreciation and Social Events. There are also Patchwork and Card Making classes as well as Mahjong, Chess and Scrabble.

• You can enhance your retirement and have fun without ongoing high weekly fees.

Date: Thursday, 12th September | Time: 12:00 PM - 2:00 PM

U3A Ringwood is one of the first U3A’s in Australia and has been operating since 1985. It is located in two convenient locations, one in Mullum Mullum Road Ringwood and one on Tortice Drive Ringwood North. We have 300 members and over 40 courses all offered at a once year cost of only $65.00.

If you have a skill or interest that you would like to share you would be made very welcome. We have Class Coordinators that will support any new class.

If you are interested in joining you can visit our website u3aringwood.org.au or ring 0481591224 or email info@ u3aringwood.org.au Our members enjoying their Exercise Class.

Location: Central Ringwood Community Centre - Rosewarne Lane, Bedford Park, Ringwood - Community Garden

Come together with your community to share RUOk? Day. Enjoy a BBQ in our beautiful Community Garden while participating in interactive online trivia or a classic board game. There’s even a chance to win a special Game Prize!

This free event is a wonderful opportunity to meet new people, make friends, and start conversations that could make a real difference in someone’s life. We look forward to seeing you there!

Please RSVP for catering numbers. To let us know you’re coming, please email community@crccinc.org.au or call 9870 2602

By Warren Strybosch

With continuing uncertainty around the world, Australia, despite the current challenges it is facing, is still better poised to cope with these uncertainties than most other countries around the world. Some take home points include:

1. $28.5 in budget improvements, with the underlying cash deficit in 202223 expected to be $36.9bn, down significantly from that announced in the March 2022 Budget.

2. The economy is expected to grow by 3¼% in 2022-23 before slowing to 1½% in 2023-24.

3. Unemployment is at a historic low level and is expected to remain low through until June 2024.

4. Rising interest rates and inflation are negatively impacting many families with wages growth not keeping pace with increased costs of living. Inflation is expected to hit 7¾% by the end of 2022 before starting to ease over the following two years.

Housing stock is a real issue for young families. For many retirees, their home, is their largest asset and with significant prices rises over the last decade, these retirees are holding on to a greater amount of wealth than they had anticipated. It makes sense then to create a way for retirees to benefit from selling their principle homes to free up equity they can invest and generate an income whilst at the same time increase the amount of properties that younger people can purchase.

With this in mind, the government, in their bid to tackle housing accessibility, has announced the extension of the downsizer superannuation contribution to those between the age of 55 and 59.

This measure was first introduced in 2017 and was previously restricted to those aged 60 and older. Now, it will become available to anyone over the age of 55.

The downsizer contribution allows people to make a one-off post-tax contribution to their superannuation of up to $300,000 per person (up to $600,000 per couple) from the proceeds of selling their home. Both members of a couple can contribute, and these contributions do not count towards their respective non-concessional contribution caps

Whilst not legislated, it is believed this measure will gain bi-partisan support and be passed in the first quarter of next year.

When retirees sell their home, they have to act quickly with the sale proceeds before the money is deemed by Centrelink. Often, retirees need longer than 12 months to build the new home and/or move into the new place of residency. It can become a real shock to some retirees, when they have been relying on their age pension, to have it either reduced or stopped all together and in some circumstances, having to pay back some money.

From 1 January 2023, it is proposed that a two-year asset test exemption will be available for home sale proceeds that are going to be used to buy, build, rebuild, repair or renovate a new principal home. Currently, the proceeds from a home sale that are earmarked to buy, build, rebuild, repair or renovate a new principal home are only exempt from the asset test for 12 months.

Only the amount of sale proceeds that will be used for the new home are exempt. For example, if your home is sold for $1 million and $800,000 of this will be used for the new home, the amount exempt under the asset test is limited to $800,000. The impact of home sale proceeds during the exemption period will also reduce under the income test. Sale proceeds are often deemed to earn an income at the higher 2.25% rate. Under this measure, the exempt amount will have the lower deeming rate applied (currently 0.25% frozen until 30 June 2024).

This measure will be a great relief for all retirees who are currently receiving the age pension. It will mean that they will have plenty of time to move into their new principal place of residence and not have those funds deemed.

The Government is committing $2.5 billion over the next four years to help fund more care for older Australians and to increase nursing numbers in care facilities. The package includes:

• Mandating that facilities have a registered nurse on site 24 hours per day from 1 July 2023

• Increasing average care minutes per resident to 215 minutes per day from 1 October 2024

• Better food options which are fresh, healthy, and safe

• Strengthening regulation of aged care providers

• Capping administration and management fees charged by providers in the Home Care Packages Program

Cost of medication to decrease

From 1 January 2023, the Government will decrease the general patient co-payment for treatments on the Pharmaceutical Benefits Scheme from $42.50 to $30.00. This provides a $12.50 reduction per script for those paying the general rate.

Reduced impact of employment income on pensioners

Currently, the Work Bonus system allows age and veterans pensioners (both employees and the self-employed) to earn $7,800 per year of employment income with no impact on their pension payments under the income test. The Government has proposed to add a one-off credit of $4,000 to their Work Bonus income bank effectively increasing the amount of exempt employment income that can be generated in this financial year from $7,800 to $11,800.

The additional $4,000 income credit will be available until 30 June 2023. Other measures supporting working pensioners include a proposal to allow employment income to exceed the income limits for up to two years without a need to re-submit a pension claim and the Pensioner Concession Card will also be retained for a period of two years where the pensioner has a nil rate of pension due to employment income.

Commonwealth Senior Health Card income thresholds increase

The Government will increase the income thresholds for eligibility to the Commonwealth Seniors Health Card to:

• $90,000 per year for singles (up from $61,284) and

• $144,000 combined per year for couples (up from $98,054)

community

www.findagedcare.services

For more information, please contact us at 1300 88 38 30 or email info@findagedcare.services

Getting the balance right between a safe spending rate and having enough income to enjoy retirement takes some careful planning. Investing for a reasonable return is one approach to helping your savings go the distance.

Getting the balance right between a safe spending rate and having enough income to enjoy retirement takes some careful planning. Investing for a reasonable return is one approach to helping your savings go the distance.

risk, and generally provide you with more potential to grow your investment over time.

risk, and generally provide you with more potential to grow your investment over time. Here are some of the assets in each category that you might come across when exploring your investment options:

Here are some of the assets in each category that you might come across when exploring your

payments for either a fixed period or for the rest of your life depending on the type of annuity you choose.

payments for either a fixed period or for the rest of your life depending on the type of annuity you choose.

As with term deposits, your payment rate will remain fixed. So whilst you won’t be affected by share market falls, you also won’t benefit from higher returns when share markets perform strongly.

There’s a rule of thumb when it comes to investment risk. Generally speaking, the higher the expected return, the higher the risk involved. But taking on investments with the least possible risk can make it difficult to earn investment returns that keep up with inflation and any rises in living costs.

There’s a rule of thumb when it comes to investment risk. Generally speaking, the higher the expected return, the higher the risk involved. But taking on investments with the least possible risk can make it difficult to earn investment returns that keep up with inflation and any rises in living costs.

Defensive assets include investments like cash, term deposits, fixed interest securities, and annuities.

Defensive assets include investments like cash, term deposits, fixed interest securities, and annuities.

As with term deposits, your payment rate will remain fixed. So whilst you won’t be affected by share market falls, you also won’t benefit from higher returns when share markets perform strongly.

Growth assets include investments like property, shares and equities.

On the other hand, taking on too much risk could lead to steep falls in the value of your investments. This can have an even bigger impact when you’re retired, because you can’t expect to replace these losses from your salary or other types of income. Plus, you’re relying on your ‘nest egg’ to provide at least some of your income. When you lose a portion of those savings to risky investments, you have less to spend for the rest of retirement and less to earn returns on over the long term.

On the other hand, taking on too much risk could lead to steep falls in the value of your investments. This can have an even bigger impact when you’re retired, because you can’t expect to replace these losses from your salary or other types of income. Plus, you’re relying on your ‘nest egg’ to provide at least some of your income. When you lose a portion of those savings to risky investments, you have less to spend for the rest of retirement and less to earn returns on over the long term.

Cash is considered the safest form your money can take but it typically generates the lowest returns. However, it can be good to have some cash in a bank account because of the safety it provides and because you can access it right away when you need it.

Cash is considered the safest form your money can take but it typically generates the lowest returns. However, it can be good to have some cash in a bank account because of the safety it provides and because you can access it right away when you need it.

Term deposits are held for a set period of time with a bank, building society or credit union. The rate of return is fixed, and you can be certain of your income, but you should be prepared to have your capital locked away for the full term. Whilst term deposits offer this security, there is a tradeoff. When markets perform strongly, your rate of return will remain fixed and you won’t benefit from higher returns.

Growth assets include investments like property, shares and equities.

Understanding the investments available to you, and their risks, will be crucial to looking forward with confidence in your retirement.

Understanding the investments available to you, and their risks, will be crucial to looking forward with confidence in your retirement.

Term deposits are held for a set period of time with a bank, building society or credit union. The rate of return is fixed, and you can be certain of your income, but you should be prepared to have your capital locked away for the full term. Whilst term deposits offer this security, there is a trade-off. When markets perform strongly, your rate of return will remain fixed and you won’t benefit from higher returns.

An asset class is a group of investments with similar characteristics and laws. They’re typically grouped into two broad categories, defensive and growth. Defensive assets offer less opportunity for growth, and generally provide you with income stability and security for your original investment and income. Growth assets carry more

An asset class is a group of investments with similar characteristics and laws. They’re typically grouped into two broad categories, defensive and growth. Defensive assets offer less opportunity for growth, and generally provide you with income stability and security for your original investment and income. Growth assets carry more

Fixed interest securities, such as bonds, involve you usually loaning money to a company or entity. You receive regular interest payments and can expect to get back the original sum invested at the end of the term, known as the ‘maturity’. The underlying value of the fixed interest security can change with interest rate movements.

Fixed interest securities, such as bonds, involve you usually loaning money to a company or entity. You receive regular interest payments and can expect to get back the original sum invested at the end of the term, known as the ‘maturity’. The underlying value of the fixed interest security can change with interest rate movements.

Annuities can also be viewed as a type of fixed interest investment. You invest a lump sum with an annuity provider and receive regular

Annuities can also be viewed as a type of fixed interest investment. You invest a lump sum with an annuity provider and receive regular

Property can provide you with rental income and potential for capital gains. In Australia property prices have generally performed well over the long term. However, property prices are notoriously difficult to predict due to the number of variables that impact them. Investing in shares means buying a share of ownership in a company, usually on a stock exchange. The value of the shares are generally linked to a company’s value and as a shareholder, you can be paid a share of profits as a dividend. Shares are generally considered to be a higher risk asset class as their value tends to be more volatile. You can control the amount of risk you take on by investing in share portfolios that invest in companies that have delivered consistent returns over the long term.

Property can provide you with rental income and potential for capital gains. In Australia property prices have generally performed well over the long term. However, property prices are notoriously difficult to predict due to the number of variables that impact them. Investing in shares means buying a share of ownership in a company, usually on a stock exchange. The value of the shares are generally linked to a company’s value and as a shareholder, you can be paid a share of profits as a dividend. Shares are generally considered to be a higher risk asset class as their value tends to be more volatile. You can control the amount of risk you take on by investing in share portfolios that invest in companies that have delivered consistent returns over the long term.

Everyone has different investment goals. However, a common objective for many people investing for their retirement is striking a balance between maximising available cash flow and protecting the remaining savings. Your risk appetite will determine which investment strategy is right for

Everyone has different investment goals. However, a common objective for many people investing for their retirement is striking a balance between maximising available cash flow and protecting the remaining savings. Your risk appetite will determine which investment strategy is right for

you, and according to the Government website MoneySmart1 may fall into one of the following four types:

you, and according to the Government website MoneySmart may fall into one of the following four types:

chance of having a bad year than in the balanced or growth options below.

term. There is less chance of having a bad year than in the balanced or growth options below

1. Cash: Invests 100% in deposits with Australian deposit-taking institutions or in a ‘capital guaranteed’ life insurance policy. This option aims to guarantee your capital and accumulated earnings cannot be reduced by losses on investments.

1. Cash: Invests 100% in deposits with Australian deposit-taking institutions or in a ‘capital guaranteed’ life insurance policy. This option aims to guarantee your capital and accumulated earnings cannot be reduced by losses on investments.

2. Conservative: Invests around 30% in shares and property with the majority in fixed interest and cash. Aims to reduce the risk of loss and therefore accepts a lower return over the long term. There is less

2. Conservative: Invests around 30% in shares and property with the majority in fixed interest and cash. Aims to reduce the risk of loss and therefore accepts a lower return over the long.

3. Balanced: Invests around 70% in shares or property, and the rest in fixed interest and cash. Aims for reasonable returns, but less than growth funds to reduce risk of losses in bad years. Those losses usually occur less frequently than in the growth option. You may also be able to invest in a ‘moderate’ option with around 50% in shares and property.

4. Balanced: Invests around 70% in shares or property, and the rest in fixed interest and cash. Aims for reasonable returns, but less than growth funds to reduce risk of losses in bad years. Those losses usually occur less frequently than in the growth option. You may also be able to invest in a ‘moderate’ option with around 50% in shares and property.

4. Growth: Invests around 85% in shares or property. Aims for higher average returns over the long term. This also

5. Growth: Invests around 85% in shares or property. Aims for higher average returns over the long term.

This also means higher losses in bad years compared to investing in other low risk options. You may also be able to invest in a 'high growth' option with 100% in shares and property.

means higher losses in bad years than those you would experience with lower risk options. You may also be able to invest in a ‘high growth’ option with 100% in shares and property.

The importance of diversification Diversification is a golden rule of investing. Spreading investments across different asset classes can strike a balance between security (defensive assets), and higher investment returns (growth assets). This can reduce your overall investment risk and the impact of significant market downturns, or poor returns from a particular business or sector.

The importance of diversification Diversification is a golden rule of investing. Spreading investments across different asset classes can strike a balance between security (defensive assets), and higher investment returns (growth assets). This can reduce your overall investment risk and the impact of significant market downturns, or poor returns from a particular business or sector.

As a transition into retirement is made, there needs to be a much bigger focus on income stability and wealth protection rather than wealth accumulation.

We have made it cheaper and easier for you to get your returns completed & you can do it all from the comfort of your own home.

Here are the steps involved:

1. Email to info@findaccountant.com.au requesting your PAYG return to be completed. Provide us with your full name, D.O.B and address

2. A Tax engagement letter will be emailed to you for signing via your mobile (no printing or scanning required).

3. You will be then sent a tax checklist to complete online. Takes less than 5 minutes.

4. We will then require you to upload your documents to our secure portal.

5. Once we have received all your documentation, we will complete the return.

SERVICES

• Architect ------------------------------ 00

• Find Accountant ----------------- 34

• Financial Planning ------------- 36

• Find Insurance -------------------- 35

• Bookkeeping ---------------------- 00

6. We will email you the completed return with our invoices. Once you sign the return and pay the invoice we will lodge the return on your behalf. Email your artwork to editor@findmaroondah.com.au If you wish us to create your ad, we will do this for a minimal cost. Go to www.findmaroondah.com.au/graphic-design to upload your details and we will create this for you.

• Editor|Copywriter --------------- 00

• General Insurance ------------- 35

• Life Coach --------------------------- 36

• Mortgage Brokering ----------- 36

• Signages ------------------------------ 00

• Solicitor/Lawyer ------------------ 35

If you have any questions, contact the editor on 1300 88 38 30 or Email warren@findmaroondah.com.au *Available until your category is taken when a Tradie joins the Find Network Team.

At Find we can help you find the ‘right’ personal insurance. Our aim is to help you obtain and retain the personal insurances that are appropriate for you and at cost that you can afford.

Personal Insurances Include:

• Income Protection (IP)

• Life Insurances or Death Cover

• Total and Permanent Disability (TPD)

When your insurance are in place, our services do not stop there. We will provide you with an after care service that includes policy notifications, insurance report, help desk, reviews and help at claim time. We provide ourselves in providing honest advice that you can rely on. • Trauma

warren@findinsurance.com.au

www.findinsurance.com.au

• Coffee Machine Machine -- 00

• Garage Doors ---------------------- 00

• Builder ----------------------------------- 00

• Electrician ----------------------------- 00

• Painter ----------------------------------- 00

• Plasterer -------------------------------- 00

• Property Maintenance ------- 00

88 38 30

For every $50 spent at our dining retailers, receive a $10 gift card*

Enjoy More When You Dine at Eastland!

Discover more

The new Prada Linea Rossa Optical collection stays true to its distinctive sporty and casual appeal, continuing down the path of modern design with refined finishing.

Explore the collection at OPSM today.

Discover more

Oktoberfest in The Park!

Experience Germany's iconic festival with traditional tunes, authentic feasts, and endless cheers!

Embrace the joy of longer days and vibrant styles! This season is all about bold prints, bright colors, and endless laughter under the sun.

• Lactation Consultant ----------- 39

• Swen Pouches ---------------------- 40

• Hair Dresser --------------------------- 00

• Chiropractor ------------------------- 00

•

• Gym ---------------------------------------

• Massage Therapy ---------------- 00

Osteopathy in Australia is a government registered, allied health profession. Osteopaths focus on improving the function of the neuro-musculoskeletal system (bones, muscles, nerves and connective tissues) to optimise health and well-being.

Joanna is highly qualified and experienced in the osteopathic assessment and treatment of babies and infants.

She can assist with the following assessments: