By Warren Strybosch

By Warren Strybosch

The Find Yarra Ranges is a community paper that aims to support all things Yarra Ranges. We want to provide a place where all Not-For-Profits (NFP), schools, sporting groups and other like organisations can share their news in one place. For instance, submitting upand-coming events in the Find Darebin for Free.

We do not proclaim to be another newspaper and we will not be aiming to compete with other news outlets. You can obtain your news from other sources. We feel you get enough of this already. We will keep our news topics to a minimum and only provide what we feel is most relevant topics to you each month.

We invite local council and the current council members to participate by submitting information each month so as to keep us informed of any changes that may be of relevance to us, their local constituents.

We will also try and showcase different organisations throughout the year so you, the reader, can learn more about what is on offer in your local area.

To help support the paper, we invite local businesses owners to sponsor the paper and in return we will provide exclusive advertising and opportunities to submit articles about their businesses. As a community we encourage you to support these businesses/columnists. Without their support, we would not be able to provide this community paper to you.

Lastly, we want to ask you, the local community, to support the fundraising initiatives that we will be developing

and rolling out over the coming years. Our aim is to help as many NFP and other like organisations to raise much needed funds to help them to keep operating. Our fundraising initiatives will never simply ask for money from you. We will also aim to provide something of worth to you before you part with your hard-earned money. The first initiative is the Find Cards and Find Coupons – similar to the Entertainment Book but cheaper and more localised. Any NFP and similar organisations e.g., schools, sporting clubs, can participate.

Follow us on facebook (https://www. facebook.com/findyarraranges) so you keep up to date with what we are doing.

We value your support,

We value your support,

The Find Yarra Ranges Team.

EDITORIAL ENQUIRES: Warren Strybosch | 1300 88 38 30 info@findnetwork.com.au

PUBLISHER: Issuu pty Ltd POSTAL ADDRESS: 248 Wonga Road, Warranwood VIC 3134 ADVERTISING AND ACCOUNTS: info@findnetwork.com.au

GENERAL ENQUIRIES: 1300 88 38 30 EMAIL SPORT: info@findnetwork.com.au WEBSITE: www.findyarraranges.com.au

The Find Yarra Ranges was established in 2020 and is owned by the Find Foundation, a Not-For-Profit organisation with is core focus of helping other Not-ForProfits, schools, clubs and other similar organisations in the local community - to bring everyone together in one place and to support each other. We provide the above organisations FREE advertising in the community paper to promote themselves as well as to make the community more aware of the services these organisations can offer. The Find Darebin has a strong editorial focus and is supported via local grants and financed predominantly by local business owners.

The City of Yarra Ranges is a local government area in Victoria, Australia in eastern and northeastern suburbs of Melbourne. Yarra Ranges had a population of approximately 149,537 as at the 2016 report and close to 58,972 households. The City of Yarra Ranges was formed in 1995 by the merger of parts of the Shire of Sherbrooke, Shire of Lillydale, Shire of Healesville and Shire of Upper Yarra.

The Find Yarra Ranges acknowledge the Wurundjeri people, the original custodians of this land and their rich cultural heritage and spiritual connection to the land. We recognise and respect the unique diversity of the Indigenous community in Yarra Ranges, which is part of the world's oldest living culture.

Readers are advised that the Find Yarra Ranges accepts no responsibility for financial, health or other claims published in advertising or in articles written in this newspaper. All comments are of a general nature and do not take into account your personal financial situation, health and/or wellbeing. We recommend you seek professional advice before acting on anything written herein.

With food and petrol prices on the rise and now interest rates putting pressure on new homeowners, people are starting to find it hard to put food on the table.

Already, we are hearing stories of families having to go without. With likely interest rate rises continuing to occur this will place even more pressure on those families already struggling to obtain the essentials they require to get by on a day-to-day basis.

In this month’s edition we have tried to find some organisations in the local area who may be able to help those families doing it really tough and require some additional support. Started on page 14, we list some of these organisations that are providing food relief, a community meal, and/or shelter for the night.

We want to thank these organsiations for the work they do in looking after our community.

The great Australian dream of home ownership is being realised by fewer young people than it was half a century ago.

Data collected in the latest Census shows the home ownership rate of people aged 30 to 34-years-old sat at 50 per cent in 2021, a drop of 14 per cent since 1971.

For those aged 25 to 29, the decrease was also 14 per cent over the same period, dropping to 36 per cent in 2021.

Some of those people aged below 30 who owned their own home in the 1970s are among the Aussies with the highest rate of ownership in 2021. Baby Boomers – those born between 1946 and 1964 –make up the highest rate (82 per cent) of home owners in 2021.

The data released on Tuesday by the Australian Institute of Health and Welfare was drawn from information gathered in the latest Census, including that there were nearly 9.8 million households in 2021. Of those, 67 per cent were occupied by “owners”, with roughly half of those subject to mortgage.

About a third of households, or 2.9 million, are occupied by renters.

“There has been a sharper increase in the proportion of young Australians renting compared with older Australians,” the institute said as part of its data release.

With all the changes that have occurred in the financial planning profession, it was good to note that there was nearly a 50% reduction in complaints in the 2022 FY compared to the 2021 FY relating to ‘Failure to act in the client’s best interests’ and ‘Inappropriate advice’.

The evidence from AFCA (the external resolution board that handles financial planning complaints) provides us with a clear picture: The changes that have occurred over the past few years e.g. introduction of the FASEA Code of Ethics and increased education standards, have indeed had a positive impact for consumers.

I believe we are moving in the right direction as a profession.

(Source: AFCA)It’s hoped Fraser Island will follow the lead of Uluru and only be known by it’s Indigenous name, as the Queensland government flags an official name change.

The proposal will take a step forward this week as two months of public consultation begin, Resources Minister Scott Stewart said on Wednesday.

He hopes the process will lead to the Indigenous name of K’gari entering the common vernacular in the same way Uluru has replaced Ayers Rock.

“No one calls it Ayers Rock any more, they call it Uluru, and it’s about respecting our First Nations people, and about respecting the connection they have with this land,” Mr Stewart said.

“(For) 60,000 years they’ve been calling it K’gari, I think it’s about time we started to do exactly the same.”

The reinstatement of K’gari as the island’s name has been a long time coming, chair of the Butchulla Aboriginal Corporation Aunty Gayle Minniecon said.

“It means so much to the Butchulla people,” she said.

“For us it’s about respect for our people. It’s important for us to let our ancestors know that our culture is still strong and we continue to care for our country.”

The consultation follows the island’s world heritage area being renamed K’gari last year, Environment Minister Meaghan Scanlon said

“K’gari means paradise in the Butchulla language and as a popular destination for its natural beauty, is a much more fitting name for such an iconic place,” Ms Scanlon said.

“The name Fraser Island is culturally inappropriate – it is a tribute to Eliza Fraser, a woman whose narrative directly led to the massacre and dispossession of the Butchulla people.”

K’gari was originally known by Europeans as Great Sandy Island before it was changed to Fraser Island after Scotswoman Eliza Fraser was shipwrecked there in 1836.

While the World Heritage Area became K’gari last year, the official place name for the world’s largest sand island had yet to change.

The ATO has issued a release stating that rental properties are one of its four main focus areas for the 2022 returns now being submitted. The ATO urged rental property owners to ensure they carefully review their records before declaring income or claiming deductions. The release highlights common pitfalls, including the importance of keeping adequate records.

Assistant Commissioner Tim Loh noted that the ATO’s Random Enquiry Program found that nine out of 10 tax returns that reported rental income contained at least one error. This is despite most of those property owners being assisted by a registered tax agent. While tax agents can only work with the information they gather from clients, the ATO said it expects agents to ask a few extra questions to ensure their client’s return is completed correctly.

There appears to be a growing trend amongst Melbourne councils to bring in stricter policies when it comes to cat ownership. In April 2022, Knox Council implemented a 24/7 ban on domestic cats leaving their owner’s property. There will be a 6 month grace period where only warnings will be issued but then this will change to a $91 fine for first time offences, then jump to $545 for subsequent breaches starting in October 2022.

In July 2023, Bass Coast Shire Council will also implement a 24/7 ban on cats straying from their owners property. They intend to have a 12 month education drive in the lead up to this ban.

Manningham Council have announced that they will be implementing a trial 24/7 ban but have not yet announced a date for this. The general consensus for this growing trend is to protect the wildlife with a side note about protecting the cats themselves from injury and illness. Protecting the wildlife is important and a night curfew will help with this, but I think it is up to the cat’s owner to worry about illness and injury. However, what about the

consequences? Many outdoor cats help to keep the rodent population down. Will we suddenly see a spike in rats and mice throughout these Councils and neighbouring councils, potentially causing much bigger problems?

There doesn’t appear to have been much thought given as to how local households will be able to implement this. Simply building a cat run or enclosing your property in a high fence will be costly (and potentially unsightly) and prohibit many low-income families from doing this. Locking cats up, particularly older cats that are used to being outside seems cruel and is no better than locking up a wild animal in a cage at the zoo. Families who are renting will likely be unable to get permission from their landlord to build an enclosure as well. Will this lead to a lot of cats having to be rehomed because the families can’t afford to catproof their property?

As I am sure you can guess, I do have a cat. She is a beautiful tortoiseshell DMH who loves being outside as well as inside. We have a number of cats in our street, and once they established their pecking order, they all seem to get on really well and we quite often find one or two other cats sitting near or in our front yard a couple of metres from our cat. Although they don’t sit together, it appears they still like the company of each other. We ensure our cat comes inside overnight, as do our neighbours and often that means she has to come in by 4pm in the summer otherwise she hides from us so she can stay out. Our house also doesn’t get a lot of sunshine inside throughout the day so she would miss out on that precious light if we were to keep her in 24/7.

What are your thoughts on a 24/7 ban on cats leaving their owners property? Email us at editor@findgeelong.com.au and we’ll publish your comments next month.

Mr Greco said the ATO used the ability to disclose tax debt information to CRBs as a tool to influence businesses to take their debt seriously.

“A lot of businesses treat the ATO as the lender of last resort so just don’t pay it,” he said. “When money becomes tight businesses just stop paying one of their creditors, and the easiest one is the ATO.

“A credit rating is very important if you are highly leveraged, therefore this ability to provide this information so all can see is the thing that sometimes gets people to take note of the debt because it starts to impact their ability to finance their operations.”

Mr Greco said the IPA wanted to see the ATO customise its approach for each business.

“Tax debts are a big problem and it has blown out for a good reason, the tax office was giving businesses a bit more leeway during COVID which was understandable,” he said.

If you are a sole trader, you have not had to worry too much about any debts owing to the ATO. You would simply be placed on a payment plan and pay off what you can when you can. However, this is has now changed and the ATO is taking a harder stance against those business owners who owe money to the ATO.

The ATO will now inform credit provides of debts larger than $100,000. This will have an impact on sole traders and partners seeking any type of finance e.g., home loan, investment loan or car finance, in the future.

General manager of technical policy at the IPA, Tony Greco, said the move could provide a more even playing field for businesses.

“There are pluses and minuses, the pluses are it makes it more transparent that the market and all credit providers, including trade credit, get to see what level of debt the business has and it provides an extra impetus to that client to engage with the tax office,” said Mr Greco.

“If you’ve got one business compliant and another not compliant then that’s

an unfair advantage, so it promotes fairness in the tax system.”

The change applies only to sole traders with ATO debts that meet certain criteria.

“The rules are currently that it has to be over $100,000 and has to be related to a business debt and it also has to be when the business is basically not responding to current attempts to put it on the payment plan or to pay it,” said Mr Greco.

The ATO said that a business or sole trader effectively engaging with it would not be subject to CRB referral, even if the debt exceeded $100,000.

The ATO said effective engagement involved having:

• A payment plan and complying with the terms of the arrangement

• An application for release from the tax debt

• An active objection against a tax decision to which the debt related

• An active review with the AAT or an active appeal to the court

• An active review with the AAT of a reviewable decision that might affect the amount of a non-complying superannuation fund’s tax debt with the relevant regulator

• An active complaint with the IGTO in relation to the tax debt.

“We’ve always asked for a tailored approach so if a business has been caught up in negative COVID scenarios then they [the ATO] should go soft, but if other businesses have thrived during COVID the tax office should go hard.”

Before disclosing a tax debt to CRBs, the ATO said it would send a written notice to the business that included steps that could be taken to avoid the information from being reported.

As a sole trader it is important to work with your accountant and/or tax agent to make sure you can meet your meet your obligations going forward. That might mean setting up separate bank accounts to keep track of your GST, PAGW, and Super owing, so you have enough funds to pay those amounts when they fall due.

At Find Accountant, we provide SMSF tax advice. Our senior accountant is also an award-winning financial advisor. If you require SMSF advice or are considering whether or not to wind up your SMSF, then speak to Warren Strybosch at Find Accountant Pty Ltd.

GENERAL INSURANCE

By Craig Anderson

GENERAL INSURANCE

By Craig Anderson

Working from home was unexpectedly thrust upon many employees and employers due to COVID – 19 and due to the unplanned nature of the circumstances, both parties have had to rapidly adjust their thinking. Employers are still responsible, from a duty of care perspective, for staff safety while working from their own home, which is to put it mildly, “challenging”.

If you try to imagine a standard office space, you probably don’t consider the lighting level, the testing and tagging of equipment, the ergonomic furniture, the ambient temperature, the hands free phone head set, and a host of other things like the boiling water tap with safety features. You probably won’t imagine the planning it took to eliminate trip hazards, eye and ear strain, back strain, mental stress and fatigue and other stressors. Now look at a home work environment. Possibly no ergonomic furniture, trip hazards galore, cords

everywhere, low lighting, no testing and tagging, noisy pre-schoolers interrupting, dogs barking and a whole host of other potential issues. Having said that, how employees spend their free time is up to them, however the environment in which they spend work hours is really important for their wellbeing, and the employer is still responsible for any injuries they suffer, even when they work from home.

The connection to insurance is straightforward. Following a serious injury “at work” like an electrocution, slip and fall, serious burn, or laceration for example, an employer may be prosecuted by WorkSafe after an investigation if they have contributed due to lack of care or failure of due dilligence. However; if the employer has audited the home work environment and made every attempt to eliminate wherever possible all of the hazards, and if the employer has Management Liability Insurance including Statutory Liability, the insurer may legally defend the claim or pay fines where appropriate and avert a possible conviction where unwaranted.

If this is a situation currently causing you concern, and you’d like to explore. Management Liability Insurance to protect you and your assets, please contact us for a preliminary no obligation discussion. Please also consider engaging an OH&S Consultant to ensure all due diligence is exercised, as this may help insurers to view your business as a “good risk”.

For a health check of your business insurance, contact Small Business Insurance Brokers via email sales@ smallbusinessinsurancebrokers.com.au

Any advice in this article has been prepared without taking into account your objectives, financial situation or needs. Because of that, before acting on the above advice, you should consider its appropriateness (having regard to your objectives,needs and financial situation).

GENERAL INSURANCE

Small Business Insurance Brokers

www. heightsafetyinsurancebrokers.com.au 0418 300 096

The Reserve Bank has lifted the official cash rate by 50 basis points to 1.85 per cent – its highest level in over six years.

For someone with a $500,000 mortgage at the start of May, with 25 years remaining, the total increase across the four hikes would be $472 a month, according to RateCity.

RBA governor Philip Lowe said in a statement after the board meeting the rate rises in recent months were required “to bring inflation back to target and to create a more sustainable balance of demand and supply in the Australian economy”.

“The board expects to take further steps in the process of normalising monetary conditions over the months ahead, but it is not on a pre-set path,” he said.

“The size and timing of future interest rate increases will be guided by the incoming data and the board’s assessment of the outlook for inflation and the labour market.”

The RBA is seeking to return inflation to its target band of two to three per cent from its current level of 6.1 per cent – the highest it has been since the early 1990s.

Dr Lowe said inflation was expected to peak later this year and decline back to the target range.

The bank’s central forecast is for CPI inflation to be around 7.75 per cent over 2022, a little above four per cent over 2023, and around three per cent over 2024, he said.

He said higher inflation and higher interest rates were putting pressure on household budgets, with consumer confidence falling and housing prices declining in some markets after large increases in recent years.

“Working in the other direction, people are finding jobs and obtaining more hours of work,” he said.

“Many households have also built up large financial buffers and the saving rate remains higher than it was before the pandemic.

“The board will be paying close attention to how these various factors balance out as it assesses the appropriate setting of monetary policy.”

Paul Osborne (Australian Associated Press)Treasurer Jim Chalmers told parliament it was “another difficult day” for Australian homeowners.

“It’s not a shock to anybody, but it will still sting,” he said.

“Families will now have to make more hard decisions about how to balance the household budget in the face of other pressures like higher grocery prices and higher power prices and the costs of other essentials.”

He said the new government would “focus on what we can responsibly influence”.

“Australians know that we are in for a difficult time ahead when it comes to the storm clouds in our economy, but we are confident that we will emerge on the other side of this stronger than before.”

PropTrack senior economist, Eleanor Creagh, said it had been the fastest increase in rates since 1994.

Treasurer Jim Chalmers told parliament it was “another difficult day” for Australian homeowners.

“It’s not a shock to anybody, but it will still sting,” he said.

“Families will now have to make more hard decisions about how to balance the household budget in the face of other pressures like higher grocery prices and higher power prices and the costs of other essentials.”

Anneke Thompson, chief economist at CreditorWatch, said the rate of default by small businesses was expected to rise by a percentage point over the next year.

The likes of Surfers Paradise in Queensland and Auburn in NSW are likely hotspots for mortgage defaults, flowing on to debt problems for local businesses.

The rate rise came as the value of new loan commitments for housing fell 4.4 per cent in June, but remained at a historically elevated level of $31 billion, according to the Australian Bureau of Statistics.

The value of new owner-occupier loan commitments fell 3.3 per cent in June, while new investor loan commitments fell 6.3 per cent.

The total number of dwellings approved fell 0.7 per cent in June, following a 11.2 per cent rise in May.

Last month we discussed how much personal insurance you should consider having in place. It was a starting point and seeking professional financial advice is important to determine the right amount of cover for your needs.

This month we are going to review the different types of personal insurances you can obtain. It is important to note that that not every insurer offers the below type of cover but they are available through different insurers. Again, seeking appropriate financial planning advice is important. Talk to a licenced financial planner and they can discuss with you what types of cover you should consider. Please do not go to a mortgage broker, the bank or a general insurance broker and ask them to provide you with personal insurance. That is akin to asking a masseur to perform surgery on you…they could do it but they are likely to botch it up. Go to the professionals if you want a professional job done right.

We insure our cars, home, pet and even our health. But many of us neglect to insure our most important asset – our lives. Whether you need to take time off work to recover from a sickness or injury; change your lifestyle due to a permanent disability, or you die unexpectedly, without your income, it can have a huge impact on you and your family’s quality of life.

That’s where life insurance can help. Our range of life insurance covers can help you and your family financially if something bad happens to you. The right cover can help with:

• Paying the mortgage or rent

• Paying for your children’s education

• Covering your day to day bills, and

• Covering out-of-pocket medical expenses

Life insurance is there to pay you and your family when you need it the most. This could be anything from a temporary sickness or injury, through to a permanent disability or death.

Life insurance products differ by:

• Events covered: Covers typically protects financially against sickness, injuries or death (or a combination of these)

• Causes: Some types of cover are limited to accidents only, while others cover you for sickness and accident

• Lump sum benefit vs daily benefit: Some types of cover pay the benefit as a one off lump sum, while others pay as an ongoing benefit amount. Insurance that makes regular payments typically cover you for the period that you’re out of action

You choose the type of cover and the benefit amount you need. To keep your cover in place, you need to pay your premiums. If you suffer an insured event while your cover is in place, you (or your beneficiaries if you’ve died) can claim the benefit amount, subject to satisfying the relevant terms and conditions.

If the unfortunate happens, we will pay out on genuine claims. The conditions on which we pay out depend on the type of cover. Remember to consider this carefully before taking out cover and read the relevant PDS.

Cover for your family when you’re gone...

Life Cover can help ease the financial burden for your family if you’re terminally ill or die. With a lump sum benefit, your family can use the money to pay off the mortgage or other debts and maintain their current standard of living. You choose an amount of cover that’s right for you.

Some sickness and injuries may end up leaving you totally and permanently disabled and unlikely to ever work again. TPD Cover pays a lump sum benefit that can be used to make modifications to the family home, access the best rehabilitation or simply provide money to live on. Income Protection Cover only covers up to 70% of your income, so TPD Cover can be used to top up the shortfall.

If you suffer from a specified serious illness such as cancer, heart attack or stroke, a lump sum benefit paid upon diagnosis may help you access the best medical treatment, or pay down some of your debt. You can choose a benefit amount of up to $2 million, and you are covered for more than 40 specified conditions.

Income Protection Cover pays an ongoing monthly income for as long as you’re unable to work or until the end of the benefit period, whichever happens first. You can cover up to 70% of your income. Select from a range of benefit periods, from 2 years, 5 years or to age 65.

You can’t afford to be sick if you’re selfemployed or running a small business. Business Expense Cover helps cover the fixed operating expenses of your business if you are unable to work due to sickness or injury. Similar to Income Protection Cover, you receive an ongoing monthly income (for a maximum of 1 year), but instead of replacing your salary, it covers your business expenses. This can help keep your business afloat while you’re on the road to recovery.

No one wants to see their child sick. But if it happened to your child, you’d want the best medical treatment available, and that can be expensive. Child Cover allows you to take up to $200,000 cover for kids aged between 2 and 18 and will pay a lump sum benefit if they suffer from a specified serious illness or in the event of their death.

Helpful little extras (provided by some insurers)

Some insurers provide the following quality features:

• Provision for continuing cover: Once we issue your policy, we won’t change the terms and conditions or the premium you pay because of a change in your personal circumstances

• Indexation: We will automatically increase your cover each year to ensure your benefit amount keeps up with inflation (premiums will increase in line with increased cover)

cover: You are covered 24/7 anywhere in the world

• Provision for upgrades: If we make changes or introduce new benefits to our products, we will pass this on to you

There are some situations where you’re not covered and when we won’t pay a claim. This includes not telling us the truth about your health or financial situation when applying for cover.

Read the Product Disclosure Document (PDS)

Before accepting the cover that is being recommended to you, take time to read the PDS that should be provided to you prior to filling in an application for insurance. The PDS will go into great detail about each type of insurance and what you are covered for. Given not all insurers cover the same things, it is important you understand what your insurance is going to cover.

If you are requiring a review of your personal insurances or wish to get some cover in place, then book a time with Warren Strybosch from Find Wealth Pty Ltd t/as Find Insurance. Warren has been

helping clients for the past 20 years with their personal insurance needs. He has been a finalist for many financial planning awards, won a few awards of the years, and has been recognised as one of Australian’s top 50 most influential advisors. You are in safe hands with Warren.

Booking link: https://calendly.com/findgroup/15minute-phone-conversation

After the meeting you will be provided with a FREE Insurance Report so you can make an informed decision about your personal insurance needs.

This information is current as at August 2022. This article is intended to provide general information only and has been prepared without taking into account any particular person’s objectives, financial situation or needs (‘circumstances’).Before acting on such information, you should consider its appropriateness, taking into account your circumstances and obtain your own independent financial, legal or tax advice. You should read the relevant Product Disclosure Statement (PDS) before making any decision about a product. While all care has been taken to ensure the information is accurate and reliable, to the maximum extent the law permits, Alliance Wealth and its related bodies corporate, or each of their directors, officers, employees, contractors or agents, will not assume liability to any person for any error or omission in this material however caused,nor be responsible for any loss or damage suffered, sustained or incurred by any person who either does, or omits to do, anything in reliance on the information contained herein.

All eligible businesses who employ an apprentice between 5 October 2020 and 30 June 2022 are eligible to receive a 50% wage subsidy. The wage subsidy is available for 12 months from commencement of employment. The maximum available subsidy is $7,000 per quarter per apprentice. This wage subsidy is a stimulus payment announced to effectively boost employment for young people and help businesses transition away from the COVID-19 downturn. These payments will be received via the Australian Apprentices Incentives Program. This program currently services employers by providing cash payments when apprentices meet certain targets.

Another program for apprentices that was in place prior to 5 October 2020 dealt with keeping apprentices employed (as opposed to employing new apprentices). These subsidies were to combat rising unemployment and an expected economic downturn due to COVID-19. The wage subsidy was based on which apprentices remained in employment with their employer on 1 March 2020 and 1 July 2020. Originally, only small business employers were eligible to participate. From 1 July 2020, the government extended the measure to include medium-sized businesses. The original wage subsidy commenced for employers from 1 January 2020 and ran through to 31 March 2021.

Excise and excise-equivalent customs duty that applies to petrol and diesel will be temporarily reduced by 50%.

The reduction of the fuel excise will be in place for 6 months, beginning at 12:01am on 30 March 2022 and ending at 11:59pm on 28 September 2022.

The new temporary excise rate of 22.1 cents per litre will bring excise below the road user charge for businesses who claim fuel tax credits.

Announcement(29-Mar-2022) Consultation

Introduced(30-Mar-2022) Passed(30-Mar-2022) Royal Assent(31-Mar-2022) Date of effect(30-Mar-2022)

Announcement(29-Mar-2022) Consultation Introduced(30-Mar-2022) Passed(30-Mar-2022) Royal Assent(31-Mar-2022) Date of effect(30-Mar-2022)

Minimum

1 July 2019 through 30 June 2023.

This measure is intended to support retirees in managing the impact of the: recent volatility in financial markets, and prevailing low interest rates on their retirement savings.

Announced: 22-Mar-2020 Updated: 12-Apr-2022

Sole traders and partners in a partnership may be able to utilise a safe harbour to deduct non-commercial losses against other assessable income.

The draft PCG bypasses the Commissioner’s discretion under the non-commercial loss rules, where a business has been directly affected by floods, bushfires or the COVID-19 pandemic.

The business will be required to show necessary evidence to support using the safe harbour. Once finalised, the draft guideline will apply to the 2019–20, 2020–21 and 2021–22 income years.

Announcement(11-May-2022) Consultation period(21-Jun-2022) Released

drawdowns for superannuation pensions have been halved again for the 2022–23 income year. This extension means that the reduction of minimum drawdowns will be available for self-funded retirees from

drawdowns for superannuation pensions have been halved again for the 2022–23 income year. This extension means that the reduction of minimum drawdowns will be available for self-funded retirees from

On 23 February 2022, the ATO released TR 2022/D1 and PCG 2022/D1 in relation to distributions made by trustees of discretionary trusts. This was complemented by TA 2022/1, which discusses parents benefitting from the trust entitlements of the adult children.

All 3 documents focus on schemes where income is diverted from an intended beneficiary in order to reduce tax liabilities. The rulings discuss these at detail and include significant attention to an important carve out for dealings that are “ordinary family or commercial” dealings. These dealings are excluded from the anti-avoidance provisions.

Following on from the release of the draft guidance, the ATO has reiterated its stance in many areas relating to s 100A. In particular, where situations would generally come under an ordinary family or commercial dealing.Trustees need to make sure that their distributions are in accordance with the expectations of the ATO, otherwise they may be subject to an audit. Helping them understand their obligations is paramount coming up to the end of the current income year.

The ATO is allowing an extension for unpaid present entitlements (UPE) to private companies initially under an interest-only loan on the final repayment date. The practical compliance guideline deals with UPEs that were put on commercial investment terms in accordance with PS LA 2010/4. If there is a balance to be repaid at the end of the investment period, it may become a new Div 7A loan.

30 June 2018 is the first year in which an interest-only loan at benchmark rates is due to be repaid after the issuing of PS LA 2010/4. That is, 7 years after the initial UPE was put on a sub-trust from the 30 June 2010 year.

The PCG has recently been updated to relate to arrangements ending in the 2017, 2018, 2019, 2020, 2021 and 2022 income years. However, as TR 2010/3 and PS LA 2010/4 have now been withdrawn, only UPEs that arose on or before 30 June 2022 are allowed.

Family groups using this strategy may benefit from utilising this extension of time to repay the initial unpaid present entitlement from the 2009–10 income year.

Announcement(23-Feb-2022) Consultation period(29-Apr-2022) Released

Announcement(19-Jul-2017) Consultation period(19-Jul-2017) Released(19-Jul-2017)

A finalised tax determination has changed the ATO’s position on how sub-trust arrangements apply within the context of Div 7A.

Effectively, when a corporate beneficiary and trustee of the trust are ultimately the same people, Div 7A will apply directly to unpaid present entitlements (UPEs).

In this instance, the provision of financial accommodation will now be assumed. In practice, this means that sub-trust arrangements will have no additional benefits either in deferral of tax or repayment of loans.

The tax determination applies to trust entitlements arising on or after 1 July 2022.

Announcement(23-Feb-2022) Consultation period(29-Apr-2022) Released(13-Jul-2022)

Community facilities will be more comfortable, energy efficient and ready for disasters, thanks to funding from the State and Federal Governments.

Council’s Climate Resilient Buildings for Our Community project will see nine facilities improved to be more energy efficient and ready to be activated in case of widespread power failure.

Facilities being improved through the project include:

• Coldstream Community Centre,

• Healesville Memorial Hall (The Memo),

• Powelltown Reserve Pavilion,

• Warburton-Millgrove Sporting Complex,

• Yarra Centre Pool and stadium,

• Yarra Glen Memorial Hall and RSL,

• Monbulk Community Link,

• Olinda Recreation Reserve Pavilion

• Gary Tait Pavilion, Kilsyth

Yarra Ranges Deputy Mayor, Johanna Skelton, said the works would mean that in the event of storm, heatwave, fire or flood, community would have a place to go.

“When disaster strikes and power goes out, the community need somewhere safe to go, ideally close to home, where they can access supplies and chat with people who can help them,” Cr Skelton said.

“When this project finishes in early-2024, people in every corner of the Yarra Ranges will have a community facility nearby that can operate from battery power and generators. This is the kind of facility we need as climate change increases the rate of extreme weather events.

“Each site will have its own specific upgrades, but a focus of this project is to make sure each building is well-insulated and sealed, so they need less energy to run and air stays cleaner inside. This also means that if a disaster strikes, the batteries on site – charged by rooftop solar if air quality permits – can run for longer.

"Residents will recall how important being able to access charging points for phones, battery packs, torches, radios and other devices was in the aftermath of last years storm. Access to showers, water, a comfortable place to warm up or cool down and an information hub will be possible at these locations too.

"Buildings that use less energy and create solar power all year round, as well as prepare us for emergencies, are the goal. It’s not fun to think about when we’ll need to use these additions, but we know now, more than ever, that we need to be better prepared.

“Of course, this wouldn’t be possible without the support of the State Government, through the Growing Suburbs Fund, and the Federal Government, through the Local Roads and Community Infrastructure fund.

“Thank you to the State and Federal Governments for recognising the importance of this project, particularly as we pass the one year anniversary of the catastrophic June 2021 storms.”

The Memo in Healesville, Yarra Glen Memorial Hall and Coldstream Community Centre will be the first facilities upgraded, with works starting in August.

On days of extreme or catastrophic Fire Danger Rating, or when major bushfire activity is predicted in the area, leaving the area early is always the safest option.

Neighbourhood Safer Places and Fire Refuges exist as places of last resort. Find out more about these at yarraranges. vic.gov.au/saferplaces, and always have a bushfire plan ready to go

“We’re setting out to build a sustainable economy, one that not only meets the needs of our community, but also our environment.”

“We feel this draft strategy sets a clear vision for how we’ll continue to regenerate the Yarra Ranges and ensure that our businesses become more resilient and able to thrive in the face of change.” “This draft document has been shaped by a great depth of local expertise, so I encourage our community to take a look and let us know if we’ve captured everything they wish to see and to let us know if we’ve missed anything.”

“I look forward to working with our community to make these goals a reality.”

Council’s draft 10-year Economic Development Strategy is now out for community consultation. The draft strategy sets out a bold new direction for the region’s economic future.

The strategy prioritises purposeful growth, regenerative principles and resilient communities. The strategy was developed in collaboration with the business community, subject matter experts and Yarra Ranges locals.

The first stage of engagement, undertaken in 2021, asked residents and businesses for their ideas on how to facilitate economic growth, strengthen

business resilience, create jobs, attract investment and improve liveability in the Yarra Ranges.

The resulting draft strategy is now open for feedback

Yarra Ranges Mayor, Cr Jim Child, said that strong strategic planning for the next 10 years would be crucial to economic growth in the Yarra Ranges.

“The economic conditions that enabled us to flourish in the past are changing, with new technology, climate change and global trends having impacts on our businesses and community,” Cr Child said.

Residents can visit Council’s online community engagement platform, Shaping Yarra Ranges, to learn more about the Economic Development Strategy, see the Action Plan and share their feedback on the draft.

There are also two webinars for residents and businesses to join, and Council’s Economic Development Officers will be available at the Civic Centre, and Community Links for face-to-face engagement opportunities. You can find details of dates, times and locations here

Visit Shaping Yarra Ranges to have your say.

Chirnside Park Shopping Centre has been servicing the community in outer eastern Melbourne since 1979. We offer our customers an extensive selection of stores, with a strong focus on convenient and value driven fresh food.

Welcome to Chirnside Park Shopping Centre’s Facebook Page – a great space for sharing with you information about Chirnside Park Shopping Centre and its retailers, and all the great things we have to offer.

It’s also a space where we welcome comments, discussions, ideas and feedback from you. We’d love to hear what’s on your mind and to ensure this is an enjoyable place for all, ask that your contributions be made in a constructive, respectful and polite manner. Posts or other content that is trolling, defamatory, a personal attack, threatening, harassing, harmful, abusive, discriminatory, unlawful, offensive, obscene, misleading or deceptive, fraudulent, spam, or any content that may breach intellectual property rights of another is not permitted.

WEAR IT PURPLE WAS FOUNDED IN 2010 IN RESPONSE TO GLOBAL STORIES OF REAL TEENAGERS, REAL HEARTACHE AND THEIR VERY REAL RESPONSES. IN 2010, SEVERAL RAINBOW YOUNG PEOPLE TOOK THEIR OWN LIVES FOLLOWING BULLYING AND HARASSMENT RESULTING FROM THE LACK OF ACCEPTANCE OF THEIR SEXUALITY OR GENDER IDENTITY

Wear it Purple Day is about showing LGBTIQ+ young people that they have the right to be proud of who they are. It is about creating safe spaces in schools, universities, workplaces and public spaces to show LGBTIQ+ young people that they are seen and supported.

This year the theme for Wear It Purple Day 2022 is ‘Still me, still human'. The message being that people tend to focus on labels, the news story, the target or data and forget what we truly are – human. The 2022 theme encapsulates the message of humanity, honesty, integrity and authenticity when discussing all diverse

identities within the LGBTIQA+ community.

• Community Organisation/Charity of the Year at the 2019 Australian LGBTI Awards

• 100% volunteer-run, from our youth leaders to the board.

Awareness – They provide support and resources for Schools, Universities, Gender & Sexuality Alliances (GSA’s) and Youth Organisations to assist them in creating inclusive experiences for rainbow young people. They act as a source of resources to support the effective delivery of Wear It Purple Day in Schools, Universities, Workplaces and the broader community.

Opportunity - They provide meaningful opportunities for rainbow young people to develop their skills, expand their network and contribute to the inclusivity of their communities.

Environment – They provide supportive & safe spaces (digital and physical) and contribute to a world where young rainbow people feel proud of who they are.

Collaboration – They collaborate and unite with other organisations to further the inclusion of rainbow young people. Through partnerships, we support the effective delivery of Wear It Purple Day in Schools, Universities, Workplaces and the broader community.

What’s happening around us today and why is this important?

• 75% of LGBTIQ+ youth in Australia will be bullied because of their identity.

• 80% will experience it at school. Because of this, LGBTIQ+ youth are up to 12x more likely to experience depression and up to 5x more likely to experience anxiety.

Support Wear It Purple Day and find out more at: https://www.wearitpurple.org/

40.0% is the new permissible interest rate (up from 4.01%) that can be charged to calculate the daily payments for outstanding acccommodation balances for new residents entering care between 1 January 2022 and 31 March 2022.

For many retirees, one of the questions on their mind is whether they will be eligible for a Centrelink Concession Card and what will this entitle them to.

We explore in this article the benefits pensioners can enjoy if they obtain the Pensioner Concession Card (PCC) compared to other Centrelink cards like the Low Income Health Care Card (LIHCC) and the Commonwealth Seniors Health Card (CSHC).

The following are the benefits provided by the abovementioned cards - PCC, LIHCC and CSHC:

Medicare Safety Nets can help to lower your out-of-pocket medical costs for out of hospital services.

If you need to see a doctor or get tests regularly, you could end up with high medical costs. Medicare Safety Nets can help to lower your out-of-pocket costs. These can include:

• seeing a doctor or specialist

• some tests and scans like blood tests and CT scans.

When you spend over a certain amount in a calendar year, you will receive a higher amount back. Services Australia will calculate the Safety Nets each calendar year, 1 January to 31 December.

Keep in mind, your doctor’s visit or test will still cost the same.

If you’re enrolled in Medicare, you’re eligible for Medicare Safety Nets. If you’re part of a family or couple you can combine your costs by registering as a family

Medicare Safety Nets have thresholds. When you spend certain amounts in gap and out of pocket costs, you’ll reach the thresholds. Once you’ve reached the thresholds, you’ll start getting higher Medicare benefits. This means you’ll get more money back from Services Australia for certain Medicare services.

Only verified payments count towards the threshold. Verified payments are when you pay for your health professional service in full, before you make a claim from Services Australia. If you have unverified payments, you’ll need to pay them before they count towards your threshold. Unverified payments are when you don’t pay your doctor’s fee before you claim from Services Australia. Read more about the difference between verified and unverified payments. The threshold amounts are set each year from 1 January.

Medicare Safety Nets have thresholds. These are the dollar amounts you need to reach in gap and out of pocket costs to be eligible. When you’re eligible, you’ll start getting higher Medicare benefits. This means you’ll get more money back from Service Australia for certain Medicare services.

A Medicare benefit is the dollar amount Service Australia pays you when you’ve made a claim for a medical service. This is usually 85-100% of the schedule fee. A schedule fee is the dollar amount the Australian Government sets for each medical service. The MBS Online website lists the schedule fee amount. You can search the MBS by keyword or item number to find the schedule fee amount.

The Department of Health and Aged Care sets threshold amounts each year from 1 January.

Pharmaceutical Benefits Scheme provides benefits to both concession and non- concession card holders. Concession card holders can use the PSB to pay $6.60 for each medicine as a maximum limit while the non- concession card holders can use PSB to pay a maximum of $41.30 for medicine.

If a concession card holder is able to pay $ 316.80 which is equivalent to an amount for a calendar year PBS safety net threshold, then their medicine will be free for the rest of the year.

For your clients to know about the medicine’s PBS eligibility they could visit this site (http://www.pbs.gov.au/browse/ medicine-listing)

This benefit is for doctors. Medicare will give higher pay for doctors who are treating concession card holder. So, unlike the usual practise with other patients, bulk bill is applicable to concession cardholder.

If your client is a concession card holder, he is eligible for a MyPost account which entitles him for free stamps discounts on mail hold or mail redirection.

The following benefits are provided by the PCC yet are not provided by the LIHCC and CSHC:

This includes hearing assistance or aids and assistive listening devices that are subsidised.

PCC holders are eligible to avail home telephone discounts.

Seniors card eligibility in this state consists of: (1) age 60 or over, (2) working 20 hours or less per week, (3) permanent resident of NSW, and (4) a holder of a green Medicare Card.

Table 1: NSW mainstream concession card benefits p.a.

Benefit Type PCC LIHCC CSHC Seniors

Council Rates Up to $250 - - -

Water $526 - -Energy Up to $285 Up to 285 -Gas Up to $110 Up to $110 - -

Drivers Licence $60 - - -

Car Registration $381 - -Value $1,612 $395 - -

i. Sydney Water typical changes example for water and wastewater (stormwater mot included).

ii. Based on yearly renewal fee. iii. Car between 1,155kg - 1,504kg.

You might benefit from other concessions like public dental services- PCC, LIHCC and CSHC; ambulance services- PCC, LIHCC and CSHC; and medical Energy rebate- PCC and LIHCC.

Seniors card eligibility includes (1) age should be 60 or over; (2) working less than 35 hours per week; and (3) permanent resident of Victoria.

Table 2: VIC mainstream concession card benefit p.a.

Benefit Type PCC LIHCC CSHC Seniors

Council Rates Up to $247 - -Water Up to $346 - -Electricity $402 Up to $402 -Gas $177ii $177ii -Car Registration $423 $153 -Value $1,595 $1,078 - -

i. Victorian Health and Human Services Department example, $100.62 off $672 quarterly bill.

ii. Victorian Health and Human Services department example, $88.54 off $580 quarterly bill (only available for charges between 1 May and 31 October). iii. 3000 postcode, includes Transport Accident Charges (TAC).

You might benefit from other concessions in Victoria like nonmains water concession- PCC and LIHCC; excess electricity concessions- PCC and LIHCC if electricity bill is greater than $2,973 p.a.; and excess gas concession- PCC and LIHCC if gas bill is greater than $1,644 p.a.

In Queensland, the seniors card eligibility includes (1) 65 or over, or 60-64 plus holder of PCC, LIHCC or CSHC; (2) working less than 35 hours per week; and (3) permanent resident resident of Queensland.

Table 3: QLD mainstream concession card benefit p.a.

Benefit Type

Council Rates

PCC LIHCC CSHC Seniors

Up to $200 - - -

Water Up to $120 - - -

Electricity $341 $341 $341Gas $76 $76 - -

Car Registration $170 $170 $170iSpectacles $50ii $50ii $50ii

Value $957 $637 $391 -

i. Assume four cylinder vehicle and concession card issued after 1 July 1994.

ii. Eligible for one pair every two years if held card at least 6 months. Assumes a cost of $100.

You might benefit from other concessions in Queensland from the following: (1) boat registration discounts- PCC and QLD seniors card; (2) some public dental services- all four cards; and (3) medical aids and equipment- PCC, LIHCC and QLD seniors card.

Western Australia requires the following for seniors card eligibility: (1) age of 64 or over; (2) working less than 25 hours per week; and (3) permanent resident of Western Australia.

Table 4: WA mainstream concession card benefit p.a.

Benefit Type PCC Seniors + CSHC LIHCC Seniors CSHC

Council Rates Up to $750 Up to $750 - Up to $100 -

Water Up to $600 Up to $600 - Up to $100 -

Electricity $300 - $300 -

Drivers license $44 $44 - $22 -

Car Registration $240ii $240ii - - -

Dentaliii $75 - $75 - -

Spectacles $27iv $27iv - - -

Value $2,000 $1,625 $375 $249 -

i. With Synergy or Horizon Power.

ii. 50% discount off example from WA department of transport, a car weighing 1,650 kg.

iii. Assumes cost $150 p.a.

iv. $53.85 every two years.

South Australia requires the following for seniors card eligibility: (1) age of 60 or over; (2) working 20 hours or less per week; and (3) permanent resident of South Australia.

Table 5: SA mainstream concession card benefit p.a.

Benefit Type PCC LIHCC CSHC Seniors

Cost of living concession $217 $217 $109 -

Emergency services levy remission Up to $46 Up to $46 Up to $46 -

Water Up to $440 Up to $440 - -

Energy Up to $234 Up to $234 Up to $234 -

Drivers License $24 - - -

Car Registration $129ii - -

Value $1,090 $937 $389 -

i. Must not be living with anyone with more than $3,000 p.a. income, unless a spouse or receiving a Centerlink allowance.

ii. District zone one.

You might benefit from other concessions in South Australia from the following: (1) subsidised glasses for full pensioners and contact lenses for PCC and LIHCC holders; (2) medical heating and cooling concession for PCC, LIHCC and CSHC holders; and (3) personal alert systems rebate for eligible PCC holders who are 70 yrs. Old or over.

Tasmania requires the following for seniors card eligibility: (1) age of 60 or over; (2) working 20 hours or less per week; and (3) permanent resident of Tasmania.

Benefit Type PCC LIHCC CSHC Seniors

Concil Rates Up to $326 Up to $326 - -

Water Up to $205 Up to $205 - -

Electricity Up to $514ii

Car Registration $109 $109 - -

Dental $105ii $105ii - -

Spectacles $70iv - -

Value $1,329 $1,259 - -

i. If TasWater client, up to $479 if not.

ii. Maximum daily concession multiplied by 365.

iii. $45 co-payment for subsidised general check-up. Assumes total cost of $150.

iv. 70% discount, assume one pair per year, need to meet additional income and assest test.

You might benefit from other concessions in South Australia from the following: (1)will and Enduring Power of Attorney discounts with Public trustee for PCC and TAS senior card; (2) wigs for cancer patients for PCC holder; (3) right to information request fee waiver ($41.25) for PCC and LIHCC.

7.

ACT requires the following for seniors card eligibility: (1) age of 60 or over; (2) working 20 hours or less per week; and (3) permanent resident of ACT.

Table 7: ACT mainstream concession card benefit p.a.

Benefit Type PCC LIHCC CSHC Seniors

Up to $750 - - -

Concil Rates

Fire and emergency services levy rebate $98 - - -

Utilities Up to $800 Up to $800 - -

Drivers Licence $41 $27 -Car Registration $401 - $40Spectacles $100ii $100ii -

Value $2,190 $927 $40 -

i. Pro-rated discount on five-year $204.90 licence.

ii. Car 1,155 - 1,504 kg.

iii. $200 subsidy every two years.

You might benefit from other concessions in South Australia from the following: (1) free or reduced ambulance fees for PCC and LIHCC; and (2) green waste concession($ 50) for PCC and MyWay seniors card.

ACT requires the following for seniors card eligibility: (1) age of 60 or over; and (2) permanent resident of NT.

Table 8: NT mainstream concession card benefit p.a.

Benefit Type PCC LIHCC CSHC Seniors

Concil Rates

Up to $200 - -Garbage $46 - -Water Up to $800 - -Electricity Up to $1,200 - -Drivers License $33 - -Spectacles Up to $251 -Value $2,684 $55 - -

i. Darwin rate.

ii. Up to $502.20 every two years for the individual and their registered dependents.

Those who are 65 and above are entitled to join the NT Seniors Recognition Scheme and can receive a $ 500.00.

We invite a representative from each sporting club to submit team selections, results and any interesting stories relating to your club/sport.

Part of the secret of success is to eat what you like and let the food fight it out inside

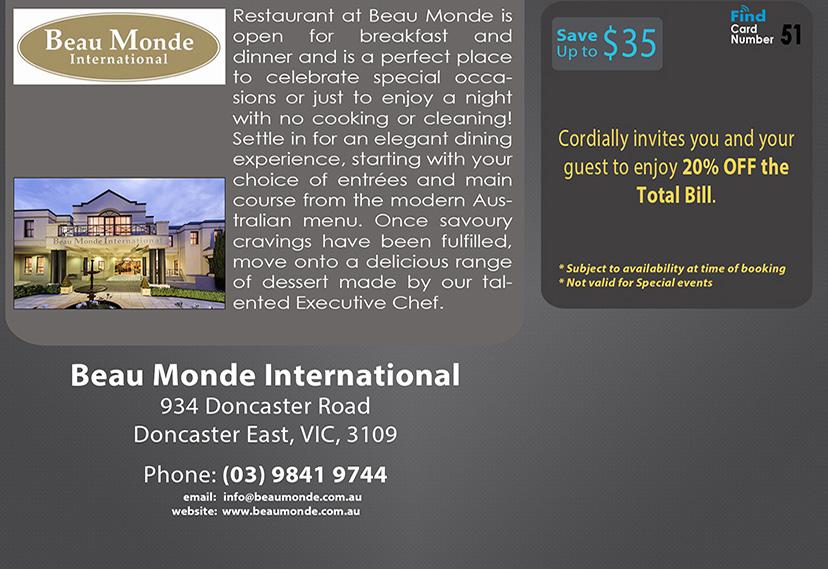

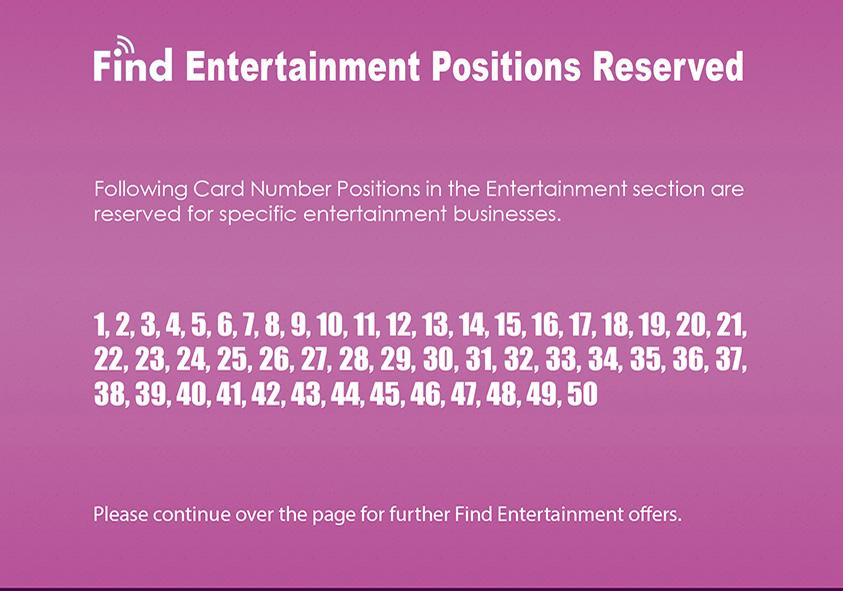

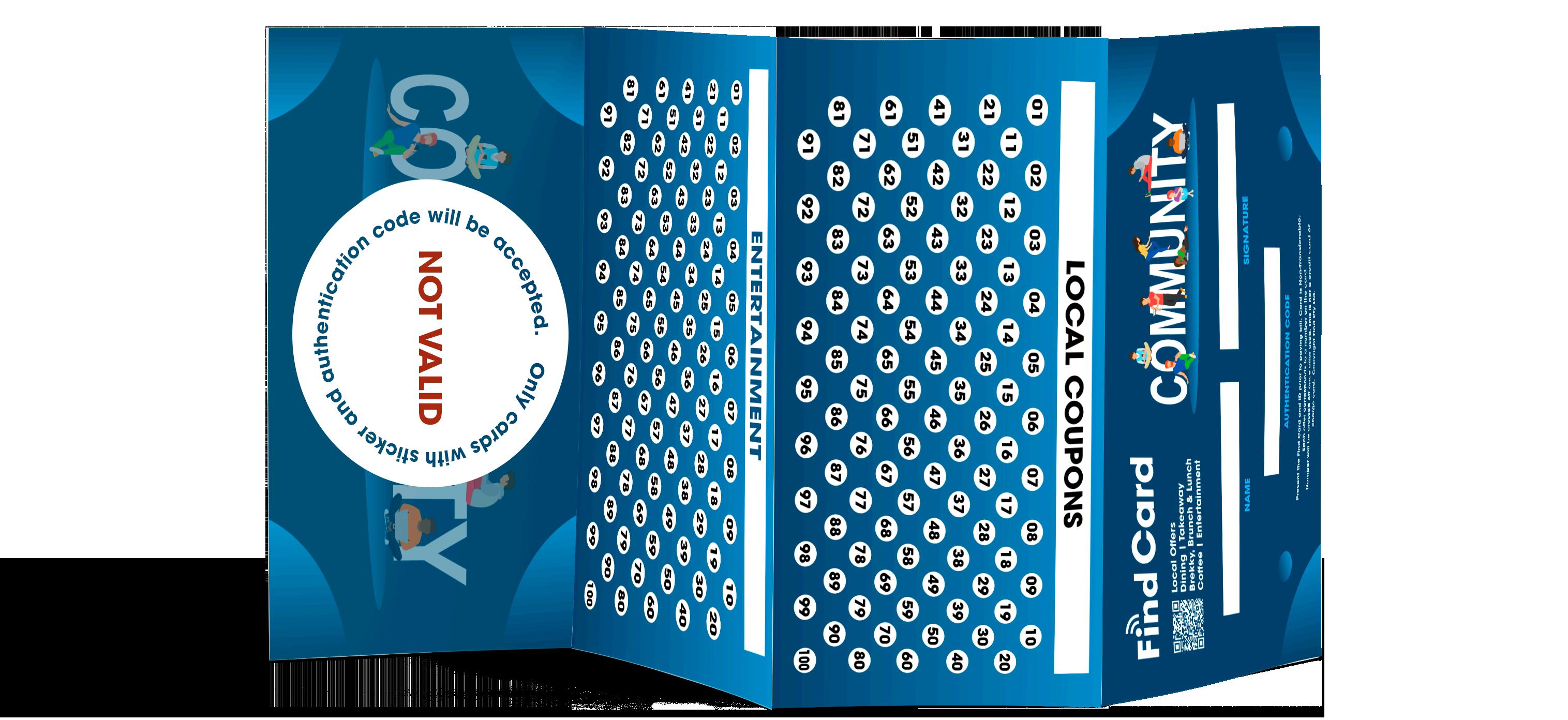

The barter trade, sale, purchase, or transfer of the Find Coupons &/or Find Cards, by any person or entity, including but not limited to business placing offers in the Find Paper, printers, publishers, and distributors of the Find Coupons /Find Card, is strictly prohibited, unless expressly authorized by Find Pty. Ltd. Find reserves the right to make changes to the participants and their offers at its sole discretion. Members will be notified of these changes via email or via the Site.

The Find Coupons and its Offers are intended for the non-profits use of the individual purchaser of the Find Cards &/or Find Coupons. Additionally, the use of the Find Coupons &/or Find Cards or any of the Offers placed in our Find Paper, for advertising purpose, in any form of fashion, is strictly prohibited. Any use of a Offers in violation of these Rules will render the Offer VOID, and violators will be prosecuted. Offers may not be reproduced and are void where prohibited, taxed, or restricted by law. Find, will not be responsible if any establishment breaches its contract of refuses to acccept the Find Cards / Offers with in the Find Paper: we will however, use our best efforts to secure compliance, Find, will not be responsible in the events beyond its control. © 2020 Find.

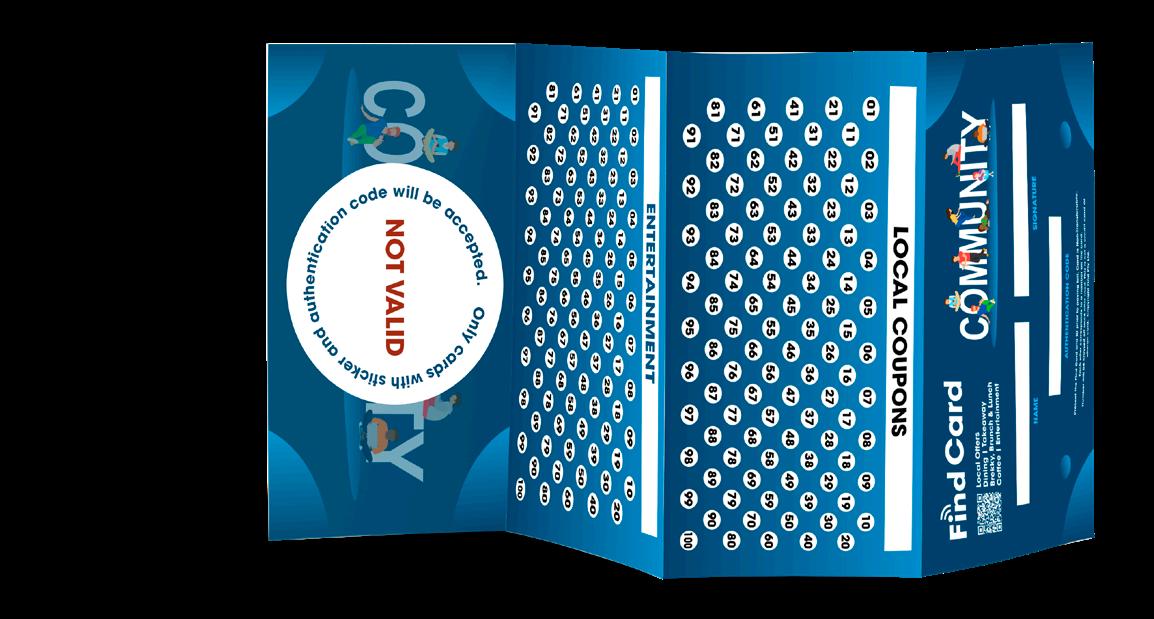

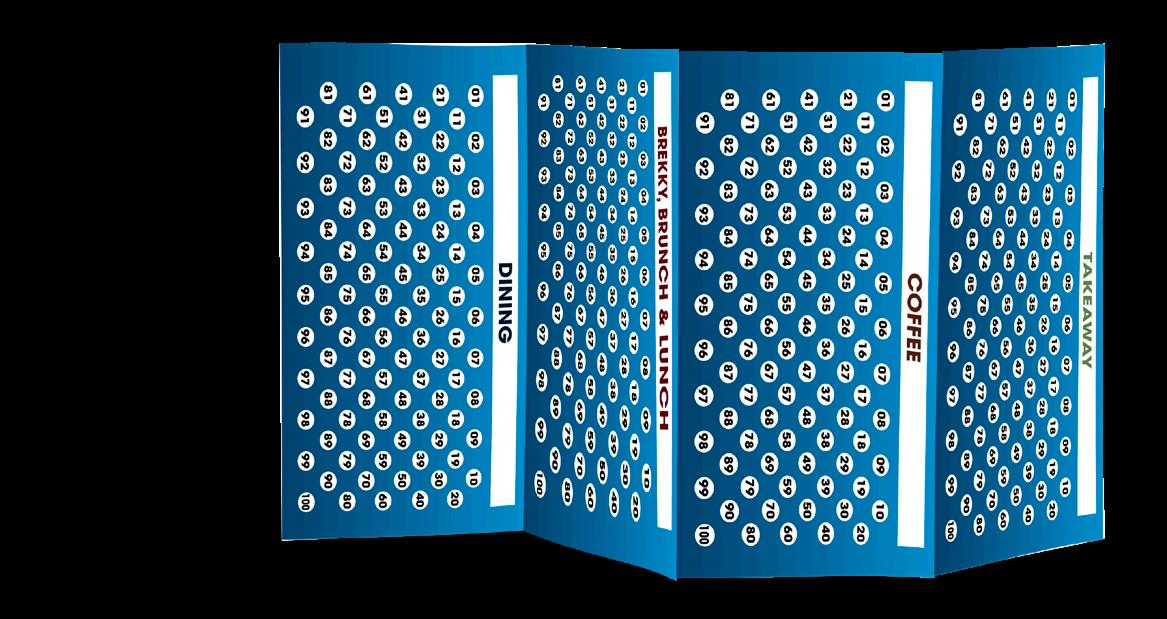

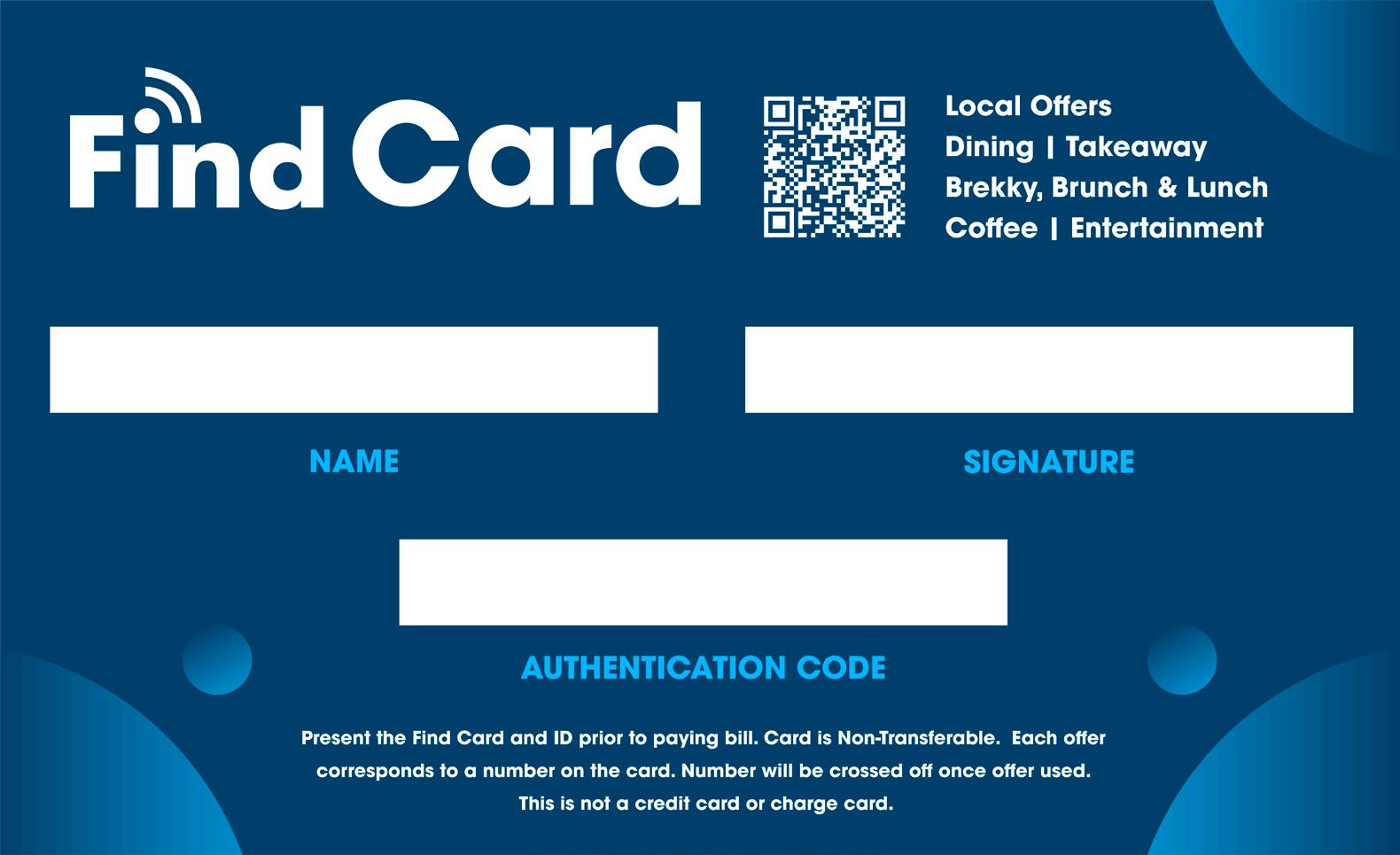

Valid Find Cards have four folds and contain six different categories. Valid Find Cards will have its Regions logo sticker placed in the circle at the back and has an Authentication code display in front of the Find Cards

Find Cards that DO NOT display its Regions Sticker in the circle at the back and DO NOT display an Authentication code in front of the Find Card are INVALID. They will not be accepted at any participating businesses. Also, your signature must be present. You may be asked to present ID to verify that Find Card belongs to you.

Present the Find Card and ID prior to paying bill. Card is Non-Transferable. Each offer corresponds to a number on the card. Number will be crossed off once offer used. This is not a credit or charge card. Copyright 2022 Find © Pty Ltd.