STORY

2022 EDITION

GROUP

YOUR

YOUR

TABLE

CONTENTS

PERSONAL DETAILS...........................

family.............................................

goals & objectives.........................

personal insurance.......................

investment profile........................

Assets............................................

superannuation.............................

liabilities......................................

general insurance........................

estate planning needs..................

OF

YOUR

YOUR

YOUR

YOUR

YOUR

YOUR

YOUR

YOUR

YOUR

YOUR

retirement....................................

binding nomination.......................

income stream.............................. i II III IV V VI VII VIII IX X xi xii xiii

YOUR

Annual Income: Date Commenced: YOUR DETAILS CLIENT 1 Annual Income: Date Commenced: CLIENT 1 CivilEngineer HansonHeilderberg CementGroup 123MainStreet,WarranwoodVIC3810 0456589287 01/05/2005 $160,000.00 JackUptohill jackuptohill@gmail.com.au 44 1978-03-05 JillUptohill $74,718.00 06/06/2008 0457895245 123MainStreet,WarranwoodVIC3810 AdelaideBank SystemAnalyst jilluptohill@gmail.com.au 42 1980-05-12

DateofBirthDateofBirthDateofBirth DateofBirth DateofBirthDateofBirth DateofBirthDateofBirthDateofBirthDateofBirth

John 1940-08-07 Natalie 1945-12-08 Damon 1937-05-04 Caroline 1939-12-05 Jack 1978-03-05 Jill 1980-03-05 Katherine 2008-07-05 Stephan 2005-05-05

YOUR FAMILY

GOALS & OBJECTIVES

Goals are general guidelines that explain what you want to achieve in your community. Objectives define strategies or implementation steps to attain the identified goals. Unlike goals, objectives are specific, measurable, and have a defined completion date.

INVESTMENT PROPERTY

Do you own an investment Property?

Have you paid it off e.g. no investment

If not, do you wish to have your own one in the future?

HOUSE

Do you own your own house?

Have you paid it off e.g. no mortgage?

If Renting, do you wish to have your own home in the future?

HOLIDAY OVERSEAS

Do you take holidays overseas?

If yes, where would you like to go?

How much will it cost?

CARAVAN

Do you own a Caravan or Camper Trailer?

If not, do you wish to own one?

How much will it cost?

RETIREMENT

At what age do you wish to retire?

How much do you wish to retire on e.g. $50k per annum?

Do you think you will reach this goal before retirement?

Would you like to know if you will or will not reach this goal by doing some modelling?

QUESTION

Is there a goal you would like to achieve/obtain in the future not listed above?

What is it?

BUCKET LIST

What is on the top of your bucket list to do?

1.UpgradeCar

2.AnnualTrip

3.HouseRenovation

4.Upgradeoursolarpanelsandbatterysystem

How much will it cost?

How much will it cost?

MARK

? YES YES $40,000 65

$50,000

Payoffmortgage Assistkidswithhomedeposit YES YES $60,000 Bali,Indonesia YES NO YES NO YES

5.Developmentofinfrastructure&maintenanceofour property

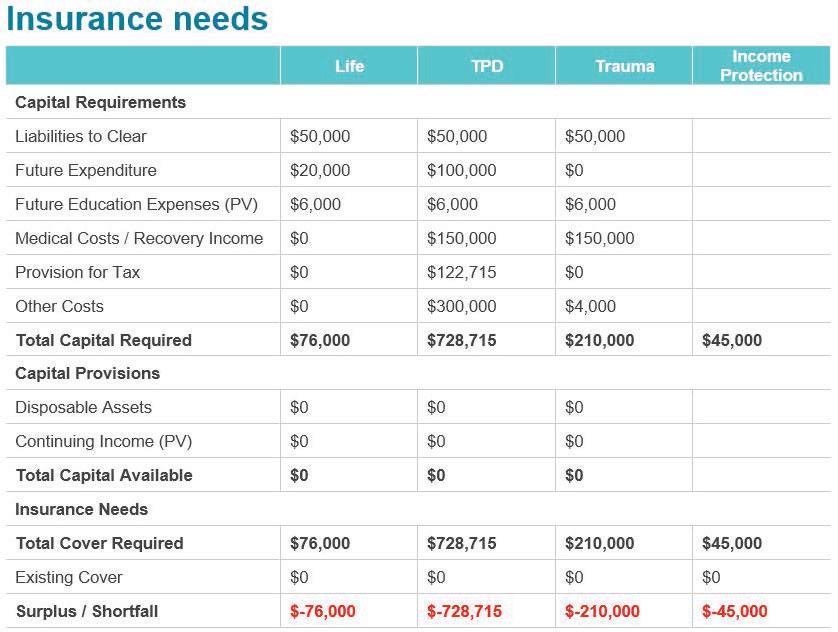

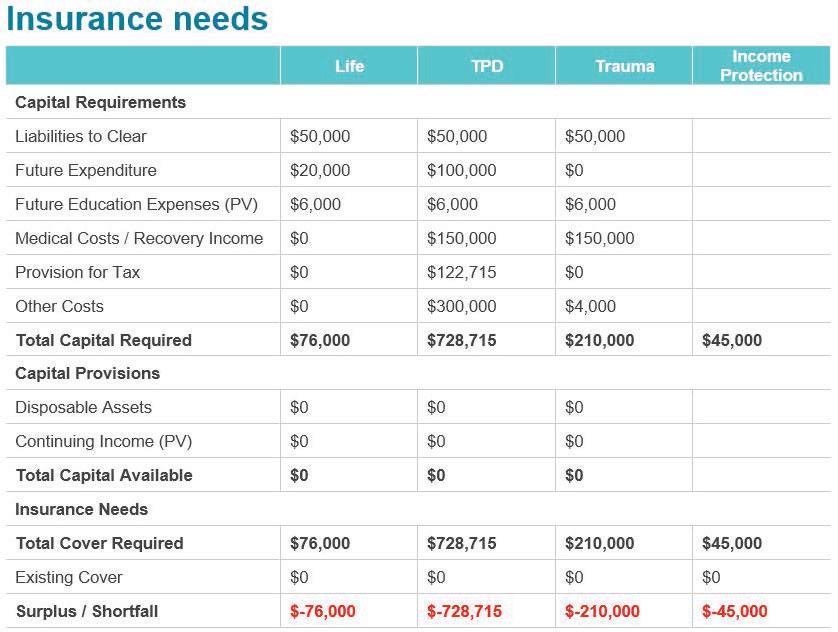

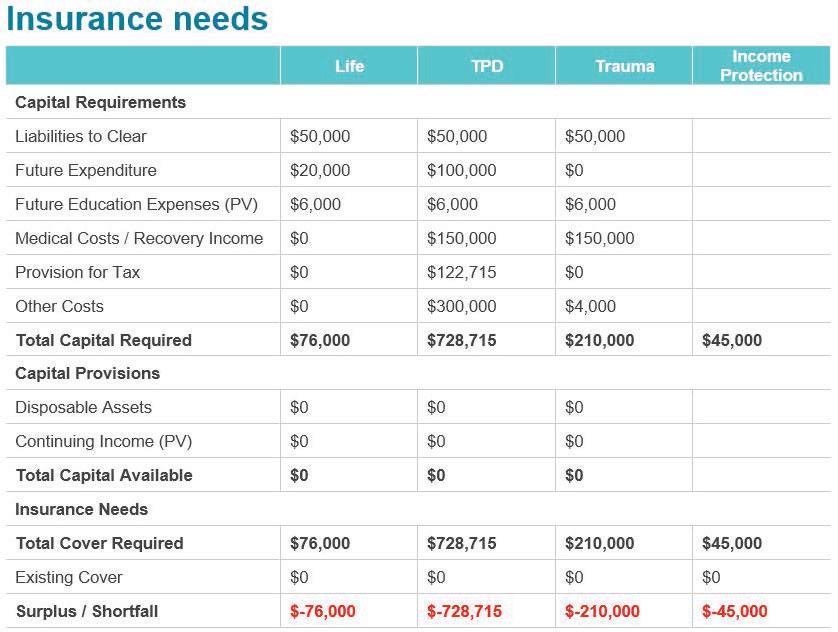

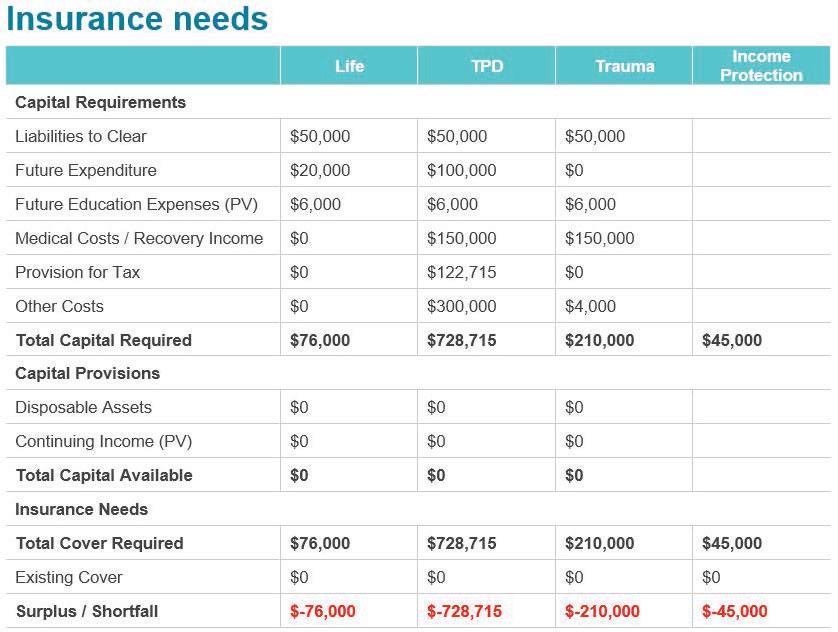

YOURPERSONALINSURANCE

Last Completed:

01-10-2021

Jack

Trauma Cover

Income Protection Cover (IP)

Life

Business Expense:

THE current AMOUNT

Cover SUM INSURED:

and Permanent Disability Cover

SUM INSURED:

Total

(TPD)

SUM INSURED: SUM INSURED: Policy Number:

Cover: SUM INSURED: er

Child

SUM INSURED: $200,000 Level/NonSuper $500,000 Level/Super $350,000 Level/Super $5,000 Level/Super 1234567 Jack None None

Last Completed:

01-10-2021

Jill

Jill

THE current AMOUNT

Policy Number:

Trauma

Total and Permanent Disability Cover (TPD) SUM INSURED:

Income Protection Cover (IP)

Expense:

Child Cover: SUM INSURED:

Life Cover SUM INSURED:

Cover SUM INSURED: SUM INSURED:

er

None

Level/Super

Level/Super

Jill

None

Business

SUM INSURED:

$1,000,000

None $7,500

7891011

None

YOUR RISK PROFILE

Strategic Asset Allocation and Risk Profiles

This table provides an overview of the defensive/growth splits and underlying assets allocations for the new risk profiles.

International share allocation can be a combination of hedged and unhedged strategies; a ratio of 50% / 50% is recommended. International Shares may also include an allocation to emerging markets depending upon client’s circumstances.

**Diversified Alternatives have been classified as both defensive and growth assests at a ratio of 50% / 50%.

Assets classesDefensiveConservativeBalancedGrowthHigh Growth High Growth Plus Defensive Assets Cash 28%21%10%4%2%2% Fixed Interest - Australian 31%25%20%12%5%0% Fixed Interest - International 26%21%17%10%5%0% Growth Assets Australian Shares 5%10%18%25%31%38% International Shares* 7%12%21%30%38%46% Australian Listed Property 0%0%0%2%3%0% International Listed Property 0%2%4%3%4%4% Global Insfrastructure 3%3%4%6%6%4% Total Defensive Assets85%70%50%30%15%5% Total Growth Assets15%30%50%70%85%95% Alternatives Diversitified Alternatives** 0%6%6%8%6%6% Additional Information Minimum investment Timeframes (years) 3357910 Agreed Investment profile/asset allocation C1C2JC1C2J C1C2JC1C2JC1C2JC1C2J

YOUR INVESTMENT PROFILE

years

The Defensive risk profile is designed for investors with a minimum three-year timeframe or those that seek a portfolio invested predominantly in interest bearing assets, with a small proportion of growth assests. This portfolio also suits investors who give a high priority to the preservation of capital (while understanding loss is still possible) and are therefore willing to accept lower potential investment performance, hence the 85 percent exposure to defensive assets (cash and fixed interest).

If the risk tolerance score is zero, a cash account should be considered.

Conservative12-293 years

The conservative risk profile is designed for investors with a minimum three-year timeframe or those seek a diversified portfolio of interest bearing and growth asset classes, with an emphasis on interest bearing assets. This portfolio also suits investors seeking a lower level mof investment value volativity, and therefore willing to accept lower potential investment performance, hence the 70 percent exposure to defensive assets (cash and fixed interest.

Balanced30-445 years

The Balanced risk profile is designed for investors with a minimum five-year timeframe. This portfolio also suits investors who desire a modest level of capital stability but are willing to accept moderate investment performance, hence the 50 percent exposure to growth assests (shares, listed property and infrastructure) and 50 percent exposure to defensive assets (cash and fixed interest).

Growth45-597 years

High Growth60-749

years

High Growth Plus 75-10010 years +

The Growth risk profile is designed for investors with a minimum seven-year timeframe or those who are willing to accept higher levels of investment value volatility compared to more defensive options in return for higher potential investment performance. Some exposure to interest bearing assets is stil desired, but the primary concern is a higher return, hence th 70 percent exposure to growth assets (shares, listed property and infrastructure).

The High Growth risk profile is designed for investors with a minimum nine-year time or those who are willing to accept high levels of investment performance. The 85 percent exposure to growth assets (shares, listed property and infrastructure) means that capital stability is only a minor consideration.

The High Grow Plus is designed for investors with a minimum ten-year timeframe or those who are willing to accept very high levels of investment value volatility to maximise potential investment performance. The 95 percent exposure to growth assets (shares, listed property and infrastructure) means that capital stability is not a consideration.

CL1:CL2: CL1CL2

Investment Profile you chosen:

Risk ProfilePoints Time Frame Description Defensive0-113

PRIMARY RESIDENCE & OTHER ASSETS

Assets Name: Address: Suburb/Town: State: ate of Purchase:

Purchase Price:

Current Value:

VEHICLES & CARAVANS

Assets Name:

Purchase Price:

Current Value: Description:

2014ToyotaBlackAvalonHybrid

Assets Name:

Purchase Price:

Current Value: Description:

Primary Residence 123MainStreet Warranwood VIC 3810 $400,000 $850,000 Car1 $28,000 $15,000

$22,000 Car2 $12,000 HoldenRedCommodore

ACCOUNT - SAVINGS & TERM DEPOSIT

NAME OF INSTITUTION CL1CL2 AMOUNT

INVESTMENT PROPERTIES 1 Assets Name: Address: Suburb/Town: State: ate of Purchase: Purchase Price: Current Value: INVESTMENT PROPERTIES 2 Assets Name: Address: Suburb/Town: State: ate of Purchase: Purchase Price: Current Value: CashinBank $270,000 SharedChequeAccount $50,800 SharedSavingsAccount $300,000 TrustShares $130,000 Apartment1 98Shirley Street Townsville VIC3213 2008 $350,000 $800,000 Apartment2 813HowardCrescent CentralCoast VIC3222 2010 $450,000 $900,000

INVESTMENT PROPERTIES

YOUR SUPERANNUATION

Member Number: Balance: Member Number: Balance: Member Number: Balance: Member Number: Balance: 11121314 $650,000 21354868 520,000

CL1CL2 Description Lender’s Name Current Interest Rate Monthly Repayments $ Amount Owing $ 5.14% $1,500 $120,000 Property2 CBA 2.85% $2,500 $80,000 Property1 NAB 0.15% $500 $4,500 CreditCard CommonwealthBank 0.10% $2,000 $150,000 PrimaryHome Westpac

YOUR LIABILITIES

WewillalsoorganizedforaFREE GeneralInsuranceReporttobeprepare comparing your current policies with what isoutinthemarketplace.Ifour generalinsuranceteamcanprovide better pricing they will let you know.

Just some of the areas Craig can providecomparison quotes on:

1.Landlords Insurance 2.Business insurance 3.Professional Indemnity Insurance 4.Public Liability 5.General Liability 6.Cyber Liability 7.Management Liability 8.Commercial Motor Vehicle 9.Corporate Transit 10.Contracts Work 11.Strata Type of Insurance (General) Owner Insurer Amount Covers Can we do better e.g pricing FindInsurance $500,000 YES FindInsurance $350,000 YES Businessinsurance Joint PublicLiability Jack

ESTATE DETAILS

A.Do you have a will?

YOURESTATE PLANNING NEEDS

B.When was your Will last reviewed?

C.Have your circumstances changed since your last review?

D. Does your Will make provision for the use of testamentary trust?

E.Executor of Will

F.Who are the Beneficiaries of your Will?

YESNOYES NO YESNOYES NO YESNOYES NO 2009 JonathanMiles StephanUptohill KatherineUptohill 2009 JonathanMiles StephanUptohill

KatherineUptohill

YOUR RETIREMENT A.Planned Retirement Date D.What does retirement look like for you e.g. travelling, hobby, writing a book, sports? B.Target Age for Retirement: C.Income in retirement (after Tax): RETIREMENT DETAILS 19/05/2044 65 $80,000 AnnualOverseasTravel Writeablog Takegrandkidsonavacation Startavegetablegarden Gocamping Exploreyourlocalmuseums Takeafitnesschallenge ReadalloftheGreatBooks Takeballroomdancingclasses 28/11/2040 65 $80,000

OURBINDING NOMINATION

Name of Super Fund / Pension Fund Super Insurance Owner Beneficiaries Non-Lapsing Binding Nominations pension / annuity Jack JillUptohill 100%Binding Jill JackUptohill 100%Binding Jack JillUptohill 100%Binding Jill JackUptohill 100%Binding

Member Number: Balance: Member Number: Balance: Member Number: Balance: Member Number: Balance: PENSION & ANNUITY 4958234 $150,000 2893752 $120,000

YOUR INCOME STREAM

WHAT YOU MIGHT NEED YO SAVE UP FOR RETIREMENT

Source: https://www.superannuation.asn.au/resources/retirement-standard

for various households and living standards for those aged 65-84 (March quarter 2022)

for various

and living standards for those aged 85 (March quarter 2022)

ASFA Retirement Standards for retirees March quarter 2022 for retirees aged 65-84

COUPLESINGLE Expenditure items Comfortable lifestyleModest lifestyle Comfortable lifestyleModest lifestyle Building and contents insurance$35.01$34.94$33.02$27.49 Council Rates $41.18$37.61$41.18$35.43 Water charges $24.71$24.71$21.27$21.27 Home Improvements$7.25$0.00$7.25$0.00 Repair and maintenance$21.75$21.75$21.75$21.75 Total housing $129.91$119.01$124.48$105.95 Electricity and gas $53.35$45.61$43.02$33.96 Food - groceries and other fresh food $221.97$183.13$127.71$98.78 Bundle of home phone, broadband, mobile $28.83$19.95$22.15$17.71 Household cleaning and other supplies$27.20$16.25$20.84$16.25 Cosmetic and personal items$6.93$6.63$4.95$4.74 Barber or hairdressing $24.32$10.76$15.84$6.45 Media, including digital$8.77$2.56$8.56$2.56 Computer, printer and software$4.99$2.81$4.99$2.81 Household appliances, air conditioners, smart phone$18.01$2.95$16.62$2.95 Miscellaneous $7.46$0.00$7.46$0.00 Total household goods an services $97.68$41.97$79.28$35.77 Clothing and footwear $50.22$38.36$26.97$20.19 Car transport and running costs$175.36$103.48$164.09$99.42 Public Transport $5.16$5.16$2.58$2.58 Total Transport $180.52$108.64$166.67$102.00 Number are weekly,except where otherwise specified. Budgets

Comfortable

Couple Single $65,445$46,494 Couple Single $42,621$29,632 Budgets

Comfortable

Couple Single $65,445$46,494 Couple Single $42,621$29,632

lifestyle (p.a.)Modest lifestyle (p.a.)

households

lifestyle (p.a.)Modest lifestyle (p.a.)

GROUP Please consider our environment before printing this e-mail. Awards. CURRENT SERVICES WE ARE PROVIDING TO YOU: 1. Financial Planning: Personal Insurance 2. Financial Planning: Superannuation 3. Financial Planning: SMSF Advice 4. Financial Planning: Pre & Post Retirement Advice 5. Cash Flow Monitoring 6. Taxation: Individual 13. Networking: Find Network 14. Graphic Design 15. Web Hosting 16. Staff - VA Admin Support 17. Other 7. Taxation: Sole Trader 8. Taxation: Company 9. Taxation: Trust 10. Taxation: SMSF 11. General Insurance 12. Find Community Paper ✔ ✔ ✔ ✔ ✔ ✔

Jill

Jill